1. Introduction

The rapid development of digital transformation technology has brought the global community into the digital era. Advanced digital technologies (e.g., the Internet of Things, big data analytics, machine learning, artificial intelligence, and cloud computing) have changed social and industrial activities. Currently, digital transformation is becoming an inevitable reality. This phenomenon was accelerated by the COVID-19 pandemic, which has increased people’s online activities due to physical contact restrictions. The impact of the global pandemic has become an important trigger for industry, academics, regulators, and societies in many countries to consider digital transformation as the game changer in boosting sustainable economic growth. Digital transformation is happening massively and has become the power source for corporate management and development, even for micro–small–medium enterprises in various sectors such as manufacturing, transportation, health, education, and agriculture, as well as the economic and financial sectors.

The rapid development of digital economy activities requires banks to undergo digitalization to stay competitive and relevant in their industry, as digital technologies can improve the bank’s business values and propositions from the customer perspective. Digital transformation has become an important issue in the banking sector as it can enlarge customer outreach by servicing without physical branches, marketing differentiation from competitors, and for operational cost efficiency [

1]. The banking sector should adjust its digital capabilities to compete with FinTech, because this new player influences the competitiveness and performance of the banking sector; thus, technology management will directly impact the bank’s performance [

2]. The digital transformation, which is supported by technology-enabled innovation, also becomes a solution for leveraging financial inclusion for economic development in emerging countries [

3].

Digital transformation is associated with technology investment to support productivity, but not all scholars and banks believe in its impact on business values. Existing researchers state that no definitive conclusions can be drawn from digital transformation’s effects on bank performance [

4]. The findings argue that technology is not a driver of bank performance and mentions that there is a profitability paradox between technology investment and profitability, because the research did not empirically find a positive relationship between technology investment and bank profitability. This opinion is based on the argument that the use of technology by market participants is caused by competitive pressures in which technology is required to increase efficiency, but it has no impact on profitability [

5,

6,

7].

The development of digital technology encourages banks to carry out a digital transformation in their service processes, as it makes customers consider that the bank is still relevant with the current conditions; thus, banks can then gain profits in their business. The use of digital technologies in organizations has been proven to support organizational performance, including operating and financial performance [

8]. The motive for profit in banking’s digital transformation was also analyzed in a study which found banks that focused on digitalization and sustainability [

9], even during the coronavirus disease 2019 (COVID-19) pandemic, were profitable, as these principles can enable operations and stimulate product, service, and business model innovation [

10].

This study aims to examine the impact of digital transformation of Indonesia’s digital business model banks in the dimension of banks’ profitability and to identify the indicative duration speed of the adjustment in bank profitability due to the digital transformation shock. Most academic papers focus on the determinant of a bank’s profitability with their existing business model, without considering the impact of digital transformation. Hopefully, this study can suggest some recommendations for the banking industry and the policymakers who want to encourage digital transformation in Indonesia’s banking industry for an efficient and high-performance banking system that is able to support sustainable economic growth. Our study proposes that digital transformation supports the efficiency of bank operations and has a positive impact on bank profitability in the long run, after reducing the bank’s profit in the short run due to the high cost of digital transformation. This result was confirmed by another study that found that three times more money is spent on IT investment in the banking industry than in other industries as a whole [

11].

The arrangement of the next parts is as follows:

Section 2 is the literature review of the digital transformation and banking digital transformation,

Section 3 provides data sources and secondary data process by using statistical methods,

Section 4 elaborates on the results and discussion,

Section 5 discusses the conclusions and recommendations, and

Section 6 provides the limitations of this study and suggestions for future studies.

