Investment Decision of Blockchain Technology in Fresh Food Supply Chains Considering Misreporting Behavior

Abstract

1. Introduction

2. Literature Review

2.1. Food Loss and Waste and CP Technology

2.2. Misreporting Behavior in an FFSC

2.3. Application of BT Technology in an FFSC

2.4. Summary of Knowledge Gaps

3. Method and Model Setup

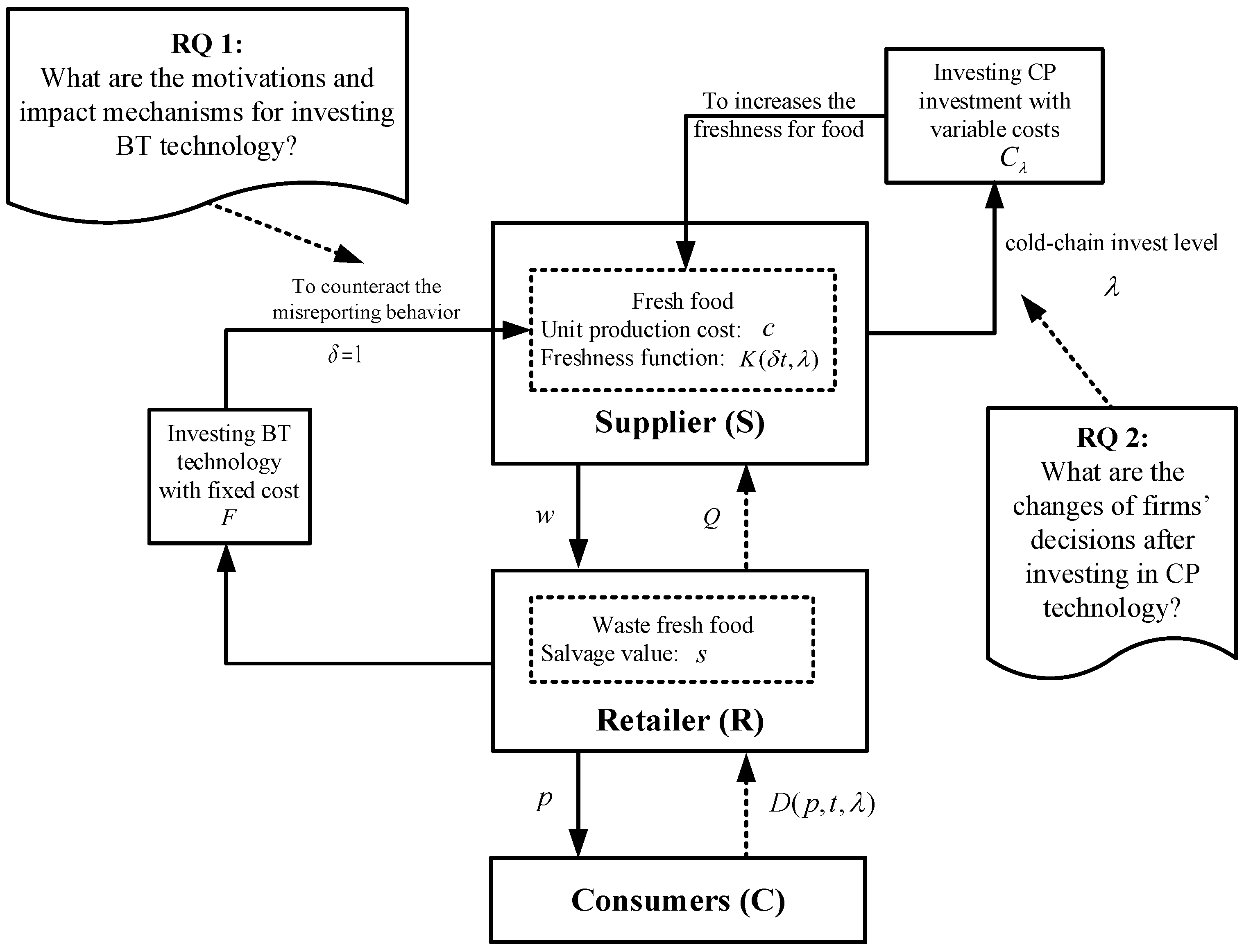

3.1. Problem Description

3.2. Assumptions

- (1)

- The supplier announces the warehouse price with misreporting behavior;

- (2)

- Observing the warehouse price , the retailer decides the sales price .

- (1)

- The retailer selects BT technology;

- (2)

- Observing it, the supplier announces the warehouse price without misreporting behavior;

- (3)

- Observing the warehouse price , the retailer decides the sales price .

