Abstract

The status of real estate investment trusts (REITs) rose in investment decisions and research since 2008, after the global financial crisis (GFC) and the surge in REITs. However, the sector is still in its infancy in most emerging markets and African countries. The current study examines the literature on the performance of REITs and the related risks using bibliometric and content analyses. The study’s objectives were to determine the research trends on the topic since 2008, the prominent authors, countries, and sources, the knowledge trend and themes associated with the existing research to date, and future or new directions for research. Materials from 2008 to 2022 indexed in the Scopus database were retrieved and visualised using VOSviewer software. The findings revealed that publications were mostly in Australia, Italy, Singapore, and Canada. The co-authorship links were dominant among the Australian authors. The themes that emerged were centred around REITs’ portfolio measurement, risk management in diversified portfolios, capital structure, efficiency measurement, corporate governance, portfolio risk assessment, portfolio construction, and asset allocation strategies. The findings are envisaged to be beneficial in informing further research directions on the subject. The performance threats are also highlighted for industry stakeholders’ decision-making and strategic planning around REITs’ sustainability.

1. Introduction

While there are a variety of ways to invest in real estate, an investment in REITs has proved to be popular in global markets. A REIT ‘owns or finances income-producing real estate properties of various types, providing an investment instrument for investors to get exposure to the real estate sector with flexibility and liquidity’ [1]. REITs began in the United States (US) in 1960 with a legislation that created an approach to income-producing real estate investment, and has since been refined and enhanced over the past sixty years [2]. Since then, REITs have achieved a successful stable growth market and their performance is widely observed in mature markets such as the US, Japan, Australia, and the UK, which have attracted several economies to enter the REITs regime [3]. In 2015, for instance, the Shenzhen stock exchange market raised three billion yuan in shares in just four days after launching the first Chinese REITs IPO [2]. The attractive performance and market stability of REITs have allowed several economies to use them as an economic and environmental development tool due to REITs’ potential to attract investors globally. REITs have then been asserted as profitable investment platforms in many developed markets, although the investment tool is still gaining recognition in some developing and emerging countries [4].

According to Cai and Xu [1], under the US Tax Code, companies must meet certain regulatory requirements regarding the organisation’s structure, business operation, and income distribution, to be considered an REIT. These include: “invest at least 75% of total assets in real estate properties, earn at least 75% of gross income from rents generated from real estate properties, from interest payments generated from mortgages, or from proceeds from the sale of real estate properties, and distribute at least 90% taxable income in the form of dividends”. These requirements are common practice in the REITs sector of many economies, although REITs may possess minimal variations across different jurisdictions.

Many REITs begin as an amalgam of a few individual properties, and then become not only substantial, structured real estate portfolios, but also large business enterprises [5]. The REIT model provides investors with the ability to invest in the income-generating sectors on a large scale without owning the actual real estate [6]. Sotelo and McGreal [7] noted that REITs structures are a tool to manage financial distress, especially for real estate investors to reduce the risk of non-performing loans. REITs create the potential and possibility to incur capital gains, giving the investor indirect exposure to a wide variety of expertly managed properties supported predominantly by lease agreements with escalation clauses. The transfer of risk may be said to be dispersed across the investor base; however, the minimum regulatory requirement still poses threats to the performance of REITs firms, as little earnings are reserved for expansion and future growth. Many firms therefore turn to rely on huge debt capital, which increases the exposures in this market. For instance, Harrison et al. [8] indicated a positive correlation between REITs’ leverage and their assets’ tangibility, which is contrary to findings by Modigliani and Miller [9], who argued that there is no connection between firm value, performance, and its capital structure.

REITs have been highly successful prior to the global financial crisis, which had a significant impact on the performance globally [10]. The stock market performance of some REITs during the financial crisis indicated the inadequacies of the opaque, curious, and ad-hoc investment decision-making processes of these REITs. The lessons learned from that incident have resulted in important structural changes in the credit lending departments of the global economy, including South Africa.

As a result of the global financial crisis, REITs found it a major challenge to regain both credibility and confidence with their institutional investors. However, established REITs remained resilient during this economic downturn and investors still responded favourably to real estate companies that managed to maintain strong balance sheets [11]. Intuition and judgement remain vital when it comes to making decisions. All asset classes are prone to risk, and the strategies developed by asset managers and the implementation and adjustment of risks are constantly being evaluated. Further, the recent global developments because of what some may refer to as a “Black-Swan” event in the form of COVID-19, exposed a risk factor in property markets across the globe. Job loss because of it, coupled with the lockdown phases implemented by all nations, has resulted in REITs being forced to rethink strategies, lease terms, and lease commitments. Therefore, focused performance monitoring and the identification of possible threats are essential.

With the status of REITs rising in investment decisions, the research literature about REITs has also increased. Studies have investigated the performance of REITs; however, these are mostly based on quantitative measures including returns and dividend [12,13]. Qualitative measures or impacts, such as the human aspects, are rarely considered. Parker [5] outlined a phased approach to ensure effective decision-making takes place with a careful allocation of resources. However, the study focused on the management of risks. According to the study, the management of the modern REIT requires a combination of professional skills from the real estate sector, portfolio management skills from the finance and capital markets sectors, and management skills akin to those required for the successful operation of other global enterprises.

Further, studies have indicated a relationship between specific risk factors and their impact on REITs using other methods. For instance, Newell [14] used REITs futures contract scenarios to examine risk management strategies in the Australian REIT sector with information on market conditions from 2002 to 2009. Similarly, Newell and Peng [10] assessed the changing risk profile and portfolio diversification benefits of A-REITs over 1996–2008, with a focus on international property exposure, high debt levels and stapled securities structures, and their impact on A-REIT performance. More current information on the existing knowledge is needed. On their part, Marzuki and Newell [15] investigated risk-adjusted performance pre- and post-global financial crisis (GFC), and the associated benefits of a mixed-asset diversification strategy in the US commercial property market. The study employed the Sharpe ratio, reward to risk ratio, and correlation coefficient analysis to analyse the data from 1994 to 2016, and it found no improvement in REITs diversification, except for risk-adjusted returns for direct property (not a mix of assets).

Following the above, studies have been done covering pre, during, and post the global financial crisis, but on specific REITs risk factors [10,15,16]. In addition, some studies have investigated the risks to REITs performance using bibliometric analysis; for instance, Meng et al. [2] sorted the research on REITS using Web of Science and CiteSpace visualisation software, but without a specific focus. The study focused on analysing references, journal articles, cooperation, and development networks generally in the REITs study field. Likewise, Luo et al. [17] examined the research evolution of REITs in the new century using the VOSviewer bibliometric tools, but with a specific focus on investigating the general research trend.

Although these studies reveal the research trends and future direction on REITS performance, the databases used may result in different outcomes [18]. In addition, the studies do not highlight the risk aspects that threaten RIETs’ performance. It appears that there is little focus on the associated risks to avoid failures.

Therefore, the current study investigates the risks associated with the performance of REITs using a bibliometric analysis. Data from 2008 (after the GFC) to 2022 were used. This period represents the wide and increased recognition of the REITs sector across many markets. Additionally, studies have assessed the risk profile and factors prior to 2008, for example, Newell and Peng [10] and Reddy and Wong [16] (which included pre, during, and post the GFC). This paper thus selected the period from 2008 to 2022 to determine factors that have affected the performance of REITs since then, according to the body of knowledge during this period.

Therefore, the study’s objectives are to: (1) map research trends on REITs risks and performance from 2008 to 2022; (2) analyse prominent authors, countries, and sources on the topic; (3) establish the themes or discussion points around REITs knowledge; and (4) recommend future research directions on REITs performance risks. The study findings provide a framework of future research directions for other researchers in the field. In addition, the REIT sector is indirectly connected to other sub-sectors of the economy such as construction, transport, and steel, to name a few; therefore, policy changes in each of these sectors will have an impact on REITs performance and thread, and vice versa. The themes emerging from the research clusters in the study will enable researchers to identify unattended risk and performance indicators that intend to be beneficial to the stakeholders of REITs, such as financial institutions, property developers and owners, investors, property brokers, construction companies, and more. REIT also functions as an investment vehicle among others to the investors. By understanding REITs’ risk, thread, and performance, and how the market might be impacted by policy implementations and changes, investors have the flexibility of investing in a secured and well-regulated investment vehicle. The rest of this paper presents an overview of REITs performance literature, the methodology adopted for the study, the findings, and a discussion. These are followed by the conclusions, which include the research implications and future directions.

