Do Financial Development, Institutional Quality and Natural Resources Matter the Outward FDI of G7 Countries? A Panel Gravity Model Approach

Abstract

1. Introduction

2. Literature Review

2.1. FDI, Quality of Institutions and Natural Resources

2.2. FDI and Financial Development

3. Materials and Methods

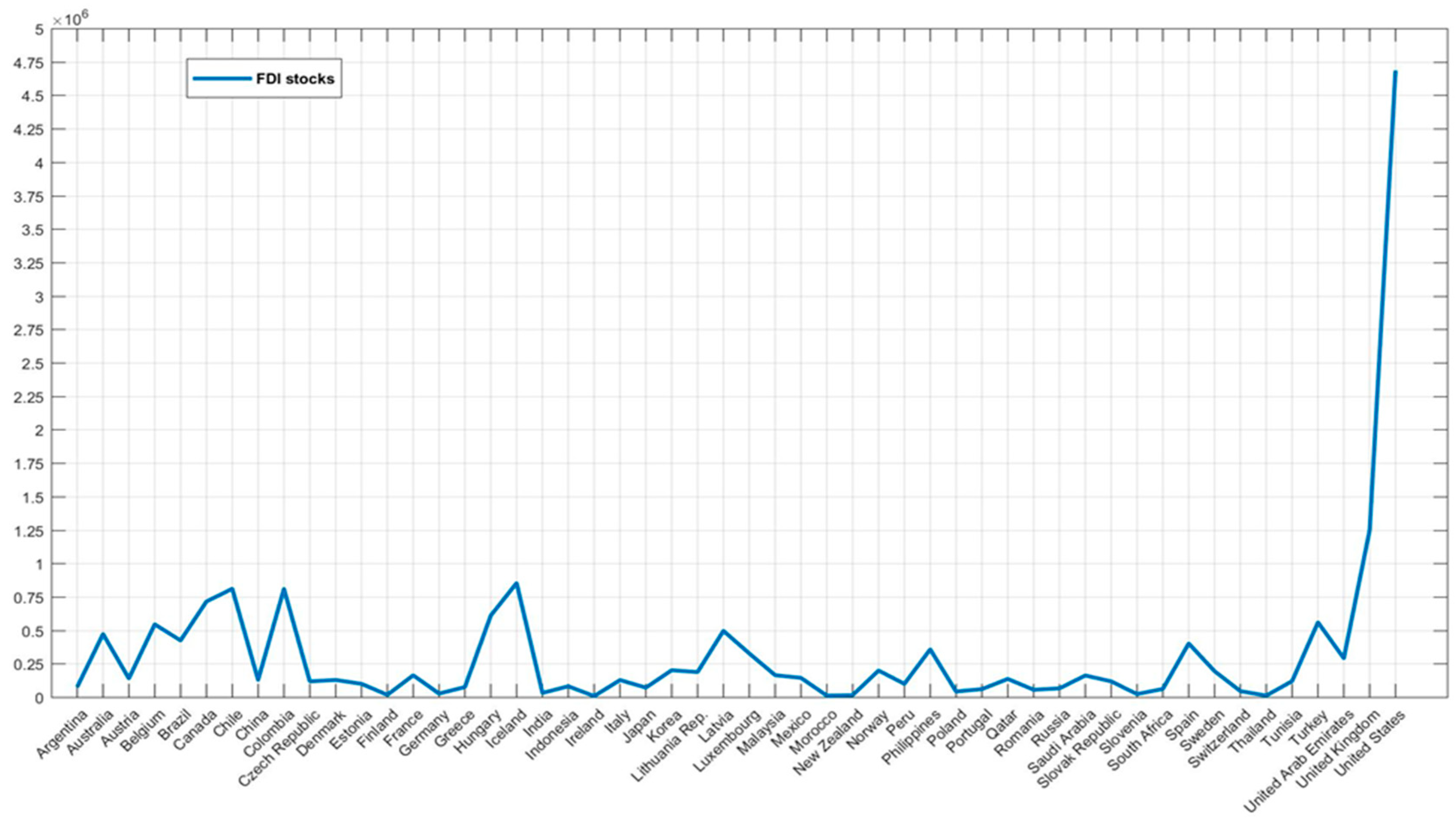

3.1. Data

3.2. The Gravity Model Approach

3.3. Robustness Check

4. Results and Discussion

4.1. FDI and FD Nexus: The Moderating Effect of IQ

4.2. FDI and NR Nexus: The Moderating Effect of IQ

4.3. Robustness Checks

5. Conclusions and Policy Implications

Author Contributions

Funding

Institutional Review Board Statement

Informed Consent Statement

Data Availability Statement

Acknowledgments

Conflicts of Interest

Appendix A

| Source Countries (G7): Canada, France, Germany, Italy, Japan, the United Kingdom, and the United States. |

| Host Countries: Argentina, Australia, Austria, Belgium, Brazil, Chile, China, Colombia, Czech Republic, Denmark, Estonia, Finland, Greece, Hungary, Iceland, India, Indonesia, Ireland, Korea, Rep., Latvia, Lithuania, Luxembourg, Malaysia, Mexico, Morocco, New Zealand, Norway, Peru, Philippines, Poland, Portugal, Qatar, Romania, Russia, Saudi Arabia, Slovak Republic, Slovenia, South Africa, Spain, Sweden, Switzerland, Thailand, Tunisia, Turkey, and the United Arab Emirates. |

| Variables | Description | Data Source |

|---|---|---|

| FDI | Outward FDI stocks from source country to host country (current USD, millions). | [58] |

| RGDPpc | Real GDP per capita (constant 2010 USD) to account for the host country’s market-seeking motives. | [62] |

| DIST | Geographic distance (air distance between capital cities, expressed in kilometers) between the host and the origin country (air distance between capital cities, expressed in kilometers). | Author |

| POP | Population density of the host country (people per sq. km of land area). | [62] |

| LPI | Logistics Performance Index that measures the logistics performance and infrastructural abilities of a country. LPI combines data on six key performance indicators—Infrastructure, Customs, Quality of logistics services, Tracking and tracing, Timeliness, and Ease of arranging shipments—into a single aggregated measure. The LPI varies from 1 to 5. A higher value indicates stronger logistics performance. | [62] |

| FD | Financial Development Index is a relative ranking of a country on the depth, access, and efficiency of its Financial Institutions (banking and non-banking sectors) and Financial Markets (stock market). The Financial Institutions Index and the Financial Market Index are combined to create a Financial Development Index. Depth, access, and efficiency are the three dimensions into which each of the sub-indices is separated. Three dimensions—depth, access, and efficiency—are used to further divide each of the sub-indices. | [37] |

| FUEL | Fuel exports (% of merchandise exports) by the host country. | [62] |

| ORME | Ores and metals exports (% of merchandise exports) by the host country. | [62] |

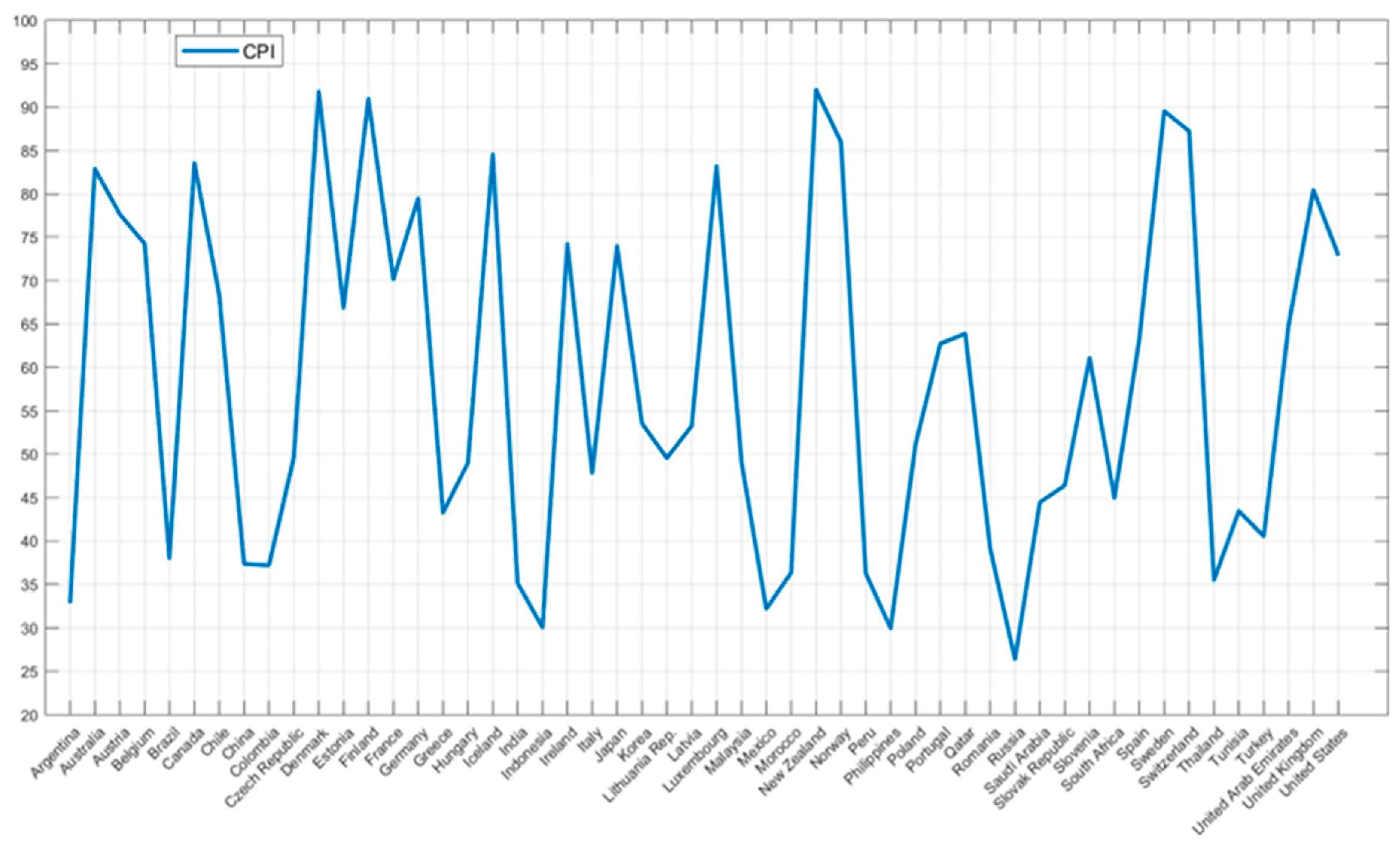

| CPI | The corruption perception index refers to the perception of corruption in the public sector in the host country. A scale from 0 to 100 is used for the index. A lower score denotes a significant level of corruption, whereas a higher score denotes an exceptionally higher level of cleanliness. | [68] |

