Exploration or Exploitation? Corporate Green Innovation Strategy for Carbon Emission Reduction-Evidence from Pilot Enterprises in China

Abstract

1. Introduction

2. Theoretical Analysis and Hypothesis Formulation

2.1. Carbon Trading and Green Innovation

2.2. Exploratory Green Innovation and Exploitative Green Innovation

2.3. Peer Pressure and Green Innovation

3. Methodology of Research

3.1. Sample Selection

3.2. Definition of Variables

3.3. Design of the Model

4. Data Analysis

4.1. Descriptive Statistics

4.2. Correlation Analysis of Key Variables

4.3. Benchmark Regression

4.4. Moderating Effects Test

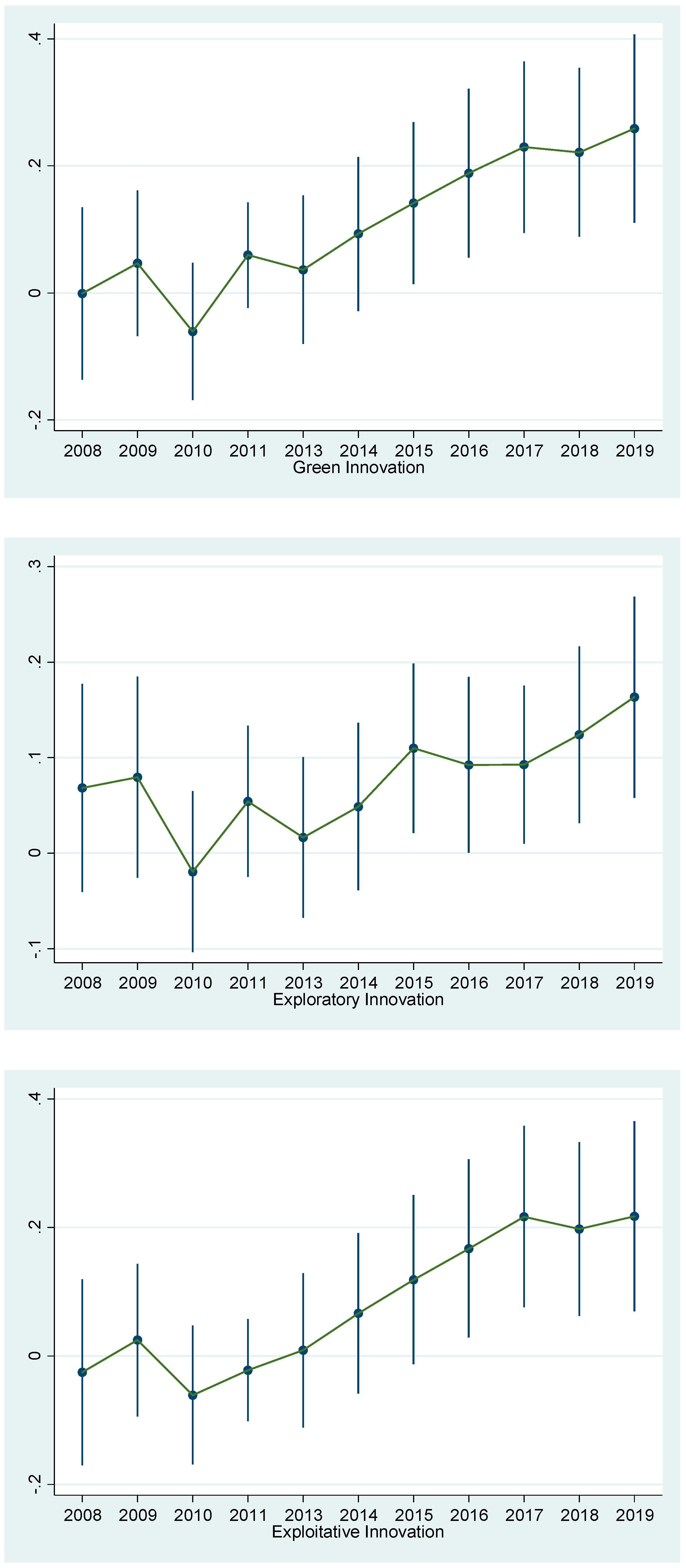

4.5. Tests for Parallel Trends and Dynamic Effects

4.6. Robustness Tests

4.6.1. Control the Time Variability of Carbon Trading Policies

4.6.2. Exclude the Impact of the SO2 Emissions Trading Pilot Policy

4.6.3. Exclude the Impact of Low-Carbon Pilot Cities

4.6.4. Replace the Peer Pressure Variable

5. Conclusions and Recommendations

5.1. Conclusions and Discussion

5.2. Research Recommendations

- Policy recommendations:

- Managerial recommendations:

5.3. Limitations and Future Prospects

Author Contributions

Funding

Institutional Review Board Statement

Informed Consent Statement

Data Availability Statement

Acknowledgments

Conflicts of Interest

References

- Ren, S.; Li, X.; Yuan, B.; Li, D.; Chen, X. The effects of three types of environmental regulation on eco-efficiency: A cross-region analysis in China. J. Clean. Prod. 2018, 173, 245–255. [Google Scholar] [CrossRef]

- Ellerman, A.D.; Buchner, B.K. Over-allocation or abatement? A preliminary analysis of the EU ETS based on the 2005–2006 emissions data. Environ. Resour. Econ. 2008, 41, 267–287. [Google Scholar] [CrossRef]

