Can Green Finance Mitigate China’s Carbon Emissions and Air Pollution? An Analysis of Spatial Spillover and Mediation Pathways

Abstract

1. Introduction

2. Literature Review

2.1. Impact of GF

2.2. Impact of GF on Carbon Emissions and Pollution

2.3. Mechanism of GF’s Effects on Carbon Emissions and Pollution

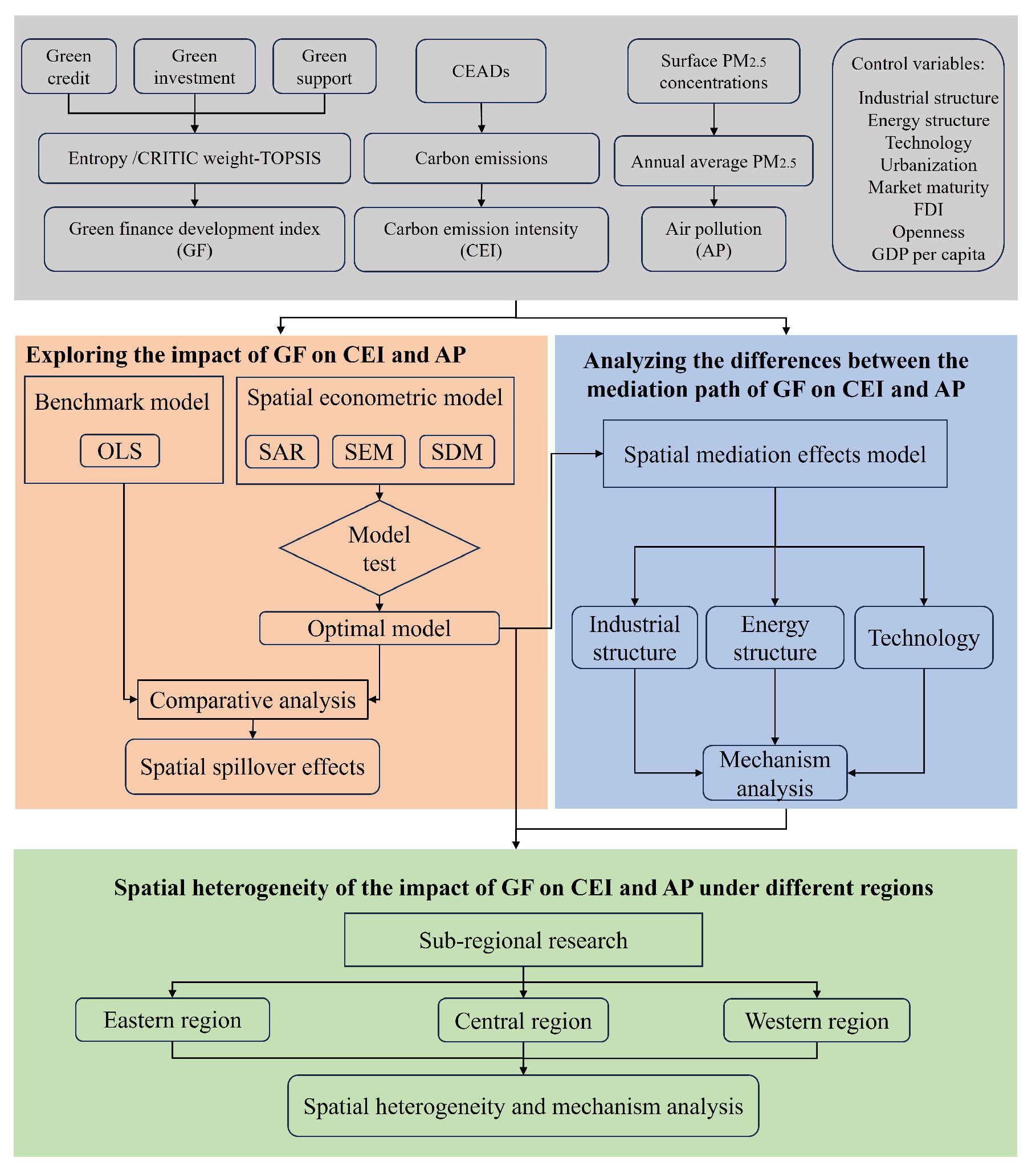

3. Methodology and Data

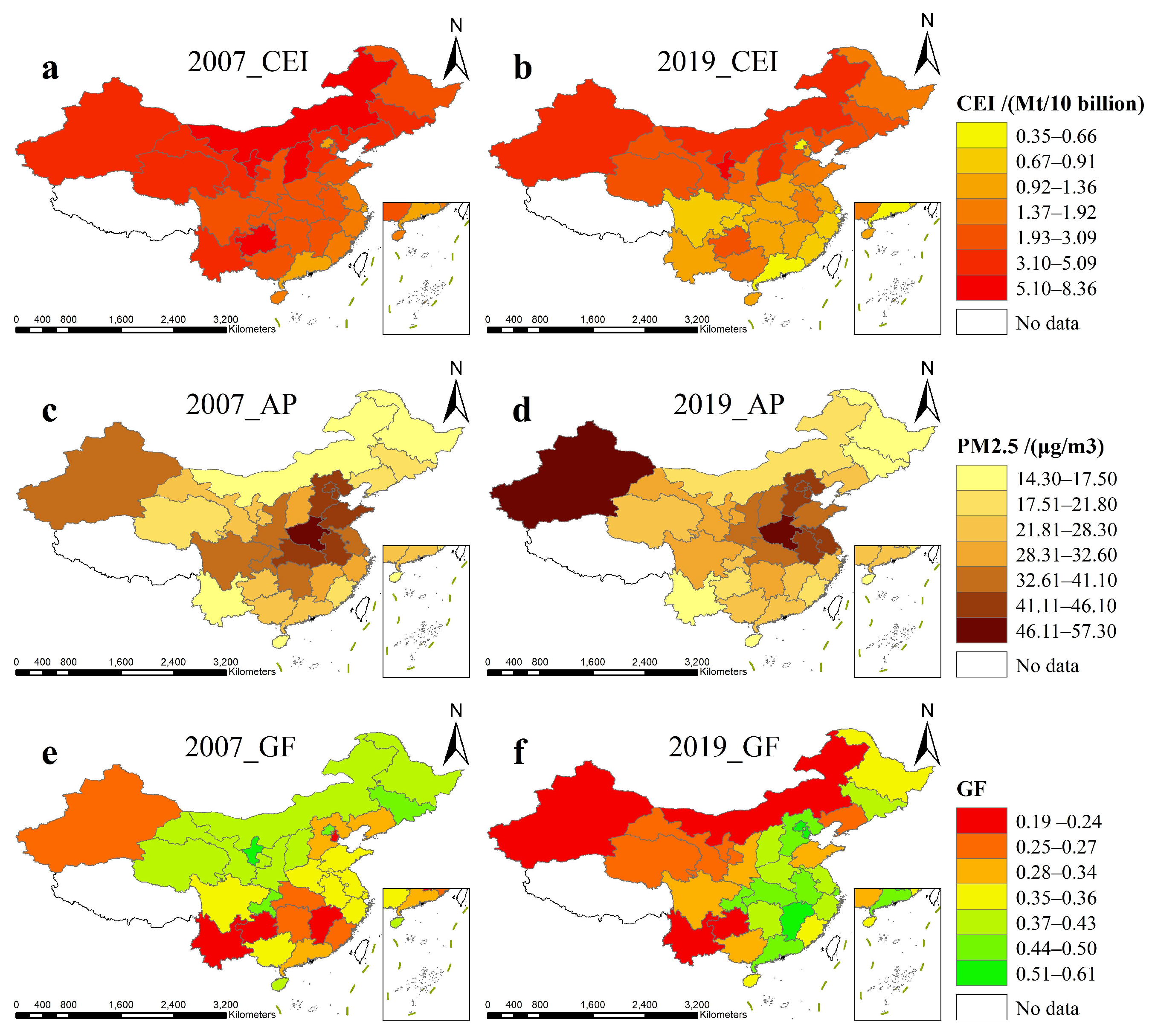

3.1. Variables and Data

3.1.1. Green Finance (GF) Development Index

3.1.2. Carbon Emission Intensity (CEI) and Air Pollution (AP)

3.1.3. Other Control Variables

3.2. Research Methodology

3.2.1. Benchmark Model

3.2.2. Spatial Econometric Model

