Abstract

Investigating the essential impact of the cryptocurrency market on carbon emissions is significant for the U.S. to realize carbon neutrality. This exploration employs low-frequency vector auto-regression (LF-VAR) and mixed-frequency VAR (MF-VAR) models to capture the complicated interrelationship between cryptocurrency policy uncertainty (CPU) and carbon emission (CE) and to answer the question of whether cryptocurrency policy uncertainty could facilitate U.S. carbon neutrality. By comparison, the MF-VAR model possesses a higher explanatory power than the LF-VAR model; the former’s impulse response indicates a negative CPU effect on CE, suggesting that cryptocurrency policy uncertainty is a promoter for the U.S. to realize the goal of carbon neutrality. In turn, CE positively impacts CPU, revealing that mass carbon emissions would raise public and national concerns about the environmental damages caused by cryptocurrency transactions and mining. Furthermore, CPU also has a mediation effect on CE; that is, CPU could affect CE through the oil price (OP). In the context of a more uncertain cryptocurrency market, valuable insights for the U.S. could be offered to realize carbon neutrality by reducing the traditional energy consumption and carbon emissions of cryptocurrency trading and mining.

1. Introduction

The study aims to probe the conduction mechanism between cryptocurrency policy uncertainty (CPU) and carbon emission (CE) and also answer the question of whether cryptocurrency policy uncertainty could facilitate the target of U.S. carbon neutrality. The cryptocurrency (e.g., Bitcoin, Ethereum, Ripple, Litecoin or Tether) is a digital currency issued by a decentralized entity that is not controlled or regulated by any central or private bank [1]. Basically, it uses blockchain technology to provide fast transfers precisely anywhere around the world and minimize any fees or commissions paid [2]. However, cryptocurrency mining and trading might negatively impact the environment. On the one hand, cryptocurrency mining verifies blockchain transactions and creates new cryptocurrency coins [3]. This process requires considerable computing resources, significantly increasing electricity consumption and greenhouse gas emissions [4,5]. On the other hand, cryptocurrency transactions also require vast amounts of electricity, threatening the environment and raising carbon emissions [6,7]. Further, cryptocurrency policy uncertainty means that the policies of trading platforms and governments towards cryptocurrency are volatile [8]; this is the uncertainty caused by the authority’s failure to clarify the direction and intensity of cryptocurrency policy expectations, implementation and stance changes, which may exert specific influences on carbon emissions. Specifically, this uncertainty may reduce the market’s willingness to trade and mine cryptocurrency [9] to avert possible losses and risks. In that case, the electricity consumption will decrease correspondingly, causing CE to fall. In addition, high CPU may be caused by some bans, directly giving an impetus towards carbon neutrality. For instance, China’s bans on bitcoin transactions and mining undoubtedly increase CPU. They also provide the benefit of controlling and reducing carbon emissions since over 65% of the world’s bitcoin miners are from China [2]. But high CPU might also be stimulated by some incidents that support the development of the cryptocurrency market, such as the government-level recognition of cryptocurrency, raising the enthusiasm for transactions and mining, which pushes CE upward. Thereupon, cryptocurrency policy uncertainty has an intimate relationship with carbon neutrality, and this is an important topic that has not been comprehensively dissected. By analyzing this subject, we could assist countries or regions in facilitating carbon neutrality by decreasing the conventional energy consumption and carbon emissions of cryptocurrency transactions and mining.

The U.S., the largest cumulative carbon emitter worldwide, has released over 509 billion tons of greenhouse gas from 1850 to 2021 (the second is China, which only has emitted 288.4 billion tons). After that, the U.S. makes up 20.3% of the total CE worldwide and contributes to 0.2 °C of global warming. Faced with such a severe climate situation, the U.S. has begun to develop policies and measures to alleviate climate problems and reduce CE [10,11] and proposed that it will reduce greenhouse gas emissions by 50% from 2005 levels by 2030 and realize carbon neutrality by 2050 [12,13]. Carbon neutrality means that carbon emissions (the greenhouse gases produced by industrial and agricultural production and transportation) equal carbon uptakes (the total amount of greenhouse gases absorbed by plants). The progress towards this target may be related to the cryptocurrency market [4,5,6,7] since there is a close relation between cryptocurrency policy uncertainty and carbon neutrality according to the above discussions. The U.S. is one of the fastest-growing countries in blockchain technology and one of the most important territories in the crypto industry [14]. Taking bitcoin as an example, the U.S. share of global computing power (the computing power needed to mine bitcoin) rose from 17% in April 2021 to 35% in August 2021, which makes the U.S. the world’s largest source of bitcoin mining activity. After that, high CPU might be accompanied by the volatile cryptocurrency market, which exerts obvious effects on CE and the progress of U.S. carbon neutrality. However, no studies have thoroughly explored the connection between cryptocurrency policy uncertainty and carbon neutrality in the U.S. The extant literature also ignores the intrinsic feature of this interaction. Thereupon, this exploration attempts to fill these gaps.

There exist three innovations in this exploration. To begin with, the existing literature primarily pays attention to the connection between cryptocurrency and energy [11,15], the effect of cryptocurrency mining and trading on the environment [16,17], and the interaction between cryptocurrency and carbon markets [18,19,20]. However, no investigations probe the cryptocurrency market and carbon emissions from a novel perspective of cryptocurrency policy uncertainty. Hence, this exploration is a groundbreaking work to answer the question of whether cryptocurrency policy uncertainty could facilitate U.S. carbon neutrality. Secondly, the extant efforts of the cryptocurrency market primarily apply the cryptocurrency price [1] or trading volume [6] as a representation, but this measurement is one-sided. This exploration aims to cope with this problem and uses the cryptocurrency policy uncertainty index to reflect the cryptocurrency market [8,9], an innovation among the existing studies. The empirical conclusion suggests that CPU has negative effects on CE, which indicates that cryptocurrency policy uncertainty could be viewed as a facilitator to achieving the target of U.S. carbon neutrality. Based on this conclusion, we could put forward meaningful insights for the U.S. to realize carbon neutrality by reducing the conventional energy consumption and carbon emissions of cryptocurrency trading and mining. Thirdly, since CPU is weekly data and CE is monthly data, the previous studies usually aggregate or average the high-frequency sequence to the low one, such as by using a low-frequency vector auto-regression (LF-VAR) model, which makes the statistical estimations inaccurate. Therefore, this exploration considers the mixed-frequency data and uses a mixed-frequency vector auto-regression (MF-VAR) model to obtain more information. This allowed us to identify the non-linear and complicated connection between CPU and CE.