| Institutional Quality Indicators (IQ): | ||

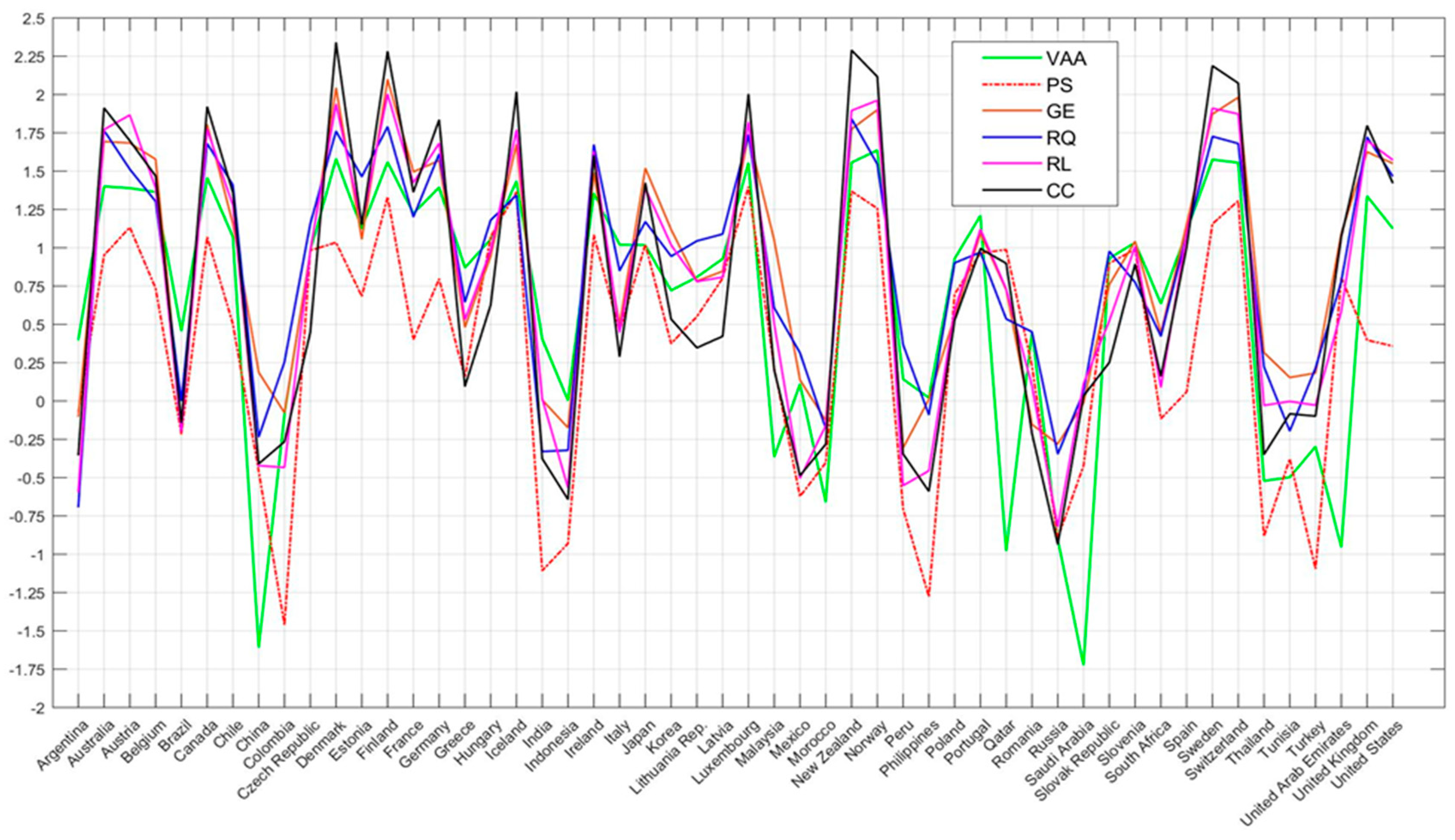

| VAA | Voice and accountability are used to gauge how much a country’s population can influence the choice of their government, along with the capacity for expression, association, and free media. | [63] |

| PS | Political stability and lack of violence capture the ability for perceptions of the government’s power to potentially cause political instability and politically inspire violence and terrorism. | [63] |

| GE | Government’s effectiveness in reaching high standards of public service, the excellence of the civil service, and the degree of political independence it has, as well as the legitimacy of the government’s adherence to these principles. | [63] |

| RQ | Regulation quality measures how well the public believes the government can create and implement sensible economic policies and rules that encourage and enable private sector improvement. | [63] |

| RL | Rule of law to assess the quality and fair-mindedness of the lawful framework securing the rights of property and persons. | [63] |

| CC | Control over the corruption that results in bribes, excessive support, and favoritism | [63] |

| ID | Difference between the host and source country in terms of institutional indicators (VAA, PS, GE, RQ, RL, and CC). | [63] |

| PosID (NegID) | There will be a positive (negative) institutional difference equal to the difference in institutions between institutional measures if the quality of institutions in the host country is better (poorer) than that in the country of origin. | [63] |

| Variables | FDI | RGDPpc | POP | LPI | FD | FUEL | ORME | |||||||

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

| Country | Mean | SD | Mean | SD | Mean | SD | Mean | SD | Mean | SD | Mean | SD | Mean | SD |

| Argentina | 75,115.61 | 14,505.14 | 12,516.89 | 1505.879 | 15.214 | 0.931 | 2.824 | 0.055 | 0.302 | 0.023 | 8.846 | 5.678 | 3.054 | 1.234 |

| Australia | 471,774.3 | 203,969.4 | 54,284.16 | 3645.21 | 2.945 | 0.263 | 3.836 | 0.105 | 0.918 | 0.023 | 24.524 | 4.531 | 29.309 | 6.729 |

| Austria | 139,426.5 | 52,780.39 | 43,557.86 | 1949.084 | 102.855 | 3.430 | 3.918 | 0.178 | 0.642 | 0.046 | 2.815 | 0.952 | 3.105 | 0.445 |

| Belgium | 544,264.5 | 102,168.5 | 40,036.02 | 1822.985 | 362.825 | 13.949 | 4.045 | 0.048 | 0.660 | 0.036 | 8.108 | 2.774 | 3.178 | 0.719 |

| Brazil | 423,669.3 | 227,108.7 | 8261.185 | 731.655 | 23.675 | 1.277 | 2.995 | 0.101 | 0.581 | 0.073 | 8.408 | 2.792 | 13.057 | 3.365 |

| Canada | 714,837 | 476,925.7 | 41,534.21 | 2903.824 | 3.861 | 0.243 | 3.999 | 0.096 | 0.855 | 0.069 | 22.062 | 4.589 | 6.976 | 1.382 |

| Chile | 810,114.2 | 262,250.9 | 12,090.42 | 1675.855 | 23.395 | 1.517 | 3.023 | 0.141 | 0.493 | 0.029 | 1.428 | 0.727 | 54.377 | 7.038 |

| China | 128,796.1 | 52,108.54 | 6482.795 | 2742.747 | 143.364 | 4.634 | 3.585 | 0.171 | 0.756 | 0.025 | 1.871 | 0.516 | 1.450 | 0.302 |

| Colombia | 809,272.45 | 579,051.34 | 5402.441 | 822.740 | 41.469 | 2.865 | 2.525 | 0.126 | 0.343 | 0.041 | 49.155 | 11.224 | 1.332 | 0.443 |

| Czech Republic | 117,771.5 | 86,307.45 | 16,922.46 | 2041.219 | 135.368 | 2.320 | 3.215 | 0.158 | 0.434 | 0.042 | 2.797 | 0.775 | 1.741 | 0.338 |

| Denmark | 128,241.8 | 32,001.88 | 53,213.41 | 2621.469 | 136.023 | 7.728 | 3.905 | 0.102 | 0.678 | 0.034 | 6.800 | 2.378 | 1.411 | 0.193 |

| Estonia | 99,361.57 | 18,547.93 | 16,594.57 | 2684.288 | 31.141 | 0.772 | 2.993 | 0.210 | 0.290 | 0.021 | 9.843 | 4.565 | 2.478 | 0.542 |

| Finland | 16,940.25 | 7843.731 | 43,751.45 | 2020.762 | 17.719 | 0.401 | 3.931 | 0.174 | 0.608 | 0.047 | 7.048 | 2.613 | 4.663 | 1.134 |

| France | 163,189.9 | 74,793.04 | 36,269.79 | 1287.159 | 119.109 | 3.317 | 3.966 | 0.054 | 0.777 | 0.041 | 3.389 | 0.871 | 2.210 | 0.334 |