3.2.3. Spatial Mediation Effects Model

4. Empirical Results and Discussion

4.1. The Impact of GF on CEI and AP

4.1.1. Results of Non-Spatial Model

4.1.2. Results of the Spatial Econometric Model

4.1.3. Robustness Tests

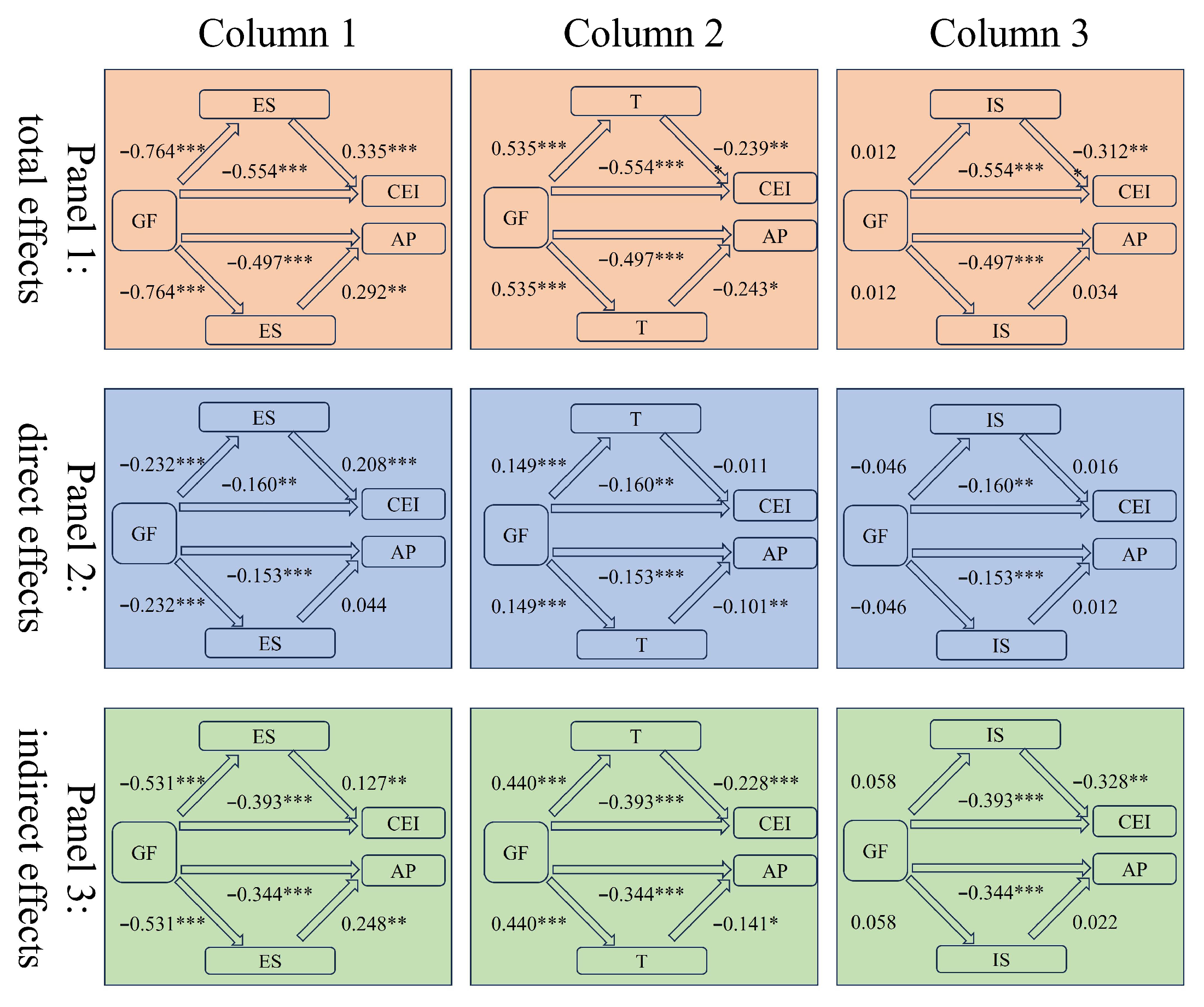

4.2. Mediation Path Analysis of GF on CE Intensity and AP

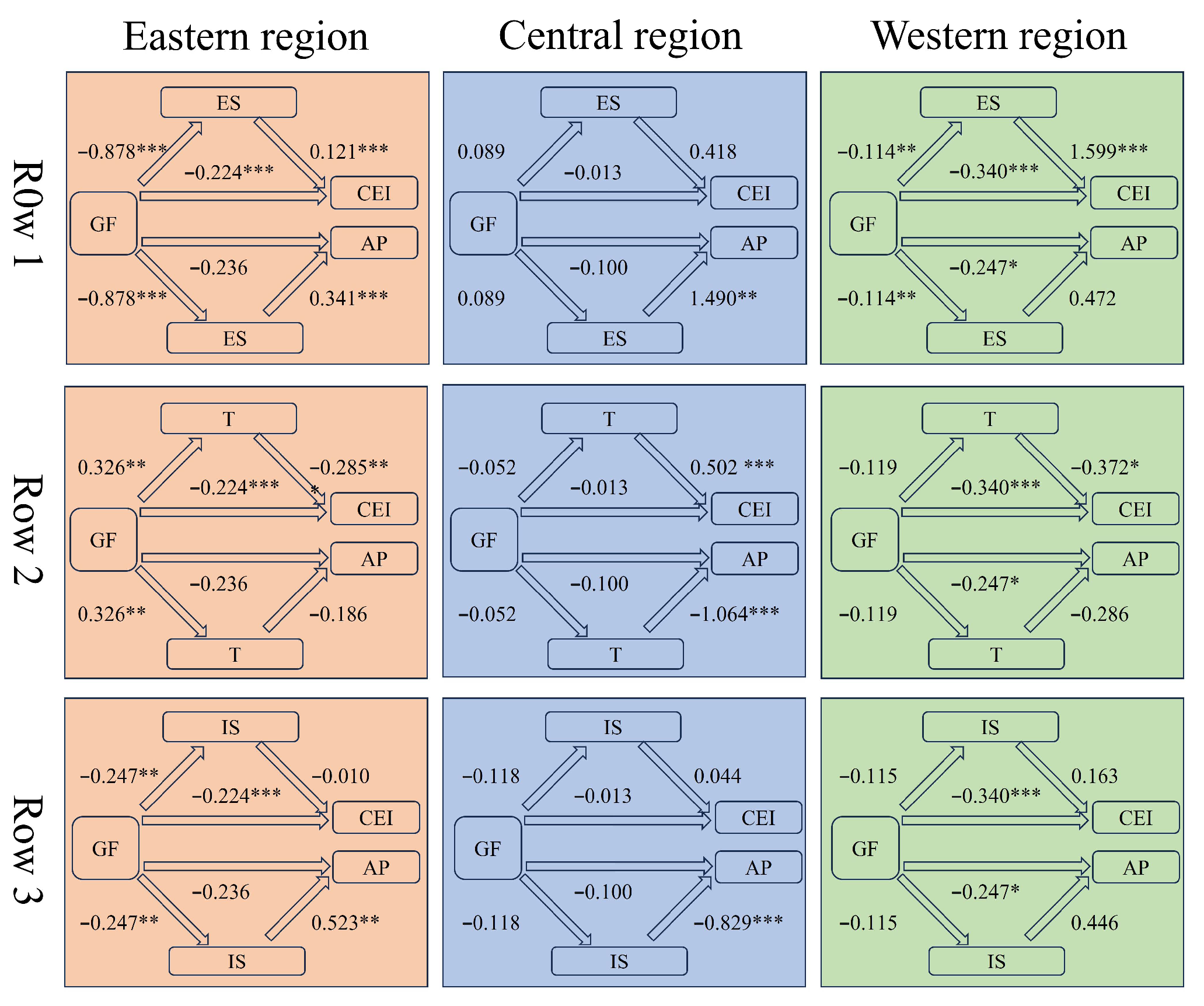

4.3. Analysis of Regional Heterogeneity of GF

5. Conclusions and Policy Recommendations

Supplementary Materials

Author Contributions

Funding

Institutional Review Board Statement

Informed Consent Statement

Data Availability Statement

Conflicts of Interest

References