5. Discussion

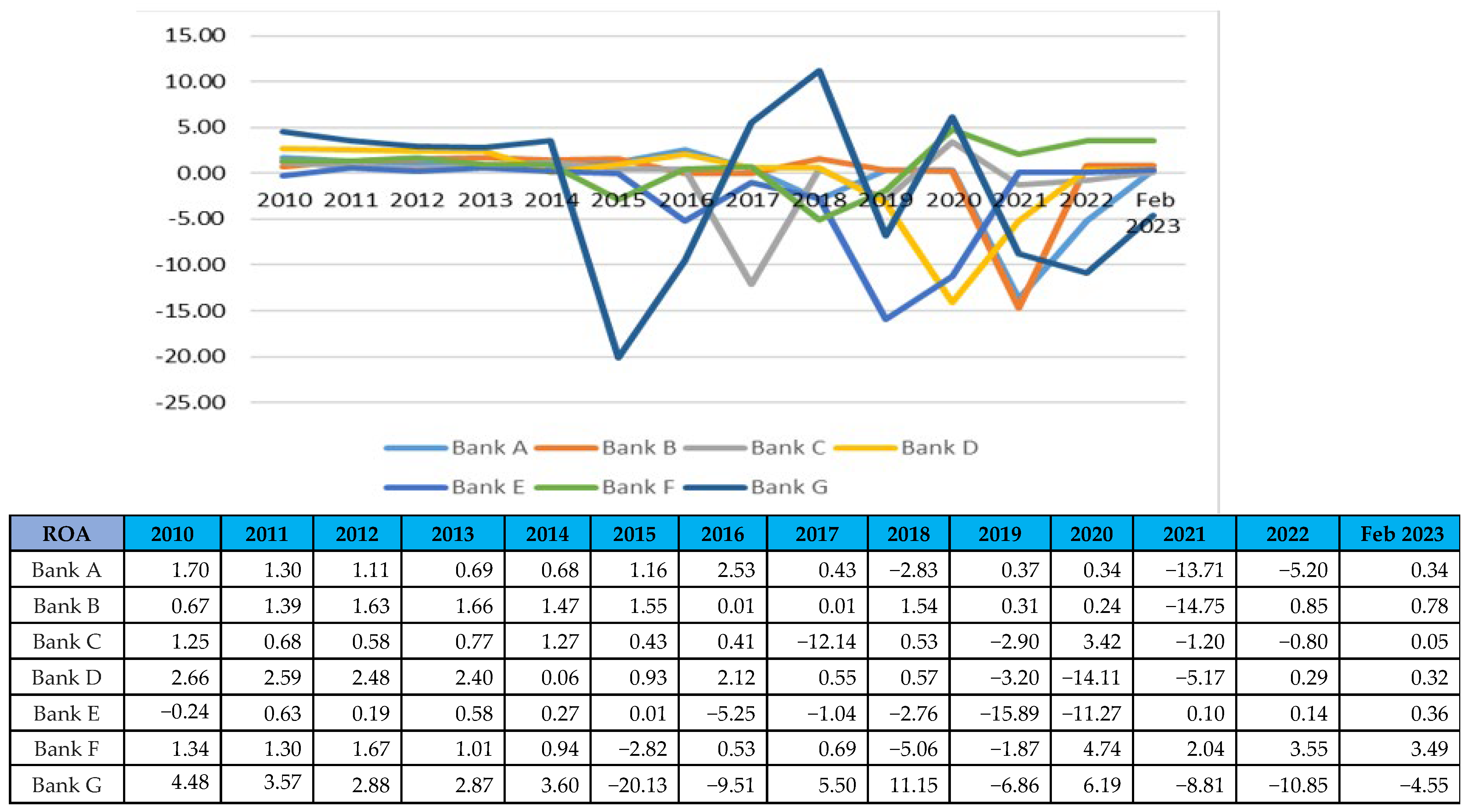

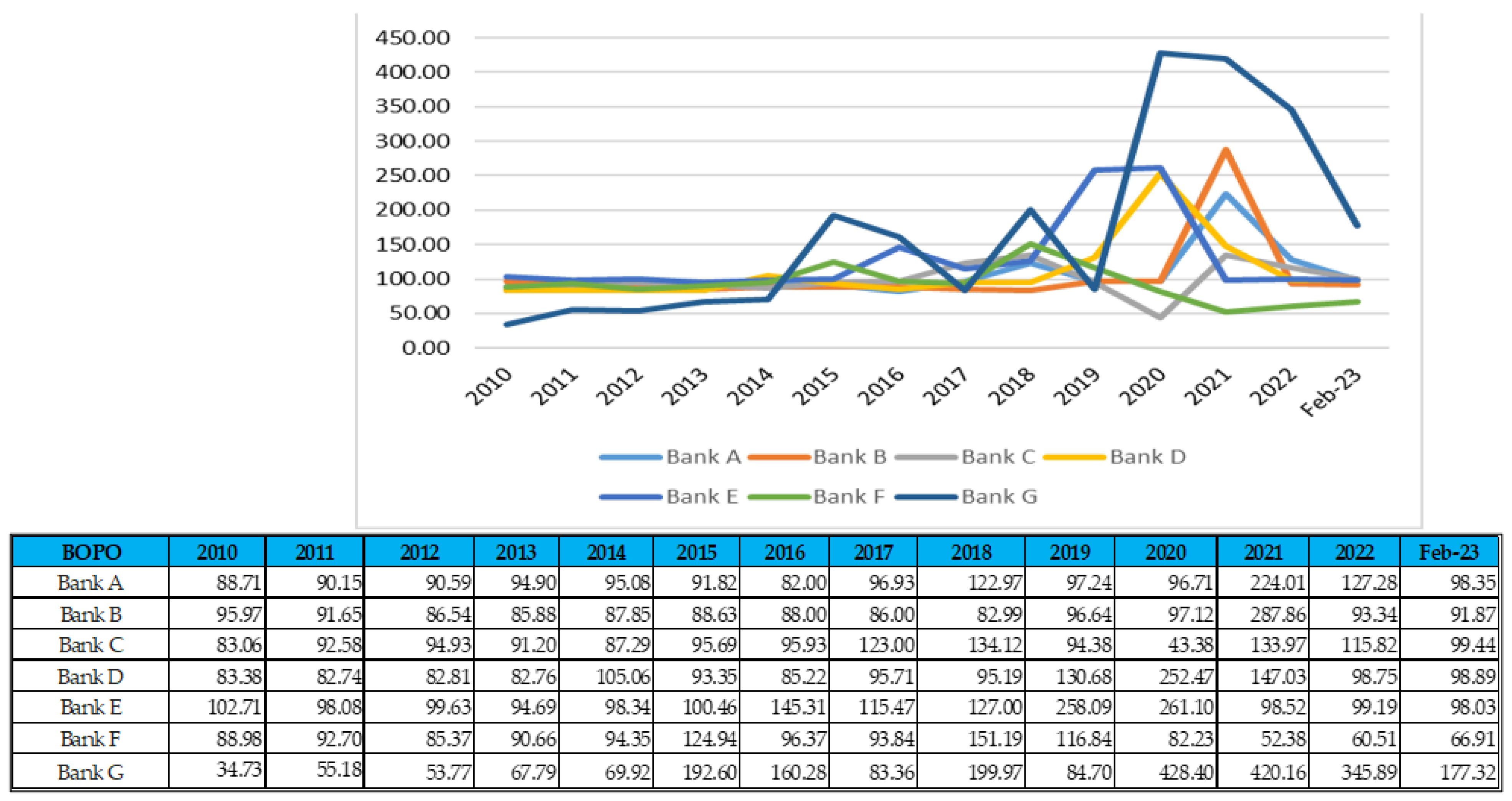

Aligned with the development of Indonesia’s financial system and digital economy, according to the Indonesia Financial Services Authority, or Otoritas Jasa Keuangan (OJK), three main aspects encourage banking digital transformation in Indonesia: namely, digital opportunities, digital behavior, and digital transactions [

