1. Introduction

Crowdfunding, an innovative form of collaborative financing, has emerged as a disruptive phenomenon on the global financial scene in recent decades. Combining the power of digital connectivity with the desire of individuals and companies to support innovative ideas and projects, crowdfunding has challenged traditional approaches to raising financial resources. In this context, the Raize platform stands out as one of the pioneers and leaders in the crowdfunding ecosystem in Portugal, playing a key role in supporting entrepreneurs in their search for capital to turn their visions into reality.

The rise of crowdfunding as a legitimate and effective alternative to traditional financing has not gone unnoticed by entrepreneurs in Portugal and around the world. As this financial revolution gains momentum, the question among entrepreneurs in Portugal is clear: “What makes entrepreneurs choose crowdfunding through the Raize platform to finance their projects?”.

This question shines a spotlight on the complex web of factors that influence entrepreneurs’ decisions regarding fundraising through crowdfunding and, more specifically, through the Raize platform. Understanding these factors is crucial not only for the entrepreneurs themselves, but also for the evolution of the crowdfunding ecosystem in Portugal and, more broadly, for the ongoing transformation of the Portuguese global financial landscape.

The specific objectives of this study are as follows: firstly, we aim to analyse the importance of financial accessibility in the process of choosing crowdfunding, investigating how this facility influences entrepreneurs’ decision to opt for crowdfunding on the Raize platform. Secondly, we aim to assess entrepreneurs’ trust in the Raize platform’s community of investors, examining the factors that contribute to this trust and how it affects their decision to obtain funding via crowdfunding. Thirdly, we aim to assess the ease of use of the Raize platform as a motivating factor for entrepreneurs, studying how usability influences their decision to obtain funding in this way. Fourthly, we aim to investigate the importance of the competitive rates offered by the Raize platform as a factor of choice, analysing whether they are more attractive and whether they influence the decision to obtain funding through this crowdfunding system. Lastly and fifthly, we aim to analyse whether crowdfunding on the Raize platform is chosen as an alternative to traditional bank financing, exploring the reasons why entrepreneurs prefer this option over banks.

These objectives are crucial for understanding why entrepreneurs prefer crowdfunding on the Raize platform. Each objective corresponds to a key area of research, which will be further explored in the study methodology. They also translate into hypotheses:

Financial accessibility positively influences entrepreneurs’ choice of the Raize platform;

Trust in the investor community is positively associated with entrepreneurs’ choice of the Raize platform;

The ease of use of the Raize platform is positively related to entrepreneurs’ choice;

Competitive rates offered by the Raize platform are positively associated with entrepreneurs’ choice;

Crowdfunding through the Raize platform is chosen as an alternative to bank financing.

These hypotheses represent specific relationships between different motivating factors and entrepreneurs’ decision to use the Raize platform to finance their projects. They will be analysed using data collected from interviews to identify patterns of behaviour and preferences.

This study aims to answer this central question by investigating the motivations and determinants described above that drive entrepreneurs to turn to the Raize platform as a source of funding. By meticulously analysing the existing literature and conducting empirical research, this study sets out to demonstrate the factors that make the Raize platform a preferred choice for entrepreneurs in Portugal. Ultimately, this study aims to contribute to a deeper and more robust opinion of crowdfunding as an innovative financing tool, as well as to improve fundraising practices for entrepreneurs trying to achieve success in a dynamic and challenging market.

The introduction sets the scene for the research, highlighting the global context of crowdfunding as an innovative source of finance and presenting the Raize platform as a prominent figure in this scenario in Portugal. It also introduces the central research question that will guide the entire study, investigating the reasons why entrepreneurs choose the Raize platform to fund their projects, ideas and companies. The theoretical and empirical basis resulting from this study has the potential to significantly enrich our understanding of crowdfunding and its relevance in the contemporary Portuguese business context.

The present article has a simplified but robust structure. It begins with an introduction that contextualises the importance of crowdfunding as an innovative form of collaborative financing. The objectives of the present study are outlined, with the aim of understanding the factors that influence entrepreneurs to resort to crowdfunding through the Raize platform. The methodology details the qualitative research methods used, including sample selection and data collection through semi-structured interviews. The results present the participating companies’ perceptions of crowdfunding and the Raize platform. The conclusion highlights the viability and attractiveness of crowdfunding as an alternative to traditional bank financing, as perceived by the companies interviewed.

2. Literature Review

Crowdfunding is a collaborative financing method that allows individuals/entrepreneurs or organisations/companies to raise funds for their projects, ideas or causes by raising small contributions from a broad base of people/individuals, usually via online platforms (Belleflamme et al. (2014) [

1]). According to the same author, crowdfunding “is an alternative to traditional financing involving financial institutions or individual investors”.

There are a few types of crowdfunding:

Donation Crowdfunding: In this model, backers contribute without the expectation of receiving a financial return. It is usually used for philanthropic purposes, such as social causes, natural disasters or charity projects, according to (Ordanini et al. (2011) [

2]).

Reward Crowdfunding: Backers contribute financially and receive non-financial rewards, such as products, services or symbolic thanks, in exchange for their financial support of the project/product (Gerber et al. (2013) [

3]).

Peer-to-Peer Crowdfunding: In this model, lenders provide loans to projects or companies with the expectation of receiving the amount financed plus interest in the future (Mollick (2014) [

4]).

Equity Crowdfunding: Investors acquire an equity stake in the projects or companies financed through crowdfunding, which offers them the opportunity to participate in profits and losses (Hornuf et al. (2018) [

5]).

The future of crowdfunding is promising, with the potential to become an even more substantial source of funding and investment. The latest crowdfunding models, such as equity crowdfunding, are gaining prominence and expanding opportunities for entrepreneurs and investors (Block et al. (2018) [

6]). In recent years, crowdfunding has emerged as a transformative force in the financing landscape for entrepreneurs and businesses around the world. Crowdfunding represents a seismic shift, with considerable positive impacts on traditional financing practices, positioning itself as and offering a disruptive alternative to conventional methods of raising capital. At the epicentre of this revolution in Portugal is the Raize platform, one of the pioneers and leaders in the country’s crowdfunding ecosystem.

As crowdfunding gains ground, it is imperative to study in depth the reasons why entrepreneurs choose this tool to obtain funding and, more specifically, why they choose the Raize platform over other available options. This study not only sheds light on the behaviour of entrepreneurs, but also provides valuable information to improve crowdfunding practices and help entrepreneurs achieve their fundraising goals effectively and efficiently.

We can see the relevant economic impact of crowdfunding, especially loan crowdfunding, in the current context. According to Howell (2017) [

7], “Loan crowdfunding has demonstrated a significant impact on the economy by providing financing to small businesses and start-ups. Studies have shown that crowdfunding can boost economic growth and support job creation”.

Loan crowdfunding plays a vital role in access to finance for small and medium-sized enterprises (SMEs) and start-ups. It contributes to economic growth by promoting job creation and innovation. A recent study found that crowdfunding played a crucial role in reducing the financing gap for SMEs (Cumming et al. (2017) [

8]). Another important factor is the choice of a particular platform by entrepreneurs. According to Mollick (2013) [

4], “The choice of a crowdfunding platform is a critical decision for entrepreneurs. Factors such as the platform’s reputation, support base and the type of funding offered influence this choice”.

