Abstract

The digital transformation of enterprises is a significant catalyst for achieving cleaner production and directly affects a company’s carbon performance. This research elucidates the theoretical logic and potential impact mechanisms of digital transformation in reducing corporate carbon emissions. Second, using a panel data set of Chinese A-share listed companies from 2007 to 2020, this study quantitatively investigates the effect of corporate digital transformation on the carbon emissions intensity of businesses. The empirical results indicate that corporate digital transformation has a statistically significant negative effect on the carbon emissions intensity of Chinese firms. Several robustness tests have validated this conclusion. The heterogeneity analysis reveals that state-owned businesses, firms with high carbon intensity, and those with strong financing capacity would benefit more from digital transformation in achieving the goal of reducing carbon emissions. Furthermore, the impact of digital transformation on corporate carbon emission abatement is more prominent in industries with limited technological input and high energy consumption. At the regional level, digital transformation has a more significant impact on reducing carbon emissions in cities with stringent environmental regulation, advanced marketization, and resource-based economies. The transmission mechanism analysis confirms that improving corporate energy use efficiency, enhancing financial performance, and fostering green innovation are crucial transmission mechanisms through which digital transformation can help enterprises decrease their carbon emissions. These findings assist companies in comprehending the role of digital transformation in lowering carbon emissions and provide them with valuable insights.

1. Introduction

As a major carbon emitter, China is taking bold steps towards conserving energy, reducing emissions, and adjusting its economic structure, with the aim of reaching its “carbon peak” and “carbon neutrality” targets by 2030 and 2060, respectively [1,2]. As the micro-subject of the economy, enterprise low-carbon transformation is the key to achieving the overall economy’s low-carbon transformation. In the process of achieving the goal of “double carbon”, businesses in China are facing significant challenges in reducing their carbon emissions. According to the “Carbon emission ranking of listed companies” in China, in 2020, the carbon emissions of the 100 listed businesses in China participating in the survey exceeded 4.4 billion tons, accounting for about 44.7% of the total CO2 emissions in the whole country. Empowering enterprises to achieve low-carbon transition is not only correlated with the survival of firms in the context of strict environmental policies, but is also connected to the attainment of carbon neutrality for the whole country.

Enterprises often require technical support for low-carbon transformation. Recently, with the advancement of digital technologies including big data, cloud computing, and blockchain [3,4], a growing number of enterprises have embraced the trend of digital economy and initiated digital transformation, utilizing emerging technologies. For one thing, digital transformation has prominent digital spillover effects in terms of fostering corporate innovation [5,6], optimizing organizational structures [7], and enhancing financial performance [8]. In addition, digital technology, due to its distinctive role in monitoring enterprise processes, operations, and energy consumption, has exerted a profound impact on corporate environmental performance [9]. According to the “2019 Global Digital Transformation Income Report”, Schneider Electric and its global partners completed 230 projects, with enterprises that deployed digital technology platforms achieving the maximum energy savings of 85%, with an average reduction of 24% and a maximum CO2 footprint optimization of 50%, with an average optimization of 20%. However, in the context of China’s “dual carbon” strategy, further research is needed on whether digital transformation can promote the reduction of carbon emissions by Chinese enterprises. Exploring this issue has important theoretical and practical significance for China to explore low-carbon economic transformation from a micro perspective.

Part of the research has begun on exploring the concept and evaluation of digital transformation. In terms of the concept, digital transformation essentially falls within the scope of the digital economy. Previous studies have proposed the term “digital economy” [10] and provided definitions based on the description of digital economic phenomena [11], a summarization of characteristics [12], and the decomposition of structure [13]. From an industry perspective, industrial digital transformation refers to the part of the broad digital economy where traditional industries increase output and enhance efficiency through the adoption of digital technologies [14]. It involves leveraging advanced digital technologies, empowering and extracting value from data, and digitally transforming and upgrading all factors in the industrial chain (National Information Center, 2021). From an enterprise perspective, most studies consider enterprise digital transformation to be a process that involves the combination of information, computation, communication, and connectivity technologies to reconstruct products and services, business processes, organizational structures, business models, and collaboration models, thereby helping companies create and capture more value [15,16,17] In terms of evaluation, existing research has measured the digitalization of industries from a macro-regional and industry-level perspective based on the broad-scale digital economy [18]. This measurement is primarily carried out through input–output analysis [19], and single or composite index evaluation methods [20]. At the micro-level of enterprises, researchers have employed methods such as questionnaire surveys [21], text analysis [22], and index evaluation based on the “input-output” theory [23] to measure enterprise digital transformation.

Another part of the research field examines the economic effects of digital transformation. From macro perspectives, Choi and Hoon Yi [24] took the lead in discussing the promotion influence of the popularization of Internet technology on economic growth. On this basis, more and more scholars have further explored the positive impacts of digital technologies and digital transformation on economic development and green economic growth [25,26,27]. Additionally, digital transformation plays an effective role in international trade. According to Freund and Weinhold [28], web hosts growth can lead to an increase in export growth by reducing the search cost of export trade. Jiang and Jia [29] found that digitalized service at a higher level can significantly improve digital service trade exports across countries. As for its impacts on industrial chains, Liu and Pan [30] believed that the application of artificial intelligence may improve the engagement of a country’s industry in the global value chain by reducing trade costs, promoting technological innovation and optimizing resource allocation. From a micro perspective, the impacts of digital transformation on enterprises have attracted more and more attention from scholars. Shang and Wu [31], Peng and Tao [32], etc., all found that digital transformation is conducive to improving enterprises’ value. A study by Du and Jiang [33] also analyzed the facilitation impacts between digital transformation and firm productivity, and showed which effect is, relatively, stronger in downstream firms. Furthermore, digital transformation is also an important factor in reducing firms’ costs, and in increasing operating revenue [34]. In addition to enterprises’ performance, the corporate digital transformation also affects enterprises’ internal control [35], management efficiency [36], and capital market performance [37], and further exerts influence on risk-taking [38]. There have also been studies focusing on the effects of digitalization on technology innovation. Wen et al. [39] discussed the positive effect of digital transformation in corporate innovative practices and indicated that digitalization is a vital driving force in corporate innovation investment. Digital transformation can prompt both the incremental and radical innovation of enterprises [40].

There have also been studies starting to explore the environmental effects of digital transformation. From a macro perspective, some studies have used urban data from China and empirically found that big data [41] and artificial intelligence [42] significantly reduce carbon emissions, while digital finance increases resident carbon emissions through consumption and employment effects [43]. Another study discovered an inverted U-shaped relationship between digitization and carbon emissions in China [44], where the digital economy improves carbon emission performance through energy intensity, energy consumption scale, and urban greening, exhibiting non-linear characteristics under different conditions of energy consumption structure [45]. Research has indicated that digital energy consumption and energy rebound are the main reasons for the non-linear impact of digital development and carbon emissions [46]. Additionally, based on national panel data analysis, digital transformation reduces the carbon intensity of the transportation industry through technological progress, internal structural upgrades, and energy consumption improvements [47]. Industrial robots increase productivity, optimize factor structures, promote technological innovation in production, and thus enhance energy efficiency and reduce carbon intensity [48]. From a micro perspective, research has examined the emission reduction effects of enterprise digital transformation on Chinese industrial enterprises using imported digital products as a natural experiment. The empirical findings indicate that enterprise digital transformation can significantly reduce pollution emissions [49]. The findings reveal a significant inverted U-shaped non-linear relationship between digital transformation and corporate environmental performance [50]. Moreover, Shang et al. [51] measured the level of enterprise digital transformation through the textual analysis of annual reports of A-share listed companies in the Shanghai and Shenzhen stock markets. The study empirically concluded that enterprise digital transformation can significantly reduce carbon emission intensity by enhancing technological innovation, internal control capability, and environmental information disclosure. The impact of digital transformation is stronger for companies in regions with stronger intellectual property protection and for capital-intensive enterprises, but there is no heterogeneity with respect to company type, environmental regulation intensity, and enterprise information infrastructure construction [51].

