Analysis of Business Risk Measurement and Factors Influencing Plantation-Based Farming Cooperatives: Evidence from Guizhou Province, China

Abstract

1. Introduction

2. Materials and Methods

2.1. Construction of an Assessment Indicator System for Business Risks

- Natural risk: There are many uncertainties and uncontrollable factors in agricultural operations, mostly due to their natural attributes. On one hand, extreme weather events such as droughts and floods are highly destructive to agricultural production and can easily lead to reduced crop yields; on the other hand, crops are susceptible to diseases or insect pests, which can harm the quality and yields of crops. Therefore, in this article, losses due to extreme whether events (including droughts and floods) or caused by diseases and insect pests are listed as natural risk indicators.

- Market risk: The plantation-based farming cooperative is a market entity, and its input and output are closely related to the market [40]. Therefore, losses due to the mismatch between agricultural produce and market demands, along with losses due to the fluctuations in produce market prices, are set as the specific indicators of market risk. Whether the produce meets market demands largely determines its market competitiveness, and fluctuations in produce prices have a major impact on the management efficiency of cooperatives, which can then affect the future operations and development of cooperatives.

- Management risk: Losses due to inexperienced managers and lack of innovation were selected as specific indicators for management risk. On one hand, cooperatives are mostly run by migrant workers who return home to start a business, larger growers, village cadres, and farmers, all of whom lack experience in operating cooperatives. This can easily cause management risk. On the other hand, innovation is the primary driving force for development, which requires cooperative managers to have a strong capability to innovate and an adventurous spirit. However, during the survey, we found that some of the managers are less educated, some are vulnerable due to their age, and some are stuck in the small farmer’s way of thinking. All of these managers lack the spirit of innovation, curbing the development of cooperatives.

- Technical risk: Losses due to the lack of agricultural technical personnel or caused by the mismatch between agricultural technologies and operating requirements were set as technical risk indicators. Science and technology constitute the primary productive forces. The application of agricultural technology requires technological professionals, and there is increasing demand for qualified technical personnel. However, due to poor infrastructure and low payment, there is an outflow of talent in rural areas, and it is difficult to recruit talent, leading to a lack of agricultural technical talent in rural areas and the possibility of technical risk. At the same time, whether technology can meet the operating requirements of cooperatives also determines the technical risk faced by cooperatives [41].

- Policy risk: Losses due to inadequate policy support and by financial difficulties were set as policy risk indicators. Policy support reflects how much attention the relevant departments pay to farming cooperatives, while financial status reflects whether the cooperative is well funded and if the relevant financing policies and mechanisms are sound. According to the survey, at present, China’s agricultural insurance still has problems, including imperfect mechanisms, limited scope of insurance coverage, and limited categories of insurance. The insurance demands of these cooperatives cannot be met. Furthermore, financial difficulties and unsound mechanisms also make it difficult for cooperatives to expand the scale of their operations, as well as bringing more business risks.

