The Impact of Financial System on Carbon Intensity: From the Perspective of Digitalization

Abstract

1. Introduction

2. Literature Review

2.1. Financial Development and Environmental Pollution

2.2. Financial Structure and Environmental Pollution

2.3. Summary

3. Theoretical Analysis and Hypotheses

4. Model Construction and Data Selection

4.1. Model Construction

Benchmark Regression

4.2. Variable Selection

4.2.1. Explained Variables (Carbon Intensity, Cabi)

4.2.2. Explanatory Variable (Degree of Marketization of the Financial System, Finm)

4.2.3. Mediating Variable (Digitization, Digt):

4.2.4. Control Variable

4.3. Data Sources

5. Empirical Results and Analysis

5.1. Benchmark Regression Results

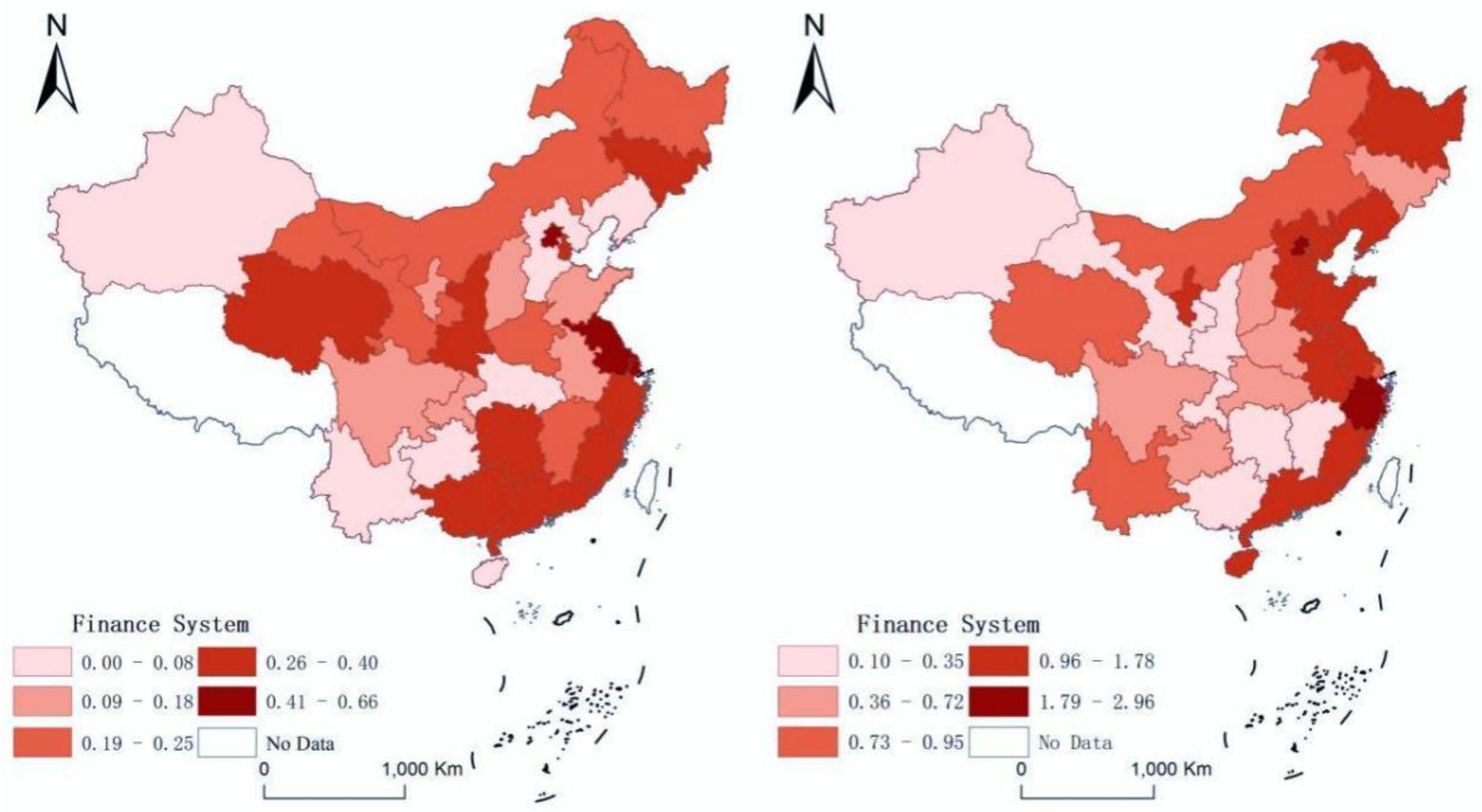

5.2. Regional Heterogeneity Analysis

5.3. Intermediary Effect Test

5.3.1. The Intermediary Effect Test of the Development Level of Digital Economy

5.3.2. The Intermediary Effect Test of the Digital Infrastructure Construction

5.3.3. The Intermediary Effect Test of the Digital Ecological Environment Construction

5.3.4. The Intermediary Effect Test of the Digital Talent

6. Conclusions and Policy Recommendations

6.1. Conclusions

- With the improvement of China’s economic development level, finance should adapt to the regional industrial structure and human capital accumulation in order to better serve the development of the real economy; Therefore, market-oriented finance can help reduce the carbon intensity. By dealing with the robustness tests such as endogeneity among variables and hysteresis of test variables, the conclusion is still robust.