This exploration is organized as follows: The extant literature is reviewed in Section 2. Section 3 reveals the methodology, including LF-VAR and MF-VAR models. The data are introduced in Section 4. Section 5 discusses the empirical outcomes. The conclusions and related suggestions are elaborated in Section 6.

2. Literature Review

Although no actual effort analyzes carbon neutrality in terms of CPU, the existing investigations pay more attention to the following three aspects. Some scholars draw various conclusions concerning the effect of cryptocurrency mining on the environment. Li et al. [21] highlight that Monero mining might consume 645.62 gigawatt-hours after its hard fork, contributing 19,120–19,420 tons of carbon emissions from April to December 2018. Corbet et al. [22] demonstrate that the electricity consumption of cryptocurrency transactions has increased considerably during recent periods, primarily caused by the growing difficulty in mining, and the total CE might exceed that of an individually developed economy. Vries and Stoll [23] propose a novel method to evaluate bitcoin’s e-waste, discovering that it will add up to 30.7 metric kilotons per year by May 2021. Howson and Vries [24] state that the digital infrastructure behind bitcoin (the most popular cryptocurrency) requires as much energy as the entire country of Thailand, which causes an aggravated climate crisis. Jana et al. [5] point out that bitcoin mining, hosted in a blockchain network, could consume considerable energy and generate e-waste at alarming rates. Sarkodie et al. [6] suggest that a rise in bitcoin trading volume spurs the carbon and energy footprint by 24% in the long term, while a dynamic impact promotes it by nearly 50%. Tee et al. [25] underline that economic policy uncertainty has a positive relationship with the carbon footprint, and this conclusion is suitable for the total, direct and indirect carbon emission measurements. Kohli et al. [16] reveal that as of July 2021, bitcoin’s energy consumption is equivalent to that of countries such as Sweden and Thailand; it emits 64.18 million tons of carbon dioxide, and this emission is close to that of Greece and Oman. Zhang et al. [17] evidence that there is a significant Granger causality between the energy usage of bitcoin and CE, and the hash rate passes the most obvious net spillover effect to CE and bitcoin electricity consumption. However, the above view could not always be supported. Vranken [26] underlines that since there is a given amount of bitcoin, its growing popularity makes the competitors adopt new technologies to boost their profits at the lowest cost, which is beneficial to decrease the concerns about sustainability. Baur and Oll [4] ascertain that adding bitcoin into a diversified equity portfolio could improve its risk–return relation and decrease its aggregate carbon emission.

Some scholars explore the connection between cryptocurrency and energy. Su et al. [1] find that bitcoin and blockchain technology are the critical drivers of the Fourth Industrial Revolution, and the branches of the technology are rapidly spreading to other areas such as the oil market. Chitkasame et al. [27] point out a significant bidirectional causal relation between renewable energy consumption and bitcoin activity in low and high energy consumption regimes, highlighting that bitcoin’s action can not be ignored in preparing the energy policy. Ghabri et al. [28] present that bitcoin futures and stablecoins lead West Texas Intermediate (WTI) and Brent crude oil prices. Ethereum, Litecoin and Ripple preserve their position as leaders of WTI crude oil prices. Ghosh and Bouri [29] find that the bitcoin mining process possesses a feature of being energy-intensive, which could hinder the much-desired ecological balance. Lu et al. [30] investigate the dynamic spillover effect among cryptocurrency, clean energy and oil during the coronavirus disease 2019 (COVID-19) pandemic, and show that the former is a net transmitter of spillover while the latter two are the net receivers. Meiryani et al. [31] show that global prices of energy sector commodities (mainly crude oil and natural gas) positively affect the bitcoin price movement. Yuan et al. [11] employ quantile connectedness to discuss the whole situation and dynamic evolution of information spillovers in the bitcoin market and discover that the hash rate and electricity demand are the main sources of risks. Le [15] indicates that the dynamic connectedness between crypto and energy volatilities is about 25% in the short run and 9% in the long run, the uncertain incidents (e.g., the COVID-19 pandemic and the Russo-Ukrainian war) exert specific impacts on the crypto and renewable energy volatilities. Salisu et al. [32] evidence that an increase in the oil price might be inclined to raise the costs of producing bitcoin, which is a benefit that lowers its return and then reduces its trading and volatility.

Other scholars focus on the interaction between cryptocurrency and carbon markets, mainly from the investment perspective. Yang and Hamori [18] suggest that the European carbon market could be considered a safe haven or a hedge to avoid the cryptocurrency market, but this quality could not be shown in the Chinese carbon market. Chen and Xu [33] reveal that cryptocurrency possesses an extremely strong explanatory power for the carbon market and is also a favorite hedge for this market. Anwer et al. [20] prove that the environmentally sustainable and cryptocurrency indices show a common movement during the COVID-19 pandemic; both could be viewed as hedges against each other. But Pham et al. [19] indicate that carbon price is mainly independent of cryptocurrencies during periods of low volatility. In addition, Ghosh et al. [34] highlight that the carbon credit bubbles are social and fueled by the newfound interest in trading carbon credits, and pricing carbon is a crucial step in the transition to the future [35].