- Campbell-Lendrum, D.; Neville, T.; Schweizer, C.; Neira, M. Climate change and health: Three grand challenges. Nat. Med. 2023, 29, 1631–1638. [Google Scholar] [CrossRef] [PubMed]

- Manisalidis, I.; Stavropoulou, E.; Stavropoulos, A.; Bezirtzoglou, E. Environmental and Health Impacts of Air Pollution: A Review. Front. Public Health 2020, 8, 13. [Google Scholar] [CrossRef] [PubMed]

- Liu, Z.; Deng, Z.; He, G.; Wang, H.L.; Zhang, X.; Lin, J.; Qi, Y.; Liang, X. Challenges and opportunities for carbon neutrality in China. Nat. Rev. Earth Environ. 2022, 3, 141–155. [Google Scholar] [CrossRef]

- Jiang, X.J. A conversation on air pollution in China. Nat. Geosci. 2023, 16, 939–940. [Google Scholar] [CrossRef]

- Wang, X.Y.; Wang, Q. Research on the impact of green finance on the upgrading of China’s regional industrial structure from the perspective of sustainable development. Resour. Policy 2021, 74, 102436. [Google Scholar] [CrossRef]

- Nedopil, C. Integrating biodiversity into financial decision-making: Challenges and four principles. Bus. Strateg. Environ. 2023, 32, 1619–1633. [Google Scholar] [CrossRef]

- Zhang, T. Can green finance policies affect corporate financing? Evidence from China’s green finance innovation and reform pilot zones. J. Clean. Prod. 2023, 419, 138289. [Google Scholar] [CrossRef]