| Germany | 26,428.97 | 7300.364 | 39,161.03 | 2951.752 | 235.261 | 2.394 | 4.322 | 0.069 | 0.736 | 0.022 | 2.044 | 0.356 | 2.702 | 0.355 |

| Greece | 75,293.35 | 20,600.4 | 20,138.14 | 2274.916 | 84.688 | 1.169 | 3.075 | 0.146 | 0.553 | 0.064 | 23.033 | 11.410 | 8.639 | 0.946 |

| Hungary | 609,876.7 | 206,901.1 | 12,290.08 | 1572.764 | 109.836 | 2.427 | 3.203 | 0.131 | 0.476 | 0.053 | 2.894 | 1.457 | 1.991 | 1.684 |

| Iceland | 852,789.7 | 177,809.7 | 51,335.74 | 4158.117 | 3.231 | 0.242 | 3.041 | 0.523 | 0.552 | 0.045 | 1.302 | 0.628 | 32.526 | 8.939 |

| India | 31,258.32 | 10,228.36 | 1372.147 | 394.244 | 421.126 | 31.420 | 2.967 | 0.145 | 0.440 | 0.029 | 13.275 | 4.922 | 4.824 | 1.803 |

| Indonesia | 81,201.8 | 24,893.9 | 2929.261 | 650.208 | 134.729 | 8.485 | 2.706 | 0.135 | 0.327 | 0.033 | 26.006 | 4.637 | 6.974 | 1.779 |

| Ireland | 7701.36 | 4101.594 | 56,246.2 | 13,420.47 | 66.016 | 4.701 | 3.642 | 0.180 | 0.704 | 0.042 | 0.766 | 0.370 | 0.999 | 0.263 |

| Italy | 127,703.1 | 63,751.038 | 31,887.37 | 1356.581 | 200.830 | 3.866 | 3.731 | 0.181 | 0.760 | 0.017 | 3.359 | 0.963 | 1.886 | 0.333 |

| Japan | 71,061.59 | 46,718.95 | 33,889.34 | 1438.491 | 349.45 | 1.784 | 4.151 | 0.042 | 0.826 | 0.055 | 1.424 | 0.692 | 2.282 | 0.531 |

| Korea, Rep. | 201,028.6 | 144,154.3 | 26,113.89 | 4309.333 | 513.637 | 13.387 | 3.684 | 0.117 | 0.818 | 0.022 | 6.803 | 2.020 | 2.004 | 0.368 |

| Latvia | 187,464.5 | 80,901.0 | 12,641.6 | 2442.288 | 33.411 | 2.262 | 2.870 | 0.229 | 0.259 | 0.034 | 5.227 | 2.356 | 3.282 | 1.139 |

| Lithuania | 495,557.5 | 403,750.5 | 12,840.36 | 3101.899 | 48.841 | 3.596 | 2.856 | 0.384 | 0.231 | 0.033 | 19.462 | 5.411 | 1.645 | 0.290 |

| Luxembourg | 326,633.9 | 98,511.17 | 105,376 | 4066.354 | 219.371 | 26.242 | 3.936 | 0.153 | 0.730 | 0.010 | 0.560 | 0.359 | 5.137 | 0.763 |

| Malaysia | 164,136.4 | 57,156.39 | 8906.82 | 1565.765 | 87.296 | 8.080 | 3.421 | 0.112 | 0.634 | 0.046 | 15.007 | 3.845 | 2.379 | 1.203 |

| Mexico | 143,952.1 | 65,499.48 | 9202.626 | 430.281 | 59.787 | 4.670 | 2.916 | 0.106 | 0.366 | 0.035 | 10.797 | 4.341 | 2.346 | 0.742 |

| Morocco | 11,420.93 | 5644.107 | 2571.009 | 365.448 | 74.349 | 5.639 | 1.892 | 0.786 | 0.315 | 0.033 | 3.399 | 1.803 | 8.827 | 2.594 |

| New Zealand | 14,579.68 | 6692.143 | 36,999.27 | 2439.601 | 16.995 | 1.355 | 3.610 | 0.149 | 0.554 | 0.036 | 3.115 | 1.694 | 3.720 | 0.799 |

| Norway | 199,052.9 | 228,200.6 | 73,714.13 | 2146.713 | 13.624 | 0.825 | 3.986 | 0.161 | 0.684 | 0.057 | 62.407 | 5.534 | 6.266 | 0.915 |

| Peru | 99,106.85 | 46,633.99 | 5287.292 | 1118.532 | 23.245 | 1.494 | 2.615 | 0.131 | 0.305 | 0.062 | 8.285 | 2.325 | 40.598 | 5.265 |

| Philippines | 357,259.7 | 131,125.0 | 2670.474 | 571.166 | 323.397 | 31.093 | 2.585 | 0.147 | 0.330 | 0.024 | 1.979 | 0.813 | 4.360 | 1.623 |

| Poland | 42,010.7 | 18,364.98 | 11,397.89 | 2451.022 | 124.264 | 0.349 | 3.035 | 0.156 | 0.422 | 0.056 | 3.953 | 1.189 | 3.965 | 0.652 |

| Portugal | 59,843.79 | 18,718.15 | 19,634.08 | 811.648 | 113.976 | 1.218 | 3.240 | 0.108 | 0.694 | 0.041 | 5.613 | 2.326 | 2.532 | 0.683 |

| Qatar | 135,877.2 | 53,005.28 | 60,550.18 | 2603.435 | 166.909 | 72.057 | 3.142 | 0.361 | 0.512 | 0.040 | 87.911 | 4.568 | 0.941 | 1.074 |

| Romania | 55,127.97 | 37,368.4 | 8340.29 | 1896.512 | 88.192 | 3.577 | 2.638 | 0.232 | 0.234 | 0.071 | 6.010 | 2.180 | 3.598 | 1.118 |

| Russia | 65,420.54 | 24,152.47 | 8737.696 | 1234.445 | 8.776 | 0.045 | 2.463 | 0.150 | 0.504 | 0.035 | 58.917 | 8.287 | 6.288 | 1.240 |

| Saudi Arabia | 161,839.8 | 68,115.73 | 19,135.11 | 1163.03 | 13.365 | 2.059 | 3.201 | 0.106 | 0.435 | 0.056 | 85.588 | 6.239 | 0.597 | 0.577 |

| Slovak Republic | 117,781.2 | 38,875.06 | 14,635.21 | 2634.795 | 112.434 | 0.666 | 3.028 | 0.168 | 0.265 | 0.023 | 4.762 | 1.342 | 2.557 | 0.547 |

| Slovenia | 22,762.67 | 13,268.53 | 20,976.53 | 1970.58 | 101.586 | 1.763 | 3.114 | 0.225 | 0.442 | 0.072 | 3.770 | 1.894 | 4.407 | 0.589 |

| South Africa | 61,416.75 | 31,227.11 | 5944.994 | 367.839 | 43.463 | 3.677 | 3.475 | 0.185 | 0.564 | 0.059 | 10.411 | 0.999 | 25.106 | 4.622 |

| Spain | 401,199.8 | 83,584.44 | 26,013.57 | 1066.742 | 91.439 | 3.513 | 3.684 | 0.109 | 0.851 | 0.028 | 5.148 | 1.523 | 3.026 | 0.632 |

| Sweden | 193,825.8 | 50,542.91 | 49,076.83 | 3305.452 | 23.400 | 1.296 | 4.135 | 0.082 | 0.768 | 0.039 | 5.922 | 1.781 | 3.988 | 0.948 |

| Switzerland | 44,617.93 | 16,280.22 | 82,299.52 | 4542.199 | 201.712 | 12.004 | 4.096 | 0.069 | 0.938 | 0.061 | 1.647 | 0.861 | 2.710 | 0.830 |

| Thailand | 11,399.44 | 4619.855 | 5326.683 | 850.634 | 132.049 | 3.609 | 3.179 | 0.087 | 0.626 | 0.086 | 4.321 | 1.288 | 1.334 | 0.240 |

| Tunisia | 119,738.2 | 42,027.12 | 3792.683 | 368.137 | 69.697 | 4.210 | 2.532 | 0.238 | 0.203 | 0.030 | 11.324 | 4.038 | 1.491 | 0.227 |

| Turkey | 559,340.3 | 174,174.9 | 9621.728 | 2032.104 | 97.087 | 8.398 | 3.310 | 0.244 | 0.473 | 0.054 | 3.610 | 1.313 | 3.353 | 0.773 |

| UAE | 290,187.3 | 94,740.42 | 42,429.53 | 8706.398 | 108.961 | 32.373 | 3.865 | 0.116 | 0.444 | 0.080 | 55.989 | 14.498 | 2.544 | 1.671 |

| UK | 1,249,089 | 529,530.1 | 44,067.8 | 1982.593 | 262.184 | 10.940 | 4.052 | 0.093 | 0.890 | 0.026 | 9.683 | 2.161 | 3.490 | 0.989 |

| US | 4,685,226.25 | 2,510,780.41 | 55,013.56 | 3387.293 | 34.056 | 1.567 | 4.130 | 0.040 | 0.905 | 0.010 | 7.358 | 4.090 | 3.027 | 0.659 |

| Full Sample | 23,3219.7 | 307,138 | 27,360.21 | 23,255.94 | 114.839 | 113.469 | 3.357 | 0.586 | 0.559 | 0.211 | 14.237 | 20.943 | 6.672 | 10.703 |

| Variables | CPI | VAA | PS | GE | RQ | RL | CC | |||||||

| Country | Mean | SD | Mean | SD | Mean | SD | Mean | SD | Mean | SD | Mean | SD | Mean | SD |

| Argentina | 32.8 | 5.699 | 0.394 | 0.106 | −0.075 | 0.258 | −0.107 | 0.132 | −0.697 | 0.218 | −0.599 | 0.179 | −0.358 | 0.142 |

