Abstract

Green finance (GF) is a vital strategy implemented by China to minimize carbon emissions to achieve targets of carbon peak and carbon neutrality. Thus, the objective of this study is to reduce carbon emissions by developing green finance practices in China. This study identifies, evaluates, and ranks the factors and sub-factors of green finance because it is the core issue for sustainable development. In this regard, this study utilizes the Delphi and fuzzy Analytical Hierarchy Process (FAHP) method to analyze the main factors and sub-factors of green finance. The Delphi method finalizes the 6 factors and 26 sub-factors after a thorough investigation. The FAHP method was used to assess and rank the identified factors and sub-factors of green finance. The findings show that the political (POF) is the most crucial factor of green finance in the Chinese economy. The economic (ECF) and environmental (ENF) factors are ranked second and third important factors. The further results of the FAHP reveal that ecological and political identification (POF1), political stability (POF3), and climate commitments (POF2) are the top-ranked sub-factors of green finance. The results specify that green finance development is a very crucial strategy to minimize carbon emissions.

1. Introduction

The Paris Agreement and the sustainable development goals (SDGs) 2030 agenda set in 2015 proved that collective wisdom prevailed, and the global community realized the severity and gravity of the issues related to climate change, global warming, and sustainable development [1]. Since then, multiple and multilevel strategies, policy tools, and legislator efforts have been underway to stimulate climate actions to achieve the objectives of sustainable environmental development. One of the important wheels-in-motion toward the pathways of sustainable development is green finance (GF). The latter refers to any structured financial activity that ensures a better sustainable environment outcome. Green finances enhance the possibility of green and eco-friendly projects and also make possible the negative environmental impacts of a project [2,3]. Moreover, green credit policy instruments play a key role in achieving carbon peak and carbon neutrality as such instruments enhance green enterprises [4]. The demand for GF has unprecedentedly increased across the globe. However, the identification and evaluation of the drivers of GF growth are important, especially in developing and emerging economies.

A stream of review studies focused on the overview of concepts of GF such as green loans and green bonds [5,6] and green investment [7]. However, GF is a broad concept of financing related to sustainability, the environment, carbon emission, and climate change [8]. In addition to these studies, a review of the literature in the next section makes evident that the researchers and academician have put forth their effort to scrutinize the impact of GF on sustainable growth, green growth [9], innovation [9,10], energy efficiency [11,12], renewable energy adoption [13], environmental sustainability [14], and carbon dioxide emissions [12,15,16,17]. Furthermore, some studies focused on analyzing how digital finance impacted energy-environmental performance (EEP). A study revealed that efficiency of the green financial investment increased due to the digital economy [18]. GF has shown impressive growth during the last years, and the banking sectors in the economies have started considering it in their portfolios owing to the growth potential of GF products [19]. Along with GF, corporate social responsibility (CSR) has also proved to be a stimulating factor [20].

Though GF is nascent in the Chinese economy, the government has made remarkable progress supported by a steadily developed GF system, policies, and initiatives put forth by the government, such as carbon trading marking and GF pilot zones [21]. Official data showed that green credit reached US$2.37 trillion by the end of the year 2021, with the 2nd largest green bond market globally [22]. However, there is still a long way to realize a carbon peak by 2030 and a carbon neutrality target by 2060. The estimates show that the Chinese economy needs US$450-570 billion annually to reach the targets of carbon peak and carbon neutrality [21]. The study also unveiled that GF exhibited a polarization trend. Moreover, Gilchrist et al. [6] revealed that GF in China is growing fast, but still, the levels of green financial sector development and green financing are far from their potential. The review of existing studies regarding green finance in Section 2 reveals that the researchers analyzed its impacts and role in green growth, renewable energy promotion, carbon emission reduction, and climate change mitigation efforts. However, to the best of our knowledge, there is very limited literature on the identification, evaluation, and analysis of factors of green finance to achieve the “dual targets” of carbon peak and carbon neutrality targets, especially in the second largest economy—China. This provides strong motivation to the authors to fill this research gap. The authors find it imperious to identify and evaluate the factors of green finance to achieve the objectives of carbon peak and carbon neutrality within the targeted time in China. The evaluation of drivers of green growth would help understand the factors of GF, which would provide deeper insight for policymakers to set effective and productive policies to stimulate GF development in the 2nd largest economy in the world.

The study contributes to the analysis of the factors of green finance to achieve the objectives of carbon peak and carbon neutrality. The objective is to pinpoint, analyze, and prioritize the factors of GF in an upper-middle-income economy—China—by employing the Delphi and fuzzy AHP methods. The AHP is a significant multi-criteria decision-making method (MCDM). Firstly, the study identifies the factors and sub-factors of GF. Secondly, identified factors and sub-factors are finalized using the Delphi method. Thirdly, the finalized factors are analyzed using the fuzzy Analytical Hierarchical Process (FAHP) method. The study findings would provide a deeper understanding of political, economic, environmental, social, technological, legal, and institutional factors and sub-factors of GF in China. This understanding would help to strategize GF practices in China and would help to reduce carbon emissions and stimulate sustainable development. In addition, owing to the size of the economy, the volume of trade, investments under the belt and road initiative, and innovative ideas, China has a growing influence on other developing economies not only in the region but also across the globe. GF in China would also positively impact the promotion of GF on the economies having economic ties and constructive engagements with the Chinese economy.

The research paper comprises 6 Sections: Section 1 is the introduction followed by Section 2 which represents the literature review. Section 3 describes identified factors of green finance. Analytical methods and results of the study are given in Section 4 (Decision methodology). Discussion is presented in Section 5. Section 6 comprises the conclusion, implications, limitations, and prospects of the research.

2. Literature Review

The international collective Paris Agreement has made national governments take climate actions to deal with climate change. The international community agreed to take collective action for climate change mitigation and adaptation [1]. Political decision-making is important in climate finance. Since the political ideology and affiliations with a political party or group may have an impact on green finance development support. Some studies focused on examining the impact of such factors on green finance development. For instance, Yan and Xu [23] analyzed whether political membership and affiliation of private entrepreneurs positively affect corporate environmental investment. The study revealed that such affiliations positively affect environmental investment and encourage investors to participate in environmental activities. The authors revealed that the entrepreneurs’ party status was a pivotal driver of environmentally responsible corporate decision-making.

The listing and promulgation of regulations for investment play pivotal roles in decision-making regarding green finance. In a study, Bae et al. [24] argued that the listing of regulations showed an insignificant impact on climate investment. Moreover, the political connection was found to have a negative moderating influence between media and climate finance. Stringent environmental policy implementation is productive in ensuring environmental sustainability [25]. Moreover, economic and environmental dimensions determine the sustainability performance of financial institutions. Zheng et al. [19] examined how these dimensions of GF influence the sustainability performance of financial intuitions. The findings suggested all three dimensions of GF exposed positive and significant influence on the sustainability performance of financial institutions in Bangladesh. The authors also identified that almost 95 percent of bankers identified green financing as a pivotal element of banking strategies. In recent years, corporate social responsibility (CSR) has gotten central importance in the perspectives of climate change mitigation. It also has its role to play in green financing and the environmental performance of the banking sector industry. CSR practices play an important role and have a positive influence on the environmental performance of the banking sector [20].

When it comes to carbon emission reduction and carbon neutrality, the shifting from traditional fossil fuels to alternative renewable energy has the most critical role to play. Green finance has been considered one of the most important stimulants of renewable energy adoption. In this regard, a strand of empirical literature has focused on the analysis of the impact of green financing on renewable energy (RE) and green infrastructure. For instance, Mngumi et al. [13] examined the link between green financing, RE, and CO2 emission in BRICS economies using a panel quantile regression. The study concluded that the increased RE use and developments in the green financial development index significantly reduces carbon emission [26]. However, carbon emissions slowed down renewable energy use growth and also slowed the flow of investments in green energy projects. Moreover, the GF policies failed to produce any impact. The study suggested improvements in GF policies. In another study, Rasoulinezhad and Taghizadeh-Hesary [11] attempted to determine the impact of green financing on energy efficiency and RE development. The authors suggested the implementation of productive policies with a long-term approach for private investors’ involvement in green energy investment projects. Findings in [12] confirmed the negative impact of green financing and energy efficiency on carbon emissions. Moreover, the authors asserted GF as the best stratagem for CO2 emission reduction.

