Transaction Costs in Agri-Environment-Climate Measures: A Review of the Literature

Abstract

1. Introduction

2. Transaction Costs Theory: A Brief Review

3. Methodology

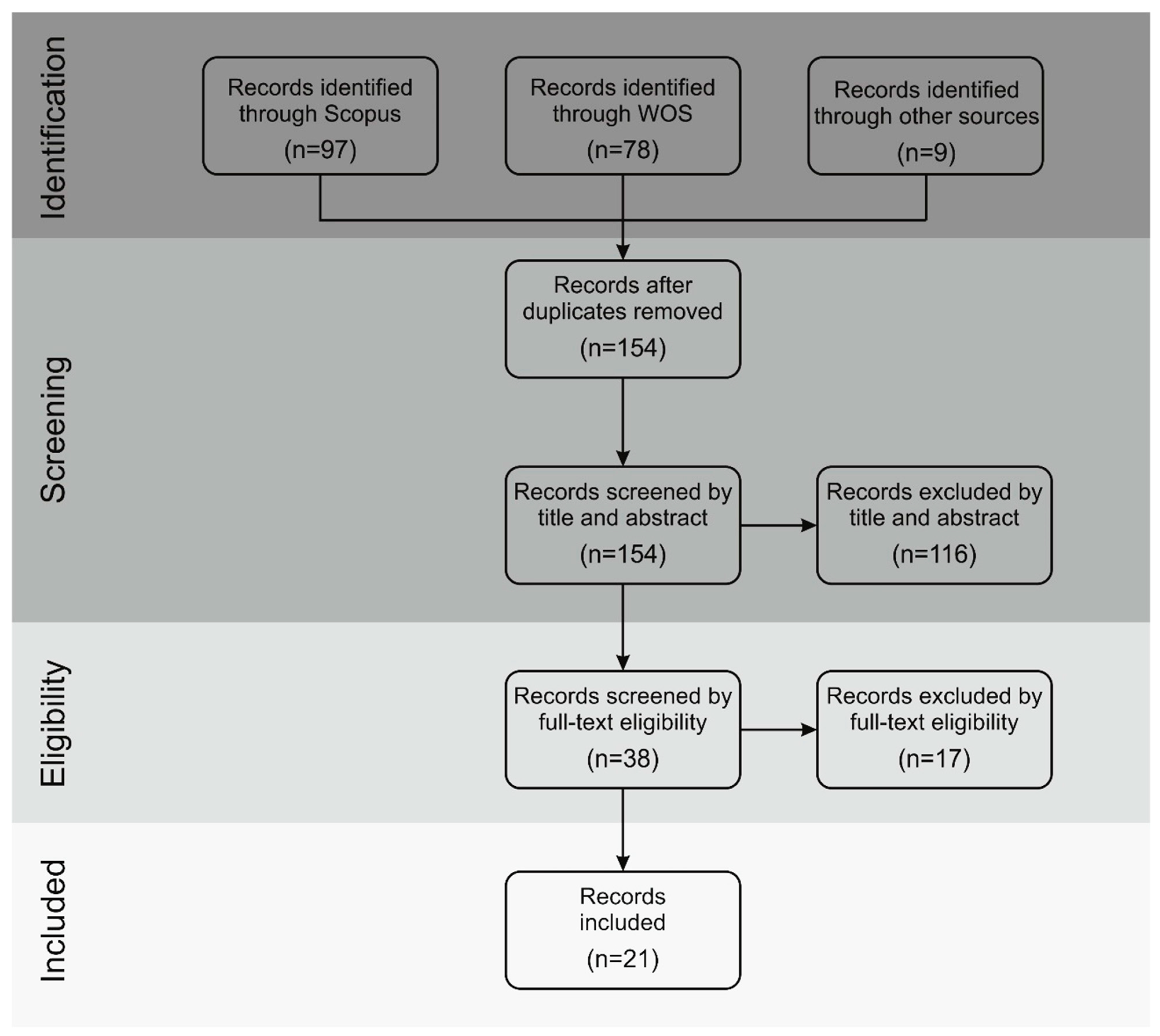

3.1. Eligibility Criteria and Databases

3.2. Search Strategy

3.3. Data Collection Process

4. Overview of Key Differences and Findings across Studies

4.1. Main Investigated Agri-Environment-Climate Measures

4.2. Main Differences in Scope and Objectives

- -

- Geographical scope

- -

- Research objectives

4.3. Main Differences in Methodological Approach

- -

- Type of methodology

- -

- Actors involved

4.4. Main Reported Empirical Results and Findings

- -

- Key insights linked to public transaction costs

- -

- Key insights linked to private transaction costs

5. Conclusions and Final Remarks

Author Contributions

Funding

Institutional Review Board Statement

Informed Consent Statement

Data Availability Statement

Conflicts of Interest

Abbreviations

| AES | Agri-environmental schemes |

| AECMs | Agri-environment-climate measures |

| CAP | Common agricultural policy |

| EU | European union |

| NIE | New Institutional Economics |

| PPPs | Public-private partnerships |

| PRTCs | Policy-related transaction costs |

| TCs | Transaction costs |

| TCT | Transaction costs theory |

| TCE | Transaction costs economics |

| WES | Wildlife Enhancement Scheme |

| WOS | Web of science |

Appendix A

| Scopus | |

|---|---|

| 97 | TITLE-ABS-KEY ((("transaction cost*") OR ("transaction cost*" AND analysis) OR ("transaction cost*" AND measure*) OR ("transaction cost*" AND assessment*)) AND ((agri-environment* AND measure*) OR ("payment for ecosystem services*") OR (agri-environment* AND scheme*) OR (agri-environment* AND policy*) OR (agri-environment* AND program*))) Timespan = 1999–2023; Search language = Auto |

| Web of Science | |

| 78 | TI = ((("transaction cost*") OR ("transaction cost*" AND analysis) OR ("transaction cost*" AND measure*) OR ("transaction cost*" AND assessment*)) AND ((agri-environment* AND measure*) OR (agri-environment* AND scheme*) OR ("payment for ecosystem services*") OR (agri-environment* AND policy*) OR (agri-environment* AND program*))) OR TS = ((("transaction cost*") OR ("transaction cost*" AND analysis) OR ("transaction cost*" AND measure*) OR ("transaction cost*" AND assessment*)) AND ((agri-environment* AND measure*) OR (agri-environment* AND scheme*) OR ("payment for ecosystem services*") OR (agri-environment* AND policy*) OR (agri-environment* AND program*))) OR AB = ((("transaction cost*") OR ("transaction cost*" AND analysis) OR ("transaction cost*" AND measure*) OR ("transaction cost*" AND assessment*)) AND ((agri-environment* AND measure*) OR ("payment for ecosystem services*") OR (agri-environment* AND scheme*) OR (agri-environment* AND policy*) OR (agri-environment* AND program*))) Databases = WOS, KJD, MEDLINE, RSCI, SCIELO Timespan = 1999–2023; Search language = Auto TI = title; TS = topic; AB = abstract |

References

- Cheung, S. Economic Organization and Transaction Costs. In The New Palgrave: A Dictionary of Economics; Eatwell, J., Milgate, M., Newman, P., Eds.; Palgrave Macmillan: London, UK, 1987; pp. 378–384. [Google Scholar]

- North, D.C. Transaction Costs, Institutions, and Economic Performance; ICS Press: San Francisco, CA, USA, 1992; ISBN 1-55815-211-3. [Google Scholar]

- Williamson, O.E. Transaction Cost Economics: The Comparative Contracting Perspective. J. Econ. Behav. Organ. 1987, 8, 617–625. [Google Scholar] [CrossRef]

- Williamson, O.E. Transaction-Cost Economics: The Governance of Contractual Relations. J. Law Econ. 1979, 22, 233–262. [Google Scholar] [CrossRef]

- Williamson, O.E. Transaction Cost Economics: How It Works; Where It Is Headed. Economist 1998, 146, 23–58. [Google Scholar] [CrossRef]

- Cheung, S.N.S. On the New Institutional Economics. In Contract Economics; Blackwell, Ed.: Oxford, UK, 1992; pp. 48–65. [Google Scholar]

- Nantongo, M.; Vatn, A. Estimating Transaction Costs of REDD+. Ecol. Econ. 2019, 156, 1–11. [Google Scholar] [CrossRef]

- Coggan, A.; Van Grieken, M.; Boullier, A.; Jardi, X. Private Transaction Costs of Participation in Water Quality Improvement Programs for Australia’ s Great Barrier Reef: Extent, Causes and Policy Implications. Aust. J. Agric. Resour. Econ. 2014, 59, 499–517. [Google Scholar] [CrossRef]

- Shahab, S.; Clinch, J.P.; Neill, E.O. Estimates of Transaction Costs in Transfer of Development Rights Programs. J. Am. Plan. Assoc. 2018, 84, 61–75. [Google Scholar] [CrossRef]

- Eurostat Archive: Agri-Environmental Indicator. Available online: https://ec.europa.eu/eurostat/statistics-explained/index.php?title=Agri-environmental_indicators (accessed on 9 March 2023).