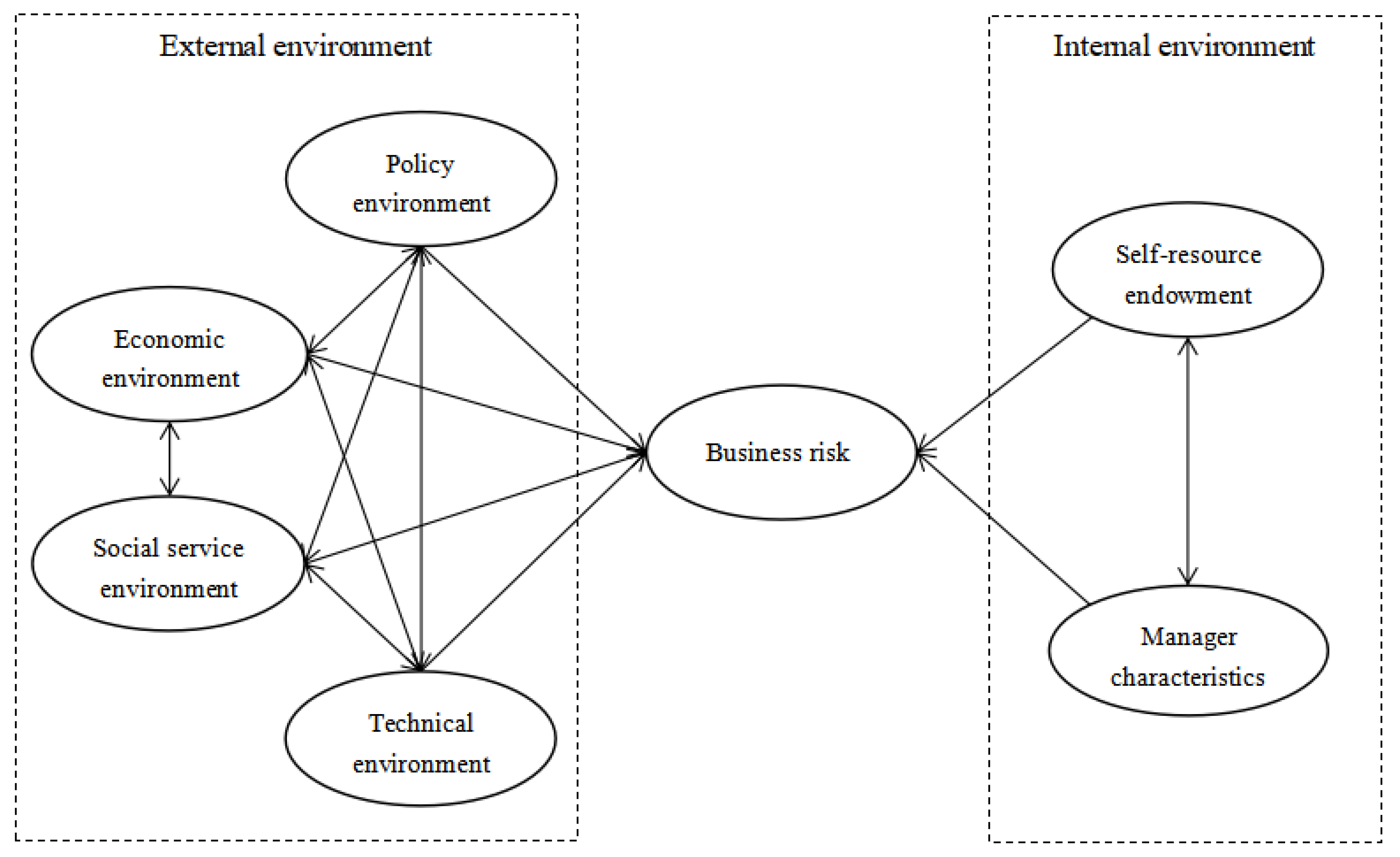

2.2. Latent Variables of Influencing Factors and Research Hypothesis

- Policy environment: The policy environment can effectively promote the development of emerging business entities, including cooperatives [42]. In recent years, China has been paying attention to the development of farmers’ cooperatives. In Several Opinions on Improving Farmer Cooperative Regulation, issued by the Ministry of Agriculture and Rural Affairs, as well as Financial Regulations of Farmers’ Professional Cooperative, jointly issued by the Ministry of Finance and the Ministry of Agriculture and Rural Affairs, it is stressed that farming cooperatives need to enjoy support in terms of fiscal projects, financial services, and talent support polices. At the provincial level, Guizhou Province has also introduced targeted measures to improve the development of farming cooperatives. The Department of Agriculture and Rural Affairs and other departments of Guizhou Province jointly formulated the Implementing Program for Jointly Improving High-quality Development of Farmer Cooperatives, Opinions on Promoting High-quality Development of Farmer Cooperatives, and other relevant documents, all of which play an important role in promoting the rapid development of local farming cooperatives. From a practical standpoint, the development of farming cooperatives cannot be divorced from the policy environment, laws, and regulations [43]. Government support for emerging agricultural entities is beneficial to agricultural resource allocation and good for entities to develop a comparative edge, thus gaining additional profits. Based on the above, this article puts forward the following hypothesis:

- 2.

- Economic environment: The economist Schultz believes that the economic environment has a significant impact on agricultural production [44]. Changes in the economic environment will directly affect decision-making behavior in agricultural production [45]. On one hand, produce prices and their stability are important factors that affect the development of cooperatives. Produce prices determine the willingness of plantations and the behavioral choices of the cooperative. A stable produce price is the foundation of a sustainable economy and market stability, and it is also the key factor in the adjustment of the cooperative’s product structure. On the other hand, whether or not it is easy to raise funds is also an important factor affecting the development of cooperatives. The range of financial institution types in rural areas is limited, the risk-sharing mechanism for agricultural loans is unsound, and cooperatives are short of collateral for loans. All of these factors have a negative impact on cooperatives’ scale of production and market management, increasing the business risk. Furthermore, the stability of marketing channels has a significant impact on agricultural operations. The more stable the marketing channel, the lower the business risk faced by cooperatives will become [46]. Based on the above, this article proposes the following hypothesis:

- 3.

- Social service environment: Social services are the basic path to improve agricultural efficiency [47]. The development of plantation-based farming cooperatives needs the support of agricultural social services that have wide coverage and are highly efficient. Effective social services can provide support for cooperatives in their operation and production, improve their capacity for development, and make them the foundation for connecting modern agriculture and agricultural economic organization. From the standpoint of institutional economics, outsourcing in agricultural production is a practice through which agricultural entities share land management rights with social service providers by buying the latter’s services. Such practices will definitely improve agricultural production efficiency and increase the economic benefits for agricultural entities [48]. Mechanized production can improve production efficiency and reduce production costs in agriculture, but the purchase and maintenance of agricultural machinery is very expensive. Therefore, the leasing of agricultural equipment is a good way to reduce costs and increase benefits for business entities. Logistics is important for the storage and transportation of agricultural products from production to consumption. Therefore, the social service environment has a major impact on agricultural operations and production. Based on the above, this article proposes the following hypothesis:

- 4.

- Technical environment: Agricultural technology is the primary driving force of agricultural development. Advanced productive forces can increase agricultural outputs, improve production efficiency, and increase managers’ incomes by reducing the cost of production. Advanced agricultural technology is also the main driver for promoting plantation-based farming cooperatives. The application of agricultural technology and employment of technical talents have major impacts on the production and operations of plantation-based farming cooperatives. Moreover, different geographical conditions and different crops have different technological requirements. Therefore, whether the technology meets the cooperatives’ operational requirements also has an impact on the business risk. Based on above, this article proposes the following hypothesis:

- 5.

- Self-resource endowment: In a market economy, the external environment will affect the business risk, and internal conditions are also a key factor for the successful operation of businesses [49]. The internal conditions of plantation-based farming cooperatives that can affect business risks mainly include the cooperative’s scale of operation, years in operation, and the level of industrial organization. According to existing research, scholars generally believe that the scale of land management has a major impact on the development of agricultural businesses. The larger the scale of operations, the higher the risk level [50]. The longer the years in operation, the better the operating efficiency and the lower the level of business risk [51]. Improving the level of industrial organization of cooperatives can not only reduce market transaction costs but also spread risks to other members of the organization, thus reducing the business risk faced by the entity itself [52]. Based on the above, the following hypothesis is proposed:

- 6.

- Manager characteristics: As the core members of cooperatives, managers’ business capabilities and managerial expertise are crucial to the development of cooperatives. Usually, managers with higher levels of education and knowledge tend to be more far-sighted. They are prone to running cooperatives through modern management methods and agricultural technology, and they tend to make operational decisions and solve problems via an economic way of thinking [53]. Furthermore, the age of managers has a major impact on their management philosophy and operational decisions. Younger managers tend to make risky and innovative decisions, while older managers are less advantaged in learning and making risky choices, which has an impact on their operations [54]. Finally, cooperatives’ operation is similar to that of an enterprise, so the leadership abilities of entrepreneurs—including firm enterprise belief, pioneering and innovative spirit, strong competitiveness, and tolerance—are also essential to the successful operation of cooperatives. Therefore, whether managers have an entrepreneurial spirit has an impact on the operation of cooperatives. Based on the above, the following hypothesis is proposed:

