An Assessment Tool to Identify the Financial Literacy Level of Financial Education Programs Participants’ Executed by Ecuadorian Financial Institutions

Abstract

1. Introduction

2. FL Conceptual Basis

2.1. FL and Its Dimensions

2.2. Scales for Measuring FL

2.3. FEP in Ecuador

2.4. Sociodemographic Factors in FL

3. Research Design

3.1. Sample

3.2. Data Collection

3.3. Informed Consent

3.4. Scale Design

- Structure, concepts, actors, and operation of controlled systems;

- Financial planning, saving, and preparation of a family budget;

- Rights and obligations contained in the “Code of Rights of the User of the Financial System”;

- Role of the Superintendency of Banks;

- Administration, associated risks, rights, and obligations of credit operations;

- Forms and legal figures established to exercise their rights and claims both within the controlled entity and in public bodies.

- Administration, handling, use, rights and obligations, and associated risks of the products offered by the controlled system, such as savings books, current accounts, and use of checks, term deposits, credits, and credit cards, among others;

- Administration, management, use, rights and obligations; and risks associated with the financial services offered, such as debit cards, ATMs, electronic banking, drafts and transfers, and remittances, among others;

- Insurance related to the products offered by the controlled entities, especially about general information on insurance, the rights and obligations of the insured, the risks covered and insurance exclusions, the insured amounts, and the process, requirements, and deadlines to make claims in the event of the loss, among others;

- Use of transactional channels.

3.5. Analysis Procedure

4. Results

4.1. EFA

4.2. CFA

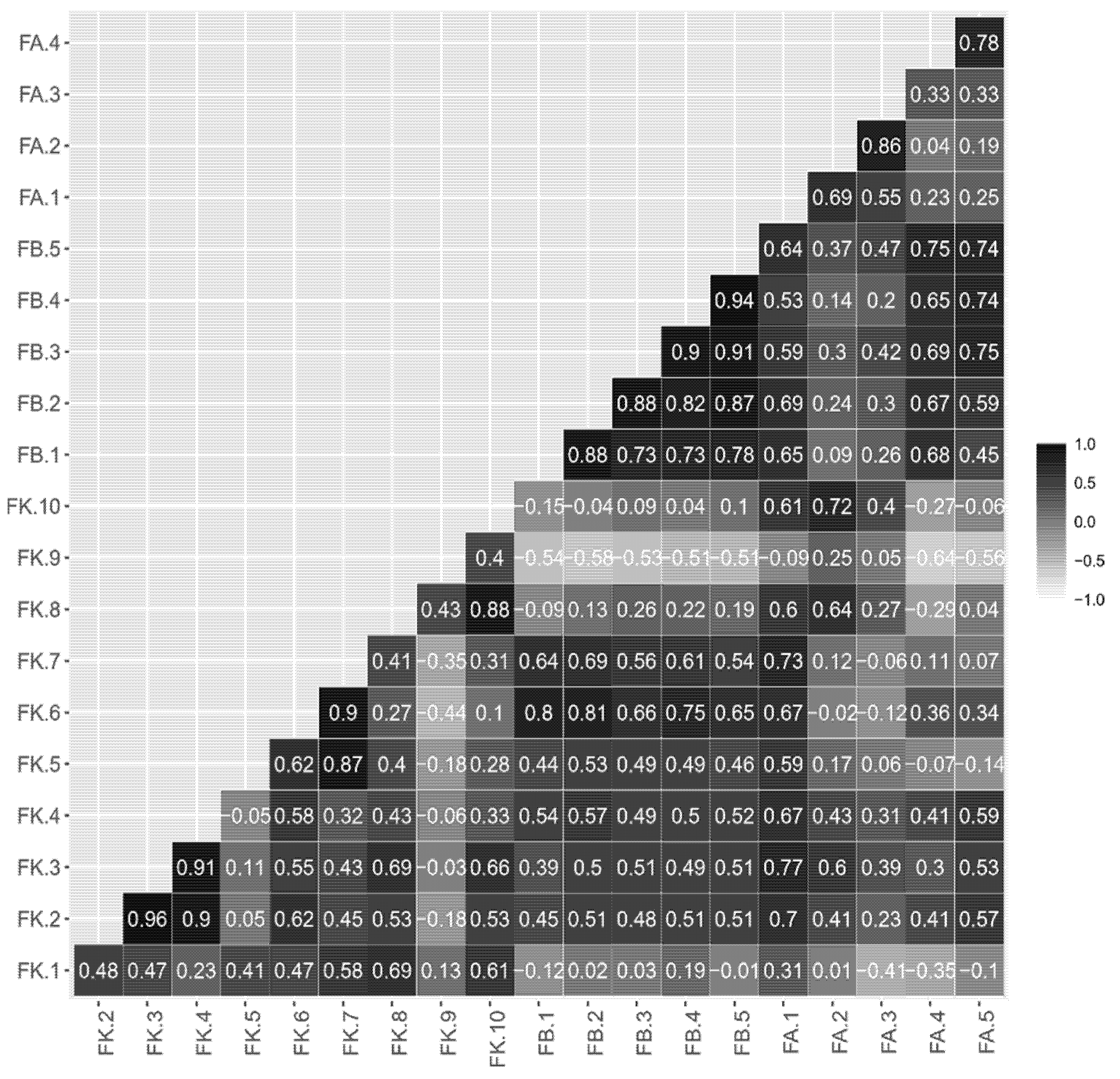

4.2.1. Correlation Matrix Analysis

4.2.2. Fit Measures

4.2.3. Measure of Reliability and Validity of Convergence (Convergent Validity)

4.2.4. Structural Relationships and Hypothesis Testing

4.3. Descriptive Analysis and Correlation Analysis

4.4. Hypotheses

4.5. The Bank’s Customer Preferences

5. Discussion

6. Conclusions

Supplementary Materials

Author Contributions

Funding

Institutional Review Board Statement

Informed Consent Statement

Data Availability Statement

Acknowledgments

Conflicts of Interest

Appendix A

| Code | Items | Factor Loading | Item Source | |

|---|---|---|---|---|

| Author | Action | |||

| FK (correct answer). α 0.794 | ||||

| FK-1 | What type of income do you think should be used for budgeting? [Money owed to us by other people]; [Inheritance to receive in the future]; [Fixed income]; [Variable income]; [None of the above]; [I don’t know] | X | 2 | A |

