Assessing Shock Propagation and Cascading Uncertainties Using the Input–Output Framework: Analysis of an Oil Refinery Accident in Singapore

Abstract

1. Introduction

2. Methodology

2.1. Leontief IO Model

2.2. Inoperability IO Model (IIM)

2.3. Dynamic Inoperability IO Model (DIIM)

2.3.1. Recovery Coefficients and Uncertainty Modelling

2.3.2. DIIM Extensions

3. Singapore IO Data and Structure of the Economy

4. Description of the PB Refinery Fire

5. Results and Discussion

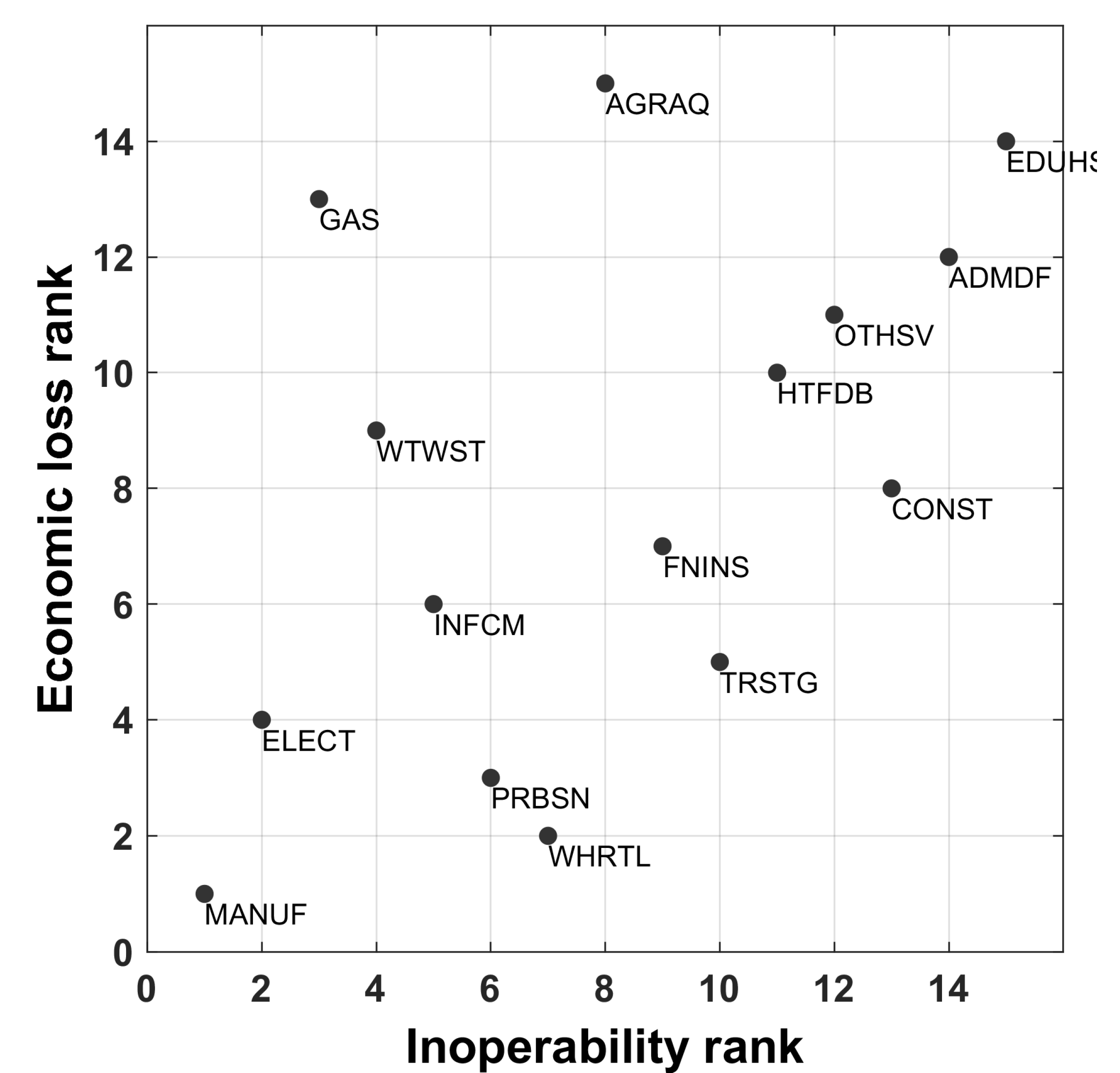

5.1. Static IIM

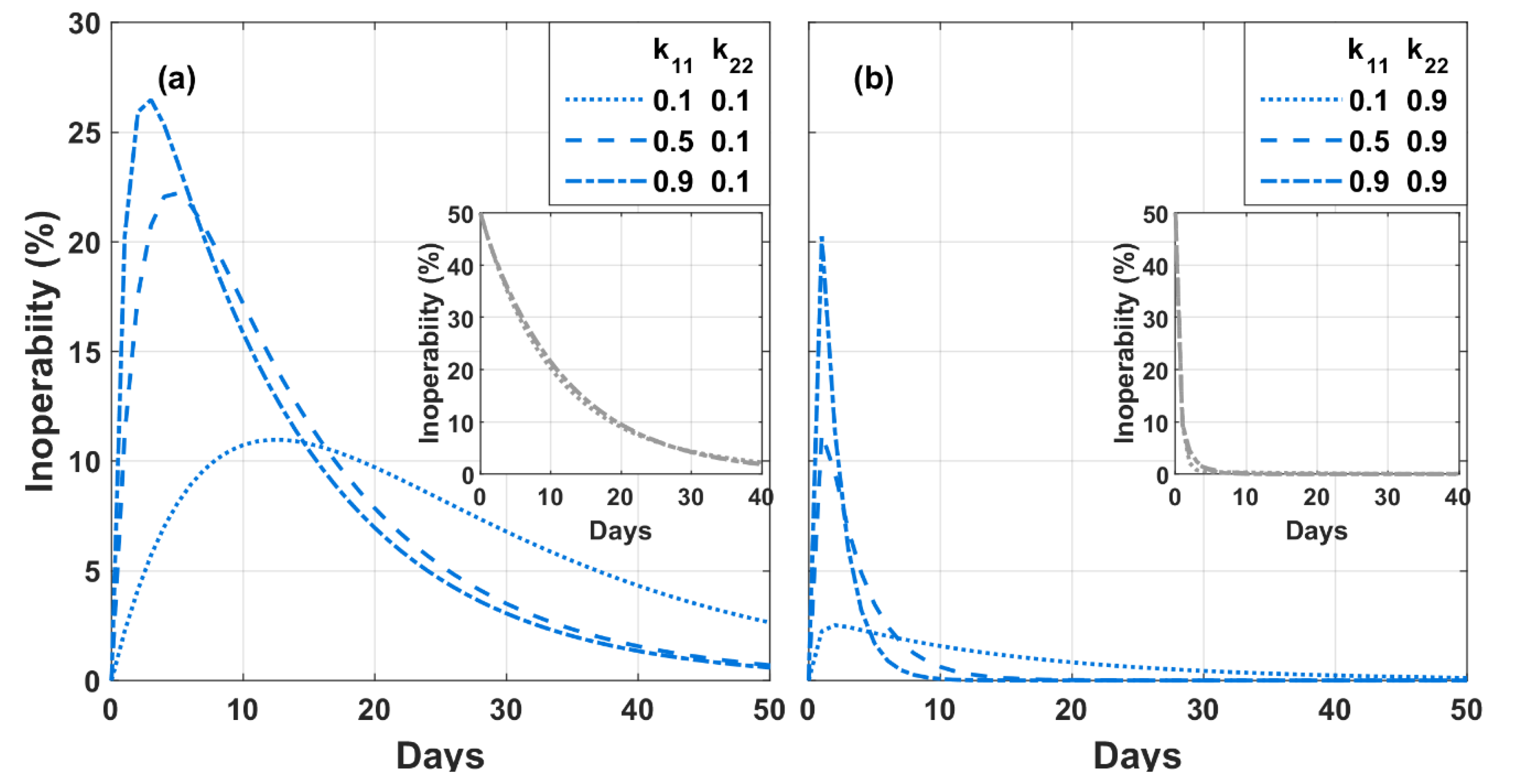

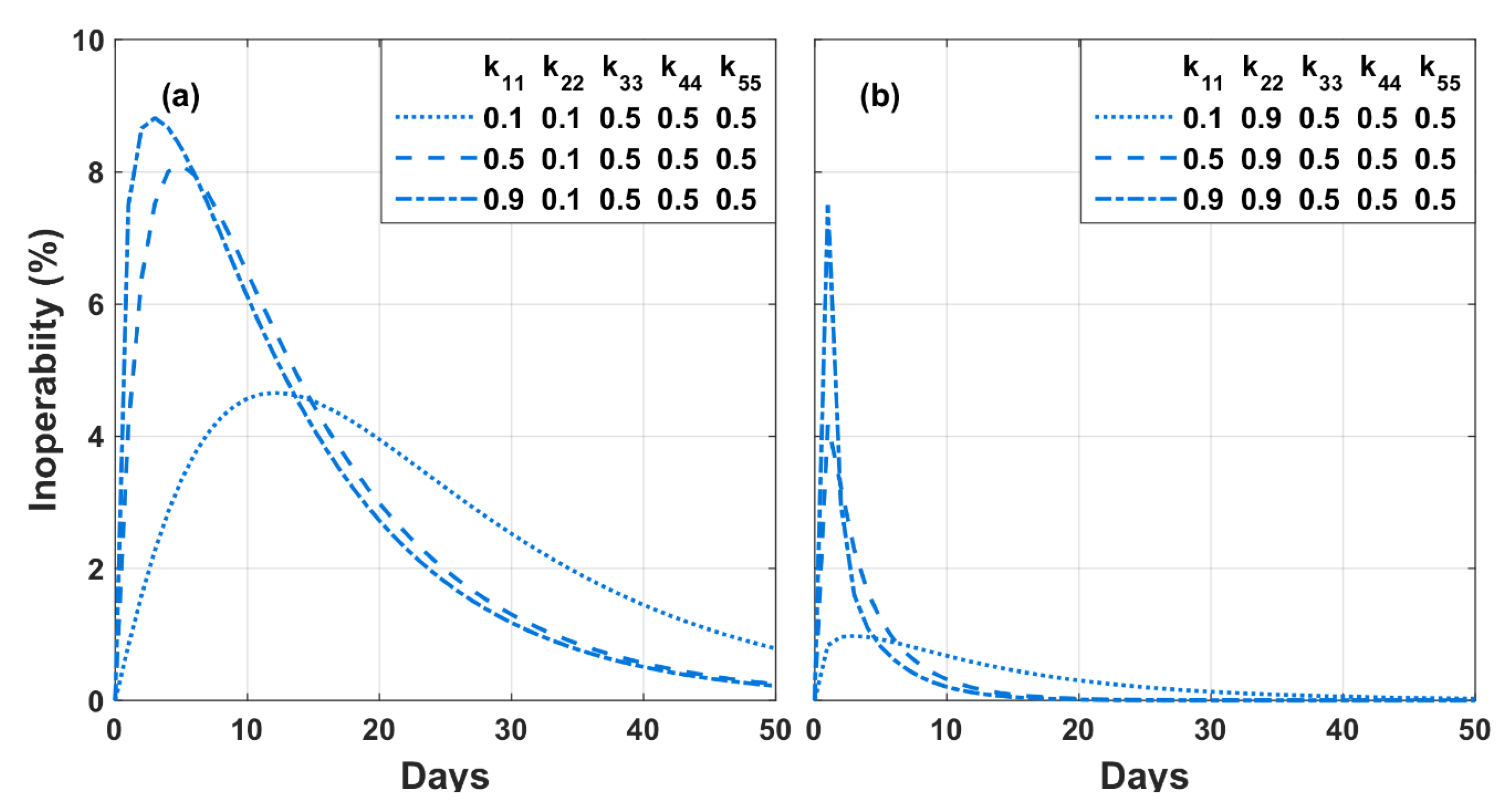

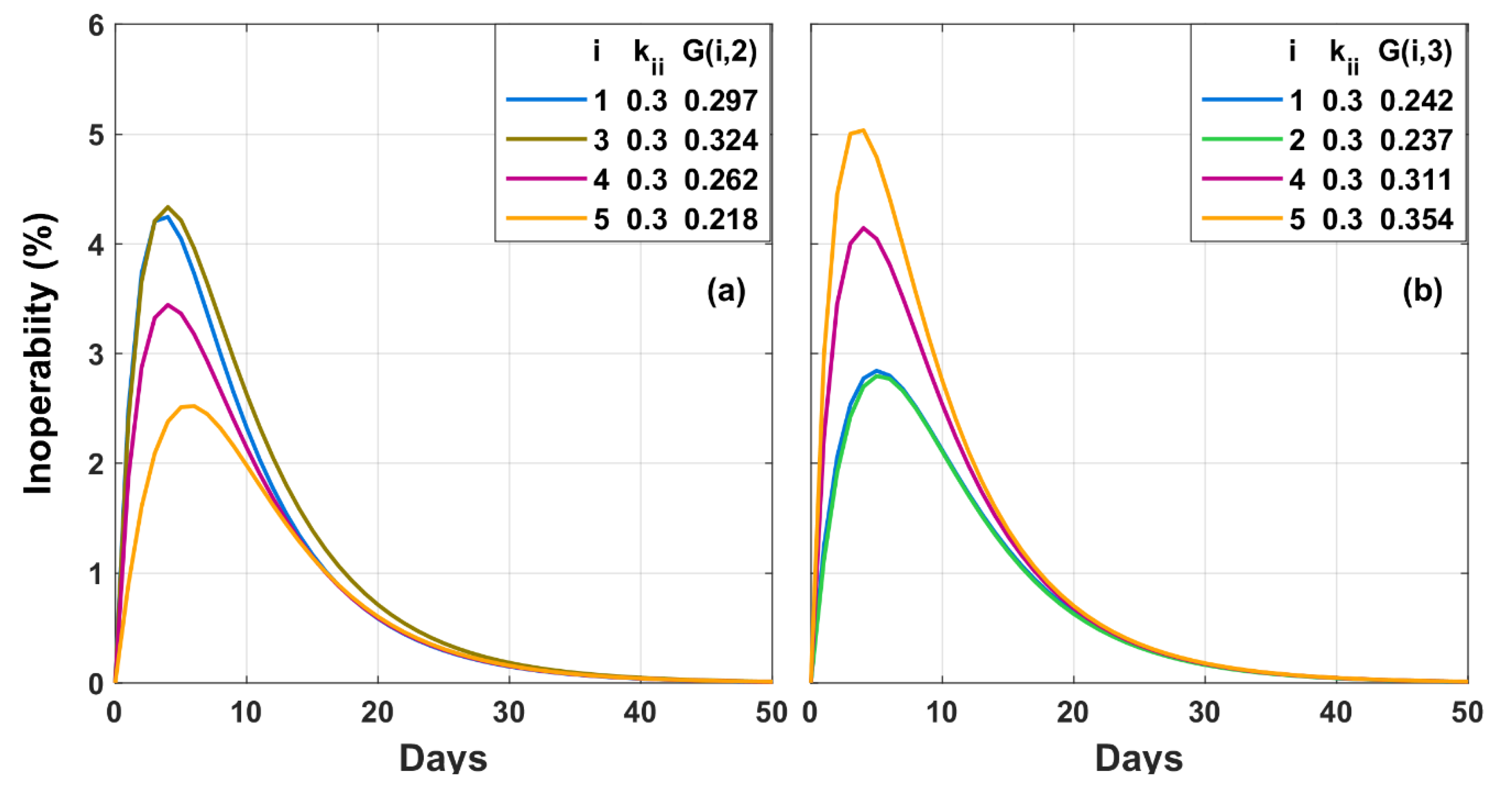

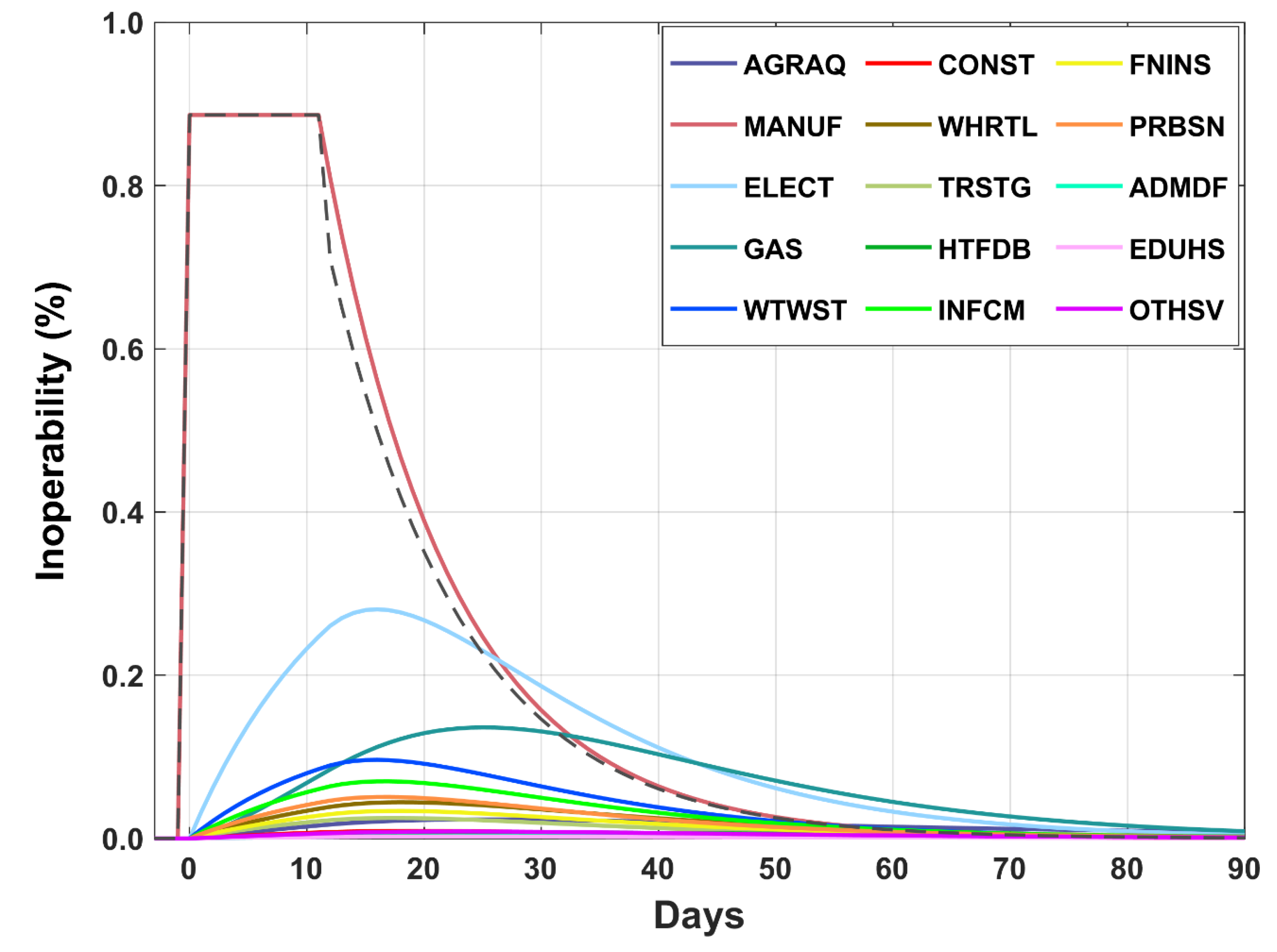

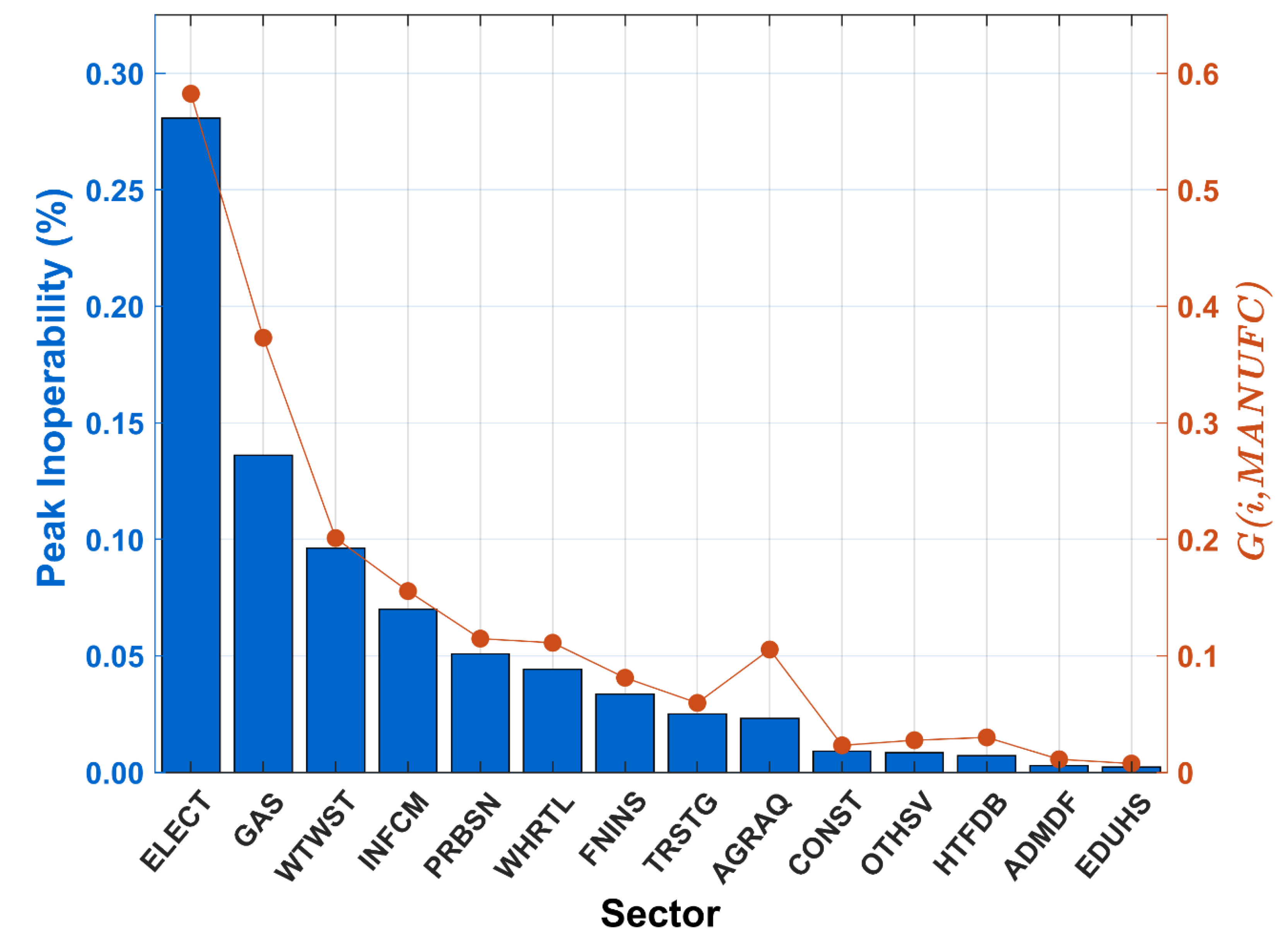

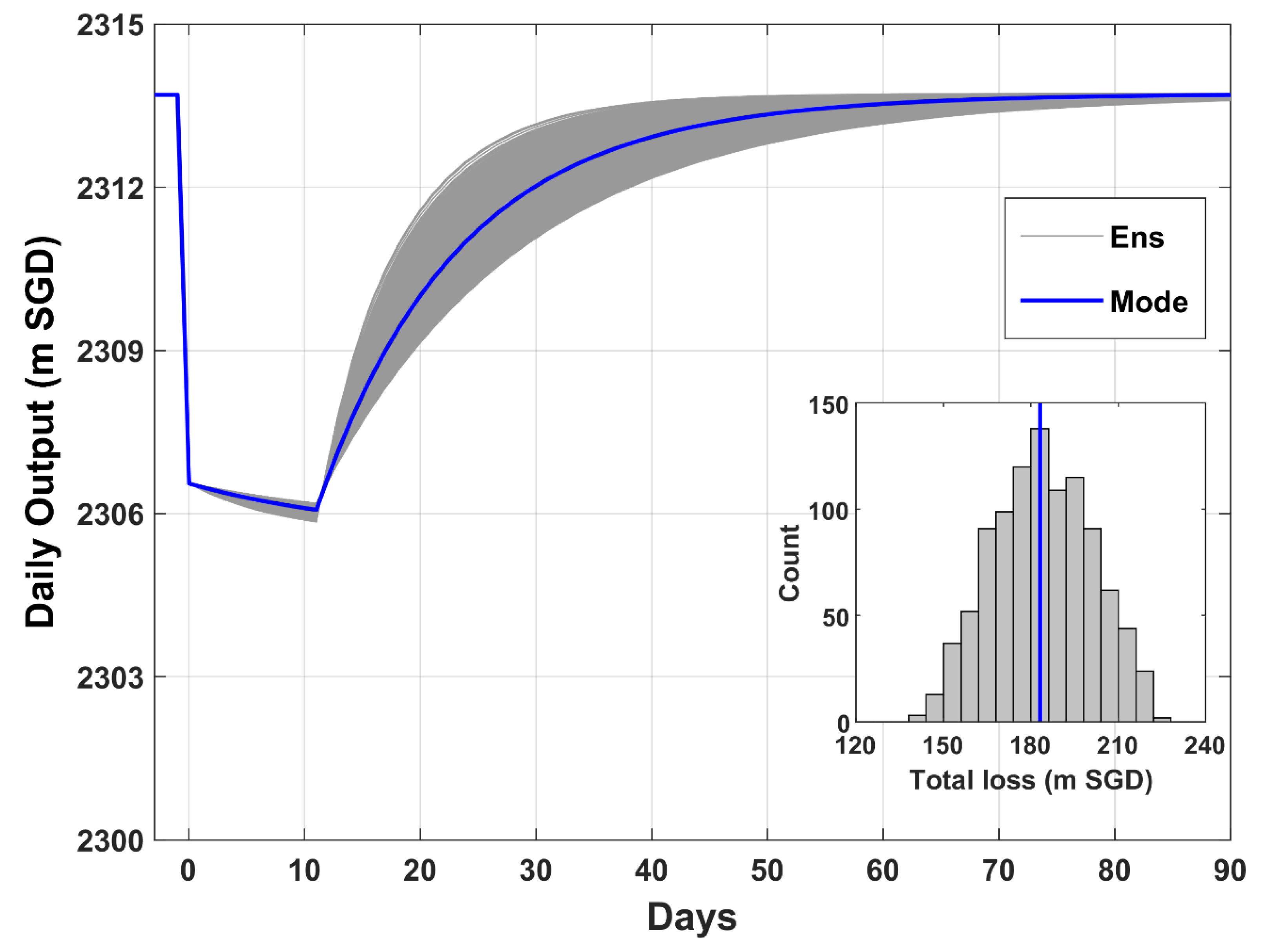

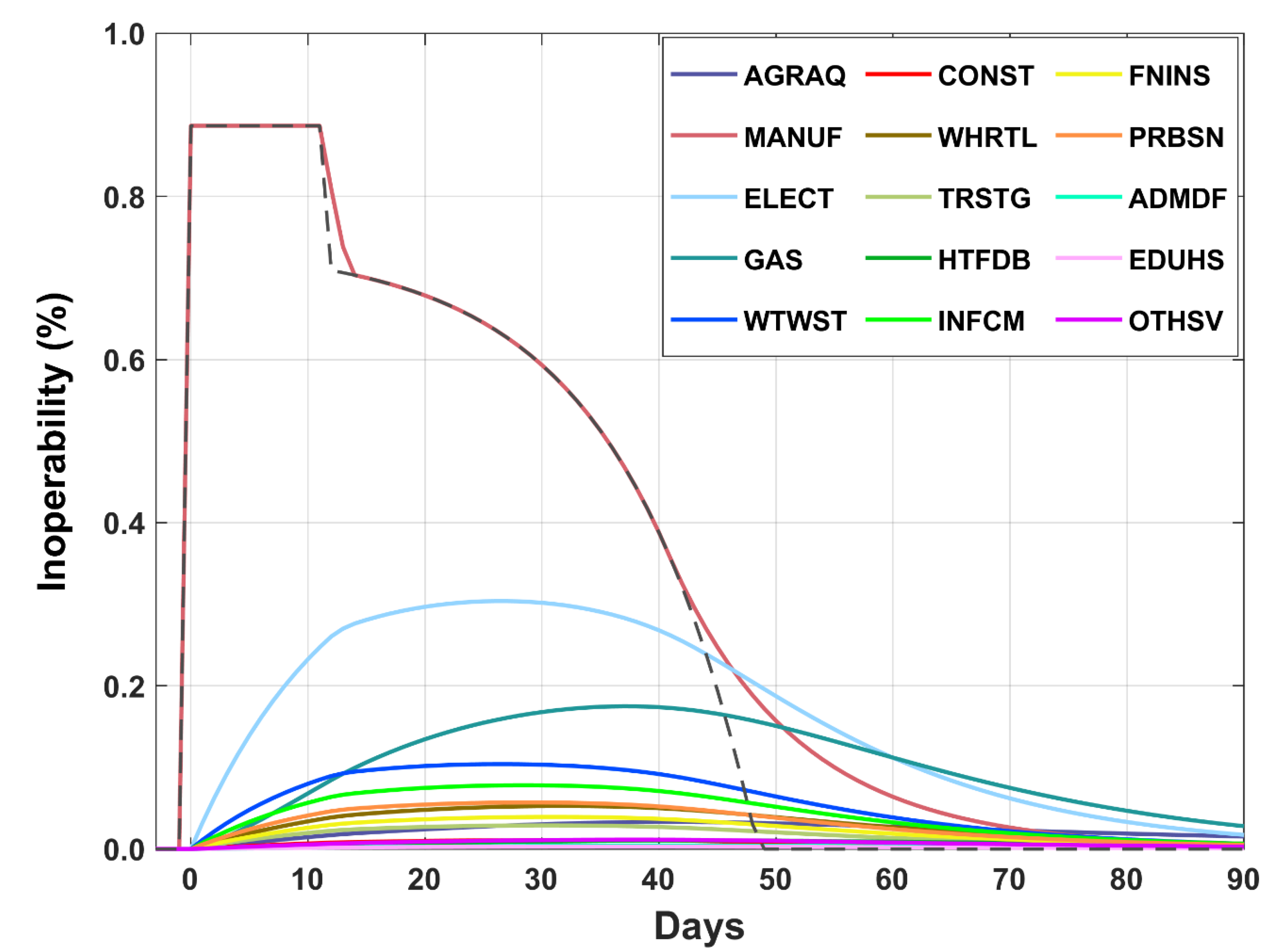

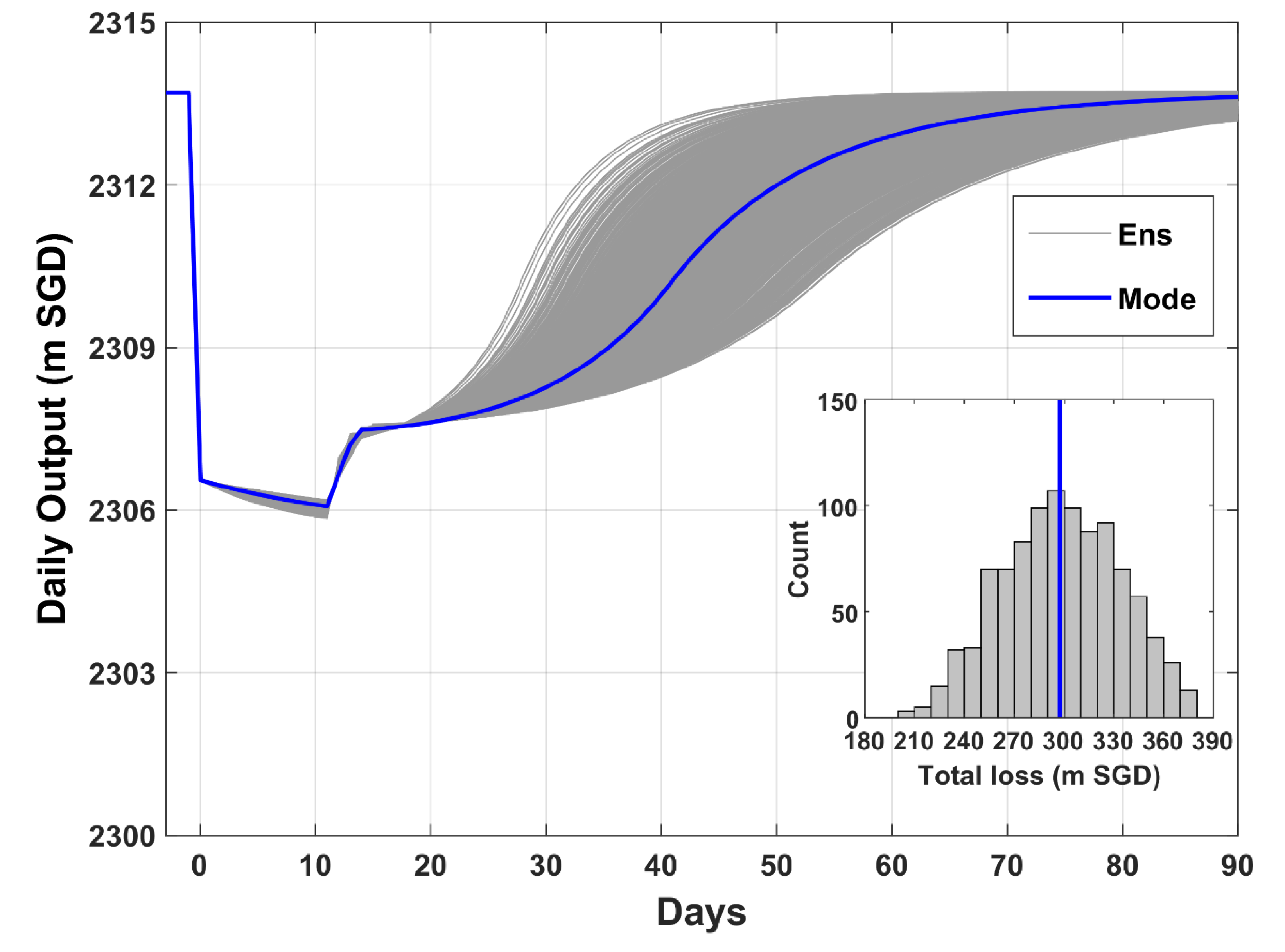

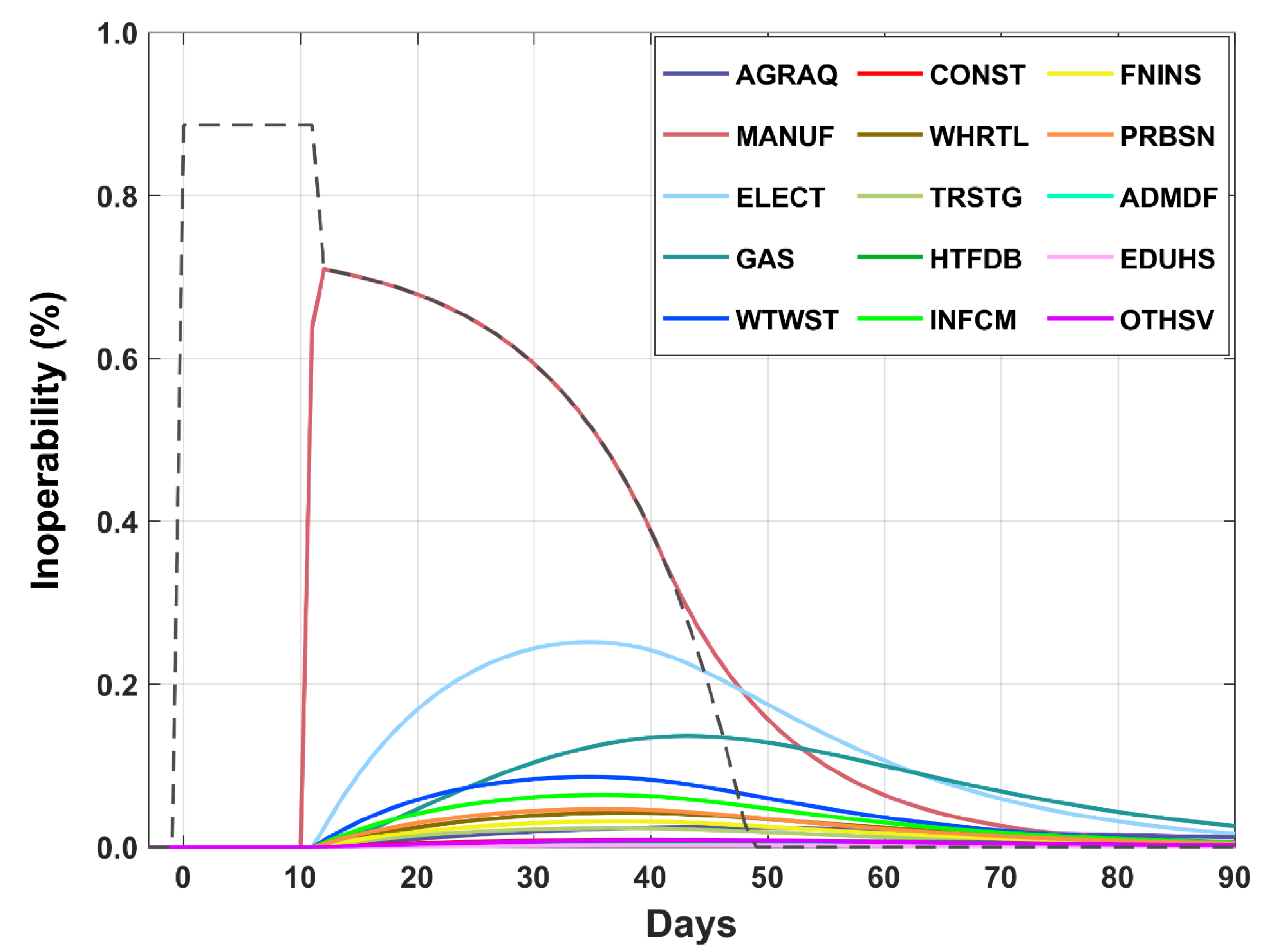

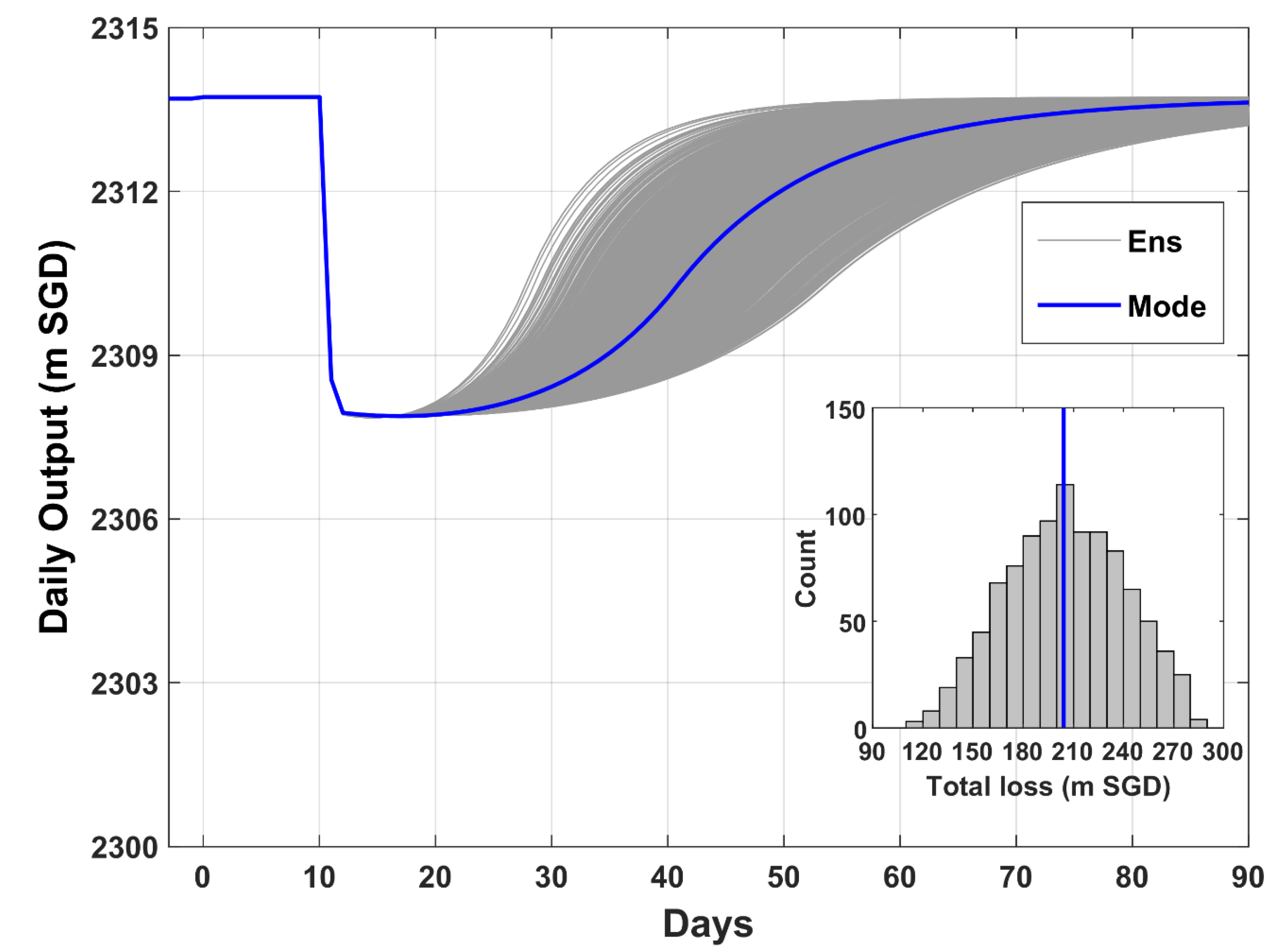

5.2. Dynamic IIM

5.2.1. Rapid Initial Recovery of the MANUF Sector’s Production Inoperability

5.2.2. Slow Initial Recovery of MANUF’s Production Inoperability

5.2.3. Effect of Inventory

5.3. Supply Side Inoperability IO Analysis

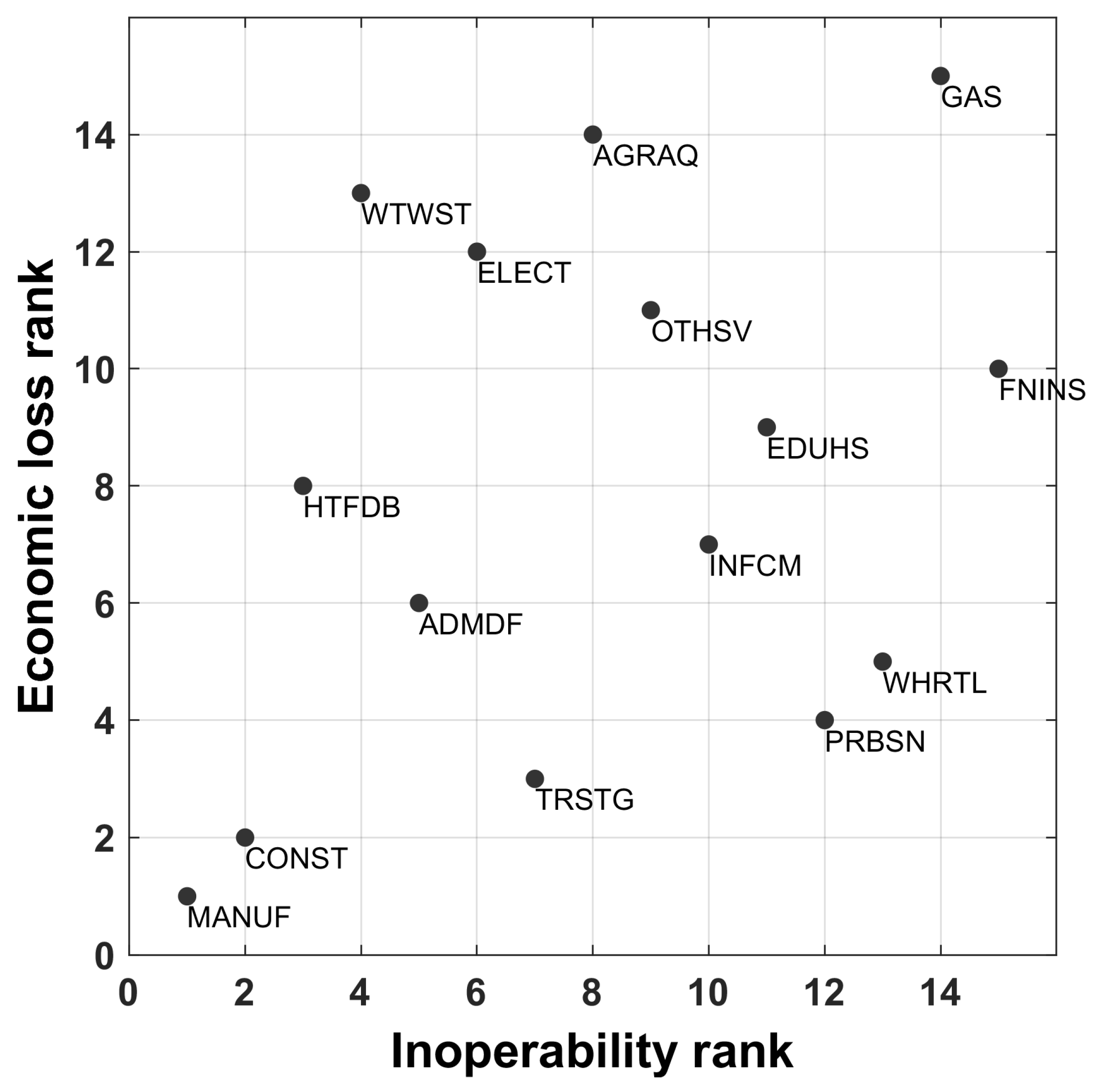

5.4. Linkage Analysis