80]. Digital opportunities arise with the huge potential population in Indonesia and their digital behavior, which includes massive use of smartphones including the e-commerce applications, as well as using digital transactions for payment settlements. However, the digital transformation of banks in Indonesia into digital banks has not yet shown the maximum profitability performance, as described by the high inefficiency with a high level of OC/OI and low level of Return on Assets (ROA), even causing negative ROA. The low level of performance is perhaps because of the economic scale of these digital banks, as all of them are small banks. A study on commercial bank digital transformation in Vietnam found that digital transformation increases bank performance, but it depends on the bank scale. Bank performance will receive a bigger positive impact if the bank has a larger asset size [

81,

82].

The low level of profitability after digital transformation confirms that technology is not the sole driver of bank performance. There is a profitability paradox between technology investment and profitability, as there were no empirical studies on the positive relationship between technology investment and bank profitability at the beginning of the digital transformation [

4]. As time goes by, the massive usage and development of digital technology has currently brought a positive impact on organizational performance, after several time lag phases [

4,

7,

83,

84]. However, digital transformation is not only about using new technology, but also includes strategic transformation for bank organizational changes [

10,

30] to be more efficient and profitable as the benefits outweigh the cost.

Banks and other financial institutions are affected by digital transformation in three business dimensions: value creation, value proposition, and customer interaction [

85,

86]. The impact on the value creation model (VCM) is captured by the creation process of products and services, which includes all processes conducted by the banks in generating a unique value for the customer, in terms of advantages of product/services, risk management, added value, security, or information [

85]. Obtaining advantages such as efficiency and effectiveness needs a re-engineering of process-based bank operation, as the identical cycle of business needs a distinctive organization structure [

87].

The impact on the value proposition model (VPM) is captured by the digital transformation effect on the creation of products and services, which includes the improvement of products and services, the novelty of the products and services, or revenue model changes [

85,

88,

89]. This aspect requires a concrete outcome of the distinct line of business serving diverse segments of customers. Banks might analyze the operational performance and profitability by using big data analytics to generate new products and services.

The last one, impact on the customer interaction model (CIM) describes the quality and substance of customer communication in banks, for example the comprehensive design of customer interaction through different kinds of channels, the automation of inclusive communication, and digital forms of data analytics [

85], which are shown by the concrete interaction with customers in terms of sales, service, and marketing purposes. That is why marketing and promotion become an important aspect of the banking sector, as they can support corporate and product/services branding. Consequently, the promotional cost in bank digital transformation is expensive.

To connect those three dimensions in a systematic interlinkage, the bank needs relevant IT resources (hardware, applications, database, data warehouse, and data analytics) to support business functions properly. IT resources include core systems and cross-functional systems as technological drivers to support banking operations [

90]. Many operational activities in digital banks are driven by digital technologies and data analytics, such as the decision-making process for customers’ applications, risk management, fraud detection, and improving compliance [

91]. Other studies regarding business agility also found IT as the most influencing factor on business agility in the era of industry 4.0, while other factors such as operational and human resource management, firm and transformational performance, organizational culture and creativity, marketing, knowledge management and learning, dynamic capabilities, and strategic transformation, also play important roles [

92]. Another key driver in bank digital transformation is digital strategies [

93,

94,

95], which also includes strategic technological partnerships for enhancing business models and increasing the bank’s competitiveness among financial service providers [

96,

97].