| Australia | 82.85 | 4.997 | 1.398 | 0.064 | 0.949 | 0.084 | 1.691 | 0.119 | 1.763 | 0.124 | 1.769 | 0.063 | 1.910 | 0.114 |

| Austria | 77.6 | 4.849 | 1.387 | 0.043 | 1.131 | 0.168 | 1.681 | 0.165 | 1.510 | 0.087 | 1.864 | 0.051 | 1.696 | 0.219 |

| Belgium | 74.2 | 1.989 | 1.362 | 0.046 | 0.733 | 0.219 | 1.575 | 0.249 | 1.300 | 0.061 | 1.388 | 0.075 | 1.466 | 0.080 |

| Brazil | 37.95 | 2.723 | 0.453 | 0.082 | −0.219 | 0.251 | −0.143 | 0.156 | −0.002 | 0.173 | −0.202 | 0.139 | −0.147 | 0.203 |

| Canada | 83.5 | 4.211 | 1.455 | 0.071 | 1.068 | 0.117 | 1.804 | 0.085 | 1.678 | 0.092 | 1.771 | 0.063 | 1.918 | 0.115 |

| Chile | 68.3 | 8.304 | 1.069 | 0.078 | 0.499 | 0.252 | 1.155 | 0.103 | 1.407 | 0.116 | 1.273 | 0.113 | 1.356 | 0.179 |

| China | 37.3 | 3.404 | −1.611 | 0.087 | −0.461 | 0.124 | 0.185 | 0.229 | −0.238 | 0.092 | −0.424 | 0.145 | −0.412 | 0.148 |

| Colombia | 37.15 | 1.461 | −0.093 | 0.191 | −1.463 | 0.535 | −0.079 | 0.123 | 0.253 | 0.178 | −0.436 | 0.148 | −0.268 | 0.092 |

| Czech Republic | 49.55 | 6.194 | 0.974 | 0.068 | 0.980 | 0.099 | 0.966 | 0.069 | 1.153 | 0.101 | 0.982 | 0.105 | 0.444 | 0.102 |

| Denmark | 91.75 | 2.844 | 1.578 | 0.083 | 1.032 | 0.150 | 2.042 | 0.184 | 1.759 | 0.111 | 1.936 | 0.071 | 2.338 | 0.096 |

| Estonia | 66.8 | 5.559 | 1.122 | 0.059 | 0.681 | 0.101 | 1.053 | 0.130 | 1.461 | 0.139 | 1.158 | 0.165 | 1.148 | 0.231 |

| Finland | 90.9 | 4.216 | 1.557 | 0.079 | 1.330 | 0.277 | 2.097 | 0.124 | 1.788 | 0.102 | 2.001 | 0.065 | 2.280 | 0.106 |

| France | 70.1 | 2.490 | 1.221 | 0.107 | 0.399 | 0.246 | 1.493 | 0.136 | 1.198 | 0.098 | 1.422 | 0.062 | 1.360 | 0.101 |

| Germany | 79.45 | 1.986 | 1.392 | 0.053 | 0.795 | 0.167 | 1.567 | 0.097 | 1.610 | 0.106 | 1.679 | 0.076 | 1.833 | 0.064 |

| Greece | 43.2 | 4.607 | 0.867 | 0.180 | 0.151 | 0.343 | 0.479 | 0.211 | 0.642 | 0.266 | 0.528 | 0.288 | 0.092 | 0.216 |

| Hungary | 48.95 | 3.634 | 1.054 | 1.201 | 1.070 | 1.174 | 0.942 | 1.168 | 1.178 | 1.128 | 0.979 | 1.177 | 0.625 | 1.208 |

| Iceland | 84.5 | 8.042 | 1.432 | 0.079 | 1.362 | 0.154 | 1.674 | 0.238 | 1.341 | 0.219 | 1.768 | 0.123 | 2.016 | 0.205 |

| India | 35.1 | 4.678 | 0.403 | 0.076 | −1.110 | 0.206 | 0.005 | 0.161 | −0.332 | 0.095 | 0.013 | 0.077 | −0.378 | 0.108 |

| Indonesia | 30.0 | 7.071 | 0.001 | 0.151 | −0.932 | 0.534 | −0.177 | 0.238 | −0.324 | 0.233 | −0.569 | 0.196 | −0.645 | 0.248 |

| Ireland | 74.2 | 2.764 | 1.353 | 0.086 | 1.082 | 0.174 | 1.488 | 0.119 | 1.671 | 0.126 | 1.629 | 0.135 | 1.600 | 0.131 |

| Italy | 47.8 | 5.053 | 1.018 | 0.069 | 0.452 | 0.122 | 0.493 | 0.150 | 0.847 | 0.162 | 0.444 | 0.137 | 0.286 | 0.162 |

| Japan | 73.95 | 2.625 | 1.015 | 0.051 | 1.020 | 0.074 | 1.517 | 0.197 | 1.168 | 0.193 | 1.386 | 0.131 | 1.421 | 0.189 |

| Korea, Rep. | 53.5 | 4.979 | 0.719 | 0.046 | 0.372 | 0.151 | 1.117 | 0.145 | 0.942 | 0.138 | 1.016 | 0.118 | 0.532 | 0.106 |

| Latvia | 49.5 | 7.388 | 0.806 | 0.046 | 0.548 | 0.212 | 0.781 | 0.200 | 1.042 | 0.092 | 0.777 | 0.164 | 0.345 | 0.153 |

| Lithuania | 53.2 | 5.764 | 0.925 | 0.050 | 0.799 | 0.098 | 0.844 | 0.180 | 1.087 | 0.091 | 0.806 | 0.174 | 0.420 | 0.201 |

| Luxembourg | 83.15 | 2.739 | 1.552 | 0.060 | 1.396 | 0.092 | 1.734 | 0.119 | 1.736 | 0.083 | 1.818 | 0.054 | 2.001 | 0.142 |

| Malaysia | 49.1 | 2.712 | −0.368 | 0.159 | 0.213 | 0.173 | 1.047 | 0.113 | 0.606 | 0.140 | 0.501 | 0.073 | 0.200 | 0.136 |

| Mexico | 32.15 | 2.961 | 0.109 | 0.137 | −0.625 | 0.242 | 0.135 | 0.153 | 0.312 | 0.121 | −0.507 | 0.114 | −0.489 | 0.259 |

| Morocco | 36.3 | 3.262 | −0.662 | 0.077 | −0.405 | 0.086 | −0.130 | 0.063 | −0.183 | 0.086 | −0.163 | 0.087 | −0.284 | 0.096 |

| New Zealand | 91.95 | 3.136 | 1.554 | 0.056 | 1.366 | 0.149 | 1.772 | 0.109 | 1.840 | 0.136 | 1.893 | 0.052 | 2.287 | 0.071 |

| Norway | 85.95 | 2.438 | 1.634 | 0.078 | 1.254 | 0.113 | 1.898 | 0.066 | 1.543 | 0.183 | 1.959 | 0.051 | 2.114 | 0.113 |

| Peru | 36.25 | 1.650 | 0.141 | 0.103 | −0.705 | 0.343 | −0.309 | 0.176 | 0.366 | 0.174 | −0.554 | 0.097 | −0.348 | 0.138 |

| Philippines | 29.9 | 5.270 | 0.018 | 0.099 | −1.279 | 0.354 | 0.008 | 0.106 | −0.093 | 0.091 | −0.458 | 0.084 | −0.592 | 0.130 |

| Poland | 51.1 | 10.182 | 0.927 | 0.149 | 0.695 | 0.267 | 0.552 | 0.112 | 0.899 | 0.103 | 0.592 | 0.150 | 0.524 | 0.185 |

| Portugal | 62.7 | 2.003 | 1.207 | 0.122 | 0.963 | 0.193 | 1.091 | 0.124 | 0.968 | 0.196 | 1.119 | 0.104 | 0.992 | 0.135 |

| Qatar | 63.85 | 6.175 | −0.982 | 0.246 | 0.985 | 0.201 | 0.722 | 0.202 | 0.533 | 0.207 | 0.728 | 0.179 | 0.896 | 0.266 |

| Romania | 39.1 | 7.152 | 0.451 | 0.091 | 0.226 | 0.168 | −0.155 | 0.150 | 0.449 | 0.206 | 0.097 | 0.226 | −0.215 | 0.108 |

| Russia | 26.35 | 2.870 | −0.905 | 0.209 | −0.897 | 0.243 | −0.283 | 0.196 | −0.349 | 0.117 | −0.824 | 0.082 | −0.939 | 0.114 |

| Saudi Arabia | 44.4 | 6.885 | −1.726 | 0.140 | −0.425 | 0.222 | −0.016 | 0.240 | 0.057 | 0.089 | 0.111 | 0.086 | 0.031 | 0.207 |

| Slovak Republic | 46.35 | 4.793 | 0.928 | 0.041 | 0.896 | 0.162 | 0.757 | 0.110 | 0.975 | 0.120 | 0.521 | 0.083 | 0.249 | 0.140 |

| Slovenia | 61.05 | 2.892 | 1.032 | 0.058 | 0.988 | 0.143 | 1.040 | 0.095 | 0.772 | 0.129 | 1.006 | 0.062 | 0.892 | 0.103 |

| South Africa | 44.9 | 2.404 | 0.633 | 0.043 | −0.118 | 0.140 | 0.440 | 0.135 | 0.420 | 0.203 | 0.086 | 0.099 | 0.158 | 0.201 |

| Spain | 63.25 | 4.655 | 1.105 | 0.100 | 0.057 | 0.285 | 1.152 | 0.289 | 1.082 | 0.196 | 1.093 | 0.108 | 1.001 | 0.293 |

