1. Introduction

In recent years, issues of financial inclusion have been the subject of many scientific studies and an area of interest of international organizations (such as the World Bank, International Monetary Fund, Alliance for Financial Inclusion, and Global Partnership for Financial Inclusion), central banks, and other governmental and non-governmental organizations. Financial inclusion is considered an important factor in reducing poverty and overcoming income inequality. In the conditions of the COVID-19 pandemic, which led to a decrease in economic activity and a reduction in household income, this issue has become even more urgent [

1,

2]. In addition, the importance of financial inclusion is related to its positive impact on financial security, macroeconomic stability, and inclusive growth, which was confirmed by the results of many scientific studies [

3,

4,

5,

6,

7,

8], as well as its enabling of many of the Sustainable Development Goals.

The World Bank defines financial inclusion as “access by individuals and businesses to useful and affordable financial products and services that meet their needs – transactions, payments, savings, credit and insurance – delivered in a responsible and sustainable way” [

9]. In the most simplified version, the level of financial inclusion is estimated using the share of the population that has an account at a financial institution. Of course, this approach does not take into account the various aspects of financial relations, nor does it allow an assessment of the “quality” of financial inclusion (for example, the number of open accounts that are active). Since 2011, the World Bank has been accumulating statistical data on global access to different financial services (payments, savings, and borrowing) in the Global Findex Database, which can be used to analyze various aspects of financial inclusion [

10].

In the period before the COVID-19 pandemic, the development of innovative technologies such as artificial intelligence, the Internet of Things, blockchain technology, and others; their active implementation in the financial sphere; and the growth of the FinTech segment and social networks began to significantly influence the financial market and the availability of financial services to consumers [

11,

12,

13,

14,

15]. With this in mind, the World Bank added indicators of digital payments to the Global Findex Database, but digital financial inclusion was not given much importance as a separate component.

The COVID-19 pandemic and the lockdown it caused significantly affected key macroeconomic indicators such as the GDP and employment rate of almost all of the countries of the world, and they also had a negative impact on economic, social, and ecological growth [

16,

17,

18,

19]. At the same time, the pace of implementation of digital technologies accelerated; this included the rapid development of online payment systems, online marketing, FinTech, and InsurTech segments. Many representatives of the business segment, academic circles, and the government saw opportunities to minimize the negative economic consequences of the current crisis by adapting digital technologies. In turn, digital financial inclusion has come to be seen as a key aspect of the resilience of households and SMEs.

The purpose of this article was to assess the impact of the COVID-19 pandemic on digital financial inclusion by constructing and calculating an integral index of digital financial inclusion based on data from the Global Findex Database. The value of the work lay in the development of the methodology for calculating the index of digital financial inclusion and its components (sub-indices of passive and active use of digital technologies) and the analysis of the results globally, by country, and by groups of countries according to income level. The main contribution of the study was in measuring the growth of the level of digital financial inclusion in the period of the COVID-19 pandemic and identifying differences in the dynamics of this growth between countries. Impacts of and opportunities created by COVID-19 for digital financial inclusion were considered both directly from the point of view of impacts on the behavior and decisions of consumers regarding the choice of digital channels for receiving financial services and from a broader perspective: as an impact on the development of digital infrastructure, digital inclusion in business segments, changes in the business models of financial intermediaries, and the favorable regulatory environment.

2. Materials and Methods

The study of the impact of the COVID-19 pandemic on the level of involvement of the population in the financial system; in particular the use of digital channels to access financial services, should begin with a comparison of the state of digital financial inclusion before the COVID-19 pandemic and in the post-pandemic period. Such a comparative analysis will be the most objective and informative in the case of using a comprehensive integral indicator that takes into account different levels and types of financial relations. The digital financial inclusion (DFI) index was used in this study as such an integral indicator. The methodological approach to calculating this index included the following stages:

Formation of a sample of indicators for the analysis of digital financial inclusion based on the World Bank’s Findex database;

Grouping indicators according to sub-indices of digital financial inclusion and establishing their priority;

Calculation of weighting coefficients for digital financial inclusion indicators using the Fishburn formula;

Calculation of sub-indices and the digital financial inclusion index;

Analysis of the results globally, by country, and by groups of countries according to income level.

In order to calculate the digital financial inclusion index for different countries and to conduct a comparative analysis by country groups and at the global level, the Global Findex Database [

10] was used as a basis. This database is formed by the World Bank and contains a sample of more than 80 basic indicators, most of which are detailed by different categories of the population. In general, the sample includes more than 500 indicators that characterize various aspects of financial inclusion from the standpoint of access and use of financial services. In other words, the Global Findex Database contains indicators of the share of the population that is “included” in the financial system; that is, has access to certain types of financial services, uses them, and acts as a subject in certain types of financial relations. The data are provided in percentages both for the entire adult population (the sample covers the population aged 15 and over) and for certain categories of the population grouped by age, education, gender, place of residence, and other parameters.

The World Bank publishes the results of the study on digital financial inclusion every 3 years. Currently, the database contains data for 2011, 2014, 2017, and 2021 (due to the pandemic, the database was created for 2021 and not 2020). The list of indicators for each new research period contains both a constant component (time series variables) and specific indicators for this period in accordance with the needs of the analysis and the features of the current stage of development of the world community. For example, the 2021 study was supplemented with indicators of population resilience (“main source of emergency funds”, “coming up with emergency funds in 30 days”, and “experience or continue to experience severe financial hardship as a result of the disruption caused by COVID-19“) and digital payments (“made a digital in-store merchant payment” and “made a digital online merchant payment”), which became relevant in connection with the COVID-19 pandemic. The World Bank does not allocate a block of indicators related to digital finance. However, it is possible to select indicators that directly or indirectly characterize digital financial inclusion from the available list of indicators.

Therefore, the Global Findex Database of the World Bank contains a large-scale and diverse sample of indicators for the analysis of financial inclusion for several years and for most countries, so the methodological approach to the calculation of the index of digital financial inclusion was formed based on the available statistical data and the list of indicators proposed by the World Bank.

However, among the indicators of financial inclusion analyzed by the World Bank in 2011, there are practically no data on the financial involvement of the population through digital channels due to the low level of penetration of digital technologies and the irrelevance of this issue at that time. Therefore, in this study, the analysis of digital financial inclusion was limited to the available data for three years: 2014, 2017, and 2021.

