Risk Contagion of Local Government Implicit Debt Integrating Complex Network and Multi-Subject Coordination

Abstract

:1. Introduction

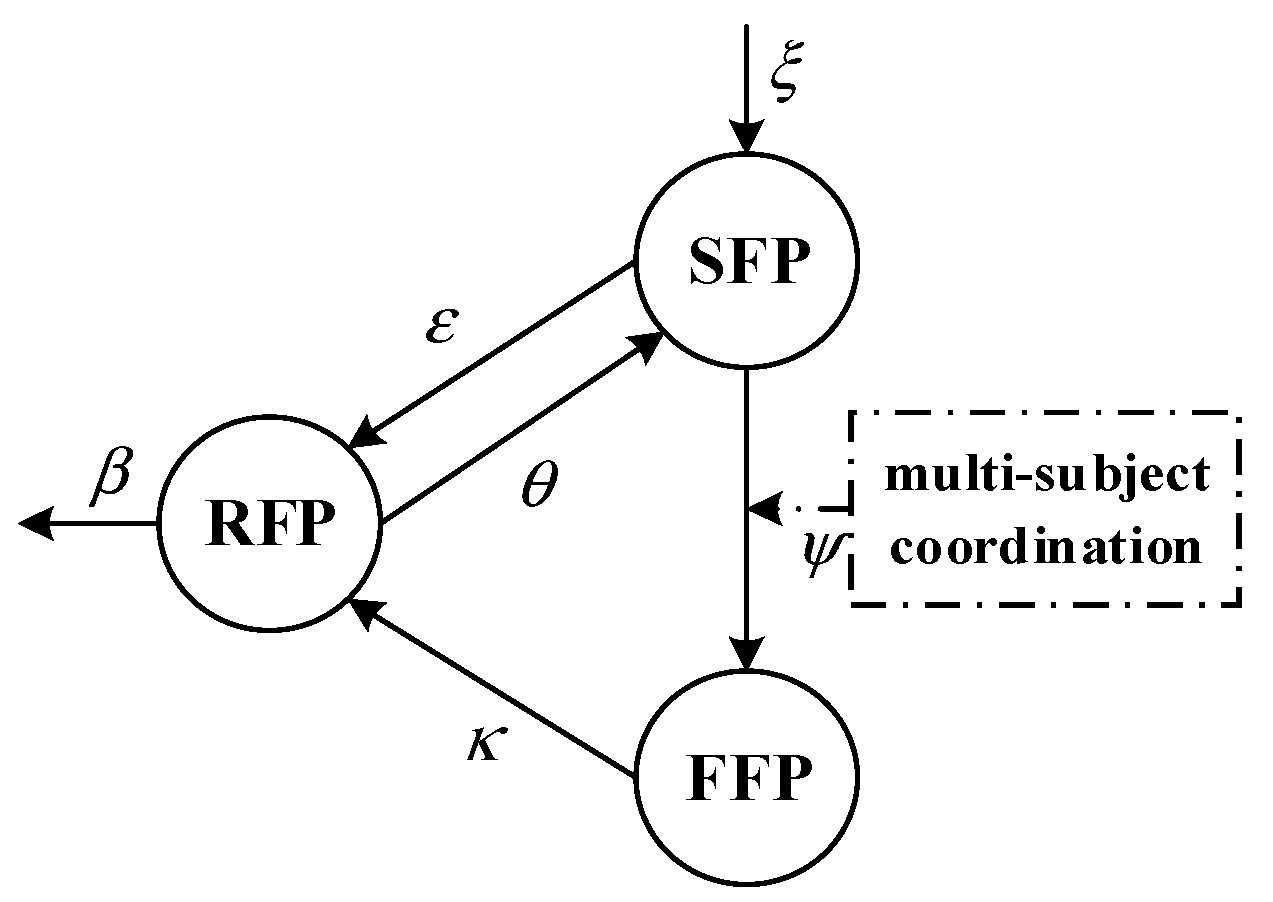

2. Risk Contagion Mechanism Underlying Local Government Implicit Debt from the Perspective of Multi-Subject Collaboration

2.1. Contagion Mechanism

- (1)

- Local governments at all levels. Local governments at all levels have a direct impact on risk formation, contagion, and control of implicit debt [3]. The main factors of local governments at all levels that affect the implicit debt risk include the following. The first factor is the debt management level [4]. directly reflects the ability of local governments to manage implicit debt at all levels. The larger the , the higher the debt management level of local governments at all levels, which is more conducive to reducing the risk formation and contagion probability of implicit debt. On the contrary, the more likely it is to cause the risk formation and contagion of implicit debt. The second factor is the information openness accuracy [5]. reflects the openness accuracy of implicit debt information of local governments and the responsibility of local governments at all levels. However, information openness has two sides. When is low, the public may question the implicit debt of local governments at all levels, which can increase the potential risk of implicit debt. As increases, the public’s right to know guaranteed to a certain extent and local governments at all levels are also prone to establishing a good image, which helps to enhance confidence among all sectors and thus helps to reduce implicit debt risk. However, when is too high, a large amount of bad information is disclosed, and due to the limited cognitive ability and psychological acceptance of investors, anxiety tends to easily increase in all sectors, thereby exacerbating the risk contagion of implicit debt.

- (2)

- Media. The media has an indirect impact on the risk formation, contagion, and control of local government implicit debt through information feedback effects, herd effects, and panic psychology [6]. The main factors that influence local government implicit debt risk by the media include, first, the information disclosure strategy [6]. reflects the strategy chosen by the media when disclosing the implicit debt information of local governments. represents the media’s choice to use an objective information disclosure strategy as the dividing point for its information disclosure strategy. As approaches 1, the media chooses to disclose more positive information. As approaches 0, the media chooses to disclose more negative information. The second factor is emotional tendency [5,7]. represents the attitude of the media toward local government implicit debt. As approaches 1, the media emotion becomes more positive. As approaches 0, the media emotion becomes more negative.

- (3)

- Financial institutions. Financial institutions have become important disruptors in the risk formation, contagion, and control of local government implicit debt through financing channels [8]. The main factors affecting local government implicit debt risk by financial institutions include, first, the risk preference level [9]. reflects the level of tolerance of financial institutions toward a local government’s implicit debt risk. The larger the , the stronger the preference of financial institutions for local government implicit debt risk, the higher the level of risk tolerance, and the more likely they are to provide financing during periods when local governments experience implicit debt risk. The smaller the , the weaker the preference of financial institutions for implicit local government debt risk, the lower their risk tolerance, and the less willing they are to provide financing during the period when implicit debt risk occurs in local governments. The second factor is the credit policy robustness [10]. indicates whether financial institutions have stability in their credit policies toward local governments. The larger the , the higher the stability of financial institutions’ credit policy toward local governments, and the easier it is for local governments to continuously obtain financial support. The smaller the , the lower the stability of financial institutions’ credit policy toward local governments. Financial institutions are more likely to change their credit policy based on changes in the actual situation of local government implicit debt, which is less conducive to local governments’ sustained access to financial support.

- (4)

- Central government. The central government exerts a macro direct impact on the risk formation, contagion, and control of local government implicit debt through policies and regulations [11]. The main factors affecting local government implicit debt risk by the central government include, first, the accountability mechanism soundness [12]. reflects the central government’s determination and implementation of accountability for a local government’s implicit debt. The larger the , the higher the level of accountability of the central government for a local government’s implicit debt, and the more helpful it is in suppressing a local government’s arbitrary and unreasonable implicit debt behavior. At the same time, it helps local governments better fulfill the main responsibilities and obligations of implicit debt. The smaller the , the lower the level of accountability of the central government for a local government’s implicit debt, and the more likely local governments are to recklessly engage in unreasonable implicit debt behavior. At the same time, local governments are more likely to evade the main responsibilities and obligations of implicit debt. The second factor is the perfection of laws and regulations [13]. indicates whether the central government’s policies and regulations on local government implicit debt are complete. The larger the , the more comprehensive the policies and regulations regarding local government implicit debt and the more helpful the central government is in providing guidance for local governments to make implicit debt decisions and to constrain their non-performing implicit debt behavior. The smaller the , the fewer policies and regulations are in place to address a local government’s implicit debt. The lack of basis and constraints for local governments to adopt implicit debt behavior is more likely to encourage them to choose non-performing implicit debt.

