The Economic Influence of Energy Storage Construction in the Context of New Power Systems

Abstract

1. Introduction

2. Literature Review

3. Methodology

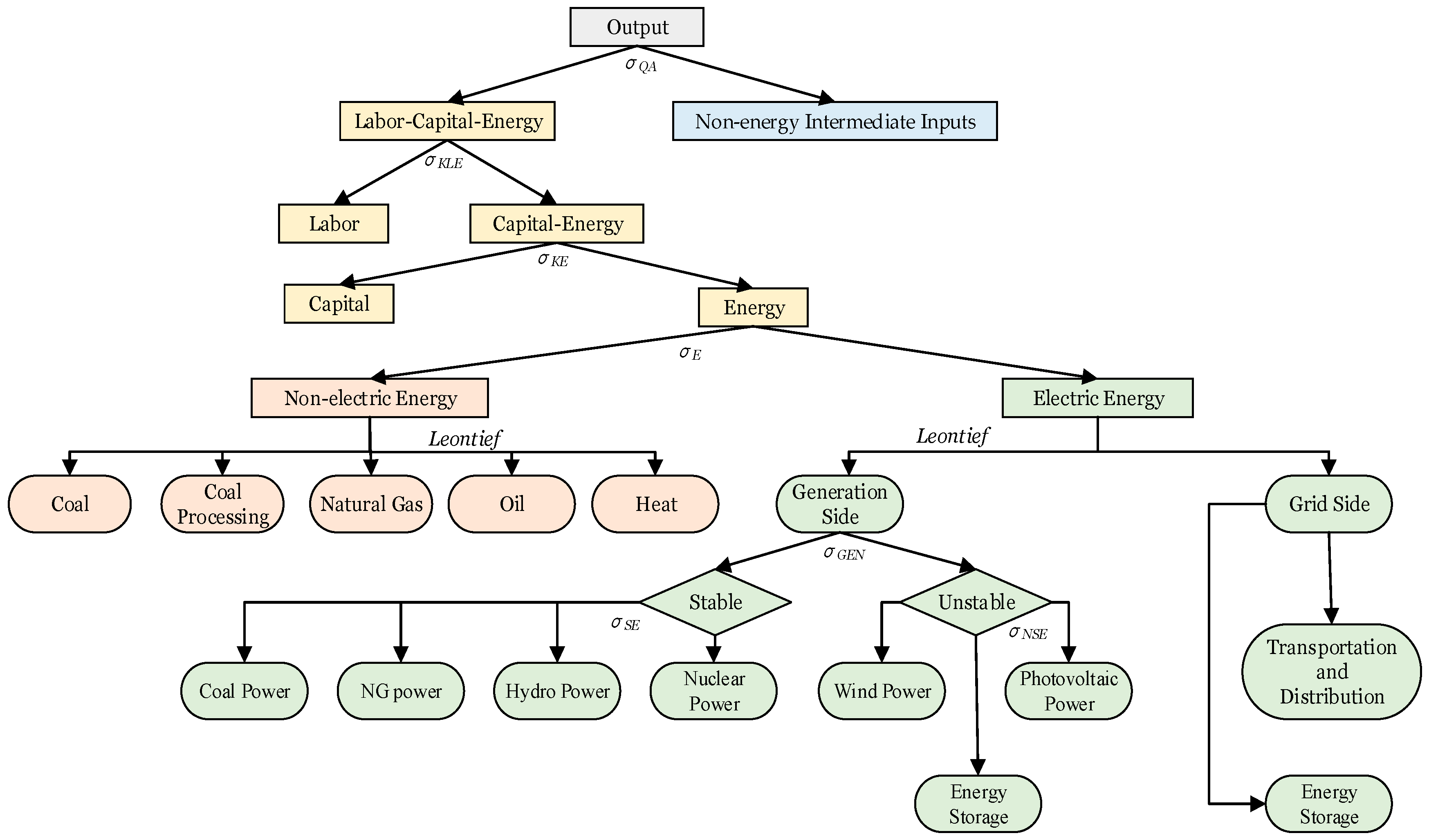

3.1. The CGE Model

3.2. SAM Table and Account Setting

3.3. Data Sources

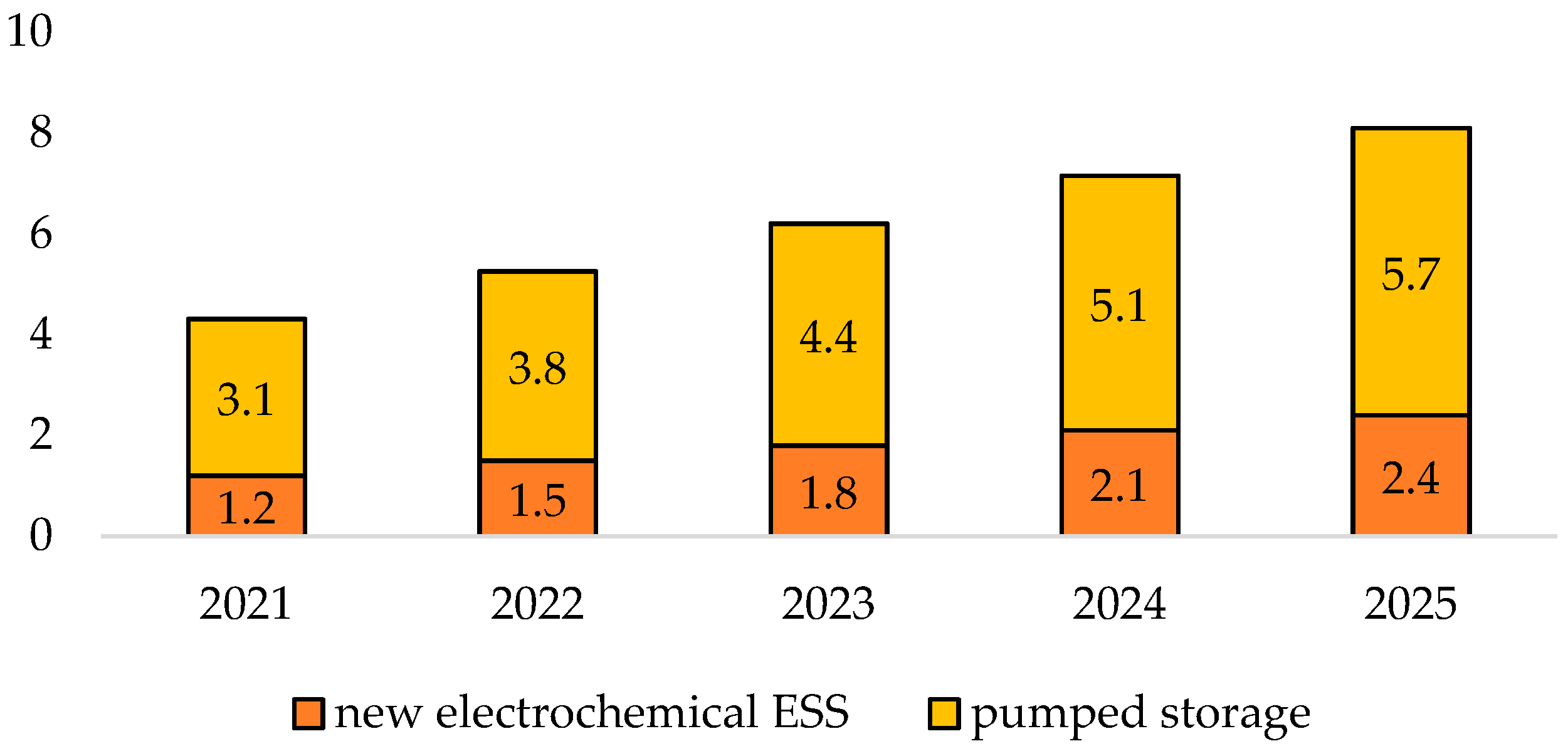

3.4. Scenarios Setting

4. Results

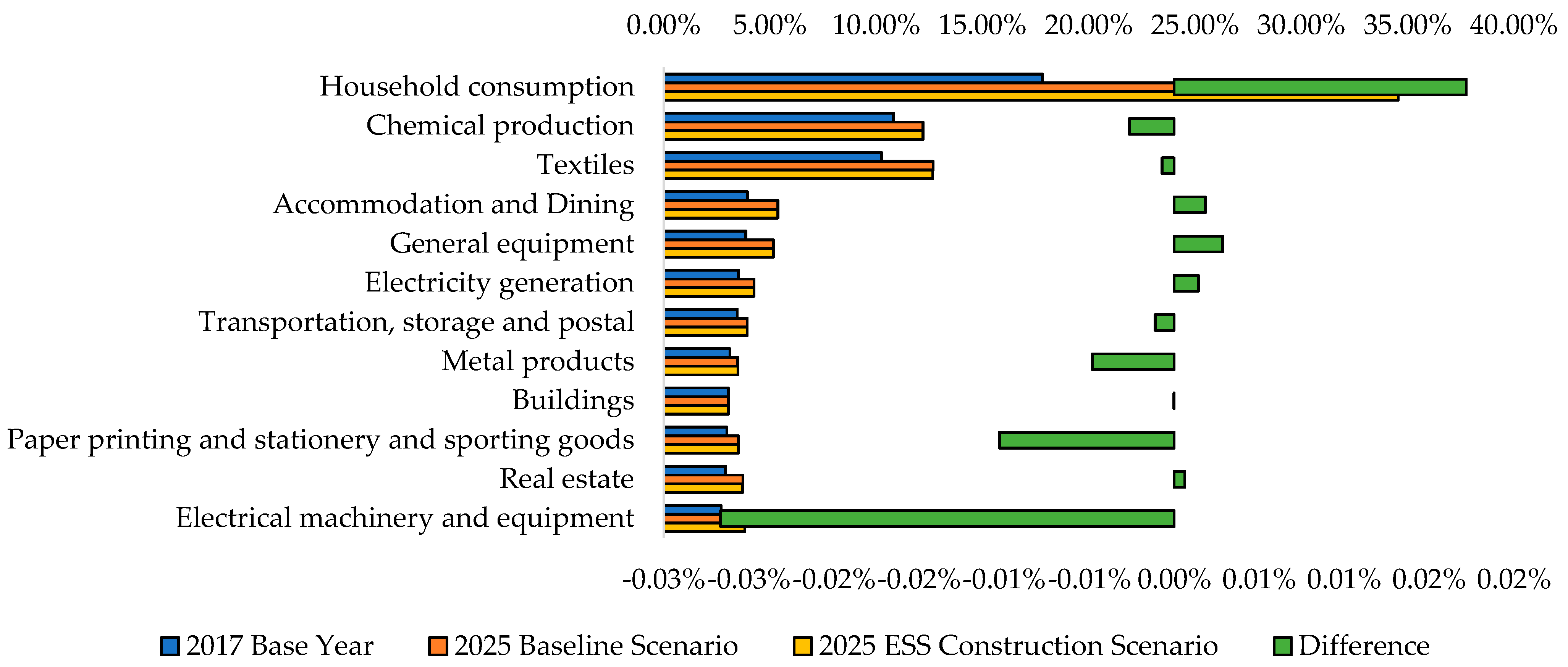

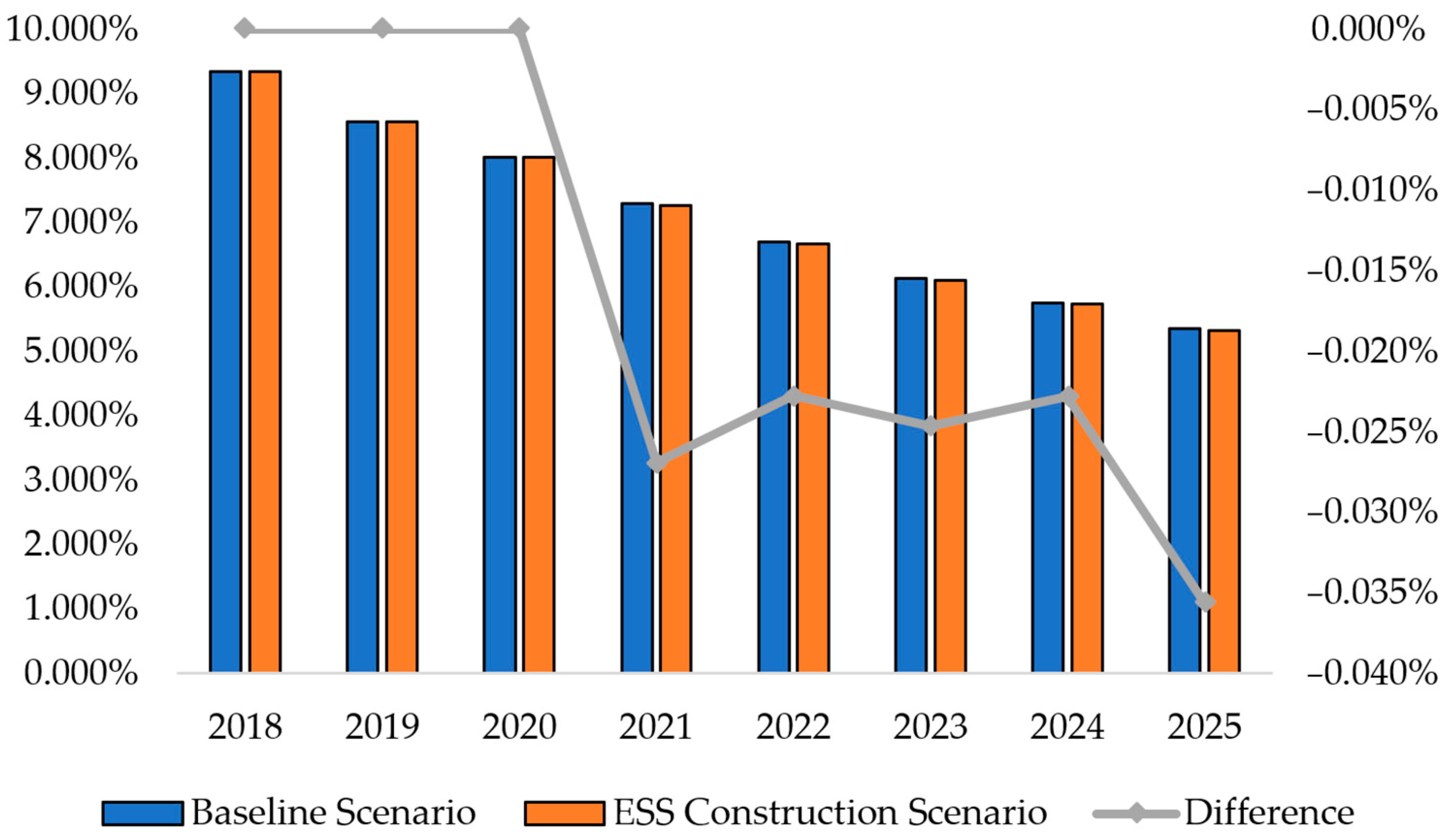

4.1. The Impact of Energy Storage Construction on Economic

