Anhydrous Ethanol Pricing in Economies with an Underdeveloped Biofuels Market: The Case of Mexico

Abstract

:1. Introduction

2. Problem Definition and Theoretical Framework

2.1. Problem Definition

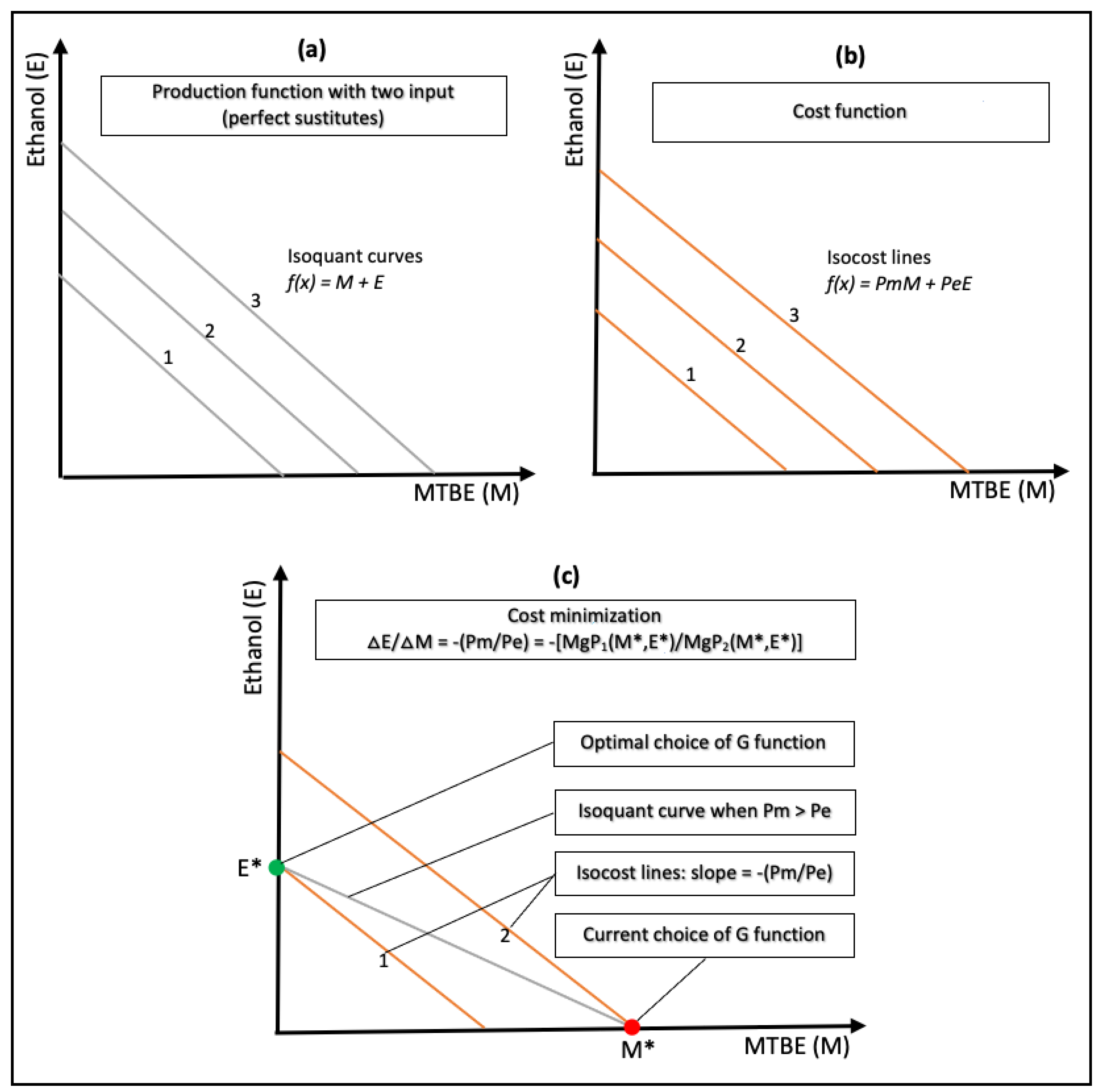

2.2. Neoclassical Theory of the Firm

3. Materials and Methods

3.1. Institutional Framework

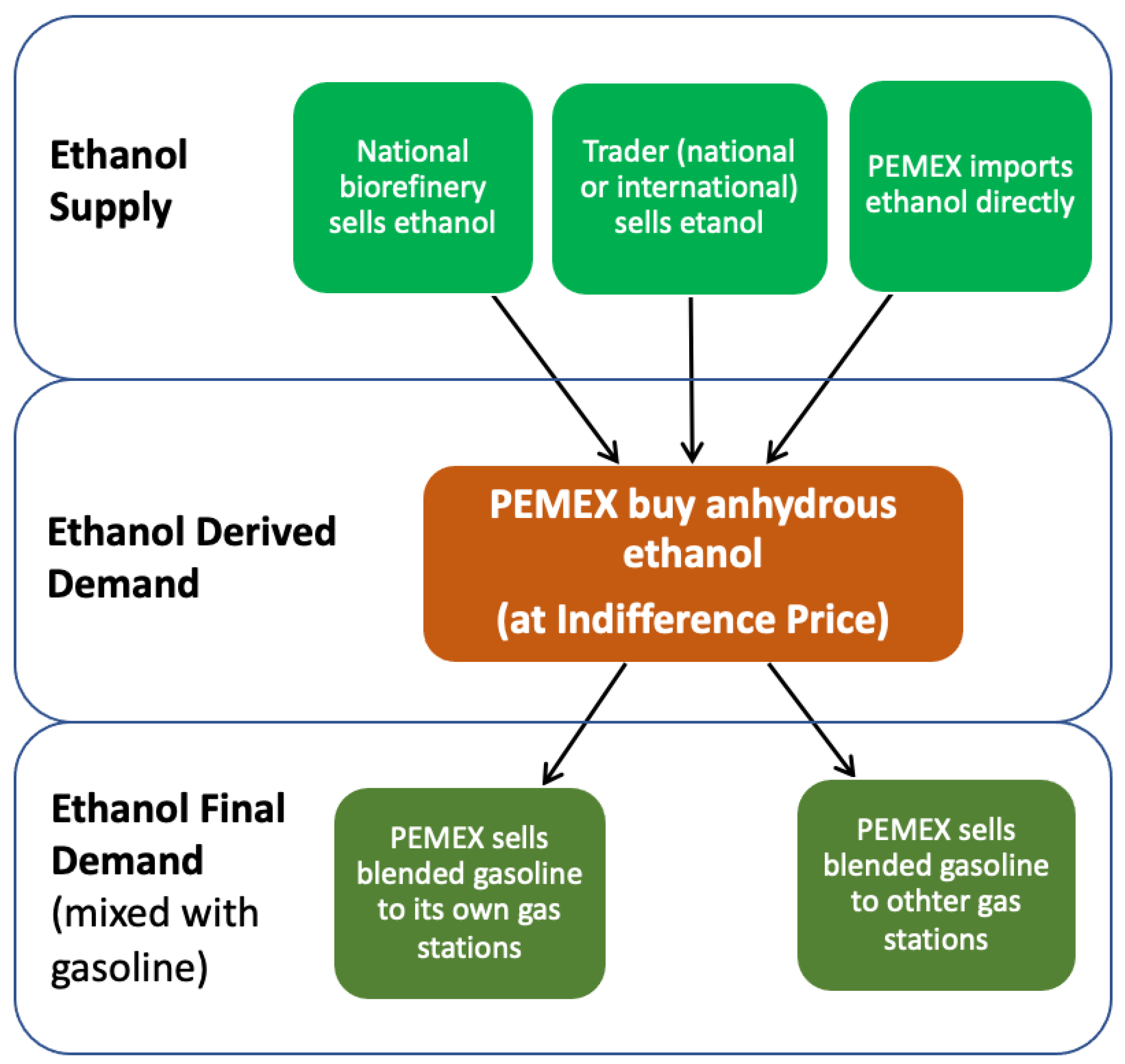

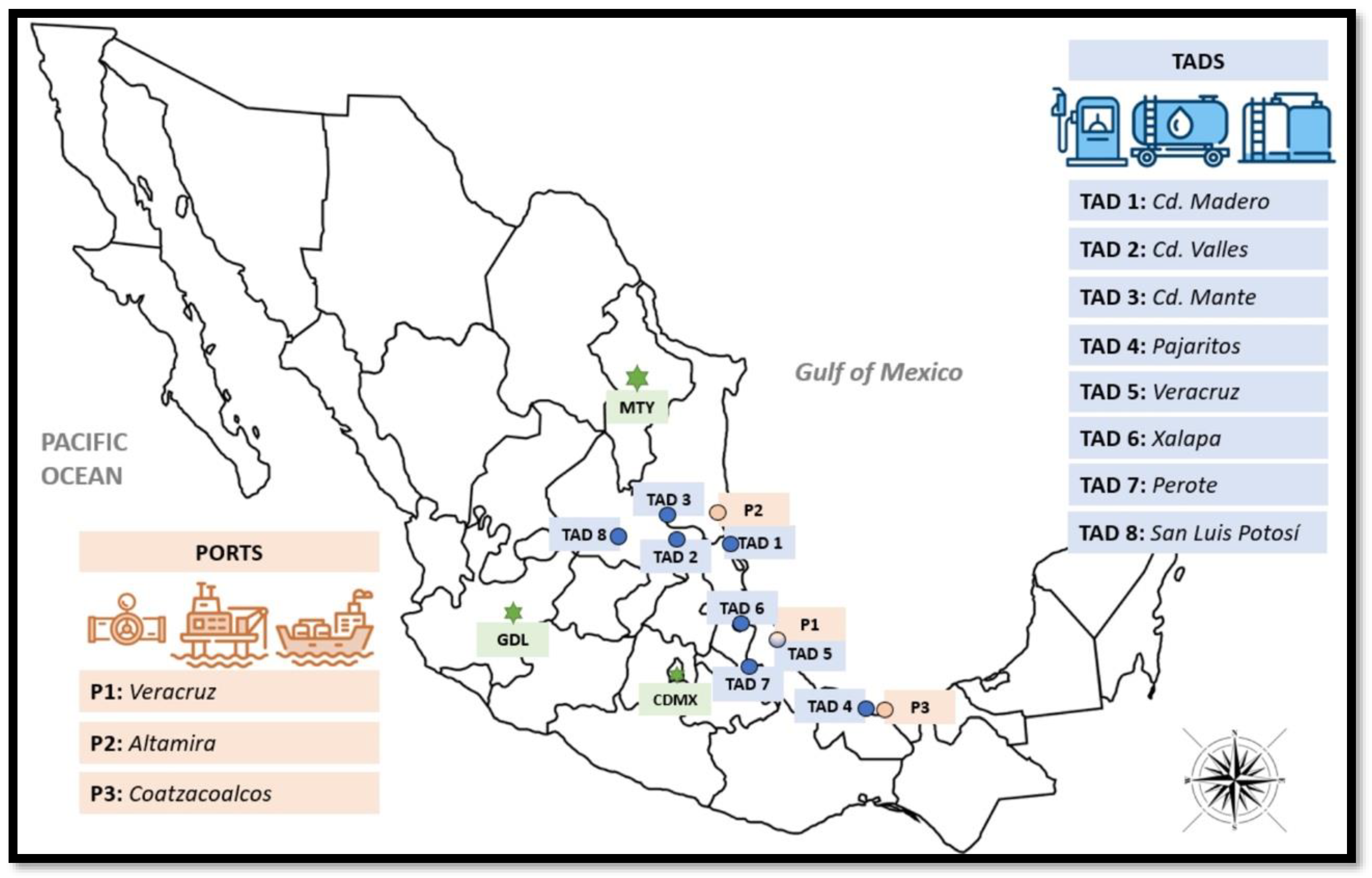

3.2. Indifference Price Methodology

4. Results and Discussion

4.1. Institutional Framework and Actions Carried out by Mexico in the Area of Biofuels

- (1)

- Pilot test of oxygenated gasoline with 6% by volume (v/v) of anhydrous ethanol, carried out at the end of 2008 and beginning of 2009.

- (2)

- PEMEX public bidding process to purchase between 658 and 823 million liters of anhydrous ethanol, carried out in 2009—declared void after the winning companies declined to sign the contracts, alleging cost problems concerning the purchase price proposed by PEMEX.

- (3)

- PEMEX public tender to purchase 425 to 520 million liters of anhydrous ethanol, executed in 2012—declared deserted due to disagreements between potential participants and PEMEX on the purchase price.

