AI-Driven Risk Management and Sustainable Decision-Making: Role of Perceived Environmental Responsibility

Abstract

1. Introduction

2. Literature Review

2.1. Sustainable Decision-Making

| Phase | Timeframe | Characteristics | References |

|---|---|---|---|

| Emergence and Awareness | 1970 to 1990 | Rise of environmental awareness and consciousness and introduction of sustainable development concept | [18,19,20] |

| Compliance and Regulation | 1990 to 2000 | Regulatory emphasis: Prioritizing government policies, international agreements, and corporate environmental compliance. | [29,30] |

| Integration and Mainstreaming | 2000 to 2010 | Mainstreaming sustainability in business practices, focus on sustainable supply chains, green innovation, and corporate sustainability reporting | [30,34] |

| Innovation and Transformation | 2010 to present | Emphasis on innovative sustainability solutions and disruptive technologies and business models, highlighting interconnected social, environmental, and economic systems | [35,37] |

2.2. AI’s Contribution towards Sustainable Decisions

2.3. Risk Management—Traditional vs. AI-Driven

2.4. AI Techniques for Risk Management Processes

2.4.1. Cost Modeling Methods

2.4.2. Time Modeling Methods

2.4.3. Risk Modeling Methods

2.4.4. Hybrid Models

2.5. Theoretical Foundation

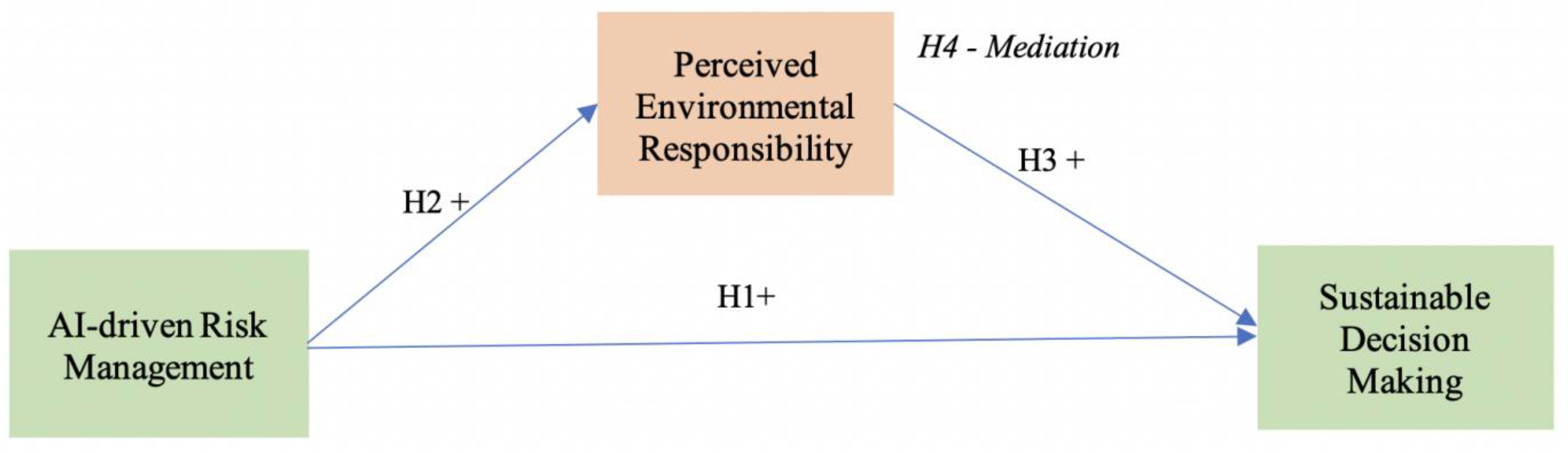

2.6. Hypothesis Development

2.6.1. AI-Driven Risk Management and Sustainable Decision-Making

2.6.2. Perceived Environmental Responsibility

3. Methodology

3.1. Sampling Strategy

3.2. Measures

3.3. Common Method Variance Measures

4. Results

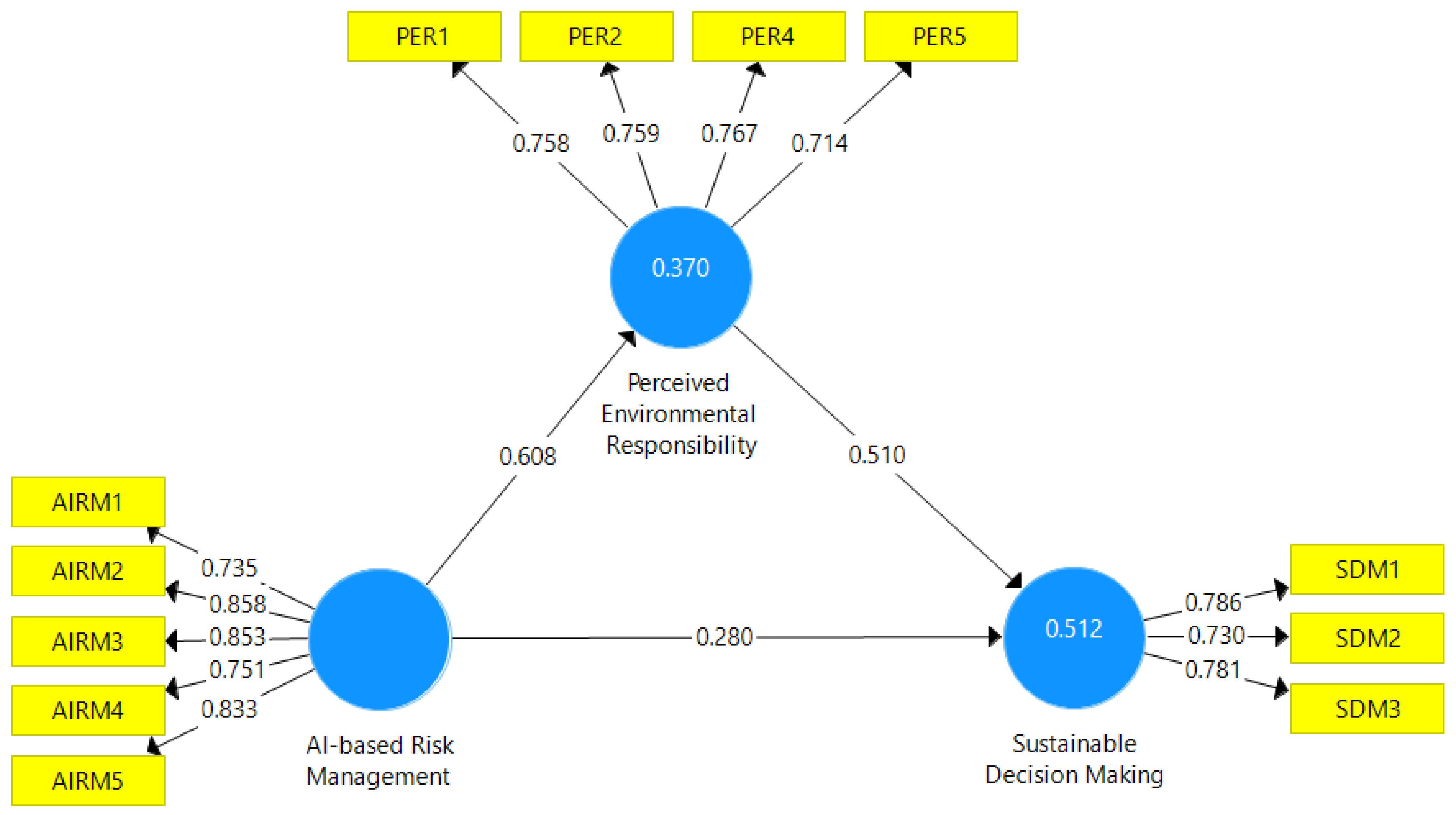

4.1. Measurement Model (Outer Model)

4.2. Structural Model Assessment

5. Discussion

5.1. Implications

5.1.1. Theoretical Implications

5.1.2. Practical Implications

Managerial Implications

Implications for Employees

Societal Implications

5.2. Limitations and Future Research Directions

6. Conclusions

Author Contributions

Funding

Institutional Review Board Statement

Informed Consent Statement

Data Availability Statement

Conflicts of Interest

Appendix A. Questionnaire Survey

| Factor | Items |

