Abstract

Carsharing has received considerable attention as a sustainable mobility paradigm. Various service designs and dynamic business environments have increased the decision complexity for the carsharing business. Therefore, carsharing operators require a tool for assessing business development from holistic perspectives. This research provides a framework for outlining the requirements of the carsharing system with holistic perspectives of stakeholders being considered, as well as to derive assessment metrics for examining carsharing development. To create the framework, the system modeling tool, context diagram, was adopted to map out the interactions of externalities with the system and the requirements of the system. Eight assessment metrics: the market condition, business advantage, parking condition, electric vehicle deployment, self-serving configuration, vehicle reservation, vehicle maintenance, and pricing scheme, were eventually identified from the system modeling. From these dimensions, we review 24 carsharing cases from China, Europe, Japan, and the United States, and we summarize discrepancies among different marketplaces and some managerial insights on carsharing development, such as carsharing motivators and inhibitors, innovations in respect of different business backgrounds, approaches of increasing parking privileges, approaches of increasing electrifications, essential digital features, reservation regimes, methods of vehicle maintenances, and service pricing regimes.

1. Introduction

Carsharing has attracted considerable attention as a sustainable transportation mode. Its adoption, particularly in the integration of electric vehicles (EVs) in carsharing fleets, aligns with the sustainable mobility paradigm [1,2]. In the most recent decade, the top–down initiatives on eco-friendly mobility have triggered a global boom in the number of carsharing organizations. Different service designs and operational strategies have been developed and piloted among these carsharing organizations. Various business decisions, such as service features, pricing strategies, and operational rules, can affect the business’ performance. Moreover, dynamic business environments regarding technology development, regulatory policies, adaptive management, and collaborative governance have increased decision difficulties. Carsharing operators, therefore, require a tool for assessing business development from multiple dimensions. To create this tool and to push the knowledge frontier on carsharing development, this research delves into carsharing system modeling to develop a conceptual framework of deriving carsharing assessment metrics. Abdelkaf et al. [3] denoted that the knowledge on values captured by relevant actors and resources in the supply chain is important for business model innovation in electric mobility. Consequently, we applied a similar approach to sketch the proposed conceptual framework. In the past, significant research attention in the scientific community had been dedicated to the technical-driven side of carsharing to account for one or several specifications [4], such as to improve the service based on the prescriptive approach [5,6,7,8,9], or empirical studies on the user’s choice behavior based on the descriptive approach [10,11,12,13,14]. There is a lack of approaches to assess the carsharing development in holistic perspectives. Therefore, this research aims to fill this gap through providing a framework outlining the requirements of the carsharing system, with the holistic perspectives of stakeholders being considered.

Carsharing, as a representative access-based consumption, has developed its own niche in the sustainable mobility paradigm [15]. The exploration on how carsharing has aligned with and struggled to achieve the goal of sustainability in terms of the economic, ecologic, and social equilibrium is important [16]. Ferrero et al. [2] classified the fields of carsharing research using the cluster method and found that the carsharing business’s development has been overlooked in recent research. Nansubuga and Kowalkowski [17] arrived at similar conclusions in their systematic review on carsharing themes. Authors found that there is a lack of carsharing research on challenges faced in business upscaling and market development. To fill this gap as well as to validate the framework regarding its capability to provide knowledge on carsharing development, we considered 24 representative carsharing cases from different marketplaces and examined them using the assessment metrics derived from the proposed framework. To the best of our knowledge, the study by Golalikhani et al. [1] is the only scientific research on carsharing services regarding managerial practices. Different from their study, which compiles the major features of 34 carsharing cases worldwide, we generalized the managerial practices using comprehensive assessment metrics. Carsharing enterprises are co-creations driven by interwoven interests of stakeholders [2,18,19]. In this context, comprehensive assessment metrics establish the merits of (1) systematically reviewing managerial practices and (2) enlightening values captured by different stakeholders. Considering the variations in stakeholder empowerments and business environments in different markets [20], we examined disaggregated markets, i.e., China, Europe, Japan, and the United States. These markets were carefully selected based on the market growth and the intensity of carsharing attempts regarding policy and infrastructure supports; thus, we believe that insightful lessons can be learned from the selected regions.

The remainder of the paper is organized as follows. Section 2 provides an overview of carsharing in the new service domain to clarify the boundary of this study. Section 3 introduces the conceptual framework that is applied to derive the assessment metrics for evaluating the carsharing development in the studied regions. Section 4 discusses the carsharing services with respect to each assessment matric. Section 5 is a summary of observations on carsharing business development and market comparisons. The conclusion is presented in Section 6.

2. Carsharing Overview

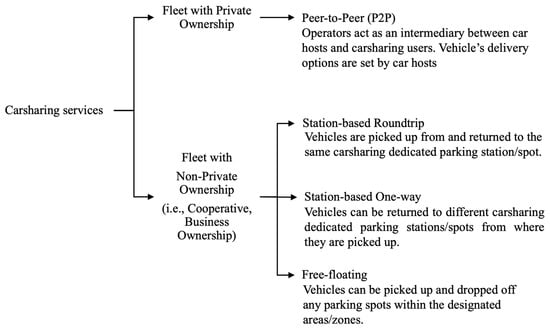

Carsharing is an example of Product-as-a-Service (PaaS), serving only the technical function of a car [21,22,23] and as part of a solution to sustainable mobility [1]. Several studies have documented the beneficial effects of carsharing, including: (1) complementing public transits in urban areas and to alleviate the car-related economic stress in car-dependent areas [24,25,26,27], (2) as a substitutive choice to private cars to effectuate car-ownership and vehicle kilometers [10,13,25,26], and (3) diverting the fit-for-purpose mobility demand away from a typical self-serving car rental choice with more flexible service designs and pricing strategies [17,28,29]. Based on the fleet ownership, carsharing services can be demarcated into private and non-private ownerships, as illustrated in Figure 1. Retaining the legal ownership enables the operator to govern the level of service: the extent to which the access regimes maximize users’ benefits. A carsharing service with non-private fleet falls into the access-based service [15].

Figure 1.

Carsharing access models.

Carsharing is often confused with car rental, particularly with the advent of self-service car rental, as both services enable users to access a vehicle with non-private ownership in a high level of interpersonal anonymity. Elucidating distinctions between them can foster clarifications on the scope of this study. Carsharing differs from car rental by being enabled via digital technologies, being more access flexible, and thereby being underlined by more flexible access regimes and pricing strategies [15]. Pricing strategies for car rental incent long-term occupancy of a vehicle, such as in hours or days, whereas pricing strategies for carsharing incent trip-based occupancy, such as per-minute or per-hour. To incentivize trip-based access, carsharing requires higher flexibility in terms of more access points or integration into the local transportation network. Compatible with the high flexibility, station-based one-way and free-floating models have been developed for carsharing services. The definitions of these flexible models are depicted in Figure 1 [22,28]. Moreover, the discrepancy can be reinforced by being more prosocial and altruistic [15]. For example, there are significant numbers of nonprofit/cooperative carsharing organizations prioritizing social values and serving in small communities [30].

Peer-to-peer (P2P) carsharing falls outside the category of access-based services because of the triadic structure [31], as illustrated in Figure 1. In the typical P2P arrangement, vehicle hosts decide the level of service [32]. Vehicle hosts are primarily motivated by the extra income from sharing idled assets [33,34]. Hence, the environmental merit of P2P carsharing in the context of lowering vehicle kilometers traveled remains unclear [13,35]. Shaheen et al. [35] reported that P2P rental durations are typically longer than access-based rental durations, thus raising the concern that a P2P carsharing operated by for-profit ventures is similar to the car rental. For aforementioned reasons, the for-profit P2P carsharing (e.g., Getaround and Turo) is excluded in this research.

3. Assessment Metrics Creation and Case Collection

3.1. Conceptual Framework and Assessment Metrics

This study innovatively created a conceptual framework for a carsharing system using a system modeling tool, namely context diagram [36]. The context diagram primarily outlines the scope of a new system through mapping out the interactions of externalities with the system and delineation of the requirement of the system using macroscopic information. Boons and Lüdeke-Freund [37] defined the business model for sustainability (BMfS) with four normative elements: value propositions, supply chains, customer interfaces, and financial models, which jointly demonstrated the interests of relevant stakeholders. Cohen and Kietzmann [38] applied the BMfS framework to investigate different carsharing access models. The framework proposed in this research can reveal the holistic requirements of the carsharing system, including access models. The requirements are generated based on values created by individual actors and their interactions. Those values are combined and transformed into specific captured values of the carsharing system, which are leveraged to derive carsharing assessment metrics. The metrics are intuitive and concise enough for any party of interest to evaluate carsharing services. An actor is any externality that can interact with the system, which can be a group of people, an organization, an object, or a system [39].

