Environmental Protection Tax Reform in China: A Catalyst or a Barrier to Total Factor Productivity? An Analysis through a Quasi-Natural Experiment

Abstract

:1. Introduction

2. Literature and Hypothesis

2.1. Environmental Tax Reform and TFP Enhancement

2.2. Heterogeneity in the Impact of the Environmental Tax Reform on TFP

2.3. Green Innovation as a Mediating Mechanism for TFP Enhancement

2.4. Financing Constraints as a Mediating Mechanism between the Environmental Tax Reform and TFP

3. Data and Methodology

3.1. Data Sources

3.2. Sample Selection

3.2.1. Explained Variables

3.2.2. Explanatory Variables

3.2.3. Mediating Variables

3.2.4. Control Variables

3.3. Model Setting

4. Empirical Results

4.1. Parallel Trend Test

4.2. Basic Regression Results

4.3. Robustness Tests

4.3.1. Replacing the Dependent Variable

4.3.2. Lagging All Explanatory Variables by One Period

4.3.3. Regression Using the Propensity Score Matching–Difference-in-Differences Approach

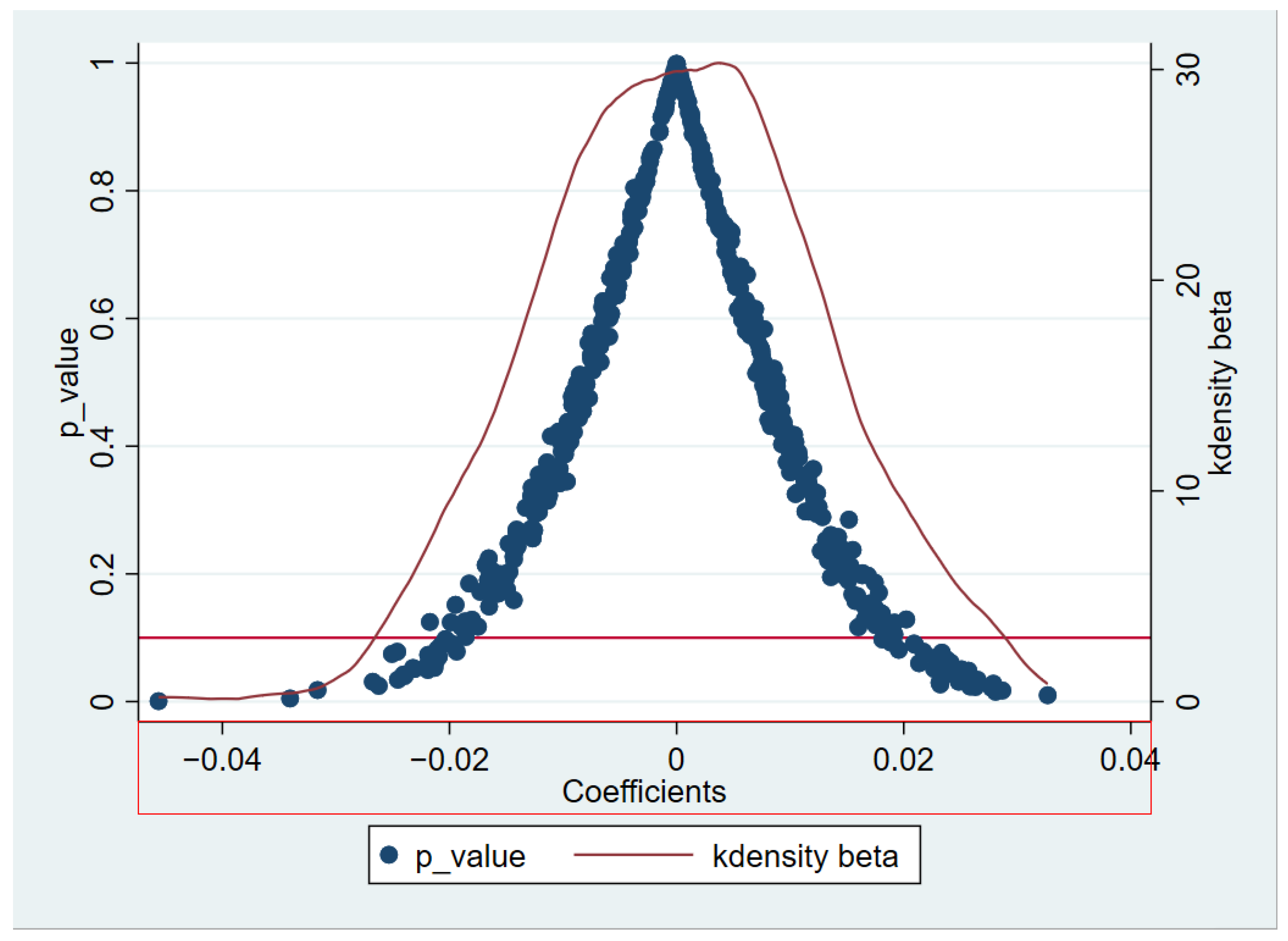

4.3.4. Placebo Test

4.4. Heterogeneity Analysis

4.4.1. Property Rights Heterogeneity

4.4.2. Financing Constraint Heterogeneity

4.5. Mechanism Testing

4.5.1. Green Innovation

4.5.2. Financing Constraints

5. Discussion

5.1. EPT and TFP

5.2. Heterogeneity in TFP Improvements

5.3. Mechanisms of Impact

6. Conclusions and Policy Implications

6.1. Conclusions

6.2. Policy Implications

6.2.1. Implement and Refine Environmental Tax Policies

6.2.2. Encourage and Support Green Innovation

6.2.3. Improve Financing Mechanism

6.2.4. Tailor Policies to Enterprise Characteristics and Financing Constraints

6.3. Limitations and Further Research Prospects

Author Contributions

Funding

Institutional Review Board Statement

Informed Consent Statement

Data Availability Statement

Conflicts of Interest

