3.1. Patterns of Energy Sector Development

In the historical context of centralized energy as part of civil development, the individual human has never before been a functional unit of an integrated system [

17,

18]. Today, the material paradigm is one of the use of capabilities and resources closely related to the formation and implementation of energy as the base for socioeconomic progress [

19]. Current development in sustainable energy sources has been based on the premise in which industry will use renewable materials for production within circularity in an economically prosperous way [

19].

Current energy production can be divided into two categories: products related to fossil fuels used alone, i.e., forms of combustion, and electricity, generated either from the combustive use of fossil fuels or by other natural or technological means [

18,

19]. Renewable energy will help pave the way to a cleaner, more sustainable energy future based largely on electricity generation, with longer term emergence of green hydrogen related back to renewable energy, plus the even longer term likelihood of nuclear fusion. Within the fossil fuel category, exploration and production, refining, transportation, and retail companies produce and transport a variety of petroleum products, both liquid and gas, from the ground to the end user [

18,

19]. Renewables include wind power, hydropower (small and large hydroelectric power plants), solar energy (photovoltaic and solar thermal), energy extracted from the sea (waves, tides, heat, salinity, electrolysis), biomass energy and geothermal energy (huge residual amounts of unused or untapped energy) [

20]. However, these resources cannot be used without the introduction of the right incentives and legal frameworks, for which the Global Climate Commission and the institutions of the European Union have been activated and are advocating [

21]. As the energy market is facing challenges in operation of conventional power plants, they also have to contend with high costs in long-distance energy transmission processes [

9,

19,

20]. The existing electricity model, with its immense infrastructure, will not be able to cope with the increasing demand for electricity, which is expected to more than double by 2050, partly added to by the conversion of transportation, and so the idea of future implementation is focused on emerging renewable energy [

21].

The development of energy from renewable sources will solve many of the environmental challenges that are being faced by the growing world population and the demand for global industrial development, enabling the right paths to be followed in societal development towards energy security and, likewise, greater prosperity [

21]. It is expected that by 2040 more than 60% of the energy sector investment will be within the area of renewable energy sources [

22]. It is predicted that in Europe and the US, as much as USD 1 trillion (US short scale 10

12) in future investment and fuel costs for natural gas power plants through 2030 could be stranded by cost and technology competitive combinations of renewables and smart devices [

22]. Therefore, it is crucial to develop the regulatory environment that will establish rules of conduct in the theater of attempts to decentralize the renewables energy market within both global and local blockchain networks, and proposing solutions for making regulations towards more electricity-based energy trade [

23]. As a result of these trades, billions (US short scale 10

9) of connections will exist within the electricity grid, including customer-sited technologies, such as the ‘Internet of Things (IoT)’ and ‘cloud’ computing [

24]. For the decarbonized energy future, it is necessary to create decentralized solutions, which have to bridge the gap between the centralized grids of yesterday and today to sustainable valorization of renewable energy in the decentralized grids of tomorrow. Such rapid changes associated with renewable energy solutions can be achieved with the implementation of digitalization and the use of blockchain technology [

25]. Simultaneously, with the increase in the use of renewable energy sources, the IoT will be used to provide balance between the level of production and weather conditions [

14,

25] in synergy with the blockchain technology. The development of the number of devices connected to the IoT from 2015 towards the predicted usage in 2030 has been summarized to show growth from 15 billion in 2022 to ~30 billion (US short 10

9) (Source Statista, statistic portal,

https://www.statista.com/statistics/471264/iot-number-of-connected-devices-worldwide/ (accessed on 22 December 2022)).

Allowing the distribution of digital information without copying, blockchain technology opened the door to a new kind of Internet. It was originally developed and used for digital currencies, but recently it has been adopted in many other applications due to its great potential in data transmission [

1]. The name blockchain itself consists of two concepts; “block” and “chain”. “Block” refers to the transactions, while “chain” describes the way in which the blocks are connected. The chain is constantly growing, new blocks are created by each new transaction and encryption. Block creation process is called mining [

3,

4]. The concept of a single blockchain is based on a database, where data, information and documents can be stored, and is the complete list all transactions of, say, a cryptocurrency, i.e., the general ledger in which is written the chronological history of all transactions [

7,

8]. The advantage of this technology is that it is possible to transparently, inexpensively, and securely carry out transactions, verifications, and automations [

16,

20]. The system itself is greatly protected and designed to make it almost impossible to penetrate or manipulate data. This method was primarily developed for Bitcoin but is also used today in other virtual currencies [

