Exploring Institutional Pressures, Green Innovation, and Sustainable Performance: Examining the Mediated Moderation Role of Entrepreneurial Orientation

Abstract

1. Introduction

2. Theoretical Background

2.1. Institutional Perspective on Environmental Sustainability

2.2. Green Innovation

2.3. Entrepreneurial Orientation

2.4. Sustainable Performance

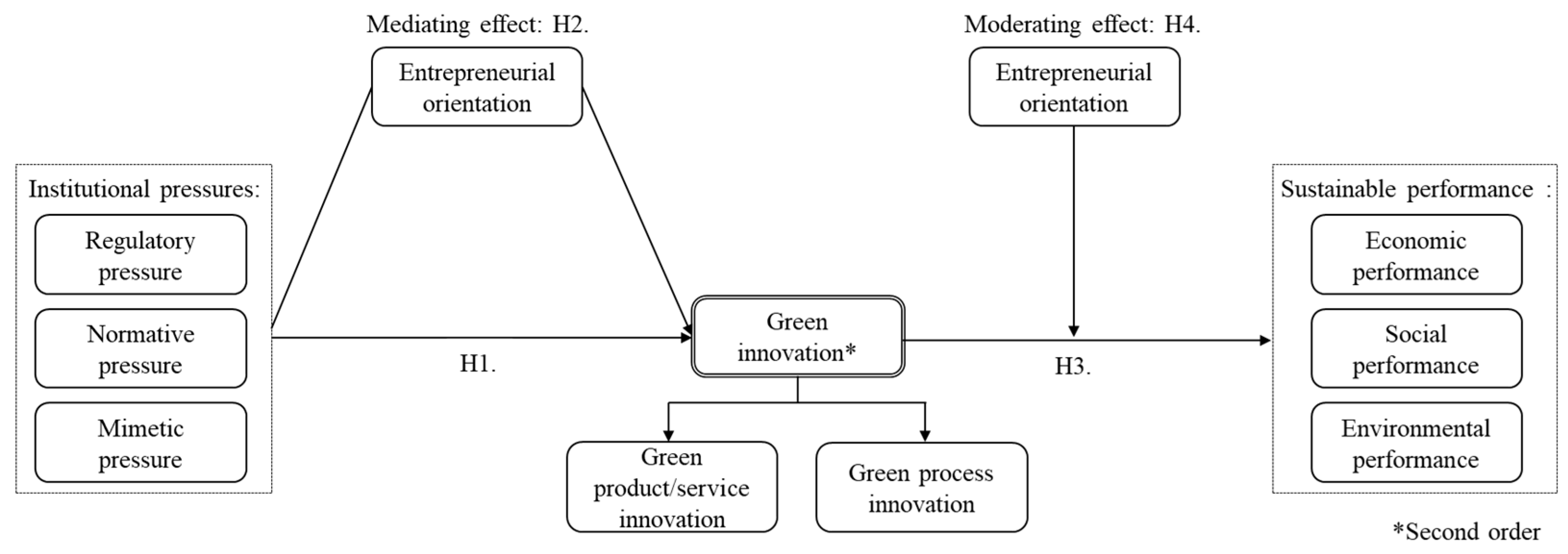

3. Hypothesis Development

3.1. Institutional Pressures and Corporate Green Innovation

3.2. Mediation of Entrepreneurial Orientation

3.3. Green Innovation and Sustainable Performance

3.4. Moderation of Entrepreneurial Orientation

4. Research Methods and Results

4.1. Research Context and Sample Collection

4.2. Variables and Measurement

4.3. Common Method Bias Assessment

4.4. Analysis Method

4.5. Validity and Hypotheses Tests

5. Discussion and Implications

5.1. Discussion

5.2. Theoretical Contributions

5.3. Practical Implications

6. Conclusions

Author Contributions

Funding

Institutional Review Board Statement

Informed Consent Statement

Data Availability Statement

Acknowledgments

Conflicts of Interest

References

- Bamgbade, J.A.; Kamaruddeen, A.M.; Nawi, M. Malaysian construction firms’ social sustainability via organizational innovativeness and government support: The mediating role of market culture. J. Clean. Prod. 2017, 154, 114–124. [Google Scholar] [CrossRef]

- Kumar, A.; Anbanandam, R. Development of social sustainability index for freight transportation system. J. Clean. Prod. 2019, 210, 77–92. [Google Scholar] [CrossRef]

- Elkington, J. 25 years ago I coined the phrase “triple bottom line”. Here’s why it’s time to rethink it. Harv. Bus. Rev. 2018, 25, 2–5. [Google Scholar]

- Berrone, P.; Fosfuri, A.; Gelabert, L.; Gomez-Mejia, L.R. Necessity as the mother of ‘green’inventions: Institutional pressures and environmental innovations. Strateg. Manag. J. 2013, 34, 891–909. [Google Scholar] [CrossRef]

- Yang, D.; Jiang, W.; Zhao, W. Proactive environmental strategy, innovation capability, and stakeholder integration capability: A mediation analysis. Bus. Strategy Environ. 2019, 28, 1534–1547. [Google Scholar] [CrossRef]

- Fliaster, A.; Kolloch, M. Implementation of green innovations–The impact of stakeholders and their network relations. RD Manag. 2017, 47, 689–700. [Google Scholar] [CrossRef]