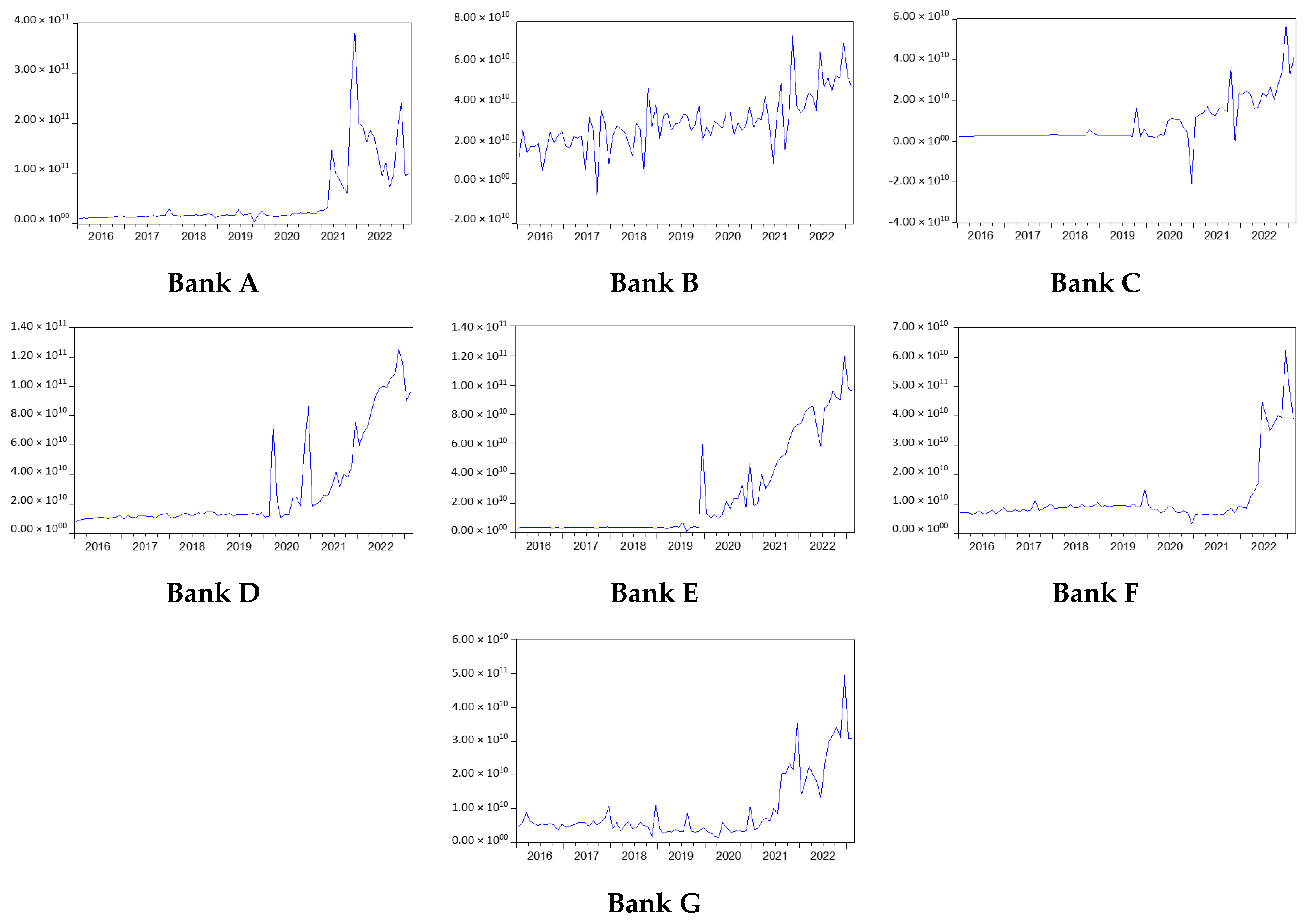

When implementing digital transformation, the operational cost will significantly increase, given the high cost required for digital infrastructure, professional management and tech talent, and promotional costs. After the digital transformation intensity decreases to a low level and the advantages arise, the digital technology adoption will support the business growth, improve the bank’s competitiveness, and increase bank operational efficiency. Then, afterwards, the marginal revenue will exceed the marginal cost. The complexity of digital transformation leads to financial performance uncertainty, but digital transformation plays a key role in bank profitability in the digital era as it can boost business growth through digital marketing by using big data analytics [

31,

77,

98,

99], supports product and service innovation by developing data-driven personalized customization products and services [

100], and transforms bank business models into digital ones [

16,

17,

101].