3. Methodology

3.1. The Low-Frequency Vector Auto-Regression Model

First, we construct the conventional low-frequency vector auto-regression (LF-VAR) model [36] as the following formula:

where CPUa,t and CEt refer to the monthly cryptocurrency policy uncertainty and carbon emission. The oil market has close relations with cryptocurrency and carbon emissions, which might impact the interrelationship between CPU and CE [2,10,11]. Thereupon, this exploration takes the oil price (OP) as control series, and Equation (1) can be rewritten as follows:

Then, we suppose that every sequence adequately obviously conforms to the covariance stationarity [37,38]. In addition, this exploration sets the lag length (k) as 4. Moreover, refers to the corresponding coefficient, where i, j = 1, 2 and 3 and k = 1, 2, 3 and 4. On the basis of Equation (2), CEt can be expressed as Equation (3).

where CPUa,t indicates a monthly sequence counted by averaging weekly CPU, which can be rewritten as CPUa,t = (CPU1t + CPU2t + CPU3t + CPU4t)/4. CPUit (i = 1, 2, 3 and 4) refers to the CPU at the i-th week of month t, and then Equation (3) can be further extended to the following formula. In Equation (4), CPUi,t−k (i and k = 1, 2, 3 and 4) exerts a homogeneous effect of on CEt.

3.2. The Mixed-Frequency Vector Auto-Regression Model

The LF-VAR method generally utilizes time-dependent summation to deal with different-frequency data. But Silvestrini and Veredas [39] ascertain that if high-frequency variables are forcibly aggregated or averaged (e.g., LF-VAR model), the statistical inference would be inaccurate due to the loss of information. The mixed-frequency vector auto-regression (MF-VAR) model, by contrast, possesses a unique advantage in making full use of mixed-frequency data information [40], which is beneficial to capture the heterogeneous effects of high-frequency sequences on low-frequency variables [36,37]. Thereby, applying the MF-VAR model that does not require any filtering program can acquire the influence of weekly CPU on monthly CE under the control of OP.

The MF-VAR model is a more efficient estimated technique than the conventional approaches of collecting all sequences into the lowest-frequency sampling [41]. This model is mainly developed to be used in small proportions of sampling frequency [42,43]. Hence, the MF-VAR model, which consists of weekly CPU and monthly CE and OP, can be developed as Equation (5).

where (i, j = 1, 2, 3, 4, 5 and 6, k = 1, 2, 3 and 4) is the coefficient matrix and (i = 1, 2, 3, 4, 5 and 6) is a disturbance term. The MF-VAR model can decrease the parameters’ number by fitting the function to a parameter of a high-frequency variable [38,41]. In the above formula, it can be observed that CPU1t, CPU2t, CPU3t and CPU4t are stacked up as one vector. Thus, in order to distinctly represent the interaction between cryptocurrency policy uncertainty and carbon emission, Equation (5) can be further expressed as the following formula:

where (j = 1, 2, 3, 4, 5 and 6, k = 1, 2, 3 and 4) can take various values from each other, and thus CPU1,t−k, CPU2,t−k, CPU3,t−k and CPU4,t−k are viewed to possess a heterogeneous effect on CEt. Following Wang et al. [37] and Hu et al. [38], we explicitly set the Cholesky order, which is CPUt–CEt–OPt in the LF-VAR model and CPU1t–CPU2t–CPU3t–CPU4t–CEt–OPt in the MF-VAR model.

There are many methods to deal with the mixed-frequency data of the MF-VAR model, such as the Kalman filtering approach, interpolation technique and Bayesian method in state space. Among them, the Bayesian method adopts an iterative technique to estimate the missing value, in order to make full use of the known sample information. Through using the Bayesian method, the loss of some information can be avoided, and the parameter estimation under the mode of full information can be carried out, which is helpful to improve the accuracy of the MF-VAR model.

4. Data

This exploration selects the weekly (428 weeks) and monthly (107 months) sequences of January 2014 to November 2022 to probe whether cryptocurrency policy uncertainty could facilitate U.S. carbon neutrality. In 2014, the Federal Election Committee (FEC) allowed political donations in Bitcoin for the first time, where the cap on individual contributions is set at USD 100, but there is no limit to the currency donations of Super Political Action Committees. This action dramatically changed the cryptocurrency policy, which inevitably raised its uncertainty. Since then, cryptocurrency policy has had more uncertainties, such as hacking incidents, the Ethereum blockchain project and China’s bans on bitcoin transactions and mining. This exploration chooses the weekly cryptocurrency policy uncertainty (CPU) index to reflect the situation of cryptocurrency policy, which can be taken from the authors’ website [8]. This index is counted by the following formula:

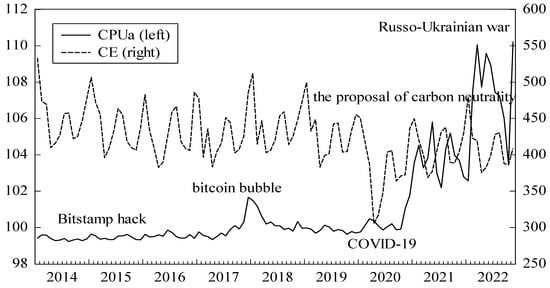

where Nt refers to the weekly observation of news articles on LexisNexis Business Database, which covers a wide variety of newspapers and news agencies, containing three groups about the uncertainty of cryptocurrency policy: uncertainty or uncertainty; Bitcoin, Ethereum, Ripple, Litecoin, Tether, cryptocurrency or cryptocurrencies; government, regulator or central bank. The Group Duplicate option is set to MODERATE to minimize duplicate outcomes. v indicates the average of these articles and points out the standard deviation. A higher CPU indicates there is a stronger uncertainty on cryptocurrency policy. In addition, we set CPU1, CPU2, CPU3 and CPU4 as CPU at the first, second, third and fourth week of each month, respectively, and CPUa is the average of CPU1, CPU2, CPU3 and CPU4. The transactions and mining of cryptocurrencies require considerable electricity, which may result in substantial carbon emissions. On 22 April 2021, Joseph R. Biden promised that the U.S. would expand the administration’s commitment to reduce greenhouse gas emissions by 50% from 2005 levels by 2030 and achieve carbon neutrality by 2050. Thereupon, there might be a close connection between cryptocurrency and carbon neutrality, and we choose monthly carbon emission (CE) in the U.S. to represent the progress of carbon neutrality [2], which can be taken from the Energy Information Administration (EIA). A higher CE means that the progress towards carbon neutrality has been hampered. Thus, we could recognize the interrelationship between CPU and CE and further probe whether cryptocurrency policy uncertainty can facilitate the target of U.S. carbon neutrality. Since CPU and CE are different-frequency data, the conventional LF-VAR model could not capture the whole information of mixed-frequency data. Then, this exploration applies the relatively advanced MF-VAR model that incorporates data of different frequencies into the same model to accurately identify the non-linear connection between CPU and CE. The trends of CPUa and CE are depicted in Figure 1.

