Bank Risk Literature (1978–2022): A Bibliometric Analysis and Research Front Mapping

Abstract

1. Introduction

2. Literature Review

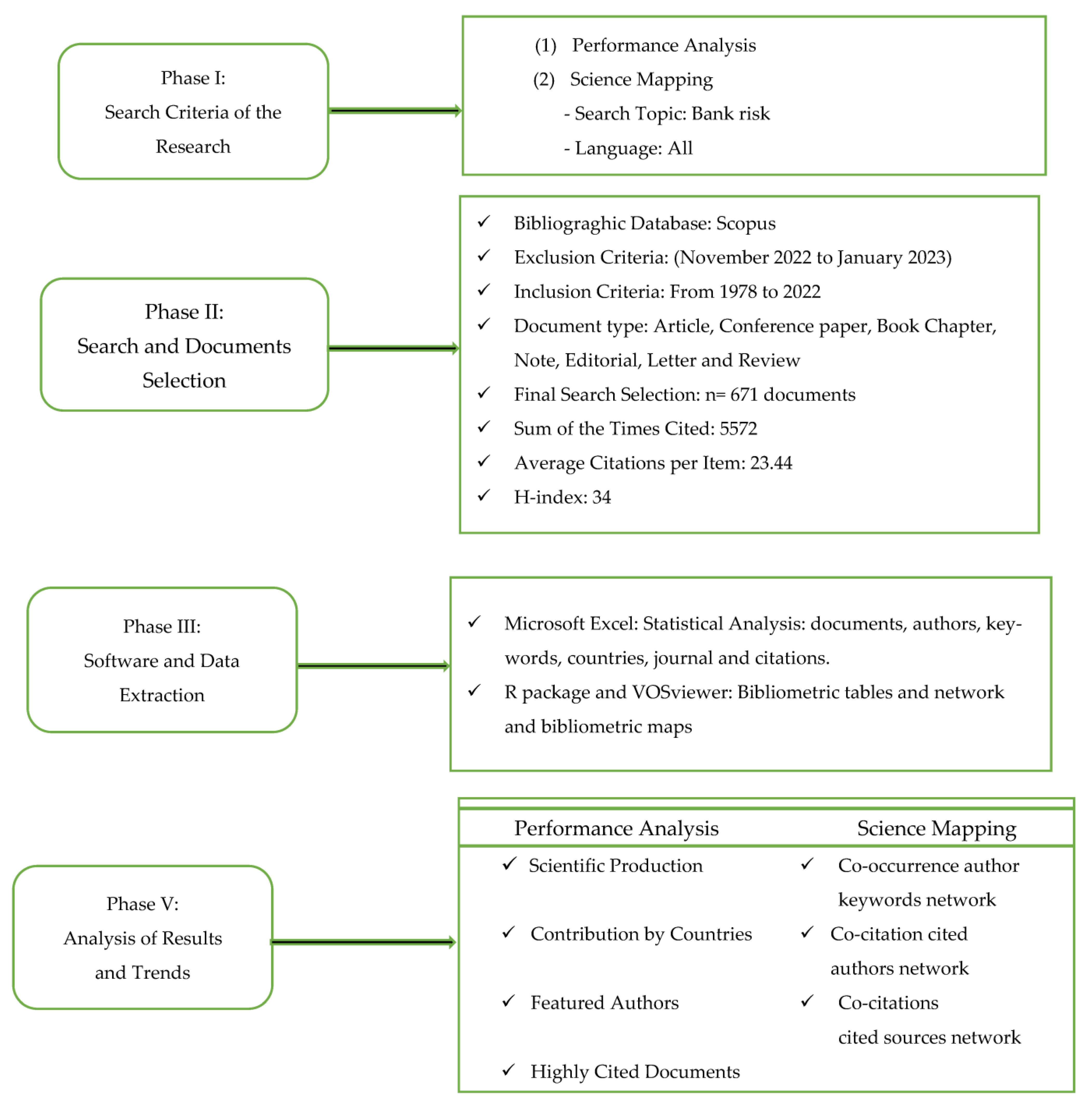

3. Methodology

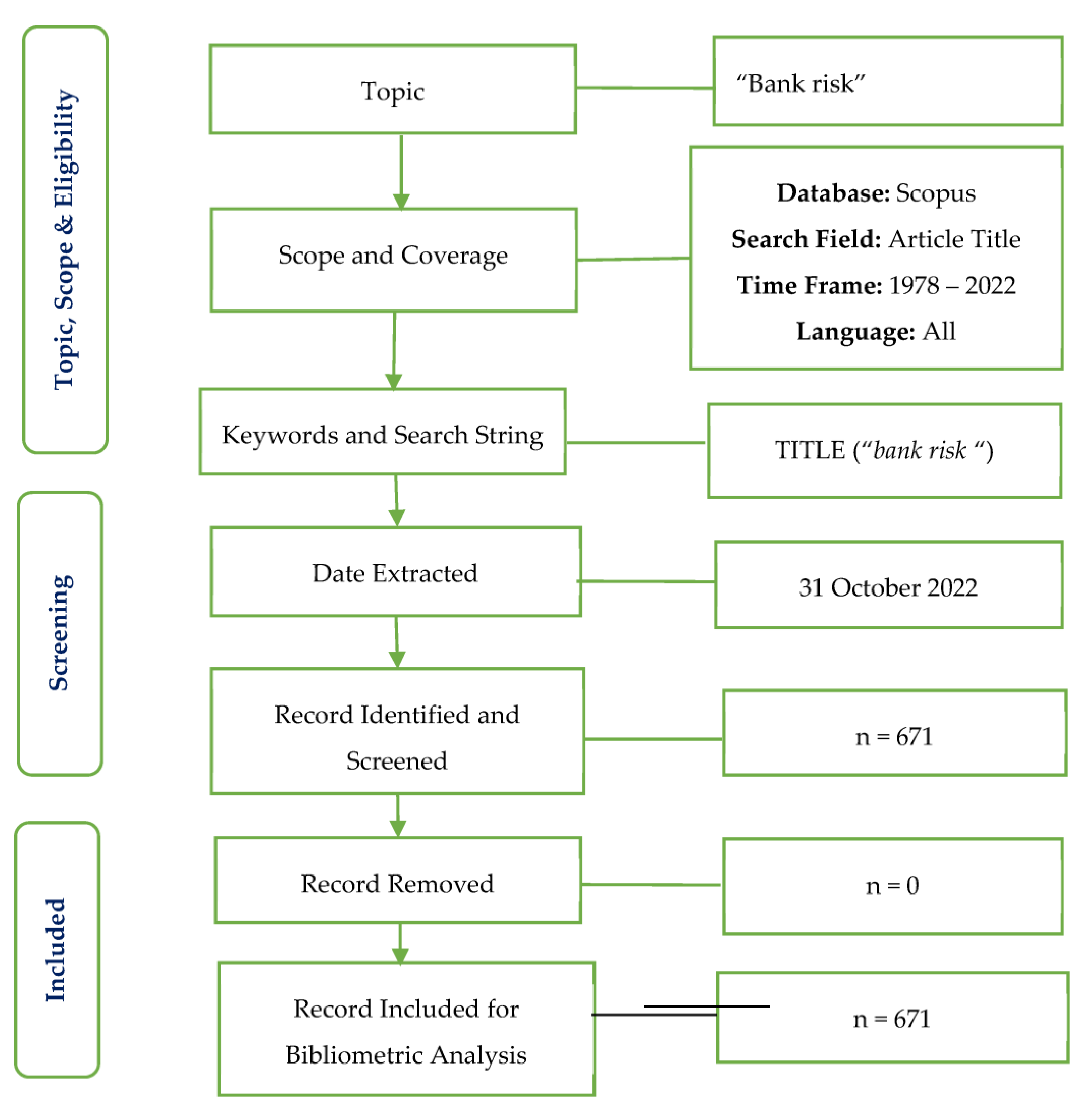

3.1. Data Sources and Data Collection

3.2. Analysis and Tools

4. Results

4.1. General Information

4.2. Descriptive Bibliometric Analysis

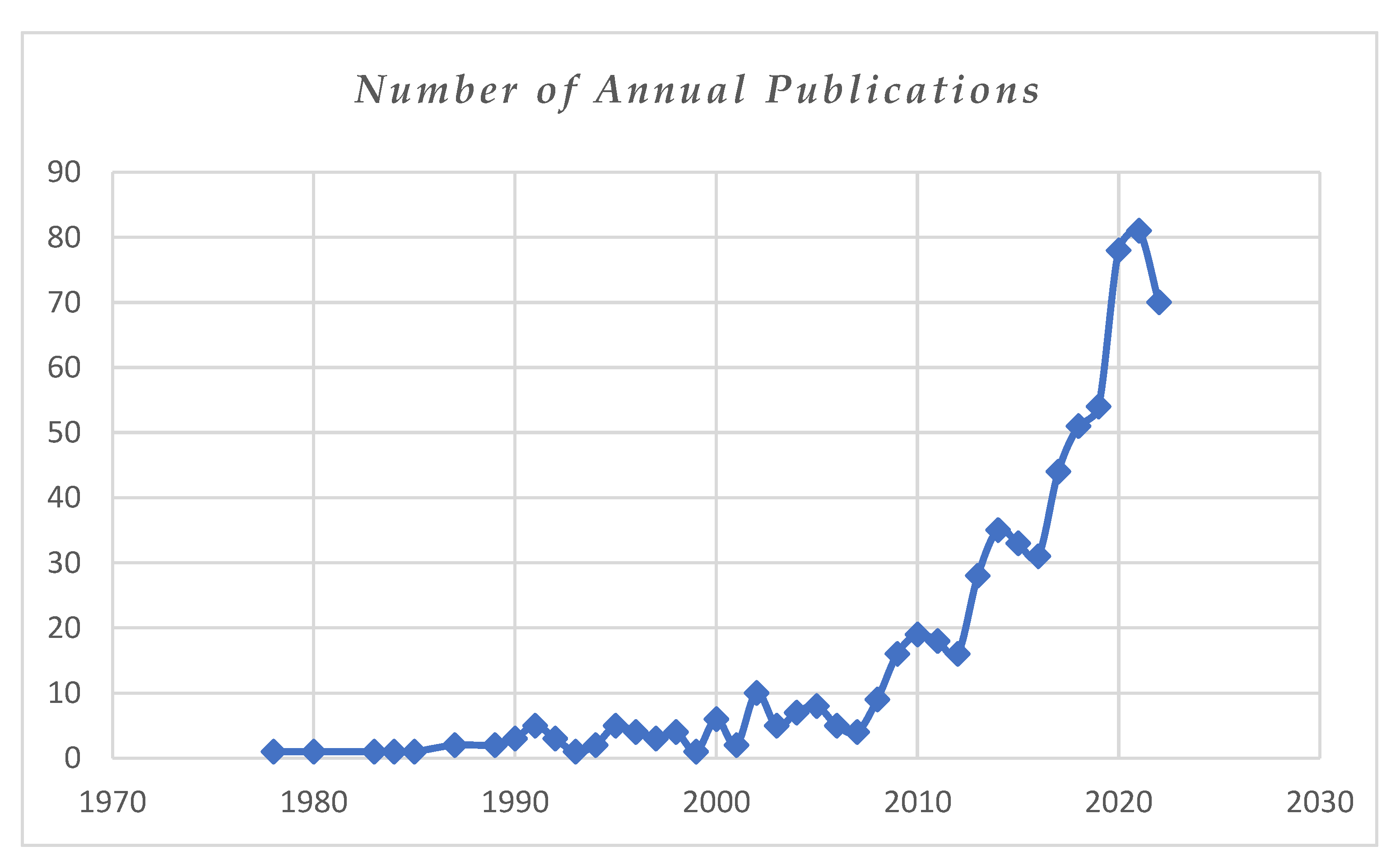

4.2.1. Number of Annual Publications

4.2.2. Languages of Documents

4.2.3. Most Productive Authors

4.2.4. Most Cited Papers

4.2.5. Most Productive Countries

4.2.6. Most Productive Affiliations

4.2.7. Most Frequent Keywords

4.3. Network Analysis

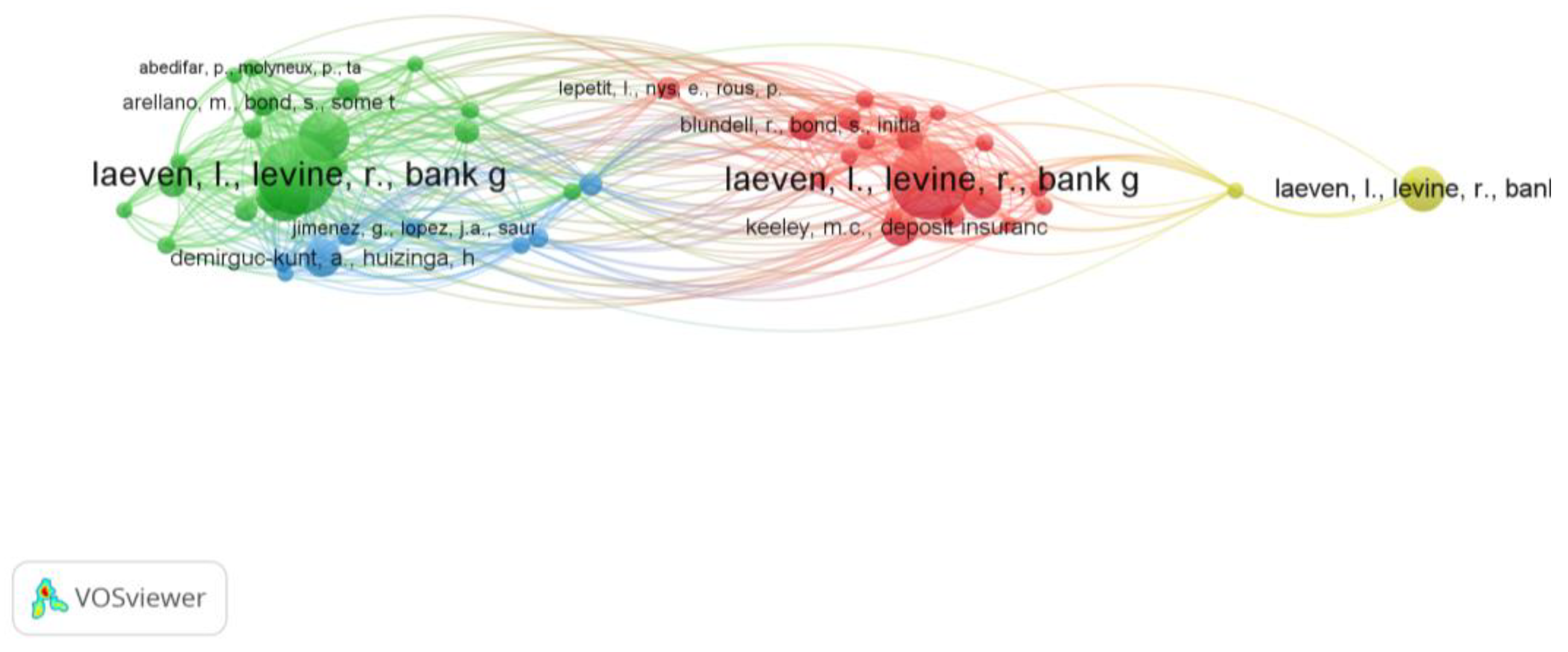

4.3.1. Co-Citation Analysis

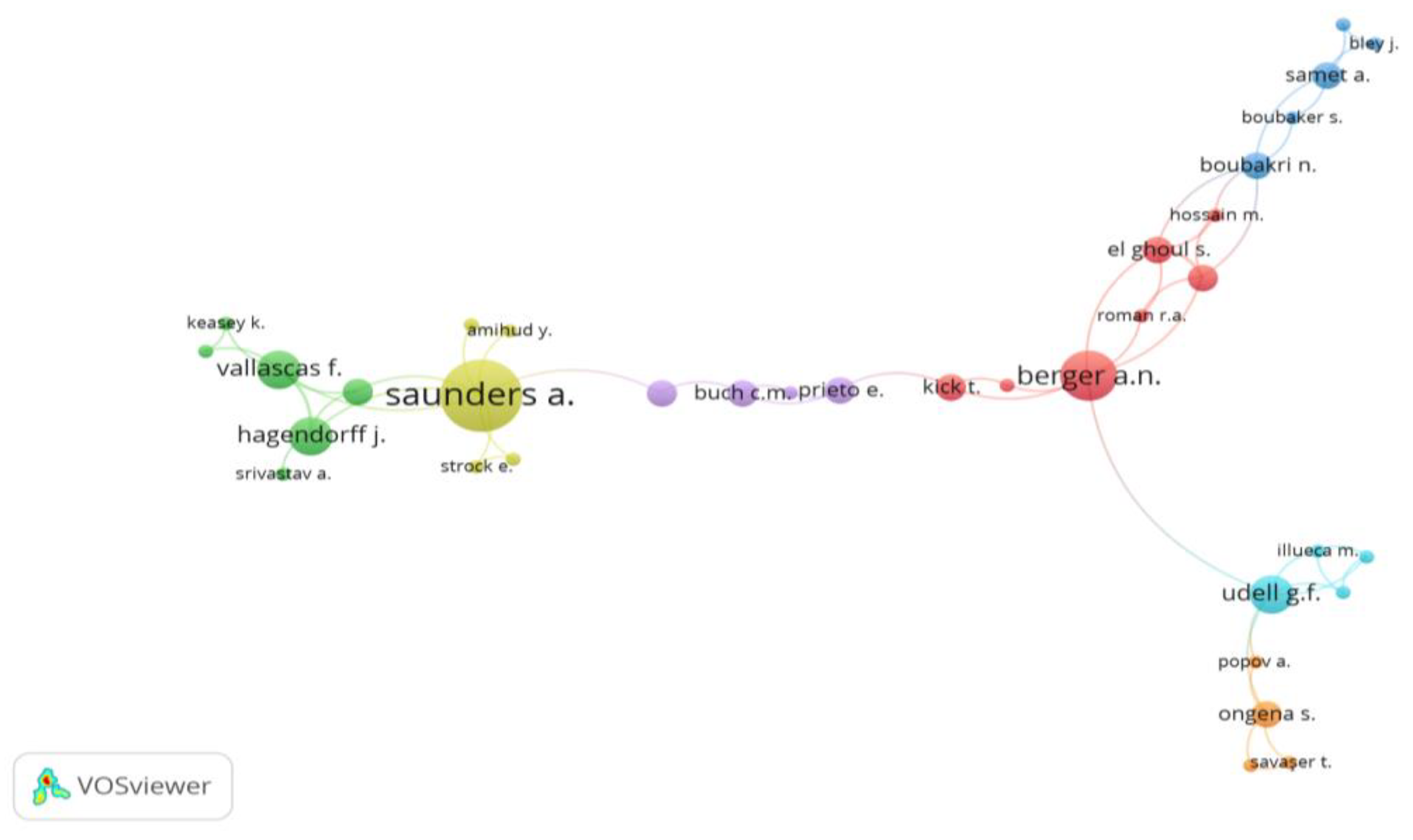

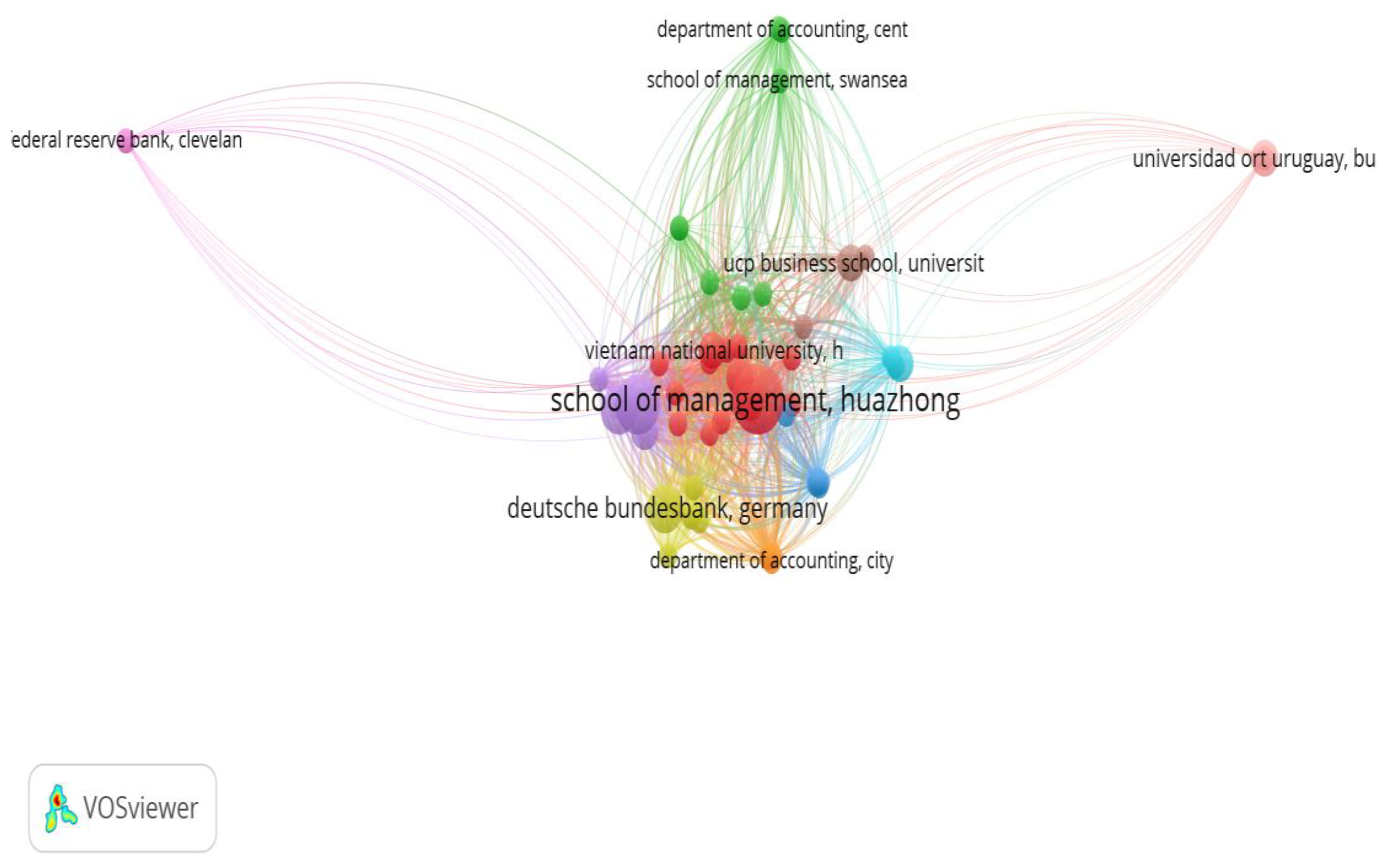

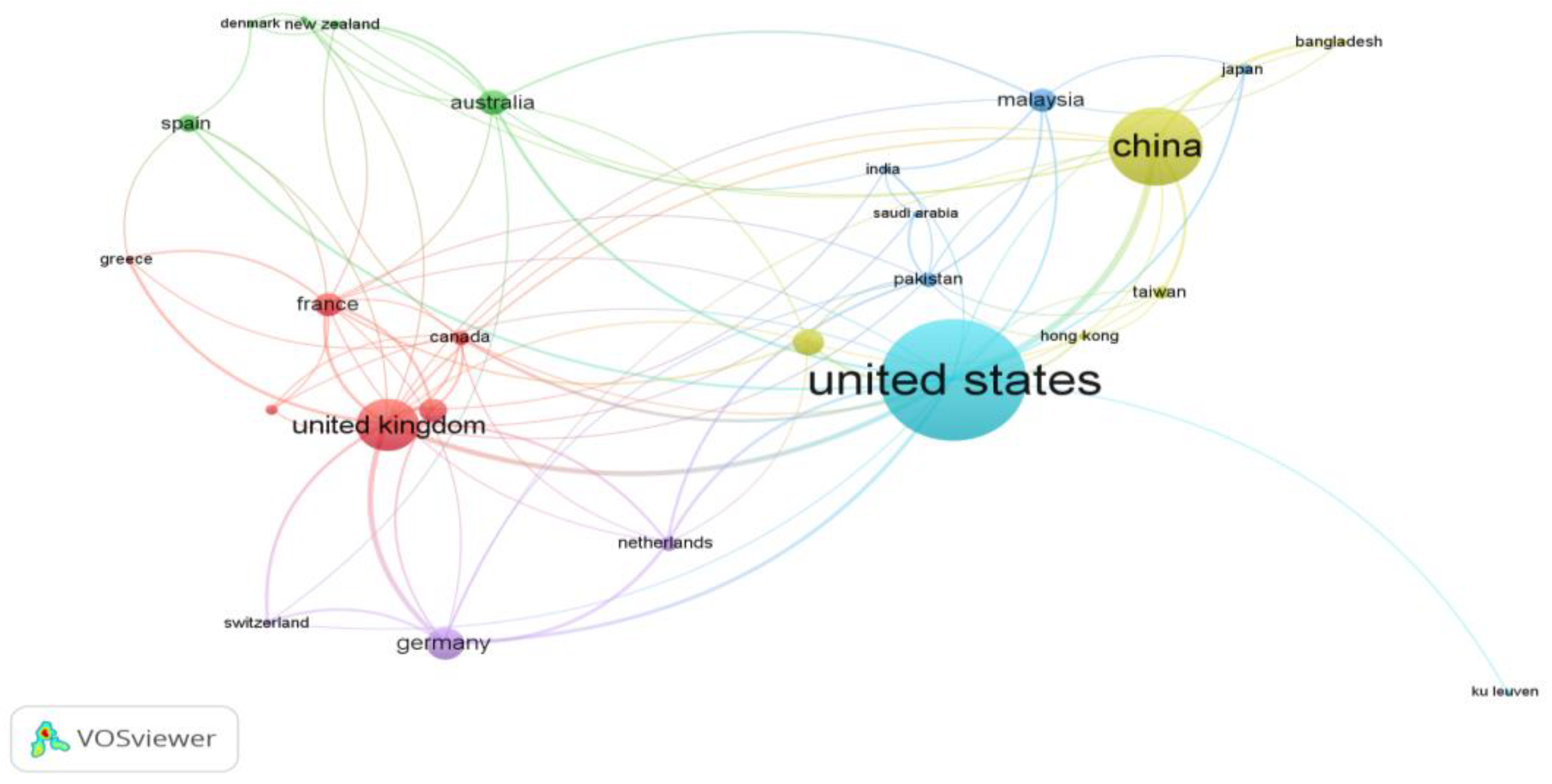

4.3.2. Collaboration Analysis

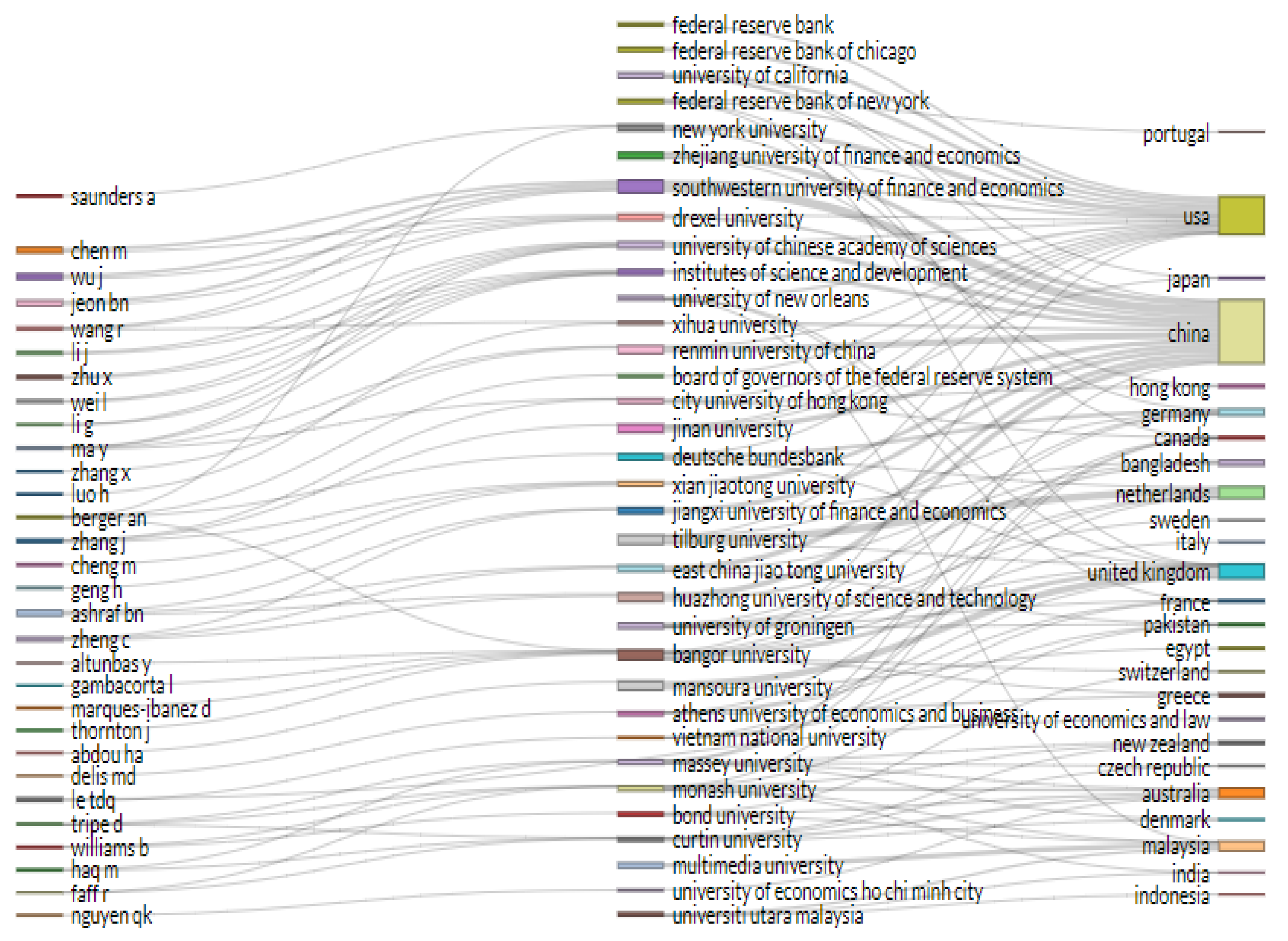

4.3.3. Three-Field Plot

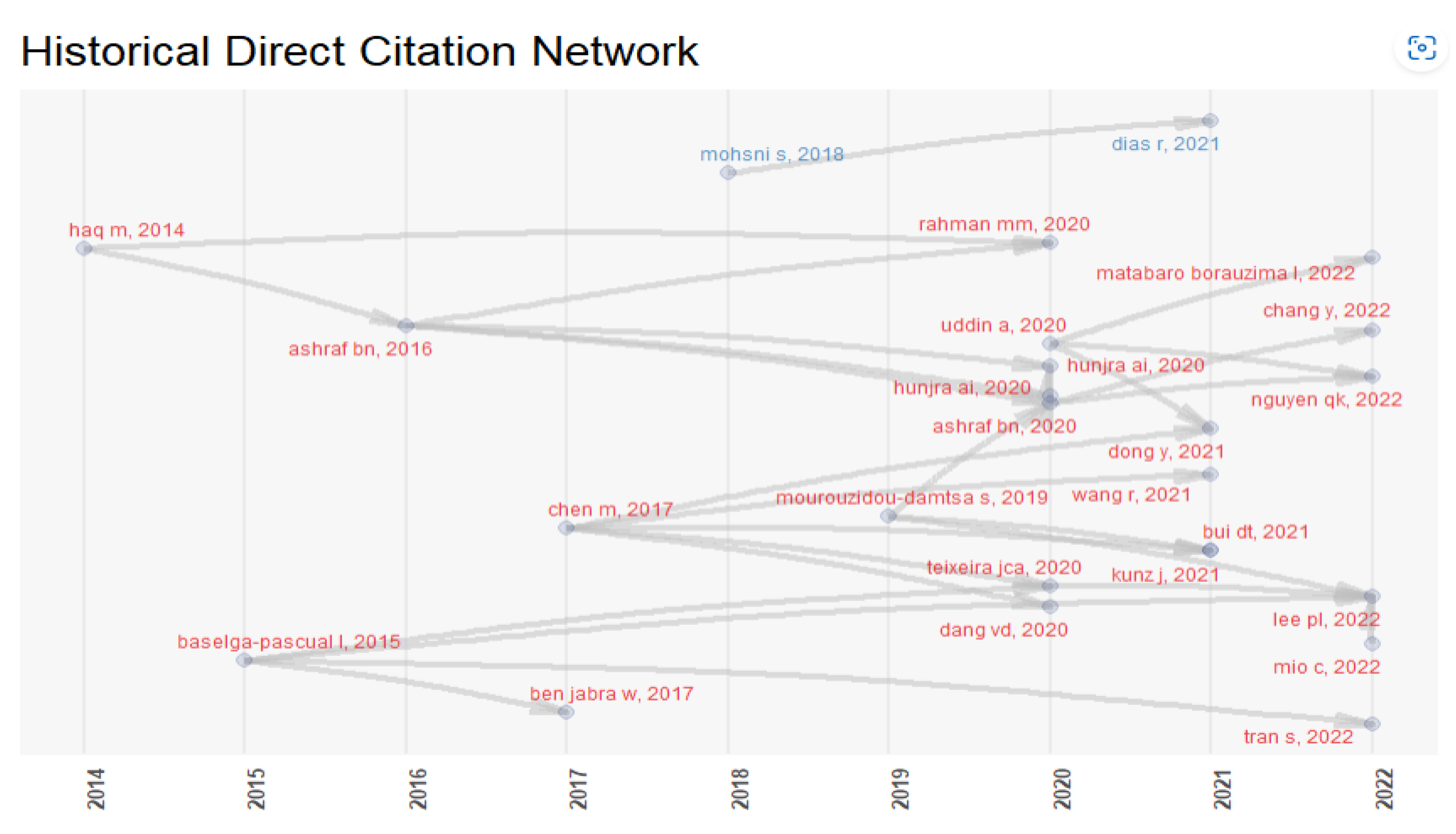

4.3.4. Historiography

5. Discussion

6. Conclusions

7. Theoretical and Practical Implications

8. Limitations and Future Research

Author Contributions

Funding

Institutional Review Board Statement

Informed Consent Statement

Data Availability Statement

Acknowledgments

Conflicts of Interest

References

- Haq, M.; Heaney, R. Factors determining European bank risk. J. Int. Financ. Mark. Inst. Money 2012, 22, 696–718. [Google Scholar] [CrossRef]

- Leo, M.; Sharma, S.; Maddulety, K. Machine learning in banking risk management: A literature review. Risks 2019, 7, 29. [Google Scholar] [CrossRef]

- McKinsey & Co. 2016. Available online: https://www.mckinsey.com/business-functions/risk-and-resilience/our-insights/the-future-of-bank-risk-management (accessed on 8 February 2023).

- Anderson, J.A. A study of risk management in the United Arab Emirates banking system. SSRN 2010. [Google Scholar] [CrossRef]

