The Impact of Carbon Emission Trading Policy on Industrial Structure Adjustment: A Perspective of Sustainable Development

Abstract

1. Introduction

2. Literature Review

2.1. Research Related to the Carbon Emission Trading Policy

2.2. Research Related to ISA

3. Date and Methods

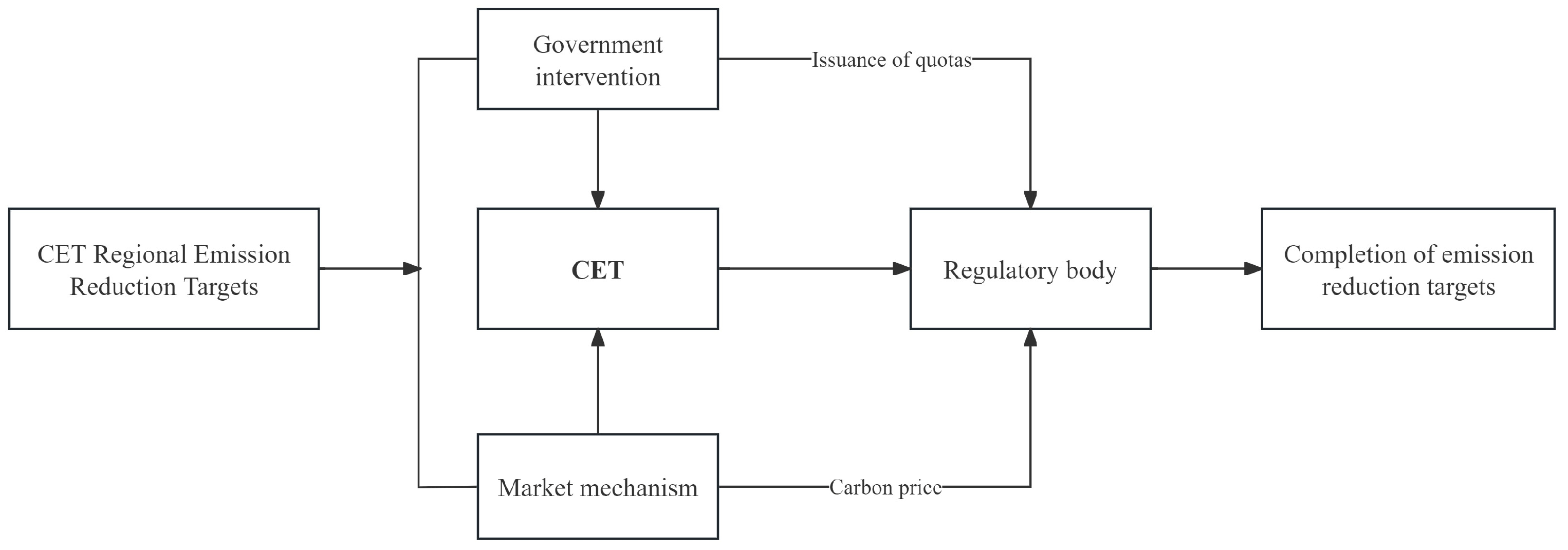

3.1. Modeling

3.2. Variables and Data

3.2.1. Explained Variables

3.2.2. Explanatory Variables

3.2.3. Control Variables

4. Empirical Analysis

4.1. Benchmark Model Regression

4.2. Robustness Tests

4.2.1. Parallel Trend Test

4.2.2. Reduction in Sample Data

4.2.3. Impact of the CET Market in Non-Pilot Provinces

4.2.4. Placebo Test

4.2.5. CET Market Mechanism Test

4.2.6. Expected Effects Test

4.3. Analysis of Impact Mechanisms

4.4. Heterogeneity Analysis

5. Conclusions and Discussion

5.1. Conclusions

5.2. Policy Implications

5.3. Limitations and Prospects

Author Contributions

Funding

Institutional Review Board Statement

Informed Consent Statement

Data Availability Statement

Acknowledgments

Conflicts of Interest

References

- Meierrieks, D.; Stadelmann, D. Is temperature adversely related to economic development? Evidence on the short-run and the long-run links from sub-national data. Energy Econ. 2024, 136, 107758. [Google Scholar] [CrossRef]

