1. Introduction

Logistics service is the most effective tool to connect production and consumption, but the logistics-service industry is a large energy-consumption carrier [

1]. At present, China’s logistics industry maintains an extensive development model, which causes a huge consumption of energy [

2]. If logistics enterprises still adopt the existing high energy-consumption mode, the energy consumption will increase by 80% by 2030 compared with the present, which violates China’s “double carbon” goal [

3]. In addition, the traditional logistics-service system has been unable to meet the diverse and individual needs of customers, and it is particularly important to improve the efficiency of the logistics-service system. Driven by advanced technologies such as blockchain, big data, and the Internet of Things, the intelligent transformation of logistics has become the development strategy of many enterprises [

4,

5]. For logistics enterprises, the development of an intelligent logistics mode can not only provide customers with advanced visualization and personalized capital increase services but also the premise and foundation of realizing a low-carbon economy [

6,

7]. For the long-term development of the country, the intelligent logistics-service model will directly affect the quality and speed of China’s economic development [

8]. The upgrading of the support system of intelligent logistics is the modern Internet technology. Intelligent logistics optimizes the logistics system with the help of technology, analyzes the response data of the logistics system, and realizes the optimization of the entire logistics process [

9,

10]. The implementation of intelligent logistics can significantly increase the added value of logistics services, thereby making the logistics process of enterprises more efficient and ultimately save costs [

11,

12,

13]. At the same time, the implementation of intelligent logistics can help logistics enterprises achieve on-demand delivery of packages, intelligent matching of “vehicles and goods,” and dynamic path optimization driven by real-time information, thereby effectively reducing carbon emissions of logistics activities [

14,

15]. In other words, intelligent logistics improves the efficiency of business-process execution and decision-making and is an important part of the process of building a sustainable supply chain [

16].

Driven by new technologies, intelligent logistics can cope with the challenges brought by the rapid changes in customer expectations and sustainable green concepts and effectively promote the transformation of business models [

17]. The development of intelligent logistics can not only enable enterprises to gain competitiveness but is also an inevitable choice in the process of development [

18]. Close cooperation of participants in the intelligent-transformation process of logistics services can effectively solve technical problems such as demand and information sharing. Through collaborative innovation, providing consumers with more value-added services has gained the consensus of multiple logistics participants [

19]. The transformation of intelligent logistics can realize the effective connection of various participating entities, complement each other’s resource advantages, and realize the coordination of logistics services, thereby improving logistics efficiency and reducing logistics costs [

20,

21]. Since the intelligent transformation of logistics services can gain more markets, LSPs that provide specific logistics services can usually get more orders from LSIs. For example, as an LSP of Cainiao Network, YTO Express has maintained close cooperation in intelligent transformation. Through intelligent transformation such as introducing advanced technology, optimizing logistics processes, and designing more abundant networks and other intelligent transformations, YTO has obtained more orders from Cainiao Network.

Limited by technology and cost, some enterprises are facing the pressure of funds for the intelligent transformation of logistics services. The shortage of funds will not only affect the performance but also restrict the improvement of the overall operational efficiency of logistics services. To ease the financial pressure, most small- and medium-sized enterprises finance through trade-credit channels such as deferred payment and advance payment or bank credit [

22,

23]. Since business-management decisions are affected by various factors such as loan interest rates and default risks, the high uncertainty and complexity pose challenges for LSPs to make intelligent transformation decisions. A large amount of capital required for technical equipment and system transformation may not be able to achieve significant results for enterprises in the short term, and uncertainty and the inability to obtain benefits in the short time will severely restrict the enthusiasm of LSPs [

11]. At the same time, if logistics enterprises do not carry out intelligent transformation, their market share will be further squeezed, which will seriously affect their overall business operations and pose serious challenges to sustainable operations. In other words, the decision-making of intelligent transformation is related to the survival of logistics enterprises. LSIs’ incentives for LSPs are more conducive to improving their motivation for intelligent transformation. The design of supply-chain contracts has been widely used in supply chains, including technology improvement, product improvement, and third-party logistics to encourage the high-level transformation of partners [

24].

Motivated by the above issues, this paper constructs a logistics-service supply chain consisting of an LSP and an LSI and discusses the effectiveness of the LSI adopting contracts to motivate the LSP to carry out the intelligent transformation of logistics services under the financial constraint of the LSP. This paper mainly answers the following three questions:

- (1)

Can the supply-chain contracts achieve the purpose of stimulating the intelligent transformation of the capital-constrained LSP?

- (2)

How is a supply-chain contract chosen according to the different needs of consumers for intelligent logistics services?

- (3)

Are there key influencing factors in the decision-making process of contract coordination?

The main contributions of this paper are the following three points. First, this paper studies for the first time the incentive contracts of the intelligent transformation of logistics services under capital constraint by proposing five coordinated contracts and analyzing the incentive effects of those contracts. Second, this study analyzes the different needs of consumers for intelligent logistics services and proposes the choice of incentive contracts under different needs. Third, this study conducts an in-depth discussion of the key factors in the decision-making of intelligent transformation of logistics services and provides a scientific reference for the design of incentive contracts for LSIs.

The rest of this paper is organized as follows.

Section 2 reviews the relevant literature on intelligent logistics, supply chains under capital constraint, and supply-chain contracts of collaboration. In

Section 3, we establish the basic model of centralized decision-making and five different coordination-contract models and then solve and analyze the models. In

Section 4, we make a comparative analysis combined with numerical simulation, and

Section 5 concludes the paper. The proofs of this paper are presented in

Appendix A.

2. Literature Review

The related research in this paper mainly includes the following three aspects: intelligent logistics, supply chains under capital constraint, and supply-chain contracts of collaboration.