- Shafiq, A.; Nasr, M. Risk management practices followed by the commercial banks in Pakistan. Int. Rev. Bus. Res. Pap. 2010, 6, 308–325. [Google Scholar]

- Shafique, O.; Hussain, N.; Hassan, M.T. Differences in the risk management practices of Islamic versus conventional financial institutions in Pakistan: An empirical study. J. Risk Financ. 2013, 14, 179–196. [Google Scholar] [CrossRef]

- Wood, A.; Kellman, A.; Campus, C.H. Risk management practices by Barbadian banks. Int. J. Bus. Soc. Res. 2013, 3, 22–33. [Google Scholar]

- Rahman, N.A.A.; Abdullah, N.A.H.; Ahmad, N.H. Banking Risk: Ownership Structure, Moral Hazard and Capital Regulation; Lap Lambert Academic Publishing: Saarbrucken, Germany, 2012. [Google Scholar]

- Al-Tamimi, H.A.H.; Al-Mazrooei, F.M. Banks’ risk management: A comparison study of UAE national and foreign banks. J. Risk Financ. 2007, 8, 394–409. [Google Scholar] [CrossRef]

- Abu-Hussain, H.A.; Al-Ajmi, J. Risk management practices of conventional and Islamic banks in Bahrain. J. Risk Financ. 2012, 13, 215–239. [Google Scholar] [CrossRef]

- Ghosh, A. Managing Risks in Commercial and Retail Banking; John Wiley & Sons: Hoboken, NJ, USA, 2012. [Google Scholar]

- Bessis, J. Risk Management in Banking; John Wiley and Sons, Inc.: West Sussex, UK, 2002. [Google Scholar]

- Schroeck, G. Risk Management and Value Creation in Financial Institutions; John Wiley and Sons, Inc.: Hoboken, NJ, USA, 2002. [Google Scholar]

- Santomero, A.M. Commercial bank risk management: An analysis of the process. J. Financ. Serv. Res. 1997, 12, 83–115. [Google Scholar] [CrossRef]

- Crouhy, M.; Galai, D.; Mark, R. The Essentials of Risk Management; McGraw-Hill: New York, NY, USA, 2006. [Google Scholar]

- Hassan, W.M. Risk management practices: A comparative analysis between Islamic banks and conventional banks in the Middle East. Int. J. Acad. Res. 2011, 3, 288–295. [Google Scholar]

