1. Introduction

Financial distress, which refers to a situation where firms struggle to generate enough income to meet their obligations, has become a hot topic among companies. Recent financial crises, such as the Great Financial Crisis of 2008, the European Sovereign Debt Crisis, and the COVID-19 pandemic, have intensified the attention of scholars, shareholders, regulators, and policymakers to the topic, which includes the financial health deterioration of firms around the globe.

Financial distress has been the focus of a substantial stream of literature in several fields, including accounting, corporate finance, economics, and risk management. Specifically, the causes and effects of financial distress have been of broad interest in the literature. For instance, previous studies have indicated that financial distress can impact corporate investment decisions [

1,

2,

3,

4]. In addition, distress might affect ownership structure [

5], relationships with employees and suppliers [

6,

7], and even pricing strategies employed by the company [

8].

Furthermore, corporate social responsibility (CSR) has emerged as a critical element of corporate administration. Hence, scholars, stakeholders (i.e., management, board of directors, shareholders, creditors), and regulators are not only interested in the financial aspects of a company, since the concern about the environment, social factors, and corporate governance (i.e., ESG) has been actively expanding. The related literature has investigated the impacts of ESG scores on corporate performance and decision-making [

9,

10,

11,

12,

13]. Additionally, previous research has examined the relationship between ESG and finance, such as Apergis et al. [

14] and Li et al. [

15]. Notably, the emergence of ESG ratings allows us to contrast firms that own a rating with those that do not possess an ESG score.

Accounting and financial indicators are paramount for analyzing corporate performance. Previous empirical research has explored the financial distress efficiency of firms. For illustration, Scalzer et al. [

16] analyzed which financial indicators can predict financial distress, considering a sample of sixty companies from the electricity sector. Additionally, Wanke et al. [

17] studied the Malaysian dual banking system’s efficiency by assessing financial distress. In addition, related literature has examined the efficiency of ESG. For instance, Abate et al. [

18] exhibited evidence regarding the efficiency of mutual funds through the implementation of ESG scores. Therefore, although earlier empirical studies demonstrated some evidence regarding firms’ financial distress and efficiency as well as ESG scores and efficiency, they do not assess the association between a firm’s financial distress and ESG performance, which is our goal in the current article.

Thus, while there is extant individual literature on financial distress and ESG, few studies have focused on the connection between financial distress and ESG (see [

19]). Consequently, the current research fills this gap in the literature by presenting a Dynamic Network Data Envelopment Analysis (DEA) approach. The DEA model enables the computation of the underlying relationships between three sub-structures—profit sheet, balance sheet, and capital and operating expenditures—over the 2018–2021 period.

Thereupon, this research aims to examine the impact of contextual variables (i.e., exogenous variables), such as ESG Risk Scores, macro-economic and socio-economic variables, sustainability indicators, and sector, firm, and time-fixed effects on distinct accounting and financial indicators, which are endogenous variables. The efficiency scores for the profit sheet, balance sheet, and capital and operating expenditures over the 2018–2021 period are calculated through the Dynamic Network DEA, considering a three-stage process structure. The association of those endogenous and exogenous variables on the three sub-structures is computed through stochastic programming and estimated by robust regression, which consists of the optimal combination of the Simplex, Tobit, and Beta regression results. We also apply a random forest as a robustness check for the obtained outcomes. In summary, we aimed to answer the following research question in the current paper: what is the impact of ESG risk scores on financial distress?

This study makes several contributions to the literature on financial distress and ESG and has several distinguishing features. Firstly, it provides empirical evidence regarding the benefits of owning an ESG rating. Secondly, our research results suggest that the Governance Score has an inverse and significant impact on financial distress efficiency. Thirdly, this study unfolds the deterioration of firms’ financial health due to the COVID-19 pandemic. Fourthly, most studies that implement the DEA methodology neglect the internal relationship network structure that might guide the decision-making unit (DMU). Finally, this research innovatively applies stochastic programming to compute the connection between financial-distress efficiency scores and the endogenous and exogenous variables considered using a dataset of public companies across the globe.

Overall, several studies provide explanations concerning the causes and outcomes of financial distress, but they do not include ESG aspects. Thus, our goal is to assess the relationship between financial distress and ESG disclosure and performance. Our analysis has several components and includes the calculation of efficiency scores through a Dynamic Network DEA, the computation of a censored robust regression to assess the impact of the contextual variables, and finally, the implementation of a random forest. The results support, for instance, the study of Friede et al. [

13], which implies that ESG and financial performance have a positive relationship. Moreover, the empirical results of our research also reinforce further studies that suggest a positive effect of ESG disclosure on financial performance [

9].

The rest of the article is organized as follows. We disclose some background in financial distress and ESG in

Section 2. In

Section 3, we discuss the DEA approach to producing efficiency scores as well as the stochastic programming model, i.e., censored robust regression, employed in this study. We examine the dataset in

Section 4 and the results of our empirical analysis in

Section 5. In

Section 6, we discuss the execution of the random forest and its results. Lastly,

Section 7 summarizes the limitations of this research and avenues for future studies.

2. Literature Review

2.1. Financial Distress

Financial distress is a common issue in the corporate universe, and the related literature investigates the topic and its effects on corporations, investors, and the economy. Some studies emphasize the impact of financial distress on corporate decision-making.

Firstly, the trade-off theory of capital structure predicts that a firm weighs the benefits of tax shields with the costs of financial distress. Hence, Elkamhi et al. [

20]) argue that the accumulated present value of distress costs cancels out the possible tax benefits from higher leverage. Moreover, distress costs might explain the unwillingness of firms to expand their financial leverage [

21].

Therefore, firms have large costs when in financial distress, and bankruptcy is indeed costlier. Among these costs are expenses for lawyers and advisors as indirect costs [

22]. Conversely, Giammarino [

23] argues that it might be rational for firms to induce those costs because of asymmetric information and judicial discretion. Consequently, firms may have a preference to face a costly arbitrator than provide equity holders an opportunity to lead the reorganization.

As defined by Chan and Chen [

24], distressed firms that lose their market share due to poor performance are usually inefficient producers, and they are prone to high leverage and cash flow issues. Hence, many factors might lead a company to distress. For instance, the company’s capital structure impacts the restructuring of financially distressed companies [

25]). Contrarily, Graham and Harvey [

26] suggest that potential costs of distress are not considered very important when the management is evaluating debt decisions, even though companies contemplate credit ratings, which can be perceived as a signal of concern about distress. According to Altman et al. [

22], the most common reasons for corporate failures are poor operating performance and high financial leverage, lack of technological innovation, and liquidity and funding shocks. Additionally, firms may become financially distressed due to unexpected liabilities.

Financial distress has several effects on a firm’s performance. Opler and Titman [

27] demonstrate that highly leveraged firms lose their market share in industry downturns and also experience a reduction in their market value of equity. Additionally, the effects of financial distress are more powerful for firms with substantial R&D expenses. Distress might also influence the relationship between companies and their suppliers. For example, firms in financial distress make use of larger amounts of supplier trade credit as an alternative source of financing [

7]. In contrast, financial distress provokes waterfall effects on a firm’s suppliers and is associated with an increase in the suppliers’ leverage ratio [

28]. Finally, financial distress may affect a firm’s pricing strategy since companies facing distress might employ aggressive pricing strategies to immediately generate cash [

8].

Furthermore, financial distress impacts corporate investments. Eisdorfer [

1] exhibits that distressed firms’ investments generate less value in periods of uncertainty. Additionally, firms with poor financial performance and fewer investment opportunities are more likely to under-invest, while distressed firms with greater investment opportunities have a similar behavior to healthier firms [

3]. Investment and dividend contraction are also related to firms’ recovery from financial distress [

4]. Finally, defaults and bankruptcy have the power to affect the investment decisions of non-distressed peers [

2].

Distress also affects the relationship between firms and employees. For instance, managers experience personal costs and higher rates of turnover when their firms turn into distress [

29]. Firms facing financial distress in their earlier life cycle decrease the number of employees [

4].

Moreover, companies in distress also tend to renegotiate wages and reduce labor costs [

6]. Likewise, the risk of financial distress harms the compensation of new executives [

30]. This is also supported by Altman et al. [

22], who state that management incentives regarding compensation may not be effective during financial distress situations. Lastly, Pham et al. [

31] suggest that the work environment is associated with a firm’s financial policies and is positively connected to the level of cash that the firms hold.

The relationship between companies and stakeholders (i.e., management, board of directors, shareholders, creditors) might also be influenced by financial distress. Firstly, financial distress impacts corporate ownership by reducing ownership concentration and increasing ownership by banks and outside investors [

5]. In addition, some types of investors specialize in firms in a distressed situation or distressed securities, such as high-yield bonds. Secondly, compliance with corporate governance decreases the probability of financial distress [

32]. As a result, firms with weak corporate governance are more prone to falling into financial distress [

33]. Thirdly, board composition (e.g., the proportion of outside directors) is associated with financial distress [

34]. Additionally, management and board positions are more prone to experiencing higher turnover during financial distress. Distressed firms are also more likely to experience changes in ownership. Finally, companies emerging from Chapter 11 might have former creditors as new owners [

22].

Other studies disclose possible distinct effects that financial distress may yield on firms. Among these effects, the related literature examines the association between asset sales and financial distress. Lasfer et al. [

35] investigated the stock market reaction to asset sales of the distressed firms, and the results suggest significant positive abnormal returns. The sale of assets by firms in distress, therefore, is well-perceived by the financial market.

Further research also assessed the relationship between financial distress and tax strategies. For example, the study by Richardson et al. [

36], which contemplates a sample of Australian firms, exhibits that corporate financial distress is positively associated with tax aggressiveness. Other articles also explored the connection between distress and risk management. According to Purnanandam [

37], financial distress costs and hedging have a non-linear relationship, which implies that financially distressed firms are not much engaged in hedging foreign currency and commodities, although moderately leveraged firms are active hedgers. Lastly, the level of financial distress might even affect the real economy [

38].

Furthermore, as suggested by Kahl [

39], financial distress is a long-term process and may affect firms emerging from debt restructuring. Consequently, firms re-entering financial distress is not unusual. Some firms filed for Chapter 11 more than once in the United States. As Altman et al. [

22] demonstrate, some firms emerge from Chapter 11 three, four, and even five times. Therefore, among the possible methods of overcoming financial distress, companies might attempt to restructure their debt, workouts, and informal reorganizations [

40].

Likewise, there are several established predictors of financial distress considering firm-specific characteristics. For instance, Altman [

41] introduced the Z-score approach to predict corporate bankruptcy, while Altman et al. [

42] presented the ZETA model for bankruptcy evaluation. Campbell et al. [

43] also developed a model that predicts corporate failure, which includes accounting and market-based factors.

The literature on DEA also sheds light on the impacts of financial distress on corporations. Using a Malmquist DEA approach on firms from Egypt, Habib and Shahwan [

44] found that corporate governance does not affect the propensity of financial distress, although intellectual capital has a negative impact. Moreover, Habib and Kayani [

45] point out that the efficiency of working capital management has a negative association with the propensity for a decline into financial distress. Li et al. [

46] applied a Malmquist DEA to generate a dynamic prediction of financial distress, while Shiri and Salehi [

47] implemented the DEA as a tool to measure efficiency scores of the Tehran Stock Exchange as well as predict financial distress.

Studies that measure efficiency levels at the level of the firm have been gaining popularity recently. These studies are usually grouped into two main methods: parametric and non-parametric. The most usual parametric technique is the stochastic frontier approach (SFA), while the most common nonparametric methodology is the DEA. In the context of financial distress, these methods can designate how effective a firm is in minimizing variables associated with increasing financial distress and maximizing those coupled with the variables increasing financial health.