The first aspect lies in intelligent logistics. Under the influence of the smart economy, the logistics-service model has undergone revolutionary changes, and the intelligent development of traditional logistics services has been widely recognized [

25]. Scholars have conducted many studies on the feasibility of using modern technology to improve logistics efficiency in the logistics system, such as the use of blockchain technology in different scenarios of intelligent logistics [

26], the role of IoT technology in realizing traceable and sustainable logistics under the physical Internet [

27], and the intelligent development of radio-frequency identification (RFID) technology, big data, and Internet of Things in workshop smart logistics [

28]. The trend of modern logistics development is the transformation of traditional logistics to intelligent logistics to achieve more efficient services and lower costs [

29]. In terms of intelligent logistics scheduling, Sabouhi et al. [

30] studied the logistics distribution and evacuation of emergency logistics and designed a collaborative algorithm for vehicles and routes to optimize the path of disaster areas and distribution centers. Bányai [

31] designed a heuristic algorithm for the first mile and the last mile to realize order allocation and scheduling. Through the Dijkstra algorithm and ant-colony algorithm to optimize the intelligent scheduling system of the Internet of Things technology, Wang et al. [

5] realized the dynamic coordination between customer needs and system technology. Some scholars have also conducted researched joint intelligent transformation. For example, Liu et al. [

32] studied the influence of power structure and intelligent logistics-service level on the strategy of logistics-service platforms from the perspective of collaborative innovation. From an ecological perspective, Liu et al. [

33] used evolutionary game theory to analyze the dynamic cooperation-evolution trend of smart logistics platforms and intelligent LSPs. Liu et al. [

34] and Liu et al. [

24] studied the contract design that motivates the intelligent transformation of logistics services. The former focused on the contract design between members of the logistics-service supply chain, whereas the latter focused on the contract design between manufacturing companies and LSPs. Different from the above literature research, this paper mainly focuses on the contract selection of the incentive effect of the LSI on the intelligent transformation of the LSP under consumers’ different intelligent preferences.

The second aspect of research that relates to our research is supply chains under capital constraints. Due to the existence of many small- and medium-sized enterprises, the process of supply-chain operation is often subject to capital constraints [

35]. Scholars have done a lot of research on how to ensure the positive operation of enterprises under capital constraints. For example, Raghavan and Mishra [

36] studied the optimal decision-making problem of how financial institutions lend to manufacturers and retailers in the supply chain when financial constraints affect production and ordering and when capital constraints affect production and ordering. Chen et al. [

37] studied the financing problems of retailers when they were financially constrained and found that trade credit can generate more benefits for manufacturers and retailers if wholesale-price contracts are used. Tang and Yang [

38] studied the financing mechanism of the retailer’s capital constraint in the supply of fresh products and analyzed the advantages and disadvantages of different financing methods and their impact on the equilibrium results and profits. Kouvelis and Zhao [

39] studied the problem of how to design contracts when demand was uncertain and supply-chain members were constrained by capital to make products more competitive. Xiao et al. [

40] studied the effect of different contracts for coordinating supply chains when retailers obtain trade credit. With the influence of the concept of sustainable development, the research on green and low-carbon supply chains under capital constraint has become the focus of many scholars. For example, Yang et al. [

41] analyzed the impact of different credit strategies on green supply-chain performance. Feng and Xu [

42] studied the impact of different financing methods on the equilibrium outcome under green-credit financing and hybrid financing. Huang et al. [

43] analyzed the optimal way of different government-subsidy methods and the price decision-making problem of a capital-constrained green supply chain. Another aspect is the research on how manufacturers make financing and emission-reduction decisions under capital constraints [

44,

45,

46]. The above works of literature have given us good inspiration for the research on the supply-chain decision-making problem under capital constraint, but little attention has been paid to the contract-coordination problem of the intelligent transformation of the LSP under capital constraint. This paper compares and analyzes the coordination effects of different incentive contracts in the intelligent-transformation process of the LSP under capital constraint.

The third aspect of research that relates to our research is the supply-chain contract of collaboration. In the process of supply-chain collaboration, the problem of double marginalization often occurs. The use of a contract to coordinate the supply chain has been recognized by scholars. Common contract-coordination methods include the wholesale-price contract, the cost-sharing contract, the revenue-sharing contract, and the two-part tariff contract. The wholesale-price contract is used by upstream members of the supply chain to improve downstream production and sales. For example, Nouri et al. [

47] designed compensation-based wholesale-price contracts to achieve the goal of innovation and promotion for manufacturers and retailers. Hosseini et al. [

48] studied the three-level supply-chain coordination problem with random demand considering social-responsibility input, proposed an adjustable two-level wholesale-price contract, and analyzed its application in specific scenarios. The cost-sharing contract is to share the innovation cost to improve the innovation effort level of supply-chain members. For example, Zhao et al. [

49] found that the relationship between the LSP and other members can be coordinated by adopting a cost-sharing contract. Xiao et al. [

50] studied a two-level sustainable supply chain through cost sharing and price commitment to incentivize suppliers to improve the level of sustainability. The revenue-sharing contract considered to be an effective tool in the coordination process of the supply chain is the profit distribution after the cooperation between the upstream and downstream of the supply chain. It was first used in the video-rental industry [

51]. The revenue-sharing contract is widely used in the logistics-service supply chain [

52], the low-carbon supply chain [

53], and other fields. The two-part tariff contract starts from the whole and then realizes the distribution of benefits to increase the benefits of all parties and is widely used as a coordination contract [

54,

55]. In addition, scholars also used hybrid contracts to analyze the coordination efficiency of different supply chains, such as hybrid two-part tariff contracts [

48], cost-sharing and revenue-sharing hybrid contracts [

24,

34], and wholesale-price and revenue-sharing hybrid contracts [

56]. Different from the above literature, this paper considers the different intelligent preferences of consumers and the capital constraint of the LSP in the model construction and discusses how to design contracts to meet different consumer preferences and motivate the LSP for intelligent transformation, thus enriching the research field of intelligent transformation of the logistics-service supply chain.

