Promoting or Inhibiting? Digital Inclusive Finance and Cultural Consumption of Rural Residents

Abstract

1. Introduction

2. Literature Review, Theoretical Analysis, and Research Hypothesis

2.1. Literature Review

2.2. Theoretical Analysis

2.3. Research Hypothesis

3. Study Design

3.1. Baseline Regression Model

3.2. Mediation Effect Model

3.3. Variable Selection

3.4. Data Sources and Descriptive Statistics of Variables

4. Analysis of Empirical Results

4.1. Baseline Regression Results and Analysis

4.2. Robustness Test

4.3. Endogeneity Analysis

5. Further Discussion: Heterogeneity Analysis and Mediating Effect Test

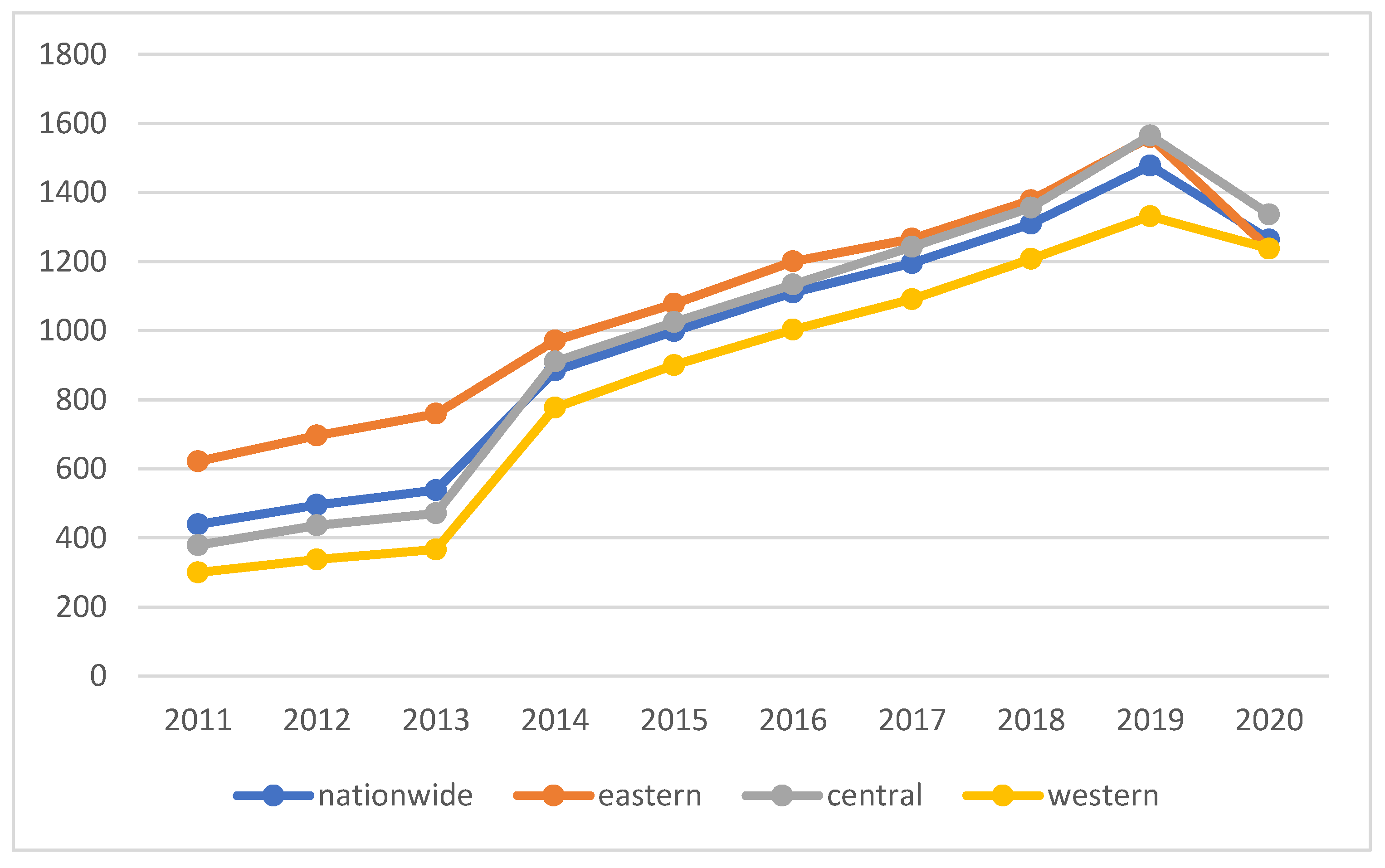

5.1. Heterogeneity Analysis

5.1.1. The Impact of Different Dimensions of Digital Inclusive Finance on Rural Residents’ Cultural Consumption

5.1.2. The Impact of Digital Inclusive Finance on Rural Residents’ Cultural Consumption in Different Regions

5.2. Mediating Effect Test

6. Research Conclusions and Policy Recommendations

Author Contributions

Funding

Data Availability Statement

Conflicts of Interest

References

- Benzecry, C.; Collins, R. The High of Cultural Experience. Sociol. Theory 2014, 32, 307–326. [Google Scholar] [CrossRef]

- Gu, J. The Achievements, Experience and Prospects of China’s Cultural Industry Development Since the 18th National Congress of the Communist Party of China. J. Manag. World 2022, 38, 49–60. [Google Scholar] [CrossRef]

- Kántor, S. Culture-Based Urban Development: The Relationship between Culture Consumption, Residence Preferences, and Quality of Life in Győr, Debrecen, and Veszprém. 2021. Available online: https://xs2.studiodahu.com/scholar?cluster=129826857145513286&hl=zh-CN&as_sdt=0,5 (accessed on 1 August 2022).

- Lin, L. Present Situation, Problems and Countermeasures of Rural Cultural Consumption in the New Era. Chin. J. Agric. Resour. Reg. Plan. 2022, 43, 188–200. Available online: https://kns.cnki.net/kcms/detail/detail.aspx?FileName=ZGNZ202208033&DbName=CJFQ2022 (accessed on 18 January 2023).

- Zhu, H.; Chen, H. Level Measurement, Spatial-temporal Evolution and Promotion Path of Digital Village Development in China. Issues Agric. Econ. 2022, 1–14. [Google Scholar] [CrossRef]