- Liu, L.; Chen, C.; Zhao, Y.; Zhao, E. China’s carbon-emissions trading: Overview, challenges and future. Renew. Sustain. Energy Rev. 2015, 49, 254–266. [Google Scholar] [CrossRef]

- Lee, K.-H.; Min, B. Green R&D for eco-innovation and its impact on carbon emissions and firm performance. J. Clean. Prod. 2015, 108, 534–542. [Google Scholar]

- Rubashkina, Y.; Galeotti, M.; Verdolini, E. Environmental regulation and competitiveness: Empirical evidence on the Porter Hypothesis from European manufacturing sectors. Energy Policy 2015, 83, 288–300. [Google Scholar] [CrossRef]

- Deng, Y.; You, D.; Wang, J. Optimal strategy for enterprises’ green technology innovation from the perspective of political competition. J. Clean. Prod. 2019, 235, 930–942. [Google Scholar] [CrossRef]

- Zhao, X.; Zhao, Y.; Zeng, S.; Zhang, S. Corporate behavior and competitiveness: Impact of environmental regulation on Chinese firms. J. Clean. Prod. 2015, 86, 311–322. [Google Scholar] [CrossRef]

- Petroni, G.; Bigliardi, B.; Galati, F. Rethinking the Porter hypothesis: The underappreciated importance of value appropriation and pollution intensity. Rev. Policy Res. 2019, 36, 121–140. [Google Scholar] [CrossRef]

- Zhang, W.; Li, G.; Guo, F. Does carbon emissions trading promote green technology innovation in China? Appl. Energy 2022, 315, 119012. [Google Scholar] [CrossRef]

- Du, G.; Yu, M.; Sun, C.; Han, Z. Green innovation effect of emission trading policy on pilot areas and neighboring areas: An analysis based on the spatial econometric model. Energy Policy 2021, 156, 112431. [Google Scholar] [CrossRef]

- Hu, J.; Pan, X.; Huang, Q. Quantity or quality? The impacts of environmental regulation on firms’ innovation–Quasi-natural experiment based on China’s carbon emissions trading pilot. Technol. Forecast. Soc. Chang. 2020, 158, 120122. [Google Scholar] [CrossRef]

- Peng, H.; Shen, N.; Ying, H.; Wang, Q. Can environmental regulation directly promote green innovation behavior?—Based on situation of industrial agglomeration. J. Clean. Prod. 2021, 314, 128044. [Google Scholar] [CrossRef]

- Barnett, W.P.; Greve, H.R.; Park, D.Y. An evolutionary model of organizational performance. Strateg. Manag. J. 1994, 15, 11–28. [Google Scholar] [CrossRef]

- Feng, C.; Shi, B.; Kang, R. Does environmental policy reduce enterprise innovation?—Evidence from China. Sustainability 2017, 9, 872. [Google Scholar] [CrossRef]

- Fang, G.; Tian, L.; Liu, M.; Fu, M.; Sun, M. How to optimize the development of carbon trading in China—Enlightenment from evolution rules of the EU carbon price. Appl. Energy 2018, 211, 1039–1049. [Google Scholar] [CrossRef]

- Borghesi, S.; Cainelli, G.; Mazzanti, M. Linking emission trading to environmental innovation: Evidence from the Italian manufacturing industry. Res. Policy 2015, 44, 669–683. [Google Scholar] [CrossRef]

- Guo, Y.; Xia, X.; Zhang, S.; Zhang, D. Environmental regulation, government R&D funding and green technology innovation: Evidence from China provincial data. Sustainability 2018, 10, 940. [Google Scholar] [CrossRef]

- Yang, X.; Jiang, P.; Pan, Y. Does China’s carbon emission trading policy have an employment double dividend and a Porter effect? Energy Policy 2020, 142, 111492. [Google Scholar] [CrossRef]

- Dai, J.; Cantor, D.E.; Montabon, F.L. How Environmental Management Competitive Pressure Affects a Focal Firm’s Environmental Innovation Activities: A Green Supply Chain Perspective. J. Bus. Logist. 2015, 36, 242–259. [Google Scholar] [CrossRef]

- Palmer, K.; Oates, W.E.; Portney, P.R. Tightening environmental standards: The benefit-cost or the no-cost paradigm? J. Econ. Perspect. 1995, 9, 119–132. [Google Scholar] [CrossRef]

- Chen, Z.; Zhang, X.; Chen, F. Do carbon emission trading schemes stimulate green innovation in enterprises? Evidence from China. Technol. Forecast. Soc. Chang. 2021, 168, 120744. [Google Scholar] [CrossRef]

- Lian, G.; Xu, A.; Zhu, Y. Substantive green innovation or symbolic green innovation? The impact of ER on enterprise green innovation based on the dual moderating effects. J. Innov. Knowl. 2022, 7, 100203. [Google Scholar] [CrossRef]

- Ambec, S.; Cohen, M.A.; Elgie, S.; Lanoie, P. The Porter hypothesis at 20: Can environmental regulation enhance innovation and competitiveness? Rev. Environ. Econ. Policy 2013, 7, 1. [Google Scholar] [CrossRef]

