1. Introduction

Inflation primarily refers to persistent increases in the prices of goods and services. A rise in the prices of commodities leads to a decrease in the purchasing power of the people in society. The decline in the purchasing power of individuals in the economy eventually leads to a reduction in the level of savings and investments in the economy [

1]. Oil is an imported good and the exchange rate affects the price of oil immensely. Therefore, understanding the relationship between the exchange rate and the price of oil and its pass-through on inflation is critical for developing economic policies [

2]. Fluctuations in exchange rates play a crucial role in shaping the economic link or as a transmission mechanism between domestic and international markets, directly affecting the prices of goods and services in the domestic economy [

2]. Exchange rate movements can influence actual inflation and future price movements. Macroeconomists simultaneously linked oil price shocks to diminished economic activity and higher inflation [

3]. As Lescaroux and Mignon [

4] observed, several transmission networks exist through which oil prices can influence economic activity and inflation. For instance, a surge in the price of crude oil affects the prices of petroleum products, eventually affecting consumers and producers. This is because crude oil prices directly affect the prices of energy-related items, such as household fuels, electricity, and motor fuels. From the production side, a rise in the price of crude oil increases production costs, which lowers the overall output, employment, real wages, investments, and profits.

The government does not fix the exchange rate at a specific level but lets the supply and demand for the currency determine the exchange rate [

4]. The participation of the Central Bank in the foreign exchange market (whether buying or selling dollars) is limited to ensuring orderly conditions and avoiding extreme exchange rate swings [

5]. Central banks are also critical to maintaining economic and financial stability. They implement monetary policy to achieve low and stable inflation. Following the global financial crisis, central banks’ toolkits for dealing with financial stability risks and managing volatile exchange rates have grown. The policy response of central banks ultimately explains the transmission of the fluctuations in energy prices to general inflation. Theoretically, the degree to which a rise in oil prices gives rise to inflation through complex production costs depends, among other things, on the supply and demand conditions underlying the global oil market and the inflationary expectations of producers and consumers. As inflation expectations rise in the long run, the chances of an increase in energy costs and wages to consumer prices also surge. In other words, rising oil prices may lead to a perpetual increase in general inflation. As oil prices fall, inflationary pressures begin to dissipate [

6].

The Asymmetric Relationship between Oil Prices and Other Variables

Shocks to the price of oil were blamed for economic recessions, financial crises in different industries, unemployment, depression of investment through uncertainty, high inflation, low equity and bond values, trade deficits, etc. [

7]. Furthermore, oil prices can have both real effects and inflationary effects. The impact of oil price shocks on the US economy is asymmetric. Specifically, increases in oil prices tend to have significant adverse effects, while decreases do not produce corresponding positive results [

8,

9]. Therefore, analyzing the asymmetric effects of oil price shocks in the context in which they affect domestic prices is interesting.

The asymmetric impact of a shock can be broadly subdivided into two types. One is an asymmetry in sign (asymmetry of direction), which means that the effect will be different in direction. The other one is an asymmetry in magnitude (asymmetry of size), which describes a difference in the scale of changes. Several studies [

10,

11,

12,

13] considered the symmetric impact of oil prices and exchange rate pass-through (EXRPT) on food prices. All these studies addressed the symmetric and linear effects of exchange rate fluctuation. Thus, there exists a research gap in estimating the non-linear impacts of changes in oil prices and their impacts on macroeconomic variables. This is because the macroeconomic variables do not behave linearly in practice if real-time data is used.

Asymmetric relationships between variables suggest that increasing and decreasing variables may have differential effects. For example, rising oil prices may impact inflation differently than falling oil prices. Positive oil price shocks tend to increase the money supply in oil-producing countries [

14], significantly affecting consumer prices [

15]. Furthermore, falling oil prices reduce the foreign earnings of oil-producing countries, resulting in currency depreciation and rising inflation [

16].

