Innovation Business Model: Adoption of Blockchain Technology and Big Data Analytics

Abstract

1. Introduction

2. Theoretical Background and Literature

2.1. Dynamic Capability View

2.2. Business Model Innovation

2.3. Blockchain Technology (BC)

2.4. Big Data Analytics Capabilities (BDACs)

2.5. Corporate Entrepreneurship

2.6. Environmental Uncertainty

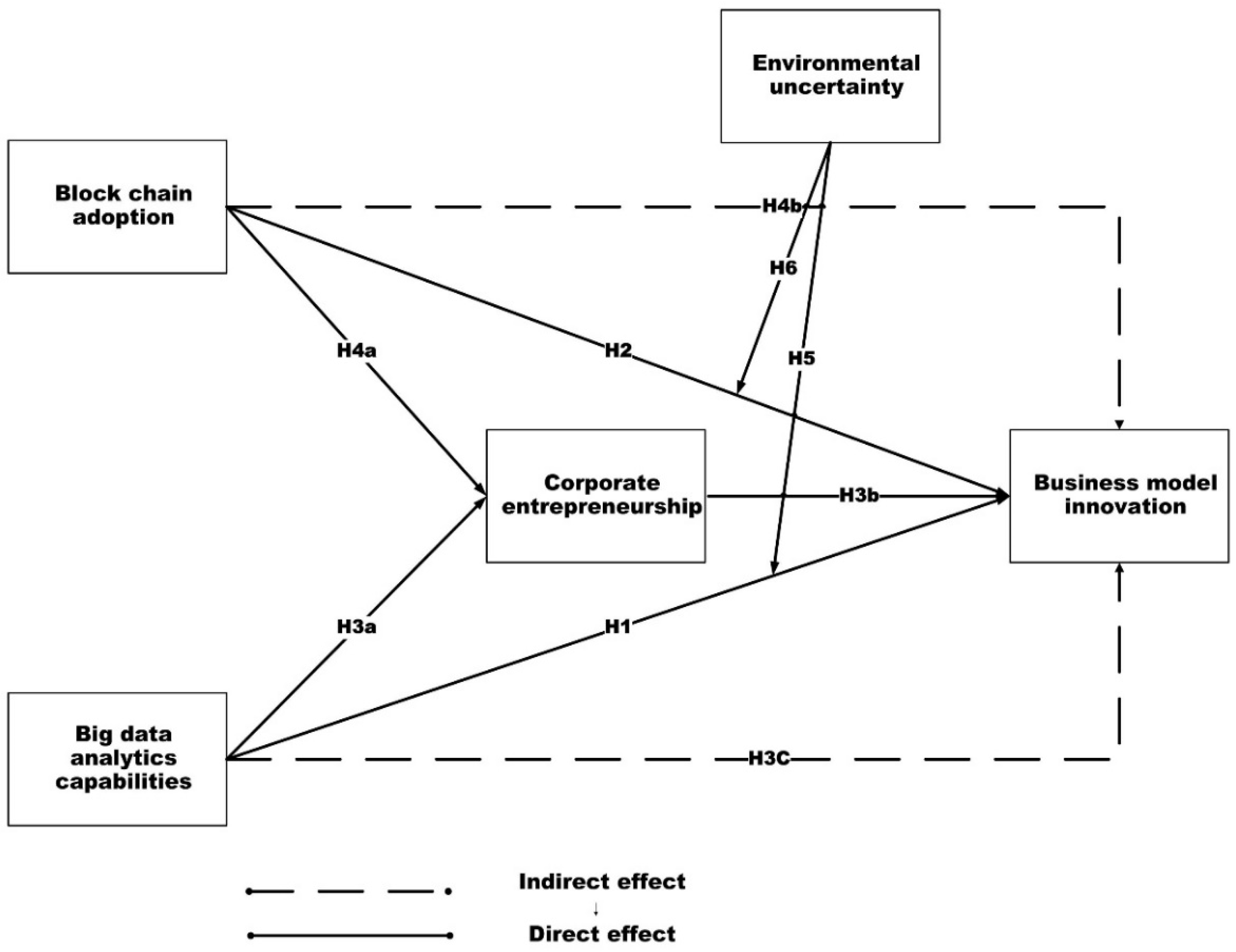

3. Hypothesis Development

3.1. Business Model Innovation and Big Data Analytics

3.2. Blockchain Adoption and Business Model Innovation

3.3. Big Data Analytics Capabilities and Corporate Entrepreneurship

3.4. Blockchain and Corporate Entrepreneurship

3.5. The Moderating Role of Environmental Uncertainty

4. Methodology

4.1. Data Collection

4.2. Measures

4.3. Non-Response Bias

4.4. Analysis and Results

4.5. Measurement Model

4.6. Structural Model

5. Discussion

5.1. Theoretical Implications

5.2. Managerial Implications

5.3. Limitations and Future Research

6. Conclusions

Author Contributions

Funding

Institutional Review Board Statement

Informed Consent Statement

Data Availability Statement

Conflicts of Interest

References

- Abed, S.E.; Jaffal, R.; Mohd, B.J. A review on blockchain and iot integration from energy, security and hardware perspectives. Wirel. Pers. Commun. 2023, 129, 2079–2122. [Google Scholar] [CrossRef]

- Hajiheydari, N.; Kargar Shouraki, M.; Vares, H.; Mohammadian, A. Digital sustainable business model innovation: Applying dynamic capabilities approach (DSBMI-DC). Foresight 2022, 25, 420–447. [Google Scholar] [CrossRef]

- Ciampi, F.; Demi, S.; Magrini, A.; Marzi, G.; Papa, A. Exploring the impact of big data analytics capabilities on business model innovation: The mediating role of entrepreneurial orientation. J. Bus. Res. 2021, 123, 1–13. [Google Scholar] [CrossRef]

