A New Resource Allocation Multiple Criteria Decision-Making Method in a Two-Stage Inverse Data Envelopment Analysis Framework for the Sustainable Development of Chinese Commercial Banks

Abstract

1. Introduction

2. Preliminaries

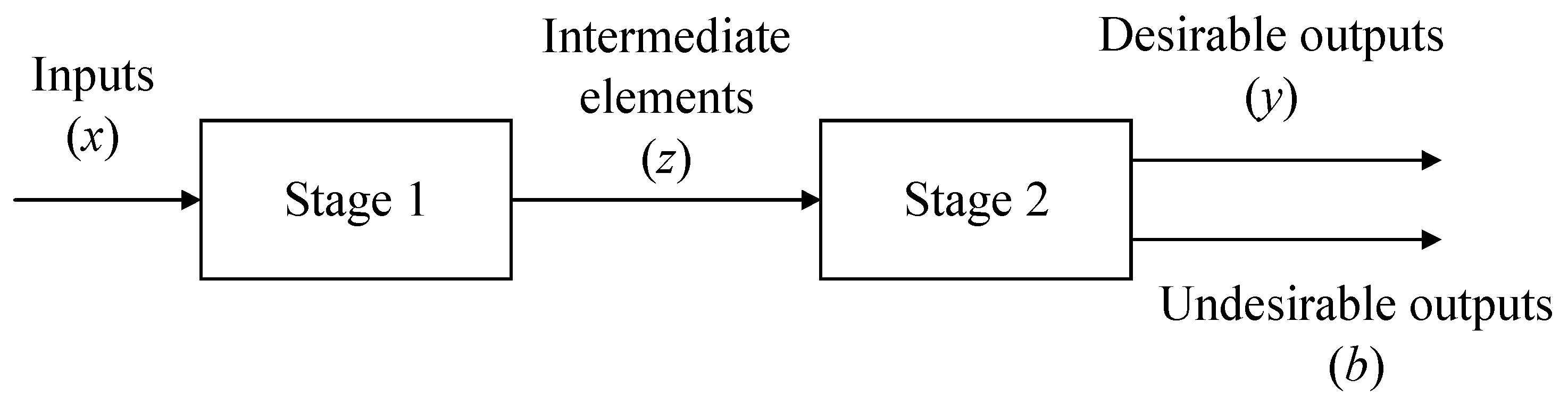

2.1. Two-Stage DEA Model

2.2. Traditional Inverse DEA Model

3. New Two-Stage Inverse DEA Resource Allocation Method

3.1. Two-Stage DEA Model with Undesirable Outputs

3.2. Two-Stage Inverse DEA Model

4. Discussion on the Effectiveness of the New Method

5. Application in the Resource Allocation of Chinese Commercial Banks

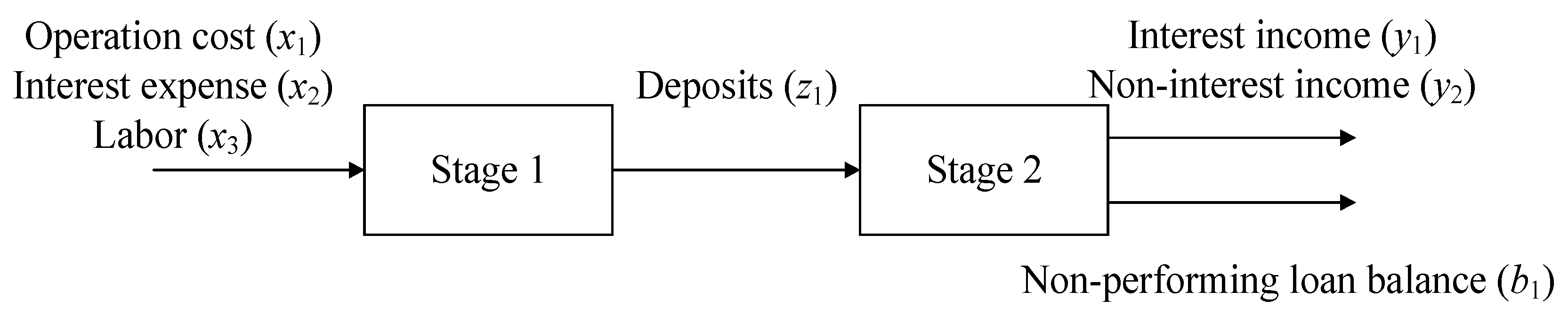

5.1. Case Description

5.2. Result Analysis

5.3. Methods Comparison

6. Conclusions

Author Contributions

Funding

Institutional Review Board Statement

Informed Consent Statement

Data Availability Statement

Conflicts of Interest

References

- Shi, X.; Wang, L.; Emrouznejad, A. Performance evaluation of Chinese commercial banks by an improved slacks-based DEA model. Socio-Econ. Plan. Sci. 2023, 90, 101702. [Google Scholar] [CrossRef]

- Antunes, J.; Hadi-Vecheh, A.; Jamshidi, A.; Tan, Y.; Wanke, P. Cost efficiency of Chinese banks: Evidence from DEA and MLP-SSRP analysis. Expert Syst. Appl. 2024, 237, 121432. [Google Scholar] [CrossRef]

- Zhang, Z.; Li, Z. Consensus-based TOPSIS-Sort-B for multi-criteria sorting in the context of group decision-making. Ann. Oper. Res. 2023, 325, 911–938. [Google Scholar] [CrossRef]

- Kundu, P.; Görçün, O.F.; Garg, C.P.; Küçükönder, H.; Çanakçıoğlu, M. Evaluation of public transportation systems for sustainable cities using an integrated fuzzy multi-criteria group decision-making model. Environ. Dev. Sustain. 2023. [Google Scholar] [CrossRef]