Concern regarding asymmetric pricing was explored by researchers during high-priced episodes. Karrenbrock [

17] published several studies from the United States during the gasoline price spike caused by Iraq’s invasion of Kuwait in 1990. Sen [

18] referenced official investigations into anti-competitive practices in Canada and the United States. Bacon [

19] noted that the Monopolies and Mergers Commission in the United Kingdom had investigated gasoline pricing for anti-competitive behavior three times and found evidence of asymmetric pricing. The high oil prices that caused the peak in 2008 produced similar responses. A typical reaction was the Attorney General’s Report on gasoline pricing in Bocklet and Baek [

20] and an investigation into asymmetric pricing in Portugal. Similar responses also occurred in developing countries, as noted by Kojima [

21]. Currently, the Russia–Ukraine war has created the same scenario. As stated by a Bloomberg report, thousands of miles away from the Ukraine conflict, Pakistan is facing the strain of the war and the West’s push to penalize Russia for its invasion. South Asian countries are experiencing an energy crisis due to a fuel shortage and rising oil prices in the international market. They are enduring prolonged power outages, mainly due to their inability to procure liquefied natural gas (LNG) from Italian and Qatari suppliers.

All of this is the outcome of a European campaign to abandon Russian fuel to isolate Moscow due to its offensive against Ukraine, shifting the entire burden of fuel procurement to suppliers other than Russia. This has caused an oil price hike and led to mayhem in Pakistan. With the increase in oil prices amid the Russia–Ukraine war, the economy of Pakistan could be gravely impacted, causing the country’s currency to be devalued, increasing the current account deficit, and spiking inflation [

21,

22]. With rising oil prices, declining exchange rates, and rising inflation in Pakistan, scholars are researching the subject.

In exchange-rate-related studies, especially in Pakistan, researchers [

23,

24,

25,

26] empirically investigated the effect of oil price changes and shocks on inflation. In Pakistan, petroleum products account for approximately 50% of the current energy consumption. Moreover, the share of motor spirit (petrol) and high-speed diesel (HSD) exceeds 50% in the petroleum product group. The country’s demand for petroleum products is nearly 21 million tons, out of which not even 19% is met through resources that are available locally, while the balance is met through imports. Oil is the most expensive and widely used among the fuels utilized in thermal power plants. Policymakers cannot overlook the fluctuating price of oil and its potential impact on prices because it is inextricably linked to our daily lives in modern times.

Previous studies did not account for the role of exchange rate fluctuations and oil prices to determine the reasons behind asymmetric inflation (rocket and feather hypothesis) in Pakistan. Therefore, the first contribution that this study made was to provide additional evidence on the rocket and feather hypothesis as shown in Pakistan. The rocket and feather hypothesis refers to the asymmetric changes in domestic price indices of exchange rate pass-through, together with fluctuations in the price of oil. Prices do not always change systematically. Hence, the logic behind it is interpreted as the rocket and feather hypothesis [

27]. The rocket and feather hypothesis focuses on the rapid change in variables associated with the economy caused by transactions on the real effective exchange rate and fluctuations in oil prices. In other words, the rocket and feather hypothesis analyses the pattern of the consumer price index varying on one side differently to how it varies on the other. A rocket speeding swiftly and a feather drifting slowly are analogous to the asymmetric pattern associated with the movement of the variables because of the oscillations and variations in the economy. The inspection of asymmetric patterns in EXRPT and oil prices was previously absent in Pakistan’s case.