- Basel Committee. A Brief History of the Basel Committee; Basel Committee on Banking Supervision; Bank for International Settlements (BIS): Basel, Switzerland, 2013. [Google Scholar]

- Brownlees, C.; Hans, C.; Nualart, E. Bank credit risk networks: Evidence from the Eurozone. J. Monetary Econ. 2020, 117, 585–599. [Google Scholar] [CrossRef]

- Altaf, K.; Ayub, H.; Shabbir, M.S.; Usman, M. Do operational risk and corporate governance affect the banking industry of Pakistan? Rev. Econ. Political Sci. 2021, in press. [Google Scholar] [CrossRef]

- Pennathur, A.K. “Clicks and Bricks”: E-Risk Management for Banks in the Age of the Internet. J. Bank. Financ. 2001, 25, 2103–2123. [Google Scholar] [CrossRef]

- Solanki, V.S. Risks in E-Banking and their Management. Int. J. Mark. Financ. Serv. Manag. Res. 2012, 1, 164–178. [Google Scholar]

- Sbârcea, I.R. International Concerns for Evaluating and Preventing the Bank Risks–Basel I Versus Basel II Versus Basel III. Procedia Econ. Financ. 2014, 16, 336–341. [Google Scholar] [CrossRef]

- Demirgüç-Kunt, A.; Detragiache, E. Basel core principles and bank soundness: Does compliance matter? J. Financ. Stab. 2011, 7, 179–190. [Google Scholar] [CrossRef]

- Allahrakha, M.; Cetina, J.; Munyan, B. Do higher capital standards always reduce bank risk? The impact of the Basel leverage ratio on the US triparty repo market. J. Financ. Intermediat. 2018, 34, 3–16. [Google Scholar] [CrossRef]

- Blundell-Wignall, A.; Atkinson, P.; Roulet, C. Bank business models and the Basel system: Complexity and interconnectedness. OECD J. Financ. Mark. Trends 2014, 2013, 43–68. [Google Scholar] [CrossRef]

- Drumond, I. Bank capital requirements, business cycle fluctuations and the Basel accords: A synthesis. J. Econ. Surv. 2009, 23, 798–830. [Google Scholar] [CrossRef]

- ElBannan, M.A. The financial crisis, Basel accords and bank regulations: An overview. Int. J. Account. Financ. Report. 2017, 7, 225–275. [Google Scholar] [CrossRef]