- Khazaei, M.; Hajiaghaei-Keshteli, M.; Ghatari, A.R.; Ramezani, M.; Fooladvand, A.; Azar, A. A multi-criteria supplier evaluation and selection model without reducing the level of optimality. Soft Comput. 2023, 27, 17175–17188. [Google Scholar] [CrossRef]

- Puri, J.; Yadav, S.P. A fuzzy DEA model with undesirable fuzzy outputs and its application to the banking sector in India. Expert Syst. Appl. 2014, 41, 6419–6432. [Google Scholar] [CrossRef]

- Wu, H.Q.; Yang, J.Y.; Wu, W.S.; Chen, Y. Interest rate liberalization and bank efficiency: A DEA analysis of Chinese commercial banks. Cent. Eur. J. Oper. Res. 2023, 31, 467–498. [Google Scholar] [CrossRef]

- Li, M.; Zhu, N.; He, K.; Li, M. Operational efficiency evaluation of Chinese internet banks: Two-stage network DEA approach. Sustainability 2022, 14, 14165. [Google Scholar] [CrossRef]

- Omrani, H.; Oveysi, Z.; Emrouznejad, A.; Teplova, T. A mixed-integer network DEA with shared inputs and undesirable outputs for performance evaluation: Efficiency measurement of bank branches. J. Oper. Res. Soc. 2023, 74, 1150–1165. [Google Scholar] [CrossRef]

- Tong, B.N.; Cheng, C.P.; Liang, L.W. Using Network DEA to Explore the Effect of Mobile Payment on Taiwanese Bank Efficiency. Sustainability 2023, 15, 6344. [Google Scholar] [CrossRef]

- Xie, Q.; Xu, Q.; Chen, L.F.; Jin, X.; Li, S.; Li, Y. Efficiency evaluation of China’s listed commercial banks based on a multi-period leader-follower model. Omega 2022, 110, 102615. [Google Scholar] [CrossRef]

- Soltanifar, M.; Lotfi, F.H.; Sharafi, H.; Lozano, S. Reource allocation and target setting: A CSW-DEA based approach. Ann. Oper. Res. 2022, 318, 557–589. [Google Scholar] [CrossRef]

