1. Introduction

With the accelerated pace of China’s integration into economic globalization as well as the deepening participation in trade and investment integration, China has attracted a large amount of foreign direct investment (FDI) in last couple of decades. High-level opening up is an effective path to promote economical development, while FDI has always been the main approach and measurement of that (Liu et al., 2014; Jiang et al., 2021) [

1,

2]. China Commerce Ministry Statistics (CCMS) reports that China’s utilization of FDI amounted to USD 144.369 billion with more than 1,041,630 FDI projects signed in 2020; both are ranked second in the world. However, rapid urban growth also triggered a series of environmental issues, such as carbon emission and air pollution (Wang et al., 2019; Liu et al., 2023) [

3,

4]. In addition, the huge inflow of foreign capital accompanied by environmental pollution and resource depletion seriously restricts the high-quality development of the local economy (Singhania and Saini 2021; Zhang and Zhou, 2016) [

5,

6]. Just as the “pollution paradise” hypothesis (Walter and Ugelow, 1979) [

7] indicated, developed countries implement stricter environmental regulations than developing countries, resulting in the transfer of polluting industries among them. That would further exacerbate the environmental pollution in developing countries (Sarkodie and Strezov, 2019) [

8]. On the other hand, Growth Theory (Feldman, 1999) [

9] suggests that FDI is a critical factor in promoting technological progress as well as an important motivation of innovation for local enterprises. In view of this dual effect of FDI on green development and technological progress, green innovation (GI) may alleviate environmental pollution by creating the spatial transfer of highly pollution-intensive industries (Zheng et al., 2022) [

10], so green innovation is becoming an essential support for global technological competition which may lead to a new round of industrial revolution. However, can FDI promote China’s green innovation? And how does FDI assist China to carry out more green innovation activities? Scholars have not yet reached a consensus on the above two issues. Thus, exploring the relationship between FDI and GI has practical significance for the government to provide a reasonable decision-making basis for the effective introduction of FDI inflow.

The remaining study structure is as follows:

Section 2 analyzes the existing literature, while

Section 3 develops our hypotheses.

Section 4 focuses on the data sources and main methodological techniques to explain key variables.

Section 5 reveals the empirical findings, validating them with several robustness tests. Finally,

Section 6 provides the conclusions and policy implications of the overall study.

2. Literature Review

Research on green innovation originated in the 1990s, mainly referring to green and environmentally friendly technology. Braun et al. (1997) [

11] took the lead in proposing the concept of green innovation, defining it as a technology that reduces energy resource consumption, reduces environmental pollution, and improves production efficiency, while the general term is used for process and product. So far, the academic community has not reached a unified understanding of the definition of green innovation. James (1997) [

12] defined green innovation as new technologies, processes, and products that can significantly reduce the environmental impact and enable individuals and enterprises to realize value-added. Horbach et al. (2012) [

13] proposed that green innovation refers to the innovative behavior of products, production processes, marketing methods, and organizational structures that can significantly alleviate environmental problems. More recently, Yi et al. (2019) [

14] believed that green innovation is essentially a knowledge-creation process that integrates multiple disciplines and reconstructs a series of knowledge elements. In general, green innovation is critical for China to promote green industrial transformation and high-quality development in the new era.

Many scholars have revealed the influencing factors or motivations of green innovation, mainly at the macro-social and micro-enterprise levels. At the macro-social level, some scholars have conducted research on foreign investment, environmental policy, government subsidy, and industrial agglomeration. Eskeland (2003) [

15] found that transnational investment is conducive to improving enterprises’ green innovation ability. Gong et al. (2017) [

16] indicated that outward foreign direct investment (OFDI) could promote the efficiency of green industrial innovation via three mechanisms: agglomeration scale economical effect, agglomeration structure lightening effect, and agglomeration resource allocation effect. Li and Zhang (2016), Song and Han (2022), and Liu et al. (2021) [

17,

18,

19] found that there are regional differences and a spillover effect in international R&D investment in China’s green technology innovation, which has a significant role in promoting green technology innovation in the eastern and central regions. The studies of Cary and Shadbegian (2003), Kneller and Manderson (2012), and Luo et al., (2021) [

20,

21,

22] suggested that environmental regulation would increase the pressure on enterprises to reduce pollution and emissions, resulting in an increase in production and operating costs, thereby reducing profits and affecting green innovation activities. Even if environmental regulation may increase the pollution cost of enterprises, these regulations can still achieve innovative compensation and stimulate green innovation activities if properly designed [