2.2. Contagion Rules

- (1)

- After the outbreak of an emergency or significant fluctuation in the economic situation, it is assumed that the debt management ability of local governments at all levels is low, and the information openness accuracy is too high or too low. At the same time, if media information disclosure tends to be positive or negative with negative emotional tendency, financial institutions have low-risk preference and credit policies are unstable, coupled with inadequate accountability mechanisms and laws and regulations by the central government. At this point, on the one hand, sensitive financing platforms will transform into fragile financing platforms with () probability. On the other hand, robust financing platforms will transform into sensitive financing platforms with () probability.

- (2)

- We assume local governments at all levels have high debt management levels and moderate accuracy of information openness. At the same time, we assume that media information disclosure is objective and emotionally inclined, financial institutions have a high-risk preference, and credit policies are stable, coupled with sound accountability mechanisms and laws and regulations in the central government. At this point, on the one hand, some sensitive financing platforms are exempt from the impact of implicit debt risk and directly transform into robust financing platforms with () probability. On the other hand, some fragile financing platforms have recovered from implicit debt risk and transformed into robust financing platforms with () probability.

- (3)

- We assume that at each time period, the association network of local financing platforms enters new local financing platforms with () probability and exit some local financing platforms with () probability.

3. Risk Contagion Model of Local Government Implicit Debt under Multi-Subject Coordination

3.1. Model Building

3.2. Local Financing Platform Association Network

- (1)

- At time t, there are fragile financing platforms and information correlation relationships ().

- (2)

- At each time period ( = 1, 2, 3, ……), add sensitive financing platforms to the association network, and each newly added sensitive financing platform contains information association relationships ().

- (3)

- Newly added sensitive financing platforms are randomly connected to existing fragile financing platforms with probability or are selectively connected to existing fragile financing platforms with probability ().

- (4)

- During the random connection process, the probability of any existing local financing platform being selected is . During the preferential attachment process, the probability of any existing local financing platform being selected is :where represents the degree of existing local financing platforms .

4. Theoretical Analysis of Risk Contagion of Local Government Implicit Debt from the Perspective of Multi-Subject Collaboration

4.1. Equant Analysis of Risk Contagion of Local Government Implicit Debt

4.2. Threshold Analysis of Risk Contagion of Local Government Implicit Debt

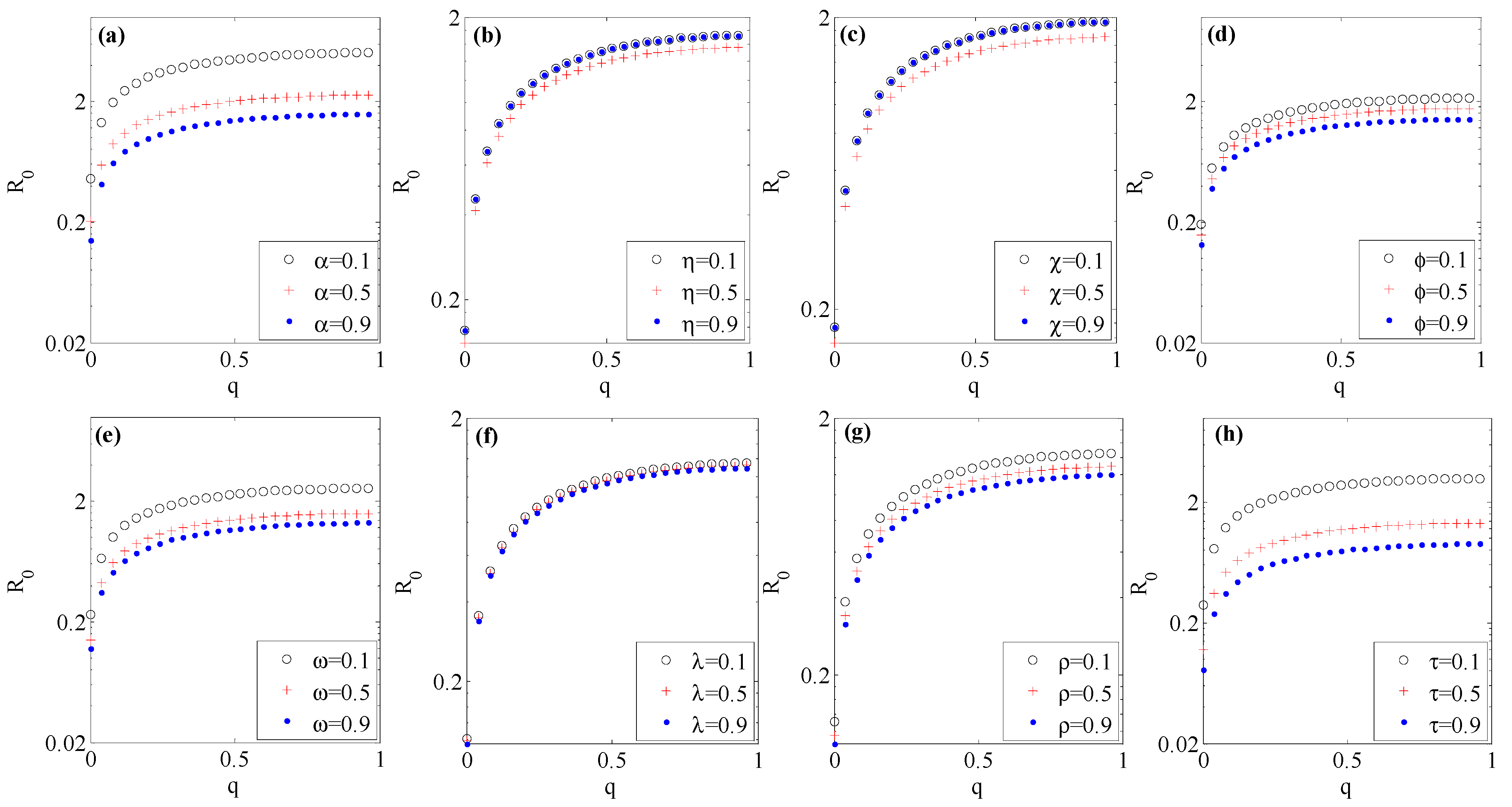

5. Simulation Analysis

5.1. Structural Evolution of the Local Financing Platform Association Network Characteristics

5.2. Evolution Characteristics of Risk Contagion of Local Government Implicit Debt

5.3. Robustness Testing

6. Conclusions

- (1)

- A scale-free network is not conducive to the risk contagion of local government implicit debt. However, a random network is most conducive to the risk contagion of local government implicit debt. When controlling local government implicit debt risk, special attention should be paid to local financing platforms that have significant potential risks and occupy a core position. The information openness accuracy and information disclosure strategy both exhibit a positive “U” shaped relationship with the risk contagion of local government implicit debt. In addition, the debt management level, emotional tendency, risk preference level, credit policy robustness, accountability mechanism soundness, and perfection of laws and regulations are all negatively correlated with the risk contagion of local government implicit debt.

- (2)

- Comprehensively adjusting the debt management level, emotion tendency, risk preference level, credit policy robustness, accountability mechanism soundness, perfection of laws and regulations, information openness accuracy, and information disclosure strategy can reduce the risk contagion intensity of local government implicit debt; however, the conditions for eradicating local government implicit debt risk are very strict. Moreover, the debt management level of local governments at all levels plays a risk “intensifier” role. From a deeper perspective, this indicates that local government implicit debt risk is an inherent risk that is difficult to eliminate. Therefore, when dealing with a local government’s implicit debt risk, the focus of control should be on reducing the risk rather than eliminating it. At the same time, local governments should strengthen their own debt management capability and information openness level, and the central government should continuously improve accountability mechanisms and laws and regulations. In this process, financial institutions and the media should actively play the role of “stability maintainers” and should not blindly adopt irrational behaviors such as loan withdrawals, loan restrictions, and the release of negative information.