Previous research considered the DEA and bootstrap approach to assessing the insolvency of the Brazilian electricity distributors [

16] and also a dynamic network DEA and SFA to evaluate the efficiency of the OECD banks [

48]. DEA models were also implemented to verify efficiency in Middle East and North African banking, Chinese banking during the global financial crisis, the Malaysian dual bank system, and distress drivers of the Brazilian banks [

49,

50].

In sum, financial distress is a relevant topic that affects corporate financial and operational performance as well as the relationship between firms and stakeholders. However, the connection between ESG and financial distress has not been broadly explored, which is our goal in the current study.

2.2. Environmental, Social, and Governance (ESG)

ESG represents Environmental, Social, and Governance. Firstly, environmental issues are related to the conservation of nature and include topics such as climate change, carbon emissions, pollution, waste management, and water usage. In addition, social actions depict what firms are doing to promote diversity, inclusion, human rights, customer satisfaction, and even data security. Finally, the governance structure appraises standards for running a company and comprehends board composition, management compensation, audit committee structure, lobbying, and corruption.

The interest of stakeholders (i.e., politics, investors, employees, and the population) in sustainability issues has been growing exponentially since the beginning of the last decade. The increase in sustainable demands has improved the drive for sustainable actions, as well as the disclosure of information regarding corporate responsibility efforts. The concept of environmental, social, and governance has evolved in recent years to meet social demands associated with the risks and opportunities of corporate sustainable actions. On top of that, country-level concerns related to ESG are also a topic of broad discussion [

51].

ESG is connected to the Sustainable Development Goals (SDGs) developed by the United Nations (UN), which aim to overcome several issues faced by society. The 17 Sustainable Development Goals address social problems (e.g., education, women, inequalities, and children), as well as environmental and climate issues (e.g., water, biodiversity, and energy). Overall, the SDGs are a plan of action encompassing people, the planet, and prosperity and contain 169 target actions for the world’s sustainable development. ESG might also be defined as a framework of the Association for Supporting the SDGs for the UN, which includes non-financial elements that should materialize as the core values of firms, financial institutions, and shareholders.

Furthermore, regulatory agencies are increasing their action range to include ESG topics. For instance, the Sustainability Accounting Standards Board (SASB) was introduced by the IFRS Foundation and aims to highlight the paramount set of sustainability issues for a company’s financial performance. In addition, the Global Reporting Initiative (GRI) has developed the best practice standards for sustainability reporting. Lastly, the Task Force on Climate-related Financial Disclosures (TCFD) focuses on improving market transparency related to risks and opportunities of climate change through the release of recommendations to assist firms in disclosing better information and support capital allocation.

Previous literature has concentrated on the association of ESG and corporate decisions [

52,

53]. Some studies investigate the relationship between ESG and firms’ investments. For instance, Zhang et al. [

12] argue that environmental and social perspectives are important drivers of corporate investments within the United Kingdom. In addition, further research has examined the association between ESG and corporate performance. The research developed by Friede et al. [

13] explores the association between ESG criteria and corporate financial performance. Their findings point out a positive association between ESG and financial performance. In addition, ESG disclosure impacts positively on financial performance [

9,

10,

11]. On top of that, the presence of independent outside directors, foreign institutional stockholders, and domestic financial institutional shareholders positively affects financial performance [

54]. Likewise, institutional ownership has a positive relationship with firms’ environmental and social performance (E&S) [

55]. Finally, sustainability is also related to better financial performance [

56].

Scholars have investigated the connection between ESG and finance topics. Apergis et al. [

14] show that a higher ESG rating is associated with lower costs of debt and a reduced default risk [

15]. Wong et al. [

57] demonstrate that ESG certifications lead to a decrease in a firm’s cost of capital. Zhang et al. [

12] demonstrate that superior ESG performance helps firms reduce debt overhang. Specifically in the banking industry, socially responsible actions are rewarded [

58].

Further studies have explored the connection between ESG and investors. For example, investors require higher expected returns on firms with higher environmental concerns, such as those related to the emission of toxic chemicals, hazardous waste concerns, and climate change. As a result, firms that generate more revenue from clean energy tend to have lower costs of capital [

59].

ESG rating downgrades are also associated with negative stock abnormal returns [

60]. Moreover, Barros et al. [

61] show that firms have higher ESG performance following M&A activity. Studies have also explored the effects of ESG at a national level. Pineau et al. [

62] assess ESG factors in sovereign credit risk and demonstrate that the evolution of ESG is influenced by the level of economic development of a country. Cherkasova and Nenuzhenko’s [

63] study suggests that international firms in developed Asia or North America are more likely to succeed in ESG development, while Latin American firms might struggle.

Previous research has explored the relationship between ESG and stakeholders, such as management, board of directors, shareholders, and creditors [

64]. ESG is related to executives’ compensation as a mechanism of alignment. The use of ESG metrics in incentive plans is expanding, and nearly 60% of companies include ESG metrics in their incentive plans [

65]. For example, McDonald’s ties 15% of its management bonuses to targets such as diversity and inclusion. Additionally, BlackRock’s CEO, Larry Fink, emphasizes the importance of sustainability and ESG as value drivers.

Previous studies have explored the impact of CSR on firms, which may act as a predecessor of the term ESG. Borghesi et al. [

66] demonstrate that larger firms and those with more free cash flow tend to have higher CSR. The authors also point out that firms with stronger institutional ownership are less likely to invest in CSR activities. Additionally, financial constraints are an important driver of CSR. Thus, companies are more likely to be involved in CSR when they have an outstanding financial performance [

67].

Amiraslani et al. [

68] demonstrate that firms with higher volumes of CSR activities hold lower bond spreads in the secondary debt market during the financial crisis, which is enhanced for firms in distress. These firms are capable of raising a higher amount of debt for longer maturities and better initial credit ratings. In sum, debtholders trust high-CSR companies.

Recently, the DEA methodology has been introduced to evaluate ESG efficiency by considering firm-level information. Abate et al. [

18] examined the efficiency of mutual funds delineated by distinct degrees of sustainability, assessed by the ESG scores, through DEA. In addition, the DEA methodology has also been employed to study portfolio optimization comprising ESG scores [

69]. Moreover, Alam et al. [

70] analyzed the influence of ESG involvement on the technical efficiency of both conventional and Islamic banks.

Furthermore, Ren et al. [

71] analyzed the effect of ESG performance on energy-adjusted firm efficiency, while Chang et al. [

72] used the DEA method to assess the effects of digital finance and ESG performance on financing efficiency. The same methodology was implemented to examine the relationship between corporate efficiency and sustainability [

73]. Finally, Vincentiis [

74] points out that news related to ESG issues is interpreted differently in different locations, and ESG reputation impacts the relationship between the news and equity returns.

In sum, ESG is an emerging topic that has acquired great importance recently. Investors, managers, policymakers, and other stakeholders have highlighted the importance of ESG disclosure and standards, which can be represented through ESG ratings.

2.3. Financial Distress and ESG

To our knowledge, few studies have measured the association between financial distress and a firm’s ESG performance. For instance, Boubaker et al. [

19] argue that CSR is related to lower financial distress risks as well as default risks, providing a better corporate environment, and enhancing firms’ financial stability. The stakeholder theory argues that moral capital or goodwill can be generated through enhanced investments in CSR. This moral capital and goodwill can act as an insurance protection mechanism which reduces the firm’s risk exposure [

75]. Lee and Faff [

76] argued that investment decisions should be based on both financial and non-financial criteria, and they predicted that socially responsible companies would attract more investors, which could reduce the company’s risk. A study by Sun and Stuebs [

77] investigated the relationship between CSR and firm productivity using a sample of companies in the chemical industry in the United States. They argued that CSR is positively related to firm competitiveness through a learning and innovation cycle. The firm’s competitiveness includes five dimensions, including financial performance, quality of product/service, productivity, innovation, and image/reputation [

78]. Guillamon-Saorin et al. [

79] investigated the relationship between CSR and operational inefficiency using a sample of US firms between 2004 and 2015. They argued that the engagement of CSR will benefit the firms from the perspective of reputation enhancement, insurance-like protection, shareholder wealth improvement, better risk management, improvement of market demand from customers, increased disclosure and reporting transparency, and an overall ability to access financial markets in better conditions.

Using a sample of S&P 500 stocks data between 2019 and 2021, Cohen [

80] investigated the influence of ESG risk scores on a company’s survival chances. The results indicated that higher environmental and social risk reduces a corporation’s financial stability and increases their default risk. Glover [

81] argued that investing in resources to reduce environmental and social risks may increase the firm’s overall value due to the fact that environmental and social risks are associated with default costs.

Using a sample of Australian firms, Jia and Li [

82] investigated the relationship between corporate environmental performance and financial distress. They argue that there are four reasons to expect a negative relationship between environmental performance and financial stress. Firstly, better environmental performance improves the relationship with different stakeholders, resulting in an improvement in the firm’s financial performance and sustainability as well as a reduction in the possibility of financial distress [

83,

84]. Secondly, better environmental performance indicates the availability and efficient allocation of resources and good management quality [

85,

86]. Firms with higher quality of management and better allocation of resources would have better access to financing and a lower probability of financial distress [

87,

88]. Thirdly, negative environmental events trigger sanctions from stakeholders, and firms with good environmental performance will receive less severe sanctions. Moreover, the likelihood of negative regulatory and legislative actions can be mitigated, thus reducing the environmental risk for firms with higher levels of environmental performance [

89,

90]. Finally, good relationships with stakeholders from companies with higher levels of environmental performance will improve the firm’s ability to raise funding by attracting financial resources from socially responsible investors [

91]. This will reduce the level of financial distress.

Regarding the “G” component in ESG, numerous studies have addressed the relationship between corporate governance and financial distress [

33,

92,

93]. It has been argued that good corporate governance, together with business contract transparency, ethical standards, legal and constitutional agreement, effective decision-making, and true disclosure of financial information leads to the success of a company. On the other hand, poor corporate governance would increase the opportunities for controlling shareholders to transfer value from the firm into their own pockets. The resulting decline in corporate value would result in a higher probability of falling into financial distress [

94,

95]. Therefore, based on our discussions above, we have the following hypotheses:

Hypothesis 1. There would be a significant and negative impact of environmental risk scores on financial distress.

Hypothesis 2. The impact of social risk scores on financial distress would be significant and negative.

Hypothesis 3. We do not have any a priori expectation regarding the impact of governance risk scores on financial distress.

We did not identify a similar study that has implemented the DEA methodology to assess the described association. Therefore, this paper is innovative in the literature by considering a dataset of public companies for the application of a DEA model to measure financial distress efficiency and compute the relationship between financial efficiency and ESG ratings, which is performed through robust regression in the current study. Moreover, we also analyze the impact of each score (e.g., Environmental Score, Social Score, and Governance Score) as well as the ESG Score as a whole, which is a further contribution of our study. We summarize the literature studies above that are related to our research topic in

Table 1.

3. Methodology

3.1. Background on DEA

DEA is a non-parametric linear programming method introduced by Charnes, Cooper, and Rhodes [

96] that connects the estimation of the technology with the calculation of performance as related to this technology [

97]. In other words, DEA is a technique that calculates the best-practice production frontiers and estimates the relative efficiency of distinct decision-making units, denominated DMUs, based on input-output observations. This method, therefore, is a measure of relative efficiency and is utilized to evaluate a group of DMUs.

Different from the parametric methods, DEA grants multiple inputs and multiple outputs as well as the inclusion of some specific functional form that does not dictate the efficient frontier. The DEA, thus, is less restricted since the data variation is assumed to contain information regarding efficiency and technology conditions.

The efficiency score of a given DMU is estimated through the constructed efficient frontier established by the best-performing DMUs [

98]. In addition, a group of DMUs is used to evaluate each other and the DEA approach mixes the procedures of minimal extrapolation and the Farrell efficiency of a firm, which generates an outcome of proportional improvement [

97].