23]. Szücs (2018) [

24] found that government subsidies can provide direct financial support for corporate green innovation activities, thus reducing corporate R&D investment costs and stimulating the enthusiasm of green innovation. Research by Bontoux et al. (2016) demonstrated that the government’s policy framework to support environmental sustainability plays a powerful role in supporting resource efficiency and green ecological innovation [

25]. From the perspective of regional industrial agglomeration, Castaldi et al. (2015) [

26] pointed out that the green innovation activities of enterprises often occur under better R&D investment and knowledge spillover circumstances. However, Bischi et al. (2003) [

27] illustrated that excessive competition offsets the innovation advantages of industrial agglomeration, and it is difficult to bring continuous improvement to green innovation. At the micro-enterprise level, some scholars also researched the enterprise’s external factors and competitive advantages. Pang et al. (2019) [

28] found that the external relationship network of enterprises can significantly impact green innovation. Chen et al. (2006) [

29] found that the performance of green innovation and process are positively correlated with the competitive advantage of enterprises.

With the in-depth promotion of “bringing in” and “going out” strategies, China has become a developing country attracting the most foreign direct investment in the world for many years, and that has made a significant impact on China’s green innovation (Dai et al., 2021) [

30]. The Chinese government has repeatedly mentioned the promotion of domestic green innovation through “bringing in,” because FDI can bring more funds, advanced technology, and management experience (Feng et al., 2019; Zhang et al., 2020) [

31,

32]. At present, scholars mainly have three different views on the spillover effect of FDI. Firstly, FDI has a positive spillover effect on the host country (Chen and Zhou, 2022) [

33]. Kokko (1994) [

34] suggested that once foreign firms enter a new market to train local workers and managers, providing technical assistance to local suppliers and customers, the technology and productivity of local firms would increase rapidly. Moreover, the competitive pressure imposed by foreign companies may further force local companies to operate more efficiently and introduce more technologies. Secondly, FDI has a negative spillover effect on the host country. Sasidharan and Kathuria (2010) [

35] found that FDI would seize the local market share, hinder the growth of local industries, and intensify competition among local enterprises. Under the pressure of the high risk of external capital, local enterprises would rather choose to acquire knowledge from outside than carry out independent R&D investment, which ultimately inhibits the technological innovation activities of the host country. Thirdly, there is no spillover effect of FDI on the host country. The research of Aitken and Harrison (1999) [

36] pointed out that since most technology from foreign companies has been completely captured by joint ventures, the impact of FDI on domestic companies is quite small.

In general, existing studies have conducted in-depth discussions around the spillover effects of FDI on the host country’s technology. However, research on the relationship between FDI and GI is more concerned with the theoretical path; few studies have expanded to the empirical level to verify the existence of the impact mechanism of FDI on GI. There are two main deficiencies in the existing literature on the impact mechanism between FDI and GI. First, existing research focuses more on the national level or case study, which fails to fully measure the differentiation characteristics among regions. Second, previous literature mainly focuses on the theoretical perspective of the investment motivation of FDI as well as possible paths to green innovation activities; few studies have reached the empirical level to verify the impact of FDI on GI in consideration of the regulatory role of external macro factors. Our study contributes towards existing literature by verifying the threshold effect and heterogeneity characteristics from the perspective of the spatial dynamic evolution of GI, by introducing moderators of policy environment (PE) and market level (ML) into the model to fill the gap between national and regional levels. Moreover, it is undoubtedly of great theoretical and practical significance to carry out differentiated FDI activities in promoting green innovation-driven strategy. Our findings have more policy recommendations to implement the “development of green and low-carbon industries” proposed by the 20th National Congress of Communist Party of China (NCCPC) as well as guidelines for the provincial governments by regions to improve the green policy system.

