Early Insolvency Prediction as a Key for Sustainable Business Growth

Abstract

1. Introduction

2. Theoretical Background

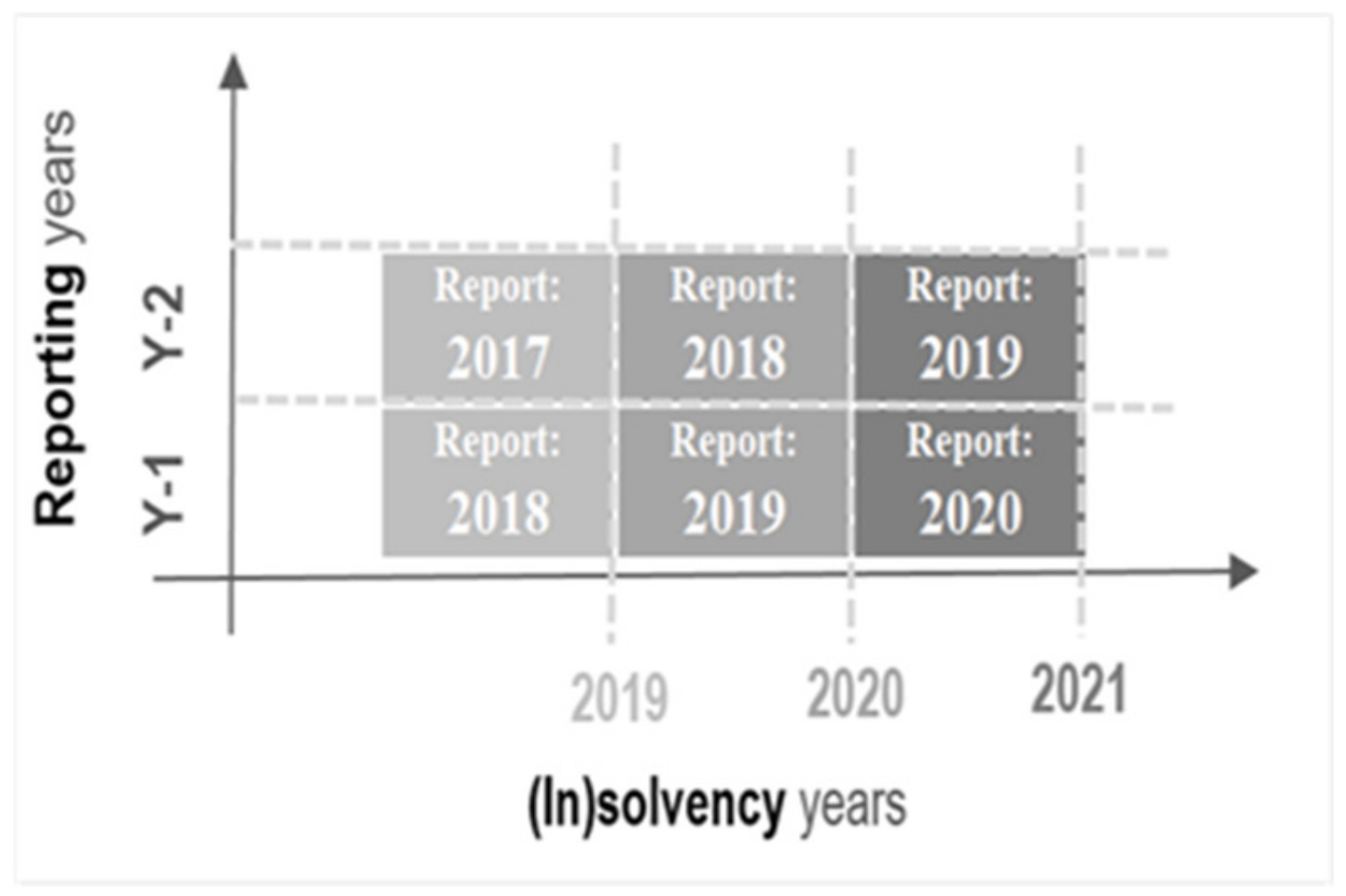

3. Variables, Research Sample, and Methods