Digital transformation in banking activities can improve business operations by reducing financial transaction costs as data collaboration and accurate algorithms support precise decision making in products and services, increasing human resources’ productivity through optimal synergy between units/departments and optimal organizational structure, improving operational efficiency by automation and robotics, or artificial intelligence in analyzing consumer behavior, and optimizing the value chain in delivering products and services as well as in improving marketing capabilities [

24]. Digital transformation’s impact on banks’ and other financial service providers’ performance also shows a significant and positive long-term effect [

102], as well as on productivity [

103] and organizational agility [

104]. A similar positive relationship between digital transformation and community bank profitability is also shown by another study [

105]. Digitalization in the banking sector is very important to maintain bank performance in competing with other sectors, such as the telecommunication sector, which can provide financial services through mobile money in their product [

106].

This paper conducts a comprehensive analysis of digital transformation’s impact on digital bank profitability, specifically in the long-run perspective. The analysis is devoted to studies on the implication of digital transformation in the context of banks with digital business models. The existing digital transformation literature generally discusses digital transformation’s effect on the manufacturing industry and its organizational or financial performance, or about determinants of profitability on the traditional bank, while the largest portion of research concerns the influence of certain digital technologies on institutions [

107,

108]. Currently, understanding digital transformation involves understanding a combination of multiple digital innovations affecting the organization, rather than the impact of the implementation of a single digital technology [

12]. To the best of our knowledge, this work is the first study that clarifies the effect of digital transformation on digital business model bank profitability, suggesting significant recommendations for study on banking digital transformation. The state of the art of this research is to observe the effect of digital technology applications and other related aspects in digital transformation, on the profitability of digital banks.