By consulting relevant works of literature, we found that the intelligent transformation of logistics services has attracted the attention of many scholars, but there is no literature discussing the capital constraint faced by SMEs. Second, works of literature similar to our study are [

24,

34]; with them we found that adopting cost-sharing and revenue-sharing contracts can also coordinate the intelligent transformation under capital constraint. However, the difference is that the conditions met in the coordination process are different. Furthermore, we found that a single two-part tariff contract can lead to Pareto improvement of the supply chain when consumers do not have high requirements for the level of logistics intelligence. Finally, we also analyzed the key factors that affect the contract design and provided more references for the selection of intelligent transformation contracts.

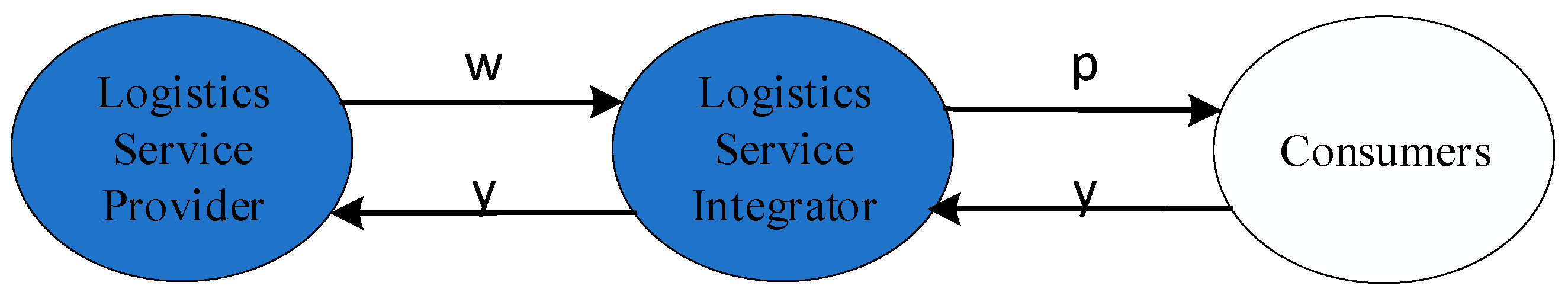

3. The Model

This section considers a logistics-service supply chain consisting of an LSP and an LSI, where the former is under capital constraint and the latter is fully capitalized. The LSP provides the logistics services to the LSI at the wholesale price , and the LSI decides the final logistics-service sales price . Due to the diversified and personalized needs of consumers, the LSP needs to improve the quality of logistics services, such as adopting advanced technology and equipment, optimizing logistics processes, and enriching logistics networks, which in turn leads to an increase in the demand for logistics services. However, the LSP needs to spend a lot on intelligent transformation. Due to financial constraints, the LSP needs to borrow from the bank, where the borrowing interest rate is and the total loan amount is . Meanwhile, the LSI also adopts contracts that encourage the LSP to carry out intelligent transformation. Intelligent transformation is also an inevitable choice for the LSP because it can not only obtain more orders for itself but also improve the intelligence level of the logistics-service supply chain to gain market initiative.

The logistics-service demand is negatively affected by the sales price

; on the other hand, it is positively affected by the level of intelligence of logistics service

. Referring to the literature [

24,

34], this paper defines the demand function as

; among them,

is the basic demand of the logistics-service market,

is the consumer’s preference for the intelligent level of logistics services, and

is the price-sensitivity coefficient. Referring to [

24,

32], we assume that when the level of logistic-service intelligence is

, the cost invested by the LSP is

, indicating that it is more and more difficult to stimulate the market with the increase in intelligence level. The notations related to this paper are shown in Abbreviations.

To ensure that the results of each decision model are non-negative, similar to the literature [

24,

32,

57], we assume

,

and

. Generall speaking, the intelligent transformation of logistics services requires a huge cost. In addition, the demand of the logistics-service market should be large enough; otherwise, the operation of the logistics-service market is meaningless. In other words, our assumption is reasonable. We use the superscripts

to denote the centralized decision-making model (Model C), the wholesale-price contract model (Model WP), the cost-sharing contract model (Model CS), the revenue-sharing contract model (Model RS), the two-part-tariff contract model (Model TP), and the hybrid cost-sharing and revenue-sharing contract model (Model CR). The superscript * indicates the optimal equilibrium results, and

, and

represent the profit of the LSP, the profit of the LSI, and the total profit of the logistics-service supply chain, respectively. The structure diagram of this paper is shown in

Figure 1.

3.1. Model C

Under Model C, the LSI and the LSP jointly decide the intelligence level and the sale price of logistics services. In order to carry out the intelligent transformation, the LSP needs to borrow

from the bank, where

. In this model, the profit function of the supply-chain system is as follows:

Lemma 1. When , there is an optimal solution under Model C. The equilibrium results are as follows:

3.2. Coordination Contract

In this section, we mainly analyze the coordination problem of the LSI and the LSP under decentralized decision-making, which mainly includes five decision models, including Model WP, Model CS, Model RS, Model TP, and Model CR.

