Abstract

A scientific understanding of the real estate sector’s role in the national economy is essential for facilitating reasonable and effective regulation and promoting economic development. By analyzing panel data from a sample of 67 countries between 2010 and 2018, we examine the role of the real estate sector in different countries and its determinants. This empirical study yields three main findings. Firstly, there is a strong correlation between the real estate sector and the financial services sector, the construction industry, as well as wholesale and retail trade. Notably, China’s real estate sector exhibits relatively high direct consumption of financial service activities compared to other major countries. Secondly, there is a transition trend in both the input and output of the real estate sector from primary and secondary industries towards service-oriented industries. Lastly, key determinants influencing the economic effects of the real estate sector in a country include economic growth, current national income level, expense structure of the economy, aging population, as well as urbanization speed.

1. Introduction

Real estate plays a pivotal role in the socio-economic development of all countries worldwide. Several empirical studies have demonstrated that the progress of the real estate market is closely linked to economic development and social stability [1,2,3,4,5]. A housing boom has the potential to stimulate household consumption and drive GDP growth [6,7]. In addition, as typical collateral, housing commodities largely determine the credit constraints of various industries and play an important role in economic development [8].

In the context of globalization and open markets, the real estate market is inevitably influenced by external factors, which in turn have ripple effects on other sectors of the economy [9]. Governments typically view real estate regulation as a crucial policy tool for driving economic growth due to the strong interdependence between the real estate sector and other sectors of the economy [10,11]. Therefore, it is imperative to accurately comprehend the linkages between the real estate sector and other sectors within national economies and to explore the core drivers of industrial linkage effects in the real estate sector.

Reaching a comprehensive understanding of the linkages is essential for gaining a competitive advantage in the real estate sector as the rapid growth of sectors with high linkages will stimulate real estate development. Furthermore, when these sectors enter foreign markets, it will be easier for the real estate sector to gain access to those markets [12]. Additionally, identifying the determinants of the economic effects of the real estate sector is crucial for systematically examining its role. Internationally comparative studies on the role of real estate within economies are of great importance for policymaking and economic development, providing comprehensive information on the impacts of the real estate sector on the economy.

Input–output analysis, established by Leontief in 1936 [13], is a widely utilized method for examining the industrial structure, which holds significance in shaping industry policies and business strategies [14]. The input–output technique offers a quantitative approach to analyzing sectoral linkages and proposing policy implications [15,16,17]. While many researchers have investigated the macroeconomic impacts of the real estate sector using input–output analysis, most have focused solely on horizontally comparing the related effects of real estate across different regions or countries without specifically analyzing the key factors influencing its economic effects.

For instance, Pagliari et al. has conducted an analysis of the input–output relationship between commercial real estate in Australia, Canada, the United Kingdom, and the United States from 1985 to 1995, focusing on U.S. investors [18]. The empirical study by Song et al. revealed that the correlation effect of the real estate sector in Australia, France, and the United States consistently ranked in the top five during the study period, and as the sample countries’ economies developed, the total correlation effect of the real estate industry gradually increased [19]. Bielsa and Duarte assessed inter-sectoral linkage effects of Spain’s construction industry based on Spain’s input–output table and compared results with OECD countries such as Belgium, Denmark, Finland, France, and Germany [20]. Ren et al. examined the significance of China’s real estate construction sector through input–output analysis, which showed a strong final demand for this sector, with the regional economies highly dependent on it being particularly vulnerable to falling demand [21]. Chan et al. investigated real and financial linkages between China’s real estate sector and other sectors using input–output analysis, which indicated strengthened linkages between them while also highlighting that credit risk in the real estate sector has a larger spillover effect on other sectors, suggesting that turmoil in this market may have a greater impact on China’s economy than previously reported [22]. Using data from the World Input–Output Database, Liu and Zhu conducted a detailed analysis of changes in output structure within various countries’ construction sectors from 1995 to 2011, demonstrating that real estate activities are one of the main outputs for most countries’ construction sectors [23].

While researchers have examined the linkages between the real estate sector and other sectors in various countries, there has been a lack of focus on the input and output structures as well as the key factors that influence the economic effects of the real estate sector. Utilizing the Inter-Country Input–Output Tables (ICIO) from the OECD Input–Output Database, we conduct an analysis of the inter-sectoral linkage effects of real estate sectors in various countries and undertake a comprehensive investigation into the key factors influencing real estate economic effects.

The major contributions of this study lie in two aspects. Firstly, it presents new evidence on the push and pull effects of the real estate sector, as well as its changes in input and output structure. Secondly, this study empirically demonstrates the determinants of development using a panel dataset containing annual data from 63 countries (regions) between 2010 and 2018.

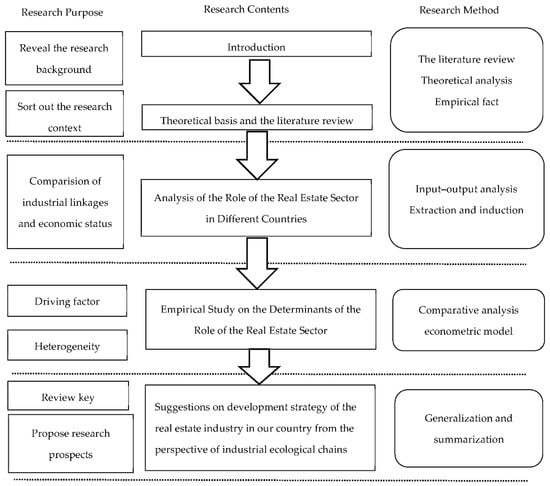

The rest of this paper is organized as follows. Section 2 analyzes the economic effects of the real estate sector in the economy using the input–output approach. Section 3 investigates the key factors that affect the real estate’s economic effects by using the panel data model, to deeply understand the real estate sector’s impact on the national economy. Section 4 presents the discussion, and Section 5 provides the conclusion. The technical roadmap for this paper is as follows (Figure 1):

Figure 1.

Research technical roadmap.

2. Analysis of the Role of the Real Estate Sector in Different Countries

2.1. Methods

A typical input–output table can be divided into three parts: the intermediate demand table, the final demand table, and the value-added table. The intermediate demand table describes the mutual input–output relationships between departments. Rows indicate the flow of output from one department to other departments, while lists indicate the input received by one department from other departments. The final demand table displays the demand for final goods and services that are not intended for further production, including household consumption, government consumption, investment, and exports. The value-added table records the value added by each department in the production process, including labor remuneration, capital income, and taxes.

It is widely accepted that input–output analysis within a country’s economy can be categorized into two forms: a physical input–output analysis and monetary input–output analysis. The former primarily examines the flow of intermediate goods between sectors, excluding monetary factors, while the latter considers fluctuations arising from relative price changes across various economic sectors. Unlike traditional industries, real estate commodities are quintessential investment products, whose economic significance is more contingent on their monetary attributes than their physical characteristics. Fluctuations in real estate value directly influence a company’s financing capacity and asset valuation. Therefore, relying solely on physical intermediate goods flow analysis can lead to significant biases. Indeed, the predominant research on the economic impact of the real estate sector often employs monetary input–output analysis [18,24]; this approach acknowledges that changes in the monetary value of real estate assets not only affect enterprise asset valuation but also inform production decisions, making it inseparable from the input–output analysis process.

The method to investigate inter-sectoral linkages and economic effects is based on two types of indicators derived from input–output analysis. The indicators to measure the linkages between the real estate sector and other sectors include the direct requirement coefficient and direct distribution coefficient; the former represents the direct backward linkage and the latter represents the direct forward linkage. The indicators to measure the economic effects of the real estate sector include the index of power of dispersion (IPD) and index of sensitivity of dispersion (ISD), which represent the pull effect and push effect on the economy, respectively.

In this paper, the direct requirement (technical coefficient) coefficient is used to measure the direct backward linkage between the real estate sector and other sectors, which presents the influence of the real estate sector on other sectors due to direct consumption in the process of production and operation. The formula for the direct consumption coefficient is as follows:

where represents the intermediate demand of products or services of sector by sector ; and denotes the gross input of sector . The greater the value of , the greater the demand of sector for sector , which means a stronger direct backward linkage. The direct distribution coefficient is used to indicate the direct forward linkage of the real estate sectors with other sectors, which is denoted as follows:

where denotes the gross output of sector . The greater the value of , the stronger the direct forward linkage, which means more output of sector flow to sector .

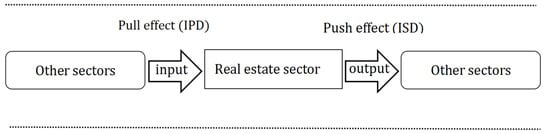

Leontief’s Inverse Matrix is used to measure the total demand effects between sectors within an economy, derived from the Intermediate Input Matrix. Assuming Z as the Intermediate Input Matrix, the relationship between total output X and intermediate inputs and final demand Y can be denoted as . Solving for X, we can finally obtain the relationship between total output and final demand: , where is the identity matrix and is Leontief’s Inverse Matrix. In this paper, IPD and ISD are used to measure the pull and push effects of the real estate sector on the macro-economy, respectively. The IPD and ISD were introduced by Rasmussen [25], the former reflects the extent of the production demand generated by various sectors of the national economy when a sector adds one unit for final use in a national economy, measuring to what extent the development of other economic sectors has driven the growth of the real estate industry. The latter presents the amount of output that the sector needs to provide for the production of other sectors for an increase in one unit for final use in each sector of the national economy, measuring to what extent the development of the real estate sector contributes to the growth of other industries. According to its description, we provide graphical representation of the IPD and ISD (Figure 2):

Figure 2.

Graphical representation of IPD and ISD.

IPD and ISD actually measure the pull and push effects of the real estate sector in the economy. We can imagine that within an economy, the development of other sectors will require more factories and collateral, thereby creating demand for real estate products, “pulling” the development of real estate. With the further prosperity of the real estate industry, more diverse housing products and diversified development models have provided support for the further development of other industries, thereby “pushing” the development of other sectors. The larger the value of IPD, the stronger the pull effect for economic development is, indicating the sector is a leading sector. The larger the value of ISD, the stronger the push effects for economic development are, implying the sector plays a key role in an economy [26]. We use the method improved by Liu (2002) to calculate IPD and ISD [27]. The IPD is calculated as follows:

where is Leontief’s inverse coefficient; is the final product composition coefficient; is the final product quantity of sector ; is the total output of the national economy. The ISD is calculated as follows:

where is the fully supplied matrix element, namely ; H is the matrix of direct distribution coefficient. Finally, is the constituent coefficient of initial input, where is the initial input of sector ; is the total initial input of the national economy.

