1. Introduction

The emergence of artificial intelligence (AI) is rapidly changing the operating environment of businesses in several industries. The enhanced capabilities of AI have a significant influence on decision-making processes, resulting in increased operational efficiency and better workflow [

1,

2]. The capacity of AI to evaluate vast quantities of data, provide profound perspectives, and enhance efficiency is propelling its increasing influence on companies. AI has a substantial influence on the field of data analysis. The growing availability of extensive datasets and artificial intelligence technologies enables firms to obtain valuable insights into consumer behavior, market trends, and operational procedures. Artificial intelligence algorithms have the capability to effectively process and analyze large volumes of data in real time, enabling enterprises to make choices based on facts. By improving accuracy, organizations can discern patterns and predict future trends, strengthening their overall performance and competitiveness [

3].

Furthermore, AI can envision and reshape strategic leadership, particularly in relation to environmental, social, and corporate governance (ESG) goals. The convergence of AI with ESG factors is significantly impacting the direction of both enterprises and society in our fast-paced global environment [

4,

5]. This collaboration has significant potential to tackle important issues such as reducing the impact of climate change, fostering social inclusivity, and improving corporate governance. Nevertheless, the implementation of AI presents intricate challenges and apprehensions, as it brings out a distinctive array of hazards and moral predicaments for ESG performance. Given the limited amount of research available on the positive and negative impacts of AI on sustainability, it is crucial for companies to form a leadership working group to gather the necessary information and develop solutions [

6,

7,

8]. This will assist organizations in navigating the intricate intersection of AI and ESG, providing guidance to ensure that their actions are both commercially lucrative and socially and ecologically conscientious [

9].

Hence, the present study seeks to rectify this lack by gathering and presenting an up-to-date assessment of how emerging technologies impact the corporate purpose in strategic leadership, with a focus on the lens of ESG factors. To achieve the research purpose of this study, we used bibliometric analysis together with the R statistical programming language (R 3.6.0+) and the bibliometric tools VOSviewer and Biblioshiny. For this analysis, we obtained a total of 205 research papers from the Scopus database using the PRISMA approach to assure accurate selection. The results emphasize the need of digitizing the boardroom via the integration of AI and ESG practices. It is crucial to prioritize the security of this digitalization process by developing a comprehensive detection system. Therefore, the results indicate that CEOs should give high importance to cybersecurity and transparency issues to successfully build trust in company activities and reduce risks.

The paper is structured in the following manner:

Section 2 offers a concise overview of the existing literature, while

Section 3 gives a comprehensive discussion of the materials and processes used in the study.

Section 4 presents the findings of the bibliometric analysis conducted on the articles sourced from the Scopus database.

Section 5 analyzes the findings and consequences of the study, proposing prospective areas of investigation for future research. The paper is concluded in

Section 6.

2. ESG Principles for AI Governance: A Path Forward for Businesses

Organizations are adopting AI at an unprecedented rate, which has the potential to revolutionize the business sector. However, the governance aspect of AI integration is multifaceted. In the current era of digital transformation, how can companies regulate AI in a manner that is consistent with their core values and societal responsibilities? The solution is the implementation of corporate governance, environmental, and social principles by enterprises.

ESG criteria have emerged as indispensable benchmarks for evaluating an organization’s commitment to sustainable and ethical business practices. When assessing a corporation’s impact on the environment, society, and its internal governance structures, investors, constituents, and regulators consider a diverse array of factors. In recent years, there has been a substantial increase in the significance of ESG consideration and compliance. This is primarily due to the regulations that have been implemented by regulatory bodies in a multitude of countries. For example, the Securities and Exchange Board of India (SEBI) in India has mandated that listed companies adhere to ESG guidelines and submit supplementary ESG reports in addition to their annual financial reports. In addition, the United Nations has established a set of 17 global objectives, which are referred to as the United Nations Sustainable Development Goals (UNSDG). This was ratified by all UN member states in 2015 as part of the 2030 agenda for sustainable development. In addition to profit margins, corporations worldwide are recognizing that sustainable practices have a substantial impact on long-term success, reputation, and stakeholder trust. The implementation of ESG compliance is a demonstration of a commitment to responsible business practices, which aligns companies with global objectives for environmental preservation, social equity, and transparent governance.

A variety of challenges impede the implementation of ESG practices in corporations. However, the integration of technology into the application of ESG is one of the most critical. A commitment to genuine sustainability, transparency, and ongoing development is essential for navigating the complex landscape of ESG issues. In light of the ESG landscape’s continuous and rapid evolution, it is imperative to implement advanced methodologies, techniques, and tools to overcome specific challenges. The manner in which we interact with the world, work, and exist has been radically transformed by the rapid evolution of artificial intelligence (AI). AI is fundamentally concerned with the development of intelligent machines that are capable of learning from experience, resolving complex issues, and adapting to new challenges. AI offers society unparalleled opportunities for efficiency, productivity, and advancement, in addition to technological innovation. AI is a powerful ally in the pursuit of a more connected, inclusive, and intelligent future for humanity. It has the potential to revolutionize health care by providing personalized remedies and to enhance accessibility and convenience in a variety of sectors.

The rapidly evolving landscape of corporate responsibility and governance is being revolutionized by the convergence of AI and ESG principles. AI functions as a beacon, illuminating the path to a future in which businesses not only accomplish financial objectives but also excel in ethical, environmental, and social performance, as the global community increases its commitment to sustainable practices. The current discourse concerning ESG emphasizes the imperative need for strategic interventions and increased awareness. Critical challenges, including climate change, social inequalities, and governance deficiencies, must be addressed by businesses. In this context, the synergy between AI and ESG is indispensable, offering a transformative solution to the intricacies that conventional methods frequently encounter. This article investigates the substantial impact of AI on the improvement of ESG practices, as humanity is presently situated at the intersection of technological innovation and societal responsibility. It aims to demonstrate the potential of AI in enhancing the fundamental principles of environmental sustainability, social responsibility, and effective governance, rather than merely addressing obstacles. Artificial intelligence (AI) is a dynamic tool that has the potential to revolutionize the way corporations operate, from the prediction and prevention of risks to the decoding of complex datasets. This analysis of the potential of AI to facilitate ESG will disclose the awareness gap, analyze the impediments that impede current ESG frameworks, and elucidate the optimistic pathways by which AI can guide us toward a more sustainable and conscientious future. The corporate responsibility landscape is on the brink of a revolution as a result of the transformative capabilities of AI, which are poised to facilitate the harmonious integration of profit and purpose.

