The Effect of Golden Ratio-Based Capital Structure on Firm’s Financial Performance

Abstract

1. Introduction

2. Literature Review and Hypothesis Development

2.1. Pecking Order Theory

2.2. Agency Cost Theory

2.3. Market Timing Theory

2.4. Golden Ratio and Its Application

2.5. Hypothesis Development

2.5.1. Debt to Equity (DEEUTY) Ratio

2.5.2. Equity (EYTRAT) Ratio

2.5.3. Capitalization (CAPRAT) Ratio

2.5.4. Debt to Total to Asset Ratio

3. Research Methodology

3.1. Target Population, Sample Size, and Data

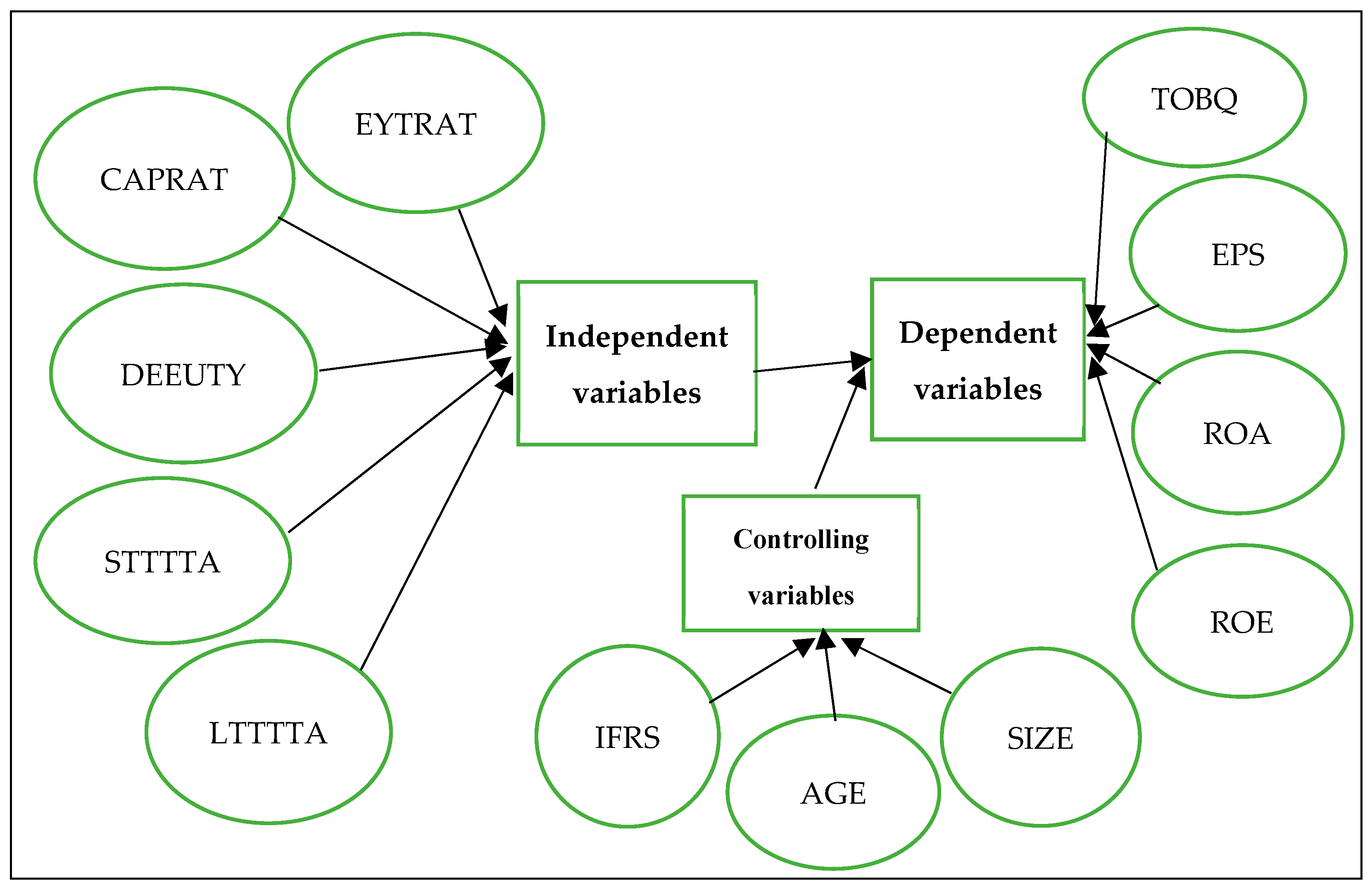

3.2. Selection of Variables

3.3. Model Specification

β5 LTTTTA + β6 IFRS + β7 AGE + β8SIZE + ℇ

β5 LTTTTA + β6 IFRS + β7 AGE + β8SIZE + ℇ

β5 LTTTTA + β6 IFRS + β7 AGE + β8SIZE + ℇ

β5 LTTTTA + β6 IFRS + β7 AGE + β8SIZE + ℇ

4. Data Analysis, Results, and Discussions

4.1. Descriptive Statistics

4.2. Matrix of Correlations

4.3. Model Diagnostic Tests

4.4. Panel Unit Root Tests

4.5. Dealing with the Problem of Endogeneity

4.6. Dynamic Panel-Data Estimation, Two-Step Difference GMM

4.6.1. The Impact of a Golden Ratio-Based Capital Structure on Tobin’s Q

4.6.2. The Impact of a Golden Ratio-Based Capital Structure on EPS

4.6.3. The Impact of A Golden Ratio-Based Capital Structure on ROA

4.6.4. The Impact of Golden Ratio-Based Capital Structure on ROE

4.7. Sensitivity Analysis

5. Conclusions

5.1. Implication for A Manager

5.2. Limitations, Recommendations, and Future Research Direction

Author Contributions

Funding

Institutional Review Board Statement

Informed Consent Statement

Data Availability Statement

Conflicts of Interest

References

- Uremadu, S.O.; Efobi, R.U. The impact of capital structure and liquidity on corporate returns in Nigeria: Evidence from manufacturing firms. Int. J. Acad. Res. Account. Financ. Manag. Sci. 2012, 2, 1–16. [Google Scholar]

- Brav, A.; Jiang, W.; Partnoy, F.; Thomas, R. Hedge fund activism, corporate governance, and firm performance. J. Financ. 2008, 63, 1729–1775. [Google Scholar] [CrossRef]

- Myers, S.C. Capital structure. J. Econ. Perspect. 2001, 15, 81–102. [Google Scholar] [CrossRef]

- Chandra, R. Financial management. BookRix 2013. Available online: https://scholar.google.com/scholar?hl=en&as_sdt=0%2C5&q=Chandra%2C+R.+Financial+management.+BookRix.+2013.&btnG= (accessed on 24 December 2022).