- The market-oriented financial structure helps to reduce the carbon emission intensity in Eastern, Central, Western and Northeastern China, and has a more significant inhibition effect in northeastern China. It shows that Northeast China needs to further transform into the market economy, broaden the financing channels for industrial development, and provide impetus for the development of green industries.

- The improvement of the digital level can significantly enhance the inhibition of financial structure on carbon intensity, mainly through the application of digital talents and the construction of digital infrastructure.

6.2. Policy Recommendations

6.3. Discussion

Funding

Institutional Review Board Statement

Informed Consent Statement

Data Availability Statement

Conflicts of Interest

References

- Lal, R. Carbon emission from farm operations. Environ. Int. 2004, 30, 981–990. [Google Scholar] [CrossRef]

- Huang, L.; Krigsvoll, G.; Johansen, F.; Liu, Y.; Zhang, X. Carbon emission of global construction sector. Renew. Sustain. Energy Rev. 2018, 81, 1906–1916. [Google Scholar] [CrossRef]

- Xu, L.; Fan, M.; Yang, L.; Shao, S. Heterogeneous green innovations and carbon emission performance: Evidence at China’s city level. Energy Econ. 2021, 99, 105269. [Google Scholar] [CrossRef]

- Sun, W.; Huang, C. Predictions of carbon emission intensity based on factor analysis and an improved extreme learning machine from the perspective of carbon emission efficiency. J. Clean. Prod. 2022, 338, 130414. [Google Scholar] [CrossRef]

- Fischer, S. Financial crises and reform of the international financial system. Rev. World Econ. 2003, 139, 1–37. [Google Scholar] [CrossRef]

- Monasterolo, I. Climate change and the financial system. Annu. Rev. Resour. Econ. 2020, 12, 299–320. [Google Scholar] [CrossRef]

- Baur, D.G.; Oll, J. Bitcoin investments and climate change: A financial and carbon intensity perspective. Financ. Res. Lett. 2022, 47, 102575. [Google Scholar] [CrossRef]

- Shen, Y.; Su, Z.W.; Malik, M.Y.; Umar, M.; Khan, Z.; Khan, M. Does green investment, financial development and natural resources rent limit carbon emissions? A provincial panel analysis of China. Sci. Total Environ. 2021, 755, 142538. [Google Scholar] [CrossRef]

- Stiglitz, J.E. Why financial structure matters. J. Econ. Perspect. 1988, 2, 121–126. [Google Scholar] [CrossRef]

- Luintel, K.B.; Khan, M.; Arestis, P.; Theodoridis, K. Financial structure and economic growth. J. Dev. Econ. 2008, 86, 181–200. [Google Scholar] [CrossRef]

- Allen, F.; Bartiloro, L.; Gu, X.; Kowalewski, O. Does economic structure determine financial structure? J. Int. Econ. 2018, 114, 389–409. [Google Scholar] [CrossRef]

- Oyebanji, M.O.; Castanho, R.A.; Genc, S.Y.; Kirikkaleli, D. Patents on Environmental Technologies and Environmental Sustainability in Spain. Sustainability 2022, 14, 6670. [Google Scholar] [CrossRef]

- Townsend, R.M. Financial structure and economic activity. Am. Econ. Rev. 1983, 73, 895–911. [Google Scholar]

- Qu, C.; Shao, J.; Shi, Z. Does financial agglomeration promote the increase of energy efficiency in China? Energy Policy 2020, 146, 111810. [Google Scholar] [CrossRef]

- Yuan, H.; Zhang, T.; Hu, K.; Feng, Y.; Feng, C.; Jia, P. Influences and transmission mechanisms of financial agglomeration on environmental pollution. J. Environ. Manag. 2022, 303, 114136. [Google Scholar] [CrossRef]

- Fu, H.; Huang, P.; Xu, Y.; Zhang, Z. Digital trade and environmental sustainability: The role of financial development and ecological innovation for a greener revolution in China. Econ. Res.-Ekon. Istraživanja 2022, 11, 1–19. [Google Scholar] [CrossRef]

- Jiang, H.; Murmann, J.P. The rise of China’s digital economy: An overview. Manag. Organ. Rev. 2022, 18, 790–802. [Google Scholar] [CrossRef]