- Li, C. How does environmental regulation affect different approaches of technical progress?—Evidence from China’s industrial sectors from 2005 to 2015. J. Clean. Prod. 2019, 209, 572–580. [Google Scholar] [CrossRef]

- Jaffe, A.B.; Palmer, K. Environmental regulation and innovation: A panel data study. Rev. Econ. Stat. 1997, 79, 610–619. [Google Scholar] [CrossRef]

- Lanoie, P.; Laurent-Lucchetti, J.; Johnstone, N.; Ambec, S. Environmental policy, innovation and performance: New insights on the Porter hypothesis. J. Econ. Manag. Strategy 2011, 20, 803–842. [Google Scholar] [CrossRef]

- Zhang, G.; Lv, X.; Zhou, J. Private value of patent right and patent infringement: An empirical study based on patent renewal data of China. China Econ. Rev. 2014, 28, 37–54. [Google Scholar] [CrossRef]

- Porter, M.E.; Linde, C.v.d. Toward a new conception of the environment-competitiveness relationship. J. Econ. Perspect. 1995, 9, 97–118. [Google Scholar] [CrossRef]

- Zhao, X.; Shang, Y.; Ma, X.; Xia, P.; Shahzad, U. Does carbon trading lead to green technology innovation: Recent evidence from Chinese companies in resource-based industries. IEEE Trans. Eng. Manag. 2022, 71, 2506–2523. [Google Scholar] [CrossRef]

- Harford, J.D. Firm behavior under imperfectly enforceable pollution standards and taxes. J. Environ. Econ. Manag. 1978, 5, 26–43. [Google Scholar] [CrossRef]

- Clarkson, P.M.; Li, Y.; Richardson, G.D. The market valuation of environmental capital expenditures by pulp and paper companies. Account. Rev. 2004, 79, 329–353. [Google Scholar] [CrossRef]

- Hall, B.H.; Helmers, C. Innovation and diffusion of clean/green technology: Can patent commons help? J. Environ. Econ. Manag. 2013, 66, 33–51. [Google Scholar] [CrossRef]

- Hart, S.L. A natural-resource-based view of the firm. Acad. Manag. Rev. 1995, 20, 986–1014. [Google Scholar] [CrossRef]

- Barney, J. Firm resources and sustained competitive advantage. J. Manag. 1991, 17, 99–120. [Google Scholar] [CrossRef]

- Buysse, K.; Verbeke, A. Proactive environmental strategies: A stakeholder management perspective. Strateg. Manag. J. 2003, 24, 453–470. [Google Scholar] [CrossRef]

- Benner, M.J.; Tushman, M.L. Exploitation, exploration, and process management: The productivity dilemma revisited. Acad. Manag. Rev. 2003, 28, 238–256. [Google Scholar] [CrossRef]

- March, J.G. Exploration and exploitation in organizational learning. Organ. Sci. 1991, 2, 71–87. [Google Scholar] [CrossRef]

- Damanpour, F. Organizational complexity and innovation: Developing and testing multiple contingency models. Manag. Sci. 1996, 42, 693–716. [Google Scholar] [CrossRef]

- Jansen, J.J.; Van Den Bosch, F.A.; Volberda, H.W. Exploratory innovation, exploitative innovation, and performance: Effects of organizational antecedents and environmental moderators. Manag. Sci. 2006, 52, 1661–1674. [Google Scholar] [CrossRef]

- Danneels, E. The dynamics of product innovation and firm competences. Strateg. Manag. J. 2002, 23, 1095–1121. [Google Scholar] [CrossRef]

- Zhang, J.; Su, T.; Meng, L. Retreat in order to advance: Environmental performance below legality aspiration and corporate disclosure strategy. Int. Rev. Financ. Anal. 2024, 93, 103135. [Google Scholar] [CrossRef]

- Manso, G. Motivating innovation. J. Financ. 2011, 66, 1823–1860. [Google Scholar] [CrossRef]

- Ahuja, G.; Morris Lampert, C. Entrepreneurship in the large corporation: A longitudinal study of how established firms create breakthrough inventions. Strateg. Manag. J. 2001, 22, 521–543. [Google Scholar] [CrossRef]

- He, Z.-L.; Wong, P.-K. Exploration vs. exploitation: An empirical test of the ambidexterity hypothesis. Organ. Sci. 2004, 15, 481–494. [Google Scholar] [CrossRef]

- Levinthal, D.A.; March, J.G. The myopia of learning. Strateg. Manag. J. 1993, 14, 95–112. [Google Scholar] [CrossRef]

- Lumpkin, G.T.; Dess, G.G. Linking two dimensions of entrepreneurial orientation to firm performance: The moderating role of environment and industry life cycle. J. Bus. Ventur. 2001, 16, 429–451. [Google Scholar] [CrossRef]

- Porter Michael, E. Competitive Strategy: Techniques for Analyzing Industries and Competitors; The Free Press: New York, NY, USA, 1980. [Google Scholar]

- Chen, M.-J. Competitive dynamics: Eastern roots, Western growth. Cross Cult. Strateg. Manag. 2016, 23, 510–530. [Google Scholar] [CrossRef]

- Barnett, W.P.; Hansen, M.T. The red queen in organizational evolution. Strateg. Manag. J. 1996, 17, 139–157. [Google Scholar] [CrossRef]