The Role of AI in ESG

Today’s business executives must comprehend AI, as it has become a fundamental component of contemporary business strategies. AI is fundamentally a collection of technologies and algorithms that empower machines to execute tasks that ordinarily necessitate human intelligence. These responsibilities encompass the recognition of data patterns, the formulation of decisions based on data analysis, and the comprehension and response to human language. The development of AI has been both swift and transformative. Initially, it was solely a topic of academic research; however, it has since evolved into a practical instrument for businesses in a variety of sectors. This evolution has been driven by advancements in machine learning and deep learning, which are branches of AI that allow computers to learn from data and progress over time. For a business executive, this implies that AI is not an inert instrument, but rather a dynamic solution that adapts and evolves in accordance with the demands of your organization. AI’s importance in the business sector is derived from its capacity to process and analyze data at a rate and scale that exceeds that of humans. This capability opens a plethora of opportunities. AI can offer insights that facilitate more intelligent and effective decision-making, from optimizing supply chains to comprehending consumer behavior patterns. Additionally, it enables your teams to concentrate on the more intricate and innovative aspects of their work by automating routine duties. Nevertheless, the integration of AI into the business environment is not solely a matter of technological adoption; it also requires cultural adaptation. The implementation of AI necessitates a change in the manner in which teams operate and make decisions. It necessitates a data-driven approach, in which decisions are made based on insights obtained from AI analysis rather than merely on intuition or experience.

Therefore, based on the above, AI is essential for ESG activities due to its significant involvement in the analysis of extensive data related to ESG factors. Companies can extract valuable information regarding their environmental impact, social practices, and governance structures from complex data by employing robust machine learning algorithms. Organizations can utilize AI analytics to effectively monitor and evaluate their ESG performance over time. This enables firms to identify areas that require improvement and devise strategies to mitigate their environmental impact, thereby facilitating evidence-based decision-making. AI is instrumental in the management of ESG risk by accurately predicting and identifying potential hazards associated with environmental concerns, societal disputes, and governance failures. Machine learning models can predict the occurrence of ESG difficulties through predictive analytics, which enables companies to take proactive measures to mitigate and resolve these risks before they escalate. In the event of unforeseen ESG disturbances, foresight not only promotes long-term sustainability and resilience but also safeguards a company’s image.

Additionally, the utilization of AI technology is essential for the improvement of transparency in intricate supply chains. By utilizing AI-driven technologies to monitor the environmental and social behaviors of their suppliers, companies can guarantee ethical compliance. This transparency not only facilitates the identification and correction of any unethical business practices within the supply chain, but it also corresponds with the principles of accountability and responsible sourcing in the ESG framework. By offering data-driven insights into ESG issues, artificial intelligence facilitates strategic decision-making. The most effective strategies for attaining sustainability objectives can be identified by companies through the evaluation of the impact of a variety of ESG activities using machine learning algorithms. Additionally, AI assists in the development of ESG policies by analyzing historical performance data and predicting the potential repercussions of various policy strategies. This guarantees that corporations implement ESG policies that are not only effective but also grounded in sound knowledge, thereby fostering positive social and environmental consequences.

Additionally, it is impossible to dispute the undeniable ability of AI to effect substantial changes in ESG issues. It gives businesses the ability to contribute to a fair and robust world while also achieving their sustainability objectives through a diverse array of tools. By employing data-driven insights, AI enables organizations to efficiently navigate the intricacies of ESG concerns. This encompasses the cultivation of meaningful interactions with stakeholders and the optimization of resource utilization. Nevertheless, it is imperative to bear in mind that AI is not a cure-all. It is imperative that we prioritize ethical concerns such as data privacy, prejudice, and transparency. Thus, it is essential to foster collaboration among tech developers, corporations, legislators, and communities to guarantee that AI operates as a beneficial influence in the ESG environment. In the future, we can establish a mutually beneficial partnership between sustainability and technology by confronting the challenges of AI and embracing its potential. Utilizing data and insights, we can establish a trajectory toward a future in which environmental stewardship, social equality, and economic development are intricately linked. The current influx of data, which is being driven by AI, has the potential to create a more equitable and environmentally responsible society for future generations.

Therefore, the integration of artificial intelligence with environmental, social, and governance principles is a potent force that facilitates beneficial transformation. Businesses have a positive impact on the development of a sustainable and socially responsible global society by enhancing their operational efficiency and risk management using AI capabilities for ESG. The advantages are not limited to company performance; they also encompass social welfare, thereby reconciling financial objectives with the common good. The integration of AI into ESG practices is on the brink of becoming an essential component in the pursuit of a more ethical, sustainable, and accountable future as we progress. By incorporating these AI tools and approaches, companies can demonstrate their dedication to responsible and ethical business practices, improve the efficacy of their sustainability initiatives, and expedite the development of their ESG policies.

3. Data and Research Methodology

The current study used bibliometric analysis to investigate the subject topic. Over the last several years, there has been a notable rise in the frequency of bibliometric analysis in business research. There are two main elements that might explain the popularity of this item. The availability and accessibility of scientific databases, such as Scopus and Web of Science, have improved. Similarly, there have been advancements in bibliometric software, like Biblioshiny and VOSviewer [

10,

11]. Secondly, there has been a cross-disciplinary transfer of the bibliometric methodology from information science to business research.

Interestingly, using bibliometric analysis in business research is more than a fad. It is because it is good at (i) organizing large amounts of scientific data and (ii) giving numbers to show how research has affected and improved productivity [

11]. This methodology allows researchers to analyze and compare large datasets efficiently, identify influential authors and institutions, and track the citation patterns of scholarly publications. Moreover, the objective nature of bibliometric analysis adds credibility to business research findings, providing a transparent and replicable way to evaluate the impact and visibility of academic work. As a result, integrating bibliometric analysis in business research has become increasingly valuable for researchers, institutions, and policymakers alike, generating substantial research influence [

12].