In summary, while there is a significant body of literature closely related to this study, there are still areas for further exploration: (1) Most works in the literature primarily focus on the macro-level examination of the economic and environmental effects of digital transformation, as well as the micro-level investigation of the economic effects of digital transformation within enterprises. However, there is still a need to further supplement the literature by investigating the environmental effects of enterprise digital transformation from a micro-level perspective. (2) This study differs from the existing literature, specifically from the research conducted by Shang et al. [51], in terms of the explored transmission mechanisms, heterogeneity analysis, and selection of instrumental variables. Therefore, there is scope for further research to elucidate the transmission mechanisms of digital transformation, analyze heterogeneity effects, and carefully select instrumental variables to enhance the robustness of the findings.

In view of this, the present study endeavors to utilize data from Chinese A-share listed companies spanning the years 2007 to 2020. The study aims to explore the impact and mechanisms of corporate digital transformation on carbon emissions from both theoretical and empirical perspectives. The potential incremental contributions of this research can be outlined in the following three aspects: (1) This study further reveals the transmission mechanisms of digital transformation on corporate carbon emissions by delving into energy utilization efficiency, financial performance, and green innovation, thereby enhancing the understanding of the interplay between the two phenomena. (2) This study systematically elucidates the heterogeneous impacts of digital transformation on corporate carbon emissions at the corporate level, considering attributes, carbon emission intensity, and financing capacity; at the industry level, assessing technological input intensity and energy consumption intensity; and at the regional level, considering urban environmental regulations, degree of marketization, and resource endowment. This systemic analysis aims to provide explanatory insights into the diverse effects of carbon reduction among different types of companies, industries, and cities. (3) Differing from the instrument variable employed by Shang et al. [51], this study employs the total word count of annual corporate reports as the instrumental variable, aiming to address endogeneity issues in the model.

2. Theoretical Analysis and Hypothesis

Dissimilar to enterprise informatization transformation, corporate digital transformation involves the utilization of digital technologies (ABCD—Artificial Intelligence, Blockchain, Cloud Computing, Big Data) [52,53] to reconstruct products and services, business processes, organizational structures, business models, and collaborative approaches. This process aims to assist enterprises in generating and acquiring greater value [15,16,17]. Throughout this journey, enterprises rely heavily on various digital technologies to reduce costs, enhance operational efficiency, and boost competitiveness, thereby achieving energy conservation and emission reduction [54].

According to traditional enterprise theory, the primary goal of firms is to maximize profits and the value of shareholders [55]. However, modern corporate governance theory and stakeholder theory suggest that enterprises should not only be responsible for shareholders, but also take active steps to fulfill their responsibilities towards creditors, the government, and the environment, in order to maximize the overall interests of stakeholders [56]. Despite the strong externalities associated with environmental protection practices and carbon emission reduction measures in enterprises, there is a significant lack of motivation for firms to pursue such initiatives. On the one hand, excessive investment in environmental protection would increase corporate expenditures, decrease corporate profitability, and harm the interests of shareholders. On the other hand, enterprises may encounter challenges such as resource limitations, technological constraints, informational constraints, and a shortage of talent, resulting in high costs for reducing carbon emissions and a limited capacity to carry out such measures. With the emergence of new digital technologies, enterprises now have the opportunity to reverse this trend. By combining digital technology with traditional production methods, enterprises can undergo digital transformation and transform their operations, which will not only increase enterprise value but also provide important support for cleaner production. Firstly, corporate digital transformation may offer energy-saving and emission-reduction technologies [57], which can positively impact their ability to reduce carbon emissions. Secondly, digital technology applications can improve the allocation of production factors such as human and material capital, and enhance internal control within enterprises [58], thereby reducing the cost of reducing carbon emissions. Finally, digital transformation offers a convenient way for enterprises to access production, technical, and market information, reducing the negative effects of information asymmetry [59] and lowering transaction costs, thereby enhancing corporate governance and improving carbon performance. Based on the aforementioned analysis, we postulate the first research hypothesis.

Hypothesis 1 (H1).

Digital transformation is beneficial for corporate carbon emissions reduction.

In addition to direct impacts, corporate digital transformation may influence carbon emissions through various transmission mechanisms.

One such mechanism is the improvement of energy use efficiency. Chen and Chen [60] have found that there are significant differences in energy use efficiency among Chinese enterprises due to the scale effect. Small- and medium-sized companies often struggle with low energy efficiency due to outdated technology and equipment, but digital technologies can help improve their energy efficiency. From an energy consumption perspective, digital technology, for one thing, provides a certain technical basis for the promotion of R&D of clean energy, and is beneficial to the promotion and use of clean energy among enterprises [61]. For another, digital technology enhances the substitution of cleaner energy for traditional fossil energy [62], empowering the upgrading of the energy consumption structure. From the perspective of energy supply and demand, digital technologies such as cloud computing and big data can improve energy collection efficiency, digitize and optimize energy supply, and enable the more accurate prediction of energy consumption through data monitoring, thus improving energy use efficiency [63]. Additionally, the usage of digital technology can also enhance the corporate monitoring of energy use processes, leading to a more effective identification and correction of issues. In conclusion, corporate digital transformation can enhance energy use efficiency, which has been shown to directly reduce carbon emissions [64], enabling enterprises to achieve long-term clean production. As such, it can be argued that improving energy utilization efficiency is a crucial transmission mechanism for corporate digital transformation to reduce carbon emissions.

Second, the promotion effect on enterprises’ financial performance is an effective influence mechanism for digital transformation, helping to reduce corporate carbon emissions. According to the theory of redundant resources, the improvement of corporate financial performance can provide passive resources for corporations shouldering more social responsibility [65]. Therefore, high-quality financial performance can provide more capital and resources for enterprises to improve carbon performance. Meanwhile, according to natural resources theory, the implementation of environmental strategy and management practice depends on organizational resources and organizational capacity, while organizational redundancy can provide disposable resources for the enhancement of corporate carbon performance [66]. Therefore, the improvement of corporate financial performance plays a fundamental role in CO2 abatement. Digital transformation can enhance a company’s financial performance through several channels. Firstly, digital technology can effectively integrate production factors, breaking down information silos between departments and improving production management. Additionally, intelligent data analysis and data-driven decision-making can refine production plans, resulting in improved production efficiency and financial performance [67]. Thirdly, the application of digital networks also allows companies to receive customer feedback and optimize production, ultimately improving their financial performance [68]. In conclusion, digital transformation can positively impact a company’s financial performance and, indirectly, reduce its carbon emissions.

The green innovation effect represents another transmission mechanism. Green technology innovation plays a crucial role in mitigating CO2 emissions [69]. Both innovations in green technology at the production end and those in the treatment of pollution at end-use contribute directly to reducing corporate carbon emissions [70]. The digital transformation of enterprises provides a foundation for low-carbon and green technological innovation. First of all, the implementation of digital technology accelerates the digitization, algorithmic modeling, and streamlining of innovation processes, potentially significantly shortening the R&D cycle for low-carbon technology [61]. Secondly, networking connectivity overcomes the barriers to innovation within enterprises and breaks down the “information barrier” to corporate green innovation, facilitating the exchange of innovation elements and enhancing the low-carbon spillover effects of green innovation. Finally, the use of embedded intelligent devices allows enterprises to continuously monitor energy consumption and pollutant emissions, improve information collection, and control carbon emissions [71]. Enterprise digital transformation can thus effectively help control carbon emissions through facilitating green technology innovation.