This section introduces the modeling process of deriving the assessment metrics. The system before modeling is presented as an abstracted concept, with latent visions and logics being deciphered through interactions. This enables business model dimensions: value proposition, value network, and value capture, as advocated by Münzel et al. [30], being surfaced in one dimension of value creations. To realize it, the model takes the points of view of all relevant actors as value creations rather than assuming that only customers can affect the value propositions and only operators can generate the capturing values as described by Münzel et al. [30]. Actors of a carsharing system can be stakeholders: e.g., users, agents, and principals [16,28,30,38,40,41]; technologies, e.g., EVs, digital platforms, keyless technologies [3,40,41]; and local resources, e.g., parking, policies, transportation networks, and local cultures [16,30,40].

We first identified actors and their interactions based on existing empirical research on the carsharing business [20,30,38,40,41,42,43,44]. Actors were categorized into two types: (1) primary actors, which directly create values in affecting the supply and demand, and (2) secondary actors, which can affect the business innovations and, depending on the level of engagement, can create additional values. Primary actors include registered users, operators, shared vehicles, digital platforms and technologies, and parking spaces. Secondary actors include government and policymakers, potential users (e.g., residents and visitors), other transportation systems or agencies (e.g., public transits, ride hailing), and local infrastructure development.

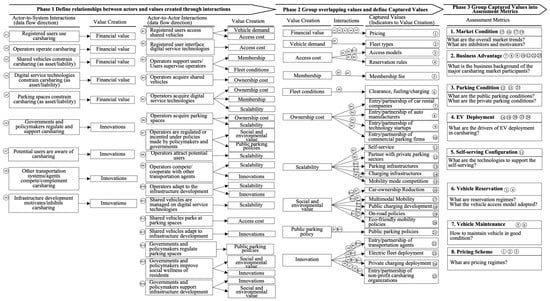

Figure 2 illustrates the three phases of modeling the conceptual framework. Phase 1 identified the actor-to-system interactions (Index A1 to A9) and actor-to-actor interactions (Index B1 to B16) in terms of value creations from interactions. Phase 2 reduced the overlapping values and translated remains into the captured values (Index 1 to 25) from the perspective of a carsharing system. Phase 3 grouped captured values into assessment metrics. The assessment metrics, i.e., market condition, business advantage, parking condition, EV deployment, self-serving configuration, vehicle reservation, vehicle maintenance, and pricing scheme were eventually derived.

Figure 2.

Modelling process of the carsharing conceptual framework.

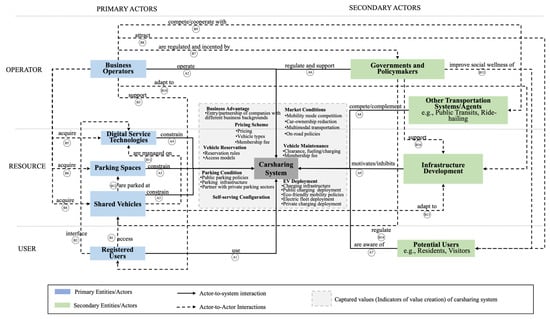

The context diagram in Figure 3 exhibits that the carsharing system has internalized the captured values and the assessment metric they are affiliated to. For example, the market condition (shown in the “grey box”) encompasses captured values of mobility mode competition, car-ownership reduction, multimodal transportation, and on-road policies. Captured values, derived from actor-to-system interactions (in solid line arrows) and/or actor-to-actor interactions (in dash line arrows), can outline the carsharing requirements. For instance, the mobility mode competition outlines that the system must compete or cooperate with other transportation systems or agents (Index B9) to attract potential users (Index B8).

Figure 3.

Context diagram of the carsharing system.

3.2. Carsharing Cases

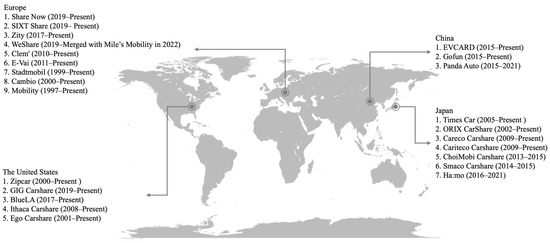

To investigate the challenges and opportunities of carsharing development in different marketplaces, China, Europe, Japan, and the United States were chosen as markets of interest in this study. Figure 4 summarizes 24 carsharing cases in the markets of interest. These cases were reviewed using the assessment metrics derived from the conceptual framework, as discussed in Section 3.1. As it is impractical to exhaustively examine all carsharing cases, we attempted to choose those that are representative in terms of the scale, longevity, and innovation in studied regions. Carsharing markets in Japan and China are led by a few dominant players. Therefore, we investigated those carsharing cases with a considerable number of members. In the Japanese market, we also examined some pilot cases of micro electric vehicles (MEVs) as the shared fleet, such as the ChoiMobi Carshare, Smaco Carshare, and Ha:mo. Among the enormous number of carsharing cases in both Europe and the United States, we selected representative examples based on existing studies, work reports, and advice from local carsharing experts. Owing to the language barrier, we considered only those cases in the European market for which information was available in English online.

Figure 4.

Carsharing cases from marketplaces in China, Europe, Japan, and the United States.

4. Carsharing Business Development Assessment

This section describes the carsharing services regarding the assessment metrics shown in Figure 2, Phase 3. This consists of eight categories including the market condition, business advantage, parking condition, EV deployment, self-serving configuration, vehicle reservation, vehicle maintenance, and pricing scheme. For each metric, we will explain the discrepancies on carsharing development in different markets probed from the selected carsharing cases and the market environments. Some assessment metrics are closely related to the market environment (Section 4.1, Section 4.2, Section 4.3 and Section 4.4), which thereby are investigated with stories in the independent market. Other metrics correspond to the general business features of carsharing services (Section 4.5, Section 4.6, Section 4.7 and Section 4.8), which thereby are explained as an aspect of discrepancies with exemplifying carsharing cases in the market.

4.1. Market Condition

In the modeling process, we showed that the market condition metric is derived from values related to scalability, e.g., market competition, and social and environmental values, e.g., multimodal mobility and car-ownership reduction. Thus, the carsharing market conditions will be explained from the aspects of overall market trends and market inhibitors and motivators to demonstrate the scalability and the performance of the social and sustainable values.

4.1.1. Overall Market Trends

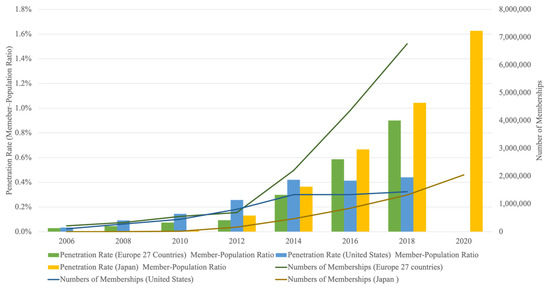

Overall, the global carsharing market has seen a notable growth in membership and fleet stock. Figure 5 exhibits the carsharing market penetrations, which are the carsharing members per population (bar chart) and total memberships (line chart) in Europe [22,23], the United States [22,23], and Japan [45] from 2006 to 2022. Figure 6 shows the total fleet stock (bar chart) and member-and-vehicle-ratio (line chart) in Europe [22,23], the United States [22,23], and Japan [45] from 2006 to 2020. The statistical data in the Chinese market are deficient; therefore, it is excluded in the graph. The market penetration rates in Europe, the United States, and Japan are growing, as shown in Figure 5. China has the largest carsharing market in the world with 130,000 operating vehicles and more than eight million registered members; however, in relation to its population, the carsharing market penetration rate is still low [46].

Figure 5.

Carsharing members and market penetration rates from 2006 to 2020.

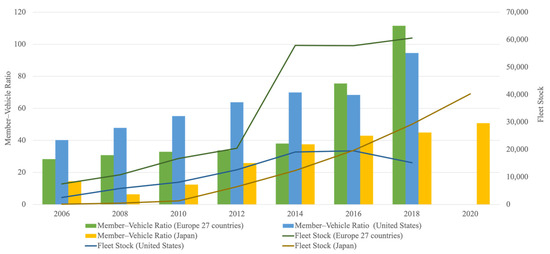

Figure 6.

Carsharing fleet stock from 2006 to 2020.