Figure 1.

The trends of CPUa and CE.

As shown in Figure 1, CE moves in different directions from CPUa in most cases. For instance, COVID-19 increases CPUa from 99.759 in January 2020 to 100.481 in March 2020, while CE is in a downward trend from 450.192 to 387.613 million metric tons during the same period (decreasing by nearly 15%). In addition, CPUa reaches a relatively high level in May 2021 (105.806), but CE sharply decreases from 436.315 million metric tons in December 2020 to 377.241 million metric tons in May 2021, reducing by nearly 15%. With the outbreak of the Russo-Ukrainian war, CPUa rises to its highest level ever in March 2022 (110.057), while CE falls from 478.896 million metric tons in January 2021 to 419.241 million metric tons in March 2022. These cases indicate that cryptocurrency policy uncertainty might facilitate the target of U.S. carbon neutrality; however, this above view could not always be perceived. A notable example is that the bitcoin bubble in 2017 leads to an increase in CPUa (from 99.923 in October to 101.661 in December), and CE shows a similar trend that raises from 407.891 to 486.152 million metric tons during the same time. In addition, the oil market might be viewed as a safe haven to hedge against cryptocurrency policy uncertainty [1], and oil consumption and its price may have some influences on carbon emissions. The oil market could affect the interrelationship between CPU and CE. This exploration chooses the monthly Brent spot oil price (OP) to reflect the oil market, which is taken from the EIA. Based on the above discussions, the connection between CPU and CE is not linear but complex and influenced by OP.

According to Table 1, the averages of CPU1, CPU2, CPU3, CPU4, CPUa and CPU are 100.959, 101.046, 101.078, 101.103, 101.047 and 101.029, indicating that the whole performance of cryptocurrency policy in 2014–2022 is under relatively high uncertainty. In addition, the averages of CE and OP suggest that these two sequences are concentrated on 434.314 and 66.287 levels. The considerable difference between the maximum and minimum of CPU1, CPU2, CPU3, CPU4, CPUa, CPU, CE and OP reveals that these eight sequences fluctuate obviously. The skewness is negative in CE, pointing out that this time series obeys the left-skewed distribution, whereas CPU1, CPU2, CPU3, CPU4, CPUa, CPU and OP obey the right-skewed one. CPU1, CPU2, CPU3, CPU4, CPUa, CPU and CE possess the features of high peak and fat tail, while OP obeys the platykurtic distribution. Moreover, the Jarque–Bera test offers evidence that the original assumption of standard normal distribution in CPU1, CPU2, CPU3, CPU4, CPUa and CPU could be rejected at a 1% level; for OP, this hypothesis can be rejected at the significance level of 5%, but it should be accepted for CE.

Table 1.

Descriptive statistics for CPU1, CPU2, CPU3, CPU4, CPUa, CPU, CE and OP.

5. Empirical Results and Discussions

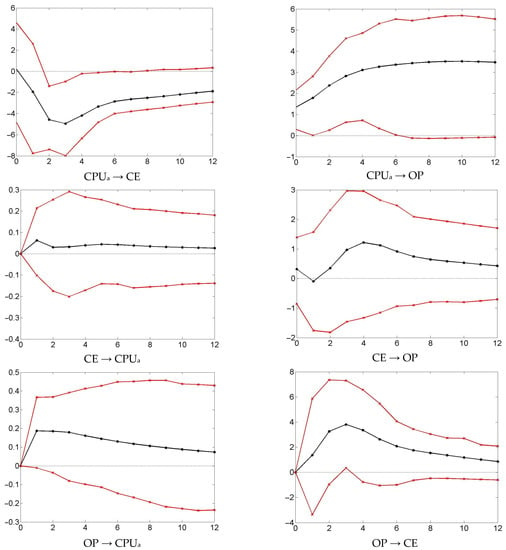

By applying the parameter bootstrapping of 10,000 iterations to all horizons (h = 0, 1, …, 12), we construct the LF-VAR model with CPUa and CE, and the low-frequency impulse response outcomes with the 95% confidence interval (solid red lines) are reported in Figure 2. It could be observed that CPUa negatively influences CE, indicating that high CPUa may decrease CE and then facilitate the progress of carbon neutrality. In turn, CE has a positive impact on CPUa, highlighting that high CE may cause uncertainties towards cryptocurrency policy. In addition, CPUa has a positive effect on OP, and OP also exerts a positive influence on CPUa, underlining that there is a positive connection between CPUa and OP. In addition, CE also has a positive interrelationship with OP.

Figure 2.

Impulse responses of the LF-VAR model. Notes: The black line is the fitting value, and the red lines refer to the 95% confidence interval.

Table 2 reveals the outcomes of prediction error variance decomposition of the LF-VAR method. In the short term (h = 4), the prediction error variance of CE could be explained 4.1% by CPUa, 2.3% by OP and 93.5% by itself; the prediction error variance of CPUa could be explained 0.2% by CE, 3.1% by OP and 96.7% by itself; the prediction error variance of OP could be explained 9.7% by CPUa, 0.6% by CE and 89.7% by itself. In the medium term (h = 8), the prediction error variance of CE could be explained 7.3% by CPUa, 4.2% by OP and 88.5% by itself; the prediction error variance of CPUa could be explained 0.2% by CE, 3.2% by OP and 96.6% by itself; the prediction error variance of OP could be explained 19.5% by CPUa, 1.7% by CE and 78.8% by itself. In the long term (h = 12), the prediction error variance of CE could be interpreted as 8.8% by CPUa, 4.6% by OP and 86.6% by itself; the prediction error variance of CPUa could be explained as 0.2% by CE, 2.9% by OP and 96.9% by itself; the prediction error variance of OP could be explained 28.1% by CPUa, 1.7% by CE and 70.2% by itself.

