Value Creation with Project Risk Management: A Holistic Framework

Abstract

1. Introduction

2. Theoretical Background

2.1. Perspectives on Projects and Value Creation

2.2. Project Risk Management Main Concepts and Methods

2.3. Value Creation through PRM

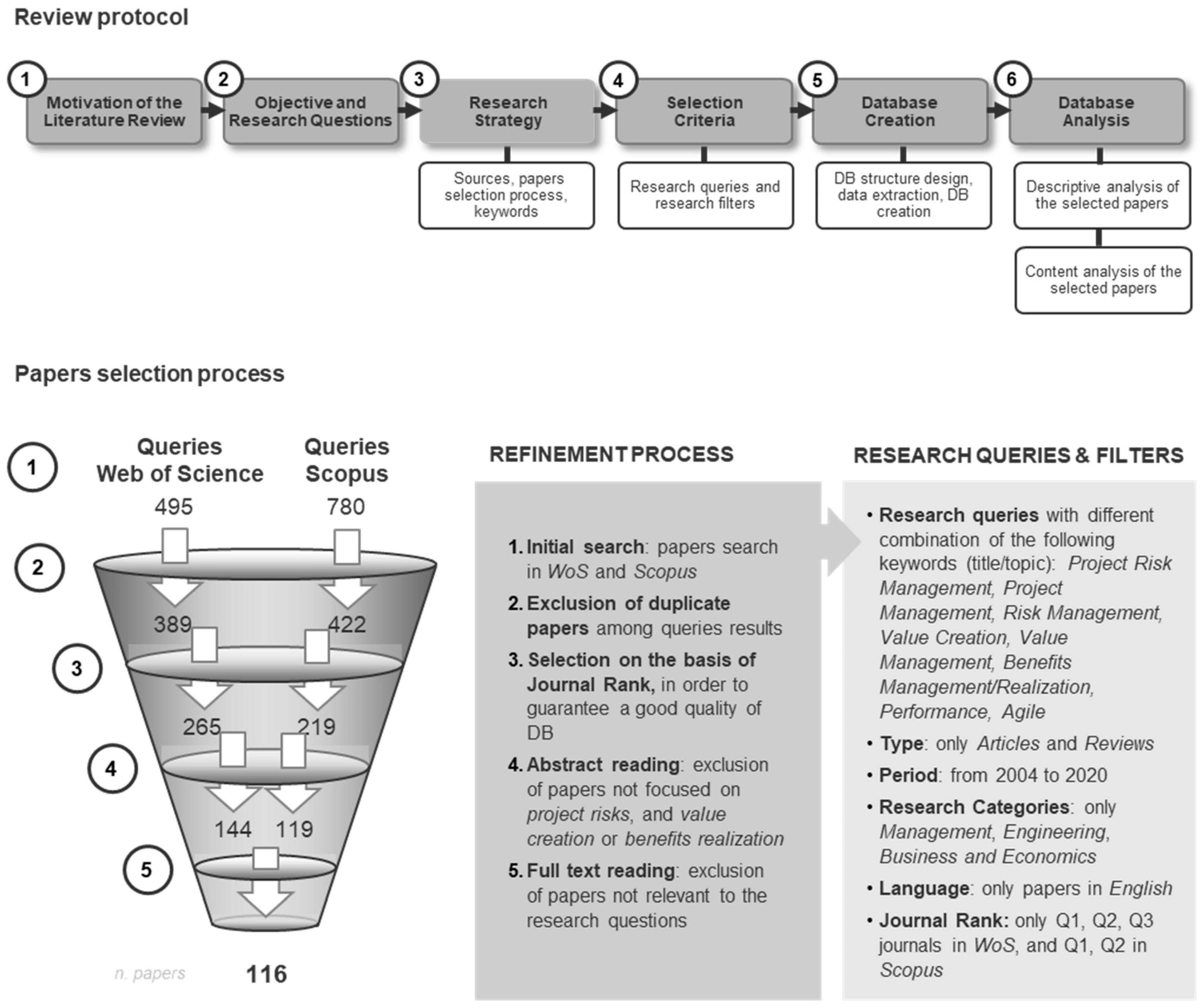

3. Objectives and Methodology

- SLR RQ1: What is the value created through PRM for different project stakeholders?

- SLR RQ2: What PRM activities, practices, and tools lead to value creation?

- SLR RQ3: What contextual factors can moderate value creation through PRM?

- SLR RQ4: How can the PRM value be measured?

- First author, to identify the authors who are more devoted to the research topic;

- Country of the first author, to identify whether there is a country or region in which more studies have been carried out;

- Year of publication, to identify whether there is a trend in the number of studies;

- Journal, to identify whether one or more journals are dedicated to the topic.