- Shahbaz, M.; Wang, J.; Dong, K.; Zhao, J. The impact of digital economy on energy transition across the globe: The mediating role of government governance. Renew. Sustain. Energy Rev. 2022, 166, 112620. [Google Scholar] [CrossRef]

- Khan, H.; Khan, I.; Binh, T.T. The heterogeneity of renewable energy consumption, carbon emission and financial development in the globe: A panel quantile regression approach. Energy Rep. 2020, 6, 859–867. [Google Scholar] [CrossRef]

- Sharif, A.; Saqib, N.; Dong, K.; Khan, S.A.R. Nexus between green technology innovation, green financing, and CO2 emissions in the G7 countries: The moderating role of social globalisation. Sustain. Dev. 2022, 30, 1934–1946. [Google Scholar] [CrossRef]

- Wang, Q.; Zhang, F. The Effects of Trade Openness on Decoupling Carbon Emissions from Economic Growth-Evidence from 182 Countries. J. Clean. Prod. 2021, 279, 1–10. [Google Scholar] [CrossRef]

- Liu, F.; Huang, P.; Tang, D. The Carbon Emission Reduction Effect of Green Finance Development and Its Impact Pathways. Res. Financ. Econ. 2022, 37, 144–158. [Google Scholar]

- Boutabba, M.A. The impact of financial development, income, energy and trade on carbon emissions: Evidence from the Indian economy. Econ. Model. 2014, 40, 33–41. [Google Scholar] [CrossRef]

- Busch, T.; Hoffmann, V.H. How hot is your bottom line? Linking carbon and financial performance. Bus. Soc. 2011, 50, 233–265. [Google Scholar] [CrossRef]

- Gallego-Álvarez, I.; Segura, L.; Martínez-Ferrero, J. Carbon emission reduction: The impact on the financial and operational performance of international companies. J. Clean. Prod. 2015, 103, 149–159. [Google Scholar] [CrossRef]

- Li, X.; Bai, R.; McKechnie, J. Environmental and financial performance of mechanical recycling of carbon fibre reinforced polymers and comparison with conventional disposal routes. J. Clean. Prod. 2016, 127, 451–460. [Google Scholar] [CrossRef]

- Dogan, E.; Seker, F. The Influence of Real Output, Renewable and Non-renewable Energy, Trade and Financial Development on Carbon Emissions in the Top Renewable Energy Countries. Renew. Sustain. Energy Rev. 2016, 60, 1074–1085. [Google Scholar] [CrossRef]

- Zheng, J.; Zhao, Q.Y.; Zhu, H.; Fu, C.H. Financial structure and environmental pollution: A theoretical study of new structural environmental finance. Explor. Econ. Probl. 2021, 10, 165–172. [Google Scholar]

- Chen, X. Y. Financial structure, technological innovation and carbon emission: Also on the development of green finance system. Guangdong Soc. Sci. 2020, 4, 41–50. [Google Scholar]

- Allen, F.; Gale, D. Comparing Financial Systems; MIT Press: Cambridge, MA, USA, 2000. [Google Scholar]

- Frankel, J.A.; Romer, D.H. Does trade cause growth? Am. Econ. Rev. 1999, 89, 379–399. [Google Scholar] [CrossRef]

- Dasgupta, S.; Laplante, B.; Mamingi, N. Pollution and capital markets in developing countries. J. Environ. Econ. Manag. 2001, 42, 310–335. [Google Scholar] [CrossRef]

- Chang, S.C. Effects of financial developments and income on energy consumption. Int. Rev. Econ. Financ. 2015, 35, 28–44. [Google Scholar] [CrossRef]

- Baker, H.K.; Kumar, S.; Goyal, K.; Sharma, A. International review of financial analysis: A retrospective evaluation between 1992 and 2020. Int. Rev. Financ. Anal. 2021, 78, 101946. [Google Scholar] [CrossRef]

- Tamazian, A.; Chousa, J.P.; Vadlamannati, K.C. Does higher economic and financial development lead to environmental degradation: Evidence from BRIC countries. Energy Policy 2009, 37, 246–253. [Google Scholar] [CrossRef]

- Chen, J.; Zhang, J. Effect Mechanism Research of Carbon Price Drivers in China—A Case Study of Shenzhen. Int. J. Environ. Res. Public Health 2022, 19, 10876. [Google Scholar] [CrossRef]

- Zhang, Y.J. The impact of financial development on carbon emissions: An empirical analysis in China. Energy Policy 2011, 39, 2197–2203. [Google Scholar] [CrossRef]

- Calmès, C.; Théoret, R. Market-oriented banking, financial stability and macro-prudential indicators of leverage. J. Int. Financ. Mark. Inst. Money 2013, 27, 13–34. [Google Scholar] [CrossRef]