- Huffman, W.E.; Jin, Y.; Xu, Z. The economic impacts of technology and climate change: New evidence from U.S. corn yields. Agric. Econ. 2018, 49, 463–479. [Google Scholar] [CrossRef]

- Huang, K.; Zhao, H.; Huang, J.; Wang, J.; Findlay, C. The impact of climate change on the labor allocation: Empirical evidence from China. J. Environ. Econ. Manag. 2020, 104, 102376. [Google Scholar] [CrossRef]

- Yu, X.; Lei, X.; Wang, M. Temperature effects on mortality and household adaptation: Evidence from China. J. Environ. Econ. Manag. 2019, 96, 195–212. [Google Scholar] [CrossRef]

- Glenn, J.; Florescu, E. 2015-16 State of the Future. J. Soc. 2016, 5, 168. [Google Scholar] [CrossRef]

- Pachauri, R.; Allen, M.; Minx, J. Climate Change 2014: Synthesis Report; IPCC: Geneva, Switzerland, 2014. [Google Scholar]

- Sechi, S.; Giarola, S.; Leone, P. Taxonomy for Industrial Cluster Decarbonization: An Analysis for the Italian Hard-to-Abate Industry. Energies 2022, 15, 8586. [Google Scholar] [CrossRef]

- Zhao, F.; Liu, X.; Zhang, H.; Liu, Z. Automobile Industry under China’s Carbon Peaking and Carbon Neutrality Goals: Challenges, Opportunities, and Coping Strategies. J. Adv. Transp. 2022, 2022, 5834707. [Google Scholar] [CrossRef]

- Yu, H.; Zheng, C. Environmental regulation, land use efficiency and industrial structure upgrading: Test analysis based on spatial durbin model and threshold effect. Heliyon 2024, 10, e26508. [Google Scholar] [CrossRef] [PubMed]

- Wang, R.; Tang, H.; Ma, X. Can Carbon Emission Trading Policy Reduce PM2.5? Evidence from Hubei, China. Sustainability 2022, 14, 10755. [Google Scholar] [CrossRef]

- Xuan, D.; Ma, X.; Shang, Y. Can China’s policy of carbon emission trading promote carbon emission reduction? J. Clean. Prod. 2020, 270, 122383. [Google Scholar] [CrossRef]

- Chen, X.; Chen, Y.E.; Chang, C.-P. The effects of environmental regulation and industrial structure on carbon dioxide emission: A non-linear investigation. Environ. Sci. Pollut. Res. 2019, 26, 30252–30267. [Google Scholar] [CrossRef] [PubMed]

- Coase, R.H. The Problem of Social Cost. J. Law Econ. 2013, 56, 837–877. [Google Scholar] [CrossRef]

- Winch, D.M. Review of Pollution, Property and Prices. Can. J. Econ. Rev. Can. Econ. 1969, 2, 322–324. [Google Scholar] [CrossRef]

- Xu, S.; Chen, J.; Wen, D. Research on the Impact of Carbon Trading Policy on the Structural Upgrading of Marine Industry. Sustainability 2023, 15, 7029. [Google Scholar] [CrossRef]

- Martin, R.; Muûls, M.; Wagner, U.J. The Impact of the European Union Emissions Trading Scheme on Regulated Firms: What Is the Evidence after Ten Years? Rev. Environ. Econ. Policy 2016, 10, 129–148. [Google Scholar] [CrossRef]

- Brink, C.; Vollebergh, H.R.J.; van der Werf, E. Carbon pricing in the EU: Evaluation of different EU ETS reform options. Energy Policy 2016, 97, 603–617. [Google Scholar] [CrossRef]

- Delarue, E.; Lamberts, H.; D’haeseleer, W. Simulating greenhouse gas (GHG) allowance cost and GHG emission reduction in Western Europe. Energy 2007, 32, 1299–1309. [Google Scholar] [CrossRef]

- Hoffmann, V.H. EU ETS and Investment Decisions: The Case of the German Electricity Industry. Eur. Manag. J. 2007, 25, 464–474. [Google Scholar] [CrossRef]