- Liu, X.; Zhu, J.; Guo, J.; Cui, C. Spatial Association and Explanation of China’s Digital Financial Inclusion Development Based on the Network Analysis Method. Complexity 2021, 2021, 6649894. [Google Scholar] [CrossRef]

- Zhong, T.; Huang, Y.; Sun, F. Digital Inclusive Finance and Green Technology Innovation: Dividend or Gap. Financ. Econ. Res. 2022, 37, 131–145. [Google Scholar]

- Greenwood, J.; Jovanovic, B. Financial Development Growth and the Distribution of Income. J. Political Econ. 1990, 98, 1076–1107. [Google Scholar] [CrossRef]

- Xie, W.; Wang, T.; Zhao, X. Does Digital Inclusive Finance Promote Coastal Rural Entrepreneurship? J. Coast. Res. 2020, 103, 240–245. [Google Scholar] [CrossRef]

- Ding, R.; Shi, F.; Hao, S. Digital Inclusive Finance, Environmental Regulation, and Regional Economic Growth: An Empirical Study Based on Spatial Spillover Effect and Panel Threshold Effect. Sustainability 2022, 14, 4340. [Google Scholar] [CrossRef]

- Dollar, D.; Kraay, A. Growth is Good for the Poor. J. Econ. Growth 2002, 7, 195–225. [Google Scholar] [CrossRef]

- Honohan, P. Financial Development, Growth and Poverty: How Close Are the Links? World Bank Policy Research Working Paper; Working Paper No. 3203; World Bank Website: Washington, DC, USA, 2004. [Google Scholar] [CrossRef]

- Shoji, M.; Aoyagi, K.; Kasahara, R.; Sawada, Y.; Ueyama, M. Social Capital Formation and Credit Access: Evidence from Sri Lanka. World Dev. 2012, 40, 2522–2536. [Google Scholar] [CrossRef]

- Claessens, S.; Feijen, E. Finance and Hunger: Empirical Evidence of the Agricultural Productivity Channel; Social Science Electronic Publishing: New York, NY, USA, 2007; pp. 1–48. [Google Scholar] [CrossRef]

- Abor, J.Y.; Amidu, M.; Issahaku, H. Mobile Telephony, Financial Inclusion and Inclusive Growth. J. Afr. Bus. 2018, 19, 430–453. [Google Scholar] [CrossRef]

- Zhou, L.; Wang, H. An Approach to Study the Poverty Reduction Effect of Digital Inclusive Finance from a Multidimensional Perspective Based on Clustering Algorithms. Sci. Program. 2021, 2021, 4645596. [Google Scholar] [CrossRef]

