Corporate Social Responsibility Practices and Financial Performance of New Ventures: The Moderating Role of Government Support

Abstract

1. Introduction

2. Literature Review and Hypotheses

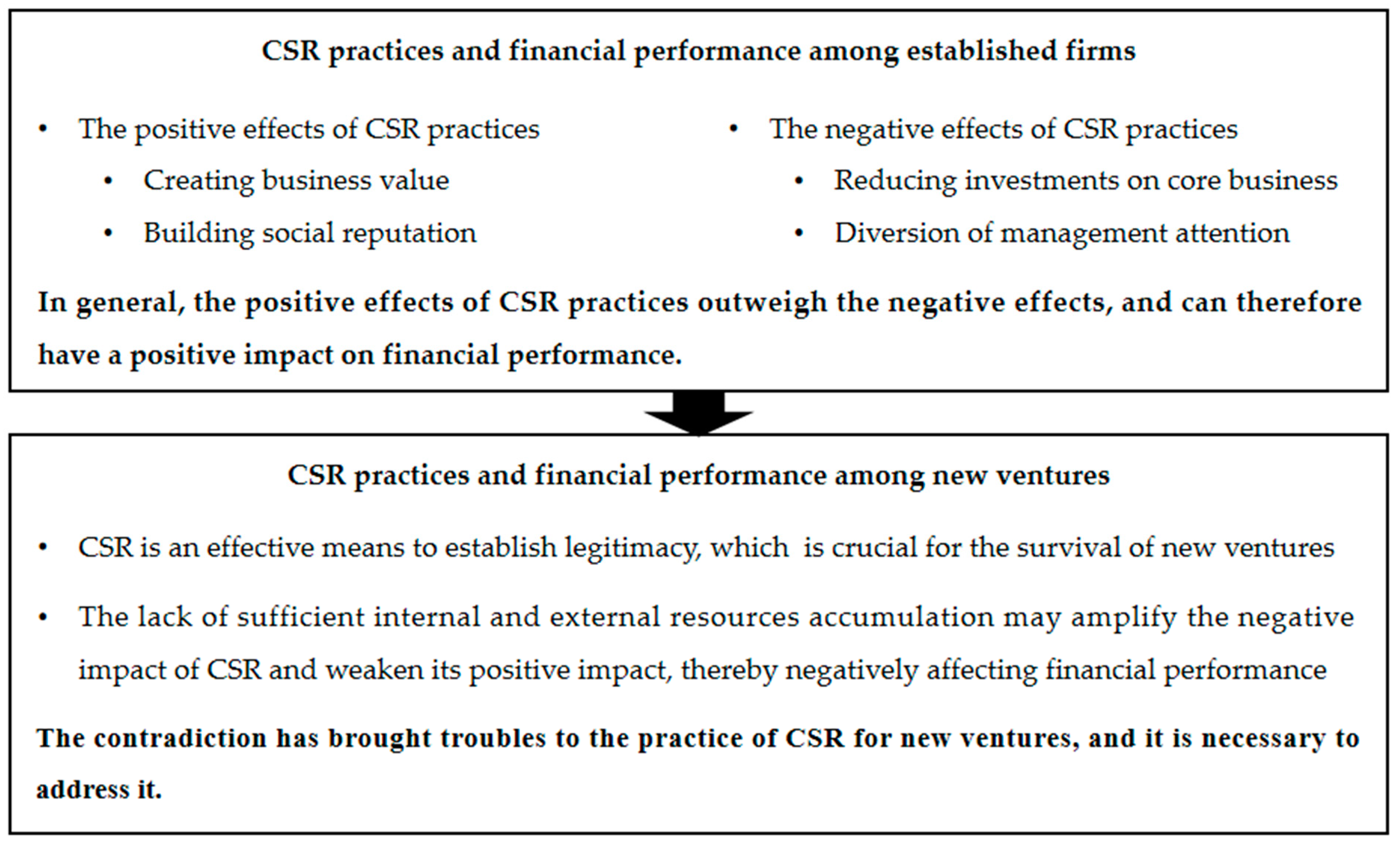

2.1. The Economics of CSR Practices in New Ventures

2.2. CSR Practices and Financial Performance of New Ventures

2.3. Moderating Role of Government Support

3. Methods

3.1. Sample and Data Sources

3.2. Variable Measurement and Description

3.2.1. Dependent Variable: Financial Performance (FP)

3.2.2. Independent Variables: Primary Stakeholder CSR Practices (PCSR) and Secondary CSR Practices (SCSR)

3.2.3. Moderating Variables: New Ventures (NV), Direct Government Support (DGS), and Indirect Government Support (IGS)

3.2.4. Control Variables

3.3. Common Method Bias

3.4. Factor Analysis

4. Results

4.1. Hierarchical Regression Analysis

4.2. Robustness Test

4.3. Additional Analysis

5. Discussion and Implications

6. Conclusions

Author Contributions

Funding

Institutional Review Board Statement

Informed Consent Statement

Data Availability Statement

Conflicts of Interest

References

- Bosma, N.; Hill, S.; Ionescu-Somers, A.; Kelley, D.; Levie, J.; Tarnawa, A. Global Entrepreneurship Monitor 2019/2020 Global Report; Global Entrepreneurship Research Association, London Business School: London, UK, 2020; pp. 5–7. [Google Scholar]

- Wei, J.; Liu, T.; Chavez, D.E.; Chen, H.A. Managing corporate-government relationships in a multi-cultural setting: How political corporate social responsibility (PCSR) as a response to legitimacy pressures affects firm reputation. Ind. Market Manag. 2020, 89, 1–12. [Google Scholar] [CrossRef]

- Singh, J.V.; Tucker, D.J.; House, R.J. Organizational legitimacy and the liability of newness. Admin. Sci. Quart. 1986, 31, 171–193. [Google Scholar] [CrossRef]