- Chu, J.F.; Li, X.X.; Yuan, Z. Emergency medical resource allocation among hospitals with non-regressive production technology: A DEA-based approach. Comput. Ind. Eng. 2022, 171, 108491. [Google Scholar] [CrossRef]

- Zhu, Y.F.; Wang, Z.L.; Yang, J.; Zhang, Z. Evaluating performance of innovation resource allocation in industrial enterprises: An improved two-stage DEA model. Technol. Anal. Strateg. Manag. 2023. [Google Scholar] [CrossRef]

- Wei, Q.L.; Zhang, J.; Zhang, X. An inverse DEA model for input/output estimate. Eur. J. Oper. Res. 2000, 121, 151–163. [Google Scholar] [CrossRef]

- Amin, G.R.; Al-Muharrami, S.; Toloo, M. A combined goal programming and inverse DEA method for target setting in mergers. Expert Syst. Appl. 2019, 115, 412–417. [Google Scholar] [CrossRef]

- Chen, L.; Gao, Y.; Li, M.-J.; Wang, Y.-M.; Liao, L.-H. A new inverse data envelopment analysis approach to achieve China’s road transportation safety objectives. Saf. Sci. 2021, 142, 105362. [Google Scholar] [CrossRef]

- Ghiyasi, M.; Soltanifar, M.; Sharafi, H. A novel inverse DEA-R model with application in hospital efficiency. Socio-Econ. Plan. Sci. 2022, 84, 101427. [Google Scholar] [CrossRef]

- Lu, J.C.; Li, M.J. Optimisation analysis of resource allocation for China’s high-tech industry based on an extended inverse DEA with frontier changes. Technol. Anal. Strateg. Manag. 2022. [Google Scholar] [CrossRef]

- Emrouznejad, A.; Amin, G.R.; Ghiyasi, M.; Michali, M. A review of inverse data envelopment analysis: Origins, development and future directions. IMA J. Manag. Math. 2023, 34, 421–440. [Google Scholar] [CrossRef]

- Wang, K.; Huang, W.; Wu, J.; Liu, Y.-N. Efficiency measures of the Chinese commercial banking system using an additive two-stage DEA. Omega 2014, 44, 5–20. [Google Scholar] [CrossRef]

- Azad, M.A.K.; Talib, M.B.A.; Kwek, K.T.; Saona, P. Conventional versus Islamic bank efficiency: A dynamic network data-envelopment-analysis approach. J. Intell. Fuzzy Syst. 2021, 40, 1921–1933. [Google Scholar] [CrossRef]

- Tan, Y.; Wanke, P.; Antunes, J.; Emrouznejad, A. Unveiling endogeneity between competition and efficiency in Chinese banks: A two-stage network DEA and regression analysis. Ann. Oper. Res. 2021, 306, 131–171. [Google Scholar] [CrossRef]

- Yang, J.W. Disentangling the sources of bank inefficiency: A two-stage network multi-directional efficiency analysis approach. Ann. Oper. Res. 2023, 326, 369–410. [Google Scholar] [CrossRef] [PubMed]

- Safiullah, M.; Shamsuddin, A. Technical efficiency of Islamic and conventional banks with undesirable output: Evidence from a stochastic meta-frontier directional distance function. Glob. Financ. J. 2022, 51, 100547. [Google Scholar] [CrossRef]

- Shah, W.U.H.; Hao, G.; Yan, H.; Yasmeen, R. Efficiency evaluation of commercial banks in Pakistan: A slacks-based measure Super-SBM approach with bad output (Non-performing loans). PLoS ONE 2022, 17, e0270406. [Google Scholar] [CrossRef] [PubMed]

- Wanke, P.; Rojas, F.; Tan, Y.; Moreira, J. Temporal dependence and bank efficiency drivers in OECD: A stochastic DEA-ratio approach based on generalized auto-regressive moving averages. Expert Syst. Appl. 2023, 214, 119120. [Google Scholar] [CrossRef]