| FK-2 | What is the regulation in charge of protecting the rights of the Financial User? [Comprehensive Organic Criminal Code]; [Internal Tax Regime Law]; [Companies Law]; [User Rights Code]; [None of the above]; [I don’t know] | 0.83 | 1 | N |

| FK-3 | Regulatory entity of the State that is in charge of regulating and controlling the financial activity of cooperatives at the national level. [Superintendency of Banks of Ecuador]; [Superintendence of Popular and Solidarity Economy]; [Superintendency of Companies]; [Superintendency of market power control]; [None of the above]; [I don´t know] | 0.85 | 1 | N |

| FK-4 | Is the Pledge Credit a…? [Education Credit]; [Credit to buy clothes]; [Credit to acquire a movable property]; [Credit to pay debts]; [None of the above]; [I don´t know] | 0.90 | 1 | N |

| FK-5 | Regulatory entity of the State that controls and monitors the financial activity in the country of banks, mutuals, and financial companies. [Superintendency of Companies]; [Superintendency of Banks of Ecuador]; [Superintendence of Popular and Solidarity Economy]; [Superintendency of market power control]; [None of the above]; [I don´t know] | 0.69 | 1 | N |

| FK-6 | What are the financial services distribution channels? [Virtual Banking/Mobile/Telephone/Transactional]; [ATMS]; [Agencies and Counters]; [Call center]; [All of the above]; [I don´t know] | 0.95 | 1 | N |

| FK-7 | What is defined as a demand deposit contract between the bank and the client, which allows one to earn interest? [Current account]; [Savings account]; [Policy]; [Insurance]; [None of the above]; [I don´t know] | 0.84 | 1 | N |

| FK-8 | In what kinds of situations can insurance cover us? [Loss of household assets due to theft]; [Unplanned expenses on health issues]; [Loss of income for our family, in the event of death]; [All of the above]; [None of the above]; [I don´t know] | 0.58 | 2 | A |

| FK-9 | Remittances are ….? [Money transfers made by private companies in the same country]; [Money transfers made by people in the same country]; [Money transfers made by people from one country to another]; [Money transfers made by public companies in the same country]; [None of the above]; [I don´t know] | X | 4 | A |

| FK-10 | Who is the customer advocate? [It is a support for clients in the face of any problem related to financial products and/or services]; [It is a mediator between the user and the Financial Institution]; [It is a protector of the particular rights and interests of the clients of a financial institution]; [All of the above]; [None of the above]; [I don´t know] | 0.43 | 1 | N |

| FB (1 Never–5 Always). α 0.956 | ||||

| FB-1 | When you apply to a credit do you know what INSURANCE you are paying? | 0.94 | 5 | A |

| FB-2 | Do you create a monthly budget for personal expenses. | 0.95 | 3 | A |

| FB-3 | Do you choose products in an informed way. | 0.96 | 3 | A |

| FB-4 | Do you prefer to buy assets with your own savings rather than to go into debt. | 0.89 | 2 | A |

| FB-5 | Do you frequently save at least a minimum percentage of your income. | 0.94 | 7 | A |

| FA (1 Strongly disagree- 5 Completely agree). α 0.630 | ||||

| FA-1 | Do you consider that you have extensive knowledge of the products offered by FI? | 0.81 | 3 | A |

| FA-2 | Do you consider that saving is a positive exercise for your financial growth? | 0.64 | 3 | A |

| FA-3 | Do you consider that keeping a record of income, expenses, and debts is important? | 0.72 | 2 | A |

| FA-4 | Do you rely on transactional channels to enter passwords and inquire about financial products/services? | 0.77 | 4 | A |

| FA-5 | Are you are willing to risk some of your own money when making an investment? | 0.79 | 6 | C |

| α Cronbach´s alpha (Cronbach 1951) | ||||

| X: Deleted Items after Correlational analysis. This scale based on seven formal studies.

| ||||

| FL | FK | FB | FA | Gender | Age | Marital Status | Educational Level | Occupation | |

|---|---|---|---|---|---|---|---|---|---|

| FL | 1.00 | ||||||||

| FK | 0.86 *** | 1.00 | |||||||

| FB | 0.88 *** | 0.54 *** | 1.00 | ||||||

| FA | 0.86 *** | 0.58 *** | 0.81 *** | 1.00 | |||||

| Gender | −0.04 | −0.11 | 0.04 | 0.00 | 1.00 | ||||

| Age | 0.72 | 0.54 | 0.76 | 0.62 | 0.08 | 1.00 | |||

| Marital status | 0.64 | 0.43 | 0.66 | 0.63 | 0.10 | 0.88 | 1.00 | ||

| Educational level | 0.72 | 0.54 | 0.76 | 0.58 | 0.06 | 0.77 | 0.43 | 1.00 | |

| Occupation | −0.49 | −0.41 | −0.52 | −0.33 | −0.09 | −0.61 | −0.19 | −0.80 | 1.00 |

| Source | Type II Sum of Squares | df | F-Statistic | p-Value | ηp2 | Post Hoc Comparisons-Bonferroni | |

|---|---|---|---|---|---|---|---|

| FL | Groups | 5.99 | 3 | 188.12 | 0.000 *** | 0.64 | HS < CE HS < GP HS < FIE CE = GP CE < FIE GP < FIE |

| Residuals | 3.29 | 310 | |||||

| FK | Groups | 9.45 | 3 | 81.76 | 0.000 *** | 0.44 | HS < CE HS < GP HS < FIE CE = GP CE < FIE GP = FIE |

| Residuals | 11.94 | 310 | |||||

| FB | Groups | 9.83 | 3 | 163.57 | 0.000 *** | 0.61 | HS < CE HS < GP HS < FIE CE = GP CE < FIE GP < FIE |

| Residuals | 6.21 | 310 | |||||

| FA | Groups | 1.52 | 3 | 68.37 | 0.000 *** | 0.40 | HS < CE HS < GP HS < FIE CE = GP CE < FIE GP < FIE |

| Residuals | 2.29 | 310 | |||||

References

- Tavares, F.; Santos, E.; Tavares, V.; Ratten, V. The Perception and Knowledge of Financial Risk of the Portuguese. Sustainability 2020, 12, 8255. [Google Scholar] [CrossRef]

- Mitchell, O.S.; Schieber, S.J. Living with Defined Contribution Pensions: Remaking Responsibility for Retirement; Pension Research Council, Wharton School of the University of Pennsylvania: Philadelphia, PA, USA, 1998. [Google Scholar]

- Lusardi, A.; Mitchell, O. Financial Literacy and Planning: Implications for Retirement Wellbeing; National Bureau of Economic Research: Cambridge, MA, USA, 2011; Available online: http://www.nber.org/papers/w17078.pdf (accessed on 16 November 2022).