2.2. Data

The data employed to analyze the inter-sectoral linkages and economic effects were the Inter-Country Input–Output Tables (ICIO) published by the OECD Input–Output Database in 2020 [28]. The latest edition of the OECD Inter-Country Input–Output (ICIO) has 45 unique industries based on ISIC Revision 4. Tables are provided for 76 countries (and the Rest of the World) from 1995 to 2018. Considering the integrity of the data used for better understanding the real estate sector, other sectors, and change trends in various countries, a 45 × 45 input–output table of 67 countries and regions (excluding Cypress, Melta, Mexico, etc.) over the past 9 years was used. The sector we investigate is the real estate activities sector (D68), which encompasses the buying and selling of own real estate, renting, operating own or leased real estate, real estate agencies, and the management of real estate on a fee or contract basis. In this paper, we consider the real estate activities sector as the real estate sector to perform analysis.

Backward linkages are those that occur with other industrial sectors through demand linkages. For example, for the real estate industry, its relationship with the construction industry is a backward correlation. The direct consumption coefficient is an index to measure the backward direct correlation between industries. The backward perfect correlation degree reflects the complete driving effect of an industry on other industries through direct and indirect ways to consume the products or services provided by the industry in the production operation. In Section 3.2, the backward correlation degree is expressed by the direct consumption coefficient, namely in Equation (1).

The direct distribution coefficient is an index to measure the forward direct correlation between industries. The forward correlation degree reflects the promotional effect of an industry on other industries by directly or indirectly providing products or services to other industries during production and operation. In Section 3.2, the forward correlation degree is expressed by the direct allocation coefficient, namely in Equation (2).

2.3. Results

- (1)

- Comparison of inter-sectoral linkages

Financial service activities, construction, and real estate activities are the main sectors which the real estate sector has direct backward linkages with in most countries (shown in Appendix A). The development of real estate requires large amounts of capital, and business development and consumers need assistance from financial systems. Therefore, the real estate sector has strong direct backward linkages with the financial sector. The construction sector also plays an important input role for the real estate sector. A variety of real estate products including housing, offices, and industry are built by the construction sector. Therefore, the construction sector is strongly connected with the real estate sector. In line with Liu, the top rank of output from the construction sector is real estate activities, and the high rank indicates the close linkage between the real estate sector and construction sector [23]. What is more, the real estate sector has a direct relationship with itself.

Table 1 lists the top five sectors that the real estate sector has direct backward linkage with in China from 2010 to 2018. Financial services activities and administrative and support services are most closely linked with China’s real estate sector. After the reform in 1998, China’s private property management and brokerage business was promoted. The role of the real estate sector as a service sector has been strengthened. As can be seen from Table 1, most of the sectors promoted by the real estate sector are service-oriented sectors, such as real estate activities, administrative and support services, and accommodation and food service activities. The reason for this is probably the growing demand for services in China [29].

Table 1.

Ranked sectors of the backward linkage of the real estate sector in China: 2010–2018.

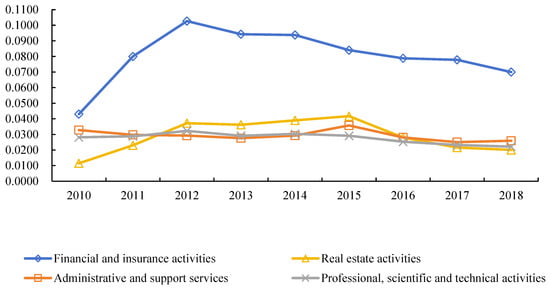

Figure 3 shows the changes in the input indicator of four main sectors. From 2010 to 2012, the direct input indicator between financial service activities and the real estate sector exhibits an upward trend, indicating a gradual increase in the demand for financial services. In 2012, the value reached 0.1027. Subsequently, the demand began to decline, reaching 0.0700 by 2018. Notably, the financial sector maintained the top rank over the 9-year period, underscoring the close relationship between real estate development and the financial sector in China. The real estate activities sector demonstrated a gradual upward trend until 2015, after which the demand for this sector decreased to 0.0201 by 2018. The demand for administrative and support services and the professional, scientific, and technical activities sector both fluctuate around 0.0300, indicating a stable pull effect of the real estate sector on these two sectors. Analyzing the changing input indicators of the four sectors reveals a gradual decrease in their linkages with the real estate sector after 2015.

Figure 3.

The changes in input indicator of real estate in China.

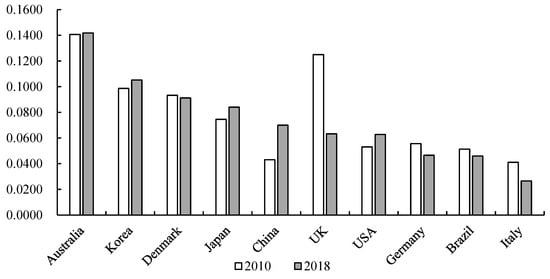

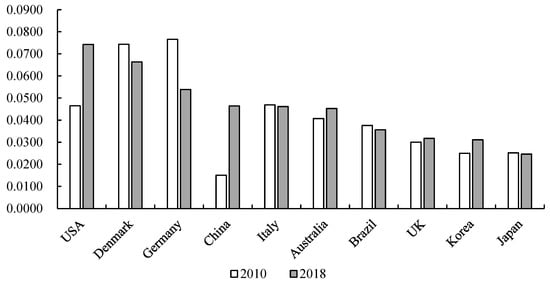

The input indicator of the financial sector in selected countries (regions) in 2010 and 2018 is displayed in Figure 4. The requirements of the financial sector of real estate in China were relatively high among those countries. In 2010, the value was 0.1407 in Australia, which was the highest among the ten selected countries during the same period. The value in the UK was 0.1250, which was larger than Korea (0.0986), Denmark (0.0933), Japan (0.0746), and Germany (0.0556). In 2018, the input indicator of the financial sector of real estate in Australia was 0.1418 and China had a value of 0.0700, which was larger than the UK (0.0632), USA (0.0628), and Germany (0.0466).

Figure 4.

The input indicator of financial sector in 2010 and 2018.

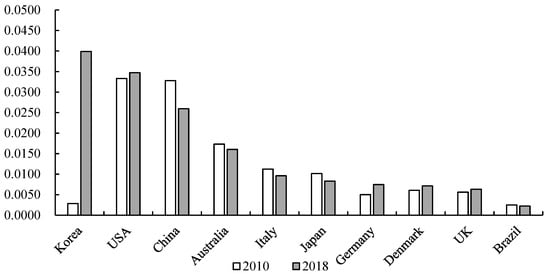

The input indicator of the administrative sector in selected countries in 2010 and 2018 is displayed in Figure 5. In 2000, the value for China was 0.0328, which was the highest among the ten countries. In 2018, Korea (0.0399) and the USA (0.0347) had higher values than China (0.0259).

Figure 5.

The input indicator of administrative sector in 2010 and 2018.

Wholesale trade and retail trade, IT and other information services, and telecommunications are the major three sectors that the real estate sector has direct forward linkage with (shown in Appendix B). Table 2 displays the top five sectors that real estate distributes to directly from 2010 to 2018. It shows that the real estate sector mainly directly flows to the wholesale and retail trade in China, which also implies the strong push effect of real estate to this sector.

Table 2.

Ranked sectors of the forward linkage of the real estate sector in China: 2010–2018.

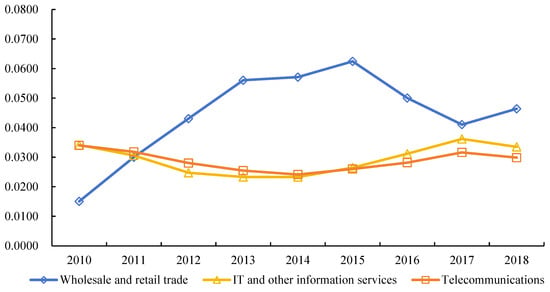

Figure 6 further illustrates the changing push effects of the real estate sector on wholesale trade and retail trade, IT and other information services, and the telecommunications sectors from 2010 to 2018 in China. The push effect on wholesale trade shows an increasing trend before 2015 (0.0624), but it decreased to 0.0410 in 2017. Similarly, the push effects on the other two sectors follow a comparable trend, fluctuating between 0.0200 and 0.0400, indicating an increase in the demand for real estate to a certain extent.

Figure 6.

The changes in output indicator of real estate in China.

The output indicator of the wholesale trade sector in selected countries (regions) in 2010 and 2018 is displayed in Figure 7. Among the selected countries (regions), the demand of the wholesale trade sector for real estate is relatively large, which implies that a large proportion of Chinese real estate products and services are distributed to the wholesale trade sector. Compared to other countries such as Korea, Japan, and the UK, Chinese real estate’s push effect on wholesale trade is much greater.

Figure 7.

The output indicator of wholesale trade sector in 2010 and 2018.

The linkage of the real estate sector with other sectors shows a transition to service-oriented sectors. Appendix D shows the changes in the input structure and output structure of the real estate sector. We calculate the ranking of 45 sectors in the input and output structure of China’s real estate industry in 2010 and 2018, respectively, and summarize the comparison results of the two years in Table 3 to demonstrate the changes in the input structure and output structure of China’s real estate industry during the sample period.

Table 3.

Statistics of input and output structure change.

Columns A–G represent the seven classifications of the forty-five sectors according to the ISIC Revision 4 standard: A represents agriculture, forestry, animal husbandry, and fishery; B stands for mining; C denotes manufacturing; D refers to electricity, gas, steam, and air conditioning supply; E pertains to water supply, sewerage, waste management, and remediation activities; F indicates construction; G represents services.

Regarding the related sectors of mining (column B), in the input structure, two mining sectors experienced a decrease in their ranking for input to real estate, while one mining sector increased its ranking. In the output structure, two mining sectors increased their ranking for the consumption of real estate, while one mining sector decreased its ranking.

From the perspective of the service industry (column G), compared with 2010, in the input–output of the real estate industry in 2018, 12 sectors of the service industry ranked lower in the input structure and 10 sectors ranked higher in the output structure, indicating that the real estate industry’s demand for the service industry has decreased but the products and services flowing from the real estate industry to the service industry have increased significantly.

At the same time, in the input and output structure of the real estate industry to the manufacturing industry (column C), the rise and fall in all sectors of the manufacturing industry are almost equal, indicating a stable linkage between the manufacturing industry and the real estate industry.