2.3. Variable Selection for Influencing Factors

2.4. Research Methods

2.4.1. Factor Analysis Method

2.4.2. Structural Equation Model

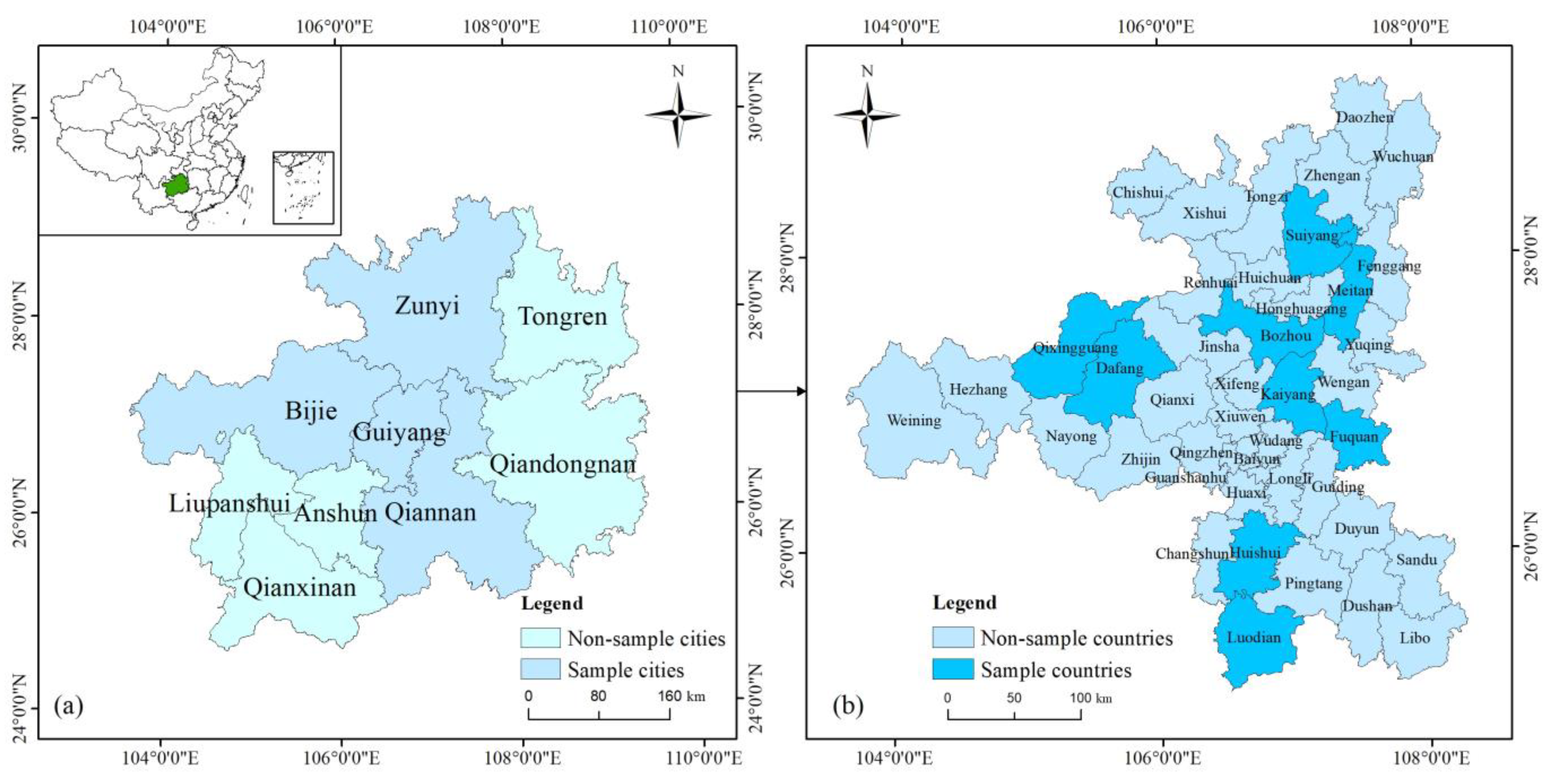

2.5. Data Sources

3. Results and Analysis

3.1. Measurement Analysis of the Business Risk Faced by Plantation-Based Farming Cooperatives

3.1.1. Validity and Reliability Testing

3.1.2. Factor Analysis

3.2. Analysis on the Factors Influencing the Business Risk Faced by Plantation-Based Farming Cooperatives

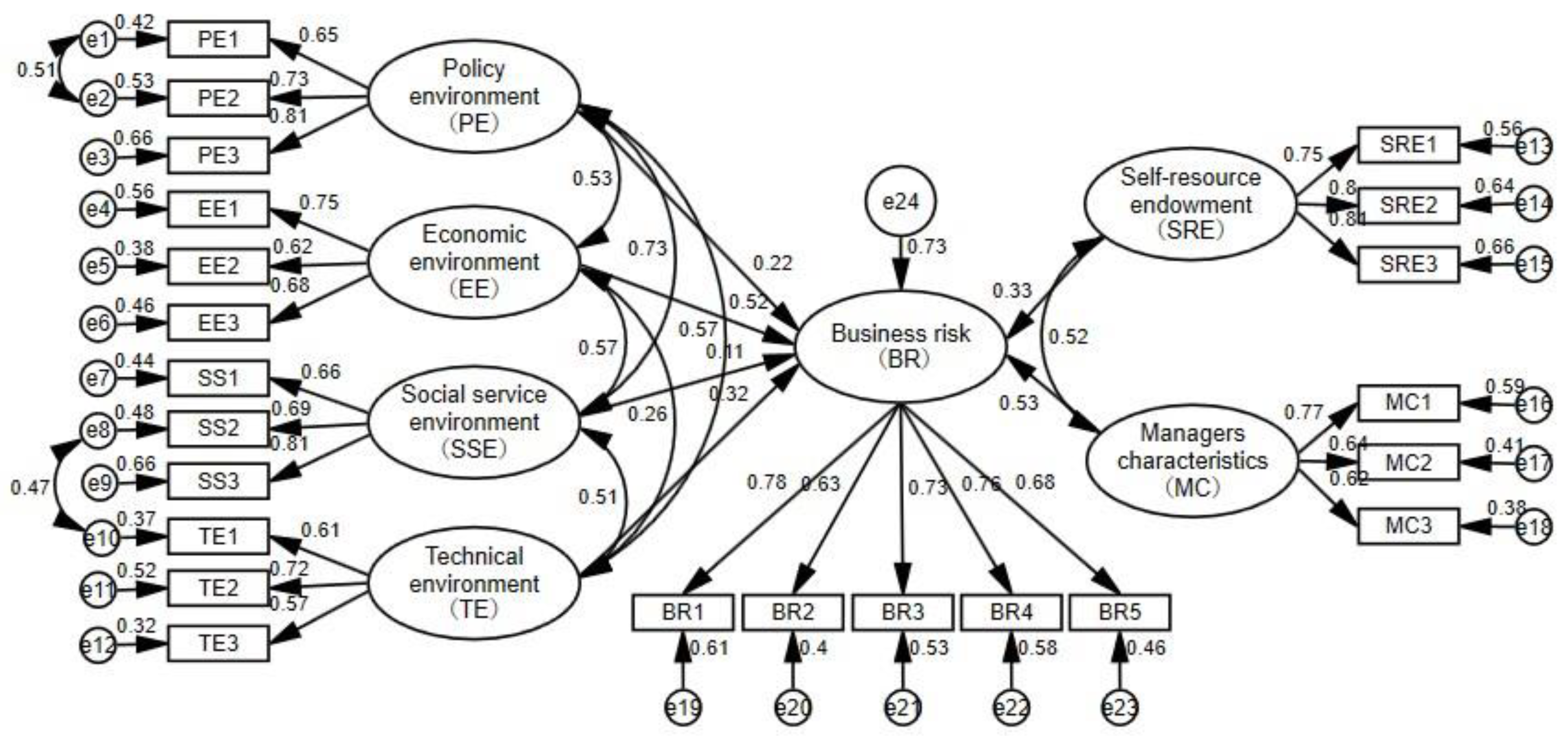

3.2.1. Reliability and Validity Testing

3.2.2. Model Fit Test

3.2.3. Hypothesis Testing of Factors Influencing Business Risk

3.2.4. Robustness Test

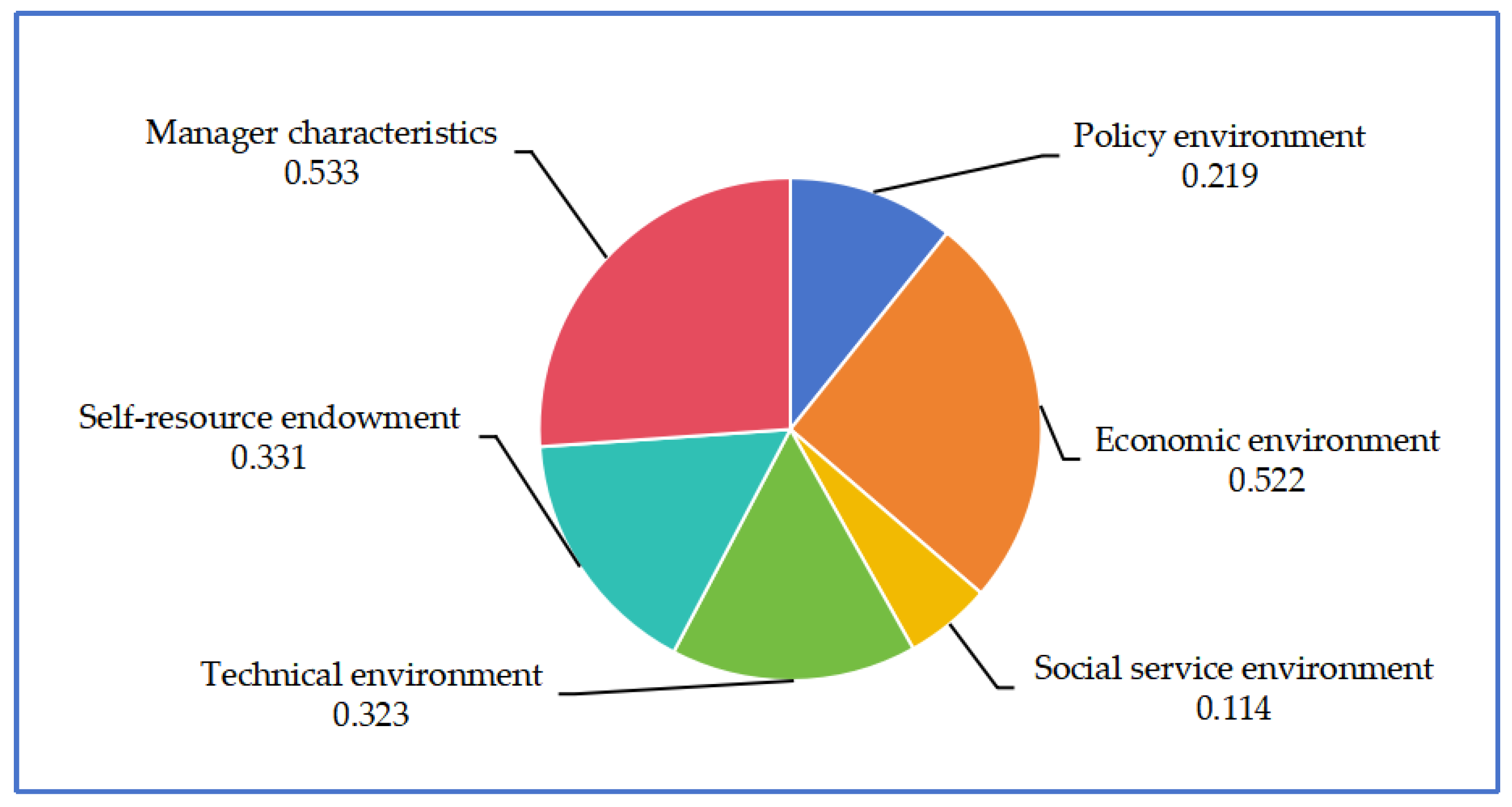

3.2.5. Analysis of Factors Influencing Business Risk

4. Conclusions

4.1. Research Conclusions

4.2. Policy Implications

4.3. Limitations and Further Study

Author Contributions

Funding

Institutional Review Board Statement

Informed Consent Statement

Data Availability Statement

Acknowledgments

Conflicts of Interest

References

- Liu, C.; Deng, M.; Ma, G.W. Research on Risk Identification and Prevention Countermeasures of Family Farm Management. J. Soochow Univ. Philos. Soc. Sci. Ed. 2019, 40, 102–110. [Google Scholar]

