The Economic Impact of Green Credit: From the Perspective of Industrial Structure and Green Total Factor Productivity

Abstract

1. Introduction

2. Literature Review

3. Theoretical Analysis and Hypothesis Proposed

3.1. Green Credit and Industrial Structure Adjustment

3.2. Green Credit and Green Total Factor Productivity

3.3. Green Credit and Economic Growth

4. Model Specification

4.1. Data

4.2. Variable Selection

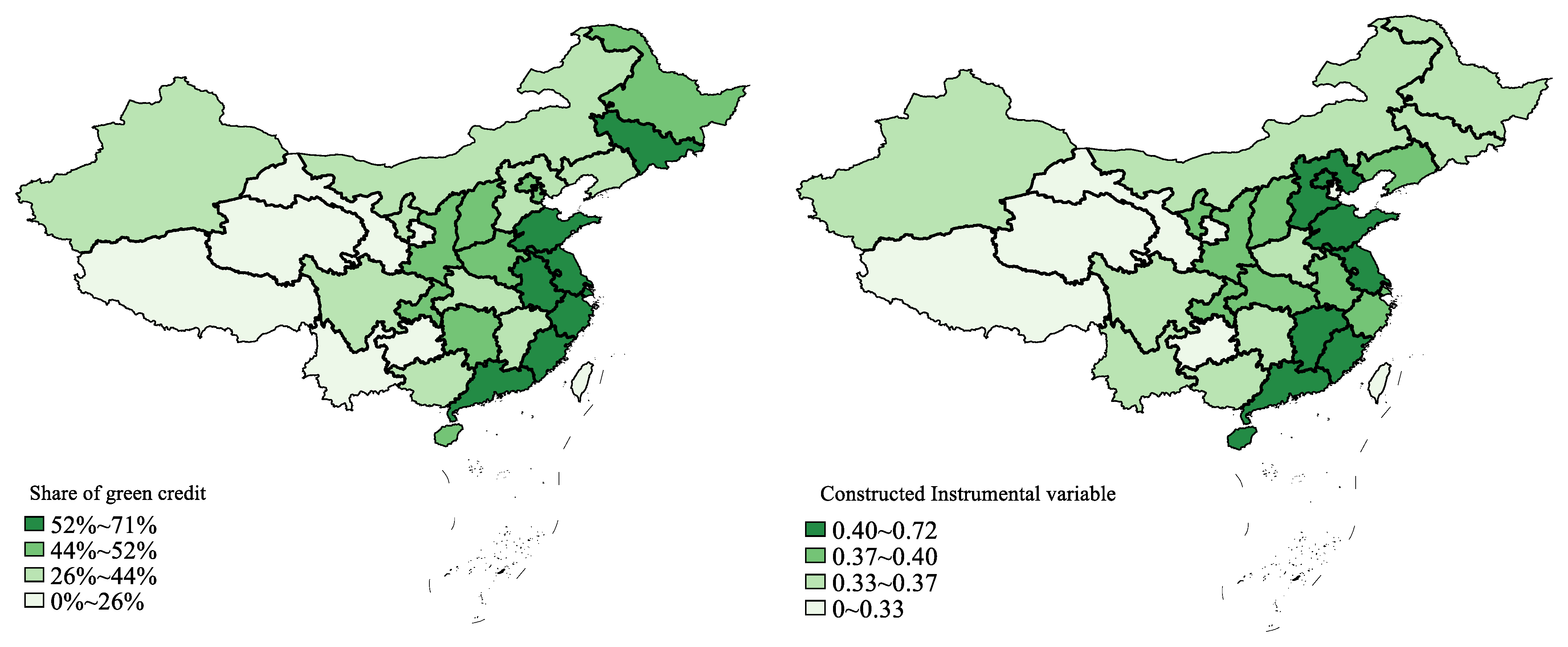

4.2.1. Green Credit

4.2.2. Economic Growth

4.2.3. Control Variables

- (1)

- Inputs: Control the impact of foreign direct investment-FDI, R&D investment and government fiscal spending on the economy-Fp [41].