- Shi, J.Y.; Yu, C.H.; Li, Y.X.; Wang, T.H. Does green financial policy affect debt-financing cost of heavy-polluting enterprises? An empirical evidence based on Chinese pilot zones for green finance reform and innovations. Technol. Forecast. Soc. Chang. 2022, 179, 121678. [Google Scholar] [CrossRef]

- Lee, C.C.; Wang, F.H.; Chang, Y.F. Does green finance promote renewable energy? Evidence from China. Resour. Policy 2023, 82, 103439. [Google Scholar] [CrossRef]

- Yuan, C.Q.; Liu, S.F.; Wu, J.L. Research on energy-saving effect of technological progress based on Cobb-Douglas production function. Energy Policy 2009, 37, 2842–2846. [Google Scholar] [CrossRef]

- Zhao, X.S.; Fan, Z.H.; Ma, Y.J.; Gao, Z.Q. Research Review on Electrical Energy Storage Technology. In Proceedings of the 36th Chinese Control Conference (CCC), Dalian, China, 26–28 July 2017; pp. 10674–10678. [Google Scholar]

- Azhgaliyeva, D.; Kapsalyamova, Z. Policy support in promoting green bonds in Asia: Empirical evidence. Clim. Policy 2023, 23, 430–445. [Google Scholar] [CrossRef]

- He, X.B.; Shi, J.J. The effect of air pollution on Chinese green bond market: The mediation role of public concern. J. Environ. Manag. 2023, 325, 116522. [Google Scholar] [CrossRef] [PubMed]

- Deng, Y.; Cui, Y.; Khan, S.U.; Zhao, M.J.; Lu, Q. The spatiotemporal dynamic and spatial spillover effect of agricultural green technological progress in China. Environ. Sci. Pollut. Res. 2022, 29, 27909–27923. [Google Scholar] [CrossRef] [PubMed]

- Peng, B.H.; Sheng, X.; Wei, G. Does environmental protection promote economic development? From the perspective of coupling coordination between environmental protection and economic development. Environ. Sci. Pollut. Res. 2020, 27, 39135–39148. [Google Scholar] [CrossRef] [PubMed]

- Chai, S.L.; Zhang, K.; Wei, W.; Ma, W.Y.; Abedin, M.Z. The impact of green credit policy on enterprises’ financing behavior: Evidence from Chinese heavily-polluting listed companies. J. Clean. Prod. 2022, 363, 132458. [Google Scholar] [CrossRef]

- Pasupuleti, A.; Ayyagari, L.R. A Thematic Study of Green Finance with Special Reference to Polluting Companies: A Review and Future Direction. Environ. Process. 2023, 10, 24. [Google Scholar] [CrossRef]

- Ameli, N.; Dessens, O.; Winning, M.; Cronin, J.; Chenet, H.; Drummond, P.; Calzadilla, A.; Anandarajah, G.; Grubb, M. Higher cost of finance exacerbates a climate investment trap in developing economies. Nat. Commun. 2021, 12, 4046. [Google Scholar] [CrossRef]

- Desalegn, G.; Tangl, A. Enhancing Green Finance for Inclusive Green Growth: A Systematic Approach. Sustainability 2022, 14, 7416. [Google Scholar] [CrossRef]

- Huang, J.B.; An, L.F.; Peng, W.H.; Guo, L.L. Identifying the role of green financial development played in carbon intensity: Evidence from China. J. Clean. Prod. 2023, 408, 136943. [Google Scholar] [CrossRef]

- Zhang, W.; Zhu, Z.R.; Liu, X.M.; Cheng, J. Can green finance improve carbon emission efficiency? Environ. Sci. Pollut. Res. 2022, 29, 68976–68989. [Google Scholar] [CrossRef]

- Purkayastha, D.; Sarkar, R. Getting Financial Markets to Work for Climate Finance. J. Struct. Financ. 2021, 27, 27–41. [Google Scholar] [CrossRef]

- Hou, H.; Wang, Y.Y.; Zhang, M.L. Impact of environmental information disclosure on green finance development: Empirical evidence from China. Environ. Dev. Sustain. 2023, 31. [Google Scholar] [CrossRef]

- Lan, J.; Wei, Y.M.; Guo, J.; Li, Q.M.; Liu, Z. The effect of green finance on industrial pollution emissions: Evidence from China. Resour. Policy 2023, 80, 103156. [Google Scholar] [CrossRef]

- Zhang, A.L.; Wang, S.Y.; Liu, B. How to control air pollution with economic means? Exploration of China’s green finance policy. J. Clean. Prod. 2022, 353, 131664. [Google Scholar] [CrossRef]