- Mettepenningen, E.; Verspecht, A.; Huylenbroeck, G. Van Measuring Private Transaction Costs of European Agri-Environmental Schemes Measuring Private Transaction Costs of European Agri-Environmental Schemes. J. Environ. Plan. Manag. 2009, 52, 649–667. [Google Scholar] [CrossRef]

- McCann, L. Transaction Costs and Environmental Policy Design. Ecol. Econ. 2013, 88, 253–262. [Google Scholar] [CrossRef]

- McCann, L.; Claassen, R. Farmer Transaction Costs of Participating in Federal Conservation Programs: Magnitudes and Determinants. Land Econ. 2016, 92, 256–272. [Google Scholar] [CrossRef]

- Shahab, S. Transaction Costs in Planning Literature: A Systematic Review. J. Plan. Lit. 2022, 37, 403–414. [Google Scholar] [CrossRef]

- Henten, A.H.; Windekilde, I.M. Transaction Costs and the Sharing Economy. Info 2016, 18, 1–15. [Google Scholar] [CrossRef]

- Schmidt, C.G.; Wagner, S.M. Blockchain and Supply Chain Relations: A Transaction Cost Theory Perspective. J. Purch. Supply Manag. 2019, 25, 100552. [Google Scholar] [CrossRef]

- Gatzert, N. An Analysis of Transaction Costs in Participating Life Insurance under Mean–Variance Preferences. Insur. Math. Econ. 2019, 85, 185–197. [Google Scholar] [CrossRef]

- Phan, T.H.D.; Brouwer, R.; Davidson, M.D.; Hoang, L.P. A Comparative Study of Transaction Costs of Payments for Forest Ecosystem Services in Vietnam. For. Policy Econ. 2017, 80, 141–149. [Google Scholar] [CrossRef]

- Coase, R.H. The Nature of the Firm. Economica 1937, 4, 386–405. [Google Scholar] [CrossRef]

- Cuypers, I.R.P.; Hennart, J.F.; Silverman, B.S.; Ertug, G. Transaction Cost Theory: Past Progress, Current Challenges, and Suggestions for the Future. Acad. Manag. Ann. 2021, 15, 111–150. [Google Scholar] [CrossRef]

- Barzel, Y. Transaction Costs: Are They Just Costs? J. Inst. Theor. Econ. 1985, 141, 17–20. [Google Scholar]

- Demsetz, H. The Economics of the Business Firm: Seven Critical Commentaries; Cambridge University Press: Cambridge, UK, 1995; ISBN 0521481198. [Google Scholar]

- Arrow, K. The Organisation of Economic Activity: Issues Pertinent to the Choice of Market Versus Non-Market Allocation, The Analysis and Evaluation of Public Expenditure: The PPB System. In Proceedings of the US Joint Economic Committee, 91st Congress, Washington, DC, USA, 31 December 1969. [Google Scholar]

- Niehans, J. Money and Barter in General Equilibrium with Transactions Costs. Am. Econ. Rev. 1971, 61, 773–783. [Google Scholar]

- Zhengchao, L.; Liu, Q.; Wang, P. Literatures Review on Transaction Costs Measurement Advances. Asian Soc. Sci. 2012, 8, 127–132. [Google Scholar] [CrossRef]

- McCann, L.; Colby, B.; Easter, K.W.; Kasterine, A.; Kuperan, K.V. Transaction Cost Measurement for Evaluating Environmental Policies. Ecol. Econ. 2005, 52, 527–542. [Google Scholar] [CrossRef]

- Dahlman, C.J. The Problem of Externality. J. Law Econ. 1979, 22, 141–162. [Google Scholar] [CrossRef]

- Hobbs, J. Markets in Metamorphosis: The Rise and Fall of Policy Institutions. In Role of Institutions in Rural Policies and Agricultural Markets; Elsevier: Amsterdam, The Netherlands, 2004; pp. 199–212. [Google Scholar]

