1. Introduction

Manufacturing is a major source of carbon emissions, and about 70% of China’s CO

2 emissions come from industrial or generative emissions [

1]. As a manufacturing listed company causing ecological and environmental problems, it should actively fulfill its environmental responsibility and accelerate the green transformation. It also can reduce the cost of capital [

2,

3] and enable enterprises to use R&D resources more effectively to promote corporate transformation. However, it is difficult to bring economic benefits to manufacturing enterprises in the short term with the strong externality, long period, high cost, and high risk of green transformation. Instead, it will increase the operating costs of manufacturing enterprises and reduce their financial performance [

4,

5], thus leading to market failures in environmental governance [

6] and a lower willingness of enterprises to participate in environmental protection investment and green transformation. To remedy market failures and regulate enterprises’ environmental governance, seven ministries and commissions including the People’s Bank of China issued the “Guidelines on Building a Green Finance System” in August 2016. Green finance is an economic activity to support environmental improvement, respond to climate change and saving resources efficiently. It is an economic provider supplied for challenge funding and financing, challenge operation, and hazard administration in environmental preservation, energy efficiency, renewable energy, sustainable transportation, and sustainable construction. In September 2021, China issued the Guidelines on Strengthening Industrial and Financial Cooperation to Promote Green Industrial Development, proposing to build an industrial system with mutual promotion and deep integration of low-carbon transformation of industries and green development of industrial empowerment. China strives to make industrial enterprises with crucial support from green finance a benchmark for carbon emission reduction by 2025, for supporting China’s goal of “peak carbon dioxide emissions” and “carbon neutrality”. Finally, it will contribute to tackling global climate change and protecting biodiversity. Green finance is an essential policy of China to promote the green development of the manufacturing industry, guiding financial resources to converge to high-quality industrial development through green channels. It plays an essential role in the stable growth and effective investment of the manufacturing industry [

7,

8]. The green and low-carbon transformation of the manufacturing industry aims to increase resource usage efficiency and reduce environmental impact. It is also the key to achieving carbon neutrality, peak carbon dioxide emissions, and the harmonious development of humans and nature. Despite the continuous innovation of green finance, some listed manufacturing companies in China need a docking mechanism when dealing with green finance policies. Does green finance promote or inhibit the green transformation of the manufacturing industry?

The research on the green transformation of the manufacturing industry primarily consists of green technological know-how innovation, green improvement efficiency, and whole component productivity. Changes in energy consumption and intensity drive green technology innovation It lowers the price of pollution control for businesses, therefore decreasing the threshold of green transformation of corporations [

9], and promotes the transformation and upgrading of enterprises; The green transformation of the manufacturing industry ought to take energy conservation and emission discount as a probability to promote the green improvement of the economy, whilst the reason of green technology innovation is to assist agencies to keep power and limit emission, construct a resource-saving and environment-friendly society, and achieve a “win-win” for economic growth and environmental protection [

10,

11,

12]; Green technology innovation has an essential effect on the green transformation of companies and even the improvement of the complete society. It is an essential factor for the improvement of the green competitiveness of the manufacturing industry [

13,

14,

15,

16]. The green development effectivity is to enhance the spatial cooperation and agglomeration impact of agencies via energy conservation, emission reduction, and useful resource conservation and to enhance the normal green improvement degree of the manufacturing enterprise thru understanding and technology spillovers [

17], to complete the green transformation of enterprises independently; The most crucial factor affecting the efficiency of green development is technological progress. Enterprises need to strengthen their technological progress in order better to realize green transformation [

18]; However, the regional gap in green development efficiency in China is noticeable, showing that the eastern coastal areas are higher than the central and western inland areas [

19], which is consistent with the distribution of enterprise transformation efficiency; Therefore, only by improving the efficiency of green development can enterprises encourage manufacturing enterprises to carry out green transformation effectively. The green transformation of enterprises is for their sustainable development, which is closely related to total factor productivity [

20,

21]; The motivating element for the transition is enhancing total factor productivity (TFP) [

22,

23]; One of the critical driving factors of TFP growth is information and communication technology (ICT) [

24]. ICT is one of the key power sources to raise the standard and productivity of the manufacturing industry and may either directly or indirectly support its transformation [

25].

The research on the impact of green finance on the green transformation of enterprises mainly includes technological progress, financial agglomeration, productivity improvement, industrial coordinated development, industrial life cycle, market mechanism, and incentive mechanism. Technological progress has played a specific role as a bridge in the process of green finance promoting industrial structure upgrading [

26,

27,

28]; Technological progress in the same period will affect long-term energy demand, reduce energy intensity, and ultimately promote the green transformation of enterprises. Financial agglomeration can provide direct support for upgrading the industrial structure [

29,

30] and technical support for green transformation by alleviating the financing constraints of technological progress. Technology diffusion and accumulation caused by financial agglomeration are the basis for the green transformation of enterprises [

31]. Green finance has promoted enterprise productivity and paved the way for enterprise transformation [

32]. Green finance promotes the coordinated development of environment and industry, promotes the improvement of enterprise productivity, and forces enterprises to transform and upgrade [

33]; Seven green financial policy mechanisms, including capital orientation, policy guidance, information transmission mechanism, resource integration mechanism, credit catalysis, innovation incentive, and risk management, are used to promote the transformation of enterprises to green and high-end. In addition, different green financial products have their specific realization paths [

34,

35]. In different life cycles of industrial development, the supporting mechanism of green finance for enterprise transformation is different. At the early stage of industrial development, green finance mainly assists enterprises in completing the accumulation of essential elements such as factory buildings, human resources, and working capital and promotes the expansion of enterprise scale. In the industrial growth stage, the marginal income of fundamental factors decreases. Green finance mainly catalyzes the improvement of efficiency factors such as scientific management, technological innovation, and organizational structure upgrading of enterprises. In the mature period of the industry, efficiency gains are stable. Green finance mainly encourages the development of innovative elements such as technology, management, and strategy [

36]. By maximizing the benefits of market mechanism and incentive mechanism, green finance provides strong support for the transformation and upgrading of national enterprises in three aspects: widely raising funds, providing risk management tools, and improving the efficiency of fund use [

37,

38]. It also guides and encourages enterprises to transform, optimize resources, and reduce energy consumption from the dimensions of scale, structure, and efficiency through the effect of capital agglomeration, investment orientation, and technological innovation [

39,

40].

