1. Introduction

A major thrust of China’s efforts to promote sustainable development is to decarbonize transportation through the widespread production and use of new energy vehicles (NEVs). China has succeeded in achieving global leadership in NEV production and adoption. Yet, the industry’s remarkable rise has actually occurred through regional development—a phenomenon that lacks systematic analysis in existing studies.

In terms of actual production, automobile manufacturing has emerged as a

regional industry across the globe [

1,

2,

3,

4,

5]. China’s NEV industry shares such geographic clustering in its evolution. However, scant analysis exists on the regional configuration of NEV production, as well as on how national policies interact with regional ones. An additional underexamined dimension is the fact that regions have internal competitive jurisdictional dynamics that can either support or hinder the evolution of the industry. Understanding the development of China’s NEV industry requires examining its regional development, especially in the Greater Bay Area (GBA) of Guangdong province.

This paper focuses on the GBA because it has rapidly established itself as China’s foremost NEV production region, where BYD is the world’s leading manufacturer; Guangzhou Automotive Corporation produces the most electric vehicles (EVs) among state-owned car producers; Xpeng is a high-end rival to Tesla; and VW-FAW is using Foshan to develop EVs. Over one-third of China’s pure EV units are produced in the GBA, and the value-added proportion is even higher [

6]. Moreover, the GBA’s momentum continues to grow despite China’s economic slowdown since the late 2010s.

The GBA’s ascension as an NEV production hub has benefitted from the combination of its pre-existing automobile production capacities, as well as its electronic and information technology industries. However, we contend that the GBA’s success is also due to effective coordination of multi-level policies that promote differentiation and competition. The industrial capacities of the GBA are unevenly distributed among the 11 competitive cities, with each seeking to capture all or important parts of the NEV industrial chain. This intra-regional competition informs the expectations of national and provincial policies as cities vie with each other, adapt higher level policies, and enact their own measures to attract industry. The cities compete to attract and develop assembly companies and component suppliers to advance local development. Meanwhile, both car companies and cities recognize the reality of the interdependencies among supply chains and thus, also among individual cities. This means that not only are auto manufacturers competing and interdependent in the region, but the cities themselves are also competing and interdependent. The industry is thus infused with internal competition among both firm-level and governmental actors.

The cities, like the car companies, seek to maximize their revenues from the new NEV industry, but they also understand the importance of regional interdependence on both the production and consumption sides. Building the NEV industry requires promoting production on the supply side, as well as demand from consumers. Each GBA city—with varying capacities and degrees of path dependence in the vehicle industry—is striving to develop some of the NEV production industry chain positions by deploying traditional policy tools such as subsidies, building industrial parks, and attracting technical talent. Consumer demand is built by policies that support charging stations and other necessary infrastructure at a sufficient magnitude, as well as by providing subsidies to purchasers. Regional policy also increases the demand for NEV vehicles by disincentivizing the use of internal combustion engine vehicles (ICEVs) by imposing expensive emission controls. Yet, the introduction of charging stations and emission control policies raises further dilemmas and strategic choices for city governments. Do they support their own industry with these policies? Should they increase interdependence and collective benefits by harmonizing policies in the region? Or do they simply freeride on the efforts of the other cities?

This paper has both empirical and analytical objectives. Empirically, our study provides evidence of the GBA NEV cluster, which provides the foundation for complex policy dynamics between the GBA cities. In so doing, we document evidence of the policy competition and complementarity among the cities regarding NEV production, recharging infrastructure support, and emissions control. Methodologically, this entailed systematic examination of the production, recharging infrastructure and purchasing subsidies, and emissions control policies among the GBA cities. The mixed-method policy inventory employed here is distinct from the many quantitative and case study examinations of China’s NEV industry. Examining these issues in this manner is important not only for clarifying the actual basis for the rise of China’s NEV industry, but it is also analytically relevant for showing how China’s city-based industrial development strategy is a key component of the country’s regionally decentralized system of authoritarian governance. Although the GBA has risen to the top due to being supported by coordinated regional policies, China’s broader strategy to foster pilot cities and NEV manufacturing across the country has incurred considerable misallocation of resources. Only by assessing the regional dynamics of the GBA’s NEV industry and the policy influences on the coordination, competition, and cooperation among the cities can the successes and weaknesses of China’s NEV development be understood.

2. Literature Review

The literature on China’s NEV development typically examines the roles of either national- or city-level policies. To provide a regional perspective, which is inadequately explored in other studies, this review starts by identifying the policy elements used in China and globally to promote the NEV industry. The relevant policy areas involve encouraging production, consumption, recharging infrastructure, and suppressing internal combustion engine (ICE) vehicles. Next, we discuss studies on the regional construction of the auto industry, which offer insights on policy elements that are equally germane for NEV development.

2.1. Regionally Decentralized Authoritarianism and Local Competition

The dynamics of central–local relations in China provide context for examining its NEV policies from a regional perspective. In China’s political system, the central government exerts control over sub-national governments, while simultaneously compelling cities to be responsible for providing public services and delivering the development to finance those services. Concurrently, local governments are expected to fulfill other objectives set by the national government. China’s “regionally decentralized authoritarianism (RDA)” system incentivizes the performance of lower-level government officials by controlling their career paths in the government and Chinese Communist Party [

7,

8,

9]. A signature feature of the policy process under RDA is the central government’s designation of selecting cities to run pilot programs in areas such as healthcare, industrial development, the one-child policy, and urbanization [

10,

11,

12]. China’s NEV strategy is a prime example of how such pilot programs have been used to develop and implement environmental policies [

13,

14,

15]. A result of this fragmented governance system has been vigorous sub-national competition among local governments for the purpose of development, thus leading to impediments to regional coordination and cooperation [

8,

16], which could pose a challenge for NEV development. The relevance of China’s RDA is reflected in academic analysis, especially on studies that examined the policies generated in this central–local structure. The following passages thus discuss the main policy thrusts of

production,

consumption,

infrastructure, and

ICE suppression, which is then followed by making the case for a regional perspective.

