Abstract

This work focuses on understanding the different strategies adopted by wine cooperatives located in Argentina and the main E.U. wine countries for penetrating international distribution networks in the U.S. and Canadian markets. This study adopts a contingency framework integrating a stakeholder approach for the understanding of the logic behind a cooperative’s strategies to penetrate distribution networks (wholesalers, importers, and alcohol monopolies). This empirical study is based on the analysis of still and sparkling wine exports to the U.S. and Canadian markets, covering a period of approximately 54 months (2017–2021). The sample includes the analysis of more than 7000 containers shipped by the leading wine cooperatives in each individual country. The findings suggest the existence of heterogeneous choices in the distribution networks among wine cooperatives but also uniqueness related to the nature of the type of products marketed (still wines, sparkling wines, etc.) as well as the nature of the geographic origin of wine cooperatives. More precisely, the distribution of wine cooperatives in the U.S. and Canada shows different patterns. This investigation contributes to a better understanding of the behavior of wine cooperatives in marketing channels and to the literature on buyer-driven chains. It provides insights into the strategic choices of wine cooperatives and contributes to wine policies by providing insights on the modalities for the financing of the promotion of cooperative wines in non-E.U. countries.

1. Introduction

In the field of business studies, there has been increased recognition among researchers and decision-makers that in the context of the increasing internationalization of supply chains, a deeper understanding of the entire value chain of a given product is essential, including the organizational processes and opportunities for cooperatives’ ‘upgrading’ (i.e., moving wine cooperatives into strategic positions where more value added is created) [1,2,3,4,5,6,7]. The study of ‘governance’ relationships is essential in global value chains [8].

Recent studies raised interest in upgrading wine chains. For example, Ref. [9] explained the influence of large Canadian retailers and distributors in setting ‘quality’ standards across wine and food chains.

Many successful wine cooperatives were established by grape growers and winemakers in most of the wine regions around the world (Valentinnov and Illiopolous, 2013) [10]. Wine cooperatives provide small-scale producers with the tools to prevent market failures and non-market risks. Wine cooperatives contribute to improving the margins of the members and lowering transaction costs [11] between wine production and the market. In international markets, wine cooperatives allow small- and medium-sized growers to benefit from economies of scale through shared purchases and marketing [12,13].

Wine cooperatives are a type of non-profit organization that has a significant share of the wine production in the main wine countries in the E.U. and Argentina. In the wine industry, cooperatives are characterized by a dual role of membership, which are members and suppliers [14,15,16].

Historically, wine cooperatives produce and sell wine from the grapes grown by their members. Cooperatives mutualize operations such as winemaking, storage, and, in some cases, the bottling process. Previous studies on wine cooperatives documented the importance of wine cooperatives in production (see, for example, [17]). Wine cooperatives account for approximately 42 percent of the wine production in the E.U. [17]. At the national level, the share of wine cooperatives in the main E.U. countries varies as follows: Spain (70 percent of the volume), Italy (52 percent), Portugal (42 percent), France (38 percent), and Germany (38 percent) [17].

In Argentina, there were 36 first-tier wine cooperatives in 2018, accounting for approximately 25 percent of the wine production in the country, among which 29 are integrated in Fecovita (a second-tier wine cooperative) [18]. Wine cooperatives are also important in terms of membership (growers), vineyard surfaces (hectares), and job creation. Up until recently, only a limited number of international comparative studies addressed the importance of wine cooperatives [18,19,20].

The boundaries of wine cooperatives are sometimes not easy to define as they are involved in many other grape- and wine-related activities (distilled spirits, potable alcohol, grape musts, grape juice, etc.). In recent years, cooperatives integrated various backward and forward activities in the wine chain. For example, wine cooperatives can also directly own wine estates (ownership of land and vineyard, etc.). Further, cooperatives can also own wine traders specialized in bulk and/or bottling activities. Some wine cooperatives also developed considerable activities in wine distilling (spirits, etc.) and in the concentration of grape musts and grape juices. Further, many basic cooperatives (first tier) are also integrated into larger organizations (second-/third-tier marketing cooperatives…) that are specialized or not in the wine industry [16,20].

Few studies focused on the penetration of wine distribution channels. Early studies focused primarily on legal studies and very little on business-related aspects (see, for example, Refs. [21,22]).

There are significant differences between wine imports and distribution in the U.S. and Canada. The imports and distribution of wine in Canada are mainly operated through regional state-owned and -controlled monopolies. The imports and distribution of wine and other alcoholic beverages are mainly controlled by provincial government-owned companies. Alcohol monopolies are established under the laws of provincial authorities, not federal laws. State-owned monopolies include the following: British Columbia, Alberta, Manitoba, Brunswick, Nova Scotia, Ontario, Québec, Yukon, Saskatchewan, Newfoundland and Labrador, Northwest Territories, Nunavut, and Prince Edward Island.

The two major wine importers and distributors in Canada are LCBO (Ontario) and SAQ. From the exporters’ perspective, the supply of wine to monopolies requires participation in tenders. Québec is the largest wine-importing province in Canada, accounting for approximately 40 percent of the wine volumes and 39 percent of the value of the wines imported. In 2020, the volumes of imported wines were as follows: 64 percent was packaged wine, 31 percent was bulk wine, and 3 percent was sparkling wine [23].

The organization of the wine supply chain has been modified over recent years. In addition to foreign suppliers, the number of wineries in the U.S. increased substantially. Early 2023, according to Wines and Vines Analytics, there were 11,546 wineries in the United States with only 865 unique distributors of wine and distilled spirits. The number of wine and distilled spirits distributors was considerably reduced in recent years as a result of a continuous wave of mergers and acquisitions, while the number of domestic and international wine suppliers increased significantly. Therefore, these long-run moves increased the bargaining power steadily downstream of the wine chain.

Wine distribution in the U.S. and Canada is highly regulated [11,24], in which the sales and consumption of wines are highly restricted. The U.S. market has a strong potential with more than twenty-five years of continuous growth and sales reaching over USD 60 billion [25]. The U.S. market is a highly developed and attractive market for international wine firms. However, wine distribution is influenced by major legal and organizational constraints to distribute wine.

In the U.S., the import and distribution of wines is operated through the ‘three-tier system’ which is a network of large importers, wholesalers, and distributors that operates through licensing agreements. This network was established under U.S. federal law. Vertical integration in the U.S. market is restricted by law. It particularly prevents negative externalities over wine pricing. Alcohol imports, distribution, and sales are also operated through monopolies in a limited number of U.S. states (North Carolina, Pennsylvania, Virginia, and Maryland).