A strand of empirical studies has enriched the literature on green finance and its role in improving climate change mitigation. In a recent study, Cao et al. [27] showed that digital finance enhances energy-environmental performance (EEP) in China. The authors revealed that digital finance improves the EEP through the channel of technological innovation. The study further asserted that financial monitoring and environmental regulation underpin the role of digital finance in enhancing EEP in China. Bai et al. [17] concluded that green financial development showed an inverted N-shaped association with carbon emissions. The authors asserted that GF played a pivotal part in reducing CO2 emissions. The study also stressed that the need for improvement in the quality of GF empowered by science and technology was key to realizing sustainable development. In bibliometric and systematic reviews of drivers of green investment, Chiţimiea et al. [7] highlighted internal and external drivers of green investment. The study concluded that climate change, stakeholder behavior, target market, legislation and regulation, public financing, and incentives are major drivers of green investment. In another study, Agaykum et al. [28] concluded eight drivers are important in investment in green buildings. These drivers included high return on investment, emerging business opportunities, ethical investment, resource conservation, compulsory regulations, standards, and policies. Another study by Bao and Meiling [29] looked at whether green credit promotes sustainable development in 280 cities in China. The study showed that green credit stimulates green sustainable development and this impact strengthens with the incremental implementation of complementary policies. Green credit reduces the number of green inputs and optimizes the energy input structure. However, the green technological level is not enhanced, rather it crowds out high-tech value green innovations. Moreover, it is also pointed out that green credit performs better to reduce pollution in cities with relatively strong green credit binding effects.

Chen and Pak [30] attempted to identify feasible green performance evaluation indices in Chinese ports. The authors used the Delphi technique to serve this purpose. The study concluded that green performance indices were strongly consistent with the environmental policies implemented by the Chinese government. Fu et al. [31] assessed the sustainable green financial environment by examining the structure of monetary aftershocks due to COVID-19 outbreaks. In a recent study, Cheung et al. [32] examined the barriers and enablers of sustainable finance in Australian retail banks. The authors pointed out that the climate risks and opportunities affected the consumers. Moreover, it was also stressed that such risks and opportunities had the potential to affect climate actions through lending decisions. Kumar et al. [33] examining the development of green finance for sustainable development in Pakistan showed that excessive resource use and inadequate environmental management practices posed threats to the viability and embracement of the circular economy paradigm in the textile and SME sectors in the long run.

Tian et al. [18] examined how the digital economy impacted the efficiency of green financial investment in China. The authors showed that the digital economy enhanced the overall efficiency of GF. Du et al. [10] explored whether GF policies enhance technological innovation and the financial performance of Chinese-listed green enterprises. The analyses in the study provided important insights. First, GF was found to stimulate innovation and financial performance. Second, the GF policies incentized the green enterprises in digital finance. Third, green enterprises with high green development were considerably affected by GF policies. Niu et al. [34] explored whether green credit impacts the green operation of enterprises. The study unveiled that the green credit policy was effective in the transformation of green enterprises. It was also found that the green credit policy also moderated the green transformation of enterprises through debt cost and government subsidies. Zhang et al. [35] examining how green credit impacted the green innovation level of heavily polluting enterprises in China unveiled that, compared to non-heavy polluting enterprises, green credit policies inhibited the green innovation of all heavy-polluting enterprises. The authors showed that the green credit policy limited the efficiency of business investment and the cost of financing business debt. Moreover, the elimination of corporate credit financing adversely affected the green innovation behavior of enterprises. In another study, Lin et al. [36] revealed that green bonds significantly enhanced enterprise green technology innovation. The authors attributed these positive impacts of green finance to increased media attention and R&D capital investment and reduced financing constraints. It is also notable that green credit policy incentivizes heavily polluting enterprises to increase investment in technological innovation and improves corporate sustainability performance through the innovation compensation effect [4].

3. Factors of Green Finance Development and Research Gaps

3.1. Identified Factors and Sub-Factors of GF Development

This study proposed the multiple factors and sub-factors for the expansion of GF development in China. These factors are very effective and significant in minimizing carbon emission levels and promoting sustainable development. GF factors encourage sustainable business activities and significantly reduce environmental degradation. In this regard, a detailed investigation was undertaken to classify and finalize the critical factors and sub-factors using a Delphi method [37]. The study followed the identification and finalization approach used by Saihi et al. [38] and Ali et al. [39] Therefore, this study identifies 6 factors and 26 sub-factors of GF. The main factors are Political (POF), Economic (ECF), Environmental (ENF), Social (SOF), Technological (TEF), and Legal and Institutional (LIF), respectively. Table 1 presents the factors and sub-factors for the development of GF.

Table 1.

Factors and sub-factors of green finance development.

3.2. Research Gap Analysis

It is identified from preceding studies that GF is a very useful practice to attain the SDGs of the United Nations. GF would help to boost the economy and increase trust among stakeholders and policymakers for more sustainable environments and development. Moreover, GF is considered environmentally friendly for adopting sustainable practices. The current study identified the vital factors and sub-factors for the development of GF and carbon emission reduction. This research proposed the Delphi and FAHP method to finalize, assess, and prioritize the factors and sub-factors of GF development. This is the first study that analyzed and ranked various factors and sub-factors of GF using the Delphi and FAHP method.

4. Decision Methodology

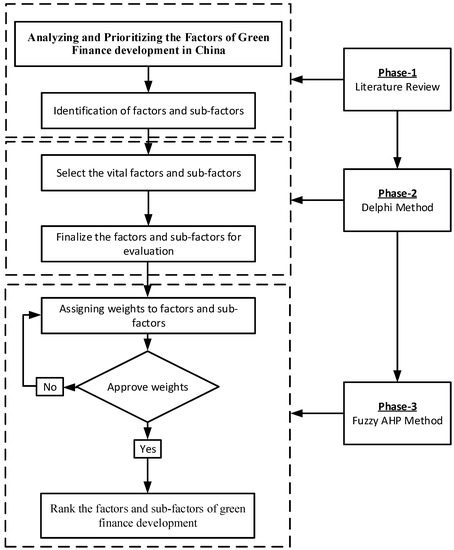

The objective of this study is to analyze the factors and sub-factors of GF. These factors would help to minimize carbon emissions and increase sustainable development. Thus, the Delphi and FAHP methods have been employed to solve this multifaceted problem. Initially, the Delphi method would help to finalize the factors and sub-factors of GF. Further, the fuzzy-based AHP method is applied to evaluate and rank multiple identified factors of GF. Figure 1 presents the decision framework of the research.

Figure 1.

The decision methodology.

4.1. Delphi Method

The Delphi approach is used to obtain the most critical factors and sub-factors for GF development. The main purpose of this technique is to refine the crucial factors for further investigation. The group experts gives the opinion regarding a particular decision problem. The opinion or survey can be obtained through webmail, group discussion, questionnaires, and interviews [37]. The experts share their knowledge and ideas and provide feedback to make a mutual decision [55]. The Delphi method, like other areas of study, is highly relevant to environmental issues. It is suitable when information or knowledge is uncertain and incomplete. In the Delphi method, the expert evaluates such information in an iterative process. It is productive in reaching a consensus between the experts [56,57]. The experts assert that the Delphi method is suitable and should be used to develop a consensus and deal with the limitations of majority rule [31]. The Delphi method has a wide range of applications in every sphere of life including public healthcare [39,40], renewable energy and sustainable development [46], disaster resilience [58], assessment of sustainable green financial environments [31], and green finance evaluation [30].

Multiple steps are involved in the Delphi method for analyzing any decision-making problem. The experts can select the vital factors and sub-factors for GF development in China. The experts continue this process until they make the final decision and reach a mutual consensus [59]. In the presented study, 10 experts were consulted through webmail to finalize the significant factors and sub-factors for GF development. Each expert was asked to score each factor on a five-point Likert scale. Experts from universities, industry, the government, and research analysts were consulted. A total of four rounds were conducted to finalize the factors and sub-factors based on the mutual consensus of all the experts. Each of the experts was consulted through webmail to provide the most important GF factors and sub-factors. After completion of all the rounds of the Delphi method, this study identified 6 factors and 26 sub-factors for GF development in China.

