The Impact of Chief Sustainability Officers on Environmental Performance of Korean Listed Companies: The Mediating Role of Corporate Sustainability Practices

Abstract

:1. Introduction

2. Literature Review

2.1. Chief Sustainability Officer & Sustainability Management Team

2.2. Corporate Sustainability Practices

2.3. Environmental Performance

2.4. Related Theories and Hypothesis Development

2.4.1. Upper Echelons Theory

2.4.2. Legitimacy Theory

2.5. Hypothesis Development

2.5.1. CSO and Environmental Performance

2.5.2. CSO and Corporate Sustainability Practices

2.5.3. Corporate Sustainability Practices and Environmental Performance

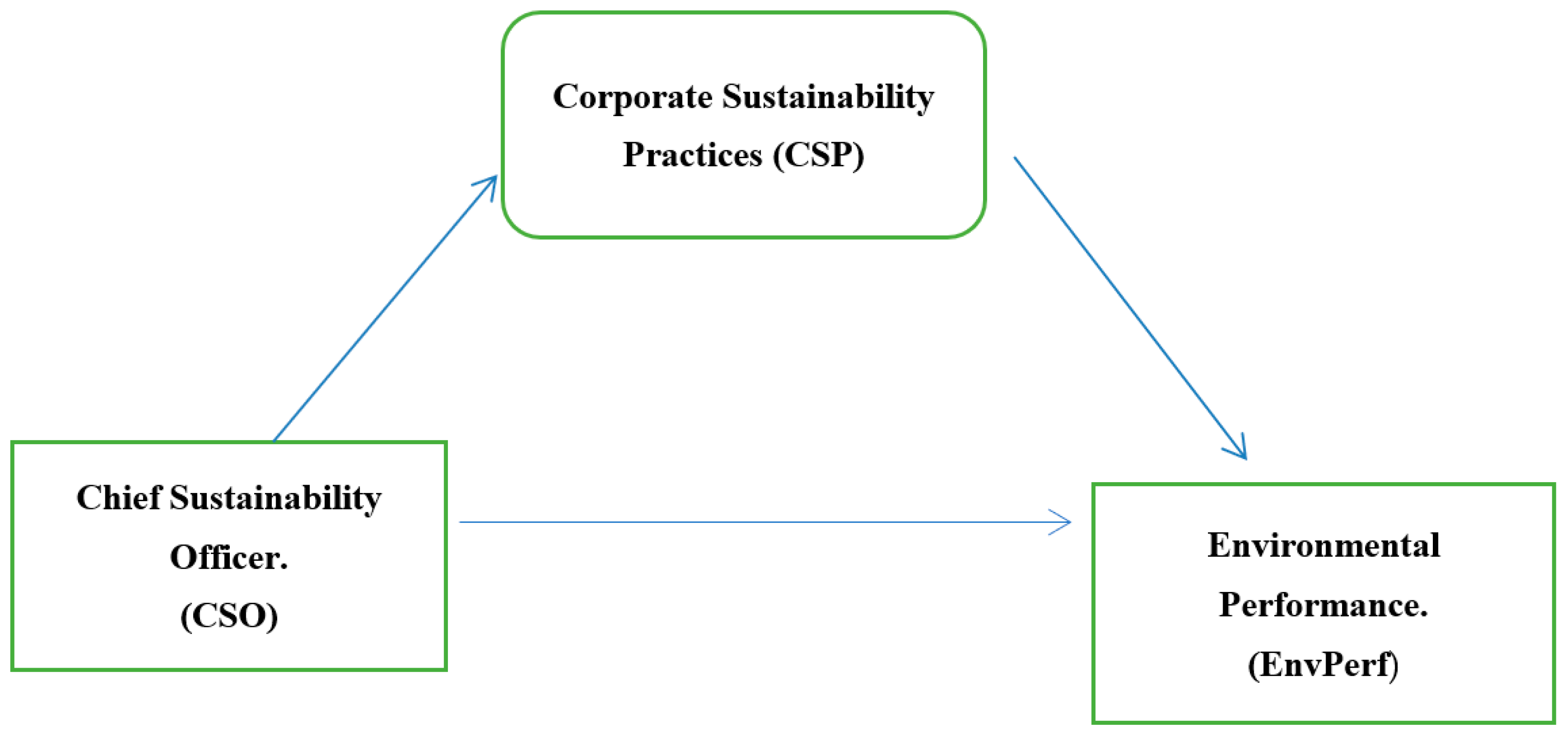

2.5.4. CSO and Environmental Performance: The Mediating Effect of CSP

3. Samples and Methodology

3.1. Samples

3.2. Measurement of Variables

3.2.1. Dependent Variable

3.2.2. Independent Variables

3.2.3. Mediating Variable

3.2.4. Control Variables

3.3. Model Specification

4. Results

Descriptive Analysis

5. Theoretical and Empirical Implications

6. Conclusions

Author Contributions

Funding

Data Availability Statement

Conflicts of Interest

Appendix A. The Constructs or Items Used for Measuring the Variables for This Research