In recent years, the legislation in both countries has become more flexible allowing other firms to distribute and sell wine and spirits (for example, direct-to-consumer channels).

The capacity of the firms to select and manage relationships with importers and distributors are two main key success factors. Ref. [26] argues that the value chain in the U.S. market is not very well studied. Past studies of the U.S. and Canadian markets focused mainly on the relationship between wineries and grape growers [27] but very little on the relationships between wineries and distributors [22,28,29,30,31,32].

Large U.S. private wine firms and publicly listed firms in the stock exchange play a major role in structuring wine marketing in the U.S. and Canadian markets. Furthermore, wine traders exporting to the U.S. and Canada face competitive pressures from the strong economic concentration of importers and distributors. Concentration in alcohol beverage distribution channels intensified in the last few years and established a new level playing field for domestic and international wine firms. In July 2021, President Joe Biden signed an executive order defining a new vision for the U.S. economy. The order intends to assess the effects of consolidation in the wholesale tier and the impact on small businesses (wineries, distilleries, breweries…). Such an executive order will lead the Federal and Trade Commission (FTC) and the Alcohol and Tobacco Tax and Trade Bureau (TTB) to engage in a new era of anti-trust enforcement and rulemaking of alcohol trade practices with major implications for wine distribution.

In this study, we hypothesize that the entry strategies of wine exporters are influenced not only by the characteristics of the distribution chain in the target market (see, for example, Ref. [33]) but also by the features of the wine cooperatives (size, membership). Therefore, it combines a voluntary and a determinist perspective of cooperation and competition in the wine chain.

Very little research exists to explain the determinants of exports in the particular case of wine cooperatives (see, for example, [14,34,35]). As far as we know, this is the first study to investigate the determinants of exports of E.U. and Argentinean wine cooperatives to U.S. and Canadian markets.

Historical reasons explain the little interest in studying the determinants of wine exports among wine cooperatives. Traditionally, wine cooperatives sold their wines in bulk or through traders (i.e., similar to French ‘négociants’). Nowadays, more and more wine cooperatives search for alternatives to their historical marketing channels by lowering transaction costs and improving their economic situation.

In accordance with this study, we intend to understand how international wine cooperatives organize their roads to the market into the U.S. and Canadian wine markets. This paper is organized as follows. The next section is dedicated to a literature review of the cooperative forms and the export decision. In addition, this section presents a contingency framework for buyer–seller relationships in the wine sector. Part two introduces the empirical study. The two last sections present the results and discuss the findings. The conclusion summarizes our findings and points out the limitations and the managerial implications of this investigation.

2. Literature Review

2.1. Organization Cooperative Forms and Export Decision-Making in Wine Markets

Wine cooperatives are unique organizations governed by the general principles defined by the International Cooperative Alliance (ICA). Those principles include unique features related to decision-making (‘one man, one voice’) and non-profit activities. In more recent years, organizational forms of cooperatives evolved to foster vertical integration both upstream and downstream of the wine chain. Vertical integration forward concerns mainly the operations related to sales, marketing, and distribution (I). Another, type of organizational form consists of the establishment of second-tier and three-tier organizational structures. In these structures, the association of cooperatives puts together a pool of resources and competencies to vertically integrate marketing and distribution activities. In this case, wine cooperatives become an extension of the traditional cooperative form (II). An alternative possibility to vertically integrate forward the downstream of the wine chain consists of the establishment of private subsidiaries in domestic or foreign markets to market and distribute cooperative wines (III). Those evolutions illustrate the recent dynamics of the cooperative organization.

The majority of wine cooperatives in Argentina and the European Union produce wine from the grapes collected by farmer members and sell it in bulk. Traditional wine cooperatives in Argentina and the E.U. do not provide incentives to their farmer members to invest in innovation related to branding and retailing because of a vague definition of the ownership structure [20].

The cooperative model is perceived as dynamic but with little innovation. Recent investigations related to the introduction of sustainability innovations and the level of wine export activity documented new avenues for improving cooperative performance [35,36]. With the progressive decline in wine consumption in domestic markets, the search for opportunities in export markets became a key issue for wine cooperatives [37]. A study on wine cooperatives in France concluded that only approximately a third of individuals think agricultural cooperatives export and that only 39 percent of people think agricultural cooperatives are able to face international competition [38].

Cooperatives involved in the grape and wine sector as well as in other agricultural crops may improve resilience and performance by engaging and benefitting from unique and dedicated resources derived from cluster membership (see, for example, [39,40,41]).

2.2. Large-Scale and Multi-Level Distribution in the U.S. and Canadian Markets

Alcohol distribution in the U.S. is a highly regulated industry. It includes a complex set of federal and state regulations. The ‘three-tier system’ is an organization arrangement for the import/distribution and sales of alcoholic beverages in the U.S. Such arrangement is managed at the federal and state levels. In addition, some U.S. states established distribution franchise laws to leverage the relationships between distributors and their suppliers and customers [26]. The Canadian states also maintain direct control over alcohol distribution (LCBO in Ontario, SAQ in Québec…). Inter-state wine shipping directly from small and middle-size wineries to consumers was authorized in recent years but not in all U.S. states.

The main motivation behind alcohol regulations is the protection of public interest. Such regulations impact the demand for alcoholic beverages but also make it difficult to penetrate the U.S. market.

Ref. [22] claims that ‘distributors maintain a position of power over most wineries’. Domestic and international wineries planning to position their wines in the U.S. market are required to negotiate with state-licensed or franchised wholesalers. Typically, distributors must be licensed in every individual state. Therefore, wineries wishing to export to the U.S. market need to negotiate with distributors located intended target states. A consequence of such an arrangement is an increase in the costs of distribution for domestic and international wineries.

With the continuous concentration of wholesalers, distributors, and importers in the U.S. market, finding a commercial path for wineries to sell to consumers remains a key challenge. Wineries with long-established brands and those with strong distributor relationships outperform peer wineries [25,37,42,43,44].

In the wine business, the challenge for wholesalers, distributors, and importers is to manage inventories and balance inventory availability and the demands of on-premises and off-premises. Delays in shipping from overseas markets and changes in excise duties may impact wine inventory levels and profitability.