Author Contributions

Funding

Institutional Review Board Statement

Informed Consent Statement

Data Availability Statement

Conflicts of Interest

References

- Symeonidis, G.; Tinios, P.; Chouzouris, M. Public pensions and implicit debt: An investigation for EU member states using ageing working group 2021 projections. Risks 2021, 9, 190. [Google Scholar] [CrossRef]

- Zhang, M.; Chen, W.; Kou, A.; Wu, Y. Promotion incentives, tenure uncertainty, and local government debt risk. Financ. Res. Lett. 2023, 56, 104136. [Google Scholar] [CrossRef]

- Alloza, M.; Andrés, J.; Pérez, J.J.; Rojas, J. Implicit public debt thresholds: An operational proposal. J. Policy Model. 2020, 42, 1408–1424. [Google Scholar] [CrossRef]

- Duan, Y.; Guo, M.; Huang, Y. Leverage of Local State-Owned Enterprises, Implicit Contingent Liabilities of Government and Economic Growth. Sustainability 2022, 14, 3481. [Google Scholar] [CrossRef]

- Guo, Y.; Li, Y.; Qian, Y. Local government debt risk assessment: A deep learning-based perspective. Inf. Process. Manag. 2022, 59, 102948. [Google Scholar] [CrossRef]

- Liu, C.; Li, X. Media coverage and investor scare behavior diffusion. Physica A 2019, 527, 121398. [Google Scholar] [CrossRef]

- Li, T.; Chen, H.; Liu, W.; Yu, G.; Yu, Y. Understanding the role of social media sentiment in identifying irrational herding behavior in the stock market. Int. Rev. Econ. Financ. 2023, 87, 163–179. [Google Scholar] [CrossRef]

- Zheng, C.; Huang, S.; Qian, N. Analysis of the co-movement between local government debt risk and bank risk in China. Singap. Econ. Rev. 2021, 66, 807–835. [Google Scholar] [CrossRef]

- Feng, L.; Liu, Y.; Fang, J. Implicit government guarantees and bank risk. Econ. Res.-Ekon. Istraživanja 2023, 36, 1015–1039. [Google Scholar] [CrossRef]

- Dong, Y.; Hou, Q.; Ni, C. Implicit government guarantees and credit ratings. J. Corp. Financ. 2021, 69, 102046. [Google Scholar] [CrossRef]

- Chen, D. Risk assessment of government debt based on machine learning algorithm. Complexity 2021, 2021, 3686692. [Google Scholar] [CrossRef]

- Cutura, J.A. Debt holder monitoring and implicit guarantees: Did the BRRD improve market discipline. J. Financ. Stab. 2021, 54, 100879. [Google Scholar] [CrossRef]

- Zhao, Y.; Li, Y.; Feng, C.; Gong, C.; Tan, H. Early warning of systemic financial risk of local government implicit debt based on BP neural network model. Systems 2022, 10, 207. [Google Scholar] [CrossRef]

- Wang, L.; Li, S.; Wang, W.; Yang, W.; Wang, H. A bank liquidity multilayer network based on media emotion. Eur. Phys. J. B 2021, 94, 45. [Google Scholar] [CrossRef]

- Hua, Z.; Jing, X.; Martínez, L. Consensus reaching for social network group decision making with ELICIT information: A perspective from the complex network. Inf. Sci. 2023, 627, 71–96. [Google Scholar] [CrossRef]

- Yang, M.; Chen, H.; Long, R.; Sun, Q.; Yang, J. How does government regulation promote green product diffusion in complex network? An evolutionary analysis considering supply side and demand side. J. Environ. Manag. 2022, 318, 115642. [Google Scholar] [CrossRef]

- O’hara, M.; Shaw, W. Deposit insurance and wealth effects: The value of being “too big to fail”. J. Financ. 1990, 45, 1587–1600. [Google Scholar] [CrossRef]

- Burnside, C.; Eichenbaum, M.; Rebelo, S. Government guarantees and self-fulfilling speculative attacks. J. Econ. Theory 2004, 119, 31–63. [Google Scholar] [CrossRef]

- Gandhi, P.; Lustig, H. Size anomalies in US bank stock returns. J. Financ. 2015, 70, 733–768. [Google Scholar] [CrossRef]

- Kelly, B.; Lustig, H.; Van Nieuwerburgh, S. Too-systemic-to-fail: What option markets imply about sector-wide government guarantees. Am. Econ. Rev. 2016, 106, 1278–1319. [Google Scholar] [CrossRef]

- Allen, F.; Carletti, E.; Goldstein, I.; Leonello, A. Government guarantees and financial stability. J. Econ. Theory 2018, 177, 518–557. [Google Scholar] [CrossRef]

- Munteanu, I.; Grigorescu, A.; Condrea, E.; Pelinescu, E. Convergent insights for sustainable development and ethical cohesion: An empirical study on corporate governance in Romanian public entities. Sustainability 2020, 12, 2990. [Google Scholar] [CrossRef]

- Silva, F.B.G. Fiscal deficits, bank credit risk, and loan-loss provisions. J. Financ. Quant. Anal. 2021, 56, 1537–1589. [Google Scholar] [CrossRef]

- Dantas, M.M.; Merkley, K.J.; Silva, F.B.G. Government guarantees and banks’ income smoothing. J. Financ. Serv. Res. 2023, 63, 123–173. [Google Scholar] [CrossRef]

- Ehrmann, M.; Worms, A. Bank networks and monetary policy transmission. J. Eur. Econ. Assoc. 2004, 2, 1148–1171. [Google Scholar] [CrossRef]

- Tonzer, L. Cross-border interbank networks, banking risk and contagion. J. Financ. Stab. 2015, 18, 19–32. [Google Scholar] [CrossRef]

- Ozdagli, A.; Weber, M. Monetary Policy through Production Networks: Evidence from the Stock Market; National Bureau of Economic Research: Cambridge, MA, USA, 2017. [Google Scholar] [CrossRef]

- Carvalho, V.M.; Tahbaz-Salehi, A. Production networks: A primer. Annu. Rev. Econ. 2019, 11, 635–663. [Google Scholar] [CrossRef]

- Carvalho, V.M.; Nirei, M.; Saito, Y.U.; Tahbaz-Salehi, A. Supply chain disruptions: Evidence from the great east japan earthquake. Q. J. Econ. 2021, 136, 1255–1321. [Google Scholar] [CrossRef]

- Lin, H.; Wu, Z.; Huang, L.; Chen, S.; Li, Z. Application of BP Neural Network Technology and Principal Component Analysis on Local Government Implicit Debt Risk Prediction. In Proceedings of the International Joint Conference on Information and Communication Engineering (JCICE), Seoul, Republic of Korea, 20–22 May 2022; pp. 53–57. [Google Scholar] [CrossRef]

- Bo, L.; Jiang, L.; Mear, F.C.J.; Zhang, S. New development: Implicit government debt in China—Past, present and future. Public Money Manag. 2023, 43, 370–373. [Google Scholar] [CrossRef]

- Wang, L.; Li, S.; Chen, T. Investor behavior, information disclosure strategy and counterparty credit risk contagion. Chaos Solitons Fractals 2019, 119, 37–49. [Google Scholar] [CrossRef]

- Zhao, C.; Li, M.; Wang, J.; Ma, S. The mechanism of credit risk contagion among internet P2P lending platforms based on a SEIR model with time-lag. Res. Int. Bus. Financ. 2021, 57, 101407. [Google Scholar] [CrossRef]

- Chen, N.; Fan, H. Credit risk contagion and optimal dual control—An SIS/R model. Math. Comput. Simul. 2023, 210, 448–472. [Google Scholar] [CrossRef]