- Tsai, K.H.; Liao, Y.C. Innovation capacity and the implementation of eco-innovation: Toward a contingency perspective. Bus. Strategy Environ. 2017, 26, 1000–1013. [Google Scholar] [CrossRef]

- Horbach, J. Determinants of environmental innovation—New evidence from German panel data sources. Res. Policy 2008, 37, 163–173. [Google Scholar] [CrossRef]

- Liao, Z. Institutional pressure, knowledge acquisition and a firm’s environmental innovation. Bus. Strategy Environ. 2018, 27, 849–857. [Google Scholar] [CrossRef]

- Huang, Y.-C.; Chen, C.T. Exploring institutional pressures, firm green slack, green product innovation and green new product success: Evidence from Taiwan’s high-tech industries. Technol. Forecast. Soc. Chang. 2022, 174, 121196. [Google Scholar] [CrossRef]

- Qi, G.; Jia, Y.; Zou, H. Is institutional pressure the mother of green innovation? Examining the moderating effect of absorptive capacity. J. Clean. Prod. 2021, 278, 123957. [Google Scholar] [CrossRef]

- Wang, S.; Li, J.; Zhao, D. Institutional pressures and environmental management practices: The moderating effects of environmental commitment and resource availability. Bus. Strategy Environ. 2018, 27, 52–69. [Google Scholar] [CrossRef]

- Colwell, S.R.; Joshi, A.W. Corporate ecological responsiveness: Antecedent effects of institutional pressure and top management commitment and their impact on organizational performance. Bus. Strategy Environ. 2013, 22, 73–91. [Google Scholar] [CrossRef]

- Kraus, S.; Rehman, S.U.; García, F.J.S. Corporate social responsibility and environmental performance: The mediating role of environmental strategy and green innovation. Technol. Forecast. Soc. Chang. 2020, 160, 120262. [Google Scholar] [CrossRef]

- Singh, S.K.; Del Giudice, M.; Chiappetta Jabbour, C.J.; Latan, H.; Sohal, A.S. Stakeholder pressure, green innovation, and performance in small and medium-sized enterprises: The role of green dynamic capabilities. Bus. Strategy Environ. 2022, 31, 500–514. [Google Scholar] [CrossRef]

- Scott, W.R. Institutions and Organizations; Sage Publications: Thousands Oaks, CA, USA, 1995. [Google Scholar]

- Daddi, T.; Testa, F.; Frey, M.; Iraldo, F. Exploring the link between institutional pressures and environmental management systems effectiveness: An empirical study. J. Environ. Manag. 2016, 183, 647–656. [Google Scholar] [CrossRef]

- Covin, J.G.; Wales, W.J. The measurement of entrepreneurial orientation. Entrep. Theory Pract. 2012, 36, 677–703. [Google Scholar] [CrossRef]

- Wong, C.Y.; Wong, C.W.; Boon-itt, S. Effects of green supply chain integration and green innovation on environmental and cost performance. Int. J. Prod. Res. 2020, 58, 4589–4609. [Google Scholar] [CrossRef]

- Faccio, M. Politically connected firms. Am. Econ. Rev. 2006, 96, 369–386. [Google Scholar] [CrossRef]

- Shehzad, M.U.; Zhang, J.; Latif, K.F.; Jamil, K.; Waseel, A.H. Do green entrepreneurial orientation and green knowledge management matter in the pursuit of ambidextrous green innovation: A moderated mediation model. J. Clean. Prod. 2023, 388, 135971. [Google Scholar] [CrossRef]

- Lee, S.M.; Peterson, S.J. Culture, entrepreneurial orientation, and global competitiveness. J. World Bus. 2000, 35, 401–416. [Google Scholar] [CrossRef]

- Lyon, T.P.; Maxwell, J.W. Greenwash: Corporate environmental disclosure under threat of audit. J. Econ. Manag. Strategy 2011, 20, 3–41. [Google Scholar] [CrossRef]

- Wiklund, J. The sustainability of the entrepreneurial orientation—Performance relationship. Entrep. Theory Pract. 1999, 24, 37–48. [Google Scholar] [CrossRef]

- Wiklund, J.; Shepherd, D. Entrepreneurial orientation and small business performance: A configurational approach. J. Bus. Ventur. 2005, 20, 71–91. [Google Scholar] [CrossRef]

- Porter, M.; Van der Linde, C. Green and competitive: Ending the stalemate. Dyn. Eco-Effic. Econ. Environ. Regul. Compet. Advant. 1995, 33, 120–134. [Google Scholar]

- Kostova, T.; Roth, K.; Dacin, M.T. Institutional theory in the study of multinational corporations: A critique and new directions. Acad. Manag. Rev. 2008, 33, 994–1006. [Google Scholar] [CrossRef]

- Meyer, R.E.; Höllerer, M.A. Does institutional theory need redirecting? J. Manag. Stud. 2014, 51, 1221–1233. [Google Scholar] [CrossRef]

- Suchman, M.C. Managing legitimacy: Strategic and institutional approaches. Acad. Manag. Rev. 1995, 20, 571–610. [Google Scholar] [CrossRef]

- Meyer, J.W.; Rowan, B. Institutionalized organizations: Formal structure as myth and ceremony. Am. J. Sociol. 1977, 83, 340–363. [Google Scholar] [CrossRef]