Researchers employ bibliometric analysis to evaluate a variety of factors, including the conceptual framework of a specific issue in the existing literature, the effectiveness of academic publications, and the identification of emergent trends in scholarly works. Citations, publications, and the occurrence of keywords and topics are among the objective indicators that are extensively incorporated into comprehensive datasets for bibliometric analysis. The quantity of these indicators may fluctuate, extending from hundreds to thousands. Nevertheless, the analysis of these data frequently necessitates a combination of subjective evaluations, such as theme analysis, and quantitative evaluations, such as performance analysis, which are conducted using well-informed methodologies and techniques. The assessment of the progress of current subjects and the expansion of scientific knowledge is facilitated by bibliometric analysis. It utilizes rigorous methodologies to analyze immense quantities of unstructured data [

13,

14]. Consequently, well-executed bibliometric studies can establish strong bases for advancing a field innovatively and significantly. They provide scholars with the ability to (i) obtain a comprehensive overview in one place, (ii) identify areas where knowledge is lacking, (iii) generate new ideas for further research, and (iv) position their intended contributions within the field [

15].

The data were collected from the Scopus database in the current study, focusing on four key terms: corporate purpose, strategic leadership, emerging technologies, and artificial intelligence. The keyword search is thoroughly given and detailed in

Table 1.

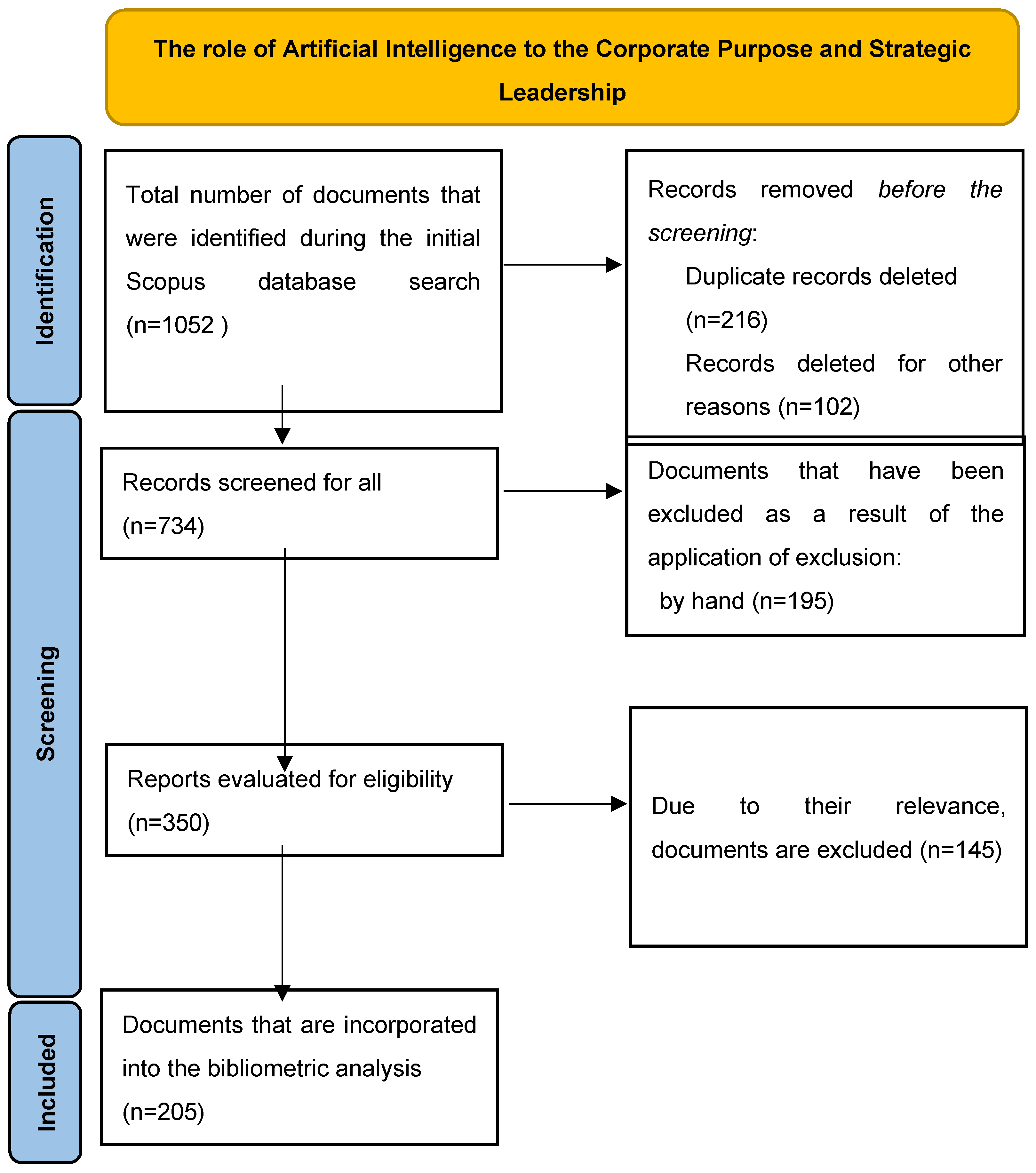

The PRISMA flow diagram visually illustrates the essential stages in the process of choosing a dependable collection of publications for bibliometric research (

Figure 1). The search query yielded 1052 sources in the collection. Nevertheless, when excluding sources that were not articles, the quantity was decreased to 734. Afterward, a comprehensive examination was conducted on a total of 384 publications to exclude those unconnected or that used a broad framework unsuited for studying the influence of artificial intelligence on corporate purpose and strategic leadership. Upon scrutiny of the articles, it was discovered that some of the selected sources need to explicitly indicate the scope and characteristics of the studied region in their title or keywords. As a result, the search criteria were adjusted only to consider publications falling within the predetermined range, excluding any references not pertinent to the present study topic. After this filtering technique, 205 scientific papers were retained and included in the bibliometric analysis.

Additionally,

Figure 2 depicts the five-step procedure of the bibliometric analysis. Furthermore, the bibliometric analysis was conducted exclusively using publications that were published in internationally recognized journals and underwent a rigorous peer-review process. Moreover, the investigation exclusively included articles that were written in the English language. Conversely, the investigation was executed in October 2023. Also, specific criteria were incorporated to guarantee that the final sample was relevant. The following criteria were established: (i) the articles should primarily concentrate on the concepts of artificial intelligence and its impact on corporate purpose and strategic leadership; and (ii) the articles should investigate emerging strategies that companies can implement to adapt to the constantly evolving field of artificial intelligence and ESG criteria. Furthermore, the authors conducted a screening process that entailed an examination of the titles, keywords, and abstracts of the selected publications to prevent any duplications. The articles that did not satisfy the specified criteria were removed from the final sample under examination. As previously indicated, the ultimate sample was obtained by selecting 205 articles.