- Abrell, J.; Rausch, S.; Yonezawa, H. Higher Price, Lower Costs? Minimum Prices in the EU Emissions Trading Scheme. Scand. J. Econ. 2019, 121, 446–481. [Google Scholar] [CrossRef]

- Zhang, Y.; Li, S.; Luo, T.; Gao, J. The effect of emission trading policy on carbon emission reduction: Evidence from an integrated study of pilot regions in China. J. Clean. Prod. 2020, 265, 121843. [Google Scholar] [CrossRef]

- Feng, Y. Does China’s carbon emission trading policy alleviate urban carbon emissions? IOP Conf. Ser. Earth Environ. Sci. 2020, 508, 012044. [Google Scholar] [CrossRef]

- Hübler, M.; Voigt, S.; Löschel, A. Designing an emissions trading scheme for China—An up-to-date climate policy assessment. Energy Policy 2014, 75, 57–72. [Google Scholar] [CrossRef]

- Wu, L.; Gong, Z. Can national carbon emission trading policy effectively recover GDP losses? A new linear programming-based three-step estimation approach. J. Clean. Prod. 2021, 287, 125052. [Google Scholar] [CrossRef]

- Wang, L.; Cui, L.; Weng, S.; Liu, C. Promoting industrial structure advancement through an emission trading scheme: Lessons from China’s pilot practice. Comput. Ind. Eng. 2021, 157, 107339. [Google Scholar] [CrossRef]

- Salant, S.W. Exhaustible Resources and Industrial Structure: A Nash-Cournot Approach to the World Oil Market. J. Political Econ. 1976, 84, 1079–1093. [Google Scholar] [CrossRef]

- Zhao, J.; Jiang, Q.; Dong, X.; Dong, K.; Jiang, H. How does industrial structure adjustment reduce CO2 emissions? Spatial and mediation effects analysis for China. Energy Econ. 2022, 105, 105704. [Google Scholar] [CrossRef]

- Cheng, Z.; Shi, X. Can Industrial Structural Adjustment Improve the Total-Factor Carbon Emission Performance in China? Int. J. Environ. Res. Public Health 2018, 15, 2291. [Google Scholar] [CrossRef]

- Xu, W.; Wang, M. How Do Financial Development and Industrial Structure Affect Green Total Factor Energy Efficiency: Evidence from China. Energies 2024, 17, 389. [Google Scholar] [CrossRef]

- Wang, X.; Chen, M.; Chen, N. How artificial intelligence affects the labour force employment structure from the perspective of industrial structure optimisation. Heliyon 2024, 10, e26686. [Google Scholar] [CrossRef]

- He, Z.; Zhang, R.; Qiu, Q.; Chen, Z. Research on industrial structure adjustment and spillover effect in resource-based regions in the post-pandemic era. PLoS ONE 2024, 19, e0296772. [Google Scholar] [CrossRef]

- Zhang, X.; Tian, C. Measurement and Influencing Factors of Regional Economic Resilience in China. Sustainability 2024, 16, 3338. [Google Scholar] [CrossRef]

- Zhao, J.; Tang, J. Industrial structure change and economic growth: A China-Russia comparison. China Econ. Rev. 2018, 47, 219–233. [Google Scholar] [CrossRef]

- Li, F.; Wu, Y.; Liu, J.; Zhong, S. Does digital inclusive finance promote industrial transformation? New evidence from 115 resource-based cities in China. PLoS ONE 2022, 17, e0273680. [Google Scholar] [CrossRef] [PubMed]

- Yu, H.; Xu, J.; Hu, H.; Shi, X.; Wang, J.; Liu, Y. How does green technology innovation influence industrial structure? Evidence of heterogeneous environmental regulation effects. Environ. Dev. Sustain. 2023, 26, 17875–17903. [Google Scholar] [CrossRef]

- Xu, B.; Lu, Y. An Empirical Study of the Relationship among Population Mobility, Industrial Structure Upgrading, and Economic Growth—Based on the SPVAR Model. Proc. Bus. Econ. Stud. 2021, 4, 14–25. [Google Scholar] [CrossRef]