4. State of the Art on Value Creation through PRM

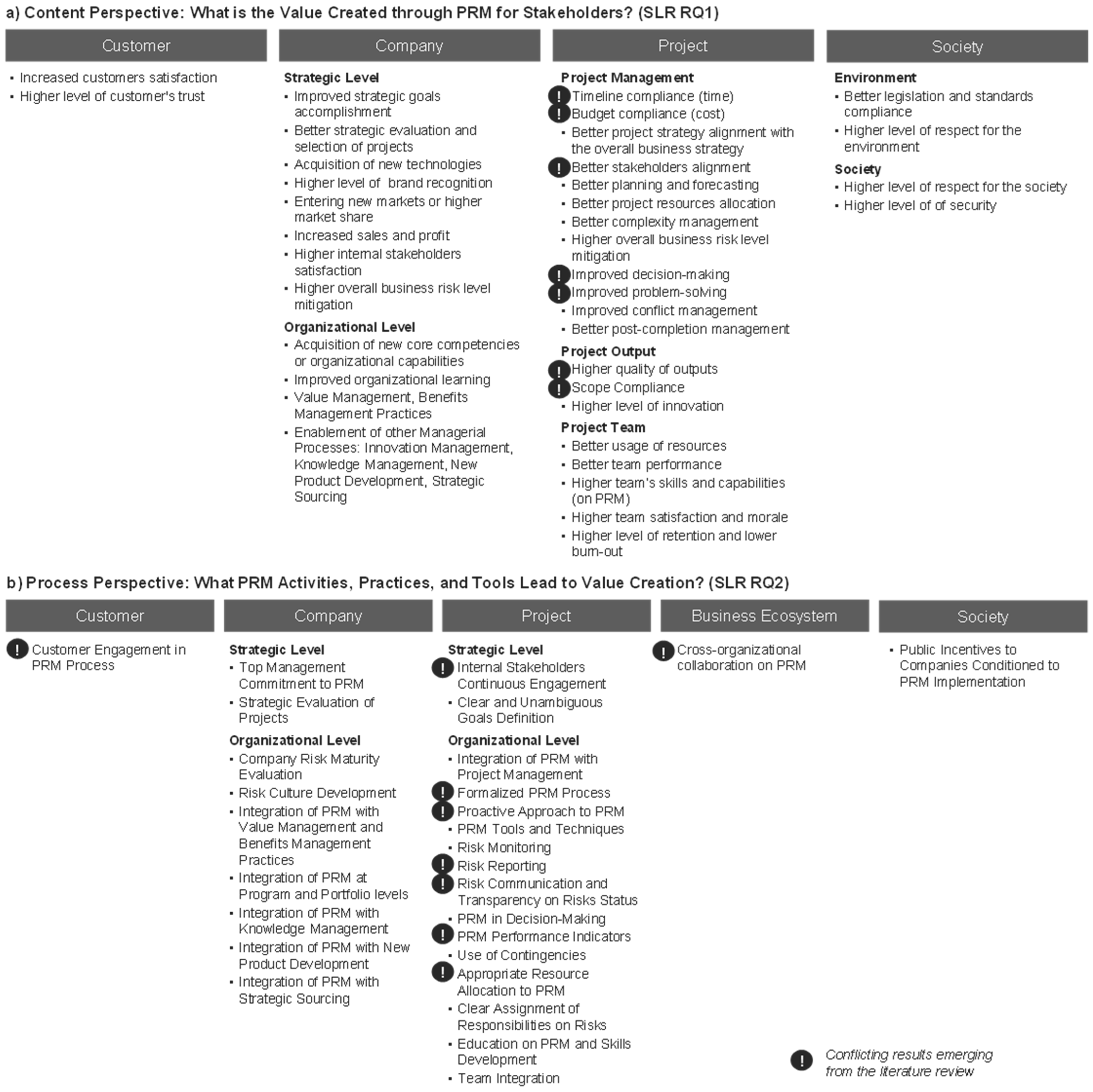

5. Detailed Content Analysis on Value Creation through PRM

5.1. Content Perspective: Benefits Generated through PRM

5.2. Process Perspective: PRM Activities, Practices, and Tools

5.3. Contextual Factors

5.4. Value Measurement

5.5. Reasons for Conflicting Results in the Literature

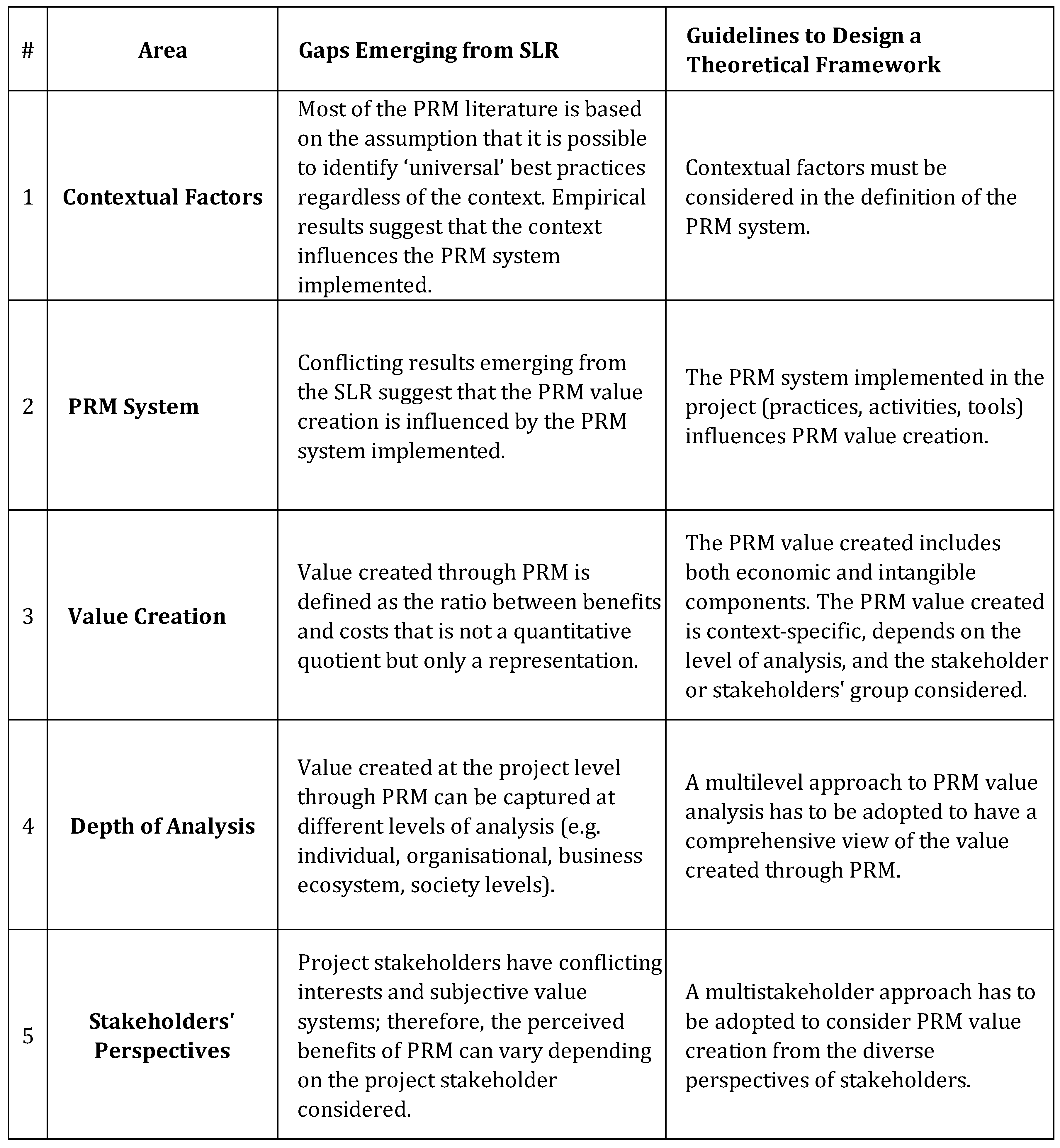

- Contextual factors: most of the PRM literature is based on the assumption that it is possible to identify ‘universal’ best practices regardless of the context (Figure 3);

- PRM system: the conflicting results emerging from the SLR suggest that PRM value creation is influenced by the PRM system implemented in the project;

- Levels of analysis: the value created through PRM at the project level can slip to different levels of analysis and be captured by diverse stakeholders [45]; thus, unless a multilevel approach in the analysis is adopted, it is impossible to have a comprehensive view of the value created through PRM;

- Project stakeholders: project stakeholders have conflicting interests and subjective value systems; therefore, the perceived benefits of PRM can vary depending on the project stakeholder considered. Therefore, it is impossible to truly consider the value and suitability of PRM results without understanding their relevance to project stakeholders [45,111,115,116,117].

6. A Theoretical Framework for Value Creation through PRM

- Contextual factors: It is fundamental to identify the relevant contextual factors that influence the definition of a suitable PRM system.

- PRM: The PRM system can be implemented at different maturity levels, in terms of the practices, activities, and tools adopted. Specifically, the PRM process is composed of the following steps: (1) PRM Context and Planning, (2) Risk Identification, (3) Risk Analysis, (4) Response Planning, (5) Monitoring and Control, (6) Results Management and Lessons Learned. The selection of PRM practices, activities, and tools is guided by the project context. Information on risks collected during each iteration of the PRM process are analysed and formalised (Step 6) to support the subsequent iterations (in the current project or in future projects). A process iteration will be started when a new project is launched or, alternatively, during the execution phase of a project, if its scope or goals are changed to take advantage of certain opportunities (positive risks), or if negative risks require reconsidering the planned approach to PRM (e.g., diverse strategies for risk responses, skills or effort, different practices and activities). The implemented PRM system influences the creation of value.