4. Results

The sample used in this study, spanning from 2009 to 2023, reveals descriptive statistics (

Table 2) indicating that a total of 520 authors have made contributions to the literature on redefining corporate purpose and strategic leadership using emerging technologies, such as AI. Remarkably, out of the whole compilation of documents, a mere 47 were written by a single person. The index is fascinating since it can promote broad collaboration among writers, as seen by the author ratio of 0.394. The above ratio may be concisely expressed as follows: Three authors have worked to create a unified document on the subject under investigation. Moreover,

Figure 3 illustrates the chronological advancement of scientific study, demonstrating a steady growth in the publication of studies about corporate purpose and its correlation with emerging technology. The notable increase in the publication of relevant papers from 2020 to 2023 exemplifies companies’ prompt reaction to the disruption caused by the pandemic crisis, which hit the business world hard.

Table 3 presents the H-index, subject area, and ranks of the most prolific journals in both The Academic Journal Guide provided by the Chartered Association of Business Schools (ABS) and Scimago lists. Most articles are categorized based on computer science to highlight the connection between technology and the digitalization of business goals. In addition, two of the top ten prestigious journals chose to focus specifically on the field of environment and sustainability. As an example, sustainability is the primary focus of the list, consisting of 10 publications. It aims to publish research on the sustainable growth of enterprises using emerging technologies like artificial intelligence and machine learning. Furthermore, the

International Journal of Advanced Science and Technology,

Journal of Cleaner Production, and

Journal of Computer Information Systems hold the second position on the list, with each journal having four publications. The research indicated above highlights the clear and influential goals of corporations, giving priority to their strategic positioning to enhance their beneficial influence on society and the environment. Hence, to achieve their goals, enhance the process of making decisions, and meet the needs of their customers, businesses must include sustainable practices into their plan for digitization.

The most relevant and significant published study on the process of converting information into a digital format and its influence on the goals and aims of corporations is shown in

Table 4. The research article titled “Explaining Social Media Adoption for a Business Purpose: An Application of the UTAUT Model” has a notable position in the list of highly referenced publications. The study aimed to examine the elements that impact the adoption of social media for business reasons using the Unified Theory of Acceptance and Use of Technology (UTAUT), a well-recognized paradigm in technology acceptance research [

16,

17]. The results demonstrated that performance, effort anticipation, and social influence have a considerable impact on the likelihood of using social media for business purposes. Moreover, the results suggested that using the model mentioned above may enhance the circumstances inside a company or business and can also impact the behavior of technology users, including executives and board members.

Furthermore, the study demonstrated that younger executives are more adept at adapting and using new technology to enhance decision-making and overall daily operations. The report titled “Users of the world, unite! The challenges and opportunities of social media” emphasized the vital significance of incorporating developing technology into social media usage. This integration enables organizations to fundamentally change their objectives [

18]. Therefore, several corporate leaders have prioritized the notion of social media. Decisionmakers and experts endeavor to ascertain strategies for organizations to effectively use programs such as Wikipedia, YouTube, Facebook, and Twitter in a lucrative manner [

19,

20]. However, despite the curiosity, there seems to be a significant lack of understanding of the precise definition of “social media,” as seen by the limited knowledge of the present topic. More precisely, it is essential to train executives on the use of developing technologies and social media. This training will enable board members to adapt the company’s objectives to the requirements of the modern digital landscape, ultimately ensuring the satisfaction of shareholders.

Furthermore, the authors have provided an improved explanation of the concept of social media and corporate purpose, which incorporates the features of collaborative projects, blogs, content communities, social networking sites, virtual gaming worlds, and virtual social worlds [

21]. This comprehensive understanding of social media and its integration with corporate purposes will empower executives to effectively leverage these platforms for strategic decision-making and brand-building. Additionally, the authors highlighted the importance of fostering a culture of innovation within the organization, encouraging executives to explore emerging technologies and stay ahead of industry trends.

Table 5 displays the primary affiliations that have published research papers on the digitalization of the boardroom and its impact on corporate purposes. Empirical data indicate that academic institutions originating from India and China substantially influence the publications pertaining to the subject under investigation. India is now seeing a notable trend within the business sector aimed at implementing substantial transformations in boardrooms and setting new benchmarks in corporate governance [

22,

23]. Indian entrepreneurs believe digital transformation is essential for achieving sustainable growth and competitiveness in today’s rapidly changing business environment [

22,

23,

24,

25]. Companies see a substantial and profound shift in their corporate governance and sustainability endeavors. Given the significant influence of advanced technologies on many industries, it has become more important to possess essential skills such as executive leadership, ESG (environmental, social, and governance) proficiency, and corporate governance knowledge [

26,

27,

28,

29]. As a result, Indian businesses are embracing digitalization, causing a re-evaluation of traditional corporate objectives [

30,

31]. Board members must acquire an extensive understanding of subjects pertaining to the digital transformation of the boardroom to do this. To do this, board members must actively endeavor to bridge this gap by fully embracing digital transformation with the aid of technical experts. Embracing this collaborative approach may help boards make well-informed decisions on the company’s mission and the digital strategies they need to follow to meet the requirements of the ever-changing digital environment [

23,

25].

Chinese companies have the same perspective as their Indian counterparts about the digitization of the boardroom and its impact on business goals [

22,

23,

30,

31,

32,

33,

34]. Global corporations face significant obstacles in addressing ambiguity by adopting digital transformation and strategically using new technologies to support their business goals. This issue has garnered significant interest. Previous studies have primarily focused on the economic consequences of digital transformation in businesses [

30,

31,

32], with less emphasis on the impact of internal factors, specifically human variables like board members, on digital transformation. Chinese scholars contend that CEOs with sufficient knowledge and technology competence are crucial in driving the digital transformation of boardrooms. Empirical academic research has shown the substantial influence that CEOs’ specific professional knowledge and skills have on a firm’s business and innovation strategy. Chinese universities prioritize evaluating the chairman’s proficiency in IT and how it can assist companies in developing and implementing digital strategies in the Chinese context. They also assess their capability to adapt the corporate purpose to the changing digital business environment. The emphasis on IT proficiency is essential as it allows boardrooms to efficiently use technology and negotiate the intricacies of the digital environment. Moreover, by evaluating the chairman’s proficiency in information technology, Chinese universities may pinpoint any areas of knowledge deficiency and provide specialized training initiatives to bolster digital competencies inside institutions.