- (4)

- PEMEX public tender to purchase 1550 to 2215 million liters of anhydrous ethanol, executed in 2014, to be blended with base gasoline at 5.8% by volume (v/v) in eight PEMEX TADs. Four companies were winners for six TADs, but they still need to deliver the product, again, due to price problems.

- (5)

- A financial fund was created in 2008 to support R&D, called the CONACYT-SENER-Sustainability Energy Sectorial Fund, which disappeared at the end of 2021.

- (6)

- Creation of a research network in 2015 on different types of bioenergy, called the Mexican Center for Innovation in Bioenergy (CEMIEBio, for its acronym in Spanish). This network was formed through clusters, with the participation of several universities and national and foreign institutions. In the case of ethanol, the bio-alcohols cluster was formed to achieve technological development through four lines of research: (a) characteristics and national availability of sugarcane bagasse, agave bagasse, wheat straw and corn stover; (b) production of biohydrogen and butanol with native microbial consortia; (c) sustainability and life cycle analysis (LCA); (d) human resources training. The R&D work undertaken by the different clusters advanced the state of the art significantly, but with the disappearance of funding these efforts also gradually faded away, although in some cases certain initiatives remain due to economic support from other calls for proposals and/or participating institutions.

- (7)

- In 2014, the Bioenergy Thematic Network (RTB) of CONACYT was created to promote scientific research and technological development. In this case, knowledge exchange has been promoted, but again, economic resources are the main limitation.

- (8)

- In addition to the above, since at least 2015, certain institutional funds have been supporting R&D projects, validation of inputs and processes, innovation in private companies, consulting and sectoral diagnosis, among others, but positive results have been scarce due to insufficient economic resources, bureaucratic problems, continuity, and above all, the lack of a biofuels policy that integrates production chains aimed at solving structural and social problems of a regional/local nature.