- Berk, J.; DeMarzo, P.; Harford, J.; Ford, G.; Mollica, V.; Finch, N. Fundamentals of Corporate Finance, 5th ed.; Pearson Higher Education AU: New York, NY, USA, 2013; pp. 495–497. [Google Scholar]

- Myers, S.C.; Majluf, N.S. Corporate financing and investment decisions when firms have information that investors do not have. J. Financ. Econ. 1984, 13, 187–221. [Google Scholar] [CrossRef]

- Ibrahim, M. Capital structure and firm value in Nigerian listed manufacturing companies: An empirical investigation using Tobin’s Q model. Int. J. Innov. Res. Soc. Sci. Strateg. Manag. Tech. 2017, 4, 112–125. [Google Scholar]

- Chaklader, B.; Padmapriya, B. Impact of cash surplus on firm’s capital structure: Validation of pecking order theory. Manag. Financ. 2021, 47, 1801–1816. [Google Scholar] [CrossRef]

- Hovakimian, A.; Hovakimian, G. Cash flow sensitivity of investment. Eur. Pean Financ. Manag. 2009, 15, 47–65. [Google Scholar] [CrossRef]

- Nadaraja, P.; Zulkafli, A.H.; Masron, T.A. Family ownership, firm’s financial characteristics and capital structure: Evidence from public listed companies in Malaysia. Econ. Ser. Manag. 2011, 14, 141–155. [Google Scholar]

- Shubita, M.F.; Alsawalhah, J.M. The relationship between capital structure and profitability. Int. J. Bus. Soc. Sci. 2012, 3, 104–112. [Google Scholar]

- Amershi, A.H.; Feroz, E.H. The occurrence of Finobacci numbers in time series of financial accounting ratios: Anomalies or indicators of firm survival, bankruptcy and fraud? An exploratory study. Manag. Financ. 2000, 26, 5–20. [Google Scholar] [CrossRef]

- Chakrabarti, A.; Chakrabarti, A. The capital structure puzzle–evidence from Indian energy sector. Int. J. Energy Sect. Manag. 2019, 13, 2–23. [Google Scholar] [CrossRef]

- De Wet, J. Determining the optimal capital structure: A practical contemporary approach. Meditari Res. J. Sch. Account. Sci. 2006, 14, 1–16. [Google Scholar] [CrossRef]

- Baker, H.K.; Martin, G.S. Capital structure: An overview. In Capital Structure and Corporate Financing Decisions: Theory, Evidence, and Practice; John Wiley Sons: Hoboken, NJ, USA, 2011; pp. 1–14. [Google Scholar]

- Goyal, A.M. Impact of capital structure on performance of listed public sector banks in India. Int. J. Bus. Manag. Invent. 2013, 2, 35–43. [Google Scholar]

- Miller, M.H. The Modigliani-Miller propositions after thirty years. J. Econ. Perspect. 1988, 2, 99–120. [Google Scholar] [CrossRef]

- Welch, I. Common flaws in empirical capital structure research. In AFA 2008 New Orleans Meetings Paper; Citeseer: Princeton, NJ, USA, 2007; pp. 1–33. [Google Scholar]

- Swanson, Z.; Srinidhi, B.N.; Seetharaman, A. The Capital Structure Paradigm: Evolution of Debt/Equity Choices; Greenwood Publishing Group: Westport, IN, USA, 2003. [Google Scholar]

- Song, H.S. Capital Structure Determinants an Empirical Study of Swedish Companies; Royal Institute of Technology, Centre of Excellence for Studies in Innovation and Science, Department of Infrastructure: Stockholm, Sweden, 2005. [Google Scholar]

- Chen, L.J.; Chen, S.Y. How the pecking-order theory explain capital structure. J. Int. Manag. Stud. 2011, 6, 92–100. [Google Scholar]

- Nguyen, T.; Nguyen, H. Capital structure and firm performance of non-financial listed companies: Cross-sector empirical evidences from Vietnam. Accounting 2020, 6, 137–150. [Google Scholar] [CrossRef]

- Shaferi, I.; Wahyudi, S.; Mawardi, W.; Hidayat, R.; Puspitasari, I. The manufacture and service companies differ leverage impact to financial performance. Int. J. Financ. Res. 2020, 11, 281–286. [Google Scholar] [CrossRef]

- Kalash, İ.; Bilen, A. The Role of Sales Growth in Determining the Effect of Operating Leverage on Financial Performance: The Case of Turkey. Muhasebe Finansman Dergisi. 2021, 91, 185–198. [Google Scholar] [CrossRef]

- Shaikh, A.U.H.; Raza, A.; Balal, S.A.; Abbasi, A.R.; Delioglu, N.; Shaikh, H. Analyzing Significance of Financial Leverage on Financial Performance in Manufacturing Sector of Pakistan. Webology 2022, 19, 3465–3478. [Google Scholar]

- Vuong, N.B.; Vu, T.T.Q.; Mitra, P. Impact of capital structure on firm’s financial performance: Evidence from United Kingdom. J. Financ. Econ. Res. 2017, 2, 16–29. [Google Scholar] [CrossRef]

- Abdullah, H.; Tursoy, T. Capital structure and firm performance: Evidence of Germany under IFRS adoption. Rev. Manag. Sci. 2021, 15, 379–398. [Google Scholar] [CrossRef]

- Ngatno, N.; Apriatni, E.P.; Youlianto, A. Moderating effects of corporate governance mechanism on the relation between capital structure and firm performance. Cogent Bus. Manag. 2021, 8, 1866822. [Google Scholar] [CrossRef]

- Vu Thi, A.H.; Phung, T.D. Capital structure, working capital, and governance quality affect the financial performance of small and medium enterprises in Taiwan. J. Risk Financ. Manag. 2021, 14, 381. [Google Scholar] [CrossRef]

- Ulbert, J.; Takács, A.; Csapi, V. Golden ratio-based capital structure as a tool for boosting firm’s financial performance and market acceptance. Heliyon 2022, 8, e09671. [Google Scholar] [CrossRef]

- Ezirim, C.B.; Ezirim, U.I.; Momodu, A.A. Capital Structure and Firm Value: Theory and Further Empirical Evidence from Nigeria. Int. J. Bus. Account. Financ. 2017, 11, 68–89. [Google Scholar]

- Le, T.P.V.; Phan, T.B.N. Capital structure and firm performance: Empirical evidence from a small transition country. Res. Int. Bus. Financ. 2017, 42, 710–726. [Google Scholar] [CrossRef]

- Rahmatillah, I.; Prasetyo, A.D. Determinants of capital structure analysis: Empirical study of telecommunication industry in Indonesia 2008–2015. J. Bus. Mannag. 2016, 5, 424–435. [Google Scholar]

- Niu, X. Theoretical and practical review of capital structure and its determinants. Int. J. Bus. Manag. 2008, 3, 133–139. [Google Scholar] [CrossRef]

- Baker, M.; Wurgler, J. Market timing and capital structure. J. Financ. 2002, 57, 1–32. [Google Scholar] [CrossRef]

- Myers, S.C. Capital structure puzzle. J. Financ. 1984, 39, 575–592. [Google Scholar] [CrossRef]

- Eckbo, B.E. (Ed.) Handbook of Empirical Corporate Finance Set; Elsevier: Hanover, NH, USA, 2008. [Google Scholar]