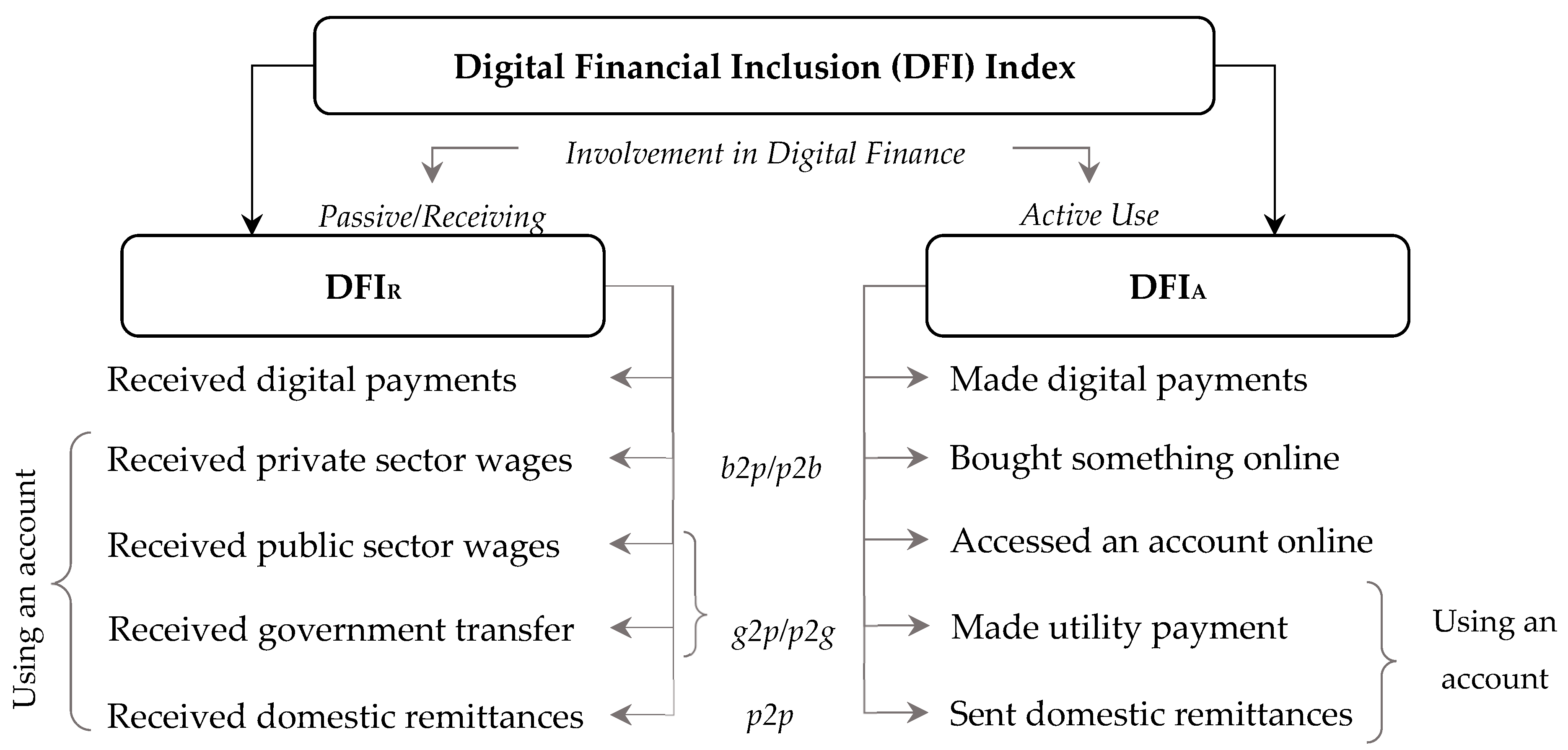

Among the financial inclusion indicators of the Findex database, 10 indicators were selected for the calculation of the digital financial inclusion index. These indicators were divided into two groups depending on the nature of involvement in digital finance: passive (receiving) or active use (

Figure 1).

The first group of indicators characterized consumers’ passive positions regarding digital financial inclusion (passive participation in digital finance)—receiving payments and crediting funds to an account. This group included the following indicators from the Findex Database:

RDP—received digital payments (%, age 15+);

PRW—received private sector wages into an account (% of private sector wage recipients, age 15+);

RGT—received government transfer into an account (% of government transfer recipients, age 15+);

PUW—received public sector wages into an account (% of public sector wage recipients, age 15+);

RDR—received domestic remittances: into an account (% of recipients, age 15+).

The second group of indicators formed the DFIA sub-index, which characterized digital financial inclusion from the standpoint of consumers’ active use of digital technologies for financial transactions, account management, etc. The indicators included in this sub-index were:

MDP—made a digital payment (%, age 15+);

BSO—used a mobile phone or the internet to buy something online (%, age 15+);

MUP—made a utility payment using an account (% who paid utility bills, age 15+);

CAB—used a mobile phone or the internet to check account balance (% with a financial institution account, age 15+);

SDR—sent domestic remittances: using an account (% of senders, age 15+).

The indicators “received private sector wages”, “received government transfer”, “received public sector wages”, “received domestic remittances”, “made a utility payment”, and “sent domestic remittances” are presented in the Findex Database at various levels of detail, in particular as the share of the population carrying out these operations using an account, a mobile phone, a financial institution account, or cash only. When detailing financial transactions as “using an account”, the percentage of respondents who carried out these transactions directly from a financial institution account or by using a mobile phone was taken into account. In different countries, the population mainly uses accounts at financial institutions (such as in countries with a developed financial market; for example, European countries) or mobile money as an alternative to traditional banking (such as in most African countries). Therefore, when calculating the digital financial inclusion index, we used the “using an account” breakdown criterion to take into account the specifics of different countries and conduct a comparative cross-country analysis.

The presented approach to calculating digital financial inclusion also allowed us to take into account the differences in financial inclusion at different levels of financial relations; namely, between individuals: peer-to-peer (domestic remittances); between individuals and the business sector: peer-to-business/business-to-peer (private-sector wages and online shopping); and between individuals and local and state authorities: peer-to-government/government-to-peer (government transfer, public-sector wages, and utility payments).

The sub-indices of digital financial inclusion were calculated using the linear mathematical model of the integrated indicator (weighted sum method) according to Formulas (1) and (2):

where w

i is a weighting coefficient of i-indicator of the corresponding sub-index of digital financial inclusion.

The Fishburn formula (Formula (3)) was used to calculate the weighting coefficients for the indicators. Its advantage is the possibility of setting weighting factors exclusively based on the priority of the indicators included in the calculation.

where n is the total number of indicators in the calculation of the sub-index of digital financial inclusion, and i is the rank of an indicator.