The choice of crowdfunding platform by entrepreneurs/companies is influenced by several factors. These include the platform’s reputation, its track record of success in similar projects and the community of investors associated with it. According to Mollick (2014) [

4], trust in the platform plays a critical role in the entrepreneur’s decision. However, challenges also arise as crowdfunding expands, such as the need for effective regulation and transparency for risk mitigation (Hornuf et al. (2018) [

5]). The future of crowdfunding involves overcoming these challenges to maintain sustainable and beneficial growth for all involved.

In this context, government regulations and guidelines are being developed to ensure investor security and the sustainable growth of crowdfunding (Mollick (2014) [

4]). The legal basis for crowdfunding in Portugal is governed by specific regulations that have been established to supervise and facilitate crowdfunding activity. Crowdfunding in Portugal is mainly regulated by Law no. 102/2015 of 24 August, which establishes the legal framework for crowdfunding and defines the rules for the activity of crowdfunding platforms. At the same time, Portugal has adopted the European Crowdfunding Directive (Directive 2020/1504/EU), which aims to create a harmonised regulatory environment for crowdfunding in the European Union. In Portugal, the Portuguese Securities Market Commission (CMVM) is the regulatory body responsible for supervising crowdfunding activities. The CMVM is responsible for issuing operating authorisations to crowdfunding platforms, ensuring regulatory compliance and protecting investors. Crowdfunding platforms must meet strict requirements to obtain authorisation from the CMVM, guaranteeing transparency and security for investors. The regulation of crowdfunding in Portugal aims to protect investors, encourage innovation and support economic growth. It also seeks to provide clear guidelines for project promoters, as well as establishing fair and transparent practices. However, from the perspective of the business model promoted by crowdfunding platforms, according to Agrawal et al. (2015) [

9], “Loan crowdfunding platforms generate revenue through commissions or fees on successful financings. Pricing is a critical aspect of these platforms’ business models”.

Loan crowdfunding platforms, such as Raize, generally generate revenue through commissions or fees charged on successful financing. Pricing is a fundamental part of these platforms’ business strategy. Pricing can vary based on the type of project and the amount financed (Hornuf et al. (2017) [

10]). Based on the study by Agrawal et al. (2015) [

9], crowdfunding has been associated with innovation, providing funding for innovative projects that may not be easily financed by traditional methods. Crowdfunding is a clear parallel with so-called traditional financing, namely, banking. For their part, authors Fabrice Hervé and Armin Schwienbacher (2019) [

11] also duly note and support the association of crowdfunding with innovation, since it offers a mechanism for financing innovative projects that may not be easily funded through traditional methods. The conclusion of this study helps and supports studies to come.

Regulation, the business models of the platforms, the legislative and regulatory context, and the role of crowdfunding in innovation are all known factors that can influence the choice of a particular platform, thus demonstrating the impact that crowdfunding has on the choice of platforms by entrepreneurs/companies.

2.1. Why Crowdfunding?

This study aims to understand the underlying factors that influence entrepreneurs to use crowdfunding through the Raize platform. To achieve this, it is essential to critically analyse the existing literature and identify the main determinants that shape entrepreneurs’ choices in this specific context.

The academic literature on crowdfunding that has been previously reviewed has flourished, providing a solid foundation for understanding the motivations driving entrepreneurs to choose this financing approach. There are a number of motivating factors in crowdfunding, and each one stands out with its own influence on entrepreneurs’ decision making. Based on the existing literature, we present below a “series” of motivating factors that lead entrepreneurs, companies and their projects to turn to crowdfunding. It was on the basis of this literature review and these motivating factors that this research study developed its specific objectives and possible hypotheses.

2.1.1. Affordability

One of the most representative reasons for choosing crowdfunding is financial accessibility. Crowdfunding allows entrepreneurs to access capital through a large number of investors, overcoming traditional barriers that often require substantial collateral for financing (Agrawal et al. (2015) [

9]). This factor reflects one of the most distinctive features of crowdfunding compared to traditional sources of finance, such as bank loans or venture capitalists.

Crowdfunding offers an inclusive financing model where entrepreneurs can access capital from a broad base of investors, many of whom are ordinary individuals. This represents a paradigm shift, as it challenges the idea that only large financial institutions have the power to provide substantial funding. Entrepreneurs with limited resources, or those who face difficulties obtaining traditional bank loans, find crowdfunding an attractive solution.

Through the Raize platform, entrepreneurs can align their financial needs with a diverse community of investors, including institutional and individual investors, who are willing to support projects they believe in. Such a dynamic creates a more accessible financing environment where entrepreneurs can seek funding without the restrictions often imposed by conventional financial institutions.

The theory of financial accessibility in the context of crowdfunding is based on the idea that the democratisation of funding is fundamental to the growth of start-ups and innovative projects. Studies such as that by Agrawal et al. (2015) [

9] highlight how financial accessibility is driven by broad access to the internet and crowdfunding platforms, creating an environment where entrepreneurs can present their ideas to a wide and diverse audience.

2.1.2. Trust in the Investor Community

Trust in the investor community is another critical factor. The transparency of operations, the reputation of the platform and the reliability of investors all play a key role in entrepreneurs choosing crowdfunding as a source of finance (Belleflamme et al. (2014) [

1]). The Raize platform, like many other crowdfunding platforms, focuses on building trust between entrepreneurs and investors. This is guaranteed through the transparency of operations, project rating systems and verification of information. Entrepreneurs who choose Raize often trust in the integrity of the system, believing that their projects will be supported by a community of investors genuinely interested in their success. Trust is often built through transparent information, interaction with entrepreneurs and previous evaluations of success. Studies suggest that trust in the investor community is a key factor in choosing crowdfunding (Mollick (2014) [

4]).

Studies such as that by Belleflamme et al. (2014) [

1] highlight the importance of transparency and reputation in building trust. Transparency in the platform’s operations, including details of how funds are used and return expectations, helps to allay investor concerns. In addition, the platform’s reputation and the quality of projects previously funded through it are critical factors affecting entrepreneurs’ trust.

Trust in the crowdfunding investor community is underpinned by the interpersonal trust theory and the transaction cost theory. Interpersonal trust emphasises the importance of trusting relationships in economic transactions, while the transaction cost theory suggests that trust can reduce the costs associated with complex contracts (Agrawal et al. (2015) [

9]).

2.1.3. Ease of Use of the Platform

The user’s experience is also of great importance. Entrepreneurs value simplicity in the process of creating campaigns and interacting with investors. A fluid, user-friendly interface and uncomplicated processes increase the attractiveness of crowdfunding (Mollick (2014) [

4]). The ease of use of the crowdfunding platform is a critical factor in entrepreneurs’ choice of this type of financing, and especially in their choice of the Raize platform. The simplicity and efficiency of the crowdfunding process can significantly influence an entrepreneur’s decision to use this approach. Studies indicate that the ease of use of the platform is a factor that has relevant influence on the choice of crowdfunding (Hornuf et al. (2018) [

5]).

The Raize platform was designed to simplify the process of creating campaigns and interacting with investors. The interface is often praised for being highly intuitive, which translates into entrepreneurs finding it easier to set up campaigns and communicate with the investor community. Research, such as that by Mollick (2014) [

4], has shown that the platform’s ease of use is one of the main reasons why entrepreneurs choose crowdfunding.