2. REITs Performance and Risks

REIT markets vary across countries, and so do their performance determinants, mainly by the different regulations. According to Akinsomi [19], USA (122 constituents), Japan (48 constituents), China (58 constituents), Germany (11 constituents), Hong Kong (12 constituents), and the United Kingdom (39 constituents) make the top five countries by market capitalisation on the FTSE EPRA NAREIT Global Indices with varying numbers of constituents listed under each of these countries. Although REIT listings are still developing on the global index, there has been a significant drop in the index performance when the FTSE EPRA NAREIT index experienced a significant loss of −23.2% three-months returns on 22 May 2020 [20]. The United State REITs (US-REITs) also experienced several declines since the global financial crisis (GFC) and other economic downturns, thereby spurring panic among investors. According to Basse et al. [21], US-REITs were considered risky investments after the hard hit from the GFC. Akinsomi [20] noted that all 39 countries that have embraced the REIT regimes experienced a decline due to the novel coronavirus. It is evident that research into the performance and risk implications of REITs is of importance.

In emerging and developing economies, many REITs are still immature with a direct impact on their performance and attractiveness. Some inadequacies include the thin distribution of real estate experts, high management fees, low market efficiency, and thinly trades in the stock markets [22]. This can hinder the judgment on the state of REITs performance as a global phenomenon. For instance, in Africa, the REITs market is still lagging relative to other advanced and some emerging economies that have long embraced the REITs regime. Ghana (joined 1994), Nigeria (joined 2007), Tanzania (joined 2011), South Africa (joined 2013), Kenya (joined 2013), Rwanda (joined 2013), and Morocco (joined 2015) are the few active countries that have embraced REITs. Their level of expertise can be said to be in the developing stage as all these countries have only one active REIT, apart from SA with 32 and Nigeria with three [4]. It can be established that REITs’ performance cannot be analysed in total isolation from the handful of country-specific and general performance indicators.

REITs as an investment tool are also becoming the most considered in assets allocation for moderate risk takers because of their low volatility, low risk, moderate re-turns, and proven liquidity source to investors, as they are transformed from the illiquid market for immovable properties. The attention gained by REITs over the years has, however, attracted different macroeconomic factors contributing to the risk-return dynamics of REITs such as high-interest rates, inflation, and systemic default rates during economic downturns [23]. Risk exposures in REITs can differ for the different REIT types. Some studies noted that specialised REITs have more market risk than diversified REITs, which have a high tendency to outperform [24]. In addition, the risk-return relationship of REITs differs between traded REITs and non-traded REITs. However, in terms of liquidity risk, the source of REITs’ liquidity is highly dependent on the liquidity of the underlying property. In a slumping environment, liquidity risk could result in other risks, such as default and leverage. Another risk associated with REITs lies internally at the management level; therefore, it is important to understand REITs’ risk profile when analysing their performance. This study, therefore, reviews eight top-cited documents on REITs’ performance and risk to gauge the extent to which the associated risk profiles of REITs in relation to their performance have been investigated over the years.

Newell et al. [25] investigated the significance and risk-adjusted performance of Hong Kong REITs (HK-REITs) in a portfolio of mixed assets from 2005 to 2008. They found that HK-REITs realised high risk-adjusted returns with notable losses in diversification during the global financial crisis. However, their study was based on risk-adjusted performance attribution in a mixed-asset portfolio, without examining the different types of risk that affected underlying performance. Newell et al. [26] also studied the significance, diversification benefits, and risk-adjusted performance of REITs in a portfolio of mixed-assets in the French market from 2003 to 2012. Their study only analysed performance in the pre- and post-GFC without examining the contributors of risk and performance. Newell [14] examined Australian REIT performance and the use of REIT futures to hedge against abnormal market conditions from 2002 to 2009 using risk management strategies. The study suggested that sophisticated risk management professionals will better undertake REITs hedging using REIT futures. Acknowledging his contribution, however, effective risk management begins with risk identification and measurement, which was not covered in the study.

Marzuki and Newell [15] studied the significance and benefits of a mixed-asset diversification strategy in the US commercial property market from 1994 to 2016 to gauge risk-adjusted performance pre- and post-GFC. The results indicated no improvement in REITs diversification, while better risk-adjusted returns were observed for the direct property. However, assessing risk-adjusted performance and diversification were performed without addressing the different risks that stand to be mitigated or reduced if efficient diversification occurs. Marzuki and Newell [27] assessed the evolution of the Belgium REITs and their transformation in enhancing performance from 1995 to 2018. Results present in sub-periods of the sample highlight a strong return and diversification benefits. The study contextualised the risk-adjusted performance and the potential of portfolio diversification in strategic transformation. However, a critical analysis of risks and their attribution to the performance evolution was not undertaken in this study.

Further, Tsai and Lee [28] investigated price convergent behaviour between Asian, Japan, and US REITs indexes to determine if a contagion effect exists. Results indicated a high interconnectivity and market interdependency between Asia and US REITs. The study, however, did not investigate the associated risks and how contagion effects affect the REIT performance. The study places emphasis on a discussion on how a reduction in market interdependency could be achieved to improve diversification. Other studies investigated the benefits of REITs in a mixed-asset portfolio and showed that REITs enhance returns or diversify risk depending on the traditional asset class within the portfolio [29,30]. However, the studies did not consider risk type, risk measures, and return performance measures to identify what risk can easily be diversified within REIT markets.

Therefore, the current study identifies the risk exposures and threats to REITs, which require risk management strategies by way of bibliometrics. Previous studies on the topic indexed in Scopus were collected and analysed to uncover other important performance and risk factors necessary for consideration by future researchers and investors.

3. Materials and Methods

Bibliometric and content analyses were used to analyse the literature published on REITS performance from 2008 to 2022. They were used to examine scientific activities in the literature by using quantitative and qualitative techniques, distinguish models in bibliographic data, and provide useful information on documents such as citations and authorship [31]. An alternative method of exposing more meaning from the studies was sought, including meta-analysis. However, it was not possible to obtain a pooled estimate necessary to establish an effect size or variance from the factors established to be significant in other studies. This was because most studies investigated the general research trend, for example, Luo et al. [17], or did not examine the correlations between a specific factor and REITs performance. Therefore, content analysis was used to explore further meaning of the bibliometric analysis findings, as was done by Leong et al. [32].

Bibliometric analysis involves information retrieval and visualisation to reveal past research and future trends on a subject [2]. It involves selecting a credible database [33] that can widely retrieve relevant documents in the research field, and analysing the documents to identify the themes and trends of publications on a particular topic [34]. Content analysis involves interpretation; the qualitative description lies in the knowledge, meaning, and solid findings that can originate from it [35]. For this study, the bibliometric approach was relevant to understanding the risk factors and trend of knowledge on REITs performance, while the content analysis yielded the latent meaning from the most-cited documents.

3.1. Database Selection

The bibliometric results depend on the citation index selected [36]. While Google and Google Scholar were also used for the initial search to refine the research purpose, the Scopus database was used for the bibliometric study due to its index capacity across all scientific research fields and wide recognition [37,38]. Scopus is a highly rated database due to the advanced search option with numerous search criteria, which increase the refinement of results, thus enhancing the validity of the research [18]. The database also undergoes constant updates, which ensures that the required literature is available for retrieval [39]. Further, it was possible to output information in a CSV format usable in the selected visualisation software (VOSviewer version 1.6.18) for further analysis. More than one database was not used because the VOSviewer software easily accommodates information from one database at a time, as the different databases have different extensions. Although data wrangling (cleaning and unifying in the context of Big Data) could been done, this process is time- and effort-consuming [36]. Thus, one database was used, as has been done in previous similar (bibliometric) studies.