- Qian, Q.; Feng, H.; Gu, J. The influence of risk attitude on credit risk contagion—Perspective of information dissemination. Physica A 2021, 582, 126226. [Google Scholar] [CrossRef]

| Parameter | Description | Benchmark Value | Value Range |

|---|---|---|---|

| Debt management level | 0.5 | [0, 1] | |

| Information openness accuracy | 0.4 | [0, 1] | |

| Information disclosure strategy | 0.6 | [0, 1] | |

| Emotion tendency | 0.3 | [0, 1] | |

| Credit policy robustness | 0.7 | [0, 1] | |

| Risk preference level | 0.4 | [0, 1] | |

| Accountability mechanism soundness | 0.5 | [0, 1] | |

| Perfection of laws and regulations | 0.6 | [0, 1] | |

| The probability of random connection among newly added local financing platforms and existing local financing platforms in the network | 0.2 | [0, 1] | |

| Number of new local financing platforms added to the network | 20 | Positive integer | |

| The number of association relationships between newly added and local financing platforms in the network | 20 | Positive integer | |

| The probability of transitioning from sensitive financing platforms into fragile financing platforms | 0.3 | [0, 1] | |

| The probability of transitioning from sensitive financing platforms into robust financing platforms | 0.2 | [0, 1] | |

| The probability of transitioning from fragile financing platforms into robust financing platforms | 0.1 | [0, 1] | |

| The probability of robust financing platforms re-transforming into sensitive financing platforms | 0.2 | [0, 1] | |

| The probability of new local financing platforms entering the network | 0.2 | [0, 1] | |

| The probability of new local financing platforms exiting the network | 0.1 | [0, 1] | |

| Degree of existing local financing platforms | 200 | Positive integer | |

| Total number of local financing platforms | 200 | Positive integer |

| Expectation | Variance | |||||||||||

|---|---|---|---|---|---|---|---|---|---|---|---|---|

| 0.1 | 0.2 | 0.3 | 0.4 | 0.5 | 0.6 | 0.7 | 0.8 | 0.9 | 1 | |||

| 0.1 | 3.698 | 3.552 | 3.445 | 3.379 | 3.357 | 3.379 | 3.445 | 3.552 | 3.698 | 3.876 | 3.538 | 0.030 |

| 0.2 | 2.615 | 2.512 | 2.436 | 2.389 | 2.374 | 2.389 | 2.436 | 2.512 | 2.615 | 2.741 | 2.502 | 0.015 |

| 0.3 | 2.135 | 2.051 | 1.989 | 1.951 | 1.938 | 1.951 | 1.989 | 2.051 | 2.135 | 2.238 | 2.043 | 0.010 |

| 0.4 | 1.849 | 1.776 | 1.723 | 1.690 | 1.678 | 1.690 | 1.723 | 1.776 | 1.849 | 1.938 | 1.769 | 0.007 |

| 0.5 | 1.653 | 1.588 | 1.540 | 1.510 | 1.500 | 1.510 | 1.540 | 1.588 | 1.653 | 1.732 | 1.581 | 0.006 |

| 0.6 | 1.502 | 1.443 | 1.400 | 1.373 | 1.364 | 1.373 | 1.400 | 1.443 | 1.502 | 1.575 | 1.437 | 0.005 |

| 0.7 | 1.374 | 1.320 | 1.280 | 1.256 | 1.247 | 1.256 | 1.280 | 1.320 | 1.374 | 1.440 | 1.315 | 0.004 |

| 0.8 | 1.258 | 1.209 | 1.172 | 1.150 | 1.142 | 1.150 | 1.172 | 1.209 | 1.258 | 1.319 | 1.204 | 0.003 |

| 0.9 | 1.151 | 1.106 | 1.073 | 1.052 | 1.045 | 1.052 | 1.073 | 1.106 | 1.151 | 1.207 | 1.101 | 0.003 |

| 1 | 1.053 | 1.012 | 0.981 | 0.962 | 0.956 | 0.962 | 0.981 | 1.012 | 1.053 | 1.104 | 1.008 | 0.002 |

| 0.1 | 3.424 | 3.290 | 3.190 | 3.129 | 3.108 | 3.129 | 3.190 | 3.290 | 3.424 | 3.589 | 3.276 | 0.025 |

| 0.2 | 2.421 | 2.326 | 2.256 | 2.213 | 2.198 | 2.213 | 2.256 | 2.326 | 2.421 | 2.538 | 2.317 | 0.013 |

| 0.3 | 1.977 | 1.899 | 1.842 | 1.807 | 1.795 | 1.807 | 1.842 | 1.899 | 1.977 | 2.072 | 1.892 | 0.008 |

| 0.4 | 1.712 | 1.645 | 1.595 | 1.564 | 1.554 | 1.564 | 1.595 | 1.645 | 1.712 | 1.795 | 1.638 | 0.006 |

| 0.5 | 1.530 | 1.470 | 1.426 | 1.398 | 1.389 | 1.398 | 1.426 | 1.470 | 1.530 | 1.604 | 1.464 | 0.005 |

| 0.6 | 1.391 | 1.336 | 1.296 | 1.271 | 1.263 | 1.271 | 1.296 | 1.336 | 1.391 | 1.458 | 1.331 | 0.004 |

| 0.7 | 1.272 | 1.222 | 1.186 | 1.163 | 1.155 | 1.163 | 1.186 | 1.222 | 1.272 | 1.334 | 1.218 | 0.004 |

| 0.8 | 1.165 | 1.119 | 1.085 | 1.065 | 1.058 | 1.065 | 1.085 | 1.119 | 1.165 | 1.221 | 1.115 | 0.003 |

| 0.9 | 1.066 | 1.024 | 0.993 | 0.974 | 0.968 | 0.974 | 0.993 | 1.024 | 1.066 | 1.117 | 1.020 | 0.002 |

| 1 | 0.975 | 0.937 | 0.909 | 0.891 | 0.885 | 0.891 | 0.909 | 0.937 | 0.975 | 1.022 | 0.933 | 0.002 |

| 0.1 | 3.698 | 3.552 | 3.445 | 3.379 | 3.357 | 3.379 | 3.445 | 3.552 | 3.698 | 3.876 | 3.538 | 0.030 |

| 0.2 | 2.615 | 2.512 | 2.436 | 2.389 | 2.374 | 2.389 | 2.436 | 2.512 | 2.615 | 2.741 | 2.502 | 0.015 |

| 0.3 | 2.135 | 2.051 | 1.989 | 1.951 | 1.938 | 1.951 | 1.989 | 2.051 | 2.135 | 2.238 | 2.043 | 0.010 |

| 0.4 | 1.849 | 1.776 | 1.723 | 1.690 | 1.678 | 1.690 | 1.723 | 1.776 | 1.849 | 1.938 | 1.769 | 0.007 |

| 0.5 | 1.653 | 1.588 | 1.540 | 1.510 | 1.500 | 1.510 | 1.540 | 1.588 | 1.653 | 1.732 | 1.581 | 0.006 |

| 0.6 | 1.502 | 1.443 | 1.400 | 1.373 | 1.364 | 1.373 | 1.400 | 1.443 | 1.502 | 1.575 | 1.437 | 0.005 |

| 0.7 | 1.374 | 1.320 | 1.280 | 1.256 | 1.247 | 1.256 | 1.280 | 1.320 | 1.374 | 1.440 | 1.315 | 0.004 |

| 0.8 | 1.258 | 1.209 | 1.172 | 1.150 | 1.142 | 1.150 | 1.172 | 1.209 | 1.258 | 1.319 | 1.204 | 0.003 |

| 0.9 | 1.151 | 1.106 | 1.073 | 1.052 | 1.045 | 1.052 | 1.073 | 1.106 | 1.151 | 1.207 | 1.101 | 0.003 |

| 1 | 1.053 | 1.012 | 0.981 | 0.962 | 0.956 | 0.962 | 0.981 | 1.012 | 1.053 | 1.104 | 1.008 | 0.002 |

| Expectation | Variance | |||||||||||

|---|---|---|---|---|---|---|---|---|---|---|---|---|

| 0.1 | 0.2 | 0.3 | 0.4 | 0.5 | 0.6 | 0.7 | 0.8 | 0.9 | 1 | |||

| 0.1 | 5.035 | 4.838 | 4.691 | 4.601 | 4.571 | 4.601 | 4.691 | 4.838 | 5.035 | 5.278 | 4.818 | 0.055 |