- Yu, Y.; Gao, X.; Meng, W.; He, Y.; Zhang, C. Industrial Structure Optimization of Wuhan Urban Agglomeration Based on TFP and Industrial Spatial Linkages. Land 2022, 11, 1703. [Google Scholar] [CrossRef]

- Shi, L. Changes of Industrial Structure and Economic Growth in Coastal Regions of China: A Threshold Panel Model Based Study. J. Coast. Res. 2020, 107, 278–282. [Google Scholar] [CrossRef]

- Zhang, H.; Zhang, L.; Zhang, N. When and Under What Conditions Does an Emission Trading Scheme Become Cost Effective? Energy J. 2024, 45, 261–294. [Google Scholar] [CrossRef]

- Liang, P.; Xie, S.; Qi, F.; Huang, Y.; Wu, X. Environmental Regulation and Green Technology Innovation under the Carbon Neutrality Goal: Dual Regulation of Human Capital and Industrial Structure. Sustainability 2023, 15, 2001. [Google Scholar] [CrossRef]

- Zhu, H.; Fang, H.; Hua, F.; Shao, W.; Cai, P. The impact of environmental regulations on the upgrading of the industrial structure: Evidence from China. Heliyon 2024, 10, E27091. [Google Scholar] [CrossRef]

- Dai, Y.; Li, N.; Gu, R.; Zhu, X. Can China’s Carbon Emissions Trading Rights Mechanism Transform its Manufacturing Industry? Based on the Perspective of Enterprise Behavior. Sustainability 2018, 10, 2421. [Google Scholar] [CrossRef]

- Zhang, X.; Lu, F.; Xue, D. Does China’s carbon emission trading policy improve regional energy efficiency?—An analysis based on quasi-experimental and policy spillover effects. Environ. Sci. Pollut. Res. 2022, 29, 21166–21183. [Google Scholar] [CrossRef] [PubMed]

- Nie, X.; Chen, Z.; Wang, H.; Wu, J.; Wu, X.; Lu, B.; Qiu, L.; Li, Y. Is the “pollution haven hypothesis” valid for China’s carbon trading system? A re-examination based on inter-provincial carbon emission transfer. Environ. Sci. Pollut. Res. 2022, 29, 40110–40122. [Google Scholar] [CrossRef]

- Zhao, Z.; Zhou, S.; Wang, S.; Ye, C.; Wu, T. The Impact of Carbon Emissions Trading Pilot Policy on Industrial Structure Upgrading. Sustainability 2022, 14, 10818. [Google Scholar] [CrossRef]

- Tang, J.; Xiao, X.; Han, M.; Shan, R.; Gu, D.; Hu, T.; Li, G.; Rao, P.; Zhang, N.; Lu, J. China’s Sustainable Energy Transition Path to Low-Carbon Renewable Infrastructure Manufacturing under Green Trade Barriers. Sustainability 2024, 16, 3387. [Google Scholar] [CrossRef]

- Porter, M.E.; van der Linde, C. Toward a New Conception of the Environment-Competitiveness Relationship. J. Econ. Perspect. 1995, 9, 97–118. [Google Scholar] [CrossRef]

- Jaffe, A.B.; Newell, R.G.; Stavins, R.N. Environmental Policy and Technological Change. Environ. Resour. Econ. 2002, 22, 41–70. [Google Scholar] [CrossRef]

- Zhou, Z.; Ma, Z.; Lin, X. Carbon emissions trading policy and green transformation of China’s manufacturing industry: Mechanism assessment and policy implications. Front. Environ. Sci. 2022, 10, 984612. [Google Scholar] [CrossRef]

- Shen, B.; Yang, X.; Xu, Y.; Ge, W.; Liu, G.; Su, X.; Zhao, S.; Dagestani, A.A.; Ran, Q. Can carbon emission trading pilot policy drive industrial structure low-carbon restructuring: New evidence from China. Environ. Sci. Pollut. Res. 2023, 30, 41553–41569. [Google Scholar] [CrossRef]

- Greenstone, M.; Hanna, R. Environmental Regulations, Air and Water Pollution, and Infant Mortality in India. Am. Econ. Rev. 2014, 104, 3038–3072. [Google Scholar] [CrossRef]