6. Concluding Remarks

Author Contributions

Funding

Institutional Review Board Statement

Informed Consent Statement

Data Availability Statement

Conflicts of Interest

Appendix A

| Aggregated Sectors | Code | Component Sectors |

|---|---|---|

| Agriculture, livestock, and aquaculture | AGRAQ | 1. Agriculture and nursery products, 2. Livestock, 3. Fishing and aquaculture |

| Manufacturing | MANUF | 4. Food preparations, 5. Oils and fats, 6. Dairy products, 7. Other food products n.e.c., 8. Beverages and tobacco products, 9. Textiles, 10. Wearing apparel and fur products, 11. Footwear and leather products, 12. Wood and wooden products (except furniture), 13. Paper and paper products, 14. Printing and reproduction of recorded media, 15. Petroleum products, 16. Basic chemicals and chemical products, 17. Petrochemicals and petrochemical products, 18. Paints and related products, 19. Detergents, perfumes, cleaning and toilet preparations, 20. Other chemical products, 21. Pharmaceuticals and biological products, 22. Rubber and plastic products, 23. Other non-metallic mineral products, 24. Basic metals, 25. Fabricated metal products (except machinery and equipment), 26. Semiconductor devices, electronic components and boards, 27. Computers and peripheral equipment, 28. Communications equipment, 29. Consumer electronics, 30. Scientific, photographic and optical products, 31. Electrical industrial apparatus, batteries and accumulators, 32. Electric wiring and lighting equipment, 33. Domestic appliances, 34. Other electrical equipment, 35. General and special purpose machinery (except oil rigs), 36. Mining, quarrying and construction equipment, 37. Semiconductor related equipment, 38. Installation of industrial machinery and equipment, 39. Land transport equipment, 40. Ships and boats, 41. Aircraft and related parts, 42. Transport equipment n.e.c., 43. Furniture (except of stone), 44. Jewelry and related articles, 45. Medical and dental instruments and supplies, 46. Other manufacturing |

| Electricity | ELECT | 47. Electricity |

| Gas | GAS | 48. Gas |

| Water and waste management | WTWST | 49. Water and sewerage, 50. Waste collection, treatment, and disposal services |

| Construction | CONST | 51. Building construction, 52. Civil engineering works, 53. Specialized construction services |

| Wholesale and retail | WHRTL | 54. Wholesale trade, 55. Retail trade |