| Sweden | 89.5 | 3.364 | 1.573 | 0.066 | 1.153 | 0.154 | 1.870 | 0.150 | 1.724 | 0.135 | 1.908 | 0.064 | 2.185 | 0.064 |

| Switzerland | 87.2 | 2.441 | 1.553 | 0.063 | 1.304 | 0.089 | 1.979 | 0.102 | 1.678 | 0.116 | 1.871 | 0.079 | 2.072 | 0.059 |

| Thailand | 35.45 | 1.700 | −0.524 | 0.426 | −0.885 | 0.472 | 0.314 | 0.071 | 0.221 | 0.089 | −0.031 | 0.161 | −0.352 | 0.084 |

| Tunisia | 43.4 | 3.470 | −0.500 | 0.686 | −0.380 | 0.520 | 0.151 | 0.297 | −0.199 | 0.204 | −0.005 | 0.105 | −0.086 | 0.161 |

| Turkey | 40.5 | 5.246 | −0.300 | 0.313 | −1.098 | 0.381 | 0.180 | 0.147 | 0.213 | 0.153 | −0.030 | 0.170 | −0.101 | 0.190 |

| UAE | 64.8 | 6.109 | −0.957 | 0.158 | 0.805 | 0.129 | 1.092 | 0.291 | 0.779 | 0.246 | 0.582 | 0.199 | 1.070 | 0.115 |

| UK | 80.4 | 4.235 | 1.335 | 0.079 | 0.395 | 0.179 | 1.623 | 0.143 | 1.721 | 0.101 | 1.696 | 0.088 | 1.795 | 0.133 |

| US | 72.85 | 2.833 | 1.123 | 0.133 | 0.356 | 0.264 | 1.548 | 0.095 | 1.463 | 0.143 | 1.570 | 0.076 | 1.418 | 0.212 |

| Full Sample | 58.384 | 20.437 | 0.638 | 0.902 | 0.355 | 0.847 | 0.892 | 0.769 | 0.861 | 0.738 | 0.787 | 0.883 | 0.757 | 0.982 |

| 1 | 2 | 3 | 4 | 5 | 6 | 7 | 8 | 9 | 10 | 11 | 12 | 13 | 14 | ||

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

| 1 | FDI | 1.000 | |||||||||||||

| 2 | RGDPpc | 0.186 *** | 1.000 | ||||||||||||

| 3 | POP | −0.140 *** | −0.131 *** | 1.000 | |||||||||||

| 4 | LPI | 0.138 *** | 0.744 *** | 0.125 *** | 1.000 | ||||||||||

| 5 | FD | 0.136 *** | 0.636 *** | 0.068 *** | 0.776 *** | 1.000 | |||||||||

| 6 | FUEL | 0.119 *** | 0.070 *** | −0.267 *** | −0.131 *** | −0.127 *** | 1.000 | ||||||||

| 7 | ORME | 0.267 *** | −0.084 *** | −0.438 *** | −0.154 *** | −0.035 | −0.095 *** | 1.000 | |||||||

| 8 | CPI | 0.107 *** | 0.840 *** | −0.156 *** | 0.732 *** | 0.602 *** | −0.110 *** | 0.037 | 1.000 | ||||||

| 9 | VAA | 0.035 | 0.556 *** | −0.059 * | 0.478 *** | 0.393 *** | −0.474 *** | 0.111 *** | 0.673 *** | 1.000 | |||||

| 10 | PS | 0.014 | 0.765 *** | −0.103 *** | 0.566 *** | 0.359 *** | −0.141 *** | −0.018 | 0.772 *** | 0.663 *** | 1.000 | ||||

| 11 | GE | 0.106 *** | 0.805 *** | −0.058 * | 0.775 *** | 0.618 *** | −0.190 *** | −0.030 | 0.921 *** | 0.725 *** | 0.814 *** | 1.000 | |||

| 12 | RQ | 0.123 *** | 0.779 *** | −0.092 *** | 0.667 *** | 0.526 *** | −0.223 *** | 0.059 * | 0.864 *** | 0.787 *** | 0.806 *** | 0.913 *** | 1.000 | ||

| 13 | RL | 0.095 *** | 0.814 *** | −0.075 ** | 0.722 *** | 0.590 *** | −0.191 *** | 0.004 | 0.928 *** | 0.776 *** | 0.839 *** | 0.958 *** | 0.937 *** | 1.000 | |

| 14 | CC | 0.091 *** | 0.832 *** | −0.150 *** | 0.724 *** | 0.584 *** | −0.135 *** | 0.057 * | 0.968 *** | 0.733 *** | 0.808 *** | 0.948 *** | 0.908 *** | 0.961 *** | 1.000 |

Appendix B

References

- Findlay, R. Relative Backwardness, Direct Foreign Investment, and The Transfer of Technology: A Simple Dynamic Model. Q. J. Econ. 1978, 92, 1–16. [Google Scholar] [CrossRef]

- Borensztein, E.; De Gregorio, J.; Lee, J.W. How Does Foreign Direct Investment Affect Economic Growth? J. Int. Econ. 1998, 45, 115–135. [Google Scholar] [CrossRef]

- Makki, S.; Somwaru, A. Impact of Foreign Direct Investment and Trade on Economic Growth: Evidence from Developing Countries. Am. J. Agric. Econ. 2004, 86, 795–801. [Google Scholar] [CrossRef]

- Herzer, D.; Klasen, S.; Nowak-Lehmann, D.F. In Search of FDI-led Growth in Developing Countries. The Way Forward. Econ. Model. 2008, 25, 793–810. [Google Scholar] [CrossRef]

- Hayat, A. FDI and Economic Growth: The Role of Natural Resources? J. Econ. Stud. 2018, 45, 283–295. [Google Scholar] [CrossRef]

- Miao, M.; Borojo, D.G.; Yushi, J.; Desalegn, T.A.; McMillan, D. The Impacts of Chinese FDI on Domestic Investment and Economic Growth for Africa. Cogent Bus. Manag. 2021, 8, 1–28. [Google Scholar] [CrossRef]

- Osei, M.J.; Kim, J. Foreign Direct Investment and Economic Growth: Is More Financial Development Better? Econ. Model. 2020, 93, 154–161. [Google Scholar] [CrossRef]

- Younsi, M.; Bechtini, M.; Khemili, H. The Effects of Foreign Aid, Foreign Direct Investment and Domestic Investment on Economic Growth in African Countries: Nonlinearities and Complementarities. Afr. Dev. Rev. 2021, 33, 55–66. [Google Scholar] [CrossRef]

- World Investment Report 2018. Investment and New Industrial Policies. UNCTAD. World Investment Report 2018. Available online: http://worldinvestmentreport.unctad.org/world-investment-report-2018 (accessed on 16 November 2022).

- Asongu, S. Financial Development Dynamic Thresholds of Financial Globalization: Evidence from Africa. J. Econ. Stud. 2014, 41, 166–195. [Google Scholar] [CrossRef]

- Adams, S.; Opoku, E.E.O. Foreign Direct Investment, Regulations and Growth in Sub-Saharan Africa. Econ. Anal. Policy 2015, 47, 48–56. [Google Scholar] [CrossRef]

- World Investment Report 2020. International Production Beyond the Pandemic. UNCTAD. World Investment Report 2020. Available online: https://unctad.org/webflyer/world-investment-report-2020 (accessed on 16 November 2022).

- World Investment Report 2022. International Tax Reforms and Sustainable Investment. UNCTAD. World Investment Report 2022. Available online: https://unctad.org/webflyer/world-investment-report-2022 (accessed on 16 November 2022).

- Anil, İ.; Armutlulu, I.; Canel, C.; Porterfield, R. The Determinants of Turkish Outward Foreign Direct Investment. Mod. Econ. 2011, 2, 717–728. [Google Scholar] [CrossRef]

- Ezeoha, A.; Cattaneo, N. FDI Flows to Sub-Saharan Africa: The Impact of Finance, Institutions, and Natural Resource Endowment. Comp. Econ. Stud. 2012, 54, 597–632. [Google Scholar] [CrossRef]

- Wang, X.Y. Natural Resource Endowment, Institutional Endowment and China’s Direct Investment in ASEAN. World Econ. 2018, 8, 123–134. [Google Scholar] [CrossRef]

- Heavilin, J.; Songur, H. Institutional Distance and Turkey’s Outward Foreign Direct Investment. Res. Int. Bus. Financ. 2020, 54, 1–16. [Google Scholar] [CrossRef]

- Daude, C.; Stein, E. The Quality of Institutions and Foreign Direct Investment. Econ. Politics 2007, 19, 317–344. [Google Scholar] [CrossRef]

- Bénassy-Quéré, A.; Coupet, M.; Mayer, T. Institutional Determinants of Foreign Direct Investment. World Econ. 2007, 30, 764–782. [Google Scholar] [CrossRef]

- Busse, M.; Hefeker, C. Political risk, Institutions and Foreign Direct Investment. Eur. J. Political Econ. 2007, 23, 397–415. [Google Scholar] [CrossRef]

- Bellos, S.; Subasat, T. Governance and Foreign Direct Investment: A Panel Gravity Model Approach. Int. Rev. Appl. Econ. 2012, 26, 303–328. [Google Scholar] [CrossRef]

- Bannaga, A.; Gangi, Y.; Abdrazak, R.; Al Fakhry, B. The Effects of Good Governance on Foreign Direct Investment Inflows in Arab Countries. Appl. Financ. Econ. 2013, 23, 1239–1247. [Google Scholar] [CrossRef]

- Aleksynska, M.; Havrylchyk, O. FDI from The South: The Role of Institutional Distance and Natural Resources. Eur. J. Political Econ. 2013, 29, 38–53. [Google Scholar] [CrossRef]