Table 2.

Prediction error variance decomposition of the LF-VAR model.

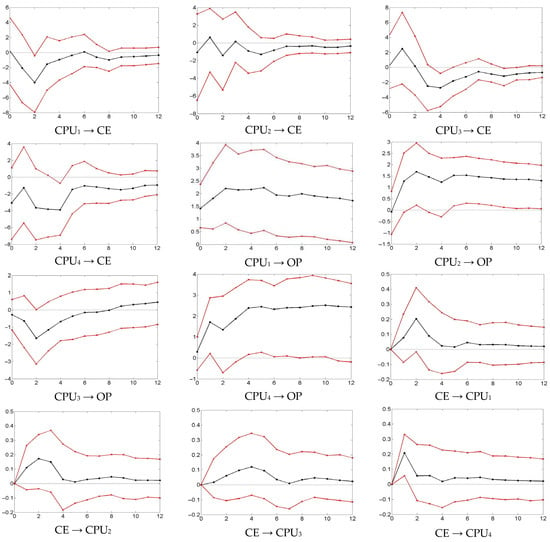

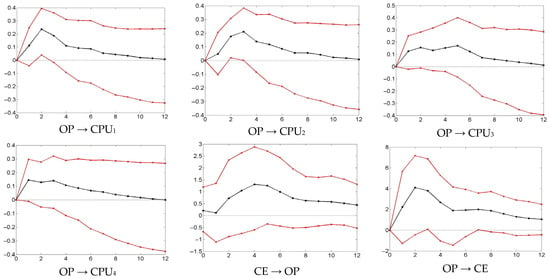

However, some information is lost when the weekly data (CPU) are averaged into the monthly sequence (CPUa) in the LF-VAR model, exhibiting a relatively weak explanatory power and even an inaccurate statistical inference [37,38,42,43]. In order to cope with this difficulty, this exploration employs the relatively advanced MF-VAR technique to reexamine the non-linear connection among the variables, and the outcomes of the MF-VAR method’s decomposition are reported in Table 3. From Table 3, we can perceive that CPU (CPU1 + CPU2 + CPU3 + CPU4) could account for 6.6% (short-run), 9.2% (medium-run) and 10% (long-run) of CE, which possesses a higher explanatory power than the LF-VAR model. A similar phenomenon can be observed in other sequences, further evidencing that the MF-VAR model could fully use mixed-frequency data information, which results in a more accurate conclusion. Thus, it is reasonable to use the MF-VAR technique to identify the complicated connection between CPU (weekly data) and CE (monthly data) under the control of OP (monthly data).

Table 3.

Prediction error variance decomposition of the MF-VAR model.

We concretely discuss the mixed-frequency impulse response outcomes with the 95% confidence interval (solid red lines) depicted in Figure 3. In most cases, CPUi (i = 1, 2, 3 and 4) exerts an adverse effect on CE, and the underlying causes can be demonstrated on two sides. On the one hand, a high CPU may decrease investors’ desire to hold cryptocurrencies since they intend to avoid possible risks and uncertainties [8,9]. After that, the transactions of cryptocurrencies would decline correspondingly, reducing electricity consumption and consequent carbon emissions in the U.S. [11]. For instance, the hackers breached the security of the Bitfinex exchange (one of the world’s largest bitcoin exchanges) in August 2016, and they initiated 2072 unauthorized transactions, resulting in the theft of nearly 120,000 bitcoins. Affected by this incident, the relevant trading platforms and governments have introduced policies to strengthen supervision, increasing CPU. The rise in CPU causes the demand for bitcoin to decrease, which is reflected in its price; the bitcoin price fell from USD 657.975 in July 2016 to USD 576.890 in August 2016. The reduction in demand and transactions for bitcoin decreases the amount of electricity used and greenhouse gases released [6,7], and thus there is a decline in CE. On the other hand, a high CPU may reduce the willingness to mine cryptocurrencies to avoid huge losses due to uncertainties. Depending on the efficiency of different mining machines, one bitcoin currently consumes 200,000 to 300,000 kilowatt-hours of electricity, which is equivalent to the annual power consumption of 66 to 100 homes. Thereupon, a reduction in cryptocurrency mining would inevitably lead to lower electricity consumption [4,5], which decreases CE correspondingly. For example, the bitcoin halves not only increase CPU but also lead to a bitcoin block reward halving, which means that the reward given to miners for verifying new blocks is reduced by 50% [44]. The cost for miners would increase since they need more computing power to obtain the same amount of bitcoins, which may cause some small-scale miners to exit the market [1]. After that, the market for bitcoin mining might shrink, further reducing electricity demand and carbon emissions.

Figure 3.

Impulse responses of the MF-VAR model. Notes: The black line is the fitting value, and the red lines refer to the 95% confidence interval.

In addition, high CPU may be caused by some restrictions that directly decrease CE. For instance, New York Governor Kathy Hochul signed a moratorium in 2022 on using fossil fuels to power bitcoin mining. This approved bill aims at bitcoin and other cryptocurrency mining enterprises that exploit cheap energy to mine digital assets, which causes CPU to increase. At the same time, the New York state plans to reduce carbon emissions by 80% through this bill, and CE would show a downward trend accordingly. Thus, we can conclude that cryptocurrency policy uncertainty can facilitate the progress of U.S. carbon neutrality. However, this opinion could not be held in a few cases, which are primarily reflected in the short-run CPU2 and CPU3. High CPU might also be caused by several events that support the development of the cryptocurrency market; for example, some governments have allowed cryptocurrency transactions or even accepted cryptocurrencies as legal tender [2]. After that, the growing popularity of cryptocurrencies sharply increases the enthusiasm for transactions and mining in the short term, which would be diminished since the public would be more rational in the medium and long term. Thus, there is a positive effect of CPU2 and CPU3 on CE in the short run. Another example is the bitcoin bubble in 2017, which caused a significant increase in CPU, and the bitcoin demand also increased obviously in the short term due to its soaring price, increasing CE. But after the bitcoin bubble burst, its demand and mining willingness dramatically decreased, which caused CE to fall accordingly in the medium and long term. Although CPU2 and CPU3 have a positive influence on CE in the short term, this effect is less than that of CPU1 and CPU4 (which is shown in Table 3). Thus, the impact of total CPU on CE is always negative, even in the short run.