- Ojo, M. Risk management by the Basel Committee: Evaluating progress made from the 1988 Basel Accord to recent developments. J. Financ. Regul. Compliance 2010, 18, 4. [Google Scholar] [CrossRef]

- Hakenes, H.; Schnabel, I. Bank size and risk-taking under Basel II. J. Bank. Finance 2011, 35, 1436–1449. [Google Scholar] [CrossRef]

- Hossain, S.A.; Islam, K.M.A. Impact of Basel II & III Implementation to Mitigate Bank Risk: A Study on Al-Arafah Islami Bank Limited. Indian. J. Financ. Bank. 2017, 1, 42–51. [Google Scholar]

- Mujtaba, G.; Akhtar, Y.; Ashfaq, S.; Abbas Jadoon, I.; Hina, S.M. The nexus between Basel capital requirements, risk-taking and profitability: What about emerging economies? Econ. Res.-Ekon. Istraž. 2022, 35, 230–251. [Google Scholar] [CrossRef]

- Afzali, M.A.; Nadri, K.; Tavakolian, H. Can the transition from Basel II to III change the monetary policy impact on the Iranian economy and banking system? Econ. Anal. Policy 2023, 77, 357–371. [Google Scholar] [CrossRef]

- Song, G. Evaluating large bank risk using stock market measures in the Basel III period. J. Corp. Account. Financ. 2022, 34, 21–32. [Google Scholar] [CrossRef]

- Azevedo, G.; Oliveira, J.; Sousa, L.; Borges, M.F.R. The determinants of risk reporting during the period of adoption of Basel II Accord: Evidence from the Portuguese commercial banks. Asian Rev. Account. 2022, 30, 177–206. [Google Scholar] [CrossRef]

- Fromage, D. The (multilevel) articulation of the European participation in international financial fora: The example of the Basel Accords. J. Bank. Regul. 2021, 23, 54–65. [Google Scholar] [CrossRef]

- Altunbaş, Y.; Polizzi, S.; Scannella, E.; Thornton, J. European Banking Union and bank risk disclosure: The effects of the Single Supervisory Mechanism. Rev. Quant. Financ. Account. 2021, 58, 649–683. [Google Scholar] [CrossRef]