- (2)

- Comparison of pull and push effects on the economy

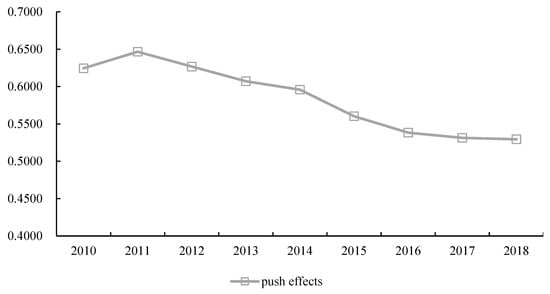

In most countries, the push effects of real estate are less than the average social impact. As shown in Appendix C, real estate in Austria, the Czech Republic, Denmark, Estonia, Finland, Germany, Greece, Hungary, Ireland, Italy, Latvia, Lithuania, The Netherlands, Norway, Russia, the Slovak Republic, Sweden, and the USA has a pull effect stronger than the average social impact, which implies real estate in these countries plays a leading role in their economic development. Only the push effects of The Netherlands’s real estate remain greater than 1.0000, which implies that real estate in The Netherlands is a key industry. The push effects of the real estate sector in the USA, Japan, and China are relatively weak, with China showing a lower value compared to the USA and Japan.

Figure 8 illustrates the trend of the push effect of China’s real estate sector. Analyzing the changes in the push effects of China’s real estate activities over the past 9 years, the value of the push effect demonstrates a decreasing trend over time, decreasing from 0.6466 in 2011 to 0.5294 in 2018. This indicates a gradual weakening of the significant role that the real estate sector plays in economic development.

Figure 8.

The push effects of China’s real estate sector from 2010 to 2018 (the OECD’s input–output table does not report final demand data for China so pull effects of China cannot be measured. The same below).

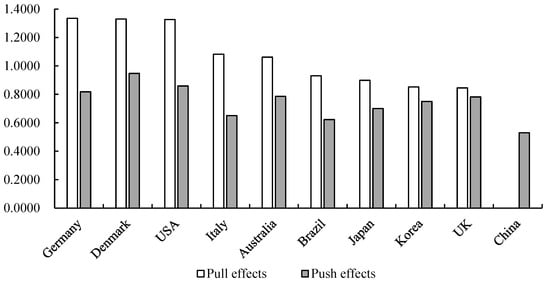

Figure 9 displays the pull and push effects of selected countries (regions) in 2018. Real estate in Germany has the strongest pull effect, with a value of 1.3347. Real estate in Denmark has the strongest push effects, and the value is 0.9474.

Figure 9.

Pull and push effects of selected countries in 2018.

Table 4 lists the rank of pull and push effects of selected countries (regions) in 2010 and 2018. Taking the example of China, the pull effect of real estate in 2010 (rank 27) fell to rank 29 in 2018 and is expressed using the symbol “↓” to represent the downward trend. On the other hand, the push effects of real estate in 2010 (rank 36) moved to 29 in 2018 and is expressed using “↑” for the upward trend. Where there was no difference between 2010 and 2018, “-” is used to express the same number. It reflects that in the USA, real estate plays an increasingly leading and supporting role in the economy. In contrast, real estate’s push effects in most countries on the economy are sliding down, except in Denmark, Korea, and the USA.

Table 4.

Rank of real estate’s pull and push effects in 2010 and 2018.

3. Empirical Study on the Determinants of the Role of the Real Estate Sector

In this section, we conduct an empirical analysis of determinants of the economic effects of the real estate sector using a panel regression model. Also, the approaches of lagging terms and removing control variables are employed to make the test robust.

3.1. Model

The development of a country’s real estate sector is generally affected by the country’s economic fundamentals, financial development, and demographics, as well as urbanization level [26,30,31,32,33,34,35].

Accordingly, the basic empirical models are constructed as the following equations.

and are the dependent variables that, respectively, represent the pull effects (IPD mentioned in Section 2) and push effects (ISD mentioned in Section 2) of the real estate sector on economy in country at the period . Eight factors are incorporated as the explanatory variables, including , , , , , , , and .

The first four factors represent the economic fundamentals of a country. Among which, and are, respectively, the annual growth of GDP and per capita GDP of country in the period , measuring the level of the country’s economic development. and measure the structural features of the country’s economic development. is the share of industry value added to GDP of country in the period , representing the country’s industrial structure. is the ratio of fixed capital formation and final consumption of country in the period , representing the expense structure of country in the period .

and are used to measure a country’s financial development. is the share of domestic credit to the private sector in the GDP of country in the period . is the share of the total value of stocks traded in the GDP of country in the period .

is the share of urban population in the total population of country in the period , representing the country’s urbanization level. The demographic factor considered is , which refers to the elderly dependency ratio of country in the period .

Finally, is the intercept; denotes the individual fixed effect; indicates error terms. The definition of variables is listed in Table 5.

Table 5.

Definition of variables.

3.2. Descriptive Analysis

There are 63 countries used in Section 2 selected as the sample in the empirical analysis; some countries (regions) are excluded due to missing data of some key variables. All the data for the sample countries over the period from 2010 to 2018 were collected from the World Bank database. The descriptive statistics for variables used in this study are presented in Table 6. The means, medians, standard deviations, and maximum and minimum values are summarized for all variables. In Table 7, we present the correlations of the variables. As shown in the table, most of the selected explanatory variables are significantly associated with the dependent variables. All variables are then standardized for regression analysis.

Table 6.

Descriptive statistics, N = 63 cross-country; T = 2010–2018.

Table 7.

Correlations.

3.3. Empirical Results

- (1)

- Regression Analysis

According to the basic models (1) and (2), we implemented regression analysis, respectively, for the pull and push effects of the real estate sector based on the cross-country panel data from 2010 to 2018. Several models are estimated including the pooled ordinary least squares (OLS), the random effects regression model (RE), and fixed effects regression model (FE). In addition, Hausman tests are carried out, which suggest the fixed effect model should be adopted for both regressions for the pull and push effects.

The empirical results of the pull effect using the fixed effect model are presented in Table 8. As shown in the table, two models are estimated for the pull effects, among which model (1) and model (2) are, respectively, the estimation results of the single fixed effects model and double fixed effects model. The results indicate the significant positive effects of INVESTRATIO, GDPY, and OLDRATIO on PULL and the significant negative effects of INPGDP and INDUSTRY on PULL. The effects of PRIVATE, STOCK, and URBANIZATION are not significant.

Table 8.

Regression results of PULL effect.

Based on the above analysis, we find that the pull effects of the real estate sector are significantly affected by a country’s economic fundamentals and expense structure of the economy. The per capita GDP has a substantial negative impact on the pull effects, while the annual growth of GDP has a positive impact on the pull effects. It means that for a country with rapid economic growth, the real estate sector has more inter-sectoral linkages with other sectors, which then has stronger pull effects on the economy. However, when an economy becomes more developed, the pull effects of the real estate sector are weaker. These might be attributed to the role change of the real estate sector in a country. In a rapidly growing economy, the real estate sector often plays a pivotal role within the economy. As an asset that combines both consumption and investment attributes, real estate products typically have strong collateral properties, acting as a financial accelerator in economic development. This leads to a higher return rate for the real estate sector in fast-growing economies, further enhancing its driving effect. However, as the economy matures and housing price growth begins to slow, this driving effect gradually diminishes.

The relative amount of fixed capital formation exhibits a positive coefficient in our regression model. As production capacity increases, the expansion needs of enterprises grow, leading to higher demand for industrial real estate and office space, further driving the real estate market, resulting in a higher pull effect on the real estate sector.

The regression results of the push effect are reported in Table 9. As it shows, three models are also estimated for the push effects, among which model (1) and model (2) are, respectively, the estimation results of the single fixed effects model and double fixed effects model. The results indicate the significant positive effects of URBANIZATION and OLDRATIO on PUSH as well as the significant negative effects of STOCK, PRIVATE, and INDUSTRY on PUSH. Except for these five variables, the effects of other explanatory variables are not significant.

Table 9.

Regression results of PUSH effect.

Urbanization has a positive impact on the PUSH effect of the real estate sector. In the early stage of urbanization, the speed of urbanization is accelerating, and the real estate sector’s role in the economy is mainly reflected in its direct contribution to investment growth in the economy, while the inter-sectoral role in other sectors is relatively weak. When the country enters the latter stage of urbanization and the process of urbanization slows down, the real estate sector is amazingly embedded in the interaction of different sectors in the progress of economic development, strengthening its supportive role in development.

The coefficient of PRIVATE and STOCK is significantly negative. The former is because when the proportion of private sector credit to GDP is too high, the risk within the financial system also increases. To address potential financial risks, financial institutions may adopt tighter credit policies, reducing support for the real estate market. This would further suppress the development of the real estate sector and its push effect on other industries. The latter is probably due to the crowding-out effect of the stock market. With the prosperity of the stock market and the increasing proportion of investors investing in the stock market, the inflow of funds into the real estate sector—which is also an important investment product—has decreased, leading to a weakening of the push effect of real estate commodities on the economy.

Industrialization has significantly suppressed the importance of the real estate sector, resulting in the negative coefficient both in the push and pull effects. This is because as industrialization deepens, resources (including capital, human resources, and land) increasingly shift towards the industrial sector. The development of the industrial sector requires substantial capital investment, leading to a transfer of investment funds from the real estate sector to the industrial sector, thereby reducing the capital available for the real estate sector and suppressing its output growth.

The aging population also positively contributes to the increasing role in economic development, which can be partially attributed to the diversity of real estate demand. As the population ages, the proportion of elderly individuals rises, leading to higher demand for age-friendly housing and communities, including an accessible design, medical facilities, and retirement homes, which drives rapid development in specific segments of the real estate market (such as senior housing), thereby boosting the status of the real estate sector in the economy.

- (2)

- Robustness tests

In order to check the robustness of the estimation, we substitute all the explanatory variables with their one-order lagging term to deal with the endogeneity. The robustness test results of the pull effect are reported in columns (1) and (2) in Table 10; the results of the push effect are presented in columns (1) and (2) in Table 11. The robustness tests show that most of the results are consistent with the former estimation.

Table 10.

Robustness test results of PULL effect with variables in lagging terms.

Table 11.

Robustness test results of PUSH effect with variables in lagging terms.

Moreover, we carry out regression with the control variables removed, The results of the pull effect without the control variable are reported in columns (3) and (4) in Table 12. The results of the push effect without the control variable are presented in columns (3) and (4) in Table 13. Compared to columns (1) and (2), it can be found from the results that the key factors are significant whether we remove the control variables or not in the regression, which proves that the empirical results are robust.

Table 12.

Robustness test results of PULL effect removing control variable.

Table 13.

Robustness test results of PUSH effect removing control variable.

- (3)

- Heterogeneity tests

Depending on the strength of government regulation, real estate industries and related industries may develop differently, and this factor is a very important aspect influencing the establishment of a balance in the development of industries and their sustainability. Therefore, considering that the national legislation of a particular country may affect the relationship between real estate market development and the financial sector, based on the government regulation data of each country, this paper divides the sample into three groups—a low level of government regulation, medium level of government regulation, and high level of government regulation—using the time spent dealing with the requirements of government regulations provided by the World Bank as the proxy of government regulation, and conducts heterogeneity analysis by regression of the low government regulation group and high government regulation group.