According to the determined priority of the indicators, they are assigned a numerical value of the rank, which is used in the formula to calculate the weighting coefficients. In the case of setting the same priority to several indicators, the same rank is set for them as the average value between the rank positions that they would occupy with different priorities. In the calculation of sub-indices of digital financial inclusion, we determined different priorities for all indicators (Formula (4)), so the numerical values of priority and rank were equal.

The set values of the ranks for the indicators of each of the sub-indices are presented in

Table 1.

The indicator ranks were established based on the following considerations: the highest priority and, accordingly, a rank equal to 1 was set for the digital payments indicator (“made digital payments” for DFIA and “received digital payments” for DFIR) because it was a direct indicator of digital financial inclusion and characterized it most accurately compared to other indicators in the sample. In addition, unlike other indicators that characterized the interaction only between certain subjects of financial relations, the digital payments indicator was the most generalizing.

For the DFIR sub-index, the priority of the remaining indicators was determined depending on the participants in the financial relations. The second priority was set for payments received by the respondents from the business sector (received private sector wages); the third and fourth priorities—received from the government (government transfer and public sector wages, respectively); and the fifth priority—settlements between individuals (domestic remittances). Government transfers had a higher priority than public sector wages because their recipients were vulnerable categories of the population and their inclusion in the financial system was a more accurate criterion. The higher priority for private-sector wages was set while taking into account greater opportunities for cash circulation and a higher level of shadow operations in the business segment compared to the public sector.

The priority setting of indicators for the DFIA generally followed the same logic as for the DFIR. However, this sub-index included not just one but three indicators that directly characterized digital financial inclusion: “made digital payments” (MDP), “bought something online” (BSO), “accessed an account online” (CAB). Therefore, the second priority was BSO, which characterized the interaction between individuals and businesses and was a direct indicator of the use of digital technologies. The CAB indicator, despite its direct relation to digital technologies, was given the fourth priority because it was a criterion for access to digital finance and not for its active use. From this point of view, making utility payments using the account was a more important indicator and was assigned the third priority. The “sent domestic remittances” indicator had the fifth priority by analogy with the “received domestic remittances” indicator in the DFIR.

By applying the Fishburn formula (3) and the established ranks for the indicators (

Table 1), the following values of the weighting factors were calculated (

Table 2).

Given the fact that the input database was formed for 142 countries over 3 periods, the values of certain indicators for some countries and certain periods may not have been available. For such cases, the corresponding sub-index was calculated on the basis of the available four indicators using the weighting factors calculated for the total number of indicators (n = 4). At the same time, the general approach regarding the established priority of the indicators was preserved (new rank values were assigned to them based on the priority defined in Formula (4)).

In addition, in 2014, the World Bank did not collect statistical data on the BSO (used a mobile phone or the internet to buy something online) and CAB (used a mobile phone or the internet to check account balance), so in the calculation of the DFI

A for 2014, weighting factors were used in terms of the total number of indicators (n = 3) according to

Table 2.

The index of digital financial inclusion was calculated as the average value of two sub-indices (Formula (5)):

All indicators included in the calculation of digital financial inclusion sub-indices were measured as the share of the population that had access to certain types of financial services and used them.

Thus, the first sub-index DFIR provided an estimate of the share of the population that was passively involved in digital finance; i.e., received payments, wages, or transfers using digital technologies. The second sub-index (DFIA) was an estimate of the share of the population that used digital channels for active financial transactions—making payments, sending transfers, online shopping, etc. The final indicator—the digital financial inclusion index—was a generalized estimate of the share of the population that had access to and used digital financial services.

The obtained values of the digital financial inclusion index as well as its components (sub-indices) were analyzed by country; by groups of countries according to income level; and globally for 2014, 2017, and 2021.

For 2021, while taking into account the growing dynamics of the use of digital technologies and changes in digital inclusion that took place under the influence of the COVID-19 pandemic, the World Bank added indicators of digital payments to the Findex Database (in particular, indicators of digital merchant payments and utility payments) as well as the results of the survey on making such payments for the first time after the pandemic began. Since these indicators were available only for 2021, they were not included in the methodology for calculating the digital financial inclusion index. This did not significantly affect the quality of the calculation of the DFI index because the specified aspects are covered by other more general indicators when calculating the sub-indices. However, the analysis of these indicators was important to understand the availability of financial services for the population under lockdown conditions as well as to determine the effect of COVID-19 as a trigger of the development of digital financial services and increases in digital financial inclusion.

With this in mind, in addition to the calculation of the DFI index, an analysis of digital financial inclusion based on specific indicators for 2021 was conducted. In addition, a detailed analysis of these indicators was carried out according to categories of the respondents based on gender, income level, education, employment status, and age to identify differences in the level of digital financial inclusion for vulnerable categories of the population.

The selected methods for calculating the digital financial inclusion index; namely, the method of weighted sums and the Fishburn formula for weighting factors, are often used in scientific research when calculating indices and integral indicators. In addition, the indicators from the World Bank database that were taken as input data ensured the reliability, comparability, and soundness of the obtained results. At the same time, the quality and accuracy of the assessment of digital financial inclusion was limited by the availability of the necessary indicators in the Findex database and an expert approach to establishing their priority.