- Meisner, G.B. The Golden Ratio: The Divine Beauty of Mathematics; Race Point Publishing: New York, NY, USA, 2018. [Google Scholar]

- Olsen, S.; Marek-Crnjac, L.; He, J.H.; El Naschie, M.S. A Grand Unification of the Sciences, Art & Consciousness: Rediscovering the Pythagorean Plato’s golden mean number system. J. Progress. Res. Math. 2020, 16, 28882931. [Google Scholar]

- Disney, S.M.; Towill, D.R.; Van de Velde, W. Variance amplification and the golden ratio in production and inventory control. Int. J. Prod. Econ. 2004, 90, 295–309. [Google Scholar] [CrossRef]

- Thomas, P.; Chrystal, A. Explaining the “buy one get one free” promotion: The golden ratio as a marketing tool. Am. J. Ind. Bus. Manag. 2013, 3, 655–673. [Google Scholar] [CrossRef]

- Papaioannou, T.G.; Vavuranakis, M.; Gialafos, E.J.; Karamanou, M.; Tsoucalas, G.; Vrachatis, D.A.; Soulis, D.; Manolesou, D.; Stefanadis, C.; Tousoulis, D. Blood pressure deviation from the golden ratio φ and all-cause mortality: A pythagorean view of the arterial pulse. Int. J. Appl. Basic Med. Res. 2019, 9, 55. [Google Scholar] [CrossRef]

- Lawless, M.; O’Connell, B.; O’Toole, C. Financial structure and diversification of Europe pean firms. Appl. Econ. 2015, 47, 2379–2398. [Google Scholar] [CrossRef]

- Dhaliwal, D.; Judd, J.S.; Serfling, M.; Shaikh, S. Customer concentration risk and the cost of equity capital. J. Account. Econ. 2016, 61, 23–48. [Google Scholar] [CrossRef]

- Allayannis, G.; Brown, G.W.; Klapper, L.F. Capital structure and financial risk: Evidence from foreign debt use in East Asia. J. Financ. 2003, 58, 2667–2710. [Google Scholar] [CrossRef]

- Heikal, M.; Khaddafi, M.; Ummah, A. Influence analysis of return on assets (ROA), return on equity (ROE), net profit margin (NPM), debt to equity ratio (DER), and current ratio (CR), against corporate profit growth in automotive in Indonesia Stock Exchange. Int. J. Acad. Res. Bus. Soc. Sci. 2014, 4, 101. [Google Scholar] [CrossRef]

- Hamada, R.S. The effect of the firm’s capital structure on the systematic risk of common stocks. J. Financ. 1972, 27, 435–452. [Google Scholar] [CrossRef]

- Altman, E.I.; Hotchkiss, E. Corporate Financial Distress and Bankruptcy; John Wiley & Sons: New York, NY, USA, 1993; Volume 1998, pp. 105–110. [Google Scholar]

- Robb, A.M.; Robinson, D.T. The capital structure decisions of new firms. Rev. Financ. Stud. 2014, 27, 153–179. [Google Scholar] [CrossRef]

- Mills, L.F.; Newberry, K.J. Firms’ off-balance sheet and hybrid debt financing: Evidence from their book-tax reporting differences. J. Account. Res. 2005, 43, 251–282. [Google Scholar] [CrossRef]

- Zou, J.; Shen, G.; Gong, Y. The effect of value-added tax on leverage: Evidence from China’s value-added tax reform. China Econ. Rev. 2019, 54, 135–146. [Google Scholar] [CrossRef]

- Weil, R.L.; Schipper, K.; Francis, J. Financial Accounting: An Introduction to Concepts, Methods and Uses, 14th ed.; Cengage Learning: Boston, MA, USA, 2013; pp. 236–239. [Google Scholar]

- Husna, A.; Satria, I. Effects of return on asset, debt to asset ratio, current ratio, firm size, and dividend payout ratio on firm value. Int. J. Econ. Financ. Issues 2019, 9, 50. [Google Scholar] [CrossRef]

- Troitiño, D.R. The British position towards European integration: A different economic and political approach. TalTech J. Eur. Stud. 2014, 4, 119–136. [Google Scholar] [CrossRef]

- Crouzet, F. A Comparative Analysis Two Economic Growths. In The Causes of the Industrial Revolution in England, England and France in the Eighteenth Century; Routledge: London, UK, 2017; pp. 139–174. [Google Scholar]

- Temouri, Y.; Vogel, A.; Wagner, J. Self-selection into export markets by business services firms–Evidence from France, Germany and the United Kingdom. Struct. Chang. Econ. Dyn. 2013, 25, 146–158. [Google Scholar] [CrossRef]

- Fauzi, F.; Locke, S. Board structure, ownership structure and firm performance: A study of New Zealand listed-firms. Asian Acad. Manag. J. Account. Financ. 2012, 8, 43–67. [Google Scholar]

- Iacobucci, D.; Schneider, M.J.; Popovich, D.L.; Bakamitsos, G.A. Behavior research methods. Mean centering helps alleviate “micro” but not “macro” multicollinearity. Behav. Res. Methods 2016, 48, 1308–1317. [Google Scholar] [CrossRef]

- Schroeder, M.A.; Lander, J.; Levine-Silverman, S. Diagnosing and dealing with multi-collinearity. West. J. Nurs. Res. 1990, 12, 175–187. [Google Scholar] [CrossRef]

- Kalnins, A. Multicollinearity: How common factors cause Type 1 errors in multivariate regression. Strateg. Manag. J. 2018, 39, 2362–2385. [Google Scholar] [CrossRef]

- Ab Hamid, M.R.; Sami, W.; Sidek, M.M. Discriminant validity assessment: Use of fornell & larcker criterion versus HTMT criterion. In Journal of Physics, Conference Series; IOP Publishing: Bristol, UK, 2017; Volume 890, p. 012163. [Google Scholar]

- Purwanto, A.; Sudargini, Y. Partial least squares structural squation modeling (PLS-SEM) analysis for social and management research: A literature review. J. Ind. Eng. Manag. Res. 2021, 2, 114–123. [Google Scholar]

- Johnston, R.; Jones, K.; Manley, D. Confounding and collinearity in regression analysis: A cautionary tale and an alternative procedure, illustrated by studies of British voting behavior. Qual. Quant. 2018, 52, 1957–1976. [Google Scholar] [CrossRef]

- Wiredu, J.; Nketiah, E.; Adjei, M. The relationship between trade openness, foreign direct investment and economic growth in West Africa: Static panel data model. J. Hum. Resour. Sustain. Stud. 2020, 8, 18–34. [Google Scholar] [CrossRef]

- Sehrawat, M.; Giri, A.K. The role of financial development in economic growth: Empirical evidence from Indian states. Int. J. Emerg. Mark. 2015, 10, 765–780. [Google Scholar] [CrossRef]

- Semadeni, M.; Withers, M.C.; Trevis Certo, S. The perils of endogeneity and instrumental variables in strategy research: Understanding through simulations. Strateg. Manag. J. 2014, 35, 1070–1079. [Google Scholar] [CrossRef]