In Table 14, the regression results of the samples with low government regulation are closest to the main test conclusions. Among the main influencing factors, gdpy and industry display great differences in their influence on the pull effects due to different levels of government regulation. In the samples with high government regulation, no matter how GDP increases, the government may adjust the development pace of the real estate industry through policy means to avoid excessive impact or dependence on other industries caused by its excessive expansion. At the same time, under the strict supervision of the government, the increase in the proportion of the output value of the real estate industry reflects the natural growth of the market scale rather than the unlimited expansion, so it is difficult for this growth to significantly weaken its role as an economic engine in driving other industries. To sum up, government regulation, as a regulator, balances the relationship between the real estate industry and other industries and ensures stable economic development.

Table 14.

Heterogene ity test results of PULL effect in different government regulation levels.

In Table 15, the regression results of the samples with low government regulation are closest to the main test conclusions. However, in samples with high government regulation, most influencing factors fail to exert the original impact on the PUSH effect due to different levels of government regulation. In the environment of high government regulation, the government’s strict supervision and regulation measures on the real estate industry may have weakened the role of the market mechanism in resource allocation. Therefore, even if the proportion of the output value of the real estate industry increases, the investment intensity increases, the private sector becomes more active, or the share circulation improves, it is difficult for these market factors to directly and significantly promote the development of other industries because the government’s policy orientation and intervention become the key factors affecting the economic effect of the real estate industry.

Table 15.

Heterogeneity test results of PUSH effect in different government regulation levels.

Additionally, considering that the construction and financial sectors in different countries are at different stages of their development life cycle, the development of the real estate industry should be taken into account when it comes to comparisons of different states. Therefore, based on the proportion of the real estate industry output value in each country, this paper divides the sample into three groups—a low level of real estate development, medium level of real estate development, and high level of real estate development—and conducts heterogeneity analysis by regression of the low and high real estate development group in Table 16 and Table 17.

Table 16.

Heterogeneity test results of PULL effect in different real estate development levels.

Table 17.

Heterogeneity test results of PUSH effect in different real estate development levels.

In Table 16, the regression results of the samples with a moderate real estate development level are closest to the main test conclusions, while in Table 17, the regression results of the samples with a low real estate development level are closest to the main test conclusions. Most main influencing factors influence the pull and push effects differently due to various real estate development levels.

Therefore, countries with high real estate development have mature markets, and GDP growth no longer significantly stimulates the extraordinary expansion of the real estate industry, so it does not play an obvious role in driving other industries. For countries with a high degree of real estate development, an increase in the share of real estate output may attract and occupy more resources, squeezing other sectors and reducing the positive pull on other sectors. Even if the proportion of the real estate industry output value increases and the private economic activity rises, the marginal effect of promoting the development of other industries will not be significantly enhanced because other industries have already adapted to the existing industrial structure. In addition, when the development of the national real estate industry is successful, aging does not cause large-scale housing demand changes or policy adjustments, which is not enough to significantly change the role of real estate in promoting other economic sectors.

4. Discussion

In most countries, the pull effect on the economy of the real estate sector ranks behind, which shows that the real estate sector in these countries has limited driving force for the development of the national economy compared with other sectors. However, in some countries, including Norway, Sweden, Austria, and The Netherlands, the pull effects on the economy of the real estate sector are higher than the average social level, indicating that the more the economy develops, the greater the demand pressure of the real estate sector on the products of other sectors. The real estate sector may become a “bottleneck” industry for the development of other sectors, and unhealthy development of the real estate sector will affect the development of other sectors [22]. Therefore, the coordinated development of the real estate sector plays a crucial role in the healthy development of a national economy.

In terms of the dynamic development of the input and output structure of the real estate sector, in response to the changing trends of the world economy, the real estate sector in all countries has shifted from incremental development to stock development, presenting a service trend to some extent. On the one hand, the importance of the real estate sector has become increasingly prominent as the proportion of the tertiary sector in the social economy has gradually increased, and the role of related sectors has gradually increased. On the other hand, with the trend of a service economy in the world, the relative sectors of the real estate sector have shifted from the traditional material sectors to service sectors. The industrial structure has gradually shown a trend of “servitization”, in other words, for the development of the real estate sector, the consumption of material resources has been relatively reduced, and the consumption of information and knowledge has increased.

However, real estate sectors in some countries rely too much on service sectors. Judging from the input structure, the real estate sector in China, Australia, and Singapore is highly related to the financial sector, and its relevance to the construction industry is relatively low. This unreasonable industrial structure may lead to a vicious change in the overall economy, which is not conducive to the long-term development of the real estate sector and the overall economy. Conversely, in Canada and Denmark, the financial sector and the construction sector are closely related to the real estate sector. The linkage between the real estate sector and the construction sector is greater than that of the financial sector. Over-reliance on the financial sector may lead to unregulated development, high market prices, and strong speculation, thus becoming a trigger for a financial crisis. In China and the USA, administrative and support service activities account for a large proportion of the input structure of the real estate sector, indicating the real estate sector has a close relationship with the government. Thus, the development of the real estate sector is strongly intervened by the government and the high housing price is inevitable. However, it is worth noting that the real estate sectors of these two countries have a different degree of correlation with themselves, and the real estate sector in the United States is closely linked with social welfare, which could promote the long-term development of the real estate sector and the overall economy. In contrast, China’s real estate sector has a low degree of linkage with itself, indicating a low degree of specialization, industrial efficiency, and social service quality. In addition, when the proportion of the real estate output value in a country is at a high level, the driving force of its promotional effect on other national economic sectors will play a more significant role. However, its promotional effect is also more likely to weaken with a decrease in urbanization speed and slow industrial development, which to some extent explains the economic status change in the real estate industry from prosperity to decline. Hence, China should expand the circulation and service areas of the real estate sector and increase its own linkage in order to avoid an unregulated and unhealthy development of the real estate sector.

Compared with current research, this paper contributes to the dynamic evolution of the role of the real estate sector in economic development as well as the driving force of the push and pull effects in terms of the real estate sector. We find that such driving forces exhibit a significant heterogeneous trend among different government regulation levels and the life cycle of the real estate sector. We hope that our research can provide a more systematic perspective on measuring the role of the real estate market in the economy, uncovering key factors that affect the intrinsic development of the real estate sector, thereby improving the sustainability of the real estate sector in the national economy.

However, there are some limitations in our study. A common concern about our research is that our research is mainly based on the input–output table, which cannot catch the relative change in prices between different economic sectors. Due to the dual attributes of investment and consumer goods in real estate products, the driving and stimulating role of the real estate sector may not only be due to its role in transforming its position in economic development but also to changes in its prices themselves. In addition, the push and pull effects proposed in this article focus more on the driving role of real estate commodities as intermediate goods between different sectors but there is relatively less involvement in the consumption of real estate commodities as final commodities. Therefore, in future research, we will shift our research approach and attempt to use a general equilibrium model based on the SAM table to strengthen the theoretical analysis of role transformation in the real estate market, in order to make up for the shortcomings of the current research.

In addition, we consider real estate activities as the real estate sector, this excludes the construction of housing, offices, etc.; this could lead to an underestimation of the real estate sector’s effects to some extent. Future research could consider restructuring the national input and output tables, combining the real estate sector and the building part of the construction sector as a new sector and, based on this, could explore the role of the real estate sector.

5. Conclusions and Implications

Using data from a world input–output table database covering 67 countries from 2010 to 2018, we examine the role of the real estate sector in various countries and its determinants by using input–output analysis and a panel model. To be specific, we quantitatively explore the inter-sectoral linkages, economic effects, and key factors of real estate on a multinational level, shedding light on the changing trends in the economy by observing changes in economic effects. The research findings can provide useful information for both policymakers and enterprises in formulating policies that facilitate the development of the economy and relative production activities of real estate.

Results show that in most countries, the input of real estate is from financial services activities, construction, and real estate activities, and the services of the real estate sector mainly flow to wholesale trade and retail trade. Moreover, the requirement of financial activities in China’s real estate sector is relatively high among major countries. In addition, the inputs and outputs of the real estate sector show a transition to serviced-oriented sectors. As in most countries, the push effects of the real estate sector are less than the average social impact, and the key industry role that China’s real estate plays is decreasing.

The key determinants of the pull effects are a country’s economic fundamentals and the expense structure of the economy. The per capita GDP has a substantial negative impact on the pull effects, while economic growth has a positive impact on the pull effects. The speed of urbanization has a positive impact on the role of the real estate sector. Additionally, the more a country’s economic growth is driven by capital formation, the less of a role the real estate sector plays in the country’s economy. Also, the push effects of the real estate sector are positively affected by a country’s aging population and the degree of urbanization.

The results of this study lead to several policy implications. First, the findings imply that the development of real estate should decrease the dependence on financial activities and it is necessary to increase the flow of financial activities to the economy. Second, the government should pay more attention to the quality of urbanization as well as the speed of urbanization.

Author Contributions

Conceptualization, J.H.; Methodology, W.G.; Software, C.G.; Validation, C.G.; Formal analysis, W.G.; Resources, J.H.; Data curation, S.W.; Writing—original draft, J.H.; Writing—review & editing, S.W.; Supervision, X.L. and S.L.; Project administration, S.L.; Funding acquisition, X.L. All authors have read and agreed to the published version of the manuscript.

Funding

This work was supported by the National Natural Science Foundation of China (Grant No. 71974180; No. 72334006).

Institutional Review Board Statement

Not applicable.

Data Availability Statement

The data presented in this study are available on request from the corresponding author.

Conflicts of Interest

The authors declare no conflict of interest.