3.2. Search Strategy

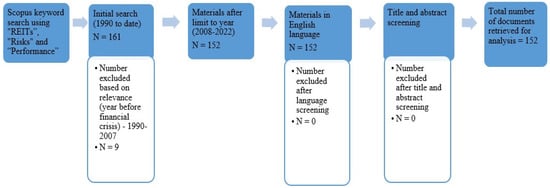

In bibliometric analysis, a lapse in a search query could lead to false-positive, false-negative, or generally irrelevant results [40]. Therefore, an effort was made to include the relevant terms and documents to achieve the study’s objectives. The search was conducted on 11 July 2022. The last year (2022) was included because there was a significant number published already by the date of search and export of materials. Figure 1 represents the procedure adopted for the search. The following keywords were used to identify materials for analysis: “REITS”, “risks”, and “performance” with the Boolean keyword AND in the advanced search criteria. The entire search string used was: TITLE-ABS-KEY (reits, AND risks, AND performance) AND (LIMIT-TO (PUBYEAR, 2022) OR LIMIT-TO (PUBYEAR, 2021) OR LIMIT-TO (PUBYEAR, 2020) OR LIMIT-TO (PUBYEAR, 2019) OR LIMIT-TO (PUBYEAR, 2018) OR LIMIT-TO (PUBYEAR, 2017) OR LIMIT-TO (PUBYEAR, 2016) OR LIMIT-TO (PUBYEAR, 2015) OR LIMIT-TO (PUBYEAR, 2014) OR LIMIT-TO (PUBYEAR, 2013) OR LIMIT-TO (PUBYEAR, 2012) OR LIMIT-TO (PUBYEAR, 2011) OR LIMIT-TO (PUBYEAR, 2010) OR LIMIT-TO (PUBYEAR, 2009) OR LIMIT-TO (PUBYEAR, 2008).

Figure 1.

Search procedure adopted.

To extensively achieve the research objectives, the study had minimal limitations on the search criteria. The initial search from 1990 to 2022 showed 161 documents. The search was then limited to 2008 to 2022. Data from 2008 (after the GFC) was used because previous studies had studied REITs performance and volatility factors prior to 2008, as explained earlier. In addition, the GFC had a significant impact on the performance of REITs [10]. Thus, the current study focused on the literature post the GFC to explore risk factors that have drawn attention and constituted knowledge areas since 2008. It is notable that the research, as indexed in Scopus, prior to 2008 (from 1990 to 2007) accounted for only nine publications. However, this could be because of the database used and the document type selected (journal articles only).

The search was also limited to the English language. One hundred and fifty-two documents were identified after these limits were applied. There were no limitations on the “open access” nature, article type, subject area, territory, source, publication stage, keywords, or funding structure. This was to increase the search scope as REITs are important in the general capital market [5]. Few limitations can be applied, provided the scope and purpose of the study are covered [41].

Further, titles and abstracts were screened to ensure only documents with related keywords were used and therefore relevant. The query was validated by performing a review of each paper title and abstract to ensure that the final sample contains only papers with keywords that support the study objectives, as suggested by Sweileh [40], to ensure that the concise nature of keywords in the subject field are included. The documents were finally exported in a “txt” format immediately to prevent misinterpretation [40] and for further analysis [42].

3.3. Visualisation Techniques and Indicators

The final sample was analysed using two analytical software: Microsoft Excel and VOSviewer. The “txt” format data is exported to Excel for further cleaning and the management of graphs and charts while the VOSviewer software is used to create text data network visualisation and bibliometric mapping [43]. The VOSviewer application is a popular software used for technical construction, pictorial imaging, and in creating bibliometric network maps across different study fields since its creation [43]. Other network visualisation tools exist, such as Cite Spec, Gephi, Bite-Excel, and Sci2; however, VOSviewer is common owing to its user-friendly and multiple network visualisation tools, such as keywords clusters to identify research themes [44]. This software was preferred over others because it displays maps and clusters in various ways and has multiple functions and features to handle and display data satisfactorily [43]. Moreover, it has been used to identify evolution trends in similar real estate research [17,45].

Three major VOSviewer analytical tools were utilised in analysing the literature identified. The outputs were: bibliographic coupling of sources, co-authorship analysis of countries and source, and keyword co-occurrence network analysis, as conducted by Maggon [45]. Bibliographic coupling is a technique used to identify and quantify the thematic relationship between documents if they share a cited reference, that is, the similarity between documents based on the citing papers [31]. To understand the bibliographic coupling of journals, it is important to acknowledge that journals are carriers of all scientific information within a subject field and contribute prominently to identifying and grouping active knowledge. Bibliographic coupling also provides direction for future research [43].

The co-authorship structures were also analysed to define intellectual collaborations and knowledge sharing among the authors and countries. Co-authorship analysis is used to analyse researchers, organisations, and countries collaborating in scientific research to build knowledge and enhance productivity [46]. Citation analysis of the publications was also used to reveal the in-depth quality of scientific research and uncover the important factors, the beginnings of the field, and how it develops over time (structure and impact) [47]. Keyword co-occurrence analysis was used as a text mining technique to map and demonstrate terms’ co-occurrence in the same title, abstract, or context [48]. High co-occurred keywords in the network are closer to each other when linked by similarities. VOSviewer further groups the keywords into clusters according to their degree of relatedness where research themes can be identified and analysed [49].

Further, the total link strength of the networks was examined. It is derived from links defined by the connectedness or relatedness between two networks or items. The total link strength indicates the cumulative strength between one item with other items in the VOSviewer visualisation software [49]. In addition, thresholds were set to ensure that the relevant top documents were obtained. According to Walsh and Rowe [50], most bibliometric analyses of authors, text, and journals require a technique that allows cut-off points (threshold) to reduce the number of items required to perform an in-depth investigation in the field and uncover interesting patterns.

Therefore, the bibliometric analysis was completed using VOSviewer to visualise co-authorship networks, citations, bibliographic coupling, and other networks, as was conducted by Maggon [45] in their mapping of research in a real estate journal and other mapping studies [32,51].

3.4. Content Analysis

Content analysis was undertaken manually to determine the authors’ perspectives regarding the relationships between the factors identified in this study and REITs performance. The manual analysis entailed reading, analysing, and recording in a Microsoft Excel file, as was carried out by Leong et al. [32]. The process followed the steps described by Okoro [52], including:

- Sampling—identifying the materials based on a criterion (in this case, the most cited papers).

- Coding—this entailed assigning themes to the studies based on their content/findings.

- Identifying themes and findings (REITs performance volatility and factors contributing to it).

- Applying theory to explain findings (discussion of the findings in an integrative and consistent manner—aligning the findings from the most occurring keywords, clusters, and trends.

The results are presented and discussed in the next section.

4. Results and Discussion

The results from the bibliometric analysis are first presented, followed by the con-tent analysis findings. Further discussion and integration are completed with reference to the literature.

4.1. Bibliometric Analysis Findings

The results are presented under different sections including the yearly evolution trend in the publication on REITs performance and related risks, subject areas, journal sources, countries, co-authorship of authors, and keywords in the field.

4.1.1. Publication Trend

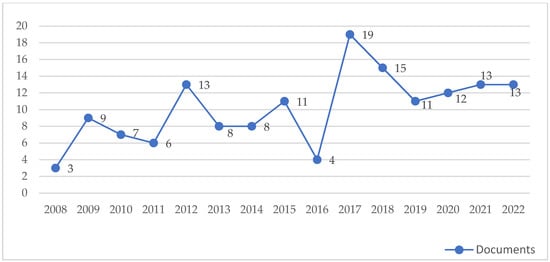

A positive trajectory is observed in the research on REITs performance and its related risk. There has been sluggish growth in publication over the study period seen in Figure 2, with relatively insignificant output since 2019 to date. A sharp decline was observed in 2016, from eleven publications in 2015 to four. This may have been due to the introduction of the real estate sector to the Global Industry Classification system (GICS) in 2016 [53], in which focus might have been on analysing abnormal returns in this market following the announcement. The year 2016 was also noted to have had the highest record of indebtedness and credit risk in the REITs sector relative to two years prior [54], in which attention must have been on whether real estate securities should trade at a discount to their net asset value [55]. However, the number improved significantly to nineteen publications in 2017. It can therefore be observed that there has been a dramatic decline of attention on REITs performance and risks among academic researchers. The publications have been stable since 2017 (thirteen on average).

Figure 2.

Annual publication trend.