- Dey, P.K.; Petridis, N.E.; Petridis, K.; Malesios, C.; Nixon, J.D.; Ghosh, S.K. Environmental management and corporate social responsibility practices of small and medium-sized enterprises. J. Clean. Prod. 2018, 195, 687–702. [Google Scholar] [CrossRef]

- Wang, T.; Bansal, P. Social responsibility in new ventures: Profiting from a long-term orientation. Strateg. Manag. J. 2012, 33, 1135–1153. [Google Scholar] [CrossRef]

- Gong, G.; Xu, S.; Gong, X. On the Value of Corporate Social Responsibility Disclosure: An Empirical Investigation of Corporate Bond Issues in China. J. Bus. Ethics 2018, 150, 227–258. [Google Scholar] [CrossRef]

- Al-Shammari, M.A.; Banerjee, S.N.; Rasheed, A.A. Corporate social responsibility and firm performance: A theory of dual responsibility. Manage. Decis. 2022, 60, 1513–1540. [Google Scholar] [CrossRef]

- Ni, N.; Egri, C.; Lo, C.; Lin, C.Y.-Y. Patterns of corporate responsibility practices for high financial performance: Evidence from three Chinese societies. J. Bus. Ethics 2015, 126, 169–183. [Google Scholar] [CrossRef]

- Mishra, S.; Suar, D. Does corporate social responsibility influence firm performance of Indian companies? J. Bus. Ethics 2010, 95, 571–601. [Google Scholar] [CrossRef]

- Xie, J.; Nozawa, W.; Yagi, M.; Fujii, H.; Managi, S. Do environmental, social, and governance activities improve corporate financial performance? Bus. Strateg. Environ. 2019, 28, 286–300. [Google Scholar] [CrossRef]

- Pacheco, D.F.; Dean, T.J.; Payne, D.S. Escaping the green prison: Entrepreneurship and the creation of opportunities for sustainable development. J. Bus. Venturing 2010, 25, 464–480. [Google Scholar] [CrossRef]

- Tylecote, A. Biotechnology as a new techno-economic paradigm that will help drive the world economy and mitigate climate change. Res. Pol. 2019, 48, 858–868. [Google Scholar] [CrossRef]