Building upon the preceding analysis, we propose a second hypothesis:

Hypothesis 2 (H2).

The digital transformation of corporations can help to decrease corporate carbon emissions by increasing energy usage efficiency, enhancing corporate financial performance, and inducing the green innovation effect.

3. Research Methods

3.1. Econometric Model

In order to empirically test the carbon emissions reduction effect of corporate digital transformation, based on above theoretical analysis, this study establishes the following regression model:

where CIit represents the carbon emissions intensity of firm i in year t. Digit is the digital transformation degree of firm i in year t. Xit denotes a set of control variables affecting corporate carbon emission intensity. indicate firm-fixed effects, year-fixed effects, and the random error term, respectively.

3.2. Variables

3.2.1. Dependent Variable: Corporate Carbon Emissions Intensity (CI)

This study uses the ratio of carbon dioxide (CO2) emissions to the operating revenue of listed companies to define CI, which has been adopted in the relevant literature [61]. At the same time, the calculation scope of CO2 emissions of listed companies in this study includes two categories: one is direct greenhouse gas emissions generated by emission sources owned or controlled by the enterprise; the other type is indirect greenhouse gas emissions generated by the consumption of externally purchased electricity and thermal energy. The study manually compiles data on annual carbon emissions, fossil fuel consumption, and electricity and heat usage from corporate social responsibility reports, sustainable development reports, and environmental reports. Subsequently, these data are subjected to computation in accordance with the methodology prescribed by the National Development and Reform Commission and “IPCC Guidelines for National Greenhouse Gas Inventories” (2006). This method of calculating CO2 emissions from listed companies has been adopted in the relevant literature [72,73].

3.2.2. Core Independent Variable: Enterprise Digital Transformation (Digitalization)

The digital transformation of enterprises involves three aspects: transformation technology, scope, and results. Its essence lies in the driving and application of “ABCD” digital technology, which has been confirmed by the relevant literature [74,75]. Therefore, we evaluated enterprise digital transformation from two perspectives: “adoption of digital technology” and “practical application of digital technology”. This approach to evaluating enterprise digital transformation has been adopted in the relevant literature [37,54]. The specific steps are as follows.

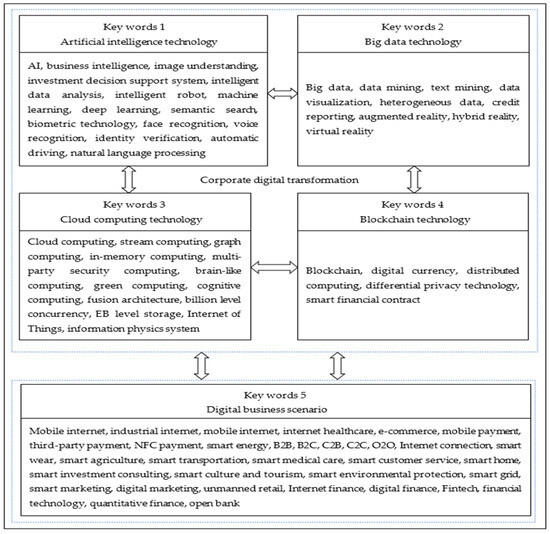

First, the characteristic words of digital transformation were identified, as shown in Figure 1, based on the works of Wu et al. [37] and Li et al. [75]. Corporate digital transformation consists of two levels. At the first level, businesses focus on digital technology-driven transformation to upgrade their existing technology systems. “ABCD” technologies, including AI, blockchain, cloud computing, and big data, play a pivotal role in this process. This level focuses on upgrading internal production and operation processes and digitalizing management models and technologies. The second level of corporate digital transformation involves moving from technology empowerment at the back end to market scenario application at the front end, thus creating a new business growth engine. The “digital technology adoption” is further divided into four mainstream technology directions (keywords 1–4), while the “practical application of digital technology” focuses on specific digital business scenario applications (keyword 5).

Figure 1.

Structured feature word map of enterprises’ digital transformation.

Secondly, we gather annual reports of publicly listed companies using Python web scraping functionality, and subsequently employ the Java PDFbox library to extract the word frequencies associated with “digital technology adoption” and “practical application of digital technology”. Thirdly, we aggregate the word frequencies for “digital technology adoption” and “practical application of digital technology”, add 1 to the total frequency, and then calculate the logarithm of this value. This calculated metric is used to quantify the extent of enterprise digital transformation (Digitalization).

3.2.3. Control Variables

In accordance with a prior study by Long et al. [76] and Zhong et al. [77], this study controls for several firm-level variables. These variables include: (1) Cash flow (Cashflow), which is assessed as the ratio of net cash flow to corporate total assets, and is a reflection of a firm’s financial viability. Higher cash flow provides more capital for investment in environmental regulation and emissions reduction, potentially lowering carbon emissions. (2) Asset-liability ratio (Leverage). It is calculated as the ratio of total liabilities to firms’ total assets, and can affect the financial support available for environmental protection activities, thereby influencing carbon emission reduction. (3) Board size (Board). The board is quantified as the natural logarithm of the number of firm directors, which can impact decision-making efficiency, indirectly affecting operations and carbon performance. (4) CEO duality (Dual), which is a binary variable indicating whether the CEO holds both the CEO and chairman positions and can impact operational efficiency. (5) Equity concentration (Top1). This is evaluated as the ratio of shares held by the largest shareholder to total shares, and directly or indirectly affects enterprise operations and environmental performance. (6) Listing age (Listage). Listage is measured as the natural logarithm of the years of listing, which is related to the maturity, corporate value, and ESG performance of the firm, and may impact carbon emissions control. (7) Corporate nature (SOE), which is a binary variable implying whether the enterprise is state-controlled, and may weaken carbon emission constraints in certain political contexts, negatively affecting carbon emission reduction.

3.3. Data Source and Statistical Analysis

To investigate how corporate digital transformation contributes to carbon emissions reduction, we selected data from Chinese A-share listed corporations between 2007 and 2020, resulting in a final sample of 25,311 observations from 3005 companies. Financial companies, ST, and *ST companies were excluded. Finally, we obtained unbalanced panel data from 3005 publicly listed companies for the years 2007 to 2020. Data pertaining to corporate digital transformation were collected from annual reports, while other firm-level and industry classification data were collected from the CSMAR database. Data at the city level were acquired from the China Urban Statistical Yearbook (2008–2021) and the China Environmental Statistical Yearbook (2008–2021). We matched the firm-level data, industry-level data, and city-level data for further analysis.

Table 1 presents the descriptive statistics of the core variables.

Table 1.

Descriptive statistics of variables.