This methodology has distinct approaches to scaling, such as constant returns to scale (CRS), increasing or decreasing returns to scale, and varying returns to scale (VRS). The varying returns to scale (VRS) specification, also known as BCC [

99], assumes free disposability, convexity, and a

. This model ensures that each observation is benchmarked only against observations of similar size. In contrast, a constant return to scale considers

. The DEA envelopment model computation is provided below for both input-oriented as well as output-oriented. Moreover, Equations (1) and (2) represent the envelopment model for both CRS and VRS frontier types:

As discussed by Wanke et al. [

49], a DMU might contemplate diverse sub-structures that can impact the overall efficiency levels in different aspects, which limits the measurement of efficiency. In addition, the DEA approach may contemplate more than one stage of the model. For illustration, Golany et al. [

100] argued that DMUs can consist of two consecutive stages, which improves the estimation of efficiencies. In this case, the first-stage outputs, therefore, are calculated as the second-stage inputs. Thus, the DEA models can be classified according to the internal structure of DMUs, ranging from shared flow, multi-stage, and network models [

101]. The definition of the network DEA, consequently, may encompass more than the two stages previously mentioned.

Fare and Grosskopf [

102] introduced the usage of carry-overs to connect two consecutive periods where the performance of DMUs arises continuously over distinct periods. Bogetoft et al. [

103] proposed a new method of multiple period efficiency in an aggregated process, which is a denominated dynamic DEA model. Kao and Hwang [

104] considered a two-stage procedure to measure efficiency considering two sub-processes, which estimate efficiency more precisely.

On top of that, the implementation of a dynamic DEA model is relevant since inputs and outputs in the current period might impact the subsequent input or output levels. Additionally, the model contemplates connecting the production functions across two consecutive periods.

Overall, DEA is a method to envelop observations to establish a technological frontier that evaluates observations representing the performance of all entities. In addition, a dynamic network is employed due to its several advantages, such as the connection of two consecutive periods by carry-overs and sharing variables among outputs and carry-overs.

3.2. Proposed Dynamic Network DEA Model

The current section exhibits the proposed model to estimate efficiency scores in dynamic network structures, which consider financial and accounting indicators related to financial distress in each sub-structure. We have followed the structure suggested by Tone and Tsutsui [

105], which proposed a dynamic DEA model that involves a network structure in each period within the framework of a slacks-based measure approach.

Firstly, we consider DMUs with sub-structures . Thus, , , and are the number of inputs and outputs in the sub-structure and the links directing from to the sub-structure . Secondly, the term is implemented, indicating the input in to generate output . Finally, the term is employed as an intermediate link from sub-structure to sub-structure .

The dynamic network DEA model is calculated through the linear programming problem presented below:

The linear programming model demonstrated above is solved for

, which considers the use of a minimal virtual input vector for each period. Moreover, each sub-structure efficiency is estimated through Equation (4). Finally, the overall structure efficiency (network efficiency = NE) is obtained throughout a weighted average which consists of each

being settled as the respective sub-structure weights. The overall efficiency is presented in Equation (5).

where

.

The dynamic network DEA model can be decomposed considering either an additive or multiplicative approach, which is determined by the specificities of the two-stage structure and the returns-to-scale (CRS or VRS) currently chosen. Our model employs additive efficiency decomposition which can be solved linearly. In contrast, we should comprehend how to establish the weights used on the efficiencies of each one of the three individual stages of the model. If we ponder that the optimal solution which reaches maximum overall efficiency is unknown—unless we test every possible value for the weights—we should operate a more convenient approach when establishing the exogenously defined weights. In the current study, we appraise three distinct efficiency vectors for each network substructure: profit sheet, balance sheet, and capital and operating expenditures. Thus, different weights should be defined exogenously to estimate the overall efficiency levels.

Our model employs variable returns-to-scale (VRS), which maintains the translation invariance property. Generally, a DEA model is translation invariant if the translated input-output yields the same results as the original data [

106]. Moreover, a given DMU can operate at different scales without modification of its efficiency scores.

Our model considers a meta-frontier to determine the efficiency scores, which allows the performance comparison of distinct DMUs that operate under different technological conditions. The meta-frontier aims to provide a homogeneous boundary for all heterogeneous firms and generates a fair performance comparison among distinct groups of DMUs.

Nevertheless, we use the

weighting model to obtain the weights, which uses a 0–1 scale for every item. Firstly, the model contemplates

DMUs per year, which must be ranked in terms of

sub-structure efficiency scores. The efficiency of

–th year DMU in terms of each of the

–th sub-structure is denominated

. Then, the distinct sub-structure of a year DMU is aggregated into a single overall score. The model also considers a non-negative weight

to soften the observation of different efficiency vectors. In addition, the sub-structure efficiency vectors are arranged in a descending order:

for every year. This model is presented below:

It is remarkably important to state that we perform the Dynamic Network DEA model twice. The first model considers the full sample, while the second model contemplates only the firms that own an ESG score. Consequently, our first NDEA model generates the results of the financial-distress efficiency scores considering the full sample. Conversely, the second NDEA model produces the results of the financial-distress efficiency scores regarding the ESG sample.

Figure 1 illustrates the inputs (I), outputs (O), carry-overs (C), and linking (L) of the variables within the scope of the three sub-structures of the dynamic network developed for the firms considered in our sample. The input variables of the first stage—profit-sheet efficiency—are net loans, total debt, and total expenses, while the output variables are net income and net interest income. In addition, the linking variables in the first stage are net interest income and cash and equivalents. The profit-sheet efficiency assesses the profitability of firms and affects the subsequent sub-structure, denominated the balance sheet.

The second sub-structure, therefore, evaluates these variables; fixed assets (I), total liabilities (I), total equity (O), and finally, total assets and total equity as the linking variables. The inputs of the second stage are converted with the firms’ profitability into total equity and total assets. Moreover, total equity and total assets are also the foundation of the third sub-structure, which is denominated as capital and operating expenditures. These variables are used with capital expenditures (CAPEX), as well as operational expenditures (OPEX), to generate indicators of income, such as operating revenue. Finally, the variables net interest income, total assets, and end cash position also act as carry-overs in the presented model. The dataset and descriptive statistics are discussed in

Section 4.

3.3. Censored Robust Regression and Random Forest

In our research design, the association between contextual variables and the financial distress efficiency levels is estimated through the robust regression method, which includes Tobit regression [

107], Simplex regression [

108], and Beta regression [

109]. Those regressions are individually designed to deal with dependent variables that range among the interval (0,1). We have selected robust regression instead of truncated regression because the latter is employed only for one-stage DEA models, while robust regression is commonly used in two-stage DEA models and removes possible limitations and drawbacks that each regression might have individually.

Firstly, the Tobit regression estimates the linear relationships between variables when there is censoring (i.e., either left censoring or the general model) in the dependent variable. This type of regression was introduced by Tobin [

110]. When left censoring is implemented, the values that fall at or below an established threshold are censored, while the values above the threshold obtain the value of that threshold. In contrast, when the general model is employed, the dependent variable is censored from above and below at the same time. For more details, see McDonald and Moffitt [

111].

Secondly, the simplex distribution can model proportional outcomes, such as percentages, rates, or proportions. Thus, the simplex distribution is a greater fit to analyze continuous proportional data and includes a class of distributions whose domains range from 0 to 1. The statistical inference is performed through the simplex generalized linear model (SGLM) via maximum likelihood for a cross-sectional proportional data set. The Simplex generalized linear model is an extension of Jørgensen [

112]. Generally, for the estimation of the parameters

and

for the SGLM considering varying dispersion, we must employ an iteratively re-weighted least-squares algorithm to estimate the maximum likelihood of the parameters. Further details can be found in Zhang et al. [

113].

Thirdly, Beta regression is usually implemented when the variables possess values in a standard unit interval (0,1), such as rates, proportions, or indices. This method assumes that the dependent variable is beta-distributed. This model considers interpretable regression parameters in terms of the mean variable of interest. In addition, Beta regression is stated as a flexible model since the beta density can handle distinct shapes conditioned to the combination of parameter values. Thus, the densities are parameterized regarding the mean

and the precision parameter

. In sum, the focus of the Beta regression is to model continuous random variables that range between the interval (0,1). For a specific discussion about Beta regression, see Cribari-Neto and Zeileis [

114].

Generally, robust regression was embraced since most regression methods generate biased two-stage DEA results, since the model does not manage the underlying problems provoked by the lack of discriminatory power of the scores produced in the first stage [

17]. Additionally, robust regression constitutes an adequate distributional assumption to overcome the bias. The employed regressions are individually designed to handle the dependent variables that range from 0 to 1. This method, therefore, represents an appropriate distributional assumption to overcome possible biases.

Furthermore, censored robust regression also overcomes the limitations of the Tobit regression. The hypothesis of residual independence does not hold in Tobit regression when DEA is implemented to measure efficiency since they are obtained from other DMUs in the sample [

17]. In addition, the Tobit estimation in two-stage models yields biased and unstable estimates [

115]. Those limitations are addressed through the employment of robust regression.

The non-linear stochastic optimization for the robust regression–Tobit, Simplex, and Beta–is exhibited in the model (7). The variables

,

, and

constitute the weight, which ranges from 0 to 1, and is set to the residuals vector of the Tobit (

), Simplex (

), and Beta regressions (

). This model optimizes the value of

so that the Variances (

) and Covariances (

) of the combined residuals are minimal. On top of that, the regressions were bootstrapped and combined one thousand times. The residual variances were collected considering a linear model for each regression connecting efficiency estimates and contextual variables.

To enhance the results of the robust regression that we have previously disclosed, we also performed random forests to find associations between contextual variables and the financial distress efficiency levels. The random forest algorithm was introduced by Breiman [

116] and, generally, develops a large sample of de-correlated trees and computes their average. This technique is derived from bootstrap aggregation, which decreases the variance of an estimated prediction function. The random forest, therefore, is an estimator that contemplates a collection of

randomized regression trees [

117].

Trees can catch the complex interactions within the data and might achieve low bias depending on their size. Thus, this method constructs decision trees on the bootstrapped training samples, and each time a tree is broken into two, a random sample of m predictors is considered as split prospects from the collection of

predictors. The split can apply only one

predictor. In addition, a new sample of

predictors is considered at each split [

118]. Moreover, random forests implement the process of tree decorrelation, which generates less varying and more reliable average resulting trees. Overall, this approach gathers several randomized decision trees and combines the prediction results through their average.

As defined by Breiman [

116], a random forest consists of a “collection of tree-structured classifiers

, where the

are independent identically distributed random vectors and each tree casts a unit vote for the most popular class at input

” (p. 2). For regressions, random forests are composed of growing trees that depend on a given random vector

as the tree predictor considers numerical values as a contrast to class labels.

Moreover, the random forest predictor is constituted by the average over

of the trees. In addition, the mean-squared generalization error for a given predictor

is:

. Furthermore, forests generate outcomes comparable to boosting and adaptative bagging, even though it does not progressively modify the training set [

116].

Biau and Scornet [

117] state that tree aggregation estimations are capable of computing the complex patterns that classical models are not. Thus, random forests can perform better than ordinary least squares [

119].

This technique has been previously applied jointly with the DEA approach. For illustration, Anouze and Bou-Hamad [

120] study bank performance through a three-stage DEA structure that applies the random forest technique. Thaker et al. [

121] also employ random forest jointly with DEA in a two-stage framework to investigate the relationship between bank efficiency and corporate governance. For a more in-depth discussion, see Breiman and Cutler [

122].

4. Data

We have treated negative and zero values by adding the minimum value to each observation, which generates only positive values in the database. Moreover, DEA models, in general, are sensitive to outliers since an outlier can help to span the frontier and might have a significant impact on the evaluation of several other observations [

97]. Therefore, we implemented logarithmic transformation on the data to reduce asymmetries and avoid distortions generated by outliers, reducing the sensitivity of the DEA model to outliers. The logarithmic transformation can diminish the impact of extreme values in the data and, consequently, make the DEA model less sensitive to outliers.