- Lusardi, A.; Mitchelli, O.S. Financial Literacy and Retirement Preparedness: Evidence and Implications for Financial Education. Bus. Econ. 2007, 42, 35–44. [Google Scholar] [CrossRef]

- Lusardi, A.; Mitchell, O. Planning and Financial Literacy: How Do Women Fare? Am. Econ. Rev. 2008, 98, 413–417. [Google Scholar] [CrossRef]

- Anderson, A.; Baker, F.; Robinson, D.T. Precautionary Savings, Retirement Planning and Misperceptions of Financial Literacy. J. Financ. Econ. 2017, 126, 383–398. [Google Scholar] [CrossRef]

- van Nguyen, H.; Ha, G.H.; Nguyen, D.N.; Doan, A.H.; Phan, H.T. Understanding Financial Literacy and Associated Factors among Adult Population in a Low-Middle Income Country. Heliyon 2022, 8, e09638. [Google Scholar] [CrossRef]

- Grohmann, A. Financial Literacy and Financial Behavior: Evidence from the Emerging Asian Middle Class. Pac. Basin Financ. J. 2018, 48, 129–143. [Google Scholar] [CrossRef]

- Boisclair, D.; Lusardi, A.; Michaud, P.C. Financial Literacy and Retirement Planning in Canada. J. Pension Econ. Financ. 2017, 16, 277–296. [Google Scholar] [CrossRef]

- van Rooij, M.; Lusardi, A.; Alessie, R. Financial Literacy and Stock Market Participation. J. Financ. Econ. 2011, 101, 449–472. [Google Scholar] [CrossRef]

- Mouna, A.; Anis, J. Financial Literacy in Tunisia: Its Determinants and Its Implications on Investment Behavior. Res. Int. Bus. Financ. 2017, 39, 568–577. [Google Scholar] [CrossRef]

- Hassan Al-Tamimi, H.A.; Anood Bin Kalli, A. Financial Literacy and Investment Decisions of UAE Investors. J. Risk Financ. 2009, 10, 500–516. [Google Scholar] [CrossRef]

- Merkoulova, Y.; Veld, C. Why Do Individuals Not Participate in the Stock Market? Int. Rev. Financ. Anal. 2022, 83, 102292. [Google Scholar] [CrossRef]

- CFPB. Financial Literacy Annual Report; CFPB: Washington, DC, USA, 2016.

- OECD. OECD/INFE 2020 International Survey of Adult Financial Literacy; OECD: Paris, France, 2020; Available online: https://www.oecd.org/financial/education/launchoftheoecdinfeglobalfinancialliteracysurveyreport.htm (accessed on 26 November 2022).

- OECD Council. Recommendation on Principles and Good Practices for Financial Education and Awareness; OECD: Paris, France, 2005. [Google Scholar]

- Méndez Prado, S.M.; Zambrano Franco, M.J.; Zambrano Zapata, S.G.; Chiluiza García, K.M.; Everaert, P.; Valcke, M. A Systematic Review of Financial Literacy Research in Latin America and The Caribbean. Sustainability 2022, 14, 3814. [Google Scholar] [CrossRef]

- Silva, T.C.; Braz, T.; Amancio, D.R.; Tabak, B.M. Financial Literacy and the Perceived Value of Stress Testing: An Experiment Using Students in Brazil. Emerg. Mark. Financ. Trade 2022, 58, 965–996. [Google Scholar] [CrossRef]

- Alí, Í.; Sepúlveda, J.; Sepúlveda, J.; Denegri, M. The Impact of Attitudes on Behavioural Change: A Multilevel Analysis of Predictors of Changes in Consumer Behaviour. Rev. Lat. Psicol. 2021, 53, 73–82. [Google Scholar] [CrossRef]

- Paraboni, A.L.; Soares, F.M.; Potrich, A.C.G.; Vieira, K.M. Does Formal and Business Education Expand the Levels of Financial Education? Int. J. Soc. Econ. 2020, 47, 769–785. [Google Scholar] [CrossRef]

- Méndez Prado, S.M.; Everaert, P.; Valcke, M. Is the Dosed Video-Vignettes Intervention More Effective with a Longer-Lasting Effect? A Financial Literacy Study. In Proceedings of the 2020 12th International Conference on Education Technology and Computers, London, UK, 23 October 2020; ACM: New York, NY, USA, 2020; pp. 193–198. [Google Scholar]

- Paraboni, A.L.; da Costa, N. Improving the Level of Financial Literacy and the Influence of the Cognitive Ability in This Process. J. Behav. Exp. Econ. 2021, 90, 101656. [Google Scholar] [CrossRef]

- Comité de Educación Financiera Estrategia Nacional de Educación FInanciera México. Available online: https://www.gob.mx/forodeinclusionfinanciera/articulos/estrategia-nacional-de-educacion-financiera-enef?idiom=es#:~:text=La%20Estrategia%20Nacional%20de%20Educaci%C3%B3n,bienestar%20financiero%20de%20la%20poblaci%C3%B3n (accessed on 26 September 2022).

- En Brasil—ENEF. Available online: https://www.vidaedinheiro.gov.br/es/educacao-financeira-no-brasil/?doing_wp_cron=1660939647.5076899528503417968750 (accessed on 18 August 2022).

- Estrategia Nacional de Educación Financiera Chile; Gobierno de Chile: Santiago, Chile, 2017. Available online: https://bibliotecadigital.mineduc.cl/handle/20.500.12365/2167 (accessed on 26 November 2022).