4.2. The Impact of Energy Storage Construction on Social Welfare

4.3. The Impact of Energy Storage Construction on the Power System of Zhejiang Province

4.4. The Impact of Energy Storage Construction on CO2 Emissions of Zhejiang Province

5. Conclusions

Author Contributions

Funding

Institutional Review Board Statement

Informed Consent Statement

Data Availability Statement

Acknowledgments

Conflicts of Interest

References

- Kebede, A.A.; Kalogiannis, T.; Van Mierlo, J.; Berecibar, M. A comprehensive review of stationary energy storage devices for large scale renewable energy sources grid integration. Renew. Sustain. Energy Rev. 2022, 159, 112213. [Google Scholar] [CrossRef]

- Rissman, J.; Bataille, C.; Masanet, E.; Aden, N.; Morrow, W.R.; Zhou, N.; Elliott, N.; Dell, R.; Heeren, N.; Huckestein, B.; et al. Technologies and policies to decarbonize global industry: Review and assessment of mitigation drivers through 2070. Appl. Energy 2020, 266, 114848. [Google Scholar] [CrossRef]

- Wu, Z.; Huang, X.; Chen, R.; Mao, X.; Qi, X. The United States and China on the paths and policies to carbon neutrality. J. Environ. Manag. 2022, 320, 115785. [Google Scholar] [CrossRef]

- Lin, B.; Wu, W. Economic viability of battery energy storage and grid strategy: A special case of China electricity market. Energy 2017, 124, 423–434. [Google Scholar] [CrossRef]

