The Impact of Economic Policy Uncertainty on Investment in Real Estate Corporations Based on Sustainable Development: The Mediating Role of House Prices

Abstract

:1. Introduction

2. Literature Review and Hypotheses

2.1. Measurement of Uncertainty

2.2. Economic Policy Uncertainty and Corporate Investment

2.3. Economic Policy Uncertainty and the Investment of Real Estate Corporations

2.4. Economic Policy Uncertainty and House Prices

2.5. Research Hypotheses

3. Materials and Methods

3.1. Data Sources and Processing

3.2. Variables

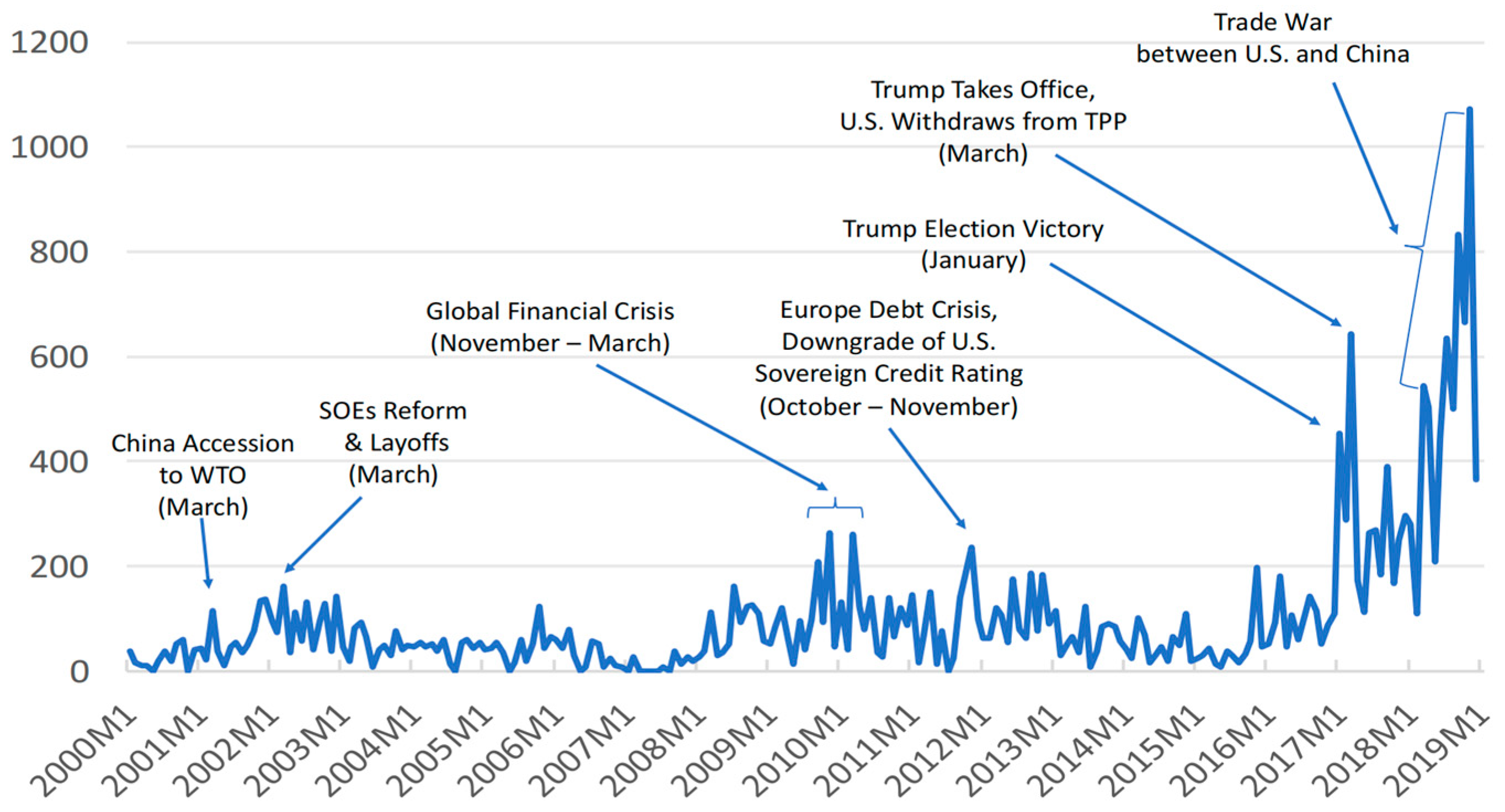

3.2.1. Independent Variable

3.2.2. Dependent Variable

3.2.3. Mediating Variable

3.2.4. Control Variables

3.3. Empirical Models

4. Results

4.1. Descriptive Statistics

4.2. Regression Results

4.3. Robustness Test

5. Discussion

6. Conclusions

Author Contributions

Funding

Institutional Review Board Statement

Informed Consent Statement

Data Availability Statement

Conflicts of Interest

References

- National Bureau of Statistics of the People’s Republic of China. China Statistical Yearbook; China Statistics Press: Beijing, China, 2022.

- Baker, S.R.; Bloom, N.; Davis, S.J.; Terry, S.J. COVID-Induced Economic Uncertainty; National Bureau of Economic Research: Cambridge, MA, USA, 2020. [Google Scholar]

- Cunha, A.M.; Lobão, J. The determinants of real estate prices in a European context: A four-level analysis. J. Eur. Real Estate Res. 2021, 14, 331–348. [Google Scholar] [CrossRef]

- Hu, S.; Gong, D. Economic policy uncertainty, prudential regulation and bank lending. Financ. Res. Lett. 2019, 29, 373–378. [Google Scholar] [CrossRef]