2.3. A Conceptual Framework

In order to advance the study of the relationships between wine cooperatives and large buyers, we adopt a contingency framework. This framework is based on the integration of the stakeholder theory [45] of the firm and competition and cooperation in marketing channels.

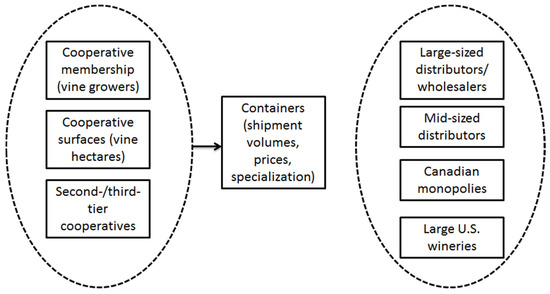

A key focus of research related to the contingency perspective [46,47,48] is to explore the factors that influence the establishment of ‘roads to the market’. The figure hereafter (Figure 1) summarizes the conceptual framework. Generally speaking, ‘the global literature strategy has underplayed the interdependence among firms and other actors in global value chains (GVCs) and highlighted the scope for firm agency, the GVCs literature limits the attention to firms strategies per se but puts more the emphasis on the governance structure of global industries’ [49]. In line with this perspective, we model the governance structures of the wine industry and their relationships between international wine cooperatives and large buyers in the U.S. and Canada.

Figure 1.

A contingency framework on wine cooperatives buyer-seller relationships.

The structuration of wine distribution in the U.S. and Canadian markets suggests that it is increasingly focused on a ‘buyer-driven’ marketing chain. Following refs. [3,8,50], in buyer-driven supply chains, profits are derived from unique combinations of high-value sales and marketing resources that allow buyers and branded merchandisers to act as strategic brokers in linking overseas suppliers and traders with evolving product niches in the main consumer markets.

The contingency framework combines the distinctive features of wine cooperatives (see Figure 1). From the supply side of the wine chain, the variable size concerns the number of vine grower members and the vine surfaces represented by each cooperative (either directly owned or owned by the members). Further, some wine cooperatives also ship wines through either second-tier or third-tier cooperatives. The buyer side is represented by large and mid-size distributors/wholesalers in the U.S. market as well as the Canadian monopolies (importers/distributors) (Société des Alcools du Québec, Liquor Control Board of Ontario…). Large U.S. brand owners also play an important role in the structuration of the buyer side.

3. Materials and Methods

3.1. Data and Sample Selection

The empirical study in this paper uses secondary data sourced from an international database identifying shipments at the cooperative level. Shipments involve transactions between a foreign cooperative and a U.S. and/or Canadian partner (importer, distributor/wholesaler…).

The variables concern the period of 2017 to 2021 using a database of international wine trade flows. Data were collected at firm and container levels.

Data were collected for the leading wine cooperatives in Argentina and the main five E.U. countries including France, Spain, Italy, Portugal, and Germany. The choice of these five countries is justified by the importance of wine cooperatives in each country. Wine cooperatives tend to be highly subsidized organizations, not only in the E.U. but also in Argentina. Such subsidies may influence international market strategies and penetration. For example, within the E.U. Common Agricultural Policy (CAP) framework, wine cooperatives benefit from subsidies to promote their wines in the U.S. and Canada as well as in other non-E.U. countries. Such funds were introduced in the 2018 CAP reform to leverage the export activities of wine cooperatives and concern different types of packaging (attending events and fairs, sponsoring, advertisement campaigns…). Another example of the influence of cooperative subsidies was recently put forward by U.S. authorities. In 2022, the U.S. Department of Commerce initiated an investigation against the white grape juice concentrate subsidies in Argentina. The U.S. imports related to the grape juice concentrated shipped by the Federation of Cooperativas Vitivinicolas Argentinas (Fecovita) was one of the two main organizations investigated.

3.2. The Baseline Model

We model the cooperative shipments from each individual country (France, Spain, Italy, Portugal, Germany, and Argentina) as a set of binary choices that each cooperative makes (1 = yes) on whether or not to ship (0 = no) wine to the target countries (the U.S. and Canada).

Since the dependent variable takes a value between 0 and 1, the direct effect of our estimation can be stated as follows:

Probability of wine shipping = α + β shipments to target markets +γcontrol variables + ε

The MAIN VARIABLES (shipments to the target markets) include the following:

- -

- ShipNumb is the total number of 20-foot containers shipped each year per cooperative to the U.S. or Canada;

- -

- Com_Wine is a dummy variable. The value equals ‘1’ if the container exported only contains wine. It takes the value of ‘0’ if otherwise;

- -

- PriceAvg is the average value of each unit transported in each container. The estimation is based on FOB values (USD per kg).

CONTROL VARIABLES

We follow the literature in selecting the relevant control variables for wine shipments as follows:

- -

- Union Tier: Cooperative members of associations (second- and third-tier) have greater bargaining power and therefore they may be able to better penetrate larger-scale distributors/importers.

- -

- HA Coop: Cooperatives representing larger vine surfaces may be able to supply larger wine volumes at lower prices. On the contrary, cooperatives representing lower vine surfaces will have a more limited capacity to supply larger importers/distributors.

- -

- Membership: Cooperatives with a higher number of associates/members may be able to supply larger volumes of wine. However, the average size of farm holdings and member heterogeneity may influence the ability of cooperatives to supply wine volumes.

- -

- Top20WineMNE: The top 20 leading wine firms in the U.S. The value equals ‘1’ if the customer of the shipment is a firm among the top 20 wine leading multinationals. It takes the value of ‘0’ if otherwise.

- -

- Top10WineDistributor: The top 10 leading wine distributors/wholesalers in the U.S. The value equals ‘1’ if the customer of the shipment is a firm among the top 10 wine distributors/wholesalers in the U.S. It takes the value of ‘0’ if otherwise.

- -

- CanadaMonopoly. It is a dummy variable. Value equals ‘1’ if the customer of the shipment is a Canadian monopoly (distribution). It takes the value of ‘0’ if otherwise.

- -

- Top8MidDistr: The top 8 mid-size wine distributors/importers in the U.S. The value equals ‘1’ if the customer of the shipment is a firm among the top 10 wine distributors/importers in the U.S. It takes the value of ‘0’ if otherwise.