References

- Li, P.; Lin, Z.; Du, H.; Feng, T.; Zuo, J. Do environmental taxes reduce air pollution? Evidence from fossil-fuel power plants in China. J. Environ. Manag. 2021, 295, 113112. [Google Scholar] [CrossRef] [PubMed]

- Wen, H.; Deng, W.; Guo, Q. The effects of the environmental protection law on heavily polluting firms in China. PLoS ONE 2021, 16, e0261342. [Google Scholar] [CrossRef]

- Cai, F. From the demographic dividend to the reform dividend. In Understanding China’s Economy; Springer: Singapore, 2021. [Google Scholar] [CrossRef]

- Li, T.; Wang, P.; Liu, X.; Cheng, H. Quality-oriented growth: A new trend for Chinese firms. China Econ. J. 2017, 10, 6–20. [Google Scholar] [CrossRef]

- Wang, X.; Chen, X. An evaluation index system of China’s development level of ecological civilization. Sustainability 2019, 11, 2270. [Google Scholar] [CrossRef]

- Zheng, Y.; Zhuang, G. Systemic governance of mountains, rivers, forests, farmlands, lakes and grasslands: Theoretical framework and approaches. Chin. J. Urban Environ. Stud. 2021, 9, 2150021. [Google Scholar] [CrossRef]

- Filipenko, A. Economic productivity: Factor approaches. Actual Probl. Int. Relat. 2021, 147, 55–64. [Google Scholar] [CrossRef]

- Trivić, N.; Todić, B. A decomposition of the total productivity factor into technical progress and technological efficiency—Methodological possibilities. Argum. Oecon. 2022, 49, 57–75. [Google Scholar] [CrossRef]

- Sun, X.; Zhang, C. Environmental protection tax and total factor productivity—Evidence from Chinese listed companies. Front. Environ. Sci. 2023, 10, 1104439. [Google Scholar] [CrossRef]

- Barbera, A.; McConnell, V. The impact of environmental regulations on industry productivity: Direct and indirect effects. J. Environ. Econ. Manag. 1990, 18, 50–65. [Google Scholar] [CrossRef]