- Tamazian, A.; Rao, B.B. Do economic, financial and institutional developments matter for environmental degradation? Evidence from transitional economies. Energy Econ. 2010, 32, 137–145. [Google Scholar] [CrossRef]

- Wang, R.; Wang, F. Exploring the Role of Green Finance and Energy Development towards High-Quality Economic Development: Application of Spatial Durbin Model and Intermediary Effect Model. Int. J. Environ. Res. Public Health 2022, 19, 8875. [Google Scholar] [CrossRef]

- Rokhmawati, A.; Gunardi, A.; Rossi, M. How powerful is your customers’ reaction to carbon performance? Linking carbon and firm financial performance. Int. J. Energy Econ. Policy 2017, 7, 85. [Google Scholar]

- Cetin, M.; Ecevit, E.; Yucel, A.G. The impact of economic growth, energy consumption, trade openness, and financial development on carbon emissions: Empirical evidence from Turkey. Environ. Sci. Pollut. Res. 2018, 25, 36589–36603. [Google Scholar] [CrossRef] [PubMed]

- Li, Z.; Li, N.; Wen, H. Digital economy and environmental quality: Evidence from 217 cities in China. Sustainability 2021, 13, 8058. [Google Scholar] [CrossRef]

- Chen, Z.; Wei, Y.; Shi, K.; Zhao, Z.; Wang, C.; Wu, B.; Qiu, B.; Yu, B. The potential of nighttime light remote sensing data to evaluate the development of digital economy: A case study of China at the city level. Comput. Environ. Urban Syst. 2022, 92, 101749. [Google Scholar] [CrossRef]

- Miao, Z. Digital economy value chain: Concept, model structure, and mechanism. Appl. Econ. 2021, 53, 4342–4357. [Google Scholar] [CrossRef]

- Haini, H. Examining the impact of ICT, human capital and carbon emissions: Evidence from the ASEAN economies. Int. Econ. 2021, 166, 116–125. [Google Scholar] [CrossRef]

- Hao, L.N.; Umar, M.; Khan, Z.; Ali, W. Green growth and low carbon emission in G7 countries: How critical the network of environmental taxes, renewable energy and human capital is? Sci. Total Environ. 2021, 752, 141853. [Google Scholar] [CrossRef] [PubMed]

- Shen, H.; Ali, S.A.; Alharthi, M.; Shah, A.S.; Basit Khan, A.; Abbas, Q.; ur Rahman, S. Carbon-free energy and sustainable environment: The role of human capital and technological revolutions in attaining sdgs. Sustainability 2021, 13, 2636. [Google Scholar] [CrossRef]

- Wang, J.; Xu, Y. Internet usage, human capital and CO2 emissions: A global perspective. Sustainability 2021, 13, 8268. [Google Scholar] [CrossRef]

- Li, B.; Liu, J.; Liu, Q.; Mohiuddin, M. The Effects of Broadband Infrastructure on Carbon Emission Efficiency of Resource-Based Cities in China: A Quasi-Natural Experiment from the “Broadband China” Pilot Policy. Int. J. Environ. Res. Public Health 2022, 19, 6734. [Google Scholar] [CrossRef]

- Wang, G.; Li, S.; Yang, L. Research on the Pathway of Green Financial System to Implement the Realization of China’s Carbon Neutrality Target. Int. J. Environ. Res. Public Health 2022, 19, 2451. [Google Scholar] [CrossRef]

- Lyu, Y.; Ji, Z.; Liang, H.; Wang, T.; Zheng, Y. Has Information Infrastructure Reduced Carbon Emissions?—Evidence from Panel Data Analysis of Chinese Cities. Buildings 2022, 12, 619. [Google Scholar] [CrossRef]

- Hayes, A.F. Beyond Baron and Kenny: Statistical mediation analysis in the new millennium. Commun. Monogr. 2009, 76, 408–420. [Google Scholar] [CrossRef]

- Eggleston, H.S.; Buendia, L.; Miwa, K.; Ngara, T.; Tanabe, K. 2006 IPCC Guidelines for National Greenhouse Gas Inventories. 2006. Available online: https://www.osti.gov/etdeweb/biblio/20880391 (accessed on 1 June 2022).