- Lai, X.; Chen, Q.; Tang, X.; Zhou, Y.; Gao, F.; Guo, Y.; Bhagat, R.; Zheng, Y. Critical review of life cycle assessment of lithium-ion batteries for electric vehicles: A lifespan perspective. Etransportation 2022, 12, 100169. [Google Scholar] [CrossRef]

- Nam, K.W.; Park, S.S.; dos Reis, R.; Dravid, V.P.; Kim, H.; Mirkin, C.A.; Stoddart, J.F. Conductive 2D metal-organic framework for high-performance cathodes in aqueous rechargeable zinc batteries. Nat. Commun. 2019, 10, 1–10. [Google Scholar] [CrossRef]

- Yue, M.; Lambert, H.; Pahon, E.; Roche, R.; Jemei, S.; Hissel, D. Hydrogen energy systems: A critical review of technologies, applications, trends and challenges. Renew. Sustain. Energy Rev. 2021, 146, 111180. [Google Scholar] [CrossRef]

- Noussan, M.; Raimondi, P.P.; Scita, R.; Hafner, M. The Role of Green and Blue Hydrogen in the Energy Transition—A Technological and Geopolitical Perspective. Sustainability 2021, 13, 298. [Google Scholar] [CrossRef]

- Lin, B.; Wu, W. The impact of electric vehicle penetration: A recursive dynamic CGE analysis of China. Energy Econ. 2021, 94, 105086. [Google Scholar] [CrossRef]

- Wang, D.; Huangfu, Y.; Dong, Z.; Dong, Y. Research Hotspots and Evolution Trends of Carbon Neutrality—Visual Analysis of Bibliometrics Based on CiteSpace. Sustainability 2022, 14, 1078. [Google Scholar] [CrossRef]

- Lin, B.; Jia, Z. Economic, energy and environmental impact of coal-to-electricity policy in China: A dynamic recursive CGE study. Sci. Total. Environ. 2020, 698, 134241. [Google Scholar] [CrossRef] [PubMed]

- Jia, Z. The hidden benefit: Emission trading scheme and business performance of downstream enterprises. Energy Econ. 2023, 117, 106488. [Google Scholar] [CrossRef]

- Jia, Z.; Lin, B. CEEEA2.0 model: A dynamic CGE model for energy-environment-economy analysis with available data and code. Energy Econ. 2022, 112, 106117. [Google Scholar] [CrossRef]

- Lin, B.; Wu, W. Cost of long distance electricity transmission in China. Energy Policy 2017, 109, 132–140. [Google Scholar] [CrossRef]

- Zakeri, B.; Syri, S. Electrical energy storage systems: A comparative life cycle cost analysis. Renew. Sustain. Energy Rev. 2015, 42, 569–596. [Google Scholar] [CrossRef]

- Long, H.; Wang, S.; Wu, W.; Zhang, G. The economic influence of oil shortage and the optimal strategic petroleum reserve in China. Energy Rep. 2022, 8, 9858–9870. [Google Scholar] [CrossRef]

- Saboori, H.; Hemmati, R.; Jirdehi, M.A. Reliability improvement in radial electrical distribution network by optimal planning of energy storage systems. Energy 2015, 93, 2299–2312. [Google Scholar] [CrossRef]

- Han, X.; Ji, T.; Zhao, Z.; Zhang, H. Economic evaluation of batteries planning in energy storage power stations for load shifting. Renew. Energy 2015, 78, 643–647. [Google Scholar] [CrossRef]

- Oh, H. Optimal Planning to Include Storage Devices in Power Systems. IEEE Trans. Power Syst. 2011, 26, 1118–1128. [Google Scholar] [CrossRef]

- Lawder, M.T.; Suthar, B.; Northrop, P.W.C.; DE, S.; Hoff, C.M.; Leitermann, O.; Crow, M.L.; Santhanagopalan, S.; Subramanian, V.R. Battery Energy Storage System (BESS) and Battery Management System (BMS) for Grid-Scale Applications. Proc. IEEE 2014, 102, 1014–1030. [Google Scholar] [CrossRef]

- Duman, A.C.; Güler, Ö. Techno-economic analysis of off-grid PV/wind/fuel cell hybrid system combinations with a comparison of regularly and seasonally occupied households. Sustain. Cities Soc. 2018, 42, 107–126. [Google Scholar] [CrossRef]