- Porter, M.E.; Van der Linde, C. Toward a new conception of the environment-competitiveness relationship. J. Econ. Perspect. 1995, 9, 97–118. [Google Scholar] [CrossRef]

- Shah, W.U.H.; Lu, Y.; Liu, J.; Rehman, A.; Yasmeen, R. The impact of climate change and production technology heterogeneity on China’s agricultural total factor productivity and production efficiency. Sci. Total Environ. 2024, 907, 168027. [Google Scholar] [CrossRef] [PubMed]

- He, X.; Jing, Q. The impact of environmental tax reform on total factor productivity of heavy-polluting firms based on a dual perspective of technological innovation and capital allocation. Sustainability 2022, 14, 14946. [Google Scholar] [CrossRef]

- Chen, Y.; Zhang, J.; Tadikamalla, P.; Gao, X. The relationship among government, enterprise, and public in environmental governance from the perspective of multi-player evolutionary game. Int. J. Environ. Res. Public Health 2019, 16, 3351. [Google Scholar] [CrossRef] [PubMed]

- Gupta, K. Environmental Sustainability and Implied Cost of Equity: International Evidence. J. Bus. Ethics 2018, 147, 343–365. [Google Scholar] [CrossRef]

- Carlson, A.-M.; Palmer, C. A qualitative meta-synthesis of the benefits of eco-labeling in developing countries. Ecol. Econ. 2016, 127, 129–145. [Google Scholar] [CrossRef]

- Wong, W.; Batten, J.; Ahmad, A.H.; Mohamed-Arshad, S.B.; Nordin, S.; Abdul Adzis, A. Does ESG certification add firm value? Financ. Res. Lett. 2020, 39, 101593. [Google Scholar] [CrossRef]

- Ding, X.; Petrovskaya, M. The relationship between environmental taxes, technological innovation and corporate financial performance: A heterogeneous analysis of micro-evidence from China. BRICS J. Econ. 2022, 3, 249–270. [Google Scholar] [CrossRef]

- Tingbani, I.; Salia, S.; Hussain, J.; Alhassan, Y. Environmental Tax, SME Financing Constraint, and Innovation: Evidence From OECD Countries. IEEE Trans. Eng. Manag. 2021, 70, 1006–1025. [Google Scholar] [CrossRef]

- Zhang, D.; Vigne, S. How does innovation efficiency contribute to green productivity? A financial constraint perspective. J. Clean. Prod. 2021, 70, 1006–1025. [Google Scholar] [CrossRef]

- He, Y.; Zhu, X.; Zheng, H. The influence of EPT law on total factor productivity: Evidence from listed firms in China. Energy Econ. 2022, 113, 106248. [Google Scholar] [CrossRef]

- Liang, H.; Wang, Z.; Niu, R. Does environmental regulations promote the green transformation of high polluters? Appl. Econ. Lett. 2022, 30, 927–931. [Google Scholar] [CrossRef]

- Wu, J.; Tal, A. From pollution charge to EPT: A comparative analysis of the potential and limitations of China’s new environmental policy initiative. J. Comp. Policy Anal. Res. Pract. 2018, 20, 223–236. [Google Scholar] [CrossRef]

- Xiong, X.; Masron, T.A.; Gondo, T.W. Can the green credit policy stimulate green innovation of heavily polluting enterprises in China? Front. Environ. Sci. 2023, 10, 1076103. [Google Scholar] [CrossRef]

- Hong, M.-K.; Li, Z.; Drakeford, B. Do the green credit guidelines affect corporate green technology innovation? Empirical research from China. Int. J. Environ. Res. Public Health 2021, 18, 1682. [Google Scholar] [CrossRef]

- Zheng, C.; Deng, F.; Zhuo, C.; Sun, W. Green credit policy, institution supply, and enterprise green innovation. J. Econ. Anal. 2022, 1, 20–34. [Google Scholar] [CrossRef]

- Bai, R.; Lin, B. Access to credit and green innovation. J. Glob. Inf. Manag. 2022, 30, 1–21. [Google Scholar] [CrossRef]

