Dynamic Effects of Climate Policy Uncertainty on Green Bond Volatility: An Empirical Investigation Based on TVP-VAR Models

Abstract

1. Introduction

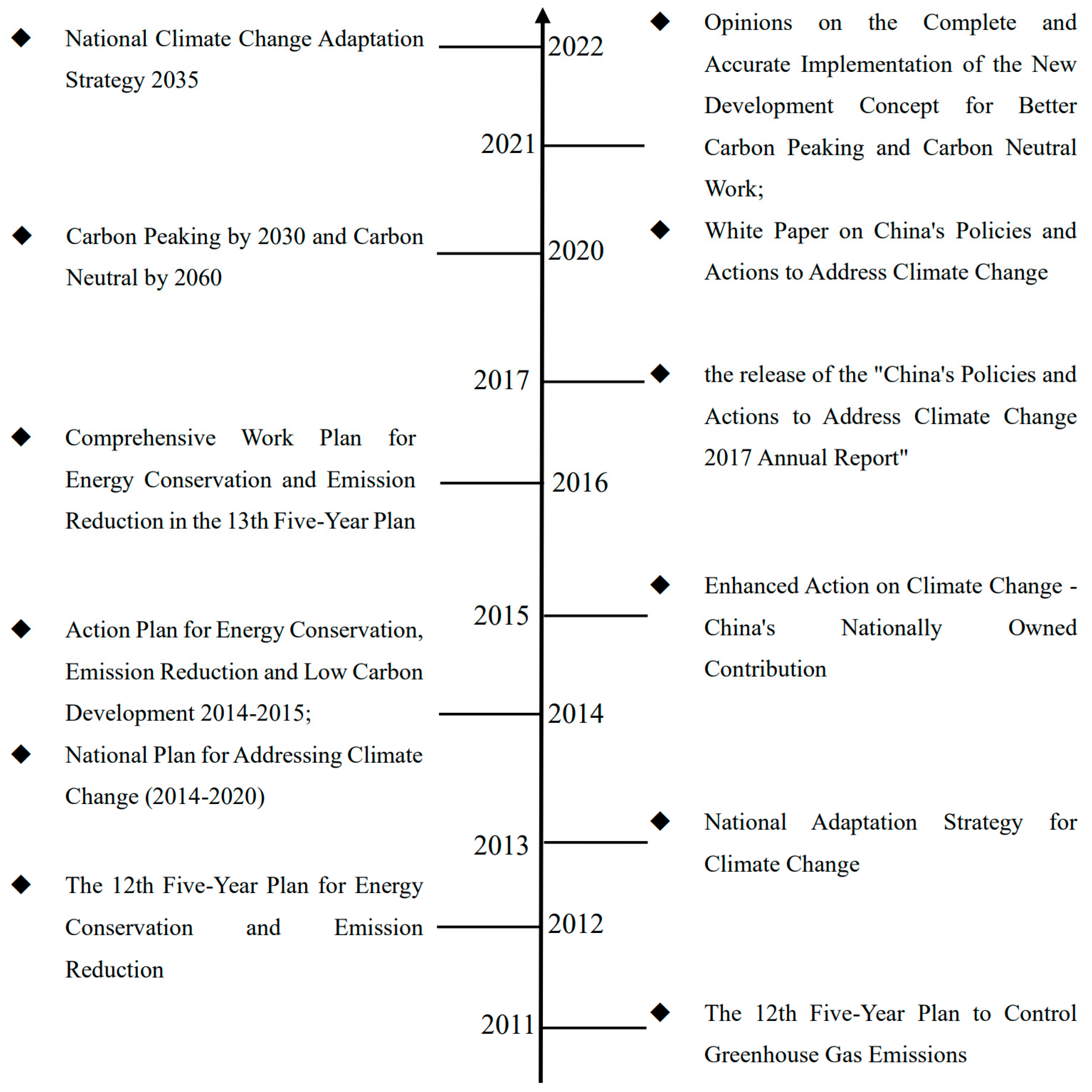

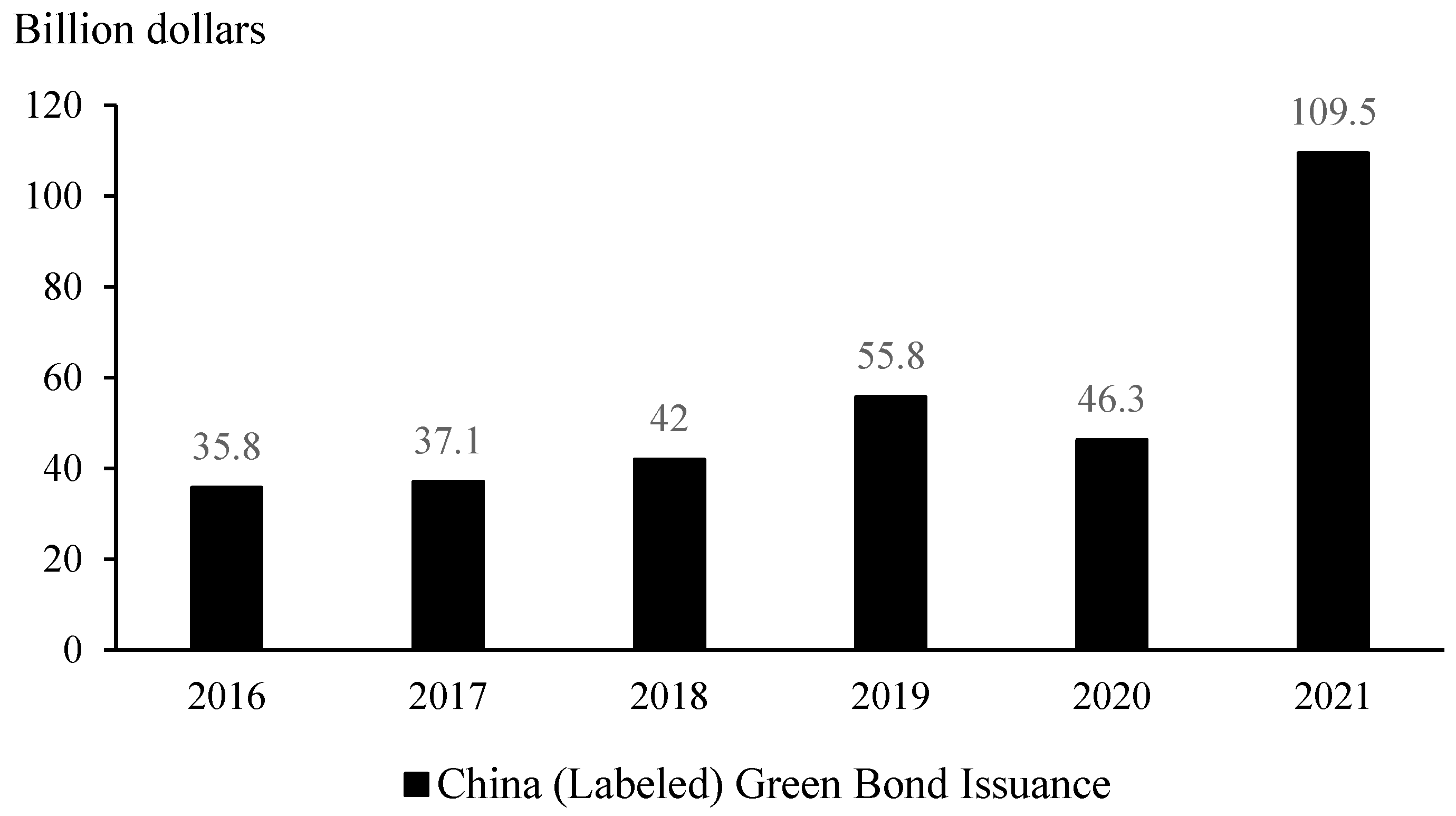

2. Background in China

3. Literature Review

3.1. Green Bond Market

3.2. Climate Change and Financial Markets

4. Research Design

4.1. Methodology

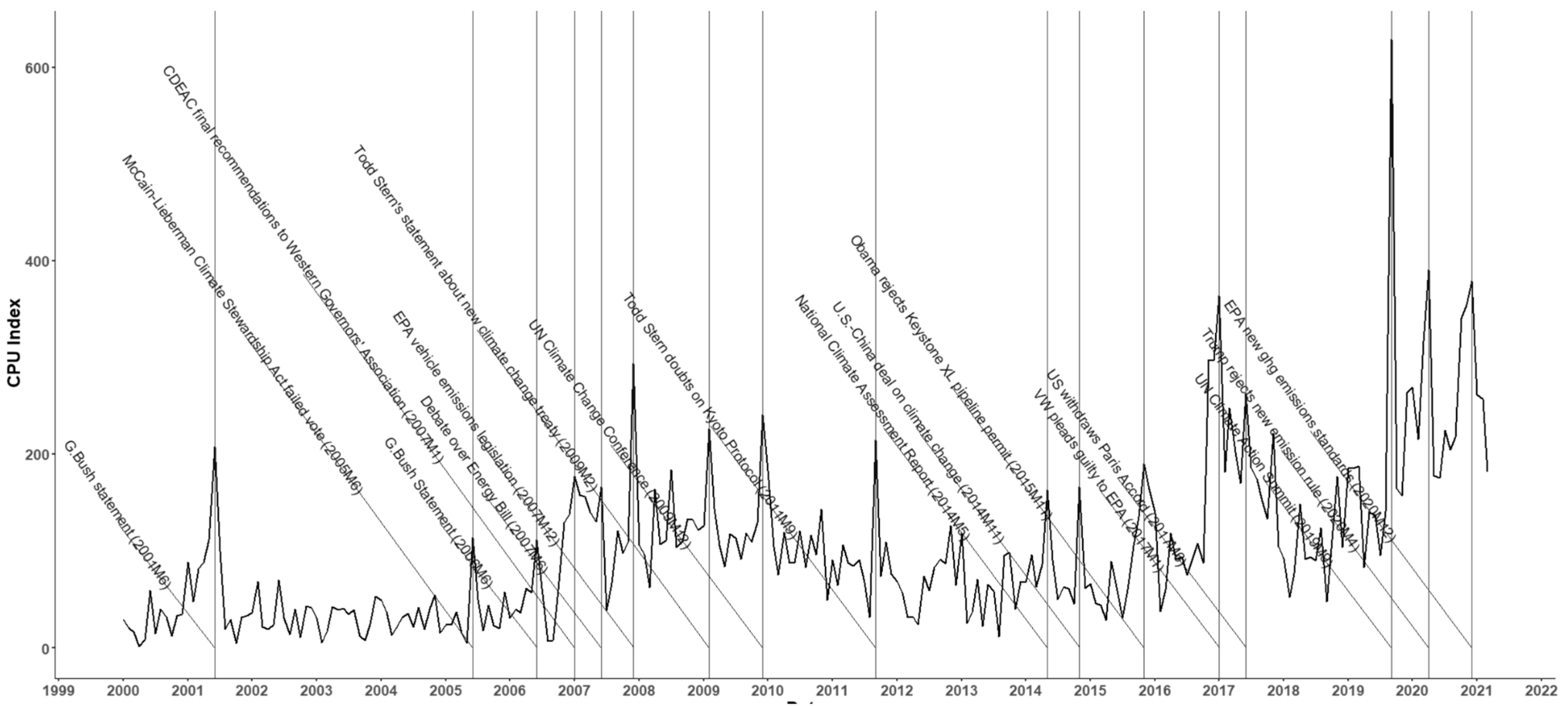

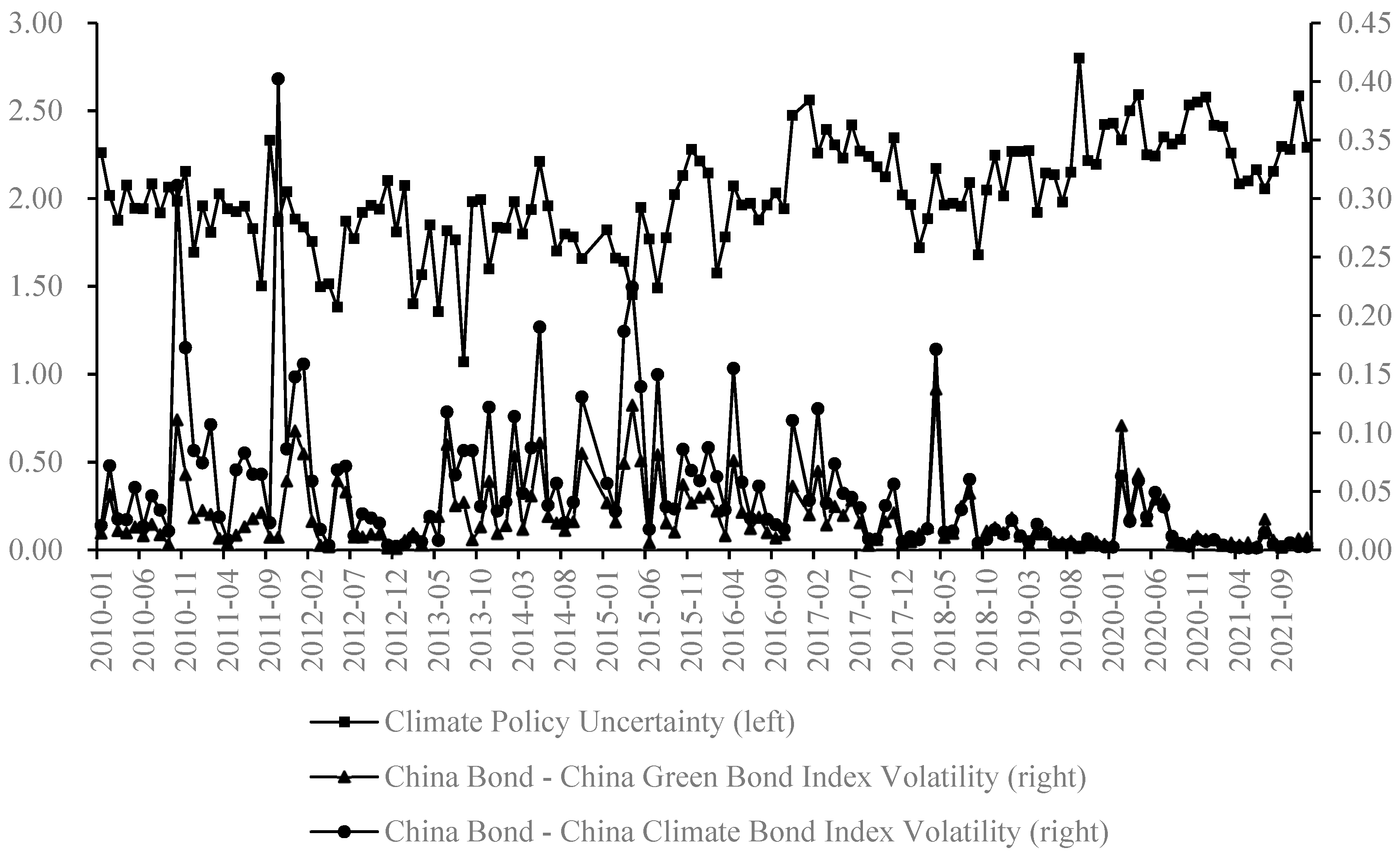

4.2. Variables

4.3. Data

5. Empirical Results