- Pannell, D.J.; Roberts, A.M.; Park, G.; Alexander, J. Improving Environmental Decisions: A Transaction-Costs Story. Ecol. Econ. 2013, 88, 244–252. [Google Scholar] [CrossRef]

- Coggan, A.; Buitelaar, E.; Whitten, S.; Bennett, J. Factors That Influence Transaction Costs in Development Offsets: Who Bears What and Why? Ecol. Econ. 2013, 88, 222–231. [Google Scholar] [CrossRef]

- Falconer, K.; Whitby, M. The Invisible Costs of Scheme Implementation and Administration. Countrys. Steward. 1999, 67–88. [Google Scholar] [CrossRef]

- Whitten, S.; Coggan, A. Transaction Costs in Agri-Environment Schemes. In Learning from Agri-Environment Schemes in Australia; ANU Press: Canberra, Australia, 2016; p. 338. ISBN 9781760460150. [Google Scholar]

- Teraji, S. Why Bounded Rationality? In The Cognitive Basis of Institutions; Academic Press: Cambridge, MA, USA, 2018; pp. 137–168. ISBN 9780128120231. [Google Scholar]

- Williamson, O.E. The Economic Institutions of Capitalism; Free Press: New York, NY, USA, 1985. [Google Scholar]

- Ramstad, Y. Is a Transaction a Transaction? J. Econ. Issues 1996, 30, 413–425. [Google Scholar] [CrossRef]

- Commons, J.R. Institutional Economics: Its Place in Political Economy; Transaction Publishers: Piscataway, NJ, USA, 1990; ISBN 9780887387975. [Google Scholar]

- Hennart, J.-F. Explaining the Swollen Middle: Why Most Transactions Are a Mix of “Market” and “Hierarchy”. Organ. Sci. 1993, 4, 529–547. [Google Scholar] [CrossRef]

- Rørstad, P.K.; Vatn, A.; Kvakkestad, V. Why Do Transaction Costs of Agricultural Policies Vary? Agric. Econ. 2007, 36, 1–11. [Google Scholar] [CrossRef]

- Anomaly, J. Public Goods and Government Action. Politics Philos. Econ. 2013, 14, 1–20. [Google Scholar] [CrossRef]

- Falconer, K.; Whitby, M. Untangling Red Tape: Scheme Administration and the Invisible Costs of European Agri-Environmental Policy. Eur. Environ. 2000, 203, 193–203. [Google Scholar] [CrossRef]

- Wätzold, F.; Schwerdtner, K. Why Be Wasteful When Preserving a Valuable Resource? A Review Article on the Cost-Effectiveness of European Biodiversity Conservation Policy. Biol. Conserv. 2005, 123, 327–338. [Google Scholar] [CrossRef]

- Coggan, A.; Whitten, S.M.; Bennett, J. Influences of Transaction Costs in Environmental Policy. Ecol. Econ. 2010, 69, 1777–1784. [Google Scholar] [CrossRef]

- Mack, G.; Kohler, A.; Heitkämper, K.; El-Benni, N. Determinants of the Perceived Administrative Transaction Costs Caused by the Uptake of an Agri-Environmental Program. J. Environ. Plan. Manag. 2019, 62, 1802–1819. [Google Scholar] [CrossRef]

- Weber, A. Implementing EU Co-Financed Agri-Environmental Schemes: Effects on Administrative Transaction Costs in a Regional Grassland Extensification Scheme. Land Use Policy 2015, 42, 183–193. [Google Scholar] [CrossRef]

- Weber, A. Does Transaction Costs Expense Create Transaction Gains for Farmers Participating in an Agri-Environmental Scheme? J. Environ. Econ. Policy 2014, 3, 215–236. [Google Scholar] [CrossRef]

- Kang, S.; Kroeger, T.; Shemie, D.; Echavarria, M.; Montalvo, T.; Bremer, L.L.; Bennett, G.; Barreto, S.R.; Bracale, H.; Calero, C.; et al. Investing in Nature-Based Solutions: Cost Profiles of Collective-Action Watershed Investment Programs. Ecosyst. Serv. 2023, 59, 101507. [Google Scholar] [CrossRef]