4. Research Results

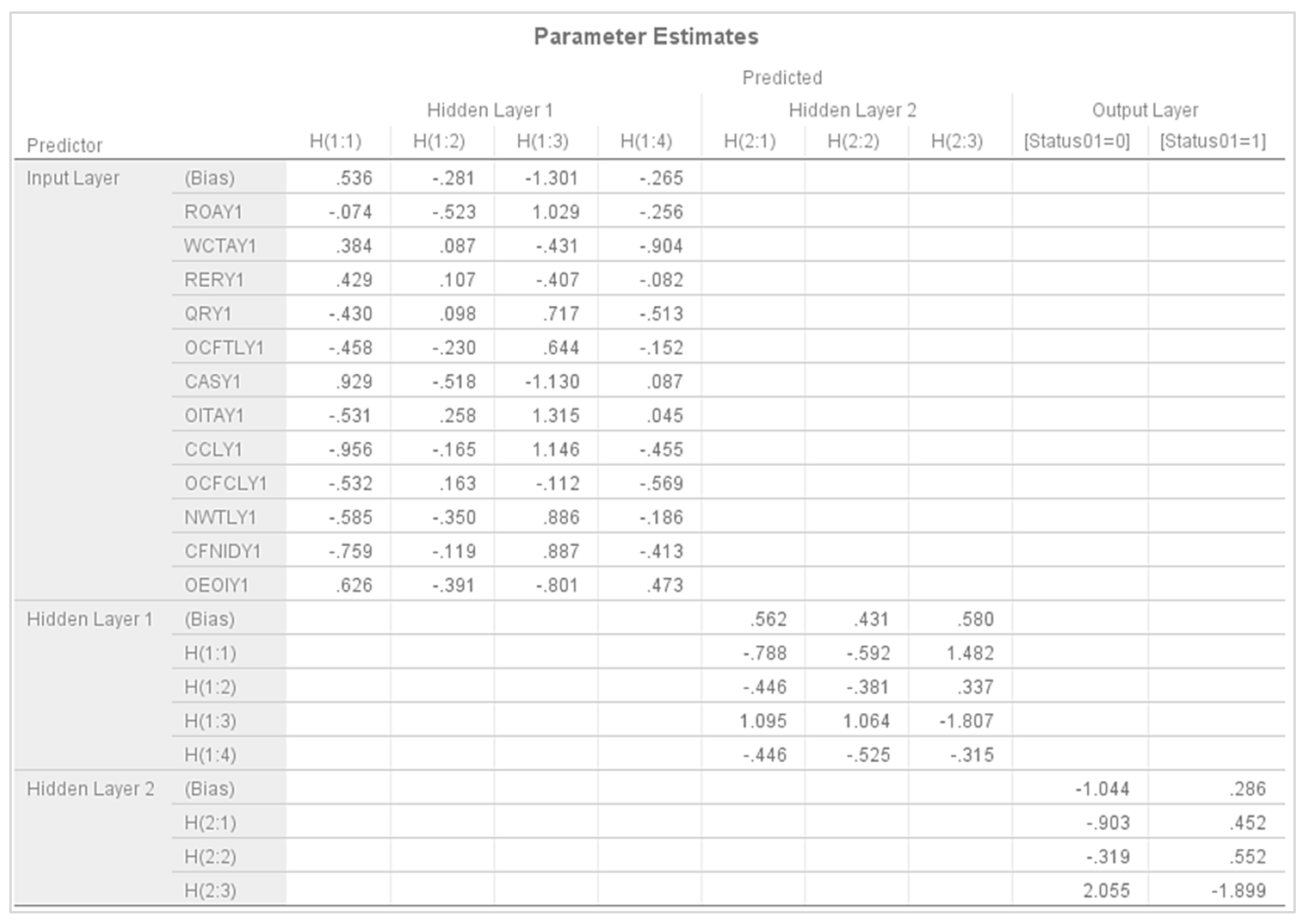

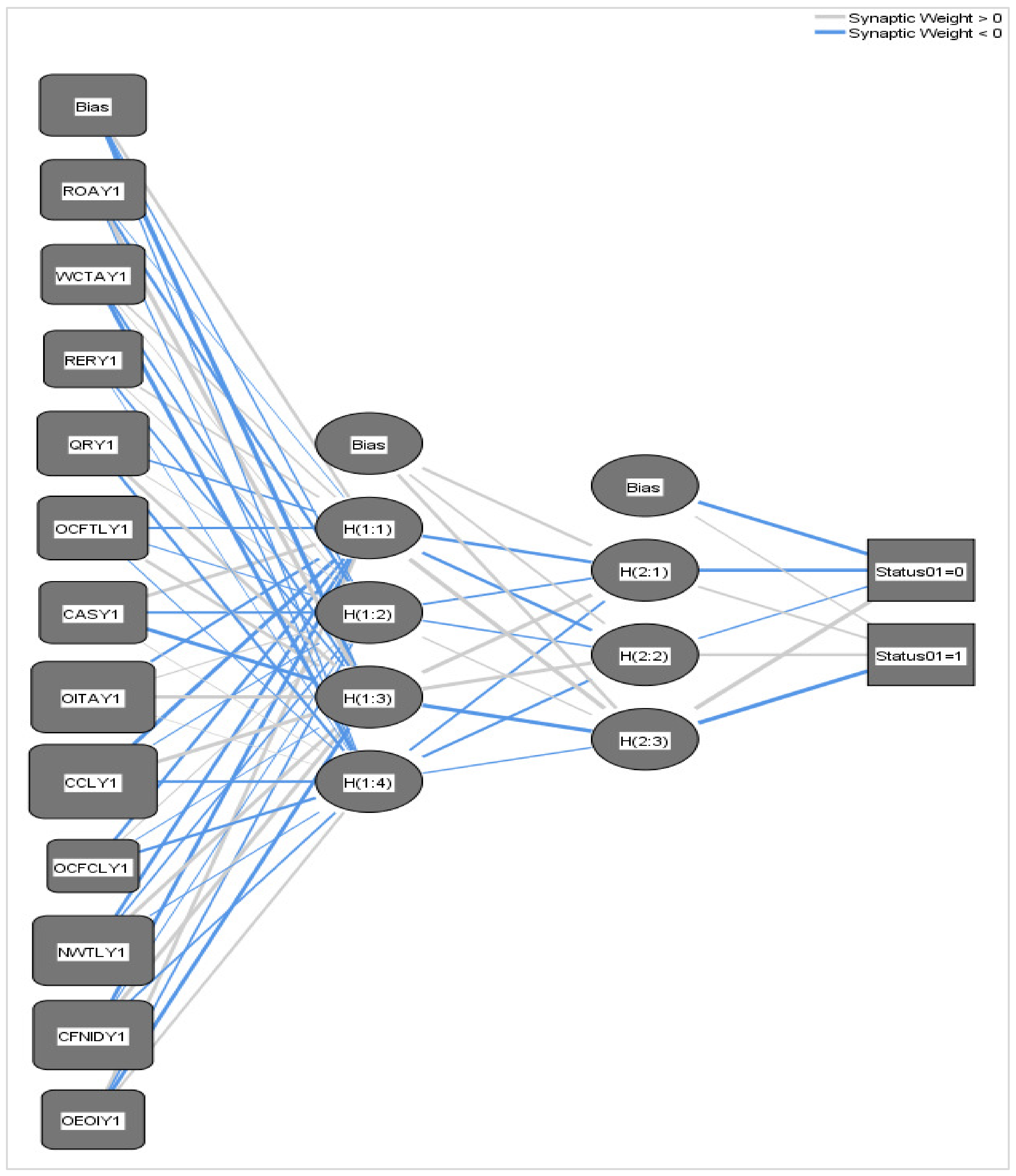

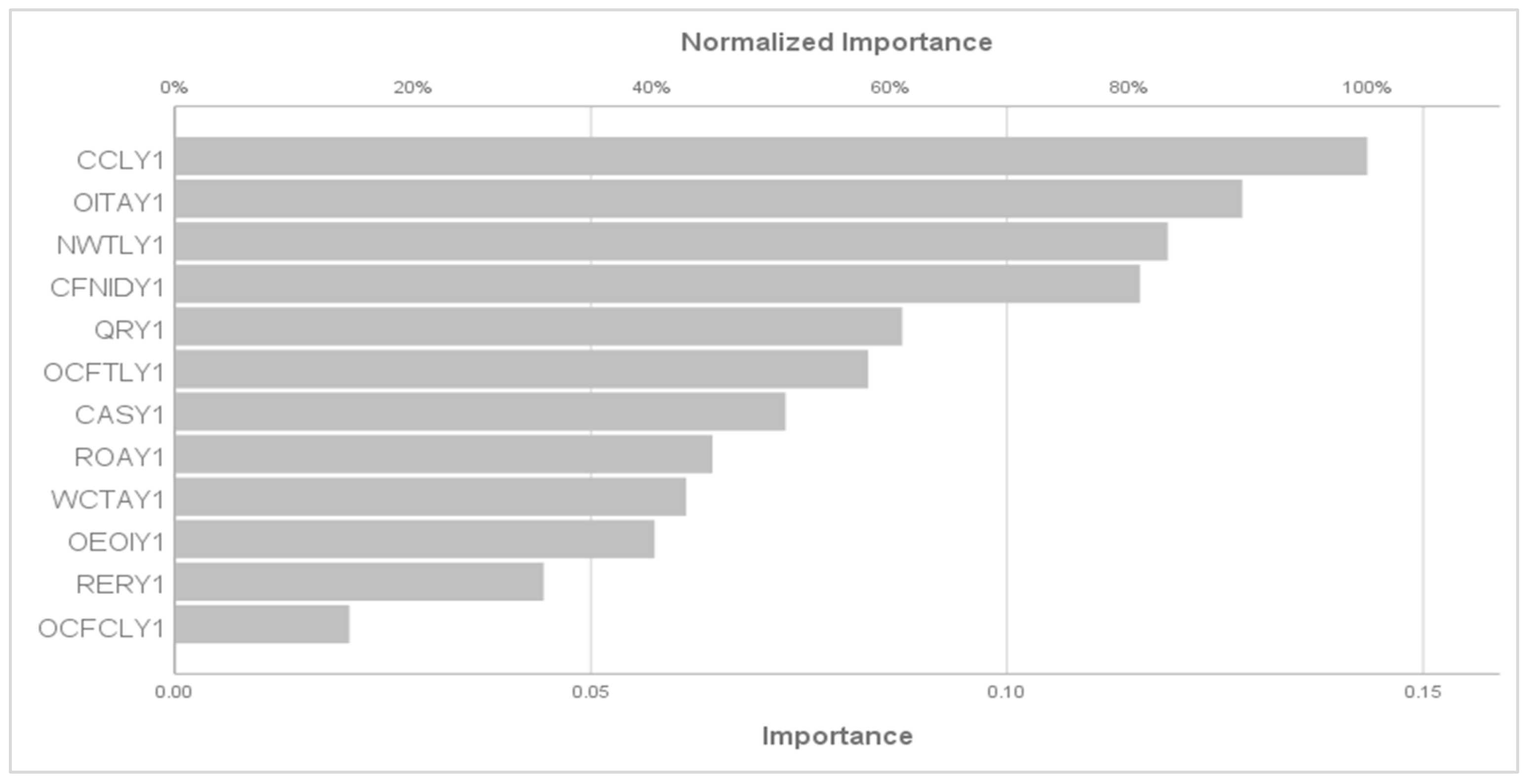

4.1. Predicting Insolvency One Year before Occurrence (Y-1)