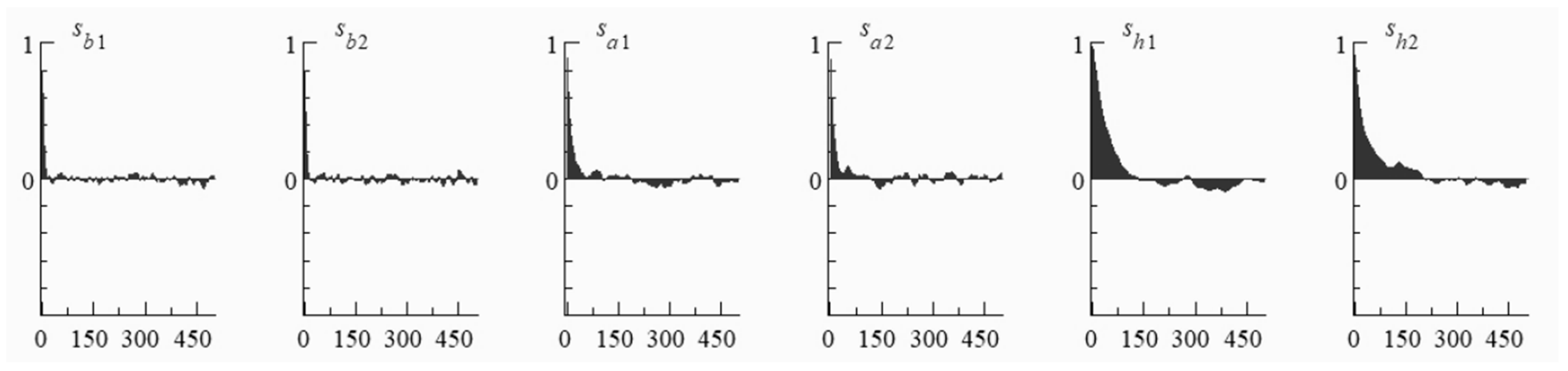

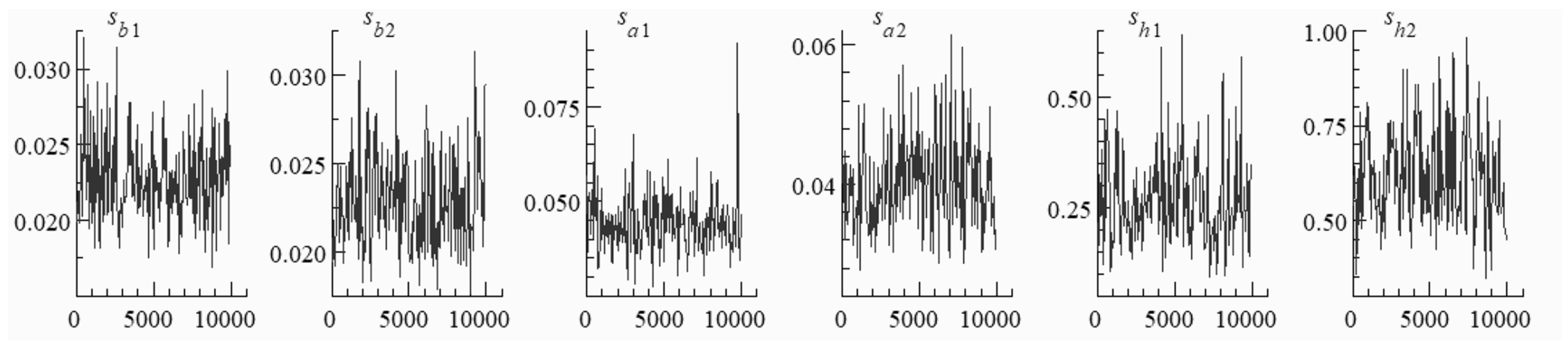

5.1. MCMC Simulation

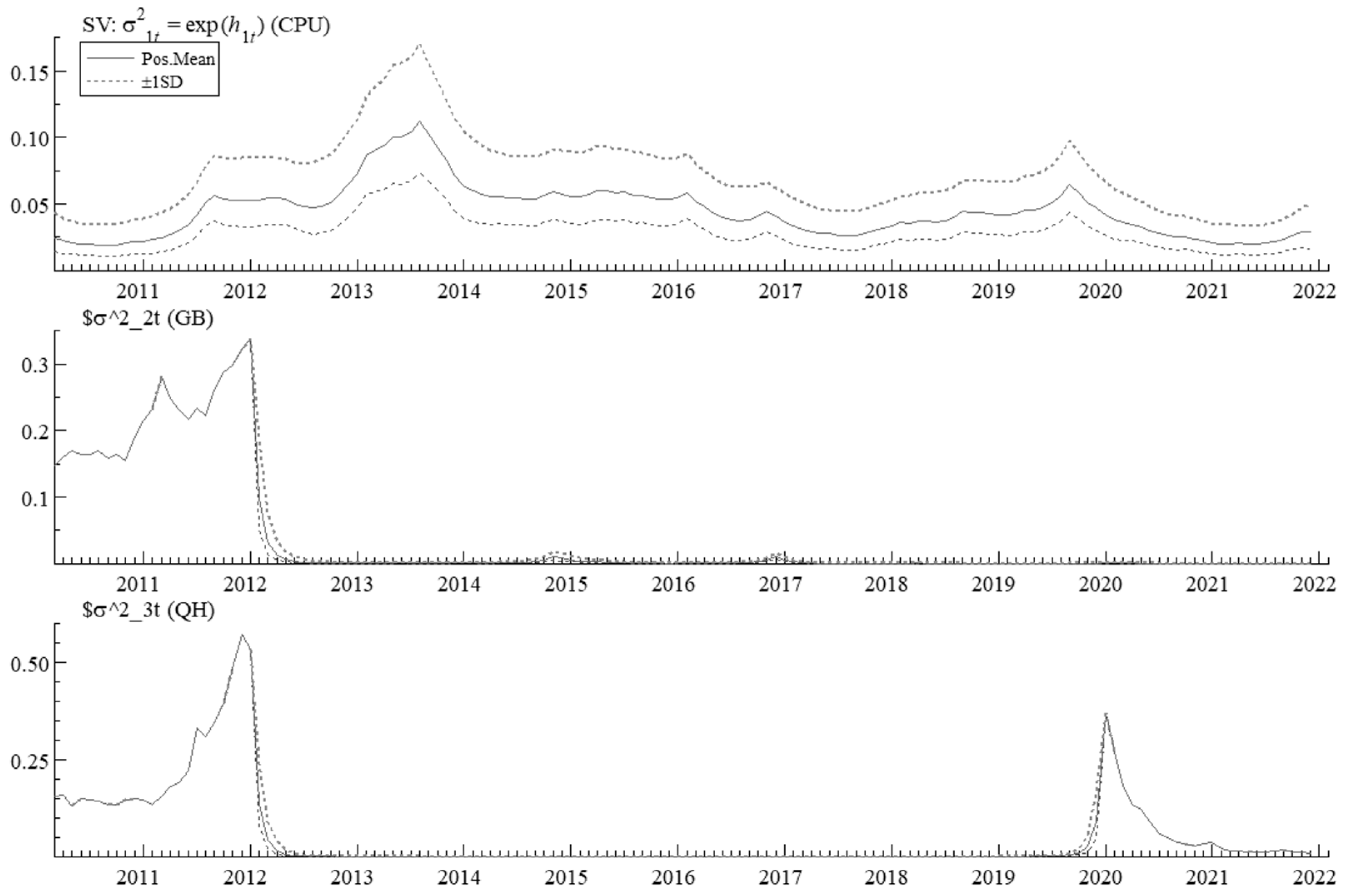

5.2. Stochastic Volatility Estimation

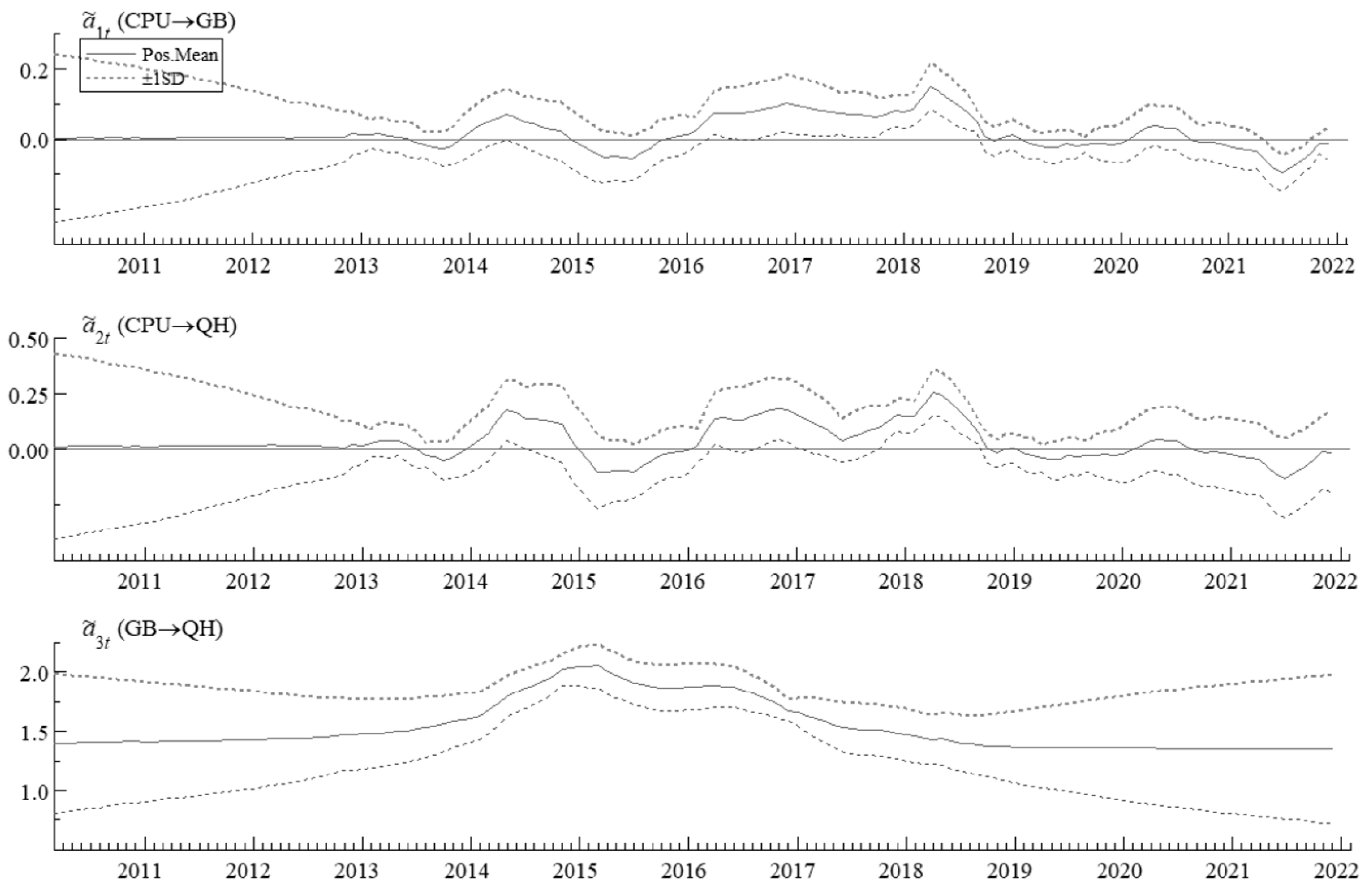

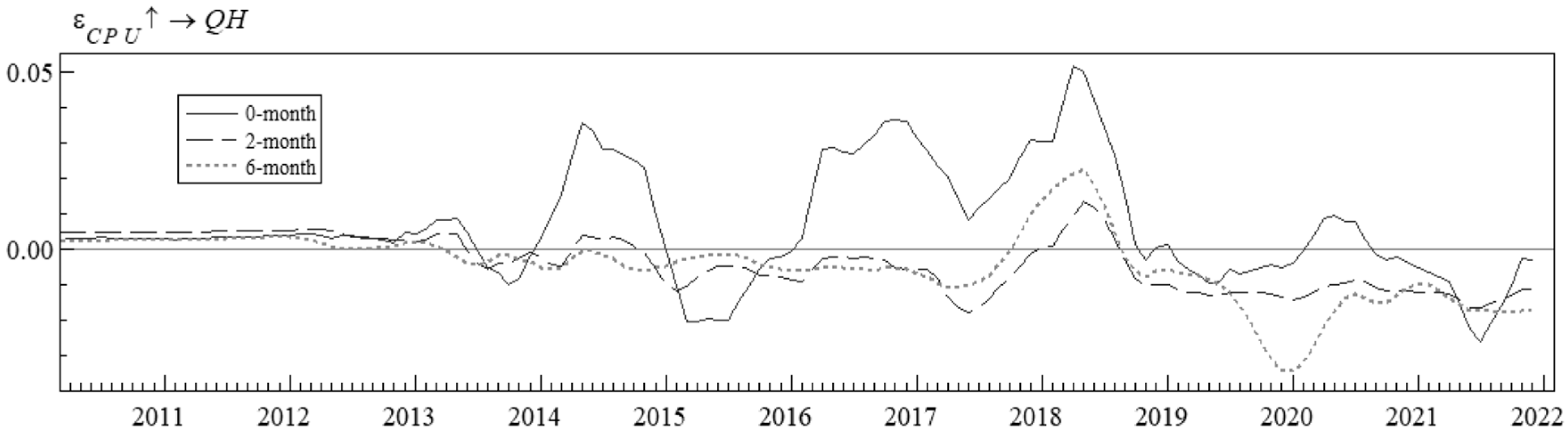

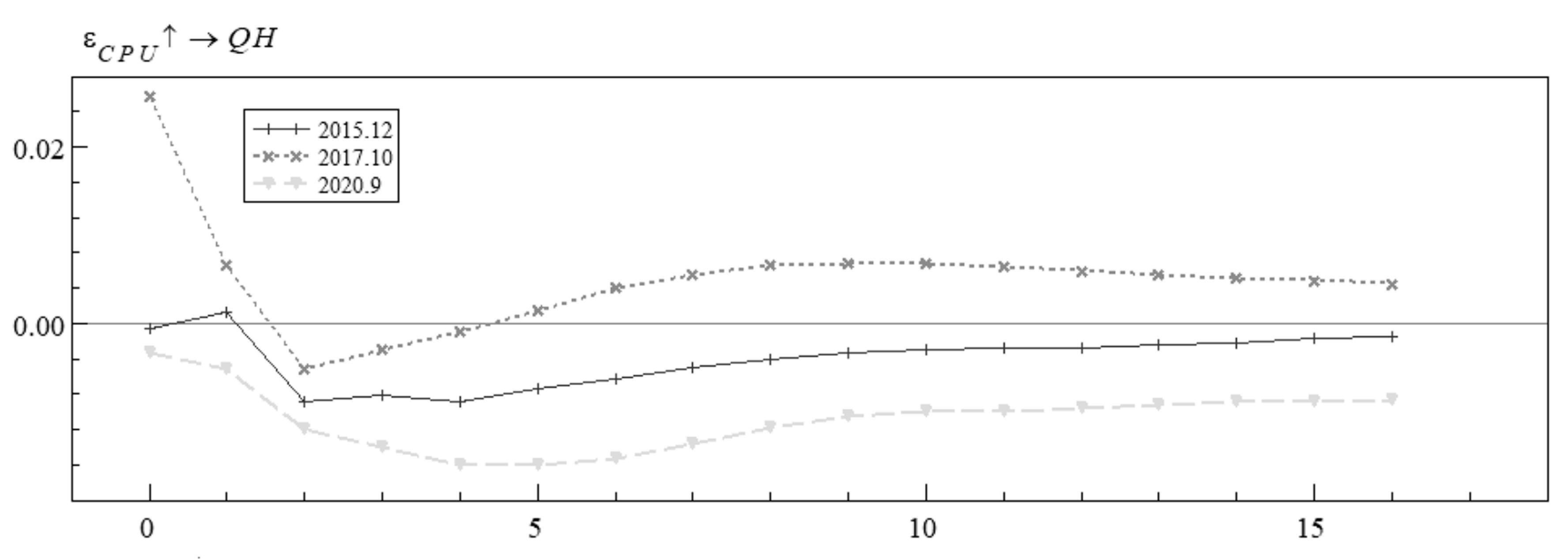

5.3. Time-Varying Impulse Response Estimation

5.4. Robustness Check

6. Conclusions

Author Contributions

Funding

Data Availability Statement

Acknowledgments

Conflicts of Interest

References