| AI-driven risk management (AIRM) AIRM—1 AIRM—2 AIRM—3 AIRM—4 AIRM—5 AIRM—6 | Our firm promotes AI tools to simulate different project scenarios and assess their associated risks. Our firm executed AI-powered systems to monitor project progress and identify potential safety hazards. Our firm use AI-powered analytics to predict and mitigate cost overruns. Our firm use AI risk management tools project schedules and resource allocation. Our firm allocates budget for implementing AI-driven risk management solutions. Our firm acknowledges the value of AI-driven risk management |

| Perceived environmental responsibility (PEM) PEM—1 PEM—2 PEM—3 PEM—4 PEM—5 | Environmental safeguard begins with me. I think I should have wider obligation for safeguarding the environment. Since I was young, I have taken resolution for environmental conservation. I am able to take responsibility for environmental conservation in construction projects. Environmental conservation is my obligation. |

| Sustainable decision-making (SDM) SDM—1 SDM—2 SDM—3 | Managers or entrepreneurs in our firm recurrently involve employees or workers in critical decisions to adopt eco-innovation practices Our firm policies are considerably affected by the view of employees about eco-innovation Employees or workers realize that they are involved in crucial enterprise’s decisions to adopt eco-innovation practices |

References

- Isensee, C.; Griese, K.M.; Teuteberg, F. Sustainable artificial intelligence: A corporate culture perspective. In Sustainability Management Forum|NachhaltigkeitsManagementForum; Springer: Berlin/Heidelberg, Germany, 2021; Volume 29, pp. 217–230. [Google Scholar]

- Yigitcanlar, T. Greening the artificial intelligence for a sustainable planet: An editorial commentary. Sustainability 2021, 13, 13508. [Google Scholar] [CrossRef]

- Abid, S.K.; Sulaiman, N.; Chan, S.W.; Nazir, U.; Abid, M.; Han, H.; Ariza-Montes, A.; Vega-Muñoz, A. Toward an integrated disaster management approach: How artificial intelligence can boost disaster management. Sustainability 2021, 13, 12560. [Google Scholar] [CrossRef]

- Baryannis, G.; Validi, S.; Dani, S.; Antoniou, G. Supply chain risk management and artificial intelligence: State of the art and future research directions. Int. J. Prod. Res. 2019, 57, 2179–2202. [Google Scholar] [CrossRef]