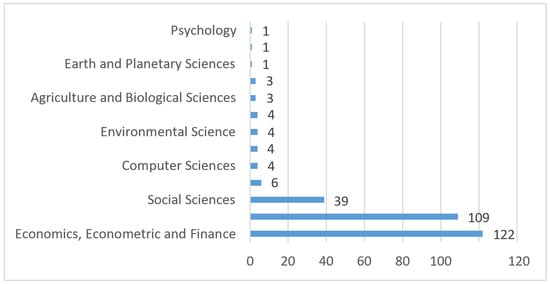

4.1.2. Publication Mapping by Subject Area

The interest in the approach of income generation put forward by the REITs sector can be observed across the subject areas from the research retrieved from Scopus (Figure 3). The figure shows the number of articles classified under a subject area. The three subject areas included Economics, Econometrics, and Finance (122), Business Management and Accounting (109), and Social Science (39). It is noteworthy that some documents were classified under more than one subject area, as some duplication is sometimes noted in Scopus [18,56].

Figure 3.

Publication map by subject area.

4.1.3. Top Sources by Bibliographic Coupling

A top contributor on REITs performance and risk by bibliographic coupling has been the Journal of Property Investment and Finance, with the highest number of publications (n = 29) and the most cited (n = 182), as seen in Table 1, with a total link strength of 720. The second most coupled source is the Journal of Real Estate Finance and Economics, with 320 citations and 23 documents. The third most coupled source is the Pacific Rim Property Research Journal, with 135 cited references in 10 documents. These three journals were observed in the same cluster with a total link strength of 720, 656, and 270, respectively, and an average link strength of 549. A link strength indicates the number of coupling units between a source and other sources within a group [57]. Therefore, at least one of these journals has been cited in each of the documents published in this cluster of sources. The Journal of Real Estate Research ranks the least, with three documents containing five cited references, which indicates that the documents published in this journal are less related in context.

Table 1.

Top ten sources.

4.1.4. Top Productive Countries

Countries are the carriers of authors producing the research documents. According to Cardoso et al. [58], a country’s performance in a knowledge area depends on authors’ productivity. The result in Table 2 indicates the performance of the top countries based on the co-occurrence analysis, with a pre-defined threshold of five documents. Australia had the highest (45 documents with 432 citations), followed by the US (44 documents with 497 citations). The next productive countries were the United Kingdom (UK), Malaysia, and Canada.

Table 2.

Most productive countries.

4.1.5. Co-Authorship Analysis

Co-authorship analysis shows the strength of the collaboration across countries. Researchers use the collaboration opportunity to uncover new knowledge, increase specialisation within science, and combine different skills and knowledge types [59]. Table 3 presents the top authors who have collaborated on a minimum of four documents, as per the pre-determined threshold. The top three co-authors by the number of documents were E. Newell, M.J. Marzuki, and C.L. Lee, all from Australia, with link strengths of 11, 8, and 3, respectively. The other authors were in Italy, Singapore, and Canada with zero link strengths, respectively, indicating no collaboration links with other authors.

Citation analysis revealed that E. Newell, M.J. Marzuki, and J. Zhou were the top three most cited researchers on the topic, with 279, 60, and 48 citations, respectively. The analysis of top-cited papers in the academic literature helped to identify and understand unique insights into the characteristics, innovations, and quality of the required knowledge shared by authors in the subject field [60].

On the co-authorship between authors, it can be observed that this is dramatically weak in this subject area, with a very high concentration of few authors collaborating in a single country, Australia. Moreover, surprisingly, none of the collaborating authors represented the US, who are the originators of REITs. Although the US is ranked second in the co-occurrence analysis previously presented, the authors may be publishing singly; thus, they are not included among the top collaborators in Table 3. The USA market, as a major influencer across the global market, should encourage international collaborations on examining the different elements of risk and performance of REITs across other markets.

Table 3.

Findings from the ten most cited papers.

Table 3.

Findings from the ten most cited papers.

| Publications | Codes (Related Clusters) | Citation Count | Key Objective(s)/Focus | Methodology | Variables/Sample | Key Findings |

|---|---|---|---|---|---|---|

| Hartzell et al. [61] | Corporate governance | 61 | Impact of corporate governance structures on initial public offering (IPO) | Tobin’s Q as the valuation metric | IPOs of REITs from 1991–1998 Variables—REITs stock prices, returns, IPO dates, total assets, total book value of equity, number of shares outstanding, proportion of compensations tied to performance, incentives, monitoring, and rent extraction. | There is higher valuation for firms with stronger governance. Insider ownership beyond 32.3% reduces firm value. |

| Newell and Osmadi [62] | Risk management in diversified portfolios Portfolio risk assessment Portfolio construction and asset allocation strategies | 40 | Diversification benefits and risk-adjusted returns in a mixed-asset portfolio | Correlation analysis | Islamic Malaysian (IM) REITs total returns calculated using market cap-weighted M-REITs weekly returns estimates (August 2006 to December 2008). | Poor performance was due to the specialised nature, few listed numbers. Diversification benefits were more for Islamic REITs than the conventional counterpart. The smaller size was attributed to the diversification benefit; large assets co-movements were because of poor diversification benefits with the conventional assets. |

| Fei et al. [63] | REITs Portfolio measurement | 35 | Correlation and volatility dynamics of REITs, returns of direct real estate, and stock | Multivariate AD-DCC Multivariate GARCH | Financial time series; monthly data (January 1987 to May 2008); macro-economic variables | Inflation, unemployment rate, and credit spread explained time-varying conditional correlations in REIT returns. Weak correlations were noted between REITs returns and the S&P 500, indicating better future performance of REITs. |

| Nakano et al. [64] | Portfolio risk assessment Portfolio construction and asset allocation strategies | 33 | A new stochastic volatility model to test time-varying expected returns in financial markets. | Generalised exponential moving average model and Particle Filter model. | Total returns of bonds, and stocks; traditional strategies: minimum variance, equal-weighted, and risk parity portfolios; compound returns, Sharpe and Sortino ratios, and drawdowns for performance measures | A simple investment strategy using the proposed model produced superior REITs performance. |

| Zhou and Anderson [65] | Portfolio risk assessment | 33 | Performance of value at risk (VaR) and expected shortfall (ES) for major REITs markets. | VaR and ES | Daily return data from REITs and stock exchanges (January 1993 to December 2009). | No standard method for measuring extreme risks in the global market. Different methods may be required to estimate risks for stocks and REITs. |

| Brounen and De Koning [66] | REITs portfolio measurement | 28 | The evolution and performance of REITs since 1960. | Using asset pricing models | Firm size, property type specialisation, monthly total return data, and geographic portfolios across highly liquid REITs Index countries. | REIT stocks’ outperformance (highest in Europe in the past decade) was positively related to firm size, geographic portfolio focus, and the level of property type specialisation. Systematic REIT risk was highest among the Asian REITs. |

| Hebb et al. [67] | Corporate Governance | 28 | Responsible real estate investment using an integrated approach. | Semi-structured interviews | Real estate companies and REITs firms; variables include stock prices and ESG ratings. | An increasing number of ESG user adoption in many property firms and awareness among institutional investors. An increasing number of ESG ratings makes it an extra-financial determinant to boost REITs performance and value creation. Environmental and social factors impact REITs. |

| Jirasakuldech et al. [68] | Portfolio risk assessment | 23 | The dynamic behaviour of equity REITs (EREIT) volatility performance | GARCH model | Equity REIT from the National Association of Real Estate Investment Trusts (NAREIT). Monthly price indexes plus dividends (January 1972 to June 2006); Russell index price data from 1979. | The conditional volatility for Equity REITs is time-varying, predictable, and persistent. A positive relationship between expected risk and expected returns in the EREIT stocks pre-1993, but not after 1993. |

| Giacomini et al. [69] | Capital structure and REITs efficiency measurement | 21 | US REIT leverage decision-making and the associated impact on risk and returns | Finance literature and theory | Target leverage ratios; the speed estimates to which REITs adjust to any deviation from the targeted capital structure; capital structure decisions on REIT returns performance (conditioned and unconditioned). | Highly levered average REIT tends to underperform less levered REITs. REITs that are highly levered in relation to their target leverage show better performance on a risk-adjusted basis than REITs with less leverage. |

| Lecomte and Ooi [70] | Corporate Governance | 20 | To investigate links between the quality of corporate governance and corporate performance in Asia Pacific Real Estate Association (APREA). | The Ordinary least square regression model | Externally managed REITs companies listed on the Singapore Stock Exchange, financial data, performance data, and corporate governance scores; absolute differences in returns; equally weighted portfolio performance measures. | Evidence of a positive correlation between stock performances and corporate governance practices. S-REITs with good corporate governance tend to register better risk-adjusted returns; however, they do not outperform in terms of operations. |

AD-DCC—asymmetric dynamic diagonal conditional correlation; MGARCH—generalised autoregressive conditionally heteroskedastic.