3. Results

3.1. DFI Index Calculation Results

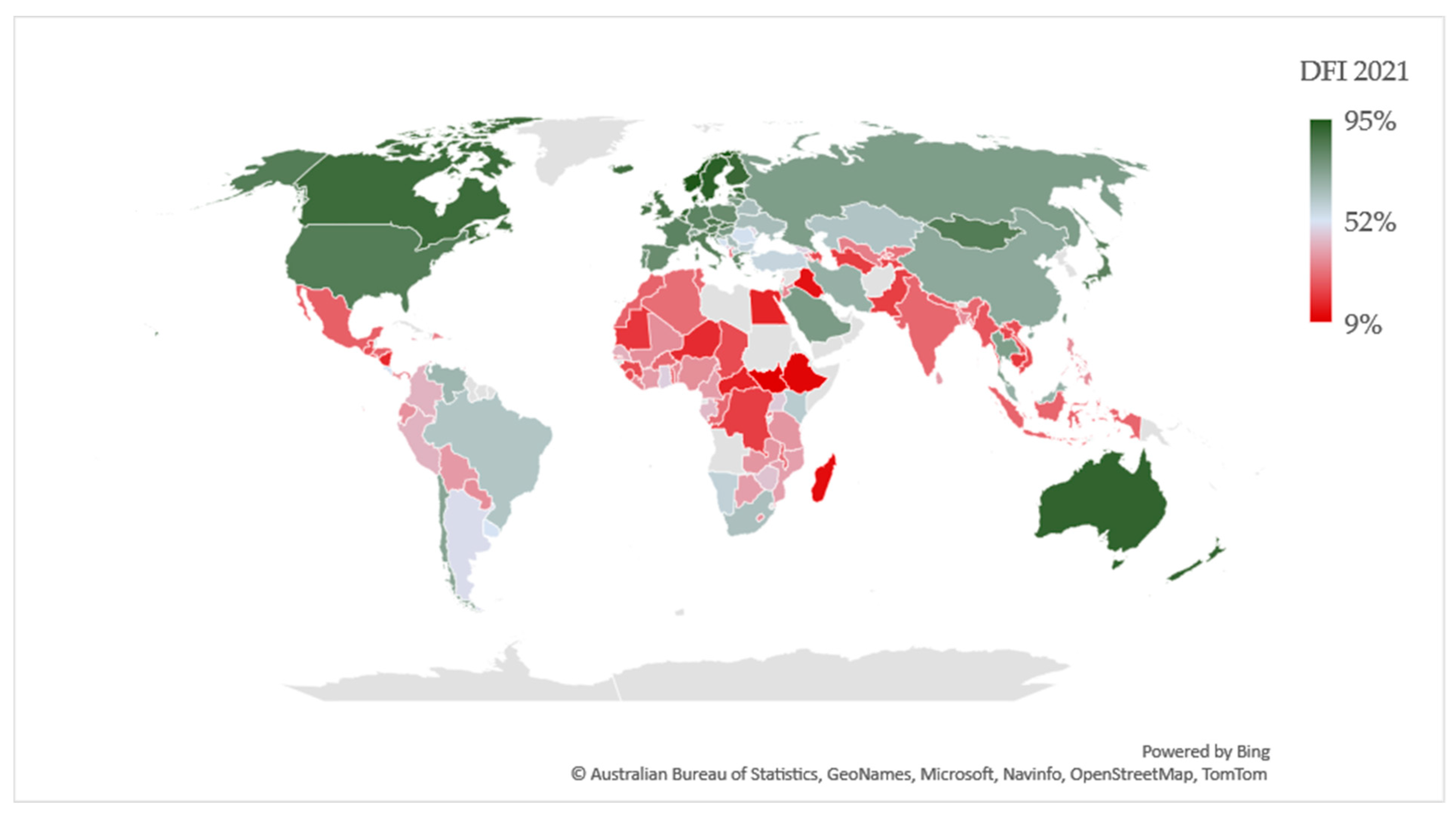

The application of a methodological approach to the calculation of the digital financial inclusion index and its components made it possible to obtain results for 142 countries for 2014, 2017, and 2021. A visualization of the results of the DFI calculation for 2021 is presented in the map in

Figure 2.

The level of digital financial inclusion among the countries in the sample ranged from 9% to 95%. There were clear regional patterns in the distribution of DFI values. The lowest DFI levels were found in African countries such as South Sudan (9%), Ethiopia (11%), Madagascar (13%), and the Central African Republic (16%), as well as in Nicaragua (17%). Other countries in the African region had below-average DFI levels (with the exception of South Africa (63%), Kenya (59%) and Namibia (58%)). The highest levels of DFI in 2021 were in the countries of the Northern European and Australian regions; in particular: Norway (95%), Denmark (94%), Sweden (92%), Estonia (92%), New Zealand (91%), and Finland (90%).

In 2021, compared to 2017, the digital financial inclusion index increased in most countries. In some countries, the DFI index almost doubled; for example, in the Philippines (↑ by 18 percentage points to 36%) and Thailand (↑ by 31 pp to 74%). There was also a significant increase in the DFI index in such countries as Greece (↑ by 24 pp to 80%), Chile (↑ by 21 pp to 72%), Mongolia (↑ by 20 pp to 84%), China (↑ by 17 pp to 70%), Ukraine (↑ by 17 pp to 64%), and Romania (↑ by 16 pp to 53%). In these countries, the rapid growth in the DFI index occurred mainly due to the increase in indicators of the active use of digital technologies (the DFIA sub-index), which can be explained by, among other things, the impact of the COVID-19 factor.

On the contrary, there were countries in which the digital financial inclusion index decreased. Among such countries were Tajikistan (↓ 17 pp to 22%), Switzerland (↓ by 10 pp to 73%), Iran (↓ by 6 pp to 68%), Burkina Faso (↓ by 6 pp to 29%), and Kenya (↓ by 5 pp to 59%). Among the mentioned countries, there were no common patterns regarding the reasons for the decline in digital financial inclusion; however, most countries had a decrease in the indicators of passive involvement in digital finance.