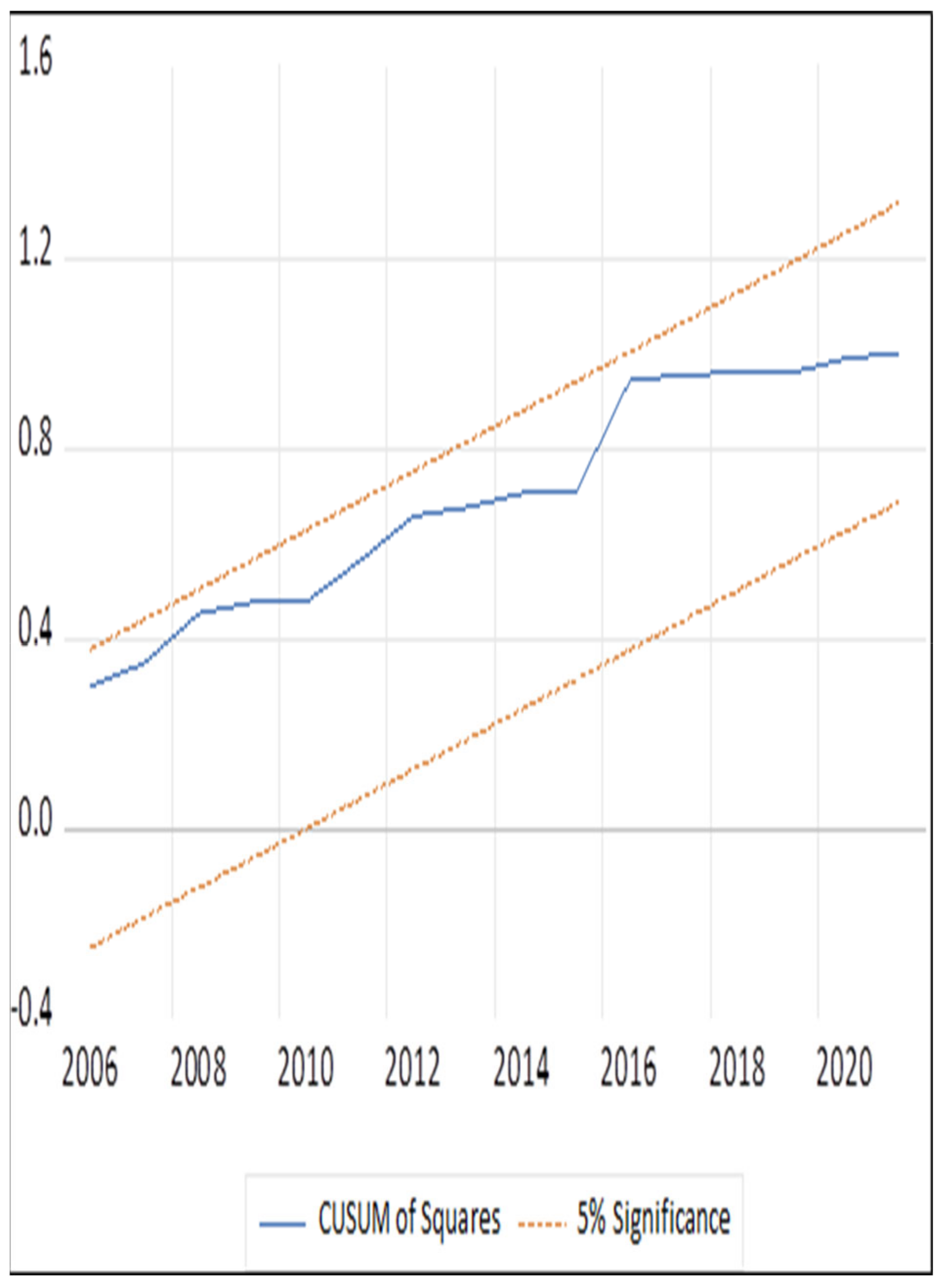

This study made three significant contributions to the literature. First, the current research objective was to test whether and how the rocket and feather hypothesis was valid under the forces of globalization. We considered three types of globalization: globalization, economic globalization, and trade globalization. Second, in contrast to the previous studies that assumed that the nature of the variables was linearly cointegrated in the case of Pakistan, we executed suitable non-linear cointegration techniques to address the issue of non-linearity. Specifically, our study used annual data from 1972 to 2021 to examine the asymmetry and non-linearities of exchange rate pass-through and oil price fluctuations on inflation. Finally, our study was the first study to our knowledge that attempted to investigate the impact of the EXRPT and oil price on inflation jointly. Accordingly, we answered the following questions: (1) Is there any evidence of an asymmetrical EXRPT to be found during appreciation and depreciation? (2) Was there any nonsignificant EXRPT in the long run? (3) Was there an asymmetric relationship between oil prices and inflation? To answer these questions, we first estimated the EXRPT and oil price effects on inflation by applying Shin et al.’s non-linear autoregressive distributed lag (NARDL) framework [

28].