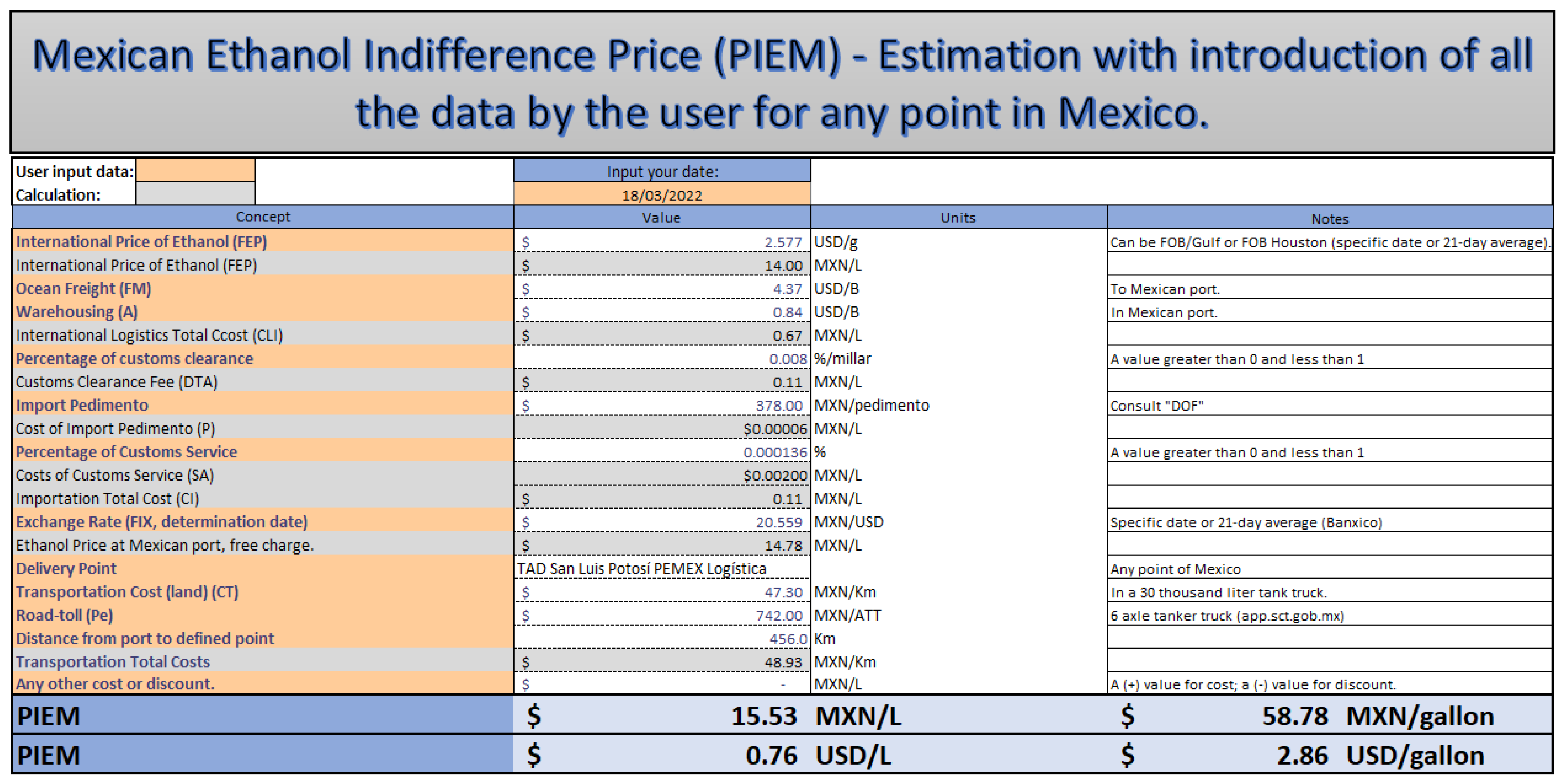

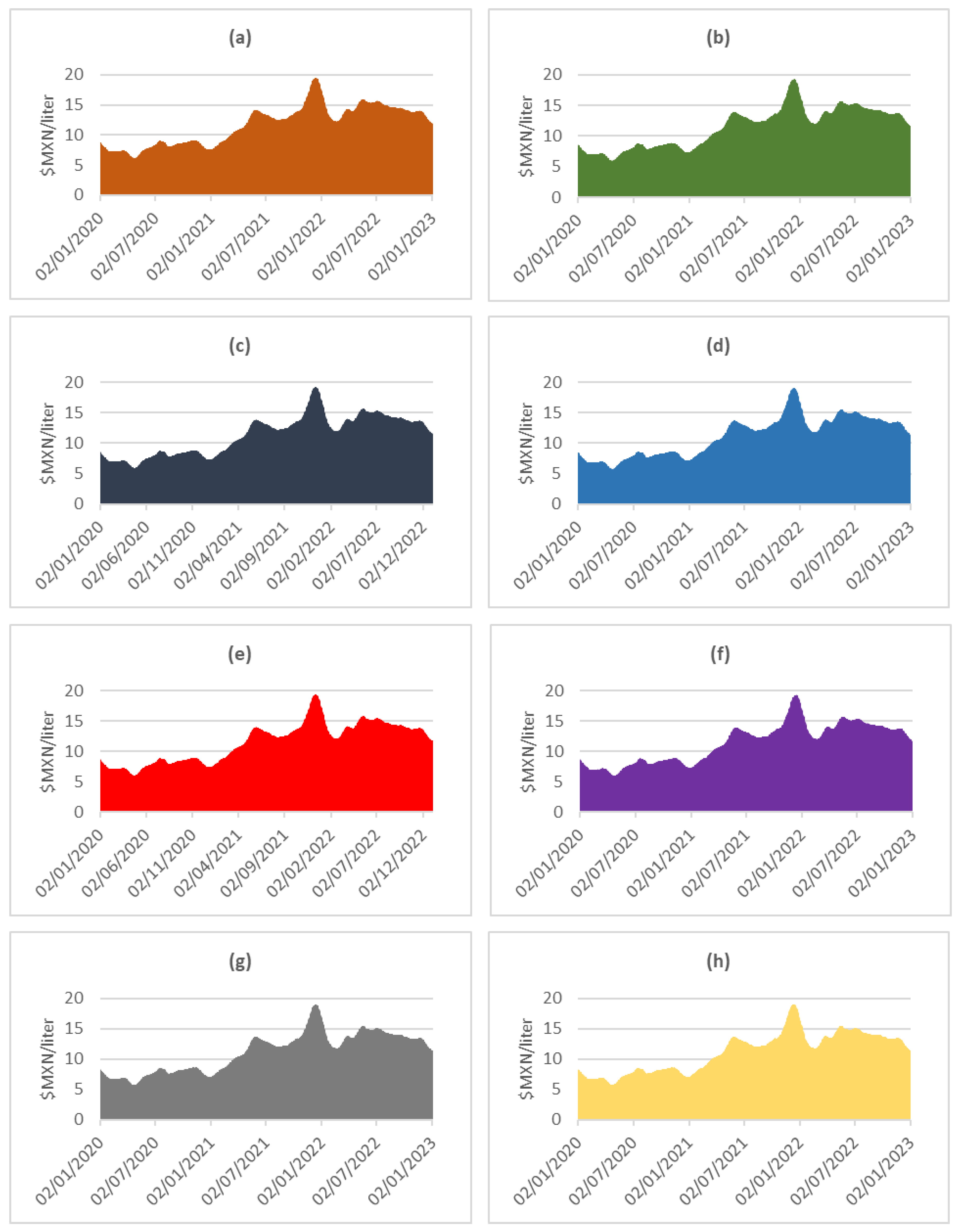

4.2. Tool to Estimate Anhydrous Ethanol Price

4.3. Policy Recommendations

- production costs and ethanol price (microeconomic level).

