The Role of Natural Gas in Mitigating Greenhouse Gas Emissions: The Environmental Kuznets Curve Hypothesis for Major Gas-Producing Countries †

Abstract

1. Introduction

- To the best of our knowledge, very few empirical studies have examined the validity of the EKC hypothesis with the impact of natural gas consumption on CO2 emissions in the case of our sample countries.

- Standard panel data techniques assume cross-sectional independence. However, this assumption is hard to satisfy due to the high degree of socioeconomic integration among countries, and this may create biased and inconsistent estimates in misleading conclusions [6,7,8]. Therefore, this analysis utilizes second-generation econometric approaches, such as the common correlated effects mean group (CCEMG) of Pesaran [9] and the augmented mean group (AMG) estimator of Eberhardt and Teal [10], assuming cross-sectional dependence to provide more robust analysis. Although there are many studies using either first- or second-generation panel data methods, there are few studies that use both methods.

2. Literature Review

| Authors | Period | Study Area | Variables | Method | Results |

|---|---|---|---|---|---|

| Alam and Adil [22] | 1971–2016 | India | CO2, GDP, PES, FD, TO | ARDL | No credence to EKC |

| Apergis and Ozturk [23] | 1990–2011 | Asian countries | CO2, GDP, LAND, POP, Industry Shares in GDP | GMM | Validity of EKC |

| Atasoy [24] | 1960–2010 | The US | CO2, GDP, EC, POP | AMG, CCEMG | AMG validates the EKC. CCEMG provides only weak evidence on the EKC |

| Baek [25] | 1980–2009 | 12 major nuclear-generating countries | CO2, GDP, EC, NE | DOLS, FMOLS | CO2 emissions tend to decrease monotonically with income growth, providing no evidence in support of EKC for CO2 emissions |

| Jammazi and Aloui [26] | 1980–2013 | GCC countries | CO2, EC, GDP | Wavelet Approaches | Bidirectional causality between EC and GDP, and unidirectional causality from EC to CO2 |

| Kohler [27] | 1960–2009 | South Africa | CO2, GDP, EC, TO | ARDL, Johansen Cointegration, VECM | Positive bidirectional causality exists |

| Lin et al., [28] | 1980–2011 | Nigeria | CO2, EI, POP, CI, IVD, GDP | VECM | An inverse significant relationship between IND and CO2 |

| El-Aasar and A. Hanafy [4] | 1971–2012 | Egypt | GHG, GDP, RE, TO | ARDL | EKC hypothesis does not exist for GHG emissions in Egypt for both short- and long term |

| Ozcan, B. [29] | 1990–2008 | Middle East countries | CO2, GDP, EC | FMOLS, VECM | Unidirectional causality from economic growth to energy consumption in the short run |

| Paramati et al., [30] | 1991–2012 | G20 countries | CO2, RE, NRE, POP, GDP, FDI, SMC | Panel Granger causality | Confirm a significant long run equilibrium relationship among the variables |

| Rafindadi [31] | 1961–2012 | Japan | CO2, GDP, EX, IM | ARDL | Presence of EKC despite the deteriorating income of the country |

| Saboori et al., [32] | 1977–2008 | OPEC countries | CO2, GDP, Labor, Capital, OC, OP | ARDL, TYDL | EKC approves. Oil prices reduce environmental damage by their negative effect on the ecological footprint |

| Saidi and Mbarek [33] | 1990–2013 | 19 emerging economies | CO2, NE, RE, GDP | ARDL | Invalidity of EKC |

| Ulucak et al., [34] | 1992–2016 | BRICS countries | GDP, RE, Urbanization, Natural Resource Rent, Ecological Footprint | FMOLS, DOLS | Approve of EKC in case of BRICS Countries |

| Wang et al., [35] | 1990–2012 | China | CO2, EC, GDP | VECM | Shocks in CO2 have a small effect on EC and GDP |

| Zoundi [36] | 1980–2012 | 25 African countries | CO2, GDP, RE | FMOLS, DOLS | No evidence of a total validation of EKC. However, CO2 emissions increase with GDP |

3. Methodology and Data

3.1. Empirical Model

- Cross-sectional dependence tests to check interdependencies between cross-sectional units (countries) (Section 4.1)

- Slope heterogeneity tests for slope homogeneity in large panels (Section 4.2)

- Panel unit root tests to check the stationarity of the variables (Section 4.3)

- Cointegration tests to check the validity of a cointegration relationship between the variables (Section 4.4)

- Estimate the long-run parameters of explanatory variables (Section 4.5)