3.2.1. Model WP

Although the wholesale-price contract often cannot realize the coordination of the supply chain in a decentralized situation due to its double-marginalization problem, as the simplest and most common contract model, it is usually used as a benchmark contract when discussing the contract problem of the supply chain. Under Model WP, for each unit of logistics-service demand, the LSI shall pay the wholesale price

to the LSP. At this time, the LSP can obtain the transfer payment

from the LSI. The LSI first declares the marginal profit for unit logistics-service demand. Meanwhile, the LSP uses the financing amount as

to carry out the intelligent transformation and determines the wholesale price and the intelligence level. Under this model, the profit functions of the LSP and the LSI are as follows:

Lemma 2. When , there is an optimal solution under Model WP. The equilibrium results are as follows:

Corollary 1. The wholesale-price contracts cannot achieve supply-chain coordination. The market demand for intelligent logistics services under the WP contract is only half of that of Model C.

3.2.2. Model CS

Under Model CS, in order to encourage the LSP to carry out intelligent transformation, the LSI shares the cost of intelligent transformation, and the proportion of sharing is , . The loan amount of the LSP in this model is .

Under this model, the profit functions of the LSP and the LSI are as follows:

Lemma 3. When , there is an optimal solution under Model CS. The equilibrium results are as follows:

Corollary 2. When the LSP is subject to capital constraint, the cost sharing-contract does not meet the participation constraints, so it cannot be used as an effective contract to stimulate the intelligent transformation of the LSP.

3.2.3. Model RS

Under Model RS, in order to encourage the LSP to carry out the intelligent transformation, the LSI shares a part of the revenue with the LSP, and the proportion of revenue sharing is

,

. The loan amount of the logistics-service provider in this model is

. Under this model, the profit functions of the LSP and the LSI are as follows:

Lemma 4. When , there is an optimal solution under Model RS. The equilibrium results are as follows:

Corollary 3. Under Model RS, if the LSI adopts the revenue-sharing contract, it only changes the wholesale price between the two and the marginal profit value of the LSI. Other equilibrium results are the same as the wholesale-price contract. Therefore, the revenue-sharing contract cannot achieve supply-chain coordination.

3.2.4. Model TP

Under Model TP, the LSI provides a wholesale price

to the LSP and pays a transfer fee

to the LSP to incentivize the intelligent transformation. The loan amount of the LSP in this model is

. Under this model, the profit functions of the LSP and the LSI are as follows:

Lemma 5. When , there is an optimal solution under Model RS. The equilibrium results are as follows:

Corollary 4 . Under Model TP, if the LSI adopts a two-part tariff contract when the contract satisfies , the Pareto improvement of the profits of the LSP and the LSI can be achieved and the logistics service demand increases.

3.2.5. Model CR

From the above analysis, we can see that although the two-part-tariff contract can make the LSP and LSI achieve Pareto improvement, it still cannot achieve perfect coordination between the two parties. This section attempts to adopt a joint contract of cost sharing and revenue sharing to achieve coordination between the two parties. At this time, the proportion of cost and revenue shared by the LSI is still

and

, respectively. The loan amount of the logistics-service provider in this model is

. Under this model, the profit functions of the LSP and the LSI are as follows:

The decision-making sequence under this is as follows. The LSI first decides the cost-allocation and revenue-sharing ratio and then decides the sales price, and finally, the LSP decides the intelligence level.

Corollary 5. In the process of intelligent transformation under capital constraint, if the LSI adopts a contract of cost sharing and revenue sharing, when the contract satisfies , the total profit under the contract is equal to Model C, and the perfect coordination of the supply chain is realized.

4. Results and Insights

In order to gain more management insights, in this section we mainly analyze the above research results through numerical simulation. According to the above analysis, we can see that under certain conditions, Model TP achieved Pareto improvement in the profits of supply-chain members, whereas the hybrid cost-sharing and revenue-sharing contract (Model CR) achieved the effect of Model C. Obviously, under Model WP, the equilibrium results were affected by consumers’ intelligent logistics preferences , the cost coefficient of intelligent transformation , and bank-loan interest rates , whereas the equilibrium results were affected by the proportion of cost sharing and revenue sharing under Model CR. Therefore, in the following, we mainly analyze the influence of various parameters on the equilibrium results of the logistics-service intelligence level, the logistics-service market demand, the total profit of the logistics-service supply chain, and the loan amount under different contracts.