- An, Q.; Liu, X.; Li, Y.; Xiong, B. Resource planning of Chinese commercial banking systems using two-stage inverse data envelopment analysis with undesirable outputs. PLoS ONE 2019, 14, e0218214. [Google Scholar] [CrossRef]

- Kazemi, A.; Galagedera, D.U.A. An inverse DEA model for intermediate and output target setting in serially linked general two-stage processes. IMA J. Manag. Math. 2023, 34, 511–539. [Google Scholar] [CrossRef]

- Chen, Y.; Cook, W.D.; Li, N.; Zhu, J. Additive efficiency decomposition in two-stage DEA. Eur. J. Oper. Res. 2009, 196, 1170–1176. [Google Scholar] [CrossRef]

- Seiford, L.M.; Zhu, J. Modeling undesirable factors in efficiency evaluation. Eur. J. Oper. Res. 2002, 142, 16–20. [Google Scholar] [CrossRef]

- André, F.J.; Buendía, A.; Santos-Arteaga, F.J. Efficient water use and reusing processes across Spanish regions: A circular data envelopment analysis with undesirable inputs. J. Clean. Prod. 2024, 434, 139929. [Google Scholar] [CrossRef]

- Si, X.; Tang, Z.; Wang, W.; Liang, Y. Evaluation and influencing factors of the tourism industry efficiency under carbon emission constraints in China. Environ. Monit. Assess. 2023, 195, 1093. [Google Scholar] [CrossRef] [PubMed]

- Younesi, A.; Lotfi, F.H.; Arana-Jiménez, M. Using slacks-based model to solve inverse DEA with integer intervals for input estimation. Fuzzy Optim. Decis. Mak. 2023, 22, 587–609. [Google Scholar] [CrossRef]

- Li, Y. Analyzing efficiencies of city commercial banks in China: An application of the bootstrapped DEA approach. Pac.-Basin Financ. J. 2020, 62, 101372. [Google Scholar] [CrossRef]

- Staub, R.B.; Souza, G.D.S.E.; Tabak, B.M. Evolution of bank efficiency in Brazil: A DEA approach. Eur. J. Oper. Res. 2010, 202, 204–213. [Google Scholar] [CrossRef]

- Fukuyama, H.; Matousek, R.; Tzeremes, N.G. A Nerlovian cost inefficiency two-stage DEA model for modeling banks’ production process: Evidence from the Turkish banking system. Omega 2020, 95, 102198. [Google Scholar] [CrossRef]

- Li, H.Z.; Yu, X.H. The impact of uncertain financial risk on the operation efficiency of banks. Heliyon 2023, 9, e21378. [Google Scholar]

| DMU | x1 | x2 | x3 | z1 | y1 | y2 | b1 |

|---|---|---|---|---|---|---|---|

| Industrial and Commercial Bank of China | 1768.29 | 3237.76 | 441,902 | 146,208.3 | 7671.11 | 1477.93 | 191.14 |

| Agricultural Bank of China | 1693.97 | 2371.82 | 473,766 | 118,114.1 | 6133.84 | 875.85 | 19.33 |

| Bank of China | 1478.42 | 2354.1 | 251,617 | 100,977.9 | 5189.95 | 1245.09 | 78.23 |

| China Construction Bank | 1557.79 | 2567.09 | 368,410 | 122,230.4 | 6462.53 | 1208.98 | 106.46 |

| Bank of Communications | 538.12 | 1286.34 | 99,919 | 41,578.33 | 2592.92 | 341.7 | 73.15 |

| China Merchants Bank | 458.96 | 745.82 | 51,667 | 27,752.76 | 1734.95 | 342.05 | 66.38 |

| China CITIC Bank | 328.45 | 776.47 | 38,803 | 26,516.78 | 1633.35 | 191.34 | 77.11 |