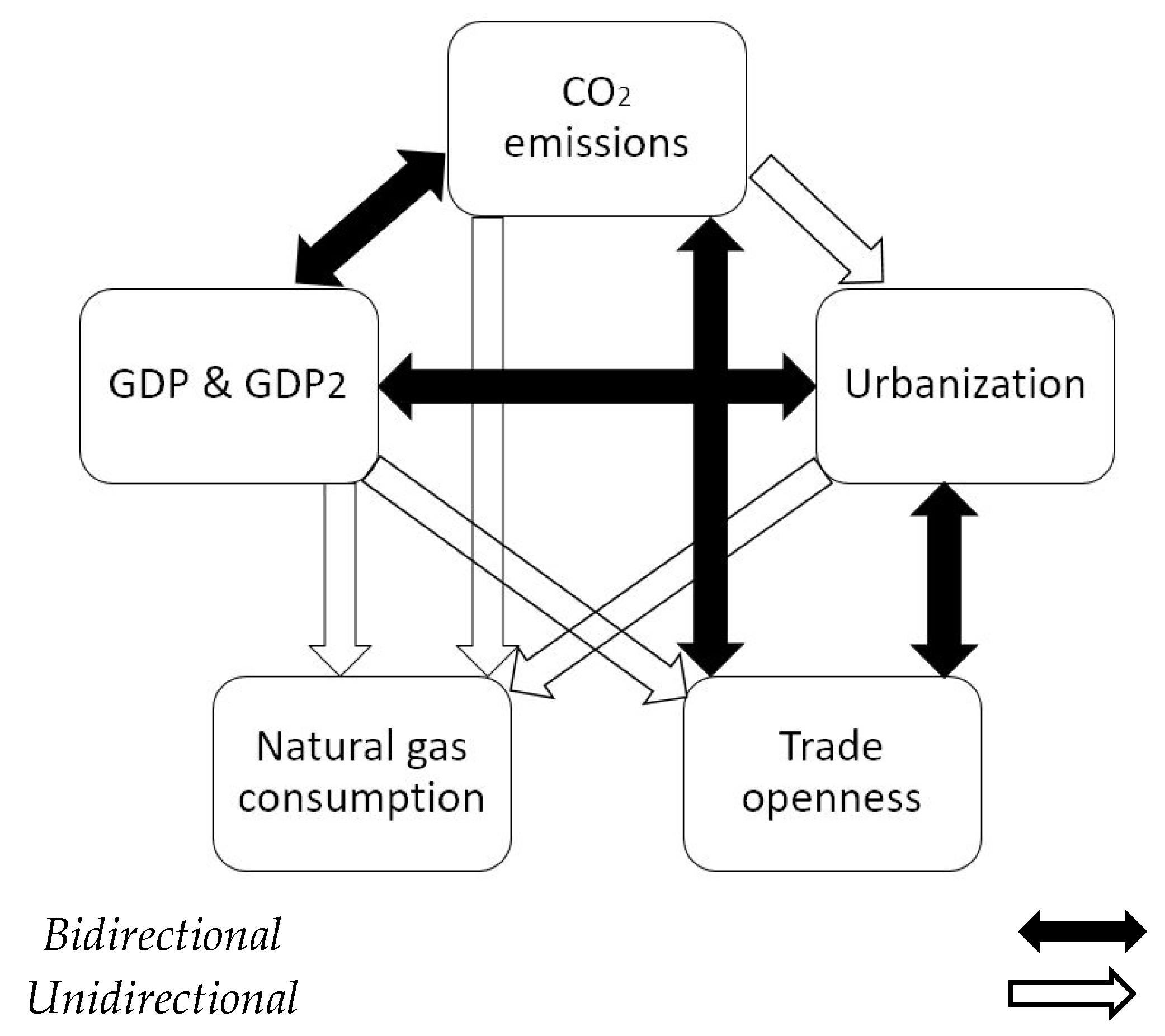

- The Dumitrescu and Hurlin (D–H) method to reveal the causal relationships between the variables (Section 4.6)

3.2. Data and Descriptive Statistics

4. Estimation Techniques and Results

4.1. Cross-Sectional Dependence Test

4.2. The Slope Homogeneity Test

4.3. Testing for Stationarity

4.4. Cointegration Tests

4.5. Estimate the Long-Run Parameters

4.6. Panel Causality Test

5. Conclusions

6. Policy Implications

- (i)

- To invest in technologies to prevent emissions from the entire gas value-chain: considering the impact of natural gas production and exports and economic development on CO2 emissions, policymakers should consider measures to not only develop their natural resources but also employ technologies to prevent release of CO2 and methane emissions generated through conventional production facilities. Today, proven technology exists to reduce gas flaring, methane venting, and even to capture, use, or store CO2 emissions (i.e., CCS/CCUS). Accordingly, the natural gas industry is capital-intensive, with long lead times and payback periods that require policy and regulatory stability. Sufficient investments through the entire gas value-chain, as well as in clean technologies, including CCS/CCUS capacity, are required to attain the UN Sustainable Development Goals and for the very battle of mitigating and adapting to climate change.

- (ii)

- To accelerate the reform of fossil fuel subsidies: the implicit subsidies typically occur in countries with relatively rich oil and gas reserves, where state-owned oil and gas companies can be mandated to sell refined products for the domestic market at lower prices than production costs (e.g., in the mentioned 12 sample countries). Fossil fuel subsidies that are offered for a long period are not only inefficient but also dangerous due to gradual increases in energy demand and consequent increases in CO2 emissions. Furthermore, as energy cost is artificially lower due to the subsidies, this will drive continued dependence on fossil-based fuels. As a result, subsidies may allow governments to build or develop new fossil fuel infrastructure, extending use of fossil fuels and, as a result, delaying economic transition to cleaner energies. Further, low domestic fossil fuel prices have led to immense oil and gas demand growth that cannot continue if oil- and gas-exporting countries wish to continue exporting. Only very high price jumps can stop this development, but, politically, these price jumps are very costly for many governments [63]. Thus, it is recommended that countries gradually remove fossil fuel subsidies, introduce true energy pricing, and promote mechanisms and policies, such as tax changes, feed-in tariffs, carbon pricing, and renewable portfolio standards.

Author Contributions

Funding

Institutional Review Board Statement

Informed Consent Statement

Data Availability Statement

Conflicts of Interest

References

- Gas Exporting Countries Forum. Available online: https://www.gecf.org/gas-data/environment.aspx (accessed on 1 March 2021).