- Liu, M. The driving forces of green bond market volatility and the response of the market to the COVID-19 pandemic. Econ. Anal. Policy 2022, 75, 288–309. [Google Scholar] [CrossRef]

- Tian, H.; Long, S.; Li, Z. Asymmetric effects of CPU, infectious diseases-related uncertainty, crude oil volatility, and geopolitical risks on green bond prices. Financ. Res. Lett. 2022, 48, 103008. [Google Scholar] [CrossRef]

- Somanathan, E.; Somanathan, R.; Sudarshan, A.; Tewari, M. The impact of temperature on productivity and labor supply: Evidence from Indian manufacturing. J. Political Econ. 2021, 129, 1797–1827. [Google Scholar] [CrossRef]

- Bouri, E.; Iqbal, N.; Klein, T. CPU and the price dynamics of green and brown energy stocks. Financ. Res. Lett. 2022, 47, 102740. [Google Scholar] [CrossRef]

- Liang, C.; Umar, M.; Ma, F.; Huynh, T. CPU and world renewable energy index volatility forecasting. Technol. Forecast. Soc. Chang. 2022, 182, 121810. [Google Scholar] [CrossRef]

- Pham, L. Is it risky to go green? A volatility analysis of the green bond market. J. Sustain. Finance Invest. 2016, 6, 263–291. [Google Scholar] [CrossRef]