One of the main benefits of the platform’s ease of use is the reduction in barriers at the initial stage of the process for entrepreneurs, who are largely new users of this type of platform and system. This allows individuals with different levels of fundraising experience to use crowdfunding as an accessible tool to finance their ideas and projects. Entrepreneurs usually opt for crowdfunding when they realise that they can create and manage campaigns without the need for more complex technical or financial knowledge.

Usability theory, widely applied in user interface and product design, serves as a basis for understanding the importance of ease of use of platforms. According to this theory, the usability of a system affects efficiency and user satisfaction (Nielsen (1994) [

12]). This is particularly relevant when considering the experience of entrepreneurs on the Raize platform.

2.1.4. Competitive Rates Offered by the Platform

The fees associated with crowdfunding platforms are often a determining factor. Some studies suggest that competitive fees can influence the choice of crowdfunding (Schwienbacher & Larralde (2010) [

13]). One of the distinctive features of the Raize platform is its approach to fees. The platform aims to keep fees competitive for both entrepreneurs and investors. This means that entrepreneurs can raise more liquid capital for their projects, as fewer funds will go towards the platform’s fees. This factor is highlighted in certain investigations, such as the study by Ahlers et al. (2015) [

14], which analysed the impact of fees on entrepreneurs’ decisions.

In a fundraising environment where every euro cent counts, rates can make a substantial difference to the total return obtained by the entrepreneur. So Raize, by offering competitive rates, attracts entrepreneurs who want to maximise their earnings and minimise the costs associated with financing.

Financial theory provides a solid context for understanding the role of fees in crowdfunding. The cost of capital theory, for example, suggests that entrepreneurs seek to minimise financing costs in order to improve the profitability of their projects (Myers (1984) [

15]). Therefore, choosing a platform with competitive fees is consistent with this principle.

2.1.5. Alternative to Bank Financing

Traditional bank financing can be costly and restrictive. Crowdfunding has emerged as a viable alternative when access to bank loans is limited. Many entrepreneurs turn to this modality in search of flexibility and opportunity (Hornuf et al. (2017) [

10]).

Crowdfunding, including through the Raize crowdfunding and lending platform, often emerges as a viable alternative to traditional bank financing. Entrepreneurs’ decision to turn to crowdfunding as an alternative to traditional loans from financial institutions is influenced by a number of factors that make crowdfunding an attractive choice.

Studies emphasise that the choice of crowdfunding over traditional bank financing is related to factors such as flexibility and simplicity (Colombo et al. (2015) [

16]).

One of the main reasons why entrepreneurs consider crowdfunding an alternative to bank financing is to overcome the restrictions imposed by banks. Financial institutions often impose strict criteria, requiring substantial collateral, a solid credit history and a lengthy approval process. In contrast, crowdfunding, as noted in the study by Hornuf et al. (2017) [

10], offers greater flexibility and access to capital, even when entrepreneurs do not meet traditional bank requirements.

The Raize platform gives entrepreneurs considerable flexibility in defining financing terms. This includes the ability to choose interest rates, payment terms and other conditions that suit the specific needs of the project/company. This flexibility is particularly attractive to entrepreneurs and companies who want to structure their financing based on their financial situation and business strategy.

The viable alternative theory offers a solid basis for understanding why entrepreneurs choose crowdfunding as an alternative to bank financing. The theory suggests that entrepreneurs turn to crowdfunding when they believe it offers advantages over traditional banking options (Colombo et al. (2015) [

16]). Flexibility, speed and accessibility through crowdfunding are factors that fit into this theoretical framework.

This literature review highlights the importance of understanding with greater rigour the reasons that lead entrepreneurs to choose crowdfunding promoted by the Raize platform. The factors discussed above demonstrate the complexity and diversification of the “why” of this study, thus creating a complex and multifaceted scenario that requires thorough and empirical investigation. The various investigations and scientific studies provide a solid theoretical and empirical foundation for this study and highlight the importance of continuing to investigate the motivations behind entrepreneurs’ choices in the context of crowdfunding, specifically through the Raize platform.

Therefore, in order to achieve the central objective of this study and answer the research question in a sustained, robust and conclusive way, five specific objectives were defined on the basis of this detailed analysis of the literature, which are translated directly into the hypotheses defined in this study and which will be presented later, based on the motivational factors ascertained through the analysis and review of the literature.

2.2. Raize Platform

Raize is a crowdfunding platform based in Portugal, dedicated to connecting investors with companies looking for funding. Raize is a remarkable example of the evolving crowdfunding scene in Portugal. Founded in 2014, it quickly established itself as one of the leading peer-to-peer crowdfunding platforms. Since its inception, the platform has distinguished itself through its commitment to supporting entrepreneurs and small and medium-sized enterprises (SMEs) in finding and obtaining funding for their projects and their growth.

The platform was founded by José Maria Rego (CEO), an entrepreneur with extensive experience in finance and investment, whose vision was to provide an innovative financing alternative that would overcome the traditional barriers faced by entrepreneurs and SMEs in finding and raising capital.

The Raize platform focuses on financing projects created by entrepreneurs and SMEs from various industries and sectors. This includes everything from innovative start-ups to established businesses looking to expand or simply have support in their cash flow. The projects financed can cover a wide range of areas, such as technology, industry, services, commerce and much more.

2.2.1. The Growth and Impact of the Raize Platform

Since it was founded, the Raize platform has travelled a remarkable path of growth and economic impact, surpassing the mark of EUR 54 million invested in the Portuguese economy to date. From the outset, this fintech has played a key role in supporting investments that have benefited the creation of more than 15,000 jobs.

Raize has brought together a community of more than 73,000 investors, with funding granted that has already reached around 3300 Portuguese small and medium-sized enterprises (SMEs), covering various sectors of activity. The platform has a broad base of more than 96,000 companies and individuals, and in 2022 alone, Raize facilitated investments worth EUR 15.1 million. The data presented here were taken from the official platform website (

https://www.raize.pt/stats, accessed on 14 January 2024).

2.2.2. Profitability and Financial Performance

In terms of profitability, the year 2022 demonstrates a solid financial performance, accumulating a historical return after losses of 59% since 2015, equivalent to an annual average of 5.63% after losses. Notably, around 98% of Raize’s investors currently enjoy positive returns on their investment portfolio.

Raize’s CEO emphasises the platform’s ongoing commitment to supporting some of the best and most dynamic micro and small businesses in Portugal, providing excellent returns. He says that “Raize has already raised more than 100 million euros to finance some of Portugal’s best and most dynamic micro and small businesses with excellent returns”. He adds that “the year 2022 was a milestone, marked by a new record in terms of financing granted and the maintenance of a remarkable performance in the loan portfolio, with more than 98% of investors maintaining positive returns”.

2.2.3. Financial Results for 2022

As can be seen in Raize’s report and accounts for 2022, the Raize Group grew by 16%, reaching total revenues of EUR 1.3 million. For the second year running, Raize recorded positive financial results. In addition, in 2022, the platform granted more than EUR 15 million in new financing, maintaining a portfolio of loans to SMEs worth EUR 24 million. The loans originated and managed by Raize produced a total of EUR 1.3 million in gross interest in 2022, representing an increase of 17 per cent compared to 2021. It should be noted that losses totalled just EUR 0.1 million, down 42% on the previous year.

Analysis of the growth and impact of the Raize platform, through its 2022 report and accounts, reveals the essential role it plays in supporting SMEs in Portugal. The solid figures and the words of its CEO underline the platform’s success in promoting economic development and the success of companies in the country.