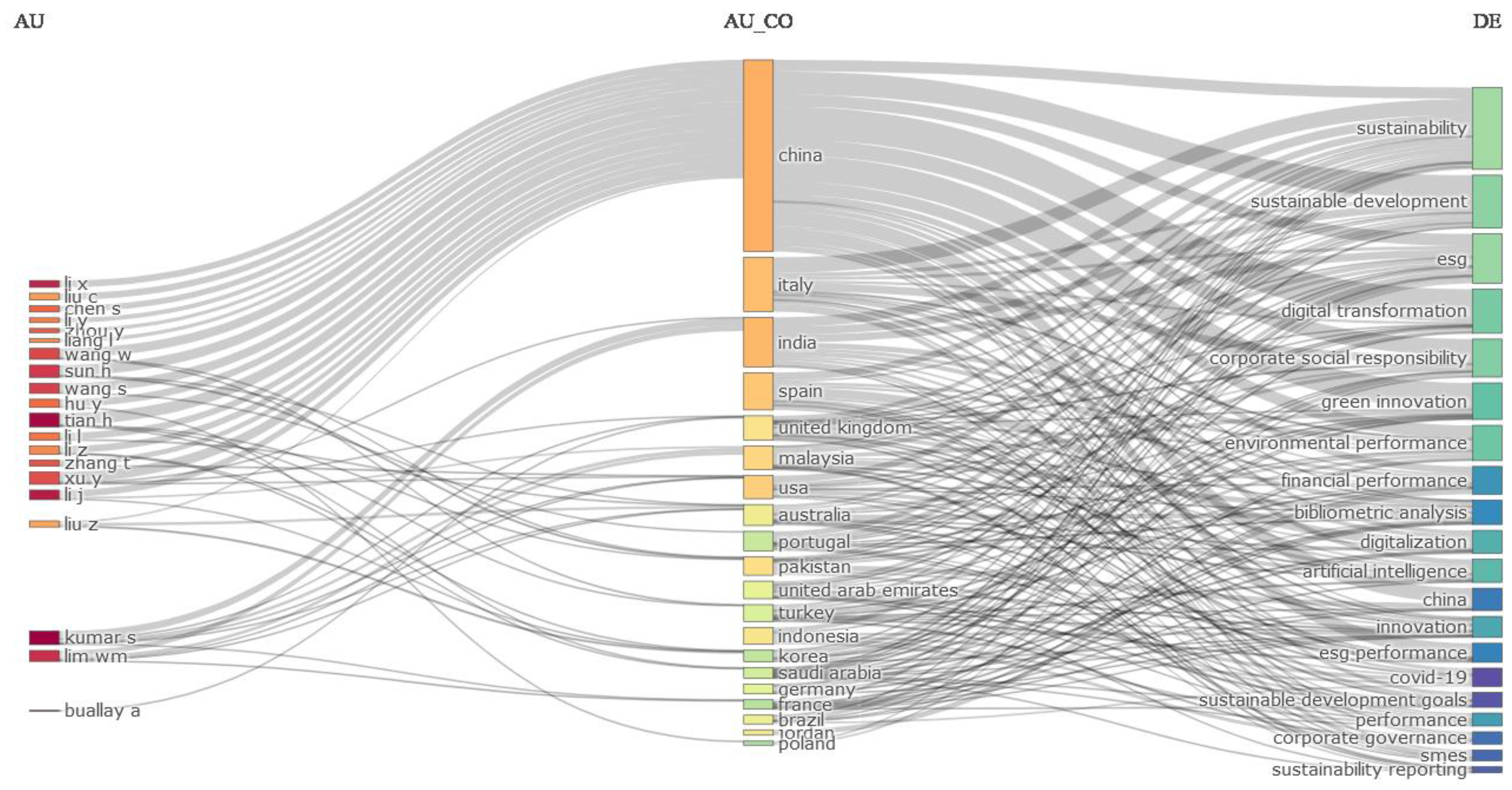

Figure 3 presents a Sankey diagram that visually represents the significant countries and authors in the subject, based on the analysis of bibliometric data. The figure’s left side depicts the nations and writers of utmost importance, while the center side showcases the most prominent authors. The figure’s right side displays the primary keywords they used in their articles. The breadth of each line that links a country, an author, and a word symbolizes the strength of the relationships among these entities. The results suggest that Chinese authors are those who are mostly interested in the field of the integration of AI and ESG principles in businesses to help them become more digitalized and sustainable in the future. Specifically, China has successfully improved ESG reporting and transparency in corporate and governance processes using domestic technology, resulting in a rise in investments in green finance. It has successfully used the latest breakthroughs in advanced technology, such as IoT and big data, to enhance the environmental and social performance of its most successful enterprises [

35,

36,

37]. In addition, Chinese enterprises have achieved enduring expansion due to advantageous government regulations and efficient strategizing in technology-focused industries, such as renewable energy and artificial intelligence. In addition, the country’s human capital development has been enhanced by technology, leading to improvements in measurable areas such as sustainable agriculture and health care.

Additionally,

Figure 3 underscores the importance of AI and ESG in fostering green innovation and competitiveness. In fact, it is imperative for corporations to prioritize sustainability. By incorporating sustainability into technological advancements like AI, your organization can differentiate itself in the market and improve its competitiveness. Furthermore, sustainable AI promotes innovation and unconventional thinking to enable organizations to develop AI solutions that achieve a harmonious equilibrium between ethical principles and technological advancement. Furthermore,

Figure 3 emphasizes the significance of AI and ESG in the promotion of green innovation and competitiveness. It is essential for corporations to prioritize sustainability. An organization can enhance its competitiveness and distinguish itself in the market by integrating sustainability into technological advancements such as AI. Additionally, sustainable AI fosters innovation and unconventional thinking to enable organizations to create AI solutions that achieve a harmonious equilibrium between technological advancement and ethical principles.