The financial dataset used in the current study was gathered from the platform Yahoo Finance for the 2018–2021 period. The financial statements data are provided by Morningstar. The choice of inputs, outputs, linking, and carry-over variables originated from the finance distress literature and aims to assess how financial indicators (inputs) are converted into outputs for each sub-structure applied in the model (i.e., profit sheet, balance sheet, and capital and operating expenditures). Every monetary value is disclosed in the company’s country of origin currency. Additionally, the ESG Risk Scores were also collected from Yahoo Finance.

In contrast, the contextual variables were assembled from the World Bank. Among the contextual variables, we include country-level variables such as Foreign Direct Investment (FDI) Inflow and Outflow, Renewable Energy Use, Urban Population, and GDP per capita. We also include time, sector, and firm fixed effects as well as the stock exchange on which the company is listed. The contextual variables are a cornerstone of the given analysis since the regression analysis aspires to verify the association between financial distress efficiency, ESG Risk Scores, and contextual variables. In other words, we aim to assess the relationship between financial efficiency and the disclosed variables.

The ESG Risk Scores collected from Yahoo Finance are provided by Sustainalytics and Morningstar, which implement a two-dimensional framework considering a company’s exposure to industry-specific ESG concerns and how the company is handling those issues. The ESG Risk Scores, thus, assess the degree to which a firm’s enterprise business value is at risk driven by environmental, social, and governance factors. The scores are calculated, therefore, considering the amount of the unmanaged risk on a 0–100 scale. Thus, the ratings are categorized across five risk levels: negligible (0–10), low (10–20), medium (20–30), high (30–40), and severe (40+). Consequently, the higher the score, the higher the firms’ ESG risk, while a lower score represents a less unmanaged ESG risk. We also include individual scores denominated Environmental Score, Social Score, and Governance Score.