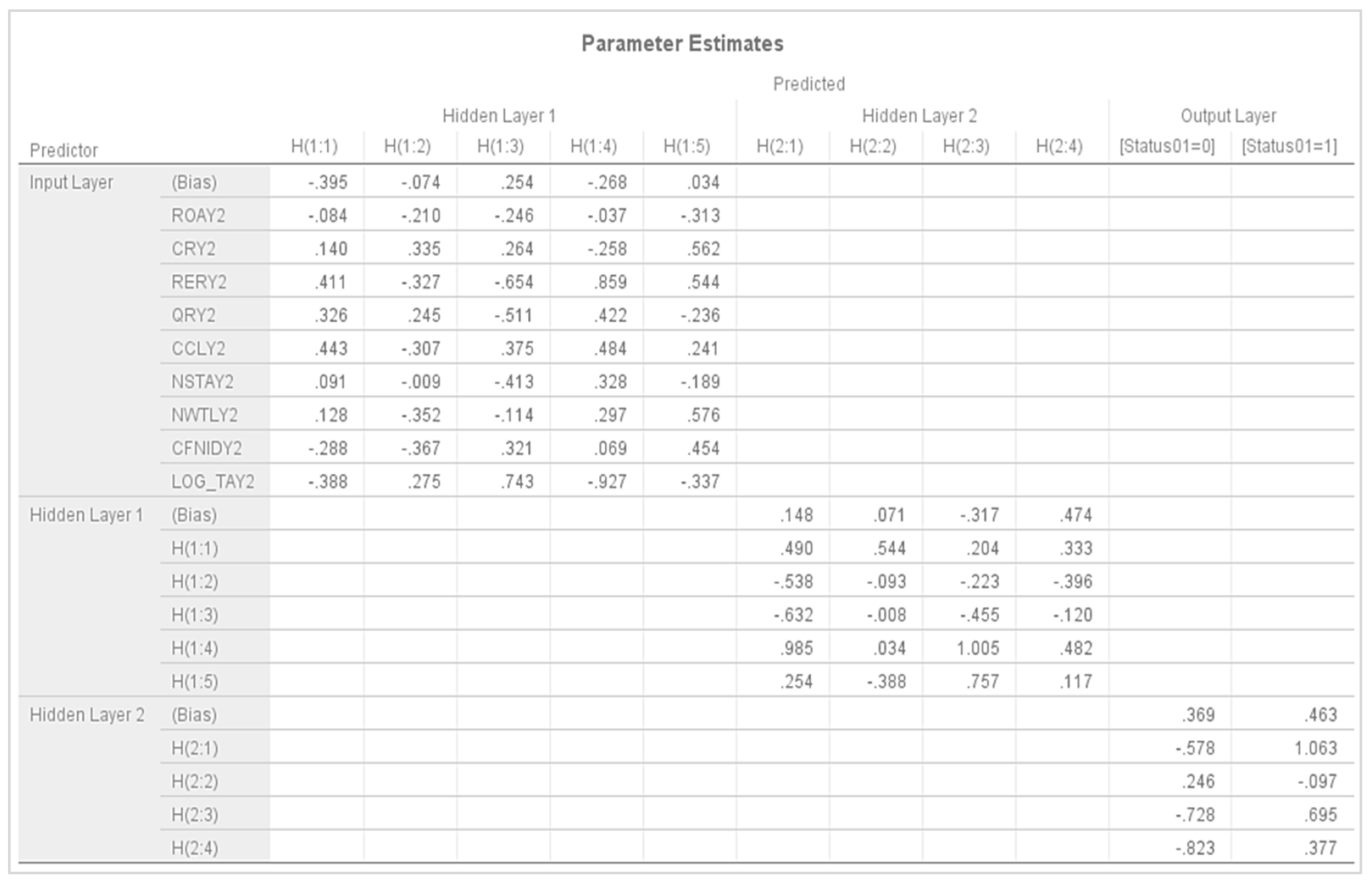

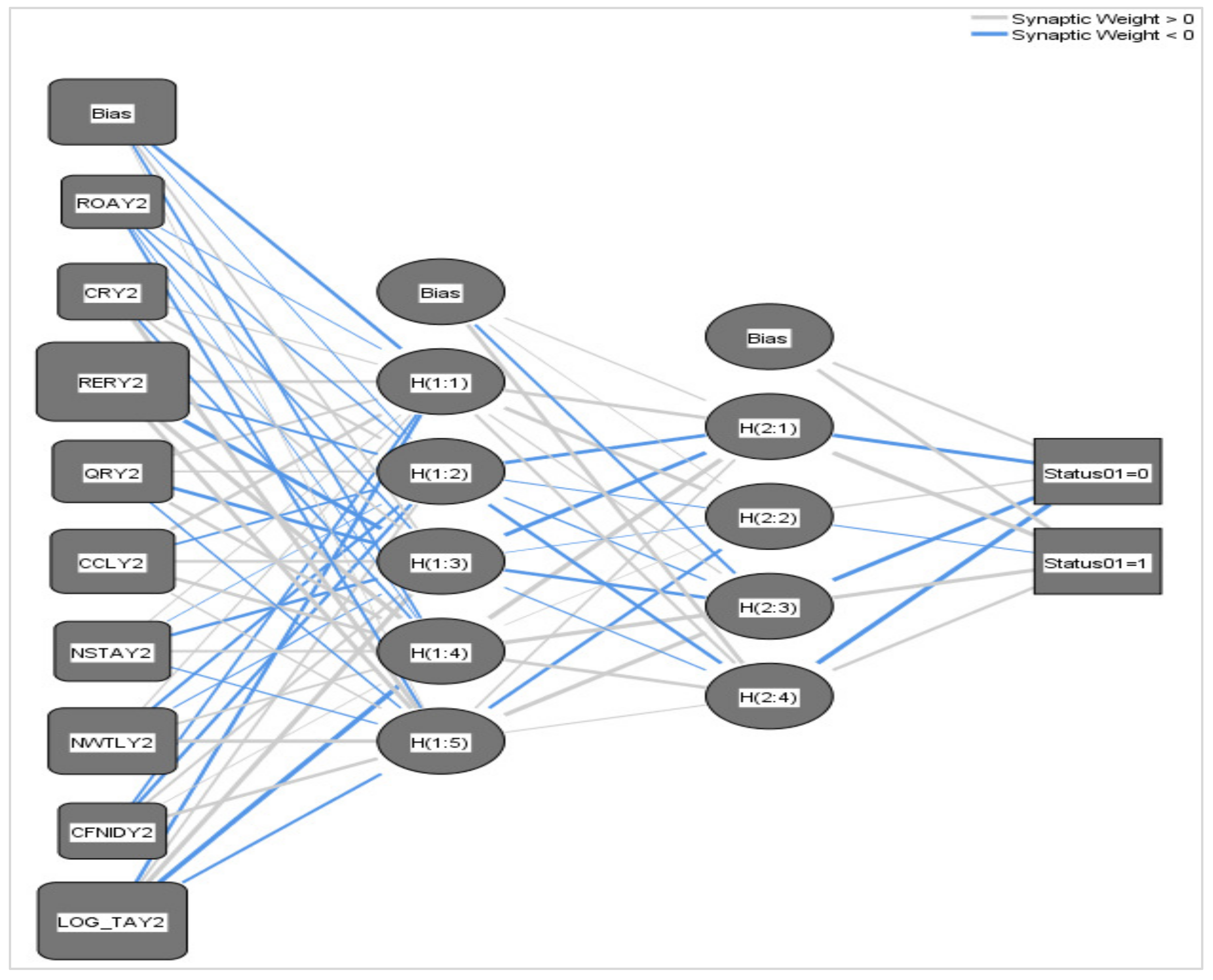

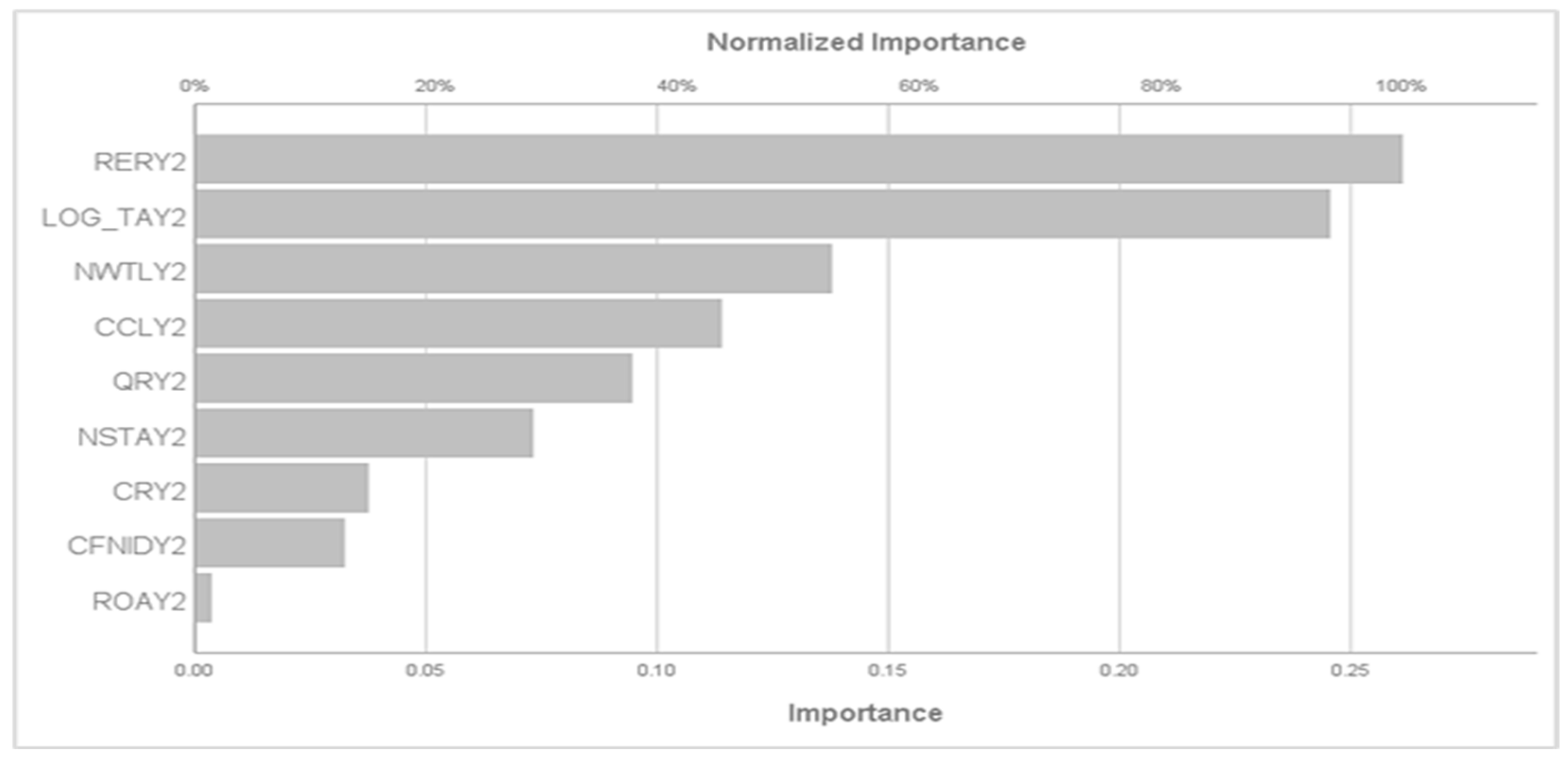

4.2. Predicting Insolvency Two Years before Occurrence

5. Discussion

- Lack of ability to explain behavior;