- Delmas, M.A. The diffusion of environmental management standards in Europe and in the United States: An institutional perspective. Policy Sci. 2002, 35, 91–119. [Google Scholar] [CrossRef]

- Ambec, S.; Cohen, M.; Elgie, S.; Lanoie, P. The Porter Hypothesis at 20: Can Environmental Regulation Enhance Innovation and Competitiveness? Rev. Environ. Econ. Policy 2013, 7, 2–22. [Google Scholar] [CrossRef]

- Qi, G.; Shen, L.Y.; Zeng, S.; Jorge, O.J. The drivers for contractors’ green innovation: An industry perspective. J. Clean. Prod. 2010, 18, 1358–1365. [Google Scholar] [CrossRef]

- Yang, D.; Wang, A.X.; Zhou, K.Z.; Jiang, W. Environmental strategy, institutional force, and innovation capability: A managerial cognition perspective. J. Bus. Ethics 2019, 159, 1147–1161. [Google Scholar] [CrossRef]

- Brunnermeier, S.B.; Cohen, M.A. Determinants of environmental innovation in US manufacturing industries. J. Environ. Econ. Manag. 2003, 45, 278–293. [Google Scholar] [CrossRef]

- Takalo, S.K.; Tooranloo, H.S. Green innovation: A systematic literature review. J. Clean. Prod. 2021, 279, 122474. [Google Scholar] [CrossRef]

- Chen, Y.-S.; Lai, S.-B.; Wen, C.-T. The influence of green innovation performance on corporate advantage in Taiwan. J. Bus. Ethics 2006, 67, 331–339. [Google Scholar] [CrossRef]

- Borghesi, S.; Cainelli, G.; Mazzanti, M. Linking emission trading to environmental innovation: Evidence from the Italian manufacturing industry. Res. Policy 2015, 44, 669–683. [Google Scholar] [CrossRef]

- Kong, T.; Feng, T.; Huang, Y.; Cai, J. How to convert green supply chain integration efforts into green innovation: A perspective of knowledge-based view. Sustain. Dev. 2020, 28, 1106–1121. [Google Scholar] [CrossRef]

- Xie, X.; Huo, J.; Zou, H. Green process innovation, green product innovation, and corporate financial performance: A content analysis method. J. Bus. Res. 2019, 101, 697–706. [Google Scholar] [CrossRef]

- Pan, X.; Pan, X.; Song, M.; Guo, R. The influence of green supply chain management on manufacturing enterprise performance: Moderating effect of collaborative communication. Prod. Plan. Control 2020, 31, 245–258. [Google Scholar] [CrossRef]

- Awan, U.; Sroufe, R.; Kraslawski, A. Creativity enables sustainable development: Supplier engagement as a boundary condition for the positive effect on green innovation. J. Clean. Prod. 2019, 226, 172–185. [Google Scholar] [CrossRef]

- Shen, C.; Li, S.; Wang, X.; Liao, Z. The effect of environmental policy tools on regional green innovation: Evidence from China. J. Clean. Prod. 2020, 254, 120122. [Google Scholar] [CrossRef]

- Chen, X.; Yi, N.; Zhang, L.; Li, D. Does institutional pressure foster corporate green innovation? Evidence from China’s top 100 companies. J. Clean. Prod. 2018, 188, 304–311. [Google Scholar] [CrossRef]

- Phan, T.N.; Baird, K. The comprehensiveness of environmental management systems: The influence of institutional pressures and the impact on environmental performance. J. Environ. Manag. 2015, 160, 45–56. [Google Scholar] [CrossRef]

- Mehmood, T.; Alzoubi, H.M.; Alshurideh, M.; Al-Gasaymeh, A.; Ahmed, G. Schumpeterian entrepreneurship theory: Evolution and relevance. Acad. Entrep. J. 2019, 25, 1–10. [Google Scholar]

- Anderson, B.S.; Kreiser, P.M.; Kuratko, D.F.; Hornsby, J.S.; Eshima, Y. Reconceptualizing entrepreneurial orientation. Strateg. Manag. J. 2015, 36, 1579–1596. [Google Scholar] [CrossRef]

- Wales, W.J.; Covin, J.G.; Monsen, E. Entrepreneurial orientation: The necessity of a multilevel conceptualization. Strateg. Entrep. J. 2020, 14, 639–660. [Google Scholar] [CrossRef]

- Bhatia, M.S.; Jakhar, S.K. The effect of environmental regulations, top management commitment, and organizational learning on green product innovation: Evidence from automobile industry. Bus. Strategy Environ. 2021, 30, 3907–3918. [Google Scholar] [CrossRef]

- Cui, J.; Dai, J.; Wang, Z.; Zhao, X. Does environmental regulation induce green innovation? A panel study of Chinese listed firms. Technol. Forecast. Soc. Chang. 2022, 176, 121492. [Google Scholar] [CrossRef]

- Taeuscher, K.; Bouncken, R.; Pesch, R. Gaining legitimacy by being different: Optimal distinctiveness in crowdfunding platforms. Acad. Manag. J. 2021, 64, 149–179. [Google Scholar] [CrossRef]

- Hristov, I.; Appolloni, A. Stakeholders’ engagement in the business strategy as a key driver to increase companies’ performance: Evidence from managerial and stakeholders’ practices. Bus. Strategy Environ. 2022, 31, 1488–1503. [Google Scholar] [CrossRef]