2.2. Production

Production-oriented policies from the late 1990s to 2009 constitute the foundation for China’s NEV strategy. They entailed the establishment of research linkages among universities, industry, government, and research institutes that focused on hybrid, battery, and fuel cell NEVs, as well as the three core technologies of power storage, motors, and powertrain control [

17]. Initiated by the national government, the policies privileged the state-owned enterprises of select cities and provinces. Localization of production was strengthened in a pilot program that began with 10 cities in 2009, which was expanded rapidly to 25 by 2010 and to 88 by 2015. Meanwhile, these cities were encouraged to develop complementary policies for public and private consumption, as well as for public transportation [

17]. An early study by Gong et al. [

18] confirmed the fragmenting impact of the pilot city approach: all 21 of the provinces where the 25 cities were located developed from 10–46 certified NEV makers. This institutional backing provided firms with the confidence to commit resources despite consumer reluctance to purchase NEVs [

19]. Complications soon arose, however. Substantial local protectionism emerged as most NEV makers focused on their own cities or on the major markets dominated by their own manufacturers [

20]. Qiu et al.’s [

21] analysis of the policy mixtures adopted in the 88 pilot NEV cities found that vehicle model development was poor due to lack of expertise, and that rewards were geared towards quantity of production rather than technological improvements. In a similar vein, Jiang and Xu [

22] found that while subsidies to pilot cities substantially increased the volume of innovation targeted by the policy, they did not enhance the efficiency of innovation. Cases of fraud, collusion, and protectionism have occurred in this localized system [

17,

23,

24,

25]. Nonetheless, in-depth studies of some cities, especially Shenzhen, demonstrate how local governance can bring stakeholders together to develop advanced production capacities [

26].

Subsidies are the primary policy tool responsible for accelerating China’s NEV industry, as confirmed in several studies [

24,

27,

28]. In practice, the so-called national subsidies also translate into local production-oriented policy because, although directly obtained by consumers, the subsidies are transferred to the producers by local governments. Local authorities can set supplemental subsidies, but these are limited to fifty percent of the national subsidies. Local governments are also responsible for determining the qualification for all subsidies and reporting them to the national government.

As NEV production matured, city-based experimentation relaxed and policies more conducive to a national market and production bases were designed. For example, the national government introduced the “dual-credits policy” (credits for improving technology standards and reducing corporate fleet emissions) to drive technological improvements. Several authors believe this initiative can achieve substantial benefits for the industry, even if they have mixed implications and will diminish over time [

25,

29,

30]. On balance, the policies have been effective for the development of NEVs, as well as for its value chain and related sub-sectors [

31]. Technological advancement has also been evident through NEV-related patents [

32], where BYD has generated as many patents as Geely, Chery, and SAIC combined [

33].

2.3. Consumption

As mentioned, the most important impetus to the NEV industry has been stimulating demand through subsidies. Related studies tend to evaluate this system from either a top-down quantitative perspective that assesses the degree to which policies have been effective across the nation, or through sub-national programs that cities or provinces have implemented (either as individual case studies or as comparative research). In terms of top-down approaches, Hao et al. [

27] examined the impact of China’s first two rounds of subsidies (2009 and 2013); Kong et al. [

24] modeled the impacts when subsidies were removed; and Guo et al. [

28] used a computable general equilibrium model to determine that subsidies could be supplanted by incentives for technological progress. From a local perspective on demand promotion, Fan et al. examined the viability of vehicle sharing companies with Beijing as their model. Overall, subsidies are considered the most effective policies when they are combined at both the national and local levels [

34].

2.4. Infrastructure

Infrastructure and other measures are necessary because although purchase subsidies benefit both consumers and producers initially, they are insufficient, expensive, and inevitably face reduction. In that vein, Wang et al. [

35] found that increasing the density of charging stations; exempting license fees; not restricting NEV driving range and times; and prioritizing land for charging infrastructure proved to be important complementary policies. Ou et al. [

36] found that parking availability for private charging varies widely across the country and parking needs can impose a heavy burden on buyers.

2.5. ICE Emissions Suppression

Vehicle emission suppression regulations were originally enacted to reduce air pollution and improve human health, but they have become incorporated into NEV industrial policy to accelerate the adoption of NEVs. The utility of leveraging that linkage has been documented in studies on how high air pollution in cities results in greater NEV sales, albeit mostly in cities with higher levels of disposable income [

37]. Thus, to speed up NEV adoption and improve air conditions, many cities have implemented policies to suppress ICE vehicle emissions. Ma et al. [

38] found that the efforts of six major cities to integrate ICE emission suppression with NEV promotion proved to be successful. Moreover, subsidies for NEVs have been found to reduce total air emissions despite increases in thermal electricity generation [

39].

2.6. A Regionally Based Global Industry

A strong commonality in most China NEV studies is policy assessment at the national or local/city levels without consideration of regional dynamics (other than tracing the governance hierarchy to examine NEV deployment at the provincial level [

40]). However, the automotive sector rarely develops in such a manner.

Globally, the automobile industry exhibits a high degree of clustering, with examples of early agglomerations occurring around Detroit [

4], Germany’s Bavaria [

41], Britain’s Coventry–Birmingham region [

1], and Japan’s Tokaido region [

5]. This model of industrial origins based on regional clustering organization has similarly occurred in Thailand [

42], China [

2,

43], and Mexico [

3]. Firms cluster to achieve externalities such as pooling labor, information flows, mimicry spurred by competition, spin-offs, as well as the evolution of complementary government, educational, and industry organizations (albeit with substantial morphological differences). Firms also cluster to develop external economies of scale and scope among suppliers, distributors, and related industries. Porter [

44] illustrated the benefits of these interdependencies in a diamond of relationships among rivalrous conditions (especially for lead firms); suppliers and related industry; and demand conditions and factor conditions, while also noting the importance of government in upgrading factor conditions and mitigating the role of chance. Although clusters are typically conceptualized in a local- or city-based scope, the automobile industry tends to be more nested. An origin city may be the focus for headquarters and R&D, but operations and supply chain firms are distributed around a metropolitan area and region where manufacturers and suppliers work most closely on customization, and later expand to the nationwide level for integrated component suppliers and internationally for more generic marketed goods [

45]. Indeed, in most cases, the automobile value chain stretches across a nation and beyond as the global auto industry has become increasingly oligopolized with the aforementioned transplantation of regional production systems as important components in building these international production networks.

The strength of these global automobile oligopolies—especially their capacity to develop economies of scale in R&D and platform development—was the barrier that Chinese policymakers sought to leapfrog when embarking on their NEV strategy. However, missing from the resulting national NEV policies—as well as the academic assessment of those policies, for that matter—was the recognition that, for the Chinese NEV industry to be successful, the industry would need to develop regional cluster efficiencies. The apparent absence of these policies in the literature, however, does not necessarily mean that they do not exist. Furthermore, it may be more important to examine how the provincial, and especially local/city policies, do or do not foster regional clustering. It is in this context that we investigate the extent of competition, cooperation, and complementarity among these policies.

The outcomes of this literature review are summarized in

Figure 1, which compares the NEV policy structure with that of the global automobile industry. Embedded within China’s RDA governance framework, the NEV policy structure starts with pilot cities as its base of production and consumption. By contrast, the global automobile industry structure entails much more interaction at the regional level but does not necessarily coordinate actions sufficiently among regional actors to achieve NEV policy goals. This is especially the case when harmonization is necessary among production, consumption, infrastructure, and emission suppression policies. Thus, the four policy thrusts taken by the Chinese government require further examination as to how they have, or have not, been implemented at the regional level.