The descriptive statistics are shown in

Table 2 and

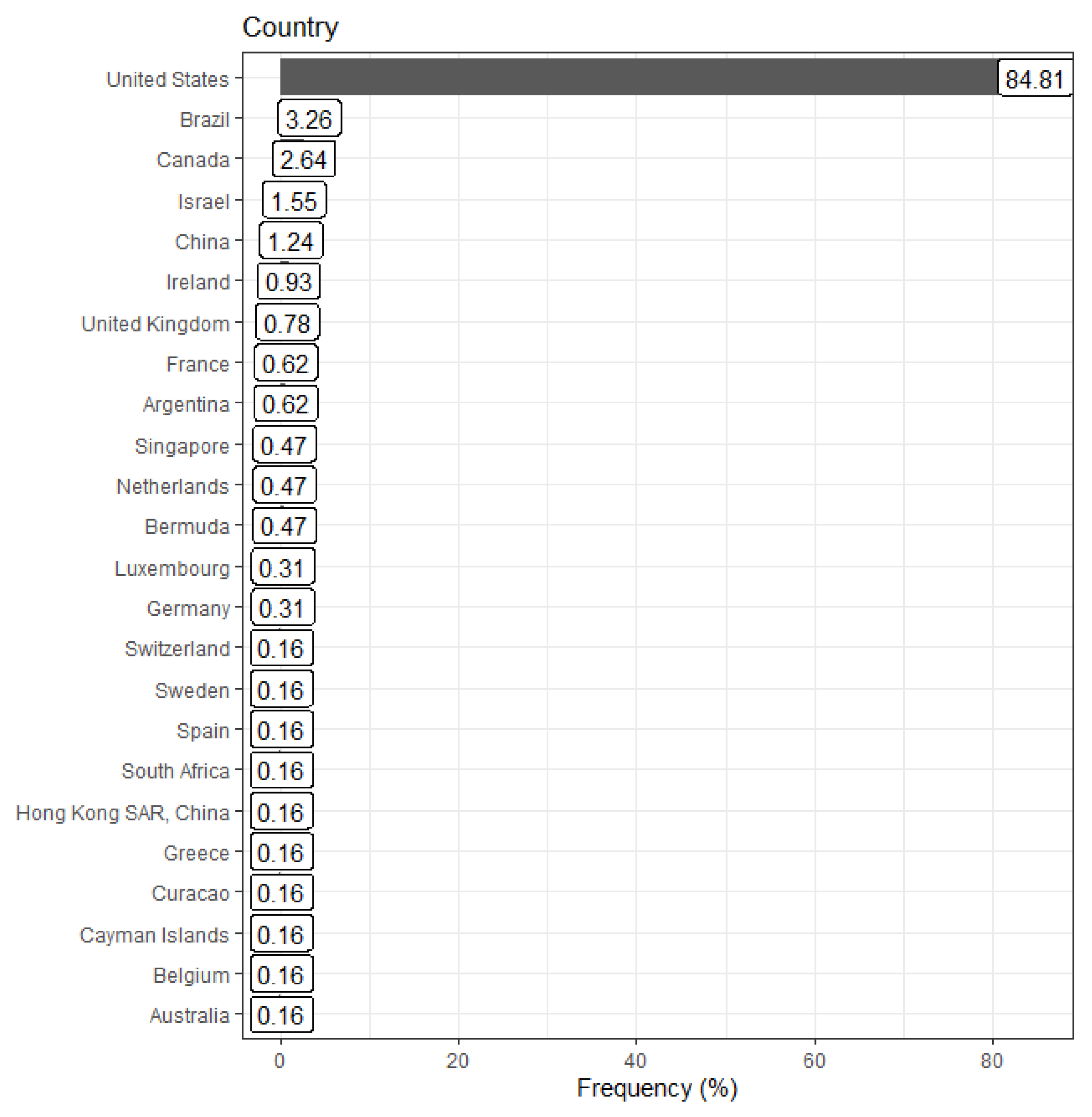

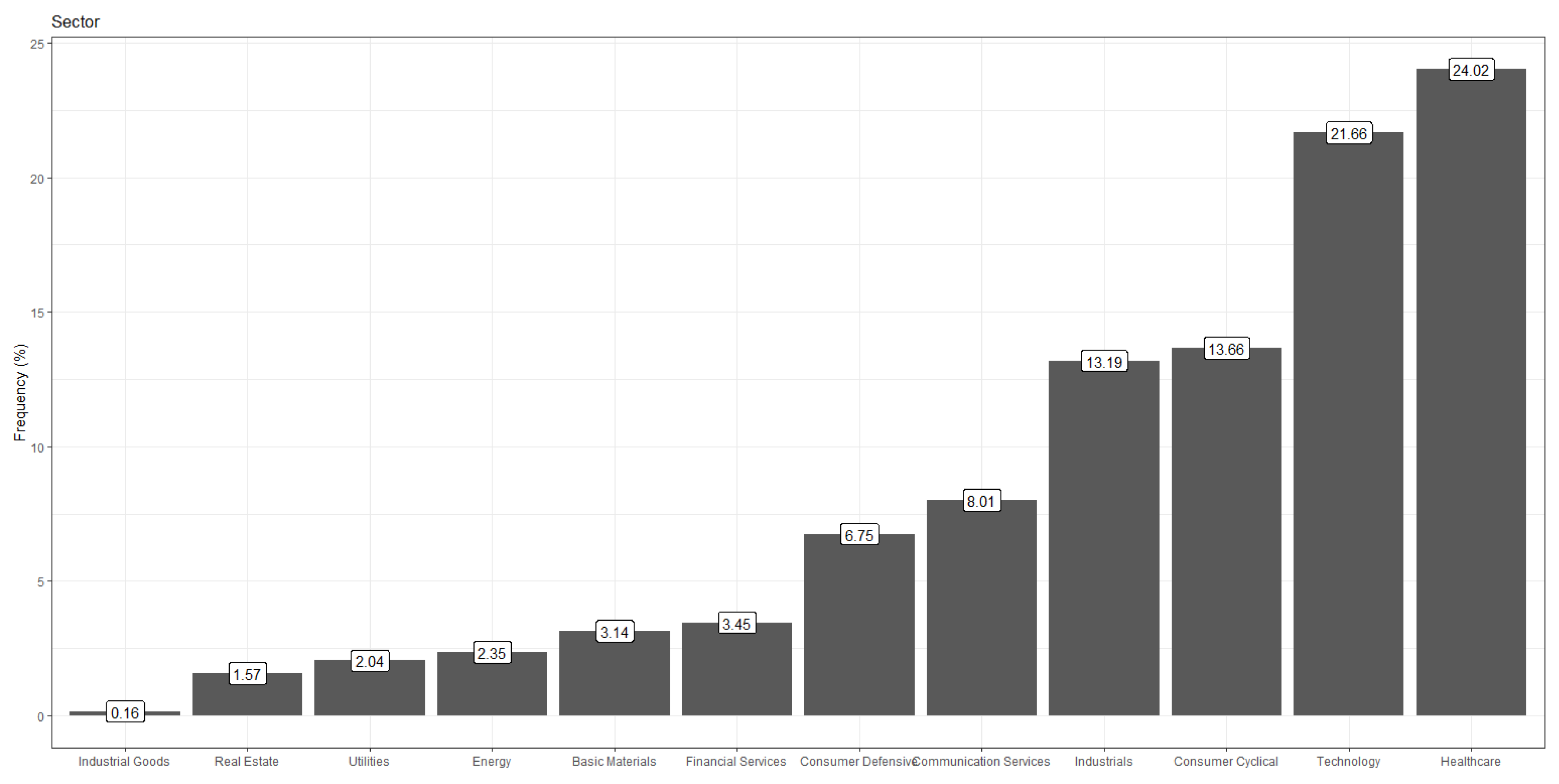

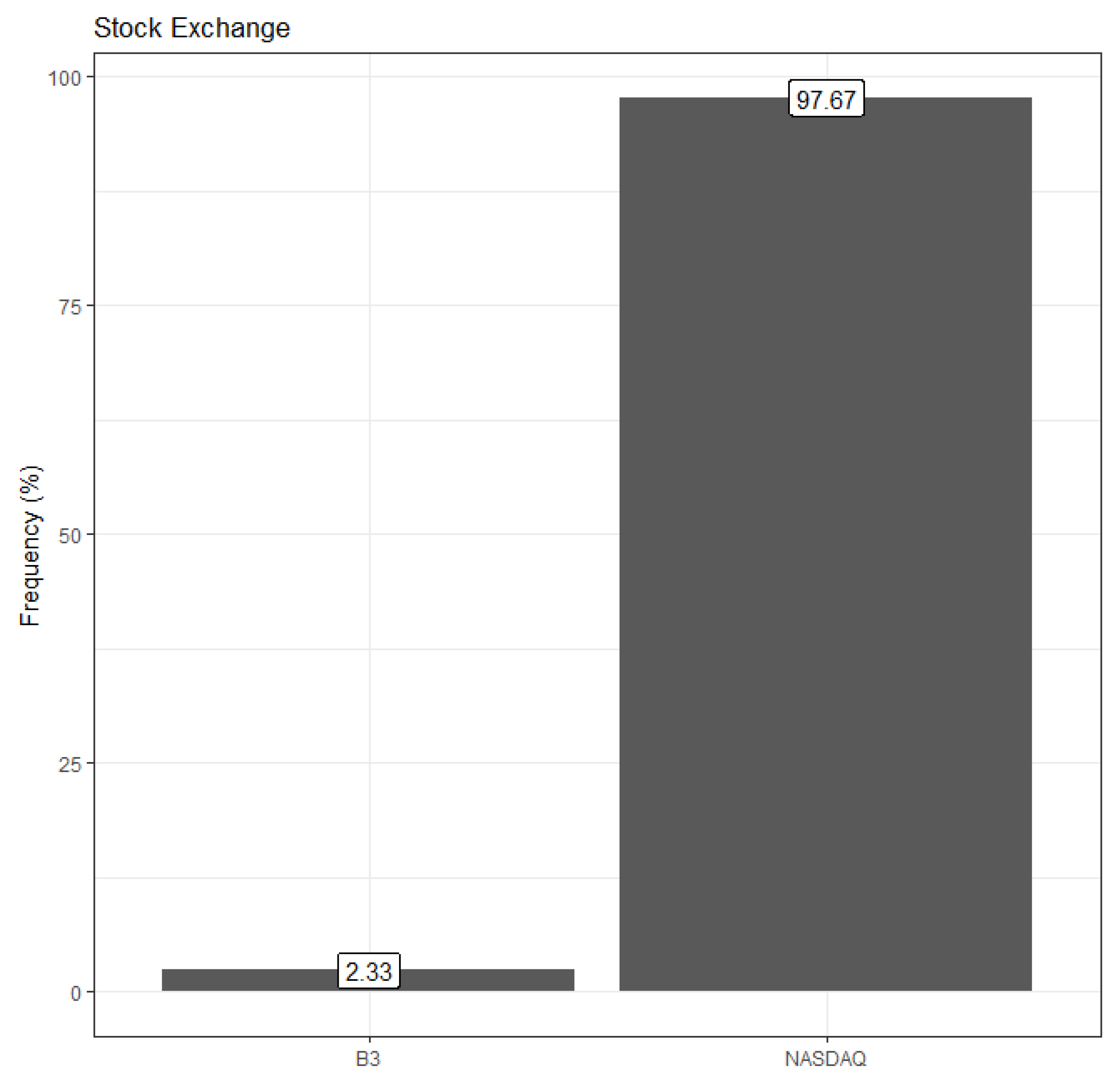

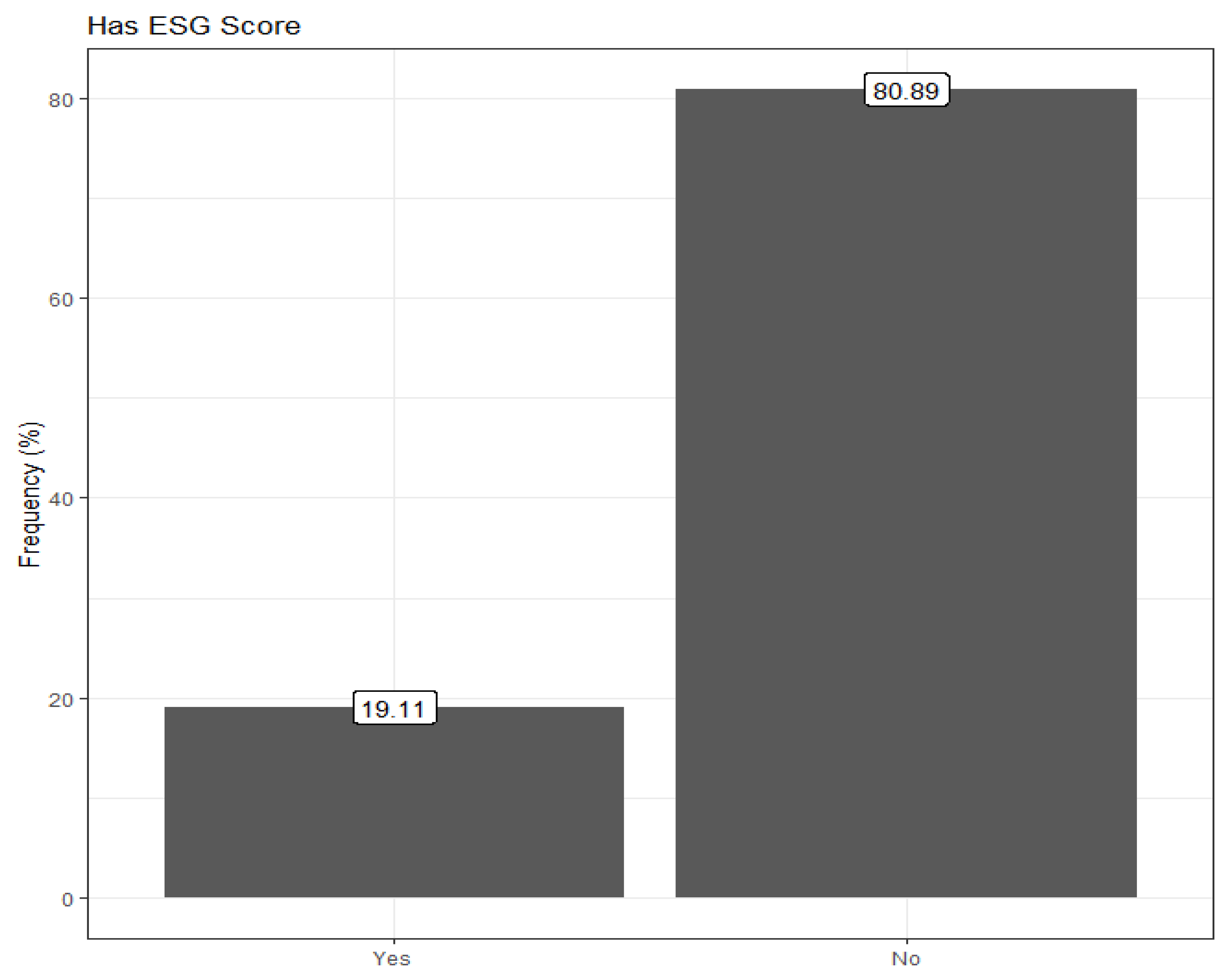

Table 3. Our final sample consists of 645 companies for 2018–2021, comprising 2580 observations. The data includes firms from twelve distinct sectors. Approximately 24% of the sample constitutes companies from the healthcare sector, while 21.7% are from the technology sector, 13.7% are from the consumer cyclical sector, and 13.19% are from the industrial sector. Overall, 84.81% of the firms in our sample are located in the United States, even though we have observations from 24 distinct countries. Moreover, 97.67% of the firms are listed on NASDAQ. Lastly, only 19.11% of the sample holds an ESG Risk Score, while the remaining observations do not have a score.

An isotonicity test was performed to assess the isotonic property assumption between the input, output, and carry-over variables, using Pearson’s correlation coefficient.

The results of the correlation analysis for the input, output, and carry-over variables are presented in

Table A1 in

Appendix A. Most of the input, output, and carry-over variables passed the isotonicity test due to their positive correlation. However, some variables showed a negative correlation. This negative correlation may exist because the companies in our sample are distributed across multiple sectors and, therefore, are exposed to different business models and financial structures.

For instance, net interest income is negatively correlated with every variable input and carry-over from the profit-sheet efficiency model. Net income is also negatively correlated with net loan, and operating revenue is negatively correlated with CAPEX. This suggests that net loans may jeopardize the company’s overall financial performance. Additionally, the negative correlation between net interest income and other variables suggests that higher debt and expenses are related to higher interest expenses. As negative values in the data were treated by adding the minimum value to each observation, a net interest income closer to zero represents higher interest expenses, while higher values for net interest income indicate higher interest income. Finally, the negative correlation between CAPEX and operating revenue implies that capital-intensive firms have lower revenue, which may also be due to the heterogeneity of the sample.

5. Empirical Results

In this section, we present the results obtained from two DEA models. The first model includes the full sample of companies in our dataset, while the second model includes only firms with ESG Risk Scores. We aim to examine the relationship between financial distress efficiency and ESG Risk Scores, which we expect to be negative. We discuss the results of the censored robust regression as well as the associations between the dependent variable (i.e., financial distress efficiency) and the contextual variables included in the statistical models.

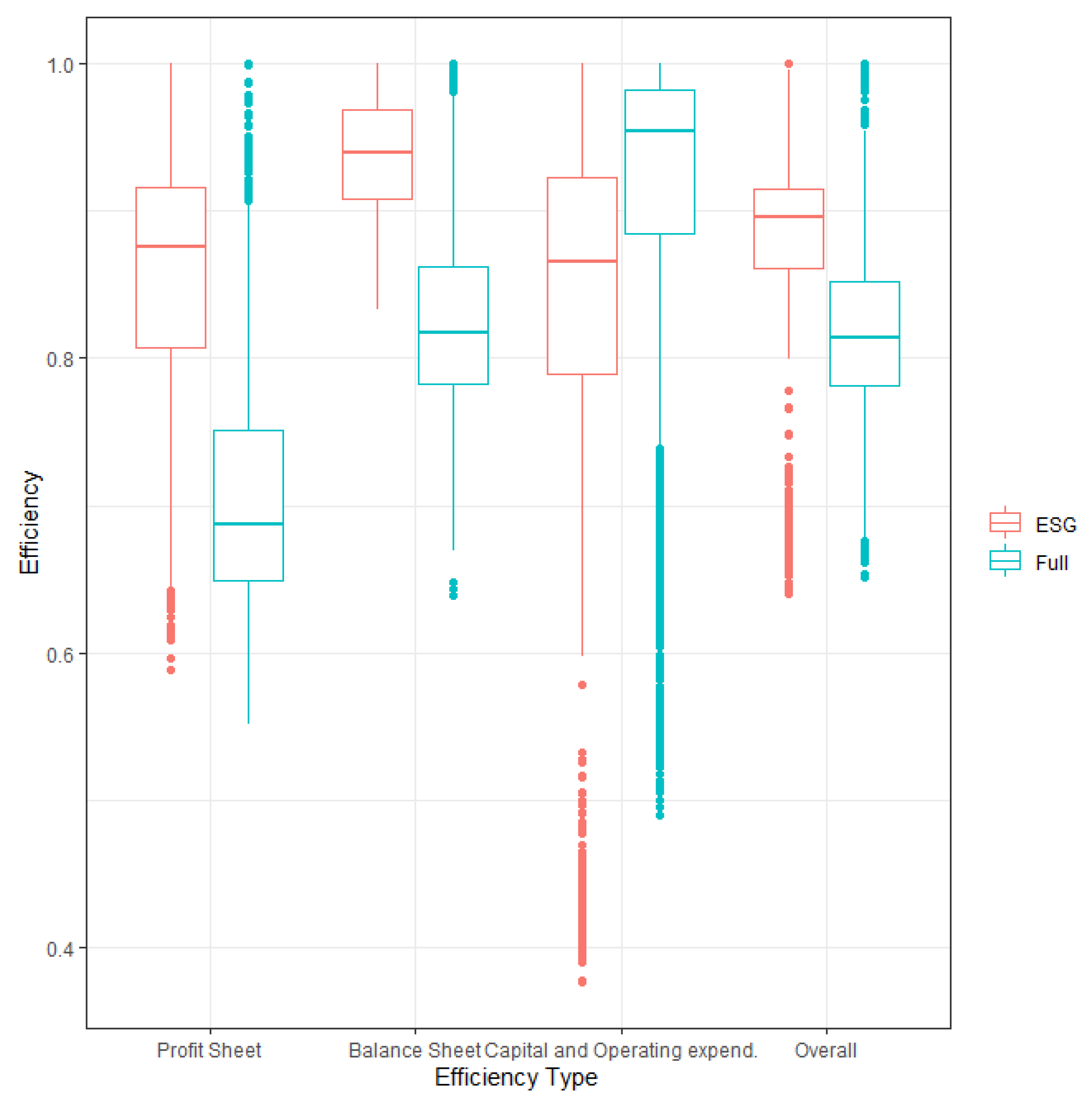

Figure 2 illustrates the efficiency score distributions for each of the sub-structures included in both models: (i) profit sheet (NE1), (ii) balance sheet (NE2), (iii) capital and operating expenditures (NE3). In summary, a higher financial-distress efficiency score indicates a more financially efficient firm, while a lower efficiency score indicates a higher likelihood of financial distress.