2.2.4. Current Status and Future Prospects

Today, the Raize platform continues to expand its presence and improve its range of services. It plays a key role in the financing ecosystem in Portugal, providing entrepreneurs with the opportunity to raise capital through a diverse community of investors. According to reports in the ECO and Jornal de Negócios newspapers, Flexdeal has increased its stake in Raize from 19% to 33.1%, making it the company’s largest shareholder, thus demonstrating its commitment to this business model and the transformation of traditional financing parameters.

In the future, the Raize platform could play an even more relevant role as crowdfunding and collaborative financing continue to gain traction globally. Its commitment to supporting entrepreneurship and its growing turnover is a clear indicator of its continued importance in the funding landscape in Portugal. The Raize platform is an outstanding example of how crowdfunding has transformed the financing landscape in Portugal. Its success story, focus on entrepreneurs, SMEs, individual investors and significant contribution to the financing of innovative projects make it a leading figure in the field of collaborative financing in Portugal and promise a bright future as it continues to support business growth in Portugal.

2.2.5. Methodology and Functionalities

Raize employs a rigorous methodology to assess and classify the credit risk of candidate companies. They use a combination of financial and non-financial factors to determine the companies’ viability and ability to pay. In addition, the platform uses continuous monitoring systems to track the financial performance of beneficiary companies over time. It presents the following steps as a functional matrix for its analysis methodology:

Registration—Companies interested in obtaining financing through Raize must register on the platform. They provide detailed information about their financing needs, business plan and other relevant information;

Risk analysis—Raize carries out a detailed analysis of candidate companies to assess their credit risk. This involves a general assessment of the company’s finances, such as checking their financial statements, financial ratios, previous loan history, market assessment, sector analysis, competence of the management team and risk rating;

Project listing—after approval, companies are listed on the platform, and registered investors can analyse the projects available for investment;

Investment—Individual investors can choose which projects they want to support financially. They can invest in multiple companies, diversifying their portfolio;

Crowdfunding—Funding is obtained through individual investors who contribute varying amounts. When the total amount required for the project is reached, financing is granted to the company;

Payment and return—beneficiary companies pay monthly or quarterly instalments to investors, including interest, until the total amount of financing is repaid.

The platform also promotes transparency by providing detailed information about the projects and companies listed. This helps investors make informed decisions about where to invest their money. In a nutshell, Raize acts as an intermediary between companies looking for funding and investors interested in financing/supporting those businesses. It uses a crowdfunding approach to enable individual investors to contribute to the growth of SMEs in Portugal. However, it is important that investors are aware of the risks associated with investing in smaller companies and that they carefully evaluate the opportunities available on the platform. It is important to note that Raize may adjust its risk assessment criteria over time to reflect changing market conditions and to improve the accuracy of its assessments. In addition, the platform emphasises the importance of transparency, providing detailed information about listed companies and risk ratings so that investors can make informed decisions. Investors can use these risk ratings as a tool to diversify their investments and manage the risk of their portfolio.

3. Study Objectives

The specific objectives of any study are intended to be clear and concise statements detailing what is to be achieved in relation to the research question. The objectives should be formulated in a specific, measurable, achievable, relevant and time-bound manner (SMART criteria). In the present context of this scientific study on the reasons that lead entrepreneurs to choose crowdfunding through the Raize platform, the specific objectives that emanate from the review of the literature previously discussed, which allow them to be supported, are defined as follows:

Specific Objective 1: Analyse the importance of financial accessibility in the process of choosing crowdfunding. This objective aims to investigate the relevance of financial accessibility as a factor that influences entrepreneurs’ decision to opt for financing through crowdfunding promoted by the Raize platform. It will assess the extent to which ease of access to finance influences the choice of crowdfunding as a financing alternative.

Specific Objective 2: Evaluate entrepreneurs’ trust in the Raize platform’s investor community. This objective aims to examine the degree of trust that entrepreneurs place in the community of investors on the Raize platform. It will investigate the factors that contribute to building this trust and how it impacts the decision to finance through crowdfunding.

Specific Objective 3: Evaluate the ease of use of the Raize platform as a motivating factor for entrepreneurs. This objective aims to understand whether the ease of use of the Raize platform plays a significant role in the choice of crowdfunding. It will investigate how the usability of the platform influences entrepreneurs’ decisions.

Specific Objective 4: Investigate the importance of the competitive rates offered by the Raize platform as a factor of choice. This objective aims to examine whether the competitive rates offered by the Raize platform are a motivating factor for entrepreneurs. It will assess the extent to which more attractive rates influence the decision to finance through crowdfunding.

Specific Objective 5: Analyse whether crowdfunding on the Raize platform is chosen as an alternative to bank financing. This objective will investigate whether entrepreneurs choose crowdfunding on the Raize platform as a viable alternative to traditional bank financing. The reasons why crowdfunding is chosen as the better option over banks will be explored.

The five objectives discussed above, catalogued as specific, are formulated in such a way as to direct the research towards the key areas that will contribute to a comprehensive understanding of the reasons why entrepreneurs choose crowdfunding through the Raize platform. Each of them corresponds to a relevant aspect of the research question that will be explored in depth in the research methodology of this study, through the application of the questionnaire to entrepreneurs/companies that have used or use the Raize platform, and their results will certainly provide more specific results for a careful analysis that will produce an interesting discussion and conclusion.

The objectives presented represent, in their final concept, the hypotheses formulated by us in this study, which has the research question as its backdrop, and will allow us to gain an in-depth understanding of the motivating factors in the context of crowdfunding through the Raize platform.

Recalling the central research question, “What leads entrepreneurs to choose crowdfunding through the Raize platform to finance their projects? “, we developed and applied the specific objectives defined above, which resulted in the definition of our hypotheses, formulated as follows:

Hypothesis 1 (H1). Financial accessibility positively influences entrepreneurs’ choice of the Raize platform to finance their projects. In other words, entrepreneurs who see the Raize platform as a more accessible source of finance are more likely to choose it over other financing options.

Hypothesis 2 (H2). Trust in the investor community is positively associated with entrepreneurs’ choice of the Raize platform. Entrepreneurs who trust the Raize platform’s investor community are more likely to use the platform to finance their projects.

Hypothesis 3 (H3). The ease of use of the Raize platform is positively related to the choice of entrepreneurs. Entrepreneurs who perceive the Raize platform as easy to use are more likely to choose it to finance their projects.

Hypothesis 4 (H4). Competitive rates offered by the Raize platform are positively associated with entrepreneurs’ choice. Thus, entrepreneurs who consider Raize’s rates to be more competitive compared to others are more inclined to choose the Raize platform for their financing.

Hypothesis 5 (H5). Crowdfunding through the Raize platform is chosen as an alternative to bank financing. Entrepreneurs choose Raize as an alternative to traditional bank financing methods because of its flexibility, simplicity of use, highly competitive rates and solid trust.

Each of the hypotheses represents a specific relationship between a motivating factor (financial accessibility, trust in the investor community, ease of use of the platform, competitive rates and the choice over bank financing) and the entrepreneurs’ decision to choose the Raize platform to finance their projects and their companies. These hypotheses will be analysed through the data collected in the interviews, and then cross-referenced in order to show where there is greater convergence of opinion among the participants, with the aim of gauging common lines of assumption of the functionalities of this alternative method of collaborative financing.