4. Empirical Results and Analysis

4.1. Benchmark Regression Results

Table 2 summarizes the outcomes of a benchmark regression analysis that examines how digital transformation impacts the intensity of corporate carbon emissions. The first column displays the coefficient estimate for Digitalization without any control variables, while columns (2) to (4) present the results obtained after incorporating control variables. Our findings reveal that the estimated coefficient for Digitalization was consistently negative at a significance level of 5%, showing that corporate digital transformation can have a substantial effect on curbing the intensity of carbon emissions. This empirical evidence supports the validity of research hypothesis 1. This aligns with the findings of previous research [51]. Overall, enterprise digital transformation involves the adoption of “ABCD” digital technologies, leading to shifts in business operations, improved operational efficiency, and reduced costs. This, in turn, serves as a catalyst for energy conservation and emissions reduction. Furthermore, as posited in this study, enterprise digital transformation holds the potential to curtail carbon emission intensity by enhancing energy utilization efficiency, optimizing financial performance, and driving eco-friendly innovation. The outcomes presented in Table 2 corroborate these assertions by providing empirical substantiation for Hypothesis 2. From the regression outcomes in the fourth column of Table 2, it can be inferred that variables such as Cashflow, Leverage, Board, and Dual do not yield statistically significant impacts on corporate carbon emission intensity. However, Listage demonstrates a noteworthy reduction in the carbon emission intensity of corporations. This phenomenon might be attributed to the extended listing duration of companies, which affords them greater opportunity to amass management expertise and industry-specific knowledge. This, in turn, heightens their likelihood of comprehending and implementing environmentally conscious technologies and practices, leading to diminished carbon emissions. Additionally, corporations with prolonged listing periods often place an increased emphasis on their brand image and social responsibility. Given the escalating societal concern for environmental matters, such companies may adopt a more proactive stance in reducing carbon emissions to uphold their favorable brand reputation. In contrast, state-owned enterprises (SOEs) exhibit a discernible elevation in corporate carbon emission intensity. This trend could be attributed to the concentration of state-owned entities in sectors characterized by higher inherent carbon emission intensity, including energy, heavy industry, and infrastructure. Furthermore, the availability of governmental support often facilitates a greater ease of access to funding for SOEs. This scenario may, however, result in a relative lack of proactive investment in technological advancements and efficiency enhancements, as compared to privately-owned enterprises.

Table 2.

Benchmark regression results.

4.2. Robustness Test

In order to further investigate the reliability of the estimation results of Equation (1), we conducted the following robustness tests.

First, the two-stage least squares (IV-2SLS) method was adopted in this study to address the potential endogeneity concern. The overall word count of the annual report of the sample enterprises was chosen as an instrumental variable for two reasons. Firstly, based on the frequency of certain keywords in the annual reports of listed companies, the digital transformation index was calculated to measure the degree of corporate digital transformation. This index was found to be strongly associated with the total word count in the annual report. Secondly, the aggregate word quantity contained in the annual report was an exogenous variable in the model and did not exert a direct causal impact on the intensity of firms’ carbon emissions. The results of the estimation passed the over-identification test at the 1% level of significance, and the Cragg–Donald Wald F value was greater than the critical value of Stock–Yogo at the 10% level of significance (16.38), indicating the validity of this instrument variable. The estimated coefficient of Digitalization in column (1), −0.0541, was significant with the 5% level of significance, implying that, due to the presence of endogenous problems, results in Table 2 underestimate the extent to which corporate digital transformation has a restraining effect on the level of carbon emissions.

Second, the independent variable was re-evaluated by conducting a text analysis and substituting the key words with four dimensions: “application of digital technology”, “Internet business model”, “intelligent manufacturing”, and “modern information system”. Using the frequency of these key words in the annual reports of enterprises, a new index of corporate digital transformation was constructed. The results of the estimation, displayed in column 2 of Table 3, indicate that the coefficient of Digitalization2 remained significantly negative, demonstrating the robustness of the conclusion that corporate digital transformation positively impacts carbon emissions’ abatement.

Table 3.

Robustness tests: 1.

Third, considering the continuity of carbon emissions of enterprises, the lag period of carbon emissions was included as a variable in the control variables, and OLS estimation was performed once again. Column (3) shows the estimated coefficient of Digitalization, which reveals that even after controlling for the first-order lag of the dependent variable and other control variables, the digital transformation of businesses continued to have a significant inhibitory impact on carbon emission intensity.

Finally, in column (4) of Table 3, industry fixed-effects were further controlled for, resulting in a three-dimensional fixed-effect model that takes into account individual, industry, and year effects. The coefficient for the key explanatory variable as estimated by the model was negative and significant at the 5% level, further confirming the reliability of the benchmark regression results.

To further eliminate the potential influence of China’s ongoing environmental policies on corporate carbon emission intensity, this study incorporated the low-carbon city pilot policy (Policy_dt), carbon trading pilot policy (Policy_tjy), and energy-saving and emission reduction fiscal policy (Policy_gf) into the baseline model for a re-regression. From the regression results presented in Table 4, it can be inferred that even after accounting for the impact of these three environmental policies, digital transformation continued to exhibit a significant inhibitory effect on corporate carbon emission intensity.

Table 4.

Robustness tests: 2.

4.3. Heterogeneity Discussion

4.3.1. Corporate Heterogeneity

According to the principal–agent theory, enterprises with different natures of ownership have different degrees of principal–agent relationship, and the business development and innovation activities of enterprises are also affected by the principal–agent relationship. Therefore, enterprises with different natures of ownership will have differences in business performance, innovation ability, and environmental performance. According to the theory of resource dependence, enterprises with different ownership modes have different resources and abilities to obtain external resources, and this difference will be extended to all aspects of enterprise management. In this section, we divide the samples into state-owned enterprises (SOEs) and non-state-owned enterprises in accordance with corporate ownership, to detect whether impacts of corporate digital transformation on carbon emissions intensity are heterogeneous. The estimation results of columns (1) and (2) in Table 5 display the impact of corporate digital transformation on the intensity of carbon emissions as significantly negative for firms with state-owned ownership, but not significantly for non-state-owned businesses. The possible reason is that, against the backdrop of China’s digital economy advancement and pursuing the “dual-carbon” strategic goal, a state-owned enterprise has the power to take the lead in realizing the digital transformation and demonstrating a role for other enterprises. In addition, state-owned enterprises always have more political connections and more advantages in the acquisition of digital technologies and financial support, so they can better play the part of digital transformation in corporate carbon emissions reduction.

Table 5.

Corporate heterogeneity.

The effect of digital transformation on reducing carbon emissions may differ depending on the carbon intensity of companies. After dividing the firm samples into two groups based on the annual median of carbon emissions intensity, the regression results of columns (3) and (4) in Table 4 show that, for high-carbon enterprises, digital transformation has a noteworthy, positive effect on reducing carbon emissions, whereas for low-carbon firms, corporate digital transformation exerts a reverse effect. This suggests that for high-carbon enterprises, digital transformation is a crucial driving force for their low-carbon development.

The financial capability of corporations is a significant limiting factor in their environmental investment [78]. Using the annual median of the SA index, companies are categorized into two groups to evaluate the different effect of corporate digital transformation on carbon emissions. Drawing from Hadlock and Pierce [79], a lower SA index suggests a more severe financing constraint, indicating weaker financial ability. Results from columns (5), (6) in Table 5 reveal the influence of corporate digital transformation on carbon emissions for firms with strong and weak financing capability. The Digitalization coefficient is negatively significant at a 5% level for corporations with strong financing capability, but not significant for those with weaker financing capacity. This implies that corporations with a strong financing capability have more resources to invest in digital technology and carbon emission control, providing financial support for digital transformation in reducing carbon emissions.

4.3.2. Industry Heterogeneity

Different industries face varying market conditions and policies, leading to different impacts of digital transformation on corporate carbon emissions intensity. This section classifies industries and examines the effect of heterogeneity based on the technology input intensity and energy consumption intensity of industries.

Using the “Classification of High-tech Industries (2017)” by the National Bureau of Statistics, the samples were categorized into two groups: the high-tech group, and the other group. The results in Table 6, columns (1) and (2), imply that in industries with low technological intensity, digital transformation exerts a more significant effect on reducing carbon emissions, as indicated by a significantly negative estimated coefficient. This suggests that for enterprises with weaker technological bases, digital technology can have a greater impact on improving their carbon performance.

Table 6.

Industry heterogeneity.