- Levine, R. Bank-based or market-based financial systems: Which is better? J. Financ. Intermediation 2002, 11, 398–428. [Google Scholar] [CrossRef]

- Mhlanga, D. The Role of Artificial Intelligence and Machine Learning Amid the COVID-19 Pandemic: What Lessons Are We Learning on 4IR and the Sustainable Development Goals. Int. J. Environ. Res. Public Health 2022, 19, 1879. [Google Scholar] [CrossRef] [PubMed]

- Hsu, P.H.; Tian, X.; Xu, Y. Financial development and innovation: Cross-country evidence. J. Financ. Econ. 2014, 112, 116–135. [Google Scholar] [CrossRef]

- Sun, C.Z.; Yan, X.D.; Zhao, L.S. Coupling efficiency measurement and spatial correlation characteristic of water-energy-food nexus in China. Resour. Conserv. Recycl. 2021, 164, 105151. [Google Scholar] [CrossRef]

- Ke, H.Q.; Dai, S.Z.; Yu, H.C. Spatial effect of innovation efficiency on ecological footprint: City-level empirical evidence from China. Environ. Technol. Innov. 2021, 22, 101536. [Google Scholar] [CrossRef]

- Wang, Y.; Chen, H.; Long, R.; Jiang, S.; Liu, B. Evaluation of Occupational Health and Safety Management of Listed Companies in China’s Energy Industry Based on the Combined Weight-Cloud Model: From the Perspective of FPE Information Disclosure. Int. J. Environ. Res. Public Health 2022, 19, 8313. [Google Scholar] [CrossRef]

- Ke, H.Q.; Yang, W.Y.; Liu, X.Y. Does Innovation Efficiency Suppress the Ecological Footprint? Empirical Evidence from 280 Chinese Cities. Int. J. Environ. Res. Public Health 2020, 17, 6826. [Google Scholar] [CrossRef]

- Bekaert, G.; Harvey, C.R.; Lundblad, C. Does financial liberalization spur growth? J. Financ. Econ. 2005, 77, 3–55. [Google Scholar] [CrossRef]

- Gamra, S.B. Does financial liberalization matter for emerging East Asian economies growth? Some new evidence. Int. Rev. Econ. Financ. 2009, 18, 392–403. [Google Scholar] [CrossRef]

- Ke, H.; Dai, S.; Yu, H. Effect of green innovation efficiency on ecological footprint in 283 Chinese Cities from 2008 to 2018. Environ. Dev. Sustain. 2022, 24, 2841–2860. [Google Scholar] [CrossRef]

- Ma, N.; Liu, P.; Xiao, Y.; Tang, H.; Zhang, J. Can Green Technological Innovation Reduce Hazardous Air Pollutants?—An Empirical Test Based on 283 Cities in China. Int. J. Environ. Res. Public Health 2022, 19, 1611. [Google Scholar] [CrossRef] [PubMed]

- Qin, L.; Raheem, S.; Murshed, M.; Miao, X.; Khan, Z.; Kirikkaleli, D. Does financial inclusion limit carbon dioxide emissions? Analyzing the role of globalization and renewable electricity output. Sustain. Dev. 2021, 29, 1138–1154. [Google Scholar] [CrossRef]

- Chen, X.; Chen, Z. Can Green Finance Development Reduce Carbon Emissions? Empirical Evidence from 30 Chinese Provinces. Sustainability 2021, 13, 12137. [Google Scholar] [CrossRef]

- Ye, Y.; Wu, C.; Zhou, X. Threshold Effect of Manufacturing Agglomeration on Environmental Pollution in Yangtze River Economic Belt. Resour. Environ. Yangtze Basin 2022, 31, 1282–1292. [Google Scholar]

| First-Level Indicator | Secondary Indicators | Three-Level Indicator | Calculation Method |

|---|---|---|---|

| Digital economy development level | Digital economy infrastructure | Internet penetration | Netizens per 100 people |

| Mobile phone penetration | Number of mobile phones per 100 people | ||

| Internet port access | Internet ports per hundred people | ||

| Internet cable access density | Long-distance cable length/regional area | ||

| Digital ecology | Investment level | Fixed investment/fixed asset investment in information transmission, software and information technology services | |

| Software business level | Software business revenue | ||

| Telecom business level | Telecom business revenue | ||

| Digital talent | Proportion of employment of information service practitioners | Information transmission, computer services and software workers per 1000 employed persons | |

| Digital Higher Education Talent | Number of college students majoring in “computer”, “Internet” or “software” | ||

| Level of digital innovation | Number of invention patents granted related to “computer”, “Internet” or “software” |

| Variable Type | Index | Sign | Source |

|---|---|---|---|

| Explanatory variable | Carbon intensity | Cabi | Calculated by Equations (4) and (5) |

| Core explanatory variable | Degree of marketization of the financial system | Finm | Financial marketization vitality, financial marketization scale and financial marketization efficiency |

| Control variable | Total GDP | Gdp | China Statistical Yearbook (2006–2020) China Environmental Statistics Yearbook (2006–2020) China Industrial Statistics Yearbook (2006–2020) |

| GDP per capita | Gpp | ||

| The secondary industry in GDP | Ssr | ||

| The tertiary industry in GDP | Tsr | ||

| Foreign capital in GDP | Fdi | ||

| Patent applications | Pat | ||

| Innovation efficiency | Ine | ||

| Mediating variable | Digital economy infrastructure | Digt1 | |

| Digital ecology | Digt2 | ||

| Digital talent | Digt3 |

| (1) OLS | (2) FE | (3) D-K | (4) GMM | (5) Drop Extreme | (6) 2SLS | |

|---|---|---|---|---|---|---|

| Finm | −1.378 *** (−5.21) | −1.345 *** (−4.44) | −1.345 *** (−4.44) | −2.742 *** (−5.43) | −1.355 *** (−2.91) | −1.463 *** (−3.46) |