4. Methodology

This section of the present study will provide a comprehensive overview of the research process steps, as well as a more detailed description of the methods used in the study, including data collection methods, tools used, analysis techniques and data processing procedures. The Methodology section is crucial to ensure the validity and reliability of the research.

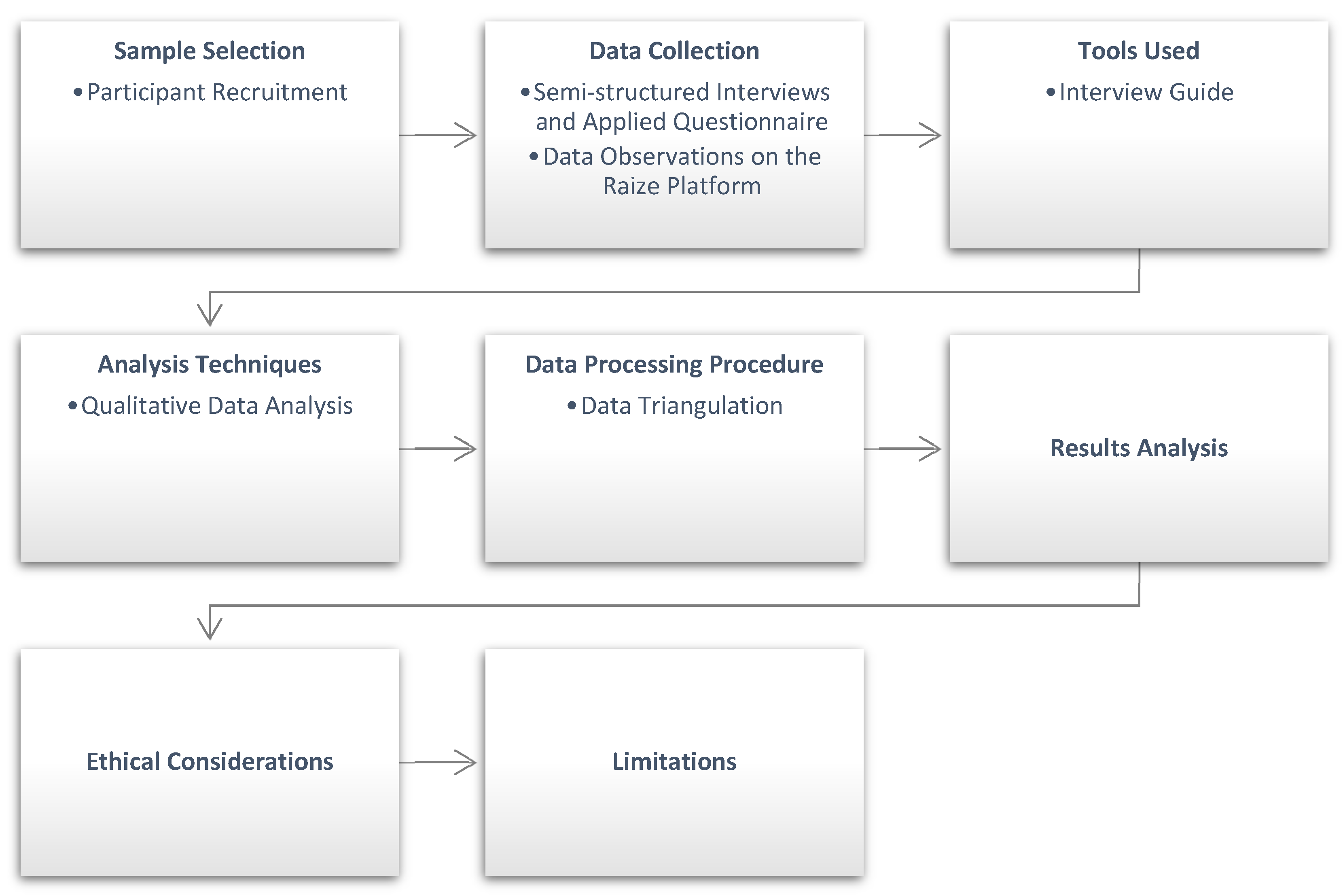

Based on the developed research methodology, the following diagram, in

Figure 1, is presented for a simpler, quicker and visual understanding of it.

The sample selected for this study comprises entrepreneurs and company managers who have used crowdfunding on the Raize platform to finance their companies, businesses and/or projects.

In qualitative research, the interaction between the researcher and the interviewee is fundamental to obtaining meaningful information (Cleary et al. (2014) [

17]). The data collection process includes interviews, observations of documentary records of crowdfunding processes and data analysis. In the qualitative multiple-case study, it is crucial to adopt an appropriate methodology, select the participants and analyse the data objectively. In order to mitigate possible biases in the data, open questions were formulated, allowing the interviewees to share their lived experiences (Bourke (2014) [

18]). Semi-structured interviews were applied to explore the attitudes, behaviours and experiences of the interviewees (Rowley (2012) [

19]), offering an effective method for investigating the reasons why entrepreneurs and business managers chose the Raize crowdfunding platform to finance their projects.

This format allows for a more in-depth analysis of the participants’ responses, providing results about their decisions and the phenomenon in question. It is imperative that participants have relevant experience with the phenomenon under study (Yin (2014) [

20]), being selected on the basis of their personal knowledge and experience of the subject related to the research question (Cleary et al. (2014) [

17]), and that they are willing to share their information and experiences.

So, the criteria for selecting the interviewees included the following:

- (a)

Companies/projects that have used the Raize platform for collaborative financing;

- (b)

Companies that have successfully used the Raize platform to finance their business;

- (c)

Companies that are currently active.

This selection process aims to ensure that participants have relevant experience with the phenomenon under study and are willing to share their information and experiences. Twenty companies were initially selected for the multiple-case study. After applying the selection criteria and assessing the availability of the companies, only five companies accepted and responded positively to the invitation to participate in this study based on the topics that the research intended to investigate.

The advantages of multiple-case studies compared to single-case studies include more convincing evidence, greater robustness of the study and a consistent structure in all cases (Yin (2014) [

20]). Despite the small number of participants, this method allows for a deeper and more comprehensive analysis of the phenomenon (Cleary et al. (2014) [

17]).

To gain access to the participants, strategies were used that included searching the Raize platform’s information base to find out which companies had used it to finance their businesses. Potential interviewees were contacted by telephone or e-mail, where the purpose of the study was explained and their consent and participation requested. Twenty companies were initially selected, guaranteeing a final sample of five companies for this study.

This study employs a qualitative multiple-case approach in order to gain a comprehensive understanding of the reasons why entrepreneurs choose crowdfunding through the Raize platform. In this way, it is a research approach that involves the detailed and in-depth analysis of several individual cases within a specific context. In this type of study, the aim is to understand social, behavioural or organisational phenomena by observing multiple cases that share identical characteristics or are situated in similar environments with regard to the subject under study.

The main data collection tools used were semi-structured interviews and observations of company data on the Raize platform. Interviews make it possible to understand the phenomenon from the point of view of the person who experienced it; using the same questions and following the same interview protocol for the various participants is a way of achieving data saturation (Fusch and Ness (2015) [

21]).

Data triangulation is a process used in qualitative research methods to enhance validity and reliability. Data triangulation involves identifying similar data across different contexts (Zivkovic, 2012 [

22]). In this study, data triangulation was employed by comparing and combining information from various sources (interviews and observations on the Raize platform) to enhance the validity and reliability of the results. This approach increased the reliability and validity of the data, providing a more comprehensive understanding of the phenomenon under study.