- Javaid, M.; Haleem, A.; Singh, R.P.; Khan, S.; Suman, R. Sustainability 4.0 and its applications in the field of manufacturing. Internet Things Cyber-Phys. Syst. 2022, 2, 82–90. [Google Scholar] [CrossRef]

- Yaseen, A. Reducing industrial risk with ai and automation. Int. J. Intell. Autom. Comput. 2021, 4, 60–80. [Google Scholar]

- Ahmed, Q.W.; Garg, S.; Rai, A.; Ramachandran, M.; Jhanjhi, N.Z.; Masud, M.; Baz, M. Ai-based resource allocation techniques in wireless sensor internet of things networks in energy efficiency with data optimization. Electronics 2022, 11, 2071. [Google Scholar] [CrossRef]

- Copiello, S. Economic implications of the energy issue: Evidence for a positive non-linear relation between embodied energy and construction cost. Energy Build. 2016, 123, 59–70. [Google Scholar] [CrossRef]

- Ahmad, N.; Zhu, Y.; Hongli, L.; Karamat, J.; Waqas, M.; Mumtaz, S.M.T. Mapping the obstacles to brownfield redevelopment adoption in developing economies: Pakistani Perspective. Land Use Policy 2020, 91, 104374. [Google Scholar] [CrossRef]

- Hussain, K.; He, Z.; Ahmad, N.; Iqbal, M.; Taskheer Mumtaz, S.M. Green, lean, Six Sigma barriers at a glance: A case from the construction sector of Pakistan. Build. Environ. 2019, 161, 106225. [Google Scholar] [CrossRef]

- Iqbal, M.; Ma, J.; Ahmad, N.; Hussain, K.; Usmani, M.S.; Ahmad, M. Sustainable construction through energy management practices in developing economies: An analysis of barriers in the construction sector. Environ. Sci. Pollut. Res. 2021, 28, 34793–34823. [Google Scholar] [CrossRef] [PubMed]

- Shah, S.A.A.; Longsheng, C. New environmental performance index for measuring sector-wise environmental performance: A case study of major economic sectors in Pakistan. Environ. Sci. Pollut. Res. 2020, 27, 41787–41802. [Google Scholar] [CrossRef] [PubMed]

- Bamgbade, J.A.; Kamaruddeen, A.M.; Nawi, M.N.M.; Yusoff, R.Z.; Bin, R.A. Does government support matter? Influence of organizational culture on sustainable construction among Malaysian contractors. Int. J. Constr. Manag. 2018, 18, 93–107. [Google Scholar] [CrossRef]

- Torgautov, B.; Zhanabayev, A.; Tleuken, A.; Turkyilmaz, A.; Mustafa, M.; Karaca, F. Circular economy: Challenges and opportunities in the construction sector of Kazakhstan. Buildings 2021, 11, 501. [Google Scholar] [CrossRef]

- Alonso, R.K.; Vélez, A.; Martínez-Monteagudo, M.C. Interventions for the Development of Intrinsic Motivation in University Online Education: Systematic Review—Enhancing the 4th Sustainable Development Goal. Sustainability 2023, 15, 9862. [Google Scholar] [CrossRef]

- Faraz, N.A.; Ahmed, F.; Ying, M.; Mehmood, S.A. The interplay of green servant leadership, self-efficacy, and intrinsic motivation in predicting employees’ pro-environmental behavior. Corp. Soc. Responsib. Environ. Manag. 2021, 28, 1171–1184. [Google Scholar] [CrossRef]

- Jarrahi, M.H.; Kenyon, S.; Brown, A.; Donahue, C.; Wicher, C. Artificial intelligence: A strategy to harness its power through organizational learning. J. Bus. Strategy 2023, 44, 126–135. [Google Scholar] [CrossRef]

- Shearman, R. The meaning and ethics of sustainability. Environ. Manag. 1990, 14, 1–8. [Google Scholar] [CrossRef]

- Steynberg, L.; Grundling, J.P. Sustainability of adventure tourism: The economic highway. WIT Trans. Ecol. Environ. 1970, 84, 1–10. [Google Scholar]

- Brown, B.J.; Hanson, M.E.; Liverman, D.M.; Merideth, R.W. Global sustainability: Toward definition. Environ. Manag. 1987, 11, 713–719. [Google Scholar] [CrossRef]

- Bowman, E.H.; Haire, M. A strategic posture toward corporate social responsibility. Calif. Manag. Rev. 1975, 18, 49–58. [Google Scholar] [CrossRef]

- Jones, T.M. Corporate social responsibility revisited, redefined. Calif. Manag. Rev. 1980, 22, 59–67. [Google Scholar] [CrossRef]

- Zondorak, V.A. A new face in corporate environmental responsibility: The Valdez Principles. Boston Coll. Environ. Aff. Law Rev. 1990, 18, 457. [Google Scholar]

- Brundtland, G.H.; Comum, N.F. Relatório Brundtland. In Our Common Future: United Nations; Oxford University Press: New York, USA, 1987; pp. 540–542. [Google Scholar]

- Logsdon, J.M.; Wartick, S.L. Commentary: Theoretically based applications and implications for using the Brown and Perry database. Bus. Soc. 1995, 34, 222–226. [Google Scholar] [CrossRef]