- Zaefarian, G.; Kadile, V.; Henneberg, S.C.; Leischnig, A. Endogeneity bias in marketing research: Problem, causes and remedies. Ind. Mark. Manag. 2017, 65, 39–46. [Google Scholar] [CrossRef]

- Park, S.; Song, S.; Lee, S. The issue of endogeneity and possible solutions in panel data analysis in the hospitality literature. J. Hosp. Tour. Res. 2021, 45, 399–418. [Google Scholar] [CrossRef]

- Bell, A.; Fairbrother, M.; Jones, K. Fixed and random effects models: Making an informed choice. Qual. Quant. 2019, 53, 1051–1074. [Google Scholar] [CrossRef]

- Antonakis, J.; Bastardoz, N.; Rönkkö, M. On ignoring the random effects assumption in multilevel models: Review, critique, and recommendations. Organ. Res. Methods 2021, 24, 443–483. [Google Scholar] [CrossRef]

- Wintoki, M.B.; Linck, J.S.; Netter, J.M. Endogeneity and the dynamics of internal corporate governance. J. Financ. Econ. 2012, 105, 581–606. [Google Scholar] [CrossRef]

- Gippel, J.; Smith, T.; Zhu, Y. Endogeneity in accounting and finance research: Natural experiments as a state-of-the-art solution. Abacus 2015, 51, 143–168. [Google Scholar] [CrossRef]

- Leszczensky, L.; Wolbring, T. How to deal with reverse causality using panel data? Recommendations for researchers based on a simulation study. Sociol. Methods Res. 2022, 51, 837–865. [Google Scholar] [CrossRef]

- Arellano, M.; Bond, S. Some tests of specification for panel data: Monte Carlo evidence and an application to employment equations. Rev. Econ. Stud. 1991, 58, 277–297. [Google Scholar] [CrossRef]

- Bellemare, M.F.; Masaki, T.; Pepinsky, T.B. Lagged explanatory variables and the estimation of causal effect. J. Politics 2017, 79, 949–963. [Google Scholar] [CrossRef]

- Li, J.; Ding, H.; Hu, Y.; Wan, G. Dealing with dynamic endogeneity in international business research. J. Int. Bus. Stud. 2021, 52, 339–362. [Google Scholar] [CrossRef]

- Durand, D. Costs of debt and equity funds for business: Trends and problems of measurement. In Conference on Research in Business Finance; NBER: Cambridge, MA, USA, 1952; pp. 215–262. [Google Scholar]

- Dada, A.O.; Ghazali, Z. The impact of capital structure on firm performance: Empirical evidence from Nigeria. IOSR J. Econ. Financ. 2016, 7, 23–30. [Google Scholar] [CrossRef]

- Dey, R.K.; Hossain, S.Z.; Rahman, R.A. Effect of corporate financial leverage on financial performance: A study on publicly traded manufacturing companies in Bangladesh. Asian Soc. Sci. 2018, 14, 124. [Google Scholar] [CrossRef]

- Ahmed, N.; Afza, T. Capital structure, competitive intensity and firm performance: Evidence from Pakistan. J. Adv. Manag. Res. 2019, 16, 796–813. [Google Scholar] [CrossRef]

- Kenn-Ndubuisi, J.I.; Joel, C. Financial leverage and firm financial performance in Nigeria: A panel data analysis approach. Glob. J. Manag. Bus. Res. 2019, 19, 13–19. [Google Scholar]

- Miller, M.H. The M&M propositions 40 years later. Eur. Financ. Manag. 1998, 4, 113–120. [Google Scholar]

- Vătavu, S. The impact of capital structure on financial performance in Romanian listed companies. Procedia Econ. Financ. 2015, 32, 1314–1322. [Google Scholar] [CrossRef]

- Udeh, S.N.; Ugwu, J.I.; Onwuka, I.O. External debt and economic growth: The Nigeria experience. Eur. J. Account. Audit. Financ. Res. 2016, 4, 33–48. [Google Scholar]

- Nenu, E.A.; Vintilă, G.; Gherghina, Ş.C. The impact of capital structure on risk and firm performance: Empirical evidence for the Bucharest Stock Exchange listed companies. Int. J. Financ. Stud. 2018, 106, 41. [Google Scholar] [CrossRef]

- Bai, K.; Ullah, F.; Arif, M.; Erfanian, S.; Urooge, S. Stakeholder-Centered Corporate Governance and Corporate Sustainable Development: Evidence from CSR Practices in the Top Companies by Market Capitalization at Shanghai Stock Exchange of China. Sustainability 2023, 15, 2990. [Google Scholar] [CrossRef]

- Scott, J.H., Jr. A theory of optimal capital structure. Bell J. Econ. 1976, 7, 33–54. [Google Scholar] [CrossRef]

- Akomeah, E.; Bentil, P.; Musah, A. The Impact of capital structure decisions on firm performance: The case of Listed non-financial institutions in Ghana. Int. J. Acad. Res. Account. Financ. Manag. Sci. 2018, 8, 1–15. [Google Scholar] [CrossRef] [PubMed]

- Maina, L.K.; Olweny, T.; Wanjau, K. Observed leverage and financial performance of listed firms in Kenya. Int. J. Financ. Bank. Stud. (2147–4486) 2018, 7, 19–38. [Google Scholar] [CrossRef]

- Akingunola, R.O.; Olawale, L.S.; Olaniyan, J.D. Capital structure decision and firm performance: Evidence from non-financial firms in Nigeria. Acta Univ. Danubius. Œconomica 2018, 13, 351–364. [Google Scholar]

- Khan, A.A.; Shaikh, Z.A.; Baitenova, L.; Mutaliyeva, L.; Moiseev, N.; Mikhaylov, A.; Laghari, A.A.; Idris, S.A.; Alshazly, H. QoS-ledger: Smart contracts and metaheuristic for secure quality-of-service and cost-efficient scheduling of medical-data processing. Electronics 2021, 10, 3083. [Google Scholar] [CrossRef]

- Yumashev, A.; Mikhaylov, A. Development of polymer film coatings with high adhesion to steel alloys and high wear resistance. Polym. Compos. 2020, 41, 2875–2880. [Google Scholar] [CrossRef]