| 0.2 | 3.560 | 3.421 | 3.317 | 3.254 | 3.232 | 3.254 | 3.317 | 3.421 | 3.560 | 3.732 | 3.407 | 0.027 |

| 0.3 | 2.907 | 2.793 | 2.709 | 2.657 | 2.639 | 2.657 | 2.709 | 2.793 | 2.907 | 3.047 | 2.782 | 0.018 |

| 0.4 | 2.517 | 2.419 | 2.346 | 2.301 | 2.285 | 2.301 | 2.346 | 2.419 | 2.517 | 2.639 | 2.409 | 0.014 |

| 0.5 | 2.250 | 2.162 | 2.097 | 2.056 | 2.043 | 2.056 | 2.097 | 2.162 | 2.250 | 2.359 | 2.153 | 0.011 |

| 0.6 | 2.045 | 1.965 | 1.906 | 1.869 | 1.857 | 1.869 | 1.906 | 1.965 | 2.045 | 2.144 | 1.957 | 0.009 |

| 0.7 | 1.871 | 1.798 | 1.743 | 1.710 | 1.699 | 1.710 | 1.743 | 1.798 | 1.871 | 1.961 | 1.790 | 0.008 |

| 0.8 | 1.713 | 1.646 | 1.596 | 1.566 | 1.555 | 1.566 | 1.596 | 1.646 | 1.713 | 1.796 | 1.639 | 0.006 |

| 0.9 | 1.567 | 1.506 | 1.460 | 1.432 | 1.423 | 1.432 | 1.460 | 1.506 | 1.567 | 1.643 | 1.500 | 0.005 |

| 1 | 1.434 | 1.378 | 1.336 | 1.310 | 1.302 | 1.310 | 1.336 | 1.378 | 1.434 | 1.503 | 1.372 | 0.004 |

| 0.1 | 3.825 | 3.675 | 3.564 | 3.495 | 3.472 | 3.495 | 3.564 | 3.675 | 3.825 | 4.010 | 3.660 | 0.032 |

| 0.2 | 2.705 | 2.599 | 2.520 | 2.472 | 2.455 | 2.472 | 2.520 | 2.599 | 2.705 | 2.835 | 2.588 | 0.016 |

| 0.3 | 2.208 | 2.122 | 2.058 | 2.018 | 2.005 | 2.018 | 2.058 | 2.122 | 2.208 | 2.315 | 2.113 | 0.011 |

| 0.4 | 1.912 | 1.837 | 1.782 | 1.748 | 1.736 | 1.748 | 1.782 | 1.837 | 1.912 | 2.005 | 1.830 | 0.008 |

| 0.5 | 1.709 | 1.642 | 1.593 | 1.562 | 1.552 | 1.562 | 1.593 | 1.642 | 1.709 | 1.792 | 1.636 | 0.006 |

| 0.6 | 1.554 | 1.493 | 1.448 | 1.420 | 1.411 | 1.420 | 1.448 | 1.493 | 1.554 | 1.629 | 1.487 | 0.005 |

| 0.7 | 1.421 | 1.366 | 1.324 | 1.299 | 1.290 | 1.299 | 1.324 | 1.366 | 1.421 | 1.490 | 1.360 | 0.004 |

| 0.8 | 1.301 | 1.250 | 1.213 | 1.189 | 1.181 | 1.189 | 1.213 | 1.250 | 1.301 | 1.364 | 1.245 | 0.004 |

| 0.9 | 1.191 | 1.144 | 1.109 | 1.088 | 1.081 | 1.088 | 1.109 | 1.144 | 1.191 | 1.248 | 1.139 | 0.003 |

| 1 | 1.089 | 1.047 | 1.015 | 0.996 | 0.989 | 0.996 | 1.015 | 1.047 | 1.089 | 1.142 | 1.042 | 0.003 |

| 0.1 | 3.322 | 3.192 | 3.095 | 3.036 | 3.016 | 3.036 | 3.095 | 3.192 | 3.322 | 3.482 | 3.179 | 0.024 |

| 0.2 | 2.349 | 2.257 | 2.189 | 2.147 | 2.132 | 2.147 | 2.189 | 2.257 | 2.349 | 2.462 | 2.248 | 0.012 |

| 0.3 | 1.918 | 1.843 | 1.787 | 1.753 | 1.741 | 1.753 | 1.787 | 1.843 | 1.918 | 2.010 | 1.835 | 0.008 |

| 0.4 | 1.661 | 1.596 | 1.548 | 1.518 | 1.508 | 1.518 | 1.548 | 1.596 | 1.661 | 1.741 | 1.589 | 0.006 |

| 0.5 | 1.485 | 1.426 | 1.383 | 1.357 | 1.348 | 1.357 | 1.383 | 1.426 | 1.485 | 1.556 | 1.421 | 0.005 |

| 0.6 | 1.350 | 1.297 | 1.257 | 1.233 | 1.225 | 1.233 | 1.257 | 1.297 | 1.350 | 1.415 | 1.291 | 0.004 |

| 0.7 | 1.234 | 1.186 | 1.150 | 1.128 | 1.121 | 1.128 | 1.150 | 1.186 | 1.234 | 1.294 | 1.181 | 0.003 |

| 0.8 | 1.130 | 1.086 | 1.053 | 1.033 | 1.026 | 1.033 | 1.053 | 1.086 | 1.130 | 1.185 | 1.081 | 0.003 |

| 0.9 | 1.034 | 0.994 | 0.964 | 0.945 | 0.939 | 0.945 | 0.964 | 0.994 | 1.034 | 1.084 | 0.990 | 0.002 |

| 1 | 0.946 | 0.909 | 0.881 | 0.865 | 0.859 | 0.865 | 0.881 | 0.909 | 0.946 | 0.992 | 0.905 | 0.002 |

| Expectation | Variance | |||||||||||

|---|---|---|---|---|---|---|---|---|---|---|---|---|

| 0.1 | 0.2 | 0.3 | 0.4 | 0.5 | 0.6 | 0.7 | 0.8 | 0.9 | 1 | |||

| 0.1 | 3.756 | 3.609 | 3.500 | 3.432 | 3.410 | 3.432 | 3.500 | 3.609 | 3.756 | 3.937 | 3.594 | 0.031 |

| 0.2 | 2.656 | 2.552 | 2.475 | 2.427 | 2.411 | 2.427 | 2.475 | 2.552 | 2.656 | 2.784 | 2.541 | 0.015 |

| 0.3 | 2.169 | 2.083 | 2.020 | 1.982 | 1.969 | 1.982 | 2.020 | 2.083 | 2.169 | 2.273 | 2.075 | 0.010 |

| 0.4 | 1.878 | 1.804 | 1.750 | 1.716 | 1.705 | 1.716 | 1.750 | 1.804 | 1.878 | 1.969 | 1.797 | 0.008 |

| 0.5 | 1.679 | 1.613 | 1.564 | 1.534 | 1.524 | 1.534 | 1.564 | 1.613 | 1.679 | 1.760 | 1.606 | 0.006 |

| 0.6 | 1.526 | 1.466 | 1.422 | 1.394 | 1.385 | 1.394 | 1.422 | 1.466 | 1.526 | 1.600 | 1.460 | 0.005 |

| 0.7 | 1.396 | 1.341 | 1.300 | 1.276 | 1.267 | 1.276 | 1.300 | 1.341 | 1.396 | 1.463 | 1.336 | 0.004 |

| 0.8 | 1.278 | 1.228 | 1.191 | 1.168 | 1.160 | 1.168 | 1.191 | 1.228 | 1.278 | 1.340 | 1.223 | 0.004 |

| 0.9 | 1.169 | 1.123 | 1.089 | 1.069 | 1.062 | 1.069 | 1.089 | 1.123 | 1.169 | 1.226 | 1.119 | 0.003 |

| 1 | 1.070 | 1.028 | 0.997 | 0.978 | 0.971 | 0.978 | 0.997 | 1.028 | 1.070 | 1.121 | 1.024 | 0.002 |

| 0.1 | 3.458 | 3.322 | 3.222 | 3.160 | 3.139 | 3.160 | 3.222 | 3.322 | 3.458 | 3.625 | 3.309 | 0.026 |