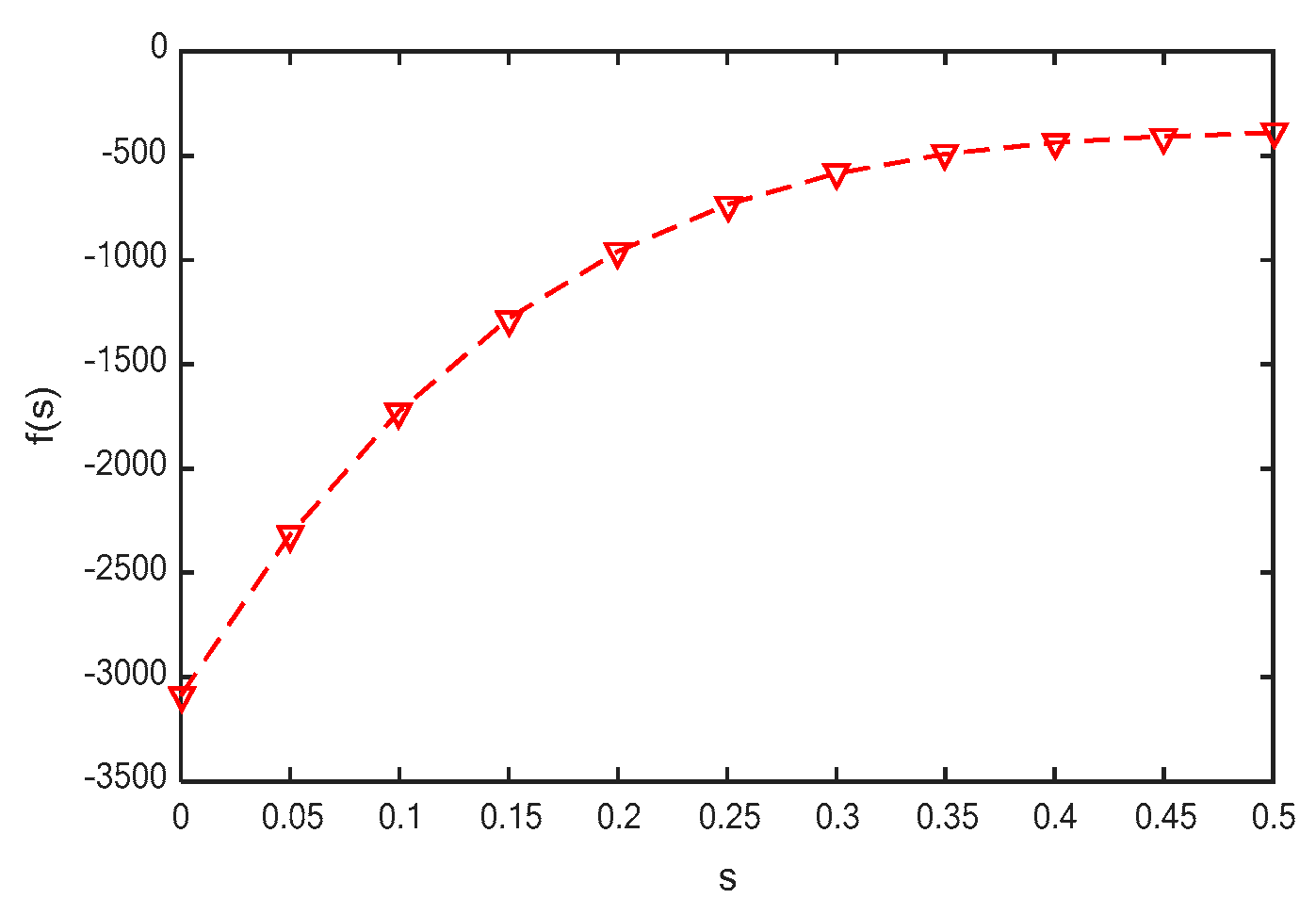

4.1. Relationship between , and

Due to the general constraints that the parameters in the equilibrium solution needed to satisfy, we set

,

, and

and obtained

Figure 2,

Figure 3,

Figure 4 and

Figure 5.

From

Figure 2,

Figure 3,

Figure 4 and

Figure 5 we can draw the following conclusions: (1) with the increases in

, the intelligence level under different decision-making models showed an increasing trend, and the increasing trend under Model TP was smaller than that under other models; the intelligent logistics-services level was the highest under Model C and the lowest under Model TP. (2) As

increased, the market demand for logistics services under Model TP decreased, whereas the demand under other models increased; although the logistics service market under Model TP was lower and smaller than that under Model C. However, the demand for logistics services under Model TP was higher than that under other models. (3) With the increases in

, the supply-chain profits under different decision-making models all showed an increasing trend, and the increasing trend under Model TP was not as good as under other decision-making models; although the supply chain’s profit under Model TP was lower than that of Model C, it was still higher than the supply-chain benefits under the other contracts. (4) As

increased, the loan amount under Model TP decreased, whereas under other decision-making situations it increased; although the loan amount under Model TP was lower, it was still higher than that under other contracts, except Model C.

Management insights: When LSPs are constrained by funds, in order to improve the intelligence level and market demand of logistics services, LSIs should make centralized decisions with LSPs to achieve high financing, high demand, high yield, and high service-level effects. When consumers have a low level of intelligence in logistics services, although LSP needs a lot of financing under the two-part tariff contract, it can obtain considerable benefits due to market expansion and achieve Pareto improvement of the interests of both parties. When consumers’ requirements for the intelligence level of logistics services gradually increase, although the cost-sharing contract can improve the intelligence level of logistics services with a lower loan amount and increase the market demand for logistics services and the profits of the supply chain, it will damage the one member’s profit. That is, for the initial stage of intelligent transformation of logistics services, the use of a single two-part-tariff contract can achieve the effect of high demand and high profit. In the process of intelligent transformation of logistics services, this contract cannot meet consumers’ requirements for a high level of intelligent logistics services. Therefore, LSIs can use their first-mover advantage to select a more suitable contract and improve the original contract according to market needs. Choosing different incentive contracts according to consumer demand will help enterprises to obtain sustainable competitiveness.