- Experiencias Y Aprendizajes De La Educación Financiera; Asobancaria: Bogotá, Colombia, 2016. Available online: https://www.sabermassermas.com/experiencias-y-aprendizajes-de-la-educacion-financiera/ (accessed on 19 August 2022).

- Superintendencia de Bancos del Ecuador. Resolución SB-2015-665; Superintendencia de Bancos del Ecuador: Quito, Ecuador, 2015; Available online: https://www.superbancos.gob.ec/bancos/wp-content/uploads/downloads/2018/04/resol_SB-2015-665.pdf (accessed on 27 September 2022).

- Quiénes Somos-Finanzas Personales Ecuador. Available online: https://tusfinanzas.ec/quienes-somos/ (accessed on 25 September 2022).

- Méndez Prado, M.; Marcillo, Q.L. La Educación Financiera Toma Rumbo En El País | Gestión. 2018. Available online:https://revistagestion.ec/economia-y-finanzas-analisis/la-educacion-financiera-toma-rumbo-en-el-pais (accessed on 12 September 2022).

- Méndez Prado, S.M.; Chiluiza, K.; Everaert, P.; Valcke, M. Design and Evaluation among Young Adults of a Financial Literacy Scale Focused on Key Financial Decisions. Educ. Sci. 2022, 12, 460. [Google Scholar] [CrossRef]

- OECD. OECD/INFE Toolkit for Measuring Financial Literacy and Financial Inclusion; OECD: Paris, France, 2018. [Google Scholar]

- Klapper, L.; Lusardi, A.; van Oudheusden, P. Financial Literacy Around the World: Insights from the S&P Global Financial Literacy Survey; GFLEC: Washington, DC, USA, 2015. [Google Scholar]

- Walstad, W.B.; Rebeck, K. The Test of Financial Literacy: Development and Measurement Characteristics. J. Econ. Educ. 2017, 48, 113–122. [Google Scholar] [CrossRef]

- Schuhen, M.; Schürkmann, S. Construct Validity of Financial Literacy. Int. Rev. Econ. Educ. 2014, 16, 1–11. [Google Scholar] [CrossRef]

- Huston, S.J. Measuring Financial Literacy. J. Consum. Aff. 2010, 44, 296–316. [Google Scholar] [CrossRef]

- Lusardi, A.; Mitchell, O.S. The Economic Importance of Financial Literacy: Theory and Evidence. J. Econ. Lit. 2014, 52, 5–44. [Google Scholar] [CrossRef] [PubMed]

- OECD. PISA 2012 Results: Students and Money; PISA; OECD: Paris, France, 2014; Volume 5, ISBN 9789264208087. [Google Scholar]

- Atkinson, A.; Messy, F.-A. Measuring Financial Literacy: Results of the OECD/International Network on Financial Education (INFE) Pilot Study. In OECD Working Papers on Finance, Insurance and Private Pensions; OECD: Paris, France, 2012; Volume 15. [Google Scholar] [CrossRef]

- Muñoz-Murillo, M.; Álvarez-Franco, P.B.; Restrepo-Tobón, D.A. The Role of Cognitive Abilities on Financial Literacy: New Experimental Evidence. J. Behav. Exp. Econ. 2020, 84, 101482. [Google Scholar] [CrossRef]

- Hernández-Mejía, S.; García-Santillán, A.; Moreno-García, E. Financial Literacy and the Use of Credit Cards in Mexico. J. Int. Stud. 2021, 14, 97–112. [Google Scholar] [CrossRef]

- Duch, R.; Granados, P.; Laroze, D.; López, M.; Ormeño, M.; Quintanilla, X. Choice Architecture Improves Pension Selection. Appl. Econ. 2021, 53, 2256–2274. [Google Scholar] [CrossRef]

- Santoyo Ledesma, D.S.; Luna Nemecio, J. Experiencia Exploratoria de Validación de Un Instrumento Sobre Nivel de Cultura Financiera En La Generación Millennial. Rev. de Métodos Cuantitativos Para La Econ. y La Empresa 2021, 31, 226–239. [Google Scholar] [CrossRef]

- Financial Literacy and Inclusion Results of OECD/INFE Survey across Countries and by Gender; OECD: Paris, France, 2013.

- Allianz. When Will the Penny Drop? Allianz: Munich, Germany, 2017. [Google Scholar]

- Ouachani, S.; Belhassine, O.; Kammoun, A. Measuring Financial Literacy: A Literature Review. Manag. Financ. 2020, 47, 266–281. [Google Scholar] [CrossRef]

- Agarwal, S.; Driscoll, J.C.; Gabaix, X.; Laibson, D. The Age of Reason: Financial Decisions over the Life Cycle and Implications for Regulation. Brook. Pap. Econ. Act. 2009, 2009, 51–117. [Google Scholar] [CrossRef]

- Klapper, L.F.; Lusardi, A.; Panos, G.A.; Thank, W.; Al-Hussainy, E.; Markov, A.; Mckenzie, D.; Melecky, M.; Rutledge, S.; Zia, B. Financial Literacy and the Financial Crisis; National Bureau of Economic Research: Washington, DC, USA, 2012. [Google Scholar]

- Christiansen, C.; Joensen, J.S.; Rangvid, J. Are Economists More Likely to Hold Stocks? Rev. Financ. 2008, 12, 465–496. [Google Scholar] [CrossRef]

- Lusardi, A.; Mitchell, O. How Ordinary Consumers Make Complex Economic Decisions: Financial Literacy and Retirement Readiness; National Bureau of Economic Research: Cambridge, MA, USA, 2009. [Google Scholar]

- Behrman, J.R.; Mitchell, O.S.; Soo, C.K.; Bravo, D. How Financial Literacy Affects Household Wealth Accumulation. Am. Econ. Rev. 2012, 102, 300–304. [Google Scholar] [CrossRef]

- Shockey, S.S. Low-Wealth Adults’ Financial Literacy, Money Management Behaviors, and Associated Factors, Including Critical Thinking; The Ohio State University: Columbus, OH, USA, 2002. [Google Scholar]

- Vieira, K.M.; Potrich, A.C.G.; Mendes-Da-Silva, W. A Financial Literacy Model for University Students. In Individual Behaviors and Technologies for Financial Innovations; Springer: Cham, Switzerland, 2019; pp. 69–95. [Google Scholar] [CrossRef]