Open-ended questions in semi-structured interviews allow participants to recount experiences of the phenomenon in their own words, with minimal influence from the researcher (Bourke (2014) [

18]). The interviews lasted between 30 and 40 min and were supplemented with written observations by the interviewer about the participant. The interview script, based on the questionnaire drawn up, was designed to investigate the satisfaction of Portuguese entrepreneurs who have used crowdfunding through the Raize platform as a form of financing. This tool aims to understand different aspects of the user’s experience, from financial accessibility to trust in the investor community, as well as the ease of use of the platform and the competitiveness of the fees.

The questionnaire is divided into three different sections, each addressing specific aspects of the entrepreneurs’ experience with crowdfunding through the Raize platform.

Section 1 collects demographic information about the respondent, such as name, age, gender, level of education and place of birth, as well as data about the company, such as name, sector of activity, turnover in 2023, number of employees, date of foundation and location.

Section 2, meanwhile, addresses different aspects of entrepreneurs’ experience with crowdfunding through the Raize platform, from financial accessibility to the alternative to bank financing. Each subsection includes questions about the user’s perception of a certain aspect, followed by a space for comments and development of the answer.

Section 3 addresses questions related to the overall user experience, such as knowledge about crowdfunding and the Raize platform, recommending the platform to other entrepreneurs, preference between Raize and traditional banking for future financing, as well as sharing additional comments about choosing to use crowdfunding through the Raize platform.

In short, the questionnaire “Satisfaction of Portuguese Entrepreneurs with Crowdfunding through the Raize Platform” was developed to investigate and understand users’ experience with crowdfunding as a form of financing. Its carefully designed structure and variety of questions allow for a rigorous and comprehensive analysis of entrepreneurs’ satisfaction with this form of financing.

Once the data are gathered, they need to be analysed properly. After analysing the data in each case, the results in the five cases were analysed to identify patterns (Yin (2014) [

20]). The data from the five semi-structured interviews served as the main data source for identifying and grouping themes according to the research question. Secondary data complemented and supported the main themes.

The data from the interviews were analysed to identify recurring themes and emerging patterns. This involved a thematic analysis of the data, where themes were grouped according to the research question. This analysis allows for a deeper understanding of the reasons driving entrepreneurs to choose crowdfunding on the Raize platform.

During the research process, fundamental ethical considerations were observed. Prior to their participation in the study, participants were adequately contacted and provided their informed consent. Additionally, rigorous measures were implemented to ensure the confidentiality and anonymity of the participants, particularly during the dissemination of the study results.

It is noteworthy that this study was conducted with a limited number of participants, consisting of only five companies. This limitation arose from the availability and acceptance of invitations. Consequently, the generalisability of the results may be compromised by the small sample size. However, this detailed description of the methods employed provides a comprehensive understanding of the adopted methodological approach, as well as the procedures utilised for data collection, analysis and processing.

5. Results

Participating Companies—Data

The participants in this study are companies based in Portugal, where their managers/administrators have used crowdfunding through the Raize platform to finance their projects and their companies. The participating and studied companies are those referenced in

Table 1. Based on the information provided on the crowdfunding campaigns carried out on the Raize platform by the companies taking part in this study, as well as the information gathered in Section 1 of the questionnaire during the interview, the following relevant information is shown in

Table 1.

A company specialising in jewellery packaging, its 68-year-old head highlighted the financial accessibility provided by the Raize crowdfunding platform, considering it faster and simpler than traditional financing methods. He also considered the trust in Raize’s community of investors to be positive and praised the promptness and accessibility of the process of obtaining financing, in contrast to his experience with traditional bank financing.

The interviewee emphasised the ease of use of the Raize platform, praising the simplicity and efficiency of the entire online process. As for the rates, he considered them competitive, especially compared to traditional banking, emphasising the importance of this factor in his choice and decision making.

For the interviewee, the Raize platform served as a direct alternative to bank financing, and he chose this platform because of his previous positive experience with it. In conclusion, the interviewee recommended the platform to other entrepreneurs and highlighted the lack of generalised knowledge about this type of financing in Portugal and the alternative, suggesting greater publicity on the part of the platforms, specifically the Raize platform. He expressed his personal satisfaction with the use of the financial aid promoted by the Raize platform and encouraged other entrepreneurs to explore this financing alternative.

The

Table 2 presents the hypotheses and answers from company B1.

The interviewee is an experienced entrepreneur and in addition to the company he manages that took part in this study, he has another company of which he is a partner that has also used crowdfunding promoted by Raize. The company’s object (CAE) is to manufacture other carpentry work for the construction industry.

The interviewee emphasises the ease of access to financing through the Raize platform compared to traditional bank financing. He emphasises the personalised assistance and the clarity of the process. He also emphasises the simplicity of submitting documents and the absence of excessive bureaucracy. He considers financial accessibility to be a crucial factor in decision making.

He expresses confidence in the Raize platform, rather than in the investor community itself. He considers the risk to be greater for investors than for companies, emphasising the importance of evaluating the company receiving the investment.

In turn, he praises the ease of use of the Raize platform, highlighting the promptness of the process compared to banking institutions. He emphasises the importance of speed in financial decisions for small business owners.

The interviewee emphasises the importance of the stable rates offered by the Raize platform compared to traditional financing. He highlights the flexibility of early repayments as a differentiating and relevant factor in the decision making process.

For the interviewee, the Raize platform is a viable alternative to traditional financing, especially when considering the valuation of equity by banking institutions. He emphasises the importance of the platform as an accessible option for companies that have difficulty obtaining financing through traditional channels.

In his final remarks, he says he heard about the Raize platform through informal conversations and recommends using it to other entrepreneurs. He emphasises the importance of negotiating financing rates with Raize and suggests that other entrepreneurs do the same.

The

Table 3 presents the hypotheses and answers from company B2.

This company is in the property sector based in Lisbon, with a turnover of around EUR 300,000 in 2023, and has two direct employees. The company was founded in 1978.

The interviewee emphasises that despite its initial appearance, the Raize platform offers more accessible financing when compared to traditional options, mainly due to the clarity and speed of the evaluation process. He expresses confidence in the community of investors on the Raize platform, although direct contact with them is minimal. The platform’s reputation and transparency contribute to this trust in the interviewee’s opinion.

Although the interviewee does not use the platform regularly, he considers it intuitive and “user-friendly”. Ease of use is perceived as a positive point, although not the most relevant.

With regard to fees, the interviewee initially did not think they were the most competitive, but after a more detailed analysis, he concluded that they were more attractive and transparent.

The Raize platform is perceived in his analysis as a complementary alternative to traditional bank financing. He values the speed, objectivity and transparent accessibility offered by the platform.

In his final remarks, he says that he found out about crowdfunding and the Raize platform through the specialised media. In his opinion, crowdfunding is an excellent financing tool that represents a viable and attractive alternative to traditional bank financing. It benefits both investors and entrepreneurs, highlighting the platform’s flexibility and transparency as strengths, contributing to the growing relevance of crowdfunding in today’s financial landscape.

There is a lot of ignorance about this type of financing, but in his opinion, traditional banking “has to take care of itself in the future”, because in his opinion, crowdfunding is strong competition.

The

Table 4 presents the hypotheses and answers from company B3.

The interview was conducted with the company’s director, a 43-year-old graduate who operates in the footwear and textile retail sector, with 135 employees and a turnover of EUR 12 million in 2023. The company was founded in 1986 and is located in Vila Franca de Xira.