- Value creation: The PRM value creation process is context-specific and depends on the level of analysis and on the stakeholder or stakeholders’ group considered. It includes the following steps: (A) Value Objectives: definition (or revision) and planning of value objectives, in terms of economic and intangible value for stakeholders, according to the identified risks, the levels of analysis, the type of project stakeholders and the project context; (B) Value Creation through the management of project risks and opportunities; (C) Value Capture from project stakeholders; (D) Value Measurement of economic and intangible value created for project stakeholders, compared with the defined value objectives; (E) Value dissemination (intentional or unintentional) to different project stakeholders from those who captured the PRM value in previous iterations (even after the termination of the project). The value created through PRM is defined as the ratio between benefits and costs, which is not a quantitative quotient but only a representation and includes both economic and intangible (not monetary) components.

- Depth of analysis: A multilevel approach to value analysis is required to have a comprehensive view of the PRM value created. The levels of analysis considered influence the PRM system adopted in the project and the evaluation of the PRM value created.

- Multi-stakeholder perspective: It is fundamental to adopt the different perspectives of the project stakeholders, considering that subjective stakeholders’ perceptions and interests influence the PRM system adopted in the project and the evaluation of the PRM value created.

Implications for Engineering Managers

7. Conclusions

8. Limitation and Future Research Directions

Supplementary Materials

Author Contributions

Funding

Institutional Review Board Statement

Informed Consent Statement

Data Availability Statement

Acknowledgments

Conflicts of Interest

References

- ISO 31000; Risk Management. ISO: Geneva, Switzerland, 2018.