Regarding the energy consumption intensity of different industries, in accordance with the “Letter on Clarifying Issues Related to the Implementation of the Policy of Reducing the Cost of Electricity by Stages” issued by the National Development and Reform Commission, industries were categorized into energy-intensive and non-energy-intensive industries. Estimation results in Table 6, columns (3) and (4), indicate that digital transformation exerts a significant negative impact on the carbon emissions intensity of businesses in energy-intensive industries, but no significant effect in non-energy-intensive industries. It is evident that digitalization in energy-intensive industries has the potential to yield greater marginal benefits for carbon emission reduction.

4.3.3. Regional Heterogeneity

To examine the heterogeneity of the impact of digital transformation on corporate carbon emissions across regions, we first categorized the samples into two groups based on the median level of environmental regulation in the cities where the enterprises are located. The proxy variable of environmental regulation was synthesized using the entropy method, taking into account the local SO2 removal rate, the utilization rate of industrial solid waste, and the industrial smoke removal rate. Different estimation results of the impact of digital transformation on corporate carbon emissions intensity are presented in columns (1) and (2) of Table 6. It was found that in cities with a high level of environmental regulation, the coefficient of Digitalization was −0.0082, with a statistical significance at the 10% level, while in the other sample group, the coefficient of Digitalization was not significant. This confirms the importance of regional environmental regulation in determining the extent of the reduction in corporate carbon emissions due to digital transformation.

Next, we categorized the cities further based on their marketization degree, which was measured by the ratio of employees in individual and private enterprises to total employees. This degree affects regional resource allocation and capital structure, and therefore the correlation between digital transformation and the carbon footprint of corporations will vary. Estimation results of this heterogeneity analysis are shown in columns (3) and (4) of Table 7, showing that in cities with a high marketization degree, corporate digital transformation has a notable impact on carbon emissions reduction, but this is not the case in cities with a low degree of marketization. In regions with greater marketization, weaker information barriers often facilitate enterprise access to digital technologies. Moreover, higher levels of marketization correspond to greater emphasis on economic efficiency by enterprises. Digital transformation can promote cost savings, enhance competitiveness, and facilitate sustainability for businesses. Consequently, in highly marketized areas, businesses tend to exhibit a relatively advanced stage of digital transformation, making it more likely for them to achieve carbon reduction goals.

Table 7.

Regional heterogeneity.

Moreover, we investigated whether the influence of digital transformation on corporate carbon emissions intensity differs depending on whether cities are resource-based or non-resource-based. The classification adheres to the guidelines outlined in the National Plan for Sustainable Development of Resource-based Cities (2013–2020) established by the State Council of China. The results of our analysis are presented in columns (5) and (6). The findings indicate that digital transformation can lower corporate carbon emissions in resource-based cities, whereas non-resource-based cities do not exhibit such an effect. The development of resource-based cities often depends on the consumption of traditional fossil fuels, resulting in relatively high carbon emissions intensity for their enterprises. The digital transformation of these corporations can enhance energy efficiency and lead to more significant carbon emissions reductions.

4.4. Transmission Mechanism Discussion

Building upon the foundation of Model (1), this study, drawing inspiration from existing research [76], establishes a panel mediation model to examine three transmission mechanisms of the impact of digital transformation on corporate carbon emission intensity.

where represents the coefficient of the influence of digital transformation on the mediating mechanism variables, and signifies the coefficient of the impact of mediating mechanism variables on corporate carbon emission intensity. When both and are statistically significant, it indicates that digital transformation can influence corporate carbon emission intensity through the mediating variables. The meanings and interpretations of other variables and symbols remain consistent with Model (1). Our theoretical analysis indicates that three possible transmission mechanisms may exist: improvement in energy use efficiency, enhancement of financial performance, and promotion of green innovation. We adopted the LP method, as described in research of Zhong and Ma [61], to compute the total factor productivity of businesses as a proxy for energy use efficiency. Return on assets (ROA) was adopted as the proxy variable for financial performance [80], and the green innovation of enterprises was measured by the natural logarithm of the number of green utility patents they had obtained independently [80].

Table 8 presents the empirical results of the mechanism test for the effect of corporate digital transformation on carbon emissions intensity. Columns (1), (3), and (5) demonstrate the influence of digitalization on the energy use efficiency of businesses, financial performance, and green innovation, respectively. The estimated coefficient of Digitalization is significantly positive, implying that corporate digital transformation is beneficial to the improvement of corporate energy use efficiency, financial performance, and green technology innovation. Columns (2), (4), and (6) demonstrate that improvements in energy use efficiency, enhancement in financial performance, and green innovation all have significantly inhibiting effects on the carbon emissions of businesses. In conclusion, the results of our test indicate that energy use efficiency improvement, financial performance enhancement, and green innovation promotion are three effective transmission mechanisms and that digital transformation helps to reduce the intensity of corporate carbon emissions. This provides evidence to support the validity of Hypothesis 2.

Table 8.

Transmission mechanism test.

4.5. Extended Analysis

The corporate digital transformation indicator is comprised of multiple dimensions, as described in Figure 1 (Keywords 1–5). We performed a word frequency analysis of these five dimensions in the annual reports of enterprises and evaluated their impact on corporate carbon emissions reduction, respectively. Table 9 presents the results of this empirical study. Our OLS estimation results, which control for the firm-level variables, indicate that digital transformation in the “AI” and “digital business scenario application” dimensions have the most significant effect on reducing corporate carbon emissions. Although applications of big data, blockchain, and cloud computing have a negative impact on carbon emission reduction, these effects were found to be insignificant.

Table 9.

Extended analysis: impacts at different dimensions.

The interpretation of the key words in Figure 1 reveals that AI-related keywords primarily focus on advanced learning and intelligent analysis, while digital business scenario applications center around intelligent devices, mobile payment, new business models, digital financial technology, and intelligent financial services. This implies that, in the current context of widespread corporate digital transformation in China, the widespread adoption of AI technology and the implementation of new business models are crucial drivers for reducing corporate carbon emissions. Meanwhile, to better contribute to improved environmental performance, efforts also should be made to enhance the promotion of big data, cloud computing, and blockchain technology.

5. Conclusions and Implications

5.1. Conclusions

The role of digital transformation in achieving low-carbon development for enterprises is becoming increasingly significant. However, as a major carbon emitter, the level of digital transformation among Chinese enterprises remains relatively low. The influence of digital transformation on the low-carbon development of Chinese enterprises still necessitates further exploration. Investigating this issue can offer theoretical and empirical insights from China’s experience for other countries globally, guiding them on leveraging digital technologies to promote low-carbon economic transitions. In light of this, our study combines theoretical analysis with empirical validation. Utilizing unbalanced panel data of 3005 listed companies from 2007 to 2020, we examined the impact of digital transformation on corporate carbon emission intensity and its underlying mechanisms. The primary findings of this research are as follows:

- (1)

- Digital transformation has a significant effect in reducing corporate carbon emissions intensity. The study employs the two-stage least squares (IV-2SLS) approach to address endogeneity in the model. It also includes lagged variables of carbon emissions as control variables and controls for industry fixed effects, ensuring the robustness of the analysis.

- (2)

- The reduction in carbon emissions intensity is more pronounced in state-owned enterprises, companies with higher initial carbon emissions intensity, and those with strong financing capabilities. In industries characterized by low technological input and high energy consumption, digital transformation leads to a greater decrease in carbon emissions intensity. Additionally, the impact of digital transformation on carbon emissions is more significant in industries with strict environmental regulations, higher levels of marketization, and resource-based cities.

- (3)

- Digital transformation can achieve a reduction in corporate carbon emissions intensity by improving energy efficiency, optimizing financial performance, and promoting green innovation.