- Nykvist, B.; Nilsson, M. Rapidly falling costs of battery packs for electric vehicles. Nat. Clim. Chang. 2015, 5, 329–332. [Google Scholar] [CrossRef]

- Heymans, C.; Walker, S.B.; Young, S.B.; Fowler, M. Economic analysis of second use electric vehicle batteries for residential energy storage and load-levelling. Energy Policy 2014, 71, 22–30. [Google Scholar] [CrossRef]

- Bradbury, K.; Pratson, L.; Patiño-Echeverri, D. Economic viability of energy storage systems based on price arbitrage potential in real-time U.S. electricity markets. Appl. Energy 2014, 114, 512–519. [Google Scholar] [CrossRef]

- Ansari, B.; Shi, D.; Sharma, R.; Simoes, M.G. Economic analysis, optimal sizing and management of energy storage for PV grid integration. In Proceedings of the 2016 IEEE/PES Transmission and Distribution Conference and Exposition (T&D), Dallas, TX, USA, 3–5 May 2016; pp. 1–5. [Google Scholar] [CrossRef]

- Das, T.; Krishnan, V.; McCalley, J.D. Assessing the benefits and economics of bulk energy storage technologies in the power grid. Appl. Energy 2015, 139, 104–118. [Google Scholar] [CrossRef]

- Berrada, A.; Loudiyi, K.; Zorkani, I. Valuation of energy storage in energy and regulation markets. Energy 2016, 115, 1109–1118. [Google Scholar] [CrossRef]

- Sioshansi, R.; Madaeni, S.H.; Denholm, P. A Dynamic Programming Approach to Estimate the Capacity Value of Energy Storage. IEEE Trans. Power Syst. 2014, 29, 395–403. [Google Scholar] [CrossRef]

- Ram, M.; Aghahosseini, A.; Breyer, C. Job creation during the global energy transition towards 100% renewable power system by 2050. Technol. Forecast. Soc. Chang. 2020, 151, 119682. [Google Scholar] [CrossRef]

- He, Y.; Zhang, S.; Yang, L.; Wang, Y.; Wang, J. Economic analysis of coal price–electricity price adjustment in China based on the CGE model. Energy Policy 2010, 38, 6629–6637. [Google Scholar] [CrossRef]

- Cui, Q.; Liu, Y.; Ali, T.; Gao, J.; Chen, H. Economic and climate impacts of reducing China’s renewable electricity curtailment: A comparison between CGE models with alternative nesting structures of electricity. Energy Econ. 2020, 91, 104892. [Google Scholar] [CrossRef]

- Lin, B.; Jia, Z. What will China’s carbon emission trading market affect with only electricity sector involvement? A CGE based study. Energy Econ. 2019, 78, 301–311. [Google Scholar] [CrossRef]

- Jia, Z. What kind of enterprises and residents bear more responsibilities in carbon trading? A step-by-step analysis based on the CGE model. Environ. Impact Assess. Rev. 2023, 98, 106950. [Google Scholar] [CrossRef]

- Dai, H.; Fujimori, S.; Herran, D.S.; Shiraki, H.; Masui, T.; Matsuoka, Y. The impacts on climate mitigation costs of considering curtailment and storage of variable renewable energy in a general equilibrium model. Energy Econ. 2017, 64, 627–637. [Google Scholar] [CrossRef]

- Bao, Q.; Tang, L.; Zhang, Z.; Wang, S. Impacts of border carbon adjustments on China’s sectoral emissions: Simulations with a dynamic computable general equilibrium model. China Econ. Rev. 2013, 24, 77–94. [Google Scholar] [CrossRef]

- Lin, B.; Chen, Y. Transportation infrastructure and efficient energy services: A perspective of China’s manufacturing industry. Energy Econ. 2020, 89, 104809. [Google Scholar] [CrossRef]

- Shan, Y.; Huang, Q.; Guan, D.; Hubacek, K. China CO2 emission accounts 2016–2017. Sci. Data 2020, 7, 54. [Google Scholar] [CrossRef] [PubMed]