4.2. FAHP Method

The AHP [60] is one of the most useful and significant techniques of MCDM. However, this study used the fuzzy-based AHP method to scrutinize the decision problem. The fuzzy AHP has been designed for the analysis and selection of alternatives in a decision problem. It integrates the concepts of hierarchical structure analysis and fuzzy set theory. It is worth noting that fuzzy methodology allows decision-makers to incorporate both quantitative and qualitative data into a decision model. This gives a decision-maker more confidence in giving interval judgments as compared to judgments based on fixed values [61]. This makes the fuzzy AHP one of the most popular MCDA methods with its extensive application in the field of research related to environmental issues. It has wider applications in environmental research including climate change policy objective prioritization [42,62]. The fuzzy AHP method provides efficient support as it breaks down the solution problems, groups them, and, finally, arranges them into a hierarchical structure. It provides priority criteria using a comparison of criteria paired with a determined measurement scale. Moreover, it uses the experts’ opinions as the main input. So, it creates a factor of subjectivity in retrieval decisions. Furthermore, the fuzzy AHP considers data validity with insistency limits [60]. However, it is also notable that probable uncertainty and doubt in assessment affect the data accuracy and the obtained results based on such opinions. The fuzzy AHP deals with such issues by using the fuzzy logic theory. Though the fuzzy AHP uses a similar method as used in the AHP, the former sets the AHP scale into the fuzzy triangle scale to assess priory [62]. It allows the fuzzy AHP to be adapted to many decision problems. It has its wider use in dealing with various real-life complex decision problems. It has extensive application in every sphere of decision analysis including analysis of barriers to Lean Six Sigma adoption [63], the determination of the quality of gemstones [62], renewable energy resource selection [64], examination of barriers to cleaner energy technology adoption [65], analysis of green management practices [66], financial performance evaluation [67], sustainable urban development [68], and sustainable project selection [69], to name a few. The stepwise process of fuzzy AHP application is as follows:

The fuzzy pairwise comparison matrix (FPCM) is created for factors and sub-factors using the triangular fuzzy numbers (TFNs) scale. Table 2 presents the linguistic variable-based TFNs scale.

Table 2.

TFNs Scale [63].

The following key steps of the FAHP method have been utilized to calculate the inconsistency ratio of the FPCM [70]:

Step I. Triangular fuzzy matrix (TFM) converted into two independent matrices:

After, the first TFM is created with the middle TFM:

Next, the second TFM is established for the upper and lower bounds of TFN using a geometric mean approach:

Step II. Create and calculate the weight vector and lambda max based on the Saaty method.

Step III. Create consistency index (CI):

Step IV: Create the consistency ratio (CR) as:

If the values of and are less than 0.10, then the fuzzy pairwise matrices are considered to be consistent. However, if the value exceeds 0.10, it would be considered inconsistent. Table 3 presents the RI scale used in the study propped by Gogus and Boucher [70].

Table 3.

RI scale.

The FAHP method would help obtain the feasible results of factors and sub-factors for the development of GF in China.

5. Results and Analysis

The Delphi and FAHP methods have been used to identify, finalize, and examine the factors and sub-factors of GF. The basic purpose of the study is to minimize carbon emissions by adopting GF practices. The Delphi method helped us to ascertain the most crucial factors and sub-factors; further, the FAHP approach analyzed and prioritized those factors for GF development.

5.1. Results of FAHP

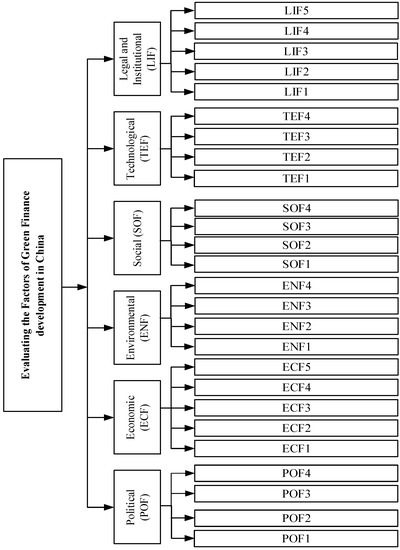

The primary purpose of the FAHP method is to construct a hierarchical-based structure, which consists of a goal, main criteria, and sub-criteria. The hierarchical structure of the study is shown in Figure 2. Next, the results of factors and sub-factors have been analyzed using the FAHP method.

Figure 2.

The hierarchical structure of the study.

This section provides the results of factors and sub-factors of GF development using the FAHP method. Initially, the study calculated the weights of factors using a fuzzy pairwise comparison matrix. The main factors are the political (POF), economic (ECF), environmental (ENF), social (SOF), technological (TEF), and legal and institutional (LIF). Table 4 shows the fuzzy pairwise comparison matrix of factors of GF. Table 5 presents the prioritizing order of factors of GF. The findings indicated that the ECF is the most vital factor, with a weight of 0.202. The POF is the second priority factor, with a weight of 0.194. The ENF is reported as a third critical factor, with a weight of 0.172. Lastly, SOF received the lowest weight of 0.129. Therefore, it is recognized that all the factors are important in analyzing GF development.

Table 4.

Fuzzy pairwise comparison matrix of factors of green finance.

Table 5.

Prioritizing order of factors of GF.

5.2. Results of Sub-Factors of Green Finance

The results of the sub-factors of GF have been analyzed using the FAHP technique. The FPCM for each factor with respect to their sub-factors was constructed. The detailed finding is given in Appendix A (Table A1, Table A2, Table A3, Table A4, Table A5 and Table A6).

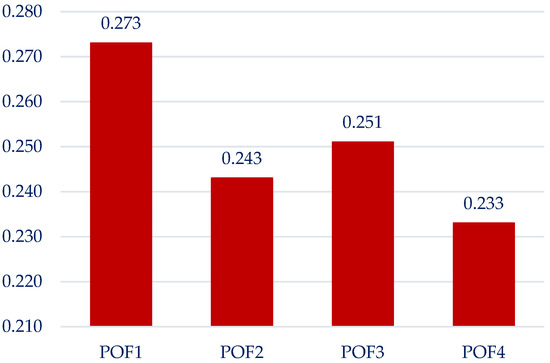

Figure 3 displays the ranking of sub-factors of POF. The findings reveal that ecological and political identification (POF1) is the most suitable sub-factor for developing GF practices in China. Political stability (POF3) and climate commitments (POF2) are considered second and third priority sub-factors.

Figure 3.

Ranking of sub-factors of POF.

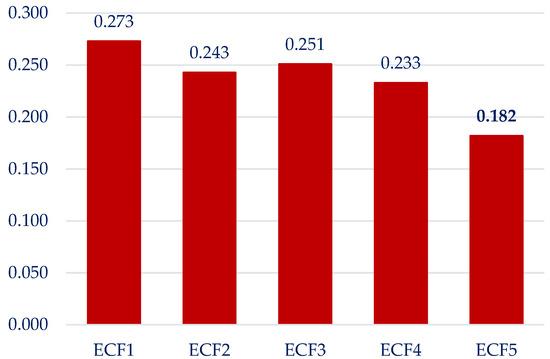

Figure 4 shows the weights and order prioritization of sub-factors of ECF. The results show that green growth and sustainable development (ECF1) are ranked as the most vital sub-factors for the development of GF in China. Higher returns on investment (ECF3), green investment (ECF2), and renewable energy (ECF4) are moderately important sub-factors. Green infrastructure (ECF5) has achieved the lowest weight. All these sub-factors are very crucial from the perspective of ECF. EPI plays an important role in the economy to stimulate green finance which also contributes to setting the basis to set green development in the economy. Political decision-making and affiliation to political groups and parties protonating green development in the economy are also critical [40]. In addition, political stability in economies is as pivotal for traditional economic development as it is important for the development of green finance and sustainable development in economies [24,42].

Figure 4.

Ranking of sub-factors of ECF.