| Transportation and storage | TRSTG | 56. Land transport, 57. Water transport, 58. Air transport, 59. Land transport supporting services, 60. Water transport supporting services, 61. Air transport supporting services, 62. Cargo handling, warehousing, and other support services, 63. Postal and courier services |

| Hotels, food, and beverage services | HTFDB | 64. Accommodation, 65. Food and beverage services |

| Information and communication services | INFCM | 66. Publishing, 67. Media entertainment, 68. Telecommunications, 69. Computer programming, consultancy, and information services |

| Finance and insurance services | FNINS | 70. Banking and finance, 71. Financial services (except insurance and pension funding), 72. Life insurance, 73. Non-life insurance, 74. Other auxiliary financial and insurance services, 75. Fund Management |

| Professional and business services | PRBSN | 76. Real estate, 77. Ownership of dwellings, 78. Legal services, 79. Accounting, auditing, and tax consultancy services, 80. Head offices and business representative offices 81. Consultancy services, 82. Architectural and engineering services, 83. Research and development, 84. Advertising and market research, 85. Specialized design services, 86. Other professional, scientific and technical services, 87. Veterinary services, 88. Rental and leasing of tangible assets, 89. Rental and leasing of intangible assets, 90. Employment and labor contracting, 91. Travel agency, tour operator and reservation services, 92. Security and investigation services, 93. Cleaning and landscape maintenance services, 94. Office administrative and support services, 95. Exhibitions, conventions and other events |

| Public administration and defense | ADMDF | 96. Public administration and defense services |

| Education, health. and social services | EDUHS | 97. Education, 98. Health services, 99. Social services |

| Other services | OTHSV | 100. Arts and entertainment, 101. Recreation and sports, 102. Member organizations, 103. Repair of computers, personal and household goods and vehicles, 104. Other personal services, 105. Domestic services |

Appendix B

Appendix B.1. Two-Sector IO Table

Appendix B.2. Five-Sector IO Table

References

- Rose, A.; Lim, D. Business interruption losses from natural hazards: Conceptual and methodological issues in the case of the Northridge earthquake. Glob. Environ. Change Part B Environ. Hazards 2002, 4, 1–14. [Google Scholar] [CrossRef]

- Hallegatte, S.; Przyluski, V. The Economics of Natural Disasters: Concepts and Methods; The World Bank: Washington, DC, USA, 2010. [Google Scholar]

