Do FDI Inflows into African Countries Impact Their CO2 Emission Levels?

Abstract

1. Introduction

2. Literature Review

2.1. Pollution Haven (PHVHP) and Halo (PHLHP) Hypotheses

2.2. CO2 Emissions

2.3. FDI vs. CO2 Emissions

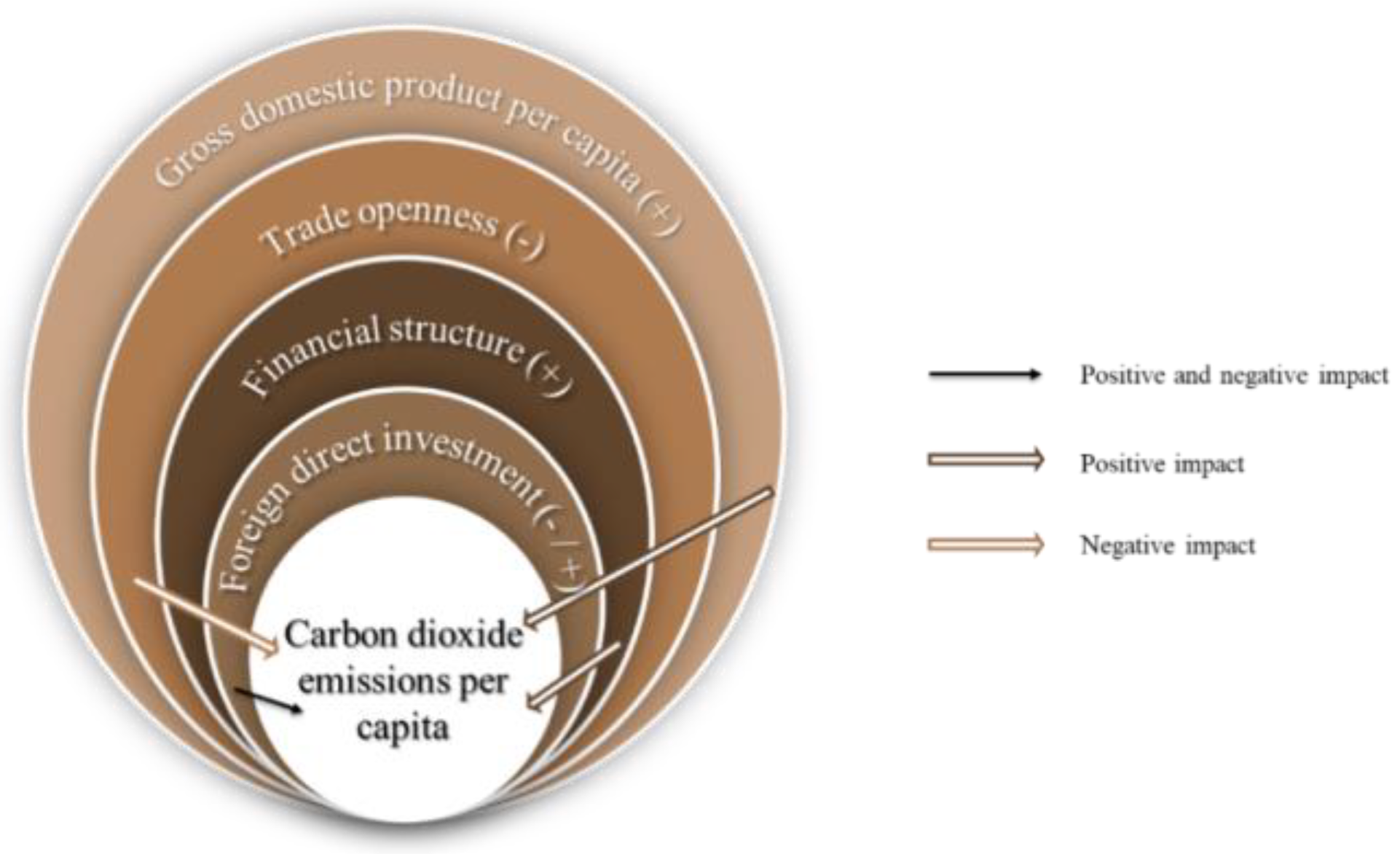

2.4. Other Financial Variables vs. CO2 Emissions

3. Study Settings

3.1. Data Normalization

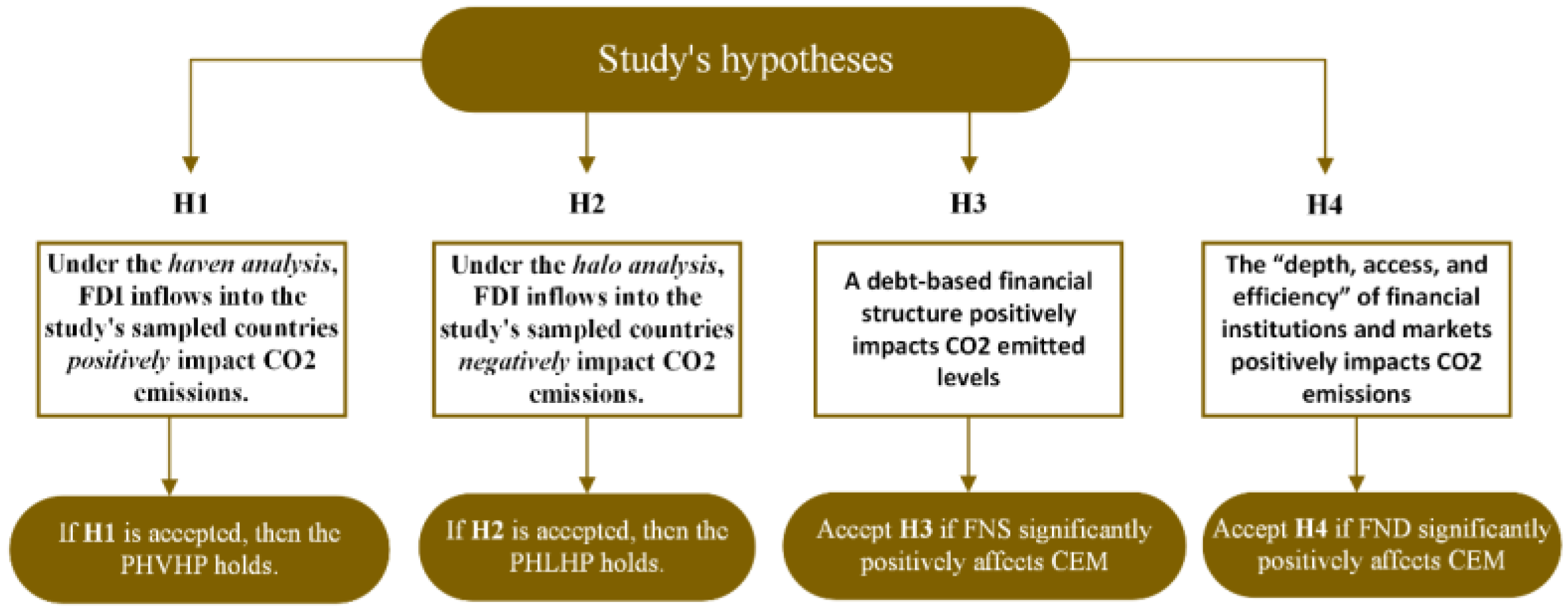

3.2. Study Hypotheses

4. Results and Discussion

4.1. Descriptive Statistics and Correlation Analysis

4.2. Diagnostic Statistics

4.2.1. Unit Root Test

4.2.2. Regression Estimates

4.3. GMM Estimates

4.4. Discussion

4.5. Hypothesis Testing

5. Conclusions and Suggestions

Limitations

Author Contributions

Funding

Institutional Review Board Statement

Informed Consent Statement

Data Availability Statement

Conflicts of Interest

References

- Thacker, P.G.; Witte, R.J.; Menaker, R. Key financial indicators and ratios: How to use them for success in your practice. Clin. Imaging 2020, 64, 80–84. [Google Scholar] [CrossRef] [PubMed]