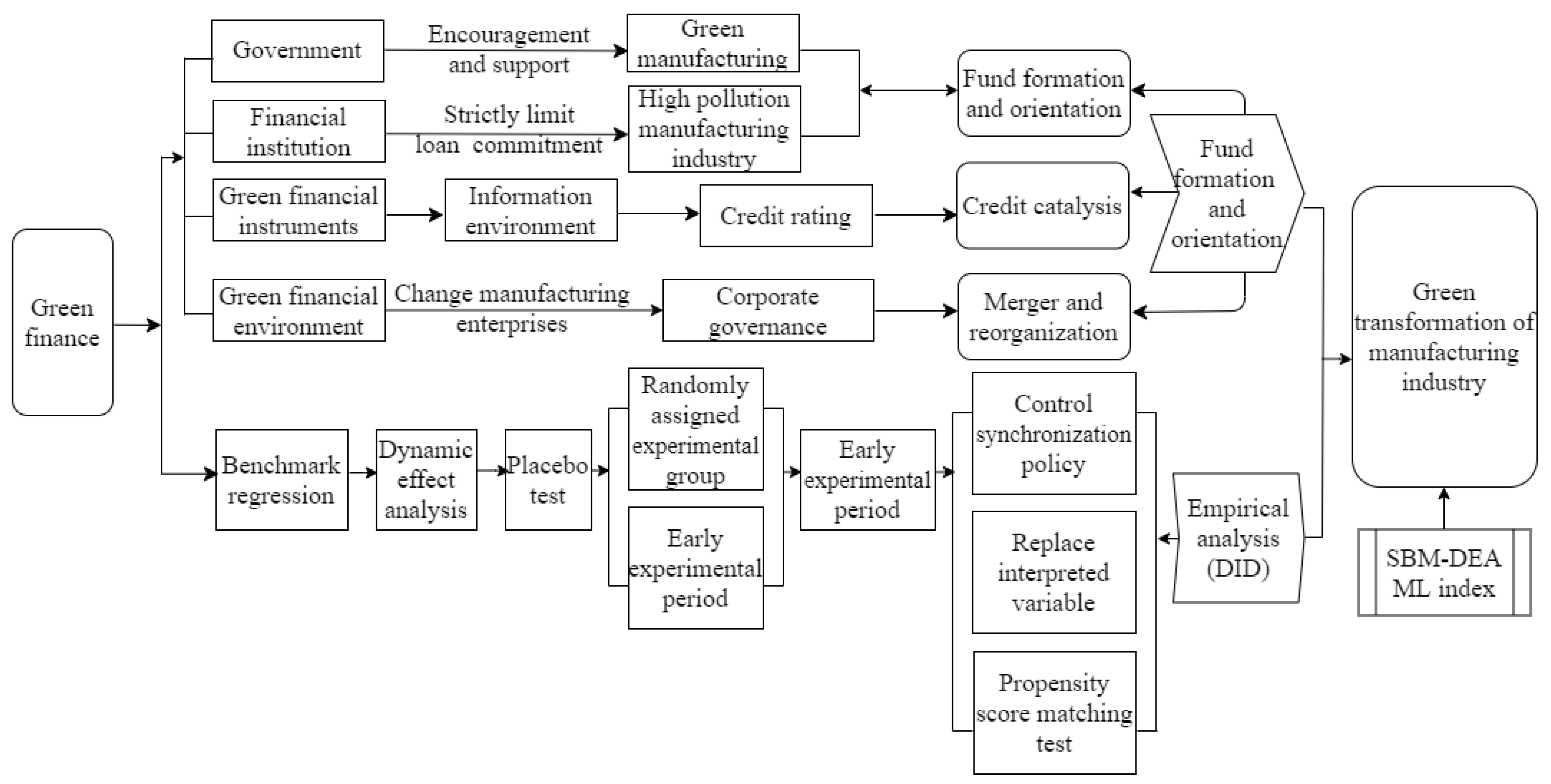

Compared with the existing literature, this paper makes the following contributions: (1) In the study of green transformation, few researchers use quasi-natural experiments to examine the effects of green finance regulations on businesses’ transition to a greener economy; (2) There is no specific index of green transformation efficiency, so to determine the manufacturing industry’s index of green transformation efficiency, we apply the SBM-ML-DEA model. add indicators representing the green transformation effect of enterprises, and finally fit the green transformation efficiency index; (3) Most studies only analyze the influence of internal factors on the green transformation of the manufacturing industry. We consider the internal factors of enterprises and discuss the influence mechanism of other channels on the green transformation of the manufacturing industry from external pressure and government subsidies; (4) As for the heterogeneity analysis, this paper conducts expansion research from three aspects: market competition, government-enterprise collusion, and financing cost, which provides an essential reference for the implementation of environmental governance policies and makes a contribution for promoting the green transformation of the manufacturing industry. The mechanism diagram is shown in

Figure 1:

2. Research Hypothesis

A portion of China’s manufacturing industry is located at the middle and bottom of the global industrial chain. It presents a high-input, high-pollution, labor-intensive, and low-added-value development model, which has caused damage to the ecological environment. To acquire the aim of carbon neutrality and carbon peak, the green transformation of the manufacturing industry is imminent. To this end, Chinese authorities have introduced a collection of green transformation policies to promote closely polluting manufacturing enterprises. Aiming to protect the environment and save resources, green finance also directs the green expansion of the manufacturing industry through green financial services [

41]. Green finance effectively allocates capital among production factors through green credit, bonds, insurance, green fund, investment, and carbon finance. With the popularity of the green environmental protection concept. Enhancing the green financial services system and developing new green financial products have become essential strategies for advancing the manufacturing industry’s transition to a low-carbon, environmentally friendly economy.

Compared with other green policies, green finance encourages financial institutions to boost their understanding of environmental concerns and safeguard the ecological environment and sustainable growth. It also guides financial institutions to make environmentally friendly investments and creates an advantageous finance environment for the manufacturing industry to develop continuously to some extent. For manufacturing enterprises, the support of financial institutions lowers the threshold of green transformation and gives them the confidence to invest in green industries. Hypothesis 1 is proposed.

Hypothesis 1 (H1). Green finance can promote the green transformation of the manufacturing industry.

According to the theory of financial function view, finance affects industrial transformation and upgrading through resource allocation, financing, information transmission, incentive mechanism, and other ways [

42]. Therefore, this paper proposes that green finance influences the manufacturing industry’s transition to a more sustainable model in three ways: fund formation and orientation, credit catalysis, integration and decentralization mechanism, and tests it from the perspective of ownership nature, information environment, and industry competition degree of manufacturing enterprises, respectively.

Green finance policy invests funds in green industries through direct and indirect channels in the short term, promoting green manufacturing enterprises from weak to profitable and complete capital appreciation. Green finance forces traditional manufacturing industries to transform by supporting green manufacturing enterprises and restricting enterprises with high pollution and high energy consumption [

43]. The implementation of green finance policy needs the correction of the government’s fund orientation and the joint efforts of financial institutions. When it comes to the provision of finances, green finance serves as a source of capital for the growth of manufacturing enterprises and aids in their transition to a more environmentally friendly business model. when it comes to demand, the state encourages and supports loans and strictly restricts credit lines with high pollution and energy consumption to enterprises [

44]. Financial institutions such as the banking industry pursue the maximization of benefits. Heavily polluting manufacturing enterprises will limit the credit line from the perspective of social responsibility and strengthen the credit support for environmentally friendly manufacturing enterprises. At the same time, banks will consider the benefits and risks of the project [

45,

46]. Due to the existence of externalities, the market fails. Currently, the government needs to intervene in the credit behavior of financial institutions. The government advocates financial institutions to implement green financial policies, guides the flow of funds to green manufacturing enterprises, promotes the green transformation of traditional manufacturing industries, and corrects the market mechanism. State-owned enterprises are more vulnerable to government policies than non-state enterprises. Under the green finance policy, will state-owned manufacturing enterprises actively respond to government environmental governance requirements and increase investment in green industries compared to non-state manufacturing enterprises? Based on the above analysis, Hypothesis 2 is proposed.

Hypothesis 2 (H2). Compared to non-state-owned manufacturing enterprises, green finance has a greater role in promoting the green transformation of state-owned enterprises.

The catalytic effect of credit is not only the reuse of idle funds but also the improvement of the utilization efficiency of production resources through the expansion of money created by credit and capital [

47]. The credit catalytic mechanism of green finance makes the investment of capital limited to manufacturing enterprises with evident high efficiency and selects forward-looking and well-diffused manufacturing enterprises as the starting point of capital increment. In other words, green financing stimulates the greening of the manufacturing industry and brings about the sustainable growth of the economy and society. The difference in the information environment of manufacturing enterprises can represent their credit rating. A good information environment increases the sensitivity of manufacturing enterprises to green finance policies. Green finance not only includes green credit but also satisfies the demand through green financial instruments such as green securities, green insurance, and green funds, giving full play to green financial capital’s initiative to drive the manufacturing industry’s green transformation. The differences in the information environment of enterprises can represent their credit ratings. Based on the above analysis, Hypothesis 3 is proposed.

Hypothesis 3 (H3). Green finance has a greater impact on the green transformation of manufacturing enterprises with good information environments than those with poor information environments.

Green finance presents the imperative manufacturing fee for the improvement of the manufacturing industry and can alternate the company governance shape via the integration of manufacturing firms. In the meanwhile, the green finance policy adopts different green credit standards according to the characteristics of different industries and pollution levels of different enterprises through the decentralization mechanism. The integration and decentralization mechanism explains the role of green finance policy in transforming and upgrading the manufacturing industry from the perspective of corporate governance, merger, reorganization, and social effects [

48].

The green transformation of the manufacturing industry requires a large amount of capital investment, and the implementation of green finance policies provides the necessary funds for manufacturing enterprises to develop low competitive industries. Although manufacturing enterprises in low competitive industries may obtain super profits and have a monopoly position in certain fields, to some extent, they are driven into green production. However, it will also promote integration and consolidation between enterprises. The integration and decentralization mechanism reflects the ecological and environmental protection function, coordinates the overall system view of the green finance system on the corporate governance of manufacturing enterprises, and realizes the separation of owner and regulator, mutual independence, cooperation, and mutual supervision. In addition, the benefits of structural reform for promoting ecological progress are gradually being released, adding a solid impetus for ecological and environmental protection. Based on the above analysis, Hypothesis 4 is proposed.

Hypothesis 4 (H4). Compared to highly competitive manufacturing enterprises, green finance has a greater impact on the green transformation of low competitive manufacturing enterprises.

3. Research Design

3.1. Sample Selection and Data Sources

In 2016, seven ministries and commissions including the People’s Bank of China issued the Guidelines on Building a Green Finance System. It defined green finance as economic activities which support environmental improvement, efficient use of resources and climate change response. It provides financial services for project investment and financing, risk management and project operation in environmental protection, energy conservation, green transportation, clean energy, and green building. The green finance policy supports the development of green economy and serves the green transformation of enterprises. However, due to China’s lack of experience in developing green finance, it is necessary to select some regions to carry out reform experiments. In 2017, the Chinese government issued the Overall Plan for the Construction of Green Finance Reform and Innovation Pilot Zone, which is a new attempt by the Chinese government to promote green finance by building green finance reform and innovation pilot zones in five provinces (Zhejiang, Guangdong, Jiangxi, Guizhou and Xinjiang) and providing support for the development of green finance through monetary and financial policies, fiscal and tax policies. So, the study selected China’s A-share manufacturing listed companies listed on Shenzhen and Shanghai Stock Exchanges from 2013 to 2021 as the research samples. The experimental group is the samples in green finance reform and innovation pilot zones and the other is the control group. In addition, the sample enterprises treated by ST and PT, with an asset-liability ratio greater than 1, some index data missing, and delisted or listed in the meantime are excluded. Finally, 9994 sample observations from 1174 enterprises are obtained, including 3078 observations from 290 enterprises in the experimental group and 6916 observations from 884 enterprises in the control group. This paper carries on the tail reduction of 1% of continuous variables’ upper and lower parts to eliminate the interference of outliers. The green transformation efficiency of listed manufacturing companies is calculated according to the data disclosed in the annual report of listed companies. Other financial data are from the CSMAR database.