- (2)

- Edu: Human capital is measured using the average length of education received by people in each province [42]. Average length of education = the proportion of population with no education × 0 + the proportion of population with elementary school education × 6 + the proportion of population with junior high school education × 9 + the proportion of population with senior high school education × 12 + the proportion of population with college education or above × 16.

- (3)

- Urban: Urbanization rate by province, controlling the impact of urbanization process on economic growth.

- (4)

- Findex: The degree of financial development, controlling the impact of the level of financial development in each province [43]. Calculation: the balance of deposits and loans of financial institutions in each province divided by GDP.

- (5)

- EC: Environmental regulation intensity. We define green credit as a “cost-based environmental regulation”, but environmental regulations are far from the only. A composite index is introduced here to control the impact of government environmental policies [44]. The index is calculated based on the discharge of industrial wastewater, SO2 and smoke. And the calculation is detailed in Appendix A.

4.3. Descriptive Statistics and Analysis of Factors for Green Credit Issuance

4.3.1. Descriptive Statistics

4.3.2. Analysis of Green Credit Impact Factors

4.4. Model Specification

5. Empirical Results

5.1. Baseline Regression Analysis

5.2. Robustness Tests

5.2.1. Variable Substitution-GDP per Capita

5.2.2. Quantile Regression

5.3. Endogeneity

6. Additional Analysis

6.1. Mechanisms

6.1.1. Industrial Rationalization

6.1.2. Green Total Factor Productivity

6.2. East-Middle-West Heterogeneity Analysis

7. Discussion

8. Conclusions and Policy Recommendations

8.1. Conclusions

8.2. Policy Recommendations

Author Contributions

Funding

Institutional Review Board Statement

Informed Consent Statement

Data Availability Statement

Conflicts of Interest

Appendix A

Appendix A.1. The Calculation of Ec

Appendix A.2. The Calculation of GTFP

Appendix A.3. Variable Definitions

| Type | Variable | Description | Measurement |

|---|---|---|---|

| Explained Variables | lnGDPi,t | GDP of each province | Natural logarithm of (GDP of each province), Q25-lnGDP, Q50-lnGDP, Q75-lnGDP, Q90-lnGDP are the 25%, 50%, 75% and 90% quantile points of lnGDP |

| lnPergdpi,t | GDP per capita | Natural logarithm of (GDP of each province/the total population of each province) | |

| Explanatory Variables | Gci,t | The volume of green credit issuance | [1 − (Interest disbursements for six high-energy industries/Industrial interest expenditure)] × 100% |

| Control Variables | FDIi,t | Foreign direct investment | Natural logarithm of (FDI of each province) |

| R&Di,t | Research and development expenditure of each province | Natural logarithm of (Research and development expense of each province) | |

| FPi,t | Fiscal spending of each province | Natural logarithm of (Fiscal spending of each province) | |

| Edui,t | Year of education | The proportion of population with no education × 0 + the proportion of population with elementary school education × 6 + the proportion of population with junior high school education × 9 + the proportion of population with senior high school education × 12 + the proportion of population with college education or above × 16 | |

| Urbani,t | Urbanization rate of each province | Urban registered population as a percentage of the permanent population | |

| Findexi,t | The degree of financial development | The balance of deposits and loans of financial institutions in each province divided by GDP | |

| Eci,t | Environmental regulation intensity | The index is calculated based on emissions of industrial wastewater, SO2 and smoke (Appendix A.1) | |

| Instrumental Variable | IVi,t | Constructed by local financial institutions and enterprises | Natural logarithm of (the number of local financial institutions of each province)/the number of local industrial enterprises of each province |

| Mechanism Variables | IRi,t | Industrial Rationalization | Thiel index calculated by labor and income, Equations (8) and (9) |

| Gtfpi,t | Green total factor productivity | Calculated by desired output (GDP of each province), undesired output (three industrial wastes) and input (capital, labor and energy) (Appendix A.2) |