- Jeon, J.H. The impact of Asian economic policy uncertainty: Evidence from Korean housing market. J. Asian Financ. Econ. Bus. (JAFEB) 2018, 5, 43–51. [Google Scholar] [CrossRef]

- Li, L.; Wu, X. Housing price and intergenerational co-residence in urban China. J. Hous. Econ. 2019, 45, 101596. [Google Scholar] [CrossRef]

- Liu, J.; Siqun, Y.; Khan, Z. The demand for money in China: A housing price perspective. Appl. Econ. Lett. 2022, 29, 676–681. [Google Scholar] [CrossRef]

- Huang, Y.; Luk, P. Measuring economic policy uncertainty in China. China Econ. Rev. 2020, 59, 101367. [Google Scholar] [CrossRef]

- Gulen, H.; Ion, M. Policy uncertainty and corporate investment. Rev. Financ. Stud. 2016, 29, 523–564. [Google Scholar] [CrossRef]

- El-Montasser, G.; Ajmi, A.N.; Chang, T.; Simo-Kengne, B.D.; André, C.; Gupta, R. Cross-country evidence on the causal relationship between policy uncertainty and housing prices. J. Hous. Res. 2016, 25, 195–211. [Google Scholar] [CrossRef]

- Wang, J.; Lu, X.; He, F.; Ma, F. Which popular predictor is more useful to forecast international stock markets during the coronavirus pandemic: VIX vs. EPU? Int. Rev. Financ. Anal. 2020, 72, 101596. [Google Scholar] [CrossRef]

- Baker, S.R.; Bloom, N.; Davis, S.J. Measuring economic policy uncertainty. Q. J. Econ. 2016, 131, 1593–1636. [Google Scholar] [CrossRef]

- Al-Thaqeb, S.A.; Algharabali, B.G. Economic policy uncertainty: A literature review. J. Econ. Asymmetries 2019, 20, e00133. [Google Scholar] [CrossRef]

- Economic Policy Uncertainty. Available online: https://www.policyuncertainty.com/ (accessed on 1 January 2012).