Figure 2 also demonstrates the overall efficiency score, which is the arithmetical average of the three efficiency scores. Generally, firms with ESG Risk Scores are more efficient than those without. This result holds for each sub-structure except for capital and operating expenditures. This outcome suggests that having an ESG Risk Score is associated with lower levels of financial distress, regardless of the rating attributed to the score.

In this section, we present the results from two DEA models. The first model includes the full sample of companies in our dataset, while the second model only includes firms with ESG Risk Scores. Our focus is on the relationship between financial distress efficiency and ESG Risk Scores, which is expected to be negative. Therefore, we discuss the outcomes of the censored robust regression, as well as the associations between the dependent variable (i.e., financial distress efficiency) and the contextual variables implemented in the statistical models.

Figure 2 illustrates the efficiency score distributions for each sub-structure included in both models: (i) profit sheet (NE1), (ii) balance sheet (NE2), (iii) capital and operating expenditures (NE3). In general, firms with ESG Risk Scores are more efficient than those without, and this result holds for each sub-structure except for capital and operating expenditures. This suggests that owning an ESG Risk Score is associated with lower levels of financial distress despite the rating attributed to the score.

When considering the full sample, the profit sheet scores are lower than the efficiency scores of other sub-structures. In addition, the balance-sheet efficiency scores are greater than the profit sheet scores but lower than the efficiency of capital and operating expenditures, which ranges from approximately 0.5 to 1. The overall efficiency scores for the three sub-structures express a midway behavior since they represent the average of the three sub-structures and indicate that, on average, firms with ESG Risk Scores are more efficient. Conversely, when we evaluate the ESG subset individually, the efficiency scores for the profit sheet are slightly larger than efficiency scores for capital and operating expenditures, while the balance-sheet efficiency scores are the highest.

These results imply that companies in the full sample are more efficient in turning capital and operating expenditures into operating revenue (i.e., NE3) than converting debt and expenses into income (i.e., profit sheet-NE1), and turning fixed assets and total liabilities into total equity (NE2). In other words, firms are less efficient at turning debt into profit, and fixed assets and liabilities into equity. This outcome might be due to the cumulative and flow characteristics of the variables within the profit sheet, while the variables from the balance sheet represent a static view of the company’s financial statements. Moreover, when pondering the efficiency scores for the ESG subset, we verify that the firms are more efficient in generating equity from fixed assets and total liabilities relative to the other sub-structures. For those reasons, managers should ponder the advantages of disclosing ESG Risk Scores and also exploit possible inefficiencies from the profit sheet. These results are also depicted in

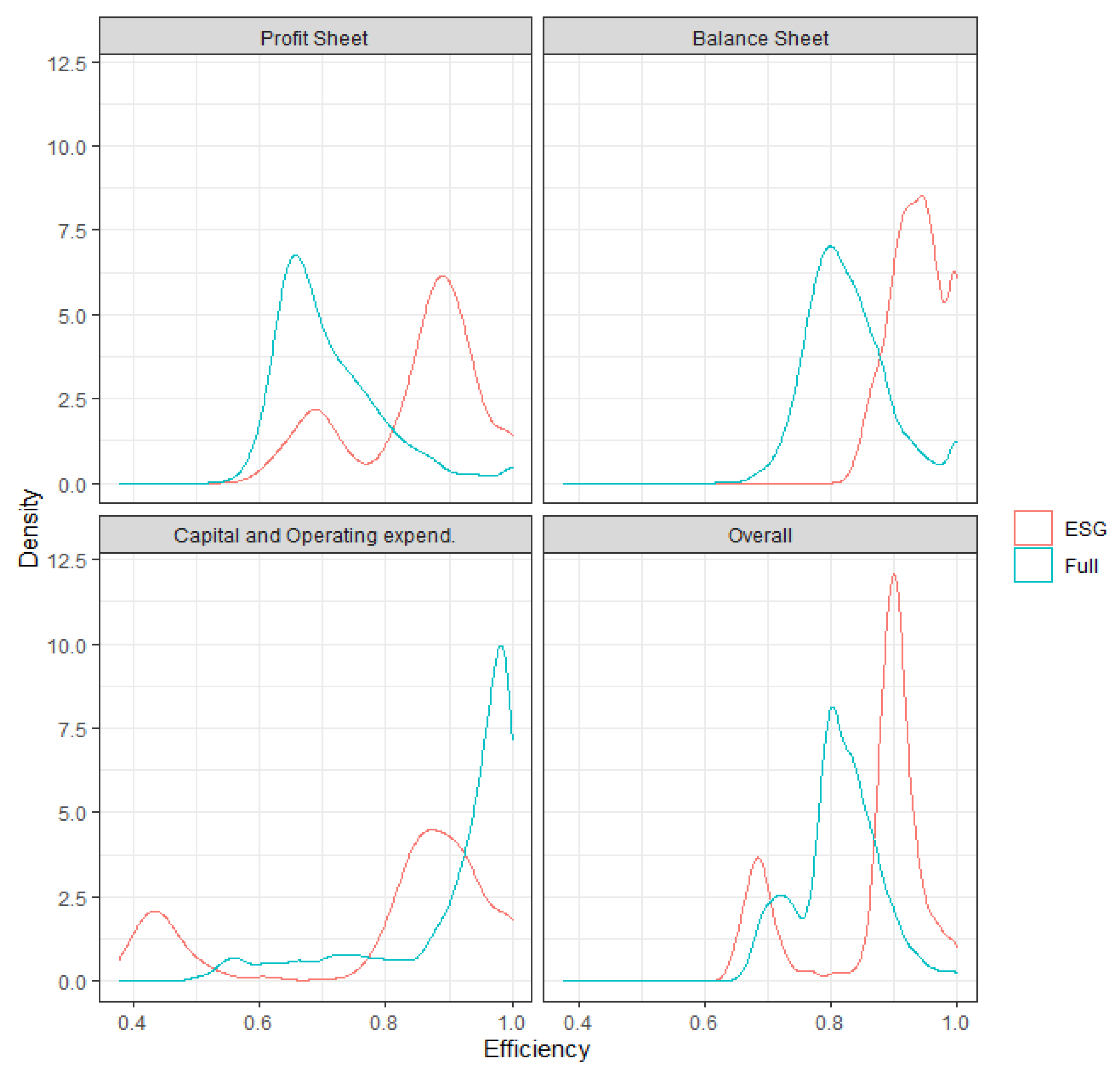

Figure 3.

To summarize, the firms in the study are more efficient in converting fixed assets and total liabilities into total equity, while firms that hold an ESG Risk Score are more efficient in generating operating revenue from capital and operating expenditures.

Figure 4 demonstrates how the efficiency scores are distributed over the 2018–2021 period, which clarifies possible trends. The first thing to note is that the three sub-structures suffered a decline in 2020 and 2021 compared to 2019. This suggests that the COVID-19 pandemic had a relevant impact on the financial efficiency of firms. Specifically, the firms’ financial health deteriorated throughout 2020 and 2021 due to the pandemic shock. Even though the firms became more efficient in converting profits from their debt and expenses in 2019, the profit sheet sub-structure degraded in the following years. These results also suggest that managers are becoming more inefficient in resource allocation since the firms’ debt, loans, and expenses are generating less income.

As shown by the balance-sheet efficiency score (NE2), firms have continued to skillfully manage their balance sheets and generate equity through fixed assets and liabilities, as this sub-structure has remained relatively stable over time. However, the capital-and-operating-expenditures efficiency score (NE3) experienced the largest decline in the period, indicating that firms have become less efficient in converting capital and operational expenditures into operating revenue. This suggests that companies are not making productive expenses when compared to previous years.

In contrast to

Figure 2,

Figure 3 shows that in 2021, for the full sample, firms were more efficient at generating equity from fixed assets and liabilities than at turning capital and operational expenditures into operating revenue.

Finally,

Figure 4 presents the density of the efficiency scores of all sub-structures for both datasets. Overall, the graph suggests that firms holding ESG Risk Scores are more financially efficient than those that do not possess such scores. Moreover, the CAPEX and OPEX sub-structure is the only one where companies are more financially efficient without owning an ESG Risk Score. These results are similar to those in

Figure 2.

As previously discussed, we performed non-linear stochastic optimization for robust regression, which optimizes the weights to minimize the variance of the combined residuals. Therefore, we implemented a censored robust regression, which includes the Tobit, Simplex, and Beta regressions, to verify the relationship between contextual variables and efficiency scores.

The results for the optimization are shown in

Figure 5 and suggest that the weights are fully driven by the Tobit regression when considering the full sample and by the Beta regression when computing the ESG sample. We can state that Tobit has a better performance for the full sample, and Beta has more power for the ESG sample. These results are crucial since the implementation of optimal values of w removes the bias from the estimations while also considering different distributional shapes.

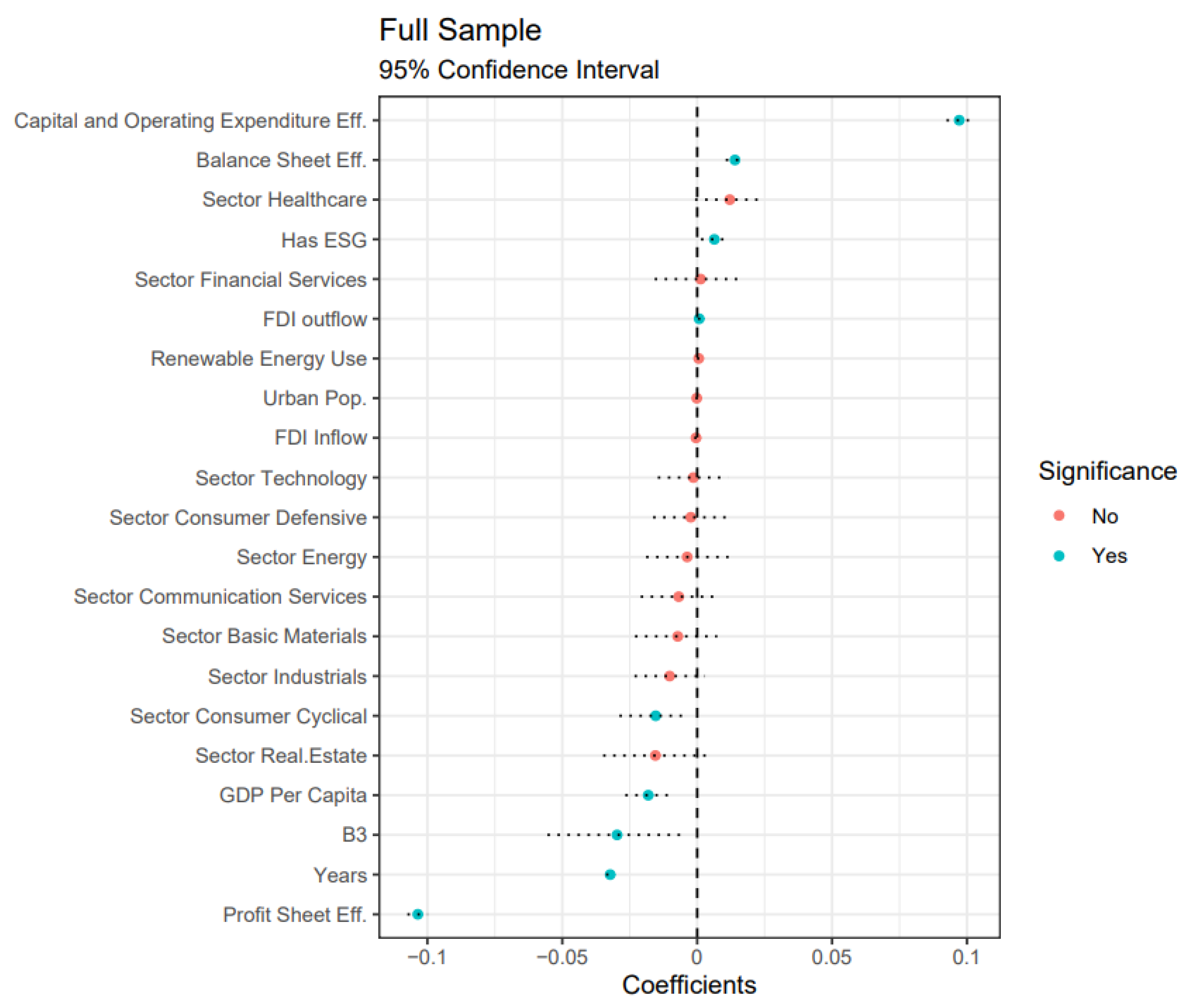

The results of the robust regression for the coefficients of the contextual variables and the intercept within each type of efficiency are shown in

Figure 6 and

Figure 7. It is important to note that variables with a red point should be interpreted as statistically non-significant, while those with a blue point are significant. The results of the first model, which includes the full sample, suggest that firms with an ESG Risk Score are less likely to experience financial distress, indicating that having an ESG score contributes positively to the overall financial efficiency of firms. Additionally, the categorical variable “Years” has a negative and significant coefficient, which may reflect the impact of the COVID-19 pandemic on the firms’ financial health. Furthermore, the firms listed on B3 are more likely to be financially distressed than those listed on NASDAQ, and firms in the consumer cyclical sector are also more likely to be in distress. Lastly, GDP per capita is negatively related to the financial-distress efficiency scores, while FDI Outflow is positively connected.