The carsharing market penetration showed rapid growth in the last two decades in Europe and the United States [47], which was earlier than that in Japan and China. The market trends and stories of the former are important to provide lessons for the latter. From 2012 to 2014, the market trend in Europe burgeoned on both the number of memberships and total fleet stock, as shown in Figure 5 and Figure 6. This is possibly attributed to the increase in carsharing awareness after a long period of market cultivation in viable service areas. The 2014 European Union (UN) survey on transportation and mobility found that the awareness of carsharing was increasing among those EU countries that have adopted carsharing schemes. In addition, the inclinations of carsharing members were more likely being observed among residents in those countries that had less motorization than the average motorization in the European region [48]. The increase in the fleet stock in the European market stopped in 2014, as shown in Figure 6, while the number of carsharing members was continuously growing. The European market is full of small-scale carsharing players, compared to those in the United States’ market. This enables them to agilely react to the dynamic market environment. A decline in the fleet stock in the United States market was also observed after 2014. While the fleet stock was decreasing, the number of memberships remained the same in the United States’ market. This is in part due to the business shrinks of nationwide companies, such as Car2go and Hertz 24/7. With the advent of ride-sourcing services, nationwide companies had to slim their assets in response to the growing market competitions [49].

A balance of the fleet stock and membership size is the lesson told in Europe and the United States’ markets. The current carsharing markets in Japan and China are dominated by a few players, and they exhibit incremental trends regarding the vehicle stock and registered members. When the growth of carsharing members slows down or the number of operators significantly increases in the market, carsharing operators must note the signals and agilely react to them. This emphasizes the importance of a nudge, rather than a push, toward upscaling based on the scalability in service areas.

4.1.2. Market Motivators and Inhibitors

Urban areas with sufficient public transportations, mixed land uses, and urban lifestyles have potential for carsharing development [50]. Several studies have proved that size and residential density of cities are positively related to carsharing usage [51,52]. Substantial evidence from previous empirical studies also has identified that carsharing users are less car-dependent [10,28], highly environmentally conscious [13,53], and multimodal mobility habitual [54]. The carsharing service, particularly with eco-friendly vehicles, is inhibited in the carbon “lock-in” environment [16,55], which in the transportation sector describes a stable system formed by carbon-intensive fuel selection, where the material, organizational, and conceptual dimensions are interlinked and interdependent [56]. In the carbon “lock-in” environment, extrinsic motivations, e.g., financial privileges and cultural promotions, are indispensable for carsharing development.

In Europe, the relatively dense population contributes to the apparent affinity of carsharing. Even though private cars have a long history of prevalence across Europe, urbanization has increased the propensity toward the multimodal transportation system. The fluctuating energy price, increased parking pressure, and long-term promotion on car-free lifestyle further hindered car ownerships, and in turn, generated positive feedback for the carsharing economy [57,58]. We have observed many successful carsharing cases in Europe, which served in urban and peri-urban areas without public funding, such as Zity, served in Madrid, Paris, Lyon, and Milan, as well as Cambio and Standtmobil in Germany. However, governmental support is important for rural carsharing programs [40,57]. We examined carsharing cases in Europe based on their service areas and found that carsharing programs served in rural areas are typically in a cooperative form and viable with financial support, such as Mobility and E-Vai.

In the United States, the carbon “lock-in” phenomenon is prominent, as shown by signs of the highest private car penetration rate among the markets of interest. The highly developed highway system, geared to facilitate travel by private cars, along with the longstanding automotive industry and advantages in fuel price, has rendered private cars an affordable travel mode in the United States [59]. Therefore, extrinsic motivations are vital. Taxation is a means for policymakers to internalize the financial incents or penalties to the consumption chains, for example, carbon tax, a direct tax levied on the carbon content upstream of value chains [60]. All markets of interest in this study have enacted the carbon tax, except the United States’ market [61]. The tax scheme for carsharing in the United States is unfavorable for operators to sustain access-based logics because shared vehicles are categorized as regular rental cars, taxed based on daily tax rates [21,62]. Certain municipalities have started to offer tax breaks for carsharing in recognition of its access-based virtue; for example, in Colorado, the shared vehicle is taxed based on the amount of time used [63]. Despite differentiating carsharing from car rental on taxation, the carsharing business is hardly competitive to ride-hailing services, such as Lyft and Uber. The ride-hailing vehicle hosts earn from driving cars, thus, making the ride-hailing services admirably adapt to and even fortify the carbon “lock-in” environment. The access-based logic attached to carsharing services, in contrast, makes them more harmonized with public interests [64]. Intensive support from public organizations are critical for carsharing development in the carbon “lock-in” environment while competing against other on-demand ride sourcing services. We found that several well-established carsharing cases in the United States are non-profit types, oriented by the communal interests and operated based on public–private partnerships, such as BlueLA and Ithaca Carshare. They typically receive public grants to support their startups.

Similar to the European services, carsharing services in Japan are expected to complement the public transport system and adapt into the multimodal mobility in the urban transportation system. The potential carsharing market is in the middle-income urban areas [65]. A carbon “lock-in” risk is reflected by the endowment effect and status quo bias of car-ownership. Besides economic rationality, users seek comfort and emotional attachment toward owning cars [10,53]. Several empirical studies on attitudes affecting carsharing usage have found that symbolic value of car-ownership can impose a negative effect to carsharing intentions, whereas the privacy-seeking and family- and peer-related conformity can impose positive effects to carsharing intentions [53,66]. Therefore, the transition may benefit from advancing the personal and social norms of carsharing with images of high-quality and communal culture.

Driven by urbanization, the public transportation system in China is well developed for meeting large mobility demands within and across cities with affordable prices. The level of private motorization is relatively low compared to other markets of interest. This provides a great opportunity for carsharing development. Despite this, vigilance on the carbon “lock-in” risk is still required. Similar to the situation introduced in the United States’ market, for-profit carsharing services (a major type of carsharing in China) are currently disadvantageous price bargainers in competing against ride-hailing services. As in Japan, the endowment effect is also salient for car users in China. Furthermore, extrinsic motivations were mainly applied on energy types rather than directly on carsharing schemes. In fact, without transiting from internal combustion engines, most of the operators in the Chinese market directly started their carsharing business with EV fleets. This means that in addition to the market competition, carsharing operators also need to overcome the uncertainties of innovative services and technologies.

4.2. Business Advantage

Figure 3 shows that advantages in acquiring essential resources enable carsharing operators to reduce asset costs and increase scalability. Consequently, previous business experience and roles in the mobility market are enablers of becoming carsharing operators [1]. Various business backgrounds also create different visions of innovations. This section discusses the business background of major market players and their visions of innovations.

The business backgrounds of carsharing operators primarily are original equipment manufacturers (OEMs), car rental, parking properties, public organizations, and technology startups. The OEM background of carsharing operators is conductive to innovations in access models and technologies, whereas the car rental or parking backgrounds easily make entrench into the traditional rental logic. Public organizations tend to reinforce the not-for-profit logic of serving in small communities based on primitive carsharing features. Innovations in the carsharing network are more likely to be observed in technology startups, which specialize in developing problem-oriented solutions with technical approaches and resource coordination.

In Europe, numerical carsharing providers have OEM backgrounds, such as Share Now (previously owned by Stellantis N.V. in 2022), Zity (owned by the Renault Group), and WeShare (owned by the Volkswagen Group). Driven by climate deals and technology innovations, operating carsharing services allow OEMs to market their products, access market feedback, and find a balance between development and sustainability [47]. In 2019, free-floating carsharing bloomed after a period of mergers, acquisitions, and new entries, reaching 32% of the total number of carsharing organizations in Europe [57]. In the dataset, there are 5 out of 9 European carsharing cases providing free-floating services. This growth was attributed to the successful market strategies of leading service providers with OEMs backgrounds. For example, Share Now ceased services in North America and positioned free-floating services in the European market to optimally leverage their advantages in acquiring vehicles and state-of-the-art technologies [67]. More innovations in the carsharing network have emerged in Europe. Clem is a technology startup founded by a team of innovators interested in EV sharing solutions. In addition to the role of being a carsharing provider, Clem also collaborates with car makers, charging station manufacturers, other carsharing service providers, housing developers, regional municipalities, and transport operators to develop sustainable mobility solutions.

In the United States, large-scale carsharing providers are dominated by car rental firms, e.g., the Enterprise Carshare (owned by Enterprise) and Zipcar (owned by Avis). Zipcar dominates the carsharing market in terms of the number of members and fleet, as well as serving 185 cities across the nation. Car rental firms enter the carsharing market by simply adding a new service line to their original business with advantageous assets, i.e., vehicles, parking stations, and booking systems. Consequently, there is a risk of addiction with the convention of car-rental business logic. Indeed, we found that carsharing services managed by car rental firms in the United States have indifferently provided stationary round-trip carsharing services in all service areas. There are also a handful of non-profit carsharing services in the United States, founded by public cooperatives, operating in low-income neighborhoods.