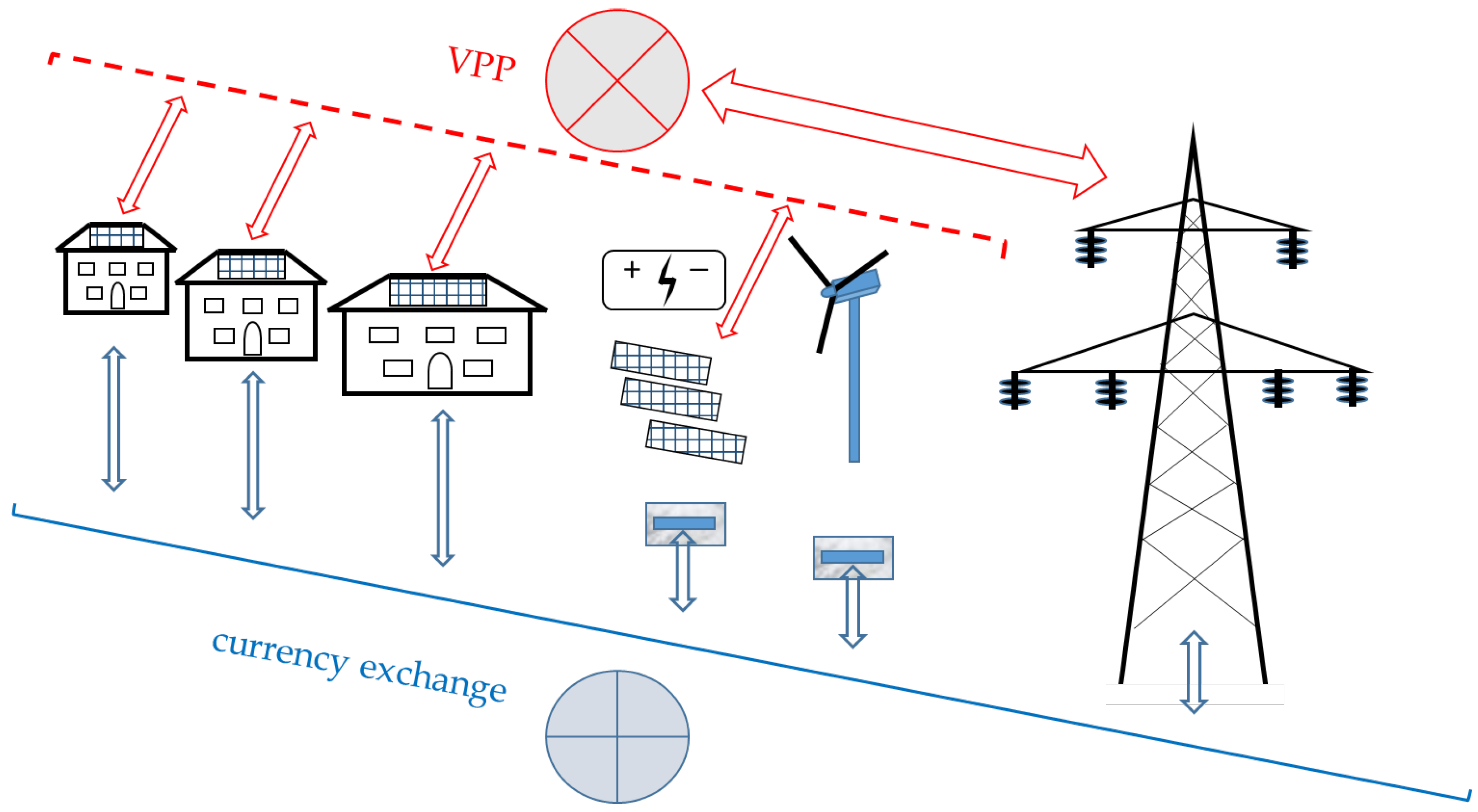

26]. Although it is primarily used to verify digital currency transactions, its application can be much wider, as it is possible to digitize, encode, and insert a given document in the blockchain. Blockchain has no central government and each change in blockchain is visible to everyone connected in the grid, and therefore all participants are responsible for their actions. This is illustrated schematically in the case of energy distribution in

Figure 2. Blockchain presents a simple and ingenious method for free transmission of information between two or more distinct points, with costs arising only from the infrastructure [

1,

17,

27]. The process is initiated through one party that creates a block, which connects up to thousands of computers distributed per network, and when the block has been added to the current list, a unique record is created with its own unique history [

11]. In this way, falsifying a single record would mean falsifying an entire chain in millions of network interlocked examples, which is, in today’s reality, effectively impossible [

2,

7,

9].

3.2. Centralized and Decentralized Blockchain Networks for Consumption

Blockchain security is bringing decentralization together with the introduction of cryptographic methods, as it is based on a time-lapse series of immutable records managed by a group of computers, containing connected blocks within a data chain, which is not the property of a single entity [

25]. Besides the advantages in integrity, there are disadvantages in terms of the huge breadth of simultaneous logging required in the multi-ledger concept, as explained in

Table 1 [

1,

7,

9].

It is possible to carry out transactions decentralized, and blockchain greatly reduces costs and improves efficiency. Excluding a third party as an intermediary, blockchain also allows broad application with respect to the use of digital assets, designed for new Internet requirements, such as smart contracts, IoT and security protocols [

1,

25]. Nowadays, the blockchain technology provides a vehicle for a possible complete transformation of processes and business models, which traditionally relied on the collection of the costs of the transactions carried out. Cost collection cases include, music and movies streaming, art, news dissemination etc. Subscriptions for streaming are becoming redundant, as the benefits of blockchain technology can be applied for direct billing, eventually precluding large streaming services, such as Apple or Spotify [

24,

25]. Hence, blockchain enables micro transactions, which provide a greater spectrum of application in the online industry with payment of video services, e-books, video games for computers, or mobile phones, and similar transactions, becoming possible even with just small amounts, as small as 1/100 cent [

9,

24].

Increasing the development of new technologies that utilize blockchain for integration will affect and change the stock exchange principle and the way that banking services and financial institutions operate, mainly making earnings on the fees for conducting transactions [

26]. Stock intermediaries will no longer receive commissions, the principle of operation buy/sell will disappear, and bankers will become just financial advisers [

11,

13,

25]. The information contained on the blockchain exists as a common, uninterrupted database stored simultaneously on all computers connected to the network with all records being public and easily verifiable [

22],

Figure 3.