- Alwaely, S.A.; Yousif, N.B.; Mikhaylov, A. Emotional development in preschoolers and socialization. Early Child Dev. Care 2021, 191, 2484–2493. [Google Scholar] [CrossRef]

| Sectors | No Firms France | No Observations France | Percentage France | No Firms UK | No Observations UK | Percentage UK |

|---|---|---|---|---|---|---|

| Basic Materials | 15 | 300 | 10% | 19 | 380 | 9.5% |

| Consumer Cyclicals | 44 | 880 | 29.3% | 41 | 820 | 20.5% |

| Consumer Non-Cyclicals | 16 | 320 | 10.7% | 25 | 500 | 12.5% |

| Energy | 3 | 60 | 2% | 11 | 220 | 5.5% |

| Industrials | 33 | 660 | 22% | 50 | 1000 | 25% |

| Healthcare | 7 | 140 | 4.7% | 11 | 220 | 5.5% |

| Real Estate | 11 | 220 | 7.3% | 20 | 400 | 10% |

| Technology | 20 | 400 | 13.3% | 16 | 320 | 8% |

| Utilities | 1 | 20 | 0.7% | 7 | 140 | 3.5% |

| Total | 150 | 3000 | 100% | 200 | 4000 | 100% |

| Variable | Tape | Description |

|---|---|---|

| Tobin’s Q | Dependent | Total market value of firm/total assets of the firm |

| Earnings per share | Dependent | Net income after tax/total outstanding shar |

| Return on asset | Dependent | Net income after tax/total assets × 100 |

| Return on equity | Dependent | Net income after tax/total equity × 100 |

| Equity ratio deviation from golden ratio | Independent | (Total equity/total asset) − 0.382 |

| Capitalization ratio deviation from golden ratio | Independent | (Total debt)/(total debt + total equity) − 0.618 |

| Debt to equity deviation from golden ratio | Independent | (Total debt/ total equity) − 0.618 |

| Short term debt to total assets deviation from golden ratio | Independent | (Total current liabilities/total asset) − 0.618 |

| Long term debt to total assets deviation from golden ratio | Independent | (Total long-term liabilities/total asset) − 0.618 |

| IFRS | Dummy | Marked “1” if the firm adopt IFRS, marked “0” if the firm do not adopt IFRS |

| Firm age | Control | The number of years that the firm has been in the stock market |

| Size of the firm | Control | Natural log of total asset |

| Variable | Observations | Mean | Std. Dev. | Min | Max |

|---|---|---|---|---|---|

| TOBQ | 3000 | 0.61 | 0.367 | 0.206 | 1.356 |

| EPS | 3000 | 2.868 | 3.474 | −0.238 | 10.257 |

| ROA | 3000 | 2.766 | 6.734 | −120.392 | 30.531 |

| ROE | 3000 | 8.872 | 8.067 | −6.244 | 20.603 |

| EYTRAT | 3000 | 0.015 | 0.157 | −0.499 | 0.551 |

| CAPRAT | 3000 | −0.326 | 0.197 | −0.618 | 0.517 |

| DEEUTY | 3000 | 0.116 | 0.519 | −0.502 | 1.118 |

| STTTTA | 3000 | −0.258 | 0.154 | −0.604 | 0.247 |

| LTTTTA | 3000 | −0.454 | 0.126 | −0.618 | 0.361 |

| IFRS | 3000 | 0.85 | 0.4 | 0 | 1 |

| AGE | 3000 | 35.82 | 18.883 | 2 | 158 |

| SIZE | 3000 | 9.098 | 0.933 | 5.856 | 11.154 |

| Variable | Observations | Mean | Std. Dev. | Min | Max |

|---|---|---|---|---|---|

| TOBQ | 3999 | 0.846 | 0.551 | 0.233 | 1.985 |

| EPS | 3999 | 0.549 | 0.651 | −0.072 | 1.976 |

| ROA | 4000 | 4.43 | 4.08 | −2.647 | 10.985 |

| ROE | 4000 | 11.261 | 11.609 | −8.584 | 31.026 |

| EYTRAT | 4000 | 0.015 | 0.217 | −3.352 | 0.89 |

| CAPRAT | 4000 | −0.275 | 0.741 | −29.018 | 5.727 |

| DEEUTY | 4000 | 0.152 | 0.59 | −0.485 | 1.395 |

| STTTTA | 4000 | −0.333 | 0.17 | −0.617 | 2.317 |

| LTTTTA | 4000 | −0.389 | 0.501 | −0.618 | 29.444 |

| IFRS | 4000 | 0.85 | 0.357 | 0 | 1 |

| AGE | 4000 | 44.382 | 35.253 | 1 | 206 |

| SIZE | 3999 | 9.109 | 0.975 | 5.084 | 11.614 |

| Variables | (1) | (2) | (3) | (4) | (5) | (6) | (7) | (8) | (9) | (10) | (11) | (12) |

|---|---|---|---|---|---|---|---|---|---|---|---|---|

| (1) TOBQ | 1.000 | |||||||||||

| (2) EPS | 0.086 | 1.000 | ||||||||||

| (3) ROA | 0.100 | 0.024 | 1.000 | |||||||||

| (4) ROE | 0.238 | 0.371 | 0.001 | 1.000 | ||||||||

| (5) EYTRAT | 0.013 | 0.048 | 0.112 | 0.006 | 1.000 | |||||||

| (6) CAPRAT | 0.026 | −0.021 | −0.117 | 0.022 | −0.624 | 1.000 | ||||||

| (7) DEEUTY | −0.385 | −0.052 | −0.034 | −0.022 | 0.023 | −0.019 | 1.000 | |||||

| (8) STTTTA | −0.004 | −0.036 | −0.035 | −0.034 | −0.574 | −0.084 | −0.016 | 1.000 | ||||

| (9) LTTTTA | 0.025 | 0.008 | −0.075 | 0.035 | −0.427 | 0.673 | −0.015 | −0.397 | 1.000 | |||

| (10) IFRS | 0.035 | 0.004 | 0.010 | 0.025 | 0.040 | 0.027 | 0.004 | −0.089 | 0.051 | 1.000 | ||

| (11) AGE | 0.001 | 0.021 | 0.022 | 0.016 | 0.059 | 0.022 | −0.011 | −0.170 | 0.041 | 0.212 | 1.000 | |

| (12) SIZE | 0.029 | −0.057 | 0.134 | 0.023 | −0.327 | 0.357 | −0.011 | −0.070 | 0.258 | 0.139 | 0.192 | 1.000 |

| Variables | (1) | (2) | (3) | (4) | (5) | (6) | (7) | (8) | (9) | (10) | (11) | (12) |