- Dietz, T.; Shwom, R.L.; Whitley, C.T. Climate Change and Society. Annu. Rev. Sociol. 2020, 46, 135–158. [Google Scholar] [CrossRef]

- Georgatzi, V.V.; Stamboulis, Y.; Vetsikas, A. Examining the determinants of CO2 emissions caused by the transport sector: Empirical evidence from 12 European countries. Econ. Anal. Policy 2019, 65, 11–20. [Google Scholar] [CrossRef]

- Seker, F.; Ertugrul, H.M.; Cetin, M. The impact of foreign direct investment on environmental quality: A bounds testing and causality analysis for Turkey. Renew. Sustain. Energy Rev. 2015, 52, 347–356. [Google Scholar] [CrossRef]

- Khan, M.A.; Ozturk, I. Examining foreign direct investment and environmental pollution linkage in Asia. Environ. Sci. Pollut. Res. 2019, 27, 7244–7255. [Google Scholar] [CrossRef]

- Jiang, C.; Ma, X. The Impact of Financial Development on Carbon Emissions: A Global Perspective. Sustainability 2019, 11, 5241. [Google Scholar] [CrossRef]

- Wen, S.; Lin, B.; Zhou, Y. Does financial structure promote energy conservation and emission reduction? Evidence from China. Int. Rev. Econ. Finance 2021, 76, 755–766. [Google Scholar] [CrossRef]