- Khan, N.R.; Ameer, F.; Bouncken, R.B.; Covin, J.G. Corporate sustainability entrepreneurship: The role of green entrepreneurial orientation and organizational resilience capacity for green innovation. J. Bus. Res. 2023, 169, 114296. [Google Scholar] [CrossRef]

- Méndez-Picazo, M.-T.; Galindo-Martín, M.-A.; Castaño-Martínez, M.-S. Effects of sociocultural and economic factors on social entrepreneurship and sustainable development. J. Innov. Knowl. 2021, 6, 69–77. [Google Scholar] [CrossRef]

- Wang, M.; Li, Y.; Li, J.; Wang, Z. Green process innovation, green product innovation and its economic performance improvement paths: A survey and structural model. J. Environ. Manag. 2021, 297, 113282. [Google Scholar] [CrossRef]

- Zhang, Q.; Ma, Y. The impact of environmental management on firm economic performance: The mediating effect of green innovation and the moderating effect of environmental leadership. J. Clean. Prod. 2021, 292, 126057. [Google Scholar] [CrossRef]

- Kamble, S.S.; Gunasekaran, A.; Gawankar, S.A. Achieving sustainable performance in a data-driven agriculture supply chain: A review for research and applications. Int. J. Prod. Econ. 2020, 219, 179–194. [Google Scholar] [CrossRef]

- Khan, S.A.R.; Zhang, Y.; Anees, M.; Golpîra, H.; Lahmar, A.; Qianli, D. Green supply chain management, economic growth and environment: A GMM based evidence. J. Clean. Prod. 2018, 185, 588–599. [Google Scholar] [CrossRef]

- Ang, S.H.; Benischke, M.H.; Doh, J.P. The interactions of institutions on foreign market entry mode. Strateg. Manag. J. 2015, 36, 1536–1553. [Google Scholar] [CrossRef]

- Julian, S.D.; Ofori-dankwa, J.C. Financial resource availability and corporate social responsibility expenditures in a sub-Saharan economy: The institutional difference hypothesis. Strateg. Manag. J. 2013, 34, 1314–1330. [Google Scholar] [CrossRef]

- Kostova, T.; Roth, K. Adoption of an organizational practice by subsidiaries of multinational corporations: Institutional and relational effects. Acad. Manag. J. 2002, 45, 215–233. [Google Scholar] [CrossRef]

- Bruton, G.D.; Ahlstrom, D.; Li, H.L. Institutional theory and entrepreneurship: Where are we now and where do we need to move in the future? Entrep. Theory Pract. 2010, 34, 421–440. [Google Scholar] [CrossRef]

- Amores-Salvadó, J.; Martín-de Castro, G.; Navas-López, J.E. Green corporate image: Moderating the connection between environmental product innovation and firm performance. J. Clean. Prod. 2014, 83, 356–365. [Google Scholar] [CrossRef]

- Eiadat, Y.; Kelly, A.; Roche, F.; Eyadat, H. Green and competitive? An empirical test of the mediating role of environmental innovation strategy. J. World Bus. 2008, 43, 131–145. [Google Scholar] [CrossRef]

- Cai, W.; Li, G. The drivers of eco-innovation and its impact on performance: Evidence from China. J. Clean. Prod. 2018, 176, 110–118. [Google Scholar] [CrossRef]

- Dechezleprêtre, A.; Sato, M. The Impacts of Environmental Regulations on Competitiveness. Rev. Environ. Econ. Policy 2017, 11, 183–206. [Google Scholar] [CrossRef]

- Menguc, B.; Auh, S.; Ozanne, L. The interactive effect of internal and external factors on a proactive environmental strategy and its influence on a firm’s performance. J. Bus. Ethics 2010, 94, 279–298. [Google Scholar] [CrossRef]

- Krell, K.; Matook, S.; Rohde, F. The impact of legitimacy-based motives on IS adoption success: An institutional theory perspective. Inf. Manag. 2016, 53, 683–697. [Google Scholar] [CrossRef]

- Zhu, Q. Institutional pressures and support from industrial zones for motivating sustainable production among Chinese manufacturers. Int. J. Prod. Econ. 2016, 181, 402–409. [Google Scholar] [CrossRef]

- Van Hemel, C.; Cramer, J. Barriers and stimuli for ecodesign in SMEs. J. Clean. Prod. 2002, 10, 439–453. [Google Scholar] [CrossRef]

- Christmann, P. Multinational companies and the natural environment: Determinants of global environmental policy. Acad. Manag. J. 2004, 47, 747–760. [Google Scholar] [CrossRef]

- Delmas, M.; Toffel, M.W. Stakeholders and environmental management practices: An institutional framework. Bus. Strategy Environ. 2004, 13, 209–222. [Google Scholar] [CrossRef]

- Li, Y. Environmental innovation practices and performance: Moderating effect of resource commitment. J. Clean. Prod. 2014, 66, 450–458. [Google Scholar] [CrossRef]

- Rennings, K.; Rammer, C. The impact of regulation-driven environmental innovation on innovation success and firm performance. Ind. Innov. 2011, 18, 255–283. [Google Scholar] [CrossRef]