- Moghaddam, H. Electric Vehicle Growth to Lead to Higher Gas Demand; Petroleum Exploration Society of Australia: Beaumaris, VIC, Australia, 2021. [Google Scholar]

- Erdogan, S.; Okumus, I.; Guzel, A.E. Revisiting the Environmental Kuznets Curve hypothesis in OECD countries: The role of renewable, non-renewable energy, and oil prices. Environ. Sci. Pollut. Res. 2020, 27, 23655–23663. [Google Scholar] [CrossRef] [PubMed]

- El-Aasar, K.M.; Hanafy, S.A. Investigating the environmental Kuznets curve hypothesis in Egypt: The role of renewable energy and trade in mitigating GHGs. Int. J. Energy Econ. Policy 2018, 8, 177–184. [Google Scholar]

- Stern, D.I. The environmental Kuznets curve after 25 years. J. Bioecon. 2017, 19, 7–28. [Google Scholar] [CrossRef]

- Dong, K.; Sun, R.; Hochman, G. Do natural gas and renewable energy consumption lead to less CO2 emission? Empirical evidence from a panel of BRICS countries. Energy 2017, 141, 1466–1478. [Google Scholar] [CrossRef]

- Dong, K.; Sun, R.; Li, H.; Liao, H. Does natural gas consumption mitigate CO2 emissions: Testing the environmental Kuznets curve hypothesis for 14 Asia-Pacific countries. Renew. Sustain. Energy Rev. 2018, 94, 419–429. [Google Scholar] [CrossRef]

- Dong, K.; Sun, R.; Dong, C.; Li, H.; Zeng, X.; Ni, G. Environmental Kuznets Curve for PM2.5 emissions in Beijing, China: What role can natural gas consumption play? Ecol. Indic. 2018, 93, 591–601. [Google Scholar] [CrossRef]

- Pesaran, M.H. Estimation and inference in large heterogeneous panels with a multifactor error structure. Econometrica 2006, 74, 967–1012. [Google Scholar] [CrossRef]

- Eberhardt, M.; Teal, F. Productivity Analysis in Global Manufacturing Production; University of Oxford: Oxford, UK, 2010. [Google Scholar]

- Kuznets, S. Economic growth and income inequality. Am. Econ. Rev. 1955, 45, 1–28. [Google Scholar]

- Grossman, G.M.; Krueger, A.B. Environmental Impacts of a North American Free Trade Agreement; National Bureau of Economic Research, Inc.: Cambridge, MA, USA, 1991. [Google Scholar]

- Zambrano-Monserrate, M.A.; Silva-Zambrano, C.A.; Davalos-Penafiel, J.L.; Zambrano-Monserrate, A.; Ruano, M.A. Testing environmental Kuznets curve hypothesis in Peru: The role of renewable electricity, petroleum and dry natural gas. Renew. Sustain. Energy Rev. 2018, 82, 4170–4178. [Google Scholar] [CrossRef]

- Layachi, O.B. Effects of energy prices on environmental pollution: Testing environmental Kuznets curve for Algeria. Int. J. Energy Econ. Policy 2019, 9, 401–408. [Google Scholar] [CrossRef]

- Lotfalipour, M.R.; Falahi, M.A.; Ashena, M. Economic growth, CO2 emissions, and fossil fuels consumption in Iran. Energy 2010, 35, 5115–5120. [Google Scholar] [CrossRef]

- Li, H.; Shahbaz, M.; Jiang, H.; Dong, K. Is natural gas consumption mitigating air pollution? Fresh evidence from national and regional analysis in China. Sustain. Prod. Consum. 2021, 27, 325–336. [Google Scholar] [CrossRef]

- Murshed, M.; Alam, R.; Ansarin, A. The environmental Kuznets curve hypothesis for Bangladesh: The importance of natural gas, liquefied petroleum gas, and hydropower consumption. Environ. Sci. Pollut. Res. 2021, 28, 17208–17227. [Google Scholar] [CrossRef] [PubMed]

- Solarin, S.A.; Lean, H.H. Natural gas consumption, income, urbanization, and CO2 emissions in China and India. Environ. Sci. Pollut. Res. 2016, 23, 18753–18765. [Google Scholar] [CrossRef] [PubMed]

- Müller-Fürstenberger, G.; Wagner, M. Exploring the environmental Kuznets hypothesis: Theoretical and econometric problems. Ecol. Econ. 2007, 62, 648–660. [Google Scholar] [CrossRef]

- Wagner, M. The environmental Kuznets curve, cointegration and nonlinearity. J. Appl. Econom. 2015, 30, 948–967. [Google Scholar] [CrossRef]

- Moosa, I.A.; Burns, K. The Energy Kuznets Curve: Evidence from Developed and Developing Economies. Energy J. 2022, 43. Available online: https://www.google.com.hk/search?q=%E2%80%8EThe+Energy+Kuznets+Curve%3A+Evidence+from+Developed+and+Developing+Economies&ei=DCP8Y__lDeDu2roPiMq6kAY&ved=0ahUKEwj_m6Xu4LT9AhVgt1YBHQilDmIQ4dUDCA4&uact=5&oq=%E2%80%8EThe+Energy+Kuznets+Curve%3A+Evidence+from+Developed+and+Developing+Economies&gs_lcp=Cgxnd3Mtd2l6LXNlcnAQAzoKCAAQRxDWBBCwA0oECEEYAFCFAViFAWD2BmgBcAF4AIABfogBfpIBAzAuMZgBAKABAqABAcgBCMABAQ&sclient=gws-wiz-serp (accessed on 1 March 2021). [CrossRef]

