Efficiency of Low-Carbon Technologies Implementation at Non-Ferrous Metallurgy Enterprises under the Conditions of Carbon-Regulation Development in Russia

Abstract

:1. Introduction

- Loss of sales markets for traditional energy carriers—the raw material structure of the Russian economy and the dependence of budget revenues on the export of hydrocarbons make the Russian economy the most vulnerable to the consequences of global energy-transition processes;

- Loss of competitiveness in the international division of labor—almost all of Russia’s key export partners are planning to abandon hydrocarbon fuel in the near future and replace it with “green energy”;

- Technological lag. The lack of a regulatory system to incentivize the Russian industry to switch to new technologies may lead to a deep technological lag and the loss in foreign markets for Russian exports;

- Direct losses of Russian exporters from the introduction of a cross-border carbon tax. According to various estimates, from the introduction of a border carbon tax, Russian exporters of carbon-intensive goods will lose annually from 0.5 to 7.5 billion euros, which will go to the EU economy, but not to the Russian budget.

- Minimizing the costs of Russian exporters from the EU carbon tax. In accordance with Directive 2023/958/EU [14] and Regulation 2023/956/EU [15] on the carbon border adjustment mechanism, at the border, payments from the accrued amount of carbon tax will be deducted from the amount of carbon payments paid in the country of origin of the goods;

- Elimination (minimization) of subsidies to EU industry at the expense of Russian exporters (environmental payments of Russian companies should be directed to the Russian budget, not to the EU budget);

- Fulfillment of international climate agreements with minimal damage to Russian industry; stimulation of Russian industry to transition to a new technological mode and more energy-efficient technologies.