- Zhu, Q.; Liu, J.; Lai, K.-H. Corporate social responsibility practices and performance improvement among Chinese national state-owned enterprises. Int. J. Prod. Econ. 2016, 171, 417–426. [Google Scholar] [CrossRef]

- Zhang, C.; Zhou, B.; Tian, X. Political connections and green innovation: The role of a corporate entrepreneurship strategy in state-owned enterprises. J. Bus. Res. 2022, 146, 375–384. [Google Scholar] [CrossRef]

- Manolova, T.S.; Eunni, R.V.; Gyoshev, B.S. Institutional environments for entrepreneurship: Evidence from emerging economies in Eastern Europe. Entrep. Theory Pract. 2008, 32, 203–218. [Google Scholar] [CrossRef]

- Wang, T.; Thornhill, S.; De Castro, J.O. Entrepreneurial orientation, legitimation, and new venture performance. Strateg. Entrep. J. 2017, 11, 373–392. [Google Scholar] [CrossRef]

- North, D.C. Institutional Change: A framework of Analysis. In Social Rules; Routledge: Oxfordshire, UK, 2018; pp. 189–201. [Google Scholar]

- Wang, C.; Zhang, X.E.; Teng, X. How to convert green entrepreneurial orientation into green innovation: The role of knowledge creation process and green absorptive capacity. Bus. Strategy Environ. 2023, 32, 1260–1273. [Google Scholar] [CrossRef]

- Bokusheva, R.; Kumbhakar, S.C.; Lehmann, B. The effect of environmental regulations on Swiss farm productivity. Int. J. Prod. Econ. 2012, 136, 93–101. [Google Scholar] [CrossRef]

- Zhu, Q.; Geng, Y. Drivers and barriers of extended supply chain practices for energy saving and emission reduction among Chinese manufacturers. J. Clean. Prod. 2013, 40, 6–12. [Google Scholar] [CrossRef]

- Agyapong, A.; Aidoo, S.O.; Acquaah, M.; Akomea, S. Environmental orientation and sustainability performance; the mediated moderation effects of green supply chain management practices and institutional pressure. J. Clean. Prod. 2023, 430, 139592. [Google Scholar] [CrossRef]

- Liu, N.; Hu, H.; Wang, Z. The relationship between institutional pressure, green entrepreneurial orientation, and entrepreneurial performance—The moderating effect of network centrality. Sustainability 2022, 14, 12055. [Google Scholar] [CrossRef]

- Wen, X.; Cheah, J.-H.; Lim, X.-J.; Ramachandran, S. Why does “green” matter in supply chain management? Exploring institutional pressures, green practices, green innovation, and economic performance in the Chinese chemical sector. J. Clean. Prod. 2023, 427, 139182. [Google Scholar] [CrossRef]

- Grewatsch, S.; Kleindienst, I. When does it pay to be good? Moderators and mediators in the corporate sustainability–corporate financial performance relationship: A critical review. J. Bus. Ethics 2017, 145, 383–416. [Google Scholar] [CrossRef]

- Przychodzen, W.; Leyva-de la Hiz, D.I.; Przychodzen, J. First-mover advantages in green innovation—Opportunities and threats for financial performance: A longitudinal analysis. Corp. Soc. Responsib. Environ. Manag. 2020, 27, 339–357. [Google Scholar] [CrossRef]

- Holzner, B.; Wagner, M. Linking levels of green innovation with profitability under environmental uncertainty: An empirical study. J. Clean. Prod. 2022, 378, 134438. [Google Scholar] [CrossRef]

- Zailani, S.; Iranmanesh, M.; Nikbin, D.; Jumadi, H.B. Determinants and environmental outcome of green technology innovation adoption in the transportation industry in Malaysia. Asian J. Technol. Innov. 2014, 22, 286–301. [Google Scholar] [CrossRef]

- Huang, X.-X.; Hu, Z.-P.; Liu, C.-S.; Yu, D.-J.; Yu, L.-F. The relationships between regulatory and customer pressure, green organizational responses, and green innovation performance. J. Clean. Prod. 2016, 112, 3423–3433. [Google Scholar] [CrossRef]

- Horbach, J.; Oltra, V.; Belin, J. Determinants and specificities of eco-innovations compared to other innovations—An econometric analysis for the French and German industry based on the community innovation survey. Ind. Innov. 2013, 20, 523–543. [Google Scholar] [CrossRef]

- Dangelico, R.M.; Pujari, D. Mainstreaming green product innovation: Why and how companies integrate environmental sustainability. J. Bus. Ethics 2010, 95, 471–486. [Google Scholar] [CrossRef]

- Fernando, Y.; Jabbour, C.J.C.; Wah, W.-X. Pursuing green growth in technology firms through the connections between environmental innovation and sustainable business performance: Does service capability matter? Resour. Conserv. Recycl. 2019, 141, 8–20. [Google Scholar] [CrossRef]

- Chiou, T.-Y.; Chan, H.K.; Lettice, F.; Chung, S.H. The influence of greening the suppliers and green innovation on environmental performance and competitive advantage in Taiwan. Transp. Res. Part E Logist. Transp. Rev. 2011, 47, 822–836. [Google Scholar] [CrossRef]

- Singh, S.K.; Del Giudice, M.; Chierici, R.; Graziano, D. Green innovation and environmental performance: The role of green transformational leadership and green human resource management. Technol. Forecast. Soc. Chang. 2020, 150, 119762. [Google Scholar] [CrossRef]