- Al-Thaqeb, S.A.; Algharabali, B.G.; Alabdulghafour, K.T. The pandemic and economic policy uncertainty. Int. J. Financ. Econ. 2022, 27, 2784–2794. [Google Scholar] [CrossRef]

- Kang, W.; Lee, K.; Ratti, R.A. Economic policy uncertainty and firm-level investment. J. Macroecon. 2014, 39, 42–53. [Google Scholar] [CrossRef]

- Rao, P.; Yue, H.; Jiang, G. Research on economic policy uncertainty and corporate investment behaviour. World Econ. 2017, 40, 27–51. [Google Scholar]

- Liu, G.; Duan, Y.; Liu, Y. Economic policy uncertainty, asset reversibility and fixed asset investment. Econ. Res. 2019, 54, 53–70. [Google Scholar]

- Hu, C.; Chen, X. Economic policy uncertainty, property market and macroeconomic fluctuations—A study of regional differences based on GVAR model. Explor. Econ. Issues. 2019, 8, 11. [Google Scholar]

- Li, X. Economic Policy Uncertainty and Corporate Cash Policy: International Evidence. J. Account. Public Policy 2019, 38, 106694. [Google Scholar] [CrossRef]

- Wang, H.; Li, Q.; Xing, F. Economic policy uncertainty, cash holding level and its market value. Financ. Res. 2014, 9, 57–72. [Google Scholar]

- Mang, Q.B.; Shi, Q. The impact of macroeconomic policy uncertainty on corporate R&D: A theoretical and empirical study. World Econ. 2017, 40, 77–100. [Google Scholar]

- Chan, X.J. Research on house price volatility, monetary policy and macroprudential policy-based on DSGE model. Contemp. Econ. 2020, 10, 16–19. [Google Scholar]

- Chen, S.Y.; Wang, X.X. Does economic policy uncertainty inhibit real estate corporate investment behaviour?—Analysis based on the data of real estate enterprises in Shanghai and Shenzhen from 2003–2018. Jianghan Forum 2020, 6, 59–68. [Google Scholar]

- Trigeorgis, L.; Reuer, J.J. Real options theory in strategic management. Strateg. Manag. J. 2017, 38, 42–63. [Google Scholar] [CrossRef]

- Beck, B. Policing gentrification: Stops and low–level arrests during demographic change and real estate reinvestment. City Community 2020, 19, 245–272. [Google Scholar] [CrossRef]

- Wan, Y.; Jia, S.H. Uncertainty, real options and government land supply decisions: Evidence from Hangzhou. World Econ. 2012, 35, 125–145. [Google Scholar]

- Christou, C.; Cunado, J.; Gupta, R.; Hassapis, C. Economic policy uncertainty and stock market returns in PacificRim countries: Evidence based on a Bayesian panel VAR model. J. Multinatl. Financ. Manag. 2017, 40, 92–102. [Google Scholar] [CrossRef]

- Chen, G.J.; Wang, S.Q. How economic policy uncertainty affects corporate investment behaviour. Financ. Trade Econ. 2016, 37, 17. [Google Scholar]

- André, C.; Bonga-Bonga, L.; Gupta, R.; Muteba Mwamba, J.W. Economic policy uncertainty, US real housing returns and their volatility: A nonparametric approach. J. Real Estate Res. 2017, 39, 493–514. [Google Scholar] [CrossRef]

- Antonakakis, N.; Gupta, R.; André, C. Dynamic co-movements between economic policy uncertainty and housing market returns. J. Real Estate Portf. Manag. 2015, 21, 53–60. [Google Scholar] [CrossRef]

- Wang, S.; Zeng, Y.; Yao, J.; Zhang, H. Economic policy uncertainty, monetary policy, and housing price in China. J. Appl. Econ. 2020, 23, 235–252. [Google Scholar] [CrossRef]

- Alola, A.A.; Uzuner, G. The housing market and agricultural land dynamics: Appraising with Economic Policy Uncertainty Index. Int. J. Financ. Econ. 2020, 25, 274–285. [Google Scholar] [CrossRef]

- Xia, T.; Yao, C.X.; Geng, J.B. Dynamic and frequency-domain spillover among economic policy uncertainty, stock and housing markets in China. Int. Rev. Financ. Anal. 2020, 67, 101427. [Google Scholar] [CrossRef]

- Balcilar, M.; Roubaud, D.; Uzuner, G.; Wohar, M.E. Housing sector and economic policy uncertainty: A GMM panel VAR approach. Int. Rev. Econ. Financ. 2021, 76, 114–126. [Google Scholar] [CrossRef]

- Zhang, H.; Li, C.F.; Deng, B.J. Policy uncertainty, macro shocks and house price volatility-an empirical analysis based on LSTVAR model. Financ. Res. 2015, 424, 32–47. [Google Scholar]

- China Stock Market & Accounting Research Database. Available online: https://www.gtarsc.com/ (accessed on 1 January 2012).