| 0.2 | 2.445 | 2.349 | 2.278 | 2.234 | 2.220 | 2.234 | 2.278 | 2.349 | 2.445 | 2.563 | 2.340 | 0.013 |

| 0.3 | 1.996 | 1.918 | 1.860 | 1.824 | 1.812 | 1.824 | 1.860 | 1.918 | 1.996 | 2.093 | 1.910 | 0.009 |

| 0.4 | 1.729 | 1.661 | 1.611 | 1.580 | 1.569 | 1.580 | 1.611 | 1.661 | 1.729 | 1.812 | 1.654 | 0.006 |

| 0.5 | 1.545 | 1.485 | 1.440 | 1.412 | 1.403 | 1.412 | 1.440 | 1.485 | 1.545 | 1.620 | 1.479 | 0.005 |

| 0.6 | 1.405 | 1.350 | 1.309 | 1.284 | 1.275 | 1.284 | 1.309 | 1.350 | 1.405 | 1.473 | 1.344 | 0.004 |

| 0.7 | 1.285 | 1.235 | 1.197 | 1.174 | 1.166 | 1.174 | 1.197 | 1.235 | 1.285 | 1.347 | 1.230 | 0.004 |

| 0.8 | 1.176 | 1.130 | 1.096 | 1.075 | 1.068 | 1.075 | 1.096 | 1.130 | 1.176 | 1.233 | 1.126 | 0.003 |

| 0.9 | 1.076 | 1.034 | 1.003 | 0.984 | 0.977 | 0.984 | 1.003 | 1.034 | 1.076 | 1.128 | 1.030 | 0.003 |

| 1 | 0.985 | 0.946 | 0.918 | 0.900 | 0.894 | 0.900 | 0.918 | 0.946 | 0.985 | 1.032 | 0.942 | 0.002 |

| 0.1 | 3.261 | 3.133 | 3.038 | 2.980 | 2.960 | 2.980 | 3.038 | 3.133 | 3.261 | 3.418 | 3.120 | 0.023 |

| 0.2 | 2.306 | 2.215 | 2.148 | 2.107 | 2.093 | 2.107 | 2.148 | 2.215 | 2.306 | 2.417 | 2.206 | 0.012 |

| 0.3 | 1.883 | 1.809 | 1.754 | 1.720 | 1.709 | 1.720 | 1.754 | 1.809 | 1.883 | 1.973 | 1.801 | 0.008 |

| 0.4 | 1.630 | 1.566 | 1.519 | 1.490 | 1.480 | 1.490 | 1.519 | 1.566 | 1.630 | 1.709 | 1.560 | 0.006 |

| 0.5 | 1.457 | 1.400 | 1.358 | 1.332 | 1.323 | 1.332 | 1.358 | 1.400 | 1.457 | 1.528 | 1.394 | 0.005 |

| 0.6 | 1.325 | 1.273 | 1.234 | 1.211 | 1.203 | 1.211 | 1.234 | 1.273 | 1.325 | 1.389 | 1.268 | 0.004 |

| 0.7 | 1.212 | 1.164 | 1.129 | 1.107 | 1.100 | 1.107 | 1.129 | 1.164 | 1.212 | 1.270 | 1.159 | 0.003 |

| 0.8 | 1.109 | 1.066 | 1.034 | 1.014 | 1.007 | 1.014 | 1.034 | 1.066 | 1.109 | 1.163 | 1.062 | 0.003 |

| 0.9 | 1.015 | 0.975 | 0.946 | 0.928 | 0.922 | 0.928 | 0.946 | 0.975 | 1.015 | 1.064 | 0.971 | 0.002 |

| 1 | 0.929 | 0.892 | 0.865 | 0.849 | 0.843 | 0.849 | 0.865 | 0.892 | 0.929 | 0.973 | 0.889 | 0.002 |

| Expectation | Variance | |||||||||||

|---|---|---|---|---|---|---|---|---|---|---|---|---|

| 0.1 | 0.2 | 0.3 | 0.4 | 0.5 | 0.6 | 0.7 | 0.8 | 0.9 | 1 | |||

| 0.1 | 2.547 | 2.423 | 2.305 | 2.192 | 2.085 | 1.984 | 1.887 | 1.795 | 1.707 | 1.624 | 2.055 | 0.096 |

| 0.2 | 2.430 | 2.312 | 2.199 | 2.092 | 1.990 | 1.893 | 1.801 | 1.713 | 1.629 | 1.550 | 1.961 | 0.088 |

| 0.3 | 2.336 | 2.222 | 2.113 | 2.010 | 1.912 | 1.819 | 1.730 | 1.646 | 1.566 | 1.489 | 1.884 | 0.081 |

| 0.4 | 2.273 | 2.162 | 2.056 | 1.956 | 1.861 | 1.770 | 1.684 | 1.602 | 1.523 | 1.449 | 1.834 | 0.077 |

| 0.5 | 2.251 | 2.141 | 2.036 | 1.937 | 1.843 | 1.753 | 1.667 | 1.586 | 1.509 | 1.435 | 1.816 | 0.075 |

| 0.6 | 2.273 | 2.162 | 2.056 | 1.956 | 1.861 | 1.770 | 1.684 | 1.602 | 1.523 | 1.449 | 1.834 | 0.077 |

| 0.7 | 2.336 | 2.222 | 2.113 | 2.010 | 1.912 | 1.819 | 1.730 | 1.646 | 1.566 | 1.489 | 1.884 | 0.081 |

| 0.8 | 2.430 | 2.312 | 2.199 | 2.092 | 1.990 | 1.893 | 1.801 | 1.713 | 1.629 | 1.550 | 1.961 | 0.088 |

| 0.9 | 2.547 | 2.423 | 2.305 | 2.192 | 2.085 | 1.984 | 1.887 | 1.795 | 1.707 | 1.624 | 2.055 | 0.096 |

| 1 | 2.676 | 2.546 | 2.422 | 2.304 | 2.191 | 2.084 | 1.983 | 1.886 | 1.794 | 1.707 | 2.159 | 0.106 |

| 0.1 | 1.935 | 1.840 | 1.751 | 1.665 | 1.584 | 1.507 | 1.433 | 1.363 | 1.297 | 1.234 | 1.561 | 0.056 |

| 0.2 | 1.846 | 1.756 | 1.671 | 1.589 | 1.512 | 1.438 | 1.368 | 1.301 | 1.238 | 1.177 | 1.490 | 0.051 |

| 0.3 | 1.774 | 1.688 | 1.605 | 1.527 | 1.453 | 1.382 | 1.314 | 1.250 | 1.189 | 1.131 | 1.431 | 0.047 |

| 0.4 | 1.727 | 1.642 | 1.562 | 1.486 | 1.414 | 1.345 | 1.279 | 1.217 | 1.157 | 1.101 | 1.393 | 0.044 |

| 0.5 | 1.710 | 1.626 | 1.547 | 1.472 | 1.400 | 1.332 | 1.267 | 1.205 | 1.146 | 1.090 | 1.379 | 0.043 |

| 0.6 | 1.727 | 1.642 | 1.562 | 1.486 | 1.414 | 1.345 | 1.279 | 1.217 | 1.157 | 1.101 | 1.393 | 0.044 |

| 0.7 | 1.774 | 1.688 | 1.605 | 1.527 | 1.453 | 1.382 | 1.314 | 1.250 | 1.189 | 1.131 | 1.431 | 0.047 |

| 0.8 | 1.846 | 1.756 | 1.671 | 1.589 | 1.512 | 1.438 | 1.368 | 1.301 | 1.238 | 1.177 | 1.490 | 0.051 |

| 0.9 | 1.935 | 1.840 | 1.751 | 1.665 | 1.584 | 1.507 | 1.433 | 1.363 | 1.297 | 1.234 | 1.561 | 0.056 |

| 1 | 2.033 | 1.934 | 1.840 | 1.750 | 1.665 | 1.583 | 1.506 | 1.433 | 1.363 | 1.296 | 1.640 | 0.061 |