- Marikyan, D.; Papagiannidis, S.; Rana, O.F.; Ranjan, R. Blockchain: A business model innovation analysis. Digit. Bus. 2022, 2, 100033. [Google Scholar] [CrossRef]

- Horng, J.-S.; Liu, C.-H.; Chou, S.-F.; Yu, T.-Y.; Hu, D.-C. Role of big data capabilities in enhancing competitive advantage and performance in the hospitality sector: Knowledge-based dynamic capabilities view. J. Hosp. Tour. Manag. 2022, 51, 22–38. [Google Scholar] [CrossRef]

- Deepa, N.; Pham, Q.-V.; Nguyen, D.C.; Bhattacharya, S.; Prabadevi, B.; Gadekallu, T.R.; Maddikunta, P.K.R.; Fang, F.; Pathirana, P.N. A survey on blockchain for big data: Approaches, opportunities, and future directions. Future Gener. Comput. Syst. 2022, 131, 209–226. [Google Scholar] [CrossRef]

- Sebastian, I.M.; Weill, P.; Woerner, S.L. Driving growth in digital ecosystems. MIT Sloan Management Review, 18 August 2020; pp. 2–4. [Google Scholar]

- Schweer, D.; Sahl, J.C. The digital transformation of industry–the benefit for Germany. In The Drivers of Digital Transformation: Why There’s No Way Around the Cloud; Springer: Berlin/Heidelberg, Germany, 2017; pp. 23–31. [Google Scholar]

- Advisors, A. Digital innovation: Australia’s $315 b opportunity. Retrieved Febr. 2018, 1, 2020. [Google Scholar]

- Vassakis, K.; Petrakis, E.; Kopanakis, I. Big data analytics: Applications, prospects and challenges. In Mobile Big Data: A Roadmap from Models to Technologies; Springer: Berlin/Heidelberg, Germany, 2018; pp. 3–20. [Google Scholar]

- Rabah, K. Convergence of AI, IoT, big data and blockchain: A review. Lake Inst. J. 2018, 1, 1–18. [Google Scholar]

- Beck, R.; Müller-Bloch, C. Blockchain as radical innovation: A framework for engaging with distributed ledgers as incumbent organization. In Proceedings of the 50th Hawaii International Conference on System Sciences, Hilton Waikoloa Village, HI, USA, 4–7 January 2017. [Google Scholar]

- Schlecht, L.; Schneider, S.; Buchwald, A. The prospective value creation potential of Blockchain in business models: A delphi study. Technol. Forecast. Soc. Chang. 2021, 166, 120601. [Google Scholar] [CrossRef]

- Lutfi, A.; Alsyouf, A.; Almaiah, M.A.; Alrawad, M.; Abdo, A.A.K.; Al-Khasawneh, A.L.; Ibrahim, N.; Saad, M. Factors influencing the adoption of big data analytics in the digital transformation era: Case study of Jordanian SMEs. Sustainability 2022, 14, 1802. [Google Scholar] [CrossRef]

- Wiener, M.; Saunders, C.; Marabelli, M. Big-data business models: A critical literature review and multiperspective research framework. J. Inf. Technol. 2020, 35, 66–91. [Google Scholar] [CrossRef]

- Morkunas, V.J.; Paschen, J.; Boon, E. How blockchain technologies impact your business model. Bus. Horiz. 2019, 62, 295–306. [Google Scholar] [CrossRef]

- Oh, J.; Shong, I. A case study on business model innovations using Blockchain: Focusing on financial institutions. Asia Pac. J. Innov. Entrep. 2017, 11, 335–344. [Google Scholar] [CrossRef]

- Nowiński, W.; Kozma, M. How can blockchain technology disrupt the existing business models? Entrep. Bus. Econ. Rev. 2017, 5, 173–188. [Google Scholar] [CrossRef]

- Khan, H.; Khan, Z.; Lee, R.; Lew, Y.K. Confrontation-coping: A psychological approach to developing market exporting firms’ intentions to adopt emerging technologies. Technol. Forecast. Soc. Chang. 2023, 194, 122697. [Google Scholar] [CrossRef]

- Teece, D.J. Dynamic capabilities: Routines versus entrepreneurial action. J. Manag. Stud. 2012, 49, 1395–1401. [Google Scholar] [CrossRef]

- Karimi, J.; Walter, Z. Corporate entrepreneurship, disruptive business model innovation adoption, and its performance: The case of the newspaper industry. Long Range Plan. 2016, 49, 342–360. [Google Scholar] [CrossRef]

- Bouwman, H.; Nikou, S.; Molina-Castillo, F.J.; de Reuver, M. The impact of digitalization on business models. Digit. Policy Regul. Gov. 2018, 20, 105–124. [Google Scholar] [CrossRef]

- Ritter, T.; Pedersen, C.L. Digitization capability and the digitalization of business models in business-to-business firms: Past, present, and future. Ind. Mark. Manag. 2020, 86, 180–190. [Google Scholar] [CrossRef]

- Caputo, A.; Pizzi, S.; Pellegrini, M.M.; Dabić, M. Digitalization and business models: Where are we going? A science map of the field. J. Bus. Res. 2021, 123, 489–501. [Google Scholar] [CrossRef]

- Purusottama, A.; Simatupang, T.M.; Sunitiyoso, Y. The spectrum of blockchain adoption for developing business model innovation. Bus. Process Manag. J. 2022, 28, 834–855. [Google Scholar] [CrossRef]

- Bamakan, S.M.H.; Moghaddam, S.G.; Manshadi, S.D. Blockchain-enabled pharmaceutical cold chain: Applications, key challenges, and future trends. J. Clean. Prod. 2021, 302, 127021. [Google Scholar] [CrossRef]

- Vo, H.T.; Mohania, M.; Verma, D.; Mehedy, L. Blockchain-powered big data analytics platform. In Proceedings of the Big Data Analytics: 6th International Conference, BDA 2018, Warangal, India, 18–21 December 2018; pp. 15–32. [Google Scholar]