Appendix A. Direct Input Indicator of the Real Estate Sector from 2010 to 2018

| No. | Country/Region | 2010 | 2014 | 2018 | |||

| Sector | Value | Sector | Value | Sector | Value | ||

| 1 | Switzerland | D41T43 | 0.0702 | D41T43 | 0.0651 | D41T43 | 0.05567 |

| D64T66 | 0.0530 | D64T66 | 0.0438 | D69T75 | 0.04021 | ||

| 2 | Türkiye | D41T43 | 0.0168 | D41T43 | 0.0306 | D41T43 | 0.04050 |

| D23 | 0.0108 | D23 | 0.0256 | D23 | 0.03283 | ||

| 3 | Japan | D64T66 | 0.0746 | D64T66 | 0.0712 | D64T66 | 0.08404 |

| D41T43 | 0.0261 | D41T43 | 0.0342 | D68 | 0.03371 | ||

| 4 | Cambodia | D35 | 0.0513 | D64T66 | 0.0395 | D64T66 | 0.03917 |

| D61 | 0.0283 | D61 | 0.0289 | D61 | 0.03028 | ||

| 5 | Thailand | D64T66 | 0.0702 | D64T66 | 0.0835 | D64T66 | 0.06453 |

| D35 | 0.0602 | D35 | 0.0579 | D35 | 0.04262 | ||

| 6 | Tunisia | D64T66 | 0.0411 | D64T66 | 0.0536 | D64T66 | 0.05853 |

| D35 | 0.0126 | D35 | 0.0090 | D35 | 0.01086 | ||

| 7 | Greece | D41T43 | 0.0437 | D64T66 | 0.0489 | D64T66 | 0.02529 |

| D64T66 | 0.0321 | D41T43 | 0.0265 | D41T43 | 0.02260 | ||

| 8 | Argentina | D41T43 | 0.0233 | D41T43 | 0.0242 | D41T43 | 0.02084 |

| D77T82 | 0.0133 | D77T82 | 0.0138 | D45T47 | 0.01355 | ||

| 9 | Lithuania | D16 | 0.0411 | D68 | 0.0849 | D68 | 0.05101 |

| D45T47 | 0.0227 | D77T82 | 0.0349 | D77T82 | 0.02893 | ||

| 10 | Slovakia | D41T43 | 0.0983 | D64T66 | 0.0654 | D68 | 0.07392 |

| D68 | 0.0580 | D68 | 0.0571 | D64T66 | 0.05415 | ||

| 11 | Australia | D64T66 | 0.1407 | D64T66 | 0.1420 | D64T66 | 0.14179 |

| D41T43 | 0.0647 | D41T43 | 0.0549 | D41T43 | 0.05588 | ||

| 12 | Denmark | D41T43 | 0.0954 | D64T66 | 0.0991 | D41T43 | 0.10031 |

| D64T66 | 0.0933 | D41T43 | 0.0922 | D64T66 | 0.09122 | ||

| 13 | Spain | D64T66 | 0.0510 | D64T66 | 0.0359 | D64T66 | 0.03844 |

| D41T43 | 0.0350 | D41T43 | 0.0246 | D41T43 | 0.03707 | ||

| 14 | Vietnam | D35 | 0.0343 | D41T43 | 0.1045 | D41T43 | 0.15955 |

| D41T43 | 0.0190 | D23 | 0.0244 | D69T75 | 0.02405 | ||

| 15 | New Zealand | D64T66 | 0.0725 | D68 | 0.0700 | D68 | 0.06804 |

| D68 | 0.0626 | D64T66 | 0.0659 | D41T43 | 0.06309 | ||

| 16 | Brunei Darussalam | D64T66 | 0.0580 | D64T66 | 0.0558 | D64T66 | 0.08456 |

| D41T43 | 0.0441 | D41T43 | 0.0397 | D41T43 | 0.01507 | ||

| 17 | Malta | D41T43 | 0.0493 | D41T43 | 0.0654 | D41T43 | 0.06780 |

| D68 | 0.0459 | D69T75 | 0.0294 | D69T75 | 0.03204 | ||

| 18 | Poland | D35 | 0.1337 | D41T43 | 0.1055 | D35 | 0.11195 |

| D41T43 | 0.0950 | D35 | 0.0878 | D41T43 | 0.09533 | ||

| 19 | Malaysia | D64T66 | 0.1246 | D64T66 | 0.0507 | D19 | 0.05428 |

| D68 | 0.0670 | D41T43 | 0.0362 | D64T66 | 0.04909 | ||

| 20 | The Netherlands | D64T66 | 0.2525 | D64T66 | 0.2845 | D64T66 | 0.16119 |

| D41T43 | 0.0956 | D41T43 | 0.0947 | D41T43 | 0.11371 | ||

| 21 | Belgium | D41T43 | 0.0631 | D64T66 | 0.0726 | D64T66 | 0.06400 |

| D64T66 | 0.0573 | D41T43 | 0.0529 | D68 | 0.04031 | ||

| 22 | The Philippines | D64T66 | 0.0468 | D45T47 | 0.0510 | D45T47 | 0.04621 |

| D45T47 | 0.0257 | D01T02 | 0.0234 | D01T02 | 0.02126 | ||

| 23 | Latvia | D41T43 | 0.0882 | D68 | 0.0922 | D68 | 0.04967 |

| D35 | 0.0499 | D35 | 0.0336 | D35 | 0.02743 | ||

| 24 | Colombia | D64T66 | 0.0452 | D77T82 | 0.0264 | D77T82 | 0.02519 |

| D77T82 | 0.0216 | D41T43 | 0.0262 | D41T43 | 0.02253 | ||

| 25 | Saudi Arabia | D64T66 | 0.0307 | D41T43 | 0.0496 | D41T43 | 0.04495 |

| D41T43 | 0.0252 | D64T66 | 0.0118 | D64T66 | 0.00955 | ||

| 26 | France | D64T66 | 0.0642 | D64T66 | 0.0680 | D64T66 | 0.04581 |

| D68 | 0.0291 | D68 | 0.0241 | D68 | 0.02424 | ||

| 27 | Kazakhstan | D68 | 0.1183 | D41T43 | 0.0287 | D41T43 | 0.04484 |

| D01T02 | 0.0552 | D77T82 | 0.0154 | D49 | 0.02913 | ||

| 28 | Finland | D41T43 | 0.0614 | D41T43 | 0.0599 | D41T43 | 0.05633 |

| D64T66 | 0.0396 | D64T66 | 0.0394 | D64T66 | 0.04742 | ||

| 29 | Peru | D64T66 | 0.0389 | D64T66 | 0.0412 | D64T66 | 0.03190 |

| D69T75 | 0.0176 | D69T75 | 0.0172 | D69T75 | 0.01443 | ||

| 30 | China Non-Processing | D64T66 | 0.0430 | D64T66 | 0.0937 | D64T66 | 0.06999 |

| D77T82 | 0.0328 | D68 | 0.0390 | D77T82 | 0.02594 | ||

| 31 | Chinese Taipei | D64T66 | 0.0730 | D64T66 | 0.0700 | D41T43 | 0.05380 |

| D41T43 | 0.0480 | D41T43 | 0.0590 | D64T66 | 0.04865 | ||

| 32 | India | D41T43 | 0.0628 | D41T43 | 0.0675 | D41T43 | 0.06684 |

| D64T66 | 0.0221 | D64T66 | 0.0201 | D64T66 | 0.01887 | ||

| 33 | Myanmar | D64T66 | 0.1208 | D64T66 | 0.1250 | D64T66 | 0.12498 |

| D41T43 | 0.0506 | D41T43 | 0.0356 | D41T43 | 0.03231 | ||

| 34 | Iceland | D41T43 | 0.0600 | D41T43 | 0.0561 | D41T43 | 0.07944 |

| D64T66 | 0.0379 | D64T66 | 0.0383 | D64T66 | 0.03170 | ||

| 35 | Estonia | D41T43 | 0.0524 | D41T43 | 0.0552 | D41T43 | 0.08130 |

| D64T66 | 0.0506 | D64T66 | 0.0372 | D64T66 | 0.04036 | ||

| 36 | Luxembourg | D64T66 | 0.0656 | D64T66 | 0.0408 | D64T66 | 0.06971 |

| D41T43 | 0.0229 | D41T43 | 0.0280 | D41T43 | 0.04826 | ||

| 37 | The United States | D64T66 | 0.0530 | D64T66 | 0.0632 | D64T66 | 0.06276 |

| D68 | 0.0449 | D41T43 | 0.0435 | D41T43 | 0.04258 | ||

| 38 | Morocco | D64T66 | 0.0917 | D64T66 | 0.0938 | D64T66 | 0.08073 |

| D68 | 0.0035 | D69T75 | 0.0047 | D69T75 | 0.00357 | ||

| 39 | The Russian Federation | D68 | 0.0500 | D68 | 0.0414 | D68 | 0.05503 |

| D35 | 0.0293 | D35 | 0.0276 | D35 | 0.03533 | ||

| 40 | Ireland | D64T66 | 0.1764 | D64T66 | 0.0558 | D69T75 | 0.04008 |

| D41T43 | 0.0283 | D41T43 | 0.0174 | D41T43 | 0.02818 | ||

| 41 | Israel (2) | D64T66 | 0.0374 | D69T75 | 0.0274 | D69T75 | 0.03283 |

| D69T75 | 0.0355 | D64T66 | 0.0264 | D64T66 | 0.02481 | ||

| 42 | Chile | D41T43 | 0.1577 | D41T43 | 0.1185 | D41T43 | 0.10594 |

| D69T75 | 0.0268 | D64T66 | 0.0414 | D64T66 | 0.03776 | ||

| 43 | Germany | D41T43 | 0.0760 | D41T43 | 0.0709 | D41T43 | 0.07856 |

| D64T66 | 0.0556 | D64T66 | 0.0582 | D64T66 | 0.04656 | ||

| 44 | Bulgaria | D41T43 | 0.0727 | D64T66 | 0.0644 | D64T66 | 0.06928 |

| D64T66 | 0.0714 | D41T43 | 0.0558 | D41T43 | 0.06456 | ||

| 45 | Slovenia | D41T43 | 0.0331 | D41T43 | 0.0280 | D64T66 | 0.03400 |

| D64T66 | 0.0173 | D69T75 | 0.0167 | D41T43 | 0.02640 | ||

| 46 | Costa Rica | D64T66 | 0.0633 | D64T66 | 0.0527 | D64T66 | 0.05889 |

| D41T43 | 0.0350 | D41T43 | 0.0394 | D69T75 | 0.02724 | ||

| 47 | South Africa | D64T66 | 0.0441 | D64T66 | 0.0608 | D64T66 | 0.06020 |

| D45T47 | 0.0269 | D45T47 | 0.0266 | D45T47 | 0.02970 | ||

| 48 | Hungary | D64T66 | 0.0847 | D64T66 | 0.0655 | D64T66 | 0.05699 |

| D69T75 | 0.0271 | D41T43 | 0.0284 | D41T43 | 0.03587 | ||

| 49 | Norway | D64T66 | 0.0649 | D64T66 | 0.0871 | D64T66 | 0.06105 |

| D41T43 | 0.0460 | D41T43 | 0.0481 | D41T43 | 0.05338 | ||

| 50 | The United Kingdom | D64T66 | 0.1250 | D64T66 | 0.0858 | D64T66 | 0.06322 |