3.2. Variable Setting

- (1)

Dependent variable

The dependent variable of this study is the green total factor productivity (GTFP) of Chinese manufacturing listed companies as the agent variable of green transformation. On the basis of traditional total factor productivity (TFP), green total factor productivity (GTFP) considers energy consumption and pollution emissions, and can objectively reflect the green development level of listed companies in China’s manufacturing industry [

49].

The SBM (Slack-Based Measure) model [

50] allows the existence of inefficient decision-making units, and the unexpected output is also considered. The Malmquist–Luenberger index [

51] can measure the dynamic change of green total factor productivity in the presence of unexpected output. Therefore, the research adopts the non-radial SBM model in the DEA model and combines the ML index to measure the GTFP of manufacturing listed companies.

denotes the

i-th input quantity for the

f-th manufacturing listed companies,

denotes the

i-th desired output for the

f-th manufacturing listed companies and

denotes the

i-th undesired output for the

f-th manufacturing listed companies.

,

;

;

;

;

.

,

and

denote inputs, desired outputs and non-desired outputs, respectively,

represents the weight of the decision unit, when

,

=

=

= 0, it means that the decision unit inputs and outputs are fully efficient, when

, it represents the loss of efficiency of the decision unit. The GTFP index of the decision unit from period

t to the next period

t + 1 is the

ML index, which can also be decomposed into the Technology Change and Efficiency Change indices, which are decomposed as follows.

denotes the GTFP index of the decision unit from period

t to the next period

t + 1,

denotes the input of the manufacturing listed companies

i in period

t,

denotes the desired output of the manufacturing listed companies

i in period

t,

denotes the non-desired output of the manufacturing listed companies

i in period

t,

denotes the manufacturing listed companies

i in period

t,

denotes the technological progress index, i.e., the degree of movement of the firm from period t to the technological frontier in period

t + 1, and

denotes the technical efficiency index, i.e., the extent to which the firm moves closer to the production possibility frontier from period t to period

t + 1.

This paper selected Chinese manufacturing listed companies in A shares from 2013 to 2021 as a sample. After a series of treatments, a total of 1174 were treated. The input-output indicators were obtained from the annual reports of both the Shanghai and Shenzhen stock exchange, the official websites of the listed enterprises and the CSMAR database. The specific input-output indicators are as follows.

I. Labor input. Labor input uses the number of employees of listed enterprises in various companies in various years [

52].

II. Capital input. Capital input selects the net asset value of the enterprise at the corporate level (the net value of the enterprise fixed asset = the original value of the enterprise fixed asset-the cumulative depreciation of the enterprise fixed assets) as the alternative indicator of capital investment [

53].

III. Energy input. Considering the availability of micro-level data, the power consumption of manufacturing enterprises in the city where the listed company is located is used to approximate the energy input. After weighting, it is used as the proxy variable of energy [

54].

IV. Green technology innovation input. The ratio of the number of green patents applied by listed companies to the total number of patent applications (Ratio Green Pat) characterizes the green technological innovation of enterprises [

55].

V. Expected output. The expected output is expressed by the gross operating income of the manufacturing listed companies for each year [

56].

VI. Unexpected output. Since NO

2, SO

2, smoke, and CO

2 are the main pollutants for manufacturing listed companies, this paper selected industrial NO

2, SO

2, smoke and dust emissions, and CO

2 as non-expected output measures. The weighted processing of carbon dioxide data of urban emissions and enterprise emissions is based on the correlation coefficient [

57].

- (2)

Key explanatory variables

The double difference model is used to investigate how the green financial policy set up in China in 2017 affects the green transformation of listed manufacturing companies. The model can use the double difference to mitigate the interference of other factors besides the policy on the estimated results. If the registered address of the manufacturing listed company is located in the green finance reform and innovation pilot zone, the value of this variable is 1, otherwise, the value is 0 [

58,

59]. Treat = 1, otherwise Treat = 0. At the same time, the policy time variable “post” is set according to the time node of the establishment of the green financial reform and innovation pilot zone [

60]. When the sample observation value is in 2017 and after, the value of this variable is 1, otherwise the value is 0.

- (3)

Control variables

Referring to relevant studies [

61,

62,

63], this paper selected firm size (Size), firm years (Time), cash holdings (Cash), asset-liability ratio (Cap), return on equity (Jcap), revenue growth rate (Rev) and Tobin’s Q value as control variables. Refer to

Table 1 for specific variable definitions.

3.3. Model Setting

As an essential method to analyze policy effects, the difference-in-difference method can effectively alleviate problems such as endogeneity and missing variables [

64,

65,

66,

67]. At the same time, green finance policy is an exogenous policy impact on manufacturing enterprises. It will have differentiated impacts according to the different environmental attributes of manufacturing enterprises to meet the basic assumptions of the differential method. Therefore, this paper builds a DID model to analyze the impact of green finance on the green transformation of China’s manufacturing industry. The specific model is as follows:

The subscript i represents the enterprise. The subscript t represents the year. Gre represents the green transformation efficiency of China’s listed manufacturing companies. Treat represents enterprise whether in green finance reform and innovation pilot zones. Post represents year whether the green finance policy has been implemented. X represents a series of control variables. γ represents the fixed effect of the enterprise. µ represents the fixed effect of the year. ε is the random disturbance term. The key parameter of this paper is β1. If β1 is significantly positive, it means that green finance policy can support the green transformation of China’s listed industrial enterprises in China.

4. Empirical Analysis

4.1. Descriptive Statistics

Table 2 provides a statistically descriptive language for the major variables. The results show that the green transformation efficiency ranges between 0.05 and 1, with a mean value of 0.29, a standard deviation of 0.42, and a range between 0.05 and 1. The variable Treat has an average value of 0.26. The observation value of the experimental group is 3078, and that of the control group is 6916, a total of 9994.

4.2. Baseline Regression Analysis

Table 3 displays the benchmark regression results of the effect of green finance on the green transformation of the manufacturing industry. Among these, (1) is stated as the outcomes of the estimation without the addition of control variables, while (2) is mentioned as the estimated outcome after the addition of control variables. The findings demonstrate that the regression coefficients of Treat × Post are significantly positive at the 1% confidence level regardless of whether control variables are included. It suggests that the greening of the manufacturing sector is significantly promoted by green finance.