References

- Qinglong, H. Wuya, Decomposition Analysis of PM2.5 Emission Differences between Regions of China Based on Socio-economic Factors. J. Quant. Tech. Econ. 2020, 37, 169–185. [Google Scholar] [CrossRef]

- Chen, Y.; Ebenstein, A.; Greenstone, M.; Li, H. Evidence on the impact of sustained exposure to air pollution on life expectancy from China’s Huai River policy. Proc. Natl. Acad. Sci. USA 2013, 110, 12936–12941. [Google Scholar] [CrossRef] [PubMed]

- Ebenstein, A.; Fan, M.; Greenstone, M.; He, G.; Yin, P.; Zhou, M. Growth, Pollution, and Life Expectancy: China from 1991–2012. Am. Econ. Rev. 2015, 105, 226–231. [Google Scholar] [CrossRef]

- Sumanth, G.; Gerardo, A.U.; Paul, T.; Jyoti, J.; Direk, L.; Rogier, V.H. Antimicrobial Resistance Surveillance in Low- and Middle-Income Countries: Progress and Challenges in Eight South Asian and Southeast Asian Countries. Clin. Microbiol. Rev. 2020, 33, e00048-19. [Google Scholar] [CrossRef]

- Xia, L.; Peng, H. Research on the Impact of Green Finance on Economic Development in Central China. J. Ind. Technol. Econ. 2019, 38, 76–84. [Google Scholar]

- Cole, M.A.; Elliott, R. FDI and the Capital Intensity of ’Dirty’ Sectors: A Missing Piece of the Pollution Haven Puzzle. Rev. Dev. Econ. 2005, 9, 530–548. [Google Scholar] [CrossRef]

- Simandan, D. Options for Moving beyond the Canonical Model of Regional Path Dependence. Int. J. Urban Reg. Res. 2012, 36, 172–178. [Google Scholar] [CrossRef]

- Martin, R. Roepke Lecture in Economic Geography—Rethinking Regional Path Dependence: Beyond Lock-in to Evolution. Econ. Geogr. 2010, 86, 1–27. [Google Scholar] [CrossRef]

- Sheng, X.; Xinxin, Z.; Shuang, Y. Analysis on the Effect of Green Credit on the Upgrading of Industrial Structure. J. Shanghai Univ. Financ. Econ. 2018, 20, 59–72. [Google Scholar] [CrossRef]

- Yu, P.; Weifeng, X.; Guoqiao, Y. Green Credit Investment, Green Industry Development and Regional Economic Growth: A Case Study of Huzhou City, Zhejiang Province. Zhejiang Soc. Sci. 2018, 3, 45–53+157. [Google Scholar] [CrossRef]

- Sha, L.; Ming, L. Green Finance, Economic Growth and Environmental Change: Is it possible for the Environmental Index in the Northwest to Fulfill the ″Paris Agreement″? Mod. Econ. Sci. 2020, 42, 71–84. [Google Scholar]

- Patrick, H.T. Dollar, Dollar, Who Has the Dollar?--Relationship between the Japanese and American Balance of Payments. Asian Surv. 1966, 6, 434–447. [Google Scholar] [CrossRef]

- Faulkender, M.; Petersen, M.A. Does the Source of Capital Affect Capital Structure? Rev. Financ. Stud. 2005, 19, 45–79. [Google Scholar] [CrossRef]

- Porter, M.E.; van der Linde, C. Toward a New Conception of the Environment-Competitiveness Relationship. J. Econ. Perspect. 1995, 9, 97–118. [Google Scholar] [CrossRef]

- Lise, T.; Gary, K. Do environmental regulations affect the location decisions of multinational gold mining firms? J. Econ. Geogr. 2011, 11, 151–177. [Google Scholar] [CrossRef]

- Zhou, Y.; Zhu, S.; He, C. How do environmental regulations affect industrial dynamics? Evidence from China′s pollution-intensive industries. Habitat Int. 2017, 60, 10–18. [Google Scholar] [CrossRef]