- (4)

- Further analysis reveals that only artificial intelligence, among the digital technologies examined, significantly reduces corporate carbon emissions intensity. While big data, blockchain, and cloud computing have a negative impact, the effects are not statistically significant.

5.2. Policy Implications

Based on the research conclusions regarding the impact and mechanisms of digital transformation on corporate carbon emission intensity, this study puts forth specific policy recommendations aimed at promoting the reduction of carbon emission intensity through digital transformation. These recommendations are formulated from both governmental and corporate perspectives.

At the government level, interdepartmental collaboration and coordination should be strengthened to create a collective effort in advancing digital transformation and carbon emission reduction. Governmental economic measures, such as carbon emissions trading systems, carbon taxes, and green financial support, can provide economic and financial incentives to encourage enterprises to adopt digital transformation strategies for carbon emission reduction. Establishing a Digital Transformation Technology Support Center could offer enterprises digital tools, technical guidance, and training to aid in effectively applying digital technologies to carbon reduction efforts. A data sharing platform should be established to encourage companies to share carbon emission data and experiences in digital transformation, thereby facilitating the spread of best practices and mutual learning. Government support should be directed towards state-owned enterprises and those with high carbon emission intensity to undergo digital transformation, while also enhancing support for resource-dependent cities to promote the development of digital infrastructure.

At the enterprise level, companies should establish clear carbon reduction goals and plans, integrating them into their strategic planning and operational decision-making processes, and progressively promote digital transformation in a systematic and organized manner. Active investment in and the adoption of technology solutions related to digital transformation, such as artificial intelligence, the Internet of Things, and big data analytics, can enhance energy utilization efficiency and lower carbon emissions. Fostering digital thinking and environmental consciousness among employees can drive internal carbon reduction initiatives. Increased investment in green innovation and sustainable development can harness digital technology to develop green products and services, catering to the market demand for sustainable offerings.

5.3. Limitations and Future Prospects

This study explores the impact of corporate digital transformation on reducing carbon emissions from a linear perspective. However, it fails to consider the potential for increased carbon emissions as a result of corporate digital transformation. Furthermore, the study overlooks the possibility of spatial spillover effects resulting from enterprises’ digital transformation. As such, our future research will concentrate on examining nonlinear as well as spatial spillover effects of corporate digital transformation on corporate carbon emissions, to provide more informed policy recommendations for companies pursuing low-carbon transformation and digital development.

Author Contributions

Conceptualization, J.G. and N.X.; methodology, N.X.; software, N.X.; validation, J.G. and J.Z.; formal analysis, J.G.; investigation, N.X.; resources, J.G.; data curation, J.Z.; writing—original draft preparation, J.G. and N.X.; visualization, N.X.; supervision, J.Z.; project administration, J.Z.; funding acquisition, J.G. and N.X. All authors have read and agreed to the published version of the manuscript.

Funding

This research was funded by the Philosophy and Social Science Project of Henan Province, grant number 2021CJJ149. The research was also funded by the Philosophy and Social Science Project of Henan Province, grant number 2022CJJ159. This research was also funded by the Soft Science Research Project of Henan Province (grant number 222400410414) and the General Project for Humanities and Social Sciences Research in Henan Province Universities (grant number 2021-ZZJH-245).

Institutional Review Board Statement

Not applicable.

Informed Consent Statement

Not applicable.

Data Availability Statement

Carbon emissions data were partly derived from enterprise information disclosure and partly calculated by the authors. Data at the city level were acquired from the China Urban Statistical Yearbook (2008–2021) and the China Environmental Statistical Yearbook (2008–2021). Firm-level data were collected from the CSMAR database.

Acknowledgments

Thanks for the support from Luoyang Normal University.

Conflicts of Interest

The authors declare no conflict of interest.

References

- Cui, X.; Xu, N.; Yan, X.; Zhang, W. How does social credit system constructions affect corporate carbon emissions? Empirical evidence from Chinese listed companies. Econ. Lett. 2023, 231, 111309. [Google Scholar] [CrossRef]

- Wang, H.; Liu, J.; Zhang, L. Carbon Emissions and Assets Pricing--Evidence from Chinese Listed Firms. China J. Econ. 2022, 9, 28–75. (In Chinese) [Google Scholar]

- Qin, M.; Zhang, X.; Li, Y.; Badarcea, R.M. Blockchain market and green finance: The enablers of carbon neutrality in China. Energy Econ. 2023, 118, 106501. [Google Scholar] [CrossRef]

- Yang, P.; Peng, S.; Benani, N.; Dong, L.; Li, X.; Liu, R.; Mao, G. An integrated evaluation on China’s provincial carbon peak and carbon neutrality. J. Clean. Prod. 2022, 377, 134497. [Google Scholar] [CrossRef]

- Ancillai, C.; Sabatini, A.; Gatti, M.; Perna, A. Digital technology and business model innovation: A systematic literature review and future research agenda. Technol. Forecast. Soc. 2023, 188, 122307. [Google Scholar] [CrossRef]

- Li, S.; Gao, L.; Han, C.; Gupta, B.; Alhalabi, W.; Almakdi, S. Exploring the effect of digital transformation on Firms’ innovation performance. J. Innov. Knowl. 2023, 8, 100317. [Google Scholar] [CrossRef]

- Niu, Y.; Wen, W.; Wang, S.; Li, S. Breaking barriers to innovation: The power of digital transformation. Financ. Res. Lett. 2023, 51, 103457. [Google Scholar] [CrossRef]

- Zhang, Z.; Jin, J.; Li, S.; Zhang, Y. Digital transformation of incumbent firms from the perspective of portfolios of innovation. Technol. Soc. 2023, 72, 102149. [Google Scholar] [CrossRef]

- Chouaibi, S.; Festa, G.; Quaglia, R.; Rossi, M. The risky impact of digital transformation on organizational performance—Evidence from Tunisia. Technol. Forecast. Soc. 2022, 178, 121571. [Google Scholar] [CrossRef]

- Alkaraan, F.; Albitar, K.; Hussainey, K.; Venkatesh, V.G. Corporate transformation toward Industry 4.0 and financial performance: The influence of environmental, social, and governance (ESG). Technol. Forecast. Soc. 2022, 175, 121423. [Google Scholar] [CrossRef]

- Beier, G.; Matthess, M.; Guan, T.; Grudzien, D.I.D.O.; Xue, B.; Lima, E.P.D.; Chen, L. Impact of Industry 4.0 on corporate environmental sustainability: Comparing practitioners’ perceptions from China, Brazil and Germany. Sustain. Prod. Consump. 2022, 31, 287–300. [Google Scholar] [CrossRef]

- Tapscott, D. The Digital Economy: Promise and Peril in the Age of Networked Intelligence; McGraw-Hill: New York, NY, USA, 1996. [Google Scholar]

- Knickrehm, M.; Berthon, B.; Daugherty, P. Digital disruption: The growth multiplier. Accent. Strategy 2016, 1, 1–11. [Google Scholar]

- Zhao, T.; Zhang, Z.; Liang, S. Digital Economy, Entrepreneurship, and High-Quality Economic Development Empirical Evidence from Urban China. J. Manag. World 2020, 36, 65–76. [Google Scholar]

- Bukht, R.; Heeks, R. Defining, conceptualising and measuring the digital economy. Dev. Inform. Work. Pap. 2017. [Google Scholar] [CrossRef]

- Guan, H.; Xu, X.; Zhang, M.; Yu, X. Research on Industrial Classification for Digital Economy in China. Stat. Res. 2020, 37, 3–16. (In Chinese) [Google Scholar]

- Vial, G. Understanding digital transformation: A review and a research agenda. J. Strateg. Inf. Syst. 2019, 28, 118–144. [Google Scholar] [CrossRef]