- Fan, E.; Li, L.; Wang, Z.; Lin, J.; Huang, Y.; Yao, Y.; Chen, R.; Wu, F. Sustainable Recycling Technology for Li-Ion Batteries and Beyond: Challenges and Future Prospects. Chem. Rev. 2020, 120, 7020–7063. [Google Scholar] [CrossRef]

- Zhang, X.; Li, L.; Fan, E.; Xue, Q.; Bian, Y.; Wu, F.; Chen, R. Toward sustainable and systematic recycling of spent rechargeable batteries. Chem. Soc. Rev. 2018, 47, 7239–7302. [Google Scholar] [CrossRef]

- Wen, R.; Qi, S.; Jrade, A. Simulation and Assessment of Whole Life-Cycle Carbon Emission Flows from Different Residential Structures. Sustainability 2016, 8, 807. [Google Scholar] [CrossRef]

- Zhang, L.; Li, Y.; Jia, Z. Impact of carbon allowance allocation on power industry in China’s carbon trading market: Computable general equilibrium based analysis. Appl. Energy 2018, 229, 814–827. [Google Scholar] [CrossRef]

- Lin, B.; Chen, Y. Will land transport infrastructure affect the energy and carbon dioxide emissions performance of China’s manufacturing industry? Appl. Energy 2020, 260, 114266. [Google Scholar] [CrossRef]

- Li, C.; Liu, N.; Liu, W.; Feng, R. Study on Characteristics of Energy Storage and Acoustic Emission of Rock under Different Moisture Content. Sustainability 2021, 13, 1041. [Google Scholar] [CrossRef]

| Cash Flow Items | Data Source | Cash Flow Items | Data Source |

|---|---|---|---|

| Total provincial output | IO table | Household tax | Finance Yearbook of China |

| Intermediate input | IO table | Finance Yearbook of Zhejiang | |

| Household consumption | IO table | Firm tax | Balance item |

| Government consumption | IO table | Import | IO table |

| Export | IO table | Foreign capital reward | China Statistical Yearbook |

| Domestic and out-of-province outflow | IO table | Zhejiang Statistical Yearbook | |

| Investment + stock | IO table | Net foreign savings | Balance item |

| Wages and salaries | IO table | Inflow of domestic and foreign provinces | IO table |

| Capital reward | IO table | Central government revenue | Finance Yearbook of China |

| Household capital reward | Zhejiang Statistical Yearbook | Finance Yearbook of Zhejiang | |

| Transfer payment From government to household | Balance item | Household savings | Balance item |

| Transfer payment from government to firm | Balance item | Firm savings | Balance item |

| Firm capital reward | Balance item | Government savings | Balance item |

| Tax on activities | IO table | Net foreign investment | Finance Yearbook of Zhejiang |

| Net interprovincial investment | Balance item |

Disclaimer/Publisher’s Note: The statements, opinions and data contained in all publications are solely those of the individual author(s) and contributor(s) and not of MDPI and/or the editor(s). MDPI and/or the editor(s) disclaim responsibility for any injury to people or property resulting from any ideas, methods, instructions or products referred to in the content. |

© 2023 by the authors. Licensee MDPI, Basel, Switzerland. This article is an open access article distributed under the terms and conditions of the Creative Commons Attribution (CC BY) license (https://creativecommons.org/licenses/by/4.0/).

Share and Cite

Sun, Q.; Zhou, J.; Lan, Z.; Ma, X. The Economic Influence of Energy Storage Construction in the Context of New Power Systems. Sustainability 2023, 15, 3070. https://doi.org/10.3390/su15043070

Sun Q, Zhou J, Lan Z, Ma X. The Economic Influence of Energy Storage Construction in the Context of New Power Systems. Sustainability. 2023; 15(4):3070. https://doi.org/10.3390/su15043070

Chicago/Turabian StyleSun, Qiujie, Jingyu Zhou, Zhou Lan, and Xiangyang Ma. 2023. "The Economic Influence of Energy Storage Construction in the Context of New Power Systems" Sustainability 15, no. 4: 3070. https://doi.org/10.3390/su15043070

APA StyleSun, Q., Zhou, J., Lan, Z., & Ma, X. (2023). The Economic Influence of Energy Storage Construction in the Context of New Power Systems. Sustainability, 15(4), 3070. https://doi.org/10.3390/su15043070