2. Literature Review

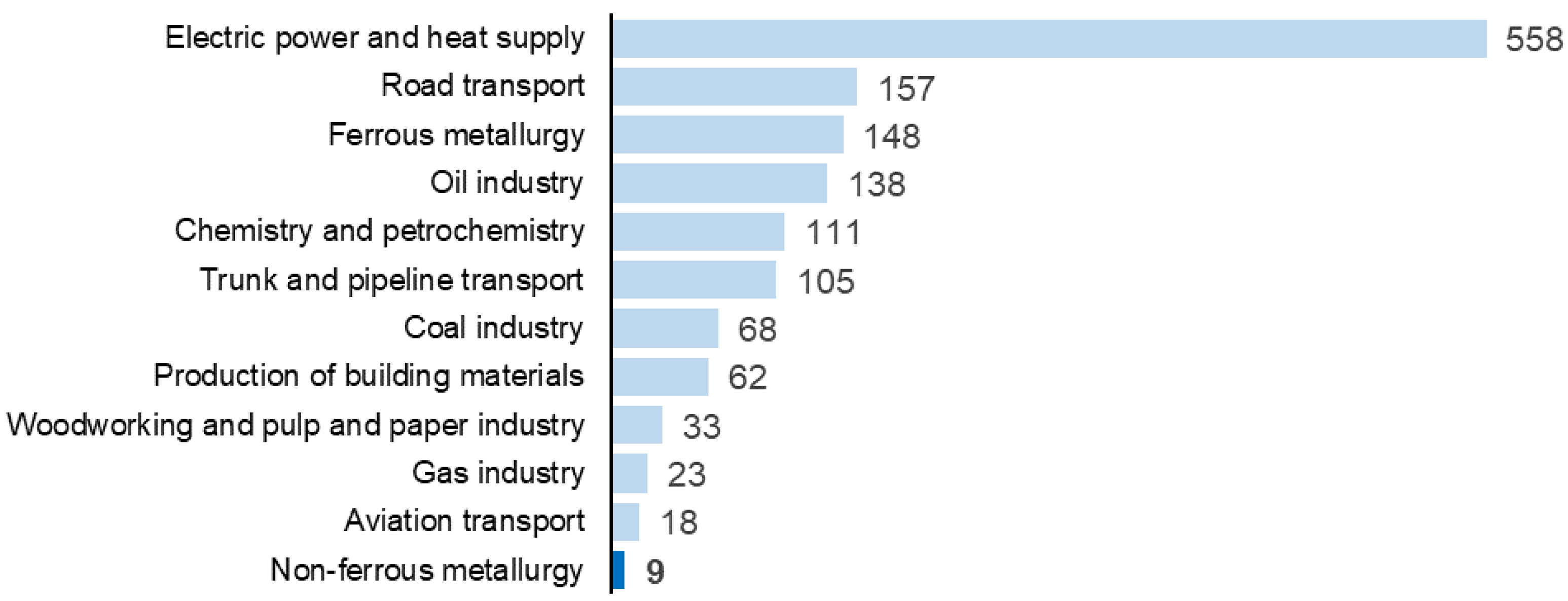

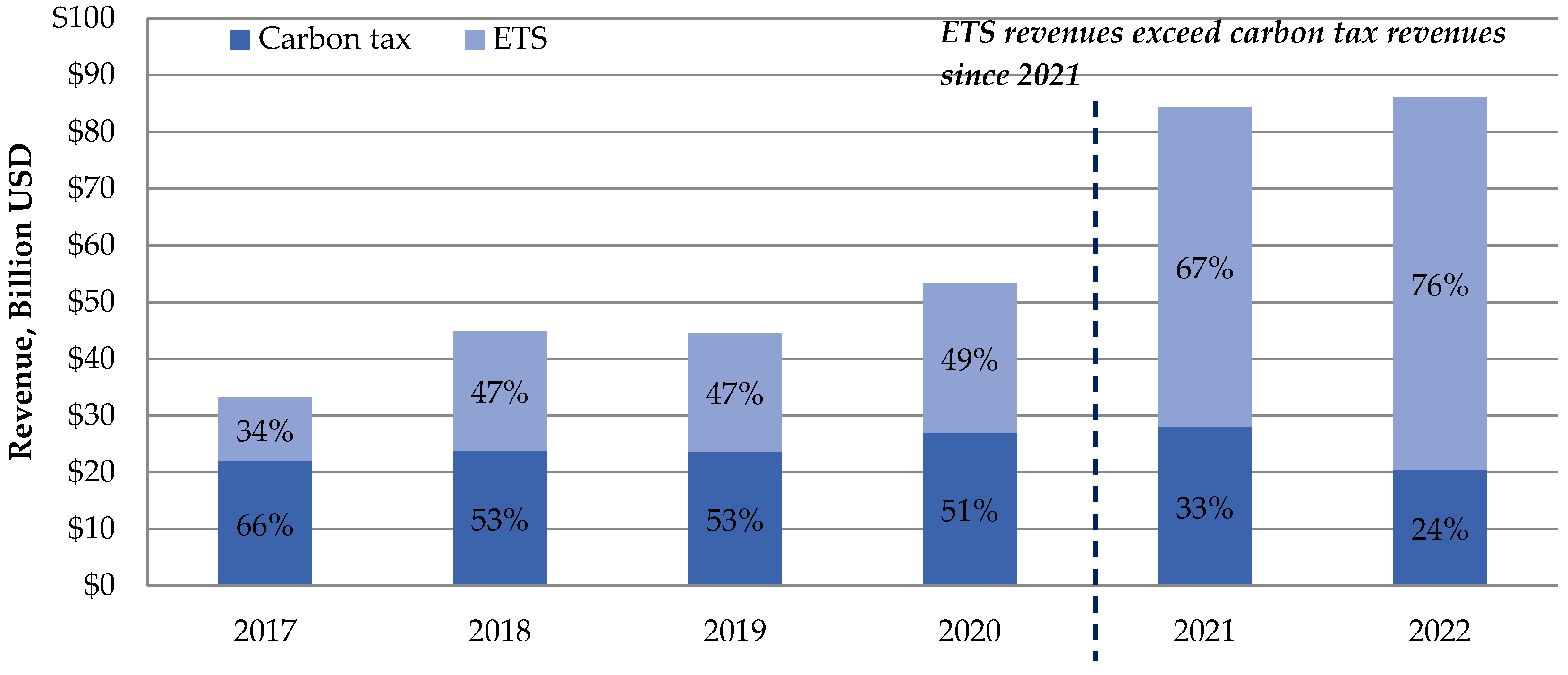

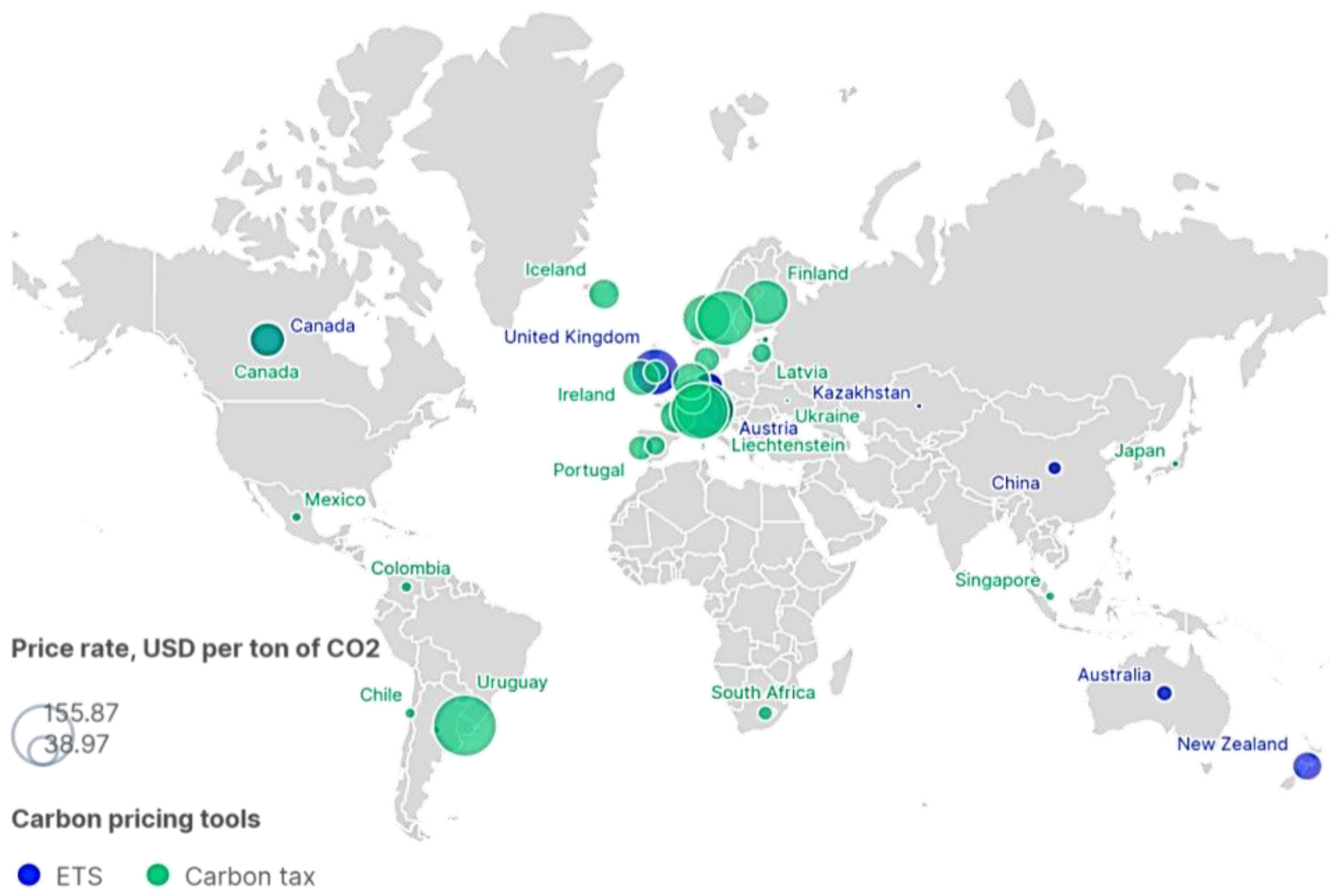

2.1. Brief Description of the Current Situation

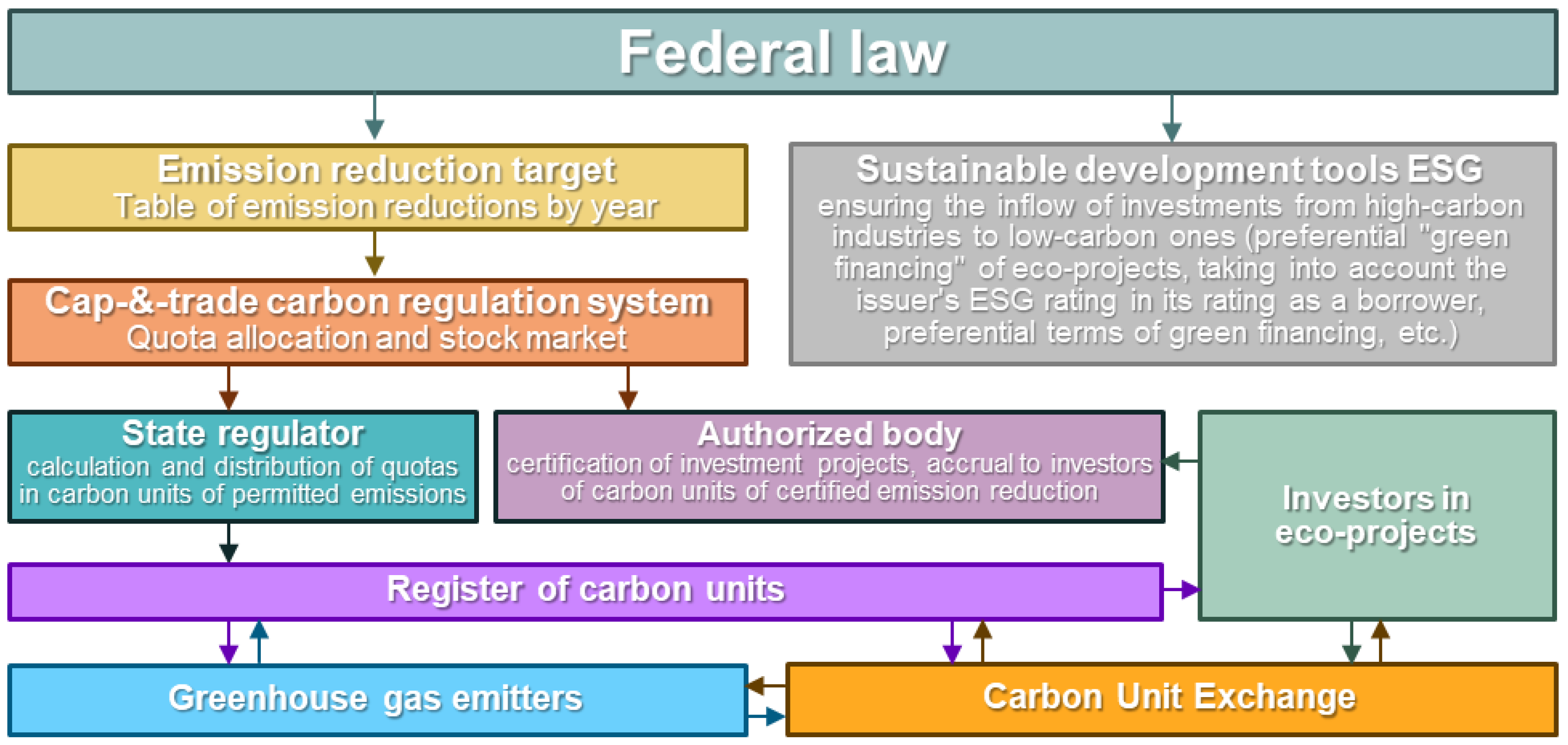

2.2. Carbon Regulation in Russia

3. Materials and Methods

- —quota for the j-th organization for the next i-th year (tons of CO2e);

- —mass of greenhouse gas emissions of the organization for the base year (tons of CO2e);

- —coefficient of specific reduction in greenhouse gas emissions in the i-th year, determined by taking into account the goal of achieving carbon neutrality by the subject of the Russian Federation (fractions of units);

- —coefficient taking into account the technological level of the j-th organization;

- coefficient taking into account the ratio of the amount of taxes and fees to the revenue of the j-th organization;

- —mass of increase in GHG emissions of the j-th organization in the i-th year, determined by taking into account the best available technologies (tons of CO2).