- Xu, G.; Zhou, Y.; Ji, H. How can government promote technology diffusion in manufacturing paradigm shift? Evidence from China. IEEE T. Eng. Manage. 2020, 70, 1547–1559. [Google Scholar] [CrossRef]

- Kong, D.; Feng, Q.; Zhou, Y.; Xue, L. Local implementation for green-manufacturing technology diffusion policy in China: From the user firms’ perspectives. J. Clean. Prod. 2016, 129, 113–124. [Google Scholar] [CrossRef]

- Sun, J.; Wang, F.; Yin, H.; Zhang, B. Money talks: The environmental impact of China’s green credit policy. J. Pol. Anal. Manage. 2019, 38, 653–680. [Google Scholar] [CrossRef]

- Ji, H.; Miao, Z. Corporate social responsibility and collaborative innovation: The role of government support. J. Clean. Prod. 2020, 260, 121028. [Google Scholar] [CrossRef]

- Zhao, M. CSR-based political legitimacy strategy: Managing the state by doing good in China and Russia. J. Bus. Ethics 2012, 111, 439–460. [Google Scholar] [CrossRef]

- Waddock, S. Parallel Universes: Companies, Academics, and the Progress of Corporate Citizenship. Bus. Soc. Rev. 2004, 109, 5–42. [Google Scholar] [CrossRef]

- Bartolacci, F.; Caputo, A.; Soverchia, M. Sustainability and financial performance of small and medium sized enterprises: A bibliometric and systematic literature review. Bus. Strateg. Environ. 2020, 29, 1297–1309. [Google Scholar] [CrossRef]

- Coelho, R.; Jayantilal, S.; Ferreira, J.J. The impact of social responsibility on corporate financial performance: A systematic literature review. Corp. Soc. Responsib. Environ. Manag. 2023, 30, 1535–1560. [Google Scholar] [CrossRef]

- Duanmu, J.-L.; Bu, M.; Pittman, R. Does market competition dampen environmental performance? Evidence from China. Strateg. Manag. J. 2018, 39, 3006–3030. [Google Scholar] [CrossRef]

- Flammer, C. Competing for government procurement contracts: The role of corporate social responsibility. Strateg. Manag. J. 2018, 39, 1299–1324. [Google Scholar] [CrossRef]

- Rezende, L.d.A.; Bansi, A.C.; Alves, M.F.R.; Galina, S.V.R. Take your time: Examining when green innovation affects financial performance in multinationals. J. Clean. Prod. 2019, 233, 993–1003. [Google Scholar] [CrossRef]

- Ji, H.; Zhou, S.; Wan, J.; Lan, C. Can green innovation promote the financial performance of SMEs? Empirical evidence from China. Corp. Soc. Responsib. Environ. Manag. 2023, 1–15. [Google Scholar] [CrossRef]

- De Lange, D.E. Start-up sustainability: An insurmountable cost or a life-giving investment? J. Clean. Prod. 2017, 156, 838–854. [Google Scholar] [CrossRef]

- Younger, S.; Fisher, G. The exemplar enigma: New venture image formation in an emergent organizational category. J. Bus. Venturing 2020, 35, 105897. [Google Scholar] [CrossRef]

- Fisher, G.; Kuratko, D.F.; Bloodgood, J.M.; Hornsby, J.S. Legitimate to whom? The challenge of audience diversity and new venture legitimacy. J. Bus. Venturing 2017, 32, 52–71. [Google Scholar] [CrossRef]

- Clarkson, M.E. A Stakeholder Framework for Analyzing and Evaluating Corporate Social Performance. Acad. Manage. Rev. 1995, 20, 92–117. [Google Scholar] [CrossRef]

- Messersmith, J.G.; Patel, P.C.; Crawford, C. Bang for the buck: Understanding employee benefit allocations and new venture survival. Int. Small Bus. J. 2018, 36, 104–125. [Google Scholar] [CrossRef]

- La Rocca, A.; Snehota, I. Mobilizing suppliers when starting up a new business venture. Ind. Market Manag. 2021, 93, 401–412. [Google Scholar] [CrossRef]