In Japan, Times Car, ORIX Carshare, and Careco Carshare are the top players in the carsharing market. Their members jointly comprise up to 93% of the total carsharing members in Japan [45]. The dominated business backgrounds of carsharing players are firms with the advantage of parking resources. For example, Times Car is owned by a commercial parking corporation. Careco Carshare was founded by Mitsui Fudosan Realty, which owned many commercial and private parking properties. ORIX Carshare has a business background of car leasing and rental, which are advantageous in both vehicles and parking resources. Dominated by a few carsharing providers who excessively rely on previous business experience, the carsharing market in Japan has yielded few innovations. The carsharing providers mostly operate round-trip services. We observed several pilot carsharing programs led by OEMs, e.g., the ChoiMobi Carshare, one-way carsharing provided by Nissan Motor in Yokohama and the Ha:mo, provided by Toyota Motor in Toyota City. Albeit in small scales, these carsharing programs featured innovative technologies, such as micro electric vehicles (MEVs), ultra-compact electric vehicles with one or two seats, and with the vision of tailoring the future urban transportation.

In China, car sellers entered the carsharing market to add a market channel of the EV line. Parking, fleet, and charging management increased the difficulty of making profits. Prior to 2017, the carsharing market was full of technology startups. Owing to a lack of vehicle resources, they adopted the P2P service model. Since 2017, the government began to regulate carsharing for its safety and privacy, as well as being explicit in its position in the sustainable transportation network; the carsharing market experienced a period of withdrawing, merging, and acquisitions and left OEMs as the major players [68].

4.3. Parking Condition

The process of modeling the values created by the stakeholders indicated that the availability of parking spaces for both public and private sectors is an inevitable constraint for the carsharing scalability. In this section, we discuss the impact of public and private parking spaces in addressing the challenges and opportunities of carsharing services’ development.

4.3.1. Public Parking Conditions

Owing to limited parking spaces, parking is a general concern for car users in urban centers. Improving the parking advantage for carsharing users can effectively increase the demand. There are mainly two approaches: (1) place supports, e.g., on-street parking, parking hubs in city centers, and restricted parking zones, and (2) cost supports, e.g., subsidiaries on parking permits, free parking zones, and dynamic parking costs. The effect of parking advantages is dependent on access models. For example, compared to the station-based carsharing, place supports are more influential to the free-floating carsharing. This is because place supports directly benefit free-floating carsharing users through flexible parking near their designations rather than fix stations, which may be distanced from their designations.

In European countries, local municipalities have created a more supportive atmosphere for carsharing services [69]. Carsharing users can access on-street public parking, parking hubs near public transport lines and congestion zones, and restricted parking zones for free and/or without time limits [57]. Some cities in European regions have specified the parking subsidiaries for operators, such as free parking zones (“Blue Zones”) in the city center of Rome [58]. Some carsharing programs are integrated into the spatial and temporal fabrics of cities through partnerships with local public transportation and retail amenities to provide more parking privileges to carsharing users. The time–space information also enables systematically managing the parking resource [70], such as to set dynamic prices and incentives depending on the parking demand [71].

Many cities in the United States allow carsharing fleets to access on-street parking spaces with parking permits. However, the problem is who bears the costs of parking permits. Most cities in the United States are hesitant to give up the public parking revenues. For example, in 2014, Car2go bore an average of USD 3000 annual cost per parking permit, resulting in its defeat in profitability [60]. Exploring the public parking policies for carsharing operators in cities that are intensively piloted with carsharing services, such as Seattle and the city of Sacramento, we found that parking permit fees are still challenging the carsharing operators. In Seattle, the annual cost of a parking permit per vehicle is USD 300 for non-metered spots and USD 1200 for metered spots [72]. In the city of Sacramento, the annual cost of a free-floating permit is USD 540 for non-metered spots and USD 1864 for metered spots [73].

In Japan, on-street public parking is rare. Most shared vehicles serve based on roundtrip schemes with designated parking spots owned by carsharing companies. This thereby reduces the potential of transitioning to a more pervasive paradigm, e.g., free-floating schemes.

In China, on-street parking is typically regulated based on time. For example, on-street parking is free for two hours. After two hours, vehicles must leave to avoid parking violation tickets. There are also situations of regulating on-street parking by allowing free parking in specific time slots. Regarding parking privilege, we found that parking rules for carsharing fleets are no difference from the private cars.

4.3.2. Private Parking Conditions

The cooperation between carsharing services and the private parking sectors can further reduce the parking pressure in urban areas and create a potential for car-lite neighborhoods. The innovative carsharing services in terms of cooperating with private sectors are mainly observed in Europe. In Bremen, Germany, housing developers could provide fewer parking spaces if they present a suitable mobility concept, such as carsharing services [71]. A good example is the car-free neighborhood of Vauban in Freiburg, Germany. The car-free households in the same flat share the same carsharing parking space. This enabled more space being freed up, and transited into a green-and-play area for residents living in the neighborhood [74].

4.4. EV Deployment

The captured values for carsharing that are attached to the EV deployment include the social and environmental value, innovation, and scalability, which were mainly derived from the combined values imposed by the secondary actors, as shown in Figure 2. This infers that EV deployment is promoted from upstream, as opposed to being initiated from downstream. In this section, we assess the EV deployment in the markets of interest regarding the effective drivers.

Owing to the high upfront cost on charging and vehicle technologies, EV deployment in carsharing is driven by supportive policies on parking, zero-emission requirement, public charging, license plate restrictions (LPRs), and financial subsidies. These policies are laid out based on the city coordination. In sub-urban or rural areas, where public charging networks are not dense, public funding is important to support station-based schemes, whereas in urban areas, which are being integrated into the dense public charging networks, free-floating schemes can be sustained without public funding.

In Europe, city municipals and policy makers have entailed different strategies to enhance EV-sharing services. The Milan council has initiated a vision of moving all shared vehicles toward zero emissions with supportive policies, e.g., to ban internal combustion engine vehicles in 2024, to increase the concession fee for non-all-electric operators, and to exempt parking costs of EV fleets in congestion zones. The Ghent council has stated a vision of 50% EV in the shared fleet by 2024, along with free parking for shared EVs. With the upscaling of public charging networks, a rapid increase in EV deployment has been observed in the free-floating scheme. Paris has achieved 100% electric free-floating fleets since January 2021. At the time of writing, Madrid had electrified 80% of free-floating carsharing fleets [67]. As station-based schemes are required to have a charging pole at each station, financial support is especially vital for station-based schemes. The electric roundtrip schemes in non-urban areas of Paris are all supported by public funding and provided with extended time on investment returns.

In the United States, EV deployment in shared fleets is far from being significant for twofold reasons. First, not as many free-floating schemes as those in Europe are piloted in cities having public charging networks. One of the few piloted practices is the GIG Carshare. It has 260 EVs serving in the free-floating zone of the city of Sacramento, which are all charged by the public Electrify America charging networks [57]. Second, without supportive policies from upstream, private charging companies must take the charge themselves, such as BlueLA powered by Blink mobility; thus, they lack electrifying momentum [57].

EV sharing has progressed insignificantly in Japan. The reason for this observation may be addressed by a range of factors related to the operator and user perceptions toward EV sharing. Therefore, more empirical studies on EV deployment in carsharing services in the Japanese market are required.

Without a long transitional period, carsharing in China almost directly entered the electric era in 2017, driven by forces from upstream. In 2018, the government enacted a policy of subsidizing compact electric fleets that have surpassed the service distance (20,000 km). In addition, electric fleets are free from all LPRs in major cities, such as the “one-day-per-week” and “odd-and-even” policies [75]. The availability of public charging networks is a critical driver for electrification. The Chinese central government issued two policies in 2015: the Guidelines on Accelerating the Construction of Charging Facilities for Electric Vehicles and the Development Guide for Electric Vehicle Charging Facilities (2015–2020), which emphasized the national guidelines of EV charging infrastructure’s (EVCI’s) deployment. Considering the national-level EVCI policies, various incentive policies on EVCI deployment were issued at the provincial or municipal levels, such as investment, construction, operation, and charging subsidies to bolster the EVCI development process [76], thus fostering EV deployment for carsharing services in China.

4.5. Self-Serving Configuration

Digital service technologies are identified as a primary actor and essential self-serving configuration for carsharing scalability, as shown in Figure 2. This section investigates digital service technologies enabling self-service.

Carsharing enables users to use the service without interacting with operators in the process of reservation, vehicle pickup and return, and pay settlement. The application of various digital technologies, such as digital platforms, digital access keys, and real-time location-tracking devices, are the key accessories for enhancing a seamless service. All carsharing cases reviewed in this research are self-services. These digital accessories are indispensable features in terms of service diffusion. We observed that carsharing cases have adopted different digital keys in the different marketplaces. In Japan, carsharing operators tend to provide users with membership cards or compatible metro cards to unlock the vehicles. In other markets, smartphones are more often used as access keys. Mobility equality projects targeting low-income users tend to offer members physical cards or authorized pin numbers as digital keys to access rental vehicles. Therefore, customizing the digital configurations considering the habits of the residents is important for increasing service inclusiveness.