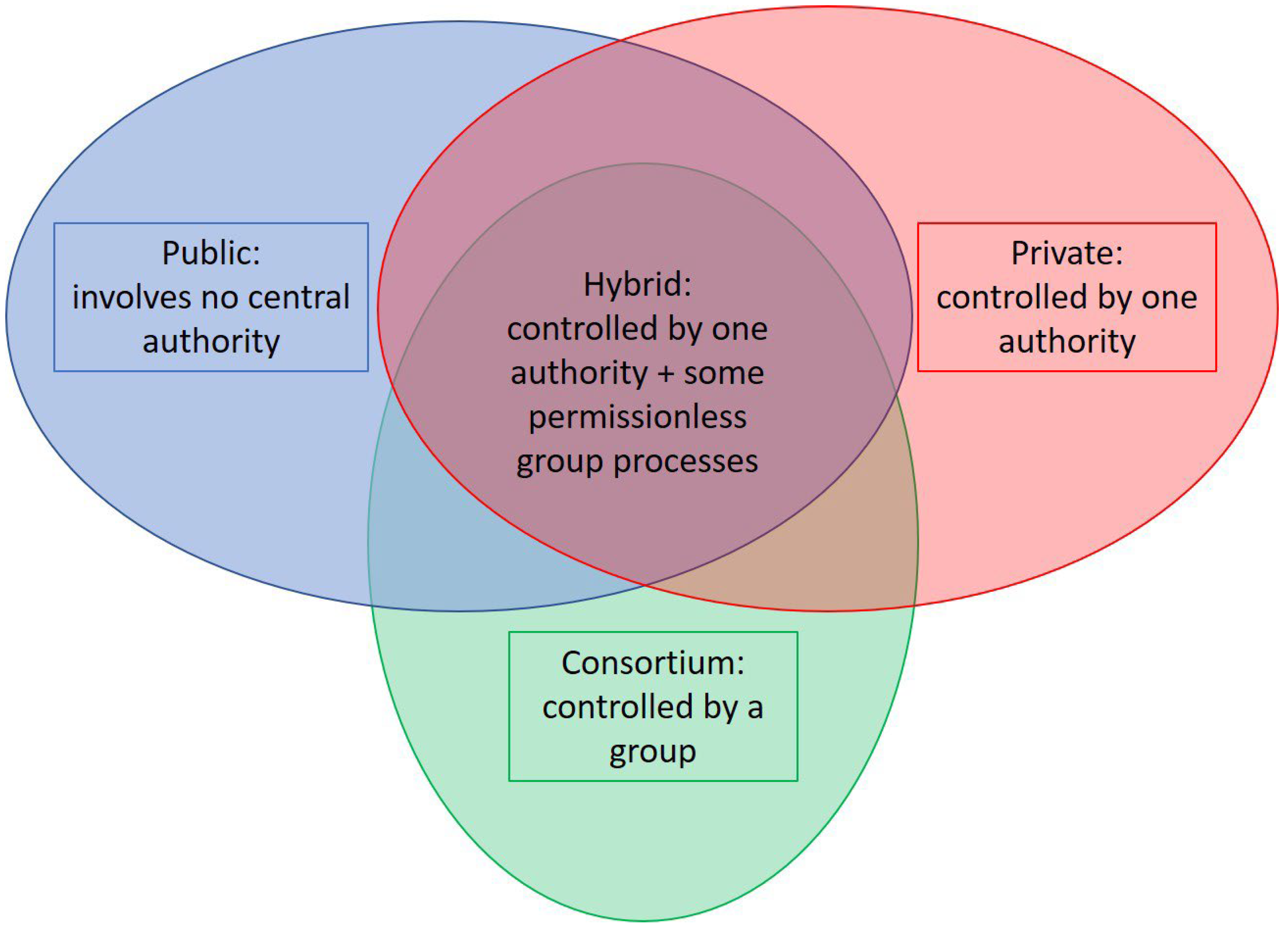

Blockchain can be divided into three types: public, hybrid, and private [

1,

9]. Public blockchain is a blockchain that can be accessed by anyone, as a user, developer, or communities, and so is fully transparent, with all transactions being public and accessible to all, recorded in the order in which they were carried out. It is fully decentralized and does not exist within any central control body. Probably the most well-known examples of decentralized public blockchain are Bitcoin and Ethereum. In private blockchain, information is not accessible to everyone, and transactions are private, visible only to members (of the coin in the cited example above), and therefore is used mainly by large business systems [

1,

4]. For someone to access it, it is necessary to get community approval. When blockchain is not completely decentralized, there is a body that grants or refuses authorization upon request for access.

Hyperledger and R3 Corda are examples of hybrid blockchain [

13,

17]. Hybrid blockchain has the characteristics of both public and private blockchain. In practice, it means that there is flexibility that allows some of the data to be public and visible to all, and part of the data remain private and visible only to some companies. This type of blockchain is used by business systems that distribute information in this way, with easy access control and without the need to create a classic database [

25,

28]. A distributed system for hybrid blockchain is a model where computers on the network communicate and coordinate actions forwarding messages, as presented in

Figure 4.

The decentralized type of blockchain lays its foundation on peer to peer networking (P2P) [

25]. It represents a way of connecting a computer in the network without a central “node”, which node itself would normally be an individual central computer within the network [

28]. There is no central computer or server, and each computer within the network communicates directly with another computer within the network, without an “intermediary” [

25,

29]. All transactions are verified and validated in the network alone, in which new blocks and chains are constantly growing. Due to decentralization and P2P networks, data integrity is additionally assured. Once recorded, data are almost impossible to manipulate or modify [

10,

30]. This is a way of facilitating and speeding up the operation and flow of data of the entire network, whilst at the same time, increasing the safety of the entire network, as there is no manipulatable central unit through which the flow is made [

24].

There are three aspects of decentralization: (i) architectural—this aspect of decentralization determines how distributed a network is, and depends on the number of physical hardware entities that comprise the system independent of the large number of connected computers in the network, without compromising the operation of the entire network; (ii) political—this aspect determines which parties the network trusts, i.e., how many decision-makers are on the grid and how many individuals or entities control computers in the network; and (iii) logic decentralization—this aspect deals with consensus on the network, in that the network can have multiple variations of value for one thing requiring consensus.

Guided by this concept, the blockchain network is architecturally and politically decentralized; architecturally due to the fact that it consists of many computers located around the world, and politically due to being no one site that can control the operation of the network [

13,

24]. Although some parts of the blockchain community do not agree and are logistically decentralized, the whole system is working towards the same final goal [

6,

31].

When considering decentralized blockchain its main defining properties are: (i) error tolerance—as the whole system relies on a multitude of separate components makes it unlikely that the decentralized system will fail; (ii) resistance to attacks—decentralized systems do not have a central impact of failure, and in the case of data attack, only part of a system will be affected, not the whole system as is case with current technologies, such that, as a result, the decentralized system is more resistant to attacks, and the attacks themselves require more resources; and (iii) inability to agree—disagreements between participants in the decentralized system are unlikely, as presented in

Table 2 [

11,

13]. The main disadvantage of decentralization, however, is the loss of focus, due to the fact that there is an increase in independent decision freedom, and so main objectives can become ambiguous and their importance reduced [

24]. Many decision-makers can act for a specific group within the blockchain with actions that are useful only for their segment and are not useful for the whole system [

25]. In centralized systems, the central authority adopts all the decisions universally, and the rest of the system acts on those decisions. In decentralized systems, governance is agreed, and decision-making is slow and sometimes overdue. The duplication of jobs is inevitable; however, by their structure, decentralized systems are safe as a result of this, due to the concept of redundancy.

Each system body repeats the same task, and this creates the necessary cost of resources such as energy and monetary reaction rate—decentralization leads to a loss of speed, i.e., prolongs the time of reaching consensus of a certain number of system participants [

9,

32]. The effort required to reach consensus is slowing down the decision-making process, further wasting resources and reduces the focus on common goals [

24,

32].

3.4. Blockchain of Energy Trade and Risk Management

Within the oil and natural gas market, many supply chains are connected in extracting, refining and distribution of products [

39]. With the use of blockchain in respect to energy distribution, any transformation of information will be factual and highly regulated [

30]. This is important for industries that are taking part in transactions within, for or outside the energy industry, such as banking or hedge funds [

13,

30]. Companies which coordinate energy trading activities within Energy Trading and Risk Management (ETRM) transact using counterparty networks using software that will support commodity trading, enabling the flow of information between each energy production segment, bringing together a large number of participants, including manufacturing, refining, distribution, and retail companies, which trade between themselves defining the pricing, logistics and risk management information [

21,

40]. Trade with blockchain finalizes settlements between trading parties, in which digital (IT) systems harmonize trade data, helping energy companies to make more efficient and faster trade systems [

41]. There is ongoing interest for continuous development of blockchain applications that can eventually restore these systems should there by a catastrophic failure, through recognizing patterns and so improve transaction testimonials in banking [

30,

40].