- Meadows, D.H.; Meadows, D.L.; Randers, J.; Behrens, W.W. The Limits to Growth: A Report for the Club of Rome’s Project on the Predicament of Mankind; Universe Books: New York, NY, USA, 1972. [Google Scholar]

- Burke, L.; Logsdon, J.M. How corporate social responsibility pays off. Long Range Plan. 1996, 29, 495–502. [Google Scholar] [CrossRef]

- McWilliams, A.; Siegel, D.; Teoh, S.H. Issues in the use of the event study methodology: A critical analysis of corporate social responsibility studies. Organ. Res. Methods 1999, 2, 340–365. [Google Scholar] [CrossRef]

- Pohekar, S.D.; Ramachandran, M. Application of multi-criteria decision making to sustainable energy planning—A review. Renew. Sustain. Energy Rev. 2004, 8, 365–381. [Google Scholar] [CrossRef]

- Wang, J.J.; Jing, Y.Y.; Zhang, C.F.; Zhao, J.H. Review on multi-criteria decision analysis aid in sustainable energy decision-making. Renew. Sustain. Energy Rev. 2009, 13, 2263–2278. [Google Scholar] [CrossRef]

- Labuschagne, C.; Brent, A.C.; Van Erck, R.P. Assessing the sustainability performances of industries. J. Clean. Prod. 2005, 13, 373–385. [Google Scholar] [CrossRef]

- International Energy Agency. Global Status Report. 2018. Available online: https://www.iea.org/reports/2018-global-status-report (accessed on 16 December 2023).

- Seuring, S.; Müller, M. From a literature review to a conceptual framework for sustainable supply chain management. J. Clean. Prod. 2008, 16, 1699–1710. [Google Scholar] [CrossRef]

- Jun, H.; Xiang, H. Development of circular economy is a fundamental way to achieve agriculture sustainable development in China. Energy Procedia 2011, 5, 1530–1534. [Google Scholar] [CrossRef]

- Liao, J.; Liu, X.; Zhou, X.; Tursunova, N.R. Analyzing the role of renewable energy transition and industrialization on ecological sustainability: Can green innovation matter in OECD countries. Renew. Energy 2023, 204, 141–151. [Google Scholar] [CrossRef]

- Mi, C.; Gou, X.; Ren, Y.; Zeng, B.; Khalid, J.; Ma, Y. Seasonal electricity consumption forecasting: An approach with novel weakening buffer operator and fractional order accumulation grey model. Grey Syst. Theory Appl. 2024, 14, 414–428. [Google Scholar] [CrossRef]

- Schroeder, P.; Anggraeni, K.; Weber, U. The relevance of circular economy practices to the sustainable development goals. J. Ind. Ecol. 2019, 23, 77–95. [Google Scholar] [CrossRef]

- Killen, C.P.; Geraldi, J.; Kock, A. The role of decision makers’ use of visualizations in project portfolio decision making. Int. J. Proj. Manag. 2020, 38, 267–277. [Google Scholar] [CrossRef]

- Rodgers, W.; Murray, J.M.; Stefanidis, A.; Degbey, W.Y.; Tarba, S.Y. An artificial intelligence algorithmic approach to ethical decision-making in human resource management processes. Hum. Resour. Manag. Rev. 2023, 33, 100925. [Google Scholar] [CrossRef]

- Soliman, M.; Ali, R.A.; Khalid, J.; Mahmud, I.; Assalihee, M. Modeling the Continuous Intention to Use the Metaverse as a Learning Platform: PLS-SEM and fsQCA Approach. In Current and Future Trends on Intelligent Technology Adoption: Volume 1; Springer Nature: Cham, Switzerland, 2023; pp. 41–62. [Google Scholar]

- Lin, M.; Zhao, Y. Artificial intelligence-empowered resource management for future wireless communications: A survey. China Commun. 2020, 17, 58–77. [Google Scholar] [CrossRef]

- Van Wynsberghe, A. Sustainable AI: AI for sustainability and the sustainability of AI. AI Ethics 2021, 1, 213–218. [Google Scholar] [CrossRef]

- Galaz, V.; Centeno, M.A.; Callahan, P.W.; Causevic, A.; Patterson, T.; Brass, I.; Baum, S.; Farber, D.; Fischer, J.; Garcia, D.; et al. Artificial intelligence, systemic risks, and sustainability. Technol. Soc. 2021, 67, 101741. [Google Scholar] [CrossRef]

- Ghodke, P.K.; Reddy, P.S.; Akiti, N.; Kilari, H. Artificial Intelligence in the digital chemical industry, its application and sustainability. In Recent Trends and Best Practices in Industry 4.0; River Publishers: Aalborg, Denmark, 2023; pp. 1–29. [Google Scholar]

- Lundqvist, S.A. Why firms implement risk governance–Stepping beyond traditional risk management to enterprise risk management. J. Account. Public Policy 2015, 34, 441–466. [Google Scholar] [CrossRef]

- Žigienė, G.; Rybakovas, E.; Alzbutas, R. Artificial intelligence based commercial risk management framework for SMEs. Sustainability 2019, 11, 4501. [Google Scholar] [CrossRef]

- Hopkin, P. Fundamentals of Risk Management: Understanding, Evaluating and Implementing Effective Risk Management; Kogan Page Publishers: London, UK, 2018. [Google Scholar]

- Schuett, J. Risk management in the artificial intelligence act. Eur. J. Risk Regul. 2023, 1–19. [Google Scholar] [CrossRef]