Our results support previous research by Friede et al. [

13], which indicated that there is a positive relationship between ESG and financial performance. Our findings also align with other studies that suggest a positive association between ESG disclosure and financial performance, such as those by Chen and Xie [

9], Bruna et al. [

10], and Alareeni and Hamdan [

11].

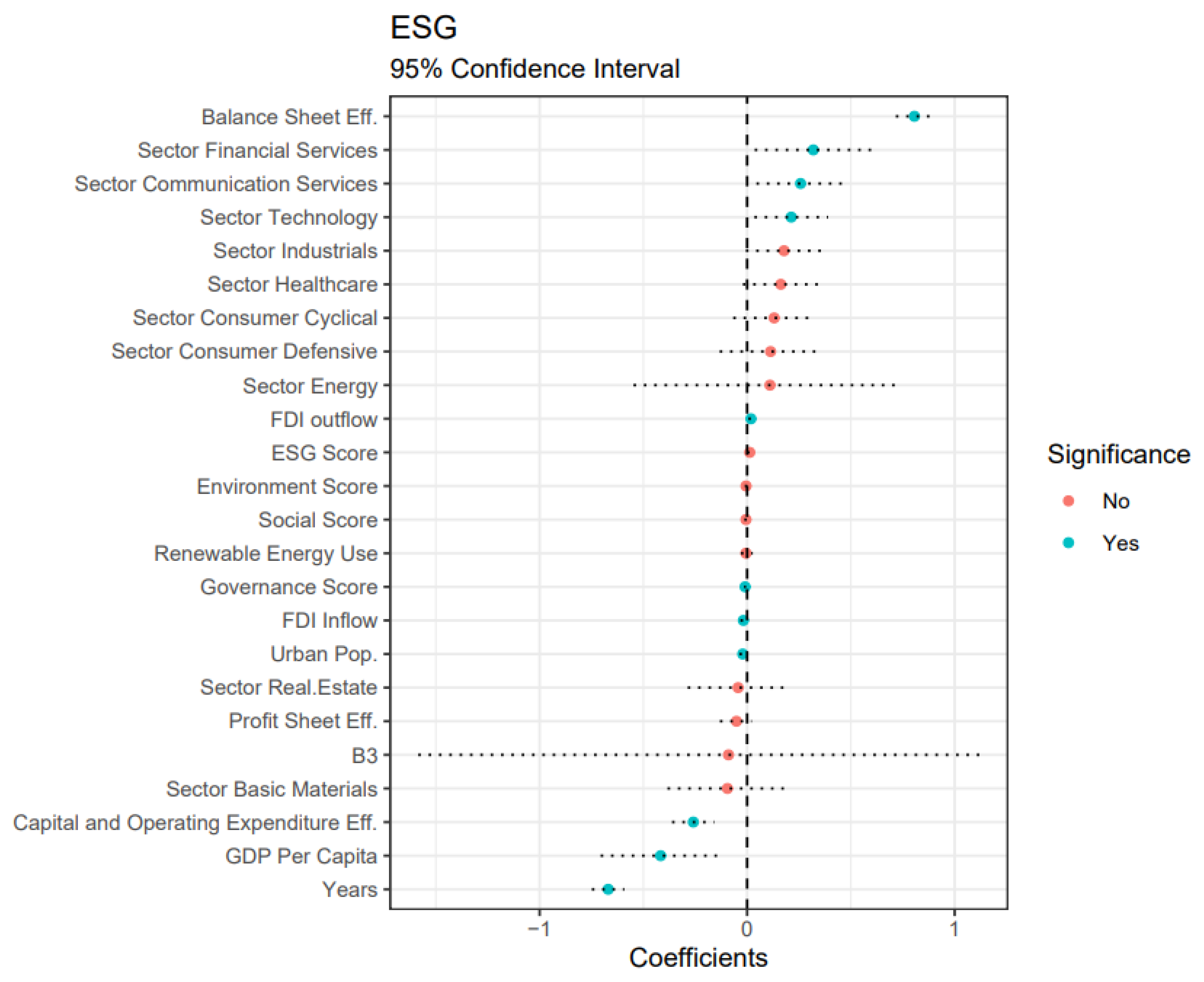

The results of the robust regression regarding the ESG sample are illustrated in

Figure 7. Firstly, the ESG Risk Score, Environment Score, and Social Score are statistically non-significant. However, the Governance Score has a negative and significant association with financial efficiency, as expected. In other words, we can state that the lower the Governance Score, the more prone a firm is to be in distress. To summarize, the Governance Score is the only variable that affects financial distress efficiency and must be carefully monitored by managers, investors, policymakers, and stakeholders.

In addition, the variable Years is significant and negative, which implies that firms are more prone to be in distress over time, and this might be an effect of COVID-19. Firms from sectors such as financial services, communication services, and technology are less likely to be in financial distress, while other sectors have non-significant coefficients. Finally, the variable GDP per capita has a negative and significant association with financial efficiency, which represents an unexpected result.

Additionally,

Table 4 illustrates the results of the coefficients and whether their differences are statistically significant. We employed the Wilcoxon Test, a non-parametric method, to compare two paired groups. The results below reveal that the differences in categorical variable coefficients across the two models (i.e., full sample and ESG sample) are not statistically significant. Thus, the outcomes imply that being listed on B3 does not affect financial distress efficiency. This also holds for other categorical variables such as FDI inflow and outflow, GDP per capita, specific sectors, Urban Population, and Years.

Overall, this subsection demonstrates the outcomes of our empirical analysis and provides significant results concerning the association between financial-distress efficiency scores and ESG Risk Scores.