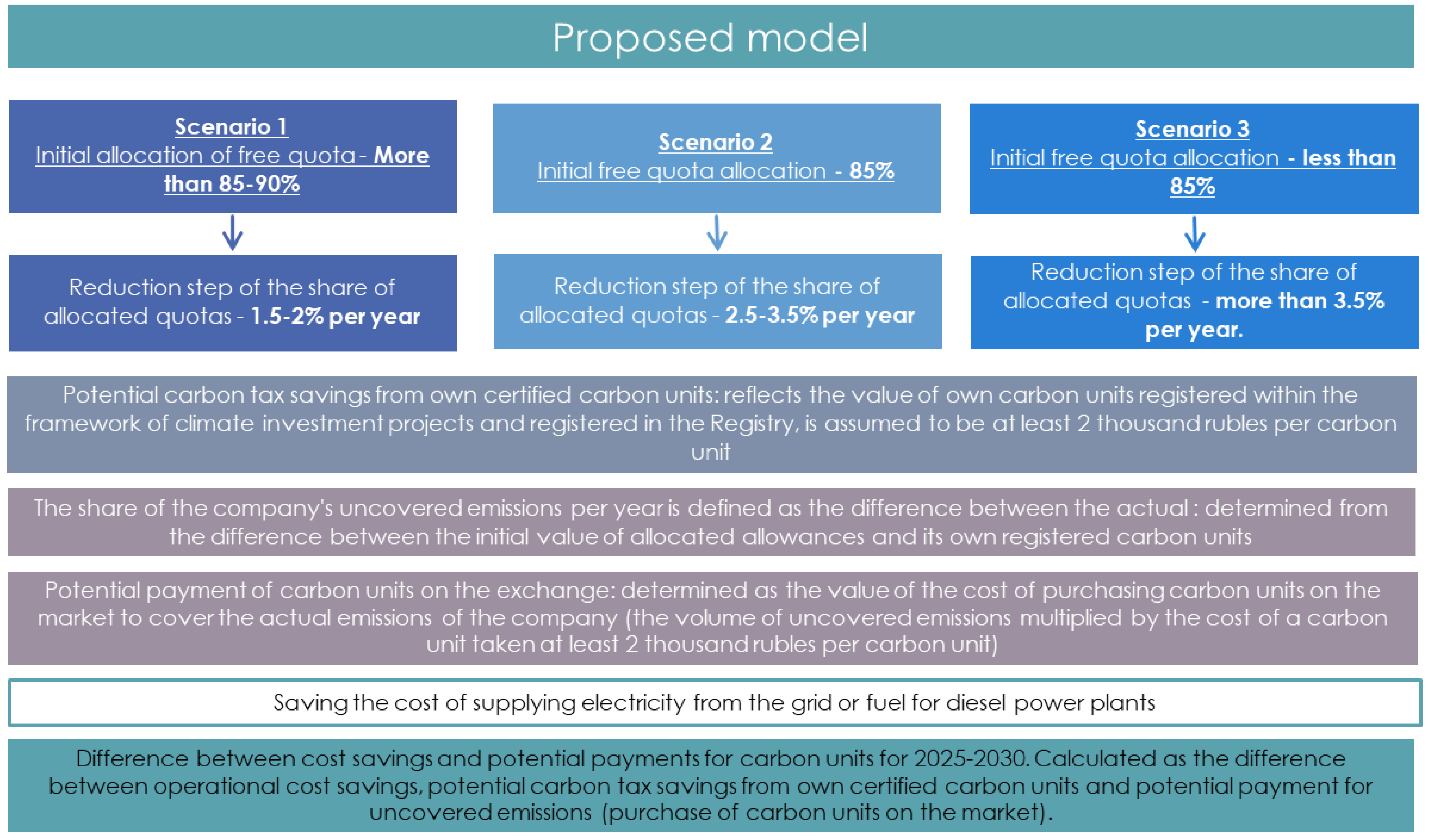

- Planned emission-reduction indicators: shows the planned annual and total emission-reduction values set according to the company’s strategy (a thousand tons of CO2 per year and total by 2030).

- Potential carbon tax savings due to own certified carbon units: shows the value of one’s own carbon units registered within the framework of climate-investment projects and registered in the Registry and is assumed to be at least 2000 rubles per carbon unit.

- Share and volume of uncovered emissions per year: is determined based on the difference between the initial value of allocated quotas and one’s own registered carbon units (the annual value of this indicator varies depending on the degree of the implementation of climate programs and the registered carbon units of the company and the initial quota).

- Potential payment of carbon units on the exchange: is defined as the value of the cost of buying carbon units on the market to cover the actual emissions of the company (the volume of uncovered emissions multiplied by the cost of carbon units taken at at least 2000 rubles per carbon unit).

- Cost savings for electricity supply from the grid or fuel for diesel power plants: takes into account savings in operating costs due to the introduction of new equipment (e.g., savings in diesel fuel when replacing with generation from renewable energy sources, etc.).

- Difference between cost savings and potential carbon unit payments for 2025–2030. Calculated as the difference between operating cost savings, potential carbon tax savings from own certified carbon units and potential payment for uncovered emissions (purchases of carbon units on the market).

- Critical indicator of the share of free allowances at the beginning of the calculation. An indicator showing the critical value of allocated allowances for the company at which the company, in the case of the calculation scenario, is able to cover potential payments for emissions (i.e., at the identified value of this indicator, the difference between cost savings and potential payments will be equal to 0).

- Necessary reduction indicator for the leveling of potential costs. Indicators of the necessary value of emissions reduction for the company, at which the company, through the implementation of its own climate programs, will avoid additional financial burden, in the case of the adoption of carbon regulation under the assumed scenarios.