| Variables | Construct/Items |

| Environmental Performance (EnvPerf) |

|

| Chief Sustainability Officer & Team |

|

| Corporate Sustainability Practices |

|

References

- Strand, R. The Chief of corporate social responsibility: A study of its presence in top management teams. J. Bus. Ethics 2013, 112, 721–734. [Google Scholar] [CrossRef]

- Wiengarten, F.; Lo, C.K.Y.; Lam, J.Y.K. How does sustainability leadership affect firm performance? The choices associated with appointing a chief officer of corporate social responsibility. J. Bus. Ethics 2017, 140, 439–453. [Google Scholar] [CrossRef]

- Deutsch, C.H. Companies Giving Green an Office. The New York Times. 2007. Available online: https://www.nytimes.com/2007/07/03/business/03sustain.html (accessed on 3 July 2007).

- Henshaw, T.; Woods, J. The emergence of the chief sustainability officer. ACRE. Available online: http://assets.acre.com/white_papers/The_Emergence_of_the_CSO.pdf (accessed on 18 August 2017).

- Eliopoulos, T.; Ailman, C.; Mitchem, K.; Edkins, M.; Guillot, J. The next wave of ESG integration: Lessons from institutional investors. J. Appl. Corp. Financ. 2017, 29, 32–43. [Google Scholar]

- Lamy, B.; Hanson, D.; Lyons, T.; Bender, J.; Bertocci, B. The analyst point of view on ESG. In Proceedings of the SASB 2016 symposium, New York, NY, USA, 1 December 2016. [Google Scholar]

- Forbes. What Do Chief Sustainability Officers Do? 2014. Available online: http://www.forbes.com/sites/hbsworkingknowledge/2014/10/8/what-do-chief-sustainability-officers-do/#40a446dc1a96 (accessed on 20 April 2023).

- Miller, K.P.; Serafeim, G. Chief Sustainability Officers: Who Are They and What Do They Do? Working Paper; Harvard Business School: Cambridge, MA, USA, 2014. [Google Scholar]

- Strand, R. Strategic leadership of corporate sustainability. J. Bus. Ethics 2014, 123, 687–706. [Google Scholar] [CrossRef]

- Berman, S.L.; Wicks, A.C.; Kotha, S.; Jones, T.M. Does stakeholder orientation matter? The relationship between stakeholder management models and firm financial performance. Acad. Manag. J. 1999, 42, 488–506. [Google Scholar] [CrossRef]

- Fu, R.; Tang, Y.; Chen, G. Chief sustainability officers and corporate social (Ir) responsibility. Strateg. Manag. J. 2020, 41, 656–680. [Google Scholar] [CrossRef]

- Kang, J. Unobservable CEO characteristics and CEO compensation as correlated determinants of CSP. Bus. Soc. 2015, 56, 419–453. [Google Scholar] [CrossRef]

- Risi, D.; Wickert, C. Reconsidering the “Symmetry” between institutionalization and professionalization: The case of corporate social responsibility managers. J. Manag. Stud. 2017, 54, 613–646. [Google Scholar] [CrossRef]

- Thun, T.; Zulch, H. The effect of chief sustainability officers on sustainability reporting—A management perspective. J. Bus. Strag. Environ. 2023, 32, 2093–2110. [Google Scholar] [CrossRef]

- Al-Tuwaijri, S.A.; Christensen, T.E.; Hughes, K.E., II. The relations among environmental disclosure, environmental performance, and economic performance: A simultaneous equations approach. Account. Organ. Soc. 2004, 29, 447–471. [Google Scholar] [CrossRef]

- Mallin, C.; Michelon, G.; Raggi, D. Monitoring intensity and stakeholders’ orientation: How does governance affect social and environmental disclosure? J. Bus. Ethics 2013, 114, 29–43. [Google Scholar] [CrossRef]