- legal and governmental decisions (macroeconomic level).

5. Conclusions

Author Contributions

Funding

Institutional Review Board Statement

Informed Consent Statement

Data Availability Statement

Acknowledgments

Conflicts of Interest

Appendix A. Ethanol Price Tool (Price-CEM, V 1.0)

References

- Milina, V. Energy Security and Geopolitics. Connections 2007, 6, 25–44. [Google Scholar] [CrossRef]

- Johannesson, J.; Clowes, D. Energy Resources and Markets—Perspectives on the Russia–Ukraine War. Eur. Rev. 2022, 30, 4–23. [Google Scholar] [CrossRef]

- WEC (World Energy Council). World Energy Trilemma Index 2021. Registered in England and Wales No. 4184478. VAT Reg. No. GB-123-3802-48. Available online: https://www.worldenergy.org/assets/downloads/WE_Trilemma_Index_2021.pdf?v=1634811254 (accessed on 12 June 2022).

- Aslanbay Guler, B.; Gurlek, C.; Sahin, Y.; Oncel, S.S.; Imamoglu, E. Renewable Bioethanol for a Sustainable Green Future. In A Sustainable Green Future, Perspectives on Energy, Economy, Industry, Cities and Environment; Oncel, S.S., Ed.; Springer: Cham, Switzerland, 2023; Chapter 21; ISBN 978-3-031-24941-9. [Google Scholar] [CrossRef]

- OECD/FAO. Biofuels, in Agricultural Outlook 2021–2030; OECD Publishing: Paris, France, 2021. [Google Scholar] [CrossRef]

- RFA (Renewable Fuels Association). Annual Ethanol Production. 2022. Available online: https://ethanolrfa.org/markets-and-statistics/annual-ethanol-production (accessed on 12 March 2022).

- Chum, H.L.; Nigro, F.E.B.; McCormick, R.; Beckham, G.; Seabra, J.E.A.; Saddler, J.; Tao, L.; Warner, E.; Overend, R.P. Conversion Technologies for Biofuels and Their Use. In Bioenergy & Sustainability: Bridging the Gaps SCOPE 72; Mendez Souza, G., Victoria, R.L., Joly, C.A., Verdade, L.M., Eds.; SCOPE: Paris, France, 2015; Chapter 12. [Google Scholar]

- OECD/IEA (Organization for Economic Co-Operation and Development/International Energy Agency) Technology Roadmap, Delivering Sustainable Bioenergy. 2017. Available online: https://www.iea.org/ (accessed on 23 March 2022).

- POET-DSM Advanced Biofuels. 2023. Available online: http://poetdsm.com/licensing (accessed on 9 January 2023).

- Enerkem Alberta Biofuels. 2023. Available online: https://enerkem.com/company/facilities-projects/ (accessed on 7 January 2023).

- Padilla Barrera, Z.; Torres Jardón, R.; Ruiz, L.G.; Castro, T.; Peralta, O.; Macera, O.; Molina, L. Coupling of two methods to obtain pollutant emission factors from biomass burning in small combustion sources. In Proceedings of the EGU General Assembly 2020 EGU2020-20875, Vienna, Austria, 4–8 May 2020. [Google Scholar] [CrossRef]

- Shell Global (Energy Database). Available online: https://www.shell.com/energy-and-innovation/the-energy-future/scenarios/shell-scenarios-energy-models/energy-resource-database.html#iframe=L3dlYmFwcHMvRW5lcmd5UmVzb3VyY2VEYXRhYmFzZS8jb3Blbk1vZGFs (accessed on 9 May 2022).

- Alemán-Nava, G.S.; Casiano-Flores, V.H.; Cárdenas-Chávez, D.L.; Díaz-Chávez, R.; Scarlat, N.; Mahlknecht, J.; Dallemand, J.F.; Parra, R. Renewable energy research progress in México: A review. Renew. Sust. Energy Rev. 2014, 32, 140–153. [Google Scholar] [CrossRef]

- EERE (US Office of Energy Efficiency and Renewable Energy). PORT-DSM: Project Liberty. 2023. Available online: https://www.energy.gov/eere/bioenergy/poet-dsm-project-liberty (accessed on 15 January 2023).

- Green Car Congress, Energy Technologies, Issues and Policies for Sustainable Mobility. Poet-DSM Pausing Production of Cellulosic Ethanol at Project Liberty, Shifting to & Blames EPA. 2019. Available online: https://www.greencarcongress.com/2019/11/20191124-poetdsm.html (accessed on 20 January 2023).

- Clayton, C. Cellulosic Production Idled. Citing EPA Decisions, POET-DSM Converting Cellulose Plant to Research & Development. DTN. 2019. Available online: https://www.dtnpf.com/agriculture/web/ag/news/business-inputs/article/2019/11/19/citing-epa-decisions-poet-dsm-plant (accessed on 14 March 2022).

- Voegele, E. Verbio Commences Operations at Iowa Biorefinery. Ethanol Producer Magazine (EPM). 2022. Available online: http://www.ethanolproducer.com/articles/18824/verbio-commences-operations-at-iowa-biorefinery (accessed on 14 January 2022).