- Chu, Z.; Wang, Z.; Xiao, J.J.; Zhang, W. Financial Literacy, Portfolio Choice and Financial Well-Being. Soc. Indic. Res. 2017, 132, 799–820. [Google Scholar] [CrossRef]

- Serido, J.; Shim, S.; Mishra, A.; Tang, C. Financial Parenting, Financial Coping Behaviors, and Well-Being of Emerging Adults. Fam. Relat. 2010, 59, 453–464. [Google Scholar] [CrossRef]

- Philippas, N.D.; Avdoulas, C. Financial Literacy and Financial Well-Being among Generation-Z University Students: Evidence from Greece. Eur. J. Financ. 2020, 26, 360–381. [Google Scholar] [CrossRef]

- Pandey, A.; Ashta, A.; Spiegelman, E.; Sutan, A. Catch Them Young: Impact of Financial Socialization, Financial Literacy and Attitude towards Money on Financial Well-Being of Young Adults. Int. J. Consum. Stud. 2020, 44, 531–541. [Google Scholar] [CrossRef]

- Limbu, Y.B.; Sato, S. Credit Card Literacy and Financial Well-Being of College Students: A Moderated Mediation Model of Self-Efficacy and Credit Card Number. Int. J. Bank Mark. 2019, 37, 991–1003. [Google Scholar] [CrossRef]

- Potrich, A.C.G.; Vieira, K.M.; Kirch, G. How Well Do Women Do When It Comes to Financial Literacy? Proposition of an Indicator and Analysis of Gender Differences. J. Behav. Exp. Financ. 2018, 17, 28–41. [Google Scholar] [CrossRef]

- Dogra, P.; Kaushal, A.; Sharma, R.R. Antecedents of the Youngster’s Awareness About Financial Literacy: A Structure Equation Modelling Approach. Vis. J. Bus. Perspect. 2021, 0, 097226292199656. [Google Scholar] [CrossRef]

- Walstad, W.B.; Rebeck, K. Test of Financial Literacy: Examiner’s Manual; Council for Economic Education: New York, NY, USA, 2016. [Google Scholar]

- Förster, M.; Happ, R.; Molerov, D. Using the U.S. Test of Financial Literacy in Germany—Adaptation and Validation. J. Econ. Educ. 2017, 48, 123–135. [Google Scholar] [CrossRef]

- Amagir, A.; Groot, W.; van den Brink, H.M.; Wilschut, A. Financial Literacy of High School Students in the Netherlands: Knowledge, Attitudes, Self-Efficacy, and Behavior. Int. Rev. Econ. Educ. 2020, 34, 100185. [Google Scholar] [CrossRef]

- Santos, D.B.; Mendes-Da-Silva, W.; Norvilitis, J.M.; Protin, P.; Onusic, L. Parents Influence Responsible Credit Use in Young Adults: Empirical Evidence from the United States, France, and Brazil. J. Fam. Econ. Issues 2022, 43, 368–383. [Google Scholar] [CrossRef]

- Garcia-Santillan, A. Knowledge and Application toward Financial Topics in High School Students: A Parametric Study. Eur. J. Educ. Res. 2020, 9, 905–919. [Google Scholar] [CrossRef]

- Moreno-García, E.; García-Santillán, A.; Gutiérrez, A.D. los S. Financial Literacy of “Telebachillerato” Students: A Study of Perception, Usefulness and Application of Financial Tools. Int. J. Educ. Pract. 2019, 7, 168–183. [Google Scholar] [CrossRef]

- Farías, P. Determinants of Knowledge of Personal Loans’ Total Costs: How Price Consciousness, Financial Literacy, Purchase Recency and Frequency Work Together. J. Bus. Res. 2019, 102, 212–219. [Google Scholar] [CrossRef]

- Campara, J.P.; Mendes Vieira, K. “Bolsa Família X” Program Financial Literacy: In Search of a Model for Low-Income Women. Espacios 2016, 37, 22. [Google Scholar]

- Arbache, J.; Mejía, D.; Andrés, P.; García, F.; Carrera Vaca, C.; Guevara, G.E.; Rojas, M.J. Encuesta De Medición De Capacidades Financieras Ecuador 2020. 2020. Available online: https://www.findevgateway.org/es/publicacion/2022/07/encuesta-de-medicion-de-capacidades-financieras-ecuador-2020 (accessed on 27 September 2022).

- Klapper, L.; Lusardi, A. Financial Literacy and Financial Resilience: Evidence from around the World. Financ. Manag. 2020, 49, 589–614. [Google Scholar] [CrossRef]

- Citybank. Programa de Educación Financiera PEF 2022-Banco de Desarrollo; Citybank N.A. Sucursal Ecuador: Quito, Ecuador, 2022. [Google Scholar]

- CNMV. Plan de Educación Financiera; Banco Central Del Ecuador; CNMV: Madrid, Spain, 2020.

- Citybank. Programa de Educación Financiera PEF 2021; Citybank N.A. Sucursal Ecuador: Quito, Ecuador, 2021. [Google Scholar]

- Lusardi, A.; Mitchell, O.S. Financial Literacy around the World: An Overview. J. Pension Econ. Financ. 2011, 10, 497–508. [Google Scholar] [CrossRef] [PubMed]

- Bucher-Koenen, T.; Lusardi, A. Financial Literacy and Retirement Planning in Germany; National Bureau of Economic Research: Cambridge, MA, USA, 2011. [Google Scholar]

- Lusardi, A.; Mitchell, O.; Curto, V. Financial Literacy among the Young: Evidence and Implications for Consumer Policy; National Bureau of Economic Research: Cambridge, MA, USA, 2009; Available online: http://www.nber.org/papers/w15352.pdf (accessed on 16 November 2022).