4. Results

4.1. Example of Calculation of a RES-Only Model

4.2. Example of Model Calculation for a Set of Company Measures

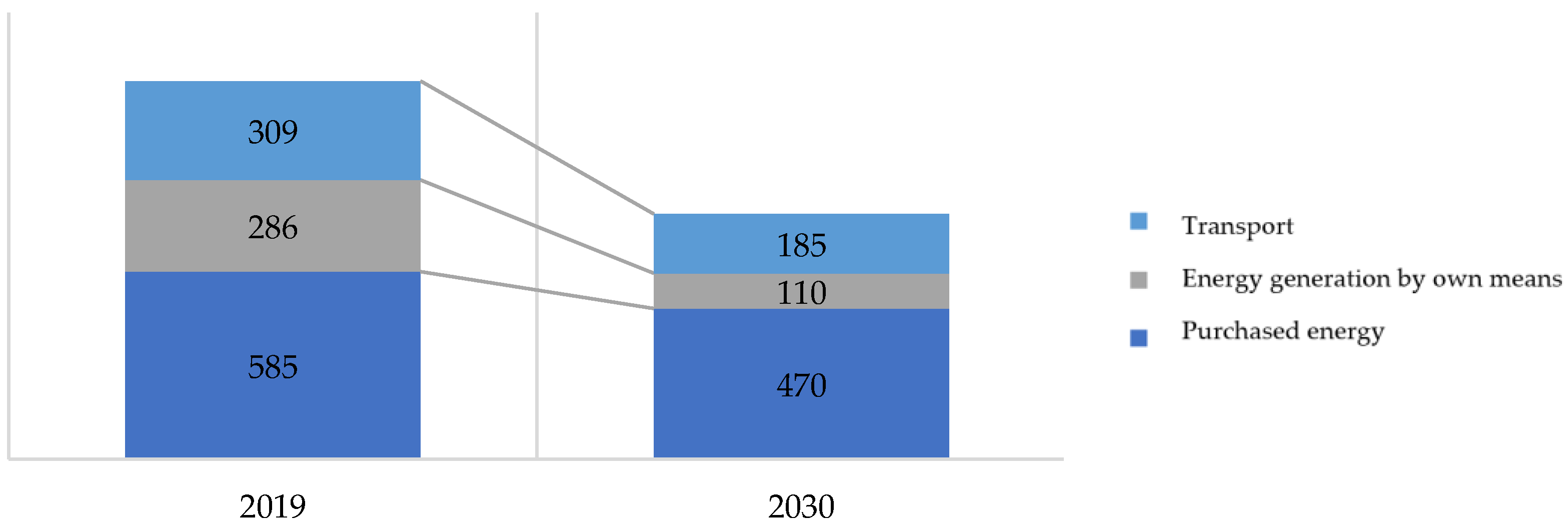

- Transition to low-carbon technologies and connection to grid electricity;

- Building our own solar and wind farms at our facilities (where possible) and ensuring efficient electricity generation;

- Switching to grid-electricity sources with the smallest carbon footprint;

- Electrification of the mining-equipment fleet;

- Improving the energy efficiency of technological processes.

5. Discussion

- Risks associated with national and international carbon regulation—reducing risks by reducing carbon footprints;

- Risks associated with the increasing cost of carbon-intensive resources—reducing risks by reducing the consumption of carbon-intensive fuels;

- Risks associated with the requirements to use renewable energy sources—risk reduction through the introduction of one’s own renewable energy sources;

- Physical risks associated with supply disruptions at remote production facilities—risk mitigation by reducing dependence on logistics and fuel supplies;

- Risks related to obligations to apply the best available technologies and stricter construction standards—risk mitigation through the introduction of advanced energy-efficient technologies;

- Risks associated with the increasing cost of carbon-intensive resources—reducing risks by reducing the consumption of carbon-intensive fuels.

6. Conclusions

- Develop, coordinate with market participants and approve target values for reducing greenhouse gas emissions by emitters in the region by year until the subject of the Federation reaches the level of carbon neutrality (the equality of emissions and carbon absorption).

- Develop and approve methods of assessment, accounting for the results of the implementation and certification of climate projects and the procedure for the accrual of carbon units of certified emission reductions.

- Develop, coordinate and approve with market participants the methodology for the calculation and allocation of quotas for greenhouse gas emissions in accordance with the approved target values, including the procedure for the correction of allocated quotas.

- Approve the authorized body responsible for the calculation of emission volumes, absorption volumes, certification of climate projects, calculation of carbon units of certified emissions and allocation of quotas.

- Form a working group responsible for the creation, organization and submission of reporting on greenhouse gas emissions, containing information on the mass of greenhouse gas emissions generated as a result of the company’s economic and other activities during the reporting period;

- Allocate a working group for the company’s participation in coordinating with market participants and approving target values for the reduction in greenhouse gas emissions by issuers with representatives of the state authorities (authorized body—market regulator);

- Develop and agree on the action plan and development strategy for the company’s climate programs in order to minimize the risks associated with the introduction of international and national programs to regulate carbon emissions by reducing the company’s carbon footprint;

- Allocate and include an investment program in the company’s strategy aimed at reducing risks by reducing the consumption of carbon-intensive fuels through the use of the best available technologies and advanced energy-efficient technologies.

Author Contributions

Funding

Institutional Review Board Statement

Informed Consent Statement

Data Availability Statement

Conflicts of Interest

References

- Skobelev, D.O.; Cherepovitsyna, A.A.; Guseva, T.V. Carbon capture and storage: Net zero contribution and cost estimation approaches. J. Min. Inst. 2023, 259, 125–140. [Google Scholar] [CrossRef]

- Boyce, J.K. Carbon Pricing: Effectiveness and Equity. Ecol. Econ. 2018, 150, 52–61. [Google Scholar] [CrossRef]

- Tost, M.; Hitch, M.; Lutter, S.; Feiel, S.; Moser, P. Carbon Prices for Meeting the Paris Agreement and Their Impact on Key Metals. Extr. Ind. Soc. 2020, 7, 593–599. [Google Scholar] [CrossRef]

- Tvinnereim, E.; Mehling, M. Carbon Pricing and Deep Decarbonisation. Energy Policy 2018, 121, 185–189. [Google Scholar] [CrossRef]

- Zhang, W.; Li, J.; Li, G.; Guo, S. Emission Reduction Effect and Carbon Market Efficiency of Carbon Emissions Trading Policy in China. Energy 2020, 196, 117117. [Google Scholar] [CrossRef]

- Martin, R.; de Preux, L.B.; Wagner, U.J. The Impact of a Carbon Tax on Manufacturing: Evidence from Microdata. J. Public Econ. 2014, 117, 1–14. [Google Scholar] [CrossRef]

- Xie, J.; Dai, H.; Xie, Y.; Hong, L. Effect of Carbon Tax on the Industrial Competitiveness of Chongqing, China. Energy Sustain. Dev. 2018, 47, 114–123. [Google Scholar] [CrossRef]

- Zakeri, A.; Dehghanian, F.; Fahimnia, B.; Sarkis, J. Carbon Pricing versus Emissions Trading: A Supply Chain Planning Perspective. Int. J. Prod. Econ. 2015, 164, 197–205. [Google Scholar] [CrossRef]

- Aghion, P.; Dechezleprêtre, A.; Hémous, D.; Martin, R.; Van Reenen, J. Carbon Taxes, Path Dependency, and Directed Technical Change: Evidence from the Auto Industry. J. Political Econ. 2016, 124, 1–51. [Google Scholar] [CrossRef]

- Pietzcker, R.C.; Osorio, S.; Rodrigues, R. Tightening EU ETS Targets in Line with the European Green Deal: Impacts on the Decarbonization of the EU Power Sector. Appl. Energy 2021, 293, 116914. [Google Scholar] [CrossRef]

- Stroykov, G.A.; Cherepovitsyn, A.E.; Romasheva, N.A. Current state and prospects for the development of carbon regulation in Russia. Econ. Entrep. 2022, 10, 295–303. [Google Scholar] [CrossRef]

- Carbon Regulation and Carbon Market Concept in Russia: Global Experience, Participants, Road Map. Available online: https://kt.tatarstan.ru/rus/file/pub/pub_3191213_enc_167420.pdf (accessed on 30 May 2023).

- Cherepovitsyn, A.; Solovyova, V.; Dmitrieva, D. New challenges for the sustainable development of the rare-earth metals sector in Russia: Transforming industrial policies. Resour. Policy 2023, 81, 103347. [Google Scholar] [CrossRef]

- Directive 2023/958. Available online: https://www.eumonitor.eu/9353000/1/j9vvik7m1c3gyxp/vm3485iwsuzv (accessed on 30 May 2023).

- Regulation 2023/956—Carbon Border Adjustment Mechanism. Available online: https://www.eumonitor.eu/9353000/1/j9vvik7m1c3gyxp/vm3485iwsmzu (accessed on 15 November 2023).