- Bioeconomía (Con Información de Reuters). Raízen Construirá su Segunda Refinería de Etanol Celulósico en Brasil. 2021. Available online: https://www.bioeconomia.info/2021/06/28/raizen-construira-su-segunda-refineria-de-etanol-celulosico-en-brasil/ (accessed on 14 March 2022).

- T&B Petroleum. Raízen Receives the Largest Part for the E2G Operation and Reaches 50% of the Works at the Guariba Plant (SP). 2022. Available online: https://www.tbpetroleum.com.br/noticia/raizen-receives-the-largest-part-for-the-e2g-operation-and-reaches-50-of-the-works-at-the-guariba-plant-sp/ (accessed on 3 March 2023).

- SENER (Secretaría de Energía). Análisis y Propuesta para la Introducción de Etanol Anhidro en las Gasolinas que Comercializa Pemex. (elaborado por la Comisión Intersecretarial para el Desarrollo de los Bioenergéticos de México). 2014. Available online: https://www.gob.mx/cms/uploads/attachment/file/86229/Bibliograf_a_9.pdf (accessed on 23 March 2022).

- García, C.A.; Manzini, F.; Islas, J. Air emissions scenarios from ethanol as a gasoline oxygenate in Mexico City Metropolitan Area. Renew. Sus. Energy Rev. 2010, 14, 3032–3040. [Google Scholar] [CrossRef]

- Rendón-Sagardi, M.A.; Sánchez-Ramírez, C.; Cortés-Robles, G.; Alor-Hernández, G.; Cedillo-Campos, M.G. Dynamic analysis of feasibility in ethanol supply chain for biofuel production in Mexico. Apply Energy 2014, 123, 358–367. [Google Scholar] [CrossRef]

- Galicia-Medina, C.M.; Barrios-Estrada, C.; Esquivel-Hernández, D.A.; Rostro-Alanís, M.J.; Torres, A.; Parra-Saldívar, R. Current state of bioethanol fuel blends in Mexico. Biofuels Bioprod. Bioref. 2018, 12, 338–347. [Google Scholar] [CrossRef]

- Energy Policy Act of 2005. Public Law 109-58. 2005. Available online: https://www.govinfo.gov/content/pkg/PLAW-109publ58/pdf/PLAW-109publ58.pdf (accessed on 23 March 2022).

- US EIA (Energy Information Administration) (Database). Available online: https://www.eia.gov/dnav/pet/hist/LeafHandler.ashx?n=PET&s=MMTEX_NUS-NMX_1&f=A (accessed on 4 February 2023).

- US Grain Council. 2022. Available online: https://grains.org/ethanol_report/ethnol-market-and-pricing-data-march-16-2022/ (accessed on 18 March 2022).

- Varian, H.R. Intermediate Microeconomics, A Modern Approach, 9th ed.; W.W. Norton & Company, Inc.: New York, NY, USA, 2014; ISBN 978-0-393-12396-8. [Google Scholar]

- Mankiw, N.G. Principios de Economía, 7th ed.; Reyes-Martínez, J., Ed.; Cengage Learning Editores: Ciudad de México, México, 2017; ISBN 978-607-526-215-4. [Google Scholar]

- Valdivia, M. Chapter 1 Condiciones Básicas del Investigador Científico. In Metodología de la Investigación Cuantitativa—Cualitativa y Redacción de la Tesis; En Ñaupas, H., Valdivia, M., Palacios, J., Romero, H., Eds.; Ediciones de la U: Bogotá, Colombia, 2018. [Google Scholar]

- LXV Legislatura, H. Camara de Diputados, Mexico. Leyes Federales Vigentes. 2023. Available online: https://www.diputados.gob.mx/LeyesBiblio/index.htm (accessed on 10 January 2023).

- DOF (Diario Ofiacial de la Federación) (Database). Secretaría de Gobernación, México. 2023. Available online: https://www.dof.gob.mx/#gsc.tab=0 (accessed on 8 January 2023).

- Cronin, P.; Ryan, F.; Coughlan, M. Undertaking a literature review: A step-by-step approach. Br. J. Nurs. 2013, 17, 38–43. [Google Scholar] [CrossRef] [PubMed]

- Official Website of the Government of Mexico. 2023. Available online: https://www.gob.mx (accessed on 20 January 2023).

- SADER (Secretaría de Agricultura y Desarrollo Rural). Programa Institucional 2020–2024 de Seguridad Alimentaria Mexicana; SEGALMEX: Ciudad de Mexico, Mexico, 2020.

- DOF (Diario Oficial de la Federación). Reglas de Operación del Programa de Precios de Garantía a Productos Alimentarios Básicos para el ejercicio fiscal 2022; Secretaría de Agricultura y Desarrollo Rural: Ciudad de México, México, 2021.

- CBOT (Chicago Board of Trade). Chicago Mercantile Exchange. Available online: https://www.card.iastate.edu/research/biorenewables/tools/hist_eth_gm.aspx (accessed on 15 March 2022).

- US Bureau of Labor Statistics (Database). Available online: https://data.bls.gov/pdq/SurveyOutputServlet (accessed on 30 March 2022).

- BANXICO (Banco de México). Mercado Cambiario; tipo de cambio FIX, fecha de determinación. Available online: https://www.banxico.org.mx/SieInternet/consultarDirectorioInternetAction.do?sector=6&accion=consultarCuadro&idCuadro=CF102&locale=es (accessed on 18 March 2022).