- Guo, H.; Shen, R.; Su, Z. The impact of organizational legitimacy on product innovation: A comparison between new ventures and established firms. IEEE T. Eng. Manage. 2018, 66, 73–83. [Google Scholar] [CrossRef]

- Nishimura, J.; Okamuro, H. Subsidy and networking: The effects of direct and indirect support programs of the cluster policy. Res. Pol. 2011, 40, 714–727. [Google Scholar] [CrossRef]

- Hoogendoorn, B.; Guerra, D.; van der Zwan, P. What drives environmental practices of SMEs? Small Bus. Econ. 2015, 44, 759–781. [Google Scholar] [CrossRef]

- Ji, H.; Zhou, Y. Policy-Related Inspirations from Technological Transformation and Intelligence Upgrading of Manufacturing in Zhejiang Province. Strateg. Study Chin. Acad. Eng. 2018, 20, 122–126. [Google Scholar] [CrossRef]

- Shu, C.; Zhou, K.Z.; Xiao, Y.; Gao, S. How green management influences product innovation in China: The role of institutional benefits. J. Bus. Ethics 2016, 133, 471–485. [Google Scholar] [CrossRef]

- Russo, A.; Tencati, A. Formal vs. informal CSR strategies: Evidence from Italian micro, small, medium-sized, and large firms. J. Bus. Ethics 2009, 85, 339–353. [Google Scholar] [CrossRef]

- Podsakoff, P.M.; MacKenzie, S.B.; Lee, J.-Y.; Podsakoff, N.P. Common method biases in behavioral research: A critical review of the literature and recommended remedies. J. Appl. Psychol. 2003, 88, 879. [Google Scholar] [CrossRef] [PubMed]

- Galant, A.; Cadez, S. Corporate social responsibility and financial performance relationship: A review of measurement approaches. Econ. Res.-Ekon. Istraz. 2017, 30, 676–693. [Google Scholar] [CrossRef]

- Ling, Y.; Zhao, H.; Baron, R.A. Influence of founder—CEOs’ personal values on firm performance: Moderating effects of firm age and size. J. Manage. 2007, 33, 673–696. [Google Scholar]

- Luo, X.R.; Wang, D.; Zhang, J. Whose Call to Answer: Institutional Complexity and Firms’ CSR Reporting. Acad. Manage. J. 2017, 60, 321–344. [Google Scholar] [CrossRef]

- Belas, J.; Çera, G.; Dvorský, J.; Čepel, M. Corporate social responsibility and sustainability issues of small- and medium-sized enterprises. Corp. Soc. Responsib. Environ. Manag. 2021, 28, 721–730. [Google Scholar] [CrossRef]

- Cardinali, P.G.; De Giovanni, P. Responsible digitalization through digital technologies and green practices. Corp. Soc. Responsib. Environ. Manag. 2022, 29, 984–995. [Google Scholar] [CrossRef]

- Bagozzi, R.P.; Yi, Y. On the evaluation of structural equation models. J. Acad. Market. Sci. 1988, 16, 74–94. [Google Scholar] [CrossRef]

- Bollen, K.; Lennox, R. Conventional wisdom on measurement: A structural equation perspective. Psychol. Bull. 1991, 110, 305–314. [Google Scholar] [CrossRef]

- Fu, L.; Boehe, D.; Orlitzky, M. Are R&D-Intensive firms also corporate social responsibility specialists? A multicountry study. Res. Pol. 2020, 49, 104082. [Google Scholar]

- Neter, J.; Wasserman, W.; Kutner, M. Applied, Linear Statistical Models Illinois; IRWIN: Homewood, CA, USA, 1990; pp. 1054–1057. [Google Scholar]

- Ragin, C.C. Redesigning Social Inquiry: Fuzzy Sets and Beyond; University of Chicago Press: Chicago, IL, USA, 2009. [Google Scholar]

- De Roeck, K.; Maon, F. Building the theoretical puzzle of employees’ reactions to corporate social responsibility: An integrative conceptual framework and research agenda. J. Bus. Ethics 2018, 149, 609–625. [Google Scholar] [CrossRef]