- Dmitrieva, D.M.; Skobelev, D.O. Decarbonization of the oil and gas sector in the context of sustainable development: Key directions and possible scenarios for the Arctic region. North Mark. Form. Econ. Order 2023, 2, 7–23. [Google Scholar] [CrossRef]

- Blinova, E.; Ponomarenko, T.; Knysh, V. Analyzing the Concept of Corporate Sustainability in the Context of Sustainable Business Development in the Mining Sector with Elements of Circular Economy. Sustainability 2022, 14, 8163. [Google Scholar] [CrossRef]

- Ilyinsky, A.A.; Kalinina, O.V.; Khasanov, M.M.; Afanasiev, M.V.; Saitova, A.A. Decarbonization of the oil and gas complex: Priorities and organizational models of development. North Mark. Form. Econ. Order 2022, 1, 33–46. [Google Scholar] [CrossRef]

- Kuznetsova, E.A.; Cherepovitsyna, A.A. Carbon dioxide utilization and circular economy: The world, Russia and the Arctic. North Mark. Form. Econ. Order 2021, 4, 42–55. [Google Scholar] [CrossRef]

- Ulanov, V.L.; Skorobogatko, O.N. Impact of EU carbon border adjustment mechanism on the economic efficiency of Russian oil refining. J. Min. Inst. 2022, 257, 865–876. [Google Scholar] [CrossRef]

- Ilyushin, Y.V. Development of a Process Control System for the Production of High-Paraffin Oil. Energies 2022, 15, 6462. [Google Scholar] [CrossRef]

- Yu, Y.; Shi, J. Environmental regulation, low-carbon technology progress and energy efficiency. Front. Environ. Sci. 2022, 10, 1012229. [Google Scholar] [CrossRef]

- Ilyushin, Y.V.; Kapostey, E.I. Developing a Comprehensive Mathematical Model for Aluminium Production in a Soderberg Electrolyser. Energies 2023, 16, 6313. [Google Scholar] [CrossRef]

- Semenova, T.; Al-Dirawi, A.; Al-Saadi, T. Environmental Challenges for Fragile Economies: Adaptation Opportunities on the Examples of the Arctic and Iraq. Agronomy 2022, 12, 2021. [Google Scholar] [CrossRef]

- Pshenin, V.V.; Zakirova, G.S. Improving the efficiency of oil vapor recovery units in the commodity transport operations at oil terminals. J. Min. Inst. 2023. [Google Scholar] [CrossRef]

- Semenov, A.S.; Kruk, M.N. Project risk analysis and management decision-making in determining the parameters of ore quarries. J. Ind. Pollut. Control 2017, 33, 1024–1028. [Google Scholar]

- Kazanin, O.I.; Sidorenko, A.A.; Meshkov, A.A.; Sidorenko, S.A. Reproduction of the longwall panels: Modern requirements for the technology and organization of the development operations at coal mines. Eurasian Min. 2020, 2, 19–23. [Google Scholar] [CrossRef]

- Romasheva, N.V.; Babenko, M.A.; Nikolaichuk, L.A. Sustainable development of the Russian Arctic region: Environmental problems and ways to solve them. Min. Inf. Anal. Bull. 2022, 2022, 78–87. [Google Scholar] [CrossRef]

- Marinina, O.; Kirsanova, N.; Nevskaya, M. Circular Economy Models in Industry: Developing a Conceptual Framework. Energies 2022, 15, 9376. [Google Scholar] [CrossRef]

- Li, L.; Wang, Y.; Tan, M.; Sun, H.; Zhu, B. Effect of Environmental Regulation on Energy-Intensive Enterprises’ Green Innovation Performance. Sustainability 2023, 15, 10108. [Google Scholar] [CrossRef]

- Tao, Y.; Destek, M.A.; Pata, U.K.; Khan, Z. Environmental Regulations and Carbon Emissions: The Role of Renewable Energy Research and Development Expenditures. Sustainability 2023, 15, 13345. [Google Scholar] [CrossRef]

- Liu, L.; Li, M.; Gong, X.; Jiang, P.; Jin, R.; Zhang, Y. Influence Mechanism of Different Environmental Regulations on Carbon Emission Efficiency. Int. J. Environ. Res. Public Health 2022, 19, 13385. [Google Scholar] [CrossRef]

- Zheng, L.; Omori, A.; Cao, J.; Guo, X. Environmental Regulation and Corporate Environmental Performance: Evidence from Chinese Carbon Emission Trading Pilot. Sustainability 2023, 15, 8518. [Google Scholar] [CrossRef]

- Litvinenko, V.S.; Petrov, E.I.; Vasilevskaya, D.V.; Yakovenko, A.V.; Naumov, I.A.; Ratnikov, M.A. Assessment of the role of the state in the management of mineral resources. J. Min. Inst. 2023, 259, 95–111. [Google Scholar] [CrossRef]

- Solovyova, V.; Ilinova, A. Complex use of mineral raw materials: Formation of organizational and economic mechanism. E3S Web Conf. 2021, 266, 06012. [Google Scholar] [CrossRef]

- Carbon Pricing Dashboard. The World Bank. Available online: https://carbonpricingdashboard.worldbank.org (accessed on 28 May 2023).

- ICAP Allowance Price Explorer. Available online: https://icapcarbonaction.com/en/ets-prices (accessed on 28 May 2023).

- The World Bank. State and Trends of Carbon Pricing 2022; World Bank: Washington, DC, USA, 2022; Available online: https://openknowledge.worldbank.org/entities/publication/a1abead2-de91-5992-bb7a-73d8aaaf767f (accessed on 29 August 2023).

- World Bank. State and Trends of Carbon Pricing 2021; World Bank: Washington, DC, USA, 2021; Available online: https://openknowledge.worldbank.org/handle/10986/35620 (accessed on 25 September 2023).

- Scimago Graphica. Available online: https://graphica.app/ (accessed on 28 August 2023).

- Emissions Trading Worldwide. Status Report 2022. ICAP. Available online: https://icapcarbonaction.com/system/files/document/220408_icap_report_rz_web.pdf (accessed on 21 June 2023).

- Rasporyazhenie Pravitel’stva RF Ot 29.10.2021 № 3052-r. Available online: http://static.government.ru/media/files/ADKkCzp3fWO32e2yA0BhtIpyzWfHaiUa.pdf (accessed on 24 June 2023).

- Romasheva, N.; Dmitrieva, D. Energy Resources Exploitation in the Russian Arctic: Challenges and Prospects for the Sustainable Development of the Ecosystem. Energies 2021, 14, 8300. [Google Scholar] [CrossRef]

- Federal Law No. 296-FZ Dated July 2, 2021. On Limiting Greenhouse Gas Emissions. Available online: http://publication.pravo.gov.ru/Document/View/0001202107020031 (accessed on 30 July 2023).

- Order of the Government of the Russian Federation Dated October 22, 2021 No. 2979-r. Available online: http://publication.pravo.gov.ru/Document/View/0001202110260021 (accessed on 30 July 2023).

- Project on Amendments to the Federal Law. On Limiting Greenhouse Gas Emissions. Available online: https://regulation.gov.ru/projects#npa=120026 (accessed on 1 August 2023).

- Decree of the Government of the Russian Federation Dated March 14, 2022 No. 355. On the Criteria for Classifying Legal Entities and Individual Entrepreneurs as Regulated Organizations. Available online: http://publication.pravo.gov.ru/Document/View/0001202203150019 (accessed on 15 September 2023).