- Shao, C.; Wei, J.; Liu, C. Empirical Analysis of the Influence of Green Credit on the Industrial Structure: A Case Study of China. Sustainability 2021, 13, 5997. [Google Scholar] [CrossRef]

- Wang, X.; Chen, Y. More Rational, More Attractive: Industrial Structure Rationalization and Migrant Workers’ Employment Choices in China. Sustainability 2024, 16, 2746. [Google Scholar] [CrossRef]

- Guan, S.; Liu, J.; Liu, Y.; Du, M. The Nonlinear Influence of Environmental Regulation on the Transformation and Upgrading of Industrial Structure. Int. J. Environ. Res. Public Health 2022, 19, 8378. [Google Scholar] [CrossRef]

- Jiang, W.; Wang, Y. Asymmetric Effects of Human Health Capital on Economic Growth in China: An Empirical Investigation Based on the NARDL Model. Sustainability 2023, 15, 5537. [Google Scholar] [CrossRef]

- Kim, S.-Y.; Kim, H.; Lee, J.-T. Health Effects of Air-Quality Regulations in Seoul Metropolitan Area: Applying Synthetic Control Method to Controlled-Interrupted Time-Series Analysis. Atmosphere 2020, 11, 868. [Google Scholar] [CrossRef]

- Fang, G.; Tian, L.; Liu, M.; Fu, M.; Sun, M. How to optimize the development of carbon trading in China—Enlightenment from evolution rules of the EU carbon price. Appl. Energy 2018, 211, 1039–1049. [Google Scholar] [CrossRef]

- Zhu, J.; Fan, Y.; Deng, X.; Xue, L. Low-carbon innovation induced by emissions trading in China. Nat. Commun. 2019, 10, 4088. [Google Scholar] [CrossRef]

- Lu, Y.; Yu, L. Trade Liberalization and Markup Dispersion: Evidence from China’s WTO Accession. Am. Econ. J. Appl. Econ. 2015, 7, 221–253. [Google Scholar] [CrossRef]

| Group | Specific Provinces and Cities |

|---|---|

| Treatment group | Beijing, Tianjin, Chongqing, Hubei, Shanghai, Guangdong |

| Control group | Shandong, Shanxi, Inner Mongolia, Qinghai, Hebei, Liaoning, Jiangsu, Zhejiang, Sichuan, Anhui, Hunan, Jiangxi, Jilin, Fujian, Henan, Guangxi, Hainan, Xinjiang, Guizhou, Yunnan, Shaanxi, Gansu, Heilongjiang, Ningxia, Tibet |

| Variable Name | Variable Symbol | Calculation Method |

|---|---|---|

| Rationalization of industrial structure | RIS | Tyrell index |

| Optimization of industrial structure | OIS | Tertiary industry output/secondary industry output |

| Carbon emission trading | did | Whether to implement a carbon trading policy |

| Level of economic development | pgdp | Logarithmic GDP per capita |

| Capital input level | invest | Fixed asset investment/gross regional product |

| Urbanization level | urban | Urbanized population/total population |

| Infrastructure status | infra | Road mileage per square kilometer |

| Government regulation level | fiscal | Government fiscal expenditure/Gross domestic product |

| Information technology level | internet | Total postal and telecommunications business/GDP |

| Carbon price | price | Logarithmic annual average of daily transaction prices |