3. Theoretical Hypothesis

From the perspective of Resource-Based Theory, resource heterogeneity can be realized via diverse approaches to sustainability that support inimitability (Ashby et al., 2012; Pagel and Shevchenko, 2014) [

37,

38], and the FDI activities of enterprises from developing countries bring more competitive advantages and resources (Pang, 2019) [

39]. First of all, when foreign companies face strict environmental regulations in their own countries, they have to adopt clean energy and develop advanced green low-carbon production technologies. Therefore, FDI not only provides investment, but also provides incentives and opportunities to adopt new green technologies, therefore improving environmental awareness (Birdsall and Wheeler, 1993) [

40]. Secondly, foreign-funded enterprises often implement uniform and strict environmental standards; these international environmental standards can promote the development of environmental protection technology in the host country (Eskeland and Harrison 2003) [

41]. That would squeeze out the low efficiency and high consuming local enterprises, stimulate the enthusiasm of local enterprises to carry out green technology activities, and improve the environmental quality of developing countries (Mert and Caglar 2020) [

42]. Finally, China is in the critical stage of transforming its development mode accompanied by issues of rising labor costs, increasing resources and environmental constraints. The inflow of FDI has promoted domestic resources to technology-intensive, low-pollution, and high value-added industries. That can improve green production efficiency and give more impetus on shifting to a new stage of high-quality development. Given this, this paper proposes hypothesis H1.

Hypothesis 1 (H1): Foreign direct investment has a positive impact on green innovation.

According to Resource Dependence Theory, the external resource from policy environment (PE) plays an important role in guiding and driving the green innovation of enterprises; these resources can create a more stable market environment for enterprises (Getz 2002) [

43]. In order to obtain more competitive advantages and resources, enterprises will continue to accelerate green transformation, develop green products, and fulfill environmental responsibilities with a more positive attitude. Autant et al. (2013) [

44] adopted local knowledge spillover effects to explore the impact of European regional innovation policy. Their results emphasized the path of regional innovation policy to support the generation of knowledge and learning, indicating that policymakers should focus on local and regional characteristics to carry out regional innovation policy. In view of Signal Theory, Lerner (1999) [

45] found that the government’s intervention in the innovative activities of enterprises through subsidies will be passed on to private investors as a signal of a favorable investing environment. This helps enterprises to become labeled as recognized by the government, which is beneficial for them to obtain the required innovation resources and improve innovation performance. Bai et al. (2019) demonstrated that government R&D subsidies increased energy-intensive enterprises’ green innovation by 107.3% and 54.1% on trend and performance, respectively [

46]. Enterprises can effectively use government subsidies to develop green and low-carbon production technologies, and to increase the enthusiasm for green innovation (Fazzari and Petersen 1988) [

47]. Williams and Brian (2021) [

48] also found that a preferential tax policy environment can effectively reduce the cost of innovation, alleviate the pressure of expensive financing, and encourage enterprises to invest in green innovation. Low taxes and more subsidies can reduce the financing constraints on enterprises, especially under an imperfect capital market where the cost of external financing is relatively high. Meanwhile, Zhou et al. (2002) [

49] indicated that FDI inflows are capable of leaving an impact on Chinese government policy that essentially emphasizes foreign direct investment, resulting in a nonlinear dependence between policy environment and FDI in China. Better policy environment enables enterprises to achieve the optimal condition from foreign investment, thereby avoiding those financing constraints on green innovation. Based on the analysis above, we propose hypothesis H2.

Hypothesis 2 (H2): Policy environment plays a positive moderating role between FDI and GI.

On the basis of Neoclassical Growth Theory, Tuzun and Kalemci (2017) [

50] found that FDI and human capital resource provide a strong push to regional economic growth. A higher level of marketization indicates a higher resource allocation efficiency (Zhang et al. 2013) [

51], which is conducive to FDI technology spillovers (Cole and Fredriksson, 2009; Hu et al., 2021) [

52,

53]. Marketization can further boost the capital allocation effectiveness from financial markets as well as encourage fair competition among financial institutions. That can benefit enterprises by lowering the cost of green financing and igniting the motivation of cutting-edge green technologies (Callon 2016) [

54]. Those administrative interventions and the inadequate protection of property rights can reduce the distortion of the market, reduce the competition from foreign-funded enterprises, and provide a more market-friendly environment. Based on that, we propose hypothesis H3.

Hypothesis 3 (H3): Marketization level plays a positive moderating role between FDI and GI.