- Sun, Y.Y. Research on the Long-term Mechanism of Agricultural Enterprises’ Joint Development with Agriculture—Multi-case Analysis Based on the Perspective of Value Network. Rural. Econ. 2023, 4, 105–113. [Google Scholar]

- Qing, T.; Jiang, Y.F.; Zhu, R. Innovation and Value Promotion of Agriculture Land Transfer Mode—Taking the “Liangshan Cooperative” in Quzhou, Zhejiang Province as an Example. World Agric. 2023, 5, 116–124. [Google Scholar]

- Li, J.P.; Wang, J.P.; Zhou, Z.Y.; Li, J.J. Study on Producing and Marketing Docking Modes and Mechanism of Agriculture Commodity. Issues Agric. Econ. 2013, 34, 31–35 + 110. [Google Scholar]

- Shen, M.; Shen, J. Evaluating the Cooperative and Family Farm Programs in China: A Rural Governance Perspective. Land Use Policy 2018, 79, 240–250. [Google Scholar] [CrossRef]

- Liu, T.S.; Chen, L. Do Farmers’ Cooperatives Promote Participation in Rural Public Affairs? World Agric. 2023, 12, 75–87. [Google Scholar]

- Zhang, M.; Yang, L.L. Performance Evaluation of Risk Management Tools for Cooperative. Insur. Stud. 2022, 3, 58–69. [Google Scholar]

- Fayol, H. (Ed.) Administration Industrielle et Générale: Prévoyance, Organisation, Commandement, Coordination, Contrôle; H. Dunod et e. Pinat: Paris, France, 1918. [Google Scholar]

- Lv, W.D.; Zhao, Y.; Tian, D.; Wei, Y. Innovation of Risk Management Theory: From Enterprise Risk Management to Resilient Risk Management. Sci. Decis. Mak. 2017, 9, 1–24. [Google Scholar]