- Solarin, S.A.; Al-Mulali, U.; Musah, I.; Ozturk, I. Investigating the pollution haven hypothesis in Ghana: An empirical investigation. Energy 2017, 124, 706–719. [Google Scholar] [CrossRef]

- Ahmad, M.; Ahmad, M.; Jabeen, G.; Jabeen, G.; Wu, Y.; Wu, Y. Heterogeneity of pollution haven/halo hypothesis and Environmental Kuznets Curve hypothesis across development levels of Chinese provinces. J. Clean. Prod. 2020, 285, 124898. [Google Scholar] [CrossRef]

- Böhringer, C. The Kyoto Protocol: A Review and Perspectives. Oxf. Rev. Econ. Policy 2003, 19, 451–466. [Google Scholar] [CrossRef]

- Falkner, R. The Paris Agreement and the new logic of international climate politics. Int. Aff. 2016, 92, 1107–1125. [Google Scholar] [CrossRef]

- EU Emissions Trading System (EU ETS). Climate Action. 2022. Available online: https://ec.europa.eu/clima/eu-action/eu-emissions-trading-system-eu-ets_en (accessed on 6 September 2022).

- Li, Z.-Z.; Li, R.Y.M.; Malik, M.Y.; Murshed, M.; Khan, Z.; Umar, M. Determinants of Carbon Emission in China: How Good is Green Investment? Sustain. Prod. Consum. 2020, 27, 392–401. [Google Scholar] [CrossRef]

- Raghutla, C.; Padmagirisan, P.; Sakthivel, P.; Chittedi, K.R.; Mishra, S. The effect of renewable energy consumption on ecological footprint in N-11 countries: Evidence from Panel Quantile Regression Approach. Renew. Energy 2022, 197, 125–137. [Google Scholar] [CrossRef]

- Yi, S.; Raghutla, C.; Chittedi, K.R.; Fareed, Z. How economic policy uncertainty and financial development contribute to renewable energy consumption? The importance of economic globalization. Renew. Energy 2023, 202, 1357–1367. [Google Scholar] [CrossRef]

- Stern, D.I. The Environmental Kuznets Curve. In Oxford Research Encyclopedia of Environmental Science; Oxford University Press: Oxford, UK, 2017. [Google Scholar] [CrossRef]

- Gill, F.L.; Viswanathan, K.K.; Abdul Karim, M.Z. The Critical Review of the Pollution Haven Hypothesis. Int. J. Energy Econ. Policy 2018, 8, 167–174. [Google Scholar]

- IGI Global’s Dictionary Search. Igi-global.com. 2022. Available online: https://www.igi-global.com/dictionary/ (accessed on 1 October 2022).

- Mert, M.; Caglar, A.E. Testing pollution haven and pollution halo hypotheses for Turkey: A new perspective. Environ. Sci. Pollut. Res. 2020, 27, 32933–32943. [Google Scholar] [CrossRef]

- Al-Mulali, U.; Tang, C.F. Investigating the validity of pollution haven hypothesis in the gulf cooperation council (GCC) countries. Energy Policy 2013, 60, 813–819. [Google Scholar] [CrossRef]

- Ren, S.; Yuan, B.; Ma, X.; Chen, X. International trade, FDI (foreign direct investment) and embodied CO2 emissions: A case study of Chinas industrial sectors. China Econ. Rev. 2014, 28, 123–134. [Google Scholar] [CrossRef]

- Shahbaz, M.; Nasreen, S.; Abbas, F.; Anis, O. Does foreign direct investment impede environmental quality in high-, middle-, and low-income countries? Energy Econ. 2015, 51, 275–287. [Google Scholar] [CrossRef]

- Riti, J.S.; Sentanu, I.G.E.P.S.; Cai, A.; Sheikh, S. Foreign direct investment, manufacturing export and the environment in Nigeria: A test of pollution haven hypothesis. NIDA Dev. J. 2016, 56, 73–98. [Google Scholar]

- Rasit, N.B.; Aralas, S.B. The pollution haven hypothesis: An analysis of ASEAN and OECD countries. In Proceedings of the International Conference on Economics, No. ICE 2017, Hong Kong, China, 14–15 January 2017; pp. 96–109. [Google Scholar]

- Kathuria, V. Does Environmental Governance Matter for Foreign Direct Investment? Testing the Pollution Haven Hypothesis for Indian States. Asian Dev. Rev. 2018, 35, 81–107. [Google Scholar] [CrossRef]

- Shao, Q.; Wang, X.; Zhou, Q.; Balogh, L. Pollution haven hypothesis revisited: A comparison of the BRICS and MINT countries based on VECM approach. J. Clean. Prod. 2019, 227, 724–738. [Google Scholar] [CrossRef]

- Guzel, A.E.; Okumus, I. Revisiting the pollution haven hypothesis in ASEAN-5 countries: New insights from panel data analysis. Environ. Sci. Pollut. Res. 2020, 27, 18157–18167. [Google Scholar] [CrossRef] [PubMed]