- Yu, N.; Wang, Y. Can Digital Inclusive Finance Narrow the Chinese Urban–Rural Income Gap? The Perspective of the Regional Urban–Rural Income Structure. Sustainability 2021, 13, 6427. [Google Scholar] [CrossRef]

- Song, K.; Liu, J.; Li, Z. Does the Development of Digital Financial Inclusion Narrows the Urban-rural Income Gap?—Concurrently Discuss the Synergistic Effect between Digital Financial Inclusion and Traditional Finance in Rural Area. China Soft Sci. 2022, 13, 133–145. [Google Scholar] [CrossRef]

- Ji, X.; Wang, K.; Xu, H.; Li, M. Has Digital Financial Inclusion Narrowed the Urban-Rural Income Gap: The Role of Entrepreneurship in China. Sustainability 2021, 13, 8292. [Google Scholar] [CrossRef]

- Zhao, H.; Zheng, X.; Yang, L. Does Digital Inclusive Finance Narrow the Urban-Rural Income Gap through Primary Distribution and Redistribution? Sustainability 2022, 14, 2120. [Google Scholar] [CrossRef]

- Li, Y. Empirical analysis of the impact of financial development on the income gap between urban and rural residents in the context of large data using fuzzy Kmeans clustering algorithm. Int. J. Electr. Eng. Educ. 2020, 002072092093683. [Google Scholar] [CrossRef]

- Yue, P.; Korkmaz, A.G.; Yin, Z.; Zhou, H. The rise of digital finance: Financial inclusion or debt trap? Financ. Res. Lett. 2022, 47, 102604. [Google Scholar] [CrossRef]

- Li, J.; Wu, Y.; Xiao, J.J. The impact of digital finance on household consumption: Evidence from China. Econ. Model. 2020, 86, 317–326. [Google Scholar] [CrossRef]

- Guo, S. Rural residents’ consumption behavior, influencing factors and development suggestions. Issues Agric. Econ. 2022, 509, 2. [Google Scholar] [CrossRef]

- Zhou, Y.; Yang, Z. Does Internet Use Promote Rural Residents’ Consumption: Based on the Survey of 739 Farmers in Jiangxi Province. Econ. Geogr. 2021, 41, 224–232. [Google Scholar] [CrossRef]

- He, D.; Gu, J. The Impact of the Internet on the Consumption Level and Structure of Rural Residents: An Empirical Study of PSM Based on CFPS Data. Rural. Econ. 2018, 10, 51–57. [Google Scholar]

- Sun, Z.; Dong, J.; Li, D. Consumption Upgrading of Rural Residents: Is Internet Literacy Important? Econ. Issues 2022, 2, 103–111. [Google Scholar] [CrossRef]

- Ma, A.; Shang, Z.; Hefan, X.; Jiafeng, Y. Research on regional differences in the impact of fiscal support expenditure on farmers’ consumption. Stat. Decis. 2020, 36, 75–78. [Google Scholar] [CrossRef]

- Qin, K.; Zhang, C. The connotation, potential and development path of digital cultural consumption in the new development pattern. Dongyue Trib. 2022, 43, 17–26. [Google Scholar] [CrossRef]

- Huang, Y.; Song, J.; Shishan, Z.; Yuanping, X. Commentaries:Multidimensional Observation and Prospect of Cultural Digitization. J. Cent. China Norm. Univ. 2023, 62, 52–69. [Google Scholar] [CrossRef]

- Yi, X.; Zhou, L. Does Digital Financial Inclusion Significantly Influence Household Consumption? Evidence from Household Survey Data in China. J. Financ. Res. 2018, 461, 47–67. [Google Scholar]

- Zhou, X.; Wang, W. The Impact of Digital Financial Inclusion on Household Consumption: An Empirical Analysis Based on a Spatial Econometric Model. Financ. Econ. Res. 2020, 35, 133–145. [Google Scholar]

- Long, H.; Li, Y.; Wu, D. The Impact of Digital Financial Inclusion on Household Consumption: “Digital Divide” or “Digital Dividend”? Stud. Int. Financ. 2022, 3–12. [Google Scholar] [CrossRef]

- Guo, H.; Zhang, Y.; Yanling, P.; Zhongwei, H. Research on Regional Differences in the Impact of Digital Financial Development on Rural Residents’ Consumption. J. Agrotech. Econ. 2020, 12, 66–80. [Google Scholar] [CrossRef]