3. Methodology

As reviewed above, studies on China’s NEV industry generally evaluate policies from a top-down, quantitative perspective using available data for subsidies, technical regulation, infrastructure availability, etc. to evaluate against sales, emission reductions, technological progress, and other such outcomes. Such studies are complemented by case studies of how key cities have implemented successful NEV strategies. As this study’s regional perspective entails multi-level governance, a mixed-method approach was adopted to reveal the connections between different policies that were implemented in the GBA by the national, provincial, and city governments (

Figure 2).

First, we compiled and coded an inventory of all NEV and vehicle air pollution-related policies at the provincial and city levels by investigating government websites and policy documents. Policies were identified as guidance, laws, action plans, and announcements, and we were able to identify relevant government websites from news articles and press releases. The inventory was coded using an iterative grounded method in conjunction with guidance from the literature review, as well as from stakeholders such as policymakers and academics. The resulting search terms were coded and classified according to four main categories: production, consumption, infrastructure, and emission suppression. Sub-categories of these policies needed to be standardized across different cities. Content analysis included determining the intentions of the policies, specific instruments and policy origins, and subsequent adaptations. We paid particular attention to whether the policy originated from national, provincial, or local governments, and—if delegated/decentralized—to what extent local governments adapted the policies to their own priorities and limitations.

Next, we compared our policy inventory against those available from private industry analysts, which facilitated the coding of major versus sub-categories and tracing of the dynamics in inter-governmental relations. Consultancy reports were also useful in describing the evolving structure of the industry. These materials were searched to establish leading assembly and supplier firms, as well as to provide evidence of the cluster value chain and its regional distribution of NEV investment data by businesses and by city governments.

Finally, we also conducted interviews with city-level officials in environmental bureaus “on background” to cross-check the organization and substance of the policy inventory, as well as to learn more about the interactions among different administrative levels of government.

Once the policy inventory was assembled into four main categories (production, consumption, infrastructure, and emission suppression), we identified the main policy instruments associated with each category. In doing this, we also mapped out the implementation of specific policies by provinces and cities; evaluated the extent of coordination among different levels of governments; and sought to identify which cities are leaders, followers, or free riders. Tracing the origin and adaptation of policies provides greater insight into how a regional structure was created, whether it is top-down, bottom-up, or integrated. Ultimately, the policy inventory served as the basis for the broader analytical goal of identifying the strands of competition, cooperation, and complementarity in multi-level interaction, with a focus on city approaches to NEV policy. These analytical issues are discussed below.

4. Context: Two Paths of NEV Development in the GBA

The production of ICE vehicles in China reflects the dualism of local government industry sponsorship and the requirements for regional clustering. Although the post-Mao central government recognized regional clustering imperatives, it initiated a “3 Large, 3 Small Plan” to distribute automobile production capacity, and it also gave local officials license to collaborate with multinational enterprises (MNEs) [

46]. Consequently, the automobile industry became widely distributed across China due to provincial and city government support for the joint ventures between their own SOE and MNE assemblers, as well as due to MNE efforts in engaging both western and eastern markets with production bases. However, the production volume of finished vehicles, parts, and components were strongly regionalized into the following six clusters: (1) the Yangtze River Delta (YRD: Shanghai, Jiangsu, Zhejiang, and Anhui); (2) the GBA and Guangdong; (3) Central China (Hubei, Henan, Hunan, and Jiangxi); (4) the Northeast (Jilin, Liaoning, and Heilongjiang); (5) the Capitol region (Beijing, Tianjin, and Hebei); and (6) Chongqing (Chongqing and Sichuan). Among these, the YRD stands out not only for its finished vehicle production from the main manufacturers of SAIC, Volkswagen, and GM in Shanghai, but also Geely, Changan, Great Wall, Chery, etc. in Anhui, Jiangsu, and Zhejiang. Just as importantly, the region is China’s dominant parts and components manufacturing cluster.

As mentioned above, local government pilot programs mirrored the national distribution of initial NEV production. However, the evolution of the NEV industry saw the rapid concentration of vehicle production in the YRD and PRD regions. There, leading ICE vehicle producers such as SAIC and GAC have entered NEV production, and the regions are attracting new entrants, such as Nio (Hefei/Shanghai), Li Auto (Changzhou), and Tesla (Shanghai) in the YRD, as well as BYD (Shenzhen) and Xpeng in Guangzhou/Zhaoqing. These entrants were primarily privately backed and seem to be attracted by both clustering efficiencies and supportive policies, which is certainly the case in Guangdong.

Unlike the other five regions, Guangdong is a single province; with over 3 million vehicles sold in 2022, it produced the greatest number of vehicles on a provincial basis. The main internal combustion engine vehicle (ICEV) producers are GAC in Guangzhou, with several Japanese joint ventures and Audi/VW in Foshan. The ICE-based distribution of the automobile production in

Table 1 shows the number of automobile production-related firms and output among the GBA cities in 2019, which is

before NEV and BYD production rose dramatically. Guangzhou is the most important location in this respect. Its pre-eminence has been due to the headquarter functions of GAC (Guangzhou Automotive Corporation) and its many JVs (Toyota, Honda, Mitsubishi, and Hino). The auto industry is one of Guangzhou’s three pillar industries, and while GAC is the substance of that pillar, Dongfeng Nissan also supports the cluster. GAC was initiated as an SOE in the 1980s, but after failed attempts with French and American partners, the government turned to the Japanese, thereby enticing them with industrial parks, specialized tertiary training, and a school for expatriate children. The Japanese assemblers brought along their own suppliers to build the local cluster [

42].

Guangdong’s industry, however, is shifting from the Guangzhou-based control and production of ICE vehicles to a wider distribution of NEV production. The shift is threatening a few cities with large sunk costs in conventional production, while empowering others that are less burdened with such legacies, both because NEVs are their entry into the industry and because the components and parts supplied can be used for either type of vehicle. Among these, BYD—which has vertically integrated battery and auto production—is by far the largest, and it became the world’s leading producer of EVs in 2022. BYD localizes its supply chain and had 12,000 suppliers in 2020, of which 48% were in southern China, 28% in eastern China, and the rest distributed throughout the country. The latter numbers are growing with BYD’s expansion of assembly and component plants to other parts of China. By 2022, BYD employed over 400,000 staff globally, with 100,000 in Shenzhen. Beyond BYD, Shenzhen and the GBA are also strong in these related industries (

Table 1). The computer, communications, and electronics industries make up over half of the manufacturing industries in Shenzhen and Dongguan, and they are also important in Guangzhou, Huizhou, Foshan, Zhongshan, and Jiangmen. Electrical machinery and equipment dominate in Foshan, Zhongshan, and Jiangmen. Although Hong Kong seems to lack presence in automobile manufacturing, its companies, such as Johnson Controls, the world’s largest manufacturer of small motors, use the GBA as a manufacturing base. Hong Kong’s R&D, advanced manufacturing, and external investment policies also promote the EV industry.