- Pham, L.; Huynh, T.L.D. How does investor attention influence the green bond market? Financ. Res. Lett. 2020, 35, 101533. [Google Scholar] [CrossRef]

- Larcker, D.F.; Watts, E.M. Where’s the greenium? J. Account. Econ. 2020, 69, 101312. [Google Scholar] [CrossRef]

- Tang, D.Y.; Zhang, Y. Do shareholders benefit from green bonds? J. Corp. Financ. 2020, 61, 101427. [Google Scholar] [CrossRef]

- Wang, J.; Chen, X.; Li, X.; Yu, J.; Zhong, R. The market reaction to green bond issuance: Evidence from China. Pac.-Basin Financ. J. 2020, 60, 101294. [Google Scholar] [CrossRef]

- Zerbib, O.D. The effect of pro-environmental preferences on bond prices: Evidence from green bonds. J. Bank. Financ. 2019, 98, 39–60. [Google Scholar] [CrossRef]

- Flammer, C. Corporate green bonds. J. Financ. Econ. 2021, 142, 499–516. [Google Scholar] [CrossRef]

- Jakubik, P.; Uguz, S. Impact of green bond policies on insurers: Evidence from the European equity market. J. Econ. Financ. 2021, 45, 381–393. [Google Scholar] [CrossRef]