- Lha, B.; Lz, A.; Zz, C.; Dw, A.; Feng, W.A. Green credit, renewable energy investment and green economy development: Empirical analysis based on 150 listed companies of China. J. Clean. Prod. 2019, 208, 363–372. [Google Scholar] [CrossRef]

- Liu, X.; Wang, E.; Cai, D. Green credit policy, property rights and debt financing: Quasi-natural experimental evidence from China. Financ. Res. Lett. 2019, 29, 129–135. [Google Scholar] [CrossRef]

- Yang, X.; Hancheng, D.; Tatsuya, H.; Toshihiko, M. Health and Economic Impacts of PM2.5 pollution in Beijing-Tianjin-Hebei Area. China Popul. Resour. Environ. 2016, 26, 19–27. [Google Scholar]

- Chen, Z.; Kahn, M.E.; Liu, Y.; Wang, Z. The consequences of spatially differentiated water pollution regulation in China. J. Environ. Econ. Manag. 2018, 88, 468–485. [Google Scholar] [CrossRef]

- Bert, S. Finance as a Driver of Corporate Social Responsibility. J. Bus. Ethics 2006, 68, 19–33. [Google Scholar]

- Yao, W.; Dongyang, P.; Xiao, Z. Research on Green Finance’s Contribution to China’s Economic Development. Comp. Econ. Soc. Syst. 2016, 6, 33–42. [Google Scholar]

- Salazar, J. Environmental Finance: Linking two world. In Financial Innovations for Biodiversity; Global Biodiversity Forum: Bratislava, Slovakia, 1998. [Google Scholar]

- Fangmin, L.; Jun, W. Financial system and Renewable Energy Development: Analysis Based on Different Types of Renewable Energy Situation. Energy Procedia 2011, 5, 829–833. [Google Scholar] [CrossRef]

- Soundarrajan, P.; Vivek, N. Green finance for sustainable green economic growth in India. Agric. Econ. Zemědělská Ekon. 2016, 62, 35–44. [Google Scholar] [CrossRef]

- Hussinger, K. R&D and Subsidies at the Firm Level: An Application of Parametric and Semi-Parametric Two-Step Selection Models. J. Appl. Ecomometrics 2008, 23, 729–747. [Google Scholar] [CrossRef]

- Montero, J.-P. Permits, Standards, and Technology Innovation. J. Environ. Econ. Manag. 2002, 44, 23–44. [Google Scholar] [CrossRef]

- Clark, C. The conditions of economic progress. Econ. J. 1941, 4, 6. [Google Scholar] [CrossRef]

- Sachs, J.D.; Woo, W.T. Structural Factors in the Economic Reforms of China, Eastern Europe and the Former Soviet Union. Economics 1994, 9, 102–145. [Google Scholar] [CrossRef]

- Chunhui, G.; Ruogu, Z.; Dianfan, Y. An Empirical Study on the Effects of Industrial Structure on Economic Growth and Fluctuations in China. Econ. Res. J. 2011, 46, 4–16+31. [Google Scholar]

- Georg, G.; Guy, M. Robots at Work. Rev. Econ. Stat. 2018, 100, 753–768. [Google Scholar] [CrossRef]

- Szirmai, A.; Timmer, M.P. Productivity growth in Asian manufacturing: The structural bonus hypothesis re-examined. Struct. Change Econ. Dyn. 2000, 4, 371–392. [Google Scholar] [CrossRef]

- Yahui, J.; Yang, Y. The Empirical Study on the Effects of Industrial Upgrading on TFP Growth and Capital Accumulation: “Structural Bonus”or “Structural Deceleration”. Ind. Econ. Rev. 2021, 12, 146–160. [Google Scholar] [CrossRef]

- Peneder, M. Industrial structure and aggregate growth. Struct. Change Econ. Dyn. 2003, 14, 427–448. [Google Scholar] [CrossRef]

- Chen, C.; Zhang, Y.; Bai, Y.; Li, W. The impact of green credit on economic growth-The mediating effect of environment on labor supply. PLoS ONE 2021, 16, e0257612. [Google Scholar] [CrossRef]