| Gdp | 0.243 *** (4.25) | 0.243 *** (4.25) | 0.351 (1.38) | 0.457 *** (3.53) | 0.336 (1.42) | |

| Gpp | 0.452 *** (4.34) | 0.452 *** (4.34) | 0.049 *** (3.04) | 0.234 *** (3.45) | 0.202 *** (3.96) | |

| Ssr | 2.532 *** (5.10) | 2.532 *** (5.10) | 0.344 (0.84) | 2.630 *** (4.75) | 2.575 (0.34) | |

| Tsr | 2.597 *** (7.71) | 2.597 *** (7.71) | 0.392 *** (5.37) | 1.842 *** (6.43) | 5.024 *** (7.58) | |

| Fdi | −0.713 (−1.23) | −0.713 (−1.23) | −0.163 ** (−2.11) | −0.574 (−0.02) | −0.098 ** (−2.74) | |

| Pat | −0.420 (0.65) | −0.420 (0.65) | −0.484 (−0.34) | −0.034 (−0.44) | −0.042 (−0.46) | |

| Ine | −0.257 *** (−3.75) | −0.257 *** (−3.75) | −0.344 *** (−4.32) | −0.456 *** (−5.67) | −0.042 *** (−3.98) | |

| Time-FE & Individual-FE | Control | Control | Control | Control | Control | Control |

| Cons | 6.265 *** (5.04) | 4.138 *** (4.06) | 4.138 *** (4.06) | 4.432 *** (5.92) | 5.833 *** (4.43) | 6.410 *** (4.92) |

| R2 | 0.3045 | 0.7171 | 0.7171 | 0.7046 | 0.5675 | 0.6829 |

| Obs | 420 | 420 | 420 | 330 | 378 | 420 |

| AR(1) | 0.0671 | |||||

| AR(2) | 0.7619 |

| (1) Eastern Region | (2) Central Region | (3) Western Region | (4) Northeast Region | |

|---|---|---|---|---|

| Finm | −1.343 *** (−3.40) | −1.327 ** (−2.23) | −1.269 *** (−5.26) | −2.231 *** (−3.21) |

| Gdp | 0.044 *** (3.46) | 0.761 *** (3.35) | 0.216 ** (2.30) | 0.121 (0.43) |

| Gpp | 0.453 (1.43) | 0.518 ** (2.25) | 0.624 (1.25) | 0.064 (1.33) |

| Ssr | 0.467 *** (3.27) | 2.954 *** (3.27) | 1.378 *** (4.26) | 3.043 *** (4.54) |

| Tsr | 4.572 *** (4.53) | 0.376 *** (5.37) | 1.462 *** (8.61) | 3.276 *** (5.21) |

| Fdi | −0.182 * (−1.88) | −0.236 (−0.21) | −0.207 (−0.52) | −0.267 * (−1.76) |

| Pat | −0.126 (−0.54) | −0.105 (−0.01) | −0.251 (−0.21) | −0.126 −0.270 |

| Ine | −0.171 *** (−4.25) | −0.271 (−1.26) | −0.112 *** (−3.02) | −0.030 (−1.29) |

| Time-FE & Individual-FE | Control | Control | Control | Control |

| Cons | 4.021 *** (4.16) | 5.261 *** (6.17) | 6.013 *** (6.23) | 5.821 *** (3.44) |

| R2 | 0.6256 | 0.5518 | 0.5056 | 0.4321 |

| Obs | 140 | 84 | 154 | 42 |

| (1) Digt OLS | (2) Cabi OLS | (3) Digt D-K | (4) Cabi D-K | (5) Digt 2SLS | (6) Cabi 2SLS | |

|---|---|---|---|---|---|---|

| Digt | −0.382 *** (−3.21) | −0.537 *** (−4.01) | −0.352 *** (−2.77) | |||

| Finm | 3.183 *** (4.48) | −1.374 ** (−2.26) | 2.482 *** (3.21) | −1.354 *** (−3.19) | 3.213 *** (4.41) | −1.272 ** (−2.44) |

| Gdp | 0.521 *** (3.21) | 0.364 *** (4.35) | 0.323 *** (4.45) | 0.227 *** (4.23) | ||

| Gpp | 0.262 *** (3.27) | 0.462 *** (4.45) | 0.164 *** (4.41) | 0.542 *** (4.63) | ||

| Ssr | −2.281 *** (−4.91) | 2.543 *** (5.46) | −2.461 *** (−3.10) | 2.426 *** (4.72) | ||