6. Conclusions and Policy Implications

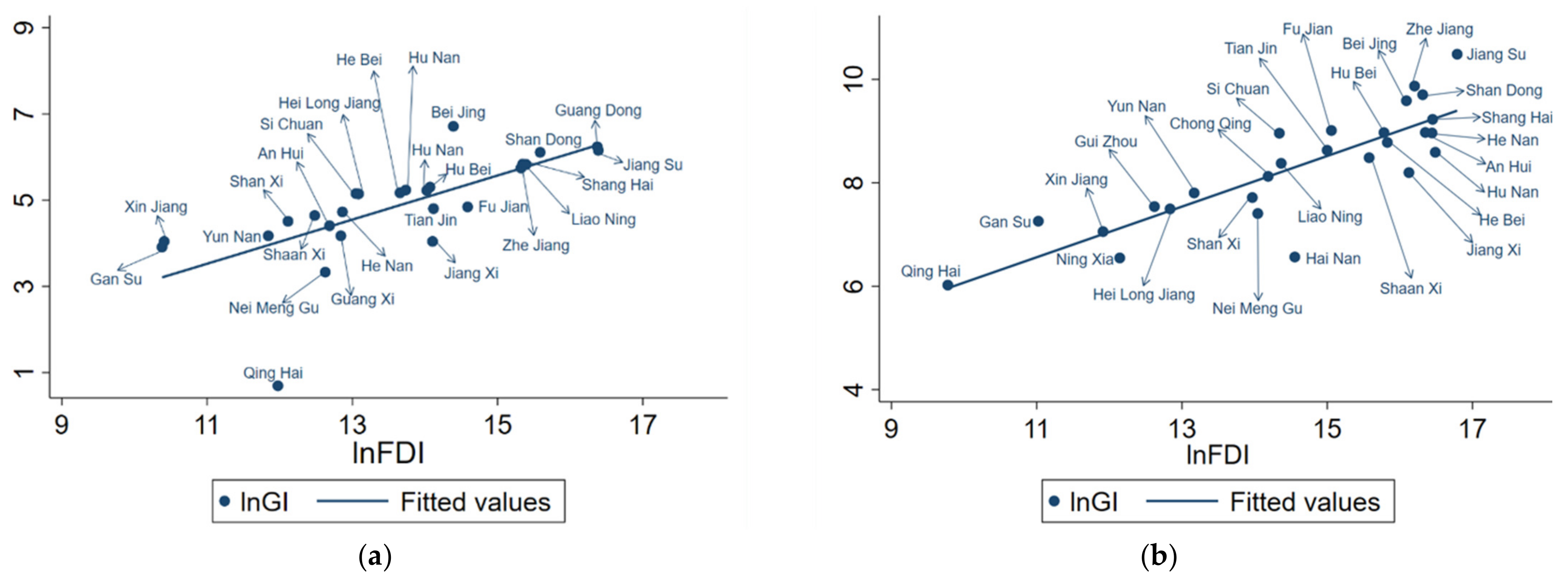

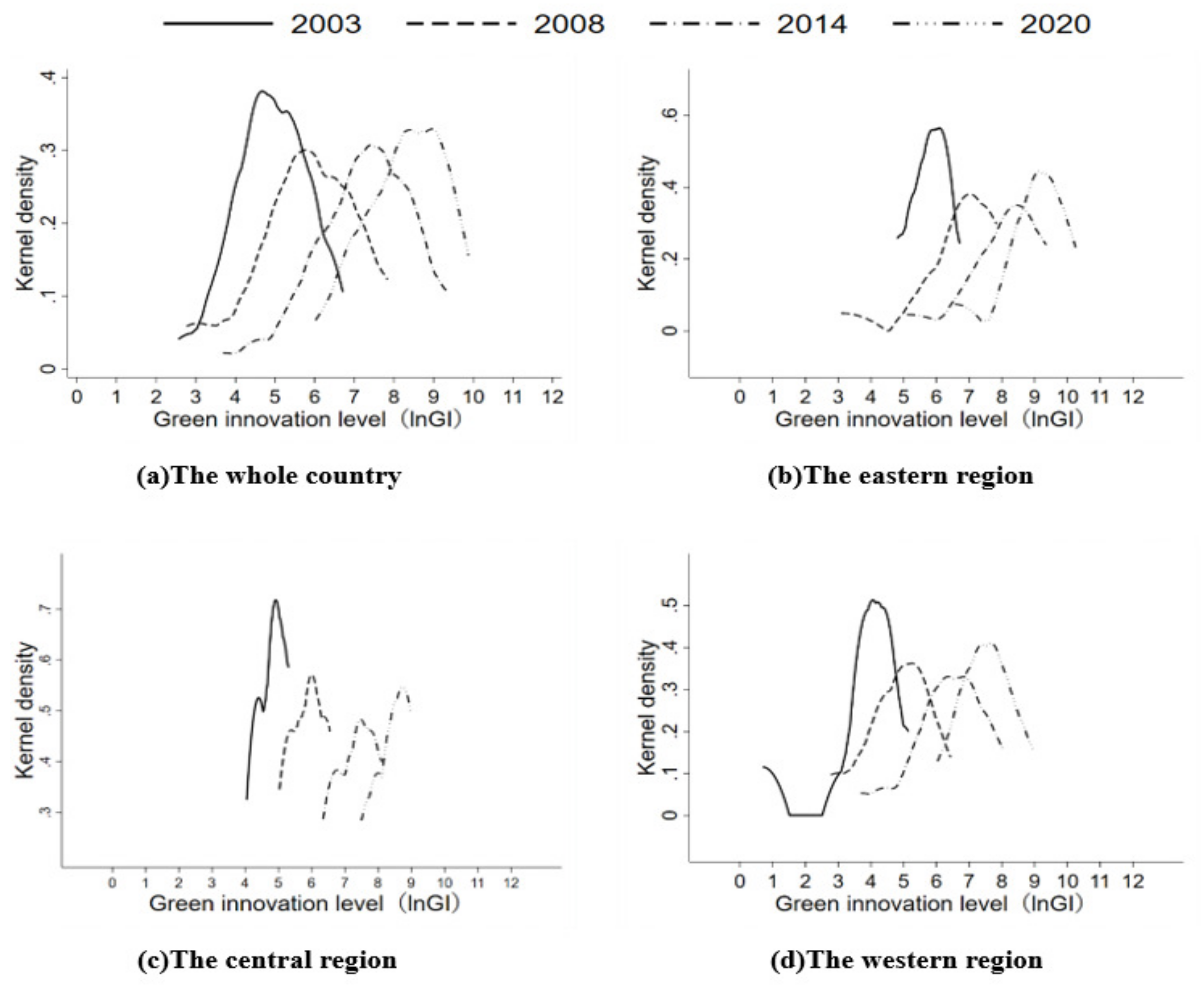

This paper examines the impact of FDI on GI from both theoretical and empirical levels by using the macro-level data of 31 provinces and cities in China from 2003 to 2020. We use the scatter plot to conduct a preliminary analysis of the relationship between FDI and GI. Kernel density estimation and the spatial distribution map are introduced to investigate the dynamics distribution characteristics of GI from both national and regional levels. Meanwhile, we discuss the moderating effects and heterogeneity analysis to investigate the impact mechanism of FDI on GI, as well as construct 2SLS and GMM regression to test the estimation reliability of empirical results. Furthermore, we adopt the threshold model to examine the threshold effect of FDI on GI. Our results show the following: (1) FDI has a significant positive and dynamic evolution feature of diminishing marginal efficiency on GI in China during the study period. (2) The heterogeneity analysis of regional regression implies that FDI significantly increases GI in the eastern and western regions. In contrast, FDI in the central region inhibits GI but not significantly. (3) Both PE and ML can positively moderate the impact of FDI on GI.

The above conclusions are mainly related to the following policy implications: (1) China should give priority to the impact on environmental quality while introducing foreign capital, paying more attention to green foreign capital as well as gathering domestic green innovation resources. That would promote the transformation of domestic resources into green and low-carbon industries. (2) The central government should improve the regional balance on low-carbon and green development, encourage local companies to actively absorb more advanced green technologies from FDI, and provide greater support for green foreign capital on promoting green innovation activities in eastern and western regions. The provincial governments in central regions also need to pay more attention to green policy to strengthen the investment environment, maximize the innovation knowledge spillover effect of FDI, and stimulate the enthusiasm of local companies for green innovation, thereby narrowing the gap among regions. (3) China’s government should adjust from industry entry barriers to green marketization mechanisms, especially to protect the green innovation activities of foreign-funded enterprises and to create better policy environment for those enterprises to conduct green R&D activities, technology diffusion, and fair competition.

Since green innovation can stimulate the transformation and upgrading of local enterprises to green production, many governments have formulated incentive policies such as issuing green bonds, reducing government intervention, and reducing green taxes. Meanwhile, green transformation is not limited to the introduction and operation of FDI; organizations may need to integrate their external investments with sustainability goals, and their decisions must be data-driven. Addressing the significance of integrating sustainability strategies into digital transformation roadmaps entails thinking beyond profit and placing social and environmental considerations on the same footing with financial objectives. Future research is encouraged to focus on the effectiveness of these behaviors by more quantitative methods.