- Narwane, V.S.; Raut, R.D.; Mangla, S.K.; Dora, M.; Narkhede, B.E. Risks to big data analytics and blockchain technology adoption in supply chains. Ann. Oper. Res. 2023, 327, 339–374. [Google Scholar] [CrossRef]

- Ferraris, A.; Mazzoleni, A.; Devalle, A.; Couturier, J. Big data analytics capabilities and knowledge management: Impact on firm performance. Manag. Decis. 2019, 57, 1923–1936. [Google Scholar] [CrossRef]

- Schwertner, K. Digital transformation of business. Trakia J. Sci. 2017, 15, 388–393. [Google Scholar] [CrossRef]

- Kotarba, M. Digital transformation of business models. Found. Manag. 2018, 10, 123–142. [Google Scholar] [CrossRef]

- Yunis, M.; Tarhini, A.; Kassar, A. The role of ICT and innovation in enhancing organizational performance: The catalysing effect of corporate entrepreneurship. J. Bus. Res. 2018, 88, 344–356. [Google Scholar] [CrossRef]

- Rehman, N.; Razaq, S.; Farooq, A.; Zohaib, N.M.; Nazri, M. Information technology and firm performance: Mediation role of absorptive capacity and corporate entrepreneurship in manufacturing SMEs. Technol. Anal. Strateg. Manag. 2020, 32, 1049–1065. [Google Scholar] [CrossRef]

- Laguir, I.; Gupta, S.; Bose, I.; Stekelorum, R.; Laguir, L. Analytics capabilities and organizational competitiveness: Unveiling the impact of management control systems and environmental uncertainty. Decis. Support Syst. 2022, 156, 113744. [Google Scholar] [CrossRef]

- Zayadin, R.; Zucchella, A.; Anand, A.; Jones, P.; Ameen, N. Entrepreneurs’ Decisions in Perceived Environmental Uncertainty. Br. J. Manag. 2023, 34, 831–848. [Google Scholar] [CrossRef]

- Dai, B.; Liang, W. The Impact of Big Data Technical Skills on Novel Business Model Innovation Based on the Role of Resource Integration and Environmental Uncertainty. Sustainability 2022, 14, 2670. [Google Scholar] [CrossRef]

- Angelis, J.; Da Silva, E.R. Blockchain adoption: A value driver perspective. Bus. Horiz. 2019, 62, 307–314. [Google Scholar] [CrossRef]

- Hassani, H.; Huang, X.; Silva, E. Banking with blockchain-ed big data. J. Manag. Anal. 2018, 5, 256–275. [Google Scholar] [CrossRef]

- Fosso Wamba, S.; Guthrie, C. The impact of blockchain adoption on competitive performance: The mediating role of process and relational innovation. Logistique Manag. 2020, 28, 88–96. [Google Scholar] [CrossRef]

- Warner, K.S.; Wäger, M. Building dynamic capabilities for digital transformation: An ongoing process of strategic renewal. Long Range Plan. 2019, 52, 326–349. [Google Scholar] [CrossRef]

- Rachinger, M.; Rauter, R.; Müller, C.; Vorraber, W.; Schirgi, E. Digitalization and its influence on business model innovation. J. Manuf. Technol. Manag. 2018, 30, 1143–1160. [Google Scholar] [CrossRef]

- Schmidt, C.G.; Wagner, S.M. Blockchain and supply chain relations: A transaction cost theory perspective. J. Purch. Supply Manag. 2019, 25, 100552. [Google Scholar] [CrossRef]

- Etzion, D.; Aragon-Correa, J.A. Big Data, Management, and Sustainability:Strategic Opportunities Ahead. Organ. Environ. 2016, 29, 147–155. [Google Scholar] [CrossRef]

- Saberi, S.; Kouhizadeh, M.; Sarkis, J.; Shen, L. Blockchain technology and its relationships to sustainable supply chain management. Int. J. Prod. Res. 2019, 57, 2117–2135. [Google Scholar] [CrossRef]

- Khatri, V.; Brown, C.V. Designing data governance. Commun. ACM 2010, 53, 148–152. [Google Scholar] [CrossRef]

- Bai, C.; Sarkis, J. A critical review of formal analytical modeling for blockchain technology in production, operations, and supply chains: Harnessing progress for future potential. Int. J. Prod. Econ. 2022, 250, 108636. [Google Scholar] [CrossRef]

- Linden, G.; Teece, D.J. Remarks on Pisano: “Toward a prescriptive theory of dynamic capabilities”. Ind. Corp. Chang. 2018, 27, 1175–1179. [Google Scholar] [CrossRef]

- Teece, D.J. Business models and dynamic capabilities. Long Range Plan. 2018, 51, 40–49. [Google Scholar] [CrossRef]

- Steininger, D.M.; Mikalef, P.; Pateli, A.; Ortiz-de-Guinea, A. Dynamic capabilities in information systems research: A critical review, synthesis of current knowledge, and recommendations for future research. J. Assoc. Inf. Syst. 2022, 23, 447–490. [Google Scholar] [CrossRef]

- Wamba, S.F.; Gunasekaran, A.; Akter, S.; Ren, S.J.-f.; Dubey, R.; Childe, S.J. Big data analytics and firm performance: Effects of dynamic capabilities. J. Bus. Res. 2017, 70, 356–365. [Google Scholar] [CrossRef]

- Yoshikuni, A.C.; Galvão, F.R.; Albertin, A.L. Knowledge strategy planning and information system strategies enable dynamic capabilities innovation capabilities impacting firm performance. VINE J. Inf. Knowl. Manag. Syst. 2022, 52, 508–530. [Google Scholar] [CrossRef]

- Matarazzo, M.; Penco, L.; Profumo, G.; Quaglia, R. Digital transformation and customer value creation in Made in Italy SMEs: A dynamic capabilities perspective. J. Bus. Res. 2021, 123, 642–656. [Google Scholar] [CrossRef]