- DOF (Diario Oficial de la Federación). Decreto por el que se establece la Tasa Aplicable del Impuesto General de Importación para las mercancías Originarias de América del Norte (artículo 5); Secretaría de Economía: Ciudad de México, México, 2020.

- DOF (Diario Oficial de la Federación). Ley de Desarrollo Rural Sustentable. In Cámara de Diputados del H; Congreso de la Unión: Ciudad de México, México, 2001. [Google Scholar]

- DOF (Diario Oficial de la Federación). Ley de Desarrollo Sustentable de la Caña de Azúcar. In Cámara de Diputados del H; Congreso de la Unión: Ciudad de México, México, 2005. [Google Scholar]

- DOF (Diario Oficial de la Federación). Ley de Promoción y Desarrollo de los Bioenergéticos. In Cámara de Diputados del H; Congreso de la Unión: Ciudad de México, México, 2008. [Google Scholar]

- DOF (Diario Oficial de la Federación). Decreto por el que se reforma y adicionan diversas disposiciones de la Constitución Política de los Estados Unidos Mexicanos, en Materia Energética. In Cámara de Diputados del H; Congreso de la Unión: Ciudad de México, México, 2013. [Google Scholar]

- DOF (Diario Oficial de la Federación). Ley de PEMEX (Petróleos Mexicanos). In Cámara de Diputados del H; Congreso de la Unión: Ciudad de México, México, 2014. [Google Scholar]

- DOF (Diario Oficial de la Federación). Ley de Órganos Reguladores Coordinados en Materia Energética. In Cámara de Diputados del H; Congreso de la Unión: Ciudad de México, México, 2014. [Google Scholar]

- DOF (Diario Oficial de la Federación). Norma Oficial Mexicana NOM-016-CRE-2016, Especificaciones de Calidad de los Petrolíferos, con Fundamento en el Artículo 51 de la Ley Federal Sobre Metrología y Normalización; Comisión Reguladora de Energía: Ciudad de México, México, 2016. Available online: https://www.dof.gob.mx/nota_detalle.php?codigo=5450011&fecha=29/08/2016#gsc.tab=0 (accessed on 26 March 2022).

- DOF (Diario Oficial de la Federación). Acuerdo por el que la Secretaría de Energía y la Comisión Reguladora de Energía Expiden Criterios de Aplicación de las Actividades Permisionadas en Materia de Bioenergéticos; Comisión Reguladora de Energía: Ciudad de México, México, 2018.

- DOF (Diario Oficial de la Federación). Acuerdo de la Comisión Reguladora de Energía que da Cumplimiento a la Resolución Dictada por la Segunda Sala de la Suprema Corte de Justicia de la Nación en el Amparo en Revisión A.R. 610/2019; Derivado del Juicio de Amparo Indirecto 1118/2017 interpuesto en contra del Acuerdo Número A/028/2017 por el que se modifica la Norma Oficial Mexicana NOM-016-CRE-2016, Especificaciones de calidad de los petrolíferos, con fundamento en el artículo 51 de la Ley Federal sobre Metrología y Normalización; Comisión Reguladora de Energía: Ciudad de México, México, 2020. Available online: https://www.dof.gob.mx/nota_detalle.php?codigo=5600830&fecha=18/09/2020#gsc.tab=0 (accessed on 26 March 2022).

- DOF (Diario Oficial de la Federación). Decreto por el que se reforman y adicionan diversas disposiciones de la Ley de la Industria Eléctrica. In Cámara de Diputados del H; Congreso de la Unión: Ciudad de México, México, 2021. [Google Scholar]

- INEGI (Instituto Nacional de Estadística y Geografía). Índice Nacional de Precios al Consumidor. (Database). 2022. Available online: https://www.inegi.org.mx/temas/inpc/ (accessed on 20 March 2022).

- INEGI (Instituto Nacional de Estadísticas y Geografía). Mapas de Distintos Temas Geográficos de México. 2022. Available online: https://www.inegi.org.mx/app/mapas/ (accessed on 16 June 2022).

- SCT (Secretaría de Comunicaciones y Transportes). Sistema Portuario Nacional. 2022. Available online: http://www.sct.gob.mx/index.php?id=171 (accessed on 7 January 2023).

- SCT (Secretaría de Comunicaciones y Transportes). Calculadora de Peajes: Traza tu Ruta, Mappir México. 2022. Available online: https://app.sct.gob.mx/sibuacinternet/ControllerUI?action=cmdEscogeRuta (accessed on 18 December 2022).

- Mayes, J.; Davis, S.; Leger, P.E.M. Análisis Costo-Beneficio del Etanol Anhidro como Oxigenante en México; Turner, Mason & Company (Estudio Elaborado por Instrucciones del Consejo Mexicano de la Energía (COMENER)): Dallas, TX, USA, 2020. [Google Scholar]

| Ranking | Country | PJ/Year | Individual Share |

|---|---|---|---|

| 1 | China | 15,721 | 15.9% |

| 2 | Brazil | 13,924 | 14.1% |

| 3 | USA | 10,681 | 10.8% |

| 4 | Russia | 10,429 | 10.5% |

| 5 | Australia | 7783 | 7.9% |

| 6 | Argentina | 6436 | 6.5% |

| 7 | Canada | 3034 | 3.1% |

| 8 | Mexico | 2194 | 2.2% |

| 9 | Ukraine | 1935 | 2.0% |

| 10 | India | 1360 | 1.4% |

| 11 | Indonesia | 1225 | 1.2% |

| 12 | Congo | 1182 | 1.2% |

| 13 | South Africa | 1166 | 1.2% |

| 14 | France | 997 | 1.0% |

| 15 | Colombia | 981 | 1.0% |

| Rest | 19,850 | 20.0% | |

| Total | 98,901 | 100.0% |

| Date | PEMEX Storage and Distribution Terminal ($MXN/liter) * | |||||||

|---|---|---|---|---|---|---|---|---|

| SLP | Cd. Valles | Cd. Mante | Cd. Madero | Perote | Xalapa | Veracruz | Pajaritos | |