2. Some Glimpses from Previous Literature

Bénassy-Quéré et al. [

29] found that the long-run pass-through is significant and inelastic in the short run, having lower pass-throughs than the long-run exchange rate pass-through effect on the consumer price index. Unlike Usman et al. [

30], Baharumshah et al. [

31] found that the pass-through was more asymmetric in the short run than in the long run. No changes were observed in appreciation in the short run, while inflation affects consumer price levels, leading to increased depreciation in Sudan. Baryan and Cecchetti; Balcilar et al. [

32,

33] also found, using the vector smooth transition autoregressive (VSTAR) method, that there was evidence of asymmetric pass-through in all the countries exhibiting a higher pass-through when the size of the shocks to the transition variable moved the system above a threshold level. Delatte and López-Villavicencio [

34] discovered that currency depreciations have stronger effects than currency appreciation in the long and short runs. The pass-through effect is higher in countries with large import shares [

35]. Jiang and Kim [

36] concluded that shocks in the exchange rate have an instant effect, i.e., within one quarter, on producers’ prices. The producer price index (PPI) and retail price index (RPI) are generally not complete relative to the exchange rate pass-through (ERPT), PPI and RPI are influenced relatively quickly, and the ERPT’s effect on the RPI is less than that of the ERPT on the PPI in China. Younus and Yucel [

37] carried out research regarding the pass-through of the exchange rate in Pakistan to inflation from the period of 2008 to 2019. Their result indicated a substantial impact of the exchange rate on domestic price levels, which had an upward trend. Saidu et al. [

38] found that a decrease in oil price had a more significant impact on the exchange rate than an increase, and this varied in sign and size across countries. In their research, Kwofie and Ansah [

39] concluded that inflation and the stock market have a significant relationship over the long run while showing no relationship in the short run.

On the other hand, the exchange rate has a relationship with the stock market, both in the long and short runs. In the short run, the parallel exchange rate pass-through affects inflation significantly in the long run [

40]. If we look at the exchange rate, depreciation of the exchange rate leads to an increase in import prices and an increase in inflation expectations, which leads to a rise in wage demand, thus creating upward inflationary pressure [

41].

Milani [

42] applied the New Keynesian model using variables, such as IS, and Philips curves to study inflation in the US economy. Their results led them to the conclusion that the sensitivity of US inflation to global measures of output may have increased over the sample, but it remained minimal. Therefore, globalization has a limited effect on the US economy. Sajid and Siddiqui; Fiaz et al. [

43,

44] studied the effect of money growth and exchange rate depreciation on inflation in Pakistan. They took Pakistani data from 1982 to 2012 and applied the Hansen Model in combination with a Philips curve equation. They evaluated their results by using the generalized moments technique. It was found that money growth affects inflation and the effect on inflation due to exchange rate depreciation is present but is not significant. Algaeed [

45] concluded that exchange rate depreciation alongside symmetric price shocks of oil could be responsible for domestic consumer price inflation in the long run in Saudi Arabia. There are threshold effects on the inflation of money growth, but there is no threshold effect on the inflation of exchange rate depreciation [

46].

Shahzad and Jaffri [

47] and Wimanda [

48] investigated whether the exchange rate, output gap, global energy inflation, and lagged inflation positively affect monthly inflation in Pakistan. Based on their results, they suggested that a fixed exchange rate is vital for controlling domestic inflation. Ahmed et al. [

49] estimated that the most significant shock in variables is noted in the money supply compared with other variables from the exchange rate, which is the most significant cause of fluctuation in Pakistan’s economy. Asad et al. [

50] also highlighted a strong and significant positive relationship between inflation and the real effective exchange rate. Ali et al. [

51] observed that an increase in interest rates and money supply leads to inflation and exchange rate volatility.

Using quarterly data from 2008 to 2019, Younus and Yucel [

37] researched the pass-through of the swapping scale in Pakistan with expansion locally, which strongly affects the customer container, from 2008 to 2019. Ahmed et al. [

49] assessed the conversion scale of the pass-through to costs of oil and imported great costs, alongside the purchaser costs, cash supply, and loan fees in Pakistan using monthly data from 2005 to 2015 and calculating it using an unlimited VAR model. These studies observed that the most significant shock in factors is noted in cash supply when contrasted with different factors from the swapping scale, which is the most crucial reason for the change in the nation’s economy.