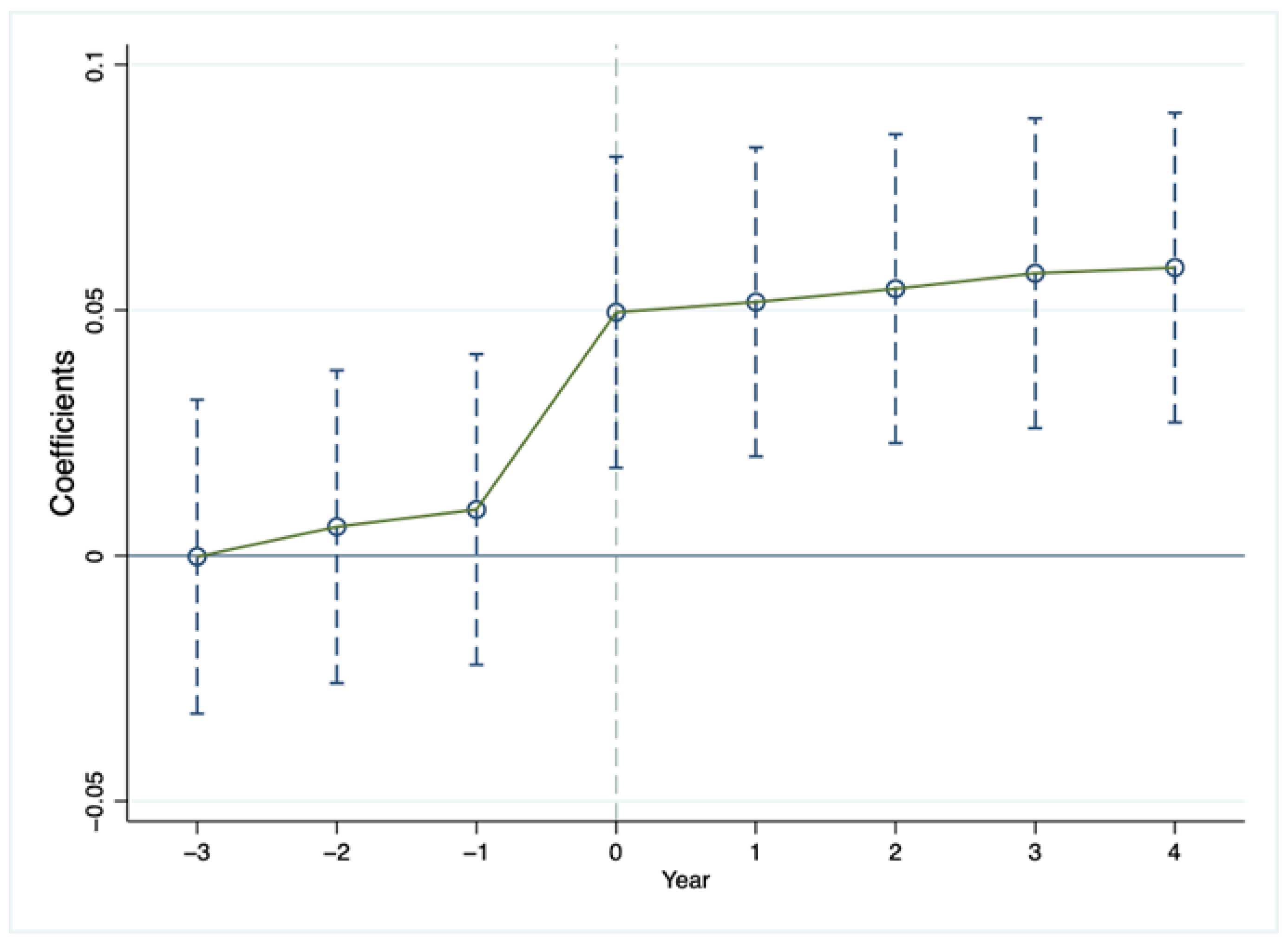

4.3. Dynamic Effect Analysis

The parallel trend hypothesis must be met by both the experimental group and the control group for the difference-in-difference method estimation to be effective. That is, in the absence of policy intervention, the development trend of the outcome variables of the experimental group and the control group is consistent. In other words, the green transformation trend of enterprises in green finance reform and innovation pilot zones and other manufacturing enterprises is consistent before the start of the green finance policy.

We test the parallel trend hypothesis and further analyze the dynamic effect of green finance on the green transformation of the manufacturing industry, and the following model is constructed:

where,

represents whether the sample year is the dummy variable of green finance policy

i affecting the

m year. If

m is negative, it represents

m year before the implementation of the green finance policy. Other variable definitions are the same as in the regression model (1). Taking the year before the implementation of green finance policy as the base year,

βm reflects the difference between the green transformation of manufacturing enterprises in green finance reform and innovation pilot zones and other manufacturing enterprises in the

m year after the implementation of green finance policy.

Figure 2 plots the estimated results of regression coefficient βk at 95% confidence intervals, dropping the experiment’s previous period as the base period. The results show that, at a 5% level of confidence, the coefficient estimates prior to the implementation of green finance policies are not significant. It indicates that there is no significant difference between the green transformation efficiency of enterprises in green finance reform and innovation pilot zones and other manufacturing enterprises before the implementation of green finance policy, satisfying the parallel trend hypothesis. In addition, after the implementation of green finance, the estimated values of the coefficients all passed the significance test at the 5% confidence level, indicating that the sustainability of the green finance policy is good. The intermediate fluctuation is related to the implementation intensity of the government, enterprises and environment. Overall, green finance policy can promote the green transformation of the manufacturing industry. The possible explanation is that the implementation of the green finance policy has improved the capital allocation of manufacturing enterprises, and continued the effect of green transformation through incentive mechanisms such as technology upgrading, so that manufacturing enterprises limit their investment and financing activities of high-pollution and low-value-added projects, and gradually guide funds to low-carbon environmental protection and green manufacturing projects with high capital efficiency. It can promote the continuous transfer of capital from the declining traditional manufacturing industry with excess capacity to the green manufacturing industry with advanced technology, and improve the efficiency of resource allocation and realize the dual optimization of industry and technology. At the same time, to avoid local governments punishing manufacturers for excessive pollution emissions, enterprises must earnestly fulfill their environmental responsibility, thus forcing enterprises to increase environmental protection investment and speed up the green transformation of the manufacturing industry.

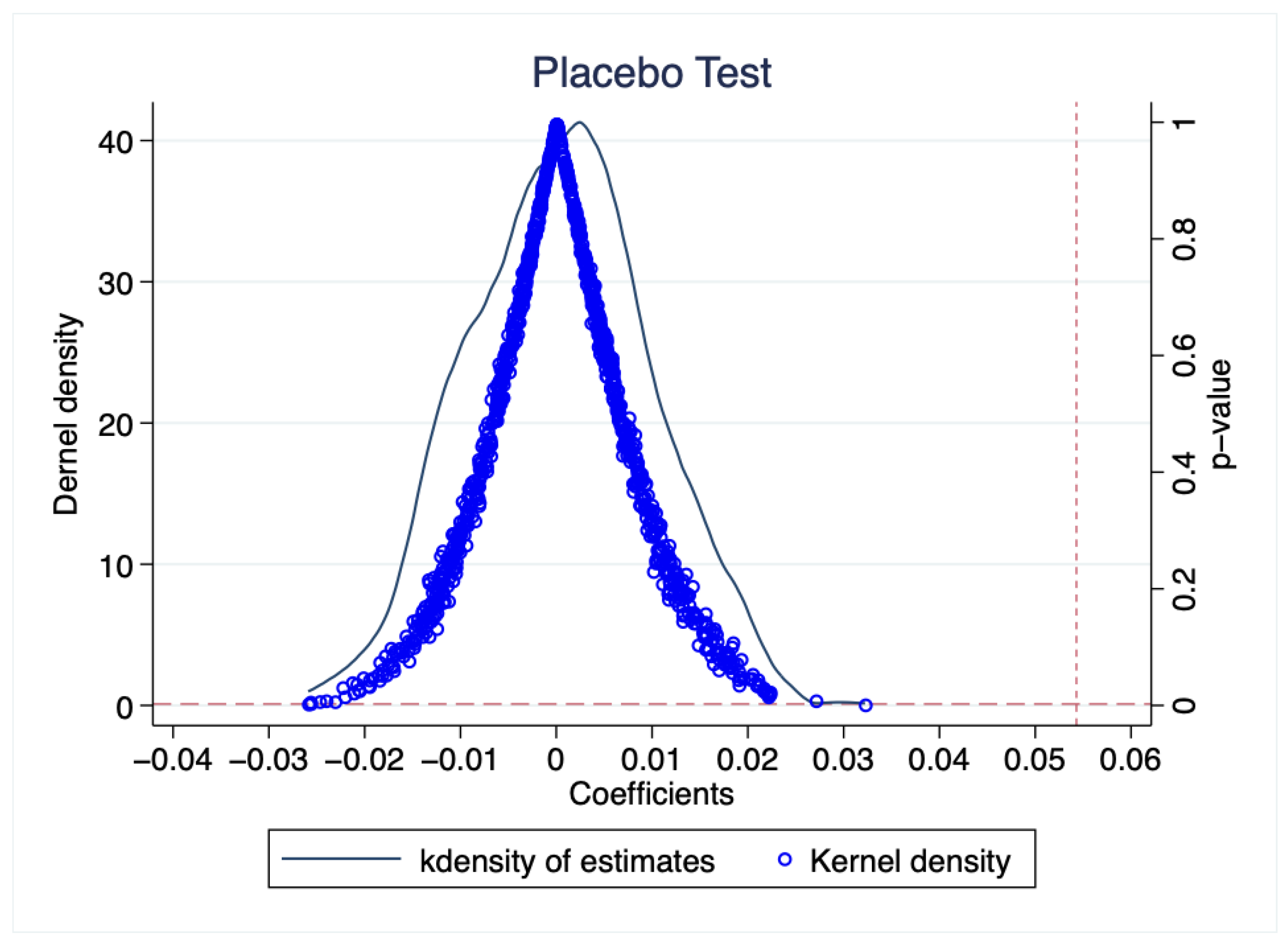

4.4. Placebo Test

- (1)

Randomly assign the experimental group

To exclude the interference of other non-observed omitted variables, such as other major national political, economic, and environmental policies in promoting the green transformation of the manufacturing industry caused by green finance policies. This paper used a randomly selected experimental group to conduct a placebo test. Referring to the study of Bradley [

68], this paper randomly assigned the experimental group in the whole sample through self-sampling and conducted benchmark regression according to model (1) This random procedure is performed 1000 times in order to increase the test’s validity.

Figure 3 plots the estimated regression coefficient’s probability density distribution, the scatter distribution of the corresponding

p-value, and the estimated coefficient of the control variable added to the reference regression. It can be found that the coefficient estimates of the random distribution experimental group are centrally distributed around 0, and most of the estimates are not significant at the 5% confidence level. The estimated results of the benchmark regression are excluded from the test results. It shows that the promoting effect of green transformation of the manufacturing industry caused by green finance policy is not seriously interfered by other non-observed missing variables.