- Olley, G.S.; Pakes, A. The dynamics of productivity in the telecommunications equipment industry. Econometrica 1996, 64, 1263–1297. [Google Scholar] [CrossRef]

- Levinsohn, J.; Petrin, A. Estimating production functions using inputs to control for unobservables. Rev. Econ. Stud. 2003, 70, 317–341. [Google Scholar] [CrossRef]

- Khan, A.; Gulati, R. Productivity growth, catching-up and technology innovation in microfinance institutions in India: Evidence using a bootstrap Malmquist Index approach. Benchmarking: Int. J. 2021, 28, 210–230. [Google Scholar] [CrossRef]

- Haider, S.; Bhat, J.A. The productivity impacts of energy efficiency programs in developing countries: Evidence from iron and steel firms in China. China Econ. Rev. 2021, 59, 101364. [Google Scholar] [CrossRef]

- Rostiana, E.; Djulius, H.; Sudarjah, G.M. Total Factor Productivity Calculation of the Indonesian Micro and Small Scale Manufacturing Industry. Ekuilibrium J. Ilm. Bid. Ilmu Ekon. 2022, 17, 54–63. [Google Scholar] [CrossRef]

- Zheng, X.; Wu, C.; He, S. Impacts of China’s differential electricity pricing on the productivity of energy-intensive industries. Energy Econ. 2020, 14, 105050. [Google Scholar] [CrossRef]

- Wu, X. The interaction between productivity and export behavior: Evidence from Chinese electronics firms. Am. J. Ind. Bus. Manag. 2020, 10, 1857–1869. [Google Scholar] [CrossRef]

- Miao, C.; Duan, M.; Zuo, Y.; Wu, X. Spatial heterogeneity and evolution trend of regional green innovation efficiency--an empirical study based on panel data of industrial enterprises in China’s provinces*. Energy Policy 2021, 156, 112370. [Google Scholar] [CrossRef]

- Ardito, L.; Messeni Petruzzelli, A.; Pascucci, F.; Peruffo, E. Inter-firm R&D collaborations and green innovation value: The role of family firms’ involvement and the moderating effects of proximity dimensions. Bus. Strat. Environ. 2018, 28, 185–197. [Google Scholar] [CrossRef]

- Xu, J.; Liu, F.; Shang, Y. R&D investment, ESG performance and green innovation performance: Evidence from China. Kybernetes 2020, 50, 737–756. [Google Scholar] [CrossRef]

- Kaplan, S.; Zingales, L. Do investment-cash flow sensitivities provide useful measures of financing constraints? Q. J. Econ. 1997, 112, 169–215. [Google Scholar] [CrossRef]

- Ren, X.; Qin, J.; Dong, K. How does climate policy uncertainty affect excessive corporate debt? The case of China. J. Environ. Assess. Policy Manag. 2022, 24, 2250025. [Google Scholar] [CrossRef]

- Pham, X.Q.; Le, L.H. Investment in the context of financial constraints: A case of Vietnamese listed firms. Minist. Sci. Technol. Vietnam. 2023, 65, 8–15. [Google Scholar] [CrossRef]

- Liu, X.; Li, H.; Li, H. Analyzing relationship between financing constraints, entrepreneurship, and agricultural company using AI-based decision support system. Sci. Program. 2022, 2022, 1634677. [Google Scholar] [CrossRef]

- Yang, S.; Wang, C.; Lyu, K.; Li, J. EPT law and total factor productivity of listed firms: Promotion or inhibition? Front. Environ. Sci. 2023, 11, 1152771. [Google Scholar] [CrossRef]

- Chen, A.; Chen, H. Decomposition Analysis of Green Technology Innovation from Green Patents in China. Math. Probl. Eng. 2021, 2021, 6672656. [Google Scholar] [CrossRef]

- Rahman, H.U.; Zahid, M.; Al-Faryan, M.A.S. ESG and firm performance: The rarely explored moderation of sustainability strategy and top management commitment. J. Clean. Prod. 2023, 404, 136859. [Google Scholar] [CrossRef]