- Jin, J.; Han, L.; Wu, L.; Zeng, H. The hedging effect of green bonds on carbon market risk. Int. Rev. Financ. Anal. 2020, 71, 101509. [Google Scholar] [CrossRef]

- Reboredo, J.C. Green bond and financial markets: Co-movement, diversification and price spillover effects. Energy Econ. 2018, 74, 38–50. [Google Scholar] [CrossRef]

- Reboredo, J.C.; Ugolini, A. Price connectedness between green bond and financial markets. Econ. Model. 2020, 88, 25–38. [Google Scholar] [CrossRef]

- Saeed, T.; Bouri, E.; Alsulami, H. Extreme return connectedness and its determinants between clean/green and dirty energy investments. Energy Econ. 2021, 96, 105017. [Google Scholar] [CrossRef]

- Wang, Q.; Zhou, Y.; Luo, L.; Ji, J. Research on the factors affecting the risk premium of China’s green bond issuance. Sustainability 2019, 11, 6394. [Google Scholar] [CrossRef]

- MacAskill, S.; Roca, E.; Liu, B.; Stewart, R.A.; Sahin, O. Is there a green premium in the green bond market? Systematic literature review revealing premium determinants. J. Clean. Prod. 2021, 280, 124491. [Google Scholar] [CrossRef]

- Xia, Y.; Ren, H.; Li, Y.; He, L.; Liu, N. Forecasting green bond volatility via novel heterogeneous ensemble approaches. Expert Syst. Appl. 2022, 204, 117580. [Google Scholar] [CrossRef]

- Kanamura, T. Are green bonds environmentally friendly and good performing assets? Energy Econ. 2020, 88, 104767. [Google Scholar] [CrossRef]

- Naeem, M.A.; Conlon, T.; Cotter, J. Green bonds and other assets: Evidence from extreme risk transmission. J. Environ. Manag. 2022, 305, 114358. [Google Scholar] [CrossRef]

- Tiwari, A.K.; Abakah, E.J.A.; Gabauer, D.; Dwumfour, R.A. Dynamic spillover effects among green bond, renewable energy stocks and carbon markets during COVID-19 pandemic: Implications for hedging and investments strategies. Glob. Financ. J. 2022, 51, 100692. [Google Scholar] [CrossRef]

- Elsayed, A.H.; Naifar, N.; Nasreen, S.; Tiwari, A.K. Dependence structure and dynamic connectedness between green bonds and financial markets: Fresh insights from time-frequency analysis before and during COVID-19 pandemic. Energy Econ. 2022, 107, 105842. [Google Scholar] [CrossRef]

- Choi, D.; Gao, Z.; Jiang, W. Attention to global warming. Rev. Financ. Stud. 2020, 33, 1112–1145. [Google Scholar] [CrossRef]

- Hong, H.; Li, F.W.; Xu, J. Climate risks and market efficiency. J. Econom. 2019, 208, 265–281. [Google Scholar] [CrossRef]

- Painter, M. An inconvenient cost: The effects of climate change on municipal bonds. J. Financ. Econ. 2020, 135, 468–482. [Google Scholar] [CrossRef]

- Seltzer, L.; Starks, L.T.; Zhu, Q. Climate Regulatory Risk and Corporate Bonds. In NBER Working Paper; NEBR: Cambridge, MA, USA, 2022. [Google Scholar]

- Huynh, T.D.; Xia, Y. Climate change news risk and corporate bond returns. J. Financ. Quant. Anal. 2021, 56, 1985–2009. [Google Scholar] [CrossRef]

- Barnett, M.; Brock, W.; Hansen, P.L. Pricing Uncertainty Induced by Climate Change. Rev. Financ. Stud. 2020, 33, 1024–1066. [Google Scholar] [CrossRef]

- Barro, R.J. Environmental protection, rare disasters and discount rates. Economica 2015, 82, 1–23. [Google Scholar] [CrossRef]

- Primiceri, G.E. Time varying structural vector autoregressions and monetary policy. Rev. Econ. Stud. 2005, 72, 821–852. [Google Scholar] [CrossRef]

- Nakajima, J. Time-Varying Parameter VAR Model with Stochastic Volatility: An Overview of Methodology and Empirical Applications. Monet. Econ. Stud. 2011, 29, 107–142. [Google Scholar]

- Bitto, A.; Frühwirth-Schnatter, S. Achieving shrinkage in a time-varying parameter model framework. J. Econom. 2019, 210, 75–97. [Google Scholar] [CrossRef]

- Jebabli, I.; Arouri, M.; Teulon, F. On the effects of world stock market and oil price shocks on food prices: An empirical investigation based on TVP-VAR models with stochastic volatility. Energy Econ. 2014, 45, 66–98. [Google Scholar] [CrossRef]

- Vuong, Q.H.; Nguyen, M.H.; La, V.P. The Mindsponge and BMF Analytics for Innovative Thinking in Social Sciences and Humanities; De Gruyter: Berlin, Germany, 2022. [Google Scholar]

- Gavriilidis, K. Measuring Climate Policy Uncertainty. Available online: https://www.policyuncertainty.com/climate_uncertainty.html (accessed on 16 November 2022).