- Fang, R.; An, Y. Risk Management Strategy Selection By Large Grain-households: Based on the Perspective of Risk Perception. Res. Agric. Mod. 2020, 41, 219–228. [Google Scholar]

- He, X.R. The Origin, Development and Reform of Agriculture Cooperatives. Soc. Sci. Front 2022, 10, 66–75. [Google Scholar]

- Gonzalez, R.A. Going Back to Go Forwards? From Multi-stakeholder Cooperatives to Open Cooperatives in Food and Farming. J. Rural. Stud. 2017, 53, 278–290. [Google Scholar] [CrossRef]

- Ajates, R. An Integrated Conceptual Framework for the Study of Agricultural Cooperatives: From Repolitisation to Cooperative Sustainability. J. Rural. Stud. 2020, 78, 467–479. [Google Scholar] [CrossRef]

- Hakelius, K.; Nilsson, J. The Logic Behind the Internal Governance of Sweden’s Largest Agricultural Cooperatives. Sustainability 2020, 12, 9073. [Google Scholar] [CrossRef]

- Zhang, X.; Guo, W.H. Credible Commitments: The Practical Mechanism of the Development and Governance of Cooperation. J. Northwestern Ethn. Stud. 2020, 4, 96–106. [Google Scholar]

- Wang, J.Y.; Zeng, L.J. Cooperative Types, Governance Mechanisms and Operating Performance. Chin. Rural. Econ. 2020, 2, 30–45. [Google Scholar]

- Ma, W.; Zheng, H.; Yuan, P. Impacts of Cooperative Membership on Banana Yield and Risk Exposure: Insights from China. J. Agric. Econ. 2022, 73, 564–579. [Google Scholar] [CrossRef]

- Wairegi, L.W.I.; Bennett, M.; Nziguheba, G.; Mawanda, A.; Rios, C.; Ampaire, E.; Jassogne, L.; Pali, P.; Mukasa, D.; Asten, P.J.A. Sustainably Improving Kenya’s Coffee Production Needs More Participation of Younger Farmers with Diversified Income. J. Rural. Stud. 2018, 63, 190–199. [Google Scholar] [CrossRef]

- Liu, H.; Liu, Y.Y.; Fu, X.H. Can the Standardized Production Services of Cooperatives Improve the Income of Farmers? Rural. Econ. 2021, 12, 55–62. [Google Scholar]

- Zou, Y.; Wang, Q.B.; Ji, R.M. Effects of Joining Farmer Cooperatives on Family Income and Agriculture Fix Production Assets in China: A Study Based on CHIP Survey Data. Collect. Essays Financ. Econ. 2021, 11, 13–24. [Google Scholar]

- Zhang, X.H.; Jin, S.H.; Zhou, L. Impact of Specialized Cooperatives on Farmers’ Income Growth from the Perspective of Internal Governance Mechanisms. J. Agro-For. Econ. Manag. 2020, 19, 431–438. [Google Scholar]

- Zhang, Q.L.; Liu, P.; Hu, L.; Wang, H.M. Research on Business Model Transformation of Full Service Carrier Based on Value Chain Theory. Econ. Manag. 2017, 31, 39–42 + 67. [Google Scholar]

- Ligon, E. Risk Management in the Cooperative Contract. Am. J. Agric. Econ. 2009, 91, 1211–1217. [Google Scholar] [CrossRef]

- Dou, Y.R.; Li, S.L. On the Training Professional Farmers Cooperatives’ Consciousness of Risk—Taking Bengdu City as an Example. J. Shanxi Agric. Univ. Soc. Sci. Ed. 2015, 14, 32–37. [Google Scholar]

- Yang, X.M.; Liang, H.Q.; Wang, Z.B. Risk Assessment and Difference of Farmers Specialized Cooperative. J. Northwest AF Univ. Soc. Sci. Ed. 2017, 17, 29–37. [Google Scholar]

- Zhang, Y.; Huang, H.Z. Identifying Risks Inherent in Farmer Cooperatives in China. China Agric. Econ. Rev. 2014, 6, 335–354. [Google Scholar] [CrossRef]

- Sandeep, B.; Ben, P. The Emergence and Persistence of the Anglo-Saxon and German Financial Systems. Rev. Financ. Stud. 2004, 17, 129–163. [Google Scholar]

- Stiglitz, J.E. Credit Markets and the Control of Capital. J. Money Credit. Bank. 1985, 17, 133–152. [Google Scholar] [CrossRef]

- Tang, X.F.; Li, Y. Financial Risk Analysis and Prevention Measures for Farmer Professional Cooperatives. J. Agrotech. Econ. 2011, 10, 115–120. [Google Scholar]

- Jia, X.W.; Feng, L. Business Risks of Rural Cooperative’ Economic Organization Based on Principal Component Analysis. J. Anhui Agric. Sci. 2010, 38, 11006–11009 + 11012. [Google Scholar]

- Donovan, J.; Blare, T.; Poole, N. Stuck in a Rut: Emerging Cocoa Cooperatives in Peru and the Factors that Influence their Performance. Int. J. Agric. Sustain. 2017, 15, 169–184. [Google Scholar] [CrossRef]

- Wang, S.B.; Wang, B.S. The Entrepreneurship of Leaders of Farmers’ Cooperatives: Theoretical Models and Case Test. China Rural. Surv. 2021, 5, 92–109. [Google Scholar]

- Shi, Y.L.; Shi, Q.Y.; Liu, M.M.; Bi, J. Study on the Influencing Factos of Environmental Risk Acceptance Based on Structural Equation Model. Chin. J. Environ. Manag. 2023, 15, 93–101. [Google Scholar]

- Vaiyapuri, T.; Priyadarshini, K.; Hemlathadhevi, A.; Dhamodaran, M.; Dutta, A.K.; Pustokhina, I.V.; Pustokhin, D.A. Intelligent feature selection with deep learning based financial risk assessment model. Comput. Mater. Contin. 2022, 72, 2429–2444. [Google Scholar] [CrossRef]

- Zhou, X.H.; Zhou, A.; Shen, S.L. Novel Model for Risk Assessment of Shield Tunnelling in Soil-rock Mixed Strata. Acta Geotech. 2024, 1–13. [Google Scholar] [CrossRef]

- Yang, C.L.; Cao, Q.J.; Chen, S.M. Evaluation and Prevention of Mortgage Loan Risk of Rural Land Management Right: From the Perspective of the Loan Provider. J. Yunnan Univ. Financ. Econ. 2021, 37, 71–82. [Google Scholar]

- Liu, C.; Deng, M.; Su, H.Q.; Cai, Y.; Zhang, X.M. The Evaluation of the Business Risk of Family Farms and the Influence Factors. Res. Agric. Mod. 2018, 39, 770–779. [Google Scholar]