- Barnett, W.P.; McKendrick, D.G. Why are some organizations more competitive than others? Evidence from a changing global market. Adm. Sci. Q. 2004, 49, 535–571. [Google Scholar] [CrossRef]

- Manski, C.F. Identification of endogenous social effects: The reflection problem. Rev. Econ. Stud. 1993, 60, 531–542. [Google Scholar] [CrossRef]

- Cao, J.; Liang, H.; Zhan, X. Peer effects of corporate social responsibility. Manag. Sci. 2019, 65, 5487–5503. [Google Scholar] [CrossRef]

- Lieberman, M.B.; Asaba, S. Why do firms imitate each other? Acad. Manag. Rev. 2006, 31, 366–385. [Google Scholar] [CrossRef]

- Marquis, C.; Glynn, M.A.; Davis, G.F. Community isomorphism and corporate social action. Acad. Manag. Rev. 2007, 32, 925–945. [Google Scholar] [CrossRef]

- Park, H.; Yoon, J. Assessing coreness and intermediarity of technology sectors using patent co-classification analysis: The case of Korean national R&D. Scientometrics 2014, 98, 853–890. [Google Scholar]

- Amore, M.D.; Bennedsen, M. Corporate governance and green innovation. J. Environ. Econ. Manag. 2016, 75, 54–72. [Google Scholar] [CrossRef]

- Podolny, J.M.; Stuart, T.E. A role-based ecology of technological change. Am. J. Sociol. 1995, 100, 1224–1260. [Google Scholar] [CrossRef]

- Guan, J.; Liu, N. Exploitative and exploratory innovations in knowledge network and collaboration network: A patent analysis in the technological field of nano-energy. Res. Policy 2016, 45, 97–112. [Google Scholar] [CrossRef]

- Geerts, A.; Leten, B.; Belderbos, R.; Van Looy, B. Does spatial ambidexterity pay off? On the benefits of geographic proximity between technology exploitation and exploration. J. Prod. Innov. Manag. 2018, 35, 151–163. [Google Scholar] [CrossRef]

- Elzinga, K.G.; Mills, D.E. The Lerner index of monopoly power: Origins and uses. Am. Econ. Rev. 2011, 101, 558–564. [Google Scholar] [CrossRef]

- Zhang, Q.; Yang, H.; Wang, Q.; Zhang, A.; Zhang, Y. Impact of high-speed rail on market concentration and Lerner index in China’s airline market. J. Air Transp. Manag. 2020, 83, 101755. [Google Scholar] [CrossRef]

- Gao, Y.; Li, M.; Xue, J.; Liu, Y. Evaluation of effectiveness of China’s carbon emissions trading scheme in carbon mitigation. Energy Econ. 2020, 90, 104872. [Google Scholar] [CrossRef]

- Li, P.; Lu, Y.; Wang, J. Does flattening government improve economic performance? Evidence from China. J. Dev. Econ. 2016, 123, 18–37. [Google Scholar] [CrossRef]

- Uotila, J.; Maula, M.; Keil, T.; Zahra, S.A. Exploration, exploitation, and financial performance: Analysis of S&P 500 corporations. Strateg. Manag. J. 2009, 30, 221–231. [Google Scholar]

- Fisch, C.; Sandner, P.; Regner, L. The value of Chinese patents: An empirical investigation of citation lags. China Econ. Rev. 2017, 45, 22–34. [Google Scholar] [CrossRef]

| Variable Name | Definition |

|---|---|

| Green Innovation | Logarithmic number of corporate green patent applications |

| Exploratory Innovation | Logarithmic number of green patents with patent classification numbers not repeated in the previous 5 years |

| Exploitative Innovation | Logarithmic number of green patents with patent classification number repeating in the previous 5 years |

| Innovation Equilibrium | The logarithm of exploratory green innovation × the logarithm of exploitative green innovation |

| Peer Pressure | Operating income of individual company/total operating income of the industry × cumulative Lerner index of individual stocks |

| Firm Size | Logarithmic total assets of enterprises |

| Liability | Total Liabilities/Total Assets × 100% |

| Firm Age | Logarithmic number of years of establishment |

| Growth Ability | Total Assets Growth Rate |

| Nature of Equity | State-owned enterprises are assigned a value of 1, and non-state-owned enterprises are assigned a value of 0 |

| Percentage of Independent Directors | Proportion of independent directors to the number of directors |

| Equity Concentration | The shareholding ratio of the top 1 shareholder |

| Capital Intensity | Total Assets/Gross Sales × 100 |

| Profitability | Net Profit/Total Assets × 100 |

| Board Activity | Logarithmic number of board meetings |

| Variable | Obs | Mean | Std. Dev. | Min | Max |

|---|---|---|---|---|---|

| Green Innovation | 2761 | 0.264 | 0.729 | 0 | 3.807 |

| Exploratory Innovation | 2761 | 0.119 | 0.360 | 0 | 1.792 |

| Exploitative Innovation | 2761 | 0.237 | 0.706 | 0 | 3.761 |

| Peer Pressure | 2761 | 0.026 | 0.053 | 0 | 0.404 |

| Firm Size | 2761 | 22.541 | 1.662 | 19.076 | 27.686 |

| Liability | 2761 | 0.459 | 0.214 | 0.048 | 0.955 |

| Firm Age | 2761 | 2.700 | 0.464 | 0.693 | 3.434 |

| Growth Ability | 2761 | 0.182 | 0.387 | −0.363 | 2.531 |

| Nature of Equity | 2761 | 0.568 | 0.495 | 0 | 1 |

| Percentage of Independent Directors | 2761 | 0.383 | 0.062 | 0.3 | 0.6 |

| Equity Concentration | 2761 | 0.367 | 0.161 | 0.084 | 0.789 |

| Capital Intensity | 2761 | 2.523 | 2.324 | 0.43 | 15.47 |

| Profitability | 2761 | 0.037 | 0.055 | −0.192 | 0.213 |

| Board Activity | 2761 | 2.249 | 0.397 | 1.386 | 3.296 |

| Green Innovation | Exploratory Innovation | Exploitative Innovation | Peer Pressure | Firm Size | Liability | Firm Age | |