- Radner, R.; Shepp, L. Risk vs. Profit Potential: A Model for Corporate Strategy. J. Econ. Dyn. Control 1996, 20, 1373–1393. [Google Scholar] [CrossRef]

- Hopkin, P. Fundamentals of Risk Management: Understanding, Evaluating and Implementing Effective Risk Management, 5th ed.; Kogan Page: London, UK, 2018. [Google Scholar]

- Maylor, H.; Brady, T.; Cooke-Davies, T.; Hodgson, D. From Projectification to Programmification. Int. J. Proj. Manag. 2006, 24, 663–674. [Google Scholar] [CrossRef]

- PMI. A Guide to the Project Management Body of Knowledge (PMBOK Guide), 3rd ed.; Project Management Institute: Newtown Square, PA, USA, 2004. [Google Scholar]

- Surco-Guillen, Y.C.; Romero, J.; Rodríguez-Rivero, R.; Ortiz-Marcos, I. Success Factors in Management of Development Projects. Sustainability 2022, 14, 780. [Google Scholar] [CrossRef]

- Verbano, C.; Venturini, K. Development Paths of Risk Management: Approaches, Methods and Fields of Application. J. Risk Res. 2011, 14, 519–550. [Google Scholar] [CrossRef]

- Conroy, G.; Soltan, H. ConSERV, a Project Specific Risk Management Concept. Int. J. Proj. Manag. 1998, 16, 353–366. [Google Scholar] [CrossRef]

- Raz, T.; Michael, E. Use and Benefits of Tools for Project Risk Management. Int. J. Proj. Manag. 2001, 19, 9–17. [Google Scholar] [CrossRef]

- Borge, D. The Book of Risk; John Wiley & Sons: Hoboken, NJ, USA, 2002. [Google Scholar]

- PMI. A Guide to the Project Management Body of Knowledge (PMBOK Guide), 5th ed.; Project Management Institute: Newtown Square, PA, USA, 2013. [Google Scholar]

- Elkington, P.; Smallman, C. Managing Project Risks: A Case Study from the Utilities Sector. Int. J. Proj. Manag. 2002, 7863, 49–57. [Google Scholar] [CrossRef]

- Willumsen, P.; Oehmen, J.; Stingl, V.; Geraldi, J. Value Creation through Project Risk Management. Int. J. Proj. Manag. 2019, 37, 731–749. [Google Scholar] [CrossRef]

- European Standard 12973; Value Management. British Standard Institution: London, UK, 2000.

- Laursen, M.; Svejvig, P. Taking Stock of Project Value Creation: A Structured Literature Review with Future Directions for Research and Practice. Int. J. Proj. Manag. 2016, 34, 736–747. [Google Scholar] [CrossRef]

- Morris, P. Reconstructing Project Management; Wiley Blackwell: Chichester, UK, 2013. [Google Scholar]

- Quartermain, M. Value Engineering; Project Management Pathways; Association for Project Management: Buckinghamshire, UK, 2002; pp. 44-1–44-20. [Google Scholar]

- Shenhar, A.J.; Dvir, D.; Levy, O.; Maltz, A.C. Project Success: A Multidimensional Strategic Concept. Long. Range Plan. 2001, 34, 699–725. [Google Scholar] [CrossRef]

- Voss, M. Impact of Customer Integration on Project Portfolio Management and Its Success-Developing a Conceptual Framework. Int. J. Proj. Manag. 2012, 30, 567–581. [Google Scholar] [CrossRef]

- COSO. Enterprise Risk Management—Integrated Framework; Committee of Sponsoring Organizations (COSO): Englewood Cliffs, NJ, USA, 2017. [Google Scholar]

- PMI. Practice Standard for Project Risk Management; Project Management Institute: Newtown Square, PA, USA, 2009; ISBN 978-1-933890-38-8. [Google Scholar]

- Voetsch, R.J.; Cioffi, D.F.; Anbari, F.T. Project Risk Management Practices and Their Association with Reported Project Success. In Proceedings of the 6th IRNOP Project Research Conference, Turku, Finland, 25–27 August 2004; pp. 4–7. [Google Scholar]

- Rabechini, R.; de Carvalho, M.M. Understanding the Impact of Project Risk Management on Project Performance: An Empirical Study. J. Technol. Manag. Innov. 2013, 8, 64–78. [Google Scholar] [CrossRef]

- Teller, J.; Kock, A. An Empirical Investigation on How Portfolio Risk Management Influences Project Portfolio Success. Int. J. Proj. Manag. 2013, 31, 817–829. [Google Scholar] [CrossRef]

- Javani, B.; Rwelamila, P.M.D. Risk Management in IT Projects—A Case of the South African Public Sector. Int. J. Manag. Proj. Bus. 2016, 9, 389–413. [Google Scholar] [CrossRef]

- Olechowski, A.; Oehmen, J.; Seering, W.; Ben-Daya, M. The Professionalization of Risk Management: What Role Can the ISO 31000 Risk Management Principles Play? Int. J. Proj. Manag. 2016, 34, 1568–1578. [Google Scholar] [CrossRef]

- Kutsch, E. The Effect of Intervening Conditions on the Management of Project Risk. Int. J. Manag. Proj. Bus. 2008, 1, 602–610. [Google Scholar] [CrossRef]

- Jun, L.; Qiuzhen, W.; Qingguo, M. The Effects of Project Uncertainty and Risk Management on IS Development Project Performance: A Vendor Perspective. Int. J. Proj. Manag. 2011, 29, 923–933. [Google Scholar] [CrossRef]

- Zhao, X.; Hwang, B.G.; Phng, W. Construction Project Risk Management in Singapore: Resources, Effectiveness, Impact, and Understanding. KSCE J. Civ. Eng. 2014, 18, 27–36. [Google Scholar] [CrossRef]

- Crispim, J.; Silva, L.H.; Rego, N. Project Risk Management Practices: The Organizational Maturity Influence. Int. J. Manag. Proj. Bus. 2019, 12, 187–210. [Google Scholar] [CrossRef]

- Moeini, M.; Rivard, S. Sublating Tensions in the It Project Risk Management Literature: A Model of the Relative Performance of Intuition and Deliberate Analysis for Risk Assessment. J. Assoc. Inf. Syst. 2019, 20, 243–284. [Google Scholar] [CrossRef]