| 0.1 | 1.680 | 1.598 | 1.520 | 1.446 | 1.376 | 1.309 | 1.245 | 1.184 | 1.126 | 1.071 | 1.356 | 0.042 |

| 0.2 | 1.603 | 1.525 | 1.451 | 1.380 | 1.313 | 1.249 | 1.188 | 1.130 | 1.075 | 1.022 | 1.294 | 0.038 |

| 0.3 | 1.541 | 1.466 | 1.394 | 1.326 | 1.262 | 1.200 | 1.142 | 1.086 | 1.033 | 0.983 | 1.243 | 0.035 |

| 0.4 | 1.499 | 1.426 | 1.357 | 1.291 | 1.228 | 1.168 | 1.111 | 1.057 | 1.005 | 0.956 | 1.210 | 0.033 |

| 0.5 | 1.485 | 1.412 | 1.344 | 1.278 | 1.216 | 1.156 | 1.100 | 1.046 | 0.995 | 0.947 | 1.198 | 0.033 |

| 0.6 | 1.499 | 1.426 | 1.357 | 1.291 | 1.228 | 1.168 | 1.111 | 1.057 | 1.005 | 0.956 | 1.210 | 0.033 |

| 0.7 | 1.541 | 1.466 | 1.394 | 1.326 | 1.262 | 1.200 | 1.142 | 1.086 | 1.033 | 0.983 | 1.243 | 0.035 |

| 0.8 | 1.603 | 1.525 | 1.451 | 1.380 | 1.313 | 1.249 | 1.188 | 1.130 | 1.075 | 1.022 | 1.294 | 0.038 |

| 0.9 | 1.680 | 1.598 | 1.520 | 1.446 | 1.376 | 1.309 | 1.245 | 1.184 | 1.126 | 1.071 | 1.356 | 0.042 |

| 1 | 1.766 | 1.680 | 1.598 | 1.520 | 1.446 | 1.375 | 1.308 | 1.244 | 1.184 | 1.126 | 1.425 | 0.046 |

| Expectation | Variance | |||||||||||

|---|---|---|---|---|---|---|---|---|---|---|---|---|

| 0.1 | 0.2 | 0.3 | 0.4 | 0.5 | 0.6 | 0.7 | 0.8 | 0.9 | 1 | |||

| 0.1 | 1.900 | 1.807 | 1.719 | 1.635 | 1.556 | 1.480 | 1.407 | 1.339 | 1.274 | 1.211 | 1.533 | 0.054 |

| 0.2 | 1.813 | 1.725 | 1.640 | 1.560 | 1.484 | 1.412 | 1.343 | 1.278 | 1.215 | 1.156 | 1.463 | 0.049 |

| 0.3 | 1.742 | 1.657 | 1.577 | 1.500 | 1.427 | 1.357 | 1.291 | 1.228 | 1.168 | 1.111 | 1.406 | 0.045 |

| 0.4 | 1.695 | 1.613 | 1.534 | 1.459 | 1.388 | 1.320 | 1.256 | 1.195 | 1.136 | 1.081 | 1.368 | 0.043 |

| 0.5 | 1.679 | 1.597 | 1.519 | 1.445 | 1.375 | 1.308 | 1.244 | 1.183 | 1.125 | 1.070 | 1.354 | 0.042 |

| 0.6 | 1.695 | 1.613 | 1.534 | 1.459 | 1.388 | 1.320 | 1.256 | 1.195 | 1.136 | 1.081 | 1.368 | 0.043 |

| 0.7 | 1.742 | 1.657 | 1.577 | 1.500 | 1.427 | 1.357 | 1.291 | 1.228 | 1.168 | 1.111 | 1.406 | 0.045 |

| 0.8 | 1.813 | 1.725 | 1.640 | 1.560 | 1.484 | 1.412 | 1.343 | 1.278 | 1.215 | 1.156 | 1.463 | 0.049 |

| 0.9 | 1.900 | 1.807 | 1.719 | 1.635 | 1.556 | 1.480 | 1.407 | 1.339 | 1.274 | 1.211 | 1.533 | 0.054 |

| 1 | 1.997 | 1.899 | 1.807 | 1.718 | 1.635 | 1.555 | 1.479 | 1.407 | 1.338 | 1.273 | 1.611 | 0.059 |

| 0.1 | 1.749 | 1.664 | 1.583 | 1.505 | 1.432 | 1.362 | 1.296 | 1.232 | 1.172 | 1.115 | 1.411 | 0.045 |

| 0.2 | 1.669 | 1.588 | 1.510 | 1.437 | 1.366 | 1.300 | 1.236 | 1.176 | 1.119 | 1.064 | 1.347 | 0.041 |

| 0.3 | 1.604 | 1.526 | 1.451 | 1.381 | 1.313 | 1.249 | 1.188 | 1.130 | 1.075 | 1.023 | 1.294 | 0.038 |

| 0.4 | 1.561 | 1.485 | 1.412 | 1.343 | 1.278 | 1.216 | 1.156 | 1.100 | 1.046 | 0.995 | 1.259 | 0.036 |

| 0.5 | 1.546 | 1.470 | 1.398 | 1.330 | 1.265 | 1.204 | 1.145 | 1.089 | 1.036 | 0.985 | 1.247 | 0.035 |

| 0.6 | 1.561 | 1.485 | 1.412 | 1.343 | 1.278 | 1.216 | 1.156 | 1.100 | 1.046 | 0.995 | 1.259 | 0.036 |

| 0.7 | 1.604 | 1.526 | 1.451 | 1.381 | 1.313 | 1.249 | 1.188 | 1.130 | 1.075 | 1.023 | 1.294 | 0.038 |

| 0.8 | 1.669 | 1.588 | 1.510 | 1.437 | 1.366 | 1.300 | 1.236 | 1.176 | 1.119 | 1.064 | 1.347 | 0.041 |

| 0.9 | 1.749 | 1.664 | 1.583 | 1.505 | 1.432 | 1.362 | 1.296 | 1.232 | 1.172 | 1.115 | 1.411 | 0.045 |

| 1 | 1.838 | 1.748 | 1.663 | 1.582 | 1.505 | 1.431 | 1.362 | 1.295 | 1.232 | 1.172 | 1.483 | 0.050 |

| 0.1 | 1.649 | 1.569 | 1.492 | 1.420 | 1.350 | 1.284 | 1.222 | 1.162 | 1.106 | 1.052 | 1.331 | 0.040 |

| 0.2 | 1.574 | 1.497 | 1.424 | 1.355 | 1.289 | 1.226 | 1.166 | 1.109 | 1.055 | 1.004 | 1.270 | 0.037 |

| 0.3 | 1.513 | 1.439 | 1.369 | 1.302 | 1.238 | 1.178 | 1.121 | 1.066 | 1.014 | 0.964 | 1.220 | 0.034 |

| 0.4 | 1.472 | 1.400 | 1.332 | 1.267 | 1.205 | 1.146 | 1.090 | 1.037 | 0.987 | 0.938 | 1.187 | 0.032 |

| 0.5 | 1.457 | 1.386 | 1.319 | 1.254 | 1.193 | 1.135 | 1.080 | 1.027 | 0.977 | 0.929 | 1.176 | 0.032 |

| 0.6 | 1.472 | 1.400 | 1.332 | 1.267 | 1.205 | 1.146 | 1.090 | 1.037 | 0.987 | 0.938 | 1.187 | 0.032 |

| 0.7 | 1.513 | 1.439 | 1.369 | 1.302 | 1.238 | 1.178 | 1.121 | 1.066 | 1.014 | 0.964 | 1.220 | 0.034 |

| 0.8 | 1.574 | 1.497 | 1.424 | 1.355 | 1.289 | 1.226 | 1.166 | 1.109 | 1.055 | 1.004 | 1.270 | 0.037 |

| 0.9 | 1.649 | 1.569 | 1.492 | 1.420 | 1.350 | 1.284 | 1.222 | 1.162 | 1.106 | 1.052 | 1.331 | 0.040 |