- Lili, L. Does Green Credit Influence Debt Financing Cost of Business?—A Comparative Study of Green Businesses and ″Two High″ Businesse. Financ. Econ. Res. 2015, 30, 83–93. [Google Scholar]

- Tingting, X.; Jinhua, L. How does green credit affect China′s green economy growth? China Popul. Resour. Environ. 2019, 29, 83–90. [Google Scholar]

- Wenwei, G.; Yingdi, L. Green Credit, Cost-benefit effect and profitability of commercial banks. South China Financ. 2019, 9, 40–50. [Google Scholar]

- Kangshi, W.; Xuran, S.; Fengrong, W. Development of Green Finance, Debt Maturity Structure and Investment of Green Enterprise. Financ. Forum 2019, 24, 9–19. [Google Scholar] [CrossRef]

- Min, W.; Ying, H. China′s Enovironmental Pollution Economic Growth. China Econ. Q. 2015, 14, 557–578. [Google Scholar] [CrossRef]

- Helian, X.; Yuping, D. Does Foreign Direct Investment Cause Environmental Pollution in China?—Spatial Econometric Study Based on China’s Provincial Panel Data. J. Manag. World 2012, 2, 30–43. [Google Scholar] [CrossRef]

- Xuehua, W.; Yali, L.; Honggang, T.; Jingjie, L. Paths for Environmental Regulation to Drive Economic Growth: A Test of Chain Multi-mediation Model. J. Univ. Jinan Soc. Sci. Ed. 2021, 31, 118–135+159–160. [Google Scholar]

- Kun, W. Threshold Effect of Financial Development and Industrial Structure Optimization under the Background of Chinese Supply Side Structure Reform. Ind. Organ. Rev. 2017, 11, 37–51. [Google Scholar]

- Cole, M.A.; Elliott, R.J. Determining the trade–environment composition effect: The role of capital, labor and environmental regulations. J. Environ. Econ. Manag. 2003, 46, 363–383. [Google Scholar] [CrossRef]

- Jenkins, S. Accounting for Inequality Trends: Decomposition Analyses for the UK, 1971–86. Economica 1995, 62, 29–63. [Google Scholar] [CrossRef]

- Chen, P. Effects of normalization on the entropy-based TOPSIS method. Expert Syst. Appl. 2019, 136, 33–41. [Google Scholar] [CrossRef]

- Bin, L.; Xing, P.; Mingke, O. Environmental Regulation, Green Total Factor Productivity and the Transformation of China′s Industrial Development Mode——Analysis Based on Data of China’s 36 Industries. China Ind. Econ. 2013, 4, 56–68. [Google Scholar] [CrossRef]

- Zhong, S.; Shen, H.; Niu, Z.; Yu, Y.; Pan, L.; Fan, Y.; Jahanger, A. Moving towards Environmental Sustainability: Can Digital Economy Reduce Environmental Degradation in China? Int. J. Environ. Res. Public Health 2022, 19, 15540. [Google Scholar] [CrossRef]

- Yang, Y.; Zhang, Y. The Impact of the Green Credit Policy on the Short-Term and Long-Term Debt Financing of Heavily Polluting Enterprises: Based on PSM-DID Method. Int. J. Environ. Res. Public Health 2022, 19, 11287. [Google Scholar] [CrossRef] [PubMed]

| Type | Variables | Symbols | N | Mean | Std.Dev | Min | Max | t-Test for Differences in Means between East and West |

|---|---|---|---|---|---|---|---|---|

| Explained variable | Gross domestic product | GDP (#) | 390 | 21,892 | 19,376 | 896.9 | 110,761 | 20,004.42 *** (8.425) |

| Explanatory variable | Green credit | Gc (%) | 390 | 0.464 | 0.150 | 0.0940 | 0.808 | 0.207 *** (13.144) |

| Control variable | Years of education | Edu (#) | 390 | 9.058 | 0.953 | 6.764 | 12.800 | 1.162 *** (10.265) |

| Foreign direct investment | FDI (#) | 390 | 762,003 | 769,823 | 446 | 3.576 × 106 | 1,019,767 *** (12.225) | |