- Peterson, J.M.; Smith, C.M.; Leatherman, J.C.; Hendricks, N.P.; Fox, J.A. Transaction Costs in Payment for Environmental Service Contracts. Am. J. Agric. Econ. 2014, 97, 219–238. [Google Scholar] [CrossRef]

- McCann, L.M.J. Transaction Costs of Environmental Policies and Returns to Scale: The Case of Comprehensive Nutrient Management Plans. Rev. Agric. Econ. 2009, 31, 561–573. [Google Scholar] [CrossRef]

- Mc Cann, L.; Easter, K.W. Transaction Costs of Policies to Reduce Agricultural Phosphorous Pollution in the Minnesota River. Econ. Water Qual. 1999, 75, 402–414. [Google Scholar]

- Weber, A. How Are Public Transaction Costs in Regional Agri-Environmental Scheme Delivery Influenced by EU Regulations? J. Environ. Plan. Manag. 2014, 57, 937–959. [Google Scholar] [CrossRef]

- Mettepenningen, E.; Beckmann, V.; Eggers, J. Public Transaction Costs of Agri-Environmental Schemes and Their Determinants-Analysing Stakeholders’ Involvement and Perceptions. Ecol. Econ. 2011, 70, 641–650. [Google Scholar] [CrossRef]

- Mettepenningen, E.; Van Huylenbroeck, G. Factors Influencing Private Transaction Costs Related to Agri-Environmental Schemes in Europe. In Multifunctional Rural Land Management; Routledge: Oxfordshire, UK, 2009; pp. 169–192. ISBN 9781844075775. [Google Scholar]

- Ollikainen, M.; Lankoski, J.; Nuutinen, S. Policy-Related Transaction Costs of Agricultural Policies in Finland. Agric. Food Sci. 2008, 17, 193–209. [Google Scholar] [CrossRef]

- Ridier, A.; Képhaliacos, C.; Carpy-Goulard, F. Private Transaction Costs and Environmental Cross Compliance in a Crop Region of Southwestern France. Int. J. Agric. Resour. Gov. Ecol. 2011, 9, 68–79. [Google Scholar] [CrossRef]

- McCann, L.; Easter, K.W. Estimates of Public Sector Transaction Costs in NRCS Programs. J. Agric. Appl. Econ. 2000, 32, 555–563. [Google Scholar] [CrossRef]

- Falconer, K.; Saunders, C. Transaction Costs for SSSIs and Policy Design. Land Use Policy 2002, 19, 157–166. [Google Scholar] [CrossRef]

- Falconer, K.; Dupraz, P.; Whitby, M. An Investigation of Policy Administrative Costs Using Panel Data for the English Environmentally Sensitive Areas. J. Agric. Econ. 2001, 52, 83–103. [Google Scholar] [CrossRef]

| ID | Study Authors | Title | Measure/Scheme/Program Analyzed | Quant. | Qualit. | Public | Private |

|---|---|---|---|---|---|---|---|

| X | O | X | O | ||||

| 1 | McCann and Easter, 1999 [1] | Transaction costs of policies to reduce agricultural phosphorous pollution in the Minnesota river | 4 policies designed to reduce agricultural sources of phosphorous pollution | X | X | ||

| 2 | Falconer and Whitby, 2000 [2] | Untangling red tape: scheme administration and the invisible costs of European agri-environmental policy | Countryside stewardship schemes | X | X | ||

| 3 | McCann and Easter, 2000 [3] | Estimates of Public Sector Transaction Costs in NRCS Programs | 60 conservation systems linked to policies to reduce non-point-source pollution | X | X | ||

| 4 | Falconer et al., 2001 [4] | An Investigation of Policy Administrative Costs Using Panel Data for the English Environmentally Sensitive Areas | Management agreements for Environmentally Sensitive Areas | X | X | ||

| 5 | Falconer and Saunders, 2002 [5] | Transaction costs for SSSIs and policy design | Wildlife Enhancement Scheme for sites of special scientific interest | X | X | O | |

| 6 | Rørstad et al., 2007 [6] | Why do transaction costs of agricultural policies vary? | 12 different agricultural policy measures | X | X | O | |

| 7 | Ollikainen et al., 2008 [7] | Policy-related transaction costs of agricultural policies in Finland | Agricultural and agri-environmental policy instruments | X | X | ||