- ANN algorithms are not guaranteed to converge an optimal solution;

- ANNs can easily be overtrained to the point of working well on the training data but poorly on the test data.

6. Conclusions

- Identification of early warning signs: the model presented in this paper provides a unique capability to identify the early warning signs of bankruptcy, allowing companies and stakeholders to take proactive measures. This is particularly crucial in an economic environment like Serbia, where businesses may face various challenges.

- Supporting financial institutions: such a model can benefit financial institutions, investors, and creditors operating in Serbia. Accurate bankruptcy predictions can help these entities manage their risks more effectively and make prudent lending or investment decisions.

- Driving business toward a secure future: a company can take proactive steps to improve its financial health. By addressing issues flagged by the model’s predictions, such as liquidity problems, the company ensures its long-term viability, secures investor trust, and contributes to the overall stability of the business environment.

- Regulatory enhancements: for example, the model showed that poor cash management leads to bankruptcy a year in advance. This information could be shared with regulatory authorities, leading to policy changes or initiatives (for example, favorable loans or some subventions for companies) aimed at improving business conditions and reducing bankruptcy rates.

Author Contributions

Funding

Institutional Review Board Statement

Informed Consent Statement

Data Availability Statement

Conflicts of Interest

Appendix A

Appendix B

References

- Vuković, B.; Jakšić, D.; Tica, T. Sustainable Growth Rate Analysis in Eastern European Companies. Sustainability 2022, 14, 10731. [Google Scholar] [CrossRef]

- Chen, X.; Liu, C.; Liu, F.; Fang, M. Firm Sustainable Growth during the COVID-19 Pandemic: The Role of Customer Concentration. Emerg. Mark. Financ. Trade 2021, 6, 1566–1577. [Google Scholar] [CrossRef]

- Allal-Cherif, O.; Guijarro-Garcia, M.; Ulrich, K. Fostering Sustainable Growth in Aeronautics: Open Social Innovation, Multifunctional Team Management, and Collaborative Governance. Technol. Forecast. Soc. Chang. 2022, 174, 121269. [Google Scholar] [CrossRef]

- Liu, H.; Li, T.; Leong, G.K. Choice of Competitive Strategy of Formal and Informal Sectors in Recycling WEEE with Fund Subsidies: Service or Price? J. Clean. Prod. 2022, 372, 133717. [Google Scholar] [CrossRef]

- Jan, A.; Marimuthu, M. Bankruptcy and Sustainability: A Conceptual Review on Islamic Banking Industry. Glob. Bus. Manag. Res. Int. J. 2015, 7, 109–138. [Google Scholar]

- Inam, F.; Inam, A.; Abbas Mian, M.; Sheikh, A.A.; Awan, H.M. Forecasting Bankruptcy for organizational sustainability in Pakistan: Using artificial neural networks, logit regression, and discriminant analysis. J. Econ. Financ. Adm. Sci. 2018, 35, 183–201. [Google Scholar] [CrossRef]

- Grosu, V.; Chelba, A.A.; Melega, A.; Botez, D.; Socoliuc, M.L. Bibliometric analysis of the literature on evaluation models of the bankruptcy risk. Strateg. Manag. 2023, 28, 21–44. [Google Scholar] [CrossRef]

- Becerra, V.M.; Galvão, R.K.H.; Abou-Seada, M. Neural and Wavelet Network Models for Financial Distress Classification. Data Min. Knowl. Disc. 2005, 11, 35–55. [Google Scholar] [CrossRef]

- Vuković, B.; Milutinović, S.; Milićević, N.; Jakšić, D. Corporate Bankruptcy Prediction: Evidence from Wholesale Companies in the Western European Countries. Ekon. Cas. 2020, 68, 477–498. [Google Scholar]

- Wu, W.W. Beyond business failure prediction. Expert Syst. Appl. 2010, 37, 2371–2376. [Google Scholar] [CrossRef]

- Lukić, R. Analysis of efficiency factors of companies in Serbia based on artificial neural networks. Ann. Fac. Econ. Subot. 2022, 58, 97–115. [Google Scholar] [CrossRef]

- Eriki, P.O.; Udegbunam, R. Predicting corporate distress in the Nigerian stock market: Neural network versus multiple discriminant analysis. Afr. J. Bus. Manag. 2013, 7, 3856–3863. [Google Scholar]

- Anandarajan, M.; Lee, P.; Anandarajan, A. Bankruptcy Prediction of Financially Stressed Firms: An Examination of the Predictive Accuracy of Artificial Neural Networks. Intell. Syst. Account. Financ. Manag. 2001, 10, 69–81. [Google Scholar] [CrossRef]

- Lin, T.H. A cross model study of corporate financial distress prediction in Taiwan: Multiple discriminant analysis, logit, probit and neural networks models. Neurocomputing 2009, 72, 3507–3516. [Google Scholar] [CrossRef]

- Kim, M.J.; Kang, D.K. Ensemble with neural networks for bankruptcy prediction. Expert Syst. Appl. 2010, 37, 3373–3379. [Google Scholar] [CrossRef]

- Ravisankar, P.; Ravi, V.; Bose, I. Failure prediction of dotcom companies using neural network–genetic programming hybrids. Inf. Sci. 2010, 180, 1257–1267. [Google Scholar] [CrossRef]

- Brédart, X. Financial Distress and Corporate Governance: The Impact of Board Configuration. Int. Bus. Res. 2014, 7, 72–80. [Google Scholar] [CrossRef]

- Simić, D.; Kovačević, I.; Simic, S. Insolvency prediction for assessing corporate financial health. Log. J. IGPL 2011, 20, 536–549. [Google Scholar] [CrossRef]

- Altman, E.; Iwanicz-Drozdowska, M.; Laitinen, E.K.; Suvas, A. Distressed Firm and Bankruptcy Prediction in an International Context: A Review and Empirical Analysis of Altman’s Z-Score Model. 2014. Available online: http://dx.doi.org/10.2139/ssrn.2536340 (accessed on 10 October 2022).

- Callejón, A.M.; Casado, A.M.; Fernández, M.A.; Peláez, J.I. A System of Insolvency Prediction for industrial companies using a financial alternative model with Neural Networks. Int. J. Comput. Intell. Syst. 2013, 6, 29–37. [Google Scholar] [CrossRef][Green Version]

- Charitou, A.; Neophytou, E.; Charalambous, C. Predicting Corporate Failure: Empirical Evidence for the UK. Eur. Account. Rev. 2004, 13, 465–497. [Google Scholar] [CrossRef]

- Blanco, A.; Pino-Mejías, R.; Lara, J.; Rayo, S. Credit scoring models for the microfinance industry using neural networks: Evidence from Peru. Expert Syst. Appl. 2013, 40, 356–364. [Google Scholar] [CrossRef]

- Atiya, A. Bankruptcy Prediction for Credit Risk Using Neural Networks: A Survey and New Results. IEEE Trans. Neural Netw. 2001, 12, 929–935. [Google Scholar] [CrossRef] [PubMed]

- Bapat, V.; Nagale, A. Comparison of bankruptcy prediction models: Evidence from India. Account. Financ. Res. 2014, 3, 91–98. [Google Scholar] [CrossRef]

- Virag, M.; Kristof, T. Neural networks in bankruptcy prediction- a comparative study on the basis of the first Hungarian bankruptcy model. Acta Oeconomica 2005, 55, 403–426. [Google Scholar] [CrossRef]

- Kouki, M.; Elkhaldi, A. Toward a predicting model of firm bankruptcy: Evidence from the Tunisian context. Middle East Financ. Econ. 2011, 14, 26–43. [Google Scholar]