- Singhania, M.; Saini, N. Demystifying pollution haven hypothesis: Role of FDI. J. Bus. Res. 2021, 123, 516–528. [Google Scholar] [CrossRef] [PubMed]

- Musah, M.; Mensah, I.A.; Alfred, M.; Mahmood, H.; Murshed, M.; Omari-Sasu, A.Y.; Boateng, F.; Nyeadi, J.D.; Coffie, C.P.K. Reinvestigating the pollution haven hypothesis: The nexus between foreign direct investments and environmental quality in G-20 countries. Environ. Sci. Pollut. Res. 2022, 29, 31330–31347. [Google Scholar] [CrossRef]

- Elliott, R.J.R.; Zhou, Y. Environmental Regulation Induced Foreign Direct Investment. Environ. Resour. Econ. 2012, 55, 141–158. [Google Scholar] [CrossRef]

- Yildirim, E. Energy use, CO2 emission and foreign direct investment: Is there any inconsistence between causal relations? Front. Energy 2014, 8, 269–278. [Google Scholar] [CrossRef]

- Zugravu-Soilita, N. How does Foreign Direct Investment Affect Pollution? Toward a Better Understanding of the Direct and Conditional Effects. Environ. Resour. Econ. 2015, 66, 293–338. [Google Scholar] [CrossRef]

- Zhang, C.; Zhou, X. Does foreign direct investment lead to lower CO2 emissions? Evidence from a regional analysis in China. Renew. Sustain. Energy Rev. 2016, 58, 943–951. [Google Scholar] [CrossRef]

- Aydemir, O.; Zeren, F. The Impact of Foreign Direct Investment on CO2 Emission. In Handbook of Research on Global Enterprise Operations And Opportunities; IGI Global: Hershey, PA, USA, 2017; pp. 81–92. [Google Scholar] [CrossRef]

- Zhou, Y.; Fu, J.; Kong, Y.; Wu, R. How Foreign Direct Investment Influences Carbon Emissions, Based on the Empirical Analysis of Chinese Urban Data. Sustainability 2018, 10, 2163. [Google Scholar] [CrossRef]

- Nasir, M.A.; Huynh, T.L.D.; Tram, H.T.X. Role of financial development, economic growth & foreign direct investment in driving climate change: A case of emerging ASEAN. J. Environ. Manag. 2019, 242, 131–141. [Google Scholar] [CrossRef]

- Xie, Q.; Wang, X.; Cong, X. How does foreign direct investment affect CO2 emissions in emerging countries?New findings from a nonlinear panel analysis. J. Clean. Prod. 2019, 249, 119422. [Google Scholar] [CrossRef]

- Opoku, E.E.O.; Adams, S.; Aluko, O.A. The foreign direct investment-environment nexus: Does emission disaggregation matter? Energy Rep. 2021, 7, 778–787. [Google Scholar] [CrossRef]

- Caetano, R.V.; Marques, A.C.; Afonso, T.L.; Vieira, I. A sectoral analysis of the role of Foreign Direct Investment in pollution and energy transition in OECD countries. J. Environ. Manag. 2021, 302, 114018. [Google Scholar] [CrossRef]

- Global Energy Review. IEA. 2022. Available online: https://www.iea.org/reports/global-energy-review-co2-emissions-in-2021-2 (accessed on 7 September 2022).

- Hao, J.; Gao, F.; Fang, X.; Nong, X.; Zhang, Y.; Hong, F. Multi-factor decomposition and multi-scenario prediction decoupling analysis of China’s carbon emission under dual carbon goal. Sci. Total Environ. 2022, 841, 156788. [Google Scholar] [CrossRef]

- Zhang, W.; Xu, H. Effects of land urbanization and land finance on carbon emissions: A panel data analysis for Chinese provinces. Land Use Policy 2017, 63, 493–500. [Google Scholar] [CrossRef]

- Ouyang, X.; Lin, B. Carbon dioxide (CO2) emissions during urbanization: A comparative study between China and Japan. J. Clean. Prod. 2017, 143, 356–368. [Google Scholar] [CrossRef]

- Hafeez, M.; Chunhui, Y.; Strohmaier, D.; Ahmed, M.; Jie, L. Does finance affect environmental degradation: Evidence from One Belt and One Road Initiative region? Environ. Sci. Pollut. Res. 2018, 25, 9579–9592. [Google Scholar] [CrossRef]

- Tang, D.; Yi, R.; Kong, H.; Da, D.; Boamah, V. Foreign direct investment entry mode and China’s carbon productivity based on spatial econometric model. Front. Environ. Sci. 2022, 10, 1368. [Google Scholar] [CrossRef]