- Chaney, T.; Sraer, D.; Thesmar, D. The collateral channel: How real estate shocks affect corporate investment. Am. Econ. Rev. 2012, 102, 2381–2409. [Google Scholar] [CrossRef]

- Duca, J.V.; Muellbauer, J.; Murphy, A. What drives house price cycles? International experience and policy issues. J. Econ. Lit. 2021, 59, 773–864. [Google Scholar] [CrossRef]

- Wind Economics Database. Available online: https://www.wind.com.cn/ (accessed on 1 January 2012).

- Bharadwaj, A.S.; Bharadwaj, S.G.; Konsynski, B.R. Information technology effects on firm performance as measured by Tobin’s q. Manag. Sci. 1999, 45, 1008–1024. [Google Scholar] [CrossRef]

- Huang, Y.T.; Pan, W.C. Hypothesis test of mediation effect in causal mediation model with high-dimensional continuous mediators. Biometrics 2016, 72, 402–413. [Google Scholar] [CrossRef]

- Wen, Z.; Ye, B. Analyses of mediating effects: The development of methods and models. Adv. Psychol. Sci. 2014, 22, 731. [Google Scholar] [CrossRef]

- O’brien, R.M. A caution regarding rules of thumb for variance inflation factors. Qual. Quant. 2007, 41, 673–690. [Google Scholar] [CrossRef]

- Akinwande, M.O.; Dikko, H.G.; Samson, A. Variance inflation factor: As a condition for the inclusion of suppressor variable(s) in regression analysis. Open J. Stat. 2015, 5, 754. [Google Scholar] [CrossRef]

- Hsiao, C. Panel data analysis—Advantages and challenges. Test 2007, 16, 1–22. [Google Scholar] [CrossRef]

- Yu, Z.; Guindani, M.; Grieco, S.F.; Chen, L.; Holmes, T.C.; Xu, X. Beyond t test and ANOVA: Applications of mixed-effects models for more rigorous statistical analysis in neuroscience research. Neuron 2022, 110, 21–35. [Google Scholar] [CrossRef]

- Kumar, S.; Attri, S.D.; Singh, K.K. Comparison of Lasso and stepwise regression technique for wheat yield prediction. J. Agrometeorol. 2019, 21, 188–192. [Google Scholar] [CrossRef]

- Jawad, M.; Hone, T.; Vamos, E.P.; Roderick, P.; Sullivan, R.; Millett, C. Estimating indirect mortality impacts of armed conflict in civilian populations: Panel regression analyses of 193 countries, 1990–2017. BMC Med. 2020, 18, 266. [Google Scholar] [CrossRef]

- Chicco, D.; Warrens, M.J.; Jurman, G. The coefficient of determination R-squared is more informative than SMAPE, MAE, MAPE, MSE and RMSE in regression analysis evaluation. PeerJ Comput. Sci. 2021, 7, e623. [Google Scholar] [CrossRef]

- Liu, H.; Yi, X.; Yin, L. The impact of operating flexibility on firms’ performance during the COVID-19 outbreak: Evidence from China. Financ. Res. Lett. 2021, 38, 101808. [Google Scholar] [CrossRef]

- Busenbark, J.R.; Yoon, H.; Gamache, D.L.; Withers, M.C. Omitted variable bias: Examining management research with the impact threshold of a confounding variable (ITCV). J. Manag. 2022, 48, 17–48. [Google Scholar] [CrossRef]

- Liu, C.; Zheng, Y.; Zhao, Q.; Wang, C. Financial stability and real estate price fluctuation in China. Phys. A Stat. Mech. Its Appl. 2020, 540, 122980. [Google Scholar] [CrossRef]

- Ling, D.C.; Wang, C.; Zhou, T. A first look at the impact of COVID-19 on commercial real estate prices: Asset-level evidence. Rev. Asset Pricing Stud. 2020, 10, 669–704. [Google Scholar] [CrossRef]