Only direct shipments from the country of origin of the co-operative and the U.S. and Canadian markets were taken into consideration. Wineries and importers use different roads to the markets. Costs, logistics, and tax considerations are important issues in wine shipping and distribution. Indirect shipments allow multiple transporters or intermediaries to handle wine containers. Indirect shipments such as wine re-exports are a common practice but represent delayed deliveries. Furthermore, some shipping companies make use of sea hubs/platforms to redistribute containers and optimize distribution across geographies. For example, ports in Mexico can be used as sea hubs to redistribute containers across North American countries. Therefore, indirect shipments to the U.S. and Canada are difficult to track because their transporter has its own tracking process and paperwork.

On the other hand, we identified the main partners (wholesalers, wineries, monopoly boards…) of the wine cooperatives in the U.S. and Canadian markets.

The data are related to the number of shipments, membership, and the size of cooperatives, as well as container value was standardized (z-scores).

For each country, we modeled the determinants of exports for each one of the six countries through five logistic regressions. The dependent variable is binary. It takes the value of ‘1’ if the wine cooperative ‘n’ is located in the export country ‘n’. It takes the value ‘0’ if otherwise. The independent variables are listed in Table 1.

Table 1.

Variable definitions.

4. Results

The results of the six logistic regressions show contrasting results for the wine cooperatives established in Argentina and each of the main exporting countries of the E.U. A summary of the descriptive statistics is introduced in Table 2 (source: Stata outputs).

Table 2.

Summary of the descriptive statistics.

Table A1 in Appendix A displays the pairwise correlation between the variables. Among the most notorious correlations is the positive relationship between membership in cooperatives and the surfaces in hectares. Furthermore, there is a significant negative relationship between the average prices of the containers’ contents and the type of products shipped. Interestingly, the pairwise correlation suggests that, in addition to wine, the inclusion of other products in the containers positively influences the wine prices.

A summary of the statistics for the wine cooperatives, the distributors/importers, and the shipment characteristics is reported in Table 2 (non-standardized variables). From the perspective of the wine cooperatives, the data suggest a high dispersion in the number of hectares of vine surfaces and memberships.

Wine cooperatives in Argentina have the highest average vine surfaces (23,411 ha) as well as the highest membership (4667.8). Italy (3957.7) and Germany (3069.4) have also a high average number of cooperative members. A high average membership can be a metric for ‘size’ and suggests better bargaining power. Improvements in bargaining power are not always successful due to membership heterogeneity. A higher concentration in membership and surfaces in Argentina is explained by the uniqueness of governance structure as most of the wine cooperatives in the country are integrated into a unique second-tier cooperative (Fecovita).

Spain (716.8 members) and Portugal (1130) have the lowest average membership among the cooperatives in the six countries. However, Spain benefits from considerably higher average vine surfaces (hectares) when compared with Portugal.

The sample for E.U. cooperatives also indicates that Italy (5339.3 ha), France (4616.8 ha), and Spain (3231 ha) have the highest average of vine surfaces. The number of hectares of vine surfaces is an indicator of the willingness to supply wine volumes and, to a lesser extent, of cooperative bargaining power. Cooperatives being able to supply higher wine volumes have the ability to target the largest buyers in export markets. Likewise, it is expected that those wine cooperatives would be able to supply a larger number of shipping containers.

From the price perspective of the containers shipped, Germany (USD 24.489 FOB) and Italy (USD 26.812 FOB) have the highest average prices.

Second-tier cooperatives are present in five out of the six countries included in the sample. This is an important issue as second-tier cooperatives generally have marketing and distribution functions. Therefore, one should expect that second- and third-tier cooperatives facilitate the penetration of larger wine markets. In our sample, Germany is the only country where second-tier membership is not represented.

Table 3 details the results of the six logistic regressions intended to assess the determinants of wine shipments to the U.S. and Canadian markets (source: Stata outputs). This table identifies different associations between wine cooperatives and the U.S. and Canadian markets.

Table 3.

Logistics regressions and the determinants of exports on wine cooperatives in each country.

According to our findings, second-tier cooperatives, the size of vine surfaces (hectares), and the targeting of the top ten largest distributors increase the likelihood of the exports of French wine cooperatives. On the contrary, the decrease in the number of total wine shipments and the increase in the number of members of wine cooperatives decrease the likelihood of French wine exports to the U.S. Likewise, cooperatives targeting the top 20 U.S. wine multinationals and the Canadian monopolies decrease the likelihood to export French wines.

The exports of Spanish wine cooperatives are particularly influenced by the second-/third-tier wine cooperatives, specialization in wine shipments, and the average price of wine shipments. On the contrary, the likelihood of Spanish cooperatives exporting wine to the U.S. decreases with the increase in the number of shipments, the total number of cooperative members, and the targeting of the top 10 U.S. distributors. This result highlights the causality link between the structural characteristics of grape farms in Spain and the performances in export markets. Spain has a moderate size of grape farms [20].

The above findings also show a broader spectrum of positive influences in the exports of Italian wine cooperatives. The exports of Italian wine cooperatives are positively influenced by the number of shipments, the increasing number of cooperative members, the specialization of shipments (i.e., only wine), and the increase in average prices.

Shipments toward the top 20 wine multinationals, the top eight middle-size distributors, and the Canadian monopolies increase the likelihood of exports from Italian wine cooperatives. Conversely, Italian wine exports associated with the second-/third-tier wine cooperatives and the increase in size (hectares) decrease the likelihood of exports to the U.S. market.

The Portuguese case is unique. Wine cooperatives in Portugal account for a similar share of production as the other three leading countries (France, Italy, and Spain) but the volumes of wines produced are smaller. The increase in the volume of shipments and the size (hectares) of the wine cooperatives decreases the likelihood of exports. Portuguese wine cooperatives own some well-known brands but, generally speaking, such cooperatives are present at the lower end of the market. According to Ref. [20], wine cooperatives in Portugal are less dynamic and lag behind in commercial orientation when compared with the wine cooperatives located in the main wine countries in the E.U. Over the last few years, Portuguese wine cooperatives increased efforts to participate in international competitions and built awareness in international markets [51].

Cooperative specialization in shipping wine increases the likelihood of exports from French, Italian, Spanish, and German wine cooperatives.