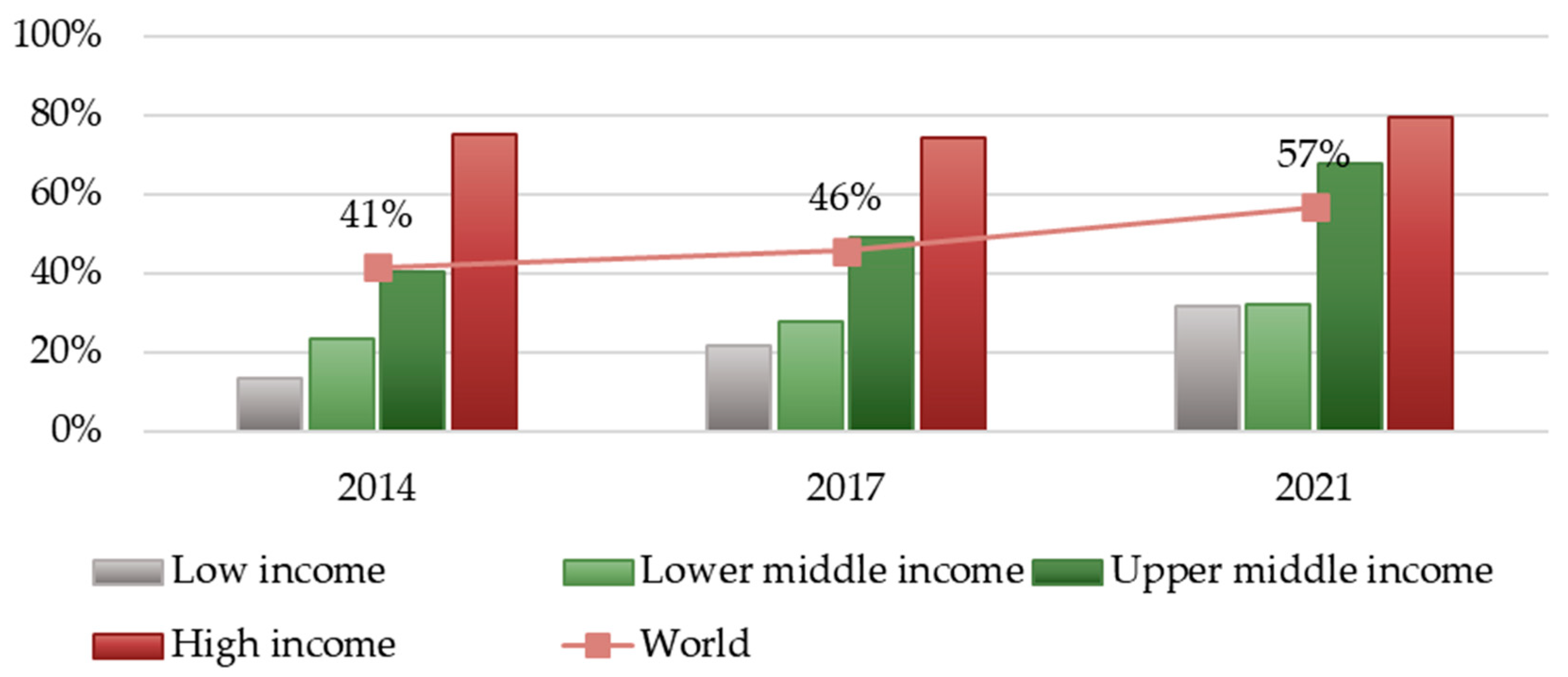

The obtained results of the level of digital financial inclusion were also correlated with the grouping of countries according to the World Bank country classifications by income level (

Figure 3). The World Bank classifies countries into four groups according to the GNI per capita indicator calculated using the World Bank Atlas method: low-income (USD 1085 or less), lower-middle-income (USD 1086–4255), upper-middle-income (USD 4256–13,205), and high-income economies (USD 13,205 or more). A list of the countries included in each group is available on the World Bank website [

20].

A clear pattern was observed regarding the lowest values of the digital financial inclusion index in low-income countries, and, in turn, its highest values in high-income countries. The dependence of digital financial inclusion on the level of income per capita persisted throughout all periods of the study. An analysis of the changes in the DFI index showed that although the growth in this index was characteristic of all groups of countries during 2014–2021, the dynamics of the growth were different. High-income and lower-middle-income countries had a slow growth in digital financial inclusion: in high-income countries, the DFI index increased by only 5 pp in 2021 compared to 2014 and 2017; while the growth in DFI in lower-middle-income countries was slightly higher—it had a uniform growth of 5 pp in 2017 and 2021 and increased from 23% to 32% in total. On the other hand, the growth in digital financial inclusion in low-income countries was more dynamic—the indicator grew annually by approximately 10 pp and in 2021 equaled the value for DFI in lower-middle-income countries. Upper-middle-income countries, which had a slight increase in DFI in 2017, had a sharp increase in DFI in 2021 (from 49% to 68%), which significantly approached the indicator for high-income countries.

It is worth noting that when calculating the DFI indices for 2014, the values for two indicators in the database were not available, which means that there was a possible error in the calculation of this index and that its real values in 2014 were more likely to be lower than the estimated values.

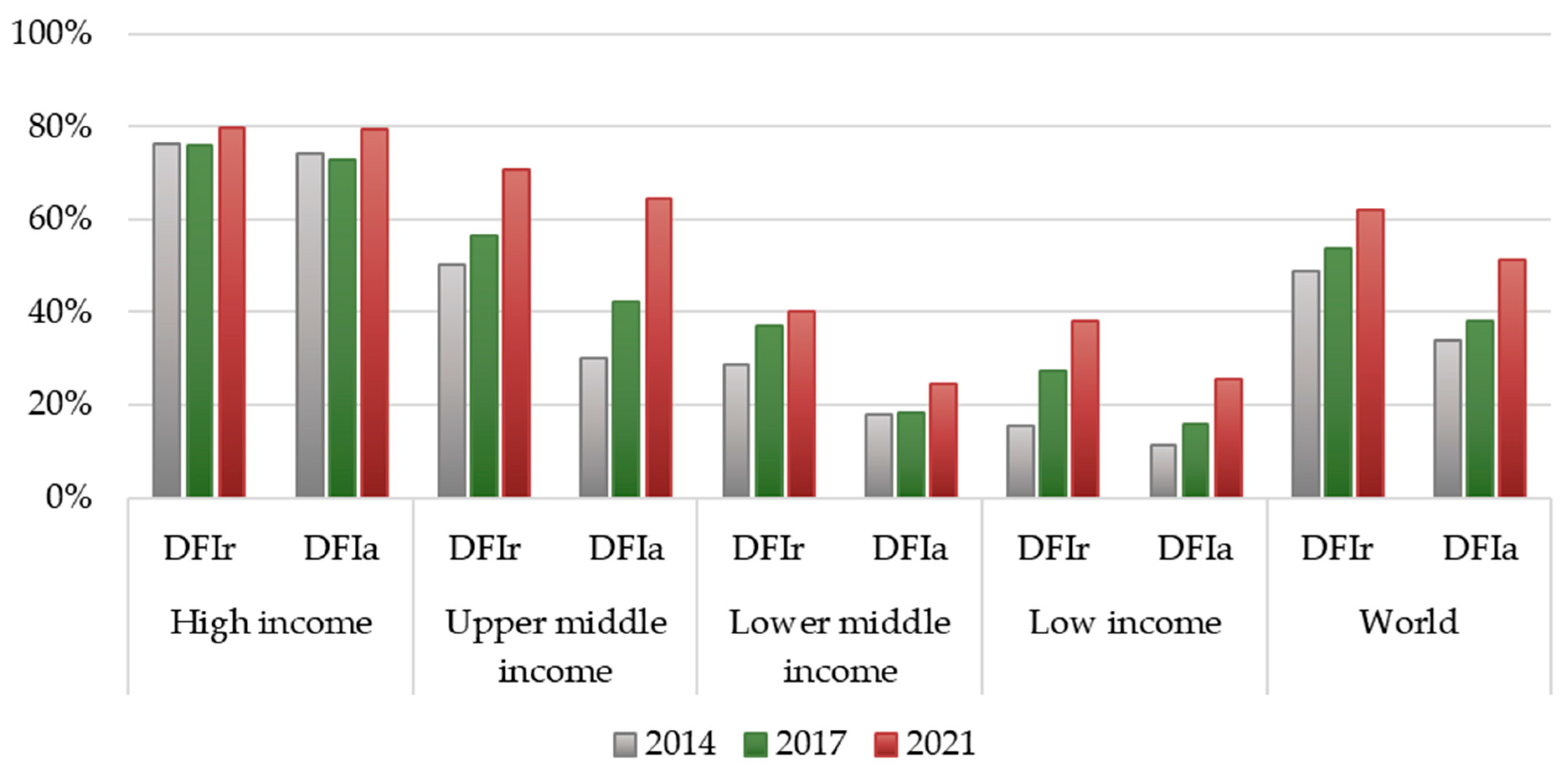

A detailed analysis of the changes in digital financial inclusion was carried out in terms of the relevant sub-indices (DFI

R and DFI

A), which characterized passive participation in financial relations and active use of digital technologies, respectively (

Figure 4).