- Tabash, M.I.; Khan, S.U.; Daud, S. Impact of return on assets on firm performance: Evidence from Middle Eastern firms. Int. J. Financ. Stud. 2020, 8, 57. [Google Scholar] [CrossRef]

- Titman, S.; Wessels, R. The determinants of capital structure choice. J. Financ. 1988, 43, 1–19. [Google Scholar] [CrossRef]

- Suriawinata, I.S.; Nurmalita, D.M. Ownership structure, firm value and the moderating effects of firm size: Empirical evidence from Indonesian consumer goods industry. J. Manaj. Dan Kewirausahaan 2022, 24, 91–104. [Google Scholar] [CrossRef]

- Mollick, A.V.; Haidar, M. Analyzing financial ratios as indicators to measure financial performance at PT. Industri Jamu dan Farmasi Sido Muncul Tbk. Asian J. Appl. Bus. Manag. 2023, 2, 173–188. [Google Scholar] [CrossRef]

- Mustafa, M.; Rafiq, M.Y.; Khalid, S. Financial stability index for the financial sector of Pakistan. Economies 2019, 7, 81. [Google Scholar] [CrossRef]

- Angrist, J.D.; Pischke, J.-S. Mostly Harmless Econometrics: An Empiricist’s Companion; Princeton University Press: Princeton, NJ, USA, 2008. [Google Scholar]

- Baron, R.M.; Kenny, D.A. The moderator–mediator variable distinction in social psychological research: Conceptual, strategic, and statistical considerations. J. Personal. Soc. Psychol. 1986, 51, 1173–1182. [Google Scholar] [CrossRef]

- Maçaira, P.; Thomé, A.M.T.; Oliveira, F.C.; Ferrer, A. Time series analysis with explanatory variables: A systematic literature review. Environ. Model. Softw. 2018, 107, 199–209. [Google Scholar] [CrossRef]

- Austin, P.C.; Stuart, E.A. Moving towards best practice when using inverse probability of treatment weighting (IPTW) using the propensity score to estimate causal treatment effects in observational studies. Stat. Med. 2015, 34, 3661–3679. [Google Scholar] [CrossRef] [PubMed]

- Hagemann, A. Placebo inference on treatment effects when the number of clusters is small. J. Econom. 2018, 213, 190–209. [Google Scholar] [CrossRef]

- Zhou, J.; Mao, J.; Tian, M.; Wang, Z. Does informal environmental regulation matter? Evidence on the different impacts of communities and ENGOs on heavy-polluting firms’ green technology innovation. J. Environ. Plan. Manag. 2022, 67, 2668–2694. [Google Scholar] [CrossRef]

- Guo, L.; Hu, C.; Fan, M.; Mao, J.; Tian, M.; Wang, Z.; Wei, Y. The spillover effects of environmental regulations: A perspective of Chinese unregulated firms’ tax burden. China World Econ. 2023, 31, 84–111. [Google Scholar] [CrossRef]

- Fang, Y.L.; Shao, Z. Whether green finance can effectively moderate the green technology innovation effect of heterogeneous environmental regulation. Int. J. Environ. Res. Public Health 2022, 19, 3646. [Google Scholar] [CrossRef] [PubMed]

- Deng, J.; Yang, J. EPT and green innovation of heavily polluting enterprises: A quasi-natural experiment based on the implementation of China’s EPT law. PLoS ONE 2023, 18, e0286253. [Google Scholar] [CrossRef]

- Ma, M. Study on the impact of environmental tax on corporate green innovation under the dual carbon target based on A-share mining listed companies. Highlights Bus. Econ. Manag. 2023, 6, 220–231. [Google Scholar] [CrossRef]

- Sobel, M.E. Asymptotic confidence intervals for indirect effects in structural equation models. Sociol. Methodol. 1982, 13, 290–312. [Google Scholar] [CrossRef]

- MacKinnon, D.P.; Lockwood, C.M.; Hoffman, J.M.; West, S.G.; Sheets, V. A comparison of methods to test mediation and other intervening variable effects. Psychol. Methods 2002, 7, 83–104. [Google Scholar] [CrossRef]