- Su, C.W.; Wang, X.Q.; Tao, R.; Chang, H.L. Does money supply drive housing prices in China? Int. Rev. Econ. Financ. 2019, 60, 85–94. [Google Scholar] [CrossRef]

- Mokhtar, M.; Yusoff, S.; Samsuddin, M.D. Modelling an economic relationship for macroeconomic determinants of Malaysian housing prices. Adv. Bus. Res. Int. J. 2021, 7, 242–251. [Google Scholar]

- Lin Lee, C. Housing price volatility and its determinants. Int. J. Hous. Mark. Anal. 2009, 2, 293–308. [Google Scholar] [CrossRef]

- Baldi, G.; Staehr, K. The European debt crisis and fiscal reactions in Europe 2000–2014. Int. Econ. Econ. Policy 2016, 13, 297–317. [Google Scholar] [CrossRef]

- Wan, J. Non-performing loans and housing prices in China. Int. Rev. Econ. Financ. 2018, 57, 26–42. [Google Scholar] [CrossRef]

- Justiniano, A.; Primiceri, G.E.; Tambalotti, A. Credit supply and the housing boom. J. Political Econ. 2019, 127, 1317–1350. [Google Scholar] [CrossRef]

- Bernanke, B.S.; Kiley, M.T.; Roberts, J.M. Monetary policy strategies for a low-rate environment. In AEA Papers and Proceedings; American Economic Association: Nashville, TN, USA, 2019; Volume 109, pp. 421–426. [Google Scholar]

- China’s Central Economic Work Conference. 2022. Available online: https://www.gov.cn/xinwen/2022-12/18/content_5732562.htm (accessed on 18 December 2022).

- Key Tasks for New Urbanisation and Integrated Urban and Rural Development in 2022, China Development and Reform Commission. 2023. Available online: https://www.ndrc.gov.cn/xwdt/ztzl/xxczhjs/ghzc/202203/t20220317_1319461.html (accessed on 17 March 2022).

| Variables | Definition | Measurement |

|---|---|---|

| INDEPENDENT VARIABLE | ||

| EPU | Economic policy uncertainty | Measured using the Baker index and quarterised |

| DEPENDENTVARIABLE | ||

| INV | Real estate corporate investment | The level of corporate investment = Cash paid for fixed assets, intangible assets and other long-term assets/Total assets for the period |

| MEDIATING VARIABLE | ||

| HP | Housing price | Average housing price index (HPI) |

| CONTROL VARIABLES | ||

| SIZE | Company size | The natural logarithm of a company’s total assets |

| LEV | Asset–liability ratio | Total liabilities of the enterprise/total assets at the end of the period |

| CASHFLOW | Cash flow ratio | Net cash flow/total assets at the beginning of the period |

| AGE | Company age | Take the natural logarithm after adding 1 to the year the company was established |

| ROA | Rate of return on total assets | Ratio of total net profit of the enterprise to the average total assets of the enterprise |

| TOBIN-Q | Tobin’s Q value | (Market Value of Equity + Market Value of Net Debt)/Total Assets |

| ATO | Total assets turnover | Net sales revenue of enterprises/average total assets |

| TOP1 | Shareholding ratio of the largest shareholder | The shareholding ratio of a company’s largest shareholder at the end of the year; if it is less than 20%, it is assigned a value of 0 |