Benigno and Faia [

52] studied the impact of globalization on pass-through channels. Specifically, they used sectoral information for the US to analyze the pass-through of conversion standards, particularly after 1999. The outcomes indicated an increase in the level of pass-through for close to half of the sectors in their study. Their results suggest that in the wake of changing the exchange strategy toward more major advancement, the ERPT rises. Additionally, López-Villavicencio and Mignon [

53] analyzed the pass-through of swapping scales to import costs of three central Eurozone nations by focusing on globalization in the pass-through channel. Gust et al. [

54] contended that rising unfamiliar rivalry through globalization prompts a lower ERPT. They argued that in an open economy, firms’ evaluating choices depend on the host’s minor expenses and the contenders’ costs. Accordingly, the fall in pass-through is ascribed to bringing down exchange costs because of globalization. A study of Nigeria also provides intriguing indications of the degree of the pass-through of the swapping scale, disregarding that pass-through during the time of enthusiasm for homegrown money is not the same as devaluation.

5. Conclusions and Policy Implications

Pakistan is a developing country that has witnessed very few years of economic stability during the period covered by this study. The low growth was due to many reasons, including political unrest, social issues, cultural barriers, and poor-quality economic policies by policymakers. In a time of rapid globalization, every country now depends on others for goods and commodities. If one country changes its policies, it quickly affects the economy of another. Moreover, in the case of developing countries, such as Pakistan, the main component of growth, namely, oil, is mainly imported from other countries. Therefore, the economic systems of developing nations suffer from having a lower ability to contribute or affect prices. The real effective exchange rate pass-through and the fluctuations in oil prices show significantly different effects on inflation that can be observed. Therefore, in this study, the evidence of the rocket and feather hypothesis was explored in the scenario of globalization in the case of Pakistan. It was observed that the asymmetric exchange rate pass-through led to the domestic economy inflation increasing similar to a rocket when the oil prices increased and falling similar to feathers when oil prices decreased. The data set used for empirical analysis was from 1972 to 2021 and applied the non-linear autoregressive distributed lag (NARDL) framework. The variables included annual crude oil prices, real effective exchange rates, imports, gross domestic product per capita, exports, globalization, interest rate, and inflation. The results showed that INCOME, EXP, and GLOB negatively impacted inflation, as an increase in income with an increase in exports and globalization led to more production, which eventually reduced inflation. However, CRATE and IMP produced a positive impact on inflation. An increase in the interest rate led to reduced investment, which reduced production, and when production was lower, the demand increased prices in the economy.

Furthermore, the increase in imports negatively impacted domestic production and demand for domestic products, which negatively affected inflation. As far as oil prices were concerned, the fluctuation was also monitored, along with the exchange rate on the consumer price index, to witness the effects. The results suggested that currency appreciation decreased inflation more than it did when the currency depreciated, which further suggested incorporating policies that increase foreign attraction to the local currency [

64,

65]. Oil prices tend to decrease inflation in both scenarios, though the decrease in oil prices supports a reduction of inflation [

66]. This result lent support to the asymmetric effect on the consumer price index of the rocket and feather hypothesis. The results showed that LRER_NEG and OILP_NEG inflation was in control as the consumer prices were decreased in such cases [

67]. Therefore, the results indicated that stabilizing the exchange rate and oil prices must be emphasized for economic growth. When the currency appreciates, inflation tends to decrease more than when the currency depreciates. Thus, appropriate policies should be developed to cope with increasing inflation [

68]. The rocket and feather hypothesis model of the real effective exchange rate and the oil price fluctuations on the inflation were verified by the results. Thus, the country’s policies should make a subtle shift and work on maximizing the purchasing power of individuals to stabilize the economic system as much as possible. Policies such as fixing the exchange rate might provide the much-required rest from the fluxes and stabilize the inflation in the economy, as the increasing pattern of the exchange rate indicated rising inflation, as well as this study’s results. This will further help to stabilize the balance of payment by giving a boost to exports. Additionally, Pakistan’s economy also requires support for the practice of sustainable energy in the economy that will increase the use of renewable energy in production and other operations. Lower utilization of oil will decrease the price fluctuations caused by inflation, as the oil price fluctuation impacts inflation significantly, as shown in the results; thus, reducing its usage will have favorable results.