A blockchain such as Ethereum is capable of keeping data of all customers at one place, and Interbit is capable of creating a single blockchain for each customer while they are all interconnected with the main blockchain. In this way, adopting the Interbit structure, a more flexible authorized system is obtained, in which it is possible to provide certain information exclusively to counterparties with the possibility to work on more than 100,000 transactions per minute [

12,

16,

41]. Previously, before blockchain, buyers would generate an appointment, making a request quantity of product at a certain price, delivery place and time from an upstream seller, and nominations would be sent in emailing systems in pdf format by attachment, which, in turn, would be fed into software. Each updating under such a system requires all participants in a trade to search for the original pdf to update it with repetitive manual data entry, which is complex, prone to error and expensive [

9,

16,

32]. Furthermore, the transaction time increases when the trading parties are not subsidiaries within the same company. Long settlement time resulting from the trade process increases product costs with the necessity that counterparties provide committed capital that can be released only when the trade is settled, which negatively affects any reconciliation process [

31,

34,

39]. In contrast, using a blockchain system, reconciliation is part of the process, and errors that occur during the addition of data become automatically eliminated, since entries containing data that are not aligned do not belong to the multiple simultaneous copies of the trade records [

21,

38,

42], as represented in

Figure 6.

In a simplified energy trade, therefore, both buyer and seller negotiate and agree on the price of a product or service, being also simultaneously connected to a consulting price exchange intermediary, both entering details of the transaction onto the ETRM system, and so both mutually confirming the trade and informing their broker [

4,

36,

40]. A transparent and synchronized distributed ledger then allows for instant settlement and a credible record of energy estimates when they were submitted together with information about parties that signed the trade agreement, simplifying settlement, and consequently reducing energy trading costs [

40,

42].

3.4.1. Peer to Peer Trading

Initially, Visa and European bank technology adopted the peer to peer (P2P) trading concept in 2016, which is used nowadays for money trades across international borders [

43]. Therefore, the P2P way of trading works in smaller environments where a small number of transactions take place. Within a micro-grid, as a decentralized energy system, P2P is suitable for performing transactions. This type of trading is often associated with the use of smart contracts, where transactions are performed automatically, and trading becomes faster [

34,

43].

The direct or P2P trading concept is achieved through the transaction platform using a decentralized system for saving transaction data [

4,

30]. Achieving decentralization requires an actual network of computers constantly exchanging information and executing complex algorithms at high speeds [

34,

40]. Scaling this technology to a system that can handle thousands of transactions per second is the challenge that needs to be met.

After success in the financial market using the Interbit system, P2P methodology became used in the trade of oil and gas. Although renewable sources account for just a small share of global electricity generation, they are rapidly displacing fossil fuel-based production [

42,

43]. In 2017, more than 50% of newly added production capacities were recorded in investments in renewable sources. To meet rising needs of electricity demand, new sustainable renewable electricity production technologies are developing within peer to peer blockchain trading platforms, which enable direct selling, say, of excess solar power produced in households to neighbors, and this is possible without any intermediaries [

7,

13].

Several drivers are pushing renewables toward adopting blockchain and smart contracts. Installed costs are plummeting, with wind turbines decreasing by 30% and solar panels by 80% already as far back as 2009, allowing these to bid competitively against fossil fuel generation, according to the International Agency for Renewable Energy Sources [

44]. In an organized system, there must be a kind of agreement between producers and consumers of energy [

7,

19]. The trading company, BC-Energy Ltd., a subsidiary of Borsodchem, Hungary, trading throughout Europe, operates such a system by contracting generation through smart contracts [

45].

A smart contract is a term used within blockchain to describe a computer program capable of facilitating, executing, and enforcing the negotiation or execution of an agreement. This achieves a transparent and fair agreement between the contracting parties. Therefore, all members in the distribution and transmission system are bypassed and the producer and consumer are directly connected, which reduces the price of electricity for the end user, and the system benefits the producers of energy from renewable sources because it enables them to make a bigger profit. The process is highly synchronized and automated, serving as a supplement or replacement of traditional legal contracts, with terms that are recorded via codes and written in a block. Smart contracts can also automatically initiate transactions between network participants, i.e., it allows producers to feed excess energy automatically into the network via a smart blockchain meter. Electric energy (termed in data) is automatically encoded in the blockchain, with algorithms that execute the renewable energy transfer and delivery to the customer using the P2P method [

45].

3.4.2. Tokens

Technically, “token” is another word used for “cryptocurrency”, but commonly confined to describing all cryptocurrencies except Bitcoin and Ethereum (although technically they are also tokens) [

9]. They describe certain digital assets that “run” on the blockchain of another cryptocurrency and can be traded or held like any other cryptocurrency [

46,

47]. Tokens have a huge range of potential functions, from helping to enable decentralized exchanges to selling rare items, for example in video games. Some cryptocurrencies, such as Bitcoin, have their own dedicated blockchain, whereas decentralized finance (DeFi) tokens, like Chainlink and Aave, run on or use an available existing blockchain, most commonly Ethereum [

48]. Tokens in the latter category help decentralized applications do everything from automating interest rates to selling virtual real estate [

47,

48]. DeFi tokens represent a new world of cryptocurrency-based protocols that aim to reproduce the traditional functions of the financial system, including lending and savings, insurance, and trading, with such functionalities emerging in recent years. These protocols issue tokens that perform not only a wide range of functions, but can also be traded or held like any other cryptocurrency [

48,

49].

Governance tokens are specialized DeFi tokens that give owners a say in the future of the protocol or application, which, being decentralized, have no boards of directors or any other central body [

49]. The popular savings protocol Compound, for example, issues a token called COMP to all users. This token gives holders the right to vote on how Compound is upgraded. The more COMP tokens you have, the more votes you get [

49].

Non-Fungible Tokens (NFTs) represent ownership rights to a unique digital or physical asset. They can be used to make it harder to copy and share digital creations, a problem understood by anyone who has ever visited a ‘torrent’ site full of the latest movies and video games [

50]. They have also been used to release limited numbers of digital artwork or sell unique virtual assets, once again such as rare items in a video game [

50].