| VarName | Obs | Mean | SD | Min | Median | Max |

|---|---|---|---|---|---|---|

| INV | 554 | −3.774 | 1.467 | −7.403 | −3.728 | −0.981 |

| EPU | 554 | 5.772 | 0.679 | 4.660 | 5.853 | 6.660 |

| Size | 554 | 23.235 | 1.486 | 19.918 | 23.111 | 26.452 |

| Lev | 554 | 0.634 | 0.188 | 0.135 | 0.657 | 0.917 |

| Cashflow | 554 | 0.009 | 0.107 | −0.414 | 0.010 | 0.310 |

| Age | 554 | 2.572 | 0.649 | 1.099 | 2.833 | 3.332 |

| ROA | 554 | 0.033 | 0.049 | −0.229 | 0.036 | 0.148 |

| Tobin-Q | 554 | 0.870 | 0.940 | 0.000 | 0.555 | 4.952 |

| ATO | 554 | 0.339 | 0.223 | 0.057 | 0.284 | 1.648 |

| Top1 | 554 | 0.350 | 0.160 | 0.081 | 0.345 | 0.758 |

| HP | 554 | 8.971 | 0.192 | 8.664 | 8.974 | 9.224 |

| VIF | 1/VIF | |

|---|---|---|

| Size | 2.439 | 0.41 |

| Lev | 2.314 | 0.432 |

| Tobin-Q | 1.892 | 0.529 |

| Age | 1.507 | 0.664 |

| ATO | 1.497 | 0.668 |

| ROA | 1.215 | 0.823 |

| Top1 | 1.188 | 0.841 |

| EPU | 1.169 | 0.856 |

| Cashflow | 1.059 | 0.945 |

| MeanVIF | 1.587 |

| Hausman Test | F-Test | ||||

|---|---|---|---|---|---|

| chi2 statistic | p-value | result | chi2 statistic | p-value | result |

| 20.88 | 0.013 | reject | 23.13 | 0.000 | reject |

| (1) | (2) | (3) | (4) | (5) | (6) | (7) | (8) | (9) | |

|---|---|---|---|---|---|---|---|---|---|

| Variables | Invest | Invest | Invest | Invest | Invest | Invest | Invest | Invest | Invest |

| EPU | 0.015 | 0.299 *** | 0.217 *** | 0.205 *** | 0.161 ** | 0.163 ** | 0.181 ** | 0.181 ** | 0.183 ** |

| (0.28) | (5.17) | (3.56) | (3.36) | (2.22) | (2.28) | (2.52) | (2.51) | (2.45) | |

| Size | −0.501 *** | −0.358 *** | −0.356 *** | −0.381 *** | −0.325 *** | −0.303 *** | −0.296 *** | −0.296 *** | |

| (−7.12) | (−4.34) | (−4.33) | (−4.51) | (−3.66) | (−3.34) | (−3.22) | (−3.20) | ||

| Lev | −1.290 *** | −1.271 *** | −1.251 *** | −1.644 *** | −1.498 *** | −1.507 *** | −1.524 *** | ||

| (−3.58) | (−3.53) | (−3.50) | (−4.04) | (−3.76) | (−3.79) | (−3.77) | |||

| Cashflow | 0.376 | 0.399 | 0.368 | 0.344 | 0.338 | 0.342 | |||

| (1.23) | (1.29) | (1.21) | (1.13) | (1.11) | (1.13) | ||||

| Age | 0.234 | 0.003 | −0.014 | −0.004 | 0.008 | ||||

| (1.30) | (0.02) | (−0.07) | (−0.02) | (0.04) | |||||

| ROA | −2.718 *** | −2.746 *** | −2.870 *** | −2.890 *** | |||||

| (−3.59) | (−3.63) | (−3.69) | (−3.68) | ||||||

| Tobin-Q | 0.091 * | 0.091 * | 0.093 * | ||||||

| (1.78) | (1.78) | (1.76) | |||||||

| ATO | 0.154 | 0.160 | |||||||

| (0.73) | (0.74) | ||||||||

| Top1 | 0.138 | ||||||||

| (0.26) | |||||||||

| Constant | −3.860 *** | 6.148 *** | 4.100 *** | 4.124 *** | 4.346 *** | 3.962 ** | 3.218 * | 2.996 * | 2.908 |

| (−12.13) | (4.14) | (2.59) | (2.62) | (2.75) | (2.51) | (1.91) | (1.71) | (1.60) | |

| Observations | 549 | 549 | 549 | 549 | 549 | 549 | 549 | 549 | 549 |

| R-squared | 0.798 | 0.826 | 0.832 | 0.833 | 0.833 | 0.838 | 0.839 | 0.839 | 0.839 |