Conversely, CE positively influences CPUi (i = 1, 2, 3 and 4), which could be interpreted as follows: High CE may raise public and national concerns about environmental issues, negatively affecting sustainable development. Then, in order to cope with this issue and achieve carbon neutrality, the U.S. might implement novel policies to reduce carbon emissions. Since the transactions and mining of cryptocurrency require large-scale electricity and then release massive greenhouse gas [4,5,6,7], decreasing cryptocurrencies’ trading and mining is an effective method. For instance, the Biden administration has released a report arguing that cryptocurrency mining, which uses considerable electricity and produces significant carbon emissions, could hamper the U.S. commitment to climate change. This report also suggests that if the environmental impacts of the cryptocurrency mining industry cannot be effectively mitigated, the White House or Congress may need to legislate to restrict or ban cryptocurrency mining.

Moreover, we discuss the mediation effect, that is, the impact of CPUi (i = 1, 2, 3 and 4) on CE via OP. Even if there is an adverse effect of CPU3 on OP (which is less than that of CPU2 and CPU4), the impact of total CPU on OP is positive according to Table 3, and the primary cause is that the oil market could be viewed as a safe haven to hedge against CPU. Specifically, high CPU could exacerbate market panic [8,9]; the public may be inclined to hold hedging assets such as oil-related products to avert possible risks in the cryptocurrency market [1]. Then, the oil demand would increase accordingly, which drives OP to increase. Further, there is a positive influence from OP to CE, and we could interpret it as follows: Oil is an essential source of energy for economic development, and a prosperous economy means more demand for oil and higher OP. Thereupon, high OP may be accompanied by the economic recovery or boom, and large oil consumption, such as the economic recovery in 2021, in which OP soared from USD 54.77 per barrel in January to USD 83.54 per barrel in October. The rising oil consumption inevitably pushes CE upward [2] and then impedes the progress of U.S. carbon neutrality.

All in all, by comparing the prediction error variance decomposition between LF-VAR and MF-VAR models, we discover that the latter possesses a higher explanatory power than the former, and it is reasonable to use the relatively advanced MF-VAR model to capture the complicated connection between the mixed-frequency data, namely weekly CPU and monthly CE. In addition, we take OP as a control sequence in order to make the empirical outcomes more accurate. The impulse response of the MF-VAR model suggests that even though CPU3 has a positive influence on CE in the short term, the effect of total CPU on CE is always negative, indicating that cryptocurrency policy uncertainty could facilitate U.S. carbon neutrality. In turn, CE has a positive influence on CPU, which reveals that massive carbon emissions might raise public and national concerns about the energy consumption and pollution of cryptocurrency transactions and mining. Additionally, there is a mediation effect of CPU on CE; that is, CPU could positively affect OP, and then OP exerts a positive effect on CE.

6. Conclusions and Policy Suggestions

This exploration probes the non-linear connection between cryptocurrency policy uncertainty and carbon emission in the U.S. and further answers the question of whether cryptocurrency policy uncertainty could facilitate U.S. carbon neutrality. We apply LF-VAR and MF-VAR models to explore the complicated interrelationship between CPU and CE, and this exploration chooses OP as the control sequence to ensure robustness. Comparing these two models suggests that the MF-VAR model is more applicable than the other in processing mixed-frequency data. The empirical conclusions suggest that CPU exerts an adverse effect on CE, which indicates that cryptocurrency policy uncertainty can facilitate the target of U.S. carbon neutrality. Conversely, CPU could be positively affected by CE, revealing that significant carbon emissions may force the U.S. to decrease cryptocurrency transactions and mining to solve the climate problem and achieve carbon neutrality. In addition, CPU has a mediation effect on CE, showing that OP could not only be positively affected by CPU but also positively influence CE. Through exploring the non-linear connection between CPU and CE, it could be observed that cryptocurrency policy uncertainty is a promoter for achieving the goal towards U.S. carbon neutrality.

Based on these outcomes, we could put forward significant lessons for the U.S. to realize carbon neutrality in the context of a more uncertain cryptocurrency market. Although cryptocurrency policy uncertainty could facilitate U.S. carbon neutrality, the core issue should not be to intensify CPU further but to reduce the traditional energy consumption and carbon emissions of cryptocurrency trading and mining. On the one hand, the cryptocurrency miners, with the help of the U.S. Environmental Protection Agency, the Department of Energy and other federal agencies, should reduce greenhouse gas emissions by using clean energy (e.g., solar energy and nuclear energy). In addition, the related authorities ought to encourage miners to apply clean energy instead of traditional energy and subsidize this process, which may include exploring ways to use nuclear power and “photovoltaic+energy storage” to provide low-carbon electricity for cryptocurrency mining. On the other hand, the U.S. government should reexamine and position the policy orientation of the cryptocurrency trading and mining industry and regulate its development from the perspective of energy consumption control and carbon emission reduction. First, all cryptocurrency mines that currently fall outside the U.S. government statistics must be included, and it would be strictly prohibited to use local off-grid hydropower for mining. Second, a separate electricity account should be set up for cryptocurrency mining, and apparent types of electricity are differentiated for detailed statistics, which provides accurate data support for energy conservation and carbon reduction, further facilitating the regulatory authorities in better controlling and managing their carbon emission behavior. Third, the relevant standards shall be formulated and improved to prohibit cryptocurrency mining operations by machines and miners with low computing power and high carbon emissions, and the green properties of this industry with low carbon or even zero carbon should be gradually increased. If the above measures are not effective in reducing CE, the U.S. government should take executive action, and Congress may need to consider legislation to limit or ban cryptocurrency transactions and mining.