| Variable | Median | Standard Deviation | Minimum | Maximum |

|---|---|---|---|---|

| RIS | 8.279 | 11.01 | 1.173 | 126.6 |

| OIS | 1.222 | 0.669 | 0.527 | 5.244 |

| did | 0.0968 | 0.296 | 0 | 1 |

| pgdp | 10.49 | 0.660 | 8.528 | 12.01 |

| invest | 0.863 | 0.919 | 0.142 | 7.379 |

| urban | 0.542 | 0.147 | 0.208 | 0.896 |

| fiscal | 0.255 | 0.193 | 0.0798 | 1.379 |

| infra | 0.832 | 0.501 | 0.0360 | 2.205 |

| internet | 0.07 | 0.05 | 0.01 | 0.29 |

| price | 3.198 | 0.570 | 1.858 | 4.343 |

| Variable | (1) | (2) | (3) | (4) |

|---|---|---|---|---|

| RIS | OIS | RIS | OIS | |

| did | 5.2384 ** | 0.2955 * | 6.3351 ** | 0.3322 ** |

| (2.2685) | (1.6501) | (2.4780) | (2.2586) | |

| pgdp | 0.5920 | 0.3346 ** | ||

| (0.4487) | (2.2715) | |||

| invest | −0.2890 | 0.0842 | ||

| (−0.2974) | (0.8295) | |||

| urban | 23.2367 *** | −1.7583 * | ||

| (4.9772) | (−1.7605) | |||

| fiscal | −0.1293 ** | −0.8991 *** | ||

| (−2.3827) | (−5.4010) | |||

| infra | −0.0530 ** | −0.0615 | ||

| (−2.0952) | (−0.5392) | |||

| internet | 27.9832 ** | 2.0865 *** | ||

| (2.0909) | (4.7758) | |||

| control variable | No | No | yes | yes |

| Area-fixed effects | yes | yes | yes | yes |

| Time-fixed effects | yes | yes | yes | yes |

| Constant | 4.3058 *** | 0.9468 *** | 1.4914 *** | 5.1198 *** |

| (8.0853) | (14.5837) | (3.5355) | (3.9574) | |

| Sample size | 496 | 496 | 496 | 496 |

| R2 | 0.682 | 0.721 | 0.927 | 0.916 |

| Variable | (1) | (2) | (3) | (4) |

|---|---|---|---|---|

| RIS | OIS | RIS | OIS | |

| did | 6.4108 ** | 0.3032 ** | 6.3206 ** | 0.3315 ** |

| (2.5195) | (2.1729) | (2.4935) | (2.2570) | |

| pgdp | 0.0173 | −0.1106 | ||

| (0.2597) | (−1.1306) | |||

| invest | 0.9976 | 0.3238 ** | 0.7153 | 0.3361 ** |

| (0.6411) | (2.2714) | (0.5465) | (2.2709) | |

| urban | −0.1510 | 0.0610 | −0.2793 | 0.0838 |

| (−0.1560) | (0.6112) | (−0.2846) | (0.8252) | |

| fiscal | 23.9452 *** | −2.1127 ** | 22.1817 *** | −1.7706 * |

| (5.1670) | (−2.0924) | (4.8545) | (−1.7508) | |

| infra | −0.8969 ** | 0.4063 | 2.0414 | −0.6452 |

| (−5.3784) | (0.5681) | (0.4555) | (−1.4626) | |

| internet | 3.0516 | −0.0565 | 3.5293 | −0.0607 |

| (0.8298) | (−0.5558) | (1.0314) | (−0.5340) | |

| control variable | 29.9543 ** | 2.2867 *** | 28.2559 ** | 2.0885 *** |

| Area-fixed effects | (2.0654) | (5.5206) | (2.1173) | (4.7380) |

| Time-fixed effects | Yes | Yes | Yes | Yes |

| Constant | Yes | Yes | Yes | Yes |

| −19.3060 | −1.6128 * | −17.0321 | −1.6177 | |

| Sample size | (−1.4171) | (−1.6777) | (−1.4245) | (−1.5660) |

| R2 | 480 | 480 | 496 | 496 |

| Variable | Policy Two Years Ahead | Policy Four Years Ahead | ||

|---|---|---|---|---|

| RIS | OIS | RIS | OIS | |

| did | 0.0016 | 0.0007 | 0.0019 | 0.0003 |

| (0.5327) | (0.2389) | (0.3159) | (0.2913) | |

| pgdp | 0.8724 | 0.4612 *** | 0.7613 | 0.3238 ** |

| (0.5716) | (3.3119) | (0.3917) | (2.2412) | |

| invest | −0.1826 | 0.0481 | −0.3126 | 0.0724 |