- Rodrigue, M.; Magan, M.; Cho, C.H. Is environmental governance substantive or symbolic? An empirical investigation. J. Bus. Ethics 2013, 114, 107–129. [Google Scholar] [CrossRef]

- Berrone, P.; Gomez-Mejia, L.R. Environmental performance and executive compensation: An integrated agency-institutional perspective. Acad. Manag. J. 2009, 52, 103–126. [Google Scholar] [CrossRef]

- Mahoney, L.S.; Thorn, L. An examination of the structure of executive compensation and corporate social responsibility: A Canadian investigation. J. Bus. Ethics 2006, 69, 149–162. [Google Scholar] [CrossRef]

- Matos, S.; Silvestre, B.S. Managing stakeholder’s relations when developing sustainable business models: The case of the Brazilian energy sector. J. Clean. Prod. 2013, 45, 61–73. [Google Scholar] [CrossRef]

- Cho, T.S.; Hambrick, D.C. Attention as the mediator between top management team characteristics and strategic change: The case of airline deregulation. Organ. Sci. 2006, 17, 453–469. [Google Scholar] [CrossRef]

- Matten, D.; Moon, J. “Implicit” and “explicit” CSR: A conceptual framework for a comparative understanding of corporate social responsibility. Acad. Manag. Rev. 2008, 33, 404–424. [Google Scholar] [CrossRef]

- Montiel, I. Corporate social responsibility and corporate sustainability: Separate pasts, common futures. Organ. Environ. 2008, 21, 245–269. [Google Scholar] [CrossRef]

- Peters, G.F.; Romi, A.M.; Sanchez, J.M. The influence of corporate sustainability officers on performance. J. Bus. Ethics 2019, 159, 1065–1087. [Google Scholar] [CrossRef]

- Walls, J.L.; Berrone, P.; Phan, P.H. Corporate governance and environmental performance: Is there really a link? Strategy Manag. J. 2012, 33, 885–913. [Google Scholar] [CrossRef]

- Greening, D.W.; Gray, B. Testing a model of organizational response to social and political issues. Acad. Manag. J. 1994, 37, 467–498. [Google Scholar] [CrossRef]

- Hussain, N.; Rigoni, U.; Orij, R.P. Corporate governance and sustainability performance: Analysis of triple bottom line performance. J. Bus. Ethics 2016, 149, 411–432. [Google Scholar] [CrossRef]

- Carroll, A.B. Corporate social responsibility (CSR) and corporate social performance (CSP). In The SAGE Encyclopedia of Business Ethics and Society; SAGE Publications, Inc.: Thousand Oaks, CA, USA, 2018; pp. 746–754. [Google Scholar]

- Lantos, G.P. The boundaries of strategic corporate social responsibility. J. Consum. Mark. 2001, 18, 595–632. [Google Scholar] [CrossRef]

- Carroll, A.B.; Shabana, K.M. The business case for corporate social responsibility: A review of concepts, research and practice. Int. J. Manag. Rev. 2010, 12, 85–105. [Google Scholar] [CrossRef]

- WCED. Our Common Future; Oxford University Press: Oxford, UK, 1987. [Google Scholar]

- Griffiths, A.; Dunphy, D.; Benn, S. Corporate sustainability. In New Horizons in Research on Sustainable Organizations; Greenleaf Pub.: Sheffield, UK, 2018; pp. 168–186. [Google Scholar] [CrossRef]

- Adams, M.; Thornton, B.; Sepehri, M. The impact of the pursuit of sustainability on the financial performance of the firm. J. Sustain. Green Bus. 2012, 1, 14. [Google Scholar]

- Kilic, M.; Kuzey, C. Factors influencing sustainability reporting: Evidence from Turkey. SSRN Electron. J. 2017, 139–175. [Google Scholar] [CrossRef]

- Klassen, R.D.; McLaughlin, C.P. The impact of environmental management on firm performance. Manag. Sci. 1996, 42, 1199–1214. [Google Scholar] [CrossRef]

- Aragón-Correa, J.A.; Hurtado-Torres, N.; Sharma, S.; Garcia-Morales, V.J. Environmental strategy and performance in small firms: A resource-based perspective. J. Environ. Manag. 2008, 86, 88–103. [Google Scholar] [CrossRef]

- Wood, D.J. Corporate social performance revisited. Acad. Manag. Rev. 1991, 16, 691–718. [Google Scholar] [CrossRef]

- Hart, S.L. A natural-resource-based view of the firm. Acad. Manag. Rev. 1995, 20, 986–1014. [Google Scholar] [CrossRef]