Unilever is a very successful example of the combination of ESG with AI, as mentioned before [

38]. Unilever consistently performs tests to determine the most efficient solutions that support sustainability and shared values. Through these trials, Unilever has accumulated a substantial amount of information about the effectiveness of different approaches. Unilever’s ongoing progress is mainly a result of its commitment to developing new ideas and approaches that may impact its whole value chain [

39,

40]. In the next years, Unilever will give priority to collaborating with stakeholders, recognizing the crucial role it plays in tackling various sustainability problems. Unilever’s transformational change initiatives will help support the systemic adjustments needed to address complex social and environmental concerns [

41]. The administrators of Unilever’s salesforce are committed to reducing the environmental effect of their department, as part of one of the company’s transformative change efforts, which are based on the concepts of ESG and AI. This aligns with the organization’s position as a vendor of software that operates on cloud-based platforms [

38,

41]. Therefore, to accomplish the goal of using 100% renewable energy and achieving net-zero carbon emissions, the company has implemented stringent requirements. Salesforce’s ranking demonstrates that digital innovation may promote ecological responsibility via the prioritization of energy-efficient practices and the promotion of renewable energy projects.

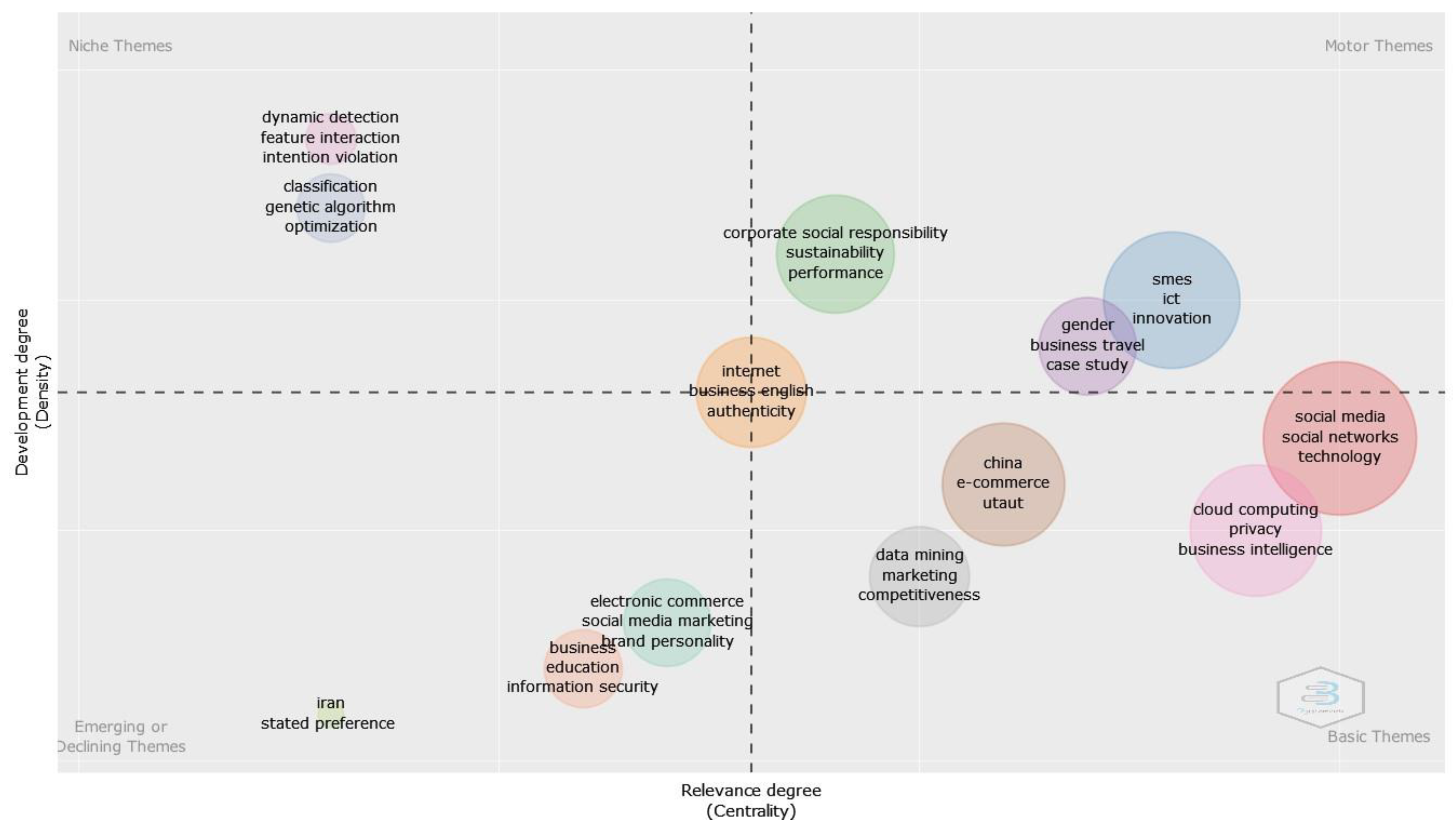

Moreover, to obtain a full grasp of the current status of the field and its potential for long-term sustainability, the objective of producing a thematic map was performed (

Figure 4). With the use of visual representations, thematic maps illustrate the spatial distribution and patterns of a specific subject or topic within a particular geographical area. Through the evaluation of these maps, researchers and decisionmakers have the potential to identify trends, disparities, and potential areas for change. In addition, understanding the current state of the industry, as well as its potential for financial success, may assist in guiding strategic planning and resource allocation to ensure the industry’s continued growth and success. The process of identifying themes using clusters of writers’ keywords and their interrelationships is called thematic analysis. These topics are distinguishable from others by their characteristics, namely their density, and centrality. Whereas the horizontal axis reflects centrality, the vertical axis shows density in the context of the graph. The term “centrality” describes the degree to which different themes are connected, while “density” measures the degree to which the nodes are cohesive. The degree to which specific topics are sufficiently developed and meaningful may be evaluated based on only these two characteristics. Within the topic network, nodes with more connections are considered to have a higher centrality and relevance, placing them in a position of critical importance within the network.

Similarly, the degree of cohesiveness inside a node, which indicates the concentration of a study subject, defines the node’s capacity to develop further and sustain itself. In

Figure 4, a thematic map is shown that highlights the sphere of digital transformation in the boardroom and its effect on the corporation’s mission. The thematic map is divided into four quarters, referred to as Q1 through Q4.