- Koseoglu, M.A. Mapping the institutional collaboration network of strategic management research: 1980–2014. Scientometrics 2016, 109, 203–226. [Google Scholar] [CrossRef]

- Galletta, S.; Mazzù, S.; Naciti, V. Bibliometric analysis of ESG performance in the banking industry: From the current status to future directions. Res. Int. Bus. Financ. 2022, 62, 101684. [Google Scholar] [CrossRef]

- Cobo, M.J.; López-Herrera, A.G.; Herrera-Viedma, E.; Herrera, F. Science mapping software tools: Review, analysis, and cooperative study among tools. J. Am. Soc. Inf. Sci. Technol. 2011, 62, 1382–1402. [Google Scholar] [CrossRef]

- Ellegaard, O.; Wallin, J.A. The bibliometric analysis of scholarly production: How great is the impact? Scientometrics 2015, 105, 1809–1831. [Google Scholar] [CrossRef]

- Liao, H.; Tang, M.; Luo, L.; Li, C.; Chiclana, F.; Zeng, X.J. A bibliometric analysis and visualisation of medical big data research. Sustainability 2018, 10, 166. [Google Scholar] [CrossRef]

- Konishi, M.; Yasuda, Y. Factors affecting bank risk taking: Evidence from Japan. J. Bank. Financ. 2004, 28, 215–232. [Google Scholar] [CrossRef]

- Das, N.M.; Rout, B.S. Impact of COVID-19 on market risk: Appraisal with value-at-risk models. Indian Econ. J. 2020, 68, 396–416. [Google Scholar] [CrossRef]

- Badarau, C.; Lapteacru, I. Bank risk, competition and bank connectedness with firms: A literature review. Res. Int. Bus. Financ. 2019, 51, 101017. [Google Scholar] [CrossRef]

- Liu, L.; Le, H.; Thompson, S. CEO overconfidence and bank systemic risk: Evidence from US bank holding companies. Int. J. Financ. Econ. 2020, 27, 2977–2996. [Google Scholar] [CrossRef]

- Bebchuk, L.A.; Spamann, H. Regulating bankers’ pay. Geo. lJ. 2009, 98, 247. [Google Scholar]

- Rajan, R.G. Has finance made the world riskier? Eur. Financ. Manag. 2006, 12, 499–533. [Google Scholar] [CrossRef]

- Çakir, M.P.; Çakar, T.; Girisken, Y.; Yurdakul, D. An investigation of the neural correlates of purchase behavior through fNIRS. Eur. J. Mark. 2018, 52, 224–243. [Google Scholar] [CrossRef]

- Bijlsma, M.J.; van der Wiel, K. What Awareness?: Consumer Perception of Bank Risk and Deposit Insurance; CPB Netherlands Bureau for Economic Policy Analysis: The Hague, Netherlands, 2012. [Google Scholar]

- Carletti, E.; Cerasi, V.; Daltung, S. Multiple-bank lending: Diversification and free-riding in monitoring. J. Financ. Intermediat. 2007, 16, 425–451. [Google Scholar] [CrossRef]

- Nguyen, M.; Skully, M.; Perera, S. Market power, revenue diversification and bank stability: Evidence from selected South Asian countries. J. Int. Financ. Mark. Inst. Money 2012, 22, 897–912. [Google Scholar] [CrossRef]

- Alshatti, A.S. The effect of credit risk management on financial performance of the Jordanian commercial banks. Invest. Manag. Financ. Innov. 2015, 12, 338–345. [Google Scholar]

- Boadi, E.K.; Li, Y.; Lartey, V.C. Role of Bank Specific, Macroeconomic and Risk Determinants of Banks Profitability: Empirical Evidence from Ghana’s Rural Banking Industry. Int. J. Econ. Financ. Issues 2016, 6, 813–823. [Google Scholar]

- Bhattarai, Y.R. Effect of credit risk on the performance of Nepalese commercial banks. NRB Econ. Rev. 2016, 28, 41–64. [Google Scholar]

- Srivastav, A.; Hagendorff, J. Corporate governance and bank risk-taking. Corp. Gov. Int. Rev. 2016, 24, 334–345. [Google Scholar] [CrossRef]

- Ebola. IMDrotio. IMF. Available online: Org/external/mmedia/view.aspx?vid=3830643908001 (accessed on 31 December 2022).

- Supervision BCoB. The Burst of High Inflation in 2021–22: How and Why Did We Get Here? Available online: https://www.bis.org/publ/work1060.pdf (accessed on 27 January 2023).

- Stulz, R.M. Risk-taking and risk management by banks. J. Appl. Corp. Financ. 2015, 27, 8–18. [Google Scholar] [CrossRef]

- Dam, L.; Koetter, M. Bank bailouts and moral hazard: Evidence from Germany. Rev. Financ. Stud. 2012, 25, 2343–2380. [Google Scholar] [CrossRef]

- Neitzert, F.; Petras, M. Corporate social responsibility and bank risk. J. Bus. Econ. 2021, 92, 397–428. [Google Scholar]

- Nguyen, H.H.; Nguyen, T.P.; Tram Tran, A.N. Impacts of monetary policy transmission on bank performance and risk in the Vietnamese market: Does the Covid-19 pandemic matter? Cogent Bus. Manag. 2022, 9, 2094591. [Google Scholar] [CrossRef]

- Mio, C.; Agostini, M.; Panfilo, S. Bank risk appetite communication and risk taking: The key role of integrated reports. Risk Anal. 2021, 42, 634–652. [Google Scholar] [CrossRef] [PubMed]

- Ge, W.; Kim, J.-B.; Li, T.; Zhang, J. Subsidiary operations in offshore financial centers and bank risk-taking: International evidence. J. Int. Bus. Stud. 2022, 53, 268–301. [Google Scholar] [CrossRef]

- Tran, D.V.; Hassan, M.K.; Houston, R.; Rabbani, M.R. The impact of bank opacity on bank risk-taking behavior. J. Corp. Account. Financ. 2022, 33, 88–101. [Google Scholar] [CrossRef]

- Abdelaziz, H.; Rim, B.; Helmi, H. The interactional relationships between credit risk, liquidity risk and bank profitability in MENA region. Glob. Bus. Rev. 2020, 23, 561–583. [Google Scholar] [CrossRef]

- Gyeke-Dako, A.; Harvey, S.K.; Azu, G.; Issahaku, H. Monetary Policy and Bank Risk-Taking Behaviour in Africa. In The Economics of Banking and Finance in Africa; Palgrave Macmillan: Cham, Switzerland, 2022; pp. 311–334. [Google Scholar]

- Boateng, A.; Nguyen, V.H.T.; Du, M.; Kwabi, F.O. The impact of CEO compensation and excess reserves on bank risk-taking: The moderating role of monetary policy. Empir. Econ. 2021, 62, 1575–1598. [Google Scholar] [CrossRef]

- Van Anh, D. Does better capitalisation enhance bank efficiency and limit risk taking? Evidence from ASEAN commercial banks. Glob. Financ. J. 2022, 53, C. [Google Scholar] [CrossRef]

- Ongena, S.; Savaşer, T.; Ciamarra, E.Ş. CEO incentives and bank risk over the business cycle. J. Bank. Financ. 2022, 138, 106460. [Google Scholar] [CrossRef]

- Phan, D.H.B.; Tran, V.T.; Iyke, B.N. Geopolitical risk and bank stability. Financ. Res. Lett. 2021, 46, 102453. [Google Scholar] [CrossRef]

- Correa, R.; Goldberg, L.S. Bank complexity, governance, and risk. J. Bank. Financ. 2022, 134, 106013. [Google Scholar] [CrossRef]

- Huang, H.H.; Kerstein, J.; Wang, C.; Wu, F. Firm climate risk, risk management, and bank loan financing. Strateg. Manag. J. 2022, 43, 2849–2880. [Google Scholar] [CrossRef]

- Zhou, X.Y.; Caldecott, B.; Hoepner, A.G.; Wang, Y. Bank green lending and credit risk: An empirical analysis of China’s Green Credit Policy. Bus. Strategy Environ. 2022, 31, 1623–1640. [Google Scholar] [CrossRef]

- Aldasoro, I.; Cho, C.H.; Park, K. Bank solvency risk and funding cost interactions: Evidence from Korea. J. Bank. Financ. 2021, 134, 106348. [Google Scholar] [CrossRef]

- Brogi, M.; Lagasio, V. Better safe than sorry. Bank corporate governance, risk-taking, and performance. Financ. Res. Lett. 2021, 44, 102039. [Google Scholar] [CrossRef]

- Cao, J.; Juelsrud, R.E. Opacity and risk-taking: Evidence from Norway. J. Bank. Financ. 2020, 134, 106010. [Google Scholar] [CrossRef]

- Adhikari, B.K.; Agrawal, A. Does local religiosity matter for bank risk-taking? J. Corp. Financ. 2016, 38, 272–293. [Google Scholar] [CrossRef]

- Berkowitz, J.; O’Brien, J. How accurate are value-at-risk models at commercial banks? J. Financ. 2002, 57, 1093–1111. [Google Scholar] [CrossRef]

- Pérignon, C.; Deng, Z.Y.; Wang, Z.J. Do banks overstate their Value-at-Risk? J. Bank. Financ. 2008, 32, 783–794. [Google Scholar] [CrossRef]

- Van Bekkum, S. Inside debt and bank risk. J. Financ. Quant. Anal. 2016, 51, 359–385. [Google Scholar] [CrossRef]

- Ellul, A.; Yerramilli, V. Stronger risk controls, lower risk: Evidence from US bank holding companies. J. Financ. 2013, 68, 1757–1803. [Google Scholar] [CrossRef]

- Baral, R.; Naik, S.P.; Patnaik, D. Macro-financial analysis of value-at-risk from banking stocks in an Indian scenario. Int. J. Bus. Contin. Risk Manag. 2021, 11, 379–396. [Google Scholar] [CrossRef]

- Elnahass, M.; Marie, M.; Elgammal, M. Terrorist attacks and bank financial stability: Evidence from MENA economies. Rev. Quant. Financ. Account. 2022, 59, 383–427. [Google Scholar] [CrossRef]

- Anderson, R.C.; Fraser, D.R. Corporate control, bank risk taking, and the health of the banking industry. J. Bank. Financ. 2000, 24, 1383–1398. [Google Scholar] [CrossRef]

- Chen, C.R.; Steiner, T.L.; Whyte, A.M. Does stock option-based executive compensation induce risk-taking? An analysis of the banking industry. J. Bank. Financ. 2006, 30, 915–945. [Google Scholar] [CrossRef]