- Perrenoud, A.; Lines, B.C.; Savicky, J.; Sullivan, K.T. Using Best-Value Procurement to Measure the Impact of Initial Risk-Management Capability on Qualitative Construction Performance. J. Manag. Eng. 2017, 33, 1–8. [Google Scholar] [CrossRef]

- Liu, S. How the User Liaison’s Understanding of Development Processes Moderates the Effects of User-Related and Project Management Risks on IT Project Performance. Inf. Manag. 2016, 53, 122–134. [Google Scholar] [CrossRef]

- De Carvalho, M.M.; Rabechini Junior, R. Impact of Risk Management on Project Performance: The Importance of Soft Skills. Int. J. Prod. Res. 2015, 53, 321–340. [Google Scholar] [CrossRef]

- Hwang, B.G.; Zhao, X.; Ong, S.Y. Value Management in Singaporean Building Projects: Implementation Status, Critical Success Factors, and Risk Factors. J. Manag. Eng. 2015, 31, 342. [Google Scholar] [CrossRef]

- Aven, T. Risk Assessment and Risk Management: Review of Recent Advances on Their Foundation. Eur. J. Oper. Res. 2016, 253, 1–13. [Google Scholar] [CrossRef]

- Soares, R.A.; Chaves, M.S.; Pedron, C.D. W4RM: A Prescriptive Framework Based on a Wiki to Support Collaborative Risk Management in Information Technology Projects. Int. J. Inf. Syst. Proj. Manag. 2020, 8, 67–83. [Google Scholar] [CrossRef]

- Doloi, H. Relational Partnerships: The Importance of Communication, Trust and Confidence and Joint Risk Management in Achieving Project Success. Constr. Manag. Econ. 2009, 27, 1099–1109. [Google Scholar] [CrossRef]

- De Bakker, K.; Boonstra, A.; Wortmann, H. Risk Managements’ Communicative Effects Influencing IT Project Success. Int. J. Proj. Manag. 2012, 30, 444–457. [Google Scholar] [CrossRef]

- Chih, Y.Y.; Zwikael, O.; Restubog, S.L.D. Enhancing Value Co-Creation in Professional Service Projects: The Roles of Professionals, Clients and Their Effective Interactions. Int. J. Proj. Manag. 2019, 37, 599–615. [Google Scholar] [CrossRef]

- Thamhain, H. Managing Risks in Complex Projects. Proj. Manag. J. 2013, 44, 20–35. [Google Scholar] [CrossRef]

- Zwikael, O.; Ahn, M. The Effectiveness of Risk Management: An Analysis of Project Risk Planning Across Industries and Countries. Risk Anal. 2011, 31, 25–37. [Google Scholar] [CrossRef] [PubMed]

- Kutsch, E.; Hall, M. Deliberate Ignorance in Project Risk Management. Int. J. Proj. Manag. 2010, 28, 245–255. [Google Scholar] [CrossRef]

- Shimizu, T.; Park, Y.W.; Hong, P. Project Managers for Risk Management: Case for Japan. Benchmarking 2012, 19, 532–547. [Google Scholar] [CrossRef]

- Lepak, D.P.; Smith, K.G.; Taylor, M.S. Value Creation and Value Capture: A Multilevel Perspective. Acad. Manag. Rev. 2007, 32, 180–194. [Google Scholar] [CrossRef]

- Winter, M.; Szczepanek, T. Projects and Programmes as Value Creation Processes: A New Perspective and Some Practical Implications. Int. J. Proj. Manag. 2008, 26, 95–103. [Google Scholar] [CrossRef]

- Andersen, E.S. Do Project Managers Have Different Perspectives on Project Management? Int. J. Proj. Manag. 2016, 34, 58–65. [Google Scholar] [CrossRef]

- Kenis, P.; Janowicz-Panjaitan, M.; Cambré, B. Temporary Organizations: Prevalence, Logic and Effectiveness; Elgar Publishing: Cheltenham, UK, 2009; Volume 6, ISBN 9781849802154. [Google Scholar]

- Packendorff, J. Inquiring into the Temporary Organization: New Directions for Project Management Research. Scand. J. Manag. 1995, 11, 319–333. [Google Scholar] [CrossRef]

- Ancona, D.; Chong, C.-L. Cycles and Syncronicity: The Temporl Role of Context in Team Behaviour. In Research on Managing Groups and Teams: Groups in Context; Elsevier Science: Amsterdam, The Netherlands, 1999. [Google Scholar]

- Winter, M.; Smith, C.; Morris, P.; Cicmil, S. Directions for Future Research in Project Management: The Main Findings of a UK Government-Funded Research Network. Int. J. Proj. Manag. 2006, 24, 638–649. [Google Scholar] [CrossRef]

- de Bakker, K.; Boonstra, A.; Wortmann, H. Does Risk Management Contribute to IT Project Success? A Meta-Analysis of Empirical Evidence. Int. J. Proj. Manag. 2010, 28, 493–503. [Google Scholar] [CrossRef]

- PMI. A Guide to the Project Management Body of Knowledge (PMBOK Guide), 6th ed.; Project Management Institute: Newtown Square, PA, USA, 2017. [Google Scholar]

- Jiang, J.J.; Klein, G.; Discenza, R. Information System Success as Impacted by Risks and Development Strategies. IEEE Trans. Eng. Manag. 2001, 48, 46–55. [Google Scholar] [CrossRef]

- Wallace, L.; Keil, M.; Rai, A. Understanding Software Project Risk: A Cluster Analysis. Inf. Manag. 2004, 42, 115–125. [Google Scholar] [CrossRef]