| (−0.1637) | (0.4558) | (−0.2986) | (0.6154) | |

| urban | 19.8713 *** | −2.3159 ** | 21.2734 *** | −1.9531 * |

| (4.6948) | (−2.1759) | (3.9716) | (−1.7249) | |

| fiscal | −1.3297 *** | 0.6179 | 0.9847 | −0.5981 |

| (−4.8492) | (0.6651) | (0.2684) | (−1.3712) | |

| infra | 2.8914 | −0.0792 | 3.1891 | −0.0824 |

| (0.8721) | (−0.8972) | (1.0142) | (−0.7759) | |

| internet | 30.6102 ** | 2.0714 *** | 34.6441 *** | 2.0144 *** |

| (2.1729) | (5.4416) | (3.0658) | (4.1298) | |

| Area-fixed effects | Yes | Yes | Yes | Yes |

| Time-fixed effects | Yes | Yes | Yes | Yes |

| Constant | −17.5187 | −1.5147 | −16.5981 | −1.6255 |

| (−1.3162) | (−1.2194) | (−1.3648) | (−1.2387) | |

| Sample size | 496 | 496 | 496 | 496 |

| R2 | 0.872 | 0.901 | 0.897 | 0.911 |

| Variable | (1) | (2) | (3) | (4) |

|---|---|---|---|---|

| RIS | OIS | RIS | OIS | |

| did | 6.1382 ** | 0.3117 * | 6.0237 ** | 0.3984 |

| (2.1794) | (1.8129) | (2.2541) | (2.273) | |

| Did * price | 0.7491 ** | 0.4258 ** | ||

| (2.3482) | (2.0853) | |||

| pre1 | 0.0127 | 0.0081 | ||

| (0.6372) | (0.4839) | |||

| control variable | yes | yes | yes | yes |

| Area-fixed effects | yes | yes | yes | yes |

| Time-fixed effects | yes | yes | yes | yes |

| Constant | 3.2912 *** | 1.1476 *** | 2.7459 *** | 1.0116 *** |

| (5.8436) | (7.2681) | (4.1679) | (5.8967) | |

| Sample size | 496 | 496 | 496 | 496 |

| R2 | 0.764 | 0.811 | 0.791 | 0.742 |

| Variant | (1) | (2) | (3) | (4) | (5) |

|---|---|---|---|---|---|

| RIS | OIS | inno | RIS | OIS | |

| did | 6.3351 ** | 0.3322 ** | 0.3327 ** | 6.5729 ** | 0.3668 ** |

| (2.4780) | (2.2586) | (2.4255) | (2.5111) | (2.3912) | |

| inno | 1.2531 *** | 8.8309 * | |||

| (3.1129) | (1.7354) | ||||

| pgdp | 0.5920 | 0.3346 ** | 0.8608 *** | 0.1382 | 0.3135 ** |

| (0.4487) | (2.2715) | (5.7469) | (0.1033) | (2.3111) | |

| invest | −0.2890 | 0.0842 | 0.0291 | −0.2582 | 0.0913 |

| (−0.2974) | (0.8295) | (0.5635) | (−0.2939) | (0.9150) | |

| urban | 23.2367 *** | −1.7583 * | 6.4124 *** | 24.9374 *** | −1.3367 * |

| (4.9772) | (−1.7605) | (6.3923) | (4.6525) | (−1.6991) | |

| fiscal | 2.0278 | −0.6363 | 0.2347 | 5.7182 | −0.3995 |

| (0.4572) | (−1.4587) | (0.3642) | (1.4000) | (−0.9963) | |

| infra | 3.5203 | −0.0615 | 0.4391 ** | 4.4878 | −0.0843 |

| (1.0351) | (−0.5392) | (2.2507) | (1.3373) | (−0.6898) | |

| internet | 27.9832 ** | 2.0865 *** | 1.4373 ** | 24.7001 * | 1.8841 *** |

| (2.0909) | (4.7758) | (2.5757) | (1.8903) | (4.9868) | |

| Area-fixed effects | Yes | Yes | Yes | Yes | Yes |

| Time-fixed effect | Yes | Yes | Yes | Yes | Yes |

| Constant | −16.0818 | −1.6196 | −3.6164 *** | −15.6071 | −1.6989 * |

| (−1.3292) | (−1.5745) | (−3.0761) | (−1.3161) | (−1.7202) | |

| Sample size | 496 | 496 | 496 | 496 | 496 |

| R2 | 0.876 | 0.891 | 0.943 | 0.874 | 0.892 |

| Variable | RIS | OIS | ||||

|---|---|---|---|---|---|---|

| Area | East | Central | West | East | Central | West |