4. Equilibrium Analysis

4.1. A FFSC without any Technology Scenario (N)

4.2. A FFSC with BT Technology Scenario (B)

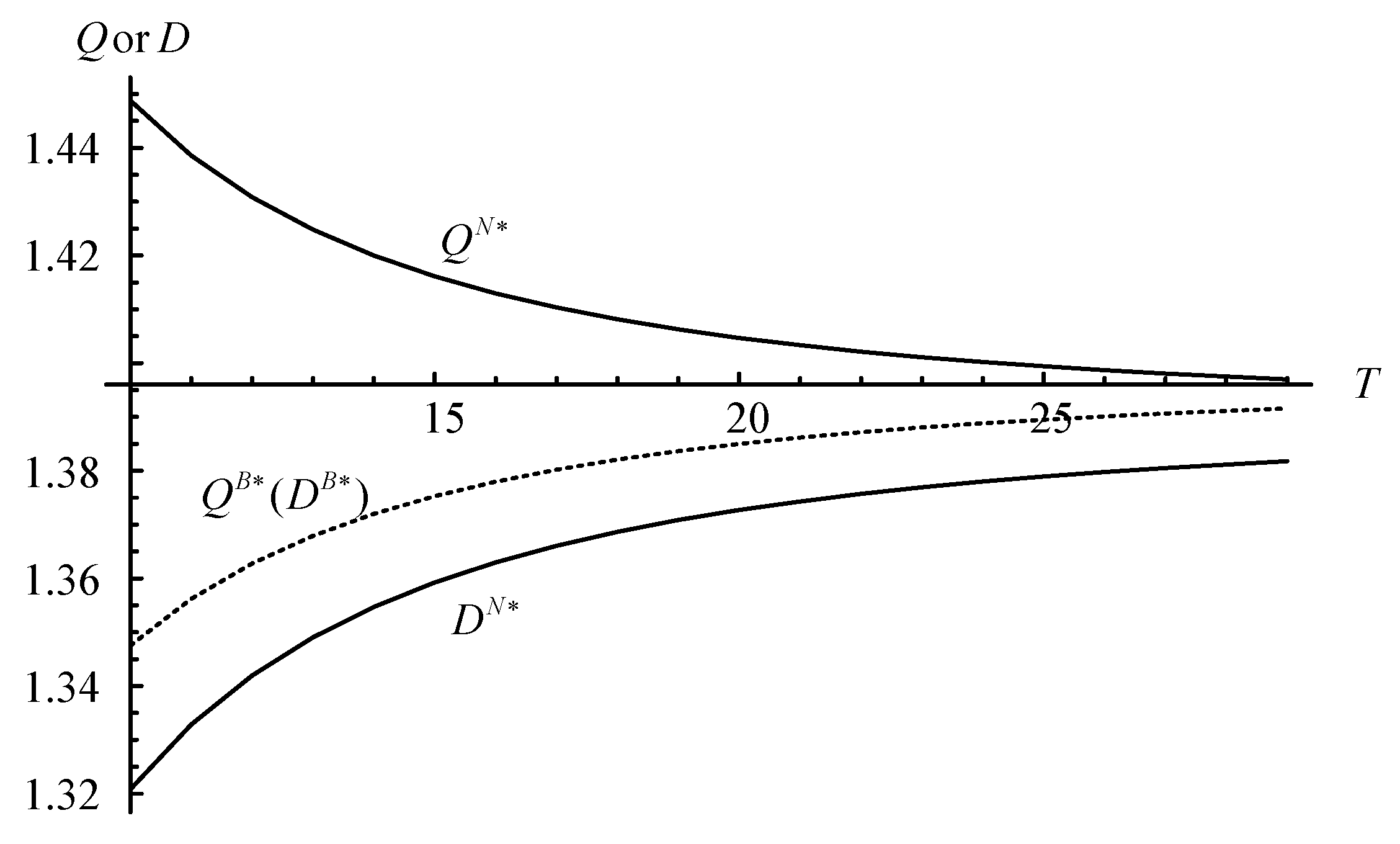

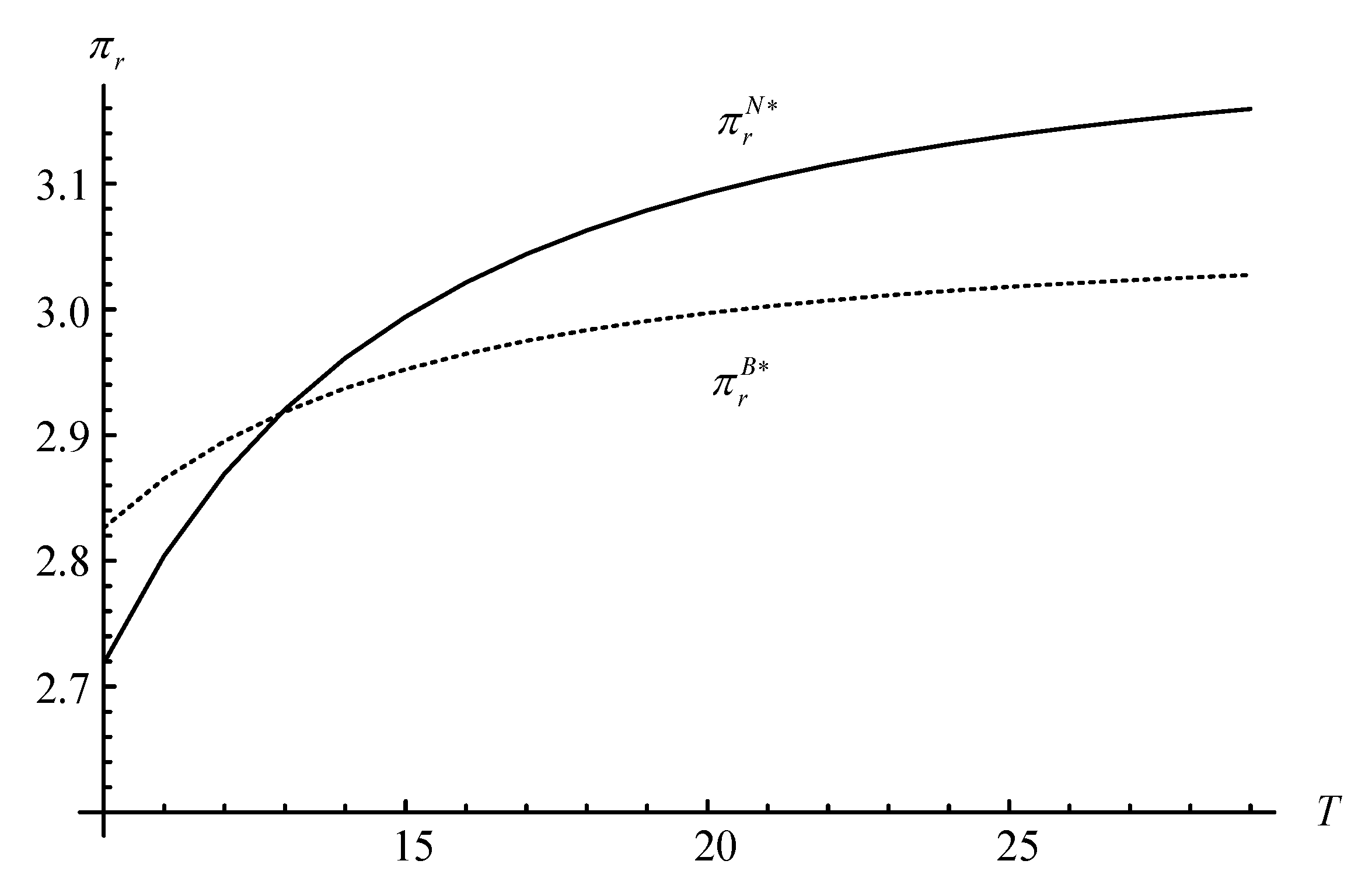

4.3. Comparison of Equilibrium Decisions and Profits

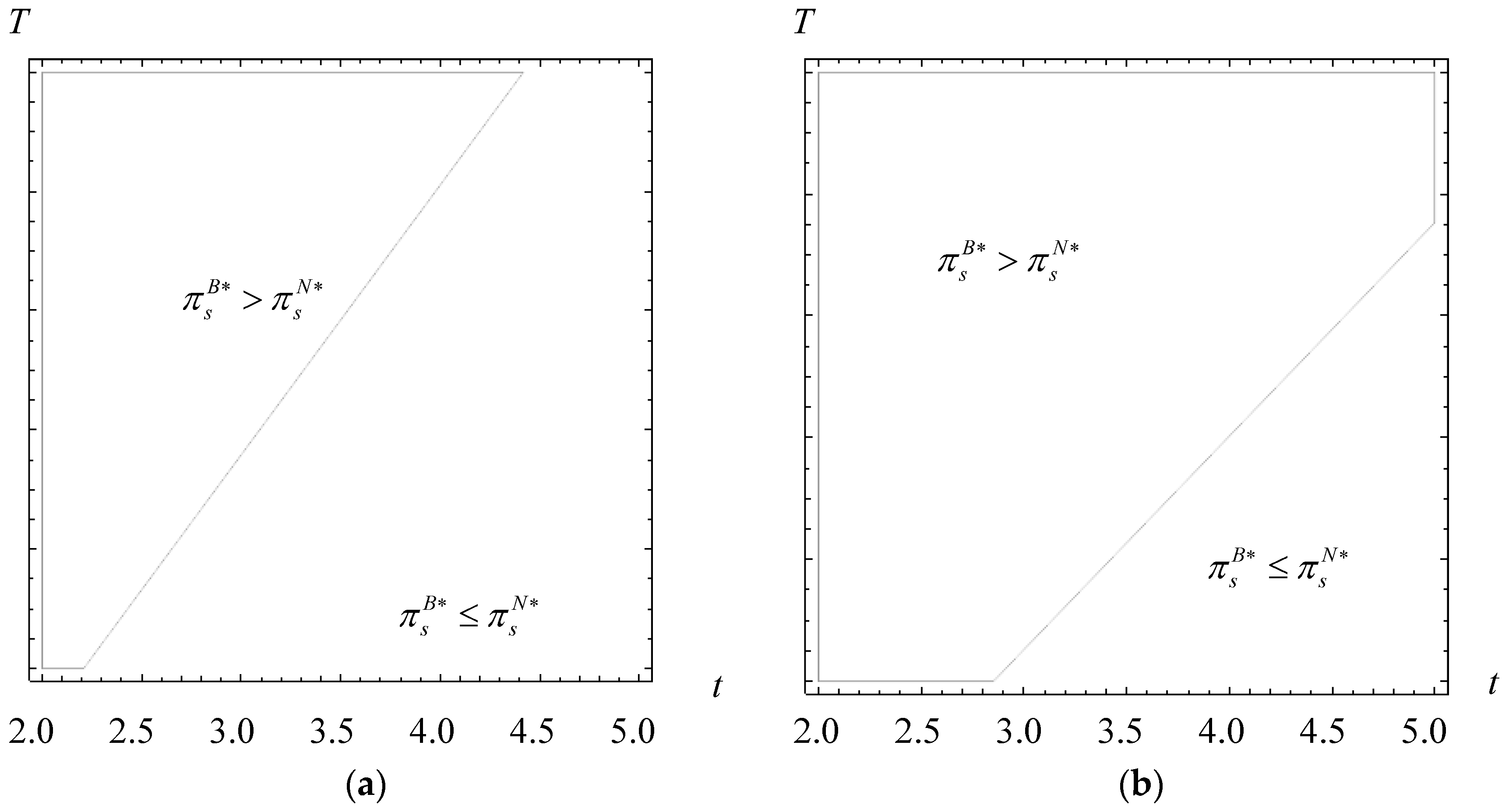

5. Alternative Models

- (1)

- The retailer selects BT technology;

- (2)

- Observing it, the supplier announces the warehouse price without misreporting behavior and decides the CP investment level ;

- (3)

- Observing the warehouse price and the CP investment level , the retailer decides the sales price .

6. Discussion and Conclusions

6.1. Managerial Insights

- The higher the degree of misreporting behavior is, the more fresh food is wasted, thereby introducing blockchain traceability technology can be more effective;