- Kim, S. CO2 emissions, foreign direct investments, energy consumption, and GDP in developing countries: A more compre-hensive study using panel vector error correction model. Korean Econ. Rev. 2019, 35, 5–24. [Google Scholar]

- Abban, O.J.; Wu, J.; Mensah, I.A. Analysis on the nexus amid CO2 emissions, energy intensity, economic growth, and foreign direct investment in Belt and Road economies: Does the level of income matter? Environ. Sci. Pollut. Res. 2020, 27, 11387–11402. [Google Scholar] [CrossRef] [PubMed]

- Islam, M.; Khan, M.K.; Tareque, M.; Jehan, N.; Dagar, V. Impact of globalization, foreign direct investment, and energy consumption on CO2 emissions in Bangladesh: Does institutional quality matter? Environ. Sci. Pollut. Res. 2021, 28, 48851–48871. [Google Scholar] [CrossRef] [PubMed]

- Yao, X.; Tang, X. Does financial structure affect CO2 emissions? Evidence from G20 countries. Finance Res. Lett. 2020, 41, 101791. [Google Scholar] [CrossRef]

- De Haas, R.; Popov, A. Finance and Carbon Emissions. SSRN Electron. J. 2019. [Google Scholar] [CrossRef]

- Jamel, L.; Maktouf, S. The nexus between economic growth, financial development, trade openness, and CO2 emissions in European countries. Cogent Econ. Finance 2017, 5, 1341456. [Google Scholar] [CrossRef]

- Acheampong, A.O.; Amponsah, M.; Boateng, E. Does financial development mitigate carbon emissions? Evidence from heterogeneous financial economies. Energy Econ. 2020, 88, 104768. [Google Scholar] [CrossRef]

- Amin, A.; Dogan, E.; Khan, Z. The impacts of different proxies for financialization on carbon emissions in top-ten emitter countries. Sci. Total Environ. 2020, 740, 140127. [Google Scholar] [CrossRef]

- Our World in Data. Available online: https://ourworldindata.org/ (accessed on 5 September 2022).

- World Bank Open Data. 2022. Available online: https://data.worldbank.org/ (accessed on 13 September 2022).

- Svirydzenka, K. Introducing a New Broad-Based Index of Financial Development. International Monetary Fund. 2016. Available online: https://books.google.com.hk/books?hl=en&lr=&id=nrMaEAAAQBAJ&oi=fnd&pg=PA4&ots=pIItZTF8ua&sig=P9FzqfaK01Z8wn8q43Jy6vsEGBM&redir_esc=y&hl=zh-CN&sourceid=cndr#v=onepage&q&f=false (accessed on 13 September 2022).

- Financial Development Index Database. International Monetary Fund. 2022. Available online: https://data.imf.org/?sk=F8032E80-B36C-43B1-AC26-493C5B1CD33B (accessed on 13 September 2022).

- Dogan, E.; Seker, F. The influence of real output, renewable and non-renewable energy, trade and financial development on carbon emissions in the top renewable energy countries. Renew. Sustain. Energy Rev. 2016, 60, 1074–1085. [Google Scholar] [CrossRef]

- Awan, A.M.; Azam, M. Evaluating the impact of GDP per capita on environmental degradation for G-20 economies: Does N-shaped environmental Kuznets curve exist? Environ. Dev. Sustain. 2021, 24, 11103–11126. [Google Scholar] [CrossRef]

- Huang, Y.; Chen, X.; Zhu, H.; Huang, C.; Tian, Z. The Heterogeneous Effects of FDI and Foreign Trade on CO2 Emissions: Evidence from China. Math. Probl. Eng. 2019, 2019, 1–14. [Google Scholar] [CrossRef]

- Xu, M.; David, J.M.; Kim, S.H. The Fourth Industrial Revolution: Opportunities and Challenges. Int. J. Financial Res. 2018, 9, 90. [Google Scholar] [CrossRef]

- Stearns, P.N. The Industrial Revolution in World History; Routledge, Taylor & Francis Group: Milton Park, UK, 2021. [Google Scholar]

- Loots, E.; Kabundi, A. Foreign direct investment to Africa: Trends, dynamics and challenges. South Afr. J. Econ. Manag. Sci. 2012, 15, 128–141. [Google Scholar] [CrossRef]

- Mannucci, P.M.; Franchini, M. Health Effects of Ambient Air Pollution in Developing Countries. Int. J. Environ. Res. Public Health 2017, 14, 1048. [Google Scholar] [CrossRef]

- Letcher, T.M. Why do we have global warming. In Managing Global Warming; Elsevier: Amsterdam, The Netherlands, 2019; pp. 3–15. ISBN 978-0-12-814104-5. [Google Scholar]

- Xu, H.; Li, Y.; Huang, H. Spatial Research on the Effect of Financial Structure on CO2 Emission. Energy Procedia 2017, 118, 179–183. [Google Scholar] [CrossRef]