- Sterlacchini, A.; Venturini, F. R&D tax incentives in EU countries: Does the impact vary with firm size? Small Bus. Econ. 2019, 53, 687–708. [Google Scholar]

- Koya, N.; Roper, J. Legislated CSR in practice: The experience of India. J. Public Aff. 2022, 22, e2507. [Google Scholar] [CrossRef]

| Variables | Measurement | Data sources | |

|---|---|---|---|

| Dependent variable | Financial performance (FP) | Five items with five-point Likert scale Please see details from Section 3.2 | Questionnaires |

| Independent variables | Primary stakeholder CSR practices (PCSR) | Eight items with five-point Likert scale Please see details from Section 3.2 | |

| Secondary stakeholder CSR practices (SCSR) | Four items with five-point Likert scale Please see details from Section 3.2 | ||

| Moderating variables | Direct government support (DGS) | Two items with five-point Likert scale Please see details from Section 3.2 | |

| Indirect government support (IGS) | Four items with five-point Likert scale Please see details from Section 3.2 | ||

| New ventures (NV) | 1 if a firm operates within 8 years, otherwise 0 | Official statistics | |

| Control variables | Firm size | Ln (employee numbers) | |

| Firm age | Ln (years since a firm was registered) | ||

| Innovation performance | Ln (patent applications + 1) | Derwent World Patent Index (DWPI) | |

| Industry dummies | Industry dummies categorized by three digital NAICS codes (311–339) | Official statistics | |

| City dummies | City dummies (Nanjing, Huzhou, Ningbo, Quanzhou, Foshan, and Zhongshan) |

| Factors | Items | Factor Loading |

|---|---|---|

| PCSR AVE = 0.77 Cronbach’s α = 0.89 | Improves products or services for enhancing customer satisfaction | 0.91 |

| Improves production/management systems for protecting customer health and safety | 0.87 | |

| Provides training and development support for all employees | 0.82 | |

| Provides equal opportunities for all employees | 0.73 | |

| Incorporates the interests of all investors in business strategy | 0.85 | |

| Meets the information needs and requirements of all investors | 0.77 | |

| Inspects supplier facilities in terms of health, safety, and environmental aspects | 0.81 | |

| Implements policies to ensure ethical and friendly procurement at suppliers’ place | 0.88 | |

| SCSR AVE = 0.81 Cronbach’s α = 0.92 | Supports social and sustainable developments related initiatives | 0.88 |

| Provides charitable donations to communities (e.g., education) | 0.92 | |

| Incorporates environmental performance objectives in strategic plans | 0.86 | |

| Employs new technologies or equipment for reducing environmental impacts | 0.91 | |