An analysis of the calculated values of the DFI sub-indices showed that most countries had a higher level of digital financial inclusion according to the sub-index of passive participation in digital finance (DFIR), while active use of digital technologies (DFIA) lagged behind significantly.

The following features were noted regarding the dynamics of changes in the sub-index values. First, the increase in the values of the sub-indices (both for the world and for groups of countries by income level) in 2021 was significantly greater than in 2017 with one exception (the DFIR in lower-middle-income countries, the growth of which slowed in 2021).

The second feature was the differences in the dynamics of changes in sub-indices in 2021 and in previous periods. In 2017, the increase in sub-indices was almost the same for world indicators, but there was no single trend in the increase in sub-indices according to country groups (the DFIR had a greater increase in low-income and lower-middle-income countries, the increase in the DFIA sub-index was more significant in upper-middle-income countries, and the growth in the sub-indices was almost the same in high-income countries). Instead, in 2021, all groups of countries had a significant increase in the values of the DFIA sub-index. Such dynamics indicated that COVID-19 acted as an incentive for more active use of technology in the financial sphere for online shopping, paying bills, etc.

3.2. Digital Financial Inclusion According to Categories of Population

When considering the significant growth in the DFI

A sub-index in 2021, it was worth additionally analyzing the indicators that characterized the digital payments of the population; namely, digital merchant and utility payments (

Figure 5).

First of all,

Figure 5 shows a significant gap in the share of the population that made digital merchant payments between high-income and upper-middle-income countries on the one hand and lower-middle-income and low-income countries on the other hand. In the first group of countries, this indicator reached 70-80%, while in the second group of countries it did not exceed 12%. Approximately the same percentage of the population (10-12%) from lower-middle-income and low-income countries paid utility bills using an account in 2021. In high-income and upper-middle-income countries, utility payments using an account were made by a much smaller share of the population compared to digital merchant payments (63% and 26%, respectively).

Analyses of digital payments for the first time after the COVID-19 pandemic began were very revealing. In lower-middle-income and upper-middle-income countries, the share of the population that made the first digital payment after the start of the pandemic was about 6% for both merchant and utility payments. In low-income countries, this indicator was lower and amounted to 3%. Therefore, in fact, the increase in the share of the population included in the financial system with the use of digital technologies after the COVID-19 pandemic began amounted to no more than 6%. A much larger increase in the DFI index was due to the evolutionary growth of the digital financial inclusion due to the development and widespread adoption of digital technologies before the start of the pandemic (the comparison base for the analysis of the increase in the DFI index was 2017).

Despite the existing positive dynamics in the indicators of digital financial inclusion, there were problems of exclusion from the financial system of the most vulnerable categories of the population. This was especially acute in countries with a lower level of economic development.

Figure 6 shows the share of the population that made digital merchant payments in 2021 according to age, education, gender, employment status, and income level.

It is obvious in

Figure 6 that there was a drastic gap in the use of digital financial services by the population in upper-middle-income countries and lower-middle-income and low-income countries. In countries with upper-middle income, digital merchant payments were made by about 65% of the population in all categories; in particular, by about 60% of the population in vulnerable groups. The smallest share of digital payments was made by people out of the labor force; namely, 35% of the respondents of this group.

In low-income countries, digital payments were made by 7% of the population on average and about 5% of the population among vulnerable categories. In lower-middle-income countries, digital merchant payments were made by 12% of respondents from the studied groups and by about 7% among vulnerable categories.

There were also differences in the scale of gaps in the share of the population that made digital payments depending on the group of the country according to the income level and population categories. For example, in upper-middle-income countries, the largest gaps were observed between population groups formed by employment status and income level, while the level of digital financial inclusion according to age and gender was almost equal and quite high (up to 70%).

Similarly to upper-middle-income countries, in lower-middle-income and low-income countries there was a significant gap in the indicators of digital financial inclusion depending on the income level and employment status of the respondents; in addition, the level of education was also a significant factor. Moreover, lower-middle-income and low-income countries had a much larger gap in digital financial inclusion according to gender.

Note that in all countries there was a small gap in the share of the population that made digital merchant payments that depended on the age of the respondents. However, the World Bank uses the following breakdown by age: 15–24 years and 25+ years. Thus, the second group included a fairly young population that actively used digital technologies. Unfortunately, no data were available for the 35+ or 60+ age groups. It is likely that the digital financial inclusion gap would be much larger for these age groups.

In general, the results of the conducted analysis indicated that despite the growth in the general level of digital financial inclusion, the problem of inclusion of vulnerable categories of the population in the financial system remains relevant.

4. Discussion

It is undeniable that the COVID-19 pandemic has become a trigger for accelerating the penetration of digital technologies into everyday life and economic activity as well as a factor in increasing the overall level of digital financial inclusion throughout the world. The developed methodological approach to the calculation of the digital financial inclusion index and the analysis carried out on its basis confirmed the acceleration of the dynamics toward a growth in DFI in 2021 compared to previous periods.

However, the growing role of digital technologies as an objective direction of modern social development cannot be ruled out. Therefore, the calculated results were only partially explained by the COVID-19 factor (in particular, the presence of quarantine restrictions, the impossibility of using financial services offline, and the desire of people to use safer methods for health payments in pandemic conditions). For example, based on empirical data, the study in [

21] proved that technological readiness became the main factor in the use of FinTech services during the pandemic. The positive impact of COVID-19 on people’s willingness to use FinTech services was also significant because it formed the belief that using FinTech services would reduce the spread of COVID-19 and offer protection from the disease.

The analysis of the dynamics of changes in the digital financial inclusion index around the world and by groups of countries according to income level, as well as the analysis of the dynamics of sub-indices, did not show a drastic impact of COVID-19 on their values. The increase in the DFI index in 2021 compared to 2017 was not significantly higher than in 2017 compared to 2014. Such a uniform growth can be explained by the general development of digital technologies and the penetration of digitization. The rapid change in the DFI indicator in 2021 was characteristic only for upper-middle-income countries. However, Mansour H. [

22] came to a somewhat different conclusion, namely that low-income and lower-middle-income countries reacted more strongly to the need to use digital means of payment during the pandemic than countries in other groups.