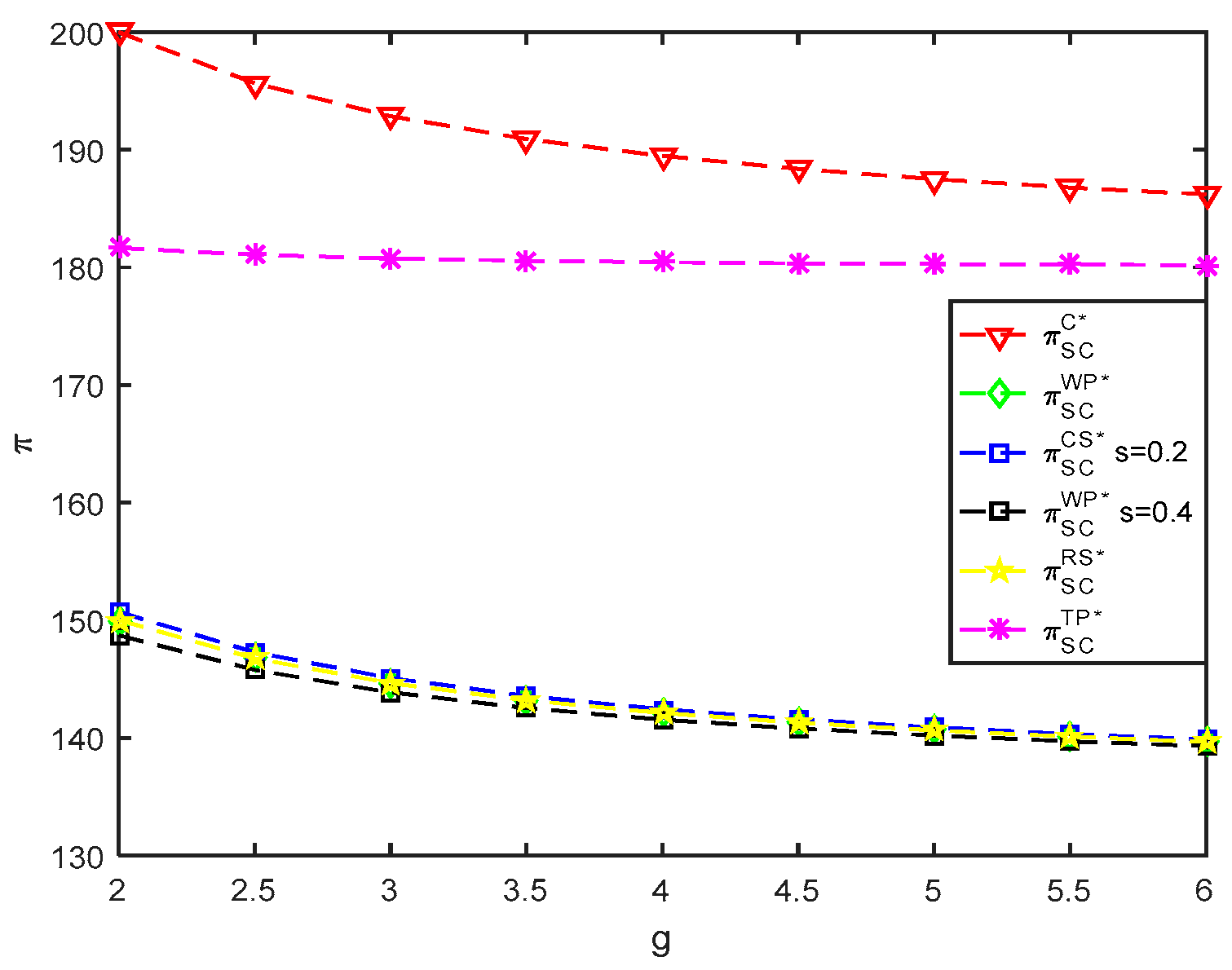

4.2. Relationship between , and

From

Figure 6,

Figure 7,

Figure 8 and

Figure 9 we can draw the following conclusions: (1) With the increases in

, the intelligence level of logistics services under different decision-making models showed a decreasing trend, and the decreasing trend under Model TP was smaller than that under other decision-making models; the intelligence level of logistics service was the highest under Model C and the lowest under Model TP. (2) As

increased, the market demand for logistics services under Model TP increased slowly, whereas the demand for other decision-making situations decreased. Although the demand for logistics services under model TP was lower and smaller than that of Model C, it was still higher than that under other contracts. (3) As

increased, the total supply-chain profit changed less under Model TP, whereas it decreased under other decision-making models. The profit of the supply chain under Model TP was lower than that under Model C but much higher than that under other decision-making models. (4) As

increased, the loan amount under Model TP increased, whereas the loan amount under other decision-making situations decreased. The loan amount under Model TP was higher than that of other contracts except Model C.

Management insights: When LSPs are constrained by funds, in order to improve the intelligence level and market demand of the entire logistics service, Model C is still the first choice for LSPs and LSIs. When the technological advantages of the intelligent transformation of logistics services are not obvious, the adoption of a two-part tariff contract can ensure the stability of the market brought about by the intelligent transformation of logistics services through financing and improve the disadvantage of the overall supply-chain revenue due to the high-cost coefficient of intelligent transformation of logistics services. In other words, when the logistics-service supply chain is faced with a relatively large cost coefficient of intelligent transformation, although the intelligent logistics service cannot reach a high level under the two-part pricing contract, it can obtain a higher market share under the specific level of intelligent logistics, which solves the survival problem of enterprises.

4.3. Relationship between , and

From

Figure 10,

Figure 11,

Figure 12 and

Figure 13 we can draw the following conclusions: (1) With the increases in

, the intelligence level of logistics services under different decision-making models showed a decreasing trend and the decreasing trend under the two-part-tariff contract was not less than that of other decision-making situations. The intelligence level of logistics service was the highest under Model C and the lowest under Model TP. (2) As

increased, the market demand for logistics services decreased. The gap between the logistics-service market under Model TP and Model C narrowed and was higher than that of other models. (3) With the increases in

, the supply-chain profits under different decision-making models all showed a decreasing trend, and the gap between Model TP and Model C narrowed. (4) As

increased, the loan amount under different decision-making models increased, and the loan amount under Model TP was smaller than Model C but higher than the value under other contract models.

Management insights: When LSPs are constrained by funds, the increase in the bank-loan interest rate will seriously weaken the intelligence level and the market demand. Although centralized decision-making requires higher financing, it can maximize the level of logistics-service intelligence and the market demand, whereas the two-part tariff has a lower level of logistics-service intelligence, but the overall logistics-service market and profit are relatively high. Therefore, comprehensive consideration of the relationship between the improvement of the intelligence level of logistics services, the expansion of market demand, the growth of supply-chain profits, and the cost of financing will help enterprises to obtain more economic benefits in the process of intelligent logistics services.