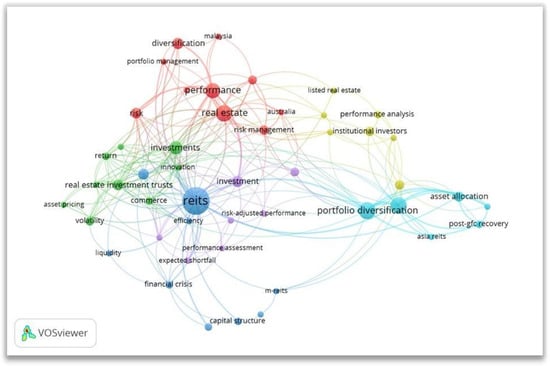

4.1.6. Keyword Analysis

Keywords are used as guides to allocate work done in the research subject field [48]. Out of 515 keywords, the top (most occurring) keywords were real estate, risk, property, market, portfolio, management, volatility, asset, trusts, diversification, returns, reits, equity, adjusted, and model(s). The grouping or networks among the keywords were examined to establish the common thematic issues. A minimum of five keywords was initially set as the threshold in VOSviewer. The visualisation results returned 18 keywords in three clusters, with the word “risks” appearing in all clusters. The analysis was then rerun to expand on the types of risks with a threshold of three, and 48 keywords were grouped into six clusters (Figure 4). These were assigned themes based on the items as follows:

Figure 4.

Network of keywords.

- Cluster 1—Risk management in diversified portfolios (red, top)—Ten keywords were identified including Australia, diversification, Malaysia, performance, portfolio management, property, real estate, risk, risk management, and trusts.

- Cluster 2—REITs portfolio measurement (green, left)—Nine items including asset pricing, CAPM, commerce, economics, innovation, investments, real estate investment trust, return, and volatility were revealed.

- Cluster 3—Capital structure and REITs efficiency measurement (dark blue, middle/left)—Here, the items consisted of capital structure, efficiency, financial crisis, leverage, liquidity, M-REITs, REITs, and REITs performance.

- Cluster 4—Corporate governance (light green, top right)—Seven items were identified including corporate social responsibility, global financial crisis, institutional investors, listed real estate, performance analysis, and real estate investment trusts.

- Cluster 5—Portfolio risk assessment (purple, middle)—The items here included expected shortfall, investment, mixed-asset portfolio, performance assessment, risk assessment, risk-adjusted performance, and stock market.

- Cluster 6—Portfolio construction and asset allocation strategies (blue, right)—Six items were grouped in the sixth cluster. These were Asia REITs, asset allocation, portfolio diversification, portfolio investment, post-GFC, and risk-adjusted returns.

4.2. Content Analysis

The findings from the content analysis are presented in this section, regarding the focus and findings from the most cited articles in the bibliometric phase. The top ten most cited articles were analysed as presented in Table 3. The top five, with over 30 citations, included:

- Hartzell et al. [61], with 61 citations, categorised as corporate governance-focused, found that there is higher value for firms with strong governance, but insider ownership reduces the value of firms. This suggests that external stakeholders may bring stronger confidence and size of investments.

- Newell and Osmadi [62] investigated diversification benefits and risk-adjusted returns in a mixed-asset portfolio. The study, with 40 citations, found that the size and extent of co-movements in REITS can be influenced by the diversification benefits. This study, however, has a cross-over link with at least three themes including Risk management in diversified portfolios, Portfolio risk assessment, and Portfolio construction and asset allocation strategies, suggesting a further potential link between diversification and other variables.

- Fei et al. [63]—With a focus on establishing the relationships between macro-economic variables and REITs, this article, cited 35 times, revealed that inflation, unemployment rate, and credit spread contribute to variations in REIT returns. This view was consistent with the second cluster (portfolio measurement), which contained items including economics, volatility, and returns, thus supporting the relationships between the variables investigated by [63].

- Nakano et al. [64] investigated the role of investment strategy and asset allocation in REITs performance and variations.

- Zhou and Anderson [65] focused on methods of portfolio risk assessment using VaR and ES. The study acknowledged that risks contribute to volatility in REITs performance.

- Brounen and De Koning’s [66] study among highly liquid REITs index countries, found that systematic REIT risk was highest among the Asian REITs, and REIT stocks’ outperformance was highest in Europe and correlated with firm size, level of specialised property, and geographic focus.

- Hebb et al. [67] focused on corporate social responsibility and found that environmental and social factors impact REITs. An increasing number of ESG ratings makes it an extra-financial determinant to boost REITs performance and value creation.

5. Discussion and Integration of the Emerging Clusters and Content Analysis Findings

The emerging clusters are discussed. The themes in the first cluster relate to the role of risk reduction in real estate diversification and the benefits of diversification in property-type portfolios and mixed-asset portfolios. According to Markovitz’s portfolio theory, these relate to optimal asset allocation, in which portfolio return becomes optimised if it can minimise risk through efficient diversification [29]. The different ways of reducing the risk and volatility by considering a mixed-assets portfolio (REITs plus other investment classes such as stock and bonds etc.) or a property-only type portfolio, were demonstrated in previous research synthesised [65,71]. Australia appeared as a keyword probably because of the increased interest in the REITs research field over the years even before it spread to other parts of the globe [5]. Diversification benefits were also central in other top cited papers [72,73]. These indicate the important role of risk management in diversified portfolios. These also align with the findings on the most occurring keywords, as presented in Section 4.1.6; diversification, risk adjusted returns, and models were prominent.

The keywords in the second cluster relate to financial performance measurements and indicators for REITs portfolios [74,75,76]; the performance of REITs can be estimated based on the returns and volatility dynamics [63,74]. The basis for asset selection, asset pricing, and portfolio diversification could influence REITs performance [15].

The theme in the third cluster is centred on the relationship between leverage and liquidity in facilitating the efficient performance of REITs during financial crisis. Research in this cluster exhibit investigations into how capital structure decisions impact the degree of profitability through variations in leverage and liquidity. For instance, Morri and Jostov [76] study the effects of leverage on pan-European REITs during and post the financial crisis to determine the cross-sectional effects on performance. In addition, Bao and Gong’s [77] framework that examined leverage return causality in terms of profit and loss, showed their relationship as explained by the level of leverage within a firm’s capital structure. Therefore, this cluster was more focused on the balance sheet management structure of REITs firms and how this can affect performance under normal and turbulent markets. This could be a crucial aspect following the lessons learned from the poor liquidity management that resulted from the GFC.

Prior studies in the fourth cluster illustrate the role of regulation, corporate social responsibility, and governance practices in REITs in improving performance and control; examples include Lecomte and Ooi [70] and Westermann et al. [78] in their Singapore and Australian studies, respectively. This aligned with findings by Hebb et al. [68] (the seventh most cited document). Incorporating self-regulation investing could also enhance sentiment investing, and thus boost performance. This may need to be investigated on a wider scope as REITs regulations seem to vary across countries.

The fifth cluster relates to investigations on the likelihood of risk occurrences. The occurrence of unforeseen events could abruptly impact performance, and this could be better forecasted by including dynamics in expected performances and related risks to both investors and REITs management [79]. Stelk et al. [80] examined extreme risks events in a mixed-asset REITs portfolio and identified the benefits of adding REITs to a traditional portfolio of stocks and bonds that could not diversify away the turmoil from the GFC. The risk association and types of implications on performance needs to be investigated further.

The sixth theme demonstrated how portfolios can be constructed and how this could impact investment risk-adjusted returns. It also highlighted that allocation strategies used post-GFC influenced performance. For instance, Coen and Lecomte [81] examined the performance of Asian REITs after the GFC using the Generalised Treynor Ratio and the Ordinary Least Squares regression intercept for the Jenson measure. The study revealed that some REITs markets in Asian countries are driven by value relative to growth, with no momentum effects. This may imply that REITs stocks are more affected by financial distress in Asian economies. This is consistent with Fei et al.’s [64] top cited study that macro-economic determinants influence the performance of REITs. The determinants and drivers of performances and financial distress should be investigated on a wider scope to capture all characteristics of value-traded REITs across markets.