Author Contributions

Conceptualization, C.-W.S. and Y.S.; methodology, M.Q.; software, W.Z.; validation, H.-L.C., C.-W.S. and Y.S.; formal analysis, M.Q.; investigation, W.Z.; resources, Y.S.; data curation, C.-W.S.; writing—original draft preparation, M.Q.; writing—review and editing, H.-L.C.; visualization, W.Z.; supervision, C.-W.S. All authors have read and agreed to the published version of the manuscript.

Funding

This research received no external funding.

Institutional Review Board Statement

Not applicable.

Informed Consent Statement

Not applicable.

Data Availability Statement

The data can be found at https://www.policyuncertainty.com/ (accessed on 28 February 2023) and https://www.eia.gov/ (accessed on 28 February 2023).

Acknowledgments

We are very grateful to all of the editors and anonymous reviewers.

Conflicts of Interest

The authors declare no conflict of interest.

References

- Su, C.W.; Qin, M.; Tao, R.; Umar, M. Financial implications of fourth industrial revolution: Can bitcoin improve prospects of energy investment? Technol. Forecast. Soc. Chang. 2020, 158, 120178. [Google Scholar] [CrossRef] [PubMed]

- Qin, M.; Zhang, X.J.; Li, Y.M.; Maria, B.R. Blockchain market and green finance: The enablers of carbon neutrality in China. Energy Econ. 2023, 118, 106501. [Google Scholar] [CrossRef]

- Aye, G.C.; Demirer, R.; Gupta, R.; Nel, J. The pricing implications of cryptocurrency mining on global electricity markets: Evidence from quantile causality tests. J. Clean. Prod. 2023, 397, 136572. [Google Scholar] [CrossRef]

- Baur, D.G.; Oll, J. Bitcoin investments and climate change: A financial and carbon intensity perspective. Financ. Res. Lett. 2022, 47, 102575. [Google Scholar] [CrossRef]

- Jana, R.K.; Ghosh, I.; Wallin, M.W. Taming energy and electronic waste generation in bitcoin mining: Insights from Facebook prophet and deep neural network. Technol. Forecast. Soc. Chang. 2022, 178, 121584. [Google Scholar] [CrossRef]

- Sarkodie, S.A.; Ahmed, M.Y.; Leirvik, T. Trade volume affects bitcoin energy consumption and carbon footprint. Financ. Res. Lett. 2022, 48, 102977. [Google Scholar] [CrossRef]

- Sarkodie, S.A.; Owusu, P.A. Dataset on bitcoin carbon footprint and energy consumption. Data Brief 2022, 42, 108252. [Google Scholar] [CrossRef]

- Lucey, B.M.; Vigne, S.A.; Yarovaya, L.; Wang, Y.Z. The cryptocurrency uncertainty index. Financ. Res. Lett. 2022, 45, 102147. [Google Scholar] [CrossRef]

- Elsayed, A.H.; Gozgor, G.; Yarovaya, L. Volatility and return connectedness of cryptocurrency, gold, and uncertainty: Evidence from the cryptocurrency uncertainty indices. Financ. Res. Lett. 2022, 47, 102732. [Google Scholar] [CrossRef]

- Qin, M.; Su, C.W.; Zhong, Y.F.; Song, Y.R.; Lobonţ, O.R. Sustainable finance and renewable energy: Promoters of carbon neutrality in the United States. J. Environ. Manag. 2022, 324, 116390. [Google Scholar] [CrossRef]

- Yuan, X.; Su, C.W.; Peculea, A.D. Dynamic linkage of the bitcoin market and energy consumption: An analysis across time. Energy Strat. Rev. 2022, 44, 100976. [Google Scholar] [CrossRef]

- Wang, Q.; Zhang, M.; Jiang, X.T.; Li, R.R. Does the COVID-19 pandemic derail US-China collaboration on carbon neutrality research? A survey. Energy Strat. Rev. 2022, 43, 100937. [Google Scholar] [CrossRef]

- Wu, Z.; Huang, X.J.; Chen, R.S.; Mao, X.Y.; Qi, X.X. The United States and China on the paths and policies to carbon neutrality. J. Environ. Manag. 2022, 320, 115785. [Google Scholar] [CrossRef] [PubMed]

- Hildebrand, B.; Baza, M.; Salman, T.; Tabassum, S.; Konatham, B.; Amsaad, F.; Razaque, A. A comprehensive review on blockchains for Internet of Vehicles: Challenges and directions. Comput. Sci. Rev. 2023, 48, 100547. [Google Scholar] [CrossRef]

- Le, T.H. Quantile time-frequency connectedness between cryptocurrency volatility and renewable energy volatility during the COVID-19 pandemic and Ukraine-Russia conflicts. Renew. Energy 2023, 202, 613–625. [Google Scholar] [CrossRef]

- Kohli, V.; Chakravarty, S.; Chamola, V.; Sangwan, K.S.; Zeadally, S. An analysis of energy consumption and carbon footprints of cryptocurrencies and possible solutions. Digit. Commun. Netw. 2023, 9, 79–89. [Google Scholar] [CrossRef]

- Zhang, D.N.; Chen, X.H.; Lau, C.K.M.; Xu, B. Implications of cryptocurrency energy usage on climate change. Technol. Forecast. Soc. Chang. 2023, 187, 122219. [Google Scholar] [CrossRef]

- Yang, L.; Hamori, S. The role of the carbon market in relation to the cryptocurrency market: Only diversification or more? Int. Rev. Financ. Anal. 2021, 77, 101864. [Google Scholar] [CrossRef]

- Pham, L.; Karim, S.; Naeem, M.A.; Long, C. A tale of two tails among carbon prices, green and non-green cryptocurrencies. Int. Rev. Financ. Anal. 2022, 82, 102139. [Google Scholar] [CrossRef]

- Anwer, Z.; Farid, S.; Khan, A.; Benlagha, N. Cryptocurrencies versus environmentally sustainable assets: Does a perfect hedge exist? Int. Rev. Econ. Financ. 2023, 85, 418–431. [Google Scholar] [CrossRef]