4.4. The Influence of Parameter Sensitivity on Equilibrium Results

In this section, we mainly analyze the sensitivity of equilibrium results under different decision models when some important parameters changes. Based on the numerical simulation values above, we varied the values of parameters

, and

in the following ranges, including +20%, +10%, 10%, and −20%. Summarizing the effects on prices under different decision models when the parameters changed, we drew

Table A1,

Table A2 and

Table A3.

From

Table A1, we can draw the following conclusions: (1) When parameter

or

increased, the logistics-service price decreased under different decision-making modes, and when

or

increased, the logistics-service price increased under different decision-making modes. (2) We compared the prices of final logistics services in

Table A1 horizontally and found that with the change in parameters, the results under Model C were relatively close to those of Model TP but far lower than other decision-making models. The reason may be that under Model TP, the LSP obtains a fixed transfer payment and sets a lower wholesale price. The LSI will also appropriately reduce their marginal profit for unit logistics services—that is, when the two-part-tariff contract is adopted, consumers can obtain intelligent logistics services at a lower price.

Based on

Table A2, we can draw the following conclusions: (1) When

increased, the final logistics-service demand, the loan amount, and the logistics-service intelligence level decreased under different decision-making modes. When

increased, the demand and the loan amount both decreased under Model TP but increased under other decision models; the intelligence level of logistics services under various decision-making models increased. The influence of parameters on the logistics-service demand, the loan amount, and the level of logistics-service intelligence was opposite to that of the parameter. That is, if consumers are not sensitive to the intelligence of logistics services or if the transformation requires a higher technical threshold, the adoption of a two-part-tariff contract can avoid the resulting market losses. When the bank-loan interest rate increased, the market demand for logistics services and the level of intelligence of logistics services decreased under different decision-making models, and the loan amount decreased under Model C, Model WP, and Model RS but increased under Model CS and Model TP. The reason may be that the LSP must maintain a high level of logistics-service intelligence under Model CS, whereas the LSP must ensure a higher market demand under Model TP, so the loan amount will also vary with the increases in the loan interest rate. (2) We compared the logistics-service demand, the loan amount, and the logistics-service intelligence level in

Table A2 and found that, with the changes in parameters, although the intelligence level of logistics services under Model TP was low, the loan amount under this contract was also relatively low, whereas the demand for logistics services was close to the situation of Model C. Combined with

Table A1, we can see that the two-part-tariff contract can obtain more market demand at a relatively low price and occupy the market opportunity when the level of logistics-service intelligence is low.

From

Table A3, we can draw the following conclusions: (1) When

increased, the profits of the LSP, the LSI, and the total supply chains all decreased under different decision-making modes. When

increased, the profits of the LSP and the total supply chains increased under different contracts, whereas the profit of the LSI decreased under the two-part-tariff contract and increased under other decision-making models. The effect of parameter

on the profit of the LSP, the LSI, and the total supply chain was opposite to that of parameter

. When parameter

increased, the profit of the LSP, the LSI, and the total supply chains all decreased under different decision-making modes. (2) With the change in parameters

, and

, the profit of the LSP was not lower than in other decision-making situations under the two-part-tariff contract, and the total profit of the LSI and the logistics-service supply chain could not reach the effect of the centralized decision-making situation but was still higher than other decision-making models. That is, the two-part-tariff contract can realize the Pareto improvement of the profits of the supply-chain members in the early stage of the intelligent transformation and effectively improve the overall performance of the supply chain after the intelligent transformation.

Management insights: We can see that the equilibrium results under different decision models have high sensitivity to the price sensitivity coefficient of logistics services. That is, the price-sensitivity coefficient of logistics services plays an important role in the process of intelligent transformation. The decision-makers should understand the factors that affect the price setting of logistics-service demand in a timely manner and provide targeted logistics services according to consumers’ preferences to gain the market initiative. That is to say, enterprises can obtain first-mover advantages through the intelligent transformation of logistics services and obtain additional income at higher prices; otherwise, logistics enterprises need to appropriately reduce the price of intelligent logistics services to avoid the adverse impact of high prices on demand and even profits.

4.5. Relationship between Equilibrium Results and

According to the above analysis, we can see that in the early stage of the intelligent transformation, the two-part-tariff contract can increase the overall market demand and obtain higher profit. However, with the improvement the intelligence level of consumers’ logistics services, the two-part-tariff contract cannot achieve the effect of a highly intelligent level. We know that the level of logistics-service intelligence has been significantly improved under the wholesale-price contract, cost-sharing contract, revenue-sharing contract, and hybrid cost-sharing–revenue-sharing contract. Therefore, in this section, we examined the effect of

on the equilibrium results under these contracts. Due to the difference between the wholesale-price contract and the revenue-sharing contract being small, except for the wholesale price, and the mixed cost-sharing and revenue-sharing contract being able to achieve centralized decision-making, our analysis of the cost-sharing contract, the revenue-sharing contract, and the centralized decision-making situation is equivalent to analyzing decision-making situations other than the two-part-tariff contract. The parameter settings in this section are as described above, and we set the ranges of

is

. The equilibrium results and relationships under different contracts are shown in

Table A4 and

Table A5.

Based on

Table A4 and

Table A5, we can draw the following conclusions: (1) When

increased,

gradually decreased and was always smaller than

, whereas

first increased and then decreased, and

was always not less than

. In addition, when

increased,

gradually increased even close to

, and the gap between

and

further expanded. (2) When

increased,

gradually decreased and was smaller than

, whereas

first increased and then decreased and was greater than

.In addition, when

increased,

first increased and then decreased, and the profit was less than

when the cost-allocation ratio was greater than a certain value. Moreover, when

increased,

gradually increased and was larger than

.