- Afzal, F.; Yunfei, S.; Nazir, M.; Bhatti, S.M. A review of artificial intelligence based risk assessment methods for capturing complexity-risk interdependencies: Cost overrun in construction projects. Int. J. Manag. Proj. Bus. 2021, 14, 300–328. [Google Scholar] [CrossRef]

- Aven, T. Risk assessment and risk management: Review of recent advances on their foundation. Eur. J. Oper. Res. 2016, 253, 1–13. [Google Scholar] [CrossRef]

- Aziz, S.; Dowling, M. Machine Learning and AI for Risk Management; Springer International Publishing: Berlin/Heidelberg, Germany, 2019; pp. 33–50. [Google Scholar]

- de Araújo Lima, P.F.; Crema, M.; Verbano, C. Risk management in SMEs: A systematic literature review and future directions. Eur. Manag. J. 2020, 38, 78–94. [Google Scholar] [CrossRef]

- Datta, P.P.; Roy, R. Cost modelling techniques for availability type service support contracts: A literature review and empirical study. CIRP J. Manuf. Sci. Technol. 2010, 3, 142–157. [Google Scholar] [CrossRef]

- Skitmore, M.; Marston, V. Cost Modelling; Routledge: London, UK, 2005. [Google Scholar]

- Matel, E.; Vahdatikhaki, F.; Hosseinyalamdary, S.; Evers, T.; Voordijk, H. An artificial neural network approach for cost estimation of engineering services. Int. J. Constr. Manag. 2022, 22, 1274–1287. [Google Scholar] [CrossRef]

- Pan, Y.; Zhang, L. Roles of artificial intelligence in construction engineering and management: A critical review and future trends. Autom. Constr. 2021, 122, 103517. [Google Scholar] [CrossRef]

- Salehi, H.; Burgueño, R. Emerging artificial intelligence methods in structural engineering. Eng. Struct. 2018, 171, 170–189. [Google Scholar] [CrossRef]

- He, R.; Zhang, L.; Chew, A.W.Z. Modeling and predicting rainfall time series using seasonal-trend decomposition and machine learning. Knowl.-Based Syst. 2022, 251, 109125. [Google Scholar] [CrossRef]

- Schaffer, A.L.; Dobbins, T.A.; Pearson, S.A. Interrupted time series analysis using autoregressive integrated moving average (ARIMA) models: A guide for evaluating large-scale health interventions. BMC Med. Res. Methodol. 2021, 21, 58. [Google Scholar] [CrossRef]

- Sekertekin, A.; Arslan, N.; Bilgili, M. Modeling diurnal Land Surface Temperature on a local scale of an arid environment using artificial Neural Network (ANN) and time series of Landsat-8 derived spectral indexes. J. Atmos. Sol.-Terr. Phys. 2020, 206, 105328. [Google Scholar] [CrossRef]

- Sherstinsky, A. Fundamentals of recurrent neural network (RNN) and long short-term memory (LSTM) network. Phys. D Nonlinear Phenom. 2020, 404, 132306. [Google Scholar] [CrossRef]

- Belhadi, A.; Kamble, S.; Fosso Wamba, S.; Queiroz, M.M. Building supply-chain resilience: An artificial intelligence-based technique and decision-making framework. Int. J. Prod. Res. 2022, 60, 4487–4507. [Google Scholar] [CrossRef]

- Bansal, M.; Goyal, A.; Choudhary, A. A comparative analysis of K-nearest neighbor, genetic, support vector machine, decision tree, and long short term memory algorithms in machine learning. Decis. Anal. J. 2022, 3, 100071. [Google Scholar] [CrossRef]

- Saravi, B.; Hassel, F.; Ülkümen, S.; Zink, A.; Shavlokhova, V.; Couillard-Despres, S.; Boeker, M.; Obid, P.; Lang, G.M. Artificial intelligence-driven prediction modeling and decision making in spine surgery using hybrid machine learning models. J. Pers. Med. 2022, 12, 509. [Google Scholar] [CrossRef]

- Sajedi-Hosseini, F.; Choubin, B.; Solaimani, K.; Cerdà, A.; Kavian, A. Spatial prediction of soil erosion susceptibility using a fuzzy analytical network process: Application of the fuzzy decision making trial and evaluation laboratory approach. Land Degrad. Dev. 2018, 29, 3092–3103. [Google Scholar] [CrossRef]

- Nguyen, P.H.; Fayek, A.R. Applications of fuzzy hybrid techniques in construction engineering and management research. Autom. Constr. 2022, 134, 104064. [Google Scholar] [CrossRef]

- Rogers, E.M.; Williams, D. Diffusion of Innovations; The Free Press: Glencoe, IL, USA, 1983. [Google Scholar]

- Karnowski, V.; Kümpel, A.S. Diffusion of innovations. In Schlüsselwerke der Medienwirkungsforschung (1962); Rogers, V.E.M., Ed.; Springer VS: Wiesbaden, Germany, 2016; pp. 97–107. [Google Scholar]

- Valente, T.W. Diffusion of innovations and policy decision-making. J. Commun. 1993, 43, 30–45. [Google Scholar] [CrossRef]

- Fernández-Márquez, C.M.; Vázquez, F.J. How information and communication technology affects decision-making on innovation diffusion: An agent-based modelling approach. Intell. Syst. Account. Financ. Manag. 2018, 25, 124–133. [Google Scholar] [CrossRef]