- Swiecka, B.; Yeşildağ, E.; Özen, E.; Grima, S. Financial Literacy: The Case of Poland. Sustainability 2020, 12, 700. [Google Scholar] [CrossRef]

- Calamato, M.P. Learning Financial Literacy in the Family; San Jose State University: San Jose, CA, USA, 2010. [Google Scholar]

- Liaqat, F.; Mahmood, K.; Ali, F.H. Demographic and Socio-Economic Differences in Financial Information Literacy among University Students. Inf. Dev. 2021, 37, 376–388. [Google Scholar] [CrossRef]

- Gerrans, P.; Heaney, R. The Impact of Undergraduate Personal Finance Education on Individual Financial Literacy, Attitudes and Intentions. Account. Financ. 2019, 59, 177–217. [Google Scholar] [CrossRef]

- Urban, C.; Schmeiser, M.; Collins, J.M.; Brown, A. The Effects of High School Personal Financial Education Policies on Financial Behavior. Econ. Educ. Rev. 2020, 78, 101786. [Google Scholar] [CrossRef]

- Bruhn, M.; de Souza Leão, L.; Legovini, A.; Marchetti, R.; Zia, B. The Impact of High School Financial Education: Evidence from a Large-Scale Evaluation in Brazil. Am. Econ. J. Appl. Econ. 2016, 8, 256–295. [Google Scholar] [CrossRef]

- Hernández Mejía, S.; García-Santillán, A.; Moreno-García, E. Financial Literacy and Its Relationship with Sociodemographic Variables. Econ. Sociol. 2022, 15, 40–55. [Google Scholar] [CrossRef]

- Agarwal, S.; Chomsisengphet, S.; ZHANG, Y. How Does Financial Literacy Affect Mortgage Default? SSRN Electron. J. 2015. [Google Scholar] [CrossRef]

- Azlan, A.; Jamal, A.; Kamal, W.; Mohdrahimie, R.; Roslemohidin, A.K.; Osman, Z. The Effects of Social Influence and Financial Literacy on Savings Behavior: A Study on Students of Higher Learning Institutions in Kota Kinabalu, Sabah. Int. J. Bus. Soc. Sci. 2015, 6, 110–119. [Google Scholar]

- Kiliyanni, A.L.; Sivaraman, S. The Perception-Reality Gap in Financial Literacy: Evidence from the Most Literate State in India. Int. Rev. Econ. Educ. 2016, 23, 47–64. [Google Scholar] [CrossRef]

- Mashizha, M.; Sibanda, M.; Maumbe, B. Financial Literacy among Small and Medium Enterprises in Zimbabwe. S. Afr. J. Entrep. Small Bus. Manag. 2019, 11, 10. [Google Scholar] [CrossRef]

- Singla, A.; Mallik, G. Determinants of Financial Literacy: Empirical Evidence from Micro and Small Enterprises in India. Asia Pac. Manag. Rev. 2021, 26, 248–255. [Google Scholar] [CrossRef]

- Rachapaettayakom, P.; Wiriyapinit, M.; Cooharojananone, N.; Tanthanongsakkun, S.; Charoenruk, N. The Need for Financial Knowledge Acquisition Tools and Technology by Small Business Entrepreneurs. J. Innov. Entrep. 2020, 9, 25. [Google Scholar] [CrossRef]

- Struckell, E.M.; Patel, P.C.; Ojha, D.; Oghazi, P. Financial Literacy and Self Employment—The Moderating Effect of Gender and Race. J. Bus. Res. 2022, 139, 639–653. [Google Scholar] [CrossRef]

- Ćumurović, A.; Hyll, W. Financial Literacy and Self-Employment. J. Consum. Aff. 2019, 53, 455–487. [Google Scholar] [CrossRef]

- Danes, S.M.; Hira, T.K. Money Management Knowledge of College Students. J. Stud. Financ. Aid 1987, 17, 1. [Google Scholar] [CrossRef]

- Klapper, L.F.; Panos, G.A. Financial Literacy and Retirement Planning: The Russian Case. SSRN Electron. J. 2011, 10, 599–618. [Google Scholar] [CrossRef][Green Version]

- Dow-Fleisner, S.J.; Seaton, C.L.; Li, E.; Plamondon, K.; Oelke, N.; Kurtz, D.; Jones, C.; Currie, L.M.; Pesut, B.; Hasan, K.; et al. Internet Access Is a Necessity: A Latent Class Analysis of COVID-19 Related Challenges and the Role of Technology Use among Rural Community Residents. BMC Public Health 2022, 22, 845. [Google Scholar] [CrossRef]

- Bumcrot, C.; Lin, J.; Lusardi, A. The Geography of Financial Literacy. Numeracy 2013, 6. [Google Scholar] [CrossRef]

- Fornero, E.; Monticone, C. Financial Literacy and Pension Plan Participation in Italy. J. Pension Econ. Financ. 2011, 10, 547–564. [Google Scholar] [CrossRef]

- Parsons, V.L. Stratified Sampling. In Wiley StatsRef: Statistics Reference Online; Wiley: Hoboken, NJ, USA, 2017; pp. 1–11. [Google Scholar]

- Monsalve, C. ESPOL Ethics Committee Certification. 2021. Available online: https://drive.google.com/file/d/1K8dUsrOdo2F2-YmFRTxj4OmeR8oYTSUX/view?usp=sharing (accessed on 2 January 2023).

- OECD. G20/OECD INFE Core Competencies Framework on Financial Literacy for Adults; OECD: Paris, France, 2016. [Google Scholar]

- OECD. OECD/INFE Core Competencies Framework on Financial Literacy for Youth; OECD: Paris, France, 2015. [Google Scholar]

- Iglesias, M.; Mejía, D. Encuesta de Medición de Capacidades Financieras En Argentina; CAF: Buenos Aires, Argentina, 2018; Available online: http://scioteca.caf.com/handle/123456789/1341 (accessed on 27 September 2022).

- OECD. OECD/INFE International Survey of Adult Financial Literacy Competencies; OECD: Paris, France, 2016; Available online:www.oecd.org/finance/OECD-INFE-International-Survey-of-Adult-Financial-Literacy-Competencies.pdf (accessed on 26 November 2022).