- Gao, J.; Wu, D.L.; Xiao, Q.; Randhawa, A.; Liu, Q.; Zhang, T. Green finance, environmental pollution and high-quality economic development-a study based on China’s provincial panel data. Environ. Sci. Pollut. Res. 2023, 30, 31917–31939. [Google Scholar] [CrossRef] [PubMed]

- Jahanger, A.; Balsalobre-Lorente, D.; Ali, M.; Samour, A.; Abbas, S.; Tursoy, T.; Joof, F. Going away or going green in ASEAN countries: Testing the impact of green financing and energy on environmental sustainability. Energy Environ. 2023, 26, 0958305X231171346. [Google Scholar] [CrossRef]

- Xu, X.Y.; Xie, Y.F.; Obobisa, E.S.; Sun, H.P. Has the establishment of green finance reform and innovation pilot zones improved air quality? Evidence from China. Hum. Soc. Sci. Commun. 2023, 10, 262. [Google Scholar] [CrossRef]

- Xiang, W.M.; Qi, Q.; Gan, L. Non-linear effects of green finance on air quality in China: New evidence from a panel threshold model. Front. Ecol. Evol. 2023, 11, 1162137. [Google Scholar] [CrossRef]

- Bai, J.C.; Chen, Z.L.; Yan, X.; Zhang, Y.Y. Research on the impact of green finance on carbon emissions: Evidence from China. Ekon. Istraz. 2022, 35, 6965–6984. [Google Scholar] [CrossRef]

- Zeng, Q.; Tong, Y.J.; Yang, Y.Y. Can green finance promote green technology innovation in enterprises: Empirical evidence from China. Environ. Sci. Pollut. Res. 2023, 30, 87628–87644. [Google Scholar] [CrossRef]

- Yao, S.J.; Zhang, X.Q.; Zheng, W.W. On green credits and carbon productivity in China. Environ. Sci. Pollut. Res. 2022, 29, 44308–44323. [Google Scholar] [CrossRef] [PubMed]

- Li, W.A.; Cui, G.Y.; Zheng, M.N. Does green credit policy affect corporate debt financing? Evidence from China. Environ. Sci. Pollut. Res. 2022, 29, 5162–5171. [Google Scholar] [CrossRef] [PubMed]

- Liu, X.H.; Wang, E.X.; Cai, D.T. Green credit policy, property rights and debt financing: Quasi-natural experimental evidence from China. Financ. Res. Lett. 2019, 29, 129–135. [Google Scholar] [CrossRef]

- Wang, W.H.; Wang, X. Does provincial green governance promote enterprise green investment? Based on the perspective of government vertical management. J. Clean. Prod. 2023, 396, 136519. [Google Scholar] [CrossRef]

- Nabeeh, N.A.; Abdel-Basset, M.; Soliman, G. A model for evaluating green credit rating and its impact on sustainability performance. J. Clean. Prod. 2021, 280, 124299. [Google Scholar] [CrossRef]

- Diakoulaki, D.; Mavrotas, G.; Papayannakis, L. Determining objective weights in multiple criteria problems: The critic method. Comput. Oper. Res. 1995, 22, 763–770. [Google Scholar] [CrossRef]

- Nie, X.; Chen, Z.P.; Wang, H.; Wu, J.X.; Wu, X.Y.; Lu, B.; Qiu, L.; Li, Y.Y. Is the “pollution haven hypothesis” valid for China’s carbon trading system? A re-examination based on inter-provincial carbon emission transfer. Environ. Sci. Pollut. Res. 2022, 29, 40110–40122. [Google Scholar] [CrossRef] [PubMed]

- Shang, L.N.; Tan, D.Q.; Feng, S.L.; Zhou, W.T. Environmental regulation, import trade, and green technology innovation. Environ. Sci. Pollut. Res. 2022, 29, 12864–12874. [Google Scholar] [CrossRef]

- Boamah, V.; Tang, D.C.; Zhang, Q.; Zhang, J.Q. Do FDI Inflows into African Countries Impact Their CO2 Emission Levels? Sustainability 2023, 15, 3131. [Google Scholar] [CrossRef]

- Lu, L.; Liu, Z.; Mohsin, M.; Zhang, C.L. Renewable energy, industrial upgradation, and import-export quality: Green finance and CO2 emission reduction nexus. Environ. Sci. Pollut. Res. 2022, 30, 13327–13341. [Google Scholar] [CrossRef]

- Anser, M.K.; Abbas, S.; Nassani, A.A.; Haffar, M.; Zaman, K.; Abro, M.M.Q. Innovative Carbon Mitigation Techniques to Achieve Environmental Sustainability Agenda: Evidence from a Panel of 21 Selected R&D Economies. Atmosphere 2021, 12, 1514. [Google Scholar] [CrossRef]