- (2)

Advance the experimental period

In recent years, the Chinese government has intensified its environmental regulation. This paper estimates that the results may have been distorted by other environmental policies introduced before 2017. On 24 April 2014, China adopted a newly revised environmental protection law, which included prominent environmental problems such as regional pollution, river basin pollution and soil pollution into the legislation. For the first time, the revised law stipulates that local government leaders and environmental protection officials will “take responsibility and resign” in the face of major environmental violations, leading to companies being affected by new environmental laws before green finance policies are formally implemented.

Based on Topalova [

69]’s research, this paper sets the sample period from 2013 to 2015 and assumes that the policy impact time is 2014 to test whether the estimated results of this paper are interfered by other green and environmental protection policies. This paper’s cross-multiplication term between the experimental group and the pseudo-experimental period (Post2014) is further constructed to conduct benchmark regression. The regression results are shown in

Table 4. The Treat-Post2014 regression coefficient is not significant at the 1% level of confidence, indicating that other environmental protection regulations do not significantly impede the stimulating effect of green finance policy on the green transformation of the manufacturing industry. The possible explanation is that in the context of incomplete implementation of local environmental policies, manufacturing enterprises can take various short-term measures to cope with the strict policies issued by the central government, thus making manufacturing enterprises slow to respond to the signal of tightening environmental policies sent by the central government.

4.5. Robustness Test

- (1)

Control the concurrent policy

I. Eliminate the interference of the “overcapacity reduction” policy

In order to eliminate the interference of the “overcapacity reduction” policy on the above conclusions in recent years, according to the Guiding Opinions on Resolving the Contradiction of Serious overcapacity issued by The State Council in 2013, enterprises in key industries of overcapacity reduction such as steel, cement, electrolytic aluminum, plate glass and shipping are excluded from the samples. Benchmark regression is carried out according to model (3). The results in column (1) of

Table 5 shows that the regression coefficient of Treat × Post is significantly positive at the 1% confidence level, and the study conclusions remain unchanged.

II. Replace explained variables

Table 5.

Green finance and green transformation of manufacturing industry: robustness test.

Table 5.

Green finance and green transformation of manufacturing industry: robustness test.

| Variable | Efficiency of Green Transformation (Gre) |

|---|

| Eliminate Industries with Excess Capacity | Replace the Explained Variable |

|---|

| (1) | (2) |

|---|

| Treat × Post | 0.0668 *** | 0.0183 *** |

| Size | (8.59) | (3.43) |

| Cash | −0.0188 *** | 0.0030 |

| Cap | (−4.15) | (0.88) |

| Jcap | 0.0175 | 0.0247 |

| Time | (0.86) | (1.61) |

| Rev | 0.0305 * | 0.0024 |

| Tq | (1.74) | (0.19) |

| Constant | 0.0470 *** | −0.0062 |

| Firm fixed effect | (4.95) | (−0.87) |

| Year fixed effect | −0.0210 | −0.0124 |

| N | (−1.42) | (−1.12) |

| R2 | 0.0054 * | −0.0007 |

In order to strengthen the robustness of the conclusion that green finance promotes the green transformation of the manufacturing industry; the proportion of enterprises’ patent applications for green inventions to the total number of enterprises’ patent applications plus one is used to quantify the green transformation. Column (2) of

Table 5 shows that the coefficient of Treat × Post is significantly positive, indicating that the conclusion remains unchanged after replacing the metric of green transformation.

- (2)

Propensity score matching test

To prevent sample selection bias from causing estimation bias, this paper further analyses the influence of green finance on the green transformation of the manufacturing industry by integrating DID analysis with propensity score matching. Specifically, this paper takes enterprise size (Size), enterprise years (Time), enterprise cash holdings (Cash), asset-liability ratio (Cap), return on equity (Jcap), revenue growth rate (Rev) and Tobin’s Q value as characteristic variables, utilizes the Logit model to estimate the probability of each sample being selected into the experimental group, and then uses the one-to-one matching method as the control group to reduce the endogenous issues brought on by the sample self-selection bias.

The propensity score matching balancing test results are displayed in

Table 6. It can be found that the absolute value of the standard deviation of all characteristic variables after matching is less than 10%, and the

p-value of the T-test after matching of all variables is greater than 10%. That is, there is no significant difference between the characteristic variables of the experimental group and the control group after matching, indicating that the matching effect is good. On this basis, the paper uses the difference-in-difference method to further identify the impact of green finance on the green transformation of the manufacturing industry, and

Table 6 displays the results of the regression. After propensity score matching, the promoting effect of green finance on the green transformation of manufacturing industry is still significant at the 5% confidence level.

4.6. Analysis of Action Mechanism

As shown by the data above, green finance strongly encourages the green transformation of the manufacturing industry across the board. Then, is there a mechanism of capital formation and orientation, credit catalysis, integration, and dispersion? Answering the above questions will help to understand the effect of green finance policies on the green transformation and environmental governance of manufacturing enterprises under different circumstances. Based on this, this paper analyses the nature of enterprise ownership, information environment, and industry competition.

- (1)

Heterogeneity test based on the nature of enterprise ownership

Table 7 shows the impact of green finance on the green transformation of state-owned and non-state-owned manufacturing industries. The results show that the promoting effect of green finance on the green transformation of manufacturing industry is only significant in the sample of state-owned industries but not significant in non-state-owned industries. On the basis of the study above, Hypothesis 2 is confirmed.

- (2)

Heterogeneity test based on the enterprise information environment

When the capital market has a high degree of knowledge asymmetry, enterprises will experience more difficult financing restrictions. The development of an “information intermediary” helps solve the problem of information asymmetry, and securities analysts play such a role as an “information intermediary”. The tracking behavior of analysts is regarded as a magnifying glass for the management behavior of listed companies [

70], and they influence the cost of capital by disseminating information and improving the environment of information disclosure. The information environment of manufacturing enterprises is mainly measured by tracking the number of analysts in manufacturing enterprises.

Columns (1) and (2) of

Table 8, respectively, report the impact of green finance on the green transformation of the manufacturing industry with the number of tracking analysts of below 10(including 10) and above 10 (excluding some years and enterprises that do not disclose the number of tracking analysts). The results show that the influence of green finance on the green transformation efficiency of the manufacturing industry with a better information environment is more significant than that of manufacturing enterprises with a worse information environment. That is, green finance stimulates the green transformation of the manufacturing industry for the purpose of achieving sustainable growth of the economy and society. In the meanwhile, the benefits of the transition to a greener economy of the manufacturing industry on the information quantity and quality of manufacturing enterprises reduces the deviation of analysts’ information acquisition, improves the information disclosure behavior of enterprises, and is advantageous to the use of green finance. Hypothesis 3 is verified. (3) Heterogeneity test based on the degree of industry competition.

Faced with the pressure of investment in the green industry, enterprises in different industries adopt different coping strategies. To this end, we measure the Herfindahl-Hirschman index of each industry and divide the sample enterprises into high-competition industries and low-competition industries. Grouping regression, the results are shown in

Table 9. It has been found that green finance policy has a large positive impact on the green transformation of the manufacturing industry in samples of low-competition industries, but that impact is less pronounced in samples of high-competition industries. Therefore, Hypothesis 4 is proven.

5. Discussion

In order to realize the harmonious development of economic development and ecological protection, China’s manufacturing sector will soon undergo a green metamorphosis. The green financial policy aims at environmental protection and resource conservation and guides the green development of the manufacturing industry through green financial services. Compared with other green policies, green finance, to a certain extent, encourages financial institutions to contribute to sustainable growth and ecological preservation, strengthens the understanding of environmental risks, guides financial institutions to make environmentally friendly investments, and lays a solid practical foundation for the sustainability of economic and social development. We found that green finance policy has an impact on transforming and upgrading the manufacturing industry from three aspects: fund formation and orientation, credit catalysis, integration and decentralization mechanism.

- (1)

Green finance can effectively promote the green transformation of state-owned industries in the manufacturing industry through the fund formation and guidance mechanism.

Putting in place a green finance policy requires the government to advocate and correct the capital orientation and make joint efforts with financial institutions. From the perspective of capital supply, finance is the source of capital for various industries and helps industrial development and transformation. Demand-wise, the state strongly restricts credit lines to sectors with high levels of pollution and energy consumption while encouraging and supporting loans to sectors focused on technological innovation, environmental protection, and energy conservation. This has an impact on the manufacturing sector’s need for capital. Only in the sample of state-owned enterprises is the effect of green finance on the green transformation of the manufacturing sector significant; it is not present in the sample of non-state-owned industries. State-owned industries are more impacted by government policies than non-state-owned ones. Under the green finance policy, state-owned industries will actively respond to the government’s environmental governance demands and increase investment in green industries. Green finance can guide the formation of funds by providing funds for green projects or reducing the interest rate of loans. It can effectively reduce the financing cost of green innovation projects of manufacturing enterprises and give the manufacturing sector’s internal green transformation a boost. In the meanwhile, the development of green finance policy will convey the information of developing green economy and the signal of green transformation policy to the whole society, attract the public’s attention to green products, guide the direction of funds and encourage manufacturing enterprises to develop new green products, transform the existing production lines, realize intensive and efficient production, and improve the market competitiveness of their products. However, non-state-owned industries are less willing to promote green investment due to the need for the above incentive mechanism. Moreover, due to the existence of externalities, the market fails. Currently, the government needs to intervene in the credit behavior of financial institutions. The government advocates implementing green financial policies by financial institutions to direct money to green industries, promote the green transformation of the manufacturing industry and correct the market mechanism. Green finance encourages manufacturing enterprises to put the green transformation into action, realize the gradual transformation of industrial structure from labor-intensive to capital, technology and knowledge-intensive, guide the formation and orientation of manufacturing capital to continuously increase the added value of products and improve economic benefits, and finally encourage the manufacturing sector’s transition to a greener economy.