The motor themes are described in the quadrant placed in the upper right corner (Q1), while the basic themes are discussed in the quadrant placed in the lower right corner (Q4). The quadrant in the upper left corner (Q2) relates to the more niche themes, while the quadrant in the lower left corner (Q3) relates to themes that are either emerging or declining. Boardrooms are increasingly expected to prioritize cybersecurity, particularly in digital transformation. The notion of “dynamic detection” illustrates the need to safeguard against all cyber threats. Company boardrooms are increasingly concerned about cybersecurity and the associated dangers [

11,

42]. The frequency of notable data breaches in recent years, including cyber risk incidents, has resulted in several business crises. Corporate governance now necessitates boards to hold CEOs responsible for cybersecurity and cyber risks, perhaps resulting in legal repercussions or undergoing regulatory scrutiny. Thus, implementing a dynamic detection system would effectively reduce this kind of danger and provide a sense of security among the board members.

Furthermore, by eradicating cyberattacks and implementing a detection-oriented strategy, the company could redefine its objectives strategically. Critical elements of an effective dynamic threat detection method are ensuring the safe digital transformation of the boardroom, aggressively combating risks, and enabling board members to identify and address dynamic threats efficiently. Furthermore, each department needs to provide a distinct security vulnerability [

43,

44]. Administrative departments often encounter deliberate phishing attacks. Upon identifying the security vulnerabilities across the organization, leaders should effectively explain the need to practice proper hygiene in certain circumstances. Therefore, the boardroom should consider that the dynamic detection approach operates similarly to the progressive accumulation of momentum experienced by a snowball as it rolls downhill. Once each department acquires a more profound comprehension of its responsibilities in safeguarding the organization, it will adopt enhanced procedures.

Moreover, optimization is often used in specific domains. Efficiently optimizing IT is crucial for organizations of all scales, regardless of their size, whether small, medium, or large. Optimizing promptly allows for the satisfaction of increasing organizational needs, fosters innovation, and facilitates advancement. Implementing a strategic IT management system is dependable and efficient to improve organizational operations. The task may be accomplished by an internal IT department or by engaging an external outsourcing company. Effective management often entails the meticulous selection of staff, the exploitation of state-of-the-art technology, and the implementation of streamlined processes to ensure organizational consistency [

45,

46]. Efficiently improving the current IT infrastructure and optimizing the use of cloud services are often crucial measures in strategic IT management. It enables the establishment of a solid basis for future accomplishments. No universally effective method for strategic IT management can address all difficulties and adequately prepare a firm for market fluctuations.

Nevertheless, a well-defined methodology exists that has four essential elements. The system has sufficient flexibility to cater to various industries, organizational scales, and objectives. The four essential components include assessing the existing IT infrastructure, establishing strategic goals and objectives, formulating an action plan, and periodically assessing and modifying the IT strategy. By adhering to this procedure, organizations may guarantee that their IT administration aligns with their company goals and can efficiently react to evolving market circumstances [

45]. This method enables firms across diverse sectors, regardless of their scale and objectives, to efficiently oversee their IT assets and maintain competitiveness in the contemporary digital environment. According to the thematic map’s results, gender is not a significant factor in the digital transformation of the boardroom and its influence on the corporate mission. The idea of gender is subordinate to the motor, indicating that it is a relatively insignificant issue in comparison to the prominent concern about cybersecurity among board members in the context of digital transformation [

47,

48,

49].

5. Discussion

In the dynamic and ever-changing landscape of the modern corporate world, where maximal productivity and innovative thinking are of the uttermost importance, the boardroom serves as the central center for the discussion and eventual determination of strategic decisions. The technology employed in boardrooms has evolved from traditional paper-based methods to more contemporary digital alternatives to enhance communication, collaboration, and overall efficiency in corporate environments [

34,

48,

50,

51]. The substantial contribution that this event has made was the sole reason for the realization of these innovations. This article examines the significance of technology in boardrooms, with a particular emphasis on its ability to enhance efficiency, facilitate informed decision-making, and offer a competitive advantage. In the current fast-paced business environment, efficiency is a critical factor in preserving a competitive edge over other enterprises [

31,

52]. The utilization of state-of-the-art technology in boardrooms enables the board to conduct meetings more efficiently and effectively, thereby freeing up additional time for the board to focus on making critical strategic decisions. Additionally, technology enables the exchange and analysis of data in real time, thereby providing board members with the necessary information to make well-informed decisions. Ultimately, the utilization of technology in the boardroom has the potential to offer businesses a competitive edge by streamlining procedures and fostering collaboration among committee members [

31,

53].

The ability to promptly acquire essential information is of the utmost significance in a dynamic business environment. Executives can promptly access the most recent market trends, financial reports, and data through the technology utilized in boardrooms. As a result, the utilization of data to make informed decisions is rendered more manageable, and it guarantees that board members have access to the most recent information to make decisions that positively impact the firm’s development. The necessity of exceptional communication is another factor that contributes to the success of organizations. Technology in the boardroom enhances communication among board members, facilitating uninterrupted collaboration, irrespective of their geographical location. Technologies such as video conferencing, collaborative document editing, and virtual meeting technology may facilitate communication among board members [

54]. This can lead to a more profound sense of engagement and connection. Furthermore, each organization prioritizes its security and compliance components. Boardroom technology resolves these challenges by integrating rigorous security measures, including secure document-sharing platforms and encrypted communication channels. Not only does this measure safeguard sensitive information, but it also ensures that the company adheres to the industry’s established norms and standards. Furthermore, the implementation of a paperless boardroom not only improves the efficacy of governance activities but also has a positive impact on the environment. The risk of information loss is reduced by reducing the reliance on physical papers using digital board portals and electronic document management systems.

Furthermore, these systems offer a centralized location for essential documents, meeting minutes, and regulations. To compound the situation, individuals must have the necessary skills to analyze data and assess a variety of strategic options to make informed evaluations. Executives are equipped with the tools required to conduct scenario analysis, identify hazards, and devise solutions with technologies in boardrooms. Board members have the potential to acquire significant insights into the dynamics of the market, the tactics employed by competitors, and the metrics used to evaluate internal performance by utilizing sophisticated analytics and visualization technologies [

53]. By doing so, they can make strategic decisions that will push the organization’s success.