| Tsr | 2.727 *** (3.20) | 2.466 *** (6.53) | 2.294 *** (4.29) | 2.354 *** (4.21) | ||

| Fdi | 0.791 ** (2.01) | −0.442 (−1.43) | 0.728 * (1.76) | −0.274 (−1.32) | ||

| Pat | 0.883 (0.27) | −0.553 (−0.62) | 0.453 (0.32) | −0.380 (0.39) | ||

| Ine | 0.273 *** (2.79) | −0.342 *** (−3.23) | 0.892 *** (2.69) | −0.672 *** (−3.37) | ||

| Time-FE & Individual-FE | Control | Control | Control | Control | Control | Control |

| Cons | 1.265 *** (5.04) | 4.345 *** (3.31) | 1.342 *** (3.28) | 4.281 *** (3.07) | 1.642 *** (4.03) | 4.363 *** (4.18) |

| R2 | 0.2811 | 0.3824 | 0.5846 | 0.7931 | 0.6073 | 0.7221 |

| Obs | 420 | 420 | 420 | 420 | 420 | 420 |

| Sobel | Sobel Z = 2.609 *** | Sobel Z = 2.505 ** | Sobel Z = 2.345 ** | |||

| Intermediary effect | Partial mediation effect | Partial mediation effect | Partial mediation effect | |||

| (1) Digt OLS | (2) Cabi OLS | (3) Digt D-K | (4) Cabi D-K | (5) Digt 2SLS | (6) Cabi 2SLS | |

|---|---|---|---|---|---|---|

| Digt1 | −0.472 *** (−2.71) | −1.465 *** (−2.94) | −0.833 * (−1.90) | |||

| Finm | 1.342 *** (3.71) | −1.171 ** (−2.10) | 1.673 *** (3.38) | −1.327 ** (−2.04) | 3.542 *** (3.35) | −2.341 *** (−2.78) |

| Gdp | 0.137 *** (4.25) | 0.582 *** (4.25) | 0.237 *** (4.21) | 0.412 *** (4.24) | ||

| Gpp | 0.022 *** (3.21) | 0.782 *** (4.45) | 0.089 *** (3.18) | 0.285 *** (3.58) | ||

| Ssr | 1.361 ** (2.15) | 1.591 *** (4.22) | 1.532 *** (2.70) | 2.358 ** (2.55) | ||

| Tsr | 2.121 *** (3.17) | 2.174 ** (2.48) | 2.547 *** (3.18) | 2.352 ** (2.58) | ||

| Fdi | −0.223 (−1.12) | −0.271 (−1.22) | −0.581 (−1.21) | −0.458 (−1.21) | ||

| Pat | 0.240 (0.25) | −0.479 (0.37) | −0.548 (0.27) | −0.582 (0.92) | ||

| Ine | 0.257 *** (2.95) | −0.582 *** (−3.22) | −0.372 *** (−3.24) | −0.372 *** (−2.84) | ||

| Time-FE & Individual-FE | Control | Control | Control | Control | Control | Control |

| Obs | 1.463 *** (7.17) | 4.279 *** (3.38) | 1.342 *** (4.57) | 4.325 *** (4.04) | 1.128 ** (2.38) | 4.253 *** (3.76) |

| R2 | 0.3507 | 0.3463 | 0.6682 | 0.7464 | 0.5729 | 0.7811 |

| Obs | 420 | 420 | 420 | 420 | 420 | 420 |

| Sobel | Sobel Z = 2.188 ** | Sobel Z = 2.218 ** | Sobel Z = 1.652 * | |||

| Intermediary effect | Partial mediation effect | Partial mediation effect | Partial mediation effect | |||

| (1) Digt2 OLS | (2) Cabi OLS | (3) Digt2 D-K | (4) Cabi D-K | (5) Digt2 2SLS | (6) Cabi 2SLS | |

|---|---|---|---|---|---|---|

| Digt2 | −0.842 (−1.01) | −0.821 (−1.13) | −0.745 (−0.77) | |||

| Finm | 0.346 ** (2.38) | −1.271 *** (−2.81) | 0.475 *** (3.19) | −1.333 ** (−2.12) | 0.573 *** (3.14) | −1.425 *** (−3.04) |

| Gdp | 0.526 *** (3.64) | 0.214 *** (4.25) | 0.443 *** (3.65) | 0.245 *** (4.65) | ||

| Gpp | 0.357 *** (5.54) | 0.452 *** (4.34) | 0.333 *** (5.34) | 0.459 *** (4.53) | ||

| Ssr | 1.152 *** (3.39) | 2.562 *** (5.10) | 1.532 ** (2.46) | 2.337 *** (3.90) | ||

| Tsr | 3.134 *** (3.34) | 2.481 *** (6.27) | 1.387 *** (3.18) | 2.436 *** (5.29) | ||