- (2)

Green finance can effectively promote the green transformation of the manufacturing industry with a better information environment through the credit catalytic mechanism.

The credit catalytic mechanism of green finance invests capital not limited to the projects and industries with obvious high benefits but usually selects the projects and industries with forward-looking and good diffusivity as the starting point. That is, the green industry sparked the manufacturing industry to green transformation to realize the sustainable development of the economy and society. The difference in enterprise information environment can represent its credit rating. A good information environment increases the sensitivity of enterprises to green finance policy. The influence of green finance on the green transformation efficiency of the manufacturing industry with a better information environment is more significant than manufacturing enterprises with a poor information environment. Analysts’ accurate earnings forecast of green finance provides a more accurate and valuable reference for manufacturing enterprises to make decisions. Meanwhile, through the double-layer credit catalytic mechanism of a good information environment of manufacturing enterprises and green finance policy, capital investment is not limited to projects and industries with obvious high benefits. Play it all out to the initiative of green finance capital to drive the manufacturing industry’s transition to sustainability. That is, green finance catalyzes the green transformation of the manufacturing industry to ensure that both the economy and society are developing sustainably. In the meanwhile, the positive impact of the green transformation of the manufacturing industry on the information quantity and quality of manufacturing enterprises reduces the deviation of analysts’ information acquisition, improves the information disclosure behavior of enterprises, and favors putting green finance into practice.

- (3)

Green finance policies can effectively promote the green transformation of enterprises in low-competition manufacturing industries through integration and decentralization mechanism.

Faced with the pressure of investment in the green industry, enterprises in different industries adopt different coping strategies. By calculating the Herfindahl-Hirschman index of each industry, we divided the sample enterprises into high-competition and low-competition industries for comparative analysis. The promoting effect of green finance policy on the green transformation of the manufacturing industry is significant in the samples of low-competition industries but insignificant in the samples of high-competition industries. The manufacturing industry’s transition to sustainability requires a large amount of capital input, and implementing a green finance policy provides the necessary funds for developing manufacturing enterprises with low-competition industries. Although manufacturing enterprises in low-competition industries may gain super profits and have a monopoly in a specific field, they are, to some extent, promoted to enter green production. However, it will also promote integration and merger among enterprises. After a manufacturing enterprise in a low-competition industry obtains capital, the technology and capital invested in green production can produce greener and more popular commodities by consumers to gain greater market competitiveness, change the corporate governance structure of the manufacturing enterprise, and reduce the manufacturing cost through integration and economies of scale between enterprises. Changing its industrial structure, mergers and acquisitions between enterprises makes inter-industries competition moderate and promotes green transformation. However, to be viable in the intensely competitive market, some manufacturing enterprises with high-competition industries can only take short-term interests as the biggest driving force for their development due to their small scale, excessively dispersed industries, and low market concentration, thus ignoring environmental protection and green transformation to a certain extent. So, the exogenous policy impact on the green transformation of such enterprises is not significant.

6. Conclusions

Under the background that China’s environmental resources are forcing the green transformation of the manufacturing industry, green finance policy has been incorporated into the national strategy. Based on the quasi-natural experiment of the adoption of green finance policy and information about publicly traded corporations in China’s manufacturing industry during 2013–2021, we discuss the impact mechanism of green finance policy implementation on the green transformation of China’s manufacturing industry from three aspects: fund formation and orientation, credit catalysis, integration and decentralization mechanisms. DID is used to make an empirical analysis of green finance for the green transformation of the Chinese manufacturing industry.

The research shows that: the implementation of green finance policy has a tremendous impact on fostering the green transformation of China’s manufacturing industry and has good sustainability. The dynamic effect test shows that the implementation of green finance policy improves the capital allocation of manufacturing enterprises while continuing the effect of green transformation through incentive mechanisms such as technology upgrading. It makes manufacturing enterprises restrict their investment and financing activities of high-pollution and low-value-added projects, guiding funds to gradually flow to low-carbon, environmental protection and capital-efficient green manufacturing projects. It’s for promoting the continuous transformation of capital from the traditional manufacturing industry in decline due to overcapacity to the green manufacturing industry with advanced technology. The placebo test respectively analyzed the randomly assigned experimental group and the experiment period in advance. We discovered that the encouraging green finance policy’s effects on the green transformation of the manufacturing industry are not seriously interfered with by other non-observed missing variables. Its promoting effect on the green transformation of the manufacturing industry is not seriously interfered with by other environmental protection policies. In the case of incomplete implementation of local environmental policies, manufacturing enterprises can take various short-term measures to cope with the strict policies issued by the central government, thus making manufacturing enterprises slow to respond to the signal of tightening environmental policies sent by the central government. The robust test is conducted from three aspects: control of concurrent policies, replacement of explained variables and propensity score matching test. The research finds that no matter removing the interference of the “overcapacity reduction” policy, replacing explained variables, or balance test of propensity score matching, the promoting effect of green finance on the green transformation of the manufacturing industry is still significant. We analyze the heterogeneity according to the nature of the enterprise own ship, the information environment of enterprises and the degree of industry competition. The promoting effect of green finance policy on the green transformation of manufacturing industry is only significant in state-owned industries but not significant in non-state-owned industries. The influence of green finance policy on the green transformation efficiency of manufacturing enterprises with a better information environment is more significant than manufacturing enterprises with a worse information environment. Faced with the pressure of investing in green industries, the coping strategies adopted by enterprises in different industries are quite different. The promoting effect of green finance policy on the green transformation of the manufacturing industry is significant in the samples of low-competition industries but insignificant in high-competition industries. Fund formation and orientation, credit catalysis, integration and decentralization are the primary mechanisms of green finance to promote the green transformation of the manufacturing industry. The four hypotheses we put forward all pass the test.

In order to actively deal with major global challenges such as policies addressing climate change and environmental protection must be established in order to support the greening of the manufacturing sector. Therefore, green finance policies can be applied to advertise the green technology innovation of the manufacturing industry, fulfill ecological protection responsibilities, and promote its green transformation and development. Firstly, the government should continue to encourage green finance innovation, improve environmental governance, hasten the adoption of green finance policies, promote green finance legislation at the national level as soon as possible, speed up the conversion of conventional financial instruments to green ones such as stocks, trusts and bonds, and provide solid financial support for the green transformation and improvement of the manufacturing industry. We will gradually improve the dual mechanisms of incentives and constraints, actively guide financial institutions to increase green investment, strengthen the awareness of risk management, and enhance the financial sector’s ability to support the green and low-carbon development of the manufacturing industry through the performance evaluation of green finance, discount encouragement and other policies. Secondly, the government should also pay more attention to the green transformation of non-state-owned industries. Although some local governments emphasize promoting green production, resource conservation and circular economy to achieve the goal of sustainable development, they still need to put it into action. We should bolster the oversight and punishment of pollution in the traditional manufacturing industry and not develop the economy at the expense of the environment. Thirdly, improve the information environment of manufacturing enterprises through adequate information disclosure. A good information environment for manufacturing enterprises will not only increase their credit but also increase their sensitivity to green finance and other policies, which is more conducive to the implementation of policies and the transformation and development of enterprises. In improving the capital market system, the government should pay attention to guiding and standardizing the information disclosure behavior, reducing the market pressure faced by manufacturing enterprises and facilitating the quality of information disclosure of manufacturing enterprises. Fourthly, manufacturing enterprises need to continuously optimize internal governance and take risk reduction and capital supplement as an opportunity. Green finance policy plays a good role in fund supplementation, merger and integration for low-competition industries. However, for manufacturing enterprises in high-competition industries to occupy market share, they are forced to pursue short-term benefits and dare only invest a little money to develop green projects, which is incompatible with the environmentally sound development and management of manufacturing enterprises. Therefore, moderate competition between industries should be allowed to improve service quality through the survival of the fittest. However, blind competition and disorderly development should not be allowed. This study theoretically expands the influence mechanism and empirical analysis of green finance policy on the green transformation of the manufacturing industry, which provides an essential reference for the government to implement green finance policy more effectively and promote the green and sustainable development of manufacturing enterprises.