- Chen, W.S.; Du, Y.K. Using neural networks and data mining techniques for the financial distress prediction model. Expert Syst. Appl. 2009, 36, 4075–4086. [Google Scholar] [CrossRef]

- Charalambous, C.; Charitou, A.; Kaourou, F. Comparative Analysis of Artificial Neural Network Models: Application in Bankruptcy Prediction. Ann. Oper. Res. 2000, 99, 403–425. [Google Scholar] [CrossRef]

- Yim, J.; Mitchell, H. A Comparison of Corporate Distress Prediction Models in Brazil: Hybrid Neural Networks, Logit Models and Discriminant Analysis. Nova Econ. 2005, 15, 73–93. [Google Scholar]

- Lee, K.; Booth, D.; Alam, P. A comparison of supervised and unsupervised neural networks in predicting bankruptcy of Korean firms. Expert Syst. Appl. 2005, 29, 1–16. [Google Scholar] [CrossRef]

- Brockett, P.L.; Golden, L.L.; Jang, J.; Yang, C. A comparison of neural network, statistical methods, and variable choice for life insurers’ financial distress prediction. J. Risk Insur. 2006, 73, 397–419. [Google Scholar] [CrossRef]

- Chung, K.C.; Tan, S.S.; Holdsworth, D.K. Insolvency Prediction Model using Multivariate Discriminant Analysis and Artificial Neural Network for the Finance Industry in New Zealand. Int. J. Bus. Manag. 2008, 39, 19–28. [Google Scholar]

- Kim, S.Y. Prediction of hotel bankruptcy using support vector machine, artificial neural network, logistic regression, and multivariate discriminant analysis. Serv. Ind. J. 2011, 31, 441–468. [Google Scholar] [CrossRef]

- Ciampi, F.; Gordini, N. Small enterprise default prediction modeling through artificial neural networks: An empirical analysis of Italian small enterprises. J. Small Bus. Manag. 2013, 51, 23–45. [Google Scholar] [CrossRef]

- Lee, S.; Choi, W.S. A multi-industry bankruptcy prediction model using back-propagation neural network and multivariate discriminant analysis. Expert Syst. Appl. 2013, 40, 2941–2946. [Google Scholar] [CrossRef]

- Sehgal, S.; Mishra, R.K.; Deisting, K.; Vashisht, R. On the determinants and prediction of corporate financial distress in India. Manag. Financ. 2021, 47, 1428–1447. [Google Scholar] [CrossRef]

- Alfaro, E.; García, N.; Gámez, M.; Elizondo, D. Bankruptcy forecasting: An empirical comparison of AdaBoost and neural networks. Decis. Support Syst. 2008, 45, 110–122. [Google Scholar] [CrossRef]

- Barboza, F.; Kimura, H.; Altman, E. Machine learning models and bankruptcy prediction. Expert Syst. Appl. 2017, 83, 405–417. [Google Scholar] [CrossRef]

- Chinedu, E.F.; Kenneth, A.C.; Nwaolisa, E.F.; Madubuko, U.C. A comparative study of genetic algorithm and neural network model in bankruptcy prediction of manufacturing firms in Nigeria. J. Contemp. Issues Account. 2022, 3, 231–271. Available online: https://journals.unizik.edu.ng/jocia (accessed on 20 October 2022).

- Zebardast, M.; Javid, D.; Taherinia, M. The use of artificial neural network in predicting bankruptcy and its comparison with genetic algorithm in firms accepted in Tehran Stock Exchange. J. Nov. Appl. Sci. 2014, 3, 151–160. [Google Scholar]

- Rafiei, F.M.; Manzari, S.M.; Bostanian, S. Financial health prediction models using artificial neural networks, genetic algorithm and multivariate discriminant analysis: Iranian evidence. Expert Syst. Appl. 2011, 38, 10210–10217. [Google Scholar] [CrossRef]

- Abdelwahed, T.; Amir, E.M. New evolutionary bankruptcy forecasting model based on genetic algorithms and neural networks. In Proceedings of the 17th IEEE International Conference on Tools with Artificial Intelligence, Hong Kong, China, 14–16 November 2005. [Google Scholar]

- Back, B.; Laitinen, T.; Sere, K. Neural network and genetic algorithm for bankruptcy prediction. Expert Syst. Appl. 1996, 11, 407–413. [Google Scholar] [CrossRef]

- Fedorova, E.; Gilenko, E.; Dovzhenko, S. Bankruptcy prediction for Russian companies: Application of combined classifiers. Expert Syst. Appl. 2013, 40, 7285–7293. [Google Scholar] [CrossRef]

- Cheng, C.B.; Chen, C.L.; Fu, C.J. Financial Distress Prediction by a Radial Basis Function Network with Logit Analysis Learning. Comput. Math. Appl. 2006, 51, 579–588. [Google Scholar] [CrossRef]

- Korol, T. Dynamic Bankruptcy Prediction Models for European Enterprises. J. Risk Financ. Manag. 2019, 12, 185. [Google Scholar] [CrossRef]

- Mselmi, N.; Lahiani, A.; Hamza, T. Financial distress prediction: The case of French small and medium-sized firms. Int. Rev. Financ. Anal. 2017, 50, 67–80. [Google Scholar] [CrossRef]

- Bellovary, J.; Giacomino, D.; Akers, M.D. A Review of Bankruptcy Prediction Studies: 1930–Present. J. Financ. Educ. 2007, 33, 1–42. [Google Scholar]

- Neophytou, E.; Molinero, C.M. Predicting Corporate Failure in the UK: A Multidimensional Scaling Approach. J. Bus. Financ. Account. 2004, 31, 677–710. [Google Scholar] [CrossRef]

- Ryu, Y.U.; Yue, W.T. Firm bankruptcy prediction: Experimental comparison of isotonic separation and other classification approaches. IEEE Trans. Syst. Manag. Cybern.-Part A Syst. Hum. 2005, 35, 727–737. [Google Scholar] [CrossRef]

- Douglas, E.; Lont, D.; Scott, T. Finance company failure in New Zealand during 2006–2009: Predictable failures? J. Contemp. Account. Econ. 2014, 10, 277–295. [Google Scholar] [CrossRef]

- Tinoco, M.H.; Wilson, N. Financial distress and bankruptcy prediction among listed companies using accounting, market and macroeconomic variables. Int. Rev. Financ. Anal. 2013, 30, 394–419. [Google Scholar] [CrossRef]

- Takahashi, K.; Kurokawa, Y.; Watase, K. Corporate bankruptcy prediction in Japan. J. Bank. Financ. 1984, 8, 229–247. [Google Scholar] [CrossRef]

- Mohamad, I. Bankruptcy prediction model with ZETAc optimal cut-off score to correct type I errors. Gadjah Mada Int. J. Bus. 2005, 7, 44–68. [Google Scholar] [CrossRef]

- Ahn, H.; Kim, K. Bankruptcy prediction modeling with hybrid case-based reasoning and genetic algorithms approach. Appl. Soft Comput. 2009, 9, 599–607. [Google Scholar] [CrossRef]

- Blanco-Oliver, A.J.; Irimia-Diéguez, A.I.; Oliver-Alfonso, M.D.; Wilson, N. Improving bankruptcy prediction in micro-entities by using nonlinear effects and non-financial variables. Financ. Uver-Czech J. Econ. Financ. 2015, 65, 144–166. Available online: http://ideas.repec.org/a/fau/fauart/v65y2015i2p144-166.html (accessed on 25 October 2022).