- Landroguez, S.M.; Castro, C.B.; Cepeda-Carrión, G. Creating dynamic capabilities to increase customer value. Manag. Decis. 2011, 49, 1141–1159. [Google Scholar] [CrossRef]

- Shamim, S.; Yang, Y.; Zia, N.U.; Shah, M.H. Big data management capabilities in the hospitality sector: Service innovation and customer generated online quality ratings. Comput. Hum. Behav. 2021, 121, 106777. [Google Scholar] [CrossRef]

- Soluk, J.; Miroshnychenko, I.; Kammerlander, N.; De Massis, A. Family influence and digital business model innovation: The enabling role of dynamic capabilities. Entrep. Theory Pract. 2021, 45, 867–905. [Google Scholar] [CrossRef]

- Wade, M.; Hulland, J. The resource-based view and information systems research: Review, extension, and suggestions for future research. MIS Q. 2004, 28, 107–142. [Google Scholar] [CrossRef]

- Teece, D.J.; Pisano, G.; Shuen, A. Dynamic capabilities and strategic management. Strateg. Manag. J. 1997, 18, 509–533. [Google Scholar] [CrossRef]

- Prescott, M.E. Big data and competitive advantage at Nielsen. Manag. Decis. 2014, 52, 573–601. [Google Scholar] [CrossRef]

- Davcik, N.S.; Sharma, P. Marketing resources, performance, and competitive advantage: A review and future research directions. J. Bus. Res. 2016, 69, 5547–5552. [Google Scholar] [CrossRef]

- Hurley, R.F.; Hult, G.T.M. Innovation, market orientation, and organizational learning: An integration and empirical examination. J. Mark. 1998, 62, 42–54. [Google Scholar] [CrossRef]

- Nonaka, I.; Takeuchi, H. The knowledge-creating company. Harv. Bus. Rev. 2007, 85, 162. [Google Scholar]

- El-Awad, Z.; Gabrielsson, J.; Politis, D. Entrepreneurial learning and innovation: The critical role of team-level learning for the evolution of innovation capabilities in technology-based ventures. Int. J. Entrep. Behav. Res. 2017, 23, 381–405. [Google Scholar] [CrossRef]

- Kafetzopoulos, D.; Psomas, E.; Skalkos, D. Innovation dimensions and business performance under environmental uncertainty. Eur. J. Innov. Manag. 2020, 23, 856–876. [Google Scholar] [CrossRef]

- Treacy, M.; Wiersema, F. Customer intimacy and other value disciplines. Harv. Bus. Rev. 1993, 71, 84–93. [Google Scholar]

- Jin, C.; Liu, A.; Liu, H.; Gu, J.; Shao, M. How business model design drives innovation performance: The roles of product innovation capabilities and technological turbulence. Technol. Forecast. Soc. Chang. 2022, 178, 121591. [Google Scholar] [CrossRef]

- Vaska, S.; Massaro, M.; Bagarotto, E.M.; Dal Mas, F. The digital transformation of business model innovation: A structured literature review. Front. Psychol. 2021, 11, 539363. [Google Scholar] [CrossRef] [PubMed]

- Clauss, T. Measuring business model innovation: Conceptualization, scale development, and proof of performance. RD Manag. 2017, 47, 385–403. [Google Scholar] [CrossRef]

- Sjödin, D.; Parida, V.; Jovanovic, M.; Visnjic, I. Value creation and value capture alignment in business model innovation: A process view on outcome-based business models. J. Prod. Innov. Manag. 2020, 37, 158–183. [Google Scholar] [CrossRef]

- Mikalef, P.; Boura, M.; Lekakos, G.; Krogstie, J. Big data analytics capabilities and innovation: The mediating role of dynamic capabilities and moderating effect of the environment. Br. J. Manag. 2019, 30, 272–298. [Google Scholar] [CrossRef]

- Nakamoto, S. Bitcoin: A peer-to-peer electronic cash system. Decentralized Bus. Rev. 2008, 21260. [Google Scholar] [CrossRef]

- McGhin, T.; Choo, K.-K.R.; Liu, C.Z.; He, D. Blockchain in healthcare applications: Research challenges and opportunities. J. Netw. Comput. Appl. 2019, 135, 62–75. [Google Scholar] [CrossRef]

- Queiroz, M.M.; Telles, R.; Bonilla, S.H. Blockchain and supply chain management integration: A systematic review of the literature. Supply Chain. Manag. Int. J. 2019, 25, 241–254. [Google Scholar] [CrossRef]

- Galvez, J.F.; Mejuto, J.C.; Simal-Gandara, J. Future challenges on the use of blockchain for food traceability analysis. TrAC Trends Anal. Chem. 2018, 107, 222–232. [Google Scholar] [CrossRef]

- Queiroz, M.M.; Wamba, S.F. Blockchain adoption challenges in supply chain: An empirical investigation of the main drivers in India and the USA. Int. J. Inf. Manag. 2019, 46, 70–82. [Google Scholar] [CrossRef]

- Tipmontian, J.; Alcover, J.C.; Rajmohan, M. Impact of blockchain adoption for safe food supply chain management through system dynamics approach from management perspectives in thailand. Multidiscip. Digit. Publ. Inst. Proc. 2020, 39, 14. [Google Scholar]

- Khan, A.; Tao, M.; Li, C. Knowledge absorption capacity’s efficacy to enhance innovation performance through big data analytics and digital platform capability. J. Innov. Knowl. 2022, 7, 100201. [Google Scholar] [CrossRef]

- Amankwah-Amoah, J.; Adomako, S. Big data analytics and business failures in data-Rich environments: An organizing framework. Comput. Ind. 2019, 105, 204–212. [Google Scholar] [CrossRef]