- Zhang, J.; Li, S. EPT, corporate ESG performance, and green technological innovation. Front. Environ. Sci. 2021, 10, 982132. [Google Scholar] [CrossRef]

- Dong, X.; Yang, Y.; Zhao, X.; Feng, Y.; Liu, C. Environmental Regulation, Resource Misallocation and Industrial Total Factor Productivity: A Spatial Empirical Study Based on China’s Provincial Panel Data. Sustainability 2021, 13, 2390. [Google Scholar] [CrossRef]

- Ai, H.; Hu, S.; Li, K.; Shao, S. Environmental regulation, total factor productivity, and enterprise duration: Evidence from China. Bus. Strategy Environ. 2020, 29, 2284–2296. [Google Scholar] [CrossRef]

- Lei, X.; Wu, S. Improvement of different types of environmental regulations on total factor productivity: A threshold effect analysis. Discret. Dyn. Nat. Soc. 2019, 2019, 9790545. [Google Scholar] [CrossRef]

- Qin, L.; Liu, S.; Zhan, C.; Duan, X.; Li, S.; Hou, Y. Impact of China’s local government competition and environmental regulation on total factor productivity. SAGE Open 2023, 13, 21582440231160438. [Google Scholar] [CrossRef]

- Zhang, Y.; Xing, C.; Wang, Y.-H. Does green innovation mitigate financing constraints? Evidence from China’s private enterprises. J. Clean. Prod. 2020, 264, 121698. [Google Scholar] [CrossRef]

- Cai, W.; Ye, P. How does environmental regulation influence enterprises’ total factor productivity? A quasi-natural experiment based on China’s new environmental protection law. J. Clean. Prod. 2020, 276, 124105. [Google Scholar] [CrossRef]

- Yuan, J.; Zhang, D. Research on the impact of environmental regulations on industrial green total factor productivity: Perspectives on the changes in the allocation ratio of factors among different industries. Sustainability 2021, 13, 12947. [Google Scholar] [CrossRef]

- Cai, W.; Bai, M.; Davey, H. Implementing EPT in China: An alternative framework. Pac. Account. Rev. 2022, 34, 479–513. [Google Scholar] [CrossRef]

- Diab, M.Y.; Khalifa, M.A.; Rady, T.A.; Abo Laban, A.M. Proposed framework for The Environmental Tax System to Reduce Environmental Pollution and Contribute to Sustainable Development. J. Environ. Sci. 2022, 51, 41–88. [Google Scholar] [CrossRef]

- Irianto, E.S.; Rosdiana, H.; Tambunan, M. On quest of environmental tax implementation in Indonesia. E3S Web Conf. 2018, 52, 00013. [Google Scholar] [CrossRef]

- Yu, C.-H.; Wu, X.; Zhang, D.; Chen, S.; Zhao, J. Demand for green finance: Resolving financing constraints on green innovation in China. Energy Policy 2021, 153, 112255. [Google Scholar] [CrossRef]

| Type | Name | Abbreviation | Definition | Reference |

|---|---|---|---|---|

| Explained Variables | Total Factor Productivity | TFP_LP | Total factor productivity calculated using the LP method | Levinsohn and Petrin [29] |

| Explanatory Variables | Time Dummy Variable | post | Set to 1 for the year 2018 and beyond, otherwise set to 0 | Yang et al., 2023 [42] |

| Policy Dummy Variable | treated | Set to 1 for heavily polluted enterprises, otherwise set to 0 | Yang et al., 2023 [42] | |

| Interaction Term | DID | Time dummy variable × policy dummy variable | Yang et al., 2023 [42] | |

| Mediating Variables | Green Innovation | GI | ln (number of green invention patent applications + 1) | Chen et al., 2021 [43] |

| Financing Constraints | KZ | KZ index | Kaplan and Zingales [38] | |

| Control Variables | Tobin’s Q Ratio | qa | Market value of firm/replacement capital of firm | Rahman et al. [44] |

| Return on Assets | roa | Net profit/average total assets | Tabash et al., 2020 [45] | |

| Debt Ratio | debt | Total liabilities/total assets | Titman and Wessels [46] | |