Our results suggest increases in the size of cooperative members, wine shipping specialization, and the targeting of Canadian monopolies decrease the likelihood of cooperative wine exports from Germany. Increases in German exports are associated with cooperatives targeting of top eight mid-sized distributors. Decreases in German wine shipments to the U.S. are associated with the increase in cooperative size (number of hectares) and the targeting of the top 10 distributors as well as the top eight mid-sized distributors.

An increase in the size of the vine surfaces (hectares) and the association with a second-tier cooperative increase the likelihood of exports from wine cooperatives in Argentina. Likewise, shipments toward the top 10 distributors and the top eight mid-sized distributors in the U.S. increase the likelihood of exports from Argentinean wine cooperatives.

Among the six models presented above, the German model is the one where the variables are best represented (BIC—Bayesian information criterion) (Table 3).

5. Discussion

This investigation intends to contribute to the understanding of the strategic choices of the leading wine cooperatives to penetrate the distribution channels in the U.S. and Canada. Our findings suggest a diversity of strategic choices to penetrate distribution channels in both markets.

5.1. Channel Structure and Strategic Choices in Wine Cooperatives

In the marketing and strategic management literature, little attention has been given to strategic choices within distribution channels [52,53]. Channel structure can assume a variety of forms [7,54,55]. Our investigation focused on the dominant forms of wine distribution in the U.S. and Canada.

The choice of the exchange mode is impacted by firm-specific and industry-level contingencies [56]. Scarce resources such as financial and human resources and expertise in competing in export markets are major contingencies for wine cooperatives to compete in large markets. Therefore, scarce resources have a determinant role in the design and choice of international wine marketing channels [56].

Wine cooperatives have a significant impact on the economies of the six countries included in our empirical study. Each country has its unique institutional and competitive environment that defines the conditions in which wine cooperatives operate. Further, at the international level, the shipping of cooperative wines is influenced by trade and non-trade barriers that shape the relationships between cooperatives located in each country and the U.S. and Canadian markets. In this respect, Argentinean wine cooperatives have significant disadvantages when compared with shippers in the E.U. [57].

From the conceptual perspective, this investigation suggests there are close relationships between the characteristics of the producers/exports and the structure of the downstream wine chain. The U.S. and Canadian wine chains are increasingly dominated by a limited number of wholesalers, importers, and distributors in oligopolistic positions. The increasing bargaining power downstream of the wine chain accentuates the pressures and dependency of wine exporters from the above geographies. According to [2], the wine chain is becoming increasingly a buyer-driven chain, where the leading firms in importing and distributor markets play a pivotal role in shaping wine cooperative exports.

From a strategic perspective, cooperative-level data can contribute to a deeper understanding of the structuring of the global wine chain.

This study highlights different patterns in cooperative linkages to diverse customers in the U.S. and Canada. It adopts a buyer-driven perspective [2,3,8].

Our empirical study sheds light on the roles of second- and third-tier cooperatives in exporting wines. Surprisingly, second- and third-tier cooperatives in Italy seem to not directly influence the exports to the U.S. market. This finding can be explained by two reasons. Firstly, some of the largest second-/third-tier cooperatives established their own private subsidiaries in the U.S. market and, therefore, shipments are not made directly. Secondly, first-tier cooperatives are dynamic and have established solid partnerships with U.S. distributors/importers. Cooperatives involved in the production of sparkling wine (Prosecco) are a good example of the second type.

5.2. Scale Economies, Cooperative Membership, and Access to Distribution Channels

The size of wine cooperatives—surfaces and memberships—has heterogeneous effects on the exports in each one of the countries. The size of Italian wine cooperatives has a strong influence on wine exports: an increase in the surfaces decreases the likelihood of exporting, and an increase in membership has the opposite statistical effect. One possible explanation for the membership effects may rely on the growth effect. Wine cooperatives performing well in export markets attract more member-owners, which in turn contributes to the expansion of exports [16,58,59]. In addition, the increase in wine volumes shipped to the U.S. market increases the likelihood that Italian cooperatives increase their presence in large and medium distributors as well as large brand owners and Canadian monopolies.

The findings for wine cooperatives in Spain are in sharp contrast with cooperatives in Italy and Germany: an increase in surfaces increases the likelihood to foster exports and an increase in membership decreases the likelihood of Spanish wine exports. An increase in membership also decreases the likelihood of wine exports from French cooperatives.

The rationale for Spain can be linked to increasing economies of scale of large cooperatives established in the largest Spanish wine region (Castilla La Mancha) but also in other Spanish regions. Such wine cooperatives are able to produce wines at very competitive prices for entry-level price points.

Membership has a negative impact on the likelihood of exporting in four countries, except in Spain. One possible explanation is related to the fact that the increase in the number of member-owners leads to greater heterogeneity and divergences in the goals of the wine cooperatives.

Studies such as [60] consider that the internationalization process may be in conflict with the essence of the cooperative organization. The democratic model of cooperatives is grounded on legislative, territorial, and cultural linkages, which may lead to tensions when it requires complying with the inner cooperative principles.

Our findings also show heterogeneity in the strategies of wine cooperatives in targeting distribution and marketing channels in the U.S. and Canadian markets.

Canadian monopolies (LCBO, SAQ…) are particularly associated with the exports of Italian wine cooperatives. French wine cooperatives are less likely to export to Canadian monopolies. Such differences can be explained by the competencies or the interest of those organizations to be involved in tenders. Exports to the Canadian market go most often through state monopolies, and those companies organize their sourcing through international competitive tenders.

French wine cooperatives are more involved with the top ten leading wholesalers/distributors which are highly concentrated (Southern Wines & Spirits of America, Southern/Glazer’s…). The ability to work with the largest wholesalers/distributors requires the availability of wine volumes but also the appropriate competencies. Ref. [20] argues that the performance of French (and German) wine cooperatives relies on a group of professionally organized farms.

Such companies have large-scale distribution all over the U.S. Spanish and Italian wine cooperatives are more involved with the top twenty U.S. wine multinationals (E&J Gallo, The Wine Group, Bronco Wine…). Wine multinationals are large brand owners. Often, Spanish and Italian cooperatives have long-term agreements with those multinationals to supply wine for some of the largest brands.

A group of Italian and German wine cooperatives target exports through middle-sized distributors in the U.S. Such wine cooperatives probably do not have the scale or the competencies to work closely either with large-scale distributors/wholesalers or U.S. wine multinationals. Therefore, the pathway to exports follows a different road to the market.