| Shanghai Pudong Development Bank | 266.05 | 926.27 | 38,976 | 24,196.96 | 1778.04 | 151.64 | 41.39 |

| Industrial Bank Co., Ltd. | 291.9 | 1037.57 | 33,134 | 21,703.45 | 1896.02 | 236.25 | 50.45 |

| China Minsheng Banking | 380.9 | 991.21 | 53,064 | 21,466.89 | 1821.54 | 332.01 | 28.81 |

| Ping An Bank | 212.79 | 524.14 | 28,369 | 12,170.02 | 931.02 | 115.86 | 6.75 |

| Huaxia Bank | 176.23 | 373.51 | 25,043 | 11,775.92 | 762.53 | 63.62 | 11.04 |

| China Everbright Bank | 207.81 | 692.2 | 31,464 | 16,052.78 | 1200.82 | 145.8 | 24.16 |

| Bank of Beijing | 78.41 | 315.96 | 9193 | 8344.8 | 578.81 | 44.32 | 8.44 |

| Bank of Nanjing | 32.55 | 116.72 | 4357 | 2601.49 | 207.68 | 14.29 | 2.64 |

| Bank of Ningbo | 44.5 | 122.36 | 6310 | 2339.38 | 234.95 | 14.16 | 4.17 |

| DMU | DMU | ||

|---|---|---|---|

| Industrial and Commercial Bank of China | 0.827 | Industrial Bank Co., Ltd. | 0.845 |

| Agricultural Bank of China | 0.791 | China Minsheng Banking | 0.791 |

| Bank of China | 0.899 | Ping An Bank | 0.746 |

| China Construction Bank | 0.820 | Huaxia Bank | 0.770 |

| Bank of Communications | 0.797 | China Everbright Bank | 0.798 |

| China Merchants Bank | 0.898 | Bank of Beijing | 0.854 |

| China CITIC Bank | 0.833 | Bank of Nanjing | 0.842 |

| Shanghai Pudong Development Bank | 0.837 | Bank of Ningbo | 0.745 |

| DMU | Δx1 | Δx2 | Δx3 | P1 | P2 | P3 |

|---|---|---|---|---|---|---|

| Industrial and Commercial Bank of China | 304.25 | 469.51 | 0 | 17% | 15% | 0% |

| Agricultural Bank of China | 0 | 369.33 | 0 | 0% | 16% | 0% |

| Bank of China | 0 | 536.83 | 0 | 0% | 23% | 0% |

| China Construction Bank | 172.33 | 530.60 | 0 | 11% | 21% | 0% |

| Bank of Communications | 109.77 | 103.86 | 0 | 20% | 8% | 0% |

| China Merchants Bank | 0 | 140.79 | 0 | 0% | 19% | 0% |

| China CITIC Bank | 0.92 | 203.49 | 0 | 0% | 26% | 0% |

| Shanghai Pudong Development Bank | 64.82 | 66.06 | 0 | 24% | 7% | 0% |

| Industrial Bank Co., Ltd. | 10.39 | 180.54 | 2307.47 | 4% | 17% | 7% |

| China Minsheng Banking | 68.43 | 108.06 | 0 | 18% | 11% | 0% |

| Ping An Bank | 27.46 | 69.90 | 0 | 13% | 13% | 0% |

| Huaxia Bank | 13.14 | 58.00 | 0 | 7% | 16% | 0% |

| China Everbright Bank | 58.91 | 25.23 | 0 | 28% | 4% | 0% |

| Bank of Beijing | 9.75 | 39.28 | 1142.80 | 12% | 12% | 12% |

| Bank of Nanjing | 4.40 | 0 | 0 | 14% | 0% | 0% |

| Bank of Ningbo | 8.94 | 10.20 | 0 | 20% | 8% | 0% |

| DMU | Δx1 | Δx2 | Δx3 | ||||||

|---|---|---|---|---|---|---|---|---|---|

| TP1 | UP1 | P1 | TP2 | UP2 | P2 | TP3 | UP3 | P3 | |

| Industrial and Commercial Bank of China | 24% | 24% | 17% | 11% | 11% | 15% | 0% | 0% | 0% |