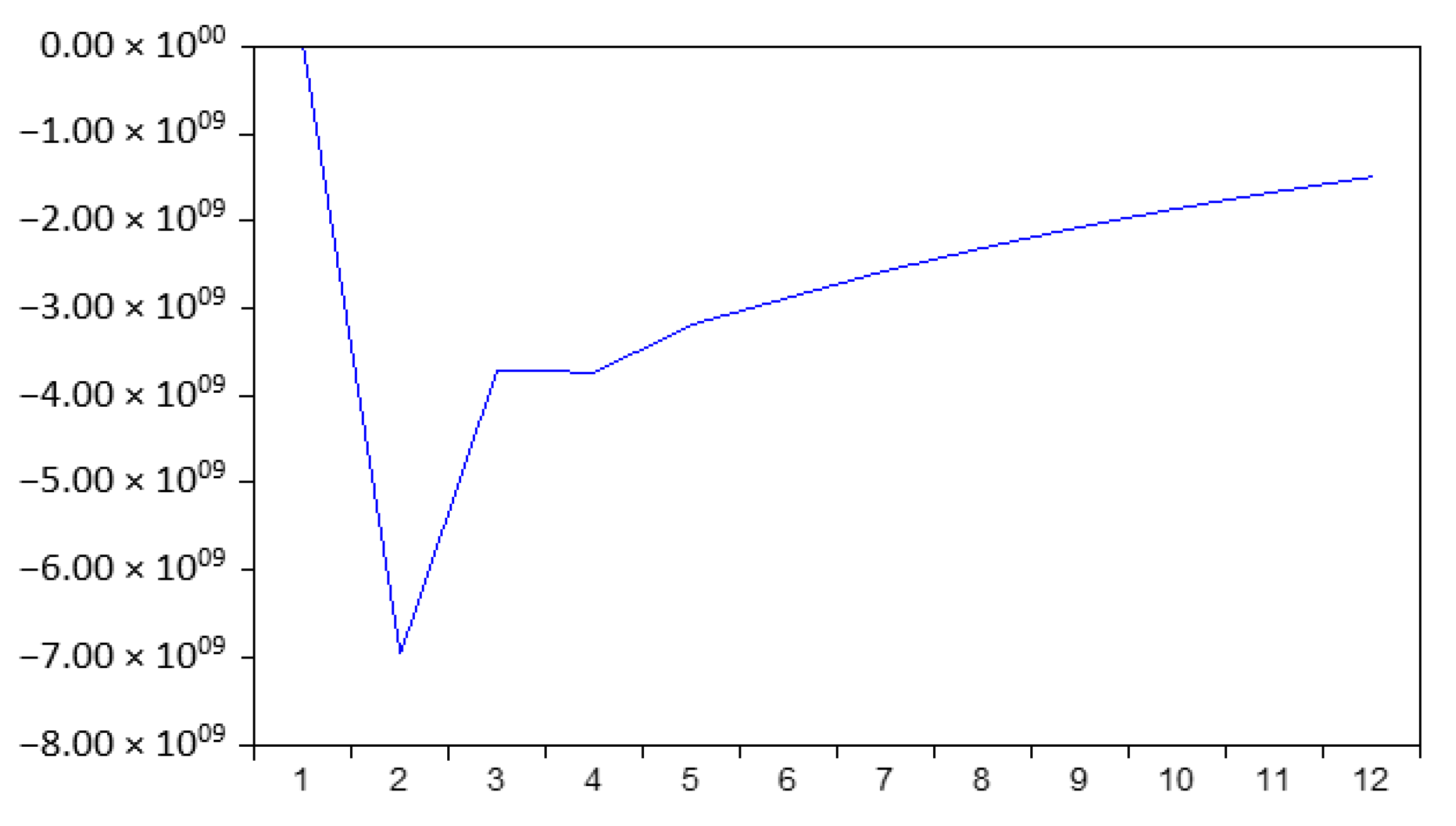

This study finds that digital transformation has a valuable effect on banks’ profitability despite the huge IT investment required. In the long run, the profit generated by the business growth and efficiency in business processes outweighs the digital operation with the brand-new digital IT infrastructure cost and new tech talent and organization. The result of this study finding confirms a long-held perspective on the information system’s advantages, because IT cannot directly optimize the operation process, so it needs more time to achieve the expected objectives [

7,

109]. We further specify the limitation of digital transformation’s impact on bank profitability by examining long-term effects, as the positive impact does not arise until a certain level of intensity of transformation. The relationship curve between digital transformation and ROA describes that digital transformation does not always imply financial performance, because of the huge amount of costs required. However, as transformation internalizes, more financial advantages will arise as the compensation of the costs.

Different from previous studies [

4,

5,

6,

7,

30], our study finds that digital transformation has a significant impact and strongly supports the digital bank’s profitability for a long time. Our results provide empirical evidence for digital transformation toward financial consequences [

110,

111], suggesting that the level of digital transformation is the important key to implementing digital transformation. Intuitively, the U-shaped relationship explains the controversy on digital transformation’s impact on a bank’s financial performance as discussed in in the previous research. This finding aligns with the statement that digital technologies’ economic value can be strongly realized after institutions significantly transform their business and organization [

112]. Another study on systemically important banks in China also demonstrates an inverted U-shaped pattern regarding the effect of financial technology in banking on the bank’s financial risks. It shows that in the beginning, financial risk increases, but afterward it declines alongside the technology development, although the responses of the banks are comparatively slow [

113].

Initially, digital transformation causes a deterioration in a bank’s financial performance as indicated by decreasing ROA and ROE [

114]. After suffering high costs and a negative impact at the beginning of digital transformation, banks will achieve a positive impact on profitability in a longer time than it takes for operational processes to see a positive impact. This finding confirms the existence of time lag for the implication of digital transformation on firm performance, as also mentioned in another study that analyzes the effects on operational performance and financial performance differently [

115], as well as the study on the impact of IT value input on economic benefits for the firm [

116]. The variable of digital performance will affect the time lag in achieving operational performance and financial performance by one year and three years, respectively [

23], while another study of IT’s impact on organizational performance states that the strong impact of IT investment will arise in 2 to 3 years after the investment [

4].