- Visser, O.; Sippel, S.R.; Thiemann, L. Imprecision Farming? Examining the (in) Accuracy and Risks of Digital Agriculture. J. Rural. Stud. 2021, 86, 623–632. [Google Scholar] [CrossRef]

- Zhang, M.; Xing, L.; Yan, H. Farmers Cooperative’s Risks Mechanisms under Agriculture industry China from the Perspective of Asset Specificity. J. Agro-For. Econ. Manag. 2022, 21, 1–9. [Google Scholar]

- Zhu, H.Y.; Meng, Z.H.; Liu, X.Z. Research on the Influence of Fruit Production Input on Output in Shangdong Province under the Background of Supply-side Reform—Based on a Survey of 502 Fruit Farmers. Chin. J. Agric. Resour. Reg. Plan. 2022, 43, 243–251. [Google Scholar]

- Zhang, Z.X.; Liu, L.; Huang, H.R. Research on Technology Progress, Large-scale Management and Production Efficiency in China’s Main Sugarcane Producing Areas. Chin. J. Agric. Resour. Reg. Plan. 2021, 42, 251–259. [Google Scholar]

- Kong, X.Z.; Zhou, Z. The Development of New Agriculture Management Entities Must Break Through the Institutional Obstacles. Hebei Acad. J. 2020, 40, 110–117. [Google Scholar]

- Wang, L.X. The Causes and Countermeasures of Financing Difficulties for New Agricultural Business Entities. Econ. Rev. J. 2016, 7, 70–73. [Google Scholar]

- Schultz, T.W. Transforming Traditional Agriculture, 2nd ed.; Commercial Press: Beijing, China, 2006; pp. 33–34. [Google Scholar]

- Xu, J.B.; Wang, Y.; Li, C.X. Is New Agriculture Management Entity Capable of Promoting the Development of Smallholder Farmers: Form the Perspective of Technical Efficiency Comparison. J. China Agric. Univ. 2020, 25, 200–214. [Google Scholar]

- Huang, Y.N.; Li, X.; Zhang, G.S. The Impact of Technology Perception and Government Support on E-commerce Sales Behavior of Farmer Cooperatives: Evidence from Liaoning Province, China. Sage Open 2021, 11, 1–10. [Google Scholar] [CrossRef]

- Yang, Y.; Li, Z.; Han, X.S. Analysis on the Threshold Effect of Agriculture Socialized Service on the “Grain Orientation” of Agriculture Land. J. Manag. 2022, 35, 44–54. [Google Scholar]

- Zhang, Z.J.; Yi, Z.Y. Research on the Impact of Agricultural Productive Service Outsourcing on Rice Productivity—An Empirical Analysis Based on 358 farmers. Issues Agric. Econ. 2015, 36, 69–76. [Google Scholar]

- Huang, Y. Does Digital Transformation Reduce Business risk? Contemp. Financ. 2023, 1, 13–21. [Google Scholar]

- Lu, W.C.; Xi, A.Q. Risk Response of Farmers’ Agricultural Production: A Case Study of Zhejiang Province Based on MOTAD model. Chin. Rural. Econ. 2005, 12, 68–75. [Google Scholar]

- Emmanuelle, R.; Tao, K. Business Models for Sustainable Technology: Strategic Re-framing and Business Model Schema Change in Internal Corporate Venturing. Organ. Environ. 2023, 36, 282–314. [Google Scholar]

- Guo, C.L. Analysis on the Causes of Industrial Organization of Agricultural Product Price Fluctuation. Price Theory Pract. 2010, 11, 25–26. [Google Scholar]

- Adhikari, S.; Khanal, A.R. Economic Sustainability and Multiple Risk Management Strategies: Examining Interlinked Decisions of Small American Farms. Sustainability 2021, 13, 1741. [Google Scholar] [CrossRef]

- Adhikari, S.; Khanal, A.R. Business risk, Financial risk and Savings: Does Perceived Higher Business Risk Induce Savings Among Small Agricultural Operations in the USA? Agric. Financ. Rev. 2023, 83, 107–123. [Google Scholar] [CrossRef]

- Fang, M.H. The Influence Factors and Countermeasure Research in the Development of the Family Farm in Heilongjiang Province. Master’s Thesis, Northeast Agricultural University, Harbin, China, 12 June 2016. [Google Scholar]

- Liang, G.H. Analysis and Prevention of Business Risk of Agricultural Production Cooperatives in Guizhou Province. Master’s Thesis, Guizhou University, Guiyang, China, 1 June 2022. [Google Scholar]

- Guo, X.Y.; Yao, J.N.; Li, T. Configuration Analysis of Efficiency Measurement and Influencing Factors of Farmers’ Professional Cooperatives—Based on the Survey Data of 120 Grain Planting Cooperatives in Three Provinces of Northeast China. Rural. Econ. 2023, 1, 137–144. [Google Scholar]

- Chen, S.L.; Zhang, X. Risk Measurement and Evaluation of P2P Online Lending Platform. Stat. Decis. 2020, 36, 159–163. [Google Scholar]

- Zhang, C.G.; Wang, M.Y. Study on Environmental Risk Assessment and Governance Policies of Countries along the “Belt and Road”. China Soft Sci. 2022, 4, 1–10 + 34. [Google Scholar]

- Ou, G.L.; Wu, G.; Zhu, X.B. Research on Financial Risk Early Warning of Real Estate Enterprises Based on Factor Analysis. Soc. Sci. 2018, 9, 56–63. [Google Scholar]

- Chen, K.M. Characteristics and Application of Structural Equation Model. Stat. Decis. 2006, 10, 22–25. [Google Scholar]

- Dong, G.L.; Su, H.; Zheng, X.Q.; Liu, R.R.; Xue, J.T. SEM Analysis on the Indicator System for Evaluating the Land Use Intensity in the Industry Development Zones Excluding the Hi-Tech ones. China Land Sci. 2012, 26, 35–40. [Google Scholar]

- Duan, L.F.; Zhou, Y. The Influence Path of Farmers’ Willingness to Withdraw from Land Contracting Rights from the Perspective of Common Prosperity—Comparison of Different age Groups. World Surv. Res. 2023, 3, 30–40. [Google Scholar]

- Deng, M. Research on the Prevention of the Business Risk of Family Farms in Heilongjiang Province. Master’s Thesis, Northeast Agricultural University, Harbin, China, 12 June 2019. [Google Scholar]

- Mu, Y.H.; Wang, S.C.; Chi, F.M. Analysis of Factors Influencing Rural E-commerce Based on Structural Equation Modeling: A Case Study of 15 Rural E-commerce Demonstration Counties in Heilongjiang Province. J. Agrotech. Econ. 2016, 8, 106–118. [Google Scholar]