6. Future Research Directions

Performance assessment is a prominent aspect of portfolio management to periodically assess the individual performance of assets within the portfolio for rebalancing, either by reallocating the weighing or reconstituting the portfolio to maintain investment objectives. The research themes identified in the clusters include the performance measures, risk management, and assessment and portfolio selection strategies increasing diversification and reducing risks to REITs. It was observed that research themes in clusters one and two were very much related to risk and return modelling and their impacts on different portfolio types. Diversification eliminates a firm’s specific risk and controls systematic risk; however, the magnitude of risk elimination will determine the degree of diversification and the benefits thereof. Moreover, the diversification process should begin by outlining the various risks associated with REITs and thereafter, those of traditional assets, which are lacking in the literature included in this study.

In addition, some macroeconomic determinants of risk including dummy factors representing unquantifiable effects on performance during different market phases in the REITs sector were not prominent in the study. These are REITs performance factors that vary across different markets and should be accounted for when measuring the different contributions and benefits in the REITs sector [63]. The factors can be used to gauge both REITs downside and total risk-adjusted performance in different REITs. These factors were tested by Schulte [82], but in the US Equity REITs market only.

Further, collaborative research on the determinants of co-movements in REITs’ market performance, and the effects of risk spillovers in REITs’ markets could be undertaken. Additionally, the impact of black swan events like the COVID-19 pandemic, which was rarely discussed among the retrieved studies, except for the studies by Milcheva [83] globally, Wasiuzzaman [84] in the Saudi stock market, and Ntuli and Akinsomi [71] in South Africa, could be the focus of more studies. Other global upheavals like the global market evolution, the Russian-Ukrainian war, and conditions in the Asian continent were also missing from the analysed literature. Their impacts could be the focus of further studies. In addition, the impact of the identified themes could be empirically investigated in future research. Further, as discussed in cluster three, there might have been great lessons learned from the poor liquidity management that resulted in the GFC, and most REITs being considered for inclusion in a mixed portfolio post the GFC; thus, stocks and bonds could not diversify the risk of loss emanating thereof. However, if the growing credit risk, debt capital, and servicing cost associated with REITs’ capital structure are considered, it is imperative to further investigate how REITs should manage the risk of loss and liquidity given that most (at least 90%) of their income generated is distributed to providers of capital. It is therefore difficult to consider REITs’ performance as sustainable in the long term if further investigation into their capital structure and liquidity management is not carried out.

7. Conclusions

The study sought to map research trends, authors, countries, sources, and discussion points around REITs risk factors since 2008, and recommend future research directions on REITs performance risks based on the gaps identified from the sampled literature. A bibliometric analysis was used to collect and visualise relevant information about the grouping of studies and focal areas published by various authors, organisations, and countries. The analysis of 152 documents extracted revealed that the publications’ authorship networks were mostly in Australia, the US, and the UK. However, collaboration was strongest among the Australian researchers. The study also identified the core journals and authors on the topic. More collaboration is needed across territories.

The themes that emerged among the sampled literature were REITs portfolio measurement, risk management in diversified portfolios, capital structure, and REITs efficiency measurement, corporate governance, portfolio risk assessment, portfolio construction, and asset allocation strategies. These highlighted the importance of identifying possible risks and management strategies during portfolio construction and asset allocation to achieve the maximum benefits from an investment portfolio. In addition, the role of diversification was highlighted to improve the performance of REITs.

The study findings primarily contribute to the dialogue by using bibliometrics for the analysis of networks, such as the trends of research work, how these studies build on each other’s knowledge via co-citation, and the evolution over time. The findings could assist future researchers to locate relevant materials for gap analysis and a critical literature review on REITs performance. They can draw on these findings to further identify hotspots and collaborative opportunities. The study also has implications for REITs investors and portfolio managers in portfolio selection and risk management to achieve optimal returns and sustainable REITs portfolios.

The limitations of the study lie in using one database (Scopus) and source (journals) to identify the documents included in the analysis. However, limited search filters were applied to ensure that a broad range of articles could still be analysed and visualised for reliable results, for the period indicated. The study’s results could be further investigated to establish the importance of the identified themes by utilising primary research approaches among a sample of investors and portfolio managers. Further, as highlighted earlier, risk-adjusted performance factors, macroeconomic variables (usually dummy) during different market phases, risk spill-over, and black swan or pandemic effects on the REITs’ markets and determinants of co-movements in REITs’ market performance could be examined in future studies. Future studies could also be undertaken using meta-analysis, with specific outcomes and relationships established based on specified outcomes. Moreover, future studies can assess the correlations between specific types of REITs and the specific factors identified in this study. With the increasing interest and publications on REITs, further studies could include more studies and coverage, especially to include more recent studies indexed from August 2022 to 2023.

Author Contributions

Conceptualization, C.O. and M.M.A.; methodology, C.O. and M.M.A.; validation, C.O. formal analysis, C.O. and M.M.A.; investigation, C.O. and M.M.A.; data curation, M.M.A.; writing—original draft preparation, C.O.; writing—review and editing, C.O. and M.M.A.; visualization, C.O. and M.M.A.; project administration, C.O.; funding acquisition, C.O. All authors have read and agreed to the published version of the manuscript.

Funding

This research was funded by the University of Johannesburg Library.

Institutional Review Board Statement

Not applicable.

Informed Consent Statement

Not applicable.

Data Availability Statement

Not applicable.

Conflicts of Interest

The authors declare no conflict of interest.

References

- Cai, Y.; Xu, K. Net impact of COVID-19 on REIT returns. J. Risk Financ. Manag. 2022, 15, 359. [Google Scholar] [CrossRef]

- Meng, W.; Shen, K.; An, Q. Visual analysis of real estate investment trusts research- A bibliometric analysis based on CiteSpace III. Am. J. Ind. Bus. Manag. 2015, 5, 794–805. [Google Scholar] [CrossRef]

- Alias, A.; Cy, S.T. Performance analysis of REITs: Comparison between M-REITS and UK-REITS. JSCP 2011, 2, 1–24. [Google Scholar] [CrossRef]

- Dabara, D.I. Evolution of REITs in the Nigerian real estate market. J. Prop. Invest. Financ. 2021, 40, 38–48. [Google Scholar] [CrossRef]

- Parker, D. Global Real Estate Investment Trusts: People, Process and Management, 1st ed.; John Wiley & Sons: Chichester, UK, 2012. [Google Scholar]

- Securities and Exchange Commission (SEC). Investor Bulletin: Real Estate Investment Trusts (REITs); Investor Bulletin: Washington, DC, USA, 2011; Volume 800, pp. 1–5. [Google Scholar]

- Sotelo, R.; McGreal, S. Real Estate Investment Trusts in Europe: Evolution, Regulation, and Opportunities for Growth; Springer: Berlin/Heidelberg, Germany, 2016. [Google Scholar] [CrossRef]

- Harrison, D.M.; Panasian, C.A.; Seiler, M.J. Further evidence on the capital structure of REITs. Real Estate Econ. 2011, 39, 133–166. [Google Scholar] [CrossRef]

- Modigliani, F.; Miller, M.H. The Cost of Capital, Corporation Finance, and the Theory of Investment. Am. Econ. Rev. 1958, 48, 261–297. [Google Scholar]

- Newell, G.; Peng, H. The impact of the global financial crisis on A-REITs. Pac. Rim Prop. Res. J. 2009, 15, 453–470. [Google Scholar] [CrossRef]

- Naidoo, N. The Introduction of REITs to the South African Property Market: Opportunities for Fund Managers. Unpublished Master’s Dissertation, University of the Witwatersrand, Johannesburg, South Africa, 2014. [Google Scholar]

- Olanrele, O.O.; Adegunle, T.O.; Fateye, O.B. Causal relationship of N-REITs dividend yield and money market indicators: A case study of Skye Shelter REITs. In Proceedings of the 18th African Real Estate Society (AFRES) Annual Conference, Abeokuta, Nigeria, 11–15 September 2018. [Google Scholar]

- Chiou, J.; Huang, G.; Liano, K.; Pan, M. Are REIT dividend changes a firm-specific or an industry-level signal? Evidence from the decomposition of stock returns. J. Real Estate Portf. Manag. 2022, 28, 139–152. [Google Scholar] [CrossRef]

- Newell, G. The effectiveness of A-REIT futures as a risk management strategy in the global financial crisis. Pac. Rim Prop. Res. J. 2010, 16, 339–357. [Google Scholar] [CrossRef]

- Marzuki, M.J.; Newell, G. The significance and performance of US commercial property in a post-GFC context. J. Prop. Investig. Financ. 2017, 35, 575–588. [Google Scholar] [CrossRef]

- Reddy, W.; Wong, W. Impact of interest rate movements on a-REITS performance before, during and after the global financial crises. In Proceedings of the 23rd Pacific Rim Real Estate Society Annual Conference, Sydney, Australia, 15–18 January 2017. [Google Scholar]

- Luo, Y.; Zhang, X.; Jin, P. Research hotspot and evolution trend of REITs since the new century-from the perspective of biblio-metrics. J. Innov. soc. Sci. Res. 2022, 9, 89–94. [Google Scholar] [CrossRef] [PubMed]

- Bosman, J.; van Mourik, I.; Rasch, M.; Sieverts, E.; Verhoeff, H. Scopus Reviewed and Compared: The Coverage and Functionality of the Citation Database Scopus, Including Comparisons with Web of Science and Google Scholar. 2006, pp. 1–63. Available online: https://www.ltu.se/cms_fs/1.25811!/scopus_reviewed.pdf (accessed on 18 July 2022).