Combining the above conclusions, we can see that under the cost-sharing contract, the cost of logistics-intelligence transformation of service providers is shared, whereas the cost of unit-logistics services is not shared. That is, the additional cost to be paid by the LSI under the cost-sharing contract is small, so the price is relatively low. In addition, the cost-sharing contract can improve the intelligence level of logistics services and stimulate the market demand for logistics services at a certain sharing ratio. Moreover, although the LSP needs to carry out higher financing and relatively lower profit due to the unit cost of logistics services in the financing process, the profit of the total supply chain increases when the cost-sharing contract is in a suitable range.

Management insights: In order to achieve a higher level of logistics-service intelligence and occupy more markets, although the intelligent-logistics-service cost-sharing contract is more effective than the revenue-sharing contract, it is still unable to achieve the expected effect by only adopting any one contract. That is, the problem of double marginalization still exists. Therefore, implementing a hybrid contract of a cost-sharing and revenue-sharing contract is a better choice to obtain a higher level of logistics-service intelligence and higher market demand in the process of gradually advancing the intelligent transformation of logistics services under capital constraints.

5. Conclusions

5.1. Key Findings and Managerial Implications

Driven by new technologies, intelligent logistics transformation of logistics enterprises can meet the diverse needs of customers, improve the efficiency of logistics services, and effectively reduce carbon emissions, which is of great significance for the implementation of the sustainable-development strategy of logistics enterprises. This paper explores the problem of contract coordination between improving the intelligence level of the logistics-service supply chain and obtaining market demand by motivating the capital-constrained LSPs to transform intelligently. First, the benchmark model of the centralized decision-making model is constructed to measure whether the contract is valid or not. Second, based on the wholesale-price contract, we have introduced a logistics-service intelligent-transformation cost-sharing model, a revenue-sharing model, a two-part-tariff model, and a hybrid logistics-service intelligent-transformation cost-sharing–revenue-sharing model. Finally, a Stackelberg game model dominated by the LSI is constructed and we solve the equilibrium results under different contract models. We can draw the following conclusions:

(1) The revenue-sharing contract is similar to the wholesale-price contract, except the wholesale price and the double marginalization is serious. (2) The cost-sharing contract can increase profits for the LSI and the total supply chain, despite hurting the LSP’s profit. (3) When consumers do not have high requirements for the intelligence level of logistics services and the LSP does not have the cost advantage of intelligent logistics services, the two-part-tariff contract can create a win–win situation for members of the supply chain within a certain range and increase market demand. (4) When consumers have a high level of logistics-service intelligence, the optimal contract to achieve a high logistics-service intelligence level and market demand is a hybrid logistics-service intelligence-transformation cost-sharing–revenue-sharing contract. (5) When the bank-loan interest rate increases, although the intelligence level of the logistics service and the market demand are seriously weakened, the adoption of the two-part tariff contract and the intelligent transformation of the logistics service cost-sharing–revenue-sharing contract can still meet the different needs of consumers and improve profits for supply-chain members. (6) The equilibrium results under each decision model are highly sensitive to changes in the price-sensitivity coefficient of logistics services. Therefore, no matter which contract is adopted in the process of intelligent transformation, it is necessary to fully grasp the influencing factors of price sensitivity in order to formulate a more reasonable price strategy.

This study provides useful enlightenment for LSIs and LSPs in the intelligent transformation of the logistics-service supply chain. The following are practical suggestions in the intelligent-transformation process of the logistics-service supply chain: (1) The choice of the design of the incentive contract for the intelligent transformation of logistics services should be reasonable based on consumers’ preference for intelligent logistics services. (2) When the LSP is constrained by funds, the LSI should share the transformation cost based on the capital advantage to promote the intelligent transformation of the logistics-service supply chain so as to achieve win–win cooperation for both parties. (3) When enterprises make optimal decisions, in addition to considering the impact of consumers’ wisdom preferences on demand, they should also pay attention to the impact of prices on demand and formulate reasonable logistics-service prices so as to gain the market initiative. In addition, our research also has some theoretical contributions, which are as follows: Firstly, existing articles on the intelligent transformation of logistics services rarely consider the situation of capital constraint [

24,

32,

34]; although Conclusion (1) and Conclusion (2) are similar to those in Ref. [

34], the difference is that the equilibrium-decision results are different, and our research on intelligent-transformation decision-making regarding logistics services under capital constraint has realized the extension of the existing theoretical research dimension. Secondly, the existing literature rarely considers the different preferences of consumers for the intelligent transformation of logistics services. Although Conclusion (3) and Conclusion (4) are similar to those in the Refs. [

24,

34], the difference is that the choice of incentive contract varies according to the sensitivity of different consumers to intelligent logistics. Our research enriches the decision-making problem of incentive-contract design under different consumers’ intelligent logistics-service preferences. Finally, the existing literature does not consider the influence of the price-sensitivity coefficient on intelligent-transformation decision-making of logistics services [

24,

32,

34], and we draw some very interesting conclusions, such as Conclusion 5 and Conclusion 6. Therefore, excavating the key factors of the intelligent transformation of logistics service can make incentive-contract design more scientific.

5.2. Limitations and Future Research Directions

In addition, there are still some limitations in this study, which can be used as a direction for further attention. First, in this paper, we set consumers’ demand for intelligent logistics service as a linear function, but in reality, consumers’ demand may be random and fuzzy in different forms, so it is worth further research to study contract design under different demand functions. Second, we only use bank credit when considering capital constraints in our research and do not consider credit models such as prepayment financing and third-party financing. It is necessary to explore the selection of intelligent-transformation contracts for logistics services under different credit models. Third, in this paper, we find that consumer price sensitivity has an important impact on the intelligent transformation of logistics services. Are there any other influencing factors, and what are the specific impacts of these factors on the process of logistics services? It will be very interesting to study these issues. Finally, this paper only considers the intelligent transformation of the LSP, and it is worth further research to consider the intelligent transformation of the LSP and the LSI at the same time.