- Meyer, V.; Becker, N.; Markantonis, V.; Schwarze, R.; van den Bergh, J.; Bouwer, L.M.; Bubeck, P.; Ciavola, P.; Genovese, E.; Green, C.; et al. Review article: Assessing the costs of natural hazards—State of the art and knowledge gaps. Nat. Hazards Earth Syst. Sci. 2013, 13, 1351–1373. [Google Scholar] [CrossRef]

- Hasan, S.; Foliente, G. Modeling infrastructure system interdependencies and socioeconomic impacts of failure in extreme events: Emerging R&D challenges. Nat. Hazards 2015, 78, 2143–2168. [Google Scholar] [CrossRef]

- Burrus, R.T., Jr.; Dumas, C.F.; Farrell, C.H.; Hall, W.W., Jr. Impact of low-intensity hurricanes on regional economic activity. Nat. Hazards Rev. 2002, 3, 118–125. [Google Scholar] [CrossRef]

- Anderson, C.W.; Santos, J.R.; Haimes, Y.Y. A risk-based input–output methodology for measuring the effects of the August 2003 northeast blackout. Econ. Syst. Res. 2007, 19, 183–204. [Google Scholar] [CrossRef]

- Kunz, M.; Muhr, B.; Kunz-Plapp, T.; Daniell, J.E.; Khazai, B.; Wenzel, F.; Vannieuwenhuyse, M.; Comes, T.; Elmer, F.; Schroter, K.; et al. Investigation of superstorm Sandy 2012 in a multi-disciplinary approach. Nat. Hazards Earth Syst. Sci. 2013, 13, 2579–2598. [Google Scholar] [CrossRef]