- Geraldi, J.; Lee-Kelley, L.; Kutsch, E. The Titanic Sunk, so What? Project Manager Response to Unexpected Events. Int. J. Proj. Manag. 2010, 28, 547–558. [Google Scholar] [CrossRef]

- Mikes, A.; Kaplan, R. Towards a Contingency Theory of Enterprise Risk Management; Harvard Business School: Boston, MA, USA, 2013; pp. 1–43. [Google Scholar]

- Sommer, S.C.; Loch, C.H. Incomplete Incentive Contracts under Ambiguity and Complexity. SSRN Electr. J. 2004. [Google Scholar] [CrossRef]

- Besner, C.; Hobbs, B. The Paradox of Risk Management; a Project Management Practice Perspective. Int. J. Manag. Proj. Bus. 2012, 5, 230–247. [Google Scholar] [CrossRef]

- Meyer, A.D.E. Managing Project Uncertainty: From Variation to Chaos. MIT Sloan Manag. Rev. 2002, 43, 60–67. [Google Scholar] [CrossRef]

- Barki, H.; Rivard, S.; Talbot, J. An Integrative Contingency Model of Software Project Risk Management. J. Manag. Inf. Syst. 2001, 17, 37–69. [Google Scholar] [CrossRef]

- Marle, F. An Assistance to Project Risk Management Based on Complex. In Complexity; Hindawi Ltd.: London, UK, 2020; Volume 2020. [Google Scholar]

- Tavares, B.G.; da Silva, C.E.S.; de Souza, A.D. Risk Management Analysis in Scrum Software Projects. Int. Trans. Oper. Res. 2019, 26, 1884–1905. [Google Scholar] [CrossRef]

- Buganová, K.; Šimíčková, J. Risk Management in Traditional and Agile Project Management. Transp. Res. Procedia 2019, 40, 986–993. [Google Scholar] [CrossRef]

- Fitsilis, P. Comparing PMBOK and Agile Project Management Software Development Processes. Adv. Comput. Inf. Sci. Eng. 2008, 378–383. [Google Scholar] [CrossRef]

- Alquier, A.M.B.; Tignol, M.H.L. Risk Management in Small- and Medium-Sized Enterprises. Prod. Plan. Control 2006, 17, 273–282. [Google Scholar] [CrossRef]

- Marcelino-Sádaba, S.; Pérez-Ezcurdia, A.; Echeverría Lazcano, A.M.; Villanueva, P. Project Risk Management Methodology for Small Firms. Int. J. Proj. Manag. 2014, 32, 327–340. [Google Scholar] [CrossRef]

- Neves, S.M.; da Silva, C.E.S.; Salomon, V.A.P.; da Silva, A.F.; Sotomonte, B.E.P. Risk Management in Software Projects through Knowledge Management Techniques: Cases in Brazilian Incubated Technology-Based Firms. Int. J. Proj. Manag. 2014, 32, 125–138. [Google Scholar] [CrossRef]

- Testorelli, R.; Ferreira de Araújo Lima, P.; Verbano, C. Fostering Project Risk Management in SMEs: An Emergent Framework from a Literature Review. Prod. Plan. Control 2020, 33, 1304–1318. [Google Scholar] [CrossRef]

- Testorelli, R.; Verbano, C. An Empirical Framework to Sustain Value Generation with Project Risk Management: A Case Study in the IT Consulting Sector. Sustainability 2022, 14, 12117. [Google Scholar] [CrossRef]

- Husted, B.W. A Contingency Theory of Corporate Social Performance. Bus. Soc. 2000, 39, 24–48. [Google Scholar] [CrossRef]

- Ragas, A.A.M.A.; Chupin, A.; Bolsunovskaya, M.; Leksashov, A.; Shirokova, S.; Senotrusova, S. Accelerating Sustainable and Economic Development via Scientific Project Risk Management Model of Industrial Facilities. Sustainability 2023, 15, 12942. [Google Scholar] [CrossRef]

- Mendelow, A. Stakeholder Mapping. In Proceedings of the 12nd International Conference on Information Systems, New York, NY, USA, 16–18 December 1991. [Google Scholar]

- Mitchell, R.K.; Agle, B.R.; Wood, D.J.; Mitchell, R.K. Toward a Theory of Stakeholders Identification and Salience. Acad. Manag. Rev. 1997, 22, 853–886. [Google Scholar] [CrossRef]

- Murray-Webster, R.; Simon, P. Making Sense of Stakeholder Mapping. PM World Today 2006, 3, 5. [Google Scholar]

- Macpherson, A.; Holt, R. Knowledge, Learning and Small Firm Growth: A Systematic Review of the Evidence. Res. Policy 2007, 36, 172–192. [Google Scholar] [CrossRef]

- Liberati, A.; Altman, D.G.; Tetzlaff, J.; Mulrow, C.; Gøtzsche, P.C.; Ioannidis, J.P.A.; Clarke, M.; Devereaux, P.J.; Kleijnen, J.; Moher, D. The PRISMA Statement for Reporting Systematic Reviews and Meta-Analyses of Studies That Evaluate Health Care Interventions: Explanation and Elaboration. J. Clin. Epidemiol. 2009, 62, e1–e34. [Google Scholar] [CrossRef]

- Tranfield, D.; Denyer, D.; Smart, P. Towards a Methodology for Developing Evidence-Informed Management Knowledge by Means of Systematic Review* Introduction: The Need for an Evidence- Informed Approach. Br. J. Manag. 2003, 14, 207–222. [Google Scholar] [CrossRef]

- Cavacini, A. What Is the Best Database for Computer Science Journal Articles? Scientometrics 2015, 102, 2059–2071. [Google Scholar] [CrossRef]

- Guz, A.N.; Rushchitsky, J.J. Scopus: A System for the Evaluation of Scientific Journals. Int. Appl. Mech. 2009, 45, 351–362. [Google Scholar] [CrossRef]

- ISO 21500; Guidance on Project Management. ISO: Geneva, Switzerland, 2012.