|---|---|---|---|---|---|---|---|---|---|---|---|---|

| (1) TOBQ | 1.000 | |||||||||||

| (2) EPS | −0.015 | 1.000 | ||||||||||

| (3) ROA | −0.014 | 0.573 | 1.000 | |||||||||

| (4) ROE | 0.006 | 0.524 | 0.686 | 1.000 | ||||||||

| (5) EYTRAT | 0.031 | 0.039 | 0.098 | 0.111 | 1.000 | |||||||

| (6) CAPRAT | −0.017 | 0.018 | −0.030 | −0.004 | −0.124 | 1.000 | ||||||

| (7) DEEUTY | −0.155 | −0.006 | −0.025 | −0.019 | 0.017 | −0.009 | 1.000 | |||||

| (8) STTTTA | 0.006 | −0.111 | −0.028 | 0.090 | −0.565 | −0.065 | −0.040 | 1.000 | ||||

| (9) LTTTTA | 0.017 | −0.001 | −0.064 | −0.026 | −0.123 | 0.091 | −0.009 | −0.092 | 1.000 | |||

| (10) IFRS | 0.074 | 0.055 | 0.000 | 0.002 | 0.032 | −0.008 | 0.083 | −0.079 | −0.001 | 1.000 | ||

| (11) AGE | 0.006 | 0.085 | 0.006 | −0.021 | 0.131 | −0.029 | 0.010 | −0.086 | −0.033 | 0.099 | 1.000 | |

| (12) SIZE | −0.000 | 0.388 | 0.106 | 0.202 | −0.138 | 0.145 | 0.026 | −0.163 | 0.063 | 0.116 | −0.005 | 1.000 |

| France | UK | |||

|---|---|---|---|---|

| Variance inflation factor | VIF | 1/VIF | VIF | 1/VIF |

| EYTRAT | 2.342 | 0.653 | 1.744 | 0.573 |

| CAPRAT | 1.272 | 0.734 | 1.057 | 0.946 |

| DEEUTY | 1.113 | 0.902 | 1.023 | 0.978 |

| STTTTA | 1.569 | 0.564 | 1.702 | 0.587 |

| LTTTTA | 1.452 | 0.867 | 1.059 | 0.944 |

| IFRS | 1.062 | 0.95 | 1.028 | 0.973 |

| AGE | 1.473 | 0.681 | 1.028 | 0.973 |

| SIZE | 1.456 | 0.345 | 1.138 | 0.879 |

| Mean VIF | 1.28 | 1.222 | . | |

| Heteroskedasticity Results | ||||

| Chi-square | 118 | 270.78 | ||

| p-value | 0.441 | 0.224 | ||

| Jarque-Bera normality test | ||||

| Chi-square | 377.6 | 744.7 | ||

| p-value | 0.444 | 0.511 |

| Variables | Statistics (Unadjusted t) | Statistics (Adjusted t *) | p-Value |

|---|---|---|---|

| TOBQ | −37.4117 | −30.8842 | 0.0000 |

| EPS | −31.9189 | −25.8361 | 0.0000 |

| ROA | −38.0033 | −31.9187 | 0.0000 |

| ROE | −38.4796 | −32.1793 | 0.0000 |

| EYTRAT | −36.5057 | −31.6321 | 0.0000 |

| CAPRAT | −38.3724 | −32.8766 | 0.0000 |

| DEEUTY | −40.2174 | −35.1034 | 0.0000 |

| STTTTA | −37.9288 | −32.9005 | 0.0000 |

| LTTTTA | −40.5286 | −35.3161 | 0.0000 |

| AGE | −34.7197 | −30.5270 | 0.0000 |

| SIZE | −31.3288 | −30.6001 | 0.0000 |

| Variables | Statistics (Unadjusted t) | Statistics (Adjusted t *) | p-Value |

|---|---|---|---|

| TOBQ | −45.2282 | −42.4775 | 0.0000 |

| EPS | −42.4437 | −35.7358 | 0.0000 |

| ROA | −47.2882 | −42.4975 | 0.0000 |

| ROE | −45.9498 | −40.6362 | 0.0000 |

| EYTRAT | −43.5707 | −36.9379 | 0.0000 |

| CAPRAT | −44.3497 | −38.4566 | 0.0000 |

| DEEUTY | −45.5836 | −40.3556 | 0.0000 |

| STTTTA | −44.4637 | −38.7328 | 0.0000 |

| LTTTTA | −45.2239 | −39.2375 | 0.0000 |

| AGE | −42.7588 | −35.8205 | 0.0000 |

| SIZE | −42.7588 | −35.8205 | 0.0000 |

| Variables | TOBQ | EPS | ROA | ROE | ||||

|---|---|---|---|---|---|---|---|---|

| Coefficient (Std. Dev.) | p-Value | Coefficient (Std. Dev.) | p-Value | Coefficient (Std. Dev.) | p-Value | Coefficient (Std. Dev.) | p-Value | |

| Lag of TOBQ, EPS, ROA and ROE | 0.032 *** | 0.000 | 0.012 *** | 0.000 | 0.234 *** | 0.000 | −0.096 *** | 0.000 |

| (0.003) | (0.005) | (0.005) | (0.006) | |||||

| EYTRAT | 0.198 | 0.076 | 7.438 *** | 0.000 | 37.928 *** | 0.000 | 24.063 *** | 0.001 |

| (0.111) | (1.347) | (1.621) | (5.889) | |||||

| CAPRAT | 1.670 *** | 0.000 | 14.885 *** | 0.000 | 20.870 *** | 0.000 | 18.477 *** | 0.004 |

| (0.117) | (0.891) | (1.143) | (5.069) | |||||

| DEEUTY | −0.297 *** | 0.000 | −0.313 *** | 0.000 | −0.406 *** | 0.000 | −0.369 *** | 0.001 |

| (0.004) | (0.026) | (0.031) | (0.095) | |||||

| STTTTA | −0.604 *** | 0.000 | 7.964 *** | 0.000 | 11.570 *** | 0.000 | 24.732 *** | 0.000 |

| (0.102) | (1.153) | (1.427) | (4.006) | |||||

| LTTTTA | −2.376 *** | 0.000 | −15.899 *** | 0.000 | −26.192 *** | 0.000 | −1.420 | 0.850 |

| (0.198) | (1.494) | (1.794) | (7.541) | |||||

| IFRS | 0.036 *** | 0.000 | 1.059 *** | 0.000 | 0.895 *** | 0.000 | 0.890 *** | 0.001 |

| (0.005) | (0.030) | (0.069) | (0.264) | |||||

| AGE | −0.0005 | 0.220 | 0.084 *** | 0.000 | −0.038 *** | 0.000 | 0.140 *** | 0.000 |

| (0.0004) | (0.004) | (0.006) | (0.015) | |||||

| SIZE | −0.148 *** | 0.000 | −6.072 *** | 0.000 | −2.017 *** | 0.000 | −8.345 *** | 0.000 |

| (0.027) | (0.116) | (0.327) | (1.007) | |||||

| Changing GDP | 0.0004 *** | 0.004 | 0.032 *** | 0.000 | 0.054 *** | 0.000 | 0.025 *** | 0.000 |

| (0.0001) | (0.001) | (0.001) | (0.004) | |||||

| Financial crisis | −0.001 *** | 0.000 | −1.053 *** | 0.000 | −0.450 *** | 0.000 | −1.789 *** | 0.000 |

| (0.060) | (0.023) | (0.041) | (0.172) | |||||

| N. of observations | 2700 | 2700 | 2700 | 2700 | ||||

| AR (1) | 0.000 | 0.004 | 0.000 | 0.003 | ||||

| AR (2) | 0.735 | 0.639 | 0.345 | 0.563 | ||||

| Sargan test | 0.567 | 0.456 | 0.234 | 0.123 | ||||

| Hansen test | 0.234 | 0.123 | 0.146 | 0.291 |

| Variables | TOBQ | EPS | ROA | ROE | ||||

|---|---|---|---|---|---|---|---|---|

| Coefficient (Std. Dev.) | p-Value | Coefficient (Std. Dev.) | p-Value | Coefficient (Std. Dev.) | p-Value | Coefficient (Std. Dev.) | p-Value | |

| Lag of TOBQ, EPS, ROA and ROE | 0.043 *** | 0.000 | 0.164 *** | 0.000 | 0.141 *** | 0.000 | 0.166 *** | 0.000 |