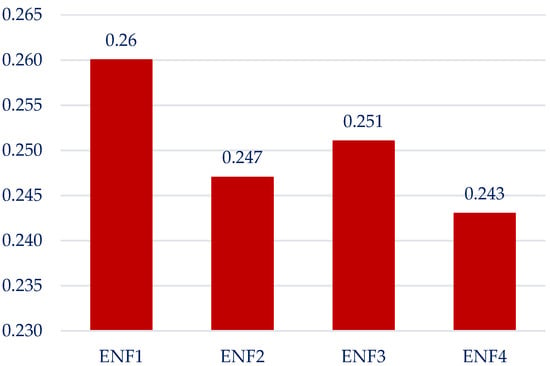

Figure 5 represents the weights and order prioritization of sub-factors of ECF. The findings show that sustainable environment (ENF1) has attained the first rank within the multiple sub-factors of GF. Energy efficiency (ENF3) and carbon capture and storage (ENF2) are placed as the second and third important sub-factors. Natural resource management (ENF4) is assigned the lowest rank according to the obtained weights. Since green growth and sustainable development are on the global agenda, especially under the targets of the SDGs, the government should focus on the development of efficient and productive green finance mechanisms and green credit products to finance green investment projects. For this purpose, enhancing returns on green finance investment would motivate investors [28,44].

Figure 5.

Ranking of sub-factors of ENF.

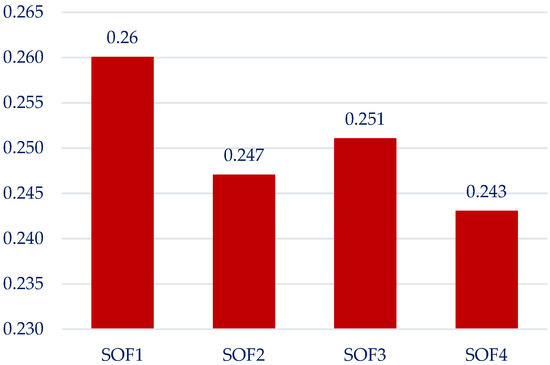

Figure 6 presents the weights and ranking of sub-factors of SOF. Green behavior (SOF1) obtained the highest weight and is considered the first-ranked sub-factor for GF development. Financial literacy (SOF3) was reported as the next important sub-factor. Moreover, corporate social responsibility (SOF2) and increased awareness of GF (SOF4) have achieved moderate to low importance. However, all the sub-factors are very crucial for the development of GF. After the Paris Agreement, the governments in national economies are striving to achieve the objective of a green, clean, sustainable environment [1]. In this regard, energy production and consumption are major areas that have attracted the attention of policymakers and experts. Green finance got to play an indispensable role by enabling economies to achieve energy efficiency, develop green energy systems, and achieve the objectives set in the SDGs.

Figure 6.

Ranking of sub-factors of SOF.

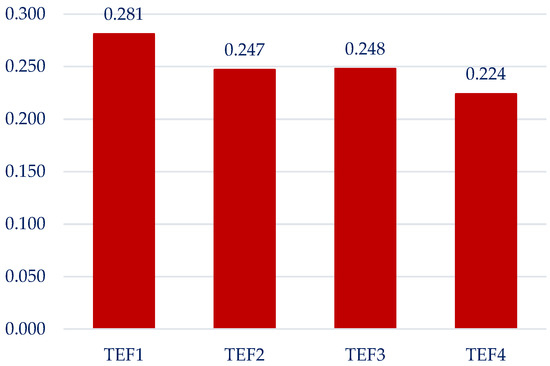

Figure 7 shows the ranking of sub-factors of TEF. Green technology and green innovation (TEF1) are categorized as top-ranked sub-factors of GF. The digital economy (TEF3) and research and development (TEF2) have ranked second and third. Financial technologies (TEF4) were reported as the least important sub-factor for the development of GF. The studies have provided enough evidence to believe that there is a strong link between sustainable behavior and financial return which, in turn, drives green and social finance [48]. It provides strong reasons to believe that green and social finance is more likely to be sustainable in the future.

Figure 7.

Ranking of sub-factors of TEF.

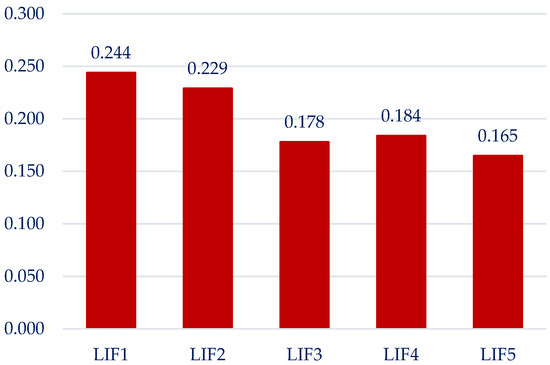

Figure 8 presents the weights and ranking of sub-factors of LIF. The policy, regulatory and legislative requirements (LIF1) have been ranked as the most critical sub-factors for the development of GF. Institutional and peer pressure (LIF2) is the second significant sub-factor. Green central banking (LIF4) is categorized as the third crucial sub-factor from the perspective of LIF. Since technology is a pivotal factor in green finance development in economies, green technology and green innovation play a crucial role in stimulating green finance, and they are the engine of green finance in economies. Shreds of evidence have shown that research and development have stimulated green technology and green innovation unprecedentedly [17,46]. One of the major outcomes of such innovations is the digital economy which has accrued its positive impact on enhancing the growth of green finance and also the overall efficiency of economies [18,27,51], especially in the Chinese economy. Green technological innovations have provided a transitional path through digital economies and influenced overall digital finance functions and their efficiency.

Figure 8.

Ranking of sub-factors of LIF.

5.3. Results of Overall Sub-Factors of GF

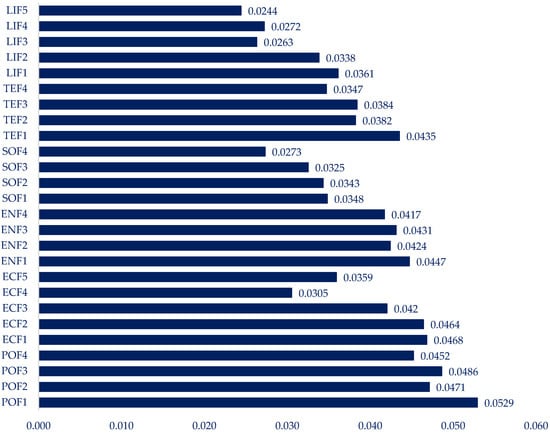

Figure 9 depicts the final weights of the overall sub-factors of GF. A total of 26 sub-factors were analyzed for GF development. The results show that political identification (POF1) is the priority sub-factor following political stability (POF3) and climate commitments (POF2). The prioritization of sub-factors with respect to legal and instructional factors of GF reveals policy, regulatory, and legislative requirements as a pivotal factor among the LIF factors. It shows that these sub-factors are critical in promoting GF in the Chinese economy. The Chinese economy has promulgated the necessary regulations and legislation to promote GF in the country. Moreover, consequent mandatory regulations and stringent policies of government could compel stakeholders to adhere to these policies and enhance green finance adoption. In this regard, green central banking comes into play to facilitate and monitor the overall function of the finance system [53]. Such developments could accrue to green financial market instruments to fuel mitigation and adaptation efforts [54].

Figure 9.

The final weights of sub-factors of green finance.

Next priorities are assigned to ECF1, ECF2, POF4, ENF1, TEF1, ENF3, ENF2, ECF3, ENF4, TEF3, TEF2, LIF1, ECF5, SOF1, TEF4, SOF2, LIF2, SOF3, ECF4, SOF4, LIF4, LIF3, and LIF5 according to the obtained weights. The overall prioritization of political, economic, environmental, social, technological, and legal sub-factors shows that the political factor is the most critical. This implies that political decision-making and political policy dynamics are critical for the development of green finance in the Chinese economy. The Chinese government, realizing the need for actions to achieve the SDGs and green economy objectives, stressed the need for an integrated reform plan for promoting ecological progress in the economy. The report asserted the coordination of five dimensions including economy, society, politics, ecology, and culture for better development of sustainable development trajectory [71]. The strategic political commitment of the Chinese leadership has been a key driver for the development of GF. However, the translation of its productive and effective implementation remains a challenge [72]. However, it has been a great source of concern for the Chinese economy to compromise the higher trajectory of traditional economic growth fueled by fossil fuels to develop a green growth trajectory based on investments in green and eco-friendly projects, industries, infrastructure, technology, R&D, and green finances. Moreover, there is a long way to go on the way to a digital and green economy.