Author Contributions

Conceptualization, M.C. and L.S.; methodology, M.C.; software, L.S. and X.Z.; validation, X.Z. and M.C.; formal analysis, L.S. and Y.Z.; investigation, C.L., L.S. and X.Z.; resources, Y.Z. and C.L.; data curation, M.C. and L.S.; writing—original draft preparation, L.S. and M.C.; writing—review and editing, X.Z., L.S. and M.C.; visualization, L.S. and C.L.; supervision, M.C.; project administration, M.C.; funding acquisition, M.C. All authors have read and agreed to the published version of the manuscript.

Funding

This research was funded by National Social Science Foundation of China (Grant No. 18bjl069); Shandong Social Science Planning Project, China (Grant No. 21CJJJ17, 21BZBJ15); Shandong natural science foundation project, China (ZR2020mg008, ZR2022QG020); Qingdao Social Science Planning Project, China (QDSKL2201229, QDSKL2201231).

Data Availability Statement

Not applicable.

Acknowledgments

Special thanks are given to those who participated in the writing of this paper.

Conflicts of Interest

The authors declare no conflict of interest.

References

- Huang, J.B.; Wu, J.; Tang, Y.; Hao, Y. The influences of openness on China’s industrial CO2 intensity. Environ. Sci. Pollut. Res. 2020, 27, 15743–15757. [Google Scholar] [CrossRef] [PubMed]

- Wong, W.C.; Batten, J.A.; Ahmad, A.H. Does ESG Certification Add Firm Value? Financ. Res. Lett. 2021, 39, 101593. [Google Scholar] [CrossRef]

- Chelawat, H.; Trinedi, I.V. The Business Value of ESG Performance: The India Context. Asian J. Bus. Ethics 2016, 5, 195–210. [Google Scholar] [CrossRef]

- Kuo, T.C.; Chen, H.M.; Meng, H.M. Do Corporate Social Responsibility Practices Improve Financial Performance? A Case Study of Airline Companies. J. Clean. Prod. 2021, 310, 127380. [Google Scholar] [CrossRef]

- Sassen, R.; Hinze, A.K.; Hardeck, I. Impact of ESG Factorson Firm Risk in Europe. J. Bus. Econ. 2016, 86, 867–904. [Google Scholar]

- Sadok, E.G.; Omrane, G.; Yongtae, K. Country-level Institutions, Firm Value, and the Role of Corporate Social Responsibility Initiatives. J. Int. Bus. Stud. 2017, 48, 360–385. [Google Scholar]

- Fritsch, M. The Theory of Economic Development-An Inquiry into Profits, Capital, Interest, and the Business Cycle. Reg. Stud. 2017, 51, 1–2. [Google Scholar] [CrossRef]

- Taghizadeh, H.F.; Yoshino, N. The Way to Induce Private Participation in Green Finance and Investment. Financ. Res. Lett. 2019, 31, 98–103. [Google Scholar] [CrossRef]

- Bergset, L. Green Start-up Finance—Where do Particular Challenges Lie? Int. J. Entrep. Behav. Res. 2018, 24, 451–575. [Google Scholar] [CrossRef]

- Bange, J. The green bond market: A potential source of climate finance for developing countries. J. Sustain. Financ. Invest. 2019, 9, 17–32. [Google Scholar] [CrossRef]

- Clark, R.; Reed, J.; Sunderland, T. Bridging funding gaps for climate and sustainable development: Pitfalls, progress and potential of private finance. Land Use Policy 2018, 71, 335–346. [Google Scholar] [CrossRef]

- Gill, A.R.; Viswanathan, K.K.; Hassan, S. A test of environment Kuznets curve (EKC) for carbon emission and potential of renewable energy to reduce green house gases (GHC) in Malaysia. Environ. Dev. Sustain. 2018, 20, 1103–1114. [Google Scholar] [CrossRef]

- Fankhauser, S.; Bovwen, A.; Calel, R. Who Will Win the Green Race? In Search of Environmental Competitiveness and Innovation. Glob. Environ. Change 2013, 23, 902–913. [Google Scholar] [CrossRef]

- Thurner, T.W.; Round, V. Greening Strategies in Russia’s Manufacturing: From Compliance to Opportunity. J. Clean. Prod. 2016, 112, 2851–2860. [Google Scholar] [CrossRef]

- Sezen, B.; Cankaya, S.Y. Effects of Green Manufacturing and Eco-innovation on Sustainability Performance. Procedia-Soc. Behav. Sci. 2013, 99, 154–163. [Google Scholar] [CrossRef]

- Dangelico, R.M. Green Product Innovation: Where We Are and Where We Are Going. Bus. Strategy Environ. 2016, 25, 560–576. [Google Scholar] [CrossRef]

- Ye, T.F.; Xiang, X.L.; Ge, X.Y.; Yang, K.L. Research on Green Finance and Green Development Based Eco-Efficiency and Spatial Econometric Analysis. Sustainability 2022, 14, 2825. [Google Scholar] [CrossRef]

- Li, B.; Wu, S. Effects of local and civil environment regulation on green total factor productivity in China: A spatial Durbin econometric analysis. J. Clean. Prod. 2017, 153, 342–353. [Google Scholar] [CrossRef]

- Zhou, L.; Che, L.; Zhou, C.F. Spatio-temporal Evolution and Influencing Factors of Urban Green Development Efficiency in China. Acta Geogr. Sin. 2019, 74, 2027–2044. [Google Scholar] [CrossRef]

- Agrawal, V.; Bellos, I. The Potential of Servicizing as a Green Business Model. Interfaces 2017, 63, 1545–1562. [Google Scholar]

- Marco, O.B.; Ferran, V.H.; Oscar, B. Uncovering Productivity Gains of Digital and Green Servitization: Implications from the Automotive Industry. Sustainability 2018, 10, 1524. [Google Scholar]

- Reboredo, J.C. Green Bond and Financial Markets: Co-Movement, Diversification and Price Spillover Effects. Energy Econ. 2018, 74, 38–50. [Google Scholar] [CrossRef]

- Tang, D.Y.; Zhang, Y. Do Shareholders Benefit from Green Bonds? J. Corp. Financ. 2018, 12, 1–18. [Google Scholar] [CrossRef]

- Venturini, F. The Modern Drivers of Productivity. Res. Policy 2015, 44, 357–369. [Google Scholar] [CrossRef]

- Edquist, H.; Henrekson, M. Do R&D and ICT Affect Total Factor Productivity Growth Differently? Telecommun. Policy 2017, 41, 106–119. [Google Scholar]

- Denbnath, S.C. Environmenetal Regulations Become Restriction or a Cause for Innovation: A Case Study of Toyota Prius and Nissan Leaf. Procedia-Soc. Behav. Sci. 2015, 195, 324–333. [Google Scholar] [CrossRef]

- Sen, S. Corporate Governance, Environmental Regulations, and Technological Change. Eur. Econ. Rev. 2015, 80, 36–61. [Google Scholar] [CrossRef]

- Ramanathan, R.; He, Q.; Black, A. Environmental Regulations, Innovation and Firm Performance: A Revisit of the Porter Hypothesis. J. Clean. Prod. 2017, 155, 79–92. [Google Scholar] [CrossRef]

- Karanfil, F.; Yeddir-Tamsamani, Y. Is Technological Change Biased Toward Energy? A Multi-Sectoral Analysis for the French Economy. Energy Policy 2010, 38, 1842–1850. [Google Scholar] [CrossRef]

- Acemoglu, D.; Aghion, P.; Bursztyn, L. The Environment and Directed Technical Change. Am. Econ. Rev. 2012, 102, 131–166. [Google Scholar] [CrossRef]

- Chava, S.; Nanda, V.; Xiao, S.C. Lending to Innovative Firms. Rev. Corp. Financ. Stud. 2017, 6, 234–289. [Google Scholar] [CrossRef]

- Albrizio, S.T.; Kozluk, V.; Zipperer, V. Environmental Policies and Productivity Growth: Evidence across Industries and Firms. J. Environ. Econ. Manag. 2017, 81, 209–226. [Google Scholar] [CrossRef]

- Rodrik, D. Green Industrial Policy. Oxf. Rev. Econ. Policy 2014, 30, 469–491. [Google Scholar] [CrossRef]

- Ghisetti, C.; Mancinelli, S.; Mazzanti, M. Financial Barriers and Environmental Innovations: Evidence from EU Manufacturing Firms. Clim. Policy 2017, 17, 131–147. [Google Scholar] [CrossRef]

- Allet, M.; Hudon, M. Green Microfinance: Characteristics of Microfinance Institutions Involved in Environmental Management. J. Bus. Ethics 2015, 126, 395–414. [Google Scholar] [CrossRef]

- Gianfrate, G.; Peri, M. The Green Advantage: Exploring the Convenience of Issuing Green Bonds. J. Clean. Prod. 2019, 219, 127–135. [Google Scholar] [CrossRef]

- He, L.Y.; Liu, L. Stand by or Follow? Responsibility Diffusion Effect and Green Credit. Emerg. Mark. Financ. Trade 2018, 54, 1740–1761. [Google Scholar] [CrossRef]