- Alam, R.; Adil, M.H. Validating the environmental Kuznets curve in India: ARDL bounds testing framework. OPEC Energy Rev. 2019, 43, 277–300. [Google Scholar] [CrossRef]

- Apergis, N.; Ozturk, I. Testing environmental Kuznets curve hypothesis in Asian countries. Ecol. Indic. 2015, 52, 16–22. [Google Scholar] [CrossRef]

- Atasoy, B.S. Testing the environmental Kuznets curve hypothesis across the US: Evidence from panel mean group estimators. Renew. Sustain. Energy Rev. 2017, 77, 731–747. [Google Scholar] [CrossRef]

- Baek, J. A panel cointegration analysis of CO2 emissions, nuclear energy and income in major nuclear generating countries. Appl. Energy 2015, 145, 133–138. [Google Scholar] [CrossRef]

- Jammazi, R.; Aloui, C. RETRACTED: On the interplay between energy consumption, economic growth and CO2 emission nexus in the GCC countries: A comparative analysis through wavelet approaches. Renew. Sustain. Energy Rev. 2015, 51, 1737–1751. [Google Scholar] [CrossRef]

- Kohler, M. CO2 emissions, energy consumption, income and foreign trade: A South African perspective. Energy Policy 2013, 63, 1042–1050. [Google Scholar] [CrossRef]

- Lin, B.; Omoju, O.E.; Okonkwo, J.U. Impact of industrialisation on CO2 emissions in Nigeria. Renew. Sustain. Energy Rev. 2015, 52, 1228–1239. [Google Scholar] [CrossRef]

- Ozcan, B. The nexus between carbon emissions, energy consumption and economic growth in Middle East countries: A panel data analysis. Energy Policy 2013, 62, 1138–1147. [Google Scholar] [CrossRef]

- Paramati, S.R.; Mo, D.; Gupta, R. The effects of stock market growth and renewable energy use on CO2 emissions: Evidence from G20 countries. Energy Econ. 2017, 66, 360–371. [Google Scholar] [CrossRef]

- Rafindadi, A.A. Revisiting the concept of environmental Kuznets curve in period of energy disaster and deteriorating income: Empirical evidence from Japan. Energy Policy 2016, 94, 274–284. [Google Scholar] [CrossRef]

- Saboori, B.; Al-Mulali, U.; Bin Baba, M.; Mohammed, A.H. Oil-induced environmental Kuznets curve in organization of petroleum exporting countries (OPEC). Int. J. Green Energy 2016, 13, 408–416. [Google Scholar] [CrossRef]

- Saidi, K.; Mbarek, M.B. Nuclear energy, renewable energy, CO2 emissions, and economic growth for nine developed countries: Evidence from panel Granger causality tests. Prog. Nucl. Energy 2016, 88, 364–374. [Google Scholar] [CrossRef]

- Ulucak, R.; Khan, S.U.D. Determinants of the ecological footprint: Role of renewable energy, natural resources, and urbanization. Sustain. Cities Soc. 2020, 54, 101996. [Google Scholar]

- Wang, S.; Li, Q.; Fang, C.; Zhou, C. The relationship between economic growth, energy consumption, and CO2 emissions: Empirical evidence from China. Sci. Total Environ. 2016, 542, 360–371. [Google Scholar] [CrossRef] [PubMed]

- Zoundi, Z. CO2 emissions, renewable energy and the Environmental Kuznets Curve, a panel cointegration approach. Renew. Sustain. Energy Rev. 2017, 72, 1067–1075. [Google Scholar] [CrossRef]

- Mahmood, N.; Wang, Z.; Hassan, S.T. Renewable energy, economic growth, human capital, and CO2 emission: An empirical analysis. Environ. Sci. Pollut. Res. 2019, 26, 20619–20630. [Google Scholar] [CrossRef] [PubMed]

- Narayan, P.K.; Narayan, S. Carbon dioxide emissions and economic growth: Panel data evidence from developing countries. Energy Policy 2010, 38, 661–666. [Google Scholar] [CrossRef]

- Sobrinho, V.G. Trade and environmental policy strategies in the north and south negotiation game. Int. J. Environ. Stud. 2005, 62, 147–161. [Google Scholar] [CrossRef]

- Demissew Beyene, S.; Kotosz, B. Testing the environmental Kuznets curve hypothesis: An empirical study for East African countries. Int. J. Environ. Stud. 2020, 77, 636–654. [Google Scholar] [CrossRef]

- Breusch, T.S.; Pagan, A.R. The Lagrange multiplier test and its applications to model specification in econometrics. Rev. Econ. Stud. 1980, 47, 239–253. [Google Scholar] [CrossRef]

- Pesaran, M.H. General Diagonist Tests for Cross Section Dependence in Panels; University of Cambridge: Cambridge, UK, 2004. [Google Scholar]

- Pesaran, M.H.; Yamagata, T. Testing slope homogeneity in large panels. J. Econom. 2008, 142, 50–93. [Google Scholar] [CrossRef]

- Blomquist, J.; Westerlund, J. Testing slope homogeneity in large panels with serial correlation. Econ. Lett. 2013, 121, 374–378. [Google Scholar] [CrossRef]

- Swamy, P.A. Efficient inference in a random coefficient regression model. Econometrica 1970, 38, 311–323. [Google Scholar] [CrossRef]