- Tan, Y.; Floros, C. Bank profitability and inflation: The case of China. J. Econ. Stud. 2012, 39, 675–696. [Google Scholar] [CrossRef]

- Camilleri, S.J.; Grima, L.; Grima, S. The effect of dividend policy on share price volatility: An analysis of Mediterranean banks’ stocks. Manag. Financ. 2019, 45, 348–364. [Google Scholar] [CrossRef]

- Ahmed, S.; Sihvonen, J.; Vähämaa, S. CEO facial masculinity and bank risk-taking. Pers. Individ. Differ. 2018, 138, 133–139. [Google Scholar] [CrossRef]

- Tasnia, M.; AlHabshi, S.M.S.J.; Rosman, R. The impact of corporate social responsibility on stock price volatility of the US banks: A moderating role of tax. J. Financ. Rep. Account. 2020, 19, 77–91. [Google Scholar] [CrossRef]

- Gkillas, K.; Konstantatos, C.; Floros, C.; Tsagkanos, A. Realised volatility spillovers between US spot and futures during ECB news: Evidence from the European sovereign debt crisis. Int. Rev. Financ. Anal. 2021, 74, 101706. [Google Scholar] [CrossRef]

- Tuna, G.; Almahadin, H.A. Does interest rate and its volatility affect banking sector development? Empirical evidence from emerging market economies. Res. Int. Bus. Financ. 2021, 58, 101436. [Google Scholar] [CrossRef]

- Foglia, M.; Addi, A.; Angelini, E. The Eurozone banking sector in the time of COVID-19: Measuring volatility connectedness. Glob. Financ. J. 2021, 51, 100677. [Google Scholar] [CrossRef]

- Houston, J.F.; Lin, C.; Lin, P.; Ma, Y. Creditor rights, information sharing, and bank risk taking. J. Financ. Econ. 2010, 96, 485–512. [Google Scholar] [CrossRef]

- Laeven, L.; Levine, R. Bank governance, regulation and risk taking. J. Financ. Econ. 2009, 93, 259–275. [Google Scholar] [CrossRef]

- Pathan, S. Strong boards, CEO power and bank risk-taking. J. Bank. Financ. 2009, 33, 1340–1350. [Google Scholar] [CrossRef]

- Lepetit, L.; Strobel, F. Bank insolvency risk and time-varying Z-score measures. J. Int. Financ. Mark. Inst. Money 2013, 25, 73–87. [Google Scholar] [CrossRef]

- Chiaramonte, L.; Croci, E.; Poli, F. Should we trust the Z-score? Evidence from the European Banking Industry. Glob. Financ. J. 2015, 28, 111–131. [Google Scholar] [CrossRef]

- Mare, D.S.; Moreira, F.; Rossi, R. Nonstationary Z-score measures. Eur. J. Oper. Res. 2017, 260, 348–358. [Google Scholar] [CrossRef]

- Li, X.; Tripe, D.; Malone, C.; Smith, D. Measuring systemic risk contribution: The leave-one-out z-score method. Financ. Res. Lett. 2019, 36, 101316. [Google Scholar] [CrossRef]

- Lepetit, L.; Strobel, F.; Tran, T.H. An alternative Z-score measure for downside bank insolvency risk. Appl. Econ. Lett. 2020, 28, 137–142. [Google Scholar] [CrossRef]

- Pradhan, A.K.; Nibedita, B. The determinants of corporate social responsibility: Evidence from Indian Firms. Glob. Bus. Rev. 2019, 22, 753–766. [Google Scholar] [CrossRef]

- Marie, M.; Kamel, H.; Elbendary, I. How does internal governance affect banks’ financial stability? Empirical evidence from Egypt. Int. J. Discl. Gov. 2021, 18, 240–255. [Google Scholar] [CrossRef]

- Hafeez, B.; Li, X.; Kabir, M.H.; Tripe, D. Measuring bank risk: Forward-looking z-score. Int. Rev. Financ. Anal. 2022, 80, 102039. [Google Scholar] [CrossRef]

- Gropp, R.; Vesala, J.; Vulpes, G. Equity and bond market signals as leading indicators of bank fragility. J. Money, Credit. Bank. 2006, 38, 399–428. [Google Scholar] [CrossRef]

- Chan-Lau, J.A.; Sy, A.N. Distance-to-default in banking: A bridge too far? J. Bank. Regul. 2007, 9, 14–24. [Google Scholar] [CrossRef]

- Bharath, S.T.; Shumway, T. Forecasting default with the Merton distance to default model. Rev. Financ. Stud. 2008, 21, 1339–1369. [Google Scholar] [CrossRef]

- Hagendorff, J.; Vallascas, F. CEO pay incentives and risk-taking: Evidence from bank acquisitions. J. Corp. Financ. 2011, 17, 1078–1095. [Google Scholar] [CrossRef]

- Jessen, C.; Lando, D. Robustness of distance-to-default. J. Bank. Financ. 2015, 50, 493–505. [Google Scholar] [CrossRef]

- Vu, V.T.T.; Do, N.H.; Dang, H.; Nguyen, T.N. Profitability and the distance to default: Evidence from Vietnam securities market. J. Asian Financ. Econ. Bus. 2019, 6, 53–63. [Google Scholar] [CrossRef]

- Nagel, S.; Purnanandam, A. Banks’ risk dynamics and distance to default. Rev. Financ. Stud. 2020, 33, 2421–2467. [Google Scholar] [CrossRef]

- García, C.J.; Herrero, B.; Morillas, F. Corporate board and default risk of financial firms. Econ. Res.-Ekon. Istraž. 2022, 35, 511–528. [Google Scholar] [CrossRef]

- Jo, K.; Choi, G.; Jeong, J.; Ahn, K. Forecasting bank default with the Merton model: The case of US banks. In International Conference on Computational Science; Springer: Cham, Switzerland, 2022; pp. 682–691. [Google Scholar]

- Kanas, A.; Molyneux, P.; Zervopoulos, P.D. Systemic risk and CO2 emissions in the US. J. Financ. Stab. 2023, 64, 101088. [Google Scholar] [CrossRef]

- Hovakimian, A.; Kane, E.; Laeven, L. How country and safety-net characteristics affect bank risk-shifting. J. Financ. Serv. Res. 2003, 23, 177–204. [Google Scholar] [CrossRef]

- Fernández, A.I.; González, F. How accounting and auditing systems can counteract risk-shifting of safety-nets in banking: Some international evidence. J. Financ. Stab. 2005, 1, 466–500. [Google Scholar] [CrossRef]

- Wilson, L.; Wu, Y.W. Common (stock) sense about risk-shifting and bank bailouts. Financ. Mark. Portf. Manag. 2010, 24, 3–29. [Google Scholar] [CrossRef]

- Gropp, R.; Hakenes, H.; Schnabel, I. Competition, risk-shifting, and public bail-out policies. Rev. Financ. Stud. 2011, 24, 2084–2120. [Google Scholar] [CrossRef]

- Duran, M.A.; Lozano-Vivas, A. Moral hazard and the financial structure of banks. J. Int. Financ. Mark. Inst. Money 2015, 34, 28–40. [Google Scholar] [CrossRef]

- Batten, J.A.; Vo, X.V. Bank risk shifting and diversification in an emerging market. Risk Manag. 2016, 18, 217–235. [Google Scholar] [CrossRef]

- Elliott, M.; Georg, C.-P.; Hazell, J. Systemic risk shifting in financial networks. J. Econ. Theory 2020, 191, 105157. [Google Scholar] [CrossRef]

- Whited, T.M.; Wu, Y.; Xiao, K. Low interest rates and risk incentives for banks with market power. J. Monet. Econ. 2021, 121, 155–174. [Google Scholar] [CrossRef]

- Allen, F.; Barlevy, G.; Gale, D. Asset price booms and macroeconomic policy: A risk-shifting approach. Am. Econ. J. Macroecon. 2022, 14, 243–280. [Google Scholar] [CrossRef]

- Nier, E.; Baumann, U. Market discipline, disclosure and moral hazard in banking. J. Financ. Intermediat. 2006, 15, 332–361. [Google Scholar] [CrossRef]

- Flannery, M.J.; Rangan, K.P. What caused the bank capital build-up of the 1990s? Rev. Financ. 2008, 12, 391–429. [Google Scholar] [CrossRef]

- Gropp, R.; Heider, F. The determinants of bank capital structure. Rev. Financ. 2010, 14, 587–622. [Google Scholar] [CrossRef]

- Ziaei, S.M. The impact of corporations and banking system leverage on renewable energy: Evidence from selected OECD countries. Renew. Energy Focus 2021, 37, 68–77. [Google Scholar] [CrossRef]

- Fu, B.; Luo, D. Monetary policy uncertainty and bank leverage: Evidence from China. Econ. Lett. 2021, 203, 109866. [Google Scholar] [CrossRef]

- Religiosa, M.W.; Surjandari, D.A. The Relation of Company Risk, Liquidity, Leverage, Capital Adequacy and Earning Management: Evidence from Indonesia Banking Companies. Mediterr. J. Soc. Sci. 2021, 12, 1. [Google Scholar] [CrossRef]

- Kahihu, P.K.; Wachira, D.M.; Muathe, S.M. Managing market risk for financial performance: Experience from micro finance institution in Kenya. J. Financ. Regul. Compliance 2021, 29, 561–579. [Google Scholar] [CrossRef]

- Coimbra, N.; Kim, D.; Rey, H. Central Bank Policy and the concentration of risk: Empirical estimates. J. Monet. Econ. 2022, 125, 182–198. [Google Scholar] [CrossRef]

- Berger, A.N.; Cai, J.; Roman, R.A.; Sedunov, J. Supervisory enforcement actions against banks and systemic risk. J. Bank. Financ. 2021, 140, 106222. [Google Scholar] [CrossRef]

- Jin, X.; Ke, Y.; Chen, X. Credit pricing for financing of small and micro enterprises under government credit enhancement: Leverage effect or credit constraint effect. J. Bus. Res. 2021, 138, 185–192. [Google Scholar] [CrossRef]

- Iwatsubo, K. Bank capital shocks and portfolio risk: Evidence from Japan. Jpn. World Econ. 2007, 19, 166–186. [Google Scholar] [CrossRef]

- Vallascas, F.; Hagendorff, J. The risk sensitivity of capital requirements: Evidence from an international sample of large banks. Rev. Financ. 2013, 17, 1947–1988. [Google Scholar] [CrossRef]

- Berger, A.N.; Kick, T.; Schaeck, K. Executive board composition and bank risk taking. J. Corp. Financ. 2014, 28, 48–65. [Google Scholar] [CrossRef]