| D41T43 | 0.0631 | D41T43 | 0.0607 | D41T43 | 0.05257 | ||

| 51 | Cyprus (1) | D41T43 | 0.0993 | D41T43 | 0.0745 | D41T43 | 0.03609 |

| D64T66 | 0.0782 | D64T66 | 0.0482 | D68 | 0.01947 | ||

| 52 | Singapore | D64T66 | 0.0911 | D64T66 | 0.1046 | D64T66 | 0.08129 |

| D69T75 | 0.0489 | D69T75 | 0.0408 | D69T75 | 0.04449 | ||

| 53 | Korea | D64T66 | 0.0986 | D64T66 | 0.1253 | D64T66 | 0.10517 |

| D35 | 0.0211 | D41T43 | 0.0296 | D77T82 | 0.03990 | ||

| 54 | Italy | D64T66 | 0.0410 | D64T66 | 0.0339 | D64T66 | 0.02653 |

| D69T75 | 0.0289 | D69T75 | 0.0214 | D69T75 | 0.01574 | ||

| 55 | Rest of the World | D64T66 | 0.0390 | D64T66 | 0.0331 | D41T43 | 0.03980 |

| D41T43 | 0.0249 | D41T43 | 0.0255 | D64T66 | 0.03669 | ||

| 56 | Croatia | D45T47 | 0.0270 | D45T47 | 0.0239 | D41T43 | 0.05734 |

| D35 | 0.0210 | D35 | 0.0207 | D35 | 0.03070 | ||

| 57 | Canada | D64T66 | 0.0682 | D64T66 | 0.0687 | D64T66 | 0.06609 |

| D41T43 | 0.0538 | D41T43 | 0.0533 | D41T43 | 0.05844 | ||

| 58 | Hong Kong, China | D64T66 | 0.1227 | D64T66 | 0.1275 | D64T66 | 0.15151 |

| D68 | 0.0534 | D68 | 0.0572 | D68 | 0.05334 | ||

| 59 | Austria | D41T43 | 0.0848 | D41T43 | 0.0928 | D41T43 | 0.09489 |

| D36T39 | 0.0525 | D68 | 0.0451 | D68 | 0.05331 | ||

| 60 | Sweden | D41T43 | 0.1240 | D41T43 | 0.1311 | D41T43 | 0.12666 |

| D64T66 | 0.0615 | D64T66 | 0.0696 | D64T66 | 0.05518 | ||

| 61 | Mexico Non-global manufacturing | D68 | 0.0320 | D68 | 0.0399 | D68 | 0.02896 |

| D69T75 | 0.0137 | D69T75 | 0.0131 | D69T75 | 0.01084 | ||

| 62 | Portugal | D64T66 | 0.0390 | D64T66 | 0.0289 | D64T66 | 0.03465 |

| D41T43 | 0.0214 | D41T43 | 0.0197 | D41T43 | 0.01705 | ||

| 63 | Romania | D64T66 | 0.0312 | D64T66 | 0.0453 | D64T66 | 0.04394 |

| D41T43 | 0.0238 | D68 | 0.0188 | D68 | 0.02303 | ||

| 64 | Indonesia | D41T43 | 0.0799 | D41T43 | 0.0826 | D41T43 | 0.07438 |

| D64T66 | 0.0249 | D64T66 | 0.0187 | D64T66 | 0.01422 | ||

| 65 | Czechia | D41T43 | 0.0715 | D64T66 | 0.0778 | D41T43 | 0.07066 |

| D64T66 | 0.0706 | D41T43 | 0.0736 | D64T66 | 0.06289 | ||

| 66 | Lao (People’s Democratic Republic) | D41T43 | 0.1651 | D41T43 | 0.2114 | D41T43 | 0.24825 |

| D68 | 0.0241 | D68 | 0.0221 | D68 | 0.01296 | ||

| 67 | Brazil | D64T66 | 0.0513 | D64T66 | 0.0546 | D64T66 | 0.04594 |

| D41T43 | 0.0068 | D69T75 | 0.0065 | D69T75 | 0.00664 | ||

Appendix B. Direct Output Indicator of the Real Estate Sector from 2010 to 2018

| No. | Country/Region | 2010 | 2014 | 2018 | |||

| Sector | Value | Sector | Value | Sector | Value | ||

| 1 | Switzerland | D52 | 0.0324 | D61 | 0.0215 | D61 | 0.0214 |

| D55T56 | 0.0319 | D68 | 0.0209 | D68 | 0.0188 | ||

| 2 | Türkiye | D53 | 0.0557 | D53 | 0.0588 | D53 | 0.0638 |

| D45T47 | 0.0544 | D45T47 | 0.0533 | D45T47 | 0.0513 | ||

| 3 | Japan | D50 | 0.1083 | D50 | 0.1095 | D52 | 0.0413 |

| D52 | 0.0381 | D52 | 0.0416 | D68 | 0.0337 | ||

| 4 | Cambodia | D07T08 | 0.0278 | D68 | 0.0218 | D68 | 0.0255 |

| D16 | 0.0240 | D62T63 | 0.0157 | D62T63 | 0.0188 | ||

| 5 | Thailand | D64T66 | 0.0077 | D64T66 | 0.0072 | D58T60 | 0.0040 |

| D62T63 | 0.0053 | D58T60 | 0.0058 | D64T66 | 0.0036 | ||

| 6 | Tunisia | D90T93 | 0.0196 | D90T93 | 0.0158 | D90T93 | 0.0195 |

| D94T96 | 0.0157 | D94T96 | 0.0108 | D94T96 | 0.0110 | ||

| 7 | Greece | D61 | 0.2276 | D61 | 0.2426 | D61 | 0.2000 |

| D69T75 | 0.1440 | D45T47 | 0.1408 | D45T47 | 0.1139 | ||

| 8 | Argentina | D52 | 0.0335 | D52 | 0.0258 | D52 | 0.0229 |

| D45T47 | 0.0210 | D45T47 | 0.0164 | D45T47 | 0.0144 | ||

| 9 | Lithuania | D29 | 0.1159 | D68 | 0.0849 | D62T63 | 0.0676 |

| D03 | 0.1074 | D90T93 | 0.0658 | D90T93 | 0.0661 | ||

| 10 | Slovakia | D49 | 0.1338 | D55T56 | 0.0850 | D68 | 0.0739 |

| D55T56 | 0.0584 | D68 | 0.0571 | D90T93 | 0.0666 | ||

| 11 | Australia | D77T82 | 0.0427 | D77T82 | 0.0492 | D77T82 | 0.0541 |

| D45T47 | 0.0407 | D45T47 | 0.0451 | D45T47 | 0.0453 | ||

| 12 | Denmark | D55T56 | 0.0850 | D55T56 | 0.0881 | D55T56 | 0.0899 |

| D45T47 | 0.0743 | D45T47 | 0.0735 | D45T47 | 0.0663 | ||

| 13 | Spain | D45T47 | 0.0474 | D45T47 | 0.0462 | D45T47 | 0.0436 |

| D50 | 0.0401 | D50 | 0.0462 | D50 | 0.0390 | ||

| 14 | Vietnam | D53 | 0.0368 | D45T47 | 0.0228 | D45T47 | 0.0242 |

| D68 | 0.0179 | D68 | 0.0214 | D68 | 0.0231 | ||

| 15 | New Zealand | D52 | 0.0781 | D52 | 0.0777 | D52 | 0.0789 |

| D68 | 0.0626 | D68 | 0.0700 | D68 | 0.0680 | ||

| 16 | Brunei Darussalam | D90T93 | 0.0430 | D90T93 | 0.0376 | D90T93 | 0.0245 |

| D94T96 | 0.0171 | D94T96 | 0.0176 | D94T96 | 0.0105 | ||

| 17 | Malta | D68 | 0.0459 | D51 | 0.0188 | D51 | 0.0296 |

| D45T47 | 0.0237 | D45T47 | 0.0168 | D68 | 0.0283 | ||

| 18 | Poland | D90T93 | 0.0278 | D90T93 | 0.0272 | D90T93 | 0.0338 |

| D86T88 | 0.0210 | D86T88 | 0.0217 | D86T88 | 0.0326 | ||

| 19 | Malaysia | D68 | 0.0670 | D68 | 0.0267 | D68 | 0.0404 |

| D84 | 0.0332 | D84 | 0.0137 | D77T82 | 0.0153 | ||

| 20 | The Netherlands | D52 | 0.0585 | D52 | 0.0549 | D55T56 | 0.0448 |

| D55T56 | 0.0535 | D55T56 | 0.0433 | D52 | 0.0446 | ||

| 21 | Belgium | D52 | 0.0391 | D45T47 | 0.0338 | D68 | 0.0403 |

| D45T47 | 0.0371 | D52 | 0.0322 | D55T56 | 0.0393 | ||

| 22 | The Philippines | D51 | 0.0444 | D21 | 0.0165 | D21 | 0.0134 |

| D62T63 | 0.0338 | D07T08 | 0.0115 | D07T08 | 0.0095 | ||

| 23 | Latvia | D45T47 | 0.0744 | D55T56 | 0.1153 | D55T56 | 0.1316 |

| D90T93 | 0.0671 | D68 | 0.0922 | D45T47 | 0.0826 | ||

| 24 | Colombia | D45T47 | 0.0639 | D52 | 0.0659 | D52 | 0.0576 |

| D61 | 0.0549 | D45T47 | 0.0567 | D45T47 | 0.0531 | ||

| 25 | Saudi Arabia | D45T47 | 0.0231 | D45T47 | 0.0308 | D45T47 | 0.0307 |

| D31T33 | 0.0172 | D31T33 | 0.0280 | D31T33 | 0.0237 | ||

| 26 | France | D45T47 | 0.0458 | D45T47 | 0.0430 | D45T47 | 0.0418 |

| D77T82 | 0.0337 | D77T82 | 0.0318 | D77T82 | 0.0281 | ||

| 27 | Kazakhstan | D68 | 0.1183 | D94T96 | 0.2798 | D94T96 | 0.1683 |

| D10T12 | 0.0348 | D62T63 | 0.0511 | D64T66 | 0.1003 | ||

| 28 | Finland | D55T56 | 0.0719 | D55T56 | 0.0714 | D55T56 | 0.0654 |

| D51 | 0.0631 | D45T47 | 0.0608 | D45T47 | 0.0606 | ||

| 29 | Peru | D94T96 | 0.1018 | D94T96 | 0.0886 | D94T96 | 0.0850 |

| D85 | 0.0601 | D85 | 0.0494 | D61 | 0.0492 | ||

| 30 | China Non-Processing | D62T63 | 0.0341 | D45T47 | 0.0571 | D94T96 | 0.0624 |