|---|---|---|---|---|---|---|---|

| Green Innovation | 1.000 | ||||||

| Exploratory Innovation | 0.857 *** | 1.000 | |||||

| Exploitative Innovation | 0.984 *** | 0.793 *** | 1.000 | ||||

| Peer Pressure | 0.233 *** | 0.227 *** | 0.218 *** | 1.000 | |||

| Firm Size | 0.160 *** | 0.150 *** | 0.162 *** | 0.127 *** | 1.000 | ||

| Liability | 0.105 *** | 0.079 *** | 0.108 *** | 0.027 | 0.431 *** | 1.000 | |

| Firm Age | 0.003 | 0.002 | 0.008 | 0.176 *** | 0.043 ** | 0.144 *** | 1.000 |

| Growth Ability | −0.005 | −0.001 | −0.004 | −0.077 *** | −0.073 *** | −0.124 *** | −0.231 *** |

| Nature of Equity | −0.111 *** | −0.075 *** | −0.110 *** | −0.036 * | 0.393 *** | 0.268 *** | 0.194 *** |

| Percentage of Independent Directors | 0.006 | 0.009 | 0.010 | −0.023 | 0.183 *** | 0.068 *** | −0.206 *** |

| Equity Concentration | 0.045 ** | 0.052 *** | 0.043 ** | 0.010 | 0.312 *** | −0.001 | −0.238 *** |

| Capital Intensity | −0.1388 *** | −0.114 *** | −0.131 *** | −0.033 * | −0.071 *** | −0.112 *** | 0.083 *** |

| Profitability | −0.019 | 0.005 | −0.020 | 0.011 | −0.030 | −0.336 *** | −0.108 *** |

| Board Activity | 0.053 *** | 0.036 * | 0.057 *** | 0.051 *** | 0.181 *** | 0.235 *** | 0.060 *** |

| Growth Ability | Nature of Equity | Percentage of Independent Directors | Equity Concentration | Capital Intensity | Profitability | Board Activity | |

| Growth Ability | 1.000 | ||||||

| Nature of Equity | −0.197 *** | 1.000 | |||||

| Percentage of Independent Directors | 0.043 ** | −0.105 *** | 1.000 | ||||

| Equity Concentration | −0.008 | 0.334 *** | 0.091*** | 1.000 | |||

| Capital Intensity | 0.068 *** | −0.117 *** | −0.030 | −0.124 *** | 1.000 | ||

| Profitability | 0.190 *** | −0.043 ** | −0.011 | 0.143 *** | −0.119 *** | 1.000 | |

| Board Activity | 0.022 | −0.031 | 0.065 *** | −0.175 *** | 0.051 *** | −0.119 *** | 1.000 |

| Variables | (1) | (2) | (3) | (4) | (5) | (6) | (7) |

|---|---|---|---|---|---|---|---|

| Green Innovation | Exploratory Innovation | Exploitative Innovation | Green Innovation | Exploratory Innovation | Exploitative Innovation | Innovation Equilibrium | |

| Timeit × Treati × Pressurei | 0.970 (0.589) | 0.936 ** (0.415) | 0.917 (0.567) | ||||

| Peer Pressurei | −0.120 | −0.097 | −0.124 | ||||

| (0.158) | (0.088) | (0.158) | |||||

| Timeit × Treati | 0.143 *** | 0.050 * | 0.152 *** | 0.045 | −0.045 | 0.060 | 0.141 ** |

| (0.046) | (0.026) | (0.047) | (0.071) | (0.047) | (0.067) | (0.069) | |

| Firm Size | 0.067 ** | 0.025 * | 0.064 ** | 0.067 ** | 0.025 * | 0.065 ** | 0.072 ** |

| (0.027) | (0.014) | (0.027) | (0.027) | (0.014) | (0.027) | (0.035) | |

| Liability | −0.103 | −0.036 | −0.096 | −0.102 | −0.035 | −0.094 | −0.116 |

| (0.103) | (0.061) | (0.100) | (0.101) | (0.060) | (0.098) | (0.169) | |

| Firm Age | 0.020 | −0.023 | 0.041 | 0.018 | −0.025 | 0.039 | 0.000 |

| (0.075) | (0.046) | (0.074) | (0.074) | (0.046) | (0.074) | (0.125) | |

| Growth Ability | −0.006 (0.013) | −0.002 (0.011) | 0.001 (0.012) | −0.006 (0.013) | −0.002 (0.011) | −0.000 (0.012) | 0.022 (0.025) |