The study conducted in [

23] using the example of the Indian market also proved that the growth in demand for digital financial services was first of all due to the technological advantages of such services, while the pandemic factor had the second strongest positive impact. Urus et al. [

24], who analyzed the adaptation of FinTech payment services in Malaysia and Indonesia as the most preferred solution for handling financial transactions in conditions of limited mobility and interaction, concluded that the main factors that influenced the use of digital payment services were performance expectancy and the cultural factor of individualism.

According to the World Bank, only 6% of the population in low-middle-income and upper-middle-income countries made digital financial payments for the first time after the start of the pandemic. On the one hand, such growth in a short period was significant; on the other hand, in the mentioned groups of countries, the majority of the population is still not covered by financial services, and even more people are not covered by digital financial services. After all, the choice in favor of digital financial services depends not only on the desires of people but also on the availability of such digital financial services in their country/region and their accessibility to users; in particular, the availability of digital financial services from traditional financial intermediaries (banks and insurance companies) and the availability of FinTech companies or other intermediaries that are capable of providing access to digital financial services.

In addition, the dynamics of DFI growth depends on the formation of the ICT infrastructure (availability of high-speed Internet and access to mobile communications in the region) and technological equipment (availability of a laptop, PC, and/or smartphone; and access to the Internet). For example, a study on the tendency toward FinTech adoption (e-commerce and e-banking) during the pandemic in Nepal showed a positive attitude toward it by the vast majority of respondents aged 21 to 40. At the same time, two-thirds of online buyers reported problems with FinTech adoption due to slow internet speeds and lack of awareness regarding its applications [

25].

In order to receive digital financial services, consumers need to possess certain skills in working with digital devices. In the conditions of the rapid spread of digital technologies during the COVID-19 pandemic, the digital skills (competencies) of citizens have become key among other skills [

26]. In general, a higher level of financial literacy can reduce financial vulnerability [

27]. Kazemikhasragh A. and Buoni Pineda M. V. [

28] also noted that the development of education contributed to a reduction in inequality in financial inclusion. In addition, studies showed different results regarding the correlation between digital and financial literacy and digital financial inclusion in the context of using the services of different types of intermediaries in developing countries. For example, a study conducted in Vietnam showed that during the pandemic, FinTech contributed to the financial inclusion of people with a lower financial literacy, while residents of Vietnam with a higher financial literacy already had access to traditional financial facilities and did not consider FinTech as an important tool for their financial transactions [

29].

The low share of users of digital financial services may be related to factors independent of a specific person; in particular, the underdevelopment of the ICT infrastructure or an insufficient supply of such services. According to the level of information technology development, there is a significant digital divide between countries. This digital divide results in a gap in the levels of digital financial inclusion between countries and groups of countries according to income level. In addition, each country has vulnerable populations that have even greater barriers to inclusion in digital finance. They may be limited in the availability of means of access to the internet (PC or smartphone) and lack sufficient knowledge. At the same time, in order to use digital financial services, both financial and digital literacy are important.

During the COVID-19 pandemic, the vulnerability of those population groups that are most difficult to include in the financial system—the poor, the elderly, the unemployed, and women (in certain groups of countries)—has increased. If some of them could at least use offline financial services previously, on the contrary, during the pandemic they found themselves excluded from the financial system due to limited access to even traditional financial services through offline channels.

Law S.-W. [

30] distinguished three categories of the population that are financially excluded: persons who do not have access to financial services at all (unbanked), persons who have access only to basic banking services and not to the rest (under-banked), and persons who have difficulties with constant access to services. As a result of the restrictions caused by the COVID-19 pandemic, the third group will potentially be filled by those who have difficulty accessing financial services through digital channels (digital exclusion). Cai et al. [

31] also pointed out that due to COVID-19, digital transactions have become the new normal. Traditional banks were forced to switch to digital platforms, but they are not available to all customers, especially the elderly and those without digital access.

Accordingly, when characterizing the impact of the COVID-19 pandemic on digital financial inclusion and the new opportunities that the pandemic has created for the financial system, it is necessary to consider both sides of the issue. On the one hand, it is necessary to consider forced digitization and the prerequisites for increasing digital financial inclusion formed as a result of the pandemic. However, on the other hand, it is necessary to take into account the asymmetry of access to digital infrastructure and the growth in the digital divide and increasing household income inequality due to the reduction in some economic activities [

32].

For a comprehensive analysis, digital financial inclusion should be considered from a broader perspective: not only from the standpoint of influencing consumer behavior and decisions regarding the choice of digital channels for receiving financial services, but also influencing the development of digital infrastructure, product policy of financial service providers, and regulation. Given this, it is appropriate to consider the opportunities and limitations that the pandemic has created for the financial system, financial institutions, the public, businesses, and regulators, as well as how it could affect digital financial inclusion accordingly.

4.1. COVID-19 Impacts on Households and Consumer Behavior

The positive impacts of the COVID-19 pandemic on digital financial inclusion include changes in consumer behavior that have taken hold and continue in the post-pandemic period. For example, during the lockdown, when consumers were forced to stay at home for long periods, the role of online shopping increased. After returning to normal conditions, the habits acquired during the quarantine were consolidated; these included online shopping [

33]. This was also confirmed by a number of other studies. Ly et al. [

34] showed that the use of virtual wallets in Vietnam showed a positive tendency of consumers toward their continuance usage.

However, consumer habits can have both positive and negative consequences for digital financial inclusion. Based on a survey of respondents in 22 European countries, Kotkowski R. and Polasik M. [

35] concluded that those users who made cashless payments before the pandemic would prefer them even more with the onset of the pandemic and that those who paid in cash would continue to do so. Thus, the gap between these groups has only widened during the pandemic.

Studies showed the existence of differences in preferences regarding the use of digital devices according to demographic characteristics (education, gender, and age). These characteristics can also shape differences in consumer behavior in the online environment regarding both online shopping and online payments [

36].

According to the results of the study in [

32], the main factors that influenced the use of digitization facilities for payments and savings were access to the internet, level of studies, gender, employment characteristics, and level of development. Jain K. and Chowdhary R. [

37] found that for surveyed respondents in India, performance expectancy and facilitating conditions were the determining factors that influenced the intention of individuals to use digital payment systems. Mugume R. and Bulime E. W. N. [

38] found that in Kenya and Uganda, digital financial inclusion was higher in middle-aged male digital users with more SIM cards registered in their names. In African countries where financial inclusion is provided through mobile money accounts, such results clearly demonstrated the existence of gender and age gaps in access to digital financial services. Zeng Y. and Li Y. [

39] noted that digital divides existed even within the same age group. Based on a survey conducted among older adults (age 60+) in China, researchers found significant sociodemographic differences between active and inactive users of digital financial services within this age group.