- CAF. Cuestionario de Medición de Capacidades Financieras de Ecuador 2013; CAF: Buenos Aires, Argentina, 2013. [Google Scholar]

- Swaminathan, V. Noncomparative Scaling Technique. In Wiley International Encyclopedia of Marketing; John Wiley & Sons, Ltd.: Chichester, UK, 2010. [Google Scholar]

- Hair, J.F.; Black, W.C.; Babin, B.J.; Anderson, R.E. Multivariate Data Analysis, 7th ed.; Pearson: New York, NY, USA, 2010. [Google Scholar]

- Ganesan, Y.; Pitchay, A.B.A.; Nasser, M.A.M. Does Intention Influence the Financial Literacy of Depositors of Islamic Banking? A Case of Malaysia. Int. J. Soc. Econ. 2020, 47, 675–690. [Google Scholar] [CrossRef]

- R Core Team R: A Language and Environment for Statistical Computing; R Foundation for Statistical Computing: Vienna, Austria, 2022.

- Revelle, W. (psych Package) psych: Procedures for Personality and Psychological Research, R package version 2.2.9; Northwestern University: Evanston, IL, USA, 2022.

- Rosseel, Y. lavaan: An R Package for Structural Equation Modeling. J. Stat. Softw. 2012, 48, 1–36. [Google Scholar] [CrossRef]

- Jorgensen, T.D.; Pornprasertmanit, S.; Schoemann, A.M.; Rosseel, Y. SemTools: Useful Tools for Structural Equation Modeling, R Package Version 0.5-6; 2022. Available online: https://cran.r-project.org/web/packages/semTools/index.html (accessed on 19 August 2022).

- Muthén, B.O. Goodness of Fit with Categorical and Other Non-Normal Variables. In Testing Structural Equation Models; Sage: Thousand Oaks, CA, USA, 1993. [Google Scholar]

- Lorenzo-Seva, U.; Ferrando, P.J. Not Positive Definite Correlation Matrices in Exploratory Item Factor Analysis: Causes, Consequences and a Proposed Solution. Struct. Equ. Model. 2021, 28, 138–147. [Google Scholar] [CrossRef]

- Barlett, M.S. The Effect of Standardization on a Χ2 Approximation in Factor Analysis. Biometrika 1951, 38, 337–344. [Google Scholar] [CrossRef]

- Kaiser, H.F. An Index of Factorial Simplicity. Psychometrika 1974, 39, 31–36. [Google Scholar] [CrossRef]

- Wirth, R.J.; Edwards, M.C. Item Factor Analysis: Current Approaches and Future Directions. Psychol. Methods 2007, 12, 58–79. [Google Scholar] [CrossRef]

- Barendse, M.T.; Oort, F.J.; Timmerman, M.E. Using Exploratory Factor Analysis to Determine the Dimensionality of Discrete Responses. Struct. Equ. Model. A Multidiscip. J. 2015, 22, 87–101. [Google Scholar] [CrossRef]

- Horn, J.L. A Rationale and Test for the Number of Factors in Factor Analysis. Psychometrika 1965, 30, 179–185. [Google Scholar] [CrossRef]

- Preacher, K.J.; MacCallum, R.C. Repairing Tom Swift’s Electric Factor Analysis Machine. Underst. Stat. 2003, 2, 13–43. [Google Scholar] [CrossRef]

- Hendrickson, A.E.; White, P.O. Promax: A Quick Method for Rotation to Oblique Simple Structure. Br. J. Stat. Psychol. 1964, 17, 65–70. [Google Scholar] [CrossRef]

- Coughlan, J.; Hooper, D.; Mullen, M.R. Structural Equation Modeling: Guidelines for Determining Model Fit. Electron. J. Bus. Res. Methods 2007, 6, 53–60. [Google Scholar]

- Cronbach, L.J. Coefficient Alpha and the Internal Structure of Tests. Psychometrika 1951, 16, 297–334. [Google Scholar] [CrossRef]

- McDonald, R.P. Test Theory; Psychology Press: New York, NY, USA, 2013; ISBN 9781410601087. [Google Scholar]

- Fornell, C.; Larcker, D.F. Evaluating Structural Equation Models with Unobservable Variables and Measurement Error. J. Mark. Res. 1981, 18, 39. [Google Scholar] [CrossRef]

- Hair, J.F.; Hult, G.T.M.; Ringle, C.M.; Sarstedt, M.; Danks, N.P.; Ray, S. Partial Least Squares Structural Equation Modeling (PLS-SEM) Using R; Classroom Companion: Business; Springer: Cham, Switzerland, 2021; ISBN 978-3-030-80518-0. [Google Scholar]

- William, S. The Probable Error of a Mean. Biometrika 1908, 6, 1. [Google Scholar] [CrossRef]

- Shapiro, S.S.; Wilk, M.B. An Analysis of Variance Test for Normality (Complete Samples). Biometrika 1965, 52, 591. [Google Scholar] [CrossRef]

- Keyes, T.K.; Levy, M.S. Analysis of Levene’s Test under Design Imbalance. J. Educ. Behav. Stat. 1997, 22, 227. [Google Scholar] [CrossRef]

- Cohen, J. Statistical Power Analysis for the Behavioral Sciences; Routledge: New York, NY, USA, 2013; ISBN 9781134742707. [Google Scholar]

- Cohen, J. Eta-Squared and Partial Eta-Squared in Fixed Factor Anova Designs. Educ. Psychol. Meas. 1973, 33, 107–112. [Google Scholar] [CrossRef]

- Pavkovic, A.; Andelinovic, M.; Misevic, D. Measuring Financial Literacy of University Students. Croat. Oper. Res. Rev. 2018, 9, 87–97. [Google Scholar] [CrossRef]

- Coria, M.D.; Concha-Salgado, A.; Aravena, J.S. Adaptation and Validation of the Economic and Financial Literacy Test for Chilean Secondary Students. Rev. Lat. Psicol. 2019, 51, 113–122. [Google Scholar] [CrossRef]

- Nguyen, T.D. The Effectiveness of Online Learning: Beyond No Significant Difference and Future Horizons. MERLOT J. Online Learn. Teach. 2015, 11, 309–319. [Google Scholar]

- Nguyen, T.X.H.; Tran, T.B.N.; Dao, T.B.; Barysheva, G.; Nguyen, C.T.; Nguyen, A.H.; Lam, T.S. Elderly People’s Adaptation to the Evolving Digital Society: A Case Study in Vietnam. Soc. Sci. 2022, 11, 324. [Google Scholar] [CrossRef]