| Return on Equity | roe | Net profit/net assets | Tabash et al. [45] | |

| Market-to-Book Ratio | mtb | Total assets/market value of the company | Titman and Wessels [46] | |

| Firm Size | size | ln (total assets of the firm) | Suriawinata and Nurmalita [47] | |

| Firm Age | lnage | ln (the number of years since firm’s inception) | Suriawinata and Nurmalita [47] | |

| Fixed Asset Ratio | ppe | Fixed assets/total assets | Mollick and Haidar [48] | |

| Cash Ratio | cash | (Cash + marketable securities)/current liabilities | Mustafa et al. [49] |

| Variable | N | Mean | SD | Min | Max |

|---|---|---|---|---|---|

| TFP_ LP | 8242 | 9.369 | 1.093 | 5.697 | 13.09 |

| post | 8328 | 0.179 | 0.383 | 0 | 1 |

| treated | 8328 | 0.381 | 0.486 | 0 | 1 |

| DID | 8328 | 0.0698 | 0.255 | 0 | 1 |

| GI | 8328 | 1.249 | 1.534 | 0 | 5.587 |

| KZ | 8328 | 1.509 | 2.126 | −9.921 | 8.948 |

| qa | 8328 | 1.948 | 1.208 | 0.855 | 7.722 |

| roa | 8328 | 0.0417 | 0.0462 | −0.102 | 0.204 |

| roe | 8328 | 0.0781 | 0.0845 | −0.265 | 0.331 |

| debt | 8328 | 0.483 | 0.190 | 0.0750 | 0.861 |

| mtb | 8328 | 0.311 | 0.142 | 0.0714 | 0.758 |

| size | 8328 | 22.60 | 1.322 | 19.90 | 26.39 |

| lnage | 8328 | 2.847 | 0.303 | 1.792 | 3.401 |

| ppe | 8328 | 0.249 | 0.180 | 0.00240 | 0.752 |

| rd | 8328 | 0.0152 | 0.0247 | 0 | 0.119 |

| cash | 8328 | 0.590 | 0.832 | 0.0289 | 5.566 |

| m1 | m2 | m3 | m4 | m5 | m6 | |

|---|---|---|---|---|---|---|

| VARIABLES | TFP_LP | TFP_LP | TFP_LP | TFP_LP | TFP_LP | TFP_LP |

| DID | 0.0603 * | 0.4207 *** | 0.0603 *** | 0.0670 *** | 0.0611 *** | 0.0653 *** |

| (0.0344) | (0.0187) | (0.0205) | (0.0159) | (0.0160) | (0.0159) | |

| Controls | NO | NO | NO | YES | YES | YES |

| Observations | 8242 | 8242 | 8242 | 8242 | 8242 | 8242 |

| R-squared | 0.3144 | 0.0638 | 0.3144 | 0.5941 | 0.5871 | 0.5947 |

| Company FE | NO | YES | YES | NO | YES | YES |

| Year FE | YES | NO | YES | YES | NO | YES |

| m1 | m2 | m3 | m4 | |

|---|---|---|---|---|

| VARIABLES | TFP_OP | TFP_LP | TFP_LP | TFP_LP |

| DID | 0.0936 *** | 0.0595 ** | 0.0655 *** | 0.0653 *** |

| (0.0184) | (0.0265) | (0.0244) | (0.0244) | |

| Controls | YES | YES | YES | YES |

| Observations | 8242 | 7351 | 8219 | 8239 |

| R-squared | 0.4439 | 0.4555 | 0.5948 | 0.5947 |

| Company FE | YES | YES | YES | YES |

| Year FE | YES | YES | YES | YES |

| m1 | m2 | m3 | m4 | |

|---|---|---|---|---|

| State-Owned | Non-State-Owned | High Financing Constraints | Low Financing Constraints | |