The increasing trend of digital transformation has evolved and combined with sustainability issues such as green credit. Banks’ digital transformation generates some advantages, namely scaling up the green loan and increasing the digitization level of bank management, enabling the more effective growth of green loans [

117]. Based on Chinese banking’s digital transformation, it is also found that innovation and bank financial technology applications support bank loan growth and effectively control credit risk and insolvency risk but increase liquidity risks [

27].

The empirical support for our finding, based on our analysis of the latest data from the website of the digital banks, we found that there is improvement in profitability (by using proxy of ROA and ROE) and efficiency (by using proxy Operational Cost over Operational Income), increase loan growth but credit risk which using proxy of Non-Performing Loan) is declining, and liquidity risk (by using Loan to Deposits Ratio) is well-maintained. Currently, new and increasing digital transformation trends in Indonesia’s banking sector also describe a tight rivalry among banks that provide digital banking services. Conventional banks tend to acquire smaller and limited activities banks, and then transform them into digital banks. Another way is for fintech or big tech to set up a new stand-alone digital bank.

The network for digital business ecosystems including MSMEs is very crucial for digital banks’ strategy in their initial process, even though these banks can obtain expected and durable sources of financing as well as attract depositors compared with fintech lenders. The basic component of digital ecosystems involves: (i) data access and sharing, (ii) useful and persistent data verification, and (iii) data feeds for decision-making process algorithms [

118]. Data are a very important raw material in the digital finance sector, and the capability to obtain, save, and use data appropriately is as valuable as embracing complicated algorithms that are used to select, clean, and serve customers with relevant products and services.

The algorithms that are added with the use of Artificial Intelligence are the basis of credit risk assessment, for example in valuing a borrower’s repayment capacity. These tools pass the filtering phase and enable setting the parameters as well as the terms and conditions of the loan, including calibrating the borrower’s risk by applying automated credit scoring. But, on top of all the sophisticated digital technologies, there are newly emerging digital-related risks that must be considered, as the banking sector has vulnerabilities in operational risk related to digital technology such as cyber threats, online fraud, data privacy, and fast-moving technologies.

6. Conclusions

This research analyzed the implication of the digital transformation on digital business model bank profitability in Indonesia. Previous research documented the determinants of bank profitability, specifically focusing on traditional banks. We examine the relationship between digital transformation and digital bank profitability by using profit as the proxy of bank profitability. We use other independent variables such as NPL, NIM, CAR, LDR, OC/OI, GDP growth, inflation, and forex to test these variables’ relationship to the profit.

The results show that in the long run, digital transformation (DT) has a significant supportive effect on bank profitability, as well as bank-specific factors like NIM and CAR and macroeconomic variables like GDP growth. Other variables, like NPL, cost-to-income ratio, LDR, and exchange rate, have significant negative effects on bank profitability. In the short-run, based on the analysis, it is concluded that digital transformation and NPL, LDR, Operational Cost to Operational Income (OC/OI), and inflation have significant impacts in the short run, while other variables, namely CAR, NIM, GDP growth, and forex, insignificantly affect the profitability of digital banks, as the digital transformation needs more time for adoption, and the relationship between digital transformation and profitability showed a negative relationship as the huge amount of investment for digital transformation reduced bank profitability.

Therefore, it is recommended that digital banks have an optimal strategy to implement the digital transformation to efficiently operate and digitally deliver their products and services, which will enable customers’ adoption of digital banking services and increase the bank’s customer base. Also, banks should consider the cost of IT investment and the required time for undergoing the digital transformation, as well as consider business models designed for optimal customer adoption.