| (0.002) | (0.012) | (0.015) | (0.016) | |||||

| EYTRAT | 0.840 *** | 0.000 | 1.761 *** | 0.000 | 21.312 *** | 0.000 | 39.847 *** | 0.000 |

| (0.064) | (0.061) | (0.763) | (2.949) | |||||

| CAPRAT | −0.032 *** | 0.000 | −0.038 *** | 0.000 | −0.060 *** | 0.161 | −0.902 *** | 0.000 |

| (0.003) | (0.004) | (0.043) | (0.110) | |||||

| DEEUTY | −0.130 *** | 0.000 | −0.014 *** | 0.000 | −0.207 *** | 0.000 | −0.537 *** | 0.000 |

| (0.003) | (0.002) | (0.035) | (0.087) | |||||

| STTTTA | −1.311 *** | 0.000 | 0.520 *** | 0.000 | 6.441 *** | 0.000 | 18.930 *** | 0.000 |

| (0.086) | (0.062) | (0.715) | (2.577) | |||||

| LTTTTA | −0.075 *** | 0.000 | 0.020 | 0.260 | −0.318 ** | 0.051 | 1.558 | 0.170 |

| (.017) | (0.017) | (0.162) | (1.131) | |||||

| IFRS | 0.015 ** | 0.056 | 0.071 *** | 0.000 | 1.043 *** | 0.000 | 3.193 *** | 0.001 |

| (0.007) | (0.009) | (0.103) | (0.234) | |||||

| AGE | 0.007 *** | 0.000 | −0.018 *** | 0.000 | −0.096 *** | 0.000 | −0.322 *** | 0.000 |

| (0.0008) | (0.001) | (0.008) | (0.034) | |||||

| SIZE | −0.532 *** | 0.000 | 0.444 *** | 0.000 | −1.970 *** | 0.000 | −5.063 *** | 0.001 |

| (0.040) | (0.047) | (0.345) | (1.276) | |||||

| Changing GDP | −0.005 *** | 0.000 | −0.001 *** | 0.000 | −0.009 *** | 0.001 | −0.030 *** | 0.000 |

| (0.0001) | (0.0001) | (0.002) | (0.006) | |||||

| Financial crisis | −0.078 *** | 0.000 | −0.163 *** | 0.000 | −1.569 *** | 0.000 | −4.239 *** | 0.000 |

| (0.005) | (0.006) | (0.084) | (0.251) | |||||

| N. of observations | 3596 | 3596 | 3596 | 3596 | ||||

| AR (1) | 0.002 | 0.000 | 0.000 | 0.005 | ||||

| AR (2) | 0.235 | 0.467 | 0.672 | 0.782 | ||||

| Sargan test | 0.123 | 0.453 | 0.873 | 0.234 | ||||

| Hansen test | 0.345 | 0.237 | 0.201 | 0.129 |

| Variables | TOBQ | EPS | ROA | ROE | ||||

|---|---|---|---|---|---|---|---|---|

| Coefficient (Std. Dev.) | p-Value | Coefficient (Std. Dev.) | p-Value | Coefficient (Std. Dev.) | p-Value | Coefficient (Std. Dev.) | p-Value | |

| EYTRAT | 0.061 | 0.641 | 1.2 | 0.371 | 13.355 *** | 0.000 | 1.639 | 0.601 |

| (0.131) | (1.193) | (2.508) | (3.136) | |||||

| CAPRAT | 0.008 | 0.947 | −1.32 | 0.269 | −10.985 *** | 0.000 | −0.855 | 0.76 |

| (0.117) | (1.193) | (2.233) | (2.793) | |||||

| DEEUTY | −0.273 *** | 0.000 | −0.302 ** | 0.013 | −0.508 ** | 0.027 | −0.233 | 0.416 |

| (0.012) | (0.122) | (0.229) | (0.287) | |||||

| STTTTA | 0.043 | 0.695 | 0.729 | 0.519 | 12.729 *** | 0.000 | 0.874 | 0.741 |

| (0.111) | (1.131) | (2.115) | (2.645) | |||||

| LTTTTA | 0.062 | 0.712 | 3.003 | 0.079 | 21.769 *** | 0.000 | 4.24 | 0.289 |

| (0.168) | (1.712) | (3.201) | (4.002) | |||||

| IFRS | 0.024 | 0.529 | 0.045 | 0.848 | 0.23 | 0.666 | 0.329 | 0.679 |

| (0.038) | (0.234) | (0.533) | (0.795) | |||||

| AGE | −0.029 | 0.479 | 0.003 | 0.492 | 0.013 * | 0.098 | −0.01 | 0.34 |

| (041) | (0.004) | (0.008) | (0.01) | |||||

| SIZE | 0.008 | 0.334 | −0.134 | 0.105 | 1.873 *** | 0.000 | 0.252 | 0.193 |

| (0.008) | (0.083) | (0.155) | (0.193) | |||||

| Changing GDP | 0.007 | 0.187 | 0.018 | 0.553 | 0.202 *** | 0.004 | 0.039 | 0.714 |

| (0.005) | (0.031) | (0.07) | (0.105) | |||||

| Financial crisis | −0.002 | 0.975 | −0.735 * | 0.075 | −0.135 | 0.886 | −1.142 | 0.419 |

| (0.067) | (0.412) | (0.943) | (1.414) | |||||

| Basic Materials | 0.012 | 0.897 | −0.87 | 0.353 | 3.976 ** | 0.023 | −5.18 ** | 0.018 |

| (0.092) | (0.937) | (1.754) | (2.195) | |||||

| Consumer Cyclical | 0.049 | 0.58 | 176. | 0.847 | 3.495 ** | 0.04 | −5.188 ** | 0.015 |

| (0.089) | (0.911) | (1.705) | (2.133) | |||||

| Consumer Noncyclical | 0.068 | 0.46 | −0.819 | 0.383 | 5.556 *** | 0.002 | −4.123 * | 0.061 |

| (0.092) | (0.939) | (1.759) | (2.2) | |||||

| Energy | −0.036 | 0.72 | 0.644 | 0.534 | 3.39 * | 0.08 | −4.824 ** | .047 |

| (0.102) | (1.036) | (1.939) | (2.425) | |||||

| Healthcare | 0.089 | 0.344 | −0.175 | 0.855 | 3.573 ** | 0.047 | −4.892 ** | 0.029 |

| (0.094) | (0.959) | (1.795) | (2.245) | |||||

| Industrials | 0.037 | 0.679 | 0.19 | 0.834 | 3.751 ** | 0.027 | −4.081 * | 0.055 |

| (0.089) | (0.908) | (1.699) | (2.125) | |||||

| Real-estate | 0.003 | 0.975 | 0.362 | 0.699 | 3.216 * | 0.066 | −4.415 ** | 0.044 |

| (0.092) | (0.934) | (1.749) | (2.188) | |||||

| Technology | 0.06 | 0.504 | −0.459 | 0.617 | 4.91 *** | 0.004 | −4.849 ** | 0.024 |