| D61 | 0.0340 | D94T96 | 0.0405 | D45T47 | 0.0464 | ||

| 31 | Chinese Taipei | D90T93 | 0.0357 | D90T93 | 0.0399 | D55T56 | 0.0469 |

| D45T47 | 0.0335 | D45T47 | 0.0333 | D90T93 | 0.0415 | ||

| 32 | India | D41T43 | 0.0185 | D41T43 | 0.0223 | D49 | 0.0191 |

| D61 | 0.0128 | D49 | 0.0122 | D41T43 | 0.0185 | ||

| 33 | Myanmar | D68 | 0.0364 | D68 | 0.0302 | D68 | 0.0273 |

| D62T63 | 0.0255 | D62T63 | 0.0226 | D62T63 | 0.0254 | ||

| 34 | Iceland | D94T96 | 0.0274 | D94T96 | 0.0261 | D94T96 | 0.0258 |

| D68 | 0.0200 | D68 | 0.0220 | D68 | 0.0222 | ||

| 35 | Estonia | D55T56 | 0.0844 | D55T56 | 0.0936 | D55T56 | 0.1230 |

| D45T47 | 0.0721 | D45T47 | 0.0764 | D45T47 | 0.0882 | ||

| 36 | Luxembourg | D41T43 | 0.0594 | D77T82 | 0.0453 | D94T96 | 0.0354 |

| D77T82 | 0.0463 | D94T96 | 0.0349 | D77T82 | 0.0341 | ||

| 37 | The United States | D94T96 | 0.0847 | D94T96 | 0.0923 | D94T96 | 0.0826 |

| D90T93 | 0.0799 | D52 | 0.0776 | D55T56 | 0.0817 | ||

| 38 | Morocco | D52 | 0.0380 | D52 | 0.0292 | D52 | 0.0256 |

| D51 | 0.0291 | D58T60 | 0.0239 | D51 | 0.0237 | ||

| 39 | The Russian Federation | D94T96 | 0.0637 | D55T56 | 0.0589 | D55T56 | 0.0755 |

| D55T56 | 0.0606 | D49 | 0.0551 | D45T47 | 0.0573 | ||

| 40 | Ireland | D55T56 | 0.0675 | D55T56 | 0.0659 | D55T56 | 0.0729 |

| D45T47 | 0.0657 | D45T47 | 0.0404 | D90T93 | 0.0708 | ||

| 41 | Israel (2) | D52 | 0.0868 | D52 | 0.0804 | D55T56 | 0.0728 |

| D55T56 | 0.0668 | D55T56 | 0.0739 | D52 | 0.0709 | ||

| 42 | Chile | D55T56 | 0.0554 | D90T93 | 0.0617 | D61 | 0.0708 |

| D45T47 | 0.0548 | D45T47 | 0.0562 | D45T47 | 0.0648 | ||

| 43 | Germany | D61 | 0.0779 | D61 | 0.0703 | D61 | 0.0712 |

| D45T47 | 0.0766 | D55T56 | 0.0615 | D41T43 | 0.0569 | ||

| 44 | Bulgaria | D62T63 | 0.0733 | D62T63 | 0.0676 | D62T63 | 0.0650 |

| D61 | 0.0419 | D52 | 0.0524 | D52 | 0.0575 | ||

| 45 | Slovenia | D45T47 | 0.0215 | D36T39 | 0.0289 | D45T47 | 0.0109 |

| D52 | 0.0157 | D45T47 | 0.0208 | D55T56 | 0.0075 | ||

| 46 | Costa Rica | D35 | 0.0751 | D35 | 0.0648 | D35 | 0.0276 |

| D58T60 | 0.0521 | D58T60 | 0.0511 | D45T47 | 0.0155 | ||

| 47 | South Africa | D55T56 | 0.0452 | D45T47 | 0.0393 | D45T47 | 0.0423 |

| D45T47 | 0.0407 | D69T75 | 0.0327 | D69T75 | 0.0337 | ||

| 48 | Hungary | D90T93 | 0.0531 | D90T93 | 0.0563 | D94T96 | 0.0661 |

| D94T96 | 0.0492 | D94T96 | 0.0553 | D90T93 | 0.0525 | ||

| 49 | Norway | D55T56 | 0.0754 | D55T56 | 0.0759 | D55T56 | 0.0369 |

| D45T47 | 0.0632 | D45T47 | 0.0607 | D45T47 | 0.0367 | ||

| 50 | The United Kingdom | D45T47 | 0.0300 | D45T47 | 0.0340 | D45T47 | 0.0318 |

| D52 | 0.0183 | D52 | 0.0252 | D55T56 | 0.0229 | ||

| 51 | Cyprus (1) | D45T47 | 0.0599 | D45T47 | 0.0693 | D45T47 | 0.0436 |

| D58T60 | 0.0275 | D51 | 0.0359 | D53 | 0.0299 | ||

| 52 | Singapore | D94T96 | 0.0787 | D55T56 | 0.0916 | D55T56 | 0.0852 |

| D55T56 | 0.0541 | D94T96 | 0.0735 | D94T96 | 0.0661 | ||

| 53 | Korea | D55T56 | 0.0479 | D55T56 | 0.0473 | D45T47 | 0.0311 |

| D69T75 | 0.0334 | D69T75 | 0.0350 | D55T56 | 0.0273 | ||

| 54 | Italy | D45T47 | 0.0469 | D45T47 | 0.0476 | D55T56 | 0.0464 |

| D55T56 | 0.0425 | D55T56 | 0.0474 | D45T47 | 0.0462 | ||

| 55 | Rest of the World | D94T96 | 0.0293 | D94T96 | 0.0362 | D94T96 | 0.0374 |

| D55T56 | 0.0257 | D62T63 | 0.0243 | D55T56 | 0.0285 | ||

| 56 | Croatia | D45T47 | 0.0524 | D45T47 | 0.0487 | D53 | 0.0202 |

| D69T75 | 0.0264 | D53 | 0.0292 | D45T47 | 0.0198 | ||

| 57 | Canada | D94T96 | 0.0575 | D94T96 | 0.0525 | D94T96 | 0.0513 |

| D45T47 | 0.0375 | D45T47 | 0.0353 | D45T47 | 0.0364 | ||

| 58 | Hong Kong, China | D52 | 0.1338 | D94T96 | 0.1292 | D52 | 0.1329 |

| D94T96 | 0.1205 | D52 | 0.1175 | D94T96 | 0.1223 | ||

| 59 | Austria | D84 | 0.0475 | D50 | 0.0520 | D68 | 0.0533 |

| D68 | 0.0444 | D84 | 0.0458 | D84 | 0.0454 | ||

| 60 | Sweden | D55T56 | 0.0874 | D90T93 | 0.0883 | D84 | 0.0543 |

| D90T93 | 0.0846 | D85 | 0.0805 | D55T56 | 0.0521 | ||

| 61 | Mexico Non-global manufacturing | D52 | 0.0915 | D62T63 | 0.0871 | D58T60 | 0.0733 |

| D58T60 | 0.0644 | D58T60 | 0.0843 | D62T63 | 0.0722 | ||

| 62 | Portugal | D45T47 | 0.0295 | D45T47 | 0.0242 | D45T47 | 0.0161 |

| D53 | 0.0265 | D58T60 | 0.0224 | D90T93 | 0.0121 | ||

| 63 | Romania | D45T47 | 0.0591 | D45T47 | 0.0644 | D45T47 | 0.0561 |

| D68 | 0.0173 | D68 | 0.0188 | D68 | 0.0230 | ||

| 64 | Indonesia | D45T47 | 0.0223 | D94T96 | 0.0410 | D94T96 | 0.0366 |

| D62T63 | 0.0146 | D45T47 | 0.0176 | D45T47 | 0.0177 | ||

| 65 | Czechia | D90T93 | 0.0694 | D55T56 | 0.0754 | D55T56 | 0.0650 |

| D68 | 0.0670 | D68 | 0.0613 | D68 | 0.0601 | ||

| 66 | Lao (People’s Democratic Republic) | D85 | 0.0274 | D85 | 0.0390 | D85 | 0.0413 |

| D68 | 0.0241 | D45T47 | 0.0357 | D45T47 | 0.0366 | ||

| 67 | Brazil | D90T93 | 0.0948 | D90T93 | 0.1149 | D90T93 | 0.1267 |

| D45T47 | 0.0376 | D45T47 | 0.0417 | D45T47 | 0.0356 | ||

Appendix C. Pull and Push of the Real Estate Sector from 2000 to 2018

| Country/Region | 2010 | 2014 | 2018 | |||

| Pull Effects | Push Effects | Pull Effects | Push Effects | Pull Effects | Push Effects | |