- Wu, J.; Chen, T.; Gong, Y.; Yang, Y. Digital Transformation of Firms: Theoretical Framework and Research Prospects. China J. Econom. 2021, 18, 1871–1880. (In Chinese) [Google Scholar]

- Qi, Y.; Du, B.; Wen, X. Mission Embeddedness and Pattern Selection of Digital Strategic Transformation of SOEs: A Case Study Based on the Typical Practice of Digitalization in Three Central Enterprises. J. Manag. World 2021, 37, 137–158. (In Chinese) [Google Scholar]

- Xu, X.; Zhang, M. Review on Measurement of Value Added of the Digital Economy. China J. Econom. 2022, 2, 19–31. (In Chinese) [Google Scholar]

- Kang, T. Research on Measuring the Scale of China’s Digital Economy. Contemp. Financ. Econ. 2008, 3, 118–121. (In Chinese) [Google Scholar]

- Habibi, F.; Zabardast, M.A. Digitalization, education and economic growth: A comparative analysis of Middle East and OECD countries. Technol. Soc. 2020, 63, 101370. [Google Scholar] [CrossRef]

- Liu, Z.; Yao, Y.; Zhang, G.; Kuang, H. Firm’s Digitalization, Specific Knowledge and Organizational Empowerment. China J. Econom. 2020, 9, 156–174. (In Chinese) [Google Scholar]

- Wu, F.; Hu, H.; Lin, H.; Ren, X. Enterprise Digital Transformation and Capital Market Performance: Empirical Evidence from Stock Liquidity. J. Manag. World 2021, 37, 130–144. (In Chinese) [Google Scholar]

- Tang, X.; Miao, Y.; Sun, Y.; Dong, L. Research on digital maturity measurement and influencing factors of advanced equipment manufacturing enterprises. Sci. Res. Manag. 2022, 43, 10–19. (In Chinese) [Google Scholar]

- Choi, C.; Hoon Yi, M. The effect of the Internet on economic growth: Evidence from cross-country panel data. Econ. Lett. 2009, 105, 39–41. [Google Scholar] [CrossRef]

- Daud, S.N.M.; Ahmad, A.H. Financial inclusion, economic growth and the role of digital technology. Financ. Res. Lett. 2022, 53, 103602. [Google Scholar] [CrossRef]

- Hao, X.; Li, Y.; Ren, S.; Wu, H.; Hao, Y. The role of digitalization on green economic growth: Does industrial structure optimization and green innovation matter? J. Environ. Manag. 2023, 325, 116504. [Google Scholar] [CrossRef]

- Zhao, C. Research on the impact of digital transformation on enterprises’ labor employment. Stud. Sci. Sci. 2023, 41, 241–252. (In Chinese) [Google Scholar]

- Freund, C.L.; Weinhold, D. The effect of the Internet on international trade. J. Int. Econ. 2004, 62, 171–189. [Google Scholar] [CrossRef]

- Jiang, M.; Jia, P. Does the level of digitalized service drive the global export of digital service trade? Evidence from global perspective. Telemat. Inform. 2022, 72, 101853. [Google Scholar] [CrossRef]

- Liu, B.; Pan, T. Research on the Impact of Artificial Intelligence on Manufacturing Value Chain Specialization. J. Quant. Technol. Econ. 2020, 37, 24–44. (In Chinese) [Google Scholar]

- Shang, H.; Wu, T. Enterprise Digital Transformation, Corporate Social Responsibility and Firm Value. J. Technol. Econ. 2022, 41, 159–168. (In Chinese) [Google Scholar]

- Peng, Y.; Tao, C. Can digital transformation promote enterprise performance?—From the perspective of public policy and innovation. J. Innov. Knowl. 2022, 7, 100198. [Google Scholar] [CrossRef]

- Du, X.; Jiang, K. Promoting enterprise productivity: The role of digital transformation. Borsa Istanb. Rev. 2022, 22, 1165–1181. [Google Scholar] [CrossRef]

- Sundaram, R.; Sharma, D.; Shakya, D. Digital transformation of business models: A systematic review of impact on revenue and supply chain. Int. J. Manag. 2020, 11, 9–21. [Google Scholar]

- Chen, W.; Cai, W.; Hu, Y.; Zhang, Y.; Yu, Q. Gimmick or revolution: Can corporate digital transformation improve accounting information quality? Int. J. Emerg. Mark. 2022. ahead-of-print. [Google Scholar] [CrossRef]

- Chen, J.; Huang, S.; Liu, Y. Operations Management in the Digitization Era:From Empowering to Enabling. J. Manag. World 2020, 36, 117–128. (In Chinese) [Google Scholar]

- Wu, K.; Fu, Y.; Kong, D. Does the digital transformation of enterprises affect stock price crash risk? Financ. Res. Lett. 2022, 48, 102888. [Google Scholar] [CrossRef]

- Tian, G.; Li, B.; Cheng, Y. Does digital transformation matter for corporate risk-taking? Financ. Res. Lett. 2022, 49, 103107. [Google Scholar] [CrossRef]

- Wen, H.; Zhong, Q.; Lee, C. Digitalization, competition strategy and corporate innovation: Evidence from Chinese manufacturing listed companies. Int. Rev. Financ. Anal. 2022, 82, 102166. [Google Scholar] [CrossRef]

- Liu, Q.; Liu, J.; Gong, C. Digital transformation and corporate innovation: A factor input perspective. Manag. Decis. Econ. 2023, in press. [Google Scholar] [CrossRef]

- Wei, X.; Jiang, F.; Yang, L. Does digital dividend matter in China’s green low-carbon development: Environmental impact assessment of the big data comprehensive pilot zones policy. Environ. Impact Assess. Rev. 2023, 101, 107143. [Google Scholar] [CrossRef]

- Li, X.; Tian, Q. How Does Usage of Robot Affect Corporate Carbon Emissions?—Evidence from China’s Manufacturing Sector. Sustainability 2023, 15, 1198. [Google Scholar] [CrossRef]

- Pu, Z.; Fei, J. The impact of digital finance on residential carbon emissions: Evidence from China. Struct. Change Econ. D 2022, 63, 515–527. [Google Scholar] [CrossRef]

- Zheng, R.; Wu, G.; Cheng, Y.; Liu, H.; Wang, Y.; Wang, X. How does digitalization drive carbon emissions? The inverted U-shaped effect in China. Environ. Impact Assess. Rev. 2023, 102, 107203. [Google Scholar] [CrossRef]

- Zhang, W.; Liu, X.; Wang, D.; Zhou, J. Digital economy and carbon emission performance: Evidence at China’s city level. Energy Policy 2022, 165, 112927. [Google Scholar] [CrossRef]

- Peng, H.; Zhang, Y.; Liu, J. The energy rebound effect of digital development: Evidence from 285 cities in China. Energy 2023, 270, 126837. [Google Scholar] [CrossRef]

- Huang, Y.; Hu, M.; Xu, J.; Jin, Z. Digital transformation and carbon intensity reduction in transportation industry: Empirical evidence from a global perspective. J. Environ. Manag. 2023, 344, 118541. [Google Scholar] [CrossRef]

- Li, Y.; Zhang, Y.; Pan, A.; Han, M.; Veglianti, E. Carbon emission reduction effects of industrial robot applications: Heterogeneity characteristics and influencing mechanisms. Technol. Soc. 2022, 70, 102034. [Google Scholar] [CrossRef]

- Li, G.; Jin, Y.; Gao, X. Digital transformation and pollution emission of enterprises: Evidence from China’s micro-enterprises. Energy Rep. 2023, 9, 552–567. [Google Scholar] [CrossRef]