- Ota, T. Economic growth, income inequality and environment: Assessing the applicability of the Kuznets hypotheses to Asia. Palgr. Commun. 2017, 3, 17069. [Google Scholar] [CrossRef]

- James LeSage, R.K.P. Introduction to Spatial Econometrics; Chapman&Hall CRC Press: Boca Raton, FL, USA, 2009. [Google Scholar]

- Lv, Z.K.; Li, S.S. How financial development affects CO2 emissions: A spatial econometric analysis. J. Environ. Manag. 2021, 277, 111397. [Google Scholar] [CrossRef] [PubMed]

- Zhou, X.G.; Tang, X.M. Spatiotemporal consistency effect of green finance on pollution emissions and its geographic attenuation process. J. Environ. Manag. 2022, 318, 115537. [Google Scholar] [CrossRef]

- Guan, S.; Liu, J.Q.; Liu, Y.F.; Du, M.Z. The Nonlinear Influence of Environmental Regulation on the Transformation and Upgrading of Industrial Structure. Int. J. Environ. Res. Public Health 2022, 19, 8378. [Google Scholar] [CrossRef]

- Jiao, J.L.; Jiang, G.L.; Yang, R.R. Impact of R&D technology spillovers on carbon emissions between China’s regions. Struct. Chang. Econ. Dyn. 2018, 47, 35–45. [Google Scholar] [CrossRef]

| Abbreviation | Variables | N | Means | Std. Dev. | Min | Max |

|---|---|---|---|---|---|---|

| CEI | Carbon emission intensity | 390 | 2.527 | 1.661 | 0.347 | 10.21 |

| AP | Air pollution | 390 | 46.78 | 17.61 | 14.3 | 91.2 |

| GF | Green finance development index | 390 | 0.374 | 0.0863 | 0.191 | 0.79 |

| IS | Industrial structure | 390 | 120.4 | 67.41 | 52.71 | 523.4 |

| ES | Energy structure | 390 | 66.52 | 18.55 | 2.263 | 96.12 |

| T | Technology | 390 | 0.169 | 0.139 | 0.0204 | 0.732 |

| U | Urbanization | 390 | 55.26 | 13.41 | 28.25 | 94.15 |

| MAR | Market maturity | 390 | 26.08 | 12.48 | 3.006 | 56.96 |

| FDI | Foreign direct investment | 390 | 2.335 | 2.064 | 0.0107 | 12.1 |

| OP | Openness | 390 | 15.35 | 16.48 | 0.688 | 88.45 |

| PGDP | Economic development level | 390 | 38,020 | 21,835 | 7778 | 128,425 |

| (1) | (2) | (3) | (4) | (5) | (6) | |

|---|---|---|---|---|---|---|

| Variables | lnCEI | lnAP | lnCEI | lnAP | lnCEI | lnAP |

| lnGF | −0.1978 *** | −0.1682 *** | −0.1882 *** | −0.1810 *** | −0.1010 *** | −0.1338 *** |

| (−5.44) | (−4.59) | (−5.16) | (−5.00) | (−2.88) | (−3.52) | |

| Mediation variables | No | No | No | No | Yes | Yes |

| Other control variables | No | No | Yes | Yes | Yes | Yes |

| Individual FE | Yes | Yes | Yes | Yes | Yes | Yes |

| Time FE | Yes | Yes | Yes | Yes | Yes | Yes |

| Observations | 390 | 390 | 390 | 390 | 390 | 390 |

| R-squared | 0.802 | 0.721 | 0.827 | 0.763 | 0.861 | 0.773 |

| Variables | (1) | (2) | (3) | (4) |

|---|---|---|---|---|

| lnCEI | lnAP | lnCEI | lnAP | |

| lnGF | −0.153 *** | −0.125 *** | −0.073 ** | −0.090 *** |

| (−4.7258) | (−4.1361) | (−2.3653) | (−2.8463) | |

| WlnGF | −0.346 *** | −0.110 ** | −0.115 * | −0.019 |

| (−5.8300) | (−1.9821) | (−1.8966) | (−0.3062) | |

| WlnCEI | 0.096 | 0.026 | ||

| (1.3086) | (0.3359) | |||

| WlnAP | 0.528 *** | 0.490 *** | ||

| (9.7740) | (8.5085) | |||

| Mediation variables | No | No | Yes | Yes |

| Control variables | Yes | Yes | Yes | Yes |

| Individual FE | Yes | Yes | Yes | Yes |

| Time FE | Yes | Yes | Yes | Yes |

| Observations | 390 | 390 | 390 | 390 |

| Variables | lnCEI | lnAP | ||||

|---|---|---|---|---|---|---|

| Direct Effects | Indirect Effects | Total Effects | Direct Effects | Indirect Effects | Total Effects | |