- ISO 9001; Quality Management. ISO: Geneva, Switzerland, 2015.

- Kloss-Grote, B.; Moss, M.A. How to Measure the Effectiveness of Risk Management in Engineering Design Projects? Presentation of RMPASS: A New Method for Assessing Risk Management Performance and the Impact of Knowledge Management-Including a Few Results. Res. Eng. Des. 2008, 19, 71–100. [Google Scholar] [CrossRef]

- Zhang, Y.; Liu, S.; Tan, J.; Jiang, G.; Zhu, Q. Effects of Risks on the Performance of Business Process Outsourcing Projects: The Moderating Roles of Knowledge Management Capabilities. Int. J. Proj. Manag. 2018, 36, 627–639. [Google Scholar] [CrossRef]

- Shrivastava, S.V.; Rathod, U. A Risk Management Framework for Distributed Agile Projects. Inf. Softw. Technol. 2017, 85, 1–15. [Google Scholar] [CrossRef]

- Choi, J.; Yun, S.; Leite, F.; Mulva, S.P. Team Integration and Owner Satisfaction: Comparing Integrated Project Delivery with Construction Management at Risk in Health Care Projects. J. Manag. Eng. 2019, 35, 654. [Google Scholar] [CrossRef]

- Santos, S.M.G.; Gaspar, A.T.F.S.; Schiozer, D.J. Risk Management in Petroleum Development Projects: Technical and Economic Indicators to Define a Robust Production Strategy. J. Pet. Sci. Eng. 2017, 151, 116–127. [Google Scholar] [CrossRef]

- Lee, H.W.; Tommelein, I.D.; Ballard, G. Energy-Related Risk Management in Integrated Project Delivery. J. Constr. Eng. Manag. 2013, 139, A4013001. [Google Scholar] [CrossRef]

- Chen, Y.S.; Chuang, H.M.; Sangaiah, A.K.; Lin, C.K.; Huang, W. Bin A Study for Project Risk Management Using an Advanced MCDM-Based DEMATEL-ANP Approach. J. Ambient. Intell. Humaniz. Comput. 2019, 10, 2669–2681. [Google Scholar] [CrossRef]

- Shojaei, P.; Haeri, S.A.S. Development of Supply Chain Risk Management Approaches for Construction Projects: A Grounded Theory Approach. Comput. Ind. Eng. 2019, 128, 837–850. [Google Scholar] [CrossRef]

- Lima, P.F.d.A.; Verbano, C. Project Risk Management Implementation in SMEs: A Case Study from Italy. J. Technol. Manag. Innov. 2019, 14, 3–10. [Google Scholar] [CrossRef][Green Version]

- Furlong, C.; De Silva, S.; Gan, K.; Guthrie, L.; Considine, R. Risk Management, Financial Evaluation and Funding for Wastewater and Stormwater Reuse Projects. J. Environ. Manag. 2017, 191, 83–95. [Google Scholar] [CrossRef] [PubMed]

- Fernando, Y.; Walters, T.; Ismail, M.N.; Seo, Y.W.; Kaimasu, M. Managing Project Success Using Project Risk and Green Supply Chain Management: A Survey of Automotive Industry. Int. J. Manag. Proj. Bus. 2018, 11, 332–365. [Google Scholar] [CrossRef]

- Abdul-Rahman, H.; Mohd-Rahim, F.A.; Chen, W. Reducing Failures in Software Development Projects: Effectiveness of Risk Mitigation Strategies. J. Risk Res. 2012, 15, 417–433. [Google Scholar] [CrossRef]

- Lee, O.K.D.; Baby, D.V. Managing Dynamic Risks in Global It Projects: Agile Risk-Management Using the Principles of Service-Oriented Architecture. Int. J. Inf. Technol. Decis. Mak. 2013, 12, 1121–1150. [Google Scholar] [CrossRef]

- Hwang, B.G.; Zhao, X.; Toh, L.P. Risk Management in Small Construction Projects in Singapore: Status, Barriers and Impact. Int. J. Proj. Manag. 2014, 32, 116–124. [Google Scholar] [CrossRef]

- Rohaninejad, M.; Bagherpour, M. Application of Risk Analysis within Value Management: A Case Study in Dam Engineering. J. Civ. Eng. Manag. 2013, 19, 364–374. [Google Scholar] [CrossRef]

- Hartono, B.; Wijaya, D.F.; Arini, H.M. The Impact of Project Risk Management Maturity on Performance: Complexity as a Moderating Variable. Int. J. Eng. Bus. Manag. 2019, 11, 184797901985550. [Google Scholar] [CrossRef]

- Ellis, R.C.T.; Wood, G.D.; Keel, D.A. Value Management Practices of Leading UK Cost Consultants. Constr. Manag. Econ. 2005, 23, 483–493. [Google Scholar] [CrossRef]

- Willems, A.; Janssen, M.; Verstegen, C.; Bedford, T. Expert Quantification of Uncertainties in a Risk Analysis for Aninfrastructure Project. J. Risk Res. 2006, 8, 3–17. [Google Scholar] [CrossRef]

- Hoseini, E.; Hertogh, M.; Bosch-Rekveldt, M. Developing a Generic Risk Maturity Model (GRMM) for Evaluating Risk Management in Construction Projects. J. Risk Res. 2019, 24, 1–20. [Google Scholar] [CrossRef]