- Deaton, A. Understanding Consumption; Oxford University Press: Oxford, UK, 1992; pp. 214–221. [Google Scholar] [CrossRef]

- Zhang, X.; Yang, T.; Chen, W.; Guanhua, W. Digital Finance and Household Consumption: Theory and Evidence from China. J. Manag. World 2020, 36, 48–63. [Google Scholar] [CrossRef]

- Leyshon, A.; Thrift, N. The restructuring of the UK financial services industry in the 1990s: A reversal of fortune? J. Rural Stud. 1993, 9, 223–241. [Google Scholar] [CrossRef]

- Zhou, X.; Cui, Y.; Zhang, S. Internet use and rural residents’ income growth. China Agric. Econ. Rev. 2020, 12, 315–327. [Google Scholar] [CrossRef]

- Fang, G.; Cai, L. How Digital Financial Inclusion Affects Agricultural Output: Facts, Mechanism and Policy Implications. Agric. Econ. Issues 2022, 10, 97–112. [Google Scholar] [CrossRef]

- Jiang, T. Mediating Effects and Moderating Effects in Causal Inference. China Ind. Econ. 2022, 5, 100–120. [Google Scholar] [CrossRef]

- Baron, R.M.; Kenny, D.A. The Moderator-Mediator Variable Distinction in Social Psychological Research: Conceptual, Strategic and Statistical Considerations. J. Personal. Soc. Psychol. 1986, 51, 1173–1182. [Google Scholar] [CrossRef]

- Shi, B.; Li, J. Does the lnternet Promote Division of Labor? Evidences from Chinese Manufacturing Enterprises. J. Manag. World 2020, 36, 130–149. [Google Scholar] [CrossRef]

- Wang, W.; Liu, B.; Li, X. How does digital financial inclusion affect the urban-rural cultural consumption gap? Rural Econ. 2021, 468, 90–98. [Google Scholar]

- Guo, F.; Wang, J.; Wang, F.; Kong, T.; Zhang, X.; Cheng, Z. Measuring China’s Digital Financial Inclusion: Index Compilation and Spatial Characteristics. China Econ. Q. 2020, 19, 1401–1418. [Google Scholar] [CrossRef]

- Xu, M.; Jiang, Y. Can the China’s Industrial Structure Upgrading Narrowthe Gap between Urban and Rural Consumption? J. Quant. Technol. Econ. 2015, 32, 3–21. [Google Scholar] [CrossRef]

- Allen, F.; Gu, X.; Jagtiani, J. A Survey of Fintech Research and Policy Discussion. Rev. Corp. Financ. 2021, 1, 259–339. [Google Scholar] [CrossRef]

| Year | Overall Differences | Inter-Regional Differences (Contribution Rates) | Intra-Regional Differences (Contribution Rates) | |||

|---|---|---|---|---|---|---|

| Overall | Eastern | Central | Western | |||

| 2011 | 0.1158 | 0.0514 (44.38) | 0.0644 (55.62) | 0.0961 (43.06) | 0.0150 (2.99) | 0.0442 (9.57) |

| 2012 | 0.1104 | 0.0497 (44.99) | 0.0607 (55.01) | 0.0948 (44.26) | 0.0197 (4.20) | 0.0289 (6.54) |

| 2013 | 0.1015 | 0.0506 (49.82) | 0.0510 (50.18) | 0.0705 (35.92) | 0.0263 (6.04) | 0.0334 (8.22) |

| 2014 | 0.0249 | 0.0046 (18.68) | 0.0202 (81.32) | 0.0182 (29.48) | 0.0128 (14.15) | 0.0291 (37.69) |

| 2015 | 0.0203 | 0.0031 (15.05) | 0.0172 (84.95) | 0.0157 (30.67) | 0.0103 (13.85) | 0.0248 (40.43) |

| 2016 | 0.0184 | 0.0030 (16.34) | 0.0154 (83.66) | 0.0115 (24.74) | 0.0122 (18.01) | 0.0228 (40.92) |

| 2017 | 0.0162 | 0.0023 (14.05) | 0.0139 (85.95) | 0.0070 (16.70) | 0.0151 (25.82) | 0.0210 (43.43) |

| 2018 | 0.0122 | 0.0018 (14.72) | 0.0104 (85.28) | 0.0076 (24.19) | 0.0087 (19.80) | 0.0149 (41.28) |

| 2019 | 0.0135 | 0.0029 (21.38) | 0.0106 (78.62) | 0.0107 (30.67) | 0.0093 (19.62) | 0.0115 (28.32) |