- Wijethilake, C.; Lama, T. Sustainability core values and sustainability risk management: Moderating effects of top management commitment and stakeholder pressure. Bus. Strategy Environ. 2019, 28, 143–154. [Google Scholar] [CrossRef]

- Tang, J.; Tang, Z.; Marino, L.D.; Zhang, Y.; Li, Q. Exploring an inverted U–shape relationship between entrepreneurial orientation and performance in Chinese ventures. Entrep. Theory Pract. 2008, 32, 219–239. [Google Scholar] [CrossRef]

- Aftab, J.; Veneziani, M.; Sarwar, H.; Ishaq, M.I. Entrepreneurial orientation, entrepreneurial competencies, innovation, and performances in SMEs of Pakistan: Moderating role of social ties. Bus. Ethics Environ. Responsib. 2022, 31, 419–437. [Google Scholar] [CrossRef]

- Tang, Z.; Tang, J. Entrepreneurial orientation and SME performance in China’s changing environment: The moderating effects of strategies. Asia Pac. J. Manag. 2012, 29, 409–431. [Google Scholar] [CrossRef]

- Papagiannakis, G.; Lioukas, S. Values, attitudes and perceptions of managers as predictors of corporate environmental responsiveness. J. Environ. Manag. 2012, 100, 41–51. [Google Scholar] [CrossRef] [PubMed]

- Shi, C.; Guo, F.; Shi, Q. Ranking effect in air pollution governance: Evidence from Chinese cities. J. Environ. Manag. 2019, 251, 109600. [Google Scholar] [CrossRef] [PubMed]

- Zhou, Y.; Shu, C.; Jiang, W.; Gao, S. Green management, firm innovations, and environmental turbulence. Bus. Strategy Environ. 2019, 28, 567–581. [Google Scholar] [CrossRef]

- ISO 14001; Environmental Management Systems Requirements with Guidance for Use. International Organization for Standardization: Geneva, Switzerland, 2015.

- Armstrong, J.S.; Overton, T.S. Estimating nonresponse bias in mail surveys. J. Mark. Res. 1977, 14, 396–402. [Google Scholar] [CrossRef]

- Dess, G.G.; Lumpkin, G.T. The role of entrepreneurial orientation in stimulating effective corporate entrepreneurship. Acad. Manag. Perspect. 2005, 19, 147–156. [Google Scholar] [CrossRef]

- Dey, P.K.; Malesios, C.; De, D.; Chowdhury, S.; Abdelaziz, F.B. The impact of lean management practices and sustainably-oriented innovation on sustainability performance of small and medium-sized enterprises: Empirical evidence from the UK. Br. J. Manag. 2020, 31, 141–161. [Google Scholar] [CrossRef]

- Sheng, S.; Zhou, K.Z.; Li, J.J. The effects of business and political ties on firm performance: Evidence from China. J. Mark. 2011, 75, 1–15. [Google Scholar] [CrossRef]

- Chang, S.-J.; Van Witteloostuijn, A.; Eden, L. Common method variance in international business research. Res. Methods Int. Bus. 2020, 385–398. [Google Scholar]

- Podsakoff, P.M.; MacKenzie, S.B.; Lee, J.-Y.; Podsakoff, N.P. Common method biases in behavioral research: A critical review of the literature and recommended remedies. J. Appl. Psychol. 2003, 88, 879. [Google Scholar] [CrossRef] [PubMed]

- Kock, N. Common method bias in PLS-SEM: A full collinearity assessment approach. Int. J. E-Collab. IJEC 2015, 11, 1–10. [Google Scholar] [CrossRef]

- Lindell, M.K.; Whitney, D.J. Accounting for common method variance in cross-sectional research designs. J. Appl. Psychol. 2001, 86, 114. [Google Scholar] [CrossRef]

- Hair, J., Jr.; Page, M.; Brunsveld, N. Essentials of Business Research Methods; Routledge: Oxfordshire, UK, 2019. [Google Scholar]

- Henseler, J.; Ringle, C.M.; Sarstedt, M. A new criterion for assessing discriminant validity in variance-based structural equation modeling. J. Acad. Mark. Sci. 2015, 43, 115–135. [Google Scholar] [CrossRef]

- Kline, E.; Wilson, C.; Ereshefsky, S.; Tsuji, T.; Schiffman, J.; Pitts, S.; Reeves, G. Convergent and discriminant validity of attenuated psychosis screening tools. Schizophr. Res. 2012, 134, 49–53. [Google Scholar] [CrossRef]

- Hair, J.; Hollingsworth, C.L.; Randolph, A.B.; Chong, A.Y.L. An updated and expanded assessment of PLS-SEM in information systems research. Ind. Manag. Data Syst. 2017, 117, 442–458. [Google Scholar] [CrossRef]

- Baron, R.M.; Kenny, D.A. The moderator–mediator variable distinction in social psychological research: Conceptual, strategic, and statistical considerations. J. Pers. Soc. Psychol. 1986, 51, 1173–1182. [Google Scholar] [CrossRef] [PubMed]

- Zeng, H.; Chen, X.; Xiao, X.; Zhou, Z. Institutional pressures, sustainable supply chain management, and circular economy capability: Empirical evidence from Chinese eco-industrial park firms. J. Clean. Prod. 2017, 2, 54–65. [Google Scholar] [CrossRef]