| Research and development expenditure | R&D (#) | 390 | 443.5 | 552.3 | 3.300 | 3480 | 621.142 *** (9.246) | |

| Urbanization rate | Urban (%) | 390 | 0.560 | 0.131 | 0.291 | 0.896 | 0.171 *** (11.430) | |

| Financial development index | Findex | 390 | 3.100 | 1.166 | 1.392 | 8.131 | 0.357 *** (2.426) | |

| Environmental regulation intensity | Ec | 390 | 0.540 | 0.546 | −0.151 | 2.754 | 0.480 *** (7.228) | |

| Fiscal expenditure | Fp (#) | 390 | 4366 | 2826 | 324.6 | 17,485 | 1937.711 *** (5.367) |

| Regions | Cities |

|---|---|

| Eastern | Beijing, Tianjin, Hebei, Liaoning, Shanghai, Jiangsu, Zhejiang, Fujian, Shandong, Guangdong, Hainan |

| Central | Shanxi, Inner Mongolia, Jilin, Heilongjiang, Anhui, Jiangxi, Henan, Hubei, Hunan, Guangxi |

| Western | Sichuan, Chongqing, Guizhou, Yunnan, Tibet (excluding), Shaanxi, Gansu, Qinghai, Ningxia, Xinjiang |

| (1) | (2) | |

|---|---|---|

| Variables | Gc | Gc |

| L.lnEdu | 0.227 ** | 0.194 |

| (0.103) | (0.129) | |

| L.lnFdi | 0.032 *** | 0.037 *** |

| (0.006) | (0.007) | |

| L.lnR&D | 0.049 *** | 0.065 *** |

| (0.014) | (0.015) | |

| L.Urban | −0.196 ** | −0.260 *** |

| (0.093) | (0.091) | |

| L.lnFindex | 0.070 ** | 0.074 ** |

| (0.032) | (0.033) | |

| L.Ec | −0.011 | −0.003 |

| (0.012) | (0.012) | |

| L.lnFinexp | −0.037 * | −0.090 *** |

| (0.021) | (0.029) | |

| Dummy-region | ||

| Central | 0.022 | 0.024 * |

| (0.015) | (0.015) | |

| Western | −0.073 *** | −0.071 *** |

| (0.017) | (0.017) | |

| Constant | −0.356 | 0.034 |

| (0.231) | (0.351) | |

| N | 360 | 360 |

| R2 | 0.629 | 0.643 |

| Region | Yes | Yes |

| Year | - | Yes |

| (1) | (2) | (3) | |

|---|---|---|---|

| lnGDP | lnGDP | lnGDP | |

| Gc | 3.624 *** | 3.097 *** | 0.482 *** |

| (0.288) | (0.286) | (0.082) | |

| Control variables | - | - | Yes |

| Constant | 7.936 *** | 8.181 *** | 3.166 *** |

| N | 390 | 390 | 390 |

| R2 | 0.441 | 0.523 | 0.979 |

| Region | Yes | Yes | Yes |

| Year | - | Yes | Yes |

| (1) | (2) | (3) | (4) | (5) | |

|---|---|---|---|---|---|

| lnPergdp | Q25-lnGDP | Q50-lnGDP | Q75-lnGDP | Q90-lnGDP | |

| Gc | 0.613 *** | 0.493 *** | 0.378 *** | 0.381 *** | 0.344 *** |

| (0.185) | (0.167) | (0.110) | (0.107) | (0.111) | |

| Constant | 9.256 *** | 3.460 *** | 3.125 *** | 3.416 *** | 4.416 *** |

| (0.301) | (0.871) | (0.870) | (0.861) | (0.646) | |

| Control variables | Yes | Yes | Yes | Yes | Yes |

| N | 390 | - | - | - | - |

| R2 | 0.690 | - | - | - | - |

| Region | Yes | Yes | Yes | Yes | Yes |

| Year | Yes | Yes | Yes | Yes | Yes |

| (1) | (2) | |

|---|---|---|

| First-Stage | Second-Stage | |

| Gc | lnGDP | |

| IV | 10.443 ** | |

| (1.640) | ||

| Gc | 13.521 *** | |

| (1.897) | ||

| Constant | 0.353 *** | 4.591 *** |

| (0.050) | (0.707) | |

| Control variables | Yes | Yes |

| Region | Yes | Yes |

| Year | Yes | Yes |

| Observations | 390 | 390 |

| R2 | 0.544 | 0.983 |

| F-statistic-Weak instrumental variable test (Cragg-Donald) | 40.567 (10% Threshold value = 16.38) | |