- Xia, Y.; Guan, D.B.; Steenge, A.E.; Dietzenbacher, E.; Meng, J.; Tinoco, D.M. Assessing the economic impacts of IT service shutdown during the York flood of 2015 in the UK. Proc. R. Soc. A-Math. Phys. Eng. Sci. 2019, 475. [Google Scholar] [CrossRef]

- Jin, X.; Sumaila, U.R.; Yin, K.D. Direct and Indirect Loss Evaluation of Storm Surge Disaster Based on Static and Dynamic Input-Output Models. Sustainability 2020, 12, 7347. [Google Scholar] [CrossRef]

- Chang, S.E.; Rose, A.Z. Towards a Theory of Economic Recovery from Disasters. Int. J. Mass Emergencies Disasters 2012, 30, 171–181. [Google Scholar] [CrossRef]

- Hallegatte, S. The Indirect Cost of Natural Disasters and an Economic Definition of Macroeconomic Resilience; The World Bank: Washington, DC, USA, 2015. [Google Scholar]

- Koks, E.E.; Carrera, L.; Jonkeren, O.; Aerts, J.; Husby, T.G.; Thissen, M.; Standardi, G.; Mysiak, J. Regional disaster impact analysis: Comparing input-output and computable general equilibrium models. Nat. Hazards Earth Syst. Sci. 2016, 16, 1911–1924. [Google Scholar] [CrossRef]

- Huang, R.; Malik, A.; Lenzen, M.; Jin, Y.T.; Wang, Y.F.; Faturay, F.; Zhu, Z.Y. Supply-chain impacts of Sichuan earthquake: A case study using disaster input-output analysis. Nat. Hazards 2022, 110, 2227–2248. [Google Scholar] [CrossRef]

- Ern, L.Y.; Abdullah, A. Fighting the shell pulau bukom fire: Strategies that worked for the SCDF. Home Team J. 2014, 2014, 66–73. [Google Scholar]

- Rose, A.; Liao, S.Y. Modeling regional economic resilience to disasters: A computable general equilibrium analysis of water service disruptions. J. Reg. Sci. 2005, 45, 75–112. [Google Scholar] [CrossRef]

- Hu, A.J.; Xie, W.; Li, N.; Xu, X.H.; Ji, Z.H.; Wu, J.D. Analyzing regional economic impact and resilience: A case study on electricity outages caused by the 2008 snowstorms in southern China. Nat. Hazards 2014, 70, 1019–1030. [Google Scholar] [CrossRef]

- Galbusera, L.; Giannopoulos, G. On input-output economic models in disaster impact assessment. Int. J. Disaster Risk Reduct. 2018, 30, 186–198. [Google Scholar] [CrossRef]

- Leontief, W. Input-Output Economics; Oxford University Press: Oxford, UK, 1986. [Google Scholar]

- Miller, R.E.; Blair, P.D. Input-Output Analysis: Foundations and Extensions; Cambridge University Press: Cambridge, UK, 2009. [Google Scholar]

- Okuyama, Y. Economic modeling for disaster impact analysis: Past, present, and future. Econ. Syst. Res. 2007, 19, 115–124. [Google Scholar] [CrossRef]

- Hallegatte, S. An adaptive regional input-output model and its application to the assessment of the economic cost of Katrina. Risk Anal. 2008, 28, 779–799. [Google Scholar] [CrossRef]

- Okuyama, Y.; Santos, J.R. Disaster impact and input–output analysis. Econ. Syst. Res. 2014, 26, 1–12. [Google Scholar] [CrossRef]

- Rose, A.; Guha, G.-S. Computable general equilibrium modeling of electric utility lifeline losses from earthquakes. In Modeling Spatial and Economic Impacts of Disasters; Springer: Berlin/Heidelberg, Germany, 2004; pp. 119–141. [Google Scholar]

- Tsuchiya, S.; Tatano, H.; Okada, N. Economic loss assessment due to railroad and highway disruptions. Econ. Syst. Res. 2007, 19, 147–162. [Google Scholar] [CrossRef]

- Zhou, L.; Chen, Z. Are CGE models reliable for disaster impact analyses? Econ. Syst. Res. 2021, 33, 20–46. [Google Scholar] [CrossRef]

- Rose, A. Economic principles, issues, and research priorities in hazard loss estimation. In Modeling Spatial and Economic Impacts of Disasters; Springer: Berlin/Heidelberg, Germany, 2004; pp. 13–36. [Google Scholar]

- Haimes, Y.Y.; Horowitz, B.M.; Lambert, J.H.; Santos, J.R.; Lian, C.Y.; Crowther, K.G. Inoperability Input-Output Model for Interdependent Infrastructure Sectors. I: Theory and Methodology. J. Infrastruct. Syst. 2005, 11, 67–79. [Google Scholar] [CrossRef]

- Lian, C.; Haimes, Y.Y. Managing the risk of terrorism to interdependent infrastructure systems through the dynamic inoperability input–output model. Syst. Eng. 2006, 9, 241–258. [Google Scholar] [CrossRef]

- Santos, J.R.; Orsi, M.J.; Bond, E.J. Pandemic Recovery Analysis Using the Dynamic Inoperability Input-Output Model. Risk Anal. 2009, 29, 1743–1758. [Google Scholar] [CrossRef] [PubMed]

- El Haimar, A.; Santos, J.R. Modeling Uncertainties in Workforce Disruptions from Influenza Pandemics Using Dynamic Input-Output Analysis. Risk Anal. 2014, 34, 401–415. [Google Scholar] [CrossRef] [PubMed]

- Khalid, M.A.; Ali, Y. Analysing economic impact on interdependent infrastructure after flood: Pakistan a case in point. Environ. Hazards-Hum. Policy Dimens. 2019, 18, 111–126. [Google Scholar] [CrossRef]

- Avelino, A.F.T.; Dall’erba, S. Comparing the Economic Impact of Natural Disasters Generated by Different Input-Output Models: An Application to the 2007 Chehalis River Flood (WA). Risk Anal. 2019, 39, 85–104. [Google Scholar] [CrossRef] [PubMed]

- Zhang, J.; Lu, M.; Zhang, L.L.; Xue, Y.D. Assessing indirect economic losses of landslides along highways. Nat. Hazards 2021, 106, 2775–2796. [Google Scholar] [CrossRef]

- Poudineh, R.; Jamasb, T. Electricity Supply Interruptions: Sectoral Interdependencies and the Cost of Energy Not Served for the Scottish Economy. Energy J. 2017, 38, 51–76. [Google Scholar] [CrossRef]

- Chen, H.; Yan, H.B.; Gong, K.; Geng, H.P.; Yuan, X.C. Assessing the business interruption costs from power outages in China. Energy Econ. 2022, 105. [Google Scholar] [CrossRef]

- Haimes, Y.Y.; Jiang, P. Leontief-based model of risk in complex interconnected infrastructures. J. Infrastruct. Syst. 2001, 7, 1–12. [Google Scholar] [CrossRef]

- Santos, J.R.; Haimes, Y.Y. Modeling the demand reduction input-output (I-O) inoperability due to terrorism of interconnected infrastructures. Risk Anal. 2004, 24, 1437–1451. [Google Scholar] [CrossRef]

- Crowther, K.G.; Haimes, Y.Y.; Taub, G. Systemic valuation of strategic preparedness through application of the inoperability input-output model with lessons learned from Hurricane Katrina. Risk Anal. 2007, 27, 1345–1364. [Google Scholar] [CrossRef] [PubMed]

- Dietzenbacher, E.; Miller, R.E. Reflections on the inoperability input–output model. Econ. Syst. Res. 2015, 27, 478–486. [Google Scholar] [CrossRef]

- Jonkeren, O.; Giannopoulos, G. Analysing Critical Infrastructure Failure with a Resilience Inoperability Input-Output Model. Econ. Syst. Res. 2014, 26, 39–59. [Google Scholar] [CrossRef]

- Vose, D. Risk Analysis: A Quantitative Guide; John Wiley & Sons: Hoboken, NJ, USA, 2008. [Google Scholar]

- Dahri, N.; Abida, H. Monte Carlo simulation-aided analytical hierarchy process (AHP) for flood susceptibility mapping in Gabes Basin (southeastern Tunisia). Environ. Earth Sci. 2017, 76, 302. [Google Scholar] [CrossRef]

- Benke, K.; Pelizaro, C. A spatial-statistical approach to the visualisation of uncertainty in land suitability analysis. J. Spat. Sci. 2010, 55, 257–272. [Google Scholar] [CrossRef]

- Xu, W.P.; Wang, Z.J.; Hong, L.; He, L.G.; Chen, X.G. The uncertainty recovery analysis for interdependent infrastructure systems using the dynamic inoperability input-output model. Int. J. Syst. Sci. 2015, 46, 1299–1306. [Google Scholar] [CrossRef]

- Jung, J.; Santos, J.R.; Haimes, Y.Y. International Trade Inoperability Input-Output Model (IT-IIM): Theory and Application. Risk Anal. 2009, 29, 137–154. [Google Scholar] [CrossRef]

- Barker, K.; Santos, J.R. Measuring the efficacy of inventory with a dynamic input-output model. Int. J. Prod. Econ. 2010, 126, 130–143. [Google Scholar] [CrossRef]

- Department of Statistics Singapore. National Accounts: Supply, Use and Input-Output Tables. Available online: https://www.singstat.gov.sg/find-data/search-by-theme/economy/national-accounts/latest-data#SU-IOT (accessed on 20 August 2022).