- Alshebami, A.S. Green innovation, self-efficacy, entrepreneurial orientation and economic performance: Interactions among Saudi small enterprises. Sustainability 2023, 15, 1961. [Google Scholar] [CrossRef]

- March, J.G. Exploration and exploitation in organizational learning. Organ. Sci. 1991, 2, 71–87. [Google Scholar] [CrossRef]

| Variable | Frequency (N) | Percentage (%) |

|---|---|---|

| Industry type | ||

| Manufacturing | 238 | 49.3 |

| Service industry | 133 | 27.5 |

| Others (construction, transportation, energy, etc.) | 112 | 13.2 |

| Firm size (Number of full-time employees) | ||

| Less than 100 people | 89 | 18.4 |

| 100–399 | 200 | 41.4 |

| 400–699 | 65 | 13.5 |

| 700–999 | 85 | 17.6 |

| More than 1000 people | 44 | 9.1 |

| Firm age | ||

| Less than 10 years | 57 | 11.8 |

| 10–19 | 38 | 7.9 |

| 20–29 | 44 | 9.1 |

| 30–39 | 170 | 35.2 |

| More than 40 years | 174 | 36.0 |

| N | 483 | 100.0 |

| Constructs and Measures | Loadings |

|---|---|

| Regulatory pressure [13] | |

| [RP1] Strict compliance with government regulations. | 0.954 |

| [RP2] Influence of government policy on promoting willingness to implement innovation. | 0.971 |

| [RP3] The favorable treatment of local governments for implementing innovation. | 0.968 |

| [RP4] The impact of government funding on innovation. | 0.939 |

| Normative pressure [13] | |

| [NP1] Adoption of environmental products by customers. | 0.890 |

| [NP2] Legitimacy of organizational activities. | 0.889 |

| [NP3] Growing stakeholder awareness of environmental innovation. | 0.921 |

| [NP4] Social media’s impact on environmental innovation. | 0.881 |

| Mimetic pressure [13] | |

| [MP1] Responses to stakeholders of the main competitors adopting innovation. | 0.923 |

| [MP2] Main competitors’ policy advantages in adopting innovation. | 0.951 |

| [MP3] Increase the ripple effect of main competitors adopting innovation. | 0.956 |

| [MP4] Increase the competitiveness of main competitors that adopt innovation. | 0.930 |

| Green product/service innovation [37] | |

| [GSI1] Choose the least polluting method for product/service development. | 0.854 |

| [GSI2] Choose the method of using the least energy and resources to develop products/services. | 0.865 |

| [GSI3] Configure product/service development with minimal material. | 0.857 |

| [GSI4] Consider recycling and reuse for product/service development. | 0.889 |

| Green process innovation [37] | |

| [GPI1] Recycling waste and emissions during the business process. | 0.850 |

| [GPI2] Effectively reduce emissions of hazardous materials or waste during business processes. | 0.840 |

| [GPI3] Effectively reduce consumption of natural resources during business processes. | 0.846 |

| [GPI4] Effectively reduce the use of raw materials during business processes. | 0.861 |

| Entrepreneurial orientation [105] | |

| [EO1] An aggressive investment toward uncertainty. | 0.907 |

| [EO2] An aggressive attitude toward uncertainty. | 0.907 |

| [EO3] Importance of R&D and technological innovation activities. | 0.868 |

| [EO4] Leading the way in introducing green products, services, or technologies. | 0.915 |

| Economic performance [106] | |

| [ECP1] Profit growth is superior to that of the main industry competitors. | 0.924 |

| [ECP2] Growth in return on investment is superior to that of industry leaders. | 0.940 |

| [ECP3] Growth in return on sales is superior to that of main industry competitors. | 0.929 |

| [ECP4] Market share growth is superior to that of main industry competitors. | 0.936 |

| Social performance [106] | |

| [SOP1] Reduces social inequality (polarization and regional income disparity) compared to its main industry competitors. | 0.961 |

| [SOP2] Contributes to the spread of social values (e.g., labor rights, revitalization of local communities) compared to its main industry competitors. | 0.958 |

| [SOP3] Enhanced worker or community health and safety compared to its main industry competitors. | 0.958 |

| [SOP4] Protected the claims and rights of aboriginal peoples or the local community compared to its main industry competitors. | 0.951 |

| Environmental performance [106] | |

| [ENP1] Reduces its energy consumption compared to its main industry competitors. | 0.959 |

| [ENP2] Reduces waste (e.g., air, water, and/or solid) emissions compared to its main industry competitors. | 0.948 |

| [ENP3] Reduced the environmental impacts of its products or services compared to its main industry competitors. | 0.957 |

| [ENP4] Undertook voluntary actions (e.g., actions that are not required by regulations) for environmental restorations compared to its main industry competitors. | 0.932 |