The interviewee highlights the ease of access and use of the Raize platform, although he mentions some less positive issues regarding the platform’s analysis of documents, especially bank statements. However, the ease of use was considered an important factor in the decision making process. In turn, he does not attach much importance to the platform’s investor community. As for the fees, he does not think they were a determining factor in choosing the platform, but instead, its suitability for his company’s financial objectives was the most important aspect. In the interviewee’s opinion, the Raize platform is seen as an alternative to bank financing, although he weighs up both options, mainly in terms of the opportunity and diversification of the financing portfolio.

He expresses an optimistic view of crowdfunding, considering it “the digital finance of the new generations”. He believes that the simplified and less bureaucratic model of crowdfunding has the potential to become predominant in the future, providing a more direct and uncomplicated approach to investments.

In short, his opinions highlight the importance of ease of access and the prospect of a more simplified and digitalised financial future.

The

Table 5 presents the hypotheses and answers from company B4.

The interviewee, Vasco Salazar, is the head of the company Celanus SA, an entity based in Vila Nova de Gaia, Portugal, operating in the tourism sector, with a focus on local accommodation and property activities. The company, founded in 1966, had a turnover of around EUR 103,000 in 2023, with two employees and a moderate debt policy.

The interviewee emphasises that financing through the Raize platform is more accessible and user-friendly compared to the traditional options offered by banks. He highlights the speed and closeness of the contact, in contrast to the distant and depersonalised approach of the banks.

Affordability was a relevant factor in the decision to choose the Raize platform to finance their project, especially due to the speed and efficiency of the process, combined with the trust previously established with the platform.

Trust in the platform’s investor community is based on previous positive experiences and the payment guarantee offered by the company, due to its solid client base and successful activities. This was a crucial factor in their decision to opt for the Raize platform, given the solid reputation and positive track record of previous investments.

The interviewee emphasises the ease of use of the platform, highlighting the intuitiveness of online interaction with the platform as well as the closeness of contact with the team, compared to the complexity and distance often found with traditional banking services.

The ease of use of the platform was a determining factor in choosing it, contributing to a positive and simplified experience in the financing process.

With regard to the rates charged, he notes that they are in line with other financing options such as banking but emphasises the platform’s competitive advantage in terms of speed, accessibility and commitment to the client. Although the rates are not significantly different, the speed and ease of interaction with the Raize platform were determining factors in choosing the platform and this type of financing.

The interviewee recognises the importance of the credit lines offered by banks, especially those supported through the state budget or public policies, but highlights Raize’s crowdfunding as a more flexible, accessible, quick and easy alternative for business financing.

Ease of access, simplicity of the process and trust in the community of investors made crowdfunding a more interesting option than traditional bank financing.

In his final comments, he has a very positive opinion of the Raize platform, highlighting it as dynamic and beneficial for companies, recommending it to other entrepreneurs and praising its practicality and ease of access compared to traditional bank financing.

If he needed financing again, the interviewee says he would choose the Raize platform again, considering it a better option than traditional banking due to its efficiency and transparency.

The

Table 6 presents the hypotheses and answers from company B5.

To summarise the results of the interviews, a simplified version is presented below in

Table 7 for a quick and comprehensive analysis, as well as to support this discussion of the results, which will follow.

6. Discussion of Results

The results of the interviews indicate that overall, the interviewed companies perceive the Raize platform as a viable and attractive alternative to traditional bank financing. Financial accessibility, trust in the investor community, ease of use of the platform and competitive rates are also aspects frequently highlighted by the interviewees. However, it is important to note that some companies may not consider fees a determining factor in choosing the platform, and some may not see Raize as more appealing than traditional bank financing. This suggests that although Raize has several perceived advantages, some companies may have different priorities or experiences that influence their financing decisions.

Financial accessibility, as one of the main reasons for choosing crowdfunding through the Raize platform, plays a crucial role in the dynamics of financing entrepreneurial projects. By allowing entrepreneurs to access capital through a diverse community of investors, the Raize platform stands out as an accessible and effective solution for financing needs, opening doors to innovation and entrepreneurship in a more inclusive manner.

Financial accessibility is one of the pillars driving the popularity of crowdfunding, and its impact on entrepreneurs’ decisions is significant. This point, deeply explored in the literature review and refined in the results of this study, highlights how the Raize platform, with its specific characteristics, meets this need for financial accessibility and underscores the importance of conducting additional research to study this factor in detail.

Trust in the investor community plays a vital role in entrepreneurs’ decision to choose the Raize platform for financing their projects. Trust is built through transparency, platform reputation and the effectiveness of security measures. A deep understanding of this factor is essential to enhance entrepreneurs’ experience with the platform and further strengthen the crowdfunding ecosystem. Trust in the investor community is a key element that influences entrepreneurs’ choice of crowdfunding through the Raize platform. The result of this study emphasises how trust is built and how it plays a critical role in entrepreneurs’ decisions regarding crowdfunding.

As for the ease of use of the Raize platform, it also plays a significant role in entrepreneurs’ choice to adopt crowdfunding as a financing approach. The platform’s intuitive and efficient interface removes entry barriers, allowing entrepreneurs of varying levels of experience to benefit from crowdfunding’s advantages. This ease of use contributes to attracting entrepreneurs seeking an accessible and effective solution to finance their projects and turn their ideas into reality.

The ease of use of the platform is one of the key factors influencing entrepreneurs’ choice of crowdfunding, and this point is emphasised in the literature review and highlighted in the results of this study, underscoring how simplicity and process efficiency can play a crucial role in entrepreneurs’ decisions regarding crowdfunding through the Raize platform.

The competitive rates offered by the Raize platform play a role in entrepreneurs’ decisions to adopt crowdfunding as a financing alternative, but they are not always decisive. However, by reducing fundraising-associated fees, the Raize platform attracts entrepreneurs seeking to maximize their investments and optimize project financing. This approach contributes to the platform’s attractiveness and highlights the importance of fees in entrepreneurs’ financing decisions.

The aim of this study was to analyse the perception of companies and entrepreneurs in relation to crowdfunding, specifically using the Raize platform as a case study. Based on a semi-structured interview conducted with companies, the interviewees’ responses were examined in relation to five hypotheses formulated on the basis of the defined objectives and the research question developed, which addresses aspects such as financial accessibility, trust in the investor community, ease of use of the platform, competitiveness of rates and alternatives to traditional bank financing. As such, it is essential to analyse the reasons why entrepreneurs opt for crowdfunding through the Raize platform as a source of funding.

Affordability stands out as one of the main drivers of this choice.

Crowdfunding offers an inclusive approach to financing, allowing entrepreneurs to access capital from a broad base of investors, many of whom are ordinary people. This feature challenges traditional norms, where financial institutions have a monopoly on substantial funding, requiring considerable collateral and a solid credit history. On the contrary, crowdfunding, as highlighted by Agrawal et al. (2015) [

9], offers an affordable alternative, especially for entrepreneurs with limited resources or difficulties in obtaining traditional bank loans.