GBA cities are rapidly using those related industries to build a NEV base in the region. NEV-committed investment data for the GBA from 2013–2020 shows the main technology emphases of different cities (

Table 2).

Only Guangzhou companies were committed to investments in all categories and attracted the most investment in vehicle production and key component production. Zhongshan received the greatest investment in battery development. Foshan received the highest investment in component manufacturing and Shenzhen in developing charging facilities. In total, Foshan received the highest investment in NEV production, where battery development has been the most common investment. Guangzhou claimed that they are leading NEV industrial development in the GBA, even though they rank fourth in terms of investment. Guangdong’s policy plan identified Zhaoqing as the key city for NEV manufacturing to support the regional development of NEVs, yet Zhaoqing has the least corporate investment within the GBA. In general, the distribution of investment across cities was more diverse than distribution in terms of categories.

The development of the NEV industry and its wide distribution is also evident in the growing number of companies claiming to be in the industry (

Figure 3). As of August 2022, there were 16,000 NEV-related enterprises in Guangdong, including 1785 focused on batteries and 60 for manufacturing vehicles [

50]. In addition to the transformation of existing enterprises, the number of newly registered NEV companies has grown from about 150 in 2014 to 910 in 2022 [

50]. Over 60 percent of NEV companies are located in Shenzhen and Guangzhou, but the value chain extends strongly into Dongguan, Huizhou, Foshan, and Zhaoqing. The assemblers are concentrated in Shenzhen, Guangzhou, Foshan, and Dongguan. Component specialization occurs with regional focus on the following: batteries in Shenzhen and Dongguan, battery recycling in Jiangmen, fuel cell vehicles in Foshan, and electronic systems in Huizhou. Innovation is another strength of the GBA. Guangdong is China’s leader in NEV patents and BYD is the dominant corporate filer with over half its patents related to batteries.

Given the GBA’s rapid development as an NEV production powerhouse, noteworthy regional dynamics are clearly at play. Most of the GBA’s auto industry produces ICE vehicles, and—in its transition to NEVs—income and jobs are threatened. Path dependency complicates the transition for legacy automakers, while companies like BYD (Shenzhen) and Xpeng (Zhaoqing) are unburdened by the costs of two types of R&D and capital investment. Meanwhile, the GBA’s ICE producers are concentrated in Guangzhou and Foshan (GAC (Toyota and Honda), Dongfeng Nissan, and FAW Volkswagen), whereas the leading NEV producer is in Shenzhen, and strong start-ups are located in Foshan and Zhaoqing. The component manufacturers’ reflecting strengths in related industries are more broadly distributed. How policies have supported NEV transformation, including the efforts to coordinate the efforts among cities while enabling competition and regional clustering, is discussed in the next section.

5. Results: GBA Policy Coordination and Differentiation

This section analyzes national, provincial, and city-level government NEV policies to determine the extent of policy coordination among these governance entities. This is performed by being based on the NEV policy categories of production, consumption, infrastructure, and emission reduction.

5.1. Production Policies

The coordination of production policies is marked by leadership and signaling at the national and provincial levels, as well as the substantive support for industry at the city level (

Figure 4). As mentioned previously, over the course of two decades, the national government has evolved city pilot projects, industry–academic collaborations on key technologies, consumption/production subsidies (next section), and technological standards. These programs have fostered confidence in the industry by providing guidance on what vehicles could be allowed on the market, what types of technologies, and what performance. After national guidance provided these signals and support, provincial governments could take it upon themselves to implement a more substantive organization of the industry, as seen in the case of Guangdong.

In 2010, Guangdong published an

Action Plan for the Development of Electric Vehicles in Guangdong Province [

51], wherein establishing a local standard system for electric vehicles with a view toward reaching national significance was proposed. The plan sought to organize the backbone of electric vehicle enterprises, universities, and research institutions in order to formulate provincial standards for electric vehicles. Since then, it has introduced dozens of NEV-related policies, such as organizing and funding industrial parks on a city basis, as well as linking up cities. The latter includes an NEV and industrial chain promotion plan in the 13th Five-Year Plan (2016–2020), and an NEV program in the 2017-30 Guangdong Coastal Economic Zone (the GBA). The NEV R&D and industry chain capacities were to be further strengthened by the

Opinions on Accelerating the Innovation and Development of NEV Industry [

52] action plan, which introduced an NEV battery recycling pilot program and battery standards in 2020; a target of 600,000 NEVs as part of the action plan to develop clusters within the automobile strategic industry pillar; the integration of NEV development into the 14th Five-year plan (2021–2025); and programs focused on fuel cell vehicles (2022, 2020). These programs sought to coordinate technology standards and to differentiate the activities by cluster and cities. The provincial government also encouraged direct cooperation among Guangzhou, Foshan, and Zhaoqing, as well as Guangzhou and Shenzhen.

5.2. City Policies

The production side of NEV development is the most open to local initiatives. The cities of Guangzhou, Shenzhen, and Foshan are committed to the large-scale development of NEVs, but most cities have instead prioritized component specialization. The points below (

Table 3) indicate the initiatives taken by individual cities.