| 2020 | 0.0122 | 0.0006 (4.89) | 0.0116 (95.11) | 0.0147 (43.23) | 0.0143 (32.99) | 0.0064 (18.89) |

| Variable | Symbol | Observation | Mean | Standard Deviation | Minimum | Maximum |

|---|---|---|---|---|---|---|

| Rural residents’ cultural consumption level | lnCONSUME | 300 | 0.094 | 0.021 | 0.044 | 0.138 |

| Digital inclusive finance | lnDFI | 300 | 5.219 | 0.668 | 2.909 | 6.068 |

| Breadth of digital inclusive finance coverage | lnBRE | 300 | 5.075 | 0.820 | 0.673 | 5.984 |

| Depth of digital inclusive finance usage | lnDEP | 300 | 5.201 | 0.648 | 1.911 | 6.192 |

| Degree of digitalization of digital inclusive finance | lnDIG | 300 | 5.510 | 0.698 | 2.026 | 6.136 |

| Level of rural residents‘ income | lnINCOME | 300 | 9.354 | 0.418 | 8.271 | 10.460 |

| Level of urbanization | lnURBAN | 300 | 0.461 | 0.075 | 0.300 | 0.640 |

| Level of financial development | lnLFD | 300 | 1.121 | 0.310 | 0.417 | 2.096 |

| Level of economic development | lnPGDP | 300 | 10.870 | 0.453 | 9.706 | 12.010 |

| Industrial structure upgrading | lnISU | 300 | 0.863 | 0.053 | 0.773 | 1.042 |

| Level of external openness | lnFDI | 300 | 0.020 | 0.018 | 0.000 | 0.114 |

| Engel coefficient lnENGEL | lnENGEL | 300 | 0.290 | 0.042 | 0.213 | 0.417 |

| Level of human capital | lnEDU | 300 | 2.063 | 0.097 | 1.766 | 2.466 |

| Variable | (1) | (2) | (3) | (4) |

|---|---|---|---|---|

| lnDFI | 0.016 *** | 0.057 *** | 0.015 *** | 0.046 *** |

| (7.76) | (4.94) | (7.74) | (4.25) | |

| lnPGDP | −0.023 * | 0.033 ** | ||

| (−2.02) | (2.04) | |||

| lnISU | 0.022 | 0.092 | ||

| (0.31) | (1.55) | |||

| lnFDI | 0.220 *** | 0.120 * | ||

| (2.89) | (1.72) | |||

| lnENGEL | −0.267 *** | −0.218 *** | ||

| (−3.62) | (−4.24) | |||

| lnEDU | −0.041 ** | 0.047 | ||

| (−2.46) | (1.46) | |||

| Constant | 0.012 | −0.134 *** | 0.406 *** | −0.545 ** |

| (1.12) | (−3.21) | (4.32) | (−2.66) | |

| Area fixed effects | YES | YES | YES | YES |

| Time fixed effects | NO | YES | NO | YES |

| R2 | 0.415 | 0.663 | 0.565 | 0.710 |

| Observation | 300 | 300 | 300 | 300 |

| Variable | (5) | (6) | (7) | (8) |

|---|---|---|---|---|

| lnDFI | 0.448 *** | 0.048 *** | ||

| (7.17) | (8.91) | |||

| lag1_lnDFI | 0.046 *** | |||

| (4.99) | ||||

| lag2_lnDFI | 0.015 *** | |||

| (3.41) | ||||

| Constant | 5.955 * | −0.649 ** | −0.730 *** | 0.249 *** |

| (1.83) | (−3.39) | (−3.36) | (3.34) | |

| Control variables | YES | YES | YES | YES |

| Area-fixed effects | YES | YES | YES | YES |

| Time-fixed effects | YES | YES | YES | YES |

| R2 | 0.853 | 0.715 | 0.532 | — |

| Observation | 300 | 270 | 240 | 300 |

| Variable | (9) | (10) | (11) |

|---|---|---|---|

| lnDFI | 0.139 *** | 0.094 *** | 0.113 ** |

| (4.38) | (3.06) | (2.16) | |

| Constant | −0.732 *** | −0.853 *** | 0.297 *** |

| (−3.84) | (−4.37) | (7.40) | |

| Control variables | YES | YES | YES |

| Area-fixed effects | YES | YES | YES |

| Time-fixed effects | YES | YES | YES |

| R2 | 0.685 | 0.501 | — |

| Observation | 270 | 240 | 300 |

| Variable | Different Dimensions of Digital Inclusive Finance | Regional Heterogeneity | ||||