- Li, J.M.; Li, N.P.; Peng, J.Q.; Cui, H.J.; Wu, Z.B. Energy consumption of cryptocurrency mining: A study of electricity consumption in mining cryptocurrencies. Energy 2019, 168, 160–168. [Google Scholar] [CrossRef]

- Corbet, S.; Lucey, B.; Yarovaya, L. Bitcoin-energy markets interrelationships—New evidence. Resour. Policy 2021, 70, 101916. [Google Scholar] [CrossRef]

- Vries, A.; Stoll, C. Bitcoin’s growing e-waste problem. Resour. Conserv. Recy. 2021, 175, 105901. [Google Scholar] [CrossRef]

- Howson, P.; Vries, A. Preying on the poor? Opportunities and challenges for tackling the social and environmental threats of cryptocurrencies for vulnerable and low-income communities. Energy Res. Soc. Sci. 2022, 84, 102394. [Google Scholar] [CrossRef]

- Tee, C.M.; Wong, W.K.; Hooy, C.W. Economic policy uncertainty and carbon footprint: International evidence. J. Multinatl. Financ. Manag. 2023, 67, 100785. [Google Scholar] [CrossRef]

- Vranken, H. Sustainability of bitcoin and blockchains. Curr. Opin. Environ. Sust. 2017, 28, 1–9. [Google Scholar] [CrossRef]

- Chitkasame, T.; Rakpho, P.; Khiewngamdee, C. Analyzing structural change and causality between energy consumption and bitcoin’s activity. Energy Rep. 2022, 8, 736–743. [Google Scholar] [CrossRef]

- Ghabri, Y.; Rhouma, O.B.; Gana, M.; Guesmi, K.; Benkraiem, R. Information transmission among energy markets, cryptocurrencies, and stablecoins under pandemic conditions. Int. Rev. Financ. Anal. 2022, 82, 102197. [Google Scholar] [CrossRef]

- Ghosh, B.; Bouri, E. Is bitcoin’s carbon footprint persistent? Multifractal evidence and policy implications. Entropy 2022, 24, 647. [Google Scholar] [CrossRef]

- Lu, X.F.; Huang, N.; Ye, Z.T.; Lai, K.K.; Cui, H.R. The spillovers among cryptocurrency, clean energy and oil. Procedia Comput. Sci. 2022, 214, 649–655. [Google Scholar] [CrossRef]

- Meiryani, M.; Tandyopranoto, C.D.; Emanuel, J.; Lindawati, A.S.L.; Fahlevi, M.; Aljuaid, M.; Hasan, F. The effect of global price movements on the energy sector commodity on bitcoin price movement during the COVID-19 pandemic. Heliyon 2022, 8, e10820. [Google Scholar] [CrossRef] [PubMed]

- Salisu, A.A.; Ndako, U.B.; Vo, X.V. Oil price and the Bitcoin market. Resour. Policy 2023, 82, 103437. [Google Scholar] [CrossRef]

- Chen, H.; Xu, C. The impact of cryptocurrencies on China’s carbon price variation during COVID-19: A quantile perspective. Technol. Forecast. Soc. Chang. 2022, 183, 121933. [Google Scholar] [CrossRef]

- Ghosh, B.; Papathanasiou, S.; Dar, V.; Gravas, K. Bubble in carbon credits during COVID-19: Financial instability or positive impact (“Minsky” or “social”)? J. Risk Financ. Manag. 2022, 15, 367. [Google Scholar] [CrossRef]

- Miltenberger, O.; Jospe, C.; Pittman, J. The good is never perfect: Why the current flaws of voluntary carbon markets are services, not barriers to successful climate change action. Front. Clim. 2021, 3, 686516. [Google Scholar] [CrossRef]

- Motegi, K.; Sadahiro, A. Sluggish private investment in Japan’s Lost Decade: Mixed frequency vector autoregression approach. N. Am. J. Econ. Financ. 2018, 43, 118–128. [Google Scholar] [CrossRef]

- Wang, K.H.; Su, C.W.; Umar, M. Geopolitical risk and crude oil security: A Chinese perspective. Energy 2021, 219, 119555. [Google Scholar] [CrossRef]

- Hu, J.Y.; Wang, K.H.; Su, C.W.; Umar, M. Oil price, green innovation and institutional pressure: A China’s perspective. Resour. Policy 2022, 78, 102788. [Google Scholar] [CrossRef]

- Silvestrini, A.; Veredas, D. Temporal aggregation of univariate and multivariate time series models: A survey. J. Econ. Surv. 2008, 22, 458–497. [Google Scholar] [CrossRef]

- Miller, J.I. Mixed-frequency cointegrating regressions with parsimonious distributed lag structures. J. Financ. Econom. 2014, 3, 584–614. [Google Scholar] [CrossRef]

- Ghysels, E.; Valkanov, R. The MIDAS touch: Mixed data sampling regression models. Cirano Work. Pap. 2004, 5, 512–517. [Google Scholar]

- Götz, T.; Hecq, A.; Smeekes, S. Testing for Granger causality in large mixed-frequency VARs. J. Econom. 2016, 193, 418–432. [Google Scholar] [CrossRef]

- Ghysels, E.; Hill, J.B.; Motegi, K. Testing for Granger causality with mixed frequency data. J. Econom. 2016, 192, 207–230. [Google Scholar] [CrossRef]

- Kim, D.; Ryu, D.J.; Webb, R.I. Determination of equilibrium transaction fees in the Bitcoin network: A rank-order contest. Int. Rev. Financ. Anal. 2023, 86, 102487. [Google Scholar] [CrossRef]

Disclaimer/Publisher’s Note: The statements, opinions and data contained in all publications are solely those of the individual author(s) and contributor(s) and not of MDPI and/or the editor(s). MDPI and/or the editor(s) disclaim responsibility for any injury to people or property resulting from any ideas, methods, instructions or products referred to in the content. |

© 2023 by the authors. Licensee MDPI, Basel, Switzerland. This article is an open access article distributed under the terms and conditions of the Creative Commons Attribution (CC BY) license (https://creativecommons.org/licenses/by/4.0/).