5.3. Consumption (Production) Policies

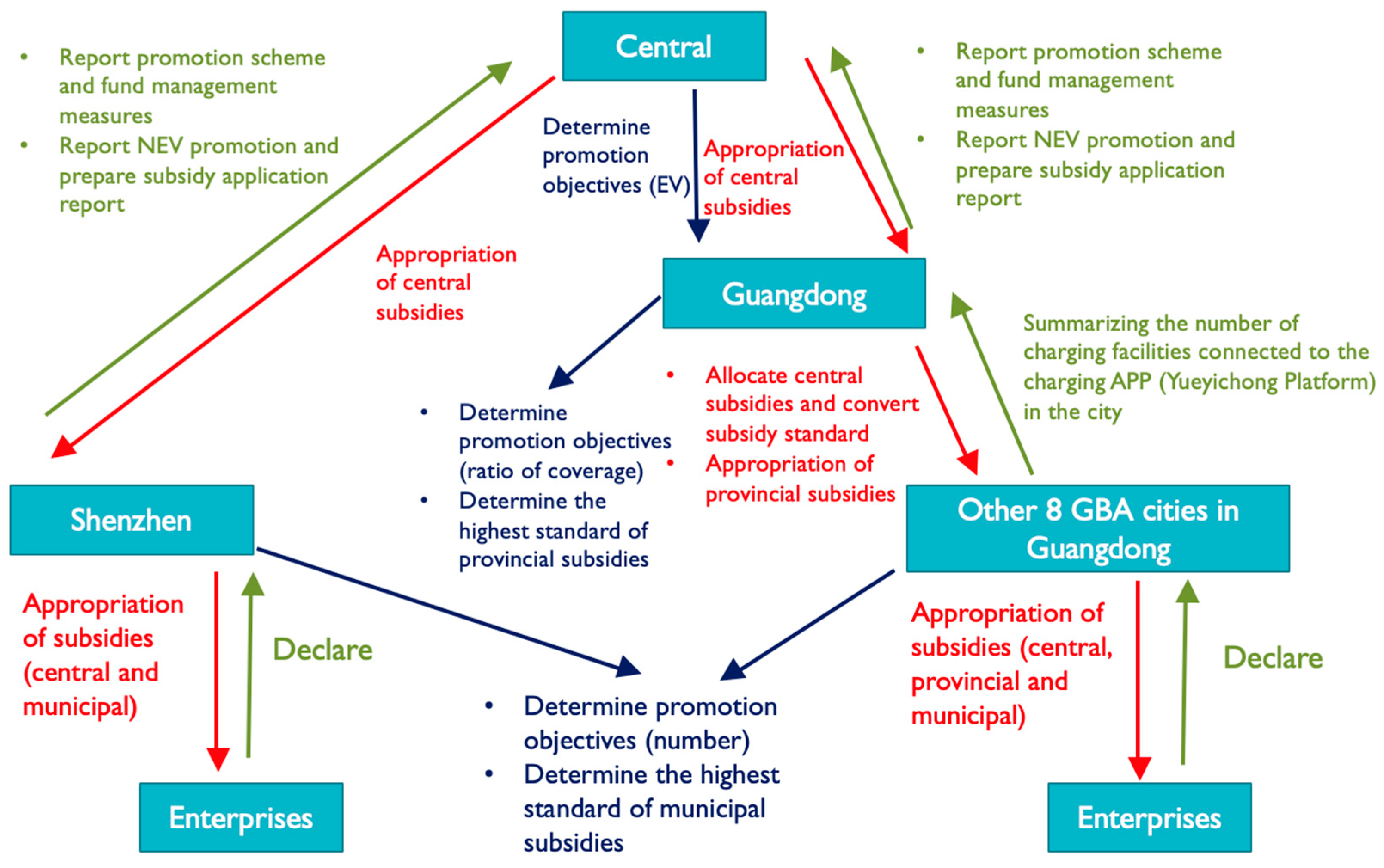

Subsidy policies, including sales tax relief and support for purchasing, are the dominant policies. Although consumer-oriented, they are a de facto production policy, and although led by the national government, they are interpreted and supplemented at the local level (

Figure 5). When selling NEVs, manufacturers settle accounts with consumers according to government subsidies, and they are compensated by the government afterward. Every year, manufacturers make a report of product sales and operations, including sales invoices, product technical parameters, and vehicle registration information. The report is made for four departments in the cities where the enterprises were registered (Finance; Science and Technology; Industry and Information Technology; and Development and Reform departments). The local departments then report to their higher counterparts in the four ministries/commission at the provincial and central government levels.

The subsidies for NEV buyers in Shenzhen consist of central and municipal subsidies, while those for NEV buyers in the other eight GBA cities include central, provincial, and municipal subsidies. Guangdong province places Guangzhou, Zhuhai, Foshan, Huizhou, Dongguan, and Zhongshan in a first category; Jiangmen and Zhaoqing in a second category; and the cities outside the GBA are in a third category. Provincial subsidy categories were developed in accordance with national purchase subsidy standards, and they are weighted to support less developed areas.

The proportion of provincial funds provided are the lowest in the first category and the highest in the third category [

53]; for instance, the province did not provide subsidies to first category corporate and private buyers of NEVs from manufacturers in Guangdong province (excluding Shenzhen) from 2017 to 2020. Buyers from cities in the second and third category were allotted successively higher provincial subsidies. The proportion of municipal subsidies supplementing the central subsidy standard similarly differed, e.g., the municipal subsidy in Guangzhou (the first category) for the NEV purchase in 2017 was 50% of the subsidy standard of the central government [

54]. In 2017, Zhaoqing (second category) ended municipal subsidies and relied solely on provincial subsidies, which was no more than 50% of the central subsidies [

55].

Hong Kong and Macau receive neither national nor local support for subsidies, but both provide substantial subsidies (principally in the form of tax reductions). Hong Kong began subsidizing low-emission vehicles in 2010. It subsequently increased the requirements from simply lower emissions to hybrids, and now the subsidy is only available to pure EVs. The subsidy tools included reductions in Hong Kong’s very onerous first registration tax, as well as a one-for-one replacement scheme for both private and commercial vehicles. The effectiveness of these policies has been such that EVs accounted for 53 percent of private cars purchased in 2022. Hong Kong will ban sales of all fossil fuel cars by 2035. Macau also subsidizes EVs by allowing them exemption from motor tax. Notably, these subsidies are not tethered to local or national manufacturers. In addition, for a few years in Hong Kong, Tesla enjoyed a near monopoly on relief from high registration taxes.

5.4. Infrastructure (Charging)

The infrastructure needed to support NEVs includes land allocation and zoning for charging stations; charging stations in public and private locations; and facilities for battery recycling, etc. A focus on recharging stations brings most of these elements together, where they are accomplished in a multi-level effort. The central government focuses on the promotion of NEVs; the provincial government focuses on the coverage of NEV charging facilities; and the municipal government’s goals are more specific to their city and its needs (

Figure 6).

In 2016, the Ministry of Industry and Information Technology (MIIT), as well as five other ministries and commissions, determined the central subsidy for NEV facilities during the 13th Five-Year Plan, and they also defined three conditions for obtaining the subsidy [

56]. First, the scale of NEV promotion had to be large. In key regions and provinces for air pollution control, NEVs should account for no less than 2%, 3%, 4%, 5%, and 6% of new vehicles in the region during the years of 2016 to 2020, respectively. Second, all provinces (cities and districts) should establish scientific and reasonable promotion and application of NEVs from 2016 to 2020, and they should also formulate charging infrastructure construction, as well as management measures and local incentive policies. Third, the market should be fair and open—insofar as the local government must not restrict the purchase of non-local NEV brands or formulate discriminatory local standards. The central government first allocated subsidy funds for the construction and operation of charging facilities for provinces (and autonomous regions and municipalities) that met the above conditions, and then those sub-national governments made overall arrangements for the next round of allocation. Based on their performance in the promotion objectives, local governments would be rewarded with increased funds for increases in scale (within a cap). For example, after Guangdong province achieved the 2020 targets, it could obtain CNY 126 million of subsidy funds from the central government. On this basis, for every 6000 additional vehicles, the subsidy funds increased by CNY 11 million, with maximum subsidies capped at CNY 200 million.