- Bandura, A. Social Foundations of Thought and Action; Prentice-Hall, Inc.: Englewood Cliffs, NJ, USA, 1986; p. 2. [Google Scholar]

- Bandura, A. Social cognitive theory for personal and social change by enabling media. In Entertainment-Education and Social Change; Routledge: London, UK, 2003; pp. 97–118. [Google Scholar]

- Schunk, D.H.; Usher, E.L. Social cognitive theory and motivation. Oxf. Handb. Hum. Motiv. 2012, 2, 11–26. [Google Scholar]

- Zhao, H.; Zhou, Q. Socially responsible human resource management and hotel employee organizational citizenship behavior for the environment: A social cognitive perspective. Int. J. Hosp. Manag. 2021, 95, 102749. [Google Scholar] [CrossRef]

- Adam, H.; Balagopalan, A.; Alsentzer, E.; Christia, F.; Ghassemi, M. Mitigating the impact of biased artificial intelligence in emergency decision-making. Commun. Med. 2022, 2, 149. [Google Scholar] [CrossRef] [PubMed]

- Pham, B.T.; Luu, C.; Van Phong, T.; Nguyen, H.D.; Van Le, H.; Tran, T.Q.; Ta, H.T.; Prakash, I. Flood risk assessment using hybrid artificial intelligence models integrated with multi-criteria decision analysis in Quang Nam Province, Vietnam. J. Hydrol. 2021, 592, 125815. [Google Scholar] [CrossRef]

- Zheng, G.W.; Siddik, A.B.; Masukujjaman, M.; Alam, S.S.; Akter, A. Perceived environmental responsibilities and green buying behavior: The mediating effect of attitude. Sustainability 2020, 13, 35. [Google Scholar] [CrossRef]

- van der Werff, E.; Steg, L.; Ruepert, A. My company is green, so am I: The relationship between perceived environmental responsibility of organisations and government, environmental self-identity, and pro-environmental behaviours. Energy Effic. 2021, 14, 50. [Google Scholar] [CrossRef]

- Liobikienė, G.; Juknys, R. The role of values, environmental risk perception, awareness of consequences, and willingness to assume responsibility for environmentally-friendly behaviour: The Lithuanian case. J. Clean. Prod. 2016, 112, 3413–3422. [Google Scholar] [CrossRef]

- Frank, B. Artificial intelligence-enabled environmental sustainability of products: Marketing benefits and their variation by consumer, location, and product types. J. Clean. Prod. 2021, 285, 125242. [Google Scholar] [CrossRef]

- Nadeem, M.; Ilyas, U.; Umer, A.; Raffae, A.; Ajmal, S.B.; Ali, Z.; Umar, H.M.T. Impact of Lockdown due to COVID-19 Pandemic on Construction Industry of Pakistan. Pak. J. Eng. Technol. 2022, 5, 42–48. [Google Scholar] [CrossRef]

- Maxwell, S.E. Sample size and multiple regression analysis. Psychol. Methods 2000, 5, 434. [Google Scholar] [CrossRef]

- Lin, H.M.; Lee, M.H.; Liang, J.C.; Chang, H.Y.; Huang, P.; Tsai, C.C. A review of using partial least square structural equation modeling in e-learning research. Br. J. Educ. Technol. 2020, 51, 1354–1372. [Google Scholar] [CrossRef]

- Wong, L.W.; Tan, G.W.H.; Ooi, K.B.; Lin, B.; Dwivedi, Y.K. Artificial intelligence-driven risk management for enhancing supply chain agility: A deep-learning-based dual-stage PLS-SEM-ANN analysis. Int. J. Prod. Res. 2022, 62, 5535–5555. [Google Scholar] [CrossRef]

- Ben Amara, D.; Chen, H. The impact of participative decision-making on eco-innovation capability: The mediating role of motivational eco-innovation factors. Environ. Dev. Sustain. 2021, 23, 6966–6986. [Google Scholar] [CrossRef]

- Kock, N. Common method bias: A full collinearity assessment method for PLS-SEM. In Partial Least Squares Path Modeling: Basic Concepts, Methodological Issues and Applications; Springer International Publishing: Berlin/Heidelberg, Germany, 2017; pp. 245–257. [Google Scholar]

- Podsakoff, P.M.; Organ, D.W. Self-reports in organizational research: Problems and prospects. J. Manag. 1986, 12, 531–544. [Google Scholar] [CrossRef]

- Podsakoff, P.M.; MacKenzie, S.B.; Lee, J.Y.; Podsakoff, N.P. Common method biases in behavioral research: A critical review of the literature and recommended remedies. J. Appl. Psychol. 2003, 88, 879. [Google Scholar] [CrossRef] [PubMed]

- Tumi, N.S.; Hasan, A.N.; Khalid, J. Impact of compensation, job enrichment and enlargement, and training on employee motivation. Bus. Perspect. Res. 2022, 10, 121–139. [Google Scholar] [CrossRef]

- Lindell, M.K.; Whitney, D.J. Accounting for common method variance in cross-sectional research designs. J. Appl. Psychol. 2001, 86, 114. [Google Scholar] [CrossRef] [PubMed]

- Kline, T.J.; Sulsky, L.M.; Rever-Moriyama, S.D. Common method variance and specification errors: A practical approach to detection. J. Psychol. 2000, 134, 401–421. [Google Scholar] [CrossRef] [PubMed]