6. Conclusions

This investigation provides a comprehensive understanding of the different strategies adopted by wine cooperatives located in France, Spain, Italy, Portugal, Germany, and Argentina for penetrating international distribution networks in the U.S. and Canada. The findings of the empirical investigation indicate the existence of alternative roads to the market. These alternatives depend on the countries where the wine cooperatives are located, the size of the cooperatives (vine surfaces, membership), and the type of target distributors.

The increasing engagement of cooperatives in international wine distribution is a new entrepreneurial process challenging the traditional view of wine cooperatives, as traditionally, such organizations were more focused on delivering wine to local markets and outsourced part of sales relationships with intermediaries (traders, brokers…).

Despite the fact most wine cooperatives lack a focus on wine exports, in recent years, many of them have undertaken a step forward and improved their competencies in export markets. The access to foreign markets was achieved through mergers and acquisitions of other firms already engaged in wine distribution in foreign markets. Or, alternatively, cooperatives established subsidiaries directly owned in export markets. In some other cases, exports took over through the establishment of international commercial agreements. Our study complements recent investigations on wine exports in the cooperative sector. We contribute to the literature by proposing a new method to investigate business-to-business relationships between wine cooperatives in major wine countries and their trade partners in the U.S. and Canada.

The present investigation has several limitations. The first limitation lies in the consideration of ‘wine’ as being a homogenous product. In practice, many leading cooperatives specialize in different types of wine (sparkling, still, fortified…) and packaging (bottled, bulk…). The specification of the nature—i.e., quality, brands, and prices—of the wine shipped to the U.S. and Canada may provide a better understanding of the strategic choices of wine cooperatives.

The period selected for analysis may influence the analysis as exports are impacted by economic conditions. Our investigation did not take into consideration partnerships and other cooperative agreements between wine cooperatives and targeting exports. According to recent contributions in buyer-driven supply chains [3,7,8], different considerations influence competition and cooperation in marketing channels (brand building, profitability, intermediaries…). Therefore, an extension of the variables within the contingency framework may enrich the analysis.

This investigation only examined direct exports. This is a research limitation, as alternative roads to the market may influence shipment decisions (intermediaries, indirect shipments, re-exports…).

It is also important to note that our analysis did not include financial data for the assessment of export performances among wine cooperatives. Further investigations using financial data on export performance and the inclusion of financial constraints (debt levels, cash flow availability, subsidies to wine exports…) may contribute to a better understanding of the logic behind the choices of the different roads to the market(s). The implementation of external validity would also help to reinforce the sense-making of our results in an international context.

Our findings have implications for managers and policymakers. Wine cooperatives use different channels to build roads to the market, but the structuring of the wine chain is increasingly a buyer-driven chain. First of all, this investigation showed that the size (hectares, membership) of wine cooperatives matters in the relationships with distributor/wholesaler channels. Greater support for wine cooperatives competing in such channels may enhance performances in marketing channels. Further, the provision of incentives to increase size (vine surfaces) and members (mergers, acquisitions…) may increase the bargaining power of wine cooperatives in buyer-driven supply chains.

Furthermore, we also identified different influences in exports for the second-/third-tier cooperatives according to country.

This work also suggests that countries in the E.U. must use a selective approach when providing subsidies from the Common Agricultural Policy to promote wines in non-E.U. countries.

Funding

This research received no external funding.

Institutional Review Board Statement

Not applicable.

Informed Consent Statement

Not applicable.

Data Availability Statement

The data presented in this study are available upon request from the corresponding author. The data are not publicly available due to data management.

Conflicts of Interest

The author declares no conflicts of interest.

Appendix A

Table A1.

Pairwise correlations.

Table A1.

Pairwise correlations.

| Variables | (1) | (2) | (3) | (4) | (5) | (6) | (7) | (8) | (9) |

|---|---|---|---|---|---|---|---|---|---|

| (1) z_ShipNb | 1.000 | ||||||||

| (2) z_HA_Coop | −0.158 *** | 1.000 | |||||||

| (0.000) | |||||||||

| (3) z_Membership | 0.258 *** | 0.586 *** | 1.000 | ||||||

| (0.000) | (0.000) | ||||||||

| (4) Top20WineMNE | 0.140 *** | −0.015 | −0.030 ** | 1.000 | |||||

| (0.000) | (0.236) | (0.019) | |||||||

| (5) Top10Distr | 0.026 ** | −0.038 *** | 0.178 *** | −0.145 *** | 1.000 | ||||

| (0.033) | (0.002) | (0.000) | (0.000) | ||||||

| (6) CanadaMonop | −0.021 * | −0.052 *** | −0.090 *** | −0.067 *** | −0.067 *** | 1.000 | |||

| (0.076) | (0.000) | (0.000) | (0.000) | (0.000) | |||||

| (7) COM_Wine | 0.116 *** | −0.424 *** | −0.076 *** | −0.315 *** | 0.086 *** | −0.103 *** | 1.000 | ||

| (0.000) | (0.000) | (0.000) | (0.000) | (0.000) | (0.000) | ||||

| (8) z_Price_Avg | 0.087 *** | −0.065 *** | −0.073 *** | 0.454 *** | 0.049 *** | −0.013 | −0.603 *** | 1.000 | |

| (0.000) | (0.000) | (0.000) | (0.000) | (0.000) | (0.283) | (0.000) | |||

| (9) Top8MidDist | 0.305 *** | −0.026 ** | 0.462 *** | −0.213 *** | −0.216 *** | −0.099 *** | 0.234 *** | −0.186 *** | 1.000 |

| (0.000) | (0.036) | (0.000) | (0.000) | (0.000) | (0.000) | (0.000) | (0.000) |

*** p < 0.01, ** p < 0.05, * p < 0.1.

References

- Gereffi, G. Global value chains and international competition. Antitrust Bull. 2011, 56, 37–56. [Google Scholar] [CrossRef]

- Gereffi, G. The Organization of Buyer-Driven Global Commodity Chains: How U.S. Retailers Shape Overseas Production Networks. In Commodity Chains and Global Capitalism; Gereffi, G., Korniewicz, M., Eds.; Greenwood Press: Wesport, CT, USA, 1994. [Google Scholar]

- Gereffi, G.; Humphrey, J.; Sturgeon, T. The governance of global value chains. Rev. Int. Political Econ. 2005, 12, 78–104. [Google Scholar] [CrossRef]