- Barreira, A.P.; Rodrigues, P.M. Unit root tests for panel data: A survey and an application. Estud. II 2005, 26, 665–685. [Google Scholar]

- Levin, A.; Lin, C.F.; Chu, C.S.J. Unit root tests in panel data: Asymptotic and finite-sample properties. J. Econom. 2002, 108, 1–24. [Google Scholar] [CrossRef]

- Maddala, G.S.; Wu, S. A comparative study of unit root tests with panel data and a new simple test. Oxf. Bull. Econ. Stat. 1999, 61, 631–652. [Google Scholar] [CrossRef]

- Im, K.S.; Pesaran, M.H.; Shin, Y. Testing for unit roots in heterogeneous panels. J. Econom. 2003, 115, 53–74. [Google Scholar] [CrossRef]

- Pesaran, M.H. A simple panel unit root test in the presence of cross-section dependence. J. Appl. Econom. 2007, 22, 265–312. [Google Scholar] [CrossRef]

- Kao, C. Spurious regression and residual-based tests for cointegration in panel data. J. Econom. 1999, 90, 1–44. [Google Scholar] [CrossRef]

- Pedroni, P. Purchasing power parity tests in cointegrated panels. Rev. Econ. Stat. 2001, 83, 727–731. [Google Scholar] [CrossRef]

- Westerlund, J. New simple tests for panel cointegration. Econom. Rev. 2005, 24, 297–316. [Google Scholar] [CrossRef]

- Harris, R.; Sollis, R. Applied Time Series Modelling and Forecasting; Wiley: Chichester, UK, 2003. [Google Scholar]

- Destek, M.A.; Ulucak, R.; Dogan, E. Analyzing the environmental Kuznets curve for the EU countries: The role of ecological footprint. Environ. Sci. Pollut. Res. 2018, 25, 29387–29396. [Google Scholar] [CrossRef]

- Liddle, B. What are the carbon emissions elasticities for income and population? Bridging STIRPAT and EKC via robust heterogeneous panel estimates. Glob. Environ. Change 2015, 31, 62–73. [Google Scholar] [CrossRef]

- Destek, M.A.; Sarkodie, S.A. Investigation of environmental Kuznets curve for ecological footprint: The role of energy and financial development. Sci. Total Environ. 2019, 650, 2483–2489. [Google Scholar] [CrossRef] [PubMed]

- Acaravci, A.; Akalin, G. Environment–economic growth nexus: A comparative analysis of developed and developing countries. Int. J. Energy Econ. Policy 2017, 7, 34. [Google Scholar]

- Dumitrescu, E.I.; Hurlin, C. Testing for Granger non-causality in heterogeneous panels. Econ. Model. 2012, 29, 1450–1460. [Google Scholar] [CrossRef]

- Granger, C.W.J. Investigating causal relations by econometric models and cross-spectral methods. Econometrica 1969, 37, 424–438. [Google Scholar] [CrossRef]

- Stern, D.I. The rise and fall of the environmental Kuznets curve. World Dev. 2004, 32, 1419–1439. [Google Scholar] [CrossRef]

- Panayotou, T. Economic growth and the environment. In Proceedings of the Spring Seminar of the United Nations Economic Commission for Europe, Geneva, Swtitzerland, 3 March 2003; pp. 45–72. Available online: https://digitallibrary.un.org/record/488313?ln=en (accessed on 1 March 2021).

- Moghaddam, H.; Wirl, F. Determinants of oil price subsidies in oil and gas exporting countries. Energy Policy 2018, 122, 409–420. [Google Scholar] [CrossRef]

| Variables. | Definition | Source | Unit | Obs. | Mean | Std. Dev. | Min | Max |

|---|---|---|---|---|---|---|---|---|

| lnCO2 | Energy-related CO2 emissions | GECF | Million ton CO2 (Mt CO2)/person | 372 | 1.9021 | 1.1877 | −0.9790 | 3.9279 |

| lnGDP | Real GDP | GECF | Real 2020 US$/person | 372 | 8.8399 | 1.1701 | 6.8237 | 11.0257 |

| lnGDP2 | Quadratic GDP | GECF | Real 2020 US$/person | 372 | 79.5100 | 21.2761 | 46.5637 | 121.567 |

| lnGC | Natural gas consumption | GECF | Million Cubic Meters (MCM)/person | 372 | 7.5359 | 1.3254 | 4.1875 | 10.0420 |

| lnU | Urbanization | United Nations | Share of total population | 372 | −0.4577 | 0.2797 | −1.2146 | −0.0076 |

| lnTO | Trade openness | World Bank | Trade (% of GDP) | 360 | 4.2714 | 0.4830 | 3.0312 | 5.3954 |

| Test | Value |

|---|---|

| Breusch–Pagan LM | 565.4625 *** |

| Pesaran scaled LM | 43.4726 *** |

| Pesaran CD | 5.2719 *** |

| Test | Value |

|---|---|

| Pesaran and Yamagata | |

| 12.696 *** | |

| 14.500 *** | |

| Blomquist and Westerlund | |

| 11.081 *** | |

| 12.656 *** |

| Variable | Level | 1st Difference | ||

|---|---|---|---|---|

| LLC Test | Intercept | Intercept and Trend | Intercept | Intercept and Trend |

| lnCO2 | −4.5124 *** | −0.4769 | −4.1597 *** | −3.0191 *** |

| lnGDP | −1.0392 | −1.5491 * | −3.3349 *** | −2.0718 * |

| lnGDP2 | −0.9070 | −1.5123 * | −3.3014 *** | −2.0293 * |

| lnGC | −3.8289 *** | −1.3094 * | −11.275 *** | −10.6326 *** |

| lnU | −8.7882 *** | −6.8910 *** | −8.6010 *** | −52.3669 *** |

| Fisher–ADF test | Intercept | Intercept and trend | Intercept | Intercept and trend |