5.4. Discussion

This research analyzed the factors and sub-factors for the development of GF in China. Green finance would help to accomplish the SDGs in economic, environmental, and social terms. The proposed decision methodology comprising Delphi and the FAHP has been used to investigate the problem of the study. The findings showed that the economic (ECF) factor is recognized as a top-ranked factor with a weight of 0.202; the political (POF) factor placed the second priority with a weight of 0.194. The environmental (ENF) factor acquired the third place with a weight of 0.172. Similarly, overall results indicate that ecological and political identification (POF1), political stability (POF3), and climate commitments (POF2) are the top-order sub-factors. In comparison, green central banking (LIF4), GF certification (LIF3), and carbon market instruments (LIF5) are the least important sub-factors for GF development.

Authors in previous studies determined a similar research problem using various methods to develop GF. However, the objective of each study was different according to the decision-making problem. The SDGs and the Paris Agreement provide the green signal to take necessary action to reduce carbon emission and ensure environmental sustainability [41,73]. So, the policymakers encourage the use of GF practices based on insightful political decisions and stability in the country. In the previous research, the authors used various criteria or factors like green investment, high returns on GF, green infrastructure, and green financial systems for GF development [7,9]. Renewable energy projects are also one of the main driving factors to achieving one of the SDGs. The results are also partially matched with the various studies [20,49] which determine the green credit for sustainable business activities. In the other study, the authors focus on increasing R&D to enhance green technology innovations and achieve a competitive advantage [10,14]. Government policies, regulations, and standards are required to promote GF in financial institutions.

In this study, the decision methodology was proposed for GF development to achieve the carbon peak and carbon neutrality targets in China. This research is very effective for the government and policymakers to assess GF practices based on various core factors. Multiple studies analyze GF practices, and their findings have already been given in the literature review. Thus, it is easy and convenient to compare the results and evaluate the robustness of the current study. It is also noticed that the previous studies used different approaches to analyze the decision-making problem. However, in this study, the Delphi and FAHP methods were used to identify, assess, and rank the factors and sub-factors of GF in China. Consequently, this study would greatly guide government and policymakers to undertake all the factors and sub-factors for the development of GF.

6. Conclusions

The study emphasized evaluation of GF development to reduce CO2 emissions and stimulate sustainable development in China. The main aim of this research was to identify and analyze the core factors of GF development using the Delphi and FAHP approach. The study encourages the use of GF practices to achieve the carbon peak and carbon neutrality targets for sustainable development. To achieve this objective, this study identified 6 factors and 26 sub-factors of GF development. The results depict that the economic (ECF), political (POF), and environmental (ENF) factors were the most suitable factors for the development of GF in China. Furthermore, the leading sub-factors were ecological and political identification (POF1), political stability (POF3), and climate commitments (POF2). Human interaction with the environment brings many negative impacts which need to be reduced. Therefore, this study supports the importance of GF for reducing CO2 emissions with significant economic growth. Moreover, substantial policies are required to promote GF. The government should bring green policies and a financial system to encourage GF development. Developing countries should also promote GF for sustainable economic, environmental, and social development.

The Chinese economy is the second largest economy in the world and collective efforts are underway to achieve the objectives of carbon reduction and carbon neutrality. Being the largest economy and contributor to global environmental pollution China has a major role to play in achieving these targets. Chinese success in the field of mitigation and adaptation of climate change would not only benefit China to improve its environmental conditions, but also would be productive to enhance China’s role in the polity of global environmental governance, especially in the economies on board the flagship projects of China’s belt and road initiative. The recent development over a decade has grown and developed, tilting toward green growth and sustainable development which are believed to achieve a sustainable environment. However, such objectives are hard to achieve without investment in green projects. Nevertheless, the latter is not possible to achieve without green financing and related institutions.

Though the Chinese government has advanced unprecedentedly in growth and manufacturing sectors, there is still a long way to go to achieve green growth, sustainable development, and sustainable development targets. This is where innovative policy promulgation and implementation, regulatory standards and measures, and legislation requirements come into play to set the stage for carbon reduction and carbon neutrality. The integration of sectorial policies including agricultural, industrial, investment, urban development, energy, transport, and financial sector policies is indispensable. Financial policies need to be integrated and linked to these sectorial policies along with necessary regulations and legislative initiatives. The banking sector should be enforced to adopt green financing products. Not only green investment projects, but also green consumer financial products can be helpful in this regard. One of the important areas that are potentially neglected is public engagement to ensure green behavior, especially in consumption. However, it cannot be achieved without efficient and productive green education and public awareness. There is also a dire need to integrate education policies into the overall policy frameworks to be implemented. Better green education could be productive in creating and stimulating new innovative green consumption behavior.

Since the energy sector is a major sector that directly contributes to carbon emissions, the government should promote the production and consumption of green and clean energy and reduce the levels of fossil fuel sources of energy levels. Moreover, mechanisms should be developed to ensure green finance allocations to industrial sectors enabling them to enhance green energy utilization. While considering the regional disparities, coordinated economic development policies need to develop credit policies that primarily focus on the development of regional financial infrastructure. Furthermore, green financial institutions should be encouraged to develop and strictly implement green credit standards and innovate new products and services. The findings of the present research provide comprehensive insight into the green finance development factors in the Chinese economy. This analysis provides a better understanding of these factors to formulate effective and productive green finance development policies to promote green finance in China. Moreover, such developments in the Chinese economy are likely to have positive impacts on green finance development in the economies engaged in the flagship project of regional development and constructive engagement—the belt and road initiative, initiated by China.

This research has not incorporated the impact of COVID-19 on GF development and corporate performance policies. Globally, the pandemic has challenged the company's operations and performance, so it is vital to analyze and overcome the problems in various sectors. The present study primarily focused on the analysis of factors of green finance in China; however, the rest of the world’s economies, especially the developing ones, have more to learn from the Chinese experience. Moreover, there is a huge potential for research regarding comparative analysis of green finance development in China and other economies. Furthermore, different economies have different social, economic, political, institutional, governance, administrative, financial sector structure, policy, and implementation dynamics, so the analysis of identification of factors of green finance may be extended to other economies for more suitable insight into the matter. Additionally, future research needs to determine the connections and challenges of the epidemic on carbon emission reduction. Moreover, in future research, policy strategies should be suggested to incorporate this issue. The other MCDM methods like TOPSIS, VIKOR, DEMATEL, and ANP would also be useful for the evaluation of the decision-making problem.

Author Contributions

Conceptualization, C.L.; methodology, Y.A.S. and S.A.; validation, C.L. and S.A.; formal analysis, C.L.; investigation, C.L. and Y.A.S.; data collection, C.L.; writing—original draft preparation, C.L.; writing—review and editing, Y.A.S. and S.A.; supervision, Y.A.S.; funding acquisition, C.L. All of the authors contributed significantly to the completion of this review, conceiving and designing the review, and writing and improving the paper. All authors have read and agreed to the published version of the manuscript.

Funding

This work was supported by the Fundamental Research Funds for the Central Universities of South-Central Minzu University (Grant Number: CSY20033).

Institutional Review Board Statement

Not applicable.

Informed Consent Statement

Not applicable.

Data Availability Statement

The datasets used and/or analyzed during the current study are available on reasonable request.

Conflicts of Interest

The authors declare no conflict of interest.

Appendix A. Fuzzy Pairwise Comparisons of Sub-Factors with Respect to Each Factor

Table A1.

Fuzzy pairwise comparison with respect to Political (POF).

Table A1.

Fuzzy pairwise comparison with respect to Political (POF).

| POF1 | POF2 | POF3 | POF4 | |

|---|---|---|---|---|

| POF1 | (1,1,1) | (1,1.719,7) | (0.200,1.904,7) | (1,2.854,9) |

| POF2 | (0.143,0.582,1) | (1,1,1) | (0.200,1,5) | (0.200,1.552,5) |

| POF3 | (0.143,0.525,5) | (0.200,1,5) | (1,1,1) | (0.200,1.380,7) |

| POF4 | (0.111,0.350,1) | (0.200,0.644,5) | (0.143,0.725,5) | (1,1,1) |

Table A2.