- Order of the Ministry of Economic Development of Russia Dated May 11, 2022 N 248. On Approval of the Criteria and Procedure for Classifying Projects Implemented by Legal Entities, Individual Entrepreneurs or Individuals as Climate Projects, the Form and Procedure for Submitting a Report on the Implementation of a Climate Project. Available online: http://www.consultant.ru/document/cons_doc_LAW_418257/81190896e9feeffbdbff3b233505fe7903d303e5 (accessed on 3 August 2023).

- Draft on Approval of the Procedure for Determining Fees for the Provision by the Operator of Services for Conducting Operations in the Register of Carbon Units. Available online: https://regulation.gov.ru/projects#npa=121676 (accessed on 5 August 2023).

- The Ministry of Economic Development Has Set Targets for Reducing Greenhouse Emissions by 2030. Available online: https://www.interfax.ru/russia/855520 (accessed on 8 August 2023).

- Federal Law. On Conducting an Axperiment to Limit Greenhouse Gas Emissions in Certain Constituent Entities of the Russian Federation. Dated 03/06/2022 N 34-FZ. Available online: http://www.consultant.ru/document/cons_doc_LAW_411051 (accessed on 16 September 2023).

- Order of the Ministry of Economic Development of the Russian Federation N 452 dated 24 August 2022. On Approval of the Methodology for Determining Projected Quotas of Greenhouse Gas Emissions within the Framework of an Experiment to Limit Greenhouse Gas Emissions in Certain Constituent Entities of the Russian Federation. Available online: https://base.garant.ru/405220553 (accessed on 19 August 2023).

- Golysheva, A.V.; Okorochkova, A.A.; Semencov, S.P. Energy Transition: Sakhalin Experiment. Available online: http://inveb-docs.ru/attachments/article/901/бюллетень_Сахалинск~.pdf (accessed on 19 August 2023).

- The Fee for Exceeding CO2 Emissions Quotas in 2024 May Amount to 1 Thousand Rubles per Ton. Available online: https://peretok.ru/news/worldenergy/24532 (accessed on 22 September 2023).

- Decree of the Government of the Russian Federation of March 30, 2022 No. 518. On the Procedure for Determining Fees for the Provision by the Operator of Services for Conducting Operations in the Register of Carbon Units. Available online: http://government.ru/docs/all/140153 (accessed on 12 September 2023).

- Polymetal International PLC. Available online: https://www.polymetalinternational.com/en (accessed on 5 August 2023).

- Polymetal International PLC. Integrated Annual Report & Accounts 2022. Available online: https://www.polymetalinternational.com/upload/ib/5/23-05-24/Polymetal_integrated-report-2022-eng.pdf (accessed on 5 August 2023).

- Norilsk Nickel Climate Change Strategy. Available online: https://nornickel.ru/sustainability/climate-change/strategy (accessed on 15 November 2023).

- Nord Gold. PLC Sustainability Report 2020. Available online: https://nordgold.com/upload/iblock/568/ALL_NRDGLD_2020_RU_compressed.pdf (accessed on 15 November 2023).

- RUSAL Has Approved the Company’s Climate Targets for 2032 and 2050. Available online: https://rusal.ru/press-center/press-releases/rusal-utverdil-klimaticheskie-tseli-kompanii-na-2032-i-2050-gody (accessed on 15 November 2023).

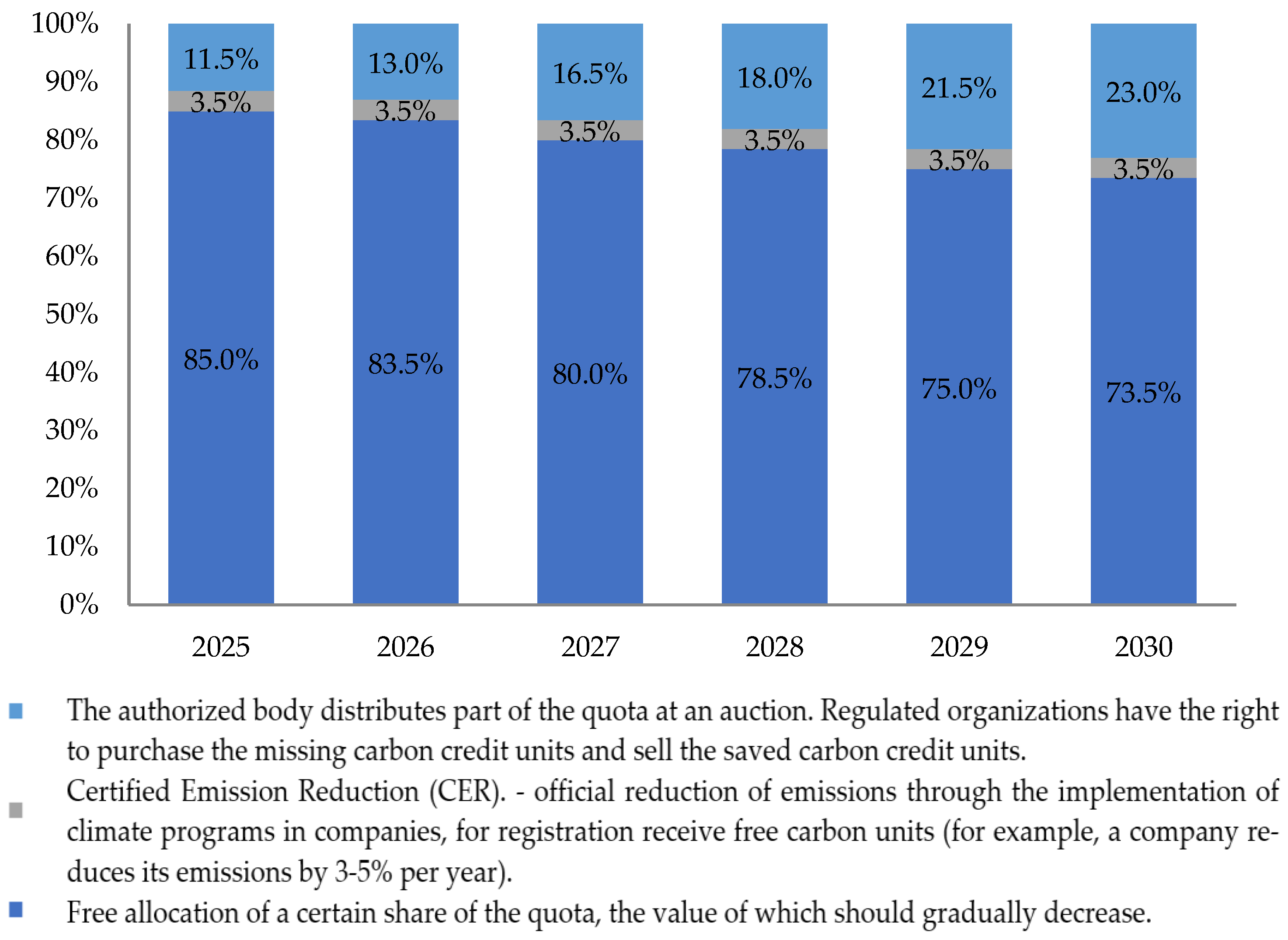

| Scenario 1 | Scenario 2 | Scenario 3 | |

|---|---|---|---|

| Initial allocation of free quotas | More than 85–90% | 85% | Less than 85% |

| Step of reducing the share of allocated quotas | 1.5–2% per year | 2.5–3.5% per year | More than 3.5% per year |

| Example for RES (calculation for 2025–2030), 10% emission reduction from RES | |||

| Emission-reduction targets | About 11,984 tons per year (about 1.1% per year) Up to 1078 thousand tons of CO2 (10% from 2019 level of about 100 thousand tons of CO2) | ||

| Investment | Total investment volume of USD 40 mln. By 2025, it is planned to build RES-based plants at six facilities, including Omolon, Varvarinskoye, Kyzyl, Svetloye (second stage), Prognoz and Kutyn, with a total capacity of more than 30 MW The program for further development of power generation from renewable sources, which runs until 2030, includes the construction of five new RES-based power plants with a total capacity of more than 45 MW | ||