| Argentina | 0.7240 | 0.6623 | 0.6816 | 0.6631 | 0.6547 | 0.6635 |

| Australia | 0.9719 | 0.8184 | 1.0419 | 0.8054 | 1.0618 | 0.7859 |

| Austria | 1.1660 | 0.9042 | 1.1861 | 0.9056 | 1.2188 | 0.9178 |

| Belgium | 1.0132 | 0.8483 | 0.9695 | 0.8234 | 1.0276 | 0.8090 |

| Bulgaria | 0.9174 | 0.7672 | 0.9977 | 0.7876 | 1.0568 | 0.8353 |

| Brazil | 0.9240 | 0.6356 | 0.9206 | 0.6250 | 0.9301 | 0.6222 |

| Brunei Darussalam | 0.5022 | 0.7342 | 0.5220 | 0.7348 | 0.4592 | 0.7285 |

| Canada | 0.9805 | 0.8403 | 0.9525 | 0.8397 | 0.9557 | 0.8463 |

| Switzerland | 0.8162 | 0.8396 | 0.6737 | 0.8081 | 0.6882 | 0.7892 |

| Chile | 1.0710 | 0.8509 | 1.0720 | 0.7890 | 1.1512 | 0.7836 |

| China | - | 0.6244 | - | 0.5958 | - | 0.5294 |

| Colombia | 1.1883 | 0.6829 | 1.1704 | 0.6653 | 1.1335 | 0.6571 |

| Costa Rica | 1.1362 | 0.8303 | 1.1558 | 0.8190 | 0.8336 | 0.8188 |

| Cyprus (1) | 0.8884 | 0.8841 | 0.9352 | 0.8466 | 0.9109 | 0.7485 |

| Czechia | 1.2871 | 0.9612 | 1.3162 | 0.9824 | 1.2969 | 0.9703 |

| Germany | 1.4208 | 0.8224 | 1.3567 | 0.8082 | 1.3347 | 0.8174 |

| Denmark | 1.3937 | 0.9189 | 1.3542 | 0.9289 | 1.3293 | 0.9474 |

| Spain | 0.9620 | 0.7005 | 0.9709 | 0.6764 | 1.0015 | 0.7139 |

| Estonia | 1.2085 | 0.8741 | 1.2922 | 0.8780 | 1.4380 | 0.8668 |

| Finland | 1.1814 | 0.8112 | 1.1845 | 0.8047 | 1.1778 | 0.8104 |

| France | 1.0367 | 0.7396 | 1.0105 | 0.7442 | 0.9911 | 0.7335 |

| The United Kingdom | 0.7914 | 0.8596 | 0.8386 | 0.8061 | 0.8452 | 0.7817 |

| Greece | 1.5648 | 0.7383 | 1.6828 | 0.7316 | 1.4925 | 0.7302 |

| Hong Kong, China | 0.4505 | 0.8196 | 0.5332 | 0.8367 | 0.6030 | 0.8488 |

| Croatia | 0.9750 | 0.7904 | 0.9846 | 0.8036 | 0.8205 | 0.9023 |

| Hungary | 1.2386 | 0.9210 | 1.1698 | 0.8934 | 1.2175 | 0.9288 |

| Indonesia | 0.6116 | 0.7217 | 0.6950 | 0.7446 | 0.6991 | 0.7179 |

| India | 0.5393 | 0.6819 | 0.5473 | 0.6816 | 0.5903 | 0.7047 |

| Ireland | 1.1166 | 0.9513 | 1.0432 | 0.8187 | 1.1893 | 0.8353 |

| Iceland | 0.8158 | 0.8300 | 0.8072 | 0.8408 | 0.8159 | 0.8775 |

| Israel (2) | 1.1326 | 0.7659 | 1.1742 | 0.7536 | 1.1770 | 0.7564 |

| Italy | 1.0799 | 0.6643 | 1.0952 | 0.6575 | 1.0822 | 0.6502 |

| Japan | 0.8948 | 0.6959 | 0.9192 | 0.7068 | 0.8988 | 0.7002 |

| Kazakhstan | 0.8641 | 0.9678 | 1.0446 | 0.7674 | 1.2353 | 0.8185 |

| Cambodia | 0.7380 | 0.9282 | 0.7609 | 0.9284 | 0.7544 | 0.9202 |

| Korea | 0.9414 | 0.6759 | 0.9523 | 0.7141 | 0.8518 | 0.7500 |

| Lao (People’s Democratic Republic) | 0.4533 | 0.8828 | 0.6445 | 0.8929 | 0.6454 | 0.8779 |

| Lithuania | 1.2074 | 0.8591 | 1.2568 | 0.9355 | 1.2912 | 0.9194 |

| Luxembourg | 1.1059 | 0.7891 | 0.9784 | 0.8082 | 1.1262 | 0.8615 |

| Latvia | 1.1303 | 0.8621 | 1.3012 | 0.7862 | 1.3313 | 0.7571 |

| Morocco | 0.9187 | 0.7590 | 0.9084 | 0.7834 | 0.9160 | 0.7853 |

| Malta | 0.9195 | 0.8613 | 0.8241 | 0.8655 | 0.8777 | 0.8828 |

| Myanmar | 0.3555 | 0.8344 | 0.3331 | 0.8319 | 0.3265 | 0.8345 |

| Malaysia | 0.6711 | 0.8398 | 0.6997 | 0.7757 | 0.6401 | 0.7854 |

| Mexico | - | 0.7027 | - | 0.7017 | - | 0.7185 |

| The Netherlands | 1.1446 | 1.0431 | 1.1010 | 1.0619 | 1.0343 | 1.0153 |

| Norway | 1.2357 | 0.8861 | 1.2243 | 0.8767 | 1.0253 | 0.8769 |

| New Zealand | 1.2664 | 0.8181 | 1.2788 | 0.8123 | 1.2875 | 0.8151 |

| Peru | 1.2119 | 0.7283 | 1.1519 | 0.7298 | 1.1563 | 0.7262 |

| The Philippines | 0.5193 | 0.7800 | 0.4080 | 0.7704 | 0.4187 | 0.7828 |

| Poland | 0.7483 | 0.9749 | 0.7945 | 0.9453 | 0.8514 | 0.9907 |

| Portugal | 0.8601 | 0.6919 | 0.8351 | 0.7042 | 0.7460 | 0.7131 |

| Romania | 0.6951 | 0.6807 | 0.7452 | 0.6975 | 0.7792 | 0.7538 |

| The Russian Federation | 1.0468 | 0.7470 | 1.0667 | 0.7453 | 1.1693 | 0.7629 |

| Saudi Arabia | 0.8141 | 0.7544 | 0.9364 | 0.7509 | 0.8299 | 0.7056 |

| Singapore | 1.0927 | 0.8953 | 1.0778 | 0.9012 | 1.0872 | 0.8989 |

| Slovakia | 1.3515 | 0.8647 | 1.2512 | 0.8913 | 1.1554 | 0.8685 |

| Slovenia | 0.8104 | 0.7506 | 0.8238 | 0.7644 | 0.6908 | 0.7736 |

| Sweden | 1.4561 | 0.9852 | 1.4617 | 0.9930 | 1.2941 | 0.9834 |

| Thailand | 0.5703 | 0.7515 | 0.5918 | 0.7529 | 0.5896 | 0.7186 |

| Tunisia | 0.8372 | 0.7640 | 0.8129 | 0.7739 | 0.8264 | 0.7791 |

| Türkiye | 0.9826 | 0.6149 | 0.9798 | 0.7426 | 1.0025 | 0.8446 |

| Chinese Taipei | 0.7439 | 0.7131 | 0.7925 | 0.7193 | 0.8504 | 0.7451 |

| The United States | 1.2636 | 0.8262 | 1.2679 | 0.8238 | 1.3262 | 0.8588 |

| Vietnam | 0.6766 | 0.7142 | 0.6655 | 0.7675 | 0.6155 | 0.8200 |

| South Africa | 1.1385 | 0.7319 | 1.0368 | 0.7878 | 1.0719 | 0.7947 |

| Rest of the World | 0.9078 | 0.7627 | 0.8858 | 0.7680 | 0.8917 | 0.7705 |

Appendix D

| No. | Classification | Sector | Change in Input Structure | Change in Output Structure | ||||||

| ↑ | ↓ | - | Total | ↑ | ↓ | - | Total | |||

| 1 | A | D01T02 | 23 | 23 | 25 | - | 37 | 21 | 13 | ↑ |

| 2 | D03 | 21 | 25 | 25 | ↓ | 17 | 11 | 43 | - | |

| 3 | B | D05T06 | 25 | 25 | 21 | ↑ | 25 | 22 | 24 | ↑ |

| 4 | D07T08 | 25 | 34 | 12 | ↓ | 30 | 18 | 23 | ↑ | |

| 5 | D09 | 26 | 31 | 14 | ↓ | 10 | 34 | 27 | ↓ | |

| 6 | C | D10T12 | 29 | 30 | 12 | ↓ | 35 | 27 | 9 | ↑ |

| 7 | D13T15 | 25 | 31 | 15 | ↓ | 27 | 26 | 18 | ↑ | |

| 8 | D16 | 31 | 27 | 13 | ↑ | 27 | 26 | 18 | ↑ | |

| 9 | D17T18 | 34 | 28 | 9 | ↑ | 22 | 39 | 10 | ↓ | |

| 10 | D19 | 24 | 25 | 22 | ↓ | 24 | 31 | 16 | ↓ | |

| 11 | D20 | 21 | 37 | 13 | ↓ | 24 | 36 | 11 | ↓ | |

| 12 | D21 | 28 | 25 | 18 | ↑ | 36 | 19 | 16 | ↑ | |

| 13 | D22 | 28 | 32 | 11 | ↓ | 31 | 28 | 12 | ↑ | |

| 14 | D23 | 29 | 26 | 16 | ↑ | 23 | 29 | 19 | ↓ | |

| 15 | D24 | 34 | 17 | 20 | ↑ | 27 | 31 | 13 | ↓ | |

| 16 | D25 | 36 | 26 | 9 | ↑ | 25 | 28 | 18 | ↓ | |

| 17 | D26 | 35 | 29 | 7 | ↑ | 30 | 34 | 7 | ↓ | |

| 18 | D27 | 29 | 29 | 13 | ↑ | 23 | 36 | 12 | ↓ | |

| 19 | D28 | 30 | 28 | 13 | ↑ | 25 | 25 | 21 | ↑ | |

| 20 | D29 | 27 | 30 | 14 | ↓ | 27 | 30 | 14 | ↓ | |

| 21 | D30 | 29 | 30 | 12 | ↓ | 29 | 20 | 22 | ↑ | |

| 22 | D31T33 | 29 | 33 | 9 | ↓ | 33 | 27 | 11 | ↑ | |

| 23 | D | D35 | 34 | 23 | 14 | ↑ | 24 | 18 | 29 | - |

| 24 | E | D36T39 | 36 | 24 | 11 | ↑ | 30 | 24 | 17 | ↑ |

| 25 | F | D41T43 | 30 | 25 | 16 | ↑ | 14 | 13 | 44 | - |

| 26 | G | D45T47 | 18 | 23 | 30 | - | 14 | 17 | 40 | - |

| 27 | D49 | 24 | 35 | 12 | ↓ | 27 | 29 | 15 | ↓ | |

| 28 | D50 | 23 | 34 | 14 | ↓ | 34 | 24 | 13 | ↑ | |

| 29 | D51 | 28 | 30 | 13 | ↓ | 37 | 22 | 12 | ↑ | |

| 30 | D52 | 21 | 34 | 16 | ↓ | 35 | 23 | 13 | ↑ | |

| 31 | D53 | 29 | 32 | 10 | ↓ | 28 | 29 | 14 | ↓ | |

| 32 | D55T56 | 31 | 21 | 19 | ↑ | 34 | 22 | 15 | ↑ | |

| 33 | D58T60 | 34 | 23 | 14 | ↑ | 22 | 37 | 12 | ↓ | |

| 34 | D61 | 32 | 26 | 13 | ↑ | 15 | 43 | 13 | ↓ | |

| 35 | D62T63 | 18 | 39 | 14 | ↓ | 45 | 14 | 12 | ↑ | |

| 36 | D64T66 | 33 | 25 | 13 | ↑ | 13 | 13 | 45 | - | |

| 37 | D68 | 24 | 31 | 16 | ↓ | 19 | 24 | 28 | - | |

| 38 | D69T75 | 26 | 27 | 18 | ↓ | 25 | 16 | 30 | - | |

| 39 | D77T82 | 19 | 31 | 21 | ↓ | 30 | 18 | 23 | ↑ | |

| 40 | D84 | 27 | 29 | 15 | ↓ | 28 | 25 | 18 | ↑ | |

| 41 | D85 | 25 | 30 | 16 | ↓ | 35 | 22 | 14 | ↑ | |

| 42 | D86T88 | 30 | 22 | 19 | ↑ | 31 | 25 | 15 | ↑ | |

| 43 | D90T93 | 23 | 30 | 18 | ↓ | 30 | 24 | 17 | ↑ | |

| 44 | D94T96 | 27 | 22 | 22 | ↑ | 24 | 30 | 17 | ↓ | |

| 45 | D97T98 | 0 | 0 | 71 | - | 0 | 0 | 71 | - | |