| Fdi | −0.275 (−1.11) | −0.713 (−1.23) | −0.713 (−1.23) | −0.344 (−1.43) | ||

| Pat | −0.323 (0.35) | −0.340 (0.62) | −0.561 (0.16) | −0.452 (0.77) | ||

| Ine | −0.227 (−0.24) | −0.553 *** (−3.33) | 0.224 (0.75) | −0.245 *** (−3.76) | ||

| Time-FE & Individual-FE | Control | Control | Control | Control | Control | Control |

| Cons | 1.372 *** (4.18) | 5.345 *** (3.34) | 1.455 *** (3.52) | 3.186 *** (3.73) | 1.248 *** (3.55) | 4.138 *** (4.06) |

| R2 | 0.4301 | 0.3744 | 0.6566 | 0.7527 | 0.6624 | 0.7245 |

| Obs | 420 | 420 | 420 | 420 | 420 | 420 |

| Sobel | Sobel Z = 0.929 | Sobel Z = 1.065 | Sobel Z = 0.747 | |||

| Intermediary effect | Not significant | Not significant | Not significant | |||

| (1) Digt3 OLS | (2) Cabi OLS | (3) Digt D-K | (4) Cabi D-K | (5) Digt3 2SLS | (6) Cabi 2SLS | |

|---|---|---|---|---|---|---|

| Digt3 | −0.346 ** (−2.51) | −0.521 ** (−2.35) | −0.432 ** (−2.74) | |||

| Finm | 0.368 *** (2.99) | −1.01 ** (−2.11) | 0.246 *** (3.78) | −1.23 ** (−2.10) | 0.463 *** (2.81) | −1.63 ** (−1.97) |

| Gdp | 0.173 ** (2.44) | 0.256 *** (3.59) | 0.171 ** (2.44) | 0.301 *** (4.32) | ||

| Gpp | 0.284 ** (2.23) | 0.543 *** (4.34) | 0.258 ** (2.43) | 0.464 *** (4.21) | ||

| Ssr | 1.124 *** (4.01) | 2.464 *** (5.34) | 1.152 *** (4.53) | 2.353 *** (5.27) | ||

| Tsr | 0.716 *** (3.28) | 2.643 *** (8.31) | 0.457 *** (3.53) | 2.114 *** (7.59) | ||

| Fdi | 0.321 *** (3.83) | −0.463 (−1.42) | 0.343 *** (3.85) | −0.433 (−1.30) | ||

| Pat | 0.612 (0.31) | −0.603 (0.53) | 0.416 (0.97) | −0.525 (0.64) | ||

| Ine | 0.411 (0.46) | −0.562 *** (−3.34) | 0.472 (0.53) | −0.898 *** (−2.79) | ||

| Time-FE & Individual-FE | Control | Control | Control | Control | Control | Control |

| Cons | 1.836 *** (3.92) | 4.295 *** (3.24) | 1.252 *** (3.63) | 4.134 *** (3.79) | 1.562 *** (3.53) | 4.380 *** (4.06) |

| R2 | 0.3306 | 0.3751 | 0.7101 | 0.7754 | 0.7458 | 0.7303 |

| Obs | 420 | 420 | 420 | 420 | 420 | 420 |

| Sobel | Sobel Z = 1.922 * | Sobel Z = 1.995 ** | Sobel Z = 1.961 ** | |||

| Intermediary effect | Partial mediation effect | Partial mediation effect | Partial mediation effect | |||

Disclaimer/Publisher’s Note: The statements, opinions and data contained in all publications are solely those of the individual author(s) and contributor(s) and not of MDPI and/or the editor(s). MDPI and/or the editor(s) disclaim responsibility for any injury to people or property resulting from any ideas, methods, instructions or products referred to in the content. |

© 2023 by the author. Licensee MDPI, Basel, Switzerland. This article is an open access article distributed under the terms and conditions of the Creative Commons Attribution (CC BY) license (https://creativecommons.org/licenses/by/4.0/).

Share and Cite

Yu, Y. The Impact of Financial System on Carbon Intensity: From the Perspective of Digitalization. Sustainability 2023, 15, 1314. https://doi.org/10.3390/su15021314

Yu Y. The Impact of Financial System on Carbon Intensity: From the Perspective of Digitalization. Sustainability. 2023; 15(2):1314. https://doi.org/10.3390/su15021314

Chicago/Turabian StyleYu, Yeguan. 2023. "The Impact of Financial System on Carbon Intensity: From the Perspective of Digitalization" Sustainability 15, no. 2: 1314. https://doi.org/10.3390/su15021314

APA StyleYu, Y. (2023). The Impact of Financial System on Carbon Intensity: From the Perspective of Digitalization. Sustainability, 15(2), 1314. https://doi.org/10.3390/su15021314