- Wegenast, T. Opening Pandora’s Box? Inclusive Institutions and The Onset of Internal Conflict in Oil-Rich Countries. Int. Political Sci. Rev. 2013, 34, 392–410. [Google Scholar] [CrossRef]

- Eregha, P.B.; Mesagan, E.P. Oil Resource Abundance, Institutions and Growth: Evidence from Oil Producing African Countries. J. Policy Model. 2016, 38, 603–619. [Google Scholar] [CrossRef]

- Muhammad, B.; Khan, M.K. Do Institutional Quality and Natural Resources Affect the Outward Foreign Direct Investment of G7 Countries? J. Knowl. Econ. 2023, 14, 116–137. [Google Scholar] [CrossRef]

- Kaur, M.; Yadav, S.S.; Gautam, V. Financial System Development and Foreign Direct Investment: A Panel Data Study for BRIC Countries. Glob. Bus. Rev. 2013, 14, 729–742. [Google Scholar] [CrossRef]

- Varnamkhasti, J.G.; Mehregan, N.; Najarzadeh, R.; Hosseini-Nasab, E. Financial Development as a Key Determinant of FDI Inflow to Developing Countries. Int. J. Humanit. Soc. 2015, 22, 1–28. [Google Scholar]

- Desbordes, R.; Wei, S.-J. The Effects of Financial Development on Foreign Direct Investment. J. Dev. Econ. 2017, 127, 153–168. [Google Scholar] [CrossRef]

- Donaubauera, J.; Neumayerb, E.; Nunnenkamp, P. Financial Market Development in Host and Source Countries and Their Effects on Bilateral Foreign Direct Investment. World Econ. 2020, 43, 534–556. [Google Scholar] [CrossRef]

- Dunning, J.H. Determinants of Foreign Direct Investment: Globalization Induced Changes and the Roles of FDI Policies. A Background Paper for the Annual Bank Conference on Development Economics Held in Oslo; World Bank: Washington, DC, USA, 2002. [Google Scholar]

- Kaufmann, D.; Kraay, A.; Mastruzzi, M. The Worldwide Governance Indicators: Methodology and Analytical Issues. Hague J. Rule Law 2011, 3, 220–246. [Google Scholar] [CrossRef]

- Huang, C.-J. Is Corruption Bad for Economic Growth? Evidence from Asia-Pacific Countries. N. Am. J. Econ. Financ. 2016, 35, 247–256. [Google Scholar] [CrossRef]

- Liu, X. Corruption Culture and Corporate Misconduct. J. Financ. Econ. 2016, 122, 307–327. [Google Scholar] [CrossRef]

- Beysenbaev, R.; Dus, Y. Proposals for Improving the Logistics Performance Index. Asian J. Shipp. Logist. 2020, 36, 34–42. [Google Scholar] [CrossRef]

- Wiederer, C.K.; Arvis, J.F.; Ojala, L.M.; Kiiski, T.M.M. The World Bank’s Logistics Performance Index. In International Encyclopedia of Transportation; Elsevier: Amsterdam, The Netherlands, 2021; pp. 94–101. [Google Scholar] [CrossRef]

- Svirydzenka, K. Introducing a New Broad-Based Index of Financial Development. IMF Working Paper 16/5. 2016. Available online: https://www.researchgate.net/publication/298912171_Introducing_a_New_Broad-based_Index_of_Financial_Development (accessed on 13 October 2022).

- Le, A.H.; Kim, T. The Impact of Institutional Quality on FDI Inflows: The Evidence from Capital Outflow of Asian Economies. J. Asian Financ. Econ. Bus. 2021, 8, 335–343. [Google Scholar] [CrossRef]

- Habib, M.; Zurawicki, L. Corruption and Foreign Direct Investment. Int. J. Bus. Stud. 2002, 33, 291–307. [Google Scholar] [CrossRef]

- Younsi, M.; Bechtini, M. Does Good Governance Matter for FDI? New Evidence from Emerging Countries Using a Static and Dynamic Panel Gravity Model Approach. Econ. Transit. Institutional Change 2020, 27, 841–860. [Google Scholar] [CrossRef]

- Kamal, M.A.; Hasanat Shah, S.; Jing, W.; Hasnat, H. Does The Quality of Institutions in Host Countries Affect the Location Choice of Chinese OFDI: Evidence from Asia and Africa? Emerg. Mark. Financ. Trade 2020, 56, 208–227. [Google Scholar] [CrossRef]

- Qi, C.; Zou, C. The quality of the host country system institutional distance and China’s foreign direct investment location. J. Contemp. Account. Econ. 2013, 7, 100–110. [Google Scholar]

- Tomio, B.T.; Amal, M. Institutional Distance and Brazilian Outward Foreign Direct Investment. M@n@gement 2015, 18, 78–101. [Google Scholar] [CrossRef]

- Zhang, L.; Xu, Z. How Do Cultural and Institutional Distance Affect China’s OFDI towards the OBOR Countries? Balt. J. Eur. Stud. 2017, 7, 24–42. [Google Scholar] [CrossRef][Green Version]

- Li, C.; Luo, Y.; De Vita, G. Institutional Difference and Outward FDI: Evidence from China. Empir. Econ. 2020, 58, 1837–1862. [Google Scholar] [CrossRef]

- Buckley, P.J.; Clegg, L.J.; Cross, A.R.; Liu, X.; Voss, H.; Zheng, P. The Determinants of Chinese Outward Foreign Direct Investment. J. Int. Bus. Stud. 2007, 38, 499–518. [Google Scholar] [CrossRef]

- Mengistu, A.A.; Adhikary, B.K. Does Good Governance Matter for FDI Inflows? Evidence from Asian Economies. Asia Pac. Bus. Rev. 2012, 17, 281–299. [Google Scholar] [CrossRef]

- Subasat, T.; Bellos, S. Governance and Foreign Direct Investment in Latin America: A panel Gravity Model Approach. Lat. Am. J. Econ. 2013, 50, 107–131. [Google Scholar] [CrossRef]

- Hossain, S.; Rahman, Z. Does Governance Facilitate Foreign Direct Investment in Developing Countries? Int. J. Econ. Financ. Issues 2017, 7, 164–177. [Google Scholar]

- Bouchoucha, N.; Benammou, S. Does Institutional Quality Matter Foreign Direct Investment? Evidence from African Countries. J. Knowl. Econ. 2020, 11, 390–404. [Google Scholar] [CrossRef]

- Feng, L.; Ge, L.; Li, Z.; Li, C.-Y. Financial Development and Natural Resources: The Dynamics of China’s Outward FDI. World Econ. 2021, 45, 739–762. [Google Scholar] [CrossRef]

- Kinda, T. Increasing Private Capital Flows to Developing Countries: The Role of Physical and Financial Infrastructure in 58 Countries, 1970–2003. Appl. Econ. Int. Dev. 2010, 10, 57–72. [Google Scholar]

- Agbloyor, E.K.; Abor, J.; Adjasi, C.K.D.; Yawson, A. Exploring the Causality Links between Financial Markets and Foreign Direct Investment in Africa. Res. Int. Bus. Financ. 2013, 28, 118–134. [Google Scholar] [CrossRef]

- Otchere, I.; Soumaré, I.; Yourougou, P. FDI and Financial Market Development in Africa. World Econ. 2016, 39, 651–678. [Google Scholar] [CrossRef]

- Soumaré, I.; Tchana, F.T. Causality between FDI and Financial Market Development: Evidence from Emerging Markets. World Bank Econ. Rev. 2015, 29, S205–S216. [Google Scholar] [CrossRef]

- Islam, M.A.; Khan, M.A.; Popp, J.; Sroka, W.; Oláh, J. Financial Development and Foreign Direct Investment—The Moderating Role of Quality Institutions. Sustainability 2020, 12, 3556. [Google Scholar] [CrossRef]

- Irandoust, M. FDI and Financial Development: Evidence from Eight Post-communist Countries. J. Stud. Econ. Econom. 2021, 45, 102–116. [Google Scholar] [CrossRef]

- OECD. Organization for Economic Cooperation and Development. 2022. Available online: https://data.oecd.org/fdi/inward-fdistocks-by-partner-country.htm#indicator-chart (accessed on 10 October 2022).

- Kang, Y.; Jiang, F. FDI Location Choice of Chinese Multinationals in East and Southeast Asia: Traditional Economic Factors and Institutional Perspective. J. World Bus. 2012, 47, 45–53. [Google Scholar] [CrossRef]

- Kunčić, A.; Jaklić, A. FDI and Institutions: Formal and Informal Institutions. Multinational Enterprises, Markets and Institutional Diversity. Emerald Group Publishing Limited. Prog. Int. Bus. Res. 2014, 9, 171–205. [Google Scholar] [CrossRef]

- Gao, C.; Wen, Y.; Yang, D. Governance, Financial Development and China’s Outward Foreign Direct Investment. PLoS ONE 2022, 17, e0270581. [Google Scholar] [CrossRef]

- WDI. World Development Indicators. World Bank: Washington, DC, USA, 2022. Available online: https://dabank.worldbank.org/source/world-development-indicators (accessed on 13 October 2022).

- WGI. Worldwide Governance Indicators. World Bank: Washington, DC, USA, 2022. Available online: https://www.govindicators.org/ (accessed on 15 October 2022).

- Gani, A. Governance and Foreign Direct Investment links: Evidence from Panel Data Estimations. Appl. Econ. Lett. 2007, 14, 753–756. [Google Scholar] [CrossRef]

- Kolstad, I.; Wiig, A. What Determines Chinese Outward FDI? J. World Bus. 2012, 47, 26–34. [Google Scholar] [CrossRef]

- Méon, P.-G.; Weill, L. Is Corruption an Efficient Grease? World Dev. 2010, 38, 244–259. [Google Scholar] [CrossRef]

- Barassi, M.R.; Zhou, Y. The Effect of Corruption on FDI: A Parametric and Non-parametric Analysis. Eur. J. Political Econ. 2018, 28, 302–312. [Google Scholar] [CrossRef]

- Transparency International. Corruption Perception Index. 2022. Available online: https://www.transparency.org/en/cpi/2021 (accessed on 23 October 2022).