On the other hand, trust plays a crucial role in choosing crowdfunding as a source of finance. The transparency of operations, the reputation of the platform and the reliability of investors are determining factors. The Raize platform, like other crowdfunding platforms, focuses on building this trust through project rating systems, information verification and transparent interaction between entrepreneurs and investors. Studies such as those by Belleflamme et al. (2014) [

1] emphasise the importance of this trust in entrepreneurs’ decision making. In addition, the ease of use of the platform plays a significant role in the choice of crowdfunding. The intuitive interface and simplified processes increase the attractiveness of crowdfunding for entrepreneurs, allowing them to create and manage campaigns without the need for complex technical knowledge. The Raize platform, in particular, is designed to simplify the fundraising process, making it accessible even to those with little experience in the area.

As for the fees associated with crowdfunding platforms, they also influence entrepreneurs’ decisions. Platforms like Raize, which offer competitive rates for both entrepreneurs and investors, attract those looking to maximise the financial return on their projects. This is consistent with financial theory, which suggests that entrepreneurs seek to minimise financing costs in order to improve the profitability of their projects.

Taking a closer and more detailed look at the answers given by those involved in this study, we can see that the head of company B1, for example, emphasises the financial accessibility provided by the Raize platform, considering it to be quicker and simpler than traditional financing methods. This response corroborates Hypothesis 1, indicating that the platform is perceived as more accessible in comparison to other forms of financing. In addition, the interviewee shows confidence in Raize’s community of investors, which is in line with Hypothesis 2. He also praises the platform’s ease of use, confirming Hypothesis 3, and highlights the competitiveness of the rates, as expected in Hypothesis 4. Finally, the interviewee sees Raize as a direct alternative to bank financing, supporting Hypothesis 5.

Company B2, for its part, emphasises the ease of access to financing through Raize compared to traditional banking, corroborating Hypothesis 1. It also shows confidence in the platform, highlighting the importance of evaluating the company receiving the investment, which confirms Hypothesis 2. As for the ease of use of the platform, he considers it positive, supporting Hypothesis 3, and mentions that the rates are competitive, confirming Hypothesis 4. Finally, he sees Raize as a viable alternative to traditional financing, especially in cases where banking would not be an option, supporting Hypothesis 5.

The representative of the company B3 emphasises the financial accessibility offered by Raize, confirming Hypothesis 1. He expresses confidence in the platform’s investor community and highlights its transparency and reliability, corroborating Hypothesis 2. Although he does not use the platform regularly, he finds it easy to use, confirming Hypothesis 3, and realises that the rates, although they initially do not seem the most attractive, become more competitive towards the end of the process, supporting Hypothesis 4. He also sees Raize as a complementary alternative to traditional bank financing, which is in line with Hypothesis 5.

Company B4 highlights the ease of access and use of the Raize platform, corroborating Hypothesis 1. It does not attach great importance to the investor community, but it does highlight the ease of use of the platform, which confirms Hypothesis 3. Fees were not a determining factor in choosing the platform, refuting Hypothesis 4, and although the company sees Raize as an alternative to bank financing, it does not consider it more appealing, which partially contradicts Hypothesis 5.

Finally, company B5 and the person in charge of it rated all of the hypotheses formulated and present in the questionnaire during the interview as very important in the process of choosing and selecting this type of collaborative financing through the Raize platform.

One of the most relevant points in the present study was to ascertain from the participants whether Raize platform crowdfunding is indeed an alternative to traditional financing. The verified result is that the Raize platform presents itself as a viable alternative to bank financing for entrepreneurs seeking to overcome banking restrictions, take advantage of financial flexibility and explore a more accessible financing process. The decision to opt for crowdfunding instead of bank financing reflects the search for solutions that meet the specific needs of entrepreneurs and businesses, adapting to an ever-evolving business environment. However, some companies did not consider fees a determining factor in choosing the platform, and some did not see the platform as more appealing than traditional bank financing.

Overall, crowdfunding, particularly through the Raize platform, emerges as a viable alternative to traditional bank financing. Its financial accessibility, reliability, ease of use and competitive fee structure make it an attractive choice for entrepreneurs seeking flexibility and opportunity in financing their projects and businesses.

7. Conclusions

The results of the interviews indicate that companies consider the Raize platform a viable alternative to traditional bank financing, highlighting financial accessibility, trust in the investor community, the platform’s ease of use and the competitiveness of rates. To deepen the understanding of how financial accessibility influences the choice of the Raize platform by entrepreneurs and companies, it is essential to guide empirical research that investigates the role of this factor. This may include analysing the demographic characteristics of entrepreneurs seeking crowdfunding, as well as identifying specific barriers that lead to the preference for this financing modality over traditional options.

On the other hand, understanding how trust is built and preserved on the Raize platform is fundamental for future research. This may include investigating the effectiveness of security and transparency measures implemented by the platform and how they influence the behaviour of entrepreneurs. Additionally, analysing past experiences of entrepreneurs who have succeeded on Raize may reveal interesting indicators about trust in the investor community.

As for ease of use, its relevance is evident in entrepreneurs’ preference for crowdfunding, highlighting the importance of simplicity and efficiency in the process.

Future investigations could explore the relationship between the ease of use of the Raize platform and the success of crowdfunding campaigns. This may include analysing metrics such as campaign completion rate and the average time required to set up a successful campaign. Furthermore, comparing experiences among entrepreneurs using the Raize platform with other crowdfunding platforms may provide additional insights into the importance of ease of use.

However, some companies may not consider fees a decisive factor in choosing the platform, suggesting different priorities or experiences. Regarding the impact of fees on entrepreneurs’ choice, future investigations may focus on comparing the fees charged by the Raize platform with those of other crowdfunding platforms, as well as with those charged by traditional banking institutions. This can help determine how fees influence entrepreneurs’ decisions and whether they play a decisive role in platform selection.

Crowdfunding, through the Raize platform, is seen as an alternative to bank financing, providing flexibility and accessibility for entrepreneurs. The use of crowdfunding, particularly the Raize platform, as an alternative tool to bank financing is motivated by several reasons. This point is supported by the literature review and the results previously presented, demonstrating how crowdfunding offers entrepreneurs a flexible and accessible alternative compared to other options, influencing their financing decisions.

Additional future research may reveal with greater rigor and depth how entrepreneurs view crowdfunding as an alternative to traditional bank financing. This may include analysing the experiences of entrepreneurs who have explored both options and the underlying reasons for choosing crowdfunding. Moreover, comparing the costs and benefits of crowdfunding versus banking alternatives can provide valuable insights into financing decisions. Additionally, a future line of investigation could be based on the pecking order theory, a financial concept describing how companies finance their investments and activities. This theory was proposed by Myers (1984) [

15]. By using this theory, a conceptual framework can be developed for studying and analysing the reasons why entrepreneurs and business managers opt for crowdfunding through these platforms. The central idea behind the pecking order theory is that companies prefer to use a specific order of financing sources, prioritising those that are cheaper and less costly in terms of asymmetric information.

In general terms, within the context of the limitations identified in this study, it is important to consider that the interviews were conducted in a specific context and with a limited number of companies, which may affect the generalisation of the results. Additionally, the perception of the interviewees may be influenced by various individual and contextual factors that were not addressed in the present analysis. Regarding the identified limitations, we can consider the possibility of having more representative samples by expanding the number of interviewed companies, including a variety of sectors and dimensions of the companies, to obtain a more representative and robust sample. On the other hand, deeper qualitative analyses of the interviewees’ responses could be conducted to identify additional patterns that may not have been initially identified.

In summary, crowdfunding emerges as a viable alternative to traditional financing, offering opportunities for projects and companies to obtain funding in a flexible and effective manner.