| VARIABLES | TFP_LP | TFP_LP | TFP_LP | TFP_LP |

| DID | 0.0697 ** | 0.0663 | 0.0360 | 0.0832 *** |

| (0.0275) | (0.0442) | (0.0424) | (0.0263) | |

| Observations | 5095 | 3147 | 4122 | 4120 |

| R-squared | 0.5717 | 0.6247 | 0.5505 | 0.6227 |

| Company FE | YES | YES | YES | YES |

| Year FE | YES | YES | YES | YES |

| m1 | m2 | m3 | |

|---|---|---|---|

| VARIABLES | TFP_LP | GI | TFP_LP |

| DID | 0.0653 *** | 0.2015 *** | 0.0538 ** |

| (0.0244) | (0.0689) | (0.0235) | |

| GI | 0.0011 | ||

| (0.0061) | |||

| Observations | 8242 | 8328 | 8242 |

| R-squared | 0.5947 | 0.2475 | 0.6100 |

| Company FE | YES | YES | YES |

| Year FE | YES | YES | YES |

| Measurement | Coefficient | Standard Error | Z-Value | p-Value |

|---|---|---|---|---|

| Sobel | 0.00304926 | 0.00142255 | 2.144 | 0.032072 |

| Goodman-1 (Aroian) | 0.00294222 | 0.00145857 | 2.091 | 0.03656543 |

| Goodman-2 | 0.00304926 | 0.0013856 | 2.201 | 0.02775897 |

| a Coefficient | 0.175276 | 0.064387 | 2.72224 | 0.006484 |

| b Coefficient | 0.017397 | 0.005003 | 3.47729 | 0.000507 |

| Indirect Effect | 0.003049 | 0.001423 | 2.14351 | 0.032072 |

| Direct Effect | 0.029252 | 0.029094 | 1.00544 | 0.314685 |

| Total Effect | 0.032302 | 0.029101 | 1.11 | 0.267001 |

| Proportion of Mediation | 9.44% | - | - | - |

| m1 | m2 | m3 | |

|---|---|---|---|

| VARIABLES | TFP_LP | KZ | TFP_LP |

| DID | 0.0653 *** | −0.2194 *** | 0.0504 ** |

| (0.0244) | (0.0663) | (0.0234) | |

| KZ | −0.0160 *** | ||

| (0.0043) | |||

| Observations | 8242 | 8328 | 8242 |

| R-squared | 0.5947 | 0.5453 | 0.6116 |

| Number of id | 797 | 797 | 797 |

| City FE | YES | YES | YES |

| Year FE | YES | YES | YES |

Disclaimer/Publisher’s Note: The statements, opinions and data contained in all publications are solely those of the individual author(s) and contributor(s) and not of MDPI and/or the editor(s). MDPI and/or the editor(s) disclaim responsibility for any injury to people or property resulting from any ideas, methods, instructions or products referred to in the content. |

© 2024 by the authors. Licensee MDPI, Basel, Switzerland. This article is an open access article distributed under the terms and conditions of the Creative Commons Attribution (CC BY) license (https://creativecommons.org/licenses/by/4.0/).

Share and Cite

Wang, J.; Pan, Y.; Tang, D. Environmental Protection Tax Reform in China: A Catalyst or a Barrier to Total Factor Productivity? An Analysis through a Quasi-Natural Experiment. Sustainability 2024, 16, 6712. https://doi.org/10.3390/su16166712

Wang J, Pan Y, Tang D. Environmental Protection Tax Reform in China: A Catalyst or a Barrier to Total Factor Productivity? An Analysis through a Quasi-Natural Experiment. Sustainability. 2024; 16(16):6712. https://doi.org/10.3390/su16166712

Chicago/Turabian StyleWang, Jingjing, Yuhan Pan, and Decai Tang. 2024. "Environmental Protection Tax Reform in China: A Catalyst or a Barrier to Total Factor Productivity? An Analysis through a Quasi-Natural Experiment" Sustainability 16, no. 16: 6712. https://doi.org/10.3390/su16166712

APA StyleWang, J., Pan, Y., & Tang, D. (2024). Environmental Protection Tax Reform in China: A Catalyst or a Barrier to Total Factor Productivity? An Analysis through a Quasi-Natural Experiment. Sustainability, 16(16), 6712. https://doi.org/10.3390/su16166712