- Mahato, S. Financial Ratios, Discriminant Analysis and the Prediction of Corporate Failure. Int. J. Nepal. Acad. Manag. 2014, 2, 50–63. [Google Scholar]

- Wagan, H.; Golo, M.A.; Rani Abro, B.; Abro, S.H.; Ali, Z. Corporate Bankruptcy Prediction in Pakistan by Employing Multiple Discriminant Analysis Technique. Dev. Ctry. Stud. 2016, 6, 70–84. [Google Scholar]

- Liang, D.; Lu, C.-C.; Tsai, C.-F.; Shih, G.A. Financial ratios and corporate governance indicators in bankruptcy prediction: A comprehensive study. Eur. J. Oper. Res. 2016, 252, 561–572. [Google Scholar] [CrossRef]

- Mossman, C.E.; Bell, G.G.; Swartz, L.M.; Turtle, H. An empirical comparison of bankruptcy models. Financ. Rev. 1998, 33, 35–54. [Google Scholar] [CrossRef]

- Africa, L. Financial distress for bankruptcy early warning by the risk analysis on go-public banks in Indonesia. J. Econ. Bus. Acc. 2016, 19, 259–270. [Google Scholar] [CrossRef][Green Version]

- Asyikin, J.; Chandrarin, G.; Harmono, H. Analysis of financial performance to predict financial distress in sharia commercial banks in Indonesia. Int. J. Account. Financ. Econ. 2018, 1, 11–20. [Google Scholar]

- Jo, H.; Han, I.; Lee, H. Bankruptcy prediction using case-based reasoning, neural networks, and discriminant analysis. Expert Syst. Appl. 1997, 13, 97–108. [Google Scholar] [CrossRef]

- Altman, E. Financial ratios. Discriminant analysis and the prediction of corporate bankruptcy. J. Financ. 1968, 23, 589–609. [Google Scholar] [CrossRef]

- Deakin, E.B. A Discriminant Analysis of Predictors of Business Failure. J. Account. Res. 1972, 10, 167–179. [Google Scholar] [CrossRef]

- Obradović, B.D.; Jakšić, D.; Rupić, B.I.; Andrić, M. Insolvency prediction model of the company: The case of the Republic of Serbia. Econ. Res. 2018, 31, 139–157. [Google Scholar] [CrossRef]

- Bankruptcy Supervision Agency. Available online: https://alsu.gov.rs/stecaj/stecajevi/ (accessed on 1 June 2022).

- Business Register Agency. Available online: https://pretraga2.apr.gov.rs/unifiedentitysearch (accessed on 1 June 2022).

- Naidu, G.P.; Govinda, K. Bankruptcy prediction using neural networks. In Proceedings of the 2nd International Conference on Inventive Systems and Control (ICISC), Coimbatore, India, 19–20 January 2018. [Google Scholar] [CrossRef]

- Zacharis, N.Z. Predicting student academic performance in blended learning using artificial neural networks. Int. J. Artif. Intell. Appl. 2016, 7, 17–29. [Google Scholar] [CrossRef]

- Fialova, V.; Folvarcna, A. Default prediction using neural networks for enterprises from the post-soviet country. Ekonom.-Manaž. Spektrum 2020, 14, 43–51. [Google Scholar] [CrossRef]

- Gupta, T.K.; Raza, K. Optimizing Deep Feedforward Neural Network Architecture: A Tabu Search Based Approach. Neural Process. Lett. 2020, 51, 2855–2870. [Google Scholar] [CrossRef]

- Panchal, G.; Ganatra, A.; Kosta, Y.P.; Panchal, D. Behaviour Analysis of Multilayer Perceptrons with Multiple Hidden Neurons and Hidden Layers. Int. J. Comput. Theory Eng. 2011, 3, 332–337. [Google Scholar] [CrossRef]

- Karsoliya, S. Approximating Number of Hidden Layer Neurons in Multiple Hidden Layer BPNN Architecture. Int. J. Eng. Trends Technol. 2012, 3, 714–717. [Google Scholar]

- Jencova, S.; Petruska, I.; Lukacova, M.; Abu-Zaid, J. Prediction of Bankruptcy in Non-financial Corporations Using Neural Network. Montenegrin J. Econ. 2021, 17, 123–134. [Google Scholar] [CrossRef]

- Rangoonwala, N.; Bhatia, H. Application of Artificial Neural Network to Predict Wilful Default for Commercial Banks in India. Int. J. Bus. Anal. Intell. 2020, 8, 13–22. [Google Scholar]

- Paule-Vianez, J.; Gómez-Martínez, R.; Prado-Román, C. A bibliometric analysis of behavioural finance with mapping analysis tools. Eur. Res. Manag. Bus. Econ. 2020, 26, 71–77. [Google Scholar] [CrossRef]

- Sharma, S.; Sharma, S.; Athaiya, A. Activation functions in neural networks. Int. J. Eng. Appl. Sci. Technol. 2020, 4, 310–316. [Google Scholar] [CrossRef]

- Min, J.; Lee, Y.C. Bankruptcy prediction using support vector machine with optimal choice of kernel function parameters. Expert Syst. Appl. 2005, 28, 603–614. [Google Scholar] [CrossRef]

- Neves, J.C.; Vieira, A. Improving Bankruptcy Prediction with Hidden Layer Learning Vector Quantization. Eur. Account. Rev. 2006, 15, 253–271. [Google Scholar] [CrossRef]

- Hájek, P.; Olej, V. Evaluating Sentiment in Annual Reports for Financial Distress Prediction Using Neural Networks and Support Vector Machines. Commun. Comput. Inf. Sci. 2013, 384, 1–10. [Google Scholar] [CrossRef]

- Sreedharan, M.; Khedr, A.M.; El Bannany, M. A Comparative Analysis of Machine Learning Classifiers and Ensemble Techniques in Financial Distress Prediction. In Proceedings of the 17th International Multi-Conference on Systems, Signals and Devices (SSD), Monastir, Tunisia, 20–23 July 2020. [Google Scholar] [CrossRef]

- Hung, C.; Chen, J.; Wermter, S. Hybrid probability-based ensembles for bankruptcy prediction. In Proceedings of the International Conference on Business and Information, Tokyo, Japan, 11–13 July 2007. [Google Scholar]

- Andone, I.; Sireteanu, N.A. A Combination of Two Classification Techniques for Businesses Bankruptcy Prediction. SSRN Electron. J. 2009. Available online: http://dx.doi.org/10.2139/ssrn.1527726 (accessed on 15 November 2022). [CrossRef]

- Hung, C.; Chen, J.H. A selective ensemble based on expected probabilities for bankruptcy prediction. Expert Syst. Appl. 2009, 36, 5297–5303. [Google Scholar] [CrossRef]

- Vieira, A.S.; Duarte, J.; Ribeiro, B.; Neves, J.C. Accurate Prediction of Financial Distress of Companies with Machine Learning Algorithms. In Proceedings of the 9th International Conference, ICANNGA, Kuopio, Finland, 23–25 April 2009. [Google Scholar] [CrossRef]

- Rodan, A.; Castillo, P.A.; Faris, H.; Mora, A.M.; Jawazneh, H. Forecasting Business Failure in Highly Imbalanced Distribution based on Delay Line Reservoir. In Proceedings of the European Symposium on Artificial Neural Networks, Computational Intelligence and Machine Learning, Bruges, Belgium, 25–27 April 2018. [Google Scholar]

- Tumpach, M. Prediction of the bankruptcy of Slovak companies using neural networks with SMOTE. Ekon. Cas. 2020, 68, 1021–1039. [Google Scholar] [CrossRef]

- Cho, R.W.; Song, Y.; Littleton, J.T. Comparative analysis of Drosophila and mammalian complexins as fusion clamps and facilitators of neurotransmitter release. Mol. Cell. Neurosci. 2010, 45, 389–397. [Google Scholar] [CrossRef]

- Yoon, J.S.; Kwon, Y.S. A practical approach to bankruptcy prediction for small businesses: Substituting the unavailable financial data for credit card sales information. Expert Syst. Appl. 2010, 37, 3624–3629. [Google Scholar] [CrossRef]

- Gordini, N. A genetic algorithm approach for SMEs bankruptcy prediction: Empirical evidence from Italy. Expert Syst. Appl. 2014, 41, 6433–6445. [Google Scholar] [CrossRef]

- O’Brien, R.M. A Caution Regarding Rules of Thumb for Variance Inflation Factors. Qual. Quant. 2007, 41, 673–690. [Google Scholar] [CrossRef]

- Hanley, J.A.; McNeil, B.J. The meaning and use of the area under a receiver operating characteristic (ROC) curve. Radiology 1982, 143, 29–36. [Google Scholar] [CrossRef]

- Mandrekar, J.N. Receiver Operating Characteristic Curve in Diagnostic Test Assessment. J. Thorac. Oncol. 2010, 5, 1315–1316. [Google Scholar] [CrossRef] [PubMed]

- Vuković, B.; Peštović, K.; Mirović, V.; Jakšić, D.; Milutinović, S. The Analysis of Company Growth Determinants Based on Financial Statements of the European Companies. Sustainability 2017, 14, 770. [Google Scholar] [CrossRef]

- Shachmurove, Y. Applying Artificial Neural Networks to Business, Economics and Finance, Working Paper 02–08; Center for Analytic Research in Economics and the Social Sciences, University of Pennsylvania: Philadelphia, PA, USA, 2002; pp. 1–47. [Google Scholar]

- Cybinski, P.J. The path to failure: Where are bankruptcy studies at now? J. Bus. Manag. 2000, 7, 11–39. [Google Scholar]

- Roiger, R.J.; Geatz, M. Data Mining: A Tutorial-Based Primer; Addison Wesley: Boston, MA, USA, 2003. [Google Scholar]