- Sedkaoui, S. How data analytics is changing entrepreneurial opportunities? Int. J. Innov. Sci. 2018, 10, 274–294. [Google Scholar] [CrossRef]

- Li, W.; Liu, Y.; Liu, W.; Tang, Z.-R.; Dong, S.; Li, W.; Zhang, K.; Xu, C.; Hu, Z.; Wang, H. Machine learning-based prediction of lymph node metastasis among osteosarcoma patients. Front. Oncol. 2022, 12, 797103. [Google Scholar] [CrossRef]

- Yang, J.; Li, Y.; Liu, Q.; Li, L.; Feng, A.; Wang, T.; Zheng, S.; Xu, A.; Lyu, J. Brief introduction of medical database and data mining technology in big data era. J. Evid.-Based Med. 2020, 13, 57–69. [Google Scholar] [CrossRef] [PubMed]

- Mikalef, P.; Framnes, V.A.; Danielsen, F.; Krogstie, J.; Olsen, D. Big data analytics capability: Antecedents and business value. In Proceedings of the PACIS 2017 Proceedings, Langkawi Island, Malaysia, 16–20 July 2017. [Google Scholar]

- Mikalef, P.; Boura, M.; Lekakos, G.; Krogstie, J. Big data analytics and firm performance: Findings from a mixed-method approach. J. Bus. Res. 2019, 98, 261–276. [Google Scholar] [CrossRef]

- Braganza, A.; Brooks, L.; Nepelski, D.; Ali, M.; Moro, R. Resource management in big data initiatives: Processes and dynamic capabilities. J. Bus. Res. 2017, 70, 328–337. [Google Scholar] [CrossRef]

- Garmaki, M.; Boughzala, I.; Wamba, S.F. The effect of big data analytics capability on firm performance. In Proceedings of the PACIS 2016 Proceedings, Chiayi, Taiwan, 27 June–1 July 2016. [Google Scholar]

- Bhatti, S.H.; Santoro, G.; Khan, J.; Rizzato, F. Antecedents and consequences of business model innovation in the IT industry. J. Bus. Res. 2021, 123, 389–400. [Google Scholar] [CrossRef]

- Cui, Y.; Firdousi, S.F.; Afzal, A.; Awais, M.; Akram, Z. The influence of big data analytic capabilities building and education on business model innovation. Front. Psychol. 2022, 13, 999944. [Google Scholar] [CrossRef]

- Xiao, X.; Tian, Q.; Mao, H. How the interaction of big data analytics capabilities and digital platform capabilities affects service innovation: A dynamic capabilities view. IEEE Access 2020, 8, 18778–18796. [Google Scholar] [CrossRef]

- Urbano, D.; Turro, A.; Wright, M.; Zahra, S. Corporate entrepreneurship: A systematic literature review and future research agenda. Small Bus. Econ. 2022, 59, 1541–1565. [Google Scholar] [CrossRef]

- Ben Arfi, W.; Hikkerova, L. Corporate entrepreneurship, product innovation, and knowledge conversion: The role of digital platforms. Small Bus. Econ. 2021, 56, 1191–1204. [Google Scholar] [CrossRef]

- Ghosh, S.; Hughes, M.; Hughes, P.; Hodgkinson, I. Corporate digital entrepreneurship: Leveraging industrial Internet of things and emerging technologies. In Digital Entrepreneurship; Springer: Cham, Switzerland, 2021; p. 183. [Google Scholar] [CrossRef]

- Chen, J.; Wang, X.; Shen, W.; Tan, Y.; Matac, L.M.; Samad, S. Environmental uncertainty, environmental regulation and enterprises’ green technological innovation. Int. J. Environ. Res. Public Health 2022, 19, 9781. [Google Scholar] [CrossRef]

- Rehman, A.U.; Jajja, M.S.S. The interplay of integration, flexibility and coordination: A dynamic capability view to responding environmental uncertainty. Int. J. Oper. Prod. Manag. 2023, 43, 916–946. [Google Scholar] [CrossRef]

- Gifford, R.; Fleuren, B.; van de Baan, F.; Ruwaard, D.; Poesen, L.; Zijlstra, F.; Westra, D. To Uncertainty and Beyond: Identifying the Capabilities Needed by Hospitals to Function in Dynamic Environments. Med. Care Res. Rev. 2022, 79, 549–561. [Google Scholar] [CrossRef]

- Naldi, L.; Wikström, P.; Von Rimscha, M.B. Dynamic capabilities and performance: An empirical study of audiovisual producers in Europe. Int. Stud. Manag. Organ. 2014, 44, 63–82. [Google Scholar] [CrossRef]

- Zhang, H.; Yuan, S. How and When Does Big Data Analytics Capability Boost Innovation Performance? Sustainability 2023, 15, 4036. [Google Scholar] [CrossRef]

- Kim, J.; Sovacool, B.K.; Bazilian, M.; Griffiths, S.; Lee, J.; Yang, M.; Lee, J. Decarbonizing the iron and steel industry: A systematic review of sociotechnical systems, technological innovations, and policy options. Energy Res. Soc. Sci. 2022, 89, 102565. [Google Scholar] [CrossRef]

- Sorescu, A. Data-driven business model innovation. J. Prod. Innov. Manag. 2017, 34, 691–696. [Google Scholar] [CrossRef]

- Wang, Y.; Kung, L.; Byrd, T.A. Big data analytics: Understanding its capabilities and potential benefits for healthcare organizations. Technol. Forecast. Soc. Chang. 2018, 126, 3–13. [Google Scholar] [CrossRef]

- Massaro, M. Digital transformation in the healthcare sector through blockchain technology. Insights from academic research and business developments. Technovation 2021, 120, 102386. [Google Scholar] [CrossRef]

- Chege, S.M.; Wang, D. Information technology innovation and its impact on job creation by SMEs in developing countries: An analysis of the literature review. Technol. Anal. Strateg. Manag. 2020, 32, 256–271. [Google Scholar] [CrossRef]