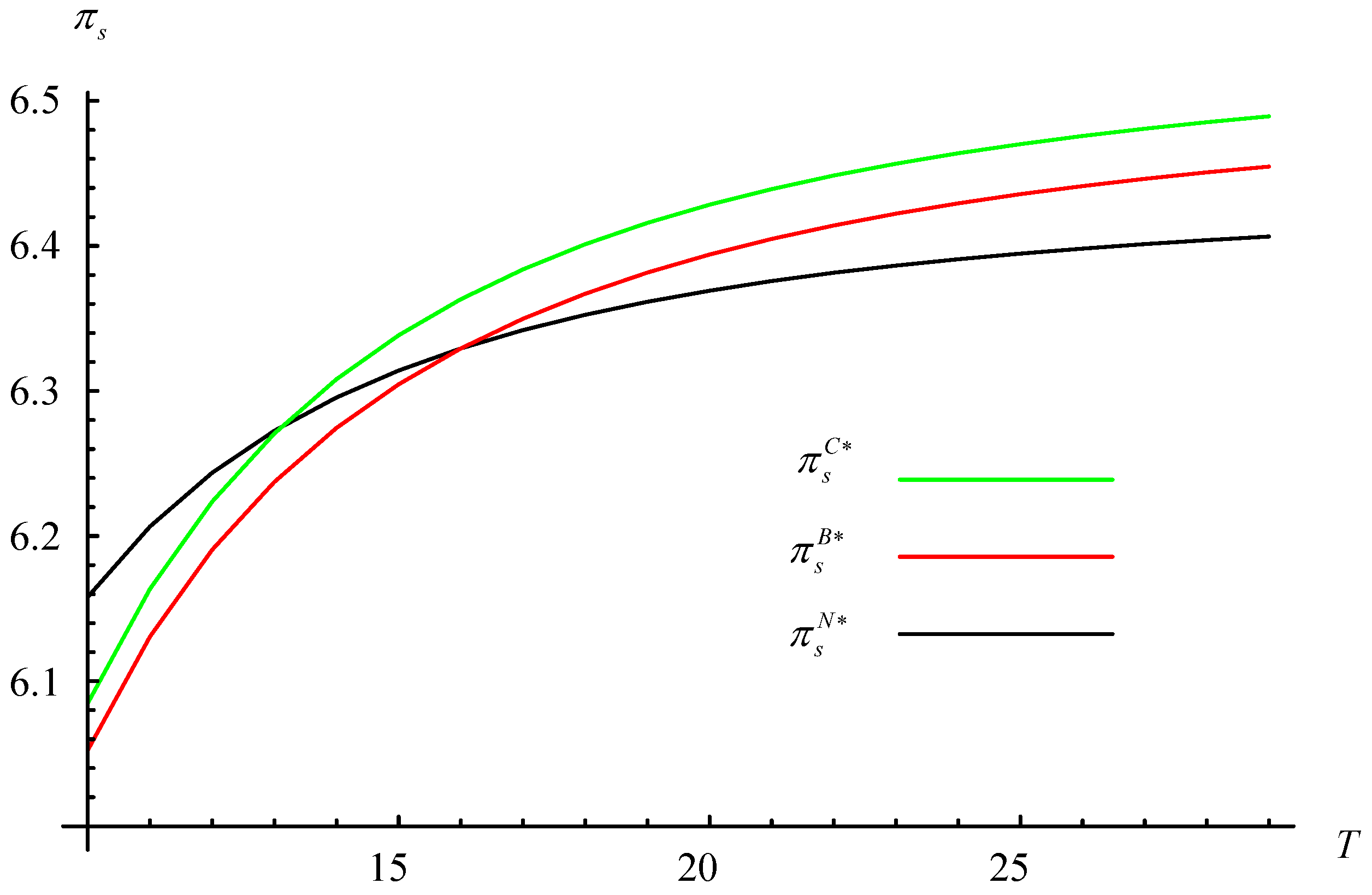

- With the foci to eliminate suppliers’ misreporting behavior and minimize the incentive fees, blockchain BT investment can increase prices, promote order quantities and demand, and promote the freshness level with a joint effect of CT investment;

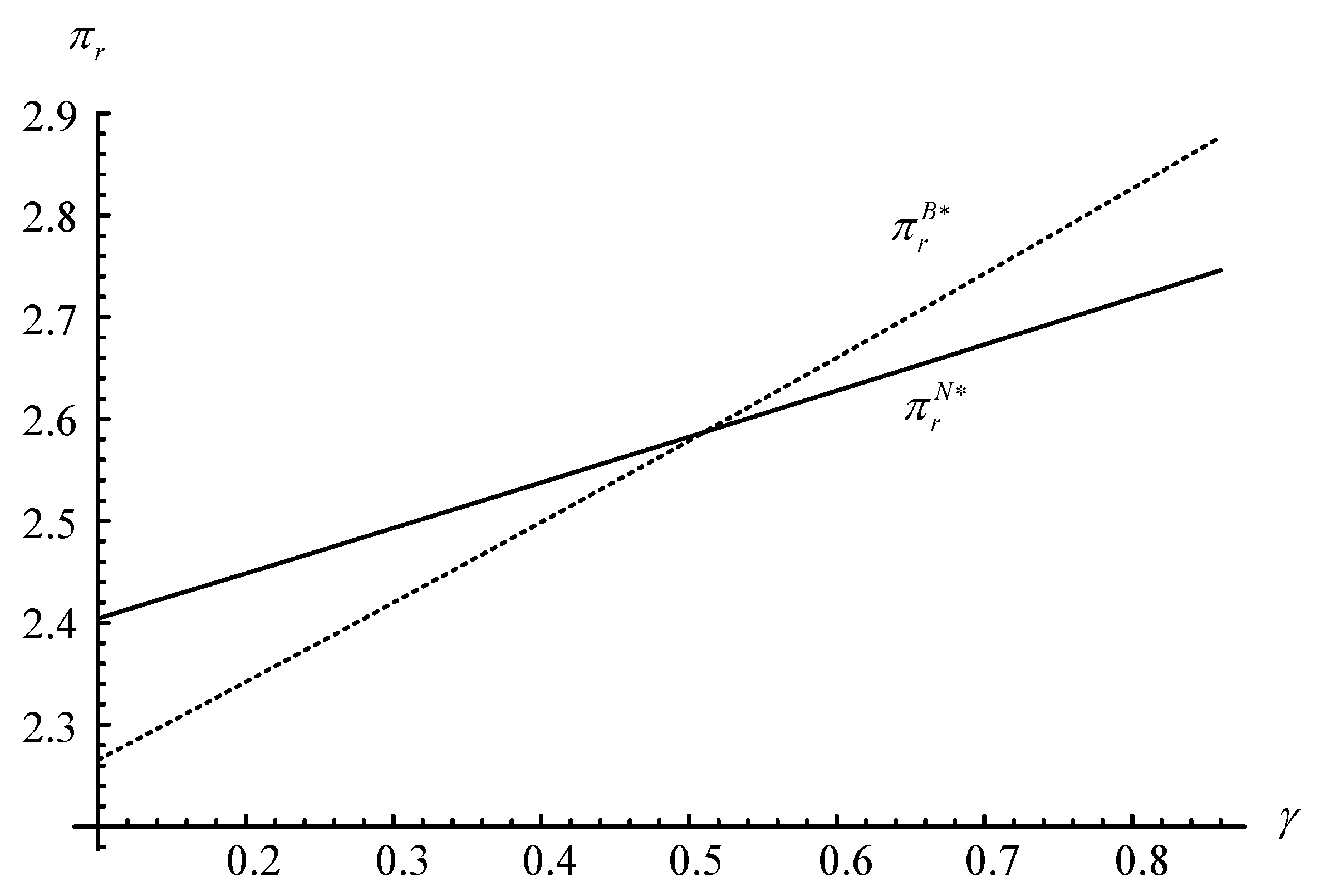

- Only when the consumers demonstrate “appropriate” sensitivity to freshness, a win–win situation can be achieved between suppliers and retailers;

- The misreporting behavior has a great impact on the loss and waste of fresh food as it leads to excessive orders, especially for some foods with high freshness sensitivity, such as some seasonal fruits and vegetables;