6. Random Forest Results

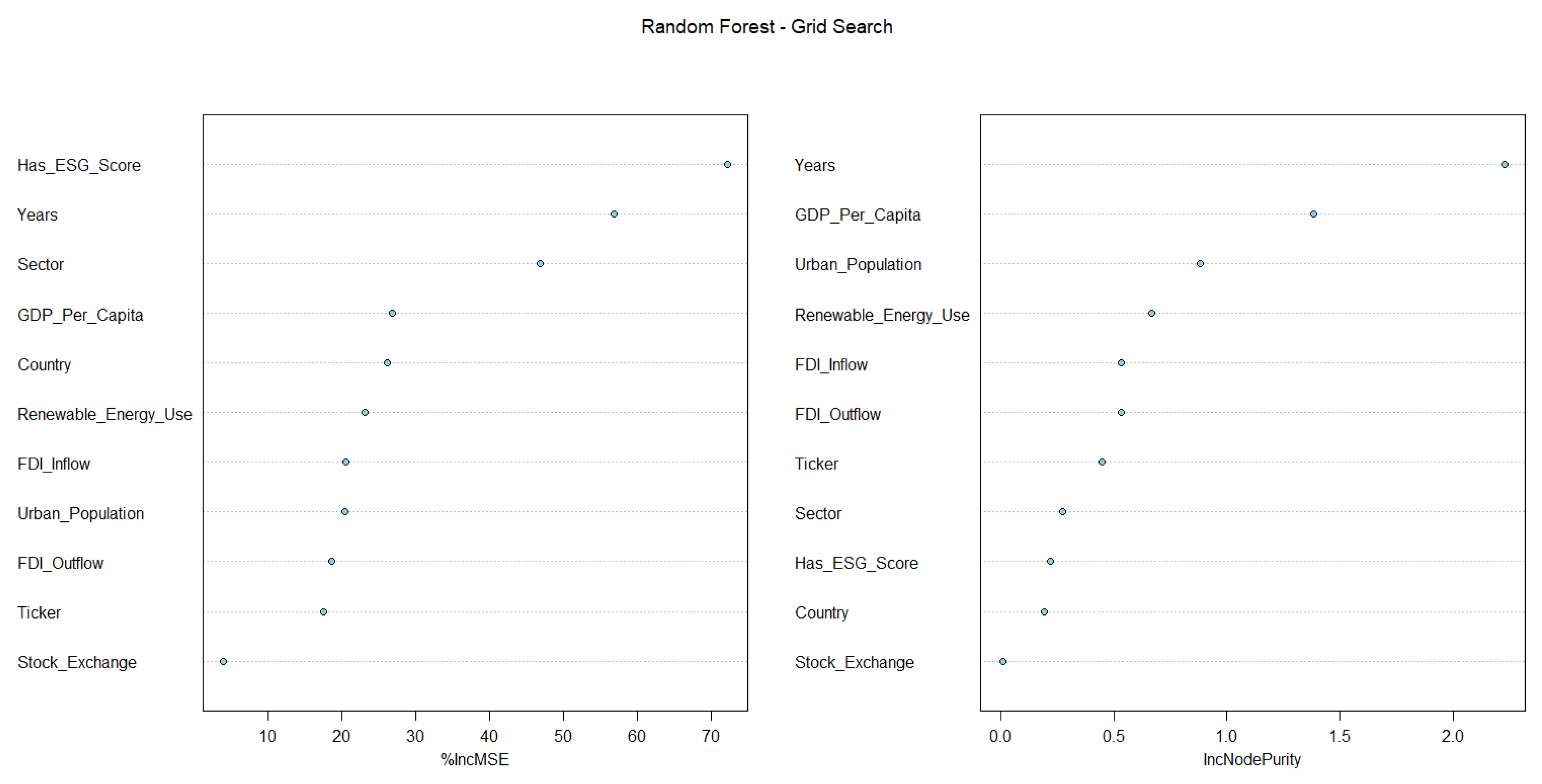

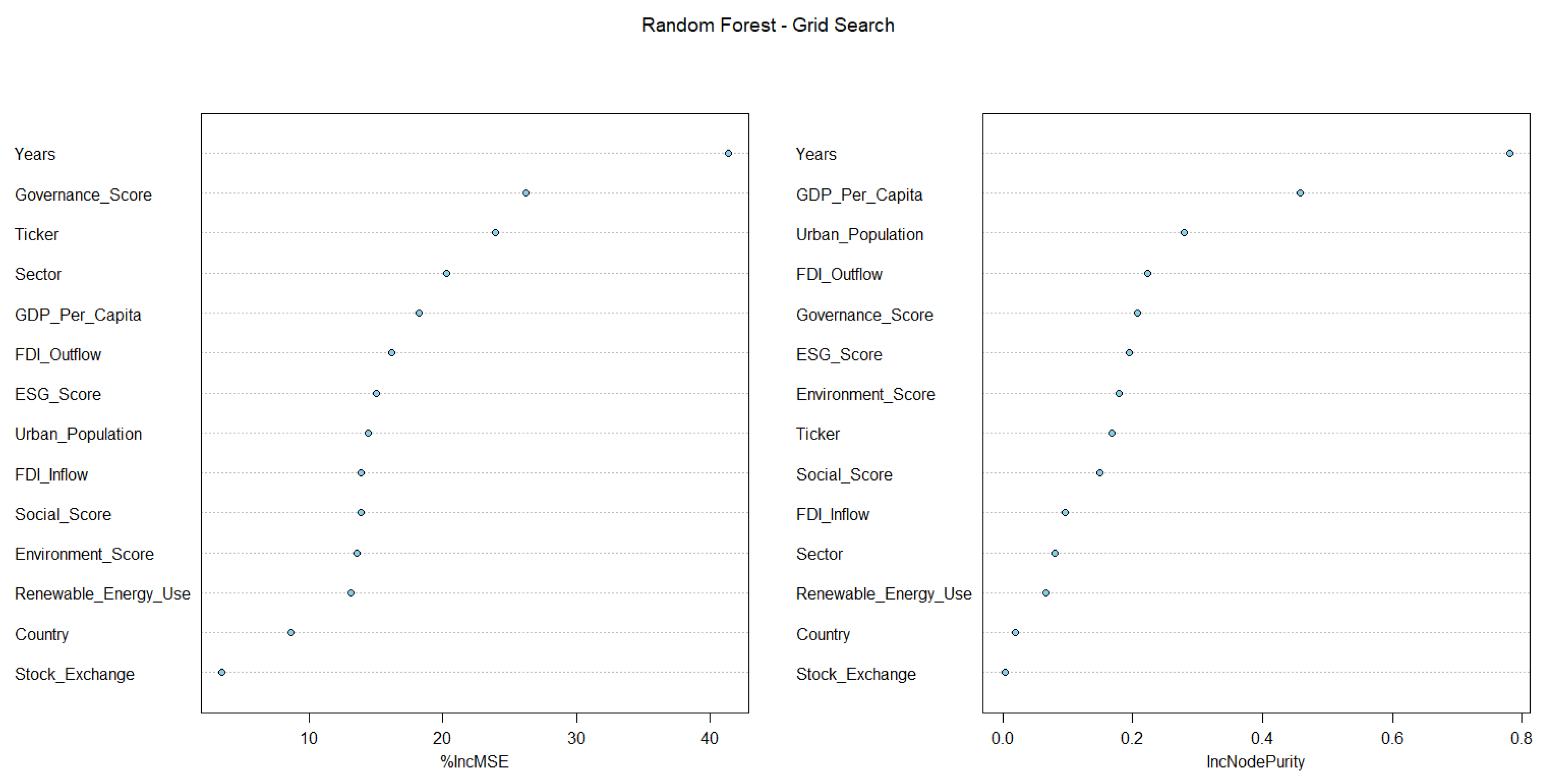

The graphs below illustrate the results of the random forest in relation to the increase in node purity and the mean decrease accuracy. The increase in node purity is calculated based on the reduction in the sum of squared errors whenever a variable is chosen to split, and is measured through the Gini index. The mean decrease accuracy, on the other hand, demonstrates how much the model accuracy declines if we eliminate a variable. In general, the higher the value of both indicators, the more relevant the variable is in our model.

Figure 8 presents the random forest results for the Full Sample. This model has a mean of squared residuals of 0.0014 and explains 64.72% of the variance. Therefore, the results suggest that having an ESG Risk Score heavily influences a firm’s financial distress efficiency, which is demonstrated by the mean decrease accuracy. Additionally, the variable Years once again has significant importance concerning financial distress efficiency, indicating the potential impact of the COVID-19 pandemic on a firm’s financial health. Other contextual variables, such as the firm’s sector, GDP per capita, Urban Population, and Renewable Energy Use, are also relevant to the model. However, the variable Stock Exchange has little effect on our empirical results.

In addition,

Figure 9 illustrates the random forest results considering the ESG Sample—i.e., only the firms that hold an ESG Risk Score rating. The results point out that the variable Years impacts financial distress efficiency, which supports the previous outcomes. In addition, the variable Governance Score is relevant considering both indicators, which also supports the robust regression results. Finally, the model explains 70.46% of its variance and has a mean of squared residuals of 0.0018.

To summarize, this subsection presents the results of our random forest analysis, which mainly supports the outcomes of our previous empirical analysis.

7. Final Remarks

In sum, this study investigated financial distress efficiency by considering a dataset of public companies around the globe implementing a Dynamic Network DEA model consisting of three distinct sub-structures which encompass different accounting and financial indicators: (i) profit sheet, (ii) balance sheet, (iii) capital and operating expenditures. The second stage of our empirical analysis comprises a non-linear stochastic optimization model, denominated robust regression, which combines three types of regressions: Tobit, Simplex, and Beta. Generally, this model optimizes the weight value of the regressions and aims to minimize the variance of the combined residuals and improve the overall accuracy. Thus, we employ robust regression to verify the association between financial distress efficiency and ESG Risk Scores as well as other contextual variables. This research, thereupon, delivers an additional contribution to both the financial distress and ESG literature, while also adding to the overall efficiency literature. Overall, this is the first study that investigates the connection between financial distress efficiency and ESG using a two-stage procedure and implementing both the Dynamic Network DEA and robust regression.

The preliminary results imply that holding an ESG Risk Score rating improves financial efficiency. Additionally, the companies that own a score are faster in asset creation and equity generation (i.e., balance sheet efficiency) and exhibit greater efficiency in converting debt and expenses into income (i.e., profit sheet efficiency). However, the firms that possess an ESG Risk Score are not more efficient in generating operating revenue from CAPEX and OPEX (i.e., capital-and-operating-expenditures efficiency).

Our results mainly suggest that the companies that own an ESG Risk Score are less prone to be in financial distress, despite the rating’s value. Therefore, the firms that have ESG Risk Scores are more financially efficient. In addition, the censored robust regression results indicate that Governance Score is the only statistically significant rating and has an inverse relationship with financial distress efficiency. Thus, the lower the Governance Score, the more financially efficient the firm is. The Governance Score is the only rating that influences financial efficiency, which implies that managers, investors, and regulators should closely track this rating. Additionally, the firm’s management, policymakers, and stakeholders might emphasize the governance aspects regarding business ethics, transparency, data security, compliance, and enterprise risk management over the environmental and social elements.

On top of that, the exogenous variables also have a significant association with financial distress efficiency. For instance, firms from the financial services, communication services, and technology sectors are more likely to be financially efficient relative to firms from other sectors. Conversely, a country’s GDP per capita is inversely related to a firm’s financial distress efficiency. These results are also supported by our random forest analysis, which indicates the disclosure of ESG Risk Score is relevant for financial-distress efficiency scores. Additionally, the Governance Score is crucial for financial efficiency, which opens a pathway for further studies. Future research, therefore, should intend to deeply understand the impact of Governance Scores on corporate financial and operational performance.

Furthermore, it is essential to consider the influence of the COVID-19 pandemic on our results, as the financial health of firms has greatly deteriorated since the beginning of 2020. Additional studies could also explore the results of our research design in other locations, since approximately 85% of our sample consists of North American firms. Thus, similar studies could be developed primarily considering European, Asian, or Latin American companies to assess how ESG Risk Scores and financial distress efficiency are connected. Moreover, another avenue for future research could be the application of methods that overcome the endogeneity issues.

Therefore, to compute the financial-distress efficiency scores, stakeholders, policymakers, and regulators should highlight the macro- and socio-economic variables, as well as the firm-level indicators originating from the profit sheet, balance sheet, and capital and operating expenditures. One should also contemplate the industry-specific factors, which might also impact efficiency scores since financial performance varies across sectors. For instance, firms from the financial services, communication services, and technology sectors are more financially efficient. Thus, policymakers and managers should explore and share the best practices of those sectors, as well as introduce tax incentives and further subsidies into other sectors to enhance financial efficiency.

The calculation of financial-distress efficiency scores is paramount for policymakers and regulators due to several factors, such as credit accessibility, collateral and covenant decisions, possible bailouts, and the potential bankruptcy of companies. In addition, the assessment of financial-distress efficiency levels may be pivotal for developing a shield against firm-specific financial crises, as well as predicting and establishing solutions for cases of financial health deterioration, which requires a greater understanding of a firm’s financial performance and distress determinants.

Likewise, our results inform stakeholders, policymakers, and regulators concerning ESG. Firstly, owning an ESG Risk Score is related to greater financial health, which should be perceived by managers and regulators. Secondly, corporate governance seems to be the only rating that affects financial-distress efficiency scores, and, consequently, should be closely followed by stakeholders. Finally, investors should also consider sector-level information when making decisions since our results suggest that companies from specific sectors (e.g., financial services, communication services, and technology) are less prone to becoming financially distressed.

Our current paper can be generalized from the following perspectives. Firstly, in terms of corporate performance in general, and more specifically, financial distress at the corporate level, in future studies, instead of using relevant accounting indicators for the measures, it would be useful to consider estimating financial distress by incorporating relevant production factors into a production process. For example, the estimation of efficiency from the financial-distress perspective can be considered for different economic sectors across various countries in the world. Secondly, the generalization of our current study also applies to our second-stage analysis using censored robust regression and random forest. In other words, for any future studies investigating corporate governance or ESG issues, efforts can be made to incorporate econometrics and machine learning techniques to replace the traditional second-stage econometric analysis conducted in previous literature studies. Our results also have a higher level of robustness and generalization due to the fact that we include a large number of companies in our dataset, and not only are the companies from different economic sectors, but they are also from different countries in the world. However, one of the limitations that affects the generalization of our results lies in the fact that we have a relatively short examined period, and the majority of the companies in the sample are from the United States. Therefore, future studies can further check the robustness of the results by increasing the length of the examined period and improving the dataset by significantly increasing the number of countries outside the United States.

Our results generate important theoretical and practical implications. From a theoretical standpoint, the results provide evidence for the growing body of research suggesting that ESG considerations can impact a firm’s financial performance. This aligns with the stakeholder theory, which posits that firms should be accountable not only to their shareholders but also to other stakeholders such as employees, customers, and the environment. Moreover, it supports the notion that ESG metrics may provide valuable information for investors and other stakeholders, and that financial performance and sustainability are not necessarily in opposition. Furthermore, the results support the idea that good corporate governance is essential for achieving better financial outcomes. Good governance practices, such as transparency, accountability, and ethical behavior, can help to build trust and confidence among stakeholders, which can ultimately lead to greater financial efficiency. Conversely, weaker governance practices may lead to increased risk-taking behavior, which can ultimately result in lower financial efficiency.

From a practical standpoint, the results suggest that companies that prioritize ESG may enjoy better financial outcomes. For example, such companies may be more attractive to investors who are increasingly interested in investing in sustainable businesses. Additionally, by addressing environmental and social issues, companies may reduce risks and costs, which could ultimately improve their bottom line. The results also suggest that companies should prioritize good governance practices to achieve better financial outcomes. This may involve implementing measures such as more transparent reporting practices, stronger board oversight, or more robust risk management strategies. Companies that neglect these aspects of their operations may ultimately experience lower financial efficiency and may be more vulnerable to financial distress. Furthermore, the results have important implications for investors and other stakeholders. A higher Governance Risk Score may indicate that a company is taking greater risks or engaging in questionable practices, which could ultimately lead to lower financial efficiency. As such, investors and other stakeholders should consider a company’s Governance Risk Score as part of their due diligence when assessing its financial health.