- Toufaily, E.; Zalan, T.; Dhaou, S.B. A framework of blockchain technology adoption: An investigation of challenges and expected value. Inf. Manag. 2021, 58, 103444. [Google Scholar] [CrossRef]

- Gao, J.; Sarwar, Z. How do firms create business value and dynamic capabilities by leveraging big data analytics management capability? In Information Technology and Management; Springer: Berlin/Heidelberg, Germany, 2022; pp. 1–22. [Google Scholar]

- Chen, Y.; Wang, Y.; Nevo, S.; Benitez-Amado, J.; Kou, G. IT capabilities and product innovation performance: The roles of corporate entrepreneurship and competitive intensity. Inf. Manag. 2015, 52, 643–657. [Google Scholar] [CrossRef]

- Urbaniec, M.; Żur, A. Business model innovation in corporate entrepreneurship: Exploratory insights from corporate accelerators. Int. Entrep. Manag. J. 2021, 17, 865–888. [Google Scholar] [CrossRef]

- Rodríguez-Peña, A. Assessing the impact of corporate entrepreneurship in the financial performance of subsidiaries of Colombian business groups: Under environmental dynamism moderation. J. Innov. Entrep. 2021, 10, 16. [Google Scholar] [CrossRef]

- Ligonenko, L.; Mysyliuk, V. Financial model for assessing the economic effect of corporate entrepreneurship development. Наукoвий журнал «Екoнoміка І Регіoн» 2023, 90, 53–60. [Google Scholar] [CrossRef] [PubMed]

- Ciacci, A.; Penco, L. Business model innovation: Harnessing big data analytics and digital transformation in hostile environments. J. Small Bus. Enterp. Dev. 2023, 31, 22–46. [Google Scholar] [CrossRef]

- Sakhdari, K.; Burgers, J.H.; Davidsson, P. Alliance portfolio management capabilities, corporate entrepreneurship, and relative firm performance in SMEs. J. Small Bus. Manag. 2023, 61, 802–830. [Google Scholar] [CrossRef]

- Muheidat, F.; Patel, D.; Tammisetty, S.; Lo’ai, A.T.; Tawalbeh, M. Emerging Concepts Using Blockchain and Big Data. Procedia Comput. Sci. 2022, 198, 15–22. [Google Scholar] [CrossRef]

- WHIG, P. Blockchain Revolution: Innovations, Challenges, and Future Directions. Int. J. Mach. Learn. Sustain. Dev. 2023, 5, 16–25. [Google Scholar]

- Chalmers, D.; Matthews, R.; Hyslop, A. Blockchain as an external enabler of new venture ideas: Digital entrepreneurs and the disintermediation of the global music industry. J. Bus. Res. 2021, 125, 577–591. [Google Scholar] [CrossRef]

- Darvishmotevali, M.; Altinay, L.; Köseoglu, M.A. The link between environmental uncertainty, organizational agility, and organizational creativity in the hotel industry. Int. J. Hosp. Manag. 2020, 87, 102499. [Google Scholar]

- Santos-Arteaga, F.J.; Di Caprio, D.; Tavana, M. A combinatorial data envelopment analysis with uncertain interval data with application to ICT evaluation. Technol. Forecast. Soc. Change 2023, 191, 122510. [Google Scholar]

- Gong, C.; Ribiere, V. Understanding the role of organizational agility in the context of digital transformation: An integrative literature review. VINE J. Inf. Knowl. Manag. Syst. 2023; ahead-of-print. [Google Scholar]

- Gangwar, H.; Mishra, R.; Kamble, S. Adoption of big data analytics practices for sustainability development in the e-commercesupply chain: A mixed-method study. Int. J. Qual. Reliab. Manag. 2023, 40, 965–989. [Google Scholar] [CrossRef]

- Leung, W.K.; Chang, M.K.; Cheung, M.L.; Shi, S.; Chan, P.C. Understanding the Determinants of Blockchain Adoption in Supply Chains: An Empirical Study in China. In Proceedings of the European Conference on Information Systems, Kristiansand, Norway, 11–16 June 2023. [Google Scholar]

- Australian Government. Australia 2030: Prosperity through Innovation. A Plan for Australia to Thrive in the Global Innovation Race; Australian Government: Canberra, Australia, 2017. [Google Scholar]

- Demircioglu, M.A. Why does innovation in government occur and persist? Evidence from the Australian government. Asia Pac. J. Public Adm. 2019, 41, 217–229. [Google Scholar] [CrossRef]

- Zahra, S.A. Goverance, ownership, and corporate entrepreneurship: The moderating impact of industry technological opportunities. Acad. Manag. J. 1996, 39, 1713–1735. [Google Scholar]

- Asemokha, A.; Musona, J.; Torkkeli, L.; Saarenketo, S. Business model innovation and entrepreneurial orientation relationships in SMEs: Implications for international performance. J. Int. Entrep. 2019, 17, 425–453. [Google Scholar] [CrossRef]

- Haarhaus, T.; Liening, A. Building dynamic capabilities to cope with environmental uncertainty: The role of strategic foresight. Technol. Forecast. Soc. Change 2020, 155, 120033. [Google Scholar] [CrossRef]

- Armstrong, J.S.; Overton, T.S. Estimating nonresponse bias in mail surveys. J. Mark. Res. 1977, 14, 396–402. [Google Scholar] [CrossRef]

- Rialti, R.; Zollo, L.; Ferraris, A.; Alon, I. Big data analytics capabilities and performance: Evidence from a moderated multi-mediation model. Technol. Forecast. Soc. Chang. 2019, 149, 119781. [Google Scholar] [CrossRef]

- Hair, J.F.; Black, W.C.; Babin, B.J.; Anderson, R.E.; Tatham, R. Multivariate Data Analysis: Pearson Education; Perarson: Upper Saddle River, NJ, USA, 2010. [Google Scholar]