- Baltagi, B.H.; Egger, P.; Pfaffermayr, M. Estimating Models of Complex FDI: Are There Third-country Effects? J. Econom. 2007, 140, 260–281. [Google Scholar] [CrossRef]

- Desbordes, R.; Vicard, V. Foreign Direct Investment and Bilateral Investment Treaties: An International Political Perspective. J. Comp. Econ. 2009, 37, 372–386. [Google Scholar] [CrossRef]

- Guerin, S.S.; Manzocchi, S. Political Regime and FDI from Advanced to Emerging Countries. Rev. World Econ. 2009, 145, 75–91. [Google Scholar] [CrossRef]

- Egger, P. Bilateral FDI Potentials for Austria. Empirica 2010, 37, 5–17. [Google Scholar] [CrossRef][Green Version]

- Kahouli, B.; Maktouf, S. The Determinants of FDI and The Impact of The Economic Crisis on The Implementation of RTAs: A Static and Dynamic Gravity Model. Int. Bus. Rev. 2015, 24, 518–529. [Google Scholar] [CrossRef]

- Shi, E.Y.; Zhang, H.W. OFDI Motivation, Financial Development Difference and Export Trade. World Econ. Stud. 2018, 8, 74–87. [Google Scholar] [CrossRef]

- Aibai, A.; Huang, X.; Luo, Y.; Peng, Y. Foreign Direct Investment, Institutional Quality, and Financial Development along the Belt and Road: An Empirical Investigation. Emerg. Mark. Financ. Trade 2019, 55, 3275–3294. [Google Scholar] [CrossRef]

- Arellano, M.; Bover, O. Another Look at The Instrumental Variable Estimation of Error-components Models. J. Econom. 1995, 68, 29–51. [Google Scholar] [CrossRef]

- Blundell, R.; Bond, S. Initial Conditions and Moment Restrictions in Dynamic Panel Data Models. J. Econom. 1998, 87, 115–143. [Google Scholar] [CrossRef]

- Arellano, M.; Bond, S. Some Tests of Specification for Panel Data: Monte Carlo Evidence and an Application to Employment Equations. Rev. Econ. Stud. 1991, 58, 277–297. [Google Scholar] [CrossRef]

- Hansen, L. Large Sample Properties of Generalized Method of Moments Estimators. Econometrica 1982, 50, 1029–1054. [Google Scholar] [CrossRef]

- Heuchemer, S.; Kleimeier, S.; Sander, H. The Determinants of Cross-Border Lending in The Euro Zone. Comp. Econ. Stud. 2009, 51, 467–499. [Google Scholar] [CrossRef]

- Mishra, B.R.; Jena, P.K. Bilateral FDI Flows in Four Major Asian Economies: A Gravity Model Analysis. J. Econ. Stud. 2019, 46, 71–89. [Google Scholar] [CrossRef]

- Gangi, Y.A.; Abdulrazak, R.S. The Impact of Governance on FDI Flows to African Countries. World J. Entrep. Manag. Sustain. Dev. 2012, 8, 162–169. [Google Scholar] [CrossRef]

| Variables | (1) | (2) | (3) | (4) | (5) | (6) | (7) | (8) |

|---|---|---|---|---|---|---|---|---|

| CPI | VAA | PS | GE | RQ | RL | CC | ID | |

| lnFDI(t−1) | 0.251 *** | 0.196 *** | 0.201 *** | 0.263 *** | 0.278 *** | 0.246 *** | 0.250 *** | 0.247 *** |

| (0.026) | (0.025) | (0.025) | (0.028) | (0.030) | (0.028) | (0.026) | (0.025) | |

| lnRGDPpc | 0.823 *** | 0.798 *** | 0.876 *** | 0.785 *** | 0.749 *** | 0.835 *** | 0.804 *** | 0.794 *** |

| (0.078) | (0.079) | (0.080) | (0.070) | (0.073) | (0.076) | (0.072) | (0.051) | |

| lnPOP | 0.565 *** | 0.578 *** | 0.559 *** | 0.515 *** | 0.542 *** | 0.548 *** | 0.521 *** | 0.527 *** |

| (0.032) | (0.032) | (0.026) | (0.027) | (0.030) | (0.032) | (0.027) | (0.025) | |

| lnDIST | −0.625 *** | −0.572 *** | −0.585 *** | −0.588 *** | −0.576 *** | −0.675 *** | −0.582 *** | −0.605 *** |

| (0.036) | (0.083) | (0.064) | (0.092) | (0.083) | (0.085) | (0.073) | (0.045) | |

| LPI | 0.214 *** | 0.272 *** | 0.196 *** | 0.235 *** | 0.263 *** | 0.205 *** | 0.241 *** | 0.234 *** |

| (0.045) | (0.055) | (0.042) | (0.041) | (0.045) | (0.045) | (0.038) | (0.040) | |

| FD | 1.021 ** | 1.402 *** | 1.538 *** | 0.946 ** | 0.254 ** | 0.955 ** | 1.137 *** | 0.968 ** |

| (0.438) | (0.472) | (0.465) | (0.454) | (0.468) | (0.442) | (0.415) | (0.426) | |

| CPI | 5.551 *** | |||||||

| (1.980) | ||||||||

| FD × CPI | 0.735 ** | |||||||

| (0.282) | ||||||||

| VAA | 7.667 *** | |||||||

| (1.832) | ||||||||

| FD × VAA | 0.665 ** | |||||||

| (0.298) | ||||||||

| PS | 4.985 *** | |||||||

| (1.526) | ||||||||

| FD × PS | 0.581 ** | |||||||

| (0.265) | ||||||||

| GE | 5.713 *** | |||||||

| (2.225) | ||||||||

| FD × GE | 0.628 ** | |||||||

| (0.272) | ||||||||

| RQ | 6.572 *** | |||||||

| (2.936) | ||||||||

| FD × RQ | 0.428 ** | |||||||

| (0.313) | ||||||||

| RL | 7.791 *** | |||||||

| (2.858) | ||||||||

| FD × RL | 0.862 *** | |||||||

| (0.295) | ||||||||

| CC | 6.972 *** | |||||||

| (2.796) | ||||||||

| FD × CC | 1.164 *** | |||||||

| (0.280) | ||||||||

| ID | 5.348 ** | |||||||

| (1.925) | ||||||||

| FD × ID | 0.616 *** | |||||||

| (0.231) | ||||||||

| Constant | 28.758 *** | 30.648 *** | 27.845 *** | 29.351 *** | 31.294 *** | 30.145 *** | 28.935 *** | 28.861 |

| (5.785) | (6.372) | (5.138) | (5.249) | (6.273) | (6.231) | (5.562) | (5.495) | |

| Year Dummy | Yes | Yes | Yes | Yes | Yes | Yes | Yes | Yes |

| AR(2) test (p-value) | 0.935 | 0.652 | 0.564 | 0.938 | 0.793 | 0.911 | 0.981 | 0.798 |

| Hansen test (p-value) | 0.188 | 0.165 | 0.167 | 0.175 | 0.169 | 0.172 | 0.181 | 0.178 |

| Observations | 7280 | 7280 | 7280 | 7280 | 7280 | 7280 | 7280 | 7280 |

| Groups | 364 | 364 | 364 | 364 | 364 | 364 | 364 | 364 |

| Variables | (1) | (2) | (3) | (4) | (5) | (6) | (7) | (8) |

|---|---|---|---|---|---|---|---|---|

| CPI | CPI | VAA | VAA | PS | PS | GE | GE | |

| lnFDI(t − 1) | 0.172 *** | 0.148 *** | 0.150 *** | 0.114 *** | 0.163 *** | 0.136 *** | 0.175 *** | 0.131 *** |

| (0.035) | (0.035) | (0.035) | (0.035) | (0.035) | (0.035) | (0.035) | (0.035) | |

| lnRGDPpc | 0.185 * | 0.964 ** | 4.172 *** | 3.825 *** | 0.224 * | 0.959 ** | 0.336 * | 1.728 *** |

| (0.356) | (0.385) | (0.661) | (0.559) | (0.336) | (0.354) | (0.392) | (0.399) | |

| lnPOP | 0.345 *** | 0.419 *** | 0.580 *** | 0.585 *** | 0.205 | 0.515 *** | 0.362 *** | 0.576 ** |

| (0.135) | (0.132) | (0.245) | (0.228) | (0.351) | (0.122) | (0.129) | (0.127) | |

| lnDIST | −0.589 *** | −0.632 *** | −0.576 *** | −0.591 *** | −0.563 *** | −0.568 *** | −0.546 *** | −0.564 *** |

| (0.040) | (0.040) | (0.041) | (0.041) | (0.041) | (0.041) | (0.042) | (0.041) | |

| LPI | 0.185 *** | 0.176 *** | 0.321 *** | 0.302 *** | 0.342 *** | 0.315 *** | 0.251 *** | 0.232 *** |

| (0.065) | (0.076) | (0.082) | (0.091) | (0.071) | (0.070) | (0.061) | (0.045) | |