Consequently, the present investigation concentrates on the initial identification of research trends regarding the digitalization of the executive and its influence on the corporate objective. To address the research question, a bibliometric analysis was implemented to evaluate 205 published research articles. The data were obtained from the Scopus database between 2009 and 2023 and analyzed using R studio and the bibliometric software Biblioshiny and VOSviewer. The results demonstrate the rapid expansion of publications concerning the digital transformation of the boardroom and its influence on corporate objectives [

55,

56]. The study field is primarily populated by Chinese and Indian researchers and affiliations, which suggests that they have a high level of specialization and expertise in corporate governance and technology-related issues [

30,

31]. The current research has also revealed a critical finding: the imminent necessity for board members to safeguard their data and strategic plans, which are characterized by high sensitivity levels, and the emphasis on cybersecurity. Consequently, dynamic detection is one of the most critical strategic assets that a business and its board members require to combat intrusions. Consequently, the boardroom must establish a strategic plan that encompasses all of the elements that have been identified as the most critical for ensuring the corporation’s data and purpose, in accordance with the aforementioned. In particular, the purpose of a company should be meticulously safeguarded from any potential threats, as it delineates the value it intends to generate for its stakeholders. In this instance, the objective is to establish a unified system of stakeholders who are dedicated to the pursuit of the company’s objectives for the mutual advantage of all parties. The purpose of a company is typically strengthened by successful innovations, such as the digitalization of the boardroom, which necessitate the creation of value for multiple stakeholders [

44,

45]. Unfortunately, weaknesses of the innovation systems lose sight of their ultimate purpose and turn a single stakeholder metric into the primary strategic goal.

To prevent any potential peril or factor that could impede the digitization of the boardroom and have a detrimental effect on the corporation’s purpose, executives should develop and execute an effective plan [

34]. One example of such a strategic plan is described below and comprises six primary components. To become more scalable and inventive, the first step is to build a Business-Led Digital Roadmap. This includes the addition of a digital leader, the creation of digital literacy, the assessment of services and business processes, the examination of client touchpoints, and the use of better talent acquisition methods as well as accelerated automation capabilities [

57,

58,

59]. The second phase aims to enhance the talent strategy by incorporating automation specialists who possess a comprehensive understanding of the business, in addition to maintaining a high level of instruction for associates. The subsequent phase involves the development of an Automated Operating Model that incorporates supplementary capabilities, including document automation, automated practice protocols, and summarization. These capabilities will enable the establishment of persistent monetization streams and client relationships, the enhancement of accuracy and speed, and the ability to price services based on value rather than time [

50]. Furthermore, by employing a data repository and reusable building blocks, a competitive advantage can be achieved by leveraging technology and data to establish a more seamless connection with significant consumers. Finally, the practice’s capabilities, the ability to serve a greater number of customers, and the acceleration of profitability can be achieved through a dynamic and perpetually expanding strategic platform.

However, the integration of ESG and AI can cause some challenges to businesses. While there are notable benefits to incorporating AI into ESG operations, it is crucial to acknowledge the considerable dangers associated with it, especially given the ongoing worldwide movement toward regulating AI. President Biden’s executive order in the United States has increased awareness of the possible dangers related to data privacy, disinformation, inequality, bias, and discrimination, all of which are covered by the ESG framework. An inherent danger that may arise from the convergence of ESG and AI inside a firm is the possibility of unauthorized access to critical data. Dealing with huge datasets may lead to the unintentional exposure of sensitive information, including customer and corporate data. These threats may include identity theft, financial criminality, and the loss of public trust. We will now conduct a comprehensive analysis of the existing presidential directive, which has placed a high emphasis on safeguarding privacy and ensuring the security of data. Furthermore, the problem of accountability problems may provide an additional obstacle. The task of assigning responsibility becomes complex when choices powered by artificial intelligence have negative ESG consequences, hence complicating the legal and ethical need to hold someone accountable.

Considering the cutting-edge strategic plan put forth by the current research, our forthcoming research plans entail assessing the performance of board members following their transition to digital platforms, as well as evaluating the effectiveness of the corporate mission after the integration of emerging technologies in the boardroom. Furthermore, the assessment of its efficiency score relies on many ESG factors and incorporates multicriteria analysis in our research roster as well.

6. Conclusions

It has the potential to considerably impact both the commercial sector and society, as indicated by recent advancements in artificial intelligence. Organizations will be assessed on their capacity to effectively manage risks and leverage the benefits of yet another revolutionary technology. Furthermore, these test cases will serve as evidence of the corporate directors’ commitment to multi-stakeholder capitalism and ESG standards. One of the primary objectives of this investigation was to identify the initial research patterns that are relevant to the integration of ESG principles with emergent technologies. The goal was to enable executives and board members to assess the impact of digitalization on company objectives and gradually implement it. We conducted a bibliometric analysis of 205 academic papers to further investigate the subject.

The findings suggest a significant increase in the quantity of articles that concentrate on the influence of AI on corporate objectives and in the boardroom. Organizations must also consider ESG to guarantee sustainable continuity, despite the importance of developing technologies such as AI. The study’s findings demonstrate that ESG thinking is not a passing fad. Initially, it requires a change in perspective that challenges traditional corporate practices. A substantial number of shared concepts are incorporated into ESG thinking, which can be employed to encourage the adoption of responsible corporate behaviors and sustainable innovation. The ESG statement acknowledges that sustainability challenges are primarily rooted in human challenges and underscores the importance of executives collaborating to capitalize on new technology, such as AI.

Additionally, the research demonstrates that AI is indispensable for the seamless transition of organizations to ESG. Boards should utilize technology to quantify, monitor, and disclose ESG data. Digital solutions, including blockchain-enabled supply chain transparency and AI-powered data analytics, empower committees to make well-informed decisions. Businesses are proactively integrating cybersecurity into their strategies to protect critical ESG data. No, ESG and digital activities are not separate pathways; rather, they intersect and mutually reinforce one another. Digital transformations can be employed to effectively implement ESG initiatives. Consequently, digital transformation is not solely a technological phenomenon in the modern interconnected society; it is a driving force behind social accountability, environmental preservation, and sustainable development. Organizations not only prosper but also have a beneficial influence on the world when digital transformation is in alignment with ESG principles. The future of boards is contingent upon the integration of ESG principles. It does not pose a challenge or inconvenience; rather, it poses an opportunity to capitalize on. By incorporating sustainability, innovation, compliance, and digitization into their fundamental values, organizations can assume a leadership role in the development of a fair and robust world. As members of the board, we should guide our organizations by the compass of ESG principles as we navigate unfamiliar territory. The expedition is certain to present obstacles; however, the goal ensures a more auspicious future.