| (0.09) | (0.919) | (1.721) | (2.152) | |||||

| Constant | 0.555 *** | 0.000 | 5.205 *** | 0.000 | −8.916 *** | 0.000 | 13.12 *** | 0.000 |

| (0.128) | (1.283) | (2.414) | (3.343) | |||||

| N. of observations | 3000 | 3000 | 3000 | 3000 | ||||

| R-square | 0.371 | 0.280 | 0.365 | 0.125 | ||||

| F-test | 534.503 *** | 81.914 *** | 276.514 *** | 22.529 *** | ||||

| (0.000) | (0.000) | (0.000) | (0.000) | |||||

| Hausman specification tests (p-value) | 0.874 | 0.581 | 0.619 | 0.821 |

| Variables | TOBQ | EPS | ROA | ROE | ||||

|---|---|---|---|---|---|---|---|---|

| Coefficient (Std. Dev.) | p-Value | Coefficient (Std. Dev.) | p-Value | Coefficient (Std. Dev.) | p-Value | Coefficient (Std. Dev.) | p-Value | |

| EYTRAT | −0.125 ** | 0.016 | 0.227 *** | 0.000 | 2.783 *** | 0.000 | −1.594 | 0.14 |

| (0.052) | (0.057) | (0.384) | (3.109) | |||||

| CAPRAT | −0.019 | 0.103 | −0.02 | 0.131 | 0.057 | 0.508 | −0.453 * | 0.062 |

| (0.012) | (0.013) | (0.086) | (2.776) | |||||

| DEEUTY | −0.152 *** | 0.000 | −0.009 | 0.569 | −0.177 * | 0.098 | −0.348 | 0.248 |

| (0.015) | (0.016) | (0.107) | (0.286) | |||||

| STTTTA | −0.11 * | 0.096 | −0.004 | 0.961 | 1.69 *** | 0.001 | 6.845 *** | 0.000 |

| (0.066) | (0.073) | (0.488) | (2.635) | |||||

| LTTTTA | 0.012 | 0.504 | −0.007 | 0.734 | −0.347 *** | 0.007 | −0.659 * | 0.068 |

| (0.017) | (0.019) | (0.128) | (3.972) | |||||

| IFRS | 0.091 | 0.244 | 0.003 | 0.941 | 0.081 | 0.799 | 0.478 | 0.57 |

| (0.078) | (0.037) | (0.319) | (0.708) | |||||

| AGE | 0.025 | 0.308 | 0.001 *** | 0.000 | 0.041 | 0.818 | 0.002 | 0.673 |

| (0.027) | (0) | (0.181) | (0.008) | |||||

| SIZE | −0.001 | 0.926 | 0.274 *** | 0.000 | 0.619 *** | 0.000 | 2.736 *** | 0.000 |

| (0.009) | (0.01) | (0.069) | (0.19) | |||||

| Changing GDP | −0.004 | 0.295 | −0.001 | 0.694 | −0.008 | 0.626 | −0.04 | 0.377 |

| (0.004) | (0.002) | (0.017) | (3.109) | |||||

| Financial crisis | −0.063 | 0.622 | −0.121 ** | 0.041 | −1.346 *** | 0.01 | −2.727 ** | 0.377 |

| (0.128) | (0.06) | (0.521) | (2.776) | |||||

| Basic Materials | −0.032 | 0.547 | −0.094 | 0.114 | −0.583 | 0.14 | −2.759 ** | 0.013 |

| (0.054) | (0.059) | (0.395) | (0.286) | |||||

| Consumer Cyclical | −0.072 | 0.142 | −0.07 | 0.197 | −0.557 | 0.125 | −2.667 *** | 0.009 |

| (0.049) | (0.054) | (0.363) | (2.635) | |||||

| Consumer Noncyclical | −0.03 | 0.561 | −0.051 | 0.368 | 0.01 | 0.98 | −1.195 | 0.265 |

| (0.052) | (0.057) | (0.381) | (3.972) | |||||

| Energy | 0.053 | 0.363 | −0.044 | 0.995 | −0.731 * | 0.089 | −2.043 * | 0.091 |

| (0.058) | (0.065) | (0.431) | (0.708) | |||||

| Healthcare | −0.038 | 0.524 | −0.254 *** | 0.000 | −0.308 | 0.48 | −1.264 | 0.032 |

| (0.059) | (0.065) | (0.436) | (0.008) | |||||

| Industrials | −0.036 | 0.458 | −0.125 ** | 0.021 | −0.501 | 0.164 | −2.756 *** | 0.006 |

| (0.049) | (0.054) | (0.359) | (0.19) | |||||

| Real-estate | −0.009 | 0.859 | −0.165 *** | 0.005 | −1.024 *** | 0.009 | −3.463 *** | 0.002 |

| (0.053) | (0.058) | (0.39) | (0.19) | |||||

| Technology | −0.009 | 0.864 | −0.28 *** | 0.000 | −1.571 *** | 0.000 | −4.208 *** | 0.000 |

| (0.054) | (0.06) | (0.401) | (0.19) | |||||

| Constant | 0.946 *** | 0.000 | −1.896 *** | 0.000 | −0.091 | 0.905 | −8.746 *** | 0.000 |

| (0.119) | (0.11) | (0.761) | (2.077) | |||||

| N. of observations | 3998 | 3998 | 3999 | 3999 | ||||

| R-square | 0.360 | 0.183 | 0.478 | 0.694 | ||||

| F-test | 133.856 *** | 880.755 *** | 186.019 *** | 302.614 *** | ||||

| (0.000) | (0.000) | (0.000) | (0.000) | |||||

| Hausman specification tests (p-value) | 0.798 | 0.672 | 0.478 | 0.625 | ||||

Disclaimer/Publisher’s Note: The statements, opinions and data contained in all publications are solely those of the individual author(s) and contributor(s) and not of MDPI and/or the editor(s). MDPI and/or the editor(s) disclaim responsibility for any injury to people or property resulting from any ideas, methods, instructions or products referred to in the content. |

© 2023 by the authors. Licensee MDPI, Basel, Switzerland. This article is an open access article distributed under the terms and conditions of the Creative Commons Attribution (CC BY) license (https://creativecommons.org/licenses/by/4.0/).

Share and Cite

Amin, H.I.M.; Cek, K. The Effect of Golden Ratio-Based Capital Structure on Firm’s Financial Performance. Sustainability 2023, 15, 7424. https://doi.org/10.3390/su15097424

Amin HIM, Cek K. The Effect of Golden Ratio-Based Capital Structure on Firm’s Financial Performance. Sustainability. 2023; 15(9):7424. https://doi.org/10.3390/su15097424

Chicago/Turabian StyleAmin, Halkawt Ismail Mohammed, and Kemal Cek. 2023. "The Effect of Golden Ratio-Based Capital Structure on Firm’s Financial Performance" Sustainability 15, no. 9: 7424. https://doi.org/10.3390/su15097424

APA StyleAmin, H. I. M., & Cek, K. (2023). The Effect of Golden Ratio-Based Capital Structure on Firm’s Financial Performance. Sustainability, 15(9), 7424. https://doi.org/10.3390/su15097424