| Potential carbon tax savings from own certified carbon units | From USD 0.1 to 0.37 million. USD 1.937 million (over the period 2025–2030) | ||

| Percentage and volume of emissions not covered per year | From 14 to 21.5% From 170 to 242 thousand tons of CO2 | From 14 to 31.5% From 170 to 350 thousand tons of CO2 | From 14 to 36.5% From 227 to 404 thousand tons of CO2 |

| Potential payment of carbon units on the exchange, mln. dollars USD | From 5.2 to 7.5 per year Up to 38.2 (for the period 2025–2030) | From 5.2 to 10.7 per year Up to 48.3 (for the period 2025–2030) | 7 to 12.5 per year Up to 58.5 (over the period 2025–2030) |

| Saving the cost of supplying electricity from the grid or fuel for diesel power plants | From 5.3 to 6 million dollars. USD 5.3 to 6 million per year Up to 28.1 (for the period 2025–2030) | ||

| The difference in cost savings and potential payments for carbon units over 2025–2030. | USD −8.15 million | −USD 18.25 million | −USD 28.49 million |

| Critical indicator of free quota shares at the beginning of calculation | Not less than 89% | Not less than 93.9% | Not less than 97.6% |

| Emission indicator for 2030, t CO2e | 1,078,581 | 1,065,000 | 1,055,000 | 1,045,000 | 1,035,000 |

| Percentage of reduction from 2019 baseline due to RES | −10.0% | −11.1% | −12.0% | −12.8% | −13.6% |

| Total volume of reduction from 2019 baseline, t CO2e | −119,842 | −133,423 | −143,423 | −153,423 | −163,423 |

| Initial share of allocated quotas, % | Difference in cost savings and potential payments for carbon units over 2025–2030, million USD | ||||