Fuzzy pairwise comparison with respect to Economic (ECF).

Table A2.

Fuzzy pairwise comparison with respect to Economic (ECF).

| ECF1 | ECF2 | ECF3 | ECF4 | ECF5 | |

|---|---|---|---|---|---|

| ECF1 | (1,1,1) | (1,1.246,5) | (1,1.246,5) | (1,2.536,9) | (1,3.322,7) |

| ECF2 | (0.200,0.803,1) | (1,1,1) | (1,1,3) | (1,2.854,9) | (1,3.322,7) |

| ECF3 | (0.200,0.803,1) | (0.333,1.000,1) | (1,1,1) | (1,1.719,7) | (1,1.933,5.) |

| ECF4 | (0.111,0.394,1) | (0.111,0.350,1) | (0.143,0.582,1) | (1,1,1) | (0.143,0.725,3) |

| ECF5 | (0.143,0.301,1) | (0.143,0.301,1) | (0.200,0.517,1) | (0.333,1.379,6.993) | (1,1,1) |

Table A3.

Fuzzy pairwise comparison with respect to Environmental (ENF).

Table A3.

Fuzzy pairwise comparison with respect to Environmental (ENF).

| ENF1 | ENF2 | ENF3 | ENF4 | |

|---|---|---|---|---|

| ENF1 | (1,1,1) | (0.200,1.380,7) | (0.200,1.552,5) | (1,1.552,5) |

| ENF2 | (0.143,0.725,5) | (1,1,1) | (0.200,0.803,5) | (0.200,1,5) |

| ENF3 | (0.200,0.644,5) | (0.200,1.245,5) | (1,1,1) | (0.200,1.108,7) |

| ENF4 | (0.200,0.644,1) | (0.200,1,5) | (0.143,0.903,5) | (1,1,1) |

Table A4.

Fuzzy pairwise comparison with respect to Social (SOF).

Table A4.

Fuzzy pairwise comparison with respect to Social (SOF).

| SOF1 | SOF2 | SOF3 | SOF4 | |

|---|---|---|---|---|

| SOF1 | (1,1,1) | (1,1,3) | (0.200,1.719,7) | (1,3.159,9) |

| SOF2 | (0.333,1,1) | (1,1,1) | (0.200,1.246,5) | (1,3.159,9) |

| SOF3 | (0.143,0.582,5) | (0.200,0.803,5) | (1,1,1) | (0.200,1.719,7) |

| SOF4 | (0.111,0.317,1) | (0.111,0.317,1) | (0.143,0.582,5) | (1,1,1) |

Table A5.

Fuzzy pairwise comparison with respect to Technological (TEF).

Table A5.

Fuzzy pairwise comparison with respect to Technological (TEF).

| TEF1 | TEF2 | TEF3 | TEF4 | |

|---|---|---|---|---|

| TEF1 | (1,1,1) | (1,1.933,5) | (0.200,2.371,7) | (1,2.408,5) |

| TEF2 | (0.200,0.517,1) | (1,1,1) | (0.200,1.552,5) | (1,1.246,5) |

| TEF3 | (0.143,0.422,5) | (0.200,0.644,5) | (1,1,1) | (0.200,0.714,7) |

| TEF4 | (0.200,0.415,1) | (0.200,0.803,1) | (0.143,1.401,5) | (1,1,1) |

Table A6.

Fuzzy pairwise comparison with respect to Legal and Institutional (LIF).

Table A6.

Fuzzy pairwise comparison with respect to Legal and Institutional (LIF).

| LIF1 | LIF2 | LIF3 | LIF4 | LIF5 | |

|---|---|---|---|---|---|

| LIF1 | (1,1,1) | (1,1.246,5) | (1,3.322,7) | (1,1.933,5) | (1,3.681,7) |

| LIF2 | (0.200,0.803,1) | (1,1,1) | (1,2.408,5) | (1,1.933,5) | (1,2.667,7) |

| LIF3 | (0.143,0.301,1) | (0.200,0.415,1) | (1,1,1) | (0.200,0.645,3) | (0.200,1.246,5) |

| LIF4 | (0.200,0.517,1) | (0.200,0.517,1) | (0.333,1.550,5) | (1,1,1) | (1,1,3) |

| LIF5 | (0.143,0.272,1) | (0.143,0.375,1) | (0.200,0.803,5) | (0.333,1,1) | (1,1,1) |

References

- Ali, S.; Xu, H.; Ahmad, N. Reviewing the Strategies for Climate Change and Sustainability after the US Defiance of the Paris Agreement: An AHP–GMCR-Based Conflict Resolution Approach. Environ. Dev. Sustain. 2021, 23, 11881–11912. [Google Scholar] [CrossRef]

- WEF What Is Green Finance and Why Is It Important? | World Economic Forum. Available online: https://www.weforum.org/agenda/2020/11/what-is-green-finance/ (accessed on 5 December 2022).

- Zimmerman, R.; Brenner, R.; Abella, J.L. Green Infrastructure Financing as an Imperative to Achieve Green Goals. Climate 2019, 7, 39. [Google Scholar] [CrossRef]

- Ding, X.; Jing, R.; Wu, K.; Petrovskaya, M.V.; Li, Z.; Steblyanskaya, A.; Ye, L.; Wang, X.; Makarov, V.M. The Impact Mechanism of Green Credit Policy on the Sustainability Performance of Heavily Polluting Enterprises—Based on the Perspectives of Technological Innovation Level and Credit Resource Allocation. Int. J. Environ. Res. Public Health 2022, 19, 14518. [Google Scholar] [CrossRef]

- Bhutta, U.S.; Tariq, A.; Farrukh, M.; Raza, A.; Iqbal, M.K. Green Bonds for Sustainable Development: Review of Literature on Development and Impact of Green Bonds. Technol. Forecast. Soc. Change 2022, 175, 121378. [Google Scholar] [CrossRef]

- Gilchrist, D.; Yu, J.; Zhong, R. The Limits of Green Finance: A Survey of Literature in the Context of Green Bonds and Green Loans. Sustainability 2021, 13, 478. [Google Scholar] [CrossRef]

- Chiţimiea, A.; Minciu, M.; Manta, A.M.; Ciocoiu, C.N.; Veith, C. The Drivers of Green Investment: A Bibliometric and Systematic Review. Sustainability 2021, 13, 3507. [Google Scholar] [CrossRef]

- Noh, H.J. Financial Strategy to Accelerate Green Growth; ADBI Working Paper 866; Asian Development Bank Institute: Tokyo, Japan, 2018. [Google Scholar]

- Soundarrajan, P.; Vivek, N. Green Finance for Sustainable Green Economic Growth in India. Agric. Econ. 2016, 62, 35–44. [Google Scholar] [CrossRef]

- Du, M.; Zhang, R.; Chai, S.; Li, Q.; Sun, R.; Chu, W. Can Green Finance Policies Stimulate Technological Innovation and Financial Performance? Evidence from Chinese Listed Green Enterprises. Sustainability 2022, 14, 9287. [Google Scholar] [CrossRef]

- Rasoulinezhad, E.; Taghizadeh-Hesary, F. Role of Green Finance in Improving Energy Efficiency and Renewable Energy Development. Energy Effic. 2022, 15, 1–12. [Google Scholar] [CrossRef]

- Fang, Z.; Yang, C.; Song, X. How Do Green Finance and Energy Efficiency Mitigate Carbon Emissions Without Reducing Economic Growth in G7 Countries? Front. Psychol. 2022, 13, 879741. [Google Scholar] [CrossRef]

- Mngumi, F.; Shaorong, S.; Shair, F.; Waqas, M. Does Green Finance Mitigate the Effects of Climate Variability: Role of Renewable Energy Investment and Infrastructure. Environ. Sci. Pollut. Res. 2022, 29, 59287–59299. [Google Scholar] [CrossRef] [PubMed]

- Fu, W.; Irfan, M. Does Green Financing Develop a Cleaner Environment for Environmental Sustainability: Empirical Insights From Association of Southeast Asian Nations Economies. Front. Psychol. 2022, 13, 904768. [Google Scholar] [CrossRef] [PubMed]