- Ng, W.H. Singapore, the Energy Economy: From the First Refinery to the End of Cheap Oil, 1960–2010; Routledge: Abingdon-on-Thames, UK, 2013. [Google Scholar]

- Chang, Y. Energy commodity trading in Singapore. In Energy Market Integration in East Asia: Energy Trade, Cross Border Electricity, and Price Mechanism; Han, P., Kimura, F., Eds.; ERIA Research Project Report FY2013; ERIA: Jakarta, Indonesia, 2014; pp. 13–26. [Google Scholar]

- British Petroleum, B. Statistical Review of World Energy 2021, 70th ed.; British Petroleum B: London, UK, 2021. [Google Scholar]

- ExxonMobil. Singapore Refinery. Available online: https://www.exxonmobil.com.sg/Company/Overview/Who-we-are/Singapore-Refinery (accessed on 26 August 2022).

- Lin, J.; Tai, K.; Tiong, R.L.K.; Sim, M.S. Analyzing Impact on Critical Infrastructure Using Input-Output Interdependency Model: Case Studies. Asce-Asme J. Risk Uncertain. Eng. Syst. Part A-Civ. Eng. 2017, 3, 04017016. [Google Scholar] [CrossRef]

- Chua, A. Pulau Bukom Fire. 2011. Available online: https://eresources.nlb.gov.sg/infopedia/articles/SIP_1868_2012-02-02.html (accessed on 20 August 2022).

- Ministry of Trade and Industry. 2nd Minister S Iswaran’s Reply on the Impact of the Shell oil Refinery Fire and Facilities Shut-down at Pulau Bukom on the Singapore Economy. Available online: https://www.mti.gov.sg/Newsroom/Parliamentary-Replies/2011/10/2nd-Minister-S-Iswarans-reply-to-Parliament-Question-on-the-impact-of-the-Shell-oil-refinery-fire-an (accessed on 20 August 2022).

- Department of Statistics Singapore. Share Of Nominal Gross Value Added, By Industry. SSIC. 2020. Available online: https://tablebuilder.singstat.gov.sg/table/TS/M015781 (accessed on 20 August 2022).

- Department of Statistics Singapore. Principal Statistics of Manufacturing by Industry Cluster-Value Added. Available online: https://tablebuilder.singstat.gov.sg/table/TS/M355181 (accessed on 20 August 2022).

- Haimes, Y.Y.; Horowitz, B.M.; Lambert, J.H.; Santos, J.; Crowther, K.; Lian, C.Y. Inoperability Input-Output Model for Interdependent Infrastructure Sectors. II: Case Studies. J. Infrastruct. Syst. 2005, 11, 80–92. [Google Scholar] [CrossRef]

- Ghosh, A. Input-output approach in an allocation system. Economica 1958, 25, 58–64. [Google Scholar] [CrossRef]

- Oosterhaven, J. On the plausibility of the supply-driven input-output model. J. Reg. Sci. 1988, 28, 203–217. [Google Scholar] [CrossRef]

- Oosterhaven, J. The supply-driven input-output model: A new interpretation but still implausible. J. Reg. Sci. 1989, 29, 459–465. [Google Scholar] [CrossRef]

- Gruver, G.W. On the Plausibility of the Supply—Driven Input-Output Model: A Theoretical Basis for Input-Coefficient Change. J. Reg. Sci. 1989, 29, 441–450. [Google Scholar] [CrossRef]

- De Mesnard, L. Is the Ghosh model interesting? J. Reg. Sci. 2009, 49, 361–372. [Google Scholar] [CrossRef]

- Dietzenbacher, E. In vindication of the Ghosh model: A reinterpretation as a price model. J. Reg. Sci. 1997, 37, 629–651. [Google Scholar] [CrossRef]

- Crowther, K.G.; Haimes, Y.Y. Application of the inoperability input—Output model (IIM) for systemic risk assessment and management of interdependent infrastructures. Syst. Eng. 2005, 8, 323–341. [Google Scholar] [CrossRef]

- Leung, M.; Haimes, Y.Y.; Santos, J.R. Supply- and Output-Side Extensions to the Inoperability Input-Output Model for Interdependent Infrastructures. J. Infrastruct. Syst. 2007, 13, 299–310. [Google Scholar] [CrossRef]

- Oosterhaven, J.; Bouwmeester, M.C. A new approach to modeling the impact of disruptive events. J. Reg. Sci. 2016, 56, 583–595. [Google Scholar] [CrossRef]

- Crowther, K.G.; Haimes, Y.Y. Development of the multiregional inoperability input-output model (MRIIM) for spatial explicitness in preparedness of interdependent regions. Syst. Eng. 2010, 13, 28–46. [Google Scholar] [CrossRef]

- MacKenzie, C.A.; Barker, K.; Grant, F.H. Evaluating the Consequences of an Inland Waterway Port Closure With a Dynamic Multiregional Interdependence Model. IEEE Trans. Syst. Man Cybern. Part A-Syst. Hum. 2012, 42, 359–370. [Google Scholar] [CrossRef]

- Pant, R.; Barker, K.; Zobel, C.W. Static and dynamic metrics of economic resilience for interdependent infrastructure and industry sectors. Reliab. Eng. Syst. Saf. 2014, 125, 92–102. [Google Scholar] [CrossRef]

| Sector | Inoperability (%) | Total Daily Loss (m SGD) |

|---|---|---|

| MANUF | 1.08 | 8.71 |

| ELECT | 0.52 | 0.14 |

| GAS | 0.33 | 0.01 |

| WTWST | 0.18 | 0.02 |

| INFCM | 0.14 | 0.13 |

| PRBSN | 0.10 | 0.26 |

| WHRTL | 0.10 | 0.31 |

| AGRAQ | 0.09 | 0.00 |

| FNINS | 0.07 | 0.13 |

| TRSTG | 0.05 | 0.13 |

| HTFDB | 0.03 | 0.01 |

| OTHSV | 0.02 | 0.01 |

| CONST | 0.02 | 0.03 |

| ADMDF | 0.01 | 0.01 |

| EDUHS | 0.01 | 0.00 |

| Sector | Inoperability (%) | Total Daily Loss (m SGD) |

|---|---|---|

| MANUF | 1.08 | 8.71 |

| CONST | 0.16 | 0.23 |

| HTFDB | 0.13 | 0.05 |

| WTWST | 0.12 | 0.01 |

| ADMDF | 0.10 | 0.07 |

| ELECT | 0.09 | 0.02 |

| TRSTG | 0.08 | 0.20 |

| AGRAQ | 0.07 | 0.00 |

| OTHSV | 0.07 | 0.02 |

| INFCM | 0.06 | 0.05 |

| EDUHS | 0.06 | 0.04 |

| PRBSN | 0.05 | 0.13 |

| WHRTL | 0.04 | 0.11 |

| GAS | 0.03 | 0.00 |

| FNINS | 0.02 | 0.03 |

Disclaimer/Publisher’s Note: The statements, opinions and data contained in all publications are solely those of the individual author(s) and contributor(s) and not of MDPI and/or the editor(s). MDPI and/or the editor(s) disclaim responsibility for any injury to people or property resulting from any ideas, methods, instructions or products referred to in the content. |

© 2023 by the authors. Licensee MDPI, Basel, Switzerland. This article is an open access article distributed under the terms and conditions of the Creative Commons Attribution (CC BY) license (https://creativecommons.org/licenses/by/4.0/).

Share and Cite

Mandapaka, P.V.; Lo, E.Y.M. Assessing Shock Propagation and Cascading Uncertainties Using the Input–Output Framework: Analysis of an Oil Refinery Accident in Singapore. Sustainability 2023, 15, 1739. https://doi.org/10.3390/su15021739

Mandapaka PV, Lo EYM. Assessing Shock Propagation and Cascading Uncertainties Using the Input–Output Framework: Analysis of an Oil Refinery Accident in Singapore. Sustainability. 2023; 15(2):1739. https://doi.org/10.3390/su15021739

Chicago/Turabian StyleMandapaka, Pradeep V., and Edmond Y. M. Lo. 2023. "Assessing Shock Propagation and Cascading Uncertainties Using the Input–Output Framework: Analysis of an Oil Refinery Accident in Singapore" Sustainability 15, no. 2: 1739. https://doi.org/10.3390/su15021739

APA StyleMandapaka, P. V., & Lo, E. Y. M. (2023). Assessing Shock Propagation and Cascading Uncertainties Using the Input–Output Framework: Analysis of an Oil Refinery Accident in Singapore. Sustainability, 15(2), 1739. https://doi.org/10.3390/su15021739