| LM-statistic-Under-identification test (Anderson canon. corr) | 38.63 (p-Value = 0.000) |

| (1) | (2) | |

|---|---|---|

| IR | IR | |

| Gc | 0.329 *** | 0.180 *** |

| (0.039) | (0.036) | |

| Constant | −0.368 *** | −0.112 |

| (0.020) | (0.243) | |

| Control variables | - | Yes |

| N | 390 | 390 |

| R2 | 0.636 | 0.715 |

| Region | Yes | Yes |

| Year | Yes | Yes |

| (1) | (2) | (3) | |

|---|---|---|---|

| Gtfp | Gtfp | Gtfp | |

| Gc | 0.193 | −0.447 | −3.612 ** |

| (0.318) | (0.351) | (1.710) | |

| Gc_2 | 3.353 * | ||

| (1.922) | |||

| Constant | 1.603 *** | 0.339 | −0.323 |

| (0.147) | (2.026) | (2.241) | |

| Control variables | - | Yes | Yes |

| N | 390 | 390 | 390 |

| R2 | 0.366 | 0.471 | 0.479 |

| Region | Yes | Yes | Yes |

| Year | Yes | Yes | Yes |

| (1) | (2) | (3) | |

|---|---|---|---|

| lnGDP-East | lnGDP-Central | lnGDP-West | |

| Gc | 0.034 | 0.588 | 0.210 ** |

| (0.181) | (0.373) | (0.103) | |

| Constant | 5.801 *** | 15.405 ** | −2.153 *** |

| (0.685) | (2.832) | (0.579) | |

| Control variables | Yes | Yes | Yes |

| N | 156 | 117 | 117 |

| R2 | 0.992 | 0.691 | 0.993 |

| Region | Yes | Yes | Yes |

| Year | Yes | Yes | Yes |

Disclaimer/Publisher’s Note: The statements, opinions and data contained in all publications are solely those of the individual author(s) and contributor(s) and not of MDPI and/or the editor(s). MDPI and/or the editor(s) disclaim responsibility for any injury to people or property resulting from any ideas, methods, instructions or products referred to in the content. |

© 2023 by the authors. Licensee MDPI, Basel, Switzerland. This article is an open access article distributed under the terms and conditions of the Creative Commons Attribution (CC BY) license (https://creativecommons.org/licenses/by/4.0/).

Share and Cite

Chen, C.; Zhong, S.; Zhang, Y.; Bai, Y. The Economic Impact of Green Credit: From the Perspective of Industrial Structure and Green Total Factor Productivity. Sustainability 2023, 15, 1224. https://doi.org/10.3390/su15021224

Chen C, Zhong S, Zhang Y, Bai Y. The Economic Impact of Green Credit: From the Perspective of Industrial Structure and Green Total Factor Productivity. Sustainability. 2023; 15(2):1224. https://doi.org/10.3390/su15021224

Chicago/Turabian StyleChen, Cai, Shunbin Zhong, Yingli Zhang, and Yun Bai. 2023. "The Economic Impact of Green Credit: From the Perspective of Industrial Structure and Green Total Factor Productivity" Sustainability 15, no. 2: 1224. https://doi.org/10.3390/su15021224

APA StyleChen, C., Zhong, S., Zhang, Y., & Bai, Y. (2023). The Economic Impact of Green Credit: From the Perspective of Industrial Structure and Green Total Factor Productivity. Sustainability, 15(2), 1224. https://doi.org/10.3390/su15021224