- Guo, C.Q.; Wang, X.; Cao, D.D.; Hou, Y.G. The Impact of Green Finance on Carbon Emission--Analysis Based on Mediation Effect and Spatial Effect. Front. Environ. Sci. 2022, 10, 1–17. [Google Scholar] [CrossRef]

- Zhang, Z.; Liu, Y.; Han, Z.; Liao, X. Green Finance and Carbon Emission Reduction: A Bibliometric Analysis and Systematic Review. Front. Environ. Sci. 2022, 10, 1–17. [Google Scholar] [CrossRef]

- Bai, J.; Chen, Z.; Yan, X.; Zhang, Y. Research on the Impact of Green Finance on Carbon Emissions: Evidence from China. Econ. Res. Istraz. 2022, 35, 6965–6984. [Google Scholar] [CrossRef]

- Tian, X.; Zhang, Y.; Qu, G. The Impact of Digital Economy on the Efficiency of Green Financial Investment in China’s Provinces. Int. J. Environ. Res. Public Health 2022, 19, 8884. [Google Scholar] [CrossRef]

- Zheng, G.W.; Siddik, A.B.; Masukujjaman, M.; Fatema, N. Factors Affecting the Sustainability Performance of Financial Institutions in Bangladesh: The Role of Green Finance. Sustainability 2021, 13, 10165. [Google Scholar] [CrossRef]

- Guang-Wen, Z.; Siddik, A.B. Do Corporate Social Responsibility Practices and Green Finance Dimensions Determine Environmental Performance? An Empirical Study on Bangladeshi Banking Institutions. Front. Environ. Sci. 2022, 10, 858. [Google Scholar] [CrossRef]

- Wu, Y. China’s Green Finance Market: Policy Support & Investment Opportunities. Available online: https://www.china-briefing.com/news/chinas-green-finance-market-policies-incentives-investment-opportunities/ (accessed on 11 December 2022).

- Xinhua China’s Green Credit Balance Tops 15 Trillion Yuan-Xinhua. Available online: https://english.news.cn/20220327/b2cfb0c9ce324d26ac929581a64901e5/c.html (accessed on 11 December 2022).

- Yan, Y.; Xu, X. Does Entrepreneur Invest More in Environmental Protection When Joining the Communist Party? Evidence from Chinese Private Firms. Emerg. Mark. Financ. Trade 2020, 58, 754–775. [Google Scholar] [CrossRef]

- Bae, S.M.; Masud, M.A.K.; Rashid, M.H.U.; Kim, J.D. Determinants of Climate Financing and the Moderating Effect of Politics: Evidence from Bangladesh. Sustain. Account. Manag. Policy J. 2022, 13, 247–272. [Google Scholar] [CrossRef]

- Ali, S.; Xu, H.; Yang, K.; Solangi, Y.A. Environment Management Policy Implementation for Sustainable Industrial Production under Power Asymmetry in the Graph Model. Sustain. Prod. Consum. 2022, 29, 636–648. [Google Scholar] [CrossRef]

- Shah, S.A.A.; Solangi, Y.A. A Sustainable Solution for Electricity Crisis in Pakistan: Opportunities, Barriers, and Policy Implications for 100% Renewable Energy. Environ. Sci. Pollut. Res. 2019, 26, 29687–29703. [Google Scholar] [CrossRef] [PubMed]

- Cao, S.; Nie, L.; Sun, H.; Sun, W.; Taghizadeh-Hesary, F. Digital Finance, Green Technological Innovation and Energy-Environmental Performance: Evidence from China’s Regional Economies. J. Clean. Prod. 2021, 327, 129458. [Google Scholar] [CrossRef]

- Agyekum, K.; Goodier, C.; Oppon, J.A. Key Drivers for Green Building Project Financing in Ghana. Eng. Constr. Archit. Manag. 2022, 29, 3023–3050. [Google Scholar] [CrossRef]

- Bao, J.; He Id, M. Does Green Credit Promote Green Sustainable Development in Regional Economies?—Empirical Evidence from 280 Cities in China. PLoS ONE 2022, 17, e0277569. [Google Scholar] [CrossRef]

- Chen, Z.; Pak, M. A Delphi Analysis on Green Performance Evaluation Indices for Ports in China. Marit. Policy Manag. 2017, 44, 537–550. [Google Scholar] [CrossRef]

- Fu, W.; Abbass, K.; Niazi, A.A.K.; Zhang, H.; Basit, A.; Qazi, T.F. Assessment of Sustainable Green Financial Environment: The Underlying Structure of Monetary Seismic Aftershocks of the COVID-19 Pandemic. Environ. Sci. Pollut. Res. 2022, 1, 1–15. [Google Scholar] [CrossRef]

- Cheung, H.; Baumber, A.; Brown, P.J. Barriers and Enablers to Sustainable Finance: A Case Study of Home Loans in an Australian Retail Bank. J. Clean. Prod. 2022, 334, 130211. [Google Scholar] [CrossRef]

- Kumar, L.; Nadeem, F.; Sloan, M.; Restle-Steinert, J.; Deitch, M.J.; Ali Naqvi, S.; Kumar, A.; Sassanelli, C. Fostering Green Finance for Sustainable Development: A Focus on Textile and Leather Small Medium Enterprises in Pakistan. Sustainability 2022, 14, 11908. [Google Scholar] [CrossRef]

- Niu, H.; Zhao, X.; Luo, Z.; Gong, Y.; Zhang, X. Green Credit and Enterprise Green Operation: Based on the Perspective of Enterprise Green Transformation. Front. Psychol. 2022, 13, 1041798. [Google Scholar] [CrossRef]

- Zhang, Z.; Duan, H.; Shan, S.; Liu, Q.; Geng, W. The Impact of Green Credit on the Green Innovation Level of Heavy-Polluting Enterprises—Evidence from China. Int. J. Environ. Res. Public Health 2022, 19, 650. [Google Scholar] [CrossRef] [PubMed]

- Lin, T.; Du, M.; Ren, S.; Lin, T.; Du, M.; Ren, S. How Do Green Bonds Affect Green Technology Innovation? Firm Evidence from China. Green Financ. 2022, 4, 492–511. [Google Scholar] [CrossRef]

- Dias, L.C.; Antunes, C.H.; Dantas, G.; de Castro, N.; Zamboni, L. A Multi-Criteria Approach to Sort and Rank Policies Based on Delphi Qualitative Assessments and ELECTRE TRI: The Case of Smart Grids in Brazil. Omega 2018, 76, 100–111. [Google Scholar] [CrossRef]

- Saihi, A.; Ben-Daya, M.; As’ad, R. Underpinning Success Factors of Maintenance Digital Transformation: A Hybrid Reactive Delphi Approach. Int. J. Prod. Econ. 2023, 255, 108701. [Google Scholar] [CrossRef]

- Ali, S.; Faizi, B.; Waqas, H.; Ahmed, W.; Shah, S.A.A. Analysis of the Socioeconomic Barriers in Implementing Public Health Measures to Contain COVID-19 Transmission in Pakistan: A DELPHI–DEMATEL-Based Approach. Kybernetes, 2021; ahead-of-print. [Google Scholar] [CrossRef]

- Niederberger, M.; Spranger, J. Delphi Technique in Health Sciences: A Map. Front. Public Health 2020, 8, 1–10. [Google Scholar] [CrossRef] [PubMed]

- Gutsche, G.; Wetzel, H.; Ziegler, A. Determinants of Individual Sustainable Investment Behavior—A Framed Field Experiment; MAGKS Joint Discussion Paper Series in Economics; Philipps-Universität Marburg: Marburg, Germany, 2020. [Google Scholar]

- United Nations THE 17 GOALS | Sustainable Development. Available online: https://sdgs.un.org/goals (accessed on 5 December 2022).