| lnGF | −0.072 ** | −0.116 * | −0.188 *** | −0.098 *** | −0.108 | −0.206 |

| (−2.2907) | (−1.8908) | (−2.7031) | (−2.7005) | (−0.9226) | (−1.4869) | |

| lnES | 0.216 *** | 0.168 *** | 0.383 *** | 0.055 * | 0.262 ** | 0.318 ** |

| (8.4860) | (2.8051) | (5.7909) | (1.9046) | (2.4554) | (2.5742) | |

| lnT | −0.020 | −0.258 *** | −0.278 *** | −0.104 ** | −0.187 | −0.291 ** |

| (−0.4691) | (−3.9004) | (−4.0528) | (−2.3447) | (−1.5874) | (−2.1428) | |

| lnIS | −0.073 | −0.442 *** | −0.515 *** | −0.041 | −0.162 | −0.203 |

| (−1.3976) | (−3.5064) | (−3.2624) | (−0.6164) | (−0.6752) | (−0.6900) | |

| Effect of GF | Replacing Dependent Variables | Replacing Core Explanatory Variable | Replacing Spatial Weight Matrix W2 | |||

|---|---|---|---|---|---|---|

| (1) | (2) | (3) | (4) | (5) | (6) | |

| lnCE | lnSPE | lnCEI | lnAP | lnCEI | lnAP | |

| Direct effect | −0.071 ** | −0.264 * | −0.078 ** | −0.107 *** | −0.100 *** | −0.120 *** |

| (−2.2247) | (−1.8851) | (−2.3753) | (−2.8122) | (−3.1094) | (−3.1999) | |

| Indirect effect | −0.095 | −0.496 | −0.128 * | −0.087 | −0.204 *** | 0.075 |

| (−1.4950) | (−1.4475) | (−1.9516) | (−0.6942) | (−3.0673) | (−0.7775) | |

| Total effect | −0.166 ** | −0.759 * | −0.206 *** | −0.193 | −0.304 *** | −0.045 |

| (−2.2806) | (−1.8511) | (−2.7850) | (−1.3094) | (−4.8211) | (−0.4476) | |

| Mediation Variables | Total Effect | Direct Effect | Indirect Effect | |||

|---|---|---|---|---|---|---|

| GF on CEI | GF on AP | GF on CEI | GF on AP | GF on CEI | GF on AP | |

| ES | 0.462 * | 0.449 * | 0.302 * | 0.067 | 0.172 * | 0.383 * |

| T | 0.231 * | 0.262 * | 0.001 | 0.098 * | 0.255 * | 0.18 * |

| IS | 0.007 | 0.001 | 0.005 | 0.004 | 0.048 | 0.004 |

Disclaimer/Publisher’s Note: The statements, opinions and data contained in all publications are solely those of the individual author(s) and contributor(s) and not of MDPI and/or the editor(s). MDPI and/or the editor(s) disclaim responsibility for any injury to people or property resulting from any ideas, methods, instructions or products referred to in the content. |

© 2024 by the authors. Licensee MDPI, Basel, Switzerland. This article is an open access article distributed under the terms and conditions of the Creative Commons Attribution (CC BY) license (https://creativecommons.org/licenses/by/4.0/).

Share and Cite

Liu, H.; Yang, J.; Zhao, F.; Jiang, L.; Li, N. Can Green Finance Mitigate China’s Carbon Emissions and Air Pollution? An Analysis of Spatial Spillover and Mediation Pathways. Sustainability 2024, 16, 1377. https://doi.org/10.3390/su16041377

Liu H, Yang J, Zhao F, Jiang L, Li N. Can Green Finance Mitigate China’s Carbon Emissions and Air Pollution? An Analysis of Spatial Spillover and Mediation Pathways. Sustainability. 2024; 16(4):1377. https://doi.org/10.3390/su16041377

Chicago/Turabian StyleLiu, Huidong, Jing Yang, Fang Zhao, Lei Jiang, and Na Li. 2024. "Can Green Finance Mitigate China’s Carbon Emissions and Air Pollution? An Analysis of Spatial Spillover and Mediation Pathways" Sustainability 16, no. 4: 1377. https://doi.org/10.3390/su16041377

APA StyleLiu, H., Yang, J., Zhao, F., Jiang, L., & Li, N. (2024). Can Green Finance Mitigate China’s Carbon Emissions and Air Pollution? An Analysis of Spatial Spillover and Mediation Pathways. Sustainability, 16(4), 1377. https://doi.org/10.3390/su16041377