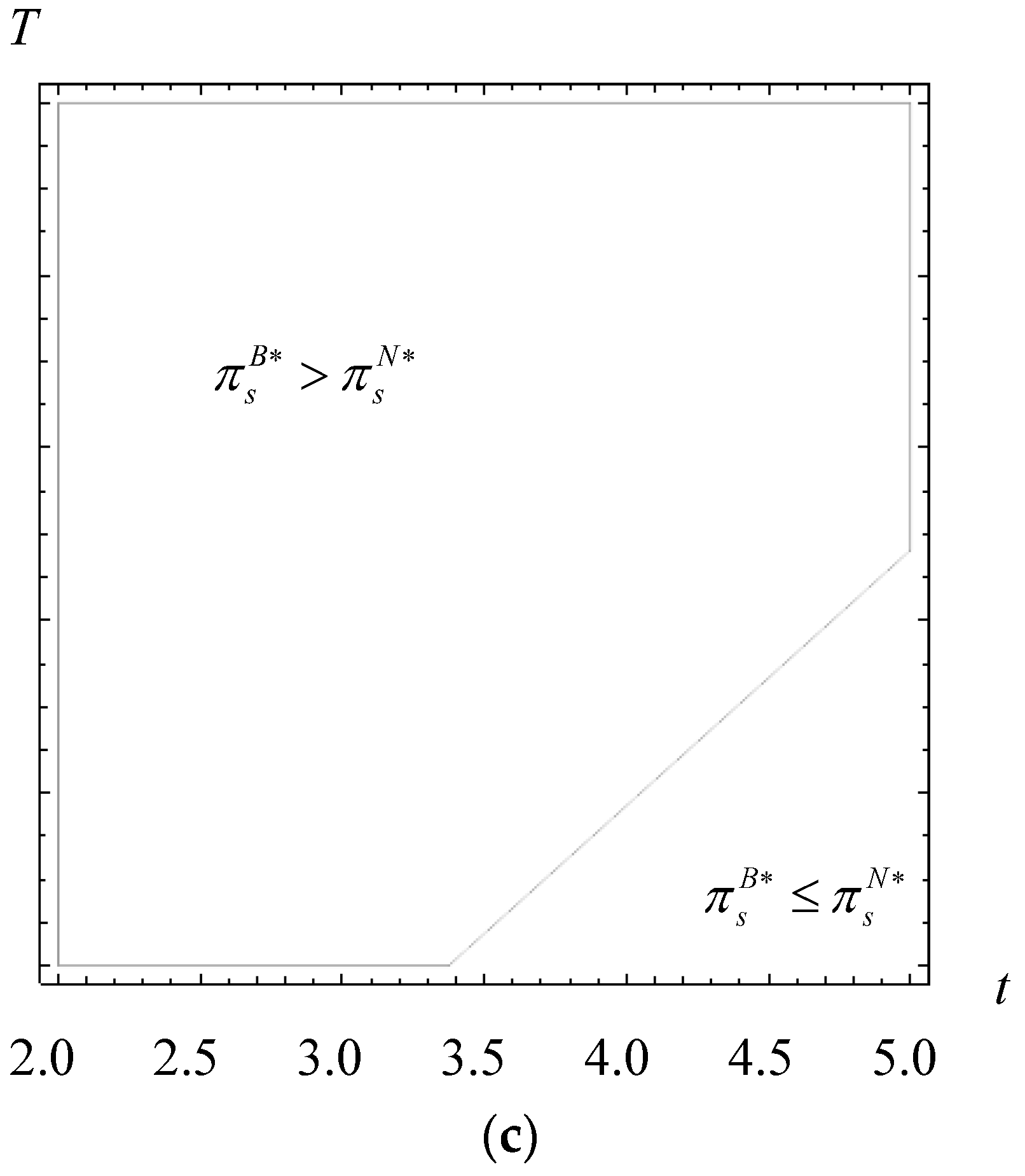

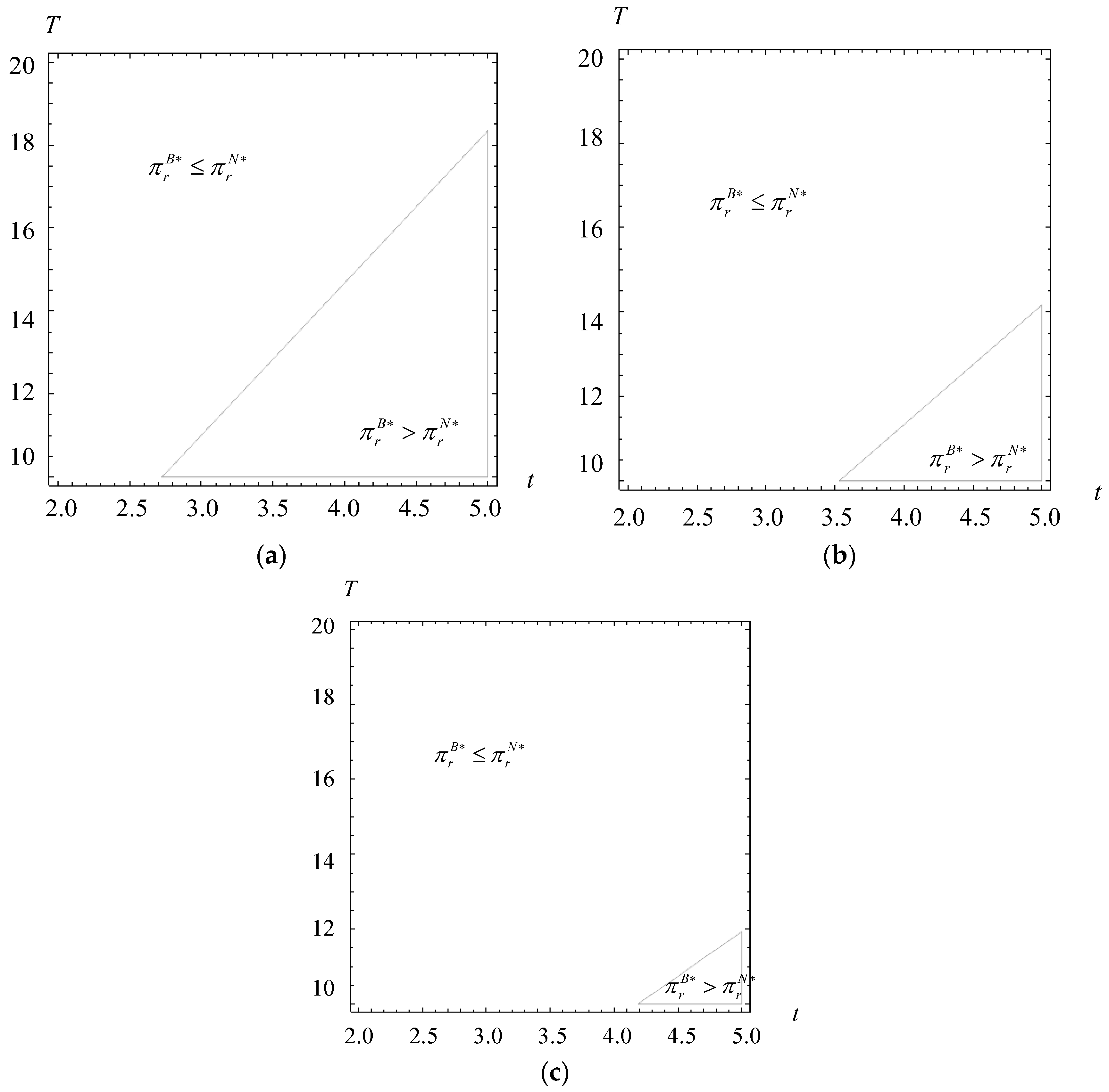

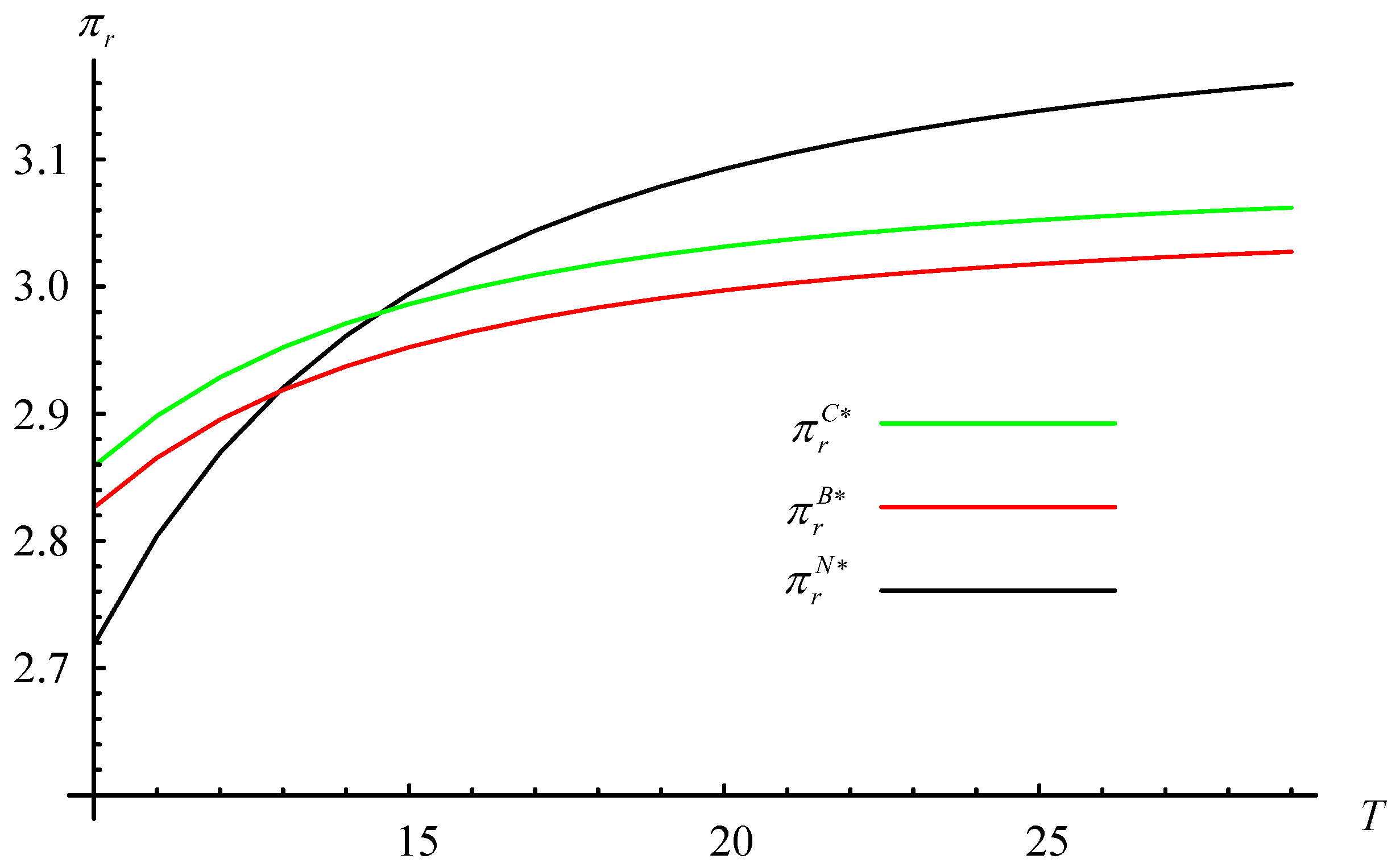

- When both BT and CP technologies are available, the suppliers are not keen to invest in any technologies when the circulation time for fresh food is short, while the retailer prefers to invest when the circulation time is long.

6.2. Limitations and Directions for Further Research

Author Contributions

Funding

Institutional Review Board Statement

Informed Consent Statement

Data Availability Statement

Acknowledgments

Conflicts of Interest

References

- The World Food Program. Global Report on Food Crises. Available online: https://docs.wfp.org/api/documents/WFP-0000114546/download/?_ga=2.244462725.1817522913.1601099339-266302079.15927929%2019 (accessed on 27 March 2023).