- Haji, A.H.; Abdulazees, A.M. Comparasion of optimization techniques based on gradient descent algorithm: A review. Palarch’s J. Archaeol. Egypt/Egyptol. 2021, 4, 2715–2743. [Google Scholar]

- Montesinos López, O.A.; Montesinos López, A.; Crossa, J. Fundamentals of Artificial Neural Networks and Deep Learning. In Multivariate Statistical Machine Learning Methods for Genomic Prediction; Springer: Cham, Switzerland, 2022. [Google Scholar]

| Symbol | Variable Calculation | Literature Source |

|---|---|---|

| ROA | Net Income/Total Assets | Back et al. [43], Atiya [23], Charitou et al. [21], Yim and Mitchell [29], Neophytou and Molinero [49], Virag and Kristof [25], Ryu and Yue [50], Chung et al. [32], Chen and Du [27], Simić et al. [18], Lin [14], Kim and Kang [15], Ravisankar et al. [16], Rafiei et al. [4], Blanco et al. [22], Callejón et al. [20], Zebardast et al. [40], Korol [46], Sehgal et al. [36], Chinedu et al. [39]. |

| CR | Current Assets/Current Liabilities | Back et al. [43], Charitou et al. [21], Neophytou and Molinero [49], Virag and Kristof [25], Ryu and Yue [50], Abdelwahed and Amir [42], Yim and Mitchell [29], Chung et al. [32], Alfaro [37], Chen and Du [27], Lin [14], Ravisankar et al. [16], Kim and Kang [15], Kim [33], Rafiei et al. [41], Callejón et al. [20], Zebardast et al. [40], Bredart [17], Bapat and Nagale [24], Inam et al. [6], Korol [46], Sehgal et al. [36], Chinedu et al. [39]. |

| WC/TA | Working Capital/Total Assets | Back et al. [43], Neophytou and Molinero [49], Charitou et al. [21], Abdelwahed and Amir [42], Ryu and Yue [50], Alfaro [37], Simić et al. [18], Chung et al. [32], Ravisankar et al. [16], Rafiei et al. [41], Eriki and Udegbunam [12], Bapat and Nagale [24], Barboza et al. [38], Inam et al. [6], Sehgal et al. [36]. |

| RER | Retained Earnings/Total Assets | Back et al. [43], Charitou et al. [21], Neophytou and Molinero [49], Ryu and Yue [50], Chung et al. [32], Lin [14], Simić et al. [18], Kim and Kang [15], Ravisankar et al. [16], Eriki and Udegbunam [12], Bapat and Nagale [24], Barboza et al. [38], Inam et al. [6], Sehgal et al. [36], Chinedu et al. [39]. |

| EBIT/TA | EBIT/Total Assets | Atiya [23], Charitou et al. [21], Neophytou and Molinero [49], Ryu and Yue [50], Alfaro [37], Chung et al. [32], Simić et al. [18], Callejón et al. [20], Eriki and Udegbunam [12], Bredart [17], Bapat and Nagale [24], Barboza et al. [38], Inam et al. [6], Korol [46], Chinedu et al. [39]. |

| S/TA | Sales/Total Assets | Neophytou and Molinero [49], Charitou et al. [21], Ryu and Yue [50], Alfaro [37], Chung et al. [32], Ravisankar et al. [16], Rafiei et al. [41], Blanco et al. [22], Bapat and Nagale [24], Eriki and Udegbunam [12], Inam et al. [6], Chinedu et al. [39]. |

| QR | (Current Asset Inventories)/ Current Liabilities | Yim and Mitchell [29], Virag and Kristof [25], Chung et al. [32], Rafiei et al. [41], Lee and Choi [35], Zebardast et al. [40], Mselmi et el. [47], Inam et al. [6], Korol [46], Chinedu et al. [39]. |

| TD/TA | Total Debt/Total Assets | Back et al. [43], Ryu and Yue [50], Chen and Du [27], Lin [14], Kim and Kang [15], Ravisankar et al. [16], Callejón et al. [20], Zebardast et al. [40]. |

| CA/TA | Current Assets/Total Assets | Back et al. [43], Charitou et al. [21], Neophytou and Molinero [49], Ryu and Yue [50], Virag and Kristof [25], Alfaro [37], Chung et al. [32], Chen and Du [27], Ravisankar et al. [16], Kim and Kang [15], Fedorova et al. [44], Bapat and Nagale [24], Douglas [51], Inam et al. [6], Sehgal et al. [36], Chinedu et al. [39]. |

| DR | Total Liabilities/Total Assets | Virag and Kristof [25], Neophytou and Molinero [49], Charitou et al. [21], Chung et al. [32], Tinoco and Wilson [52], Blanco et al. [22], Bapat and Nagale [24], Chinedu et al. [39]. |

| C/TA | Cash/ Total Assets | Back et al. [43], Abdelwahed and Amir [42], Virag and Kristof [25], Ryu and Yue [50], Alfaro [37], Chung et al. [32], Kim and Kang [15], Ravisankar et al. [16], Kouki and Elkhaldi [26], Blanco et al. [22], Korol [46], Sehgal et al. [36]. |

| OCF/TA | Operations Cash Flow/Total Assets | Back et al. [43], Atiya [23], Neophytou and Molinero [49]. Abdelwahed and Amir [42], Ryu and Yue [50], Charitou et al. [21], Callejón et al. [20], Douglas [51], Bapat and Nagale [24], Sehgal et al. [36], Chinedu et al. [39]. |

| OCF/TL | Operations Cash Flow/ Total Liabilities | Neophytou and Molinero [49], Charitou et al. [21], Tinoco and Wilson [52], Bapat and Nagale [24]. |

| LIQ | Current Liabilities/Total Assets | Charalambous et al. [28], Charitou et al. [21], Neophytou and Molinero [49], Bapat and Nagale [24], Inam et al. [6], Korol [46], Chinedu et al. [39]. |

| OCF/TD | Operations Cash Flow/Total Debt | Back et al. [43], Ryu and Yue [50], Alfaro [37]. |

| QA/TA | Quick Assets/ Total Assets | Back et al. [43], Charitou et al. [21], Ryu and Yue [50], Bapat and Nagale [24], Neophytou and Molinero [49], Ravisankar et al. [16], Kim and Kang [15], Kim [33], Inam et al. [6]. |

| CA/S | Current Assets/Sales | Neophytou and Molinero [49], Ryu and Yue [50], Charitou et al. [21], Chung et al. [32], Simić et al. [18], Bapat and Nagale [24], Chinedu et al. [39]. |

| EBIT/Int | EBIT/Interest | Back et al. [43], Kim and Kang [15], Chung et al. [32], Kouki and Elkhaldi [26], Korol [46]. |

| Inv/S | Inventory/Sales | Back et al. [43], Neophytou and Molinero [49], Charitou et al. [21], Ryu and Yue [50], Chung et al. [32], Chen and Du [27], Simić et al. [18], Kim and Kang [15], Ravisankar et al. [16], Kim [33], Bapat and Nagale [24], Chinedu et al. [39]. |

| OI/TA | Operating Income/Total Assets | Back et al. [43], Atiya [23], Ravisankar et al. [16], Rafiei et al. [41]. |

| OCF/S | Operations Cash Flow/Sales | Neophytou and Molinero [49], Charitou et al. [21], Bapat and Nagale [24], Chinedu et al. [39]. |

| NI/S | Net Income/Sales | Charitou et al. [21], Chung et al. [32], Kim and Kang [15], Rafiei et al. [41], Bapat and Nagale [24]. |

| LTD/TA | Long-Term Debt/Total Assets | Ravisankar et al. [16], Mselmi et al. [47], Sehgal et al. [36], Chinedu et al. [39]. |

| NW/TA | Net Worth/Total Assets | Takahashi et al. [53], Mohamad [54], Ahn and Kim [55], Blanco-Oliver et al. [56]. |

| Cash/Current Liabilities | Cash/Current Liabilities | Back et al. [43], Ryu and Yue [50], Alfaro [37], Chung et al. [32], Fedorova et al. [44], Zebardast et al. [40], Inam et al. [6]. |

| OCF/CL | Operations Cash Flow/ Current Liabilities | Back et al. [43], Neophytou and Molinero [49], Charitou et al. [21], Lin [14], Bapat and Nagale [24], Chinedu et al. [39]. |

| WC/S | Working Capital/Sales | Neophytou and Molinero [49], Alfaro [37], Simić et al. [18] |

| Cap/A | Capital/Assets | Yim and Mitchell [29], Virag and Kristof [25], Neophytou and Molinero [49], Kim and Kang [15], Rafiei et al. [41], Lee and Choi [35], Douglas [51], Bapat and Nagale [24], Inam et al. [6]. |

| NS/TA | Net Sales/Total Assets | Back et al. [43], Virag and Kristof [25], Lin [14], Bapat and Nagale [24], Barboza et al. [38]. |