| Nature of Equity | −0.013 (0.031) | 0.018 (0.035) | −0.027 (0.043) | −0.004 (0.030) | 0.026 (0.036) | −0.019 (0.042) | −0.013 (0.037) |

| Percentage of Independent Directors | −0.226 (0.218) | −0.138 (0.129) | −0.143 (0.222) | −0.202 (0.216) | −0.116 (0.128) | −0.121 (0.221) | −0.046 (0.291) |

| Equity Concentration | −0.137 (0.219) | −0.067 (0.119) | −0.104 (0.205) | −0.149 (0.222) | −0.080 (0.120) | −0.115 (0.208) | −0.308 (0.320) |

| Capital Intensity | −0.002 (0.004) | 0.002 (0.002) | −0.002 (0.004) | −0.001 (0.004) | 0.002 (0.002) | −0.002 (0.004) | −0.000 (0.005) |

| Profitability | 0.149 | 0.192 * | 0.144 | 0.137 | 0.179 | 0.133 | 0.412 * |

| (0.197) | (0.113) | (0.195) | (0.199) | (0.113) | (0.196) | (0.239) | |

| Board Activity | 0.024 (0.023) | 0.011 (0.016) | 0.016 (0.023) | 0.025 (0.023) | 0.012 (0.016) | 0.017 (0.023) | −0.027 (0.038) |

| Year | Control | ||||||

| Industry | Control | ||||||

| Observations | 2761 | 2761 | 2761 | 2761 | 2761 | 2761 | 2761 |

| R-squared | 0.045 | 0.018 | 0.050 | 0.049 | 0.024 | 0.053 | 0.024 |

| Variables | (1) | (2) | (3) | (4) | (5) | (6) |

|---|---|---|---|---|---|---|

| Green Innovation | Exploratory Innovation | Exploitative Innovation | Green Innovation | Exploratory Innovation | Exploitative Innovation | |

| Timeit × Treati × Pressurei | 0.867 (0.601) | 0.941 ** (0.421) | 0.811 (0.577) | |||

| Pressurei | −0.155 | −0.137 | −0.124 | |||

| (0.185) | (0.101) | (0.183) | ||||

| Timeit × Treati | 0.118 ** | 0.024 | 0.137 *** | 0.032 | −0.071 | 0.056 |

| (0.049) | (0.027) | (0.049) | (0.074) | (0.046) | (0.071) | |

| Firm Size | 0.079 ** | 0.032 | 0.072 ** | 0.081 ** | 0.034 * | 0.073 ** |

| (0.036) | (0.019) | (0.035) | (0.036) | (0.019) | (0.036) | |

| Liability | 0.001 | 0.011 | −0.012 | −0.002 | 0.008 | −0.015 |

| (0.126) | (0.073) | (0.123) | (0.125) | (0.072) | (0.122) | |

| Firm Age | 0.000 | −0.022 | 0.021 | −0.002 | −0.025 | 0.019 |

| (0.079) | (0.049) | (0.079) | (0.079) | (0.049) | (0.079) | |

| Growth Ability | −0.002 (0.015) | 0.001 (0.014) | 0.004 (0.013) | −0.003 (0.016) | 0.000 (0.014) | 0.003 (0.014) |

| Nature of Equity | −0.007 (0.025) | −0.011 (0.011) | −0.002 (0.025) | −0.003 (0.025) | −0.007 (0.017) | 0.002 (0.024) |

| Percentage of Independent Directors | −0.437 * (0.231) | −0.266 ** (0.135) | −0.364 (0.228) | −0.414 * (0.229) | −0.240 * (0.135) | −0.342 (0.227) |

| Equity Concentration | −0.194 (0.299) | −0.140 (0.161) | −0.150 (0.280) | −0.206 (0.304) | −0.154 (0.163) | −0.162 (0.285) |

| Capital Intensity | 0.000 (0.005) | 0.003 (0.003) | −0.000 (0.004) | 0.000 (0.005) | 0.003 (0.003) | 0.000 (0.004) |

| Profitability | 0.186 | 0.257 * | 0.229 | 0.172 | 0.240 * | 0.214 |

| (0.238) | (0.141) | (0.234) | (0.241) | (0.141) | (0.236) | |

| Board Activity | 0.034 (0.024) | 0.014 (0.019) | 0.032 (0.024) | 0.035 (0.024) | 0.015 (0.019) | 0.032 (0.024) |

| Observations | 2353 | 2353 | 2353 | 2353 | 2353 | 2353 |

| R-squared | 0.045 | 0.018 | 0.050 | 0.048 | 0.024 | 0.053 |

| Year fixed effects | control | |||||

| Corporate fixed effects | control | |||||

| Variables | (1) | (2) | (3) | (4) | (5) | (6) |

|---|---|---|---|---|---|---|

| Green Innovation | Exploratory Innovation | Exploitative Innovation | Green Innovation | Exploratory Innovation | Exploitative Innovation | |

| Timeit × Treati × Pressurei | 1.113 * (0.639) | 1.068 ** (0.437) | 1.077 * (0.622) | |||