- Luo, N.; Olsen, T.; Liu, Y.; Zhang, A. Reducing food loss and waste in supply chain operations. Transp. Res. Part E Logist. Transp. Rev. 2022, 162, 102730. [Google Scholar] [CrossRef]

- United Nations Environment Programme (UNEP). UNEP Food Waste Index Report 2021. Available online: https://www.unep.org/resources/report/unep-food-waste-index-report-2021 (accessed on 27 March 2023).

- Yang, S.; Xiao, Y.; Kuo, Y.-H. The supply chain design for perishable food with stochastic demand. Sustainability 2017, 9, 1195. [Google Scholar] [CrossRef]

- Zhang, X.; Li, Z.; Li, G. Impacts of blockchain-based digital transition on cold supply chains with a third-party logistics service provider. Transp. Res. Part E Logist. Transp. Rev. 2023, 170, 103014. [Google Scholar] [CrossRef]

- Yan, B.; Wang, T.; Liu, Y.-P.; Liu, Y. Decision analysis of retailer-dominated dual-channel supply chain considering cost misreporting. Int. J. Prod. Econ. 2016, 178, 34–41. [Google Scholar] [CrossRef]

- Chen, H.; Jia, X.; Jiang, M. Research on deision-making of fresh agricultural supply chain with blockchain under behavior of misreporting. Comput. Eng. Apps. 2019, 55, 265–270. (In Chinese) [Google Scholar]

- Xu, Y.; Wang, J.; Cao, K. Interaction between joining platform blockchain technology and channel encroachment for fresh agricultural product firms. Int. Trans. Oper. Res. 2023. [Google Scholar] [CrossRef]

- Kyzy, I.E.; Song, H.; Vajdi, A.; Wang, Y.; Zhou, J. Blockchain for consortium: A practical paradigm in agricultural supply chain system. Expert Syst. Appl. 2021, 184, 115425. [Google Scholar] [CrossRef]

- Liu, X.; Barenji, A.V.; Li, Z.; Montreuil, B.; Huang, G.Q. Blockchain-based smart tracking and tracing platform for drug supply chain. Comput. Ind. Eng. 2021, 507, 120235. [Google Scholar] [CrossRef]

- Cui, L.; Xiao, Z.; Wang, J.; Chen, F.; Pan, Y.; Dai, H.; Qin, J. Improving vaccine safety using blockchain. ACM Trans. Internet Technol. 2021, 21, 38. [Google Scholar] [CrossRef]

- Chen, H.; Yin, L. Research on the coordination of fresh food supply chain based on the perspective of blockchain and low carbon. Discret. Dyn. Nat. Soc. 2023, 2023, 6156039. [Google Scholar] [CrossRef]

- Friedman, N.; Ormiston, J. Blockchain as a sustainability-oriented innovation? Opportunities for and resistance to blockchain technology as a driver of sustainability in global food supply chains. Technol. Forecast. Soc. Chang. 2022, 175, 121403. [Google Scholar] [CrossRef]

- Menon, S.; Jain, K. Blockchain technology for transparency in agri-food supply chain: Use cases, limitations, and future directions. IEEE Trans. Eng. Manag. 2021. [Google Scholar] [CrossRef]

- Yu, Y.; Xiao, T.; Feng, Z. Price and cold-chain service decisions versus integration in a fresh agri-product supply chain with competing retailers. Ann. Oper. Res. 2020, 287, 465–493. [Google Scholar] [CrossRef]

- Çakanyıldırım, M.; Feng, Q.; Gan, X.; Sethi, S.P. Contracting and coordination under asymmetric production cost information. Prod. Oper. Manag. 2012, 2, 345–360. [Google Scholar] [CrossRef]

- Feng, Y.; Liu, Z. Analysis of cost misreporting in a fresh agri-products supply chain with TPL’s participation. Soft Sci. 2017, 31, 133–137. (In Chinese) [Google Scholar]

- Cant, J. Study: Blockchain Can Reduce Food Fraud by 31 Billion within 5 Years. Available online: https://cointelegraph.com/news/study-blockchain-can-reduce-food-fraud-by-31-billion-within-5-years (accessed on 27 March 2023).

- Behnke, K.; Janssen, M. Boundary conditions for traceability in food supply chains using blockchain technology. Int. J. Inf. Manag. 2020, 52, 101969. [Google Scholar] [CrossRef]

- Wang, X.; Li, D. A dynamic product quality evaluation based pricing model for perishable food supply chains. Omega-Int. J. Manag. Sci. 2012, 40, 906–917. [Google Scholar] [CrossRef]

- Zheng, Q.; Ieromonachou, P.; Fan, T.; Zhou, L. Supply chain contracting coordination for fresh products with fresh-keeping effort. Ind. Manag. Data Syst. 2017, 117, 538–559. [Google Scholar] [CrossRef]

- Qin, Y.; Wang, J.; Wei, C. Joint pricing and inventory control for fresh produce and foods with quality and physical quantity deteriorating simultaneously. Int. J. Prod. Econ. 2014, 152, 42–48. [Google Scholar] [CrossRef]

- Li, G.; He, X.; Zhou, J.; Wu, H. Pricing, replenishment and preservation technology investment decisions for non-instantaneous deteriorating items. Omega 2019, 84, 114–126. [Google Scholar] [CrossRef]

- Qian, X.; Olsen, T. Operational and financial decisions within proportional investment cooperatives. Manuf. Serv. Oper. Manag. 2020, 22, 546–561. [Google Scholar] [CrossRef]

- Besik, D.; Nagurney, A.; Dutta, P. An integrated multitiered supply chain network model of competing agricultural firms and processing firms: The case of fresh produce and quality. Eur. J. Oper. Res. 2023, 307, 364–381. [Google Scholar] [CrossRef]

- KÖhler, S.; Pizzol, M. Technology assessment of blockchain-based technologies in the food supply chain. J. Clean Prod. 2020, 269, 122193. [Google Scholar] [CrossRef]

- Liu, S.; Hua, G.; Kang, Y.; Cheng, T.E.; Xu, Y. What value does blockchain bring to the imported fresh food supply chain? Transp. Res. Part E Logist. Transp. Rev. 2022, 165, 102859. [Google Scholar] [CrossRef]

- Bettín-Díaz, R.; Rojas, A.E.; Mejía-Moncayo, C. Methodological approach to the definition of a blockchain system for the food industry supply chain traceability. In Computational Science and Its Applications—ICCSA 2018; Springer: Cham, Switzerland, 2018; pp. 19–33. [Google Scholar]