At the provincial level, Guangdong set the charging infrastructure construction goals during the 13th Five-Year Plan. The years of 2016–2018 were a demonstration period, where the focus was on the construction of charging infrastructure in urban public services to cover 60% of the GBA. Next, 2019–2020 was a promotion period, where the focus was on the commercialization of charging services to cover the GBA [

57]. Subsidies for the construction of charging facilities in the eight GBA cities (i.e., excluding Shenzhen) were composed of central subsidies, provincial subsidies, and municipal subsidies. Before the end of February every year, the financial departments of all provinces (autonomous regions and municipalities) and other relevant departments prepare an application report for the subsidy funds and jointly submit it to the central government. Companies could apply for compensation for building the chargers after the facilities were completed, put into operation, qualified in acceptance, and they had obtained the certificate of the Yueyichong platform. Additionally, from the late 2010s, Guangdong subsidized the Yueyichong electric vehicle charging app platform to help car owners quickly find nearby charging stations.

Guangdong Province provides the highest standard of provincial subsidies, and—as with the purchasing subsidy—charger subsidies are allocated according to municipal capacities, rather than being evenly distributed throughout the province. For example, the subsidy standard for DC piles in Guangdong Province from 2021 to 2023 was up to 200 CNY/kw in the GBA, but up to 300 CNY/kw in the eastern and northwestern regions of Guangdong Province. The actual subsidy standard after calculation in 2021 was 180.7 CNY/kw in the GBA and 271.95 CNY/kw in the east and northwest [

58]. Through leveraging provincial subsidies, Guangdong Province encourages municipal governments to provide funds to support the construction of local charging infrastructure.

Subsidies for charging facilities are also declared level by level. The charging facility companies report the number and rated power of public charging piles that have obtained the access certificate of the Yueyichong platform to the municipal government. The municipal government (except Shenzhen) summarizes the city’s situation to the provincial government, and then the provincial government provides a summary to the central government. Shenzhen, as one of the five Chinese cities with independent planning status, summarizes their charging station situation directly to the central government.

The specific programs were determined by the cities according to their manufacturing ambitions, urban layouts, and governance systems. For example, during the 13th Five-Year Plan, Guangzhou proposed to build 26,000 special charging piles for public transportation, 217 special charging and replacement power stations, 58 urban public charging stations, 30,000 decentralized public charging facilities, and 10 intercity fast charging stations [

59]. Shenzhen developed normal and fast charging systems in tandem with taxi and bus electrification, as well as with electricity, parking, commercial, and residential facility operators. As of 2023, Shenzhen was China’s best-serviced large city, offering 190,000 chargers; moreover, it introduced guidelines to raise the number to over 800,000 by 2025. Although public policy-driven, charging station operators are primarily private corporations. Shenzhen and Guangzhou also benefitted from their NEV assemblers, who initiated charging systems in their localities. The other cities were not as proactive, but the provincial system did achieve widespread charger coverage as Guangdong’s multi-level coordination and implementation established 380,000 chargers by 2022. That number was triple that of Jiangsu, Zhejiang, Shanghai, or Beijing [

60].

Hong Kong, while not a part of the Guangdong system, promoted charging infrastructure from 2011 by offering developers gross floor area incentives to provide stations in private buildings. Those supports were followed by HKD 2 billion in subsidies for home chargers and HKD 120 million for public chargers. By 2022, Hong Kong had 68,000 private and 1800 public chargers, with policies aiming to reach 150,000 and 5000, respectively, by 2025. By 2023, Macau had developed a network of 1265 public chargers, thereby supporting various national standards and speeds. Macau prioritized developing several hundred chargers for electric motorcycles, and it also has a well-developed electronic location and payment program for chargers that are operated by the power company.

5.5. Emissions Suppression

Another way of increasing NEV demand is by increasing the regulatory costs of owning ICE vehicles. Removing vehicles from the road, however, is more complicated than incentivizing purchases through subsidies, and it reveals the differences and willingness of the different cities to impose costs on their citizens and economies. These differences can be seen in the progression of regulations from the strictly enforced elimination of yellow label vehicles to a progressive restriction of emissions on newly bought vehicles (