| did | 8.8142 *** | 1.1032 ** | 1.9694 *** | 0.4385 ** | 0.0390 | −0.1221 |

| (3.5494) | (2.1518) | (4.9669) | (2.0897) | (0.8965) | (−0.9691) | |

| pgdp | 2.8026 | 4.0742 * | −0.9324 * | 0.5054 ** | 0.1802 | −0.1358 |

| (0.8310) | (1.8620) | (−1.7814) | (1.9803) | (1.4052) | (−1.0648) | |

| invest | −0.3224 | 0.3104 | 0.6606 | 0.0332 | −0.1215 | −0.2800 * |

| (−0.2534) | (0.1865) | (0.8263) | (0.4103) | (−0.7516) | (−1.7577) | |

| urban | 28.5462 | −26.8691 | 11.4110 *** | −4.4294 ** | −0.2392 | 0.9091 |

| (1.0464) | (−1.2594) | (2.9419) | (−2.1091) | (−0.1765) | (0.7467) | |

| fiscal | −2.7221 | 5.9188 | 1.6675 | 2.0072 | 1.0200 | 0.6405 ** |

| (−0.0615) | (0.5021) | (1.2779) | (1.5468) | (0.5880) | (2.0728) | |

| infra | 9.7516 | −1.5684 | 0.1634 | 0.0840 | −0.2197 *** | 0.1231 * |

| (1.0581) | (−0.8296) | (0.6623) | (0.4367) | (−3.2601) | (1.9436) | |

| internet | 83.3363 * | 32.9492 *** | 10.7691 *** | 3.2668 *** | 2.2060 *** | 0.6097 * |

| (1.7558) | (3.2920) | (3.7864) | (5.0116) | (3.7210) | (1.7062) | |

| Area-fixed effects | Yes | Yes | Yes | Yes | Yes | Yes |

| Time-fixed effect | Yes | Yes | Yes | Yes | Yes | Yes |

| Constant | −48.2838 | −27.5263 ** | 5.4619 | −2.4818 | −0.9797 | 1.9183 ** |

| (−1.5129) | (−2.0667) | (1.4722) | (−1.5712) | (−0.9949) | (2.2265) | |

| Sample size | 192 | 144 | 160 | 192 | 144 | 160 |

| R2 | 0.2900 | 0.4685 | 0.6537 | 0.7745 | 0.6177 | 0.3361 |

Disclaimer/Publisher’s Note: The statements, opinions and data contained in all publications are solely those of the individual author(s) and contributor(s) and not of MDPI and/or the editor(s). MDPI and/or the editor(s) disclaim responsibility for any injury to people or property resulting from any ideas, methods, instructions or products referred to in the content. |

© 2024 by the authors. Licensee MDPI, Basel, Switzerland. This article is an open access article distributed under the terms and conditions of the Creative Commons Attribution (CC BY) license (https://creativecommons.org/licenses/by/4.0/).

Share and Cite

Zhang, Y.; Tang, H.; Yan, D. The Impact of Carbon Emission Trading Policy on Industrial Structure Adjustment: A Perspective of Sustainable Development. Sustainability 2024, 16, 6753. https://doi.org/10.3390/su16166753

Zhang Y, Tang H, Yan D. The Impact of Carbon Emission Trading Policy on Industrial Structure Adjustment: A Perspective of Sustainable Development. Sustainability. 2024; 16(16):6753. https://doi.org/10.3390/su16166753

Chicago/Turabian StyleZhang, Yonglei, Huanchen Tang, and Donghai Yan. 2024. "The Impact of Carbon Emission Trading Policy on Industrial Structure Adjustment: A Perspective of Sustainable Development" Sustainability 16, no. 16: 6753. https://doi.org/10.3390/su16166753

APA StyleZhang, Y., Tang, H., & Yan, D. (2024). The Impact of Carbon Emission Trading Policy on Industrial Structure Adjustment: A Perspective of Sustainable Development. Sustainability, 16(16), 6753. https://doi.org/10.3390/su16166753