| 90% | 991.2 | −5584.1 | −10,425.7 | −15,267.2 | −20,108.8 |

| 89% | 3037.7 | −3541.8 | −8386.4 | −13,231.0 | −18,075.7 |

| 88% | 5084.3 | −1499.4 | −6347.1 | −11,194.8 | −16,042.5 |

| 87% | 7130.8 | 543.0 | −4307.8 | −9158.6 | −14,009.4 |

| 86% | 9177.3 | 2585.3 | −2268.5 | −7122.4 | −11,976.3 |

| 85% | 11,223.9 | 4627.7 | −229.3 | −5086.2 | −9943.1 |

| 84% | 13,270.4 | 6670.0 | 1810.0 | −3050.0 | −7910.0 |

| 83% | 15,316.9 | 8712.4 | 3849.3 | −1013.8 | −5876.9 |

| 82% | 17,363.5 | 10,754.7 | 5888.6 | 1022.4 | −3843.8 |

| 81% | 19,410.0 | 12,797.1 | 7927.9 | 3058.6 | −1810.6 |

| 80% | 21,456.6 | 14,839.5 | 9967.1 | 5094.8 | 222.5 |

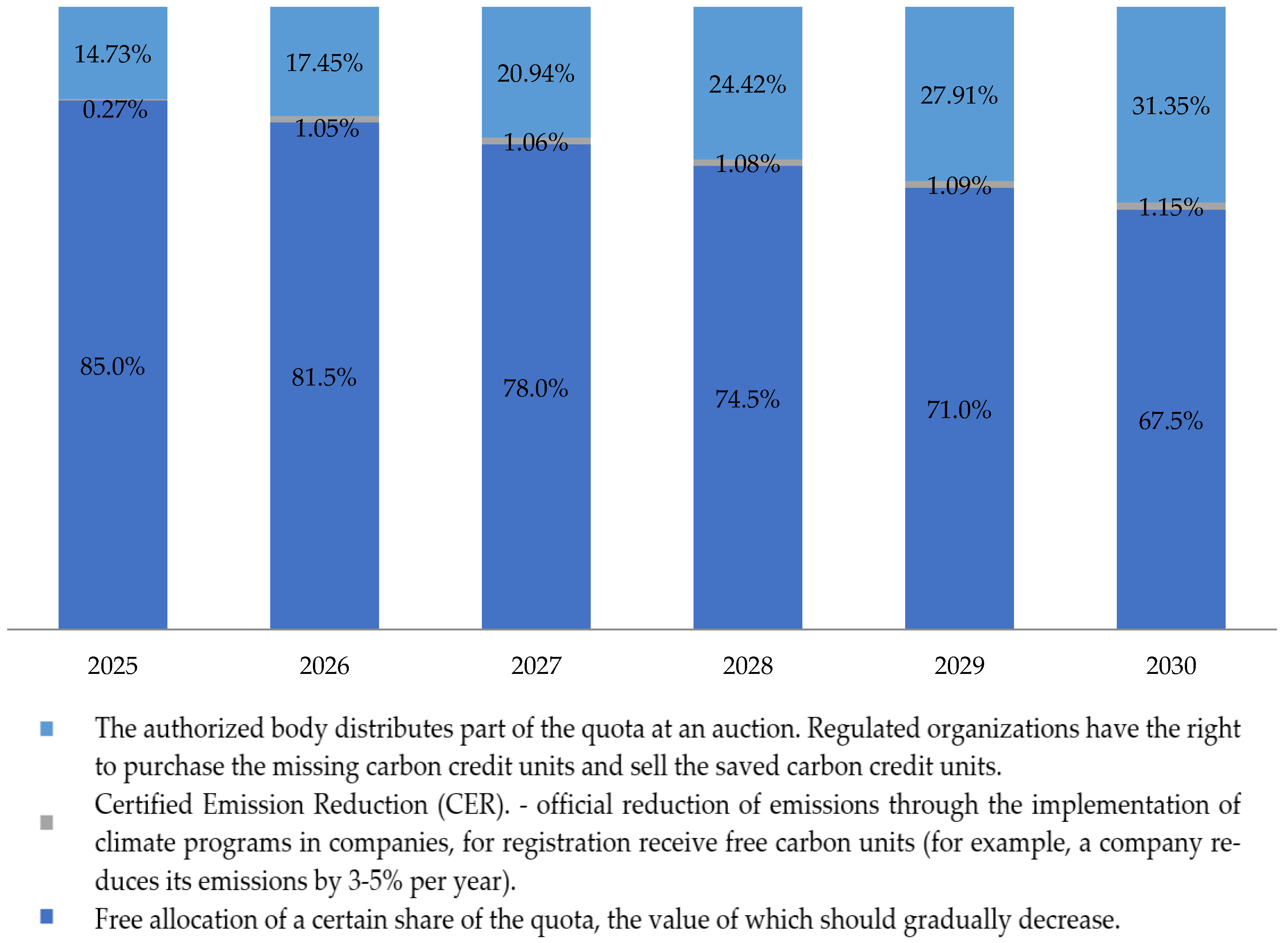

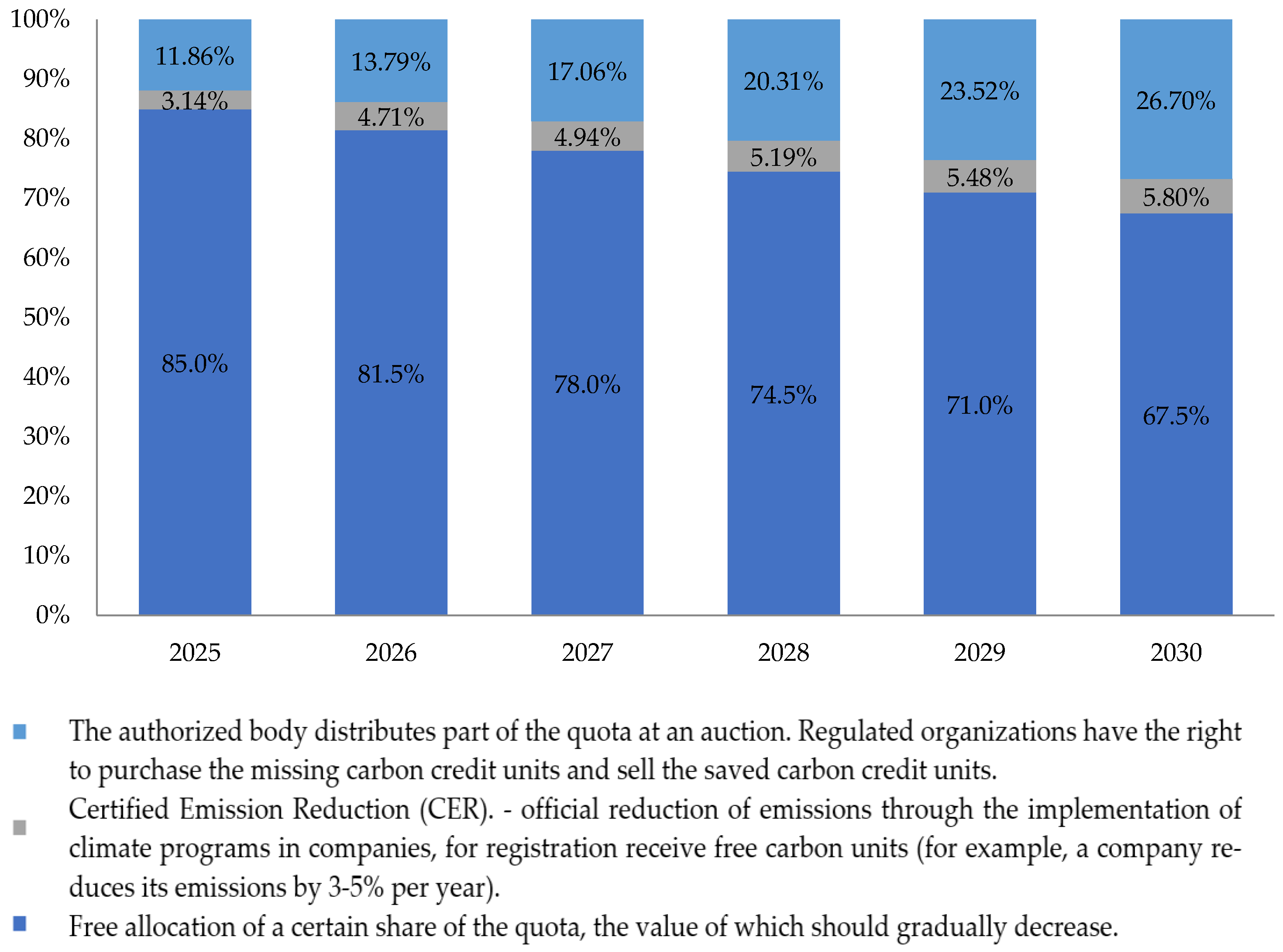

| Scenario 1 | Scenario 2 | Scenario 3 | |

|---|---|---|---|

| Initial allocation of free quotas | More than 85–90% | 85% | Less than 85% |

| Step of reducing the share of allocated quotas | 1.5–2% per year | 2.5–3.5% per year | more than 3.5% per year |

| Example for the company’s set of measures (calculation for 2025-2030), 35% reduction in emissions. | |||

| Emission-reduction targets | About 47,937 tons per year (about 3.8–5% per year) Up to 765,000 tons of CO2 (up 35% from 2019 levels of about 415,000 tons of CO2) | ||

| Investment | Key environmental initiatives are aimed at reducing carbon footprint and improving energy efficiency by connecting to grid electricity, electrifying the equipment fleet and utilizing renewable energy sources at remote facilities The baseline scenario assumes utilization of USD 400 million raised in 2021 under loan agreements. The baseline scenario assumes utilization of USD 400 million raised under loan agreements in 2021 Additional capital expenditures in the amount of USD 450 million are possible. Additional capital expenditures of USD 450 million are possible, as well as off-balance-sheet capital expenditures of up to USD 250 million. The total capital expenditures are estimated to be USD 400 million The total estimate of capital expenditures on climate change adaptation measures for 2021–2030 may amount to USD 1.1 billion | ||

| Potential carbon tax savings from own certified carbon units | From USD 1.1 million to USD 1.47 million per year USD 8.39 million (over the period 2025–2030) | ||

| Percentage and volume of emissions not covered per year | From 11.8 to 16.7% 151 to 173 thousand tons of CO2 | From 11.8 to 26.7% 151 to 251 thousand tons of CO2 | From 16.6 to 39.2% From 202 to 349 thousand tons of CO2 |

| Potential payment of carbon units on the exchange, mln. dollars USD | From 4.6 to 5.4 per year Up to 30.4 (for the period 2025–2030) | From 4.6 to 7.7 per year Up to 38.2 (for the period 2025–2030) | 6 to 10.7 per year Up to 52.3 (over the period 2025–2030) |

| Saving the cost of supplying electricity from the grid or fuel for diesel power plants | From USD 8.6 million to USD 12.5 million per year Up to 59.3 (for the period 2025–2030) | ||

| The difference in cost savings and potential payments for carbon units over 2025–2030. | USD 36.85 million | USD 29.02 million | USD 14.89 million |

| Critical indicator of free quota shares at the beginning of calculation | Not less than 62.8% | Not less than 67.5% | Not less than 76% |

| Required reduction rate to levelize potential costs by 2030 | Up to 930 thousand tons of CO2 (by 22.9% of the 2019 level) | Up to 895 thousand tons of CO2 (by 25.3% of the 2019 level) | Up to 840 thousand tons of CO2 (by 29.4% of the 2019 level) |

Disclaimer/Publisher’s Note: The statements, opinions and data contained in all publications are solely those of the individual author(s) and contributor(s) and not of MDPI and/or the editor(s). MDPI and/or the editor(s) disclaim responsibility for any injury to people or property resulting from any ideas, methods, instructions or products referred to in the content. |

© 2023 by the authors. Licensee MDPI, Basel, Switzerland. This article is an open access article distributed under the terms and conditions of the Creative Commons Attribution (CC BY) license (https://creativecommons.org/licenses/by/4.0/).

Share and Cite

Cherepovitsyn, A.; Stroykov, G.; Nevolin, A. Efficiency of Low-Carbon Technologies Implementation at Non-Ferrous Metallurgy Enterprises under the Conditions of Carbon-Regulation Development in Russia. Sustainability 2023, 15, 16640. https://doi.org/10.3390/su152416640

Cherepovitsyn A, Stroykov G, Nevolin A. Efficiency of Low-Carbon Technologies Implementation at Non-Ferrous Metallurgy Enterprises under the Conditions of Carbon-Regulation Development in Russia. Sustainability. 2023; 15(24):16640. https://doi.org/10.3390/su152416640

Chicago/Turabian StyleCherepovitsyn, Alexey, Gennady Stroykov, and Alexander Nevolin. 2023. "Efficiency of Low-Carbon Technologies Implementation at Non-Ferrous Metallurgy Enterprises under the Conditions of Carbon-Regulation Development in Russia" Sustainability 15, no. 24: 16640. https://doi.org/10.3390/su152416640

APA StyleCherepovitsyn, A., Stroykov, G., & Nevolin, A. (2023). Efficiency of Low-Carbon Technologies Implementation at Non-Ferrous Metallurgy Enterprises under the Conditions of Carbon-Regulation Development in Russia. Sustainability, 15(24), 16640. https://doi.org/10.3390/su152416640