- Fornell, C.; Larcker, D.F. Evaluating structural equation models with unobservable variables and measurement error. J. Mark. Res. 1981, 18, 39–50. [Google Scholar] [CrossRef]

- Hair, J.F.; Ringle, C.M.; Sarstedt, M. Partial least squares structural equation modeling: Rigorous applications, better results and higher acceptance. Long Range Plan. 2013, 46, 1–12. [Google Scholar] [CrossRef]

- Henseler, J.; Ringle, C.M.; Sarstedt, M. A new criterion for assessing discriminant validity in variance-based structural equation modeling. J. Acad. Mark. Sci. 2015, 43, 115–135. [Google Scholar] [CrossRef]

- Voorhees, R.M.; Hegde, R.S. Toward a structural understanding of co-translational protein translocation. Curr. Opin. Cell Biol. 2016, 41, 91–99. [Google Scholar] [CrossRef] [PubMed]

- Chin, W.W. Bootstrap cross-validation indices for PLS path model assessment. In Handbook of Partial Least Squares: Concepts, Methods and Applications; Springer: Berlin/Heidelberg, Germany, 2009; pp. 83–97. [Google Scholar]

- Hair Jr, J.F.; Howard, M.C.; Nitzl, C. Assessing measurement model quality in PLS-SEM using confirmatory composite analysis. J. Bus. Res. 2020, 109, 101–110. [Google Scholar] [CrossRef]

- Consonni, V.; Ballabio, D.; Todeschini, R. Evaluation of model predictive ability by external validation techniques. J. Chemom. 2010, 24, 194–201. [Google Scholar] [CrossRef]

- Pavlov, G.; Maydeu-Olivares, A.; Shi, D. Using the standardized root mean squared residual (SRMR) to assess exact fit in structural equation models. Educ. Psychol. Meas. 2021, 81, 110–130. [Google Scholar] [CrossRef] [PubMed]

- Nitzl, C.; Roldan, J.L.; Cepeda, G. Mediation analysis in partial least squares path modeling: Helping researchers discuss more sophisticated models. Ind. Manag. Data Syst. 2016, 116, 1849–1864. [Google Scholar] [CrossRef]

- Klüppelberg, C.; Straub, D.; Welpe, I.M. (Eds.) Risk—A Multidisciplinary Introduction; Springer: Berlin/Heidelberg, Germany, 2014. [Google Scholar]

- Araujo, T.; Helberger, N.; Kruikemeier, S.; De Vreese, C.H. In AI we trust? Perceptions about automated decision-making by artificial intelligence. AI Soc. 2020, 35, 611–623. [Google Scholar] [CrossRef]

- Stone, M.; Aravopoulou, E.; Ekinci, Y.; Evans, G.; Hobbs, M.; Labib, A.; Laughlin, P.; Machtynger, J.; Machtynger, L. Artificial intelligence (AI) in strategic marketing decision-making: A research agenda. Bottom Line 2020, 33, 183–200. [Google Scholar] [CrossRef]

- Osuszek, L.; Ledzianowski, J. Decision support and risk management in business context. J. Decis. Syst. 2020, 29 (Suppl. S1), 413–424. [Google Scholar] [CrossRef]

- Tiwari, P.; Suresha, B. Moderating role of project innovativeness on project flexibility, project risk, project performance, and business success in financial services. Glob. J. Flex. Syst. Manag. 2021, 22, 179–196. [Google Scholar] [CrossRef]

- Hallikas, J.; Lintukangas, K.; Kähkönen, A.K. The effects of sustainability practices on the performance of risk management and purchasing. J. Clean. Prod. 2020, 263, 121579. [Google Scholar] [CrossRef]

- Shad, M.K.; Lai, F.W.; Fatt, C.L.; Klemeš, J.J.; Bokhari, A. Integrating sustainability reporting into enterprise risk management and its relationship with business performance: A conceptual framework. J. Clean. Prod. 2019, 208, 415–425. [Google Scholar] [CrossRef]

| Aspect | Traditional Risk Management | AI-Driven Risk Management |

|---|---|---|

| Familiarity | ✓ | ✗ |

| Human Judgment | ✓ | ✓ |

| Low Initial Investment | ✓ | ✗ |

| Adaptability | ✓ | ✗ |

| Subjectivity | ✓ | ✗ |

| Limited Scalability | ✓ | ✓ |

| Slow Response Time | ✓ | ✗ |

| Difficulty in Predictive Analysis | ✓ | ✗ |

| Advanced Analytics | ✗ | ✓ |

| Predictive Capabilities | ✗ | ✓ |

| Automation | ✗ | ✓ |

| Real-time Insights | ✗ | ✓ |

| Complexity | ✓ | ✗ |

| Data Privacy Concerns | ✓ | ✓ |

| Potential for Bias | ✓ | ✓ |

| Overreliance on Technology | ✗ | ✓ |

| Education | |||||

|---|---|---|---|---|---|

| Diploma | Undergraduate | Master | PhD | Total | |

| Female | 12 | 69 | 49 | 2 | 132 |

| Male | 33 | 115 | 142 | 6 | 296 |

| Age | |||||

| 20–29 years | 30–39 years | 40–50 years | >50 years | Total | |

| Female | 37 | 51 | 30 | 14 | 132 |

| Male | 42 | 139 | 88 | 27 | 296 |

| Experience | |||||

| <2 years | 3–7 years | 7–10 years | >10 years | Total | |

| Female | 9 | 71 | 33 | 19 | 132 |

| Male | 27 | 119 | 92 | 58 | 296 |

| Construct | FL | α | CR | AVE |

|---|---|---|---|---|

| AI-driven risk management (AIRM) | 0.865 | 0.903 | 0.652 | |

| AIRM—1 Our firm promotes AI tools to simulate different project scenarios and assess their associated risks. | 0.735 | |||