- Hart, S.L.; Ahuja, G. Does it pay to be green? An empirical examination of the relationship between pollution prevention and firm performance. Bus. Strategy Environ. 1996, 5, 30–37. [Google Scholar] [CrossRef]

- Bansal, P.; Clelland, I. Talking trash: Legitimacy, impression management and unsystematic risk in the context of the natural environment. Acad. Manag. J. 2004, 47, 93–103. [Google Scholar] [CrossRef]

- Porter, M.E.; Kramer, M.R. Strategy and society: The link between competitive advantage and corporate social responsibility. Harv. Bus. Rev. 2006, 84, 78–92. [Google Scholar] [PubMed]

- Hambrick, D.C.; Mason, P.A. Upper echelons. The organization as a reflection of its top managers. Acad. Manag. Rev. 1984, 9, 193–296. [Google Scholar] [CrossRef]

- Carpenter, M.A.; Geletkanycz, M.A.; Sanders, W.G. Upper echelon research revisited: Antecedents, elements and consequences of top management team composition. J. Manag. 2004, 30, 749–778. [Google Scholar] [CrossRef]

- Barron, J.M.; Chulkov, D.V.; Waddle, G.R. Top management team turnover, CEO succession type and strategic change. J. Bus. Res. 2011, 64, 904–910. [Google Scholar] [CrossRef]

- Zhang, Y. The presence of a separate COO/president and its impact on strategic change and CEO dismissal. Strateg. Manag. J. 2006, 27, 283–300. [Google Scholar] [CrossRef]

- Mazutis, D. Much ado about nothing: The glacial pace of CSR implementation in practice. In Corporate Social Responsibility; James, W., David, M.W., Eds.; Emerald Publishing Limited: Bingley, UK, 2018; pp. 177–243. [Google Scholar]

- Nath, P.; Mahajan, V. Chief marketing officers: A study of their presence in firms top management team. J. Mark. 2008, 72, 65–81. [Google Scholar] [CrossRef]

- Zhasmina, T.; Natalie, S.; Anton, I. Examining the Role of Top management in Corporate Sustainability: Does Supply Chain Position Matter? Sustainability 2020, 12, 7518. [Google Scholar]

- Guthrie, J.; Parker, L.D. Corporate social reporting: A rebuttal of legitimacy theory. Account. Bus. Res. 2006, 19, 343–352. [Google Scholar] [CrossRef]

- Deegan, C. Introduction: The legitimizing effect of Social and environmental disclosures—A theoretical foundation. Account. Audit. Account. J. 2002, 15, 282–311. [Google Scholar] [CrossRef]

- Hanjani, A.; Kusumadewi, R.K.A. Environmental performance and financial performance: Empirical evidence from Indonesian companies. Corp. Soc. Responsib. Environ. Manag. 2023, 30, 1508–1513. [Google Scholar] [CrossRef]

- Patten, D.M. Seeking legitimacy. Sustain. Account. Manag. Policy J. 2019, 11, 1009–1021. [Google Scholar] [CrossRef]

- Shocker, A.D.; Sethi, S. PAn approach to incorporating societal preferences in developing corporate action strategies. Calif. Manag. Rev. 1973, 15, 97–105. [Google Scholar] [CrossRef]

- Dyllick, T.; Muff, K. Clarifying the meaning of suitable business: Introducing a typology from business-as-usual to true business sustainability. Organ. Environ. 2016, 29, 156–174. [Google Scholar] [CrossRef]

- Kanashiro, P.; Rivera, J. Do chief sustainability officers make companies green? The moderating role of regulatory pressures. J. Bus. Ethics 2017, 155, 687–701. [Google Scholar] [CrossRef]

- Burke, J.J.; Hoitash, R.; Hoitash, U. The heterogenity of board-level sustainability committees and corporate social performance. J. Bus. Ethics 2019, 154, 1161–1186. [Google Scholar] [CrossRef]

- Biswas, P.K.; Mansi, M.; Pandey, R. Board composition, Sustainability committee and corporate social and environmental performance in Australia. Pac. Account. Rev. 2018, 30, 517–540. [Google Scholar] [CrossRef]

- Lubin, D.A.; Esty, D.C. The Sustainability imperative. Harv. Bus. Rev. 2010, 88, 42–50. [Google Scholar]

- Naranjo-Gil, D. The role of management control systems and top teams in implementing environmental sustainability policies. Sustainability 2016, 8, 359. [Google Scholar] [CrossRef]