- Gereffi, G.; Lee, J. Why the world suddenly cares about global supply chains. J. Supply Chain. Manag. 2012, 48, 24–31. [Google Scholar] [CrossRef]

- Kaplinsky, R.; Morris, M. Thinning and Thickening: Productive Sector Policies in the Era of Global Value Chains. Eur. J. Dev. Res. 2016, 28, 625–645. [Google Scholar] [CrossRef]

- Kaplinsky, R.; Fitter, R. Technology and globalization: Who gains when commodities are de-commodified? Int. J. Technol. Glob. 2004, 1, 5–28. [Google Scholar] [CrossRef]

- Lee, J.; Gereffi, G. Global value chains, rising power firms and economic and social upgrading. Crit. Perspect. Int. Bus. 2015, 11, 319–339. [Google Scholar] [CrossRef]

- Humphrey, J.; Schmitz, H. Governance in Global Value Chains. IDS Bull. 2009, 32, 19–29. [Google Scholar] [CrossRef]

- Donald, B. Contested Notions of Quality in a Buyer-Driven Commodity Cluster: The Case of Food and Wine in Canada. Eur. Plan. Stud. 2009, 17, 263–280. [Google Scholar] [CrossRef]

- Touzard, J.M.; Coelho, A.; Hannin, H. Les coopératives vinicoles: Une analyse comparée à l’échelle internationale. Bull. De L’oiv 2008, 81, 381–404. [Google Scholar]

- McGiverin, S.S. Regulating alcohol Delivery y Third-Party Providers in Iowa. Iowa Law Rev. 2022, 108, 445–467. [Google Scholar]

- Coren, C.; Clamp, C. The Experience of Wisconsin’s Wine Distribution Co-operatives. J. Co-Oper. Organ. Manag. 2014, 2, 6–13. [Google Scholar] [CrossRef]

- Declerck, F.; Viviani, J.-L. Solvency and performance of French wineries in times of declining sales: Co-operatives and corporations. Int. J. Food Syst. Dyn. 2012, 3, 106–122. [Google Scholar]

- Couderc, J.-P.; Marchini, A. Governance, commercial strategies and performances of wine cooperatives: An analysis of French and Italian wine producing regions. Int. J. Wine Bus. Res. 2011, 23, 235–257. [Google Scholar] [CrossRef]

- Gupta, C. The co-operative model as a ‘living experiment in democracy’. J. Co-Oper. Organ. Manag. 2014, 2, 98–107. [Google Scholar] [CrossRef]

- Hanf, J.H.; Schweickert, E. Cooperatives in the balance between retail and member interests: The challenge of the German cooperative sector. J. Wine Res. 2014, 25, 32–44. [Google Scholar] [CrossRef]

- Simon-Elorz, K.; Castillo-Valero, J.S.; Garcia-Cortijo, M.C. Economic performance and the crisis: Strategies adopted by the wineries of Castilla La Mancha (Spain). Agribusiness 2015, 31, 107–131. [Google Scholar] [CrossRef]

- Theodorakopoulou, I.; Iliopoulos, C. Project ‘Support for Farmers’ Cooperatives Sector Report Wine’; Technical Report, European Commission, DG Agriculture and Rural Development: Brussels, Belgium, 2012; Contract Number: 30-CE-0395921/00-42. [Google Scholar]

- Storchmann, K. Introduction to the Issue: Wine Cooperatives. J. Wine Econ. 2018, 13, 239–242. [Google Scholar] [CrossRef]

- Thach, E.C.; Olsen, J. Building strategic partnerships in wine marketing: Implications for wine distribution. J. Food Prod. Mark. 2006, 12, 71–86. [Google Scholar] [CrossRef]

- Sun, L.; Gomez, M.I.; Chaddad, F.R.; Brent, R.S. Distribution channel choices of wineries in emerging cool climate regions. Agric. Resour. Econ. Rev. 2014, 43, 87–103. [Google Scholar] [CrossRef]

- Thach, L.; Cuellar, S.; Olsen, J.; Atkin, T. The impact of franchise laws on consumer choice and pricing. Int. J. Wine Bus. Res. 2013, 25, 138–158. [Google Scholar] [CrossRef]

- Yeoh, P.L.; Jeong, I. Contingency relationships between entrepreneurship, export channel structure and environment: A proposed conceptual model of export performance. Eur. J. Mark. 1995, 29, 95–115. [Google Scholar] [CrossRef]

- Mullins, M.L. Regulation and Distribution of Wine in the United States. Doctoral Dissertation, University of Missouri, Columbia, MO, USA, 2009; 129p. [Google Scholar]

- Silicon Valley Bank. State of US Wine Industry 2018; Silicon Valley Bank: Santa Clara, CA, USA, 2019. Available online: https://www.svb.com/trends-insights/reports/wine-report/ (accessed on 14 August 2023).

- Sala-Rios, M.; Farré-Perdiguer, M.; Torres-Solé, T. Exporting and Firms’ Performance—What about Cooperatives? Evidence from Spain. Sustainability 2020, 12, 8385. [Google Scholar] [CrossRef]

- Goodhue, R.E.; Heien, D.M.; Lee, H.; Sumner, D.A. Contracts and Quality in the California Winegrape Industry. Rev. Ind. Organ. 2003, 23, 267–282. [Google Scholar]

- Eyler, R. Direct shipping laws, wine and societal welfare. Int. J. Wine Mark. 2003, 17, 25. [Google Scholar] [CrossRef]

- Pesavento, M. The impact of direct to consumer shipping laws on the number and size distribution of U.S. wineries. J. Wine Econ. 2022, 17, 270–295. [Google Scholar] [CrossRef]

- Robertson, C.; Chetty, S.K. A contingency-based approach to understanding export performance. Int. Bus. Rev. 2000, 9, 211–235. [Google Scholar] [CrossRef]

- Riekhof, G.M.; Sykuta, M.E. Politics, economics and the regulations of direct interstate shipping in the wine industry. Am. J. Agric. Econ. 2005, 87, 439–452. [Google Scholar] [CrossRef]

- Valentinnov, V.; Illiopoulos, C. Economic theories of nonprofits and agricultural cooperatives compared: New perspectives for nonprofit scholars. Nonprofit Volunt. Sect. Q. 2013, 42, 102–126. [Google Scholar] [CrossRef]

- Coughlan, A.T. Competition and cooperation in marketing channel choice: Theory and application. Mark. Sci. 1985, 4, 110–129. [Google Scholar] [CrossRef]