| lnCO2 | 2.4906 ** | 1.2074 | 37.1258 *** | 35.7304 *** |

| lnGDP | −1.8509 | −0.1505 | 12.7983 *** | 10.9182 *** |

| lnGDP2 | −1.9454 | −0.1126 | 12.7340 *** | 10.8641*** |

| lnGC | 1.2259 | 0.4684 | 43.5791 *** | 39.4963 *** |

| lnU | 41.9397 | 14.5531 | 2.4923 ** | 10.1618 *** |

| lnTO | 4.2778 *** | 2.1929 ** | 35.9704 *** | 30.6290 *** |

| IPS test | Intercept | Intercept and trend | Intercept | Intercept and trend |

| lnCO2 | −1.1238 | −0.9496 | −9.9337 *** | −10.4638 *** |

| lnGDP | 2.8790 | 0.3618 | −5.2711 *** | −5.8034 *** |

| lnGDP2 | 3.0644 | 0.3481 | −5.2458 *** | −5.7710 *** |

| lnGC | −1.4087 * | −1.3933 * | −10.1395 *** | −10.6683 *** |

| lnU | 1.9344 | 1.1152 | 1.5460 | −2.5687 ** |

| lnTO | −1.9039 ** | −2.1075 ** | −9.4524 *** | −9.9113 *** |

| CIPS test | Intercept | Intercept and trend | Intercept | Intercept and trend |

| lnCO2 | −2.861 *** | −2.698 | −5.475 *** | −5.989 *** |

| lnGDP | −2.444 *** | −2.536 | −3.745 *** | −4.198 *** |

| lnGDP2 | −2.492 *** | −2.512 | −3.690 *** | −4.114 *** |

| lnGC | −2.845 *** | −2.694 * | −4.955 *** | −5.383 *** |

| lnU | −2.034 | −2.372 | −1.852 | −2.686 ** |

| lnTO | −2.110 | −2.395 | −4.618 *** | −4.797 *** |

| Test | Value |

|---|---|

| Kao | |

| Modified Dickey–Fuller | −4.3886 *** |

| Dickey–Fuller | −5.6569 *** |

| Augmented Dickey–Fuller | −3.9340 *** |

| Unadjusted modified Dickey–Fuller | −6.2985 *** |

| Unadjusted Dickey–Fuller | −6.2220 *** |

| Pedroni | |

| Modified Phillips–Perron | 1.3345 * |

| Phillips–Perron | −2.8852 *** |

| Augmented Dickey–Fuller | −2.4163 ** |

| Westerlund | |

| 1 Variance ratio | −1.8754 ** |

| 2 Variance ratio | −3.2259 *** |

| FMOLS | DOLS | |||||||||||

|---|---|---|---|---|---|---|---|---|---|---|---|---|

| Country/Panel | lnGDP | lnGDP2 | lnGC | lnU | lnTO | EKC | lnGDP | lnGDP2 | lnGC | lnU | lnTO | EKC |

| Algeria | −1.2288 *** (−5.9797) | 0.1704 *** (8.7982) | 0.2211 ** (2.3972) | −0.3165 (−1.3744) | −0.4560 *** (−7.7259) | No | −15.393 ** (−3.5182) | 1.4098 ** (3.5430) | 4.9374 ** (3.3886) | −24.264 ** (−4.1054) | −2.0256 (−2.7508) | No |

| Azerbaijan | −1.2615 *** (−3.4049) | 0.0671 ** (2.5410) | 1.0003 *** (9.5615) | −0.4274 (−0.3257) | −0.0415 (−0.4075) | No | 41.465 *** (10.294) | −2.6830 *** (−10.343) | 1.0319 *** (10.822) | −51.410 *** (−7.7455) | −2.0599 *** (−10.393) | Yes |

| Egypt | −0.3622 (−0.6790) | 0.0599 (1.6943) | 0.1611 (2.7494) | 1.5249 (0.6564) | 0.0423 (0.8654) | No | 21.293 *** (6.3334) | −1.2946 *** (−6.0513) | −0.3288 *** (−4.8434) | 6.6936 ** (4.0557) | 0.2155 ** (4.1834) | Yes |

| Iran | −0.6704 ** (−2.1706) | 0.0816 *** (4.3929) | 0.3051 * (1.9981) | 0.5521 (0.8515) | −0.0211 (−0.4547) | No | −0.6020 (−1.6941) | 0.0707 *** (3.2700) | 0.3192 * (1.8277) | 0.6528 (0.8695) | −0.0017 (−0.0315) | No |

| Malaysia | −0.3162 (−1.6903) | 0.0249 (1.4895) | 0.3802 *** (5.9629) | 0.9330 *** (3.7757) | 0.0723 (1.0705) | No | 115.75 ** (3.0992) | −6.6645 ** (−3.0717) | 1.4602 ** (2.9340) | −3.5419 (−0.4345) | −0.9107 (−1.0625) | Yes |