- Akinsomi, O. Performance of Sector-Specific and Diversified REITs in South Africa. In Understanding African Real Estate Markets, 1st ed.; Routledge: London, UK, 2022; pp. 176–187. [Google Scholar]

- Akinsomi, O. How resilient are REITs to a pandemic? The COVID-19 effect. J. Prop. Invest. Financ. 2020, 39, 19–24. [Google Scholar] [CrossRef]

- Basse, T.; Friedrich, M.; Bea, E.V. REITs and the financial crisis: Empirical evidence from the US. J. Prop. Invest. Financ. 2009, 4, 3–10. [Google Scholar] [CrossRef]

- Akinbogun, S.; Jones, C.; Dunse, N. The property market maturity framework and its application to a developing country: The case of Nigeria. J. Real Estate Lit. 2014, 22, 217–232. [Google Scholar] [CrossRef]

- Kola, K.; Kodongo, O. Macroeconomic risks and REITs returns: A comparative analysis. Res. Int. Bus. Financ. 2017, 42, 1228–1243. [Google Scholar] [CrossRef]

- Ro, S.; Ziobrowski, A.J. Does focus really matter? Specialized vs. diversified REITs. J. Real Estate Financ. Econ. 2011, 42, 68–83. [Google Scholar] [CrossRef]

- Newell, G.; Yue, W.; Kwong Wing, C.; Sui Kei, W. The development and performance of REITs in Hong Kong. Pac. Rim Prop. Res. J. 2010, 16, 190–206. [Google Scholar] [CrossRef]

- Newell, G.; Adair, A.; Nguyen, T.K. The significance and performance of French REITs (SIICs) in a mixed-asset portfolio. J. Prop. Investig. Financ. 2013, 31, 575–588. [Google Scholar] [CrossRef]

- Marzuki, M.J.; Newell, G. The evolution of Belgium REITs. J. Prop. Investig. Financ. 2019, 37, 345–362. [Google Scholar] [CrossRef]

- Tsai, I.C.; Lee, C.F. The convergence behavior in REIT markets. J. Prop. Investig. Financ. 2012, 30, 42–57. [Google Scholar] [CrossRef]

- Lee, C.; Ting, K.H. The role of Malaysian securitised real estate in a mixed asset portfolio. J. Financ. Manag. Prop. Constr. 2009, 14, 208–230. [Google Scholar]

- Lee, S. The changing benefit of REITs to the mixed-asset portfolio. J. Real Estate Portf. Manag. 2010, 16, 201–215. [Google Scholar] [CrossRef]

- Ma, T.J.; Lee, G.G.; Liu, J.S.; Lan, R.; Weng, J.H. Bibliographic coupling: A main path analysis from 1963 to 2020. Inf. Syst. Res. 2022, 27. [Google Scholar] [CrossRef]

- Leong, Y.R.; Tajudeen, F.P.; Yeong, W.C. Bibliometric and content analysis of the internet of things research: A social science perspective. OIR 2021, 45, 1148–1166. [Google Scholar] [CrossRef]

- Mora, L.; Deakin, M. Revealing the Main Development Paths of Smart Cities- Untangling Smart Cities: From Utopian Dreams to Innovation Systems for a Technology- Enabled Urban Sustainability; Elsevier: Amsterdam, The Netherlands, 2019; pp. 89–133. [Google Scholar]

- Owojori, O.M.; Okoro, C.S.; Chileshe, N. Current status and emerging trends on the adaptive reuse of buildings: A bibliometric analysis. Sustainability 2021, 13, 11646. [Google Scholar] [CrossRef]

- Vaismoradi, M.; Turunen, H.; Bondas, T. Content analysis and thematic analysis: Implications for conducting a qualitative. Nurs. Health Sci. 2013, 15, 398–405. [Google Scholar] [CrossRef]

- Kumpulainen, M.; Seppänen, M. Combining web of science and scopus datasets in citation-based literature study. Scientometrics 2022, 127, 5613–5631. [Google Scholar] [CrossRef]

- Falagas, M.E.; Pitsouni, E.I.; Malietzis, G.A.; Pappas, G. Comparison of PubMed, Scopus, Web of Science, and Google Scholar: Strengths and weaknesses. FASEB J. 2008, 22, 338–342. [Google Scholar] [CrossRef]

- Hosseini, M.R.; Maghrebi, M.; Akbarnezhad, A.; Martek, I.; Arashpour, M. Analysis of citation networks in building information modeling research. J. Constr. Eng. Manag. 2018, 144, 04018064. [Google Scholar] [CrossRef]

- Bartol, T.; Budimir, G.; Dekleva-Smrekar, D.; Pusnik, M.; Juznic, P. Assessment of research fields in Scopus and Web of Science in the view of national research evaluation in Slovenia. Scientometrics 2014, 98, 1491–1504. [Google Scholar] [CrossRef]

- Sweileh, W.M. Bibliometric analysis of peer-reviewed literature on climate change and human health with an emphasis on infectious diseases. Glob. Health 2020, 16, 1–17. [Google Scholar] [CrossRef]

- Pham, M.T.; Rajic, A.; Greig, J.D.; Sargeant, J.M.; Papadopoulos, A.; McEwen, S.A. A scoping review of scoping reviews: Advancing the approach and enhancing the consistency. Res. Synth. Methods 2014, 5, 371–385. [Google Scholar] [CrossRef]

- Šūmakaris, P.; Sceulovs, D.; Korsakiene, R. Current research trends on interrelationships of eco-innovation and internationalisation: A bibliometric analysis. J. Risk Financ. Manag. 2020, 13, 85. [Google Scholar] [CrossRef]

- Van Eck, N.; Waltman, L. Software survey: Vosviewer, a computer program for bibliometricmapping. Scientometrics 2010, 84, 523–538. [Google Scholar] [CrossRef] [PubMed]

- Cobo, M.; Lopez-Herrera, A.; Herrera-Viedma, E.; Herrera, F. Science mapping software tools: Review, analysis, and cooperative study among tools. J. Am. Soc. Inf. Sci. Technol. 2011, 62, 1382–1402. [Google Scholar] [CrossRef]

- Maggon, M. A bibliometric analysis of the first 20 years of the Journal of Corporate Real Estate. J. Corp. Real Estate 2023, 25, 7–28. [Google Scholar] [CrossRef]

- Hudson, J. Trends in multi-authored papers in economics. J. Econ. Perspect. 1996, 10, 153–158. [Google Scholar] [CrossRef]

- Bernatovic, I.; Gomezel, A.S.; Cerne, M. Mapping the knowledge-hiding field and its future prospects: A bibliometric co-citation, co-word, and coupling analysis. Knowl. Manag. Res. Pract. 2022, 20, 394–409. [Google Scholar] [CrossRef]

- Van Eck, N.; Waltman, L. Text Mining and Visualization Using VOSviewer. 2011. Available online: https://arxiv.org/ftp/arxiv/papers/1109/1109.2058.pdf (accessed on 18 July 2022).