| Agricultural Bank of China | 0% | 0% | 0% | 18% | 18% | 16% | 0% | 0% | 0% |

| Bank of China | 23% | 23% | 0% | 24% | 24% | 23% | 0% | 0% | 0% |

| China Construction Bank | 17% | 17% | 11% | 18% | 18% | 21% | 0% | 0% | 0% |

| Bank of Communications | 23% | 23% | 20% | 14% | 14% | 8% | 0% | 0% | 0% |

| China Merchants Bank | 6% | 6% | 0% | 132% | 132% | 19% | 7% | 7% | 0% |

| China CITIC Bank | 3% | 3% | 0% | 22% | 22% | 26% | 0% | 0% | 0% |

| Shanghai Pudong Development Bank | 15% | 15% | 24% | 16% | 16% | 7% | 0% | 0% | 0% |

| Industrial Bank Co., Ltd. | 15% | 15% | 4% | 15% | 15% | 17% | 15% | 15% | 7% |

| China Minsheng Banking | 24% | 24% | 18% | 69% | 69% | 11% | 1% | 1% | 0% |

| Ping An Bank | 15% | 14% | 13% | 17% | 16% | 13% | 0% | 0% | 0% |

| Huaxia Bank | 0% | 0% | 7% | 22% | 20% | 16% | 0% | 0% | 0% |

| China Everbright Bank | 32% | 32% | 28% | 9% | 9% | 4% | 0% | 0% | 0% |

| Bank of Beijing | 15% | 15% | 12% | 15% | 15% | 12% | 15% | 15% | 12% |

| Bank of Nanjing | 8% | 12% | 14% | 17% | 14% | 0% | 0% | 9% | 0% |

| Bank of Ningbo | 0% | 0% | 20% | 19% | 19% | 8% | 0% | 0% | 0% |

Disclaimer/Publisher’s Note: The statements, opinions and data contained in all publications are solely those of the individual author(s) and contributor(s) and not of MDPI and/or the editor(s). MDPI and/or the editor(s) disclaim responsibility for any injury to people or property resulting from any ideas, methods, instructions or products referred to in the content. |

© 2024 by the authors. Licensee MDPI, Basel, Switzerland. This article is an open access article distributed under the terms and conditions of the Creative Commons Attribution (CC BY) license (https://creativecommons.org/licenses/by/4.0/).

Share and Cite

Liao, L.-H.; Chen, L.; Wang, J. A New Resource Allocation Multiple Criteria Decision-Making Method in a Two-Stage Inverse Data Envelopment Analysis Framework for the Sustainable Development of Chinese Commercial Banks. Sustainability 2024, 16, 1383. https://doi.org/10.3390/su16041383

Liao L-H, Chen L, Wang J. A New Resource Allocation Multiple Criteria Decision-Making Method in a Two-Stage Inverse Data Envelopment Analysis Framework for the Sustainable Development of Chinese Commercial Banks. Sustainability. 2024; 16(4):1383. https://doi.org/10.3390/su16041383

Chicago/Turabian StyleLiao, Li-Huan, Lei Chen, and Junchao Wang. 2024. "A New Resource Allocation Multiple Criteria Decision-Making Method in a Two-Stage Inverse Data Envelopment Analysis Framework for the Sustainable Development of Chinese Commercial Banks" Sustainability 16, no. 4: 1383. https://doi.org/10.3390/su16041383

APA StyleLiao, L.-H., Chen, L., & Wang, J. (2024). A New Resource Allocation Multiple Criteria Decision-Making Method in a Two-Stage Inverse Data Envelopment Analysis Framework for the Sustainable Development of Chinese Commercial Banks. Sustainability, 16(4), 1383. https://doi.org/10.3390/su16041383