| 8 | Mettepenningen and Van Huylenbroeck, 2009 [8] | Factors influencing private transaction costs related to agri-environmental schemes in europe | AES across different European countries | X | O | ||

| 9 | Mettepenningen et al., 2009 [9] | Measuring private transaction costs of European agri-environmental schemes | AES across different European countries | X | O | ||

| 10 | McCann, 2009 [10] | Transaction Costs of Environmental Policies and Returns to Scale: The Case of Comprehensive Nutrient Management Plans | Comprehensive nutrient management plans approved by the Natural Resource Conservation Service | X | O | ||

| 11 | Ridier et al., 2011 [11] | Private transaction costs and environmental cross compliance in a crop region of Southwestern France | Different cross-compliance policy tools | X | O | ||

| 12 | Mettepenningen et al., 2011 [12] | Public transaction costs of agri-environmental schemes and their determinants—Analysing stakeholders’ involvement and perceptions | AES accross different European countries | X | O | X | |

| 13 | Peterson et al., 2014 [13] | Transaction Costs in Payment for Environmental Service Contracts | PES contracts in a hypotheticalwater quality trading market | X | O | ||

| 14 | Weber, 2014 [14] | Does transaction costs expense create transaction gains for farmers participating in an agri-environmental scheme? | Site-specific grassland extensification scheme | X | O | ||

| 15 | Weber, 2014 [15] | How are public transaction costs in regional agri-environmental scheme delivery influenced by EU regulations? | AES in general | O | X | ||

| 16 | Coggan et al., 2014 [16] | Private transaction costs of participation in water quality improvement programs for Australia’s Great Barrier Reef: Extent, causes and policy implications | Australian Government’s Reef Rescue scheme | X | O | ||

| 17 | Weber, 2015 [17] | Implementing EU co-financed agri-environmental schemes: Effects on administrative transaction costs in a regional grassland extensification scheme | Grassland extensification scheme | X | X | ||

| 18 | McCann and Claassen, 2016 [18] | Farmer Transaction Costs of Participating in Federal Conservation Programs: Magnitudes and Determinants | Different programs aimed at tackling water quality problems associated with non-point-source pollution from agricultural production | X | O | ||

| 19 | Phan et al., 2017 [19] | A comparative study of transaction costs of payments for forest ecosystem services in Vietnam | Payments for forest ecosystem services (PFES) | O | X | ||

| 20 | Mack et al., 2019 [20] | Determinants of the perceived administrative transaction costs caused by the uptake of an agri-environmental program | Voluntary grassland-based meat and milk program | X | O | ||

| 21 | Kang et al., 2023 [21] | Investing in nature-based solutions: Cost profiles of collective-action watershed investment programs | Payments for watershed services (PWS) | X | X |

Disclaimer/Publisher’s Note: The statements, opinions and data contained in all publications are solely those of the individual author(s) and contributor(s) and not of MDPI and/or the editor(s). MDPI and/or the editor(s) disclaim responsibility for any injury to people or property resulting from any ideas, methods, instructions or products referred to in the content. |

© 2023 by the authors. Licensee MDPI, Basel, Switzerland. This article is an open access article distributed under the terms and conditions of the Creative Commons Attribution (CC BY) license (https://creativecommons.org/licenses/by/4.0/).

Share and Cite

Espinosa Diaz, S.; Riccioli, F.; Di Iacovo, F.; Moruzzo, R. Transaction Costs in Agri-Environment-Climate Measures: A Review of the Literature. Sustainability 2023, 15, 7454. https://doi.org/10.3390/su15097454

Espinosa Diaz S, Riccioli F, Di Iacovo F, Moruzzo R. Transaction Costs in Agri-Environment-Climate Measures: A Review of the Literature. Sustainability. 2023; 15(9):7454. https://doi.org/10.3390/su15097454

Chicago/Turabian StyleEspinosa Diaz, Salomon, Francesco Riccioli, Francesco Di Iacovo, and Roberta Moruzzo. 2023. "Transaction Costs in Agri-Environment-Climate Measures: A Review of the Literature" Sustainability 15, no. 9: 7454. https://doi.org/10.3390/su15097454

APA StyleEspinosa Diaz, S., Riccioli, F., Di Iacovo, F., & Moruzzo, R. (2023). Transaction Costs in Agri-Environment-Climate Measures: A Review of the Literature. Sustainability, 15(9), 7454. https://doi.org/10.3390/su15097454