Security tokens are a new class of assets that aim to be the crypto equivalent of traditional securities such as stocks and bonds [

51]. Their main use case is selling shares in a company, much like shares or fractional shares sold through conventional markets, or other businesses, for example, real estate, without the need for a broker [

51]. It has been reported that major companies and startups are exploring security tokens as a potential alternative to other fundraising methods [

51,

52].

Tokens of Electrical Energy

Tokens can be relatively easy to create and issue, and can be available to anyone with a mobile phone and Internet connection, enabling investments in a democratic way, without bureaucratic obstacles, with the use of basic technical literacy and small amounts of currency [

52]. The biggest drawback to this concept is that the ecosystem of apps that support it (mobile apps, wallets etc.) is still in development, although the situation compared with just a few years ago is improving greatly. Unlike crypto currencies, which do not give the holder any rights, a crypto token is a portable unit that expresses the measure of rights to a property or service embedded in the token, derived from a smart contract [

49,

51]. The token is transmitted in real time digitally via a blockchain network, without intermediaries and authorization of third parties offline.

In Australia, this approach to energy market, adopting tokens, has given rise to many pilot projects that connect renewable energy sources with blockchain projects sponsored by the Australian Government, which enabled one of the largest energy utilities in Australia to implement tokens in monitoring and trading energy [

5,

7,

16]. Power Ledger (PL) is an example of an Australian energy trading platform, founded in 2016, that enables the decentralized sale and purchase of renewable energy with the application of P2P contracts via blockchain [

53]. PL does not require the use of special hardware, but it is necessary to install a smart meter so that data on energy production and consumption can be processed and further traded using software trading in tokens [

51,

52,

53].

Vouchers of electrical energy from renewable sources, are appearing under many different names globally, such as Sparks, Iskra etc. [

54]. They can be redeemed from the energy producing company or competent authority, and electricity buyers could trade one unit of energy (kWh) of solar power for a defined number of tokens at a given price [

54,

55], and shown schematically with extended ledgers as might become the case in practice,

Figure 7. A vendor who received tokens for the energy they produce and sell, can obtain currency, with each transaction of purchased token and electricity transaction being recorded on the blockchain, containing the record of electrical energy movement from vendor to buyer [

52,

53,

54]. Therefore, blockchain allows connection of devices that generate electricity (solar panels, heat pumps etc.), including storage devices (various types of battery), and manages the flow of electricity from producer to the nearest location where it is needed encompassing the highest bidder. Such a closed loop obtained within the blockchain circulates electricity from the producer to the consumer via the shortest route, enabling consumers also to become producers (prosumers) of the renewable electricity in transmission [

52]. However, since regulations governing electricity at the moment do not permit electricity trading via the P2P model, it is necessary to create a platform in the online marketplace, i.e., a microgrid that will enable prosumers to sell excess renewable energy produced in the form of solar, wind or other types of renewable energy tokens [

45,

52,

54].

3.5. Application to Decentralized Energy and Micro-Generation

In the traditional electricity distribution grid, the end user has no option other than to be a consumer only, and the flow of electrical power was one-way, i.e., from utility to consumer [

55]. Renewable-energy sources have brought into the picture a new class of participants that are prosumers in the electrical grid, where prosumers are those who can consume as well as produce electrical energy with financial incentives, environmental awareness, and low dependency on energy suppliers [

56]. In this portfolio the microgrid concept emerges, which integrates all local renewable-energy sources, and enables transition from a traditional centralized grid to one that it decentralized [

55,

56].

A microgrid is a small-scale, locally controlled power system, which integrates the renewable energy generating source, simultaneously managing its balance between local load and power generation [

52]. This model enables prosumers to trade electricity with their neighbors forming a local grid within a collection of autonomous microgrids that are interconnected. Microgrids have the capability of handling power flow in two directions, i.e., from the microgrid to the main grid and the main grid to the microgrid, so as to use its on-site generation optimally.

The operation of microgrids can be run in an isolated manner, called islanding mode, which is opposite to the in-grid connected mode involving hierarchical management; each level of hierarchy is made of loops, in which higher levels are forwarding benchmarks to the lower levels, with the latter having faster response [

52,

54]. The primary level is used to adjust the current benchmarks in the network regime and voltage in the island mode [

55,

56]. Hence, forecasting is necessary for all renewable energy plants, which is also the main problem due to unpredictable environmental conditions, and therefore incorporating a weather forecasting framework on day-ahead trading is difficult [

57,

58].

As mentioned in the previous section, to achieve network management and control over production and consumption data, it is necessary to install smart devices, which means that the network itself automatically becomes “smart” [

58]. The use of blockchain technology is only possible with the existence of smart devices embedded in the network, because data are actually traded with this technology. This applies primarily to producers, while consumers can buy excess produced energy from producers even without measuring devices, but then the balance that is to be achieved in the micro-grid is not sufficiently measurable and transparent.