- Couderc, J.-P.; Laye, N. Enquête sur les déterminants de la performance des entreprises ‘aval’ de la filière vins en France. In Rapport de Présentation des Résultats; Research Unit UMR MOISA/Crédit Agricole: Montpellier, France, 2006; 67p. [Google Scholar]

- Mozas-Moral, A.; Fernandez-Uclés, D.; Medina-Viruel, M.; Bernal-Jurado, E. The role of SDG as enhancers of the performance of Spanish wine cooperatives. Technol. Forecast. Soc. Chang. 2021, 173, 121176. [Google Scholar] [CrossRef]

- Fernandez, M.V.; Peña, I. Estrategia de innovation como factor determinante del éxito de las cooperativas vitivinícolas de Castilla La Mancha. Revesco-Rev. De Estud. Coop. 2009, 98, 70–96. [Google Scholar]

- Silicon Valley Bank. State of US Wine Industry 2021; Silicon Valley Bank: Santa Clara, CA, USA, 2022; Available online: https://www.svb.com/trends-insights/reports/wine-report/ (accessed on 14 August 2023).

- France AgriMer. Prospective Coopération Vinicole Française; Les études de France AgriMer: Paris, France, 2018. [Google Scholar]

- Begalli, D.; Capitello, R.; Codurri, S. Cooperatives, wine clusters and territorial value: Evidence from an Italian case study. J. Wine Res. 2014, 25, 45–61. [Google Scholar] [CrossRef]

- Carneiro Zen, A.; Fernsteiffer, J.E.; Prévot, F. The influence of resources on the internationalisation of process of cluster wine companies. Int. J. Bus. Glob. 2012, 8, 30–48. [Google Scholar]

- Hluskova, I.; Sasikova, M. The role of clusters and joint marketing alliances in facilitation of the foreign market entry (the example of Slovak wineries). Econ. Res.-Econ. Istraz. 2013, 26, 383–393. [Google Scholar]

- Santiago, M.; Sykuta, M. Regulation and Contract Distribution in the Distribution of Wine. J. Wine Econ. 2016, 11, 216–232. [Google Scholar] [CrossRef]

- Silicon Valley Bank. State of US Wine Industry 2019; Silicon Valley Bank: Santa Clara, CA, USA, 2020; Available online: https://www.svb.com/trends-insights/reports/wine-report/ (accessed on 14 August 2023).

- Silicon Valley Bank. State of US Wine Industry 2020; Silicon Valley Bank: Santa Clara, CA, USA, 2021; Available online: https://www.svb.com/trends-insights/reports/wine-report/ (accessed on 14 August 2023).

- Freeman, R. Strategic Management: A Stakeholder Approach; Pitman: Boston, MA, USA, 1984. [Google Scholar]

- Hofer, C.W. Toward a contingency theory of business strategy. Acad. Manag. J. 1975, 18, 784–810. [Google Scholar] [CrossRef]

- Mohr, J.; Nevin, J.R. Communication strategies in marketing channels: A theoretical perspective. J. Mark. 1990, 54, 36–51. [Google Scholar] [CrossRef]

- Morgan, G. Images of Organization; Sage Publications Inc.: Thousand Oaks, CA, USA, 1986; 421p. [Google Scholar]

- OECD. Agricultural Policies in Argentina, Trade and Agriculture Directorate Committee for Agriculture; TAD/CA(2018)9/FINAL; OECD: Paris, France, 2019. [Google Scholar]

- Pananond, P.; Gereffi, G.; Pedersen, T. An integrative typology of global strategy and global value chains: The management organization of cross-border activities. Glob. Strategy J. 2020, 10, 421–443. [Google Scholar] [CrossRef]

- Ponte, S.; Gibbon, P. Quality Standards, Conventions, and the Governance of Global Value Chains. Econ. Soc. 2008, 34, 1–31. [Google Scholar] [CrossRef]

- Hoppner, J.J.; Griffith, D.A. Looking back to move forward: A Review of the Evolution of Research in International Marketing Channels. J. Retail. 2015, 91, 610–626. [Google Scholar] [CrossRef]

- Wiseman, A.E.; Ellig, J. The Politics of Wine: Trade Barriers, Interest Groups, and the Commerce Clause. J. Politics 2007, 69, 859–875. [Google Scholar] [CrossRef][Green Version]

- Rebelo, J.; Caldas, J. The Economic Role of the Portuguese Agricultural Cooperatives. Rev. De Econ. E Sociol. Rurais 2015, 53 (Suppl. S1), S091–S102. [Google Scholar] [CrossRef][Green Version]

- Wren, B.M. Channel Structure and Strategic Choices in Distribution Channels. J. Manag. Res. 1987, 7, 78–86. [Google Scholar]

- Nilsson, J. The nature of cooperative values and principles: Transaction cost theoretical explanations. Ann. Public Coop. Econ. 1996, 67, 633–653. [Google Scholar] [CrossRef]

- Nyu, V.; Nilssen, F.; Kandemir, D. Small exporting firms’ choice of exchange mode in international marketing channels for perishable products: A contingency approach. Int. Bus. Rev. 2022, 31, 101919. [Google Scholar] [CrossRef]

- Hanf, J.; Schweikert, E. Changes in the wine chain—Managerial challenges and threats for German wine co-ops. In American Association of Wine Economists (AAWE) Working Paper; American Association of Wine Economists: New York, NY, USA, 2007. [Google Scholar]

- Room, R. Alcohol Monopolies in the U.S.: Challenges and Opportunities. J. Public Health Policy 1987, 8, 509–530. [Google Scholar] [CrossRef]

- Bretos, I.; Marcuello, C. Revisiting Globalization Challenges and Opportunities in the Development of Cooperatives. Ann. Public Coop. Econ. 2017, 88, 47–73. [Google Scholar] [CrossRef]

Disclaimer/Publisher’s Note: The statements, opinions and data contained in all publications are solely those of the individual author(s) and contributor(s) and not of MDPI and/or the editor(s). MDPI and/or the editor(s) disclaim responsibility for any injury to people or property resulting from any ideas, methods, instructions or products referred to in the content. |

© 2024 by the author. Licensee MDPI, Basel, Switzerland. This article is an open access article distributed under the terms and conditions of the Creative Commons Attribution (CC BY) license (https://creativecommons.org/licenses/by/4.0/).