- Farrell, A.M. Insufficient discriminant validity: A comment on Bove, Pervan, Beatty, and Shiu (2009). J. Bus. Res. 2010, 63, 324–327. [Google Scholar] [CrossRef]

- MacKenzie, S.B.; Podsakoff, P.M.; Podsakoff, N.P. Construct measurement and validation procedures in MIS and behavioral research: Integrating new and existing techniques. MIS Q. 2011, 35, 293–334. [Google Scholar] [CrossRef]

- Hair, J.F., Jr.; Hult, G.T.M.; Ringle, C.M.; Sarstedt, M. A Primer on Partial Least Squares Structural Equation Modeling (PLS-SEM); Sage Publications: Thousand Oaks, CA, USA, 2016. [Google Scholar]

- Wetzels, M.; Odekerken-Schröder, G.; Van Oppen, C. Using PLS path modeling for assessing hierarchical construct models: Guidelines and empirical illustration. MIS Q. 2009, 33, 177–195. [Google Scholar] [CrossRef]

- Cohen, J. Statistical Power Analysis for the Behavioral Sciences; Routledge: London, UK, 2013. [Google Scholar]

- Chin, W.W. The partial least squares approach to structural equation modeling. Mod. Methods Bus. Res. 1998, 295, 295–336. [Google Scholar]

- Liu, P.; Long, Y.; Song, H.-C.; He, Y.-D. Investment decision and coordination of green agri-food supply chain considering information service based on blockchain and big data. J. Clean. Prod. 2020, 277, 123646. [Google Scholar] [CrossRef]

- Karafiloski, E.; Mishev, A. Blockchain solutions for big data challenges: A literature review. In Proceedings of the IEEE EUROCON 2017-17th International Conference on Smart Technologies, Ohrid, Macedonia, 6–8 July 2017; pp. 763–768. [Google Scholar]

- Barlette, Y.; Baillette, P. Big data analytics in turbulent contexts: Towards organizational change for enhanced agility. Prod. Plan. Control. 2022, 33, 105–122. [Google Scholar] [CrossRef]

- Aljumah, A.I.; Nuseir, M.T.; Alam, M.M. Organizational performance and capabilities to analyze big data: Do the ambidexterity and business value of big data analytics matter? Bus. Process Manag. J. 2021, 27, 1088–1107. [Google Scholar] [CrossRef]

- Sun, Y.; Jiang, S.; Jia, W.; Wang, Y. Blockchain as a cutting-edge technology impacting business: A systematic literature review perspective. Telecommun. Policy 2022, 46, 102443. [Google Scholar] [CrossRef]

- Kassa, A.G.; Tsigu, G.T. Corporate entrepreneurship, employee engagement and innovation: A resource-basedview and a social exchangetheory perspective. Int. J. Organ. Anal. 2022, 30, 1694–1711. [Google Scholar] [CrossRef]

- Mikalef, P.; Boura, M.; Lekakos, G.; Krogstie, J. The role of information governance in big data analytics driven innovation. Inf. Manag. 2020, 57, 103361. [Google Scholar] [CrossRef]

- Gupta, S.; Drave, V.A.; Dwivedi, Y.K.; Baabdullah, A.M.; Ismagilova, E. Achieving superior organizational performance via big data predictive analytics: A dynamic capability view. Ind. Mark. Manag. 2020, 90, 581–592. [Google Scholar] [CrossRef]

- Kshetri, N. 1 Blockchain’s roles in meeting key supply chain management objectives. Int. J. Inf. Manag. 2018, 39, 80–89. [Google Scholar] [CrossRef]

- Dubey, R.; Gunasekaran, A.; Childe, S.J.; Papadopoulos, T.; Luo, Z.; Wamba, S.F.; Roubaud, D. Can big data and predictive analytics improve social and environmental sustainability? Technol. Forecast. Soc. Chang. 2019, 144, 534–545. [Google Scholar] [CrossRef]

- Schaltegger, S.; Hansen, E.G.; Lüdeke-Freund, F. Business Models for Sustainability:Origins, Present Research, and Future Avenues. Organ. Environ. 2016, 29, 3–10. [Google Scholar] [CrossRef]

- Truby, J. Decarbonizing Bitcoin: Law and policy choices for reducing the energy consumption of Blockchain technologies and digital currencies. Energy Res. Soc. Sci. 2018, 44, 399–410. [Google Scholar] [CrossRef]

- Heider, A.; Gerken, M.; van Dinther, N.; Hülsbeck, M. Business model innovation through dynamic capabilities in small and medium enterprises–Evidence from the German Mittelstand. J. Bus. Res. 2021, 130, 635–645. [Google Scholar] [CrossRef]

- Avolio, B.J.; Yammarino, F.J.; Bass, B.M. Identifying common methods variance with data collected from a single source: An unresolved sticky issue. J. Manag. 1991, 17, 571–587. [Google Scholar] [CrossRef]

- Phan, P.H.; Wright, M.; Ucbasaran, D.; Tan, W.-L. Corporate entrepreneurship: Current research and future directions. J. Bus. Ventur. 2009, 24, 197–205. [Google Scholar] [CrossRef]