| Construct | Age | Size | Type | 01 | 02 | 03 | 04 | 05 | 06 | 07 | 08 |

|---|---|---|---|---|---|---|---|---|---|---|---|

| Firm age | 1.000 | ||||||||||

| Firm size | 0.236 | 1.000 | |||||||||

| Industry type | 0.047 | −0.025 | 1.000 | ||||||||

| 01. RP | 0.001 | 0.017 | 0.003 | 0.958 | |||||||

| 02. NP | 0.031 | 0.068 | −0.030 | 0.735 | 0.895 | ||||||

| 03. MP | 0.054 | 0.076 | 0.006 | 0.698 | 0.739 | 0.940 | |||||

| 04. GI * | 0.045 | 0.045 | 0.011 | 0.691 | 0.716 | 0.739 | 0.858 | ||||

| 05. EO | 0.011 | 0.065 | −0.019 | 0.571 | 0.626 | 0.571 | 0.657 | 0.899 | |||

| 06. ECP | −0.001 | 0.036 | −0.028 | 0.704 | 0.700 | 0.297 | 0.696 | 0.692 | 0.932 | ||

| 07. SOP | 0.007 | 0.027 | −0.037 | 0.674 | 0.707 | 0.702 | 0.715 | 0.692 | 0.808 | 0.957 | |

| 08. ENP | −0.014 | 0.022 | −0.018 | 0.678 | 0.686 | 0.679 | 0.669 | 0.662 | 0.765 | 0.810 | 0.949 |

| Cronbach’s alpha | 0.970 | 0.917 | 0.956 | 0.949 | 0.921 | 0.950 | 0.970 | 0.963 | |||

| rho_a | 0.970 | 0.918 | 0.958 | 0.949 | 0.921 | 0.951 | 0.970 | 0.963 | |||

| AVE | 0.917 | 0.802 | 0.883 | 0.736 | 0.809 | 0.869 | 0.916 | 0.900 | |||

| R2 | 0.666 | 0.431 | 0.540 | 0.584 | 0.508 | ||||||

| Q2 | 0.628 | 0.425 | 0.555 | 0.569 | 0.525 | ||||||

| HTMT < 0.85 | Yes | Yes | Yes | Yes | Yes | Yes | Yes | Yes |

| Path | β | S.E. | t-Statistic | p-Value | BCCI |

|---|---|---|---|---|---|

| RP→GI | 0.184 | 0.042 | 4.416 | *** | |

| NP→GI | 0.175 | 0.049 | 3.561 | *** | |

| MP→GI | 0.341 | 0.045 | 7.651 | *** | |

| RP→EO | 0.181 | 0.050 | 3.647 | *** | |

| NP→EO | 0.362 | 0.065 | 5.537 | *** | |

| MP→EO | 0.177 | 0.058 | 3.053 | ** | |

| EO→GI | 0.249 | 0.045 | 5.548 | *** | |

| RP→EO→GI | 0.045 | 0.015 | 2.909 | ** | 0.019, 0.084 |

| NP→EO→GI | 0.090 | 0.021 | 4.268 | *** | 0.051, 0.139 |

| MP→EO→GI | 0.044 | 0.017 | 2.611 | ** | 0.016, 0.082 |

| GI→ECP | 0.372 | 0.045 | 8.234 | *** | |

| GI→SOP | 0.399 | 0.050 | 7.993 | *** | |

| GI→ENP | 0.314 | 0.047 | 6.685 | *** | |

| EO→ECP | 0.320 | 0.050 | 6.383 | *** | |

| EO→SOP | 0.266 | 0.046 | 5.768 | *** | |

| EO→ENP | 0.245 | 0.049 | 5.034 | *** | |

| EO x GI→ENP | −0.104 | 0.022 | 4.769 | *** | |

| EO x GI→SOP | −0.126 | 0.024 | 5.169 | *** | |

| EO x GI→ENP | −0.152 | 0.021 | 7.163 | *** |

Disclaimer/Publisher’s Note: The statements, opinions and data contained in all publications are solely those of the individual author(s) and contributor(s) and not of MDPI and/or the editor(s). MDPI and/or the editor(s) disclaim responsibility for any injury to people or property resulting from any ideas, methods, instructions or products referred to in the content. |

© 2024 by the authors. Licensee MDPI, Basel, Switzerland. This article is an open access article distributed under the terms and conditions of the Creative Commons Attribution (CC BY) license (https://creativecommons.org/licenses/by/4.0/).

Share and Cite

Zhang, Q.; Zhu, X.; Lee, M.-J. Exploring Institutional Pressures, Green Innovation, and Sustainable Performance: Examining the Mediated Moderation Role of Entrepreneurial Orientation. Sustainability 2024, 16, 2058. https://doi.org/10.3390/su16052058

Zhang Q, Zhu X, Lee M-J. Exploring Institutional Pressures, Green Innovation, and Sustainable Performance: Examining the Mediated Moderation Role of Entrepreneurial Orientation. Sustainability. 2024; 16(5):2058. https://doi.org/10.3390/su16052058

Chicago/Turabian StyleZhang, Qiang, Xiumei Zhu, and Min-Jae Lee. 2024. "Exploring Institutional Pressures, Green Innovation, and Sustainable Performance: Examining the Mediated Moderation Role of Entrepreneurial Orientation" Sustainability 16, no. 5: 2058. https://doi.org/10.3390/su16052058

APA StyleZhang, Q., Zhu, X., & Lee, M.-J. (2024). Exploring Institutional Pressures, Green Innovation, and Sustainable Performance: Examining the Mediated Moderation Role of Entrepreneurial Orientation. Sustainability, 16(5), 2058. https://doi.org/10.3390/su16052058