| DGS AVE = 0.85 Cronbach’s α = 0.96 | Subsidies for SCSR | 0.91 |

| IGS AVE = 0.80 Cronbach’s α = 0.92 | Financial guarantees for SCSR | 0.87 |

| Interest discounts for SCSR | 0.85 | |

| Equipment financial leases for SCSR | 0.92 | |

| Publicity and training for SCSR | 0.86 | |

| FP AVE = 0.87 Cronbach’s α = 0.97 | Sales growth | 0.95 |

| Return on assets | 0.90 | |

| Cash flow | 0.92 | |

| Profit growth | 0.88 | |

| Return on investment | 0.96 | |

| χ2/df = 4.016 CFI = 0.915 IFI = 0.922 RMSEA = 0.059 | ||

| Variable | Mean | S.D. | 1 | 2 | 3 | 4 | 5 | 6 | 7 | 8 |

|---|---|---|---|---|---|---|---|---|---|---|

| 1. Firm age | 2.731 | 0.416 | ||||||||

| 2. Firm size | 4.561 | 1.261 | 0.167 ** | |||||||

| 3. IP | 0.782 | 1.135 | 0.096 | 0.628 *** | ||||||

| 4. PCSR | 4.139 | 0.498 | 0.026 | −0.316 *** | −0.213 ** | |||||

| 5. SCSR | 2.766 | 0.683 | 0.087 | −0.321 *** | −0.175 ** | 0.532 *** | ||||

| 6. DGS | 3.515 | 0.541 | −0.048 | −0.155 ** | −0.113 + | 0.515 *** | 0.452 *** | |||

| 7. IGS | 4.187 | 0.623 | 0.037 | −0.407 *** | −0.153 ** | 0.625 *** | 0.618 *** | 0.680 *** | ||

| 8. NV | 0.307 | 0.467 | −0.521 *** | 0.076 | −0.041 | −0.118 | −0.073 | −0.017 | −0.156 * | |

| 9. FP | 4.185 | 0.746 | −0.143 * | 0.083 | 0.061 | 0.363 *** | 0.321 *** | 0.331 *** | 0.252 *** | −0.016 |

| New Ventures | Established Firms | Full Sample | |||

|---|---|---|---|---|---|

| Model 1 | Model 2 | Model 3 | Model 4 | Model 5 | |

| Firm age | −0.539 ** (0.147) | −0.598 *** (0.122) | 0.272 (0.325) | 0.371 (0.315) | −0.446 *** (0.111) |

| Firm size | 0.137 * (0.060) | 0.135 * (0.050) | 0.158 ** (0.072) | 0.153 * (0.071) | 0.135 ** (0.045) |

| IP | 0.049 (0.073) | 0.028 (0.068) | −0.031 (0.068) | −0.013 (0.068) | 0.009 (0.046) |

| DGS | 0.238* (0.107) | 0.171 (0.115) | −0.013 (0.068) | −0.015 (0.072) | 0.067 (0.065) |

| IGS | −0.115 (0.073) | −0.145 (0.107) | 0.151 * (0.067) | 0.076 (0.075) | −0.033 (0.070) |

| PCSR | 0.245 ** (0.077) | 0.121 * (0.061) | 0.145 ** (0.047) | ||

| SCSR | −0.096 (0.111) | 0.100 + (0.053) | 0.038 (0.052) | ||

| NV | −0.185 + (0.099) | ||||

| NV × PCSR | 0.055 (0.038) | ||||

| NV × SCSR | −0.105 * (0.050) | ||||

| Industry dummies | Yes | Yes | Yes | Yes | Yes |

| City dummies | Yes | Yes | Yes | Yes | Yes |

| N | 163 | 163 | 368 | 368 | 531 |

| R2 | 0.30 | 0.35 | 0.16 | 0.23 | 0.27 |

| F | 6.59 *** | 9.35 *** | 4.56 *** | 5.12 *** | 6.29 *** |

| New Ventures | Established Firms | Full Sample | ||||

|---|---|---|---|---|---|---|

| Model 6 | Model 7 | Model 8 | Model 9 | Model 10 | Model 11 | |

| Firm age | −0.555 *** (0.135) | −0.557 *** (0.126) | 0.105 (0.341) | 0.110 (0.346) | −0.438 ** (0.125) | −0.436 *** (0.119) |

| Firm size | 0.111 + (0.058) | 0.142 * (0.053) | 0.143 * (0.061) | 0.142 * (0.063) | 0.125 ** (0.045) | 0.138 ** (0.045) |