- Essandoh, O.K.; Islam, M.; Kakinaka, M. Linking international trade and foreign direct investment to CO2 emissions: Any differences between developed and developing countries? Sci. Total Environ. 2020, 712, 136437. [Google Scholar] [CrossRef]

- Karedla, Y.; Mishra, R.; Patel, N. The impact of economic growth, trade openness and manufacturing on CO2 emissions in India: An autoregressive distributive lag (ARDL) bounds test approach. J. Econ. Finance Adm. Sci. 2021, 26, 376–389. [Google Scholar] [CrossRef]

- Adewuyi, A.O.; Awodumi, O.B. Biomass energy consumption, economic growth and carbon emissions: Fresh evidence from West Africa using a simultaneous equation model. Energy 2017, 119, 453–471. [Google Scholar] [CrossRef]

- Zubair, A.O.; Samad, A.-R.A.; Dankumo, A.M. Does gross domestic income, trade integration, FDI inflows, GDP, and capital reduces CO2 emissions? An empirical evidence from Nigeria. Curr. Res. Environ. Sustain. 2020, 2, 100009. [Google Scholar] [CrossRef]

- Xie, H.; Ouyang, Z.; Choi, Y. Characteristics and Influencing Factors of Green Finance Development in the Yangtze River Delta of China: Analysis Based on the Spatial Durbin Model. Sustainability 2020, 12, 9753. [Google Scholar] [CrossRef]

- Gao, L.; Tian, Q.; Meng, F. The impact of green finance on industrial reasonability in China: Empirical research based on the spatial panel Durbin model. Environ. Sci. Pollut. Res. 2022. [Google Scholar] [CrossRef]

- Behera, P.; Sethi, N. Nexus between environment regulation, FDI, and green technology innovation in OECD countries. Environ. Sci. Pollut. Res. 2022, 29, 52940–52953. [Google Scholar] [CrossRef] [PubMed]

| Pollution Haven Hypothesis (PHVPH) | ||||

|---|---|---|---|---|

| Author(s) Names (Year(s)) | Chosen Period(s) | Country of Focus | Methodology | Does It Hold? |

| Al-mulali & Foon Tang (2013) [20] | 1980–2009 | Gulf Cooperation Council countries | FMOLS | No |

| Ren et al. (2014) [21] | 2000–2010 | China | GMM | Yes |

| Shahbaz et al. (2015) [22] | 1975–2012 | High, middle, and low-income countries. | FMOLS | Yes |

| Riti et al. (2016) [23] | 1980–2013 | Nigeria | ARDL | Yes |

| Rasit & Aralas (2017) [24] | 2000–2010 | ASEAN & OECD | Pooled Ordinary Least Square | No |

| Kathuria (2018) [25] | 2002–2010 | India | Industry-adjusted abatement expenditure index | No |

| Shao et al. (2019) [26] | 1982–2014 | BRICS & MINT | VECM | No |

| Guzel & Okumus (2020) [27] | 1981–2014 | ASEAN-5 | CCEMG and AMG | Yes |

| Singhania & Saini (2021) [28] | 1990–2016 | 21 developed and developing countries | GMM and Sym-GMM | Yes |

| Musah et al. (2022) [29] | 1992–2018 | G20 countries | DCCEMG | Yes |

| Pollution Halo Hypothesis (PHLPH) | ||||

| Elliott & Zhou (2012) [30] | N/A | N/A | Game-theoretic model | Yes |

| Yildirim (2014) [31] | 1980–2009 | 76 countries | Bootstrap-corrected panel causality test, Cross-correlation analysis | Mixed results |

| Zugravu-Soilit (2015) [32] | 1995–2008 | France, Germany, Sweden, United Kingdom | Empirical model | No |

| Zhang & Zhou (2016) [33] | 1995–2010 | China | STIRPAT | Yes |

| Aydemir & Zeren (2017) [34] | 1970–2010 | G20 countries | Panel data analysis | Mixed results |

| Zhou et al. (2018) [35] | 2003–2015 | China | STIRPAT, Diff-GMM, Sys-GMM | Mixed results |

| Nasir et al. (2019) [36] | 1982–2014 | ASEAN-5 | DOLS | No |

| Xie et al. (2020) [37] | 2005–2014 | Argentina, Brazil, China, India, Russia, South Korea, Mexico, Turkey, Indonesia, South Africa, Saudi Arabia | PSTR | Yes |