- Ireland, R.D.; Covin, J.G.; Kuratko, D.F. Conceptualizing corporate entrepreneurship strategy. Entrep. Theory Pract. 2009, 33, 19–46. [Google Scholar] [CrossRef]

| Description | Frequency | Percentage | |

|---|---|---|---|

| Gender (out of 284) | Male | 231 | 81.3 |

| Female | 53 | 18.7 | |

| Level of education | Diploma | 69 | 27.9 |

| Bachelor’s degree | 107 | 43.3 | |

| Postgraduate | 71 | 28.7 | |

| Industry | Construction | 22 | 7.8 |

| Financial | 44 | 15.5 | |

| Retail | 60 | 21.1 | |

| Tourism | 15 | 5.3 | |

| Technology | 33 | 11.6 | |

| ICT and communications | 16 | 5.6 | |

| Oil and gas | 18 | 5.3 | |

| Others (services, shipping, transportation, etc.) | 76 | 27.8 | |

| Position in organisation | General manager or CEO | 102 | 30.8 |

| Head of the department | 155 | 46.8 | |

| Owner | 74 | 22.4 | |

| Number of employees in a company | <10 | 12 | 4.2 |

| 10–50 | 46 | 16.2 | |

| 51–249 | 120 | 42.3 | |

| >250 | 106 | 37.3 | |

| Years of experience in big data | <1 year | 6 | 2.1 |

| 1–5 years | 60 | 21.1 | |

| 5–10 years | 176 | 62 | |

| >10 years | 42 | 14.8 |

| Factor | Item | Outer Loading | Cronbach’s Alpha | Composite Reliability | AVE |

|---|---|---|---|---|---|

| BR | BR1 | 0.845 | 0.679 | 0.826 | 0.704 |

| BR2 | 0.833 | ||||

| CENTRP | CENTRP1 | 0.788 | 0.760 | 0.842 | 0.523 |

| CENTRP2 | 0.835 | ||||

| CENTRP3 | 0.751 | ||||

| CENTRP4 | 0.702 | ||||

| DD | DD1 | 0.881 | 0.712 | 0.841 | 0.643 |

| DD2 | 0.857 | ||||

| DD3 | 0.646 | ||||

| D | D1 | 0.733 | 0.731 | 0.848 | 0.651 |

| D2 | 0.824 | ||||

| D3 | 0.858 | ||||

| T | T1 | 0.781 | 0.737 | 0.835 | 0.560 |

| T2 | 0.762 | ||||

| T3 | 0.704 | ||||

| T4 | 0.744 | ||||

| MS | MS1 | 0.831 | 0.664 | 0.814 | 0.597 |

| MS2 | 0.839 | ||||

| MS3 | 0.631 | ||||

| OLI | OLI1 | 0.849 | 0.864 | 0.907 | 0.709 |

| OLI2 | 0.871 | ||||

| OLI3 | 0.863 | ||||

| OLI4 | 0.783 | ||||

| TS | TS1 | 0.706 | 0.619 | 0.778 | 0.542 |

| TS2 | 0.832 | ||||

| TS3 | 0.660 | ||||

| T | T1 | 0.781 | 0.737 | 0.835 | 0.560 |

| T2 | 0.762 | ||||

| T3 | 0.704 | ||||

| T4 | 0.744 | ||||

| BCHAIN | BCHAIN1 | 0.812 | 0.766 | 0.863 | 0.678 |

| BCHAIN2 | 0.841 | ||||

| BCHAIN3 | 0.817 | ||||

| BMI | BMI1 | 0.817 | 0.827 | 0.880 | 0.597 |

| BMI2 | 0.856 | ||||

| BMI3 | 0.844 | ||||

| BMI4 | 0.783 |

| Original Sample | Sample Mean | Standard Deviation | T Statistics | p Values | |

|---|---|---|---|---|---|

| BDAC → BMI | 0.731 | 0.728 | 0.047 | 15.676 | 0.000 |

| BCHAIN → BMI | 0.114 | 0.114 | 0.055 | 2.072 | 0.039 |

| BDAC → CENTRP | 0.299 | 0.296 | 0.094 | 3.176 | 0.002 |

| BCHAIN → CENTRP | 0.327 | 0.331 | 0.099 | 3.303 | 0.001 |

| CENTRP → BMI | 0.085 | 0.088 | 0.040 | 2.109 | 0.035 |

| Total Effect | Direct Effect | Indirect Effect | ||||||||

|---|---|---|---|---|---|---|---|---|---|---|

| Coefficient | p Value | T Value | Coefficient | p Value | T Value | Coefficient | p Value | T Value | ||

| BDAC-BMI | 0.716 | 0.000 | 13.884 | 0.702 | 0.000 | 13.433 | BDAC-CE-BMI | 0.123 | 0.010 | 2.405 |

| BCHAIN--BMI | 0.181 | 0.002 | 3.093 | 0.151 | 0.017 | 2.355 | BCHAIN-CE-BMI | 0.316 | 0.000 | 6.096 |

Disclaimer/Publisher’s Note: The statements, opinions and data contained in all publications are solely those of the individual author(s) and contributor(s) and not of MDPI and/or the editor(s). MDPI and/or the editor(s) disclaim responsibility for any injury to people or property resulting from any ideas, methods, instructions or products referred to in the content. |

© 2024 by the authors. Licensee MDPI, Basel, Switzerland. This article is an open access article distributed under the terms and conditions of the Creative Commons Attribution (CC BY) license (https://creativecommons.org/licenses/by/4.0/).

Share and Cite

Magableh, K.N.Y.; Kannan, S.; Hmoud, A.Y.R. Innovation Business Model: Adoption of Blockchain Technology and Big Data Analytics. Sustainability 2024, 16, 5921. https://doi.org/10.3390/su16145921

Magableh KNY, Kannan S, Hmoud AYR. Innovation Business Model: Adoption of Blockchain Technology and Big Data Analytics. Sustainability. 2024; 16(14):5921. https://doi.org/10.3390/su16145921

Chicago/Turabian StyleMagableh, Khaled Naser Yousef, Selvi Kannan, and Aladeen Yousef Rashid Hmoud. 2024. "Innovation Business Model: Adoption of Blockchain Technology and Big Data Analytics" Sustainability 16, no. 14: 5921. https://doi.org/10.3390/su16145921

APA StyleMagableh, K. N. Y., Kannan, S., & Hmoud, A. Y. R. (2024). Innovation Business Model: Adoption of Blockchain Technology and Big Data Analytics. Sustainability, 16(14), 5921. https://doi.org/10.3390/su16145921