| Nigeria | −1.0181 *** (−6.6289) | 0.0996 *** (5.2751) | 0.2085 ** (2.1291) | −0.0523 (−0.3171) | 0.0952 (2.3188) | No | −2.4275 *** −4.8910 | 0.2815 *** 4.9065 | −0.0791 −0.4680 | −1.1132 ** −2.5698 | 0.4273 ** 3.1881 | No |

| Oman | −0.3397** (−2.6795) | −0.0040 (−0.2317) | 0.7260 *** (10.941) | −1.1016 ** (−2.6799) | −0.0246 (−0.1265) | No | −0.6881 *** (−4.9179) | 0.0475 ** (2.5027) | 0.6106 *** (9.6642) | −0.7520 ** (−2.1586) | −0.1182 (−0.8884) | No |

| Qatar | −0.9110*** (−8.3222) | 0.0518 *** (7.6562) | 0.8254 *** (12.661) | 2.8573*** (3.6693) | −0.1169 (−1.0005) | No | −48.725 ** (−2.8378) | 2.2822 ** (2.8486) | 1.2324 *** (9.1319) | 5.2539 ** (2.9818) | −0.7066 ** (−2.8119) | No |

| Russia | −2.2301 *** (3.0560) | 0.1112 *** (3.0361) | 1.4610 *** (3.6776) | −7.2650 ** (−2.1191) | −0.0947 * (−1.7235) | No | 7.8218 * (2.1907) | −0.4318 * (−2.1465) | 0.3443 ** (3.1545) | −32.424 ** (−4.7310) | −0.0903 * (−2.3112) | Yes |

| Saudi Arabia | −0.4266 (−1.0652) | 0.0273 (1.1866) | 0.5075 (2.2187) | 2.4701 ** (1.2033) | 0.1844 (2.3497) | No | −134.88 *** (−3.4987) | 6.8013 *** (3.4984) | −0.7370 * (−1.8678) | 12.574 ** (3.6900) | 0.6735 *** (5.1091) | No |

| Turkmenistan | −1.8434 *** (−3.2464) | 0.1341 *** (3.2073) | 0.7543 ** (7.2875) | −4.0372 ** (−2.2264) | −0.1797 *** (−3.4626) | No | 5.2139 *** (3.8249) | −0.3124 *** (−3.5168) | 0.5137 *** (8.7780) | 3.6680 (1.0454) | −0.0598 * (−1.9807) | Yes |

| UAE | −1.0595 ** (−2.7761) | 0.0709 *** (5.0749) | 0.5177 * (1.7813) | −2.4160 ** (−2.4237) | 0.2863 ** (2.4562) | No | 7.2298 * (2.0479) | −0.3216 * (−1.9233) | 0.1097 (0.8257) | −896.24 *** (−13.362) | 0.2226 ** (2.7583) | Yes |

| Panel | −0.8244 *** (−8.0283) | 0.0553 *** (7.9496) | 0.5500 *** (11.919) | 0.6150 *** (2.7656) | 0.2314 *** (3.0264) | No | 1.2793 ** (1.9678) | −0.0758 ** (−1.9115) | 0.5720*** (10.476) | −2.0604 (−1.6648) | 0.0655 * (1.7201) | Yes |

| CCEMG | AMG | |||||||||||

| Country/Panel | lnGDP | lnGDP2 | lnGC | lnU | lnTO | EKC | lnGDP | lnGDP2 | lnGC | lnU | lnTO | EKC |

| Algeria | −11.867 (7.4538) | 0.77533 * (0.46404) | 0.27069 ** (0.09984) | −3.2029 ** (1.3386) | −0.05258 (0.08540) | No | −4.7723 (6.9398) | 0.354167 (0.43681) | 0.32699 *** (0.09197) | −6.1451 *** (1.1084) | −0.03408 (0.08720) | No |

| Azerbaijan | 1.5779 * (1.1611) | −0.08666 * (0.07217) | 0.58224 *** (0.14506) | 1.179 (2.2351) | 0.09036 (0.08493) | Yes | 1.8295 * (1.3394) | −0.11959 * (0.08684) | 0.1879 * (0.11131) | 6.084 *** (1.0645) | −0.04665 (0.06744) | Yes |

| Egypt | 17.825 *** (4.6707) | −1.142 *** (0.29807) | −0.30615 * (0.07743) | −5.4118 * (3.0150) | 0.13315 *** (0.04511) | Yes | 0.01985 * (4.8554) | −0.02829 * (0.31241) | −0.15847 * (0.09565) | 0.00456 (3.3778) | 0.07530 (0.05247) | Yes |

| Iran | −15.218 (10.512) | 0.95094 (0.66042) | 0.21741 (0.22734) | 7.888 *** (2.822) | 0.04094 (0.06781) | No | −14.278 * (7.9859) | 0.92122 (0.50195) | 0.11887 (0.17451) | 5.8451 *** (2.0571) | 0.05257 (0.05308) | No |

| Malaysia | −1.4256 (6.1761) | 0.11849 (0.34923) | 0.26896 *** (0.08147) | 1.5536 (1.4143) | 0.10239 (0.19701) | No | 3.0977 * (4.4858) | −0.14973 * (0.25632) | 0.33804 *** (0.06912) | 1.3683 (1.0732) | −0.03291 (0.11823) | Yes |

| Nigeria | −0.11140 (6.466) | 0.06602 (0.43450) | 0.15508 (0.1161) | −7.0383 ** (3.577) | 0.08922 ** (0.04479) | No | −3.5440 (4.0513) | 0.29778 (0.28314) | 0.14090 (0.08919) | −8.7369 ** (3.6017) | 0.08727 ** (0.04079) | No |