| NW/TL | Net Worth/Total Liabilities | Mohamad [54], Mahato [57], Wagan et al. [58]. |

| NCI | No Credit Interval | Tinoco and Wilson [52], Fedorova et al. [44], Liang et al. [59]. |

| LOG_TA | Total Assets (log) | Alfaro [37], Callejón et al. [20], Douglas [51], Mselmi et al. [47]. |

| CFNI/D | Cash Flow (Net Income)/Debt | Brockett et al. [31], Kouki and Elkhaldi [26], Virag and Kristof [25], Chen and Du [27], Ravisankar et al. [16], Inam et al. [6]. |

| OCF | Operations Cash Flow | Mossman et al. [60], Anandarajan et al. [11]. |

| OE/OI | Operating Expenses/ Operating Income | Douglas [51], Africa [61], Asyikin [62]. |

| QA/S | Quick Assets/Sales | Back et al. [43], Charitou et al. [21], Neophytou and Molinero [49], Ryu and Yue [50], Simić et al. [18], Kouki and Elkhaldi [26], Bapat and Nagale [24]. |

| S/Inv. | Sales/Inventory | Jo et al. [63], Virag and Kristof [25], Rafiei et al. [41], Liang et al. [59]. |

| Variable | t | df | Sig. (2-Tailed) |

|---|---|---|---|

| ROA (Y-1) | −4.8269 | 98.0000 | 0.0000 |

| CR (Y-1) | −4.4554 | 98.0000 | 0.0000 |

| WC/TA (Y-1) | −2.2434 | 98.0000 | 0.0271 |

| RER (Y-1) | −3.8764 | 98.0000 | 0.0002 |

| EBIT/TA (Y-1) | −4.9624 | 98.0000 | 0.0000 |

| S/TA (Y-1) | −2.1970 | 98.0000 | 0.0304 |

| QR (Y-1) | −4.3151 | 98.0000 | 0.0000 |

| TD/TA (Y-1) | 2.2012 | 98.0000 | 0.0301 |

| DR (Y-1) | 2.2012 | 98.0000 | 0.0301 |

| C/TA (Y-1) | −3.4742 | 98.0000 | 0.0008 |

| OCF/TA (Y-1) | −2.1629 | 98.0000 | 0.0330 |

| OCF/TL (Y-1) | −2.1629 | 98.0000 | 0.0330 |

| OCF/TD (Y-1) | −2.1253 | 98.0000 | 0.0361 |

| CA/S (Y-1) | 2.1871 | 98.0000 | 0.0311 |

| OI/TA (Y-1) | −2.1970 | 98.0000 | 0.0304 |

| NI/S (Y-1) | −2.5003 | 98.0000 | 0.0141 |

| NW/TA (Y-1) | −5.6787 | 98.0000 | 0.0000 |

| C/CL (Y-1) | −3.9581 | 98.0000 | 0.0001 |

| OCF/CL (Y-1) | −2.3283 | 98.0000 | 0.0220 |

| Cap/A (Y-1) | −5.6787 | 98.0000 | 0.0000 |

| NS/TA (Y-1) | −4.2742 | 98.0000 | 0.0000 |

| NW/TL (Y-1) | −5.6787 | 98.0000 | 0.0000 |

| CFNI/D (Y-1) | −3.6697 | 98.0000 | 0.0004 |

| OE/OI (Y-1) | 2.8081 | 98.0000 | 0.0060 |

| QA/S (Y-1) | 2.0028 | 98.0000 | 0.0480 |

| Variable | Tolerance | VIF |

|---|---|---|

| ROA (Y-1) | 0.477 | 2.095 |

| WC/TA (Y-1) | 0.412 | 2.429 |

| RER (Y-1) | 0.452 | 2.21 |

| QR (Y-1) | 0.347 | 2.884 |

| OCF/TL (Y-1) | 0.518 | 1.929 |

| CA/S (Y-1) | 0.558 | 1.792 |

| OI/TA (Y-1) | 0.646 | 1.547 |

| C/CL (Y-1) | 0.565 | 1.771 |

| OCF/CL (Y-1) | 0.524 | 1.91 |

| NW/TL (Y-1) | 0.389 | 2.57 |

| CFNI/D (Y-1) | 0.4 | 2.498 |

| OE/OI (Y-1) | 0.657 | 1.522 |

| Classification | ||||

|---|---|---|---|---|

| Sample | Ground-truth | 0 | Predicted 1 | Percent Correct |

| Training | 0 | 31 | 4 | 88.6% |

| 1 | 8 | 27 | 77.1% | |

| Overall Percent | 55.7% | 44.3% | 82.9% | |

| Testing | 0 | 13 | 2 | 86.7% |

| 1 | 4 | 11 | 73.3% | |

| Overall Percent | 56.7% | 43.3% | 80.0% |

| Area Under | Curve | |

|---|---|---|

| Status 0/1 | 0 1 | 0.899 0.899 |

| Variable | t | df | Sig. (2-Tailed) |

|---|---|---|---|

| ROA (Y-2) | −2.2773 | 98 | 0.0249 |

| CR (Y-2) | −2.5725 | 98 | 0.0116 |

| RER (Y-2) | −4.3665 | 98 | 0 |

| EBIT/TA (Y-2) | −2.2965 | 98 | 0.0238 |

| QR (Y-2) | −3.0413 | 98 | 0.003 |

| NW/TA (Y-2) | −4.0167 | 98 | 0.0001 |

| C/CL (Y-2) | −2.7334 | 98 | 0.0074 |

| Cap/A (Y-2) | −4.0167 | 98 | 0.0001 |

| NS/TA (Y-2) | −3.1314 | 98 | 0.0023 |

| NW/TL (Y-2) | −4.0167 | 98 | 0.0001 |

| LOG_TA (Y-2) | 2.6562 | 98 | 0.0092 |

| CFNI/D (Y-2) | −3.3986 | 98 | 0.001 |

| Variable | Tolerance | VIF |

|---|---|---|

| ROA (Y-2) | 0.267 | 3.745 |

| CR (Y-2) | 0.427 | 2.344 |

| RER (Y-2) | 0.348 | 2.874 |

| QR (Y-2) | 0.276 | 3.629 |

| C/CL (Y-2) | 0.714 | 1.4 |

| NS/TA (Y-2) | 0.388 | 2.576 |

| NW/TL (Y-2) | 0.463 | 2.16 |

| CFNI/D (Y-2) | 0.302 | 3.313 |

| LOG_TA (Y-2) | 0.933 | 1.072 |

| Classification | ||||

|---|---|---|---|---|

| Sample | Ground-truth | 0 | Predicted 1 | Percent Correct |

| Training | 0 | 27 | 8 | 77.1% |

| 1 | 9 | 26 | 74.3% | |

| Overall Percent | 51.4% | 48.6% | 75.7% | |

| Testing | 0 | 11 | 4 | 73.3% |

| 1 | 4 | 11 | 73.3% | |

| Overall Percent | 50.0% | 50.0% | 73.3% |

| Status 0/1 | 0 1 | 0.816 0.816 |

Disclaimer/Publisher’s Note: The statements, opinions and data contained in all publications are solely those of the individual author(s) and contributor(s) and not of MDPI and/or the editor(s). MDPI and/or the editor(s) disclaim responsibility for any injury to people or property resulting from any ideas, methods, instructions or products referred to in the content. |

© 2023 by the authors. Licensee MDPI, Basel, Switzerland. This article is an open access article distributed under the terms and conditions of the Creative Commons Attribution (CC BY) license (https://creativecommons.org/licenses/by/4.0/).

Share and Cite

Kušter, D.; Vuković, B.; Milutinović, S.; Peštović, K.; Tica, T.; Jakšić, D. Early Insolvency Prediction as a Key for Sustainable Business Growth. Sustainability 2023, 15, 15304. https://doi.org/10.3390/su152115304

Kušter D, Vuković B, Milutinović S, Peštović K, Tica T, Jakšić D. Early Insolvency Prediction as a Key for Sustainable Business Growth. Sustainability. 2023; 15(21):15304. https://doi.org/10.3390/su152115304

Chicago/Turabian StyleKušter, Denis, Bojana Vuković, Sunčica Milutinović, Kristina Peštović, Teodora Tica, and Dejan Jakšić. 2023. "Early Insolvency Prediction as a Key for Sustainable Business Growth" Sustainability 15, no. 21: 15304. https://doi.org/10.3390/su152115304

APA StyleKušter, D., Vuković, B., Milutinović, S., Peštović, K., Tica, T., & Jakšić, D. (2023). Early Insolvency Prediction as a Key for Sustainable Business Growth. Sustainability, 15(21), 15304. https://doi.org/10.3390/su152115304