| FUEL | 1.051 *** | 0.595 *** | 0.383 *** | 0.985 *** | ||||

| (0.280) | (0.169) | (0.222) | (0.208) | |||||

| ORME | 4.251 *** | 3.184 *** | 2.097 *** | 5.181 *** | ||||

| (1.064) | (0.588) | (0.226) | (0.791) | |||||

| CPI | 0.092 *** | 0.201 *** | ||||||

| (0.023) | (0.035) | |||||||

| FUEL × CPI | −0.015 *** | |||||||

| (0.003) | ||||||||

| ORME × CPI | −0.081 *** | |||||||

| (0.012) | ||||||||

| VAA | 4.685 *** | 6.792 *** | ||||||

| (0.796) | (0.958) | |||||||

| FUEL × VAA | −0.422 *** | |||||||

| (0.110) | ||||||||

| ORME × VAA | −3.205 *** | |||||||

| (0.398) | ||||||||

| PS | 2.613 *** | 4.654 *** | ||||||

| (0.510) | (0.728) | |||||||

| FUEL × PS | −0.389 *** | |||||||

| (0.048) | ||||||||

| ORME × PS | −2.041 *** | |||||||

| (0.212) | ||||||||

| GE | 2.961 *** | 5.203 *** | ||||||

| (0.575) | (0.996) | |||||||

| FUEL × GE | −0.590 *** | |||||||

| (0.127) | ||||||||

| ORME × GE | −3.256 *** | |||||||

| (0.442) | ||||||||

| Constant | −5.672 | −8.323 * | 28.165 *** | 30.658 *** | −2.095 | −0.312 | −3.105 | −4.513 |

| (5.178) | (4.805) | (6.732) | (6.741) | (4.686) | (4.572) | (5.565) | (5.032) | |

| Year Dummy | Yes | Yes | Yes | Yes | Yes | Yes | Yes | Yes |

| AR(2) test (p-value) | 0.856 | 0.820 | 0.575 | 0.526 | 0.754 | 0.551 | 0.689 | 0.872 |

| Hansen test (p-value) | 0.185 | 0.177 | 0.169 | 0.180 | 0.167 | 0.168 | 0.172 | 0.175 |

| Observations | 7280 | 7280 | 7280 | 7280 | 7280 | 7280 | 7280 | 7280 |

| Groups | 364 | 364 | 364 | 364 | 364 | 364 | 364 | 364 |

| Variables | (9) | (10) | (11) | (12) | (13) | (14) | (15) | (16) |

| RQ | RQ | RL | RL | CC | CC | ID | ID | |

| RQ | 3.869 *** | 6.397 *** | ||||||

| (0.513) | (0.998) | |||||||

| FUEL × RQ | −0.794 *** | |||||||

| (0.086) | ||||||||

| ORME × RQ | −4.810 *** | |||||||

| (0.376) | ||||||||

| RL | 4.916 *** | 7.349 *** | ||||||

| (0.532) | (1.025) | |||||||

| FUEL × RL | −1.063 *** | |||||||

| (0.112) | ||||||||

| ORME × RL | −5.559 *** | |||||||

| (0.467) | ||||||||

| CC | 2.314 *** | 4.972 *** | ||||||

| (0.398) | (0.664) | |||||||

| FUEL × CC | −0.552 *** | |||||||

| (0.089) | ||||||||

| ORME × CC | −2.960 *** | |||||||

| (0.345) | ||||||||

| ID | 0.287 ** | 0.396 ** | ||||||

| (0.129) | (0.188) | |||||||

| FUEL × ID | −0.065 *** | |||||||

| (0.024) | ||||||||

| ORME × ID | −0.098 *** | |||||||

| (0.027) | ||||||||

| Constant | 13.823 ** | 28.548 *** | 22.375 *** | 22.354 *** | 18.357 ** | 20.148 *** | −29.563 *** | −30.351 *** |

| (5.368) | (5.624) | (5.692) | (5.476) | (5.766) | (5.354) | (5.547) | (5.945) | |

| Year Dummy | Yes | Yes | Yes | Yes | Yes | Yes | Yes | Yes |

| AR(2) test (p-value) | 0.780 | 0.552 | 0.658 | 0.760 | 0.645 | 0.521 | 0.702 | 0.716 |

| Hansen test (p-value) | 0.192 | 0.183 | 0.178 | 0.182 | 0.185 | 0.179 | 0.188 | 0.190 |

| Observations | 7280 | 7280 | 7280 | 7280 | 7280 | 7280 | 7280 | 7280 |

| Groups | 364 | 364 | 364 | 364 | 364 | 364 | 364 | 364 |

| Variables | (5) | (6) | (7) | |||

|---|---|---|---|---|---|---|

| Better | Worse | Better | Worse | Better | Worse | |

| lnFDI(t − 1) | 0.228 *** | 0.166 *** | 0.227 *** | 0.175 *** | 0.210 *** | 0.213 *** |

| (0.022) | (0.027) | (0.024) | (0.021) | (0.757) | (0.022) | |

| lnRGDPpc | 0.553 *** | 0.493 ** | 0.665 *** | 0.528 *** | 0.627 ** | 0.522 ** |

| (0.054) | (0.042) | (0.041) | (0.054) | (0.065) | (0.043) | |

| lnPOP | 0.505 *** | 0.564 *** | 0.524 *** | 0.559 *** | 0.527 *** | 0.525 *** |

| (0.026) | (0.031) | (0.034) | (0.032) | (0.029) | (0.024) | |

| lnDIST | −0.785 *** | −0.973 *** | −0.805 *** | −1.025 *** | −0.823 *** | −0.983 *** |

| (0.043) | (0.042) | (0.043) | (0.045) | (0.041) | (0.047) | |

| LPI | 0.026 ** | −0.035 ** | 0.042 ** | −0.082 ** | 0.061 ** | −0.065 ** |

| (0.030) | (0.033) | (0.022) | (0.034) | (0.027) | (0.028) | |

| FD | 1.458 *** | −0.185 *** | 3.586 *** | −2.789 ** | 2.102 *** | −1.391 *** |

| (0.228) | (1.160) | (0.754) | (1.375) | (0.712) | (0.516) | |

| FUEL | 2.872 *** | −3.382 ** | 2.636 *** | −2.498 ** | 2.937 *** | −3.937 ** |

| (0.375) | (0.764) | (0.370) | (2.237) | (0.243) | (1.243) | |

| ORME | 1.581 *** | −2.835 ** | 1.724 *** | −2.612 ** | 1.681 *** | −1.723 *** |

| (0.552) | (0.838) | (0.532) | (0.382) | (0.612) | (0.379) | |

| PosID | 1.018 *** | |||||

| (0.215) | ||||||

| PosID × FD | 0.053 | |||||

| (0.020) | ||||||

| NegID | −1.213 *** | |||||

| (0.265) | ||||||

| NegID × FD | 0.125 *** | |||||

| (0.034) | ||||||

| PosID | 0.738 *** | |||||

| (0.194) | ||||||

| PosID × FUEL | 0.051 | |||||

| (0.030) | ||||||

| NegID | −1.051 *** | |||||

| (0.210) | ||||||

| NegID × FUEL | 0.128 *** | |||||

| (0.023) | ||||||

| PosID | 1.245 *** | |||||

| (0.220) | ||||||

| PosID × ORME | 0.112 | |||||

| (0.031) | ||||||

| NegID | −1.852 *** | |||||

| (0.234) | ||||||

| NegID × ORME | 0.118 *** | |||||

| (0.020) | ||||||

| Constant | −58.554 *** | −35.759 *** | −54.363 *** | −32.345 *** | −18.588 *** | −18.595 *** |

| (9.625) | (5.285) | (9.492) | (7.862) | (6.466) | (5.845) | |

| Year Dummy | Yes | Yes | Yes | Yes | Yes | Yes |

| AR(2) test (p-value) | 0.688 | 0.532 | 0.656 | 0.542 | 0.551 | 0.528 |

| Hansen test (p-value) | 0.198 | 0.202 | 0.188 | 0.192 | 0.195 | 0.197 |

| Observations | 1015 | 1872 | 1045 | 1582 | 1061 | 2023 |

Disclaimer/Publisher’s Note: The statements, opinions and data contained in all publications are solely those of the individual author(s) and contributor(s) and not of MDPI and/or the editor(s). MDPI and/or the editor(s) disclaim responsibility for any injury to people or property resulting from any ideas, methods, instructions or products referred to in the content. |

© 2024 by the authors. Licensee MDPI, Basel, Switzerland. This article is an open access article distributed under the terms and conditions of the Creative Commons Attribution (CC BY) license (https://creativecommons.org/licenses/by/4.0/).

Share and Cite

Ben Belgacem, S.; Younsi, M.; Bechtini, M.; Alzuman, A.; Khalfaoui, R. Do Financial Development, Institutional Quality and Natural Resources Matter the Outward FDI of G7 Countries? A Panel Gravity Model Approach. Sustainability 2024, 16, 2237. https://doi.org/10.3390/su16062237

Ben Belgacem S, Younsi M, Bechtini M, Alzuman A, Khalfaoui R. Do Financial Development, Institutional Quality and Natural Resources Matter the Outward FDI of G7 Countries? A Panel Gravity Model Approach. Sustainability. 2024; 16(6):2237. https://doi.org/10.3390/su16062237

Chicago/Turabian StyleBen Belgacem, Samira, Moheddine Younsi, Marwa Bechtini, Abad Alzuman, and Rabeh Khalfaoui. 2024. "Do Financial Development, Institutional Quality and Natural Resources Matter the Outward FDI of G7 Countries? A Panel Gravity Model Approach" Sustainability 16, no. 6: 2237. https://doi.org/10.3390/su16062237

APA StyleBen Belgacem, S., Younsi, M., Bechtini, M., Alzuman, A., & Khalfaoui, R. (2024). Do Financial Development, Institutional Quality and Natural Resources Matter the Outward FDI of G7 Countries? A Panel Gravity Model Approach. Sustainability, 16(6), 2237. https://doi.org/10.3390/su16062237