| Peer Pressurei | −0.117 (0.177) | −0.117 (0.097) | −0.103 (0.176) | |||

| Timeit × Treati | 0.132 *** | 0.033 | 0.147 *** | 0.020 | −0.074 | 0.039 |

| (0.048) | (0.027) | (0.049) | (0.074) | (0.047) | (0.072) | |

| Firm Size | 0.072 ** | 0.029 | 0.066 ** | 0.073 ** | 0.030 * | 0.067 ** |

| (0.033) | (0.018) | (0.033) | (0.033) | (0.018) | (0.033) | |

| Liability | −0.017 | −0.002 | −0.023 | −0.017 | −0.003 | −0.024 |

| (0.117) | (0.068) | (0.114) | (0.115) | (0.067) | (0.112) | |

| Firm Age | −0.004 | −0.028 | 0.019 | −0.008 | −0.031 | 0.015 |

| (0.078) | (0.048) | (0.077) | (0.077) | (0.048) | (0.077) | |

| Growth Ability | −0.002 (0.014) | 0.002 (0.012) | 0.002 (0.012) | −0.002 (0.014) | 0.001 (0.013) | 0.002 (0.013) |

| Nature of Equity | −0.030 (0.036) | −0.018 (0.016) | −0.023 (0.035) | −0.024 (0.035) | −0.012 (0.020) | −0.017 (0.034) |

| Percentage of Independent Directors | −0.427 * | −0.259 * | −0.355 | −0.397* | −0.231 * | −0.326 |

| (0.228) | (0.133) | (0.225) | (0.225) | (0.132) | (0.224) | |

| Equity Concentration | −0.156 | −0.114 | −0.122 | −0.176 | −0.134 | −0.142 |

| (0.278) | (0.151) | (0.260) | (0.283) | (0.153) | (0.266) | |

| Capital Intensity | 0.002 | 0.003 | 0.001 | 0.002 | 0.003 | 0.002 |

| (0.004) | (0.002) | (0.004) | (0.004) | (0.002) | (0.004) | |

| Profitability | 0.168 | 0.243 * | 0.195 | 0.150 | 0.226 * | 0.177 |

| (0.222) | (0.130) | (0.218) | (0.225) | (0.130) | (0.221) | |

| Board Activity | 0.030 | 0.015 | 0.025 | 0.031 | 0.015 | 0.025 |

| (0.023) | (0.018) | (0.023) | (0.024) | (0.018) | (0.023) | |

| Observations | 2455 | 2455 | 2455 | 2455 | 2455 | 2455 |

| R-squared | 0.047 | 0.019 | 0.051 | 0.052 | 0.026 | 0.056 |

| Year fixed effects | control | |||||

| Corporate fixed effects | control | |||||

| Variables | (1) | (2) | (3) | (4) | (5) | (6) |

|---|---|---|---|---|---|---|

| Green Innovation | Exploratory Innovation | Exploitative Innovation | Green Innovation | Exploratory Innovation | Exploitative Innovation | |

| Timeit × Treati × Pressurei | 0.969 | 0.936 ** | 0.916 | |||

| (0.589) | (0.415) | (0.567) | ||||

| Peer Pressurei | −0.120 | −0.097 | −0.125 | |||

| (0.157) | (0.087) | (0.158) | ||||

| Timeit × Treati | 0.143 *** | 0.050 * | 0.152 *** | 0.045 | −0.045 | 0.060 |

| (0.046) | (0.026) | (0.047) | (0.071) | (0.047) | (0.067) | |

| Firm Size | 0.067 ** | 0.025 * | 0.065 ** | 0.068** | 0.025* | 0.065 ** |

| (0.027) | (0.014) | (0.027) | (0.027) | (0.014) | (0.027) | |

| Liability | −0.104 | −0.037 | −0.097 | −0.103 | −0.035 | −0.095 |

| (0.103) | (0.061) | (0.100) | (0.101) | (0.060) | (0.098) | |

| Firm Age | 0.019 | −0.024 | 0.041 | 0.017 | −0.025 | 0.039 |

| (0.075) | (0.046) | (0.074) | (0.074) | (0.046) | (0.074) | |

| Growth Ability | −0.006 | −0.002 | 0.000 | −0.007 | −0.002 | −0.000 |

| (0.013) | (0.011) | (0.012) | (0.013) | (0.011) | (0.012) | |

| Nature of Equity | −0.013 | 0.018 | −0.027 | −0.005 | 0.025 | −0.019 |

| (0.031) | (0.036) | (0.043) | (0.030) | (0.036) | (0.042) | |

| Percentage of Independent Directors | −0.223 | −0.136 | −0.140 | −0.199 | −0.114 | −0.117 |

| (0.218) | (0.129) | (0.221) | (0.215) | (0.128) | (0.220) | |

| Equity Concentration | −0.137 | −0.068 | −0.104 | −0.150 | −0.080 | −0.115 |

| (0.219) | (0.119) | (0.205) | (0.222) | (0.121) | (0.208) | |

| Capital Intensity | −0.002 | 0.002 | −0.002 | −0.001 | 0.002 | −0.002 |

| (0.004) | (0.002) | (0.004) | (0.004) | (0.002) | (0.004) | |

| Profitability | 0.147 | 0.191 * | 0.142 | 0.134 | 0.177 | 0.131 |

| (0.197) | (0.113) | (0.195) | (0.199) | (0.113) | (0.196) | |

| Board Activity | 0.024 | 0.011 | 0.016 | 0.025 | 0.012 | 0.017 |

| (0.023) | (0.016) | (0.023) | (0.023) | (0.016) | (0.023) | |

| City * year fixed effects | 0.024 | 0.014 | 0.022 | 0.024 | 0.014 | 0.022 |

| (0.024) | (0.018) | (0.023) | (0.024) | (0.017) | (0.023) | |

| Observations | 2761 | 2761 | 2761 | 2761 | 2761 | 2761 |

| R-squared | 0.046 | 0.018 | 0.050 | 0.049 | 0.024 | 0.053 |

| Year fixed effects | control | |||||

| Corporate fixed effects | control | |||||

| Variables | (1) | (2) | (3) | (4) | (5) | (6) |

|---|---|---|---|---|---|---|

| Green Innovation | Exploratory Innovation | Exploitative Innovation | Green Innovation | Exploratory Innovation | Exploitative Innovation | |