On the supply side, location-tracking technologies, which can acquire the spatial–temporal records of users and vehicles, are advantageous for operators to manage the fleet size, track the fleet status, and allocate the fleet to balance the dynamic demand. The application of spatial–temporal data is a substantial advantage to support vehicle-relocated strategies that are tailor-made for dynamic trip demand, which is associated with decisions at the operational level. Relocation strategies can be classified into two approaches: first, user-based relocation, which is used to encourage users to balance the fleets with financial incentives, second, operator-based relocation, which is used to assign operators to balance the fleets in the system. The various means can be exploited to realize the fleet relocation under these two approaches, as introduced in the work from Zhang et al. [77], which is a more systematical review on shared vehicle relocation. In the real-word scenario, the effective solutions are always tailor-made and substantially rely on spatial–temporal data to capture the dynamics in the system. The informative connectivity of the transportation system is the foundation of integrating carsharing into the future transportation network. The application of real-time data in carsharing scheme could further benefit from upgrade technologies, such as the Internet of Vehicle (IoV) and autonomous driving.

4.6. Vehicle Reservation

Vehicle reservation is derived from captured values of reservation rules and access models, which relate to the access cost. The access cost is a value created by interactions among primary actors, i.e., registered users, digital service technologies, shared vehicles, and parking spaces. Thus, vehicle reservation, which is an underlying element for carsharing, can be observed from aspects of reservation regimes and access models.

4.6.1. Reservation Regimes

Reservation regimes in carsharing are classified into two types: reservation-based regimes and instant access regimes. In the reservation-based regime, users must predeterminate the trip information and prepay the estimated price based on the trip information they provided. Late returns are heavily penalized unless trips are extended in advance and do not influence the next user. Cancellation is rigorous and constrained by a latest cancelation time. Therefore, the reservation-based regime associates less management complexity through restricting users’ flexibility. In contrast, the instant access regime enables a user to immediately reserve an available vehicle nearby and be charged at the time of use. Maximum access time, which is the time between the vehicle reservation and unlock, is set to avoid a vehicle being reserved without use for an excessively long time. If the reserved vehicle is not unlocked within the maximum access time, the system will either automatically cancel the reservation or start to charge the trip.

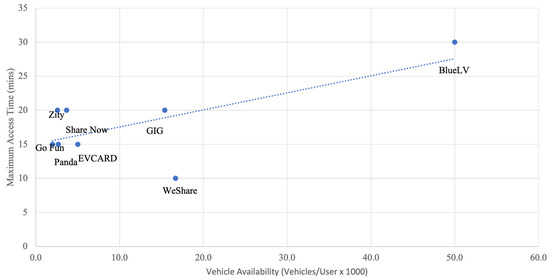

All stationary roundtrip cases reviewed in this research adopt the reserved-based regime. The rest of the cases, which operate in either the stationary one-way or free-floating schemes, all adopt the instant access regime. The maximum access time of instant access cases varies from 10 to 30 min. Figure 7 shows the relationship between the maximum access time and the vehicle availability for cases using the instant access regime, which can also infer various service levels. The higher vehicle availability the system has, the shorter time users will have to access a vehicle. The longer the maximum access time the system is set, the less anxiety users will feel to access the reserved vehicles. Therefore, the vehicle availability and the system maximum access time can both present the service level from opposite directions. In fact, exceptionally high service levels will have to compromise on the operational cost. Therefore, the safety time, which is residual between the maximum access time of the system and the actual vehicle access time, must be considered when evaluating the service level in the free-floating scheme.

Figure 7.

Maximum access time versus vehicle availability of the instant access cases.

4.6.2. Viable Vehicle Access Model

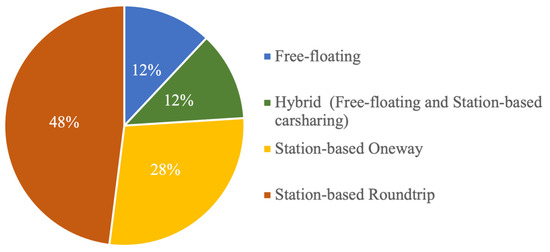

Figure 8 shows that 88% of cases in the dataset adopt a single access model; most of them are station-based schemes. The other 12% adopt a hybrid access model, which offers the free-floating and station-based carsharing dependent on service areas. For example, SIXT Share provides free-floating carsharing in Berlin and station-based one-way carsharing in Dresden.

Figure 8.

Distributions of vehicle access models.

Although the merit of carsharing in replacing private cars on the road has been settled, the merit of a more flexible scheme is disputed. When comparing the station-based and free-floating schemes regarding their effects on mode shift, there is a concern that the free-floating mode can compete with public transportation [51,78,79]. Conversely, there is also a standpoint that the most flexible scheme can be attractive for inexperienced users [71,79], thus contributing to the carsharing diffusion. The free-floating service is new; its long-term effect on car-ownerships and vehicle kilometers traveled remains unclear. Therefore, the research community and local municipalities should investigate the dynamic effect of carsharing to a transportation network in terms of the early-adopted and matured phases.

4.7. Vehicle Maintenance

Figure 2 shows that maintaining a shared vehicle in a good condition is expected from both operators and registered users. This section discusses existing vehicle maintenance practices.

The carsharing service relies on the joint liability of users and operators. The service cost is more easily perceived by carsharing users, whereas the shared cost on maintaining the vehicle in good condition tends to be easily neglected, particularly as operators often underscore the cost-saving aspect of carsharing. The user’s liability is embedded in penalty and incentive policies, which require more educated efforts. Fine penalties are the most common approach. For example, users will be charged an extra fee for not plugging an EV into a charging point or not returning a gasoline vehicle with the minimum tank level. Fine incentives are also applied in some cases. Typically, users are not required to return shared vehicles with the minimum fuel tank/battery level but incented by trip credits if doing so in a free-floating carsharing. Peer supervision is a new means of involving the users’ liability, which leverages social norms to influence the users’ behaviors. For example, Zity asks users to report the vehicle condition and to evaluate the last user’s conduct. There is a lack of knowledge on how different penalties and incentive policies can engage users to be more active stakeholders in maintaining the longevity of shared vehicles. We therefore suggest more attention in this regard from the scientific community.

4.8. Pricing Scheme

Figure 2 shows that pricing schemes are related to value creations involving all primary actors, i.e., business operators, registered users, digital service technologies, shared vehicles, and parking spaces. Therefore, investigating existing practices regarding the pricing schemes is important for carsharing arrangements.

The carsharing pricing strategy belongs to the domain of membership pricing models, in which users must pay a monthly or annual membership fee to use the service. The rental fee is separately paid at rental completion. The rental fee is set based on different pricing regimes and with different rates depending on the premium level of the vehicle.

In general, there are two ways of measuring rental rates: time-based rates (e.g., cost per minute or cost per hour) and distance-based rates (e.g., cost per mile or per km). Short-term and long-term trips must be differentiated when designing an appropriate carsharing pricing regime. To capture the demand for short-term trips, some carsharing cases have introduced different rental rates for driving and “standby” modes. For example, Ha:mo charges users based on a minute rate of JPY 20 for driving and JPY 2 for occupation while not in use. Zity uses the same pricing regime except with a more expensive standby rate (60% of the driving rate). In the literature, 33% of cases adopt the driving-and-standby pricing regime, which are either station-based one-way or free-floating carsharing. For targeting both short-term and long-term trips, some cases consider combining the time-based and distance-based methods. This combination regime can be classified into two categories: unconditionally and conditionally combined. The unconditional combination refers to a pricing regime in which the time and distance rates are added together, e.g., the standard fare of using an economic vehicle is CHF (Swiss Franc) 2.5 per hour plus CHF 0.7 per kilometer in the carsharing company, Mobility. Conditional combination refers to a pricing regime that sets a distance or time threshold at which the other type of pricing method applies. The conditional combination can be presented in two major forms: (1) an additional variable cost and (2) independent pricing rate. GIG Carshare and Share Now are good examples of the first form, which is referred to as the flat-rate-and-variable-cost regime. GIG Carshare sets different time-based flat rates, e.g., USD (United States Dollar) 0.49 per minute or USD 16.99 per hour; if the trip length exceeds 250 miles, a distance fare of USD 0.45 per mile would be billed in addition to the time-based flat rate. Share Now considers a rental time exceeding one hour as the threshold of billing the additional distance fare. The flat-rate-and-variable-cost regime is the most common pricing regime, which is adopted by 58% of cases in the dataset. WeShare is the only company that adopts the second form. WeShare sets the standard fare based on cost per kilometer, which is replaced with the time-based flat rate if the rental time exceeds one hour.