- Zhang, W.; Zhao, J. Digital transformation, environmental disclosure, and environmental performance: An examination based on listed companies in heavy-pollution industries in China. Int. Rev. Econ. Financ. 2023, 87, 505–518. [Google Scholar] [CrossRef]

- Shang, Y.; Raza, S.A.; Huo, Z.; Shahzad, U.; Zhao, X. Does enterprise digital transformation contribute to the carbon emission reduction? Micro-level evidence from China. Int. Rev. Econ. Financ. 2023, 86, 1–13. [Google Scholar] [CrossRef]

- Hilty, L.M.; Aebischer, B. ICT for sustainability: An emerging research field. In ICT Innovations for Sustainability; Springer: Berlin/Heidelberg, Germany, 2015; pp. 3–36. [Google Scholar]

- Bharadwaj, A.; El Sawy, O.A.; Pavlou, P.A.; Venkatraman, N.V. Digital business strategy: Toward a next generation of insights. Mis. Quart. 2013, 37, 471–482. [Google Scholar] [CrossRef]

- Liu, H.; Bai, C. Has Digital Transformation Helped Enterprises Realize the Goals of Energy Conservation and Pollution Reduction in China? J. Shanghai Univ. Financ. Econ. 2022, 24, 19–32. (In Chinese) [Google Scholar]

- Friedman, M. The Social Responsibility of Business Is to Increase Its Profits. In Corporate Ethics and Corporate Governance; Zimmerli, W.C., Holzinger, M., Richter, K., Eds.; Springer: Berlin/Heidelberg, Germany, 2007; pp. 173–178. [Google Scholar]

- Hu, J.; Han, Y.; Zhong, Y. How Corporate Digital Transformation Affects Corporate ESG Performance. Rev. Ind. Econ. 2023, 1, 105–123. (In Chinese) [Google Scholar]

- Tuyen, B.Q.; Phuong Anh, D.V.; Mai, N.P.; Long, T.Q. Does corporate engagement in social responsibility affect firm innovation? The mediating role of digital transformation. Int. Rev. Econ. Financ. 2023, 84, 292–303. [Google Scholar] [CrossRef]

- Fernandez-Vidal, J.; Gonzalez, R.; Gasco, J.; Llopis, J. Digitalization and corporate transformation: The case of European oil & gas firms. Technol. Forecast. Soc. 2022, 174, 121293. [Google Scholar]

- Li, H.; Wu, Y.; Cao, D.; Wang, Y. Organizational mindfulness towards digital transformation as a prerequisite of information processing capability to achieve market agility. J. Bus. Res. 2021, 122, 700–712. [Google Scholar] [CrossRef]

- Chen, Z.; Chen, Q. Energy Efficiency of Chinese Firms: Heterogeneity, Influencing Factors and Policy Implications. China Ind. Econ. 2019, 12, 78–95. (In Chinese) [Google Scholar]

- Zhong, T.; Ma, F. Carbon Reduction Effect of Enterprise Digital Transformation: Theoretical Mechanism and Empirical Test. Jianghai Acad. J. 2022, 4, 99–105. (In Chinese) [Google Scholar]

- Tleppayev, A. Digitalisation and energy: World experience and evidence of correlation from Kazakhstan. Econ. Ann.-XXI 2019, 176, 56–64. [Google Scholar] [CrossRef]

- Wang, J.; Ma, X.; Zhang, J.; Zhao, X. Impacts of digital technology on energy sustainability: China case study. Appl. Energy 2022, 323, 119329. [Google Scholar] [CrossRef]

- Finnerty, N.; Sterling, R.; Contreras, S.; Coakley, D.; Keane, M.M. Defining corporate energy policy and strategy to achieve carbon emissions reduction targets via energy management in non-energy intensive multi-site manufacturing organisations. Energy 2018, 151, 913–929. [Google Scholar] [CrossRef]

- Sharma, S. Managerial Interpretations and Organizational Context as Predictors of Corporate Choice of Environmental Strategy. Acad. Manag. J. 2000, 43, 681–697. [Google Scholar] [CrossRef]

- Xu, J.; Guan, J.; Lin, Y. The Influencing Factors of the Relationship between Corporate Environmental Performance and Corporate Financial Performance: Based on a Meta-Analysis Concerned with Measuring and Situational Factors. Chin. J. Manag. 2018, 15, 246–254. (In Chinese) [Google Scholar]

- Zeng, H.; Ran, H.; Zhou, Q.; Jin, Y.; Cheng, X. The financial effect of firm digitalization: Evidence from China. Technol. Forecast. Soc. 2022, 183, 121951. [Google Scholar] [CrossRef]

- Gupta, S.; Justy, T.; Kamboj, S.; Kumar, A.; Kristoffersen, E. Big data and firm marketing performance: Findings from knowledge-based view. Technol. Forecast. Soc. 2021, 171, 120986. [Google Scholar] [CrossRef]

- Lin, B.; Zhang, A. Can government environmental regulation promote low-carbon development in heavy polluting industries? Evidence from China’s new environmental protection law. Environ. Impact Assess. Rev. 2023, 99, 106991. [Google Scholar] [CrossRef]

- Ding, Y.; Hu, Y. Accelerating efficiency of green technology innovation on carbon mitigation under low-carbon regulation. Energy Rep. 2022, 8, 126–134. [Google Scholar] [CrossRef]

- Ning, J.; Jiang, X.; Luo, J. Relationship between enterprise digitalization and green innovation: A mediated moderation model. J. Innov. Knowl. 2023, 8, 100326. [Google Scholar] [CrossRef]

- Qi, Y.; Xiao, X. Transformation of Enterprise Management in the Era of Digital Economy. J. Manag. World 2020, 36, 135–152. (In Chinese) [Google Scholar]

- Li, M.; Jiang, A.; Ma, J. Digital transformation and income inequality within enterprises—Evidence from listed companies in China. Pac.-Basin Financ. J. 2023, 81, 102133. [Google Scholar] [CrossRef]

- Long, F.; Lin, F.; Ge, C. Impact of China’s environmental protection tax on corporate performance: Empirical data from heavily polluting industries. Environ. Impact Assess. Rev. 2022, 97, 106892. [Google Scholar] [CrossRef]

- Zhong, Q.; Wen, H.; Lee, C. How does economic growth target affect corporate environmental investment? Evidence from heavy-polluting industries in China. Environ. Impact Assess. Rev. 2022, 95, 106799. [Google Scholar] [CrossRef]

- Zhang, B.; Wang, Y.; Sun, C. Urban environmental legislation and corporate environmental performance: End governance or process control? Energy Econ. 2023, 118, 106494. [Google Scholar] [CrossRef]

- Hadlock, C.J.; Pierce, J.R. New Evidence on Measuring Financial Constraints: Moving Beyond the KZ Index. Rev. Financ. Stud. 2010, 23, 1909–1940. [Google Scholar] [CrossRef]

- Gao, Q.; Cheng, C.; Sun, G. Big data application, factor allocation, and green innovation in Chinese manufacturing enterprises. Technol. Forecast. Soc. 2023, 192, 122567. [Google Scholar] [CrossRef]

Disclaimer/Publisher’s Note: The statements, opinions and data contained in all publications are solely those of the individual author(s) and contributor(s) and not of MDPI and/or the editor(s). MDPI and/or the editor(s) disclaim responsibility for any injury to people or property resulting from any ideas, methods, instructions or products referred to in the content. |

© 2023 by the authors. Licensee MDPI, Basel, Switzerland. This article is an open access article distributed under the terms and conditions of the Creative Commons Attribution (CC BY) license (https://creativecommons.org/licenses/by/4.0/).