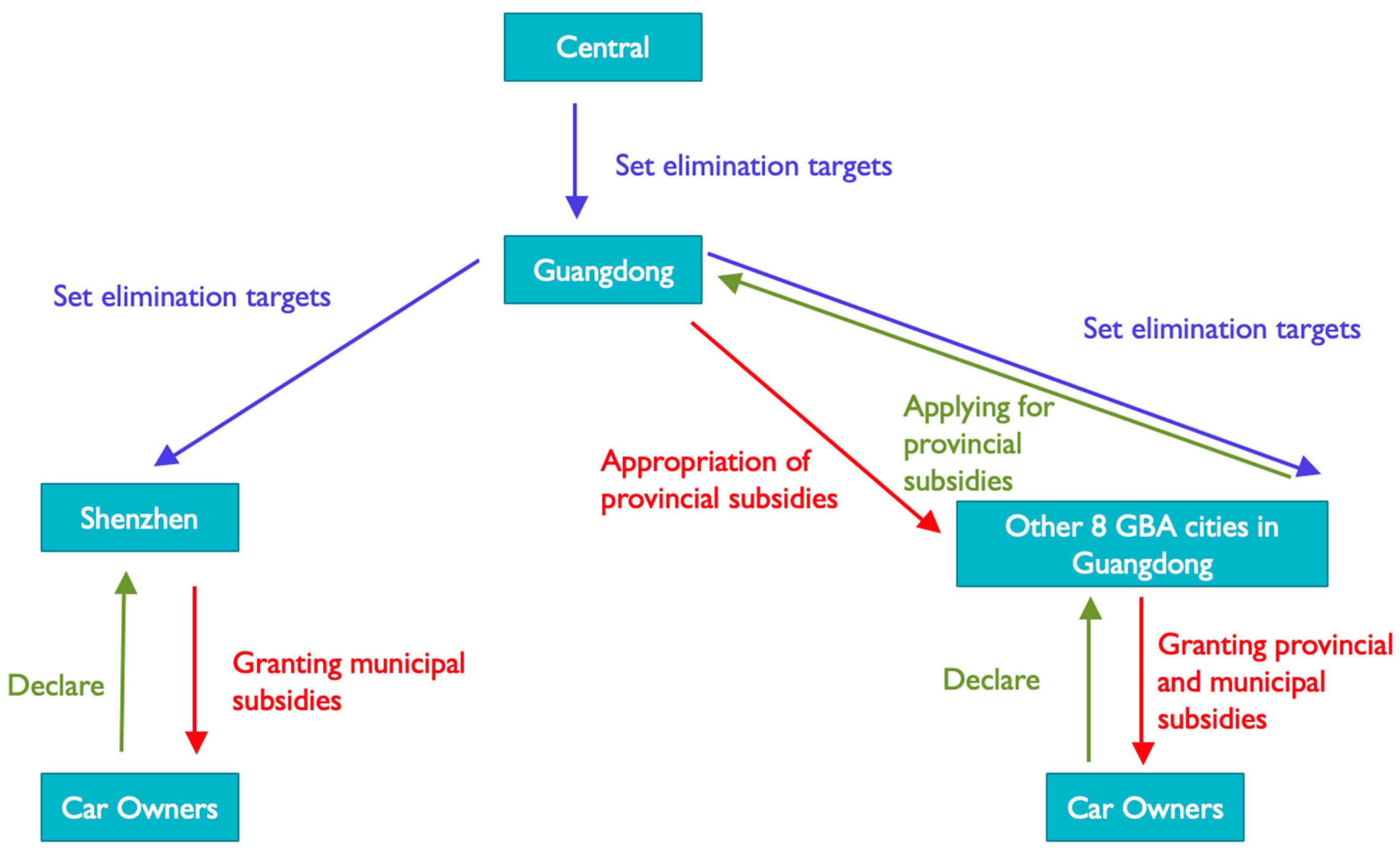

Table 4).

In 2013, the State Council decided to eliminate yellow-labeled vehicles, requiring those registered before the year end of 2005 to be removed by the end of 2015, and the rest to be eliminated by 2017 [

61] (

Figure 7). The document stipulated higher requirements for more economically developed regions, including Beijing–Tianjin–Hebei, the Yangtze River Delta, and the Pearl River Delta, thereby requiring the elimination of all yellow-labeled vehicles by the end of 2015. Guangdong Province followed this goal by ensuring that, by the end of 2015, yellow-labeled vehicles registered before the year end of 2005 were eliminated, and that the Pearl River Delta region would eliminate all yellow-labeled vehicles by the end of 2015 [

62]. Correspondingly and aggressively, each of the nine GBA cities introduced elimination targets to remove all yellow-labeled vehicles by the end of 2015. For example, Guangzhou required the elimination of 77,680 yellow-labeled vehicles and old vehicles in 2014, as well as a reduction of another 155,360 yellow-labeled vehicles and old vehicles by the end of 2015 [

63]. Zhaoqing required the elimination of 60% of yellow-labeled vehicles by the end of 2014, and then all yellow-labeled vehicles by the end of 2015 [

64].

Shenzhen was once again an exception because it was not provided with subsidies to eliminate yellow-labeled vehicles while the other eight GBA cities received provincial support to assist their municipal efforts. According to the subsidy declaration guidelines issued by cities, the owner who met the requirements should scrap the vehicle within the specified time and apply for the subsidies. Each year, the eight GBA cities (except Shenzhen) summarize the data on eliminated yellow labels before January 9th and apply for the provincial subsidy settlement. The provincial government then calculates the funds according to the audit results and allocates the provincial subsidy funds to each city.

China followed the EU’s path on stricter regulations on newly bought vehicles, ratcheting these up consistently in a 2–3-year cycles. Since the GBA’s provincial government initiated regulations earlier than other provinces, Guangzhou and Shenzhen have led in tightening their regulations in comparison to the other cities, which is when the broader standards were brought in. Still, different cities were able to adapt the regulations to their circumstances in terms of proportion of cars forced into the new standards and the strictness of the standards. Hong Kong was not part of the China emission standards, but it followed European emission standards closely and is somewhat in advance of the other GBA cities. Notably, it established roadside testing stations to enforce compliance. Macau has also followed EU standards while attending primarily to controlling emissions from motorcycles.

6. Discussion: Coordination, Competition, Complementarity, and Free riding

6.1. Production

The impact of national policies proved to be strongly path-dependent because the two pilot cities, Shenzhen and Guangzhou, became the core production bases of China’s NEV industry. At the same time, the nature of top-down coordination provided autonomy to these cities in devising their actual industrial policies. The two cities have implemented the most impactful NEV industrial policies in terms of focus, sectoral governance, subsidies, and facilities such as industrial parks. The province both supported these city actions and attempted to coordinate across the region, but the latter efforts enabled strong regional competition—particularly between the two core cities—on policies that supported headquarters and assemblies. Competition has also emerged in a complementary manner as the other cities primarily focused on developing components or other specializations. For example, Jiangmen focuses on battery recycling, Zhaoqing has comparative strength in die casting, and Zhongshan specializes in fuel cell components. That said, Shenzhen and Guangzhou are striving to develop full industrial chains within their borders, and Foshan, Zhaoqing, and Dongguan seek to maintain or develop full vehicle production. Such competition among cities impacts production locations within the region, as exemplified by Guangzhou’s success in soliciting Xpeng to build a plant within its borders while Zhaoqing lost out on that expansion.

6.2. Consumption (Production)

National influence on NEV industry coordination has been most powerfully demonstrated by providing subventions for NEV purchases, directing subsidies to pilot cities, and by limiting the number of subsidies that local governments can pay for. Early subsidies to pilot governments provided a foundation for their development, and the later expansion of subsidies was based on purchases irrespective of location-supported regional clustering for national markets. The province was a key actor in formulating subsidies because it could allocate them differentially across cities and has done so on a redistributive basis rather than focusing the subsidies on a production basis. Hence, less wealthy cities such as Jiangmen and Zhaoqing were given proportionally higher subsidies than Guangzhou and the other cities. Of special note, autonomous Shenzhen was not affected by this redistribution, and its government could thus allocate the subsidies directly.

The cities are allowed to supplement subsidies by up to 50 percent of the national level, but only Shenzhen, Guangzhou, and Zhaoqing did this, thus indicating less of a capacity to do so and/or less priority on building the NEV market. Other mainland GBA cities may have been less incentivized to do so because they are primarily component manufacturers and receive less payback for building infrastructure. The cities and the provinces can exert other forms of influence, including favoritism for their manufacturers through subsidies and the reporting systems. Zhaoqing, for example, tied subsidies to the purchase of locally manufactured products. Such actions, however, should be legible to provincial and national governments due to the administrative reporting structure. Hong Kong stands as an interesting contrast to policy formation in the mainland GBA because its strong support of EV purchases was not linked to regional production per se, but was rather driven by an acceptance of mitigation responsibilities.