Pricing schemes can depend on the local trip time and distance. The actual price of using shared fleets can depend on the local car kilometers traveled of ownerships and income level. Therefore, the average trip time and distance, cost of car kilometers traveled for ownerships, and income level in the service areas may be considered when deciding prices and pricing schemes. However, the significance of socio–economic factors in affecting the carsharing pricing can be investigated based on empirical studies.

5. Summary and Market Comparisons

In Section 4, we discussed the carsharing business development from different dimensions, including the market condition, business advantage, parking condition, self-serving configuration, vehicle reservation, vehicle maintenance, and pricing scheme, as well as illustrated discrepancies on carsharing development in different markets probed from the selected carsharing cases and market environments. The general knowledge on carsharing development on each assessment metrics are summarized in Table A1 of the Appendix A. The differences on carsharing development in Europe, the United States, Japan, and China regarding the assessment metrics are summarized in Table 1, where the marketplaces are exhibited based on the chronological order from earliest to latest according to the carsharing development.

Table 1.

A summary of carsharing discrepancies among marketplaces.

In general, the European carsharing market is well established in aspects of the assessment metrics compared to the other markets being reviewed. As the earliest developed market, carsharing in Europe is facing the inherent challenge of EV transition as opposed to the emerging markets.

One aspect of the market condition, namely the upscaling of carsharing market, highly depends on the scalability of the service areas. Carsharing is applicable in areas with good public transportation networks, mixed land uses, and urban lifestyles. Carsharing development faces more challenges in carbon “lock-in” environments. In carbon “lock-in” environments, extrinsic motivations, e.g., financial privileges and cultural promotions, become indispensable. The carsharing in Europe with characteristics of nudge towards upscaling, more tailor-made services, adaptive urban transportation networks, and appropriate extrinsic motivations establishes Europe as more advantageous than the other marketplaces being reviewed.

Carsharing enterprises with varied business backgrounds exhibit different motivations for innovation. The OEM background is conducive to innovations on aspects of access models and technologies, whereas the car rental or parking backgrounds easily carry out the traditional rental logic. Public institution background serves to reinforce the not-for-profit logic. Technology startup background is more likely conducive to network innovation. Carsharing in the European market showed more proactive innovation than in the other markets, driven by a more collaborative network involving operators from different business backgrounds, i.e., OEMs, technology startups, public institutions, and private sectors.

Regarding the parking conditions, providing parking privileges for carsharing users can be an effective strategy yet relies on supportive public parking policies. The public parking is supported mainly by two aspects: location (e.g., restricted parking zones and parking hubs near city centers and public transits) and cost (e.g., subsidiaries on parking permits, free parking zones, and dynamic parking rates). Besides public support, involving private parking sectors is a key aspect of carsharing upscaling. Compared to the other markets, more supportive public parking policies have appeared in the European market. Carsharing services, cooperating with private parking sectors in the context of developing lite-car neighborhoods, were an innovative paradigm that have been piloted in the European market, while this has not been seen in other markets.

EV deployment in carsharing strongly relies on promotions from upstream, e.g., EV parking and on-road privileges, zero-emission requirements, public charging infrastructure upscaling, and subsidies for private charging, etc. Even EV fleets are increasing in the overall European carsharing market, and the upscaling momentum is found to be more rapid in free-floating carsharing operating in cities with dense public charging networks. In fact, EV deployment is found to be more rapid in the emerging market, e.g., China. This is because the challenge of electric transition is more salient for a more developed market, which has the long-term experience with traditional carsharing.

In the context of business characteristics, more variations on aspects of the self-serving, reservation, vehicle maintenance, and pricing regimes have been observed in the European market compared to others.

Self-serving configurations such as digital platform, key, payment, and real-time location devices are indispensable features for carsharing prevalence. Carsharing in all marketplaces of interest allows users to access services without face-to-face interaction with operators. Knowing that carsharing prevalence is related to the digital prevalence in the service areas, it is important to customize digital features depending on users’ habits. On the supply side, applications of real-time spatial–temporal data are substantially advantageous for efficiently allocating carsharing resources and operating carsharing services integrating to the entire transportation network on a basis of informative connectivity in the future.

Vehicle reservation can be classified into the reservation-based regime and instant access regime. Compared to the reservation-based access, instant access is more viable for flexible schemes, such as the free-floating and stationary one-way carsharing. The system maximum access time is specifically designed in matching the service level of the free-floating carsharing. It is necessary to gain an understanding on how the system maximum access time can affect the service actual or perceived flexibility. The investigation on the maximum access time needs more attention when conducting empirical studies of free-floating carsharing.

Methods of involving users’ liability in the process of vehicle maintenance include the fine penalty, fine incentive, and peer supervision. Currently, the fine penalty is the most common method. It is also important to gain insights on how different methods can engage users to be more responsible stakeholders in the carsharing community.

The carsharing pricing scheme belongs to the membership pricing model. The differences are seen in rental fees paid per time, i.e., the time-based rate, distance-based rate, and combined rate. Compared to the distance-based method, the time-based method, which is commonly seen in a more flexible scheme, is more likely to capture short-term trips. To capture both short-term and long-distance trips, combined methods, either unconditionally or conditionally combined, can be adopted.

6. Conclusions

This study proposes a conceptual framework of a carsharing system using a system-modeling tool, which eight assessment metrics are derived from, including the market condition, business advantage, parking condition, self-serving configuration, vehicle reservation, vehicle maintenance, and pricing scheme. Twenty-four cases from China, Europe, Japan, and the United States are analyzed on dimensions of the proposed assessment metrics. From the eight assessment metrics and carsharing cases reviewed in different marketplaces, we summarized findings on current carsharing development and discrepancies between marketplaces.

This conceptual carsharing-system framework is developed considering the holistic perspectives of the stakeholders, thus enabling any party of interest to systematically review carsharing development. The eight assessment metrics are viable for examining carsharing in different markets. In this research, carsharing cases in the Chinese, European, Japanese, and the United States’ markets were specifically selected for their different market characteristics and practices. The findings on carsharing business’ development learned from these case studies aim to support the generalized application rather than a specific market. However, markets of exemplar and cases selected in these markets can be a limitation of this research. To improve the generality, the results would benefit from increasing the data size and continuously updating data on aspects of marketplaces and carsharing cases in future research. Furthermore, besides carsharing services, the proposed method is also viable for investigating shared mobility services, e.g., e-bike or e-scooter sharing, given their similarities on the access-based logic. To understand the impact of shared mobility services, this research can be further improved by involving the shared mobility cases into the carsharing framework in future studies. Additionally, the proposed framework only reveals the current developed state and managerial practices of carsharing schemes. As more new technologies such as autonomous vehicles emerge, a more expanded angle of views to model the framework can contribute to understanding the adaption to future versions of carsharing. Furthermore, carsharing, as a new paradigm of data applications outlining system requirements at the operational level, can be also substantial and realized through the system modeling. Considering that an operational system involves in-depth interactive information, a system framework, modeling specifically for the data procession and operative control, is suggested as the future extension of this research.

Author Contributions

Conceptualization: Y.W. and M.J.; Methodology: Y.W., M.J., Y.Z., C.W. and T.Y.; Data Collection: Y.W., Y.Z. and C.W.; Visualization: Y.W.; Writing—original draft preparation: Y.W.; Writing—review and editing: Y.W., M.J. and T.Y. All authors have read and agreed to the published version of the manuscript.

Funding

This research received no external funding.

Institutional Review Board Statement

Not applicable.

Informed Consent Statement

Not applicable.

Data Availability Statement

Data are contained within the article.

Acknowledgments

The author (Y.W.) is thankful to the “Interdisciplinary Frontier Next-Generation Researcher Program of the Tokai Higher Education and Research System”.

Conflicts of Interest

The authors declared that they have no known competing financial interests or personal relationships that could have appeared to influence the work reported in this paper.

Appendix A

Table A1.

Summary of findings on carsharing development from dimensions of assessment metrics.

Table A1.