| Opoku et al. (2021) [38] | 1995–2014 | 22 countries | GMM | Yes |

| Caetano et al. (2022) [39] | 2005–2018 | OECD | ARDL | Yes |

| Mean | Std. Dev. | Skewness | Kurtosis | |

|---|---|---|---|---|

| CEM | 0.490 | 0.320 | 0.078 | 1.806 |

| FDI | 0.415 | 0.309 | 0.429 | 2.062 |

| FDI1 | 0.585 | 0.309 | −0.429 | 2.062 |

| FND | 0.540 | 0.318 | −0.227 | 1.830 |

| FNS | 0.512 | 0.327 | −0.053 | 1.683 |

| POPGT | 0.551 | 0.344 | −0.217 | 1.633 |

| TRDO | 0.524 | 0.312 | −0.050 | 1.843 |

| URBNZ | 0.473 | 0.321 | 0.089 | 1.716 |

| INDVA | 0.502 | 0.320 | −0.041 | 1.783 |

| GDPPC | 0.540 | 0.315 | −0.218 | 1.843 |

| Observations | 615 | |||

| CEM | FDI | FDI1 | FND | FNS | POPGT | TRDO | URBNZ | INDVA | GDPPC | |

|---|---|---|---|---|---|---|---|---|---|---|

| CEM | 1.000 | |||||||||

| FDI | −0.016 | 1.000 | ||||||||

| FDI1 | 0.016 | −1.000 | 1.000 | |||||||

| FND | 0.389 | 0.058 | −0.058 | 1.000 | ||||||

| FNS | 0.428 | 0.108 | −0.108 | 0.574 | 1.000 | |||||

| POPGT | 0.020 | −0.012 | 0.012 | −0.116 | −0.034 | 1.000 | ||||

| TRDO | −0.105 | −0.232 | 0.232 | −0.090 | −0.059 | −0.116 | 1.000 | |||

| URBNZ | 0.484 | −0.117 | 0.117 | 0.564 | 0.563 | −0.048 | 0.030 | 1.000 | ||

| INDVA | −0.009 | 0.089 | −0.089 | −0.171 | −0.158 | 0.159 | −0.126 | −0.172 | 1.000 | |

| GDPPC | 0.474 | −0.012 | 0.012 | 0.361 | 0.378 | 0.072 | −0.027 | 0.433 | 0.081 | 1.000 |

| Level | 1st Difference | |||||

|---|---|---|---|---|---|---|

| LLC | ADF | PP | LLC | ADF | PP | |

| CEM | 0.008 | 0.714 | 0.325 | 0.000 | 0.000 | 0.000 |

| FDI | 0.000 | 0.000 | 0.000 | 0.000 | 0.000 | 0.000 |

| FDI1 | 0.000 | 0.000 | 0.000 | 0.000 | 0.000 | 0.000 |

| FND | 0.000 | 0.001 | 0.000 | 0.000 | 0.000 | 0.000 |

| FNS | 0.000 | 0.000 | 0.000 | 0.000 | 0.000 | 0.000 |

| POPGT | 0.000 | 0.000 | 0.000 | 0.000 | 0.000 | 0.000 |

| TRDO | 0.000 | 0.073 | 0.000 | 0.000 | 0.000 | 0.000 |

| URBNZ | 0.000 | 0.000 | 0.000 | 0.398 | 0.000 | 0.000 |

| INDVA | 0.000 | 0.184 | 0.334 | 0.000 | 0.000 | 0.000 |

| GDPPC | 0.000 | 0.000 | 0.007 | 0.000 | 0.000 | 0.000 |

| Haven | Halo | |||||

|---|---|---|---|---|---|---|

| Pooled | Fixed | Random | Pooled | Fixed | Random | |

| CEM | ||||||

| C | 0.252 *** | 0.391 *** | 0.403 *** | 0.238 *** | 0.326 *** | 0.365 *** |

| (0.054) | (0.097) | (0.094) | (0.056) | (0.097) | (0.094) | |

| FDI | −0.014 | −0.065 * | −0.038 | 0.014 | 0.065 * | 0.038 |

| (0.035) | (0.037) | (0.035) | (0.035) | (0.037) | (0.035) | |

| FND | 0.005 | 0.012 | 0.008 | 0.005 | 0.012 | 0.008 |

| (0.044) | (0.047) | (0.044) | (0.044) | (0.047) | (0.044) | |

| FNS | 0.133 *** | 0.187 *** | 0.156 *** | 0.133 *** | 0.187 *** | 0.156 *** |

| (0.043) | (0.045) | (0.043) | (0.043) | (0.045) | (0.043) | |

| POPGT | −0.005 | 0.009 | 0.002 | −0.005 | 0.009 | 0.002 |

| (0.031) | (0.032) | (0.031) | (0.031) | (0.032) | (0.031) | |

| TRDO | −0.190 *** | −0.207 *** | −0.198 *** | −0.190 *** | −0.207 *** | −0.198 *** |

| (0.036) | (0.036) | (0.035) | (0.036) | (0.036) | (0.035) | |

| URBNZ | 0.024 | −0.026 | 0.003 | 0.024 | −0.026 | 0.003 |

| (0.061) | (0.067) | (0.063) | (0.061) | (0.067) | (0.063) | |

| INDVA | 0.067 ** | 0.067 * | 0.067 ** | 0.067 ** | 0.067 * | 0.067 ** |

| (0.034) | (0.034) | (0.034) | (0.034) | (0.034) | (0.034) | |