- Salehi, A.; Strawderman, L.; Huang, Y.; Ahmed, S.; Babski-Reeves, K. Effectiveness of Three Training Delivery Methods in a Voluntary Program. Proc. Hum. Factors Ergon. Soc. 2009, 3, 1959–1963. [Google Scholar] [CrossRef]

| Trial | Model 1 | Model 2 | Model 3 |

|---|---|---|---|

| Applied co-variances | -- | FK~~FA FB~~FA FK~~FB | FK~~FA FB~~FA FK~~FB FK2~~FK3 FB4~~FB5 |

| Chi-square (value) | 2.062,77 | 1.450,66 | 1.436,45 |

| Chi-square (p-value) | 0.000 *** | 0.000 *** | 0.000 *** |

| Degrees of freedom | 133 | 130 | 128 |

| Chi-square/Degrees of freedom | 15.51 | 11.16 | 11.22 |

| GFI-Goodness of fit index | 0.984 | 0.990 | 0.990 |

| CFI-Comparative fit index | 0.984 | 0.991 | 0.991 |

| NFI-Normed fit index | 0.984 | 0.990 | 0.990 |

| TLI-Tucker–Lewis’s index | 0.982 | 0.989 | 0.989 |

| SRMR- Standardized Root mean square residual | 0.294 | 0.279 | 0.278 |

| RMSEA-Root mean square error of approximation | 0.313 | 0.244 | 0.244 |

| Subscale | Items | α | ω | AVE |

|---|---|---|---|---|

| FL | 18 | 0.908 | 0.962 | 0.745 |

| FK | 8 | 0.794 | 0.894 | 0.706 |

| FB | 5 | 0.956 | 0.962 | 0.946 |

| FA | 5 | 0.630 | 0.808 | 0.605 |

| Hypothesis | Path | Estimate | p-Value | Decision |

|---|---|---|---|---|

| H1 | FL ← FK | 0.43 | 0.000 *** | Supported |

| H2 | FL ← FB | 0.28 | 0.000 *** | Supported |

| H3 | FL ← FA | 0.29 | 0.000 *** | Supported |

| FL | FK | FB | FA | |||||

|---|---|---|---|---|---|---|---|---|

| M | SD | M | SD | M | SD | M | SD | |

| HS | 59 | 0.07 | 55 | 0.16 | 49 | 0.05 | 72 | 0.08 |

| CE | 82 | 0.13 | 86 | 0.26 | 78 | 0.20 | 83 | 0.10 |

| GP | 83 | 0.14 | 89 | 0.23 | 78 | 0.20 | 82 | 0.11 |

| FIE | 96 | 0.02 | 99 | 0.03 | 98 | 0.02 | 93 | 0.03 |

| Source | Type II Sum of Squares | df | F-Statistic | p-Value | ηp2 | Post Hoc Comparisons-Bonferroni |

|---|---|---|---|---|---|---|

| Age | 5.46 | 3 | 147.45 | 0.000 *** | 0.59 | 15–20 < 21–26 15–20 < 27–32 15–20 < 33–50 21–26 = 27–32 21–26 < 33–50 27–32 = 33–50 |

| Residuals | 3.83 | 310 | ||||

| Marital status | 2.24 | 3 | 32.80 | 0.000 *** | 0.24 | Single < Married Single < Free Union Single = Divorced Married = Free Union Married = Divorced Free Union = Divorced |

| Residuals | 7.05 | 310 | ||||

| Educational level | 5.76 | 3 | 169.20 | 0.000 *** | 0.62 | High school < Higher technological level High school < Third level, grade High school < Fourth level, postgraduate Higher technological level < Third level, grade Higher technological level = Fourth level, postgraduate Third level, grade > Fourth level, postgraduate |

| Residuals | 3.52 | 310 | ||||

| Occupation | 6.50 | 4 | 180.67 | 0.000 *** | 0.70 | Housewife/Househusband = Public Employee Housewife/Househusband < Private Employee Housewife/Househusband < Microentrepreneur Housewife/Househusband = Does not apply Public Employee < Private Employee Public Employee < Microentrepreneur Public Employee = Does not apply Private Employee < Microentrepreneur Private Employee > Does not apply Microentrepreneur > Does not apply |

| Residuals | 2.78 | 309 |

Disclaimer/Publisher’s Note: The statements, opinions and data contained in all publications are solely those of the individual author(s) and contributor(s) and not of MDPI and/or the editor(s). MDPI and/or the editor(s) disclaim responsibility for any injury to people or property resulting from any ideas, methods, instructions or products referred to in the content. |

© 2023 by the authors. Licensee MDPI, Basel, Switzerland. This article is an open access article distributed under the terms and conditions of the Creative Commons Attribution (CC BY) license (https://creativecommons.org/licenses/by/4.0/).

Share and Cite

Méndez-Prado, S.M.; Rodriguez, V.; Peralta-Rizzo, K.; Everaert, P.; Valcke, M. An Assessment Tool to Identify the Financial Literacy Level of Financial Education Programs Participants’ Executed by Ecuadorian Financial Institutions. Sustainability 2023, 15, 996. https://doi.org/10.3390/su15020996

Méndez-Prado SM, Rodriguez V, Peralta-Rizzo K, Everaert P, Valcke M. An Assessment Tool to Identify the Financial Literacy Level of Financial Education Programs Participants’ Executed by Ecuadorian Financial Institutions. Sustainability. 2023; 15(2):996. https://doi.org/10.3390/su15020996

Chicago/Turabian StyleMéndez-Prado, Silvia Mariela, Vanessa Rodriguez, Kevin Peralta-Rizzo, Patricia Everaert, and Martin Valcke. 2023. "An Assessment Tool to Identify the Financial Literacy Level of Financial Education Programs Participants’ Executed by Ecuadorian Financial Institutions" Sustainability 15, no. 2: 996. https://doi.org/10.3390/su15020996

APA StyleMéndez-Prado, S. M., Rodriguez, V., Peralta-Rizzo, K., Everaert, P., & Valcke, M. (2023). An Assessment Tool to Identify the Financial Literacy Level of Financial Education Programs Participants’ Executed by Ecuadorian Financial Institutions. Sustainability, 15(2), 996. https://doi.org/10.3390/su15020996