| January 2021 | $8.60 | $8.37 | $8.33 | $8.18 | $8.42 | $8.36 | $8.11 | $8.11 |

| February 2021 | $9.54 | $9.31 | $9.27 | $9.12 | $9.36 | $9.30 | $9.05 | $9.05 |

| March 2021 | $10.88 | $10.65 | $10.61 | $10.45 | $10.69 | $10.64 | $10.38 | $10.38 |

| April 2021 | $12.05 | $11.82 | $11.78 | $11.62 | $11.87 | $11.81 | $11.55 | $11.55 |

| May 2021 | $14.13 | $13.90 | $13.86 | $13.70 | $13.95 | $13.89 | $13.63 | $13.63 |

| June 2021 | $13.41 | $13.18 | $13.14 | $12.99 | $13.23 | $13.17 | $12.91 | $12.91 |

| July 2021 | $12.70 | $12.47 | $12.43 | $12.27 | $12.52 | $12.46 | $12.20 | $12.20 |

| August 2021 | $12.71 | $12.47 | $12.43 | $12.28 | $12.52 | $12.47 | $12.20 | $12.20 |

| September 2021 | $13.46 | $13.23 | $13.19 | $13.03 | $13.28 | $13.22 | $12.96 | $12.96 |

| October 2021 | $14.53 | $14.29 | $14.25 | $14.09 | $14.34 | $14.28 | $14.01 | $14.01 |

| November 2021 | $18.80 | $18.56 | $18.51 | $18.36 | $18.61 | $18.55 | $18.28 | $18.28 |

| December 2021 | $17.52 | $17.28 | $17.24 | $17.08 | $17.33 | $17.27 | $17.00 | $17.00 |

| January 2022 | $12.98 | $12.73 | $12.69 | $12.53 | $12.79 | $12.73 | $12.45 | $12.45 |

| February 2022 | $12.38 | $12.14 | $12.10 | $11.93 | $12.19 | $12.13 | $11.86 | $11.86 |

| March 2022 | $14.29 | $14.04 | $14.00 | $13.83 | $14.09 | $14.03 | $13.76 | $13.76 |

| April 2022 | $14.93 | $14.68 | $14.64 | $14.47 | $14.73 | $14.67 | $14.39 | $14.39 |

| May 2022 | $15.55 | $15.30 | $15.26 | $15.09 | $15.35 | $15.29 | $15.01 | $15.01 |

| June 2022 | $15.61 | $15.36 | $15.32 | $15.15 | $15.42 | $15.35 | $15.07 | $15.07 |

| July 2022 | $14.93 | $14.68 | $14.64 | $14.47 | $14.74 | $14.67 | $14.39 | $14.39 |

| August 2022 | $14.55 | $14.30 | $14.25 | $14.08 | $14.35 | $14.29 | $14.00 | $14.00 |

| September 2022 | $14.26 | $14.00 | $13.96 | $13.79 | $14.06 | $13.99 | $13.71 | $13.71 |

| October 2022 | $13.84 | $13.58 | $13.54 | $13.37 | $13.64 | $13.57 | $13.29 | $13.29 |

| November 2022 | $13.85 | $13.59 | $13.54 | $13.37 | $13.65 | $13.58 | $13.29 | $13.29 |

| December 2022 | $11.99 | $11.72 | $11.68 | $11.51 | $11.78 | $11.72 | $11.42 | $11.42 |

Disclaimer/Publisher’s Note: The statements, opinions and data contained in all publications are solely those of the individual author(s) and contributor(s) and not of MDPI and/or the editor(s). MDPI and/or the editor(s) disclaim responsibility for any injury to people or property resulting from any ideas, methods, instructions or products referred to in the content. |

© 2023 by the authors. Licensee MDPI, Basel, Switzerland. This article is an open access article distributed under the terms and conditions of the Creative Commons Attribution (CC BY) license (https://creativecommons.org/licenses/by/4.0/).

Share and Cite

Becerra-Pérez, L.A.; Rincón, L.E.; Posada-Duque, J.A. Anhydrous Ethanol Pricing in Economies with an Underdeveloped Biofuels Market: The Case of Mexico. Sustainability 2023, 15, 7084. https://doi.org/10.3390/su15097084

Becerra-Pérez LA, Rincón LE, Posada-Duque JA. Anhydrous Ethanol Pricing in Economies with an Underdeveloped Biofuels Market: The Case of Mexico. Sustainability. 2023; 15(9):7084. https://doi.org/10.3390/su15097084

Chicago/Turabian StyleBecerra-Pérez, Luis Armando, Luis E. Rincón, and John A. Posada-Duque. 2023. "Anhydrous Ethanol Pricing in Economies with an Underdeveloped Biofuels Market: The Case of Mexico" Sustainability 15, no. 9: 7084. https://doi.org/10.3390/su15097084

APA StyleBecerra-Pérez, L. A., Rincón, L. E., & Posada-Duque, J. A. (2023). Anhydrous Ethanol Pricing in Economies with an Underdeveloped Biofuels Market: The Case of Mexico. Sustainability, 15(9), 7084. https://doi.org/10.3390/su15097084