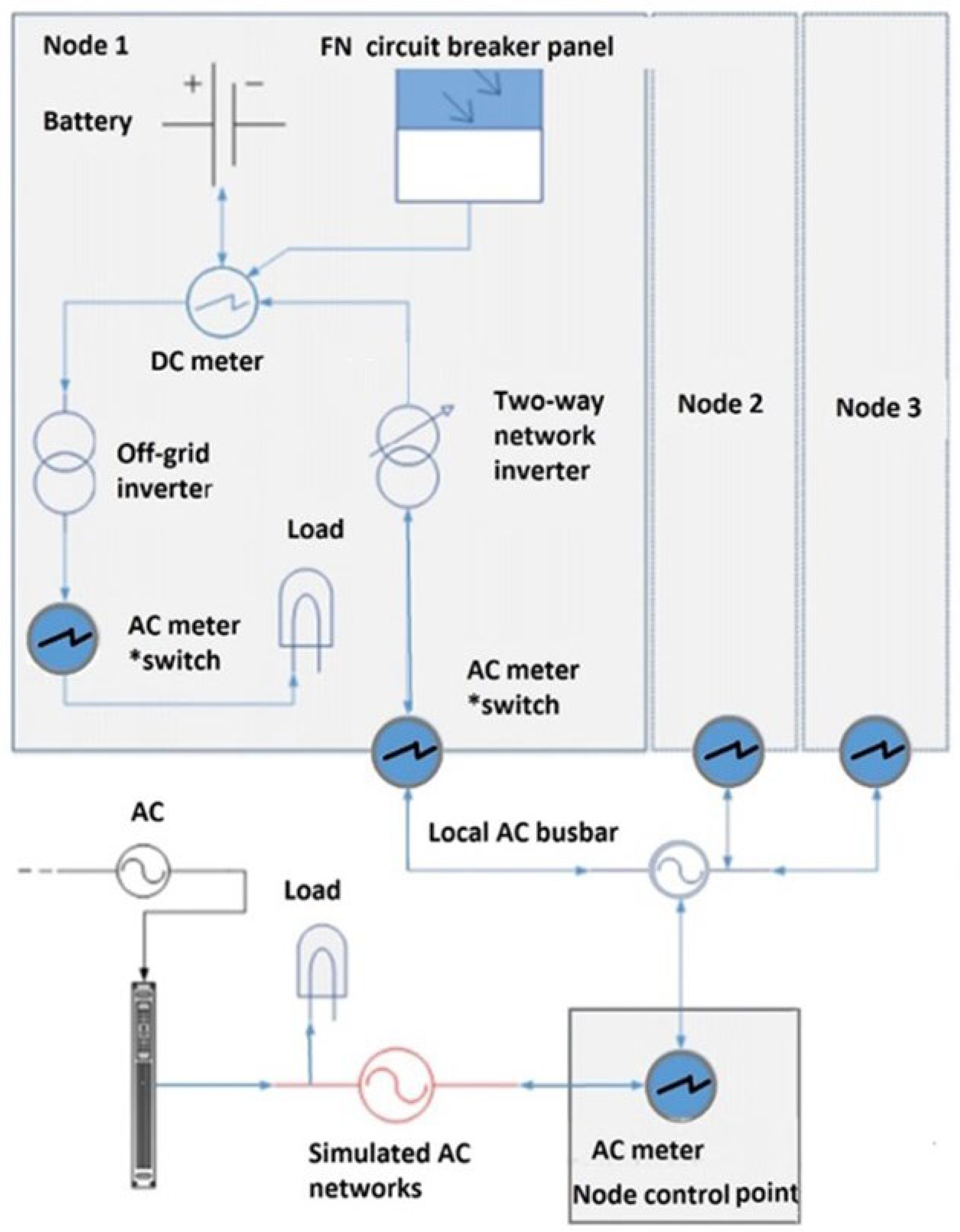

Figure 8 shows a schematic of hardware connected to a micro-grid system. This demonstration is based on laboratory conditions as in a test device for power generation and data exchange, and includes components of power generation, storage, measurement, consumption, and the simulation of alternating current. The following gives a brief description to understand the function of using hardware and software as a link between a micro-grid and blockchain technology.

From the perspective of the distribution system operator, the main problem with a high penetration into the grid of renewable sources is voltage control. Smart inverters can participate in voltage regulation, by absorbing reactive power at high voltages, and then injecting it back at low voltages. In a combined way, it is impossible to meet the requirements in all cases for both voltage control and the requirements of the virtual power plant reaching the adjusted values of active and reactive power. The model presented in

Figure 8 shows the operation of the micro-grid either in so-called island mode (in isolation) or connected to the public grid. Each node includes an AC and a DC subsystem [

55]. The DC subsystem is made of 12 V batteries (300 Ah), a solar panel (130 W) and a power regulator for charging the battery. Two converters (AC to DC) and a battery charger are located in the AC subsystem. Inside the island there is also a special access node allowing access to follow the characteristics relating to the converters.

Virtual Power Plants (VPP)

A VPP represents a medium-scale power generating unit that is also a flexible power consumer and storage system [

59]. Today, renewable power plants are normally included as sources, and even individual consumers are offered the opportunity to access the power generated, which can be either directly generated from source or transmitted as virtual power generation from an intermediary [

58,

59]. Power plants that are based on renewable natural sources cannot be manipulated in the same way as conventional generators, because they currently predominantly depend on circumstances that are outside the domain of human influence, and due to this VPPs are developed with the use of artificial intelligence such that one VPP can in reality contain several microgrids to provide the desired flexibility and coordination [

59]. The control system for the VPP consists as the response to the possibly conflicting demands of the various microgrid members. In this collective manner, a VPP can operate and behave like a conventional power plant, drawing from a large number of geographically dispersed renewable source power plants being connected without any reduction of the power variability between them [

60,

61]. In this structure it is important to create a balance of resources, as excess amounts of energy provided will add to the complexity of VPP control. Therefore, the VPP is not physical, but rather a virtual entity that contains commercial and technical units that highly depend on its software and communication links within it,

Figure 9. Thus, the VPP’s management, when based on a smart grid, needs to contribute to a greater and better integration of renewable sources into the system [

60,

61,

62,

63]. As a result, a number of outstanding questions need to be resolved regarding integration of distributed generators and providing their voltage increase control for the main network. Presently, VPPs are centralized power plants that utilize cryptocurrency and exchange virtual power to monetary value, with each cryptocurrency using its own blockchain, as presented in schematic in

Figure 9.

3.6. Regulatory Development for Blockchain Renewable Energy Grid

The increase in technology development for production of renewable energy sources will lead to ever increasing decentralization in the market due to the increasing number of users involved. In parallel internet systems managing their sourcing are expected to become more resilient so that it will be increasingly difficult to launch attacks and commit fraud [

64]. The overseeing role requires regulatory control and standards, necessary for implementation in all countries to define sustainable standardized protocols for communicating and exchanging information with clearly defined semantics and syntax [

65].

Regulatory support is important in connecting the electricity grid of the future in a sustainable way, since blockchain is new technology and at the present time is not yet fully recognized globally in the electricity market [

30]. As the more developed countries and industry leaders continuously invest in renewable energy generating plants, development has to be aligned with efforts to educate regulators in order to help them embrace the results of research into the implications and applicability of the blockchain model.

One of the more important issues addressed in regulatory is related to cyber security in centralized and decentralized blockchain networks [

4,

13]. Different types of attacks are possible, ranging from physical hardware to software systems, but since the management of energy systems is largely based on data estimation, generally one of the most dangerous means of attack is the insertion of false data and control of the grid. If an integrated VPP were to be hacked, it would affect the entire power grid. An economically attractive and feasible P2P microgrid market can be established only if there are many interested parties wanting to trade energy [

45,

64]. The microgrid should have uniform voltage within the operating system, working aligned and synchronized with a traditional grid. For the exchange of power between the distributed energy within the microgrid, the recovery of the AC frequency and voltage must be controlled at a higher level in the grid hierarchy, and regulation is needed [

62].