| Timeit × Treati × Pressurei | 0.970 | 0.936 ** | 0.917 | |||

| (0.589) | (0.415) | (0.567) | ||||

| Peer Pressurei | −0.120 | −0.097 | −0.124 | |||

| (0.158) | (0.088) | (0.158) | ||||

| Timeit × Treati | 0.143 *** | 0.050 * | 0.152 *** | 0.045 | −0.045 | 0.060 |

| (0.046) | (0.026) | (0.047) | (0.071) | (0.047) | (0.067) | |

| Firm Size | 0.067 ** | 0.025 * | 0.064 ** | 0.067 ** | 0.025 * | 0.065 ** |

| (0.027) | (0.014) | (0.027) | (0.027) | (0.014) | (0.027) | |

| Liability | −0.103 | −0.036 | −0.096 | −0.102 | −0.035 | −0.094 |

| (0.103) | (0.061) | (0.100) | (0.101) | (0.060) | (0.098) | |

| Firm Age | 0.020 | −0.023 | 0.041 | 0.018 | −0.025 | 0.039 |

| (0.075) | (0.046) | (0.074) | (0.074) | (0.046) | (0.074) | |

| Growth Ability | −0.006 | −0.002 | 0.001 | −0.006 | −0.002 | −0.000 |

| (0.013) | (0.011) | (0.012) | (0.013) | (0.011) | (0.012) | |

| Nature of Equity | −0.013 | 0.018 | −0.027 | −0.004 | 0.026 | −0.019 |

| (0.031) | (0.035) | (0.043) | (0.030) | (0.036) | (0.042) | |

| Percentage of Independent Directors | −0.226 | −0.138 | −0.143 | −0.202 | −0.116 | −0.121 |

| (0.218) | (0.129) | (0.222) | (0.216) | (0.128) | (0.221) | |

| Equity Concentration | −0.137 | −0.067 | −0.104 | −0.149 | −0.080 | −0.115 |

| (0.219) | (0.119) | (0.205) | (0.222) | (0.120) | (0.208) | |

| Capital Intensity | −0.002 | 0.002 | −0.002 | −0.001 | 0.002 | −0.002 |

| (0.004) | (0.002) | (0.004) | (0.004) | (0.002) | (0.004) | |

| Profitability | 0.149 | 0.192 * | 0.144 | 0.137 | 0.179 | 0.133 |

| (0.197) | (0.113) | (0.195) | (0.199) | (0.113) | (0.196) | |

| Board Activity | 0.024 | 0.011 | 0.016 | 0.025 | 0.012 | 0.017 |

| (0.023) | (0.016) | (0.023) | (0.023) | (0.016) | (0.023) | |

| Observations | 2761 | 2761 | 2761 | 2761 | 2761 | 2761 |

| R-squared | 0.045 | 0.018 | 0.050 | 0.049 | 0.024 | 0.053 |

| Year fixed effects | control | |||||

| Corporate fixed effects | control | |||||

Disclaimer/Publisher’s Note: The statements, opinions and data contained in all publications are solely those of the individual author(s) and contributor(s) and not of MDPI and/or the editor(s). MDPI and/or the editor(s) disclaim responsibility for any injury to people or property resulting from any ideas, methods, instructions or products referred to in the content. |

© 2024 by the authors. Licensee MDPI, Basel, Switzerland. This article is an open access article distributed under the terms and conditions of the Creative Commons Attribution (CC BY) license (https://creativecommons.org/licenses/by/4.0/).

Share and Cite

Liu, S.; Li, Y. Exploration or Exploitation? Corporate Green Innovation Strategy for Carbon Emission Reduction-Evidence from Pilot Enterprises in China. Sustainability 2024, 16, 4486. https://doi.org/10.3390/su16114486

Liu S, Li Y. Exploration or Exploitation? Corporate Green Innovation Strategy for Carbon Emission Reduction-Evidence from Pilot Enterprises in China. Sustainability. 2024; 16(11):4486. https://doi.org/10.3390/su16114486

Chicago/Turabian StyleLiu, Shanshan, and Yugang Li. 2024. "Exploration or Exploitation? Corporate Green Innovation Strategy for Carbon Emission Reduction-Evidence from Pilot Enterprises in China" Sustainability 16, no. 11: 4486. https://doi.org/10.3390/su16114486

APA StyleLiu, S., & Li, Y. (2024). Exploration or Exploitation? Corporate Green Innovation Strategy for Carbon Emission Reduction-Evidence from Pilot Enterprises in China. Sustainability, 16(11), 4486. https://doi.org/10.3390/su16114486