| IP | 0.021 (0.068) | 0.006 (0.070) | 0.036 (0.065) | 0.037 (0.066) | 0.040 (0.047) | 0.040 (0.047) |

| DGS | 0.093 (0.127) | −0.019 (0.148) | −0.145 + (0.082) | −0.170 + (0.086) | −0.039 (0.064) | −0.082 (0.066) |

| IGS | −0.101 (0.119) | −0.018 (0.126) | 0.091 (0.073) | 0.110 (0.073) | 0.003 (0.063) | 0.039 (0.059) |

| PCSR | 0.210 * (0.082) | 0.216 ** (0.078) | 0.107 * (0.052) | 0.110 * (0.051) | 0.119 ** (0.042) | 0.126 ** (0.041) |

| SCSR | −0.088 (0.110) | 0.061 (0.106) | 0.093 (0.067) | 0.091 (0.066) | 0.065 (0.048) | 0.067 (0.047) |

| SCSR × DGS | −0.066 (0.058) | −0.103 (0.075) | −0.086 (0.051) | −0.095 (0.061) | −0.055 (0.035) | −0.045 (0.047) |

| SCSR × IGS | 0.130 * (0.061) | −0.051 (0.059) | 0.059 (0.042) | |||

| NV | −0.206 + (0.112) | −0.248 * (0.117) | ||||

| NV × SCSR | −0.009 (0.036) | 0.017 (0.037) | ||||

| NV × SCSR × DGS | 0.007 (0.032) | −0.020 (0.034) | ||||

| NV × SCSR × IGS | 0.075 * (0.033) | |||||

| Industry dummies | Yes | Yes | Yes | Yes | Yes | Yes |

| City dummies | Yes | Yes | Yes | Yes | Yes | Yes |

| N | 163 | 163 | 368 | 368 | 531 | 531 |

| R2 | 0.36 | 0.38 | 0.25 | 0.26 | 0.32 | 0.33 |

| F | 10.62 *** | 12.11 *** | 5.71 *** | 6.68 *** | 8.96 *** | 10.55 *** |

| Model 12 New Ventures | Model 13 Full Sample | Model 14 New Ventures | Model 15 Full Sample | |

|---|---|---|---|---|

| PCSR | 0.395 + (0.199) | 0.156 ** (0.045) | 0.437 + (0.218) | 0.132 ** (0.039) |

| SCSR | −0.303 (0.587) | 0.049 (0.053) | 0.157 (0.582) | 0.082 + (0.049) |

| NV1 × SCSR | −0.031 (0.050) | |||

| SCSR × IGS | 0.322 * (0.116) | |||

| NV1 × SCSR × IGS | 0.055 ** (0.019) | |||

| Control variables and other interaction terms | Yes | Yes | Yes | Yes |

| N | 45 | 531 | 45 | 531 |

| R2 | 0.41 | 0.26 | 0.45 | 0.35 |

| F | 3.17 ** | 7.90 *** | 16.82 *** | 12.09 *** |

| Configurations | |||

|---|---|---|---|

| 1 | 2 | 3 | |

| Customer CSR practices | ● | ● | ● |

| Employee CSR practices | ● | ||

| Investor CSR practices | ● | ● | |

| Supplier CSR practices | ● | ||

| Community CSR practices | |||

| Environment CSR practices | |||

| Raw Coverage | 0.56 | 0.45 | 0.33 |

| Unique Coverage | 0.26 | 0.06 | 0.10 |

| Consistency | 0.90 | 0.92 | 0.96 |

| Solution Consistency | 0.91 | ||

| Solution Coverage | 0.37 | ||

Disclaimer/Publisher’s Note: The statements, opinions and data contained in all publications are solely those of the individual author(s) and contributor(s) and not of MDPI and/or the editor(s). MDPI and/or the editor(s) disclaim responsibility for any injury to people or property resulting from any ideas, methods, instructions or products referred to in the content. |

© 2024 by the authors. Licensee MDPI, Basel, Switzerland. This article is an open access article distributed under the terms and conditions of the Creative Commons Attribution (CC BY) license (https://creativecommons.org/licenses/by/4.0/).

Share and Cite

Ji, H.; Sheng, S.; Wan, J. Corporate Social Responsibility Practices and Financial Performance of New Ventures: The Moderating Role of Government Support. Sustainability 2024, 16, 1328. https://doi.org/10.3390/su16031328

Ji H, Sheng S, Wan J. Corporate Social Responsibility Practices and Financial Performance of New Ventures: The Moderating Role of Government Support. Sustainability. 2024; 16(3):1328. https://doi.org/10.3390/su16031328

Chicago/Turabian StyleJi, Huanyong, Shuya Sheng, and Jun Wan. 2024. "Corporate Social Responsibility Practices and Financial Performance of New Ventures: The Moderating Role of Government Support" Sustainability 16, no. 3: 1328. https://doi.org/10.3390/su16031328

APA StyleJi, H., Sheng, S., & Wan, J. (2024). Corporate Social Responsibility Practices and Financial Performance of New Ventures: The Moderating Role of Government Support. Sustainability, 16(3), 1328. https://doi.org/10.3390/su16031328