- Klein, A. Audit committee, board of director’s characteristics, and earnings management. J. Account. Econ. 2002, 33, 375–400. [Google Scholar] [CrossRef]

- Amran, A.; Lee, S.P.; Devi, S.S. The Influence of governance structure and strategic corporate responsibility toward sustainability reporting quality. Bus. Strategy Environ. 2014, 23, 217–235. [Google Scholar] [CrossRef]

- Dalton, D.R.; Daily, C.M.; Ellstrand, A.E.; Johnson, J.L. Meta-analytic reviews of board composition, leadership structure, and financial performance. Strateg. Manag. J. 1998, 19, 269–290. [Google Scholar] [CrossRef]

- Dyllick, T.; Hockerts, K. Beyond the business case for corporate sustainability. Bus. Strategy Environ. 2008, 11, 130–141. [Google Scholar] [CrossRef]

- Annunziata, E.; Pucci, T.; Frey, M.; Zanni, L. The role of organizational capabilities in attaining corporate sustainability practices and economic performance: Evidence from Italian wine industry. J. Clean. Prod. 2018, 171, 1300–1311. [Google Scholar] [CrossRef]

- Helfaya, A.; Moussa, T. Do board’s corporate social responsibility strategy and orientation influence environmental sustainability disclosure? UK Evid. Bus. Strategy Environ. 2017, 26, 1061–1077. [Google Scholar] [CrossRef]

- Post, C.; Rahman, N.; McQuillen, C. From board composition to corporate environmental performance through sustainability-themed alliances. J. Bus. Ethics 2015, 130, 423–435. [Google Scholar] [CrossRef]

- Shaukat, A.; Qiu, Y.; Trojanowski, G. Board attributes, corporate social responsibility strategy, and corporate environmemtal and social performance. J. Bus. Ethics 2016, 135, 569–585. [Google Scholar] [CrossRef]

- Orazalin, N. Do board sustainability committees contribute to corporate environmental and social performance? The mediating role of corporate social responsibility strategy. Bus. Strategy Environ. 2020, 29, 140–153. [Google Scholar] [CrossRef]

- Haseeb, U.R.; Muhammad, Z.; Musa, K. Corporate sustainability practices: A new perspective of linking board with firm performance. J. Total Qual. Manag. Bus. Excell. 2021, 34, 929–946. [Google Scholar] [CrossRef]

- Sial, M.S.; Zheng, C.; Cherian, J.; Gulzar, M.A.; Thu, P.A.; Khan, T.; Khuong, N.V. Does corporate social responsibility mediate the relation between boardroom gender diversity and firm performance of Chinese listed companies? Sustainability 2018, 10, 3591. [Google Scholar] [CrossRef]

- Hasan, M.T.; Rahman, A.A. Conceptual work for IFRS adoption, audit quality and earnings management: The case of Bangladesh. Int. Bus. Account. Res. J. 2019, 3, 58–66. [Google Scholar] [CrossRef]

- Kock, C.J.; Santalo, J.; Diestre, L. Corporate governance and the environment: What type of governance creates greener companies? J. Manag. Stud. 2012, 49, 492–514. [Google Scholar] [CrossRef]

- Velte, P. Chief sustainability officer expertise, sustainability-related executive compensation, and corporate biodiversity disclosure: Empirical evidence for the European capital market. J. Glob. Responsib. 2023, 14, 241–253. [Google Scholar] [CrossRef]

- Baron, R.; Kenny, D. The moderator-mediator variable distinction in social psychological research. J. Personal. Soc. Psychol. 1986, 51, 1173–1182. [Google Scholar] [CrossRef]

- Cohen, J.; Cohen, P.; West, S.G.; Aiken, L.S. Applied Multiple Regression/Correlation Analysis for Behavioral Sciences; Hillsdale; Lawrence Erlbaum Associates: Mahwah, NJ, USA, 2003. [Google Scholar]