- Ragosa, G.; Warren, P. Unpacking the Determinants of Cross-Border Private Investment in Renewable Energy in Developing Countries. J. Clean. Prod. 2019, 235, 854–865. [Google Scholar] [CrossRef]

- Ahmed, W.; Tan, Q.; Shaikh, G.M.; Waqas, H.; Kanasro, N.A.; Ali, S.; Solangi, Y.A. Assessing and Prioritizing the Climate Change Policy Objectives for Sustainable Development in Pakistan. Symmetry 2020, 12, 1203. [Google Scholar] [CrossRef]

- Krueger, P.; Sautner, Z.; Starks, L.T. The Importance of Climate Risks for Institutional Investors. Rev. Financ. Stud. 2020, 33, 1067–1111. [Google Scholar] [CrossRef]

- APEC. Promoting Innovative Green Financing Mechanisms for Sustainable and Q Ua Lity Infrastructure Development in the APEC Region; APEC: Beijing, China, 2018. [Google Scholar]

- Solangi, Y.A.; Longsheng, C.; Ali Shah, S.A.; Alsanad, A.; Ahmad, M.; Akbar, M.A.; Gumaei, A.; Ali, S. Analyzing Renewable Energy Sources of a Developing Country for Sustainable Development: An Integrated Fuzzy Based-Decision Methodology. Processes 2020, 8, 825. [Google Scholar] [CrossRef]

- ADB Carbon Capture and Storage Fund | Asian Development Bank. Available online: https://www.adb.org/what-we-do/funds/carbon-capture-storage-fund (accessed on 4 December 2022).

- Tian, S.; Park, D.; Villaruel, M.L.C. What Is Driving the Growth of Green and Social Finance? Available online: https://blogs.adb.org/blog/what-is-driving-growth-green-and-social-finance (accessed on 5 December 2022).

- Wu, S.; Wu, L.; Zhao, X.; Wu, S.; Wu, L.; Zhao, X. Can the Reform of Green Credit Policy Promote Enterprise Eco-Innovation? A Theoretical Analysis. J. Ind. Manag. Optim. 2022, 18, 1451–1485. [Google Scholar] [CrossRef]

- De Haas, R.; Popov, A.A. Finance and Carbon Emissions; Working Paper Series; European Central Bank: Frankfurt am Main, Germany, 2021. [Google Scholar]

- Zhu, Y.; Zhang, J.; Duan, C. How Does Green Finance Affect the Low-Carbon Economy? Capital Allocation, Green Technology Innovation and Industry Structure Perspectives. Econ. Res. Istraz. 2022, 1–23. [Google Scholar] [CrossRef]

- Sangiorgi, I.; Schopohl, L. Why Do Institutional Investors Buy Green Bonds: Evidence from a Survey of European Asset Managers. Int. Rev. Financ. Anal. 2021, 75, 101738. [Google Scholar] [CrossRef]

- Dikau, S.; Volz, U. Central Banking, Climate Change, and Green Finance; ADBI Working Paper Series CENTRAL; Asian Development Bank Institute: Tokyo, Japan, 2018. [Google Scholar]

- Strand, J. Climate Finance, Carbon Market Mechanisms and Finance “Blending” as Instruments to Support NDC Achievement under the Paris Agreement; Policy Research Working Paper; World Bank: Washington, DC, USA, 2019. [Google Scholar]

- Lin, C.J.; Belis, T.T.; Caesaron, D.; Jiang, B.C.; Kuo, T.C. Development of Sustainability Indicators for Employee-Activity Based Production Process Using Fuzzy Delphi Method. Sustainability 2020, 12, 6378. [Google Scholar] [CrossRef]

- Steurer, J. The Delphi Method Techniques and Applications; Addison-Wesley: Reading, MA, USA, 2002; Volume 40. [Google Scholar]

- Rodriquez, C.; Mendes, J.M.; Romão, X. Identifying the Importance of Disaster Resilience Dimensions across Different Countries Using the Delphi Method. Sustainability 2022, 14, 9162. [Google Scholar] [CrossRef]

- Tseng, M.L.; Tan, P.A.; Wu, K.J.; Lin, R.C.W.; Todumrongkul, N.; Juladacha, P.; Christianti, G. Sustainable Total Resource Management in Thailand Healthcare Industry under Uncertain Situations. Sustainability 2020, 12, 9611. [Google Scholar] [CrossRef]

- Saaty, T.L. How to Make a Decision: The Analytic Hierarchy Process. Eur. J. Oper. Res. 1990, 48, 9–26. [Google Scholar] [CrossRef]

- Perçin, S. Use of Fuzzy AHP for Evaluating the Benefits of Information-Sharing Decisions in a Supply Chain. J. Enterp. Inf. Manag. 2008, 21, 263–284. [Google Scholar] [CrossRef]

- Putra, M.S.D.; Andryana, S.; Fauziah; Gunaryati, A. Fuzzy Analytical Hierarchy Process Method to Determine the Quality of Gemstones. Adv. Fuzzy Syst. 2018, 2018, 1–6. [Google Scholar] [CrossRef]

- Yadav, G.; Seth, D.; Desai, T.N. Prioritising Solutions for Lean Six Sigma Adoption Barriers through Fuzzy AHP-Modified TOPSIS Framework. Int. J. Lean Six Sigma 2018, 9, 270–300. [Google Scholar] [CrossRef]

- Wang, Y.; Xu, L.; Solangi, Y.A. Strategic Renewable Energy Resources Selection for Pakistan: Based on SWOT-Fuzzy AHP Approach. Sustain. Cities Soc. 2020, 52, 101861. [Google Scholar] [CrossRef]

- Shah, S.A.A.; Solangi, Y.A.; Ikram, M. Analysis of Barriers to the Adoption of Cleaner Energy Technologies in Pakistan Using Modified Delphi and Fuzzy Analytical Hierarchy Process. J. Clean. Prod. 2019, 235, 1037–1050. [Google Scholar] [CrossRef]

- Piya, S.; Shamsuzzoha, A.; Azizuddin, M.; Al-Hinai, N.; Erdebilli, B. Integrated Fuzzy AHP-TOPSIS Method to Analyze Green Management Practice in Hospitality Industry in the Sultanate of Oman. Sustainability 2022, 14, 1118. [Google Scholar] [CrossRef]

- Shaverdi, M.; Heshmati, M.R.; Ramezani, I. Application of Fuzzy AHP Approach for Financial Performance Evaluation of Iranian Petrochemical Sector. Procedia Comput. Sci. 2014, 31, 995–1004. [Google Scholar] [CrossRef]

- Dang, V.T.; Wang, J.; Van-Thac Dang, W. An Integrated Fuzzy AHP and Fuzzy TOPSIS Approach to Assess Sustainable Urban Development in an Emerging Economy. Int. J. Environ. Res. Public Health 2019, 16, 2902. [Google Scholar] [CrossRef] [PubMed]

- Alyamani, R.; Long, S. The Application of Fuzzy Analytic Hierarchy Process in Sustainable Project Selection. Sustainability 2020, 12, 8314. [Google Scholar] [CrossRef]

- Gogus, O.; Boucher, T.O. Strong Transitivity, Rationality and Weak Monotonicity in Fuzzy Pairwise Comparisons. Fuzzy Sets Syst. 1998, 94, 133–144. [Google Scholar] [CrossRef]

- Li, C.; Chen, Z.; Wu, Y.; Zuo, X.; Jin, H.; Xu, Y.; Zeng, B.; Zhao, G.; Wan, Y. Impact of Green Finance on China’s High-Quality Economic Development, Environmental Pollution, and Energy Consumption. Front. Environ. Sci. 2022, 10, 2205. [Google Scholar] [CrossRef]

- Hui, T.; Ning, C.; Liping, Z.; Gang, W.; State, T.H.E. Chapter 4: Lessons From the Development of Green Finance in China. Greening China’s Financial System; International Institute for Sustainable Development (IISD): Winnipeg, MB, Canada, 2015. [Google Scholar]

- Ahmed, W.; Tan, Q.; Solangi, Y.A.; Ali, S. Sustainable and Special Economic Zone Selection under Fuzzy Environment: A Case of Pakistan. Symmetry 2020, 12, 242. [Google Scholar] [CrossRef]

Disclaimer/Publisher’s Note: The statements, opinions and data contained in all publications are solely those of the individual author(s) and contributor(s) and not of MDPI and/or the editor(s). MDPI and/or the editor(s) disclaim responsibility for any injury to people or property resulting from any ideas, methods, instructions or products referred to in the content. |

© 2023 by the authors. Licensee MDPI, Basel, Switzerland. This article is an open access article distributed under the terms and conditions of the Creative Commons Attribution (CC BY) license (https://creativecommons.org/licenses/by/4.0/).