New and modern regulatory needs to be accepted on a governmental scale to enable better performance of information and communication technology (ICT) and make it equally available for all participants, making for a clear and coherent renewable energy market [

6,

30]. In order to have financial motivation to develop integrated microgrid energy markets, the pricing of energy should be adjustable at the same instant as energy generation, i.e., during surplus with decreasing energy price and with increasing price when under large demand creating energy insufficiency [

43]. Energy supply, climate conditions and demand data can be checked on the local, state, and continental level, enabling energy transactions that are secure and transparent [

47,

65]. Blockchain technologies ensure that both big government energy agencies and small prosumers allow public to have access and confirm transaction files.

3.7. Further Expansion Opportunities and Potential Roadblocks for Blockchain

Bitcoin launched as the initial “trademark” cryptocurrency without any bank regulating it, starting as “mining” organized by a few hundred so-called “hobbits” that were miners [

9]. Miners, as described earlier, use multiple computers to verify transactions and solve cryptographic mathematical problems, by combining transactions into “blocks” and adding them to the chain of inventory (blockchain), which is the public record of all transactions, and then trading them for money. In the response to the expansion of cryptocurrency, massive computing farms have spread worldwide, that operate all day, consuming electricity. Mining of the largest cryptocurrencies requires a vast amount of energy to function, thus creating a huge environmental problem, eventually posing a threat to the Paris Agreement on global warming mitigation [

9]. This energy wastage cost is backed into the system, passed on via transaction fees, such that end-users of networks pay for them, with possible fatal lack of viability in the future [

17,

20,

25]. Due to this fact, the trend is moving toward establishing cryptocurrency computing farms that use only solar energy or comparable renewable energy sources, such as exemplified by Genesis Mining and Ethereum in the cloud [

41]. Modern blockchain is expected to offer miners that use green energy sources increased incentives, such as more cryptocurrency, or even deny payment to miners that reject to use renewable energy sources. In the dynamic and fluctuating, potentially conflict-ridden, business environment surrounding cryptocurrency development, the benefits of blockchain need to be enhanced, properly managed, and controlled [

11,

48].

Apart from entertainment, banking, and energy, other trading platforms are clearly open and ready for the application of blockchain. This is particularly so in the area of raw materials sourcing both for high value specialties, such as rare earth elements needed for batteries and control systems in the quest for further electrification in society including transportation, and industrial commodities, such as minerals and ore for construction, and the materials sourced from them, including metals, such as copper, aluminum, and steel [

7,

8].

As an example, in the case of the metal industry, particularly, the utilization of blockchain technology with its distributed ledger can connect all processes involved in the value chain from the mining of ores through the processing of metal products, their sampling, shipping, and delivery with transportation warehouses, and, finally, payments. Later in the product lifetime also comes recycling and potential re-valuation in the circular economy. All these steps consume energy, and so the metal and metal-working industries are well positioned for integration into blockchain, initially managing energy trading, as discussed in this paper, and then expanding to trading across all the linked processes within metals handling [

19,

20].

Modern industries, which choose to use blockchain, participate in a commercial tool by sharing their data base with all participants in the market in a transparent and secure manner. The use of digital blockchain technology, in which all information will be stored, will, as mentioned previously, remove the threat of forgery of, for example, certificates of laboratory analysis, documents and receipts from energy acquisition, food, cosmetics, pharmaceuticals, luxury items, and simply materials in general.

A rapid glance at

Figure 2 and

Figure 5 reinforces the conceptual understanding of the complexity of interconnectivity, and the resulting energy consumption involved.

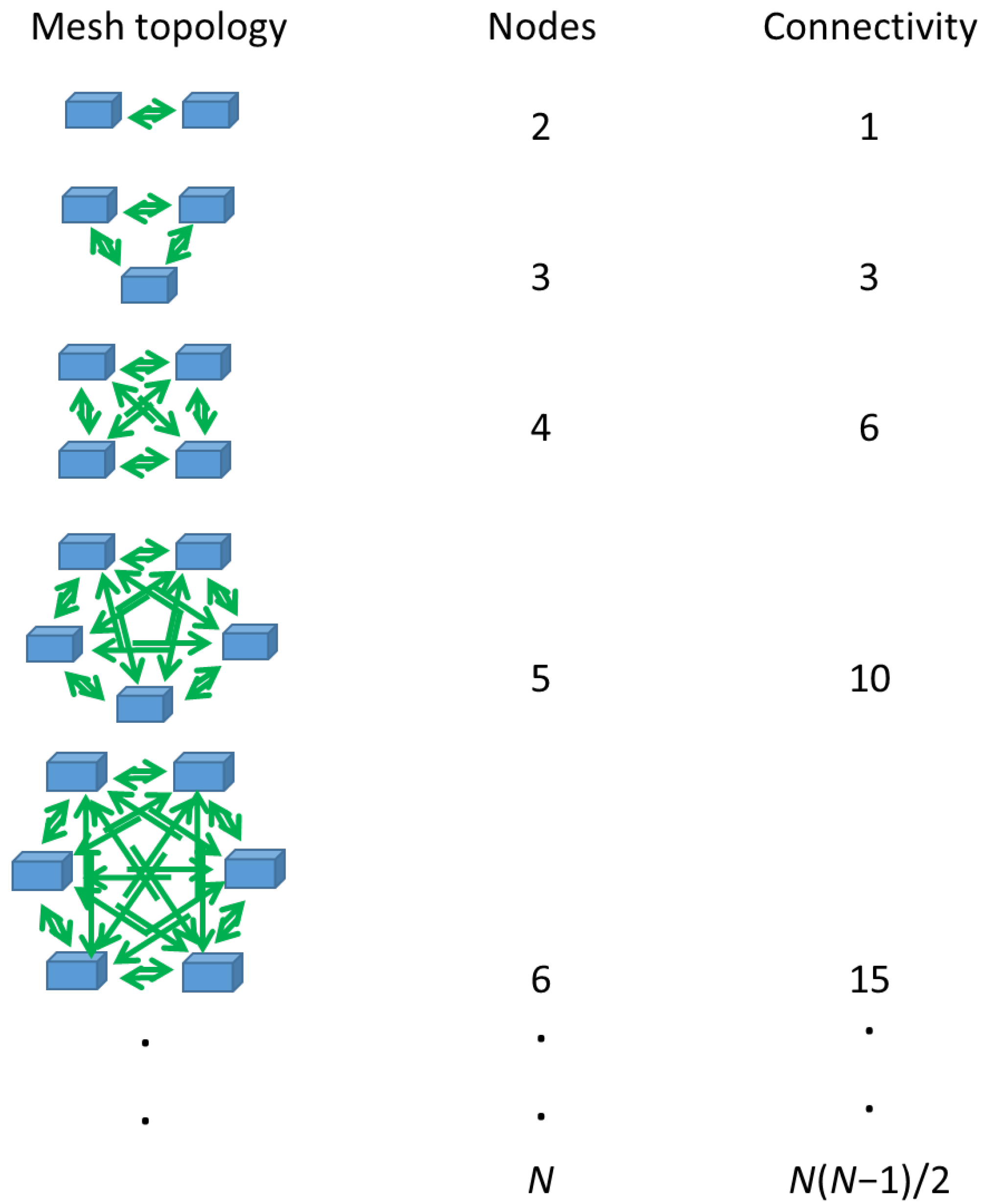

Figure 10 builds a schematic of the expanding connectivity based on the simplest of transaction protocols, i.e., a signal from one component computer in the multicomponent network and a corresponding return confirmation signal to establish the ledger replica process [