- Ren, X.; Zhang, X.; Yan, C.; Gozgor, G. CPU and firm-level total factor productivity: Evidence from China. Energy Econ. 2022, 113, 106209. [Google Scholar] [CrossRef]

- Aye, G.C.; Balcilar, M.; Demirer, R.; Gupta, R. Firm-level political risk and asymmetric volatility. J. Econ. Asymmetries 2018, 18, e00110. [Google Scholar] [CrossRef]

- Gkillas, K.; Gupta, R.; Wohar, M.E. Volatility jumps, The role of geopolitical risks. Financ. Res. Lett. 2018, 27, 247–258. [Google Scholar] [CrossRef]

- Vuong, Q.H. The Semiconducting principle of monetary and environmental values exchange. Econ. Bus. Lett. 2021, 10, 284–290. [Google Scholar] [CrossRef]

| Issues of Research | References | Main Contents |

|---|---|---|

| Green bond market | Wang et al., 2019 [18] | Factors influencing the risk premium of green bonds |

| Zerbib, 2019 [11] | Green bond pricing | |

| Larcker and Watts, 2020 [8] | ||

| Tang and Zhang, 2020 [9] | ||

| Wang et al., 2020 [10] | Green bond issuance affects corporate value | |

| Jakubik and Uguz, 2021 [13] | ||

| Flammer, 2021 [12] | ||

| Reboredo, 2018 [15] | Connection between the green bond market and other financial markets | |

| Reboredo and Ugolini, 2020 [16] | ||

| Jin et al., 2020 [14] | ||

| Saeed et al., 2021 [17] | ||

| Pham, 2016 [6] | Green bond volatility | |

| Pham and Huynh, 2020 [7] | Investor attention affects green bond volatility | |

| Xia et al., 2020 [20] | Forecasting green bond volatility | |

| MacAskill et al., 2021 [19] | Green premium literature review | |

| Liu, 2022 [1] | COVID-19 and green bond market volatility | |

| Climate change and financial markets | Barro, 2015 [31] | Uncertainty about the effectiveness of climate policy and environmental investors |

| Choi et al., 2020 [25] | Temperature affects stock prices | |

| Painter, 2020 [27] | Climate change on municipal bonds | |

| Seltzer et al., 2020 [28] | Climate regulatory risk affects corporate bonds | |

| Barnett et al., 2020 [30] | Pricing uncertainty caused by climate change | |

| Huynh and Xia, 2021 [29] | Climate change news risk affects corporate bond returns | |

| Somanathan et al., 2021 [3] | Temperature affects business labor productivity | |

| Bouri et al. 2022 [4] | Climate policy uncertainty affects energy stocks |

| Variable | Observations | Mean | Std. dev. | Min | P25 | P50 | P75 | Max |

|---|---|---|---|---|---|---|---|---|

| CPU | 144 | 2.027 | 0.291 | 1.071 | 1.837 | 2.017 | 2.245 | 2.799 |

| GB | 144 | 0.034 | 0.048 | 0.0010 | 0.0090 | 0.019 | 0.040 | 0.372 |

| QH | 144 | 0.060 | 0.092 | 0.0010 | 0.0090 | 0.033 | 0.068 | 0.591 |

| Variables | ADF | p-Value | Result |

|---|---|---|---|

| CPU | −5.896 *** | 0.000 | Stationary series |

| GB | −8.579 *** | 0.000 | Stationary series |

| QH | −8.351 *** | 0.000 | Stationary series |

| lag | LL | LR | FPE | AIC | HQIC | SBIC |

|---|---|---|---|---|---|---|

| 0 | 445.85 | NA | 3.6 × 10−7 | −6.32643 | −6.30082 | −6.2634 |

| 1 | 488.582 | 85.464 | 2.2 × 10−7 | −6.80832 | −6.70586 | −6.55618 * |

| 2 | 505.797 | 34.429 * | 2 × 10−7 * | −6.92567 * | −6.74636 * | −6.48442 |

| 3 | 513.268 | 14.943 | 2 × 10−7 | −6.90383 | −6.64768 | −6.27348 |

| 4 | 517.526 | 8.516 | 2.2 × 10−7 | −6.83609 | −6.50309 | −6.01663 |

| Parameter | Mean | Stdev | 95%L | 95%U | Geweke | Inef. |

|---|---|---|---|---|---|---|

| 0.0227 | 0.0026 | 0.0183 | 0.0284 | 0.071 | 8.99 | |

| 0.0229 | 0.0027 | 0.0183 | 0.0288 | 0.760 | 8.13 | |

| 0.0442 | 0.0078 | 0.0315 | 0.0612 | 0.885 | 25.23 | |

| 0.0403 | 0.0070 | 0.0293 | 0.0560 | 0.000 | 22.82 | |

| 0.2653 | 0.0996 | 0.1163 | 0.4957 | 0.733 | 69.45 | |

| 0.6211 | 0.1255 | 0.4078 | 0.8989 | 0.466 | 65.66 |

Disclaimer/Publisher’s Note: The statements, opinions and data contained in all publications are solely those of the individual author(s) and contributor(s) and not of MDPI and/or the editor(s). MDPI and/or the editor(s) disclaim responsibility for any injury to people or property resulting from any ideas, methods, instructions or products referred to in the content. |

© 2023 by the authors. Licensee MDPI, Basel, Switzerland. This article is an open access article distributed under the terms and conditions of the Creative Commons Attribution (CC BY) license (https://creativecommons.org/licenses/by/4.0/).

Share and Cite

Yu, J.; Zhang, M.; Liu, R.; Wang, G. Dynamic Effects of Climate Policy Uncertainty on Green Bond Volatility: An Empirical Investigation Based on TVP-VAR Models. Sustainability 2023, 15, 1692. https://doi.org/10.3390/su15021692

Yu J, Zhang M, Liu R, Wang G. Dynamic Effects of Climate Policy Uncertainty on Green Bond Volatility: An Empirical Investigation Based on TVP-VAR Models. Sustainability. 2023; 15(2):1692. https://doi.org/10.3390/su15021692

Chicago/Turabian StyleYu, Jiasheng, Maojun Zhang, Ruoyu Liu, and Guodong Wang. 2023. "Dynamic Effects of Climate Policy Uncertainty on Green Bond Volatility: An Empirical Investigation Based on TVP-VAR Models" Sustainability 15, no. 2: 1692. https://doi.org/10.3390/su15021692

APA StyleYu, J., Zhang, M., Liu, R., & Wang, G. (2023). Dynamic Effects of Climate Policy Uncertainty on Green Bond Volatility: An Empirical Investigation Based on TVP-VAR Models. Sustainability, 15(2), 1692. https://doi.org/10.3390/su15021692