- Hussain, A.; Li, M.; Kanwel, S.; Asif, M.; Jameel, A.; Hwang, J. Impact of Tourism Satisfaction and Service Quality on Destination Loyalty: A Structural Equation Modeling Approach concerning China Resort Hotels. Sustainability 2023, 15, 7713. [Google Scholar] [CrossRef]

- Guo, J.Y.; Xu, L.; Huang, Q. Government Subsidies, Production Capacity and the Duration of Cooperative Agricultural Super Docking. J. Agrotech. Econ. 2019, 3, 87–95. [Google Scholar]

- Xu, X.B.; Li, C.; Guo, J.B.; Zhang, L.X. Land Transfer-in Scale, Land Operation Scale and Carbon Emissions from Crop Planting Throughout the Life Cycle: Evidence from China Rural Development Survey. Chin. Rural. Econ. 2022, 11, 40–58. [Google Scholar]

| Primary Class Index | Secondary Class Index | Symbol | Min | Max | Mean | S.D. | One Sample t-Test |

|---|---|---|---|---|---|---|---|

| Natural risk | Losses due to extreme weather conditions, including droughts and floods | a1 | 1 | 5 | 3.798 | 0.954 | 46.514 *** |

| Losses due to plant diseases and insect pests | a2 | 1 | 5 | 3.593 | 0.883 | 30.362 *** | |

| Market risk | Losses due to a low degree of matching between produce and market requirements | b1 | 1 | 5 | 3.163 | 0.912 | 5.733 ** |

| Losses due to changes in produce prices | b2 | 1 | 5 | 3.146 | 1.036 | −8.4398 ** | |

| Management risk | Losses due to inexperienced managers | c1 | 1 | 5 | 3.476 | 0.995 | 21.259 *** |

| Losses due to lack of innovation of managers | c2 | 1 | 5 | 3.102 | 0.827 | 19.636 *** | |

| Technical risk | Losses due to lack of agricultural technological personnel | d1 | 1 | 5 | 3.116 | 0.871 | 14.219 ** |

| Losses due to unmatched technologies and operational requirements | d2 | 1 | 5 | 3.354 | 0.927 | 12.663 *** | |

| Policy risk | Losses due to inadequate policy support | e1 | 1 | 5 | 3.661 | 0.913 | 19.316 *** |

| Losses due to financial difficulties | e2 | 1 | 5 | 3.815 | 0.898 | 27.628 *** |

| Latent Variable | Observational Variable | Serial No. | Variable Declaration | Mean | S.D. |

|---|---|---|---|---|---|

| Policy environment | Subsidies acquired by cooperatives | PE1 | 0–50,000 RMB = 1, 50,000–100,000 RMB = 2, 100,000–150,000 RMB = 3, 150,000–200,000 RMB = 4, 200,000 RMB and above = 5 | 2.881 | 0.889 |

| Implementation of relevant policies | PE2 | Very poor = 1, poor = 2, normal = 3, good = 4, very good = 5 | 3.233 | 0.896 | |

| Land transfer | PE3 | Hard = 1, difficult = 2, normal = 3, easy = 4, very easy = 5 | 3.184 | 0.922 | |

| Economic environment | Price stability of agricultural products | EE1 | Very bad = 1, bad = 2, normal = 3, good = 4, very good = 5 | 2.901 | 1.045 |

| Fund raising | EE2 | Hard = 1, difficult = 2, normal = 3, easy = 4, very easy = 5 | 3.022 | 0.841 | |

| Stability of marketing channel | EE3 | Highly unstable = 1, unstable = 2, normal = 3, stable = 4, highly stable = 5 | 3.669 | 0.903 | |

| Social service environment | Outsourcing of agricultural production | SSE1 | Hardly ever = 1, few = 2, normal = 3, frequent = 4, very frequent = 5 | 2.912 | 0.857 |

| Machinery leasing | SSE2 | Hardly ever = 1, few = 2, normal = 3, frequent = 4, very frequent = 5 | 2.907 | 0.915 | |

| Logistics of production | SSE3 | Very poor = 1, poor = 2, normal = 3, sound = 4, very sound = 5 | 3.652 | 0.941 | |

| Technical environment | Modern agricultural technology | TE1 | Very poor = 1, poor = 2, average = 3, good = 4, very good = 5 | 2.851 | 0.801 |

| Matching between technology and cooperative operation | TE2 | Highly unmatched = 1, unmatched = 2, normal = 3, matched = 4, highly matched = 5 | 3.13 | 0.916 | |

| Agricultural technological talent resources | TE3 | Very scarce = 1, scarce = 2, average = 3, abundant = 4, very abundant = 5 | 2.952 | 0.849 | |

| Self-resource endowment | Scale of land management | CE1 | Below 16.47 acres = 1, 16.47–49.42 acres = 2, 49.42–82.37 acres = 3, 82.37–115.32 acres = 4, 115.32 acres and above = 5 | 3.685 | 0.969 |

| Operating years of cooperative | CE2 | Less than 1 year = 1, 1–3 years = 2, 3–5 years = 3, 5–7 years = 4, above 7 years = 5 | 3.603 | 0.992 | |

| Level of industrial organization | CE3 | Very low = 1, low = 2, average = 3, high = 4, very high = 5 | 3.232 | 1.027 | |

| Manager characteristics | Age | MC1 | 60 years or older = 1, 50–59 years old = 2, 40–49 years old = 3, 30–39 years old = 4, below 30 years old = 5 | 2.671 | 1.215 |

| Level of education | MC2 | Primary school level and below = 1, junior high-school level = 2, senior high-school and vocational high-school level = 3, junior college level = 4, undergraduate and above = 5 | 2.839 | 0.83 | |

| Entrepreneurial spirit | MC3 | Very inadequate = 1, inadequate = 2, average = 3, adequate = 4, very adequate = 5 | 3.756 | 0.981 |

| Evaluation Indicator | Variable | Market Risk | Policy Risk | Natural Risk | Technical Risk | Management Risk |

|---|---|---|---|---|---|---|

| Market risk | b1 | 0.921 | 0.178 | 0.143 | 0.061 | 0.133 |

| b2 | 0.902 | 0.099 | 0.051 | 0.139 | 0.141 | |

| Policy risk | e1 | 0.183 | 0.917 | 0.134 | 0.086 | 0.183 |

| e2 | 0.145 | 0.904 | 0.185 | 0.15 | 0.044 | |

| Natural risk | a1 | 0.103 | 0.158 | 0.911 | 0.08 | 0.137 |

| a2 | 0.112 | 0.183 | 0.906 | 0.061 | 0.152 | |

| Technical risk | d1 | 0.162 | 0.156 | 0.082 | 0.873 | 0.191 |

| d2 | 0.093 | 0.069 | 0.067 | 0.906 | 0.014 | |

| Management risk | c1 | 0.079 | 0.09 | 0.154 | 0.069 | 0.852 |

| c2 | 0.154 | 0.089 | 0.133 | 0.072 | 0.819 | |

| Cumulative variance contribution rate (%) | - | 33.376 | 49.538 | 63.567 | 73.988 | 83.732 |