| Company | YES | YES | YES | YES | YES | YES | YES | YES | YES |

| (1) | (2) | |

|---|---|---|

| Variables | HP(House_Price) | HP(House_Price) |

| EPU | 0.241 *** | 0.127 *** |

| (59.44) | (20.33) | |

| Size | 0.060 *** | |

| (6.97) | ||

| Lev | −0.170 *** | |

| (−3.76) | ||

| Cashflow | 0.016 | |

| (0.52) | ||

| Age | 0.305 *** | |

| (13.51) | ||

| ROA | −0.182 ** | |

| (−2.05) | ||

| Tobin-Q | −0.000 | |

| (−0.02) | ||

| ATO | 0.044 | |

| (1.64) | ||

| Top1 | −0.100 ** | |

| (−2.13) | ||

| Constant | 7.583 *** | 6.198 *** |

| (322.46) | (38.02) | |

| Observations | 549 | 549 |

| R-squared | 0.796 | 0.902 |

| Company | YES | YES |

| Exclusion of COVID-19 Effects | |

|---|---|

| Variables | Invest |

| EPU | 0.248 *** |

| (2.96) | |

| Size | −0.249 ** |

| (−2.30) | |

| Lev | −1.435 *** |

| (−3.36) | |

| Cashflow | 0.170 |

| (0.52) | |

| Age | −0.294 |

| (−1.18) | |

| ROA | −2.254 ** |

| (−2.24) | |

| Tobin-Q | 0.056 |

| (0.94) | |

| ATO | 0.438 * |

| (1.75) | |

| Top1 | 0.253 |

| (0.45) | |

| Constant | 2.081 |

| (0.98) | |

| Observations | 417 |

| R-squared | 0.855 |

| company | YES |

| First-Order Lag | Second-Order Lag | |

|---|---|---|

| Variables | Invest | Invest |

| L.EPU | 0.226 *** | |

| (2.73) | ||

| L2.EPU | 0.174 ** | |

| (2.29) | ||

| Size | −0.377 *** | −0.451 *** |

| (−3.64) | (−3.70) | |

| Lev | −1.627 *** | −1.220 ** |

| (−3.56) | (−2.31) | |

| Cashflow | 0.638 * | 0.213 |

| (1.77) | (0.61) | |

| Age | −0.035 | 0.163 |

| (−0.13) | (0.44) | |

| ROA | −2.130 *** | −1.405 |

| (−2.60) | (−1.57) | |

| Tobin-Q | 0.063 | 0.040 |

| (0.97) | (0.59) | |

| ATO | −0.188 | −0.204 |

| (−0.70) | (−0.92) | |

| Top1 | 0.238 | −0.480 |

| (0.39) | (−0.86) | |

| Constant | 4.836 ** | 6.417 *** |

| (2.32) | (2.70) | |

| Observations | 455 | 379 |

| R-squared | 0.853 | 0.873 |

| Company | YES | YES |

Disclaimer/Publisher’s Note: The statements, opinions and data contained in all publications are solely those of the individual author(s) and contributor(s) and not of MDPI and/or the editor(s). MDPI and/or the editor(s) disclaim responsibility for any injury to people or property resulting from any ideas, methods, instructions or products referred to in the content. |

© 2023 by the authors. Licensee MDPI, Basel, Switzerland. This article is an open access article distributed under the terms and conditions of the Creative Commons Attribution (CC BY) license (https://creativecommons.org/licenses/by/4.0/).

Share and Cite

Qu, Y.; Md Kassim, A.A. The Impact of Economic Policy Uncertainty on Investment in Real Estate Corporations Based on Sustainable Development: The Mediating Role of House Prices. Sustainability 2023, 15, 15318. https://doi.org/10.3390/su152115318

Qu Y, Md Kassim AA. The Impact of Economic Policy Uncertainty on Investment in Real Estate Corporations Based on Sustainable Development: The Mediating Role of House Prices. Sustainability. 2023; 15(21):15318. https://doi.org/10.3390/su152115318

Chicago/Turabian StyleQu, Yuanyuan, and Aza Azlina Md Kassim. 2023. "The Impact of Economic Policy Uncertainty on Investment in Real Estate Corporations Based on Sustainable Development: The Mediating Role of House Prices" Sustainability 15, no. 21: 15318. https://doi.org/10.3390/su152115318

APA StyleQu, Y., & Md Kassim, A. A. (2023). The Impact of Economic Policy Uncertainty on Investment in Real Estate Corporations Based on Sustainable Development: The Mediating Role of House Prices. Sustainability, 15(21), 15318. https://doi.org/10.3390/su152115318