- Zhou, C.B.; Qi, S.Z.; Li, Y.K. China’s green finance and total factor energy efficiency. Front. Energ. Resea. 2023, 10, 3389. [Google Scholar] [CrossRef]

- Lee, C.M.; Chou, H.H. Green Growth in Taiwan—An Application of The OECD Green Growth Monitoring Indicators. Singap. Econ. Rev. 2018, 63, 249–274. [Google Scholar] [CrossRef]

- He, L.; Zhang, L.; Zhong, Z. Green credit, renewable energy investment and green economy development: Empirical analysis based on 150 listed companies of China. J. Clean. Prod. 2019, 208, 363–372. [Google Scholar] [CrossRef]

- Chang, L.; Zhang, Q.; Liu, H.D. Digital Finance Innovation in Green Manufacturing: A Bibliometric Approach. Environ. Sci. Pollut. Res. 2022, 10, 1007. [Google Scholar] [CrossRef]

- Gu, B.B.; Chen, F.; Zhang, K. The Policy Effect of Green Finance in Promoting Industrial Transformation and Upgrading Efficiency in China: Analysis from the Perpective of Government Regulation and Public Environmental Demands. Environ. Sci. Pollut. Res. 2021, 28, 47474–47491. [Google Scholar] [CrossRef] [PubMed]

- Xu, Y.; Li, S.S.; Zhou, X.X.; Shahzad, U.; Zhao, X. How Environmental Regulations Affect the Development of Green Finance:Recent Evidence from Polluting Firms in China. Renew. Energy 2022, 189, 917–926. [Google Scholar] [CrossRef]

- Dong, Z.; Xu, H.D.; Zhang, Z.F.; Lyu, Y.P.; Lu, Y.Q.; Duan, H.Y. Whether Green Finance Improves Green Innovation of Listed Companies Evidence from China. Int. J. Environ. Res. Public Health 2022, 19, 10882. [Google Scholar] [CrossRef] [PubMed]

- Zhang, X.; Wang, Z.H.; Zhong, X.B.; Yang, S.Z.; Siddik, A. Do Green Banking Activities Improve the Banks’ Environmental Performance? The Mediating Effect of Green Financing. Sustainability 2022, 14, 989. [Google Scholar] [CrossRef]

- Chen, J.; Siddik, A.; Zheng, G.W.; Masukujjaman, M.; Bekhzod, S. The Effect of Green Banking Practices on Banks’ Environmental Performance and Green Financing: An Empirical Study. Energies 2022, 15, 1292. [Google Scholar] [CrossRef]

- Liu, T.H.; Kou, F.J.; Liu, X.; Elahi, E. Cluster Commercial Credit and Total Factor Productivity of the Manufacturing Sector. Sustainability 2022, 14, 3601. [Google Scholar] [CrossRef]

- Waqas, M.; Xue, H.G.; Ahmad, N.; Khan, S.A.R.; Iqbal, M. Big Data Analytics as a Roadmap Towards Green Innovation, Competitive Advantage and Environmental Performance. J. Clean. Prod. 2021, 323, 128998. [Google Scholar] [CrossRef]

- Jin, W.; Gao, S.; Pan, S. Research on the impact mechanism of environmental regulation on green total factor productivity from the perspective of innovative human capital. Environ. Sci. Pollut. Res. 2023, 30, 352–370. [Google Scholar] [CrossRef]

- Tonk, K. A slacks-based measure of efficiency in data envelopment analysis. Eur. J. Oper. Res. 2001, 120, 498–509. [Google Scholar]

- Chung, Y.; Fare, R. Productivity and undesirable outputs: A directional distance function approach. Microeconomics 1997, 51, 229–240. [Google Scholar] [CrossRef]

- Li, C.F.; Song, T.; Wang, W.F.; Gu, X.Y.; Li, Z.; Lai, Y.Z. Analysis and Measurement of Barriers to Green Transformation Behavior of Resource Industries. Int. J. Environ. Res. Public Health 2022, 19, 13821. [Google Scholar] [CrossRef]

- Deng, Q.Z.; Zhou, S.Z.; Peng, F. Measuring Green Innovation Efficiency for China’s High-Tech Manufacturing Industry: A Network DEA Approach. Math. Probl. Eng. 2020, 2020, 8902416. [Google Scholar] [CrossRef]

- Zhu, J.H.; Wang, S.S. Evaluation and Influencing Factor Analysis of Sustainable Green Transformation Efficiency of Resource-Based Cities in Western China in the Post-COVID-19 Era. Front. Public Health 2022, 10, 832904. [Google Scholar] [CrossRef]

- Hu, D.X.; Jiao, J.L.; Chen, C.X.; Xiao, R.Q.; Tang, Y.S. Does global value China embeddedness matter for the green innovation value chain? Front. Environ. Sci. 2022, 10, 779617. [Google Scholar] [CrossRef]

- Yang, Q.; Sun, Z.G.; Zhang, H.B.A. Assessment of Urban Green Development Efficiency Based on Three-Stage DEA: A Case Study from China’s Yangtze River Delta. Sustainability 2022, 14, 12076. [Google Scholar] [CrossRef]

- Zhou, Z.; Ma, Z.C.; Lin, X.W. Carbon emissions trading policy and green transformation of China’s manufacturing industry: Mechanism assessment and policy implications. Front. Environ. Sci. 2022, 10, 984612. [Google Scholar] [CrossRef]

- Yu, C.H.; Wu, X.Q.; Zhang, D.Y.; Chen, S.; Zhao, J.S. Demand for green finance: Resolving financing constraints on green innovation in China. Energy Policy 2021, 10, 1016. [Google Scholar] [CrossRef]

- Huang, H.F.; Zhang, J. Research on the Environmental Effect of Green Finance Policy Based on the Analysis of Pilot Zones for Green Finance Reform and Innovations. Sustainability 2021, 13, 3754. [Google Scholar] [CrossRef]

- Lu, N.; Wu, J.H.; Liu, Z.M. How Does Green Finance Reform Affect Enterprises Green Technology Innovation? Evidence from China. Sustainability 2022, 14, 9865. [Google Scholar] [CrossRef]

- Gong, M.Q.; You, Z.; Wang, L.T.; Cheng, J.H. Environmental Regulation, Trade Comparative Advantage, and the Manufacturing Industry’s Green Transformation and Upgrading. Int. J. Environ. Res. Public Health 2020, 17, 2823. [Google Scholar] [CrossRef]

- Shen, L.; Fan, R.J.; Wang, Y.Y.; Yu, Z.Q.; Tang, R.Y. Impacts of Environmental Regulation on the Green Transformation and Upgrading Manufacturing Enterprises. Int. J. Environ. Res. Public Health 2020, 17, 7680. [Google Scholar] [CrossRef]

- Zhai, X.Q.; An, Y.F. Analyzing Influencing Factors of Green Transformation in China’s Manufacturing Industry under Environmental Regulation: A Structural Equation Model. J. Clean. Prod. 2020, 251, 119760. [Google Scholar] [CrossRef]

- Wang, K.; Tsai, S.B.; Du, X.M.; Bi, D.T. Internet Finance, Green Finance, and Sustainability. Sustainability 2019, 11, 3856. [Google Scholar] [CrossRef]

- Liu, Y.H.; Lei, J.; Zhang, Y.H. A Study on the Sustainable Relationship among the Green Finance, Environment Regulation and Green-Total-Factor Productivity in China. Sustainability 2021, 13, 11926. [Google Scholar] [CrossRef]

- Du, M.; Zhang, R.R.; Chai, S.L.; Li, Q.; Sun, R.X.; Chu, W.J. Can Green Finance Policies Stimulate Technological Innovation and Financial Performance? Evidence from Chinese Listed Green Enterprises. Sustainability 2022, 14, 9287. [Google Scholar] [CrossRef]

- Desalegn, G.; Tangl, A. Enhancing Green Finance for Inclusive Green Growth: A Systematic Approach. Sustainability 2022, 14, 7416. [Google Scholar] [CrossRef]

- Bradley, D.; Kim, I.; Tian, X. Do unions affect innovation? Manag. Sci. 2017, 63, 2251–2271. [Google Scholar] [CrossRef]

- Topalova, P. Factor immobility and regional impacts of trade liberalization: Evidence on poverty from India. Am. Econ. J. Appl. Econ. 2010, 2, 1–41. [Google Scholar] [CrossRef]

- Knyazeva, D. Corporate Governance, Analyst Following, and Firm Behavior. J. Account. Res. 2008, 43, 36–74. [Google Scholar]

| Disclaimer/Publisher’s Note: The statements, opinions and data contained in all publications are solely those of the individual author(s) and contributor(s) and not of MDPI and/or the editor(s). MDPI and/or the editor(s) disclaim responsibility for any injury to people or property resulting from any ideas, methods, instructions or products referred to in the content. |

© 2023 by the authors. Licensee MDPI, Basel, Switzerland. This article is an open access article distributed under the terms and conditions of the Creative Commons Attribution (CC BY) license (https://creativecommons.org/licenses/by/4.0/).