| Evaluation Scale | Comprehensive Score | Number | Percentage (%) |

|---|---|---|---|

| Extremely high risk | Above 0.5 | 43 | 19.0 |

| High risk | 0.2 to 0.5 | 63 | 27.9 |

| Moderate risk | −0.2 to 0.2 | 39 | 17.3 |

| Low risk | −0.5 to −0.2 | 48 | 21.2 |

| Extremely low risk | Below −0.5 | 33 | 14.6 |

| Latent Variable | Cronbach’s α | KMO Measure | Bartlett’s Sphericity Test | ||

|---|---|---|---|---|---|

| x2 | df | Sig | |||

| Total scale | 0.765 | 0.780 | 721.860 | 45 | 0.000 |

| Policy environment | 0.723 | 0.698 | 1435.233 | 9 | 0.000 |

| Economic Environment | 0.686 | 0.621 | 2034.227 | 6 | 0.000 |

| Social service environment | 0.629 | 0.652 | 575.663 | 6 | 0.000 |

| Technical environment | 0.817 | 0.669 | 3653.219 | 3 | 0.000 |

| Self-resource endowment | 0.809 | 0.712 | 1576.355 | 6 | 0.000 |

| Manager characteristics | 0.763 | 0.715 | 1236.436 | 7 | 0.000 |

| Business risk | 0.756 | 0.715 | 986.217 | 3 | 0.000 |

| Fit Index | Reference Value | Model Value | Judgment Result | |

|---|---|---|---|---|

| Absolute fit indices | x2/df | <3.00 | 2.652 | Pass |

| RMSEA | <0.08 | 0.042 | Pass | |

| RMR | <0.08 | 0.039 | Pass | |

| GF | >0.90 | 0.925 | Pass | |

| AGF | >0.90 | 0.992 | Pass | |

| Relative fit indices | RFI | >0.90 | 0.967 | Pass |

| IFI | >0.90 | 0.984 | Pass | |

| NF | >0.90 | 0.978 | Pass | |

| CF | >0.90 | 0.995 | Pass | |

| TL | >0.90 | 0.989 | Pass |

| Path | Parameter Estimate | ||||||

|---|---|---|---|---|---|---|---|

| Estimate | S.E. | C.R. | p-Value | ||||

| NSEC | SEC | ||||||

| Business risk (BR) | ← | Policy environment (PE) | 0.313 | 0.219 | 0.055 | 6.418 | *** |

| Business risk (BR) | ← | Economic environment (EE) | 0.401 | 0.522 | 0.046 | 10.187 | *** |

| Business risk (BR) | ← | Social service environment (SSE) | 0.357 | 0.114 | 0.049 | 5.143 | *** |

| Business risk (BR) | ← | Technical environment (TE) | 0.617 | 0.323 | 0.078 | 8.475 | *** |

| Business risk (BR) | ← | Self-resource endowment (SRE) | 0.376 | 0.331 | 0.062 | 6.953 | *** |

| Business risk (BR) | ← | Manager characteristics (MC) | 0.504 | 0.533 | 0.053 | 7.352 | *** |

| PE1 | ← | PE | 1 | 0.651 | |||

| PE2 | ← | PE | 0.853 | 0.618 | 0.061 | 15.431 | *** |

| PE3 | ← | PE | 1.133 | 0.682 | 0.065 | 17.012 | *** |

| EE1 | ← | EE | 1 | 0.750 | |||

| EE2 | ← | EE | 0.796 | 0.623 | 0.047 | 10.326 | *** |

| EE3 | ← | EE | 0.861 | 0.677 | 0.063 | 11.865 | *** |

| SSE1 | ← | SSE | 1 | 0.664 | |||

| SSE2 | ← | SSE | 1.143 | 0.693 | 0.095 | 7.983 | *** |

| SSE3 | ← | SSE | 1.326 | 0.808 | 0.089 | 8.461 | *** |

| TE1 | ← | TE | 1 | 0.614 | |||

| TE2 | ← | TE | 1.192 | 0.720 | 0.065 | 13.436 | *** |

| TE3 | ← | TE | 0.963 | 0.573 | 0.051 | 15.763 | *** |

| SRE1 | ← | SRE | 1 | 0.749 | |||

| SRE2 | ← | SRE | 1.141 | 0.802 | 0.068 | 11.571 | *** |

| SRE3 | ← | SRE | 1.356 | 0.811 | 0.066 | 14.316 | *** |

| MC1 | ← | MC | 1 | 0.773 | |||

| MC2 | ← | MC | 0.823 | 0.637 | 0.052 | 10.763 | *** |

| MC3 | ← | MC | 0.745 | 0.622 | 0.061 | 8.357 | *** |

Disclaimer/Publisher’s Note: The statements, opinions and data contained in all publications are solely those of the individual author(s) and contributor(s) and not of MDPI and/or the editor(s). MDPI and/or the editor(s) disclaim responsibility for any injury to people or property resulting from any ideas, methods, instructions or products referred to in the content. |

© 2024 by the authors. Licensee MDPI, Basel, Switzerland. This article is an open access article distributed under the terms and conditions of the Creative Commons Attribution (CC BY) license (https://creativecommons.org/licenses/by/4.0/).

Share and Cite

Liang, G.; Zhang, Z.; Wu, P.; Zhang, Z.; Shao, X. Analysis of Business Risk Measurement and Factors Influencing Plantation-Based Farming Cooperatives: Evidence from Guizhou Province, China. Sustainability 2024, 16, 2194. https://doi.org/10.3390/su16052194

Liang G, Zhang Z, Wu P, Zhang Z, Shao X. Analysis of Business Risk Measurement and Factors Influencing Plantation-Based Farming Cooperatives: Evidence from Guizhou Province, China. Sustainability. 2024; 16(5):2194. https://doi.org/10.3390/su16052194

Chicago/Turabian StyleLiang, Genhong, Zhuo Zhang, Peirong Wu, Zhijie Zhang, and Xiwu Shao. 2024. "Analysis of Business Risk Measurement and Factors Influencing Plantation-Based Farming Cooperatives: Evidence from Guizhou Province, China" Sustainability 16, no. 5: 2194. https://doi.org/10.3390/su16052194

APA StyleLiang, G., Zhang, Z., Wu, P., Zhang, Z., & Shao, X. (2024). Analysis of Business Risk Measurement and Factors Influencing Plantation-Based Farming Cooperatives: Evidence from Guizhou Province, China. Sustainability, 16(5), 2194. https://doi.org/10.3390/su16052194