6.3. Infrastructure

Charging stations are necessary not only to secure the adoption of EVs generally, but also to create a market for EVs, whether produced locally, regionally, or imported to the region. Support for charging stations thus contributes to GHG mitigation and supporting the regional NEV industry. Variation among cities in their charging station investments, when compared with their production policies, may indicate acceptance of responsibilities or free riding. Interestingly, the national government reinforced the regional basis of NEV development by delegating charging station strategy to provinces and cities, with the proviso that they do so on an equitable basis within their jurisdiction. The Guangdong provincial government took on this responsibility not only via a differential allocation of subsidies to the cities in the province (except Shenzhen), but also in developing its Yueyichong application platform so that consumers in all cities would be able to find chargers readily. City supplementation of charging stations was allowed but, again, it was primarily Guangzhou and Shenzhen that made such investments. A few other cities did, however, go beyond the provincial government minimums, and there were considerable differences in how the cities planned out their charging station distribution and construction. In addition, Hong Kong, Guangzhou, and Shenzhen, as well as Zhongshan and Huizhou, provided priority parking for NEVs.

6.4. Emissions Suppression

Although China’s NEV strategy was arguably motivated more by the quest for industrial development than a pollution control strategy, the two policy areas are coupled. Particularly after the air pollution crisis of the early 2010s, emissions suppression became a national priority, and there was thus an increased emphasis on NEVs. Driven by urgency, the national government imposed a greater intensity of control, thereby forcing the elimination of yellow label vehicles and successively implementing stricter pollution controls on new vehicles. Yet, even in emissions control, the national government had to work through the provincial and city governments. The provincial government sought to reach the national goals early by allocating elimination quotas and subsidies to the city governments, while city governments were allowed discretion in setting their goals and means, and in applying to the provincial government for the subsidies to pursue their plans. China’s national emission control standards were introduced with the expectation that leading cities would adopt more frequent changes, while less wealthy cities were allowed to make changes on a less frequent basis.

7. Conclusions

China’s national government is typically credited with designing policies that fostered the NEV industry’s growth to to become globally leading. These policies include the foundational pilot city programs that sought to widely establish NEV production among cities, as well as the creation of subsidy programs that encourage the development of local and national markets. However, it is becoming increasingly evident that the development of China’s NEV industry is emerging through a regional industrial development pattern that is typical of the auto industry [

1,

2,

3,

4,

5,

41]. Yet, due to the necessity of social support for NEVs to displace ICE vehicles in production and consumption, effective policies are important to NEV regional industrial development. Shanghai’s inducements for Tesla not only brought the then-most sophisticated and highest volume NEV producer to the city, but it also rebuilt the regional supplier base. The GBA approach was more bottom-up and fostered through a complex and nuanced policy structure—and it was certainly guided by provincial coordination, but it also allowed for competition, differentiation, and complementarity among the different cities’ policy approaches.

Sustainable industrial development was supported by policies that were inherently competitive in nature: they were designed to attract capital and foster local manufacturing capacities that could compete not only globally, but also with firms within the region. Strong policy support from Guangzhou and Shenzhen for their respective assembly firms highlighted this regional competition. Both cities also strive to develop supply chains within their borders. Policies in Zhaoqing, Foshan, and Dongguan also encourage assembly plants. However, the main thrust of the other GBA cities has been to establish specialization within a complex cluster of regional production, thereby orienting their competition to differentiation. The province has encouraged this differentiation to the point of pushing Foshan to focus on FCVs. Coordination is much stronger in consumption, infrastructure, and emission suppression, where national government initiatives are acted on by the province. A remarkable feature of this coordination is the province’s allocation of consumption subsidies in a redistributive manner, whereby less-developed provinces receive greater financial support from the province. The market for NEVs and charging stations has thus developed sturdier foundations across the region than it would have in the absence of provincial coordination. Nonetheless, competition and capacity differences among the cities remain because Guangzhou and Shenzhen have devoted a much higher volume of resources into both forms of support. Coordination is strongest in emissions suppression, where national/provincial policies are carried out in a standard and strict manner by all cities. Yet, even on emissions, Guangzhou and Shenzhen are expected to lead, and they have also initiated rather than waited for directives. Notably, cooperation among the cities on emissions does not seem to be substantive enough, although several bilateral and multilateral agreements have been signed.

This paper demonstrates how the GBA has developed a regional cluster that has taken the lead in China’s NEV development, and it also shows that its development is associated with policies that are complex and nuanced in terms of industrial development, consumption, charging infrastructure, and emission suppression. In so doing, our study calls for attending to the structure of local and regional development policies in fostering the NEV industry, or in any industry involving new technology [

11]. These findings pave the way for a wide range of further research. Most importantly, what are the causal relations between the policies and NEV development? How important were the policies to NEV development? Perhaps the initiatives of entrepreneurs and external investment driving BYD and Xpeng were more critical. Examining the underlying causal mechanisms of the policies invites further research into determining the relative efficacy and importance of the industry, consumption, infrastructure, and emission suppression policy areas, as well as of the specific instruments in each of those areas. Another broad area requiring examination is the relationship between the policies and the structure of the industry in particular localities. On the one hand, it seems that the policies across the GBA cities lean to complementary differentiation and the creation of a regional industrial chain. On the other hand, BYD in Shenzhen is said to be highly vertically integrated even though it hosts thousands of NEV suppliers, perhaps indicating that the core firm produces more local externalities than direct external economies of scale. Another interesting issue arising from this analysis is that while the mainland GBA cities’ policy strategy linked NEV consumption with production, Hong Kong and Macau did not. Hong Kong took a much more laissez-faire approach to firm competition, and its focus on EV adoption has been remarkably successful. Lastly, while this paper has examined the roles of coordination, competition, and cooperation in the region, further studies can be conducted on determining what mix of these policy initiatives in these areas could be more effective. Moreover, while the GBA has risen, understanding the advantages and disadvantages of its regional dynamics requires its comparison with Shanghai and a few other regions that have also found success.

In summary, while the RDA governance system was deeply embedded in NEV strategy, there was room within the policy structure for Guangdong to coordinate effective consumption, infrastructure, and emission reduction policies that provide a regional base for adoption of NEVs, while serving as a foundation for the industrial development of NEVs. At the same time, fostering competition was the essential force within the RDA strategy. It resulted in competitive and complementary policy actions by the different cities. Indeed, the industrial effort seemed to eclipse the consumption, infrastructure, and emission suppression efforts of the GBA cities other than Guangzhou and Shenzhen. Without the coordination and redistribution efforts of the province, it is unlikely that a strong region-wide foundation for adopting NEVs would have emerged. Still, the benefits of policy autonomy at the city level are evident. Even though Shenzhen and Guangzhou have created a bipolar regional cluster, they also lead in pulling other cities in all areas of NEV policy design and implementation in addition to actual NEV production and adoption.