- Basher, S.A.; Kessler, L.M.; Munkin, M.K. Bank capital and portfolio risk among Islamic banks. Rev. Financ. Econ. 2017, 34, 1–9. [Google Scholar] [CrossRef]

- Shim, J. Does diversification drive down risk-adjusted returns? A quantile regression approach. Asia-Pacific J. Risk Insur. 2017, 11, 20160015. [Google Scholar] [CrossRef]

- Ding, D.; Sickles, R.C. Frontier efficiency, capital structure, and portfolio risk: An empirical analysis of US banks. BRQ Bus. Res. Q. 2018, 21, 262–277. [Google Scholar] [CrossRef]

- Shah, S.A.A.; Sukmana, R.; Fianto, B.A. Integration of Islamic bank specific risks and their impact on the portfolios of Islamic Banks. Int. J. Islam. Middle East. Financ. Manag. 2021, 14, 561–578. [Google Scholar] [CrossRef]

- Abbas, F.; Masood, O.; Ali, S.; Rizwan, S. How do capital ratios affect bank risk-taking: New evidence from the United States. SAGE Open 2021, 11, 2158244020979678. [Google Scholar] [CrossRef]

- Fernández-Aguado, P.G.; Martínez, E.T.; Ruíz, R.M.; Ureña, A.P. Evaluation of European Deposit Insurance Scheme funding based on risk analysis. Int. Rev. Econ. Financ. 2021, 78, 234–247. [Google Scholar] [CrossRef]

- Scholtens, B.; van’t Klooster, S. Sustainability and bank risk. Palgrave Commun. 2019, 5, 105. [Google Scholar] [CrossRef]

- Draghi, M. The benefits of European supervision. In Proceedings of the InSpeech by the President of the ECB, at the ACPR Conference on Financial Supervision, Paris, France, 18 September 2018. [Google Scholar]

- Ding, Y.; Chowdhury, G.G.; Foo, S. Bibliometric Cartography of Information Retrieval Research by Using Co-Word Analysis. Inf. Process. Manag. 2001, 37, 817–842. [Google Scholar] [CrossRef]

- Zupic, I.; Čater, T. Bibliometric methods in management and organisation. Organ. Res. Methods 2015, 18, 429–472. [Google Scholar] [CrossRef]

- Khudzari, J.M.; Kurian, J.; Tartakovsky, B.; Raghavan, G. Bibliometric analysis of global research trends on microbial fuel cells using Scopus database. Biochem. Eng. J. 2018, 136, 51–60. [Google Scholar] [CrossRef]

- Zhang, D.; Zhang, Z.; Managi, S. A bibliometric analysis on green finance: Current status, development, and future directions. Financ. Res. Lett. 2019, 29, 425–430. [Google Scholar] [CrossRef]

- Goyal, K.; Kumar, S. Financial literacy: A systematic review and bibliometric analysis. Int. J. Consum. Stud. 2020, 45, 80–105. [Google Scholar] [CrossRef]

- Alshater, M.M.; Saba, I.; Supriani, I.; Rabbani, M.R. Fintech in Islamic finance literature: A review. Heliyon 2022, 8, e10385. [Google Scholar] [CrossRef] [PubMed]

- Costa, D.F.; Carvalho, F.D.; Moreira, B.C. Behavioral economics and behavioral finance: A bibliometric analysis of the scientific fields. J. Econ. Surv. 2019, 33, 3–24. [Google Scholar] [CrossRef]

- Alsharif, A.H.; Salleh, N.Z.M.; Baharun, R.; Abuhassna, H.; Alharthi Rami Hashem, E. A global research trends of neuromarketing: 2015–2020. Rev. Comun 2022, 21, 15–32. [Google Scholar] [CrossRef]

- Alsharif, A.; Salleh, N.Z.M.; Pilelienė, L.; Abbas, A.F.; Ali, J. Current Trends in the Application of EEG in Neuromarketing: A Bibliometric Analysis. Sci. Ann. Econ. Bus. 2022, 69, 393–415. [Google Scholar] [CrossRef]

- Alsharif, A.H.; Salleh, N.Z.M.; Baharun, R.; Alharthi Rami Hashem, E. Neuromarketing research in the last five years: A bibliometric analysis. Cogent Bus. Manag. 2021, 8, 1978620. [Google Scholar] [CrossRef]

- Lsharif, A.H.; Salleh, N.Z.M.; Baharun, R.; Hashem, E.A.R.; Mansor, A.A.; Ali, J.; Abbas, A.F. Neuroimaging Techniques in Advertising Research: Main Applications, Development, and Brain Regions and Processes. Sustainability 2021, 13, 6488. [Google Scholar] [CrossRef]

- Meho, L.I.; Yang, K. Impact of data sources on citation counts and rankings of LIS faculty: Web of Science versus Scopus and Google Scholar. J. Am. Soc. Inf. Sci. Technol. 2007, 58, 2105–2125. [Google Scholar] [CrossRef]

- Mingo, J.J. The effect of deposit rate ceilings on bank risk. J. Bank. Finance 1978, 2, 367–378. [Google Scholar] [CrossRef]

- Boyd, J.H.; DE Nicoló, G. The theory of bank risk taking and competition revisited. J. Financ. 2005, 60, 1329–1343. [Google Scholar] [CrossRef]

- Saunders, A.; Strock, E.; Travlos, N.G. Ownership structure, deregulation, and bank risk taking. J. Financ. 1990, 45, 643–654. [Google Scholar] [CrossRef]

- Berger, A.N.; Udell, G.F. Collateral, loan quality and bank risk. J. Monet. Econ. 1990, 25, 21–42. [Google Scholar] [CrossRef]

- Morgan, D.P. Rating banks: Risk and uncertainty in an opaque industry. Am. Econ. Rev. 2002, 92, 874–888. [Google Scholar] [CrossRef]

- Agoraki, M.-E.K.; Delis, M.D.; Pasiouras, F. Regulations, competition and bank risk-taking in transition countries. J. Financ. Stab. 2011, 7, 38–48. [Google Scholar] [CrossRef]

- Furlong, F.T.; Keeley, M.C. Capital regulation and bank risk-taking: A note. J. Bank. Financ. 1989, 13, 883–891. [Google Scholar] [CrossRef]

- Bushman, R.M.; Williams, C.D. Accounting discretion, loan loss provisioning, and discipline of banks’ risk-taking. J. Account. Econ. 2012, 54, 1–18. [Google Scholar] [CrossRef]

- Delis, M.D.; Kouretas, G.P. Interest rates and bank risk-taking. J. Bank. Financ. 2011, 35, 840–855. [Google Scholar] [CrossRef]

- Aria, M.; Cuccurullo, C. Bibliometrix: An R-tool for comprehensive science mapping analysis. J. Informetr. 2017, 11, 959–975. [Google Scholar] [CrossRef]

- Allen, F.; Carletti, E.; Gu, X. The roles of banks in financial systems Oxford; Oxford University Press: Oxford, UK, 2008. [Google Scholar]

- Kao, M.C.; Lin, C.Y.; Hsu, P.P.; Chen, Y.H. Impact of the financial crisis and risk management on performance of financial holding companies in Taiwan. World Acad. Sci. Eng. Technol. 2011, 50, 413–417. [Google Scholar]

- Berger, A.N.; Demirgüç-Kunt, A. Banking research in the time of COVID-19. J. Financ. Stab. 2021, 57, 100939. [Google Scholar] [CrossRef]

- Ashraf, B.N.; Zheng, C.; Arshad, S. Effects of national culture on bank risk-taking behavior. Res. Int. Bus. Financ. 2016, 37, 309–326. [Google Scholar] [CrossRef]

- Ashraf, B.N. Political institutions and bank risk-taking behavior. J. Financ. Stab. 2017, 29, 13–35. [Google Scholar] [CrossRef]

- Zheng, C.; Moudud-Ul-Huq, S.; Rahman, M.M.; Ashraf, B.N. Does the ownership structure matter for banks’ capital regulation and risk-taking behavior? Empirical evidence from a developing country. Res. Int. Bus. Financ. 2017, 42, 404–421. [Google Scholar] [CrossRef]

- Rahman, M.M.; Zheng, C.; Ashraf, B.N.; Rahman, M.M. Capital requirements, the cost of financial intermediation and bank risk-taking: Empirical evidence from Bangladesh. Res. Int. Bus. Financ. 2018, 44, 488–503. [Google Scholar] [CrossRef]

- Qian, N.; Zhang, K.; Zheng, C.; Ashraf, B.N. How do regulatory ability and bank competition affect the adoption of explicit deposit insurance scheme and banks’ risk-taking behavior? Int. Rev. Econ. Financ. 2019, 61, 69–90. [Google Scholar] [CrossRef]

- Ashraf, B.N.; Zheng, C.; Jiang, C.; Qian, N. Capital regulation, deposit insurance and bank risk: International evidence from normal and crisis periods. Res. Int. Bus. Financ. 2020, 52, 101188. [Google Scholar] [CrossRef]

- Cheng, M.; Zhao, H.; Zhang, J. The effects of ownership structure and listed status on bank risk in China. J. Appl. Bus. Res. 2013, 29, 695. [Google Scholar] [CrossRef]

- Geng, H.; Cheng, M.; Zhang, J. Effects of wealth management products on bank risk in China: The role of audit committee effectiveness. Pac. Econ. Rev. 2021, 26, 575–616. [Google Scholar] [CrossRef]

- Geng, H.; Cheng, M.; Zhang, J.; Zhao, H. The Effects of Going Public on Bank Risks: Evidence from China. Emerg. Mark. Financ. Trade 2019, 57, 444–464. [Google Scholar] [CrossRef]

- Delis, M.D.; Staikouras, P.K. Supervisory effectiveness and bank risk. Rev. Financ. 2011, 15, 511–543. [Google Scholar] [CrossRef]

- Buch, C.M.; DeLong, G. Do weak supervisory systems encourage bank risk-taking? J. Financ. Stab. 2008, 4, 23–39. [Google Scholar] [CrossRef]

- Cunningham, D.F.; Rose, J.T. Bank risk taking and changes in the financial condition of banks’ small and midsized commercial customers, 1978–1988 and 1988–1991. J. Financ. Serv. Res. 1994, 8, 301–310. [Google Scholar] [CrossRef]

- Lambert, C.; Noth, F.; Schüwer, U. How do insured deposits affect bank risk? Evidence from the 2008 Emergency Economic Stabilization Act. J. Financ. Intermediat. 2017, 29, 81–102. [Google Scholar] [CrossRef]