Summary of findings on carsharing development from dimensions of assessment metrics.

| Market Condition |

|

| Business Advantage |

|

| Parking Condition |

|

| EV Deployment |

|

| Self-serving Configuration |

|

| Vehicle Reservation |

|

| Vehicle Maintenance |

|

| Pricing Scheme |

|

References

- Golalikhani, M.; Oliveira, B.B.; Carravilla, M.A.; Oliveira, J.F.; Pisinger, D. Understanding carsharing: A review of managerial practices towards relevant research insights. Res. Transp. Bus. Manag. 2021, 41, 100653. [Google Scholar] [CrossRef]

- Ferrero, F.; Perboli, G.; Rosano, M.; Vesco, A. Car-sharing services: An annotated review. Sustain. Cities Soc. 2018, 37, 501–518. [Google Scholar] [CrossRef]

- Abdelkaf, N.; Makhotin, S.; Posselt, T. Business model innovations for electric mobility–what can be learned from existing business model patterns? Int. J. Innov. Manag. 2013, 17, 1340003. [Google Scholar] [CrossRef]

- Golalikhani, M.; Oliveira, B.B.; Carravilla, M.A.; Oliveira, J.F.; Antunes, A.P. Carsharing: A review of academic literature and business practices toward an integrated decision-support framework. Transp. Res. Part E Logist. Transp. Rev. 2021, 149, 102280. [Google Scholar] [CrossRef]

- Cui, S.; Ma, X.; Zhang, M.; Yu, B.; Yao, B. The parallel mobile charging service for free-floating shared electric vehicle clusters. Transp. Res. Part E Logist. Transp. Rev. 2022, 160, 102652. [Google Scholar] [CrossRef]

- Folkestad, C.A.; Hansen, N.; Fagerholt, K.; Andersson, H.; Pantuso, G. Optimal charging and repositioning of electric vehicles in a free-floating carsharing system. Comput. Oper. Res. 2020, 113, 104771. [Google Scholar] [CrossRef]

- Brandstätter, G.; Kahr, M.; Leitner, M. Determining optimal locations for charging stations of electric car-sharing systems under stochastic demand. Transp. Res. Part B Methodol. 2017, 104, 17–35. [Google Scholar] [CrossRef]

- Boyacı, B.; Zografos, K.G.; Geroliminis, N. An integrated optimization-simulation framework for vehicle and personnel relocations of electric carsharing systems with reservations. Transp. Res. Part B Methodol. 2017, 95, 214–237. [Google Scholar] [CrossRef]

- Boyacı, B.; Zografos, K.G.; Geroliminis, N. An optimization framework for the development of efficient one-way car-sharing systems. Eur. J. Oper. Res. 2015, 240, 718–733. [Google Scholar] [CrossRef]

- Ikezoe, K.; Kiriyama, E.; Fujimura, S. Car-sharing intention analysis in Japan by comparing the utility of car ownership for car-owners and non-car owners. Transp. Policy 2020, 96, 1–14. [Google Scholar] [CrossRef]

- Kim, D.; Park, Y.; Ko, J. Factors underlying vehicle ownership reduction among carsharing users: A repeated cross-sectional analysis. Transp. Res. Part D Transp. Environ. 2019, 76, 123–137. [Google Scholar] [CrossRef]

- Ye, J.; Wang, D.; Zhang, H.; Yang, H. What Kind of People Use Carsharing for Commuting? Case Study in Shanghai. Transp. Res. Rec. J. Transp. Res. Board 2019, 2673, 770–778. [Google Scholar] [CrossRef]

- Clewlow, R.R. Carsharing and sustainable travel behavior: Results from the San Francisco Bay Area. Transp. Policy 2016, 51, 158–164. [Google Scholar] [CrossRef]

- Efthymiou, D.; Antoniou, C.; Waddell, P. Factors affecting the adoption of vehicle sharing systems by young drivers. Transp. Policy 2013, 29, 64–73. [Google Scholar] [CrossRef]

- Bardhi, F.; Eckhardt, G.M. Access-Based Consumption: The Case of Car Sharing. J. Consum. Res. 2012, 39, 881–898. [Google Scholar] [CrossRef]

- Meijer, L.L.J.; Schipper, F.; Huijben, J.C.C.M. Align, adapt or amplify: Upscaling strategies for car sharing business models in Sydney, Australia. Environ. Innov. Soc. Transit. 2019, 33, 215–230. [Google Scholar] [CrossRef]

- Nansubuga, B.; Kowalkowski, C. Carsharing: A systematic literature review and research agenda. J. Serv. Manag. 2021, 32, 55–91. [Google Scholar] [CrossRef]

- Shokouhyar, S.; Shokoohyar, S.; Sobhani, A.; Gorizi, A.J. Shared mobility in post-COVID era: New challenges and opportunities. Sustain. Cities Soc. 2021, 67, 102714. [Google Scholar] [CrossRef]

- Shaheen, S.; Cohen, A.; Farrar, E. Chapter Five—Carsharing’s impact and future. In Advances in Transport Policy and Planning; Academic Press: Cambridge, MA, USA, 2019; pp. 87–120. [Google Scholar] [CrossRef]

- Mair, J.; Reischauer, G. Capturing the dynamics of the sharing economy: Institutional research on the plural forms and practices of sharing economy organizations. Technol. Forecast. Soc. Chang. 2017, 125, 11–20. [Google Scholar] [CrossRef]

- Shaheen, S.; Cohen, A.; Zohdy, I. Shared Mobility: Current Practices and Guiding Principles. 2016. Available online: https://ops.fhwa.dot.gov/publications/fhwahop16022/fhwahop16022.pdf (accessed on 18 June 2023).

- Shaheen, S.; Cohen, A. Innovative Mobility: Carsharing Outlook. In Carsharing Market Overview, Analysis, and Trends; Transportation Sustainability Research Center: Berkeley, CA, USA, 2020; Available online: https://escholarship.org/uc/item/61q03282 (accessed on 21 May 2023).

- Shaheen, S.; Cohen, A. Carsharing Market Overview, Analysis, and Trends. Innovative Mobility Carsharing Outlook. 2015. Available online: http://innovativemobility.org/wp-content/uploads/2015/07/Summer-2015-Carsharing-Outlook_Final-1.pdf (accessed on 21 May 2023.).

- Ceccato, R.; Diana, M. Substitution and complementarity patterns between traditional transport means and car sharing: A person and trip level analysis. Transportation 2021, 48, 1523–1540. [Google Scholar] [CrossRef]

- Uteng, T.P.; Julsrud, T.E.; George, C. The role of life events and context in type of car share uptake: Comparing users of peer-to-peer and cooperative programs in Oslo, Norway. Transp. Res. Part D Transp. Environ. 2019, 71, 186–206. [Google Scholar] [CrossRef]

- Le Vine, S.; Polak, J. The impact of free-floating carsharing on car ownership: Early-stage findings from London. Transp. Policy 2019, 75, 119–127. [Google Scholar] [CrossRef]

- Martin, E.; Shaheen, S. The Impacts of Car2go on Vehicle Ownership, Modal Shift, Vehicle Miles Traveled, and Greenhouse Gas Emissions: An Analysis of Five North American Cities (Vol. 26). 2016. Available online: http://innovativemobility.org/wp-content/uploads/2016/07/Impactsofcar2go_FiveCities_2016.pdf (accessed on 20 March 2023).

- Münzel, K.; Boon, W.; Frenken, K.; Blomme, J.; van der Linden, D. Explaining carsharing supply across Western European cities. Int. J. Sustain. Transp. 2020, 14, 243–254. [Google Scholar] [CrossRef]

- Sprei, F.; Englund, C.; Habibi, S.; Pettersson, S.; Voronov, A.; Wedlin, J.; Engdahl, H. Comparing electric vehicles and fossil driven vehicles in free-floating car sharing services. In Proceedings of the 5th European Battery, Hybrid and Fuel Cell Electric Vehicle Congress, Geneva, Switzerland, 14–16 March 2017; Available online: https://urn.kb.se/resolve?urn=urn:nbn:se:hh:diva-35484 (accessed on 21 May 2023).

- Münzel, K.; Boon, W.; Frenken, K.; Vaskelainen, T. Carsharing business models in Germany: Characteristics, success and future prospects. Inf. Syst. E-Bus. Manag. 2018, 16, 271–291. [Google Scholar] [CrossRef]

- Hartl, B.; Sabitzer, T.; Hofmann, E.; Penz, E. “Sustainability is a nice bonus” the role of sustainability in carsharing from a consumer perspective. J. Clean. Prod. 2018, 202, 88–100. [Google Scholar] [CrossRef]

- Meelen, T.; Frenken, K.; Hobrink, S. Weak spots for car-sharing in The Netherlands? The geography of socio-technical regimes and the adoption of niche innovations. Energy Res. Soc. Sci. 2019, 52, 132–143. [Google Scholar] [CrossRef]

- Dill, J.; McNeil, N.; Howland, S. Effects of peer-to-peer carsharing on vehicle owners’ travel behavior. Transp. Res. Part C Emerg. Technol. 2019, 101, 70–78. [Google Scholar] [CrossRef]

- Ballús-Armet, I.; Shaheen, S.A.; Clonts, K.; Weinzimmer, D. Peer-to-Peer Carsharing. Transp. Res. Rec. J. Transp. Res. Board 2014, 2416, 27–36. [Google Scholar] [CrossRef]

- Shaheen, S.; Martin, E.; Hoffman-Stapleton, M. Shared mobility and urban form impacts: A case study of peer-to-peer (P2P) carsharing in the US. J. Urban Des. 2021, 26, 141–158. [Google Scholar] [CrossRef]