- Yeo, K.T.; Ren, Y.T. Risk Management Capability Maturity Model for Complex Product Systems (CoPS) Projects. Syst. Eng. 2009, 12, 275–294. [Google Scholar] [CrossRef]

- Oehmen, J.; Olechowski, A.; Robert Kenley, C.; Ben-Daya, M. Analysis of the Effect of Risk Management Practices on the Performance of New Product Development Programs. Technovation 2014, 34, 441–453. [Google Scholar] [CrossRef]

- Makarenko, Y.P.; Tereshchenko, S.I.; Metelenko, N.G.; Mykolenko, I.H.; Oliinyk, A.S. Strategic Risks Management in Implementation of It Projects. Acad. Strateg. Manag. J. 2019, 18, 1–5. [Google Scholar]

- Jafari, M.; Rezaeenour, J.; Mahdavi Mazdeh, M.; Hooshmandi, A. Development and Evaluation of a Knowledge Risk Management Model for Project-Based Organizations: A Multi-Stage Study. Manag. Decis. 2011, 49, 309–329. [Google Scholar] [CrossRef]

- Zou, Y.; Kiviniemi, A.; Jones, S.W. Retrieving Similar Cases for Construction Project Risk Management Using Natural Language Processing Techniques. Autom. Constr. 2017, 80, 66–76. [Google Scholar] [CrossRef]

- Cárdenas, I.C.; Al-Jibouri, S.S.H.; Halman, J.I.M.; van de Linde, W.; Kaalberg, F. Using Prior Risk-Related Knowledge to Support Risk Management Decisions: Lessons Learnt from a Tunneling Project. Risk Anal. 2014, 34, 1923–1943. [Google Scholar] [CrossRef] [PubMed]

- Liu, Y.; van Marrewijk, A.; Houwing, E.J.; Hertogh, M. The Co-Creation of Values-in-Use at the Front End of Infrastructure Development Programs. Int. J. Proj. Manag. 2019, 37, 684–695. [Google Scholar] [CrossRef]

- Giacomarra, M.; Crescimanno, M.; Sakka, G.; Galati, A. Stakeholder Engagement toward Value Co-Creation in the F&B Packaging Industry. EuroMed J. Bus. 2019, 15, 315–331. [Google Scholar] [CrossRef]

- Surlan, N.; Cekic, Z.; Torbica, Z. Use of Value Management Workshops and Critical Success Factors in Introducing Local Experience on the International Construction Projects. J. Civ. Eng. Manag. 2016, 22, 1021–1031. [Google Scholar] [CrossRef]

- Smyth, H.; Lecoeuvre, L.; Vaesken, P. Co-Creation of Value and the Project Context: Towards Application on the Case of Hinkley Point C Nuclear Power Station. Int. J. Proj. Manag. 2018, 36, 170–183. [Google Scholar] [CrossRef]

- Wang, J.; Lin, W.; Huang, Y.H. A Performance-Oriented Risk Management Framework for Innovative R&D Projects. Technovation 2010, 30, 601–611. [Google Scholar] [CrossRef]

- McShea, M. IT Value Management: Creating a Balanced Program. IT Prof. 2006, 8, 31–37. [Google Scholar] [CrossRef]

- Ahmadi-Javid, A.; Fateminia, S.H.; Gemünden, H.G. A Method for Risk Response Planning in Project Portfolio Management. Proj. Manag. J. 2020, 51, 77–95. [Google Scholar] [CrossRef]

- Martinsuo, M.; Hoverfält, P. Change Program Management: Toward a Capability for Managing Value-Oriented, Integrated Multi-Project Change in Its Context. Int. J. Proj. Manag. 2018, 36, 134–146. [Google Scholar] [CrossRef]

- Green, S.D.; Sergeeva, N. Value Creation in Projects: Towards a Narrative Perspective. Int. J. Proj. Manag. 2019, 37, 636–651. [Google Scholar] [CrossRef]

- Laursen, M.; Killen, C.P. Programming for Holistic Value Creation: Collaboration, Coordination and Perception. Int. J. Manag. Proj. Bus. 2019, 12, 71–94. [Google Scholar] [CrossRef]

Disclaimer/Publisher’s Note: The statements, opinions and data contained in all publications are solely those of the individual author(s) and contributor(s) and not of MDPI and/or the editor(s). MDPI and/or the editor(s) disclaim responsibility for any injury to people or property resulting from any ideas, methods, instructions or products referred to in the content. |

© 2024 by the authors. Licensee MDPI, Basel, Switzerland. This article is an open access article distributed under the terms and conditions of the Creative Commons Attribution (CC BY) license (https://creativecommons.org/licenses/by/4.0/).

Share and Cite

Testorelli, R.; Tiso, A.; Verbano, C. Value Creation with Project Risk Management: A Holistic Framework. Sustainability 2024, 16, 753. https://doi.org/10.3390/su16020753

Testorelli R, Tiso A, Verbano C. Value Creation with Project Risk Management: A Holistic Framework. Sustainability. 2024; 16(2):753. https://doi.org/10.3390/su16020753

Chicago/Turabian StyleTestorelli, Raffaele, Anna Tiso, and Chiara Verbano. 2024. "Value Creation with Project Risk Management: A Holistic Framework" Sustainability 16, no. 2: 753. https://doi.org/10.3390/su16020753

APA StyleTestorelli, R., Tiso, A., & Verbano, C. (2024). Value Creation with Project Risk Management: A Holistic Framework. Sustainability, 16(2), 753. https://doi.org/10.3390/su16020753