- Van Eck, N.; Waltman, L. Citation-based clustering of publications using CitNetExplorer and VOSviewer. Scientometrics 2017, 111, 1053–1070. [Google Scholar] [CrossRef]

- Walsh, I.; Rowe, F. BIBGT: Combining bibliometrics and grounded theory to conduct a literature review. Eur. J. Inf. Syst. 2022; in press. [Google Scholar]

- Bhandari. Design Thinking: From Bibliometric Analysis to Content Analysis, Current Research Trends, and Future Research Directions. Springer 2022. Available online: https://www.researchgate.net/publication/359298926_Design_Thinking_from_Bibliometric_Analysis_to_Content_Analysis_Current_Research_Trends_and_Future_Research_Directions (accessed on 9 February 2023).

- Okoro, C.S. Sustainable Facilities Management in the Built Environment: A Mixed-Method Review. Sustainability 2023, 15, 3174. [Google Scholar] [CrossRef]

- Stevens, J.A. Do changes in industry classification systems matter? Evidence from REITs. J. Real Estate Res. 2022, 44, 377–398. [Google Scholar] [CrossRef]

- BDO. BDO Risk Factor Report for REITs. United States. 2016. Available online: https://www.bdo.com/insights/industries/2016-bdo-riskfactor-report-for-reits (accessed on 3 January 2023).

- Morri, G.; Baccarin, A. European REITs NAV discount: Do investors believe in property appraisal? J. Prop. Invest. Financ. 2016, 34, 347–374. [Google Scholar] [CrossRef]

- Singh, V.K.; Singh, P.; Karmakar, M.; Leta, J.; Marr, P. The journal coverage of Web of Science, Scopus, and Dimensions: A comparative analysis. Scientometrics 2021, 126, 5113–5142. [Google Scholar] [CrossRef]

- Kessler, M.M. Bibliographic coupling between scientific papers. Am. Doc. 1963, 14, 10–25. [Google Scholar] [CrossRef]

- Cardoso, L.; Silva, R.; de Almeida, G.G.F.; Santos, L.L. A bibliometric model to analyze country research performance: SciVal Topic Prominence Approach in Tourism, Leisure and Hospitality. Sustainability 2020, 12, 9897. [Google Scholar] [CrossRef]

- Sampaio, R.B.; Fonseca, M.V.D.A.; Zicker, F. Co-authorship network analysis in health research: Method and potential use. Health Res. Policy Syst. 2016, 14, 1–10. [Google Scholar]

- Kelly, J.C.; Glynn, R.W.; O’Briain, D.E.; Felle, P.; McCabe, J.P. The 100 classic papers of orthopaedic surgery: A bibliometric analysis. J. Bone Jt. Surg. Br. 2010, 92, 1338–1343. [Google Scholar] [CrossRef]

- Hartzell, J.C.; Kallberg, J.G.; Liu, C.H. The role of corporate governance in initial public offerings: Evidence from real estate investment trusts. J. Law Econ. 2008, 51, 539–562. [Google Scholar] [CrossRef]

- Newell, G.; Osmadi, A. The development and preliminary performance analysis of Islamic REITs in Malaysia. J. Prop. Res. 2009, 26, 329–347. [Google Scholar] [CrossRef]

- Fei, P.; Ding, L.; Deng, Y. Correlation and volatility dynamics in REIT returns: Performance and portfolio consideration. J. Portf. Manag. Winter 2010, 36, 113–125. [Google Scholar] [CrossRef]

- Nakano, M.; Takahashi, A.; Takahashi, S. Generalized exponential moving average (EMA) model with particle filtering and anomaly detection. Expert Syst. Appl. 2017, 73, 187–200. [Google Scholar] [CrossRef]

- Zhou, J.; Anderson, R.I. Extreme risk measures for international REIT markets. J. Real Estate Financ. Econ. 2012, 45, 152–170. [Google Scholar] [CrossRef]

- Brounen, D.; De Koning, S. 50 years of real estate investment trusts: An international examination of the rise and performance of Reits. J. Real Estate Lit. 2012, 20, 197–223. [Google Scholar] [CrossRef]

- Hebb, T.; Hamilton, A.; Hachigian, H. Responsible property investing in Canada: Factoring both environmental and social impacts in the Canadian real estate market. J. Bus. 2010, 92 (Suppl. S1), 99–115. [Google Scholar] [CrossRef]

- Jirasakuldech, B.; Campbell, R.D.; Emekter, R. Conditional volatility of equity real estate investment trust returns: A pre- and post-1993 comparison. J. Real Estate Financ. Econ. 2009, 38, 137–154. [Google Scholar] [CrossRef]

- Giacomini, E.; Ling, D.C.; Naranjo, A. REIT Leverage and Return Performance: Keep Your Eye on the Target. Real Estate Econ. 2017, 45, 930–978. [Google Scholar] [CrossRef]

- Lecomte, P.; Ooi, J.T. Corporate governance and performance of externally managed Singapore REITs. J. Real Estate Financ. Econ. 2013, 46, 664–684. [Google Scholar] [CrossRef]

- Ntuli, M.; Akinsomi, O. An overview of the initial performance of the South African REIT market. J. Real Estate Lit. 2017, 25, 365–388. [Google Scholar] [CrossRef]

- Newell, G.; Marzuki, M.J.B. The significance and performance of UK-REITs in a mixed-asset portfolio. J. Eur. Real Estate Res. 2016, 9, 171–182. [Google Scholar] [CrossRef]

- Yat-Hung, C.; Joinkey, S.C.-K.; Bo-Sin, T. Time-varying performance of four Asia-Pacific REITs. J. Prop. Investig. Financ. 2008, 26, 210–231. [Google Scholar] [CrossRef]

- Coskun, Y.; Selcuk-Kestel, A.; Yilmaz, B. Diversification benefit and return performance of REITs using CAPM and Fama-French: Evidence from Turkey. Borsa Istanbul Rev. 2017, 17, 199–215. [Google Scholar] [CrossRef]

- Jackson, L.A. An application of the Fama-French three-factor model to lodging REITs: A 20-year analysis. Tour. Hosp. Res. 2020, 20, 31–40. [Google Scholar] [CrossRef]

- Morri, G.; Jostov, K. The effect of leverage on the performance of real estate companies: A pan-European post-crisis perspective of EPRA/NAREIT index. J. Eur. Real Estate Res. 2018, 11, 284–318. [Google Scholar] [CrossRef]

- Bao, H.; Gong, C. Reference-dependent analysis of capital structure and REIT performance. J. Behav. Exp. Econ. 2017, 69, 38–49. [Google Scholar] [CrossRef]

- Westermann, S.; Niblock, S.J.; Kortt, M.A. A review of corporate social responsibility and real estate investment trust studies: An Australian perspective. Econ. Pap. J. Appl. Econ. Policy 2018, 37, 92–110. [Google Scholar] [CrossRef]

- Zhou, J. Extreme risk measures for REITs: A comparison among alternative methods. Appl. Financ. Econ. 2012, 22, 113–126. [Google Scholar] [CrossRef]

- Stelk, S.J.; Zhou, J.; Anderson, R.I. REITs in a mixed-assets portfolio: An investigation of extreme risks. JAI Summer 2017, 20, 81–91. [Google Scholar]

- Coen, A.; Lecomte, P. Another look at Asian REITs performance after the global financial crisis. Handb. Asian Financ. REITs Trading Fund Perform. 2014, 2, 69–94. [Google Scholar]

- Schulte, K. Determinants of Risk-Adjusted REITs Performance-Evidence from US Equity REITs; European Real Estate Society: Istanbul, Turkey, 2009; p. 266. [Google Scholar]

- Milcheva, S. Volatility and the cross-section of real estate equity returns during COVID-19. J. Real Estate Financ. Econ. 2022, 65, 293–320. [Google Scholar] [CrossRef]

- Wasiuzzaman, S. Impact of COVID 19 on the Saudi stock market: Analysis of return, volatility and trading volume. J. Asset Manag. 2022, 23, 350–363. [Google Scholar] [CrossRef]

Disclaimer/Publisher’s Note: The statements, opinions and data contained in all publications are solely those of the individual author(s) and contributor(s) and not of MDPI and/or the editor(s). MDPI and/or the editor(s) disclaim responsibility for any injury to people or property resulting from any ideas, methods, instructions or products referred to in the content. |

© 2023 by the authors. Licensee MDPI, Basel, Switzerland. This article is an open access article distributed under the terms and conditions of the Creative Commons Attribution (CC BY) license (https://creativecommons.org/licenses/by/4.0/).