- Donald, S.; Le Vie, D.S., Jr. Understanding Data Flow Diagrams. In Proceedings of the 47th Annual Conference of Society for Technical Communication, Orlando, FL, USA, 21 May 2000. [Google Scholar]

- Boons, F.; Lüdeke-Freund, F. Business models for sustainable innovation: State-of-the-art and steps towards a research agenda. J. Clean. Prod. 2013, 45, 9–19. [Google Scholar] [CrossRef]

- Cohen, B.; Kietzmann, J. Ride On! Mobility Business Models for the Sharing Economy. Organ. Environ. 2014, 27, 279–296. [Google Scholar] [CrossRef]

- Hughes, R. Artifacts for the Enterprise Requirements Value Chain. In Agile Data Warehousing for the Enterprise; Elsevier: Amsterdam, The Netherlands, 2016; pp. 181–213. [Google Scholar] [CrossRef]

- Lagadic, M.; Verloes, A.; Louvet, N. Can carsharing services be profitable? A critical review of established and developing business models. Transp. Policy 2019, 77, 68–78. [Google Scholar] [CrossRef]

- Vaskelainen, T.; Münzel, K. The Effect of Institutional Logics on Business Model Development in the Sharing Economy: The Case of German Carsharing Services. Acad. Manag. Discov. 2018, 4, 273–293. [Google Scholar] [CrossRef]

- Giordano, D.; Vassio, L.; Cagliero, L. A multi-faceted characterization of free-floating car sharing service usage. Transp. Res. Part C Emerg. Technol. 2021, 125, 102966. [Google Scholar] [CrossRef]

- Remane, G.; Nickerson, R.C.; Hanelt, A.; Tesch, J.F.; Kolbe, L.M. A Taxonomy of Carsharing Business Models. In Proceedings of the 37th International Conference on Information Systems, Dublin, Ireland, 11–14 December 2016; Volume 18. Available online: https://aisel.aisnet.org/icis2016/Crowdsourcing/Presentations/18 (accessed on 21 May 2023).

- Jorge, D.; Correia, G. Carsharing systems demand estimation and defined operations: A literature review. Eur. J. Transp. Infrastruct. Res. 2013, 13, 201–220. [Google Scholar] [CrossRef]

- Eco-Mo Foundation. Foundation for Promoting Personal Mobility and Ecological Transportation. 2022. Available online: http://www.ecomo.or.jp/environment/carshare/carshare_graph2022.3.html (accessed on 12 June 2023).

- Ye, J.; Wang, D.; Li, X.; Axhausen, K.W.; Jin, Y. Assessing one-way carsharing’s impacts on vehicle ownership: Evidence from Shanghai with an international comparison. Transp. Res. Part A Policy Pract. 2021, 150, 16–32. [Google Scholar] [CrossRef]

- Monitor Deloitte. Car Sharing in Europe: Business Models, National Variations and Upcoming Disruption. 2017. Available online: https://www2.deloitte.com/content/dam/Deloitte/de/Documents/consumer-industrial-products/CIP-Automotive-Car-Sharing-in-Europe.pdf (accessed on 12 June 2023).

- Fiorello, D.; Zani, L. EU Survey on Issues Related to Transport and Mobility; EU Publications Office: Luxembourg, 2015. [Google Scholar] [CrossRef]

- Adrienne, R. Car-Sharing Companies Hit Speed Bumps as Demand Slows, Ride-Hailing Grows. The Wall Street Journal, 14 July 2017. Available online: https://www.wsj.com/articles/car-sharing-companies-hit-speed-bumps-as-demand-slows-ride-hailing-grows-1500024601 (accessed on 15 August 2023).

- Schlüter, J.; Weyer, J. Car sharing as a means to raise acceptance of electric vehicles: An empirical study on regime change in automobility. Transp. Res. Part F Traffic Psychol. Behav. 2019, 60, 185–201. [Google Scholar] [CrossRef]

- Becker, H.; Ciari, F.; Axhausen, K.W. Modeling free-floating car-sharing use in Switzerland: A spatial regression and conditional logit approach. Transp. Res. Part C Emerg. Technol. 2017, 81, 286–299. [Google Scholar] [CrossRef]

- Kortum, K.; Schönduwe, R.; Stolte, B.; Bock, B. Free-floating carsharing: City-specific growth rates and success factors. Transp. Res. Procedia 2016, 19, 240–328. [Google Scholar] [CrossRef]

- Kim, J.; Raouli, S.; Timmermans, H.J.P. The effects of activity-travel context and individual attitudes on car-sharing decisions under travel time uncertainty: A hybrid choice modeling approach. Transp. Res. Part D 2017, 56, 189–202. [Google Scholar] [CrossRef]

- Mishra, G.S.; Clewlow, R.R.; Mokhtarian, P.L.; Widaman, K.F. The effect of carsharing on vehicle holdings and travel behavior: A propensity score and causual mediation analysis of the San Francisco Bay Areas. Res. Transp. Econ. 2015, 52, 46–55. [Google Scholar] [CrossRef]

- Plewnia, F.; Guenther, E. Mapping the sharing economy for sustainability research. Manag. Decis. 2018, 56, 570–583. [Google Scholar] [CrossRef]

- Klitkou, A.; Bolwig, S.; Hansen, T.; Wessberg, N. The role of lock-in mechanisms in transition processes: The case of energy for road transport. Environ. Innov. Soc. Transit. 2015, 16, 22–37. [Google Scholar] [CrossRef]

- Nicholas, M.; Bernard, M.R. Success Factor for Electric Carsharing. 2021. Available online: https://theicct.org/sites/default/files/publications/na-us-eu-ldv-electric-carsharing-factors-aug21_0.pdf (accessed on 12 June 2023).

- Loose, W. The State of European Car-Sharing (Final Report D 2.4; Work Package 2). 2010. Available online: https://www.eltis.org/sites/default/files/trainingmaterials/the_state_of_carsharing_europe.pdf (accessed on 22 July 2023).

- Brown, C. What’s Happening to Carsharing? Auto Rental News. 2020. Available online: https://www.autorentalnews.com/350971/whats-happening-to-carsharing (accessed on 15 July 2023).

- Smith, E.M. Public Policy and Internalizing Externalities. In Inspiring Green Consumer Choice: Leverage Neuroscience to Reshape Marketplace Behavior, 1st ed.; Kogen Page: London, UK, 2021; pp. 173–194. [Google Scholar]

- Sethi, M. What Countries Have a Carbon Tax? 2022. Available online: https://www.gccfintax.com/articles/what-countries-have-a-carbon-tax-4100.asp (accessed on 16 June 2023).

- Bieszczat, A.; Schwieterman, J. Carsharing: Review of its public benefits and level of taxation. Transp. Res. Rec. J. Transp. Res. Board 2012, 2319, 105–112. [Google Scholar] [CrossRef]

- NCSL. Car Sharing State Laws and Legislation; National Conference of State Legislatures: Denver, CO, USA, 2020; Available online: https://www.ncsl.org/research/transportation/car-sharing-state-laws-and-legislation.aspx (accessed on 20 May 2023).

- Faivre d’Arcier, B.; Lecler, Y. Governing Carsharing as a Commercial or a Public Service? A Comparison Between France and Japan. In The Governance of Smart Transportation Systems; Finger, M., Audouin, M., Eds.; The Urban Book Series; Springer: Cham, Switzerland, 2019. [Google Scholar] [CrossRef]

- Koto, H.; Inagi, A.; Igo, T. Potential Choices of Travel Mode including Carsharing and Carsharing Membership: Evidences from Four Japanese Cities. J. East. Asia Soc. Transp. Stud. 2013, 10, 630–646. [Google Scholar] [CrossRef]

- Kim, J.; Rasouli, S.; Timmermans, H.J.P. Investigating heterogeneity in social influence by social distance in car-sharing decisions under uncertainty: A regret-minimizing hybrid choice model framework based on sequential stated adaption experiments. Transp. Res. Part C 2017, 85, 47–63. [Google Scholar] [CrossRef]

- Jochem, P.; Frankenhauser, D.; Ewald, L.; Ensslen, A.; Fromm, H. Does free-floating carsharing reduce private vehicle ownership? The case of SHARE NOW in European cities. Transp. Res. Part A Policy Pract. 2020, 141, 373–395. [Google Scholar] [CrossRef] [PubMed]

- Guan, J.; Wang, J.; Zhang, S.; Zhang, K. Carsharing in China: Present State and Future Challenges. In Proceedings of the 19th COTA International Conference of Transportation Professionals, Nanjing, China, 6–8 July 2019; pp. 4269–4380. Available online: https://ascelibrary.org/doi/10.1061/9780784482292.378 (accessed on 5 August 2023).

- Green Best Practice Community. (n.d.) Implementing a Large Car Sharing Scheme. Available online: https://greenbestpractice.jrc.ec.europa.eu/node/390 (accessed on 2 November 2022).