| AIRM—2 Our firm executed AI-powered systems to monitor project progress and identify potential safety hazards. | 0.858 | |||

| AIRM—3 Our firm use AI-powered analytics to predict and mitigate cost overruns. | 0.853 | |||

| AIRM—4 Our firm use AI risk management tools project schedules and resource allocation. | 0.751 | |||

| AIRM—5 Our firm allocates budget for implementing AI-driven risk management solutions. | 0.833 | |||

| Perceived environmental responsibility (PEM) | 0.742 | 0.837 | 0.562 | |

| PEM—1 Environmental safeguard begins with me. | 0.758 | |||

| PEM—2 I think I should have wider obligation for safeguarding the environment. | 0.759 | |||

| PEM–4 I am able to take responsibility for environmental conservation in construction projects. | 0.767 | |||

| PEM—5 Environmental conservation is my obligation. | 0.714 | |||

| Sustainable decision-making (SDM) | 0.753 | 0.810 | 0.587 | |

| SDM—1 Managers or entrepreneurs in our firm recurrently involve employees or workers in critical decisions to adopt eco-innovation practices | 0.786 | |||

| SDM—2 Our firm policies are considerably affected by the view of employees about eco-innovation | 0.730 | |||

| SDM—3 Employees or workers realize that they are involved in crucial enterprise’s decisions to adopt eco-innovation practices | 0.781 |

| Constructs | AIRM | PER | SDM |

|---|---|---|---|

| AI-driven Risk Management | 0.808 | ||

| Perceived Environmental Responsibility | 0.608 | 0.750 | |

| Sustainable Decision-Making | 0.590 | 0.680 | 0.766 |

| Constructs | AIRM | PER | SDM |

|---|---|---|---|

| AI-driven Risk Management | |||

| Perceived Environmental Responsibility | 0.756 | ||

| Sustainable Decision-Making | 0.778 | 0.840 |

| Relationship | Beta Value | Std. Error | T-Value | p Value | Decision | |

|---|---|---|---|---|---|---|

| H1 | AIRM->PER | 0.608 | 0.041 | 15.005 | 0.000 | Supported |

| H2 | AIRM->SDM | 0.280 | 0.049 | 5.749 | 0.000 | Supported |

| H3 | PER->SDM | 0.510 | 0.048 | 10.634 | 0.000 | Supported |

| Variables | R2 | Q2 | SRMR |

|---|---|---|---|

| SDM | 0.51 | 0.33 | 0.064 |

| PER | 0.37 | 0.14 |

| Relationship | Beta value | Std. Error | T-Value | p-Value | Confidence Interval (BC) | Decision | ||

|---|---|---|---|---|---|---|---|---|

| 5% LL | 95% UL | |||||||

| H4 | AIRM->PER->SDM | 0.310 | 0.035 | 8.878 | 0.000 | 0.261 | 0.375 | Supported |

Disclaimer/Publisher’s Note: The statements, opinions and data contained in all publications are solely those of the individual author(s) and contributor(s) and not of MDPI and/or the editor(s). MDPI and/or the editor(s) disclaim responsibility for any injury to people or property resulting from any ideas, methods, instructions or products referred to in the content. |

© 2024 by the authors. Licensee MDPI, Basel, Switzerland. This article is an open access article distributed under the terms and conditions of the Creative Commons Attribution (CC BY) license (https://creativecommons.org/licenses/by/4.0/).

Share and Cite

Khalid, J.; Chuanmin, M.; Altaf, F.; Shafqat, M.M.; Khan, S.K.; Ashraf, M.U. AI-Driven Risk Management and Sustainable Decision-Making: Role of Perceived Environmental Responsibility. Sustainability 2024, 16, 6799. https://doi.org/10.3390/su16166799

Khalid J, Chuanmin M, Altaf F, Shafqat MM, Khan SK, Ashraf MU. AI-Driven Risk Management and Sustainable Decision-Making: Role of Perceived Environmental Responsibility. Sustainability. 2024; 16(16):6799. https://doi.org/10.3390/su16166799

Chicago/Turabian StyleKhalid, Jamshed, Mi Chuanmin, Fasiha Altaf, Muhammad Mobeen Shafqat, Shahid Kalim Khan, and Muhammad Umair Ashraf. 2024. "AI-Driven Risk Management and Sustainable Decision-Making: Role of Perceived Environmental Responsibility" Sustainability 16, no. 16: 6799. https://doi.org/10.3390/su16166799

APA StyleKhalid, J., Chuanmin, M., Altaf, F., Shafqat, M. M., Khan, S. K., & Ashraf, M. U. (2024). AI-Driven Risk Management and Sustainable Decision-Making: Role of Perceived Environmental Responsibility. Sustainability, 16(16), 6799. https://doi.org/10.3390/su16166799