| GDPPC | 0.364 *** | 0.433 *** | 0.395 *** | 0.364 *** | 0.433 *** | 0.395 *** |

| (0.049) | (0.052) | (0.050) | (0.049) | (0.052) | (0.050) | |

| R2 | 0.421 | 0.416 | 0.420 | 0.421 | 0.416 | 0.420 |

| Prob > F | 0.000 | 0.000 | 0.000 | 0.000 | ||

| Prob > chi2 | 0.000 | 0.000 | ||||

| Year dummies | Yes | Yes | Yes | Yes | Yes | Yes |

| Samples | 2005–2019 | |||||

| Cross-sections | 41 | |||||

| Observations | 615 | |||||

| Haven | Halo | |||

|---|---|---|---|---|

| CEM | Coefficient | Robust Std. Err. | Coefficient | Robust Std. Err. |

| C | 0.129 | 0.100 | 0.073 | 0.099 |

| CEMi,t−1 | 0.623 *** | 0.047 | 0.623 *** | 0.047 |

| FDI | −0.056 ** | 0.023 | 0.056 ** | 0.023 |

| FND | −0.028 | 0.041 | −0.028 | 0.041 |

| FNS | 0.094 * | 0.051 | 0.094 * | 0.051 |

| POPGT | 0.003 | 0.034 | 0.003 | 0.034 |

| TRDO | −0.149 *** | 0.028 | −0.149 *** | 0.028 |

| URBNZ | 0.053 | 0.063 | 0.053 | 0.063 |

| INDVA | 0.035 | 0.033 | 0.035 | 0.033 |

| GDPPC | 0.207 *** | 0.035 | 0.207 *** | 0.035 |

| No. of obs | 574 | |||

| No. of groups | 41 | |||

| No. of Instruments | 36 | |||

| F-stat | 1019.40 | |||

| Prob > F | 0.000 | |||

| Year dummies | Yes | |||

| AR(2) | 0.396 | |||

| Hansen test | 0.103 | |||

| Haven | Halo | |||

|---|---|---|---|---|

| CEM | Coefficient | Robust Std. Err. | Coefficient | Robust Std. Err. |

| C | 0.177 *** | 0.033 | 0.119 *** | 0.032 |

| CEMi,t−1 | 0.624 *** | 0.049 | 0.624 *** | 0.049 |

| FDI | −0.058 ** | 0.023 | 0.058 ** | 0.023 |

| FNS | 0.089 * | 0.049 | 0.089 * | 0.049 |

| TRDO | −0.151 *** | 0.027 | −0.151 *** | 0.027 |

| GDPPC | 0.213 *** | 0.037 | 0.213 *** | 0.037 |

| No. of obs | 574 | |||

| No. of groups | 41 | |||

| No. of Instruments | 34 | |||

| F-stat | 819.49 | |||

| Prob > F | 0.000 | |||

| Year dummies | Yes | |||

| AR(2) | 0.391 | |||

| Hansen test | 0.157 | |||

Disclaimer/Publisher’s Note: The statements, opinions and data contained in all publications are solely those of the individual author(s) and contributor(s) and not of MDPI and/or the editor(s). MDPI and/or the editor(s) disclaim responsibility for any injury to people or property resulting from any ideas, methods, instructions or products referred to in the content. |

© 2023 by the authors. Licensee MDPI, Basel, Switzerland. This article is an open access article distributed under the terms and conditions of the Creative Commons Attribution (CC BY) license (https://creativecommons.org/licenses/by/4.0/).

Share and Cite

Boamah, V.; Tang, D.; Zhang, Q.; Zhang, J. Do FDI Inflows into African Countries Impact Their CO2 Emission Levels? Sustainability 2023, 15, 3131. https://doi.org/10.3390/su15043131

Boamah V, Tang D, Zhang Q, Zhang J. Do FDI Inflows into African Countries Impact Their CO2 Emission Levels? Sustainability. 2023; 15(4):3131. https://doi.org/10.3390/su15043131

Chicago/Turabian StyleBoamah, Valentina, Decai Tang, Qian Zhang, and Jianqun Zhang. 2023. "Do FDI Inflows into African Countries Impact Their CO2 Emission Levels?" Sustainability 15, no. 4: 3131. https://doi.org/10.3390/su15043131

APA StyleBoamah, V., Tang, D., Zhang, Q., & Zhang, J. (2023). Do FDI Inflows into African Countries Impact Their CO2 Emission Levels? Sustainability, 15(4), 3131. https://doi.org/10.3390/su15043131