|---|---|---|---|---|---|---|

| (12) | (13) | (14) | (15) | (16) | (17) | |

| lnDFI | 0.076 ** | 0.009 | 0.014 | |||

| (3.02) | (0.36) | (1.11) | ||||

| lnBRE | 0.016 ** | |||||

| (2.60) | ||||||

| lnDEP | 0.015 | |||||

| (1.65) | ||||||

| lnDIG | −0.023 *** | |||||

| (−3.79) | ||||||

| Constant | −0.487 ** | −0.712 ** | −0.586 ** | −0.913 | −0.137 | −0.020 |

| (−2.09) | (−2.34) | (−2.19) | (−1.50) | (−0.33) | (−0.06) | |

| Control variables | YES | YES | YES | YES | YES | YES |

| Area-fixed effects | YES | YES | YES | YES | YES | YES |

| Time-fixed effects | YES | YES | YES | YES | YES | YES |

| R2 | 0.687 | 0.648 | 0.683 | 0.477 | 0.890 | 0.843 |

| Observation | 300 | 300 | 300 | 110 | 80 | 110 |

| Variable | (18) Farmers’ Income Level | (19) Urbanization Level | (20) Level of Financial Development | |||

|---|---|---|---|---|---|---|

| lnINCOME | lnCONSUME | lnURBAN | lnCONSUME | lnLFD | lnCONSUME | |

| lnDFI | 0.111 *** | 0.035 *** | 0.034 *** | 0.035 *** | 0.292 *** | 0.041 *** |

| (3.93) | (3.59) | (4.36) | (3.21) | (6.28) | (4.04) | |

| lnINCOME | 0.095 *** | |||||

| (3.18) | ||||||

| lnURBAN | 0.320 *** | |||||

| (4.36) | ||||||

| lnLFD | 0.017 * | |||||

| (1.77) | ||||||

| Constant | 2.750 ** | −0.807 *** | −0.688 ** | −0.325 * | 17.516 *** | −0.852 *** |

| (2.12) | (−2.94) | (−2.10) | (−1.91) | (5.32) | (−2.93) | |

| Control variables | YES | YES | YES | YES | YES | YES |

| Area-fixed effects | YES | YES | YES | YES | YES | YES |

| Time-fixed effects | YES | YES | YES | YES | YES | YES |

| R2 | 0.992 | 0.733 | 0.935 | 0.728 | 0.799 | 0.715 |

| Intermediary effect volume | 22.83% | 23.70% | 10.87% | |||

| Observation | 300 | 300 | 300 | 300 | 300 | 300 |

Disclaimer/Publisher’s Note: The statements, opinions and data contained in all publications are solely those of the individual author(s) and contributor(s) and not of MDPI and/or the editor(s). MDPI and/or the editor(s) disclaim responsibility for any injury to people or property resulting from any ideas, methods, instructions or products referred to in the content. |

© 2023 by the authors. Licensee MDPI, Basel, Switzerland. This article is an open access article distributed under the terms and conditions of the Creative Commons Attribution (CC BY) license (https://creativecommons.org/licenses/by/4.0/).

Share and Cite

Shi, Y.; Cheng, Q.; Wu, Y.; Lin, Q.; Xu, A.; Zheng, Q. Promoting or Inhibiting? Digital Inclusive Finance and Cultural Consumption of Rural Residents. Sustainability 2023, 15, 2719. https://doi.org/10.3390/su15032719

Shi Y, Cheng Q, Wu Y, Lin Q, Xu A, Zheng Q. Promoting or Inhibiting? Digital Inclusive Finance and Cultural Consumption of Rural Residents. Sustainability. 2023; 15(3):2719. https://doi.org/10.3390/su15032719

Chicago/Turabian StyleShi, Yuting, Qiuwang Cheng, Yizhen Wu, Qiaohua Lin, Anxin Xu, and Qiujin Zheng. 2023. "Promoting or Inhibiting? Digital Inclusive Finance and Cultural Consumption of Rural Residents" Sustainability 15, no. 3: 2719. https://doi.org/10.3390/su15032719

APA StyleShi, Y., Cheng, Q., Wu, Y., Lin, Q., Xu, A., & Zheng, Q. (2023). Promoting or Inhibiting? Digital Inclusive Finance and Cultural Consumption of Rural Residents. Sustainability, 15(3), 2719. https://doi.org/10.3390/su15032719