| Oman | −28.704 * (14.8379) | 1.5138 ** (0.7698) | 0.43629 *** (0.08034) | 0.82887 (0.51818) | −0.05435 (0.12376) | No | −35.393 (26.550) | 1.8563 (1.3832) | 0.60413 *** (0.09085) | 1.4387 * (0.82057) | 0.15523 (0.21913) | No |

| Qatar | 7.2400 (12.262) | −0.33891 (0.57281) | 0.81448 *** (0.10300) | 4.4507 (3.2361) | −0.2076 * (0.11161) | No | −12.776 (10.2767) | 0.59990 (0.48071) | 0.88759 *** (0.06580) | 6.0296 ** (2.4841) | −0.2349 * (0.12212) | No |

| Russia | −3.084 (2.4501) | 0.20159 (0.13777) | 0.76187 *** (0.13946) | 0.86321 (3.7644) | 0.03424 (0.0241) | No | −2.6678 (1.8526) | 0.15814 (0.10502) | 0.49916 *** (0.12431) | 14.0736 *** (1.4684) | 0.01631 (0.01710) | No |

| Saudi Arabia | −119.938 ** (60.691) | 6.047 ** (3.0649) | 0.21178 (0.34282) | 21.576 ** (9.2040) | 0.36412 ** (0.15958) | No | −120.67 ** (60.606) | 6.0912 ** (3.0593) | 0.44535 (0.27792) | 1.3027 (4.5649) | 0.23492 ** (0.11221) | No |

| Turkmenistan | 2.5294 * (2.553) | −0.18008 * (0.15502) | 0.49317 *** (0.1140) | 10.210 *** (3.1237) | 0.05224 (0.03959) | Yes | 5.7003 *** (1.0965) | −0.3650 *** (0.0719) | 0.52460 *** (0.04696) | 10.504 *** (3.0939) | 0.03902 (0.03055) | Yes |

| UAE | −60.562 *** (14.971) | 2.8956 *** (0.71250) | 0.8187 *** (0.25212) | −117.6 *** (36.680) | 0.33227 ** (0.15561) | No | −6.6305 (7.7767) | 0.33175 (0.36864) | 0.28101 (0.31964) | −25.039 * (13.674) | 0.32465 (0.19975) | No |

| Panel | −3.1452 (4.6954) | 0.27606 (0.30010) | 0.4314 *** (0.08371) | 2.2542 (2.3309) | 0.04972 90.03755) | No | −4.3443 (2.7246) | 0.26488 * (0.15916) | 0.36269 *** (0.0670) | 2.7435 (2.3925) | 0.05191 (0.04219) | No |

| Null Hypothesis | Wald Statistics |

|---|---|

| LGDP = LCO2 | 6.7533 *** |

| LCO2 = LGDP | 7.3271 *** |

| LGC ≠ LCO2 | 3.0876 |

| LCO2 = LGC | 3.5557 ** |

| LUR ≠ LCO2 | 5.6659 *** |

| LCO2 = LUR | 4.7675 *** |

| LTO = LCO2 | 5.2695 *** |

| LCO2 = LTO | 3.6270 ** |

| LGC ≠ LGDP | 2.9962 |

| LGDP = LGC | 6.5912 *** |

| LUR = LGDP | 7.3501 *** |

| LGDP = LUR | 4.4033 *** |

| LTO ≠ LGDP | 2.3198 |

| LGDP = LTO | 4.7253 *** |

| LUR = LGC | 9.1723 *** |

| LGC ≠ LUR | 3.1961 |

| LTO ≠ LGC | 2.4157 |

| LGC ≠ LTO | 3.1662 |

| LTO = LUR | 3.4838 * |

| LUR = LTO | 7.0099 *** |

Disclaimer/Publisher’s Note: The statements, opinions and data contained in all publications are solely those of the individual author(s) and contributor(s) and not of MDPI and/or the editor(s). MDPI and/or the editor(s) disclaim responsibility for any injury to people or property resulting from any ideas, methods, instructions or products referred to in the content. |

© 2023 by the authors. Licensee MDPI, Basel, Switzerland. This article is an open access article distributed under the terms and conditions of the Creative Commons Attribution (CC BY) license (https://creativecommons.org/licenses/by/4.0/).

Share and Cite

Moghaddam, H.; Kunst, R.M. The Role of Natural Gas in Mitigating Greenhouse Gas Emissions: The Environmental Kuznets Curve Hypothesis for Major Gas-Producing Countries. Sustainability 2023, 15, 4266. https://doi.org/10.3390/su15054266

Moghaddam H, Kunst RM. The Role of Natural Gas in Mitigating Greenhouse Gas Emissions: The Environmental Kuznets Curve Hypothesis for Major Gas-Producing Countries. Sustainability. 2023; 15(5):4266. https://doi.org/10.3390/su15054266

Chicago/Turabian StyleMoghaddam, Hussein, and Robert M. Kunst. 2023. "The Role of Natural Gas in Mitigating Greenhouse Gas Emissions: The Environmental Kuznets Curve Hypothesis for Major Gas-Producing Countries" Sustainability 15, no. 5: 4266. https://doi.org/10.3390/su15054266

APA StyleMoghaddam, H., & Kunst, R. M. (2023). The Role of Natural Gas in Mitigating Greenhouse Gas Emissions: The Environmental Kuznets Curve Hypothesis for Major Gas-Producing Countries. Sustainability, 15(5), 4266. https://doi.org/10.3390/su15054266