| 1 | 1.733 | 1.649 | 1.568 | 1.492 | 1.419 | 1.350 | 1.284 | 1.221 | 1.162 | 1.105 | 1.398 | 0.045 |

| ω | λ | Expectation | Variance | |||||||||

|---|---|---|---|---|---|---|---|---|---|---|---|---|

| 0.1 | 0.2 | 0.3 | 0.4 | 0.5 | 0.6 | 0.7 | 0.8 | 0.9 | 1 | |||

| ρ = 0.2 τ = 0.6 | ||||||||||||

| 0.1 | 3.885 | 3.462 | 3.086 | 2.750 | 2.451 | 2.185 | 1.947 | 1.735 | 1.547 | 1.378 | 2.443 | 0.708 |

| 0.2 | 2.844 | 2.624 | 2.421 | 2.234 | 2.061 | 1.902 | 1.755 | 1.619 | 1.494 | 1.378 | 2.033 | 0.243 |

| 0.3 | 2.370 | 2.231 | 2.101 | 1.978 | 1.863 | 1.754 | 1.651 | 1.555 | 1.464 | 1.378 | 1.834 | 0.111 |

| 0.4 | 2.082 | 1.989 | 1.900 | 1.815 | 1.733 | 1.656 | 1.581 | 1.511 | 1.443 | 1.378 | 1.709 | 0.056 |

| 0.5 | 1.883 | 1.819 | 1.757 | 1.697 | 1.639 | 1.583 | 1.529 | 1.477 | 1.427 | 1.378 | 1.619 | 0.029 |

| 0.6 | 1.735 | 1.691 | 1.648 | 1.607 | 1.566 | 1.527 | 1.488 | 1.451 | 1.414 | 1.378 | 1.550 | 0.014 |

| 0.7 | 1.618 | 1.590 | 1.562 | 1.534 | 1.507 | 1.480 | 1.454 | 1.428 | 1.403 | 1.378 | 1.496 | 0.007 |

| 0.8 | 1.524 | 1.507 | 1.490 | 1.474 | 1.457 | 1.441 | 1.425 | 1.410 | 1.394 | 1.378 | 1.450 | 0.002 |

| 0.9 | 1.445 | 1.438 | 1.430 | 1.423 | 1.415 | 1.408 | 1.400 | 1.393 | 1.386 | 1.378 | 1.412 | 0.001 |

| 1 | 1.378 | 1.378 | 1.378 | 1.378 | 1.378 | 1.378 | 1.378 | 1.378 | 1.378 | 1.378 | 1.378 | 0.000 |

| ρ = 0.5 τ = 0.6 | ||||||||||||

| 0.1 | 3.576 | 3.187 | 2.841 | 2.532 | 2.257 | 2.011 | 1.792 | 1.597 | 1.424 | 1.269 | 2.249 | 0.600 |

| 0.2 | 2.618 | 2.416 | 2.229 | 2.056 | 1.897 | 1.751 | 1.615 | 1.491 | 1.375 | 1.269 | 1.872 | 0.206 |

| 0.3 | 2.181 | 2.054 | 1.934 | 1.821 | 1.715 | 1.614 | 1.520 | 1.431 | 1.348 | 1.269 | 1.689 | 0.094 |

| 0.4 | 1.917 | 1.831 | 1.749 | 1.670 | 1.596 | 1.524 | 1.456 | 1.391 | 1.328 | 1.269 | 1.573 | 0.047 |

| 0.5 | 1.733 | 1.674 | 1.617 | 1.562 | 1.509 | 1.458 | 1.408 | 1.360 | 1.314 | 1.269 | 1.490 | 0.024 |

| 0.6 | 1.597 | 1.557 | 1.517 | 1.479 | 1.442 | 1.405 | 1.370 | 1.335 | 1.302 | 1.269 | 1.427 | 0.012 |

| 0.7 | 1.490 | 1.464 | 1.438 | 1.412 | 1.387 | 1.363 | 1.339 | 1.315 | 1.292 | 1.269 | 1.377 | 0.006 |

| 0.8 | 1.403 | 1.387 | 1.372 | 1.357 | 1.342 | 1.327 | 1.312 | 1.298 | 1.283 | 1.269 | 1.335 | 0.002 |

| 0.9 | 1.331 | 1.324 | 1.317 | 1.310 | 1.303 | 1.296 | 1.289 | 1.282 | 1.276 | 1.269 | 1.300 | 0.000 |

| 1 | 1.269 | 1.269 | 1.269 | 1.269 | 1.269 | 1.269 | 1.269 | 1.269 | 1.269 | 1.269 | 1.269 | 0.000 |

| ρ = 0.8 τ = 0.6 | ||||||||||||

| 0.1 | 3.373 | 3.006 | 2.679 | 2.388 | 2.128 | 1.897 | 1.690 | 1.506 | 1.343 | 1.197 | 2.121 | 0.534 |

| 0.2 | 2.469 | 2.278 | 2.102 | 1.939 | 1.789 | 1.651 | 1.523 | 1.406 | 1.297 | 1.197 | 1.765 | 0.183 |

| 0.3 | 2.057 | 1.937 | 1.824 | 1.717 | 1.617 | 1.522 | 1.433 | 1.350 | 1.271 | 1.197 | 1.592 | 0.084 |

| 0.4 | 1.807 | 1.726 | 1.649 | 1.575 | 1.505 | 1.437 | 1.373 | 1.311 | 1.253 | 1.197 | 1.483 | 0.042 |

| 0.5 | 1.635 | 1.579 | 1.525 | 1.473 | 1.423 | 1.375 | 1.328 | 1.283 | 1.239 | 1.197 | 1.406 | 0.022 |

| 0.6 | 1.506 | 1.468 | 1.431 | 1.395 | 1.360 | 1.325 | 1.292 | 1.259 | 1.228 | 1.197 | 1.346 | 0.011 |

| 0.7 | 1.405 | 1.380 | 1.356 | 1.332 | 1.308 | 1.285 | 1.262 | 1.240 | 1.218 | 1.197 | 1.298 | 0.005 |

| 0.8 | 1.323 | 1.308 | 1.294 | 1.279 | 1.265 | 1.251 | 1.237 | 1.224 | 1.210 | 1.197 | 1.259 | 0.002 |

| 0.9 | 1.255 | 1.248 | 1.242 | 1.235 | 1.229 | 1.222 | 1.216 | 1.209 | 1.203 | 1.197 | 1.225 | 0.000 |

| 1 | 1.197 | 1.197 | 1.197 | 1.197 | 1.197 | 1.197 | 1.197 | 1.197 | 1.197 | 1.197 | 1.197 | 0.000 |

Disclaimer/Publisher’s Note: The statements, opinions and data contained in all publications are solely those of the individual author(s) and contributor(s) and not of MDPI and/or the editor(s). MDPI and/or the editor(s) disclaim responsibility for any injury to people or property resulting from any ideas, methods, instructions or products referred to in the content. |

© 2023 by the authors. Licensee MDPI, Basel, Switzerland. This article is an open access article distributed under the terms and conditions of the Creative Commons Attribution (CC BY) license (https://creativecommons.org/licenses/by/4.0/).

Share and Cite

Wang, L.; Luo, Z.; Wang, W. Risk Contagion of Local Government Implicit Debt Integrating Complex Network and Multi-Subject Coordination. Sustainability 2023, 15, 15332. https://doi.org/10.3390/su152115332

Wang L, Luo Z, Wang W. Risk Contagion of Local Government Implicit Debt Integrating Complex Network and Multi-Subject Coordination. Sustainability. 2023; 15(21):15332. https://doi.org/10.3390/su152115332

Chicago/Turabian StyleWang, Lei, Zuchun Luo, and Wenyi Wang. 2023. "Risk Contagion of Local Government Implicit Debt Integrating Complex Network and Multi-Subject Coordination" Sustainability 15, no. 21: 15332. https://doi.org/10.3390/su152115332

APA StyleWang, L., Luo, Z., & Wang, W. (2023). Risk Contagion of Local Government Implicit Debt Integrating Complex Network and Multi-Subject Coordination. Sustainability, 15(21), 15332. https://doi.org/10.3390/su152115332