- Keeley, M. Deposit insurance, risk, and market power in banking. Am. Econ. Rev. 1990, 80, 1183–1200. [Google Scholar]

| Description | Results |

|---|---|

| MAIN INFORMATION ABOUT THE DATA | |

| Timespan | 1978:2022 |

| Sources (journals, books, etc.) | 297 |

| Documents | 671 |

| Average years from publication | 7.05 |

| Average citations per document | 23.44 |

| Average citations per year per document | 2.553 |

| References | 26,709 |

| DOCUMENT TYPES | |

| Article | 605 |

| Book | 1 |

| Book chapter | 21 |

| Conference paper | 29 |

| Editorial | 2 |

| Note | 2 |

| Review | 9 |

| Short survey | 2 |

| DOCUMENT CONTENTS | |

| Keywords Plus (ID) | 541 |

| Author’s Keywords (DE) | 1286 |

| AUTHORS | |

| Authors | 1323 |

| Author appearances | 1650 |

| Authors of single-authored documents | 121 |

| Authors of multi-authored documents | 1202 |

| AUTHOR COLLABORATION | |

| Single-authored documents | 136 |

| Documents per author | 0.51 |

| Authors per document | 1.96 |

| Co-Authors per document | 2.44 |

| Collaboration index | 2.23 |

| Language | Number of Articles | % |

|---|---|---|

| English | 655 | 97.62 |

| German | 1 | 0.15 |

| Chinese | 5 | 0.75 |

| Italian | 1 | 0.15 |

| Spanish | 2 | 0.30 |

| Russian | 3 | 0.45 |

| Ukrainian | 2 | 0.30 |

| French | 2 | 0.30 |

| Total | 671 | 100 |

| Author | NP | h_Index | g_Index | m_Index | TC | PY_Start |

|---|---|---|---|---|---|---|

| ASHRAF BN | 7 | 7 | 1 | 238 | 7 | 2016 |

| ZHANG J | 5 | 9 | 0.455 | 91 | 11 | 2012 |

| DELIS MD | 5 | 6 | 0.417 | 702 | 6 | 2011 |

| LI J | 5 | 6 | 1 | 78 | 6 | 2018 |

| CHEN M | 4 | 6 | 0.5 | 197 | 6 | 2015 |

| HAQ M | 4 | 6 | 0.364 | 132 | 6 | 2012 |

| SAUNDERS A | 4 | 6 | 0.121 | 685 | 6 | 1990 |

| WANG R | 4 | 6 | 0.5 | 187 | 6 | 2015 |

| WU J | 4 | 6 | 0.5 | 196 | 6 | 2015 |

| ABBAS F | 3 | 4 | 1 | 17 | 6 | 2020 |

| Study | Title | Journal | TC | TC/Year |

|---|---|---|---|---|

| 1. | The theory of bank risk-taking and competition revisited | Journal of Finance | 852 | 47.3 |

| 2. | Ownership structure, deregulation, and bank risk-taking | Journal of Finance | 530 | 16.1 |

| 3. | Collateral, loan quality and bank risk | Journal of Monetary Economics | 500 | 15.2 |

| 4. | Rating banks: Risk and uncertainty in an opaque industry | American Economic Review | 496 | 23.6 |

| 5. | Strong boards, CEO power and bank risk-taking | Journal of Banking and Finance | 481 | 34.4 |

| 6. | Creditor rights, information sharing, and bank risk-taking | Journal of Financial Economics | 404 | 31.1 |

| 7. | Regulations, competition and bank risk-taking in transition countries | Journal of Financial Stability | 332 | 27.7 |

| 8. | Capital regulation and bank risk-taking: A note | Journal of Banking and Finance | 282 | 8.3 |

| 9. | Accounting discretion, loan loss provisioning, and discipline of ‘banks’ risk-taking | Journal of Accounting and Economics | 267 | 24.3 |

| 10. | Executive board composition and bank risk-taking | Journal of Corporate Finance | 264 | 29.3 |

| Study | Title | Journal | LC | GC | LC/GC (%) |

|---|---|---|---|---|---|

| 1. | The theory of bank risk-taking and competition revisited | Journal of Finance | 70 | 852 | 8.22 |

| 2. | Creditor rights, information sharing, and bank risk-taking | Journal of Financial Economics | 60 | 404 | 14.85 |

| 3. | Ownership structure, deregulation, and bank risk-taking | Journal of Financial Economics | 57 | 530 | 10.75 |

| 4. | Regulations, competition and bank risk-taking in transition countries | Journal of Financial Stability | 48 | 332 | 14.46 |

| 5. | Interest rates and bank risk-taking | Journal of Banking and Finance | 46 | 228 | 20.18 |

| 6. | Strong boards, CEO power and bank risk-taking | Journal of Banking and Finance | 46 | 481 | 9.56 |

| 7. | Factors affecting bank risk-taking: Evidence from Japan | Journal of Banking and Finance | 32 | 150 | 21.33 |

| 8. | How does competition affect bank risk-taking? | Journal of Financial Stability | 25 | 264 | 9.47 |

| 9. | Real interest rates, leverage, and bank risk-taking | Journal of Economic Theory | 24 | 164 | 14.63 |

| 10. | Executive board composition and bank risk-taking | Journal of Corporate Finance | 23 | 264 | 8.71 |

| Country | Number of Articles | % |

|---|---|---|

| USA | 175 | 26 |

| CHINA | 107 | 16 |

| UK | 69 | 10 |

| GERMANY | 41 | 06 |

| FRANCE | 32 | 5 |

| ITALY | 31 | 5 |

| AUSTRALIA | 29 | 4 |

| MALAYSIA | 29 | 4 |

| SPAIN | 29 | 4 |

| PAKISTAN | 21 | 3 |

| Total | 563 | 84 |

| Total Sample | 671 | 100 |

| Affiliation | Number of Articles | % |

|---|---|---|

| Southwestern University of Finance and Economics | 12 | 1.79 |

| University of Economics Ho Chi Minh City | 11 | 1.64 |

| Bangor University | 9 | 1.34 |

| Huazhong University of Science and Technology | 9 | 1.34 |

| Jinan University | 9 | 1.34 |

| Renmin University of China | 9 | 1.34 |

| New York University | 8 | 1.19 |

| Tilburg University | 8 | 1.19 |

| Federal Reserve Bank of New York | 7 | 1.04 |

| Monash University | 7 | 1.04 |

| Total | 89 | 13.26 |

| Total Sample | 671 | 100 |

| Source (Journal) | No. of Articles | % | h_Index | g_Index | % m_Index | TC | PY Start |

|---|---|---|---|---|---|---|---|

| Journal of Banking and Finance | 49 | 7.30 | 24 | 48 | 53.3 | 2874 | 1978 |

| Journal of Financial Stability | 18 | 2.68 | 13 | 18 | 86.7 | 1203 | 2008 |

| Journal of Financial Services Research | 17 | 2.53 | 10 | 14 | 34.5 | 688 | 1994 |

| Journal of Financial Intermediation | 16 | 2.38 | 11 | 13 | 45.8 | 703 | 1999 |

| Journal of International Financial Markets, Institutions and Money | 16 | 2.38 | 9 | 12 | 42.9 | 272 | 2002 |

| Research In International Business and Finance | 12 | 1.79 | 8 | 10 | 114.3 | 203 | 2016 |

| Banks And Bank Systems | 12 | 1.79 | 2 | 10 | 12.5 | 11 | 2007 |

| Journal of Money, Credit, and Banking | 10 | 1.49 | 7 | 2 | 25.9 | 209 | 1996 |

| Finance Research Letters | 9 | 1.34 | 4 | 9 | 57.1 | 50 | 2016 |

| Journal of International Money and Finance | 9 | 1.34 | 7 | 4 | 33.3 | 346 | 2002 |

| Total | 168 | 25.04 | |||||

| Total sample | 671 | 100 |

| Author Keywords | Occurrences | % | Keywords-Plus | Occurrences | % |

|---|---|---|---|---|---|

| Bank Risk | 129 | 27.56 | Banking | 47 | 37.60 |

| Bank Risk-Taking | 61 | 13.03 | Risk Assessment | 36 | 28.80 |

| Banks | 49 | 10.47 | Risk Management | 18 | 14.40 |

| Risk-Taking | 43 | 9.19 | Commercial Bank | 12 | 9.60 |

| Risk Management | 33 | 7.05 | Financial Crisis | 12 | 9.60 |

| Financial Crisis | 32 | 6.84 | Financial Market | 11 | 8.80 |

| Monetary Policy | 31 | 6.62 | China | 10 | 8.00 |

| Risk | 31 | 6.62 | Finance | 9 | 7.20 |

| Banking | 30 | 6.41 | Risk Taking | 9 | 7.20 |

| Corporate Governance | 29 | 6.20 | Empirical Analysis | 8 | 6.40 |

| Total | 468 | 100 | Total | 125 | 100 |

Disclaimer/Publisher’s Note: The statements, opinions and data contained in all publications are solely those of the individual author(s) and contributor(s) and not of MDPI and/or the editor(s). MDPI and/or the editor(s) disclaim responsibility for any injury to people or property resulting from any ideas, methods, instructions or products referred to in the content. |

© 2023 by the authors. Licensee MDPI, Basel, Switzerland. This article is an open access article distributed under the terms and conditions of the Creative Commons Attribution (CC BY) license (https://creativecommons.org/licenses/by/4.0/).

Share and Cite

Qi, B.; Marie, M.; Abdelwahed, A.S.; Khatatbeh, I.N.; Omran, M.; Fayad, A.A.S. Bank Risk Literature (1978–2022): A Bibliometric Analysis and Research Front Mapping. Sustainability 2023, 15, 4508. https://doi.org/10.3390/su15054508

Qi B, Marie M, Abdelwahed AS, Khatatbeh IN, Omran M, Fayad AAS. Bank Risk Literature (1978–2022): A Bibliometric Analysis and Research Front Mapping. Sustainability. 2023; 15(5):4508. https://doi.org/10.3390/su15054508

Chicago/Turabian StyleQi, Baolei, Mohamed Marie, Ahmed S. Abdelwahed, Ibrahim N. Khatatbeh, Mohamed Omran, and Abdallah A. S. Fayad. 2023. "Bank Risk Literature (1978–2022): A Bibliometric Analysis and Research Front Mapping" Sustainability 15, no. 5: 4508. https://doi.org/10.3390/su15054508

APA StyleQi, B., Marie, M., Abdelwahed, A. S., Khatatbeh, I. N., Omran, M., & Fayad, A. A. S. (2023). Bank Risk Literature (1978–2022): A Bibliometric Analysis and Research Front Mapping. Sustainability, 15(5), 4508. https://doi.org/10.3390/su15054508