63,

64]. The connectivity follows the mesh topology, and

Figure 10 shows the minimum connectivity needed to maintain a link between all nodes, i.e., every device (node) is connected to another device (node). The protocol used in this case is termed an ad hoc configuration protocol.

If the network is expanded to

N nodes in this way, the number of connections required by each node is

N−1. Thus, for

N nodes the total number of connections is

N(

N−1)/2, which is written mathematically as the combinatorial

NC

2, and shown to follow the series in

Figure 10, namely 1, 3, 6, 10, 15, …,

N(

N−1)/2. Thus, it is easy to see how the energy for connectivity increases as the blockchain participants increase.

The protocol complexity, as shown in

Figure 5, rapidly increases the signal number needed to achieve a recorded transaction and confirmed multi-ledger replication. Consider each connection link must transmit, say,

i signal exchanges, then the total signal exchanges between all nodes to fulfil a given agreed blockchain protocol follows (

N(

N−1)/2)

i Jiang 2018 [

66], estimated the energy of transmitting 1 bit as 10 pJ, by considering the capacitance per unit length transmission, both by cable and within a solid state device, operating typically at 1 V. If, instead of cable, optic fiber is used, the estimated energy consumption per bit of optically amplified transportation in the ideal case and limited by the Shannon bound is estimated to be 4.4 fJ [

65]. Feng et al., 2021 [

67] showed a typical blockchain network protocol time consumption to reach consistency as node number increases,

Figure 11, for a practical Byzantine fault tolerance (PBFT) and weighted PBFT, both at a tolerance threshold of 100.

Assuming as a first approximation that

Figure 11 shows linearity, a function in the form

t (ms) = (1000/50)

N = 20

N, allows an approximate estimate of transmission time. Thus, considering a USB 3.0 port to support a transmission rate of ~5 Gbps over a clock cycle ~200 ps, the energy consumption can be estimated via the number bits transmitted, i.e., 5 × 10

9 t = 5 × 10

9 × 20

N × 10

−3 = 100,000,000

N bits. Given the estimate of energy consumption above for a highly efficient optic fiber connectivity at 4.4 fJ bit

−1, the energy consumption for one consistency operation is 4.4 × 10

−15 × 10

8N = 10

−7N J. Although this seems a relatively small energy consumption for a single operation, a typical blockchain transaction is remarkably slow due to the huge number of operations required. A highly efficient blockchain operator, such as Bitcoin, completes only 4.6 transactions per second, and this is due to the immense mining required [

61,

62,

67]. If it can be assumed that a smaller operator of blockchain were to make transactions with far less mining, say at ~1000 per second, then the power consumption would be 10

−4N W. For a 24 h operation using 100 nodes, this would bring an energy consumption of 86,400 × 10

−4 × 10

2 = 864 J for data transmission only. A typical desktop computer system consumes ~200 Wh [

68] during dedicated operation, i.e., 200 × 24 J per 24 h = 4800 J. Thus, in total, for the operator suggested above the energy consumption per 24 h is ~5.7 kJ, equaling an annual consumption of ~2 MJ.

The very rough estimate considered here for small-scale blockchain use can be compared with the larger scale estimate for cryptocurrencies reported recently by Kohli et al. [

68], in which a listing taken from a number of references is provided for the electrical energy consumption of Bitcoin and Ethereum in relation to whole countries’ electrical power consumption. Bitcoin at 135.12 TWh is in line with countries such as Malaysia and Sweden, with Ethereum on a par with Switzerland. At a combined energy consumption of 0.81% (190.13 TWh) of world energy consumption (23,398.00 TWh), these blockchain energy consumers are simply gigantic [

61,

62]. Their combined consumption is close to that of the total of global data storage centers, they being ~1% of world electricity consumption [

68]. A large multinational company trading in raw materials will at most consume the energy of a small data storage facility. Nonetheless, such increases in electrical energy being consumed is likely to arouse regulatory interest, and it is expected, for example, that EU rulings will soon be considered.

Further study by Kohli et al. [

69] reveals that in contrast to the big player Bitcoin and Ehereum, smaller cryptocurrencies, such as IOTA (FPC) and Hedera (Hashgraph), consume typically between 10

−4 and 10

−2 kWh, respectively, the latter thus consuming ~36 kJ per hour = ~315.4 MJ per year. This gives some credence to the value proposed by the short analysis above, starting from first principles, of ~2 MJ per year for a single blockchain active company.

Despite the scaling comparison, even summing smaller applications of blockchain will undoubtedly bring a negative environmental load unless alternative strategies are developed [

69,

70]. The literature in general addresses the protocol strategies, the potential identification of redundancy and, of course, sustainable energy sourcing. However, quantum technology may provide an answer to improved energy efficiency. Bennet and Schakib in 2019 [

71] propose a quantum-enabled blockchain architecture via a consortium of quantum servers. The network utilizes digital systems for sharing and processing information, combined with a fiber–optic infrastructure connecting quantum nodes (devices) transmitting and processing quantum information. They claim an energy efficient mining protocol enacted between clients and servers, using quantum information encoded in light, considering the vulnerabilities and benefits of quantum computing toward blockchain applications. Quantum entanglement, in principle, could offer instantaneous flipping states (information) of records in multi-replicating registration protocols for the ledger replicas, eliminating enacting energy transmission [

65,

71].

to the decentralized larger grid with currency exchange

to the decentralized larger grid with currency exchange  , both linked via blockchain.

, both linked via blockchain.

to the decentralized larger grid with currency exchange

to the decentralized larger grid with currency exchange  , both linked via blockchain.

, both linked via blockchain.