- Dixon-Fowler, H.R.; Ellstrand, A.E.; Johnson, J.L. The role of board environmental committees in corporate environmental performance. J. Bus. Ethics 2017, 140, 423–438. [Google Scholar] [CrossRef]

| Variables | N (Obs.) | Mean | Minimum | Maximum | STD. Deviation |

|---|---|---|---|---|---|

| ENVPERF | 284 | 7.01 | 1 | 10 | 1.616 |

| CSO | 284 | 2.59 | 0 | 7 | 2.588 |

| CSP | 284 | 8.20 | 0 | 11 | 3.359 |

| ROA | 284 | 2.95 | −17 | 53 | 7.190 |

| FIRMSIZE | 284 | 7.74 | 5 | 11 | 0.817 |

| LEVERAGE | 284 | 1.78 | 0 | 50 | 4.451 |

| M2BOOK | 284 | 0.00 | 0 | 0 | 0.001 |

| BOARDSIZE | 284 | 7.90 | 0 | 15 | 2.285 |

| ENVPERF | CSO | CSP | ROA | Firm Size | Leverage | M2B | Board Size | |

|---|---|---|---|---|---|---|---|---|

| EnvPerf | 1 | |||||||

| CSO | 0.235 *** | 1 | ||||||

| CSP | 0.234 *** | 0.124 * | 1 | |||||

| ROA | 0.124 * | 0.090 | 0.005 | 1 | ||||

| Firm Size | −0.002 | 0.187 ** | −0.152 * | −0.284 *** | 1 | |||

| Leverage | −0.046 | 0.048 | −0.131 * | 0.305 *** | −0.138 * | 1 | ||

| M2B | −0.038 | 0.051 | −0.115 | 0.158 ** | −0.104 | −0.068 | 1 | |

| Board Size | 0.162 ** | 0.143 * | 0.116 | −0.046 | 0.184 ** | −0.056 | 0.055 | 1 |

| Variables | Model 1 | Model 2 | Model 3 | Model 4 |

|---|---|---|---|---|

| Constant | 5.979 *** (6.227) | 13.909 *** (6.608) | 4.681 *** (4.649) | 4.881 *** (4.783) |

| CSO | 0.069 * (1.726) | 0.278 ** (3.183) | 0.047 (1.169) | |

| CSP | 0.085 ** (3.170) | 0.079 ** (2.893) | ||

| Control Variables | ||||

| ROA | 0.022 (1.601) | 0.011 (0.359) | 0.021 (1.590) | 0.021 (1.559) |

| Firm Size | −0.128 (−1.076) | −0.942 (−3.625) | −0.032 (−0.268) | −0.053 (−0.444) |

| Leverage | −0.030 (−1.417) | −0.134 ** (−2.933) | −0.017 (−0.804) | −0.019 (−0.907) |

| Market-2-Book | −59.471 (−0.813) | −437.457 ** (−2.727) | −17.493 (−0.240) | −24.939 (−0.341) |

| Board Size | 0.165 *** (4.003) | 0.245 ** (2.711) | 0.150 *** (3.650) | 0.146 *** (3.534) |

| Industry Dummy | Yes | Yes | Yes | Yes |

| Year Dummy | Yes | Yes | Yes | Yes |

| Adjusted R | 0.193 | 0.102 | 0.213 | 0.214 |

| Observation | 284 | 284 | 284 | 284 |

Disclaimer/Publisher’s Note: The statements, opinions and data contained in all publications are solely those of the individual author(s) and contributor(s) and not of MDPI and/or the editor(s). MDPI and/or the editor(s) disclaim responsibility for any injury to people or property resulting from any ideas, methods, instructions or products referred to in the content. |

© 2023 by the authors. Licensee MDPI, Basel, Switzerland. This article is an open access article distributed under the terms and conditions of the Creative Commons Attribution (CC BY) license (https://creativecommons.org/licenses/by/4.0/).

Share and Cite

Ebele, N.E.; Bae, S.M.; Kim, J.D. The Impact of Chief Sustainability Officers on Environmental Performance of Korean Listed Companies: The Mediating Role of Corporate Sustainability Practices. Sustainability 2023, 15, 14819. https://doi.org/10.3390/su152014819

Ebele NE, Bae SM, Kim JD. The Impact of Chief Sustainability Officers on Environmental Performance of Korean Listed Companies: The Mediating Role of Corporate Sustainability Practices. Sustainability. 2023; 15(20):14819. https://doi.org/10.3390/su152014819

Chicago/Turabian StyleEbele, Nebedum Ekene, Seong Mi Bae, and Jong Dae Kim. 2023. "The Impact of Chief Sustainability Officers on Environmental Performance of Korean Listed Companies: The Mediating Role of Corporate Sustainability Practices" Sustainability 15, no. 20: 14819. https://doi.org/10.3390/su152014819

APA StyleEbele, N. E., Bae, S. M., & Kim, J. D. (2023). The Impact of Chief Sustainability Officers on Environmental Performance of Korean Listed Companies: The Mediating Role of Corporate Sustainability Practices. Sustainability, 15(20), 14819. https://doi.org/10.3390/su152014819