Additionally, some authors noted that the increase in the frequency of non-cash payments as a result of the pandemic differed considerably between countries and therefore indicated the role of country-specific factors [

35]. It should be taken into account that although the COVID-19 pandemic has affected the whole world, it still had a different degree of manifestation and destructive impact in different regions and individual countries. There are many reasons for this—both economic and social. However, within the framework of this study, it is important that the different degrees of severity of the COVID-19 pandemic in different regions were also accompanied by different approaches to quarantine restrictions, the duration of the lockdown, restrictions on the ability to visit shopping centers and financial institutions, etc. Therefore, the COVID-19 pandemic as a trigger for the growth of digital financial inclusion cannot be considered as a factor with the same influence for all countries of the world [

40].

The impact of COVID-19 on the household sector was also manifested in a significant reduction in domestic and international remittances. Given that in developing countries migrant remittances are one of the core drivers for improving household well-being, their reduction has led to a significant deterioration in the financial condition of many families [

41]. From the standpoint of financial inclusion, remittances can contribute to its increase due to the need to open accounts in financial institutions [

42]. At the post-COVID recovery stage, stimulating the flow of remittances through the development of electronic banking and ensuring cyber security and fraud protection is an important task for regulators [

43,

44].

4.2. COVID-19 Impacts on the Business Sector

In the business segment, the pandemic had mostly negative consequences; in particular, those due to the reduction in business activities and significant economic losses [

45]. Even in the period before the pandemic, digital technologies were considered to be a tool for increasing business efficiency and ensuring competitiveness [

46]. With the onset of the pandemic, digital technologies and digital financial inclusion became a salvation for those businesses that were able to organize at least part of their business processes online. Many entrepreneurs saw the solution to the reduction in offline sales in the development of online stores, receiving online orders, and implementing address delivery. For companies with largely offline businesses, cooperation with payment service providers has become relevant, which not only helps bridge the digital divide, but also ideally offers myriad financial and non-financial products and services that can help companies increase their economic empowerment [

47].

Among the most vulnerable to the negative economic consequences of the pandemic in the business segment were SMEs (especially those in developing countries). As a result of the pandemic, many entrepreneurs lost opportunities to earn money and also faced restrictions in obtaining additional financing. In the short term, financial assistance and food provisions by governments or NGOs was a form of support for small businesses. In the long term, the tool for increasing the resilience of SMEs is promoting their financial inclusion through digital payment products, savings, credit, and insurance [

48].

Digital-inclusive finance can also effectively alleviate the financing constraints of SMEs; however, digital finance is not a solution to all problems and cannot replace the need to create a favorable business environment in a country [

49]. Studies showed that as a result of the pandemic, the need to obtain additional funding for businesses and the demand for alternative financing—in particular through crowdfunding platforms—have increased significantly. However, the COVID-19 pandemic also caused a decrease in participation in crowdfunding and reduced its effectiveness for businesses [

50].

Along with the considered directions of the impact of the pandemic on changes in digital financial inclusion, it is possible to follow the feedback; namely, the positive impact of the achieved level of digital financial inclusion on the resilience of households and entrepreneurs. For example, the research in [

51] empirically confirmed that digital financial inclusion ensured the protection of agriculture supply chains in China during the pandemic through the mechanisms of financial widening, financial deepening, and financial service digitization. Instead, those who were not financially included faced additional obstacles. Chen Z. and Friedline T. [

52] provided an example showing that during the pandemic, millions of unbanked U.S. households (those without a bank account) had to wait for weeks and months for their stimulus checks to arrive.

4.3. COVID-19 Impacts on the Financial System and Regulation

The ability to implement a rapid transition to digital payments and online trading depends significantly on the functioning of a country’s financial system and regulatory components.

For the banking sector and the financial system, digitization allows the maintaining of relatively stable functioning and the preserving of economic security during a period of emergency circumstances [

53]. Digital financial inclusion encourages inclusive economic growth, reduces the default risk of banks, and keeps the financial sector sustainable even during a crisis period [

54,

55]. Research proved that even in the conditions of the COVID-19 crisis, inclusion-based deposit mobilization reduced the likelihood of bank insolvency, which suggested that inclusion provided banks with cheap sources of funding, thereby reducing moral hazards and risky behaviors [

56].

When switching to an online-platform business model, a bank can expand its range of banking products and attract more customers, thereby forming a competitive policy and gaining competitive advantages [

57]. Of course, such a transition is not instantaneous; it requires preparation, in particular to ensure information security. In addition, it takes place within the framework of the national legal field, so the policy of the central bank is very important [

5].

The COVID-19 pandemic also had a significant impact on the digitalization of the insurance industry by catalyzing the rapid adaptation of digital technologies that under normal conditions would have been implemented within several years. The main types of digital technologies developed in insurance were machine learning, predictive analytics, artificial intelligence, blockchain technology, and telematics. Due to increased digitization, insurers can now take advantage of access to data and improved analytical tools for underwriting and pricing [

58,

59].

However, traditional financial institutions are not always effective in providing the population with the necessary services in an online format. Microfinance institutions played a significant role in supporting the financial resilience of households and their financial inclusion; this was especially true in developing countries [

60,

61].

Achieving the listed positive effects of digitization during the COVID-19 pandemic was not possible without the interaction of the business segment, civil society, and government [

62]. The regulatory component of digital financial inclusion should be aimed at minimizing the risks created by digital technologies on the one hand and on stimulating innovative development, reducing digital inequality, and promoting digital financial literacy on the other hand.

COVID-19 and forced digitalization have contributed to the revision of regulatory policy regarding digital finance and increased tolerance of the use of crypto-assets [

63,

64,

65]. At the same time, the increase in the scale of work and activities performed online—including education, public administration, and others—has increased the urgency of issues related to traffic safety and data protection [

66]. In addition, the increase in the volume of online transactions and the use of digital assets required the provision of control mechanisms for the legality of the movement of funds [

67].

Thus, the pandemic contributed to the development of digital infrastructures and the formation of a more favorable policy for the activities of FinTech companies. Accelerated digitization has taken place in many countries. However, the final result depends on the share of consumers who will use a digital financial service; that is, on digital financial inclusion. Accordingly, one of the tasks of regulators is to promote digital financial inclusion by increasing trust and digital and financial literacy as well as ensuring the protection of consumer rights [

38,

68,

69]. The analysis of existing programs for increasing digital financial inclusion and the development of recommendations for their implementation while taking into account the features of post-pandemic development will be the subjects of further scientific research.