- Baralla, G.; Ibba, S.; Marchesi, M.; Tonelli, R.; Missineo, S. A Blockchain based system to ensure transparency and reliability in food supply chain. In Euro-Par 2018: Parallel Processing Workshops; Springer: Cham, Switzerland, 2018; pp. 379–391. [Google Scholar]

- Dutta, P.; Choi, T.-M.; Somani, S.; Butala, R. Blockchain technology in supply chain operations: Applications, challenges and research opportunities. Transp. Res. Part E Logist. Transp. Rev. 2020, 142, 102067. [Google Scholar] [CrossRef]

- Dong, L.; Jiang, P.; Xu, F. Impact of traceability technology adoption in food supply chain networks. Manag. Sci. 2023, 69, 1323–1934. [Google Scholar] [CrossRef]

- Wu, X.; Nie, L.; Xu, M.; Yan, F. A perishable food supply chain problem considering demand uncertainty and time deadline constraints: Modeling and application to a high-speed railway catering service. Transp. Res. Part E Logist. Transp. Rev. 2018, 111, 186–209. [Google Scholar] [CrossRef]

- Liu, L.; Li, F. Investment decision and coordination of blockchain technology in fresh supply chain considering retailers’ risk aversion. J. Ind. Eng. Eng. Manag. 2022, 36, 159–171. (In Chinese) [Google Scholar]

- Wang, Y. Joint pricing-production decisions in supply chains of complementary products with uncertain demand. Oper. Res. 2006, 54, 1110–1127. [Google Scholar] [CrossRef]

- Lodree, E.J., Jr.; Uzochukwu, B.M. Production planning for a deteriorating item with stochastic demand and consumer choice. Int. J. Prod. Econ. 2008, 116, 219–232. [Google Scholar] [CrossRef]

- Yang, X.; Cai, G.; Ingene, C.A.; Zhang, J. Manufacturer strategy on service provision in competitive channels. Prod. Oper. Manag. 2020, 29, 72–89. [Google Scholar] [CrossRef]

- Yang, L.; Tang, R. Comparisons of sales modes for a fresh product supply chain with freshness-keeping effort. Transp. Res. Part E Logist. Transp. Rev. 2019, 125, 425–448. [Google Scholar] [CrossRef]

| Article | Research Object | Research Method | BT Technology | CP Technology | Main Content |

|---|---|---|---|---|---|

| Wang and Li [20] | A perishable food supply chain | Dynamic quality evaluation | Not considered | Not considered | Reduce food waste and maximize profit through a pricing approach |

| Yu et al. [15] | A fresh agri-product supply chain | Stackelberg game and numerical examples | Not considered | Considered | Study the price and cold-chain service decisions and explores the impacts of (horizontal/vertical) integration on profits |

| Chen et al. [7] | A fresh agricultural supply chain | Stackelberg game and numerical examples | Considered | Not considered | Study the influence of the application of blockchain technology on the producer’s activity information misreporting behavior |

| Zhang et al. [5] | A cold supply chain | Game and numerical analysis | Considered | Considered | Impacts of blockchain-based digital transition on cold invests |

| Wu et al. [32] | A perishable food supply chain | Optimization | Not considered | Considered | Study demand uncertainty and time deadline constraints |

| Liu and Li [33] | A fresh supply chain | Asymmetric Nash equilibrium negotiation | Considered | Not considered | Investment decision and coordination of blockchain technology considering retailers’ risk aversion |

| Liu et al. [27] | A fresh food supply chain | Stackelberg game | Considered | Not considered | Study the role blockchain plays in imported fresh food supply chains |

| This paper | Fresh food supply chain | Stackelberg game | Considered | Considered | Investigating the influence of BT/CP adoption on misreporting behavior |

| Symbol | Definition |

|---|---|

| Model parameters | |

| The circulation time for fresh food | |

| The lead time for fresh food from farm to consumers, | |

| The unit production cost for fresh food | |

| The salvage value for waste fresh food, | |

| The market size | |

| The sensitivity coefficient of retailer price for food in demand | |

| The sensitivity coefficient of freshness of food in demand | |

| The factor for lead time due to misreporting behavior, | |

| The incentive fee paid to supplier without misreporting behavior | |

| The fixed cost of investing in BT technology | |

| The proportion of fresh food with misreporting behavior, | |

| Functions | |

| The freshness function for food, | |

| The demand for fresh food from consumers to retailer | |

| The order quantities for fresh food from retailer to supplier | |

| Decision variables | |

| The warehouse price of fresh food | |

| The retailer price of fresh food | |

| Extensions | |

| The sensitivity coefficient of CP investment level | |

| The CP investment level | |

| The CP technology investment | |

| The sensitivity coefficient of CP investment level of the freshness of food |

Disclaimer/Publisher’s Note: The statements, opinions and data contained in all publications are solely those of the individual author(s) and contributor(s) and not of MDPI and/or the editor(s). MDPI and/or the editor(s) disclaim responsibility for any injury to people or property resulting from any ideas, methods, instructions or products referred to in the content. |

© 2023 by the authors. Licensee MDPI, Basel, Switzerland. This article is an open access article distributed under the terms and conditions of the Creative Commons Attribution (CC BY) license (https://creativecommons.org/licenses/by/4.0/).

Share and Cite

Feng, Z.; Jin, P.; Li, G. Investment Decision of Blockchain Technology in Fresh Food Supply Chains Considering Misreporting Behavior. Sustainability 2023, 15, 7421. https://doi.org/10.3390/su15097421

Feng Z, Jin P, Li G. Investment Decision of Blockchain Technology in Fresh Food Supply Chains Considering Misreporting Behavior. Sustainability. 2023; 15(9):7421. https://doi.org/10.3390/su15097421

Chicago/Turabian StyleFeng, Zhangwei, Peng Jin, and Guiping Li. 2023. "Investment Decision of Blockchain Technology in Fresh Food Supply Chains Considering Misreporting Behavior" Sustainability 15, no. 9: 7421. https://doi.org/10.3390/su15097421

APA StyleFeng, Z., Jin, P., & Li, G. (2023). Investment Decision of Blockchain Technology in Fresh Food Supply Chains Considering Misreporting Behavior. Sustainability, 15(9), 7421. https://doi.org/10.3390/su15097421