Third Time’s a Charm? Assessing the Impact of the Third Phase of the EU ETS on CO2 Emissions and Performance

Abstract

1. Introduction

- Reduce GHG emissions by at least 40% compared to 1990 levels;

- Have at least 32% of energy produced from renewable sources;

- Improve energy efficiency by at least 32.5%.

Literature Review and Article’s Contribution

2. Materials and Methods

2.1. Institutional Setting

- Phase 1 (2005–2007).

- In Phase 1, carbon-intensive industries across the EU-27 member states were regulated with a hard cap of 2.058 Gton of CO2-eq. The distribution of EU Allowances was mainly through free allocation, accounting for approximately 98% of the total. The hard cap was established as a constraint to reduce overall emissions. The regulated industries included power stations and other combustion plants (≥20 MW), oil refineries, coke ovens, iron and steel plants, cement clinker, glass, lime, bricks, ceramics, pulp, paper, and board.

- Phase 2 (2008–2012).

- In Phase 2, the system was extended to include three more countries (Norway, Iceland, and Liechtenstein) and the aviation sector (the cap on aviation emissions is separate from the other sectors and in Phase 3 has been set at a constant level equivalent to 95% of the historical aviation emissions. From 2021 onward, the linear reduction factor of 2.2% that applies to stationary installations will also apply to the aviation cap). The cap for CO2-eq emissions was lowered to 1.859 Gton, and member states could include certain emissions of N2O and PFC. Free allocation remained the primary method of EUA distribution, accounting for 96% of the total. A company that receives EUA for free faces no financial burden for compliance, but may still have the incentive to reduce emissions to sell the EUA at market price (the Coase theorem [27] states that, theoretically, the initial allocation of permits should not impact incentives even if it has distributional effects. However, its assumptions are rarely satisfied, such as in the presence of taxes [28]). However, free allocation reduces the cost of compliance with EU ETS requirements, potentially reducing the urgency for businesses to reduce emissions, especially if regulations are uncertain. The free allocation of allowances may also lead to windfall gains for companies that can pass the cost of allowances to their clients, especially in markets with limited competition. Evidence from Phases 1 and 2 suggests that this occurred among companies in the energy industry [4,29].

- Phase 3 (2013–2020).

- During Phase 3, Croatia joined the EU ETS and the scope of the system grew to include more industrial sectors (aluminium, petrochemicals, ammonia, nitric, adipic and glyoxylic acid production, CO2 capture, transport in pipelines, and geological storage of CO2). The cap on CO2-eq emissions was set at 2084 Gton for 2013, with an annual reduction of 1.74% until the start of Phase 4 when it will reduce by 2.2% yearly (the legislation also covered PFC emissions from aluminium manufacturing as well as N2O emissions from nitric, adipic, and glyoxylic acid production). To overcome some of the pitfalls of previous phases’ regulation, the proportion of freely allocated EUA underwent a stark reduction (from 96% to 43%) by implementing 100% auctioning for power generation installations and increasing the target of auctioning for industrial installations from 20% in 2013 to 70% in 2020, with a target of 100% for 2030. While all electricity producers have been mandated to acquire EUA in Phase 3, as per Article 10c of the ETS directive certain EU Member States (Bulgaria, Czechia, Croatia, Estonia, Latvia, Lithuania, Hungary, Poland, Romania, and Slovakia) are granted a derogation from the general rule. These lower-income Member States may provide free EUA to electricity-generating installations to support investments that contribute to the diversification of the energy mix, restructure, and upgrade of energy infrastructure, implement clean technologies, and for modernization of the energy production and transmission sectors. Free allocation in Phase 3 was also used to prevent emission-intensive, internationally competing industries from relocating to countries with weaker environmental regulations, and avoid job losses, market share decline, and the offsetting of EU emissions reductions through carbon leakage. The targeting of free allocation in this phase had the double objective of achieving emission reduction targets while fostering investment in emissions reduction and energy-efficient technology. As such, the allocation of free EUA was revised, shifting from “grandfathering” (based on historical emissions) to benchmarks based on the lowest GHG emitters in each production process. Hence, the least polluting companies were fully covered by free allocation, while the others had to purchase EUA for their excess emissions, encouraging them to search for the most efficient way to improve their environmental performance.

- Phase 4 (2021–2030).

- Recently the European Commission set the following 2030 targets: (i) at least 55% reduction in GHG emissions from 1990 levels; (ii) a minimum renewable energy share of 32% (with a clause for a possible upwards revision by 2023); (iii) at least 32.5% improvement in energy efficiency compared to projections of the expected energy use. To meet the EU’s 2030 GHG emissions reduction target, the EU ETS installations must reduce their emissions by 43% compared to 2005. The annual decline rate of emission allowances will increase to 2.2% starting in 2021 to step up the pace of emissions cuts. To improve the resilience of EU ETS to future market shocks (a marked oversupply of EUA arose during the period 2009–2013 due to: (i) the 2008 economic crisis; (ii) unexpectedly high imports of international carbon credits; (iii) the significant increase in the use of renewable sources. This resulted in low prices of EUA between 2012 and 2017 that altered the functioning of the carbon market [3,4,5] and reduced the ability of the ETS system to curb emissions), the Market Stability Reserve will be substantially reinforced. The revised EU ETS Directive includes new rules to address the risk of carbon leakage with the free allocation system being extended for another decade, with a focus on sectors at high risk of relocating outside the EU. These sectors are entitled to 100% free allocation of allowances, while those at lower risk of relocation will phase out after 2026. From 2020, a part of the EUA has been devoted to the Innovation Fund (EUR 38 billion in 2020–2030, assuming a EUA price of EUR 75) which is allocated by the European Investment Bank to support highly innovative projects on low-carbon technologies and to bring to the market novel decarbonization processes. To foster the adoption of emissions reduction technologies in lower-income Members States, 2% of the allowances have been earmarked to financing the Modernization Fund, which supports transitioning to a low-carbon economy of energy-intensive sectors by: “funding the demonstration of innovative technologies, increasing energy security, expanding the use of renewable energy sources and promoting the exchange of best practices”. While the optional transitional free allocation provided by Article 10c remains available for lower-income Member States, only Bulgaria, Hungary, and Romania are taking advantage of this opportunity in Phase 4. Czechia, Croatia, Lithuania, Romania, and Slovakia have chosen to transfer some or all of their Article 10c allocations to the Modernization Fund, which will increase their respective volumes and share of spending under the Fund. Finally, Estonia, Latvia, and Poland, which also fall under Article 10c derogation, chose to auction their allowances instead.

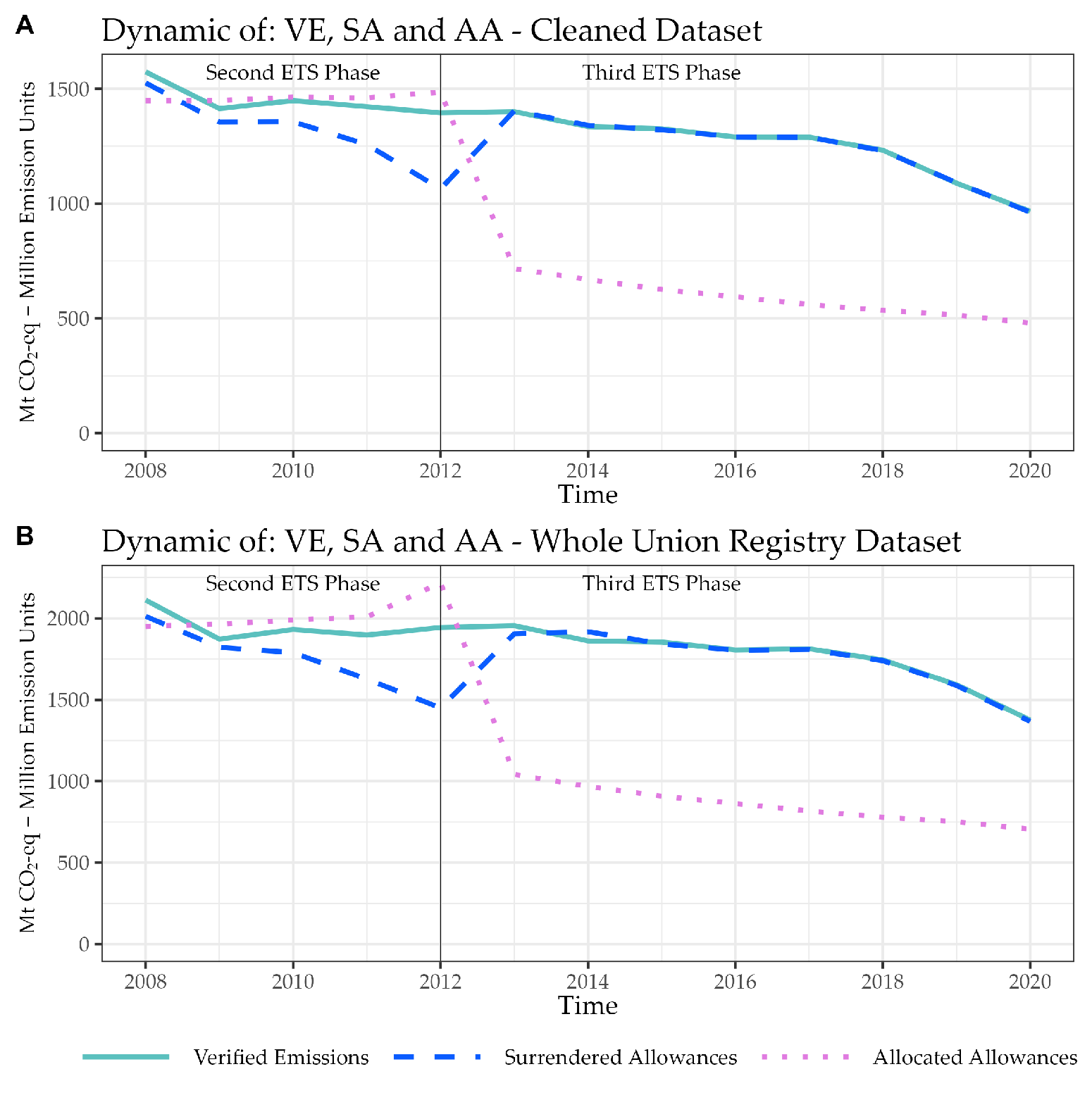

2.2. Datasets and Methodology

- Identify observations reporting VE and SA but not AA for the entire third phase.

- Identify the observations of Step 1 that are in the Nace category “Energy: Electricity generation”.

- Identify the observations of Step 2 that are not in a country granted derogation by Article 10c of the ETS directive.

- Impute 0 to the AA variable in place of a missing value to the observations identified in Step 3.

3. Results

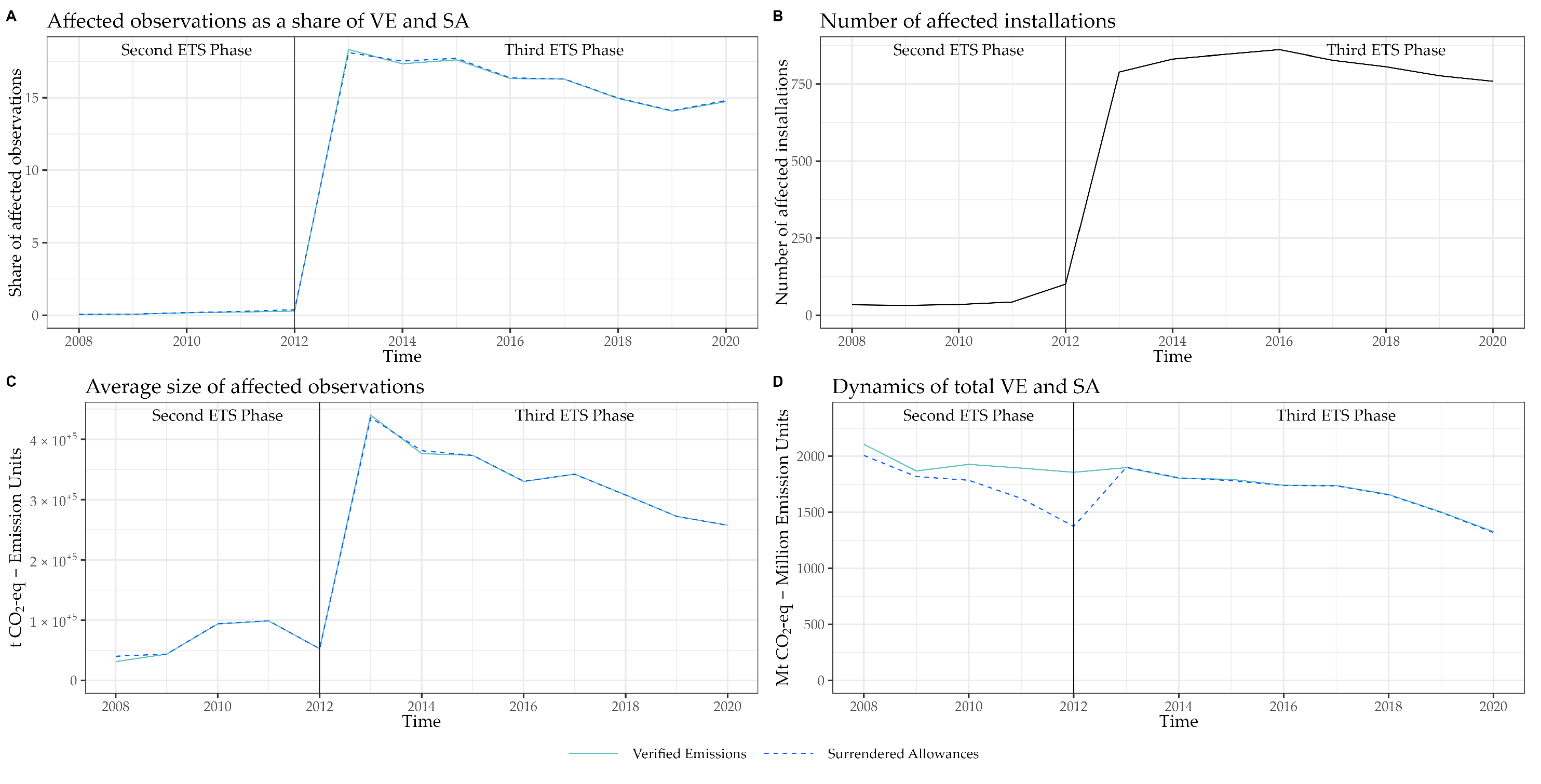

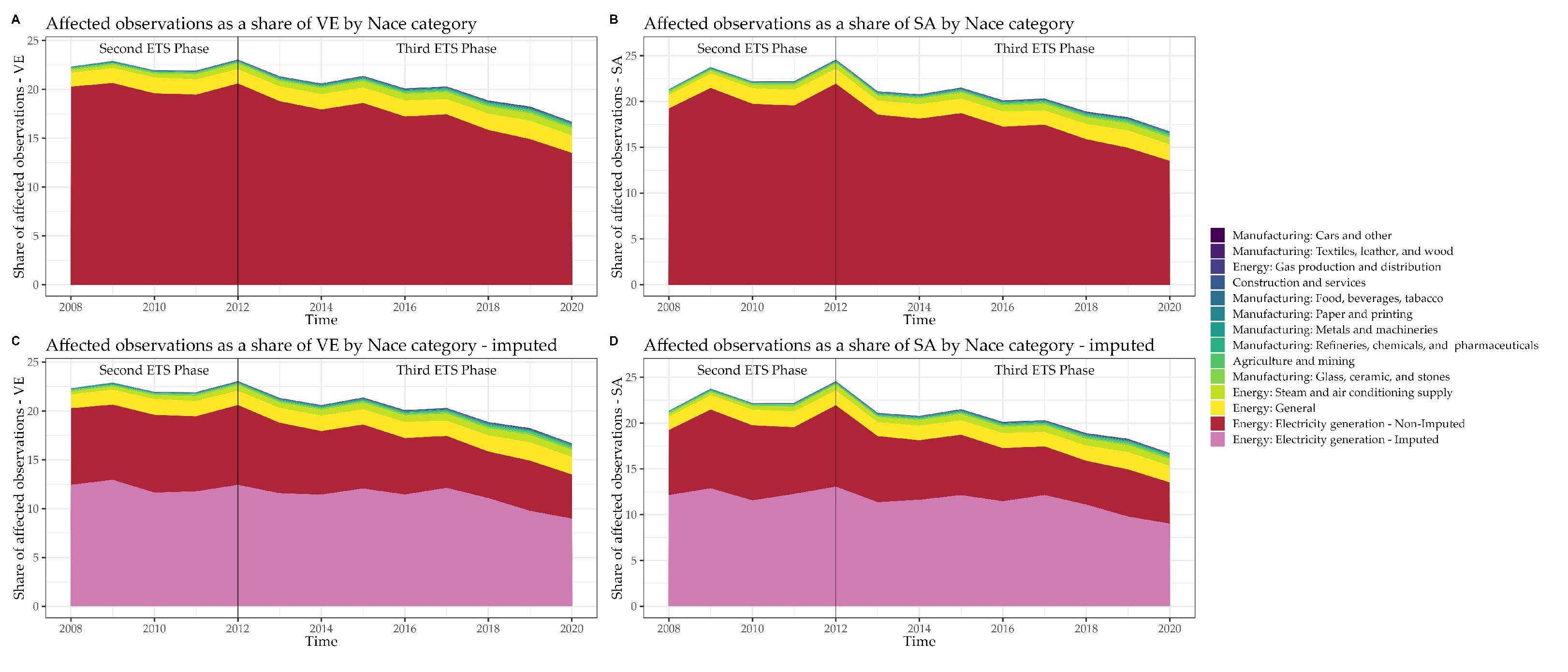

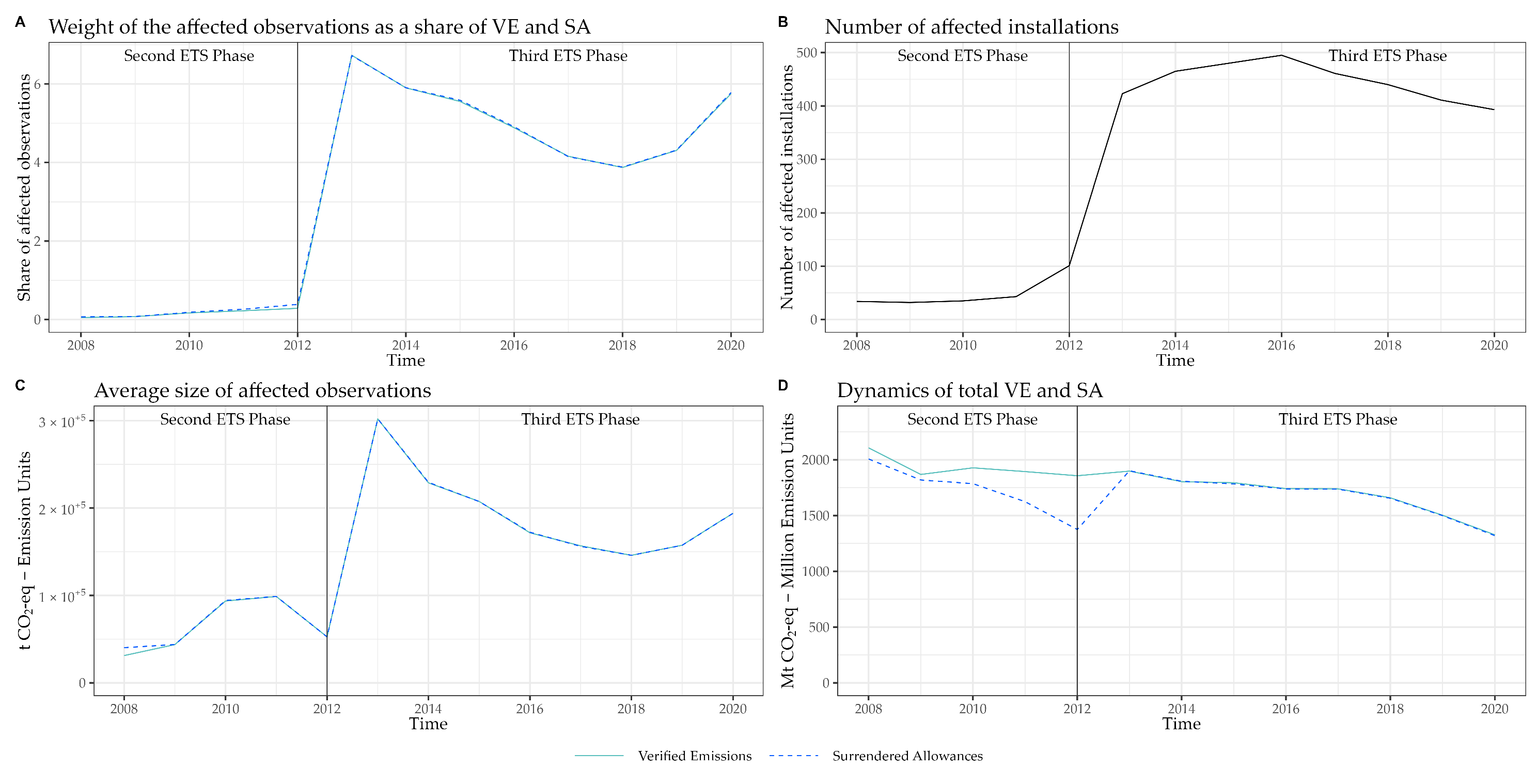

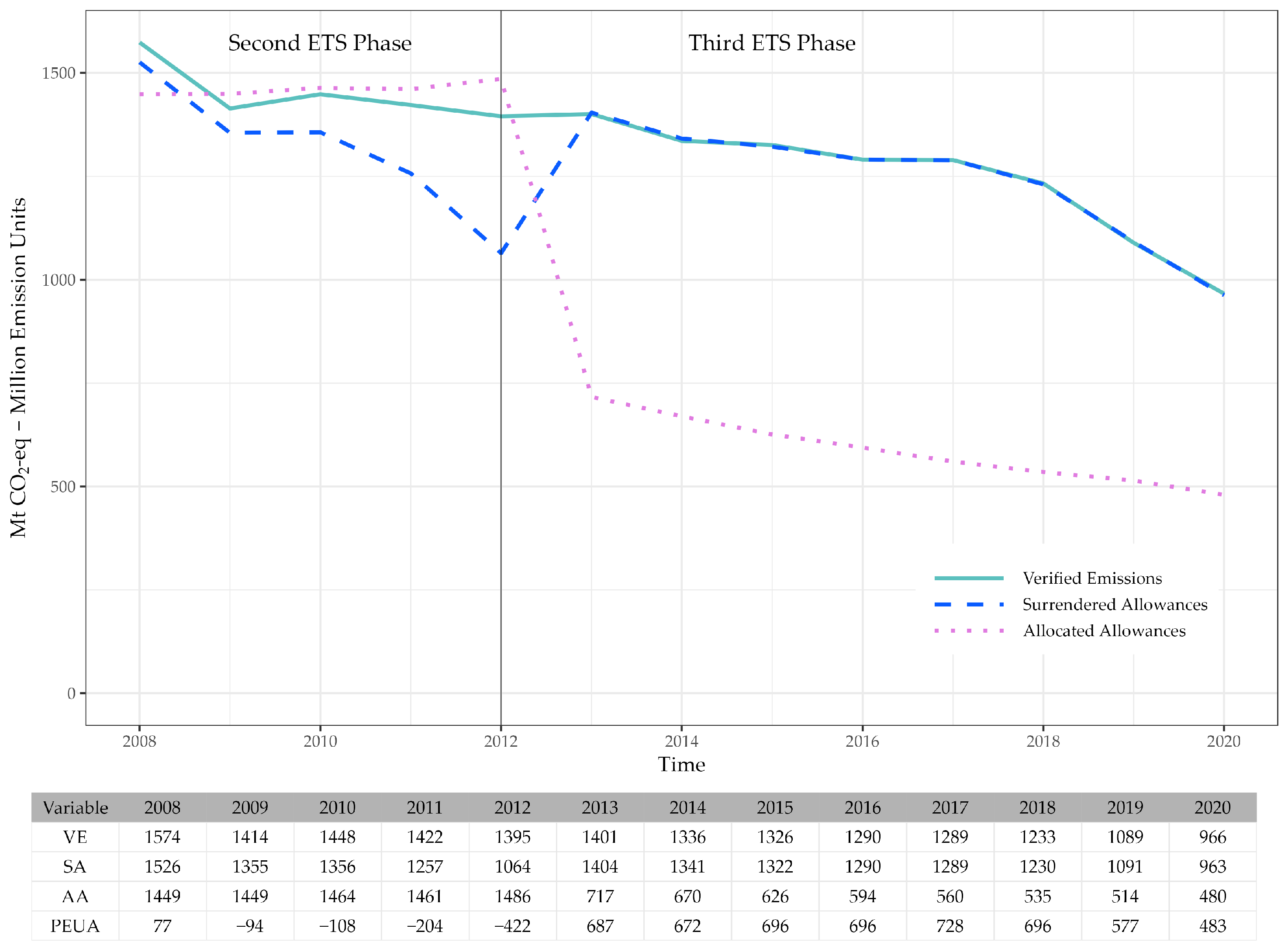

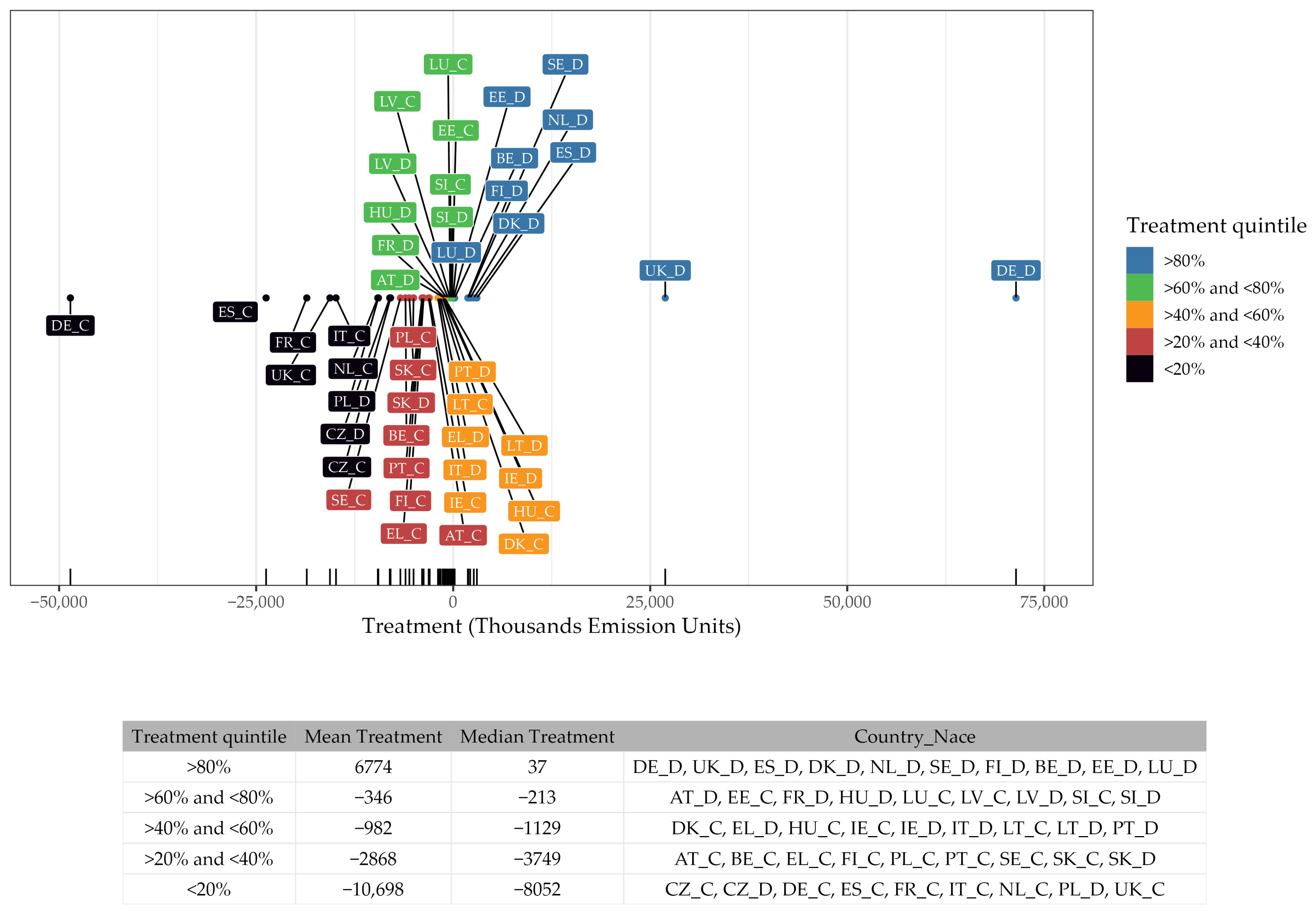

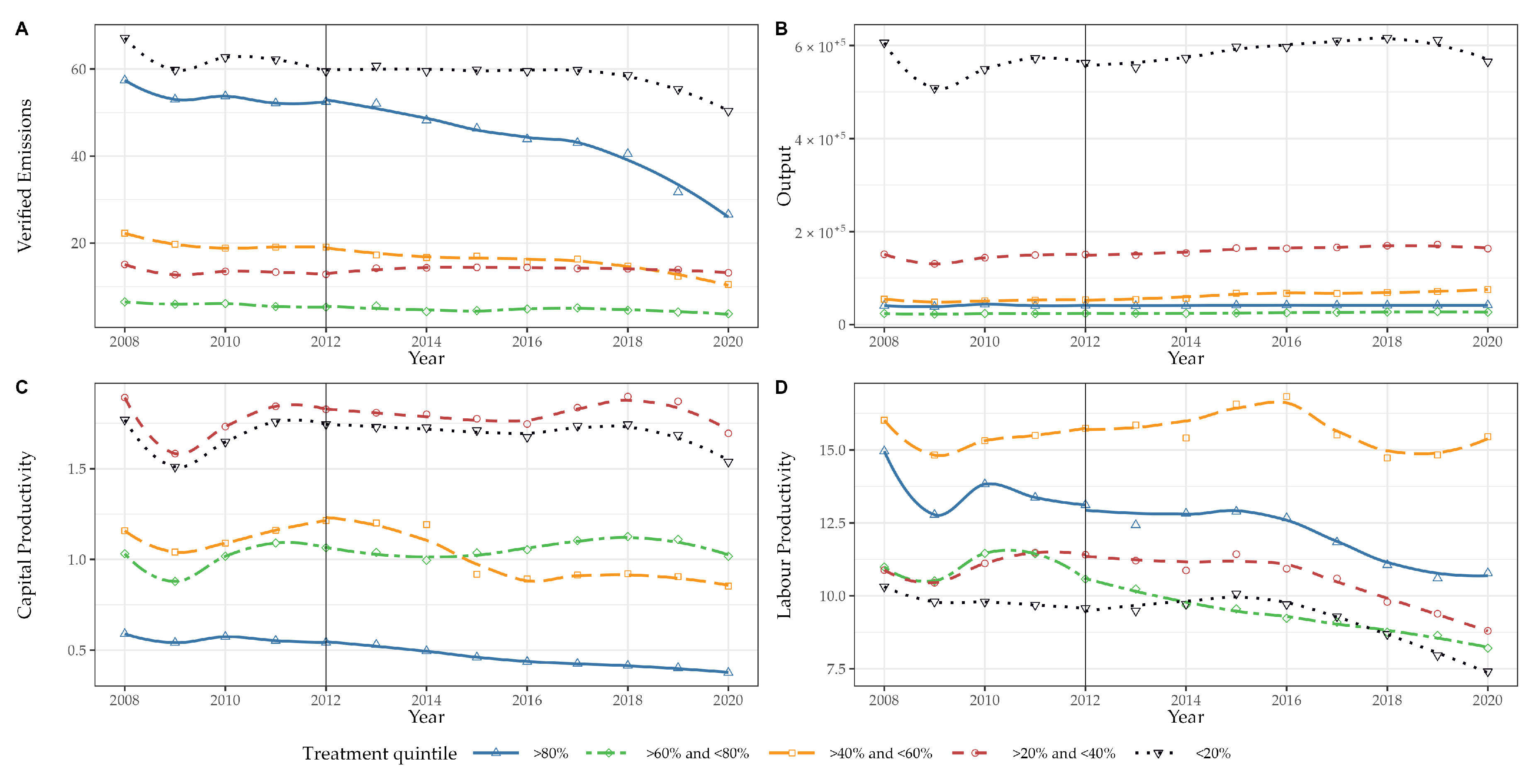

3.1. Descriptive Evidence

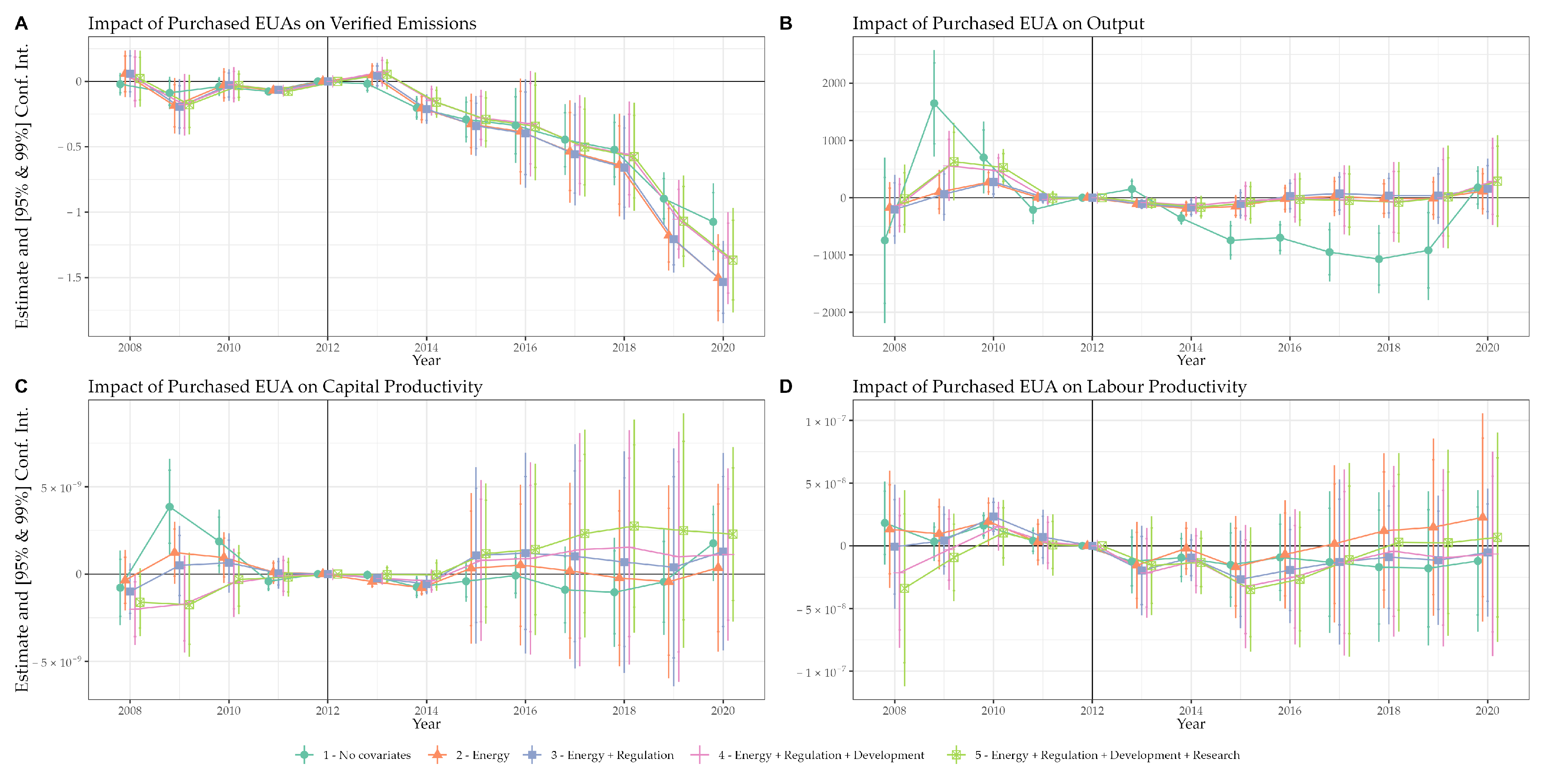

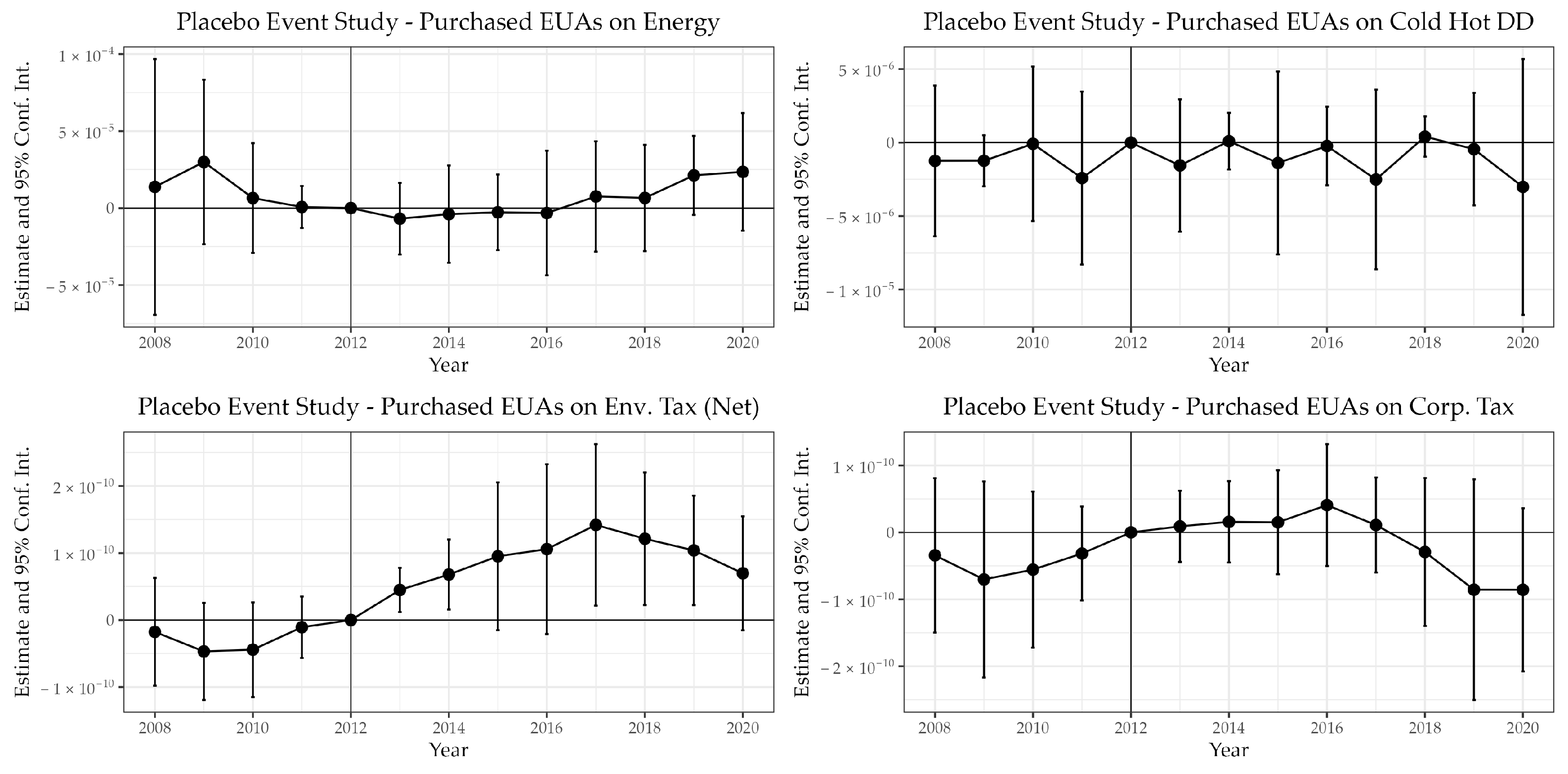

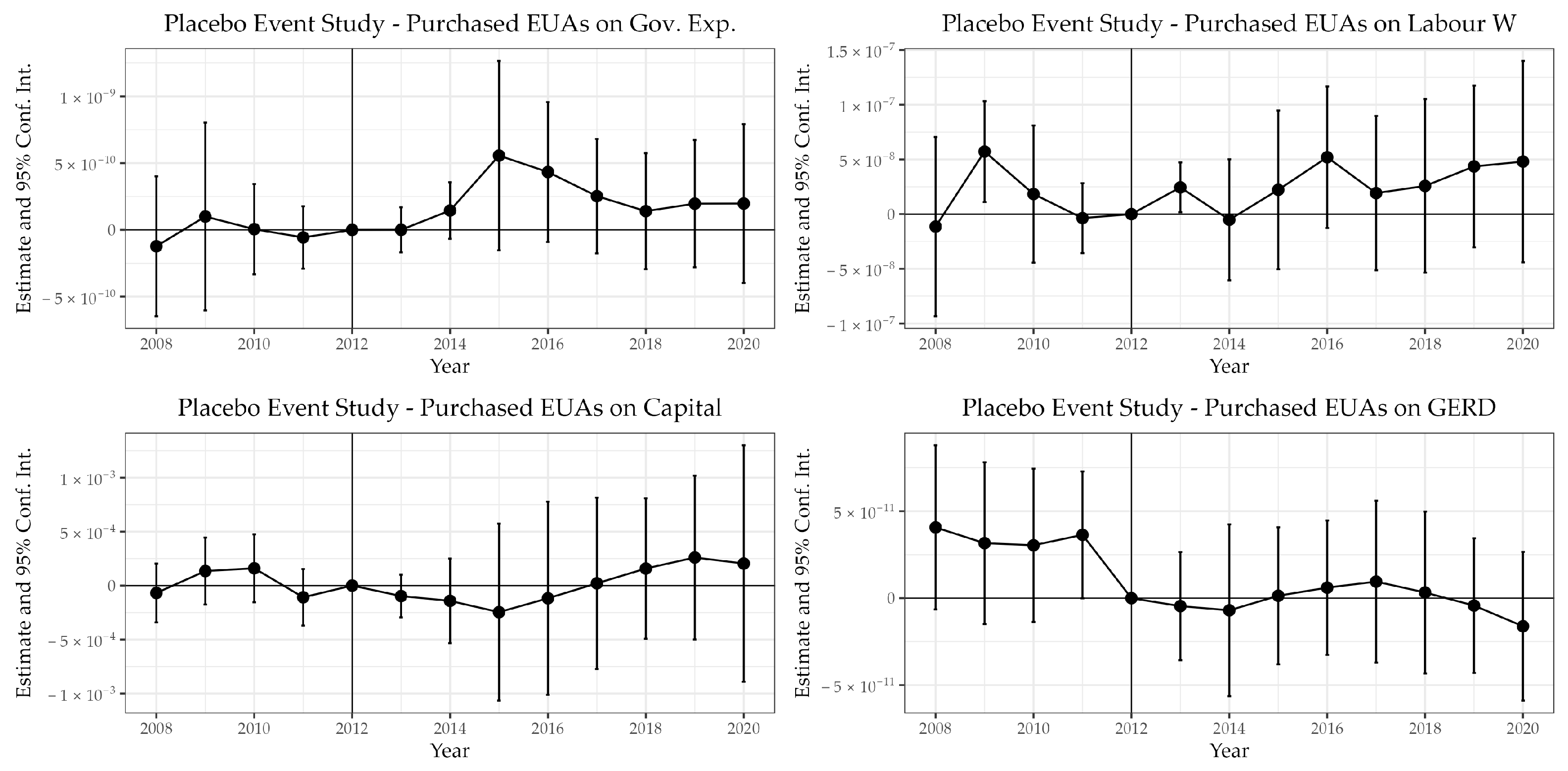

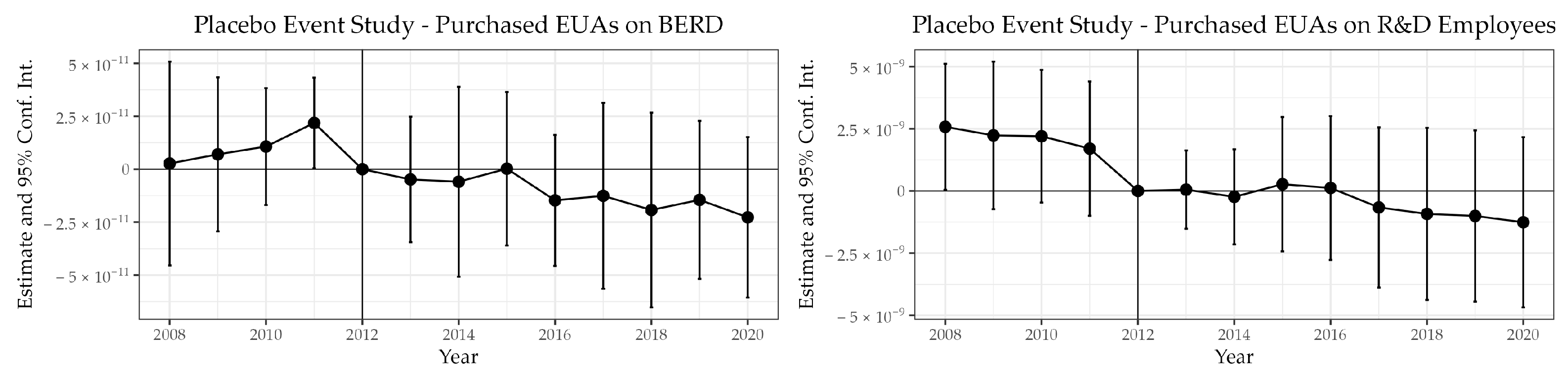

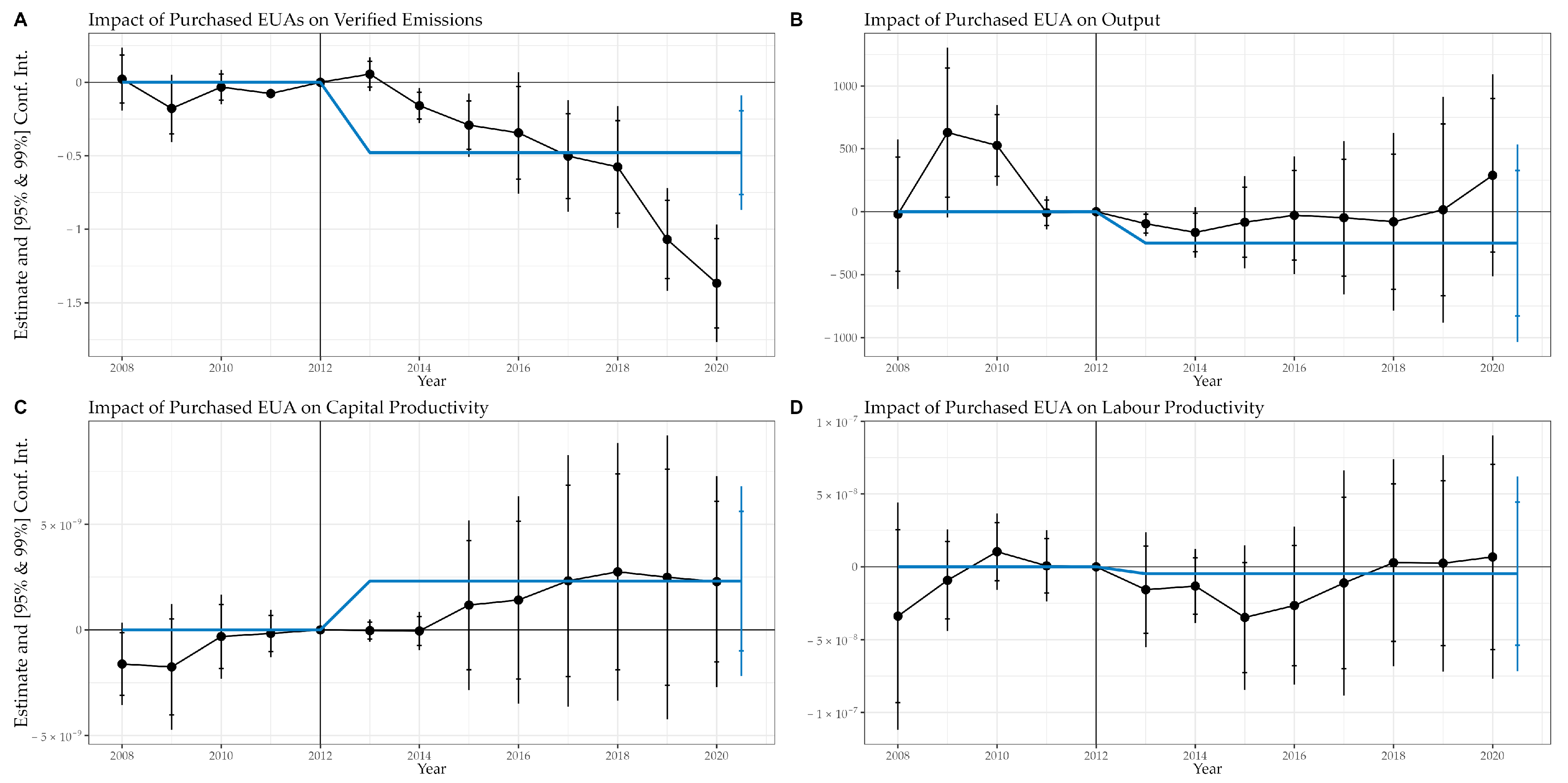

3.2. Policy Evaluation

4. Discussion

Author Contributions

Funding

Institutional Review Board Statement

Informed Consent Statement

Data Availability Statement

Acknowledgments

Conflicts of Interest

Abbreviations

| AA | Freely allocated allowances |

| DD | Difference-in-difference |

| DDD | Triple difference |

| ES | Event study |

| EU ETS | European Union Emissions Trading System |

| EUTL | European Union Transaction Log |

| EUA | European Union Allowances |

| PEUA | Purchased EUA |

| SA | Surrendered allowances |

| VE | Verified emissions |

Appendix A. Data

Appendix B. Policy Evaluation

| Verified Emissions | Output | Capital Productivity | Labour Productivity | |

|---|---|---|---|---|

| (A) | (B) | (C) | (D) | |

| Treatment × 2008 | 0.0216 | −19.75 | ** | |

| (0.0832) | (231.3) | () | () | |

| Treatment × 2009 | −0.1777 * | 629.5 ** | ||

| (0.0889) | (262.2) | () | () | |

| Treatment × 2010 | −0.0326 | 526.9 *** | ||

| (0.0454) | (124.9) | () | () | |

| Treatment × 2011 | −0.0766 *** | −8.188 | ||

| (0.0112) | (51.27) | () | () | |

| Treatment × 2013 | 0.0557 | −95.26 ** | ||

| (0.0448) | (38.14) | () | () | |

| Treatment × 2014 | −0.1587 *** | −164.9 ** | ||

| (0.0466) | (77.74) | () | () | |

| Treatment × 2015 | −0.2915 *** | −83.95 | * | |

| (0.0839) | (142.3) | () | () | |

| Treatment × 2016 | −0.3439 ** | −28.27 | ||

| (0.1606) | (181.5) | () | () | |

| Treatment × 2017 | −0.5021 *** | −47.65 | ||

| (0.1474) | (236.9) | () | () | |

| Treatment × 2018 | −0.5758 *** | −79.70 | ||

| (0.1608) | (273.9) | () | () | |

| Treatment × 2019 | −1.069 *** | 15.05 | ||

| (0.1359) | (348.3) | () | () | |

| Treatment × 2020 | −1.367 *** | 289.0 | ||

| (0.1553) | (311.8) | () | () | |

| ✓ | ✓ | ✓ | ✓ | |

| Country-Nace FE | ✓ | ✓ | ✓ | ✓ |

| Year FE | ✓ | ✓ | ✓ | ✓ |

| Observations | 559 | 559 | 559 | 559 |

| Verified Emissions | |||||

|---|---|---|---|---|---|

| (1) | (2) | (3) | (4) | (5) | |

| Post × Derog. 10c | 7,006,021.1 *** | 4,331,965.5 ** | 9,866,287.5 ** | 10,956,577.5 ** | 14,199,090.8 ** |

| (1,973,301.1) | (1,909,609.4) | (4,490,879.2) | (4,566,324.7) | (6,007,911.5) | |

| Post × Treatment | −0.4450 *** | −0.5622 *** | −0.5702 *** | −0.4599 *** | −0.4581 *** |

| (0.0844) | (0.1322) | (0.1214) | (0.1070) | (0.0973) | |

| Post × Treatment × Derog. 10c | 1.353 *** | 1.250 *** | 1.335 *** | 0.9509 *** | 1.054 *** |

| (0.2528) | (0.3080) | (0.3648) | (0.3246) | (0.3432) | |

| ✓ | ✓ | ✓ | ✓ | ✓ | |

| Country-Nace FE | ✓ | ✓ | ✓ | ✓ | ✓ |

| Year FE | ✓ | ✓ | ✓ | ✓ | ✓ |

| Observations | 598 | 598 | 572 | 559 | 559 |

References

- European Commission. Special Eurobarometer; Technical Report 459; European Commission: Luxembourg, 2017. [Google Scholar]

- European Parliamentary Research Service. Europe’s Two Trillion Euro Dividend: Mapping the Cost of Non-Europe, 2019–2024; Technical Report; European Parliamentary Research Service: Luxembourg, 2019. [Google Scholar]

- Martin, R.; Muûls, M.; Wagner, U.J. The impact of the European Union Emissions Trading Scheme on regulated firms: What is the evidence after ten years? Rev. Environ. Econ. Policy 2016, 10, 129–148. [Google Scholar] [CrossRef]

- Joltreau, E.; Sommerfeld, K. Why does emissions trading under the EU Emissions Trading System (ETS) not affect firms’ competitiveness? Empirical findings from the literature. Clim. Policy 2019, 19, 453–471. [Google Scholar] [CrossRef]

- Klemetsen, M.; Rosendahl, K.E.; Jakobsen, A.L. The impacts of the EU ETS on Norwegian plants’ environmental and economic performance. Clim. Chang. Econ. (CCE) 2020, 11, 2050006. [Google Scholar] [CrossRef]

- Carratù, M.; Chiarini, B.; Piselli, P. Effects of European emission unit allowance auctions on corporate profitability. Energy Policy 2020, 144, 111584. [Google Scholar] [CrossRef]

- Ellerman, A.D.; Buchner, B.K. Over-allocation or abatement? A preliminary analysis of the EU ETS based on the 2005–06 emissions data. Environ. Resour. Econ. 2008, 41, 267–287. [Google Scholar] [CrossRef]

- Anderson, B.; Di Maria, C. Abatement and allocation in the pilot phase of the EU ETS. Environ. Resour. Econ. 2011, 48, 83–103. [Google Scholar] [CrossRef]

- Abrell, J.; Faye, A.N.; Zachmann, G. Assessing the Impact of the EU ETS Using Firm Level Data; Bruegel Working Paper; Bruegel: Brussels, Belgium, 2011. [Google Scholar]

- Egenhofer, C.; Alessi, M.; Georgiev, A.; Fujiwara, N. The EU Emissions Trading System and Climate Policy towards 2050: Real Incentives to Reduce Emissions and Drive Innovation? Technical Report, CEPS Special Report; European Commission: Luxembourg, 2011. [Google Scholar]

- Petrick, S.; Wagner, U.J. The Impact of Carbon Trading on Industry: Evidence from German Manufacturing Firms. 2014. Available online: https://econpapers.repec.org/paper/zbwvfsc14/100472.htm (accessed on 30 March 2023).

- Wagner, U.J.; Muûls, M.; Martin, R.; Colmer, J. The causal effects of the European Union Emissions Trading Scheme: Evidence from French manufacturing plants. In Proceedings of the Fifth World Congress of Environmental and Resources Economists, Instanbul, Turkey, 28 June–2 July 2014. [Google Scholar]

- Jaraite, J.; Di Maria, C. Did the EU ETS make a difference? An empirical assessment using Lithuanian firm-level data. Energy J. 2016, 37, 1–23. [Google Scholar]

- Dechezleprêtre, A.; Nachtigall, D.; Venmans, F. The Joint Impact of the EuropeanUnion Emissions Trading System on Carbon Emissions and Economic Performance. J. Environ. Econ. Manag. 2023, 118, 102758. [Google Scholar] [CrossRef]

- Bel, G.; Joseph, S. Emission abatement: Untangling the impacts of the EU ETS and the economic crisis. Energy Econ. 2015, 49, 531–539. [Google Scholar] [CrossRef]

- Jaffe, A.B.; Peterson, S.R.; Portney, P.R.; Stavins, R.N. Environmental regulation and the competitiveness of U.S. manufacturing: What does the evidence tell us? J. Econ. Lit. 1995, 98, 853–873. [Google Scholar]

- Rose, A. Modeling the macroeconomic impact of air pollution abatement. J. Regul. Sci. 1983, 23, 441–459. [Google Scholar] [CrossRef]

- Joshi, S.; Lave, L.; Shih, J.S.; McMichael, F. Impact of Environmental Regulation on the U.S. Steel Industry; Technical Report; Carnegie Mellon University: Pittsburgh, PA, USA, 1997. [Google Scholar]

- Porter, M. America’s green strategy. Sci. Am. 1991, 264, 168. [Google Scholar] [CrossRef]

- Ambec, S.; Cohen, M.A.; Elgie, S.; Lanoie, P. The Porter hypothesis at 20: Can environmental regulation enhance innovation and competitiveness? Rev. Environ. Econ. Policy 2013, 7, 2–22. [Google Scholar] [CrossRef]

- Mazzucato, M. The Green Entrepreneurial State; Routledge: Abingdon, UK, 2015. [Google Scholar]

- Martínez-Zarzoso, I.; Bengochea-Morancho, A.; Morales-Lage, R. Does environmental policy stringency foster innovation and productivity in OECD countries? Energy Policy 2019, 134, 110982. [Google Scholar] [CrossRef]

- Jaraitė, J.; Di Maria, C. Efficiency, productivity and environmental policy: A case study of power generation in the EU. Energy Econ. 2012, 34, 1557–1568. [Google Scholar] [CrossRef]

- Chan, H.S.R.; Li, S.; Zhang, F. Firm competitiveness and the European Union emissions trading scheme. Energy Policy 2013, 63, 1056–1064. [Google Scholar] [CrossRef]

- Marin, G.; Marino, M.; Pellegrin, C. The impact of the European Emission Trading Scheme on multiple measures of economic performance. Environ. Resour. Econ. 2018, 71, 551–582. [Google Scholar] [CrossRef]

- Guo, J.; Gu, F.; Liu, Y.; Liang, X.; Mo, J.; Fan, Y. Assessing the impact of ETS trading profit on emission abatements based on firm-level transactions. Nat. Commun. 2020, 11, 2078. [Google Scholar] [CrossRef] [PubMed]

- Coase, R.H. The Problem of Social Cost. J. Law Econ. 1960, 3, 1–44. [Google Scholar] [CrossRef]

- Goulder, L.H.; Parry, I.W.; Williams III, R.C.; Burtraw, D. The cost-effectiveness of alternative instruments for environmental protection in a second-best setting. J. Public Econ. 1999, 72, 329–360. [Google Scholar] [CrossRef]

- Lise, W.; Sijm, J.; Hobbs, B.F. The impact of the EU ETS on prices, profits and emissions in the power sector: Simulation results with the COMPETES EU20 model. Environ. Resour. Econ. 2010, 47, 23–44. [Google Scholar] [CrossRef]

- European Commission, Directorate-General for Climate Action. Stakeholder meeting on the results of the preliminary carbon leakage list for phase 4 of the EU Emissions Trading System. In Commission Notice on the Preliminary Carbon Leakage List for the EU ETS for Phase 4 (2021–2030); European Commission: Luxembourg, 2018. [Google Scholar]

- Anger, N.; Oberndorfer, U. Firm performance and employment in the EU emissions trading scheme: An empirical assessment for Germany. Energy Policy 2008, 36, 12–22. [Google Scholar] [CrossRef]

- Jacobson, L.; LaLonde, R.; Sullivan, D. Earnings losses of displaced workers. Am. Econ. Rev. 1993, 83, 685–709. [Google Scholar]

- Bordignon, M.; Buso, M.; Caruso, R.; Gamannossi degl’Innocenti, D.; Gerotto, L.; Levaggi, R.; Rizzo, L.; Secomandi, R.; Turati, G. Improving the Quality of Public Spending in Europe; Technical Report; Study of the Inter-University Research Centre on Local and Regional Finance (CIFREL) at the request of the European Parliamentary Research Service; European Union: Brussels, Belgium, 2020. [Google Scholar] [CrossRef]

- Eurostat. Energy Balance Guide—Methodology Guide for the Construction of Energy Balances & Operational Guide for the Energy Balance Builder Tool; Technical Report; European Commission: Luxembourg, 2019. [Google Scholar]

- Eurostat. Manual for Air Emissions Accounts; Technical Report; European Commission: Luxembourg, 2015. [Google Scholar]

- Eurostat. Validation Rules for Air Emissions Accounts; Technical Report; European Commission: Luxembourg, 2020. [Google Scholar]

- United Nations Statistical Commission. International Recommendations for Energy Statistics; Technical Report; United Nations Statistical Commission: New York, NY, USA, 2018. [Google Scholar]

| <20% | >20% and <40% | >40% and <60% | >60% and <80% | >80% | |

|---|---|---|---|---|---|

| Energy | 23,923 ** | 8206 | 1237 *** | 668 *** | 737 *** |

| Capital | 271,730 ** | 78,865 | 55,601 | 24,075 *** | 54,593 |

| Labour HC | 21.29 | 18.92 | 22.49 | 22.35 | 37.56 ** |

| GERD | 0.016 | 0.017 | 0.014 | 0.016 | 0.023 ** |

| BERD | 0.009 | 0.011 | 0.008 | 0.01 | 0.015 ** |

| R&D Employees | 1.16 | 1.22 | 1.13 | 1.24 | 1.59 ** |

| Cold Hot DD | 2900 | 3416 | 2826 | 3375 | 3555 |

| Env. Tax (Net) | 0.014 | 0.016 | 0.012 | 0.014 | 0.014 |

| Corp. Tax | 0.026 | 0.025 | 0.021 | 0.022 | 0.027 |

| Gov. Exp. | 0.423 | 0.441 | 0.406 | 0.431 | 0.454 |

| Post × Treatment | Post × Derog. 10c | Post × Treatment × Derog. 10c | |

|---|---|---|---|

| Panel A: Verified Emissions | |||

| DD | −0.479 *** | ||

| [−0.867, −0.0896] | |||

| DDD | −0.458 *** | ** | 1.054 *** |

| [−0.7335, −0.183] | [, ] | [ 0.0827, 2.026] | |

| Panel B: Output | |||

| DD | −250 | ||

| [−1036, 536] | |||

| DDD | −77 | −1662 | |

| [−1037, 883] | [, ] | [, 1317] | |

| Panel C: Capital Productivity | |||

| DD | |||

| [, ] | |||

| DDD | 0.031 | ||

| [, ] | [−0.393, 0.456] | [, ] | |

| Panel D: Labour Productivity | |||

| DD | |||

| [, ] | |||

| DDD | −3.56 ** | * | |

| [, ] | [−7.264, 0.150] | [, ] | |

| Controls—All Panels: | |||

| , Contry-Nace FE, Year FE, Std.Errors: by Country, Num.Obs.: 559 | |||

Disclaimer/Publisher’s Note: The statements, opinions and data contained in all publications are solely those of the individual author(s) and contributor(s) and not of MDPI and/or the editor(s). MDPI and/or the editor(s) disclaim responsibility for any injury to people or property resulting from any ideas, methods, instructions or products referred to in the content. |

© 2023 by the authors. Licensee MDPI, Basel, Switzerland. This article is an open access article distributed under the terms and conditions of the Creative Commons Attribution (CC BY) license (https://creativecommons.org/licenses/by/4.0/).

Share and Cite

Bordignon, M.; Gamannossi degl’Innocenti, D. Third Time’s a Charm? Assessing the Impact of the Third Phase of the EU ETS on CO2 Emissions and Performance. Sustainability 2023, 15, 6394. https://doi.org/10.3390/su15086394

Bordignon M, Gamannossi degl’Innocenti D. Third Time’s a Charm? Assessing the Impact of the Third Phase of the EU ETS on CO2 Emissions and Performance. Sustainability. 2023; 15(8):6394. https://doi.org/10.3390/su15086394

Chicago/Turabian StyleBordignon, Massimo, and Duccio Gamannossi degl’Innocenti. 2023. "Third Time’s a Charm? Assessing the Impact of the Third Phase of the EU ETS on CO2 Emissions and Performance" Sustainability 15, no. 8: 6394. https://doi.org/10.3390/su15086394

APA StyleBordignon, M., & Gamannossi degl’Innocenti, D. (2023). Third Time’s a Charm? Assessing the Impact of the Third Phase of the EU